INVESTMENT OUTLOOK

FIXED INCOME IS ATTRACTIVE AFTER THIS YEAR’S BIG MOVE

The U.S. Consumer Price Index excluding food and energy reported a year-over-year increase of 6.3% in August, putting significant pressure on U.S. Federal Reserve (Fed) policymakers to further tighten monetary policy. They did so in September, hiking their main policy rate another 0.75% to 3.25%. Chair Jerome Powell vowed to “keep at it until the job is done” in comments announcing the increase, as he tried to convince investors that he and his team will follow through as necessary to bring inflation back to a long-term 2.0% target. Powell ruled out selling Treasuries or agency mortgage-backed securities (MBS) from the Fed’s balance sheet, however at least in the near term. The fed funds rate remains policymakers’ preferred policy tool and the market is currently expecting it to be raised an additional 1.75%2.00% by early 2023.

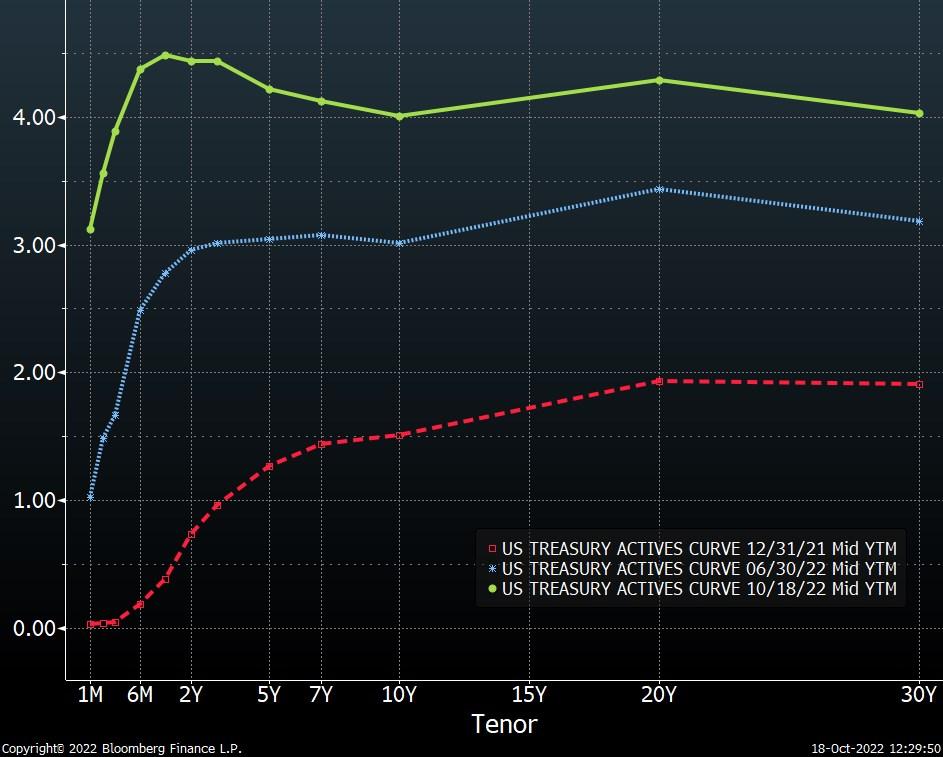

The Fed’s continued rate hikes resulted in the U.S. Treasury yield curve rising and further inverting during the third quarter, with increasing risk that monetary tightening will push the U.S. economy into recession in 2023. Recent economic data have been mixed, with strong consumer demand balanced against tepid manufacturing data, signs of strain in the housing sector, and some nascent signs of diminished demand in the labor market. Importantly, inflation breakeven rates – what the market is expecting inflation to be in

Federal Funds Target Rate

the future – have fallen significantly from highs in March, though not enough to relieve Fed policymakers from the significant pressure they face today. We believe that inflation breakeven rates will continue to trend lower, with the recent mismatch of aggregate demand and supply likely to move closer to balance in the coming months.

Short duration strategies have faced a difficult environment this year, with the short end of the yield curve rising dramatically (the yield of a 2year Treasury bond has risen 370

Source: Bloomberg

basis points since the start of the year to 4.43% in mid-October). Short duration will be the quickest fixed income sector to recover after interest rates rise, however, as investors are more quickly able to reinvest cash in the new rate environment. We’ve been doing so in our short duration strategies as rates have risen this year. These portfolios today have a yield-to-maturity of roughly 5.0%, as high as we’ve seen in over 10 years.

U.S. Treasury Yield Curve

We have maintained duration slightly lower than the benchmarks within most of our intermediate duration strategies throughout 2022, though we’ve extended duration in recent weeks by adding to lower coupon MBS positions. As previously mentioned, continued hawkishness at the Fed has the potential to push the U.S. economy into recession and we’ve been

U.S. Inflation Breakeven Rates

Source: Bloomberg

Source: Bloomberg

positioning portfolios with this in mind. Our intermediate duration strategies have a yield-to-maturity of close to 5.1% today.

The bond market is attractive today, with enticing yields across the curve. Agency mortgage-backed securities look especially good, with spreads as high as they’ve been in two years and with little prepayment risk across most coupons. There are attractive areas in

the corporate bond market as well, but we see more value with mortgages and have been adding to MBS positions in recent weeks throughout our bond strategies.

EQUITIES: RECESSION WORRIES CLOUD NEAR-TERM OUTLOOK

High inflation and resultant rising bond yields have been a negative for the stock market this year, with broad equity market indexes in bear market territory. The MSCI All Country World Index, a measure of the global stock market, was down 6.7% in the third quarter and returned -25.3% year-to-date through September 30th.

The COVID-19 pandemic and its disruptions to global supply and demand during the last two and a half years represent the principal cause of the heightened inflation recently experienced around the world. As the pandemic’s impact

on behavior continues to abate and as global monetary policymakers work to attack inflationary pressures, we believe that inflation will fall in the coming quarters. This outcome would undoubtedly be positive for the bond market and would be a long-term positive for stocks as well, as inflation has impacted many companies’ operations and profitability.

The short-term outlook for equities is clouded, however, by the increasing likelihood of a slowdown occurring in the U.S. economy next year. It’s clear that higher interest rates have already sent a chill through some parts of the macroeconomy (most notably in the housing sector) and, with more interest rate hikes almost certain to come during the next few months, we’re forecasting

Equity Returns Year-to-Date

Source: Bloomberg

heightened volatility in the equity markets to continue into early 2023.

— Brandon Fitzpatrick, CFA

THIS PUBLICATION IS FOR INFORMATIONAL PURPOSES ONLY. THIS PUBLICATION IS IN NO WAY A SOLICITATION OR OFFER TO SELL SECURITIES OR INVESTMENT ADVISORY SERVICES, EXCEPT WHERE APPLICABLE, IN STATES WHERE DB FITZPATRICK IS REGISTERED OR WHERE AN EXEMPTION OR EXCLUSION FROM SUCH REGISTRATION EXISTS.

INFORMATION THROUGHOUT THIS PUBLICATION, WHETHER STOCK QUOTES, CHARTS, ARTICLES, OR ANY OTHER STATEMENT OR STATEMENTS REGARDING MARKET OR OTHER FINANCIAL INFORMATION, IS OBTAINED FROM SOURCES WHICH WE AND OUR SUPPLIERS BELIEVE RELIABLE, BUT WE DO NOT WARRANT OR GUARANTEE THE TIMELINESS OR ACCURACY OF THIS INFORMATION.

BLOOMBERG FINANCE L.P. IS THE SOURCE UTILIZED FOR GRAPHS THROUGHOUT THIS PUBLICATION. THE GRAPHS ARE USED WITH PERMISSION OF BLOOMBERG FINANCE L.P. NEITHER WE NOR OUR INFORMATION PROVIDERS SHALL BE LIABLE FOR ANY ERRORS OR INACCURACIES, REGARDLESS OF CAUSE, OR THE LACK OF TIMELINESS OF, OR FOR ANY DELAY OR INTERRUPTION IN THE TRANSMISSION THEREOF TO THE USER. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS PUBLICATION.

NOTHING IN THIS PUBLICATION SHOULD BE INTERPRETED TO STATE OR IMPLY THAT PAST RESULTS ARE AN INDICATION OF FUTURE PERFORMANCE.