INVESTMENT OUTLOOK

YIELD CURVE REMAINS STEEP AS INFLATION SUBSIDES

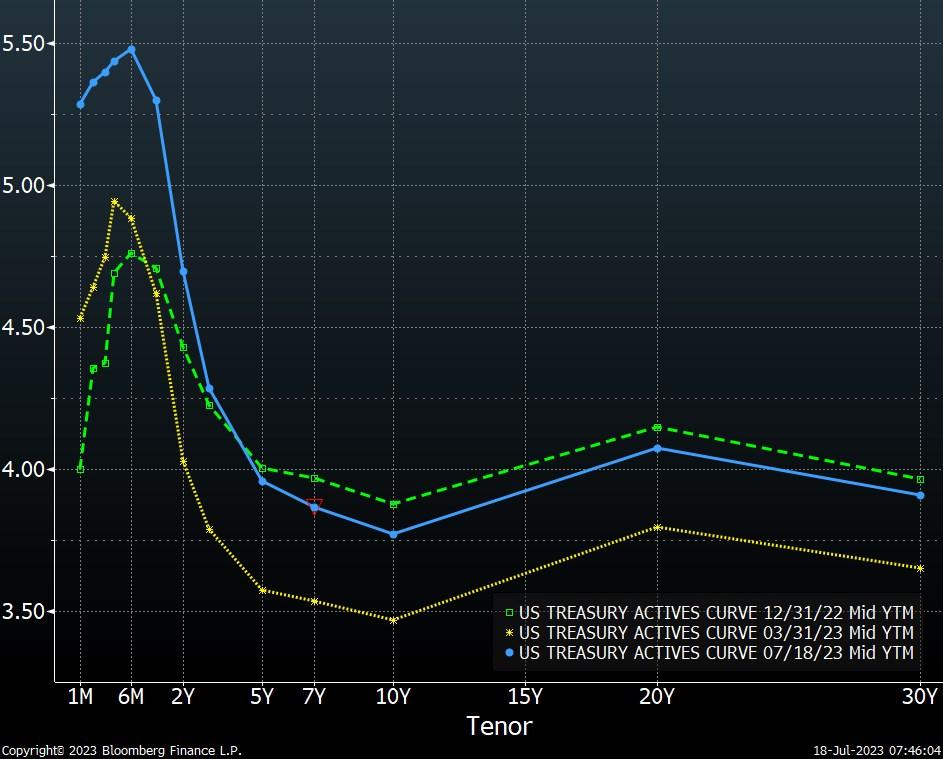

The U.S. economy has been resilient, with robust consumer spending, strong labor demand, and a buoyant national housing market that has so far avoided significant decline. In spite of this, the bond market continues to forecast an economic slowdown within the next 12 months, as the cumulative impact of U.S. Federal Reserve (Fed) interest rate hikes finally takes hold. The U.S. Treasury yield curve remains deeply inverted, with a 1-year Treasury bill yielding close to 150 basis points more than a 10-year Treasury bond. We share the bond market’s forecast regarding near-term economic growth and expect to see more signs of slowdown within the next few months.

Inflation remains elevated but the data have improved, with the U.S. Consumer Price Index 4.0% in its latest reading at the end of May. This figure remains above Fed policymakers’ long-term target of 2.0%, but is a significant improvement from 6.5% reported at the end of 2022. Inflation breakeven rates (what investors forecast inflation to be in the future) are also down, with both 2-year and 10-year breakeven rates close to 2.0% today. The potential for persistent elevated inflation remains a risk for the financial markets, but the inflationary

outlook has brightened with a good chance that inflation will return to historic norms.

Despite improvement on the inflation front, it’s unlikely that the U.S. Federal Reserve will relax tight monetary policy in the second half of 2023. Policymakers are under considerable pressure to ensure that inflation is stamped out for good and will likely err on the hawkish side of the policy debate unless forced by events to change tack. Stress in the banking sector complicates their analysis, but Fed leaders likely view this as collateral damage that is necessary to bring inflation under

control.

There was some question early in the second quarter regarding agency mortgage-backed security (MBS) pricing in the face of forced liquidation of positions previously held by bankrupt U.S. banks. Any concern has been allayed by continued strong investor demand for the asset class and an orderly liquidation of affected MBS portfolios. In fact, agency MBS option-adjusted spreads fell during the quarter, boosting the sector versus both Treasuries and investment-grade corporate bonds. MBS remain attractive, with little of the mortgage universe facing

U.S. Treasury Yield Curve

prepayment risk in today’s interest rate environment. They are especially attractive vis-à-vis corporate bonds, which face the risk that their spreads will widen as economic growth slows.

Taking a broader look, even with the risk that corporate spreads could widen in the coming months, the investment-grade bond market is very attractive today. The Bloomberg U.S. Mortgage-Backed Securities Index and Bloomberg U.S. Aggregate Index are both yielding 4.7%, and even higher yields are available on the short end of the U.S. Treasury yield curve (a 1 -year Treasury today yields 5.3%). All of these figures are near 15-year highs.

U.S. Inflation Breakeven Rates

We hold overweight positions to agency MBS within our intermediate duration and short duration bond strategies and will be looking to add to this asset class in the third quarter. In addition to MBS, our short duration bond strategies also have significant exposure to short-term Treasury bills (with a maturity of one year or less) to take advantage of attractive short-term yields. We remain close to

Source: Bloomberg

U.S. MBS and Corporate Bond Spreads

Source: Bloomberg

benchmark duration across our fixed income strategies, though we have recently extended duration in our intermediate duration portfolios as the potential for economic slowdown increases.

TECH LEADS STOCKS HIGHER AS AI POSSIBILITIES RESONATE

The stock market has returned healthy gains this year, with investors betting that corporate earnings will remain strong despite monetary policy tightening around the

world. The MSCI All Country World Index, a measure of the global stock market, returned 14.3% year-to-date through June 30th. The technology sector has led the way, while energy, financial, and small cap stocks have underperformed the broader market. Emerging market stocks have also underperformed, with higher interest rates and geopolitical

worries taking a toll on the sector.

The technology sector has jumped in recent months as investors bet that artificial intelligence (AI) will be a game changer for many tech companies. Advanced chip manufacturers have done especially well, with the market believing that many of them will be winners however the AI movement evolves. Considering the broader implications of this new technology, artificial intelligence has the potential to provide a significant boost to productivity and economic growth in the coming years. This will aid companies in various sectors and is a very positive development for Europe, Japan, and the U.S., which face demographic decline and the negative implications for growth that this entails. On the negative side of the new technology, the risk for social disunity and political strife will continue to remain high around the world, as technological change produces significant numbers of losers as well as winners. The history of the globalization movement in the 1990’s and 2000’s suggests that many governments will struggle to address the negative implications of the coming changes.

Equity Returns in 2023

Source: Bloomberg

economy is much larger and more integrated in the global economy than Russia’s. Given the risks, we believe it prudent to limit exposure to companies that would be severely impacted by a worsening relationship between the U.S. and China. Unfortunately, the economic contest between the two powers is likely to continue.

Geopolitical considerations are also becoming increasingly relevant to the financial markets. The most obvious of these is the war in Ukraine, though the markets have remained optimistic that the conflict will remain isolated and will not lead to a military clash between Russia and NATO. The more significant longterm geopolitical issue for investors is the continued escalation of tensions between the U.S. and China, whose

Macroeconomic factors, such as the short-term evolution of inflation and the exact timing of changes in the business cycle, are notoriously difficult to consistently forecast with much more prescience than the market. While keeping macro issues in mind, we focus our analysis more on the long-term growth prospects for sectors and individual companies. Today our equity strategies have overweight positions to the industrial and healthcare sectors, and underweight positions to financials and energy stocks. Our equity strategies are neutral the technology sector. We will continue to evaluate our positions in what is likely to be a dynamic second half of the year. -BrandonFitzpatrick,CFA

THIS PUBLICATION IS FOR INFORMATIONAL PURPOSES ONLY. THIS PUBLICATION IS IN NO WAY A SOLICITATION OR OFFER TO SELL SECURITIES OR INVESTMENT ADVISORY SERVICES, EXCEPT WHERE APPLICABLE, IN STATES WHERE DB FITZPATRICK IS REGISTERED OR WHERE AN EXEMPTION OR EXCLUSION FROM SUCH REGISTRATION EXISTS.

INFORMATION THROUGHOUT THIS PUBLICATION, WHETHER STOCK QUOTES, CHARTS, ARTICLES, OR ANY OTHER STATEMENT OR STATEMENTS REGARDING MARKET OR OTHER FINANCIAL INFORMATION, IS OBTAINED FROM SOURCES WHICH WE AND OUR SUPPLIERS BELIEVE RELIABLE, BUT WE DO NOT WARRANT OR GUARANTEE THE TIMELINESS OR ACCURACY OF THIS INFORMATION. BLOOMBERG FINANCE L.P. IS THE SOURCE UTILIZED FOR GRAPHS THROUGHOUT THIS PUBLICATION. THE GRAPHS ARE USED WITH PERMISSION OF BLOOMBERG FINANCE L.P. NEITHER WE NOR OUR INFORMATION PROVIDERS SHALL BE LIABLE FOR ANY ERRORS OR INACCURACIES, REGARDLESS OF CAUSE, OR THE LACK OF TIMELINESS OF, OR FOR ANY DELAY OR INTERRUPTION IN THE TRANSMISSION THEREOF TO THE USER. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS PUBLICATION.

NOTHING IN THIS PUBLICATION SHOULD BE INTERPRETED TO STATE OR IMPLY THAT PAST RESULTS ARE AN INDICATION OF FUTURE PERFORMANCE.