INVESTMENT OUTLOOK

TREASURY

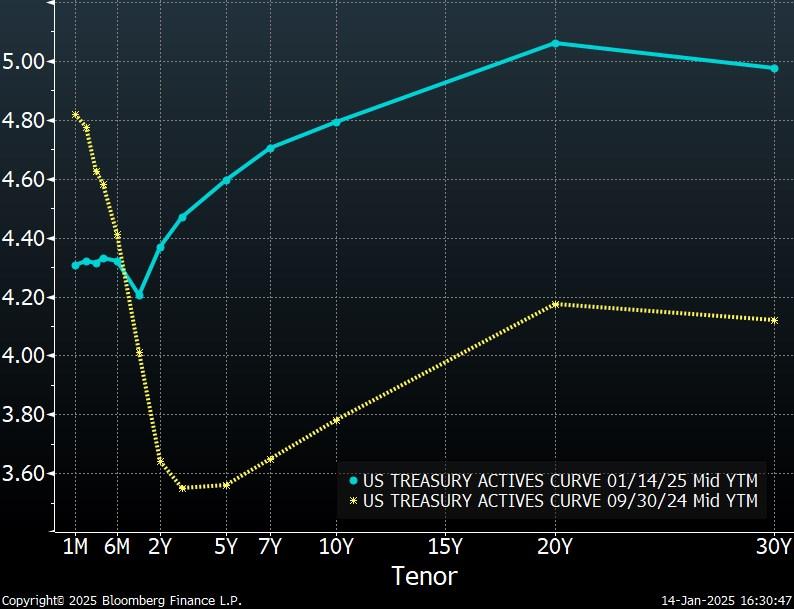

Donald Trump’s victory in the U.S. presidential election has had a significant impact on the bond market, with Treasury yields up and inflation expectations rising since September 30th. The bond market sees further fiscal stimulus as a likely outcome of the election, with a positive impact on near-term economic growth followed by inflationary pressures in the longer term. Those inflationary pressures will be exacerbated by higher tariffs on imported goods and reduced immigration, also likely outcomes of the election.

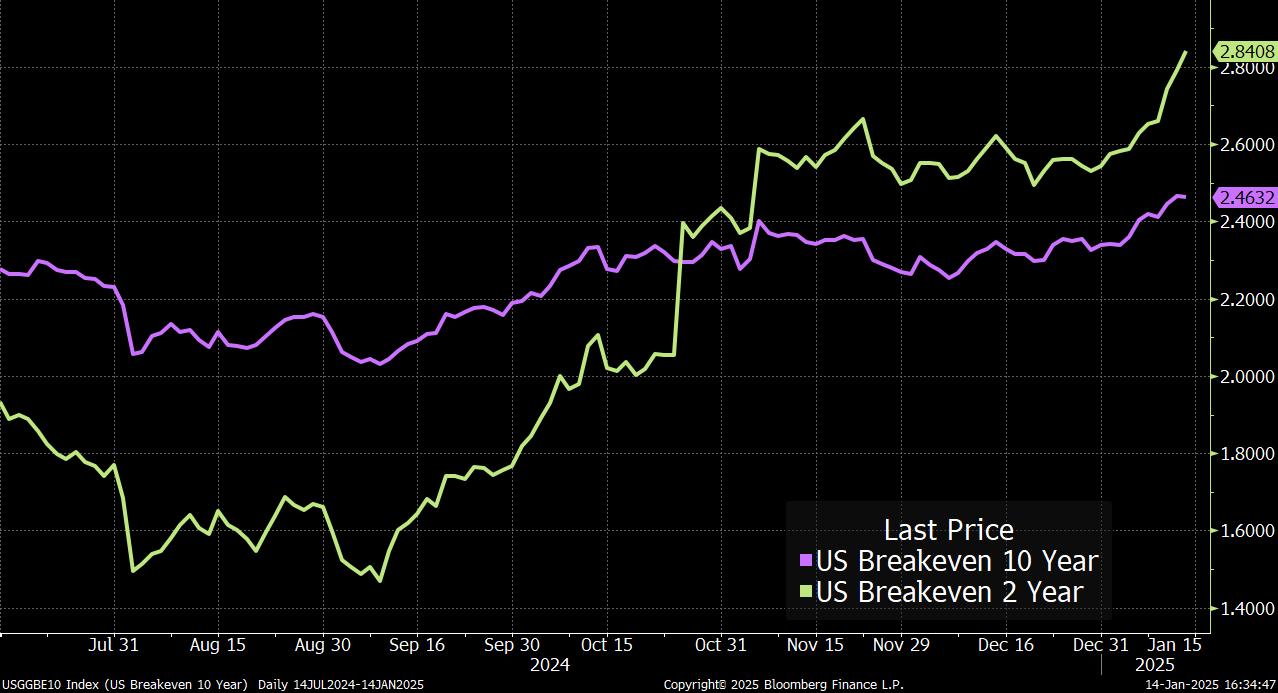

Given the new policy regime coming from the executive branch and the movement of the 10-year inflation breakeven rate (roughly what the bond market is forecasting inflation will be during the coming ten years) toward 2.5%, it is unlikely that Federal Reserve (Fed) policymakers will lower interest rates in the near term. A “higher for longer” interest rate regime is most likely, as arresting inflation is again the principal task ahead for the Fed.

YIELDS ARE UP POST-ELECTION

One important caveat to this discussion is that it’s unclear what of the president-elect’s rhetoric on tariffs is meant to lay markers for negotiations with foreign leaders, versus what is destined to occur no matter how such negotiations turn out. Almost certainly much of the tough rhetoric of recent weeks will be backed up with action, but some is probably a bluff. Also, president -elect Trump proved in his first term to be sensitive to stock market moves and may decide to moderate policy ideas or abandon some completely if the market falls in

anticipation of their implementation. The first year of the new Trump presidency will be crucial for these questions and the markets will be watching closely.

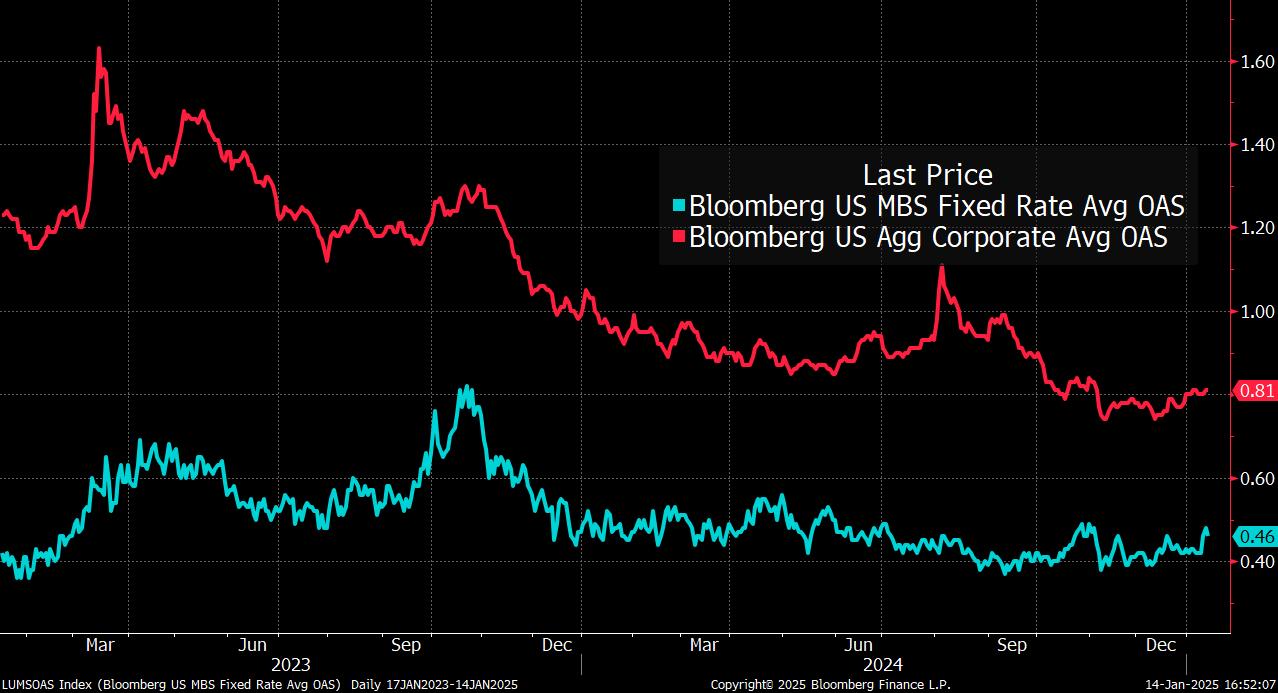

Treasury bond yields have risen during the last several weeks but there has been little change in relative value among bond sectors. Corporate bond spreads remain low compared to historical averages, as the robust economy and strong equity market have bond investors optimistic regarding risk in the credit markets. Virtually the entire

U.S. Treasury Yield Curve

Source: Bloomberg

corporate bond universe appears overvalued compared to U.S. government-backed alternatives, with lower-rated corporate bonds offering especially poor value compared to U.S. Treasuries. Agency mortgage-backed securities (MBS), on the other hand, offer attractive spread vis-à-vis Treasury yields despite the fact that the asset class has little to no credit risk.

U.S. Inflation Breakeven Rates

Source: Bloomberg

Bond Market Option-Adjusted Spreads

With the S&P 500 trading at 22x forward earnings and Treasury bond yields near 15 -year highs, the bond market today offers good value both on a relative and absolute basis. The Bloomberg U.S. Mortgage-Backed Security Index, for example, has a yield-to-maturity of 5.5%, while the short duration Bloomberg 1-3 Year U.S. Treasury Index is yielding 4.4%. Both of these figures are near multi-year highs. In today’s environment of aggressive risk

Source: Bloomberg

appetite coupled with heightened geopolitical uncertainty, the safer parts of the fixed income market represent an attractive option for investors.

EQUITIES: TECHNOLOGY OUTPERFORMS

The equity market reacted quiescently to Donald Trump’s win in November’s U.S. presidential election, with the general 2024 trends continuing in

the weeks following the election. The technology sector, led by the largest tech names and buoyed by investor belief in artificial intelligence (AI), outperformed

again in the fourth quarter, while most other sectors (including healthcare, industrials, small caps, and international stocks) underperformed technology.

Equity Returns 2024 (normalized)

Regarding the market outlook for 2025, the technology sector is expensive, both in absolute terms and relative to other equity sectors. While artificial intelligence excitement has supercharged many of the largest cap tech companies during the last two years, much depends (both for them and for the increasingly tech-heavy broad stock indexes) on how the AI movement plays out over the next 2-3 years. Given the evident ebullience within the

Source: Bloomberg

technology sector, we believe it’s best to be cautious regarding AI-related companies and we’re underweight mega-cap tech stocks. Recently underperforming sectors such as healthcare, industrials, international developed stocks, and small caps offer better relative value today and our portfolios are positioned with this forecast in mind.

- Brandon Fitzpatrick, CFA

THIS PUBLICATION IS FOR INFORMATIONAL PURPOSES ONLY. THIS PUBLICATION IS IN NO WAY A SOLICITATION OR OFFER TO SELL SECURITIES OR INVESTMENT ADVISORY SERVICES, EXCEPT WHERE APPLICABLE, IN STATES WHERE DB FITZPATRICK IS REGISTERED OR WHERE AN EXEMPTION OR EXCLUSION FROM SUCH REGISTRATION EXISTS.

INFORMATION THROUGHOUT THIS PUBLICATION, WHETHER STOCK QUOTES, CHARTS, ARTICLES, OR ANY OTHER STATEMENT OR STATEMENTS REGARDING MARKET OR OTHER FINANCIAL INFORMATION, IS OBTAINED FROM SOURCES WHICH WE AND OUR SUPPLIERS BELIEVE RELIABLE, BUT WE DO NOT WARRANT OR GUARANTEE THE TIMELINESS OR ACCURACY OF THIS INFORMATION. BLOOMBERG FINANCE L.P. IS THE SOURCE UTILIZED FOR GRAPHS THROUGHOUT THIS PUBLICATION. THE GRAPHS ARE USED WITH PERMISSION OF BLOOMBERG FINANCE L.P. NEITHER WE NOR OUR INFORMATION PROVIDERS SHALL BE LIABLE FOR ANY ERRORS OR INACCURACIES, REGARDLESS OF CAUSE, OR THE LACK OF TIMELINESS OF, OR FOR ANY DELAY OR INTERRUPTION IN THE TRANSMISSION THEREOF TO THE USER. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS PUBLICATION.

NOTHING IN THIS PUBLICATION SHOULD BE INTERPRETED TO STATE OR IMPLY THAT PAST RESULTS ARE AN INDICATION OF FUTURE PERFORMANCE.