INVESTMENT OUTLOOK

TREASURY YIELDS FALL AS DISINFLATION CONTINUES

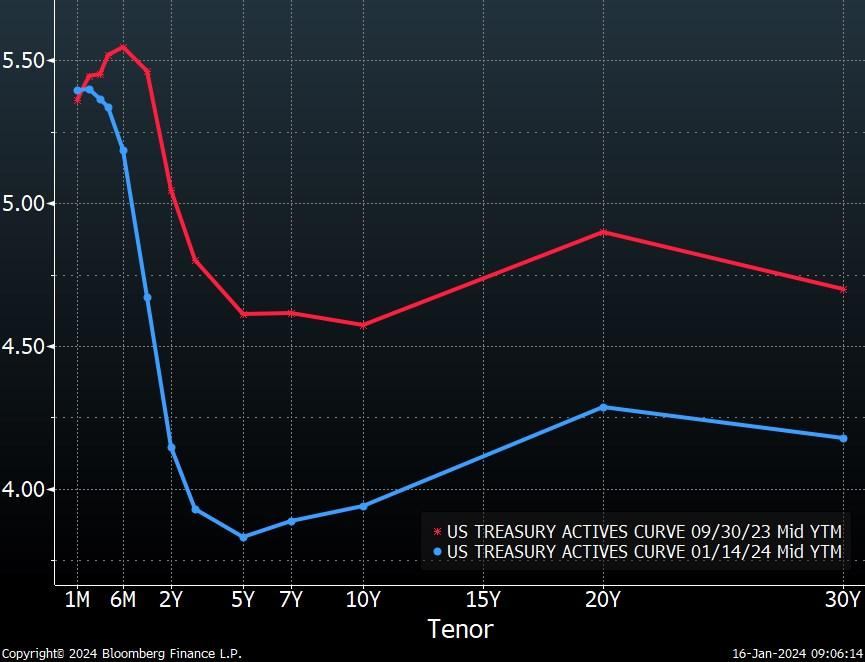

Interest rates fell during the fourth quarter, as lower inflation and weakening economic data convinced many investors that U.S. Federal Reserve (Fed) policymakers will soon begin cutting rates. All but extremely short-term Treasury yields have fallen, with large moves occurring in all tenors of two years and higher. The yield of a two-year Treasury note has fallen 90 basis points since the end of September to 4.15% in midJanuary, for example, while the yield of a 10-year note is down 63 basis points to 3.94%.

As investors digested evidence of a slowing economy, inflation breakeven rates (roughly what bond investors expect inflation to be in the future) also fell during the fourth quarter. The 10-year inflation breakeven rate fell 17 basis points to 2.17% at year-end, while the two-year inflation breakeven rate fell three basis points to 2.02%. In the first half of January inflation breakeven rates retraced their steps a bit, with the 10-year breakeven climbing to 2.28%. Breakevens are still down considerably from highs in October, however.

It should be noted that, despite the overall move downward during the last three months, inflation breakeven rates for all time periods in the U.S. are currently above the Fed’s 2.0% target. The market continues to discount some risk that the high inflation of the last two years will become embedded in economic actors’ longer-term expectations. Bond investors will be watching economic data closely in the coming months to see whether inflation picks up again, or, in our view the more likely outcome, that the disinflation of the last few months persists into 2024.

Both agency mortgage-backed security (MBS) and investmentgrade corporate option-adjusted spreads (OAS) fell in November and December. Corporate bonds were aided by many investors’ belief that Fed policymakers will achieve their goal of a “soft landing” (a slowdown of growth without the onset of a full-blown recession) for the U.S. economy, while MBS have been helped by lessened rate volatility and improved bank demand. MBS OAS today are close to their average of the last five years, while investment grade corporate bond spreads are below their average and appear tight given

U.S. Treasury Yield Curve

macroeconomic conditions.

We have avoided lower quality corporate bonds in our fixed income strategies and believe that there is heightened risk in the near term for this sector. MBS spreads, on the other hand, are close to historical averages despite the fact that most of the sector still faces limited prepayment risk in today’s interest rate environment. Consequently, we see MBS as attractive vis-à-vis Treasuries and corporate bonds.

After the big fall of interest rates during November and December, it wouldn’t surprise us if Treasury

yields continue to retrace their steps and drift higher in the near-term. With inflation breakeven rates still above 2.0% and the U.S. labor market showing considerable strength, bond investors may have gotten a bit too aggressive in their forecast of multiple fed funds rate cuts occurring in 2024 (the market is currently predicting six 25 basis point cuts to the fed funds rate by the end of the year). Looking past the very short term and toward the longer-term outlook for bonds, however, we believe that interest rates are likely to eventually fall further as the disinflation process continues.

U.S. Inflation Breakeven Rates

Source: Bloomberg

U.S. MBS and Corporate Bond Spreads

Source: Bloomberg

EQUITIES TAKE BOND MARKET FEARS IN STRIDE

The stock market experienced notable success in 2023, with the MSCI All Country World Index

returning 22.8%. The technology sector led the way, with investors increasingly enthusiastic

regarding the impact of artificial intelligence on technology companies’ earnings. The

Russell 1000 Technology Index returned 67% during the year, far outperforming all other major equity sectors. Consumer discretionary stocks also had a solid year and outperformed the broad market in 2023. More defensive sectors such as healthcare and utilities underperformed the market, with the volatile energy sector also underperforming in 2023.

The U.S. economy has remained robust despite the drag of elevated interest rates. The labor market has been especially strong, with the U.S. unemployment rate just 3.7% at the latest reading in December. The bond market has been predicting a slowdown in the economy for roughly a year, based on the idea that the cumulative impact of higher interest rates will eventually dent the housing sector and dampen

consumer sentiment. The stock market’s recent performance has belied that prediction, however, as equity investors continue to forecast solid corporate earnings results in the coming months.

Looking to the remainder of 2024, we’re forecasting a weakening economy and continued disinflation. The S&P 500 is currently trading at 19.7x 2024 earnings estimates (using Bloomberg’s forecast for earnings), a high valuation given today’s interest rate environment and the bond market’s forecast of worsening economic conditions during the coming 12 months. Given these lofty valuations, we believe that equity investors’ enthusiasm and optimism will be tested in the coming weeks.

- Brandon Fitzpatrick, CFA

Equity Returns

Source: Bloomberg

THIS PUBLICATION IS FOR INFORMATIONAL PURPOSES ONLY. THIS PUBLICATION IS IN NO WAY A SOLICITATION OR OFFER TO SELL SECURITIES OR INVESTMENT ADVISORY SERVICES, EXCEPT WHERE APPLICABLE, IN STATES WHERE DB FITZPATRICK IS REGISTERED OR WHERE AN EXEMPTION OR EXCLUSION FROM SUCH REGISTRATION EXISTS.

INFORMATION THROUGHOUT THIS PUBLICATION, WHETHER STOCK QUOTES, CHARTS, ARTICLES, OR ANY OTHER STATEMENT OR STATEMENTS REGARDING MARKET OR OTHER FINANCIAL INFORMATION, IS OBTAINED FROM SOURCES WHICH WE AND OUR SUPPLIERS BELIEVE RELIABLE, BUT WE DO NOT WARRANT OR GUARANTEE THE TIMELINESS OR ACCURACY OF THIS INFORMATION. BLOOMBERG FINANCE L.P. IS THE SOURCE UTILIZED FOR GRAPHS THROUGHOUT THIS PUBLICATION. THE GRAPHS ARE USED WITH PERMISSION OF BLOOMBERG FINANCE L.P. NEITHER WE NOR OUR INFORMATION PROVIDERS SHALL BE LIABLE FOR ANY ERRORS OR INACCURACIES, REGARDLESS OF CAUSE, OR THE LACK OF TIMELINESS OF, OR FOR ANY DELAY OR INTERRUPTION IN THE TRANSMISSION THEREOF TO THE USER. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS PUBLICATION.

NOTHING IN THIS PUBLICATION SHOULD BE INTERPRETED TO STATE OR IMPLY THAT PAST RESULTS ARE AN INDICATION OF FUTURE PERFORMANCE.