INVESTMENT OUTLOOK

YIELD CURVE FLATTENS ON RENEWED WORRIES

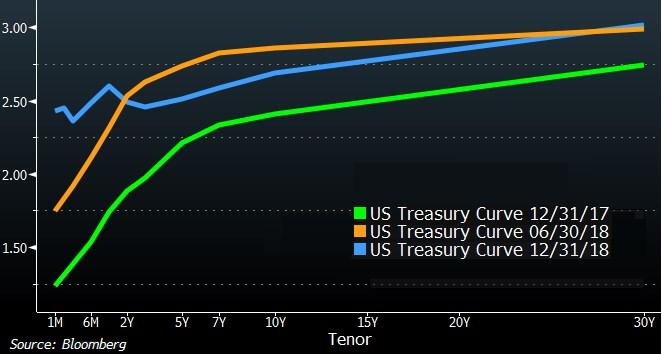

Three principal issues, all ongoing throughout 2018, came to a head in the last weeks of December to result in falling interest rates and a very flat yield curve (the short end of the curve is inverted). First, the Federal Reserve raised the fed funds rate four times last year and as recently as three weeks ago promised two additional hikes in 2019. The Fed has also been allowing $50 billion of Treasuries and agency mortgage-backed securities to burn off its balance sheet each month. Monetary policy tightening through rate hikes has resulted in the short end of the yield curve rising significantly during the last 12 months, with bond investors showing increasing skepticism regarding the wisdom and durability of this policy. The long end of the curve refused to move much higher even with the continued balance sheet wind-down.

Fears of a continuation of the trade conflict between China and the U.S. have been another important factor

holding down the long end of the curve. The lack of resolution to this issue has many investors concerned and has recently contributed to a flight to high quality assets and falling Treasury yields. The cost of tariffs has begun to show up in economic data in both China and the U.S., and corporate earnings are being impacted both directly by tariffs and indirectly by the economic slowdown they cause (Apple is a prime example, with its recent warning of a sharp slowdown of sales in China).

Finally, there are signs that the U.S. economy is weakening, most notably evidenced in the housing sector, which has added to the pessimistic

outlook among investors and has helped keep long-term Treasury yields low. Home price appreciation has slowed in recent months, while inflation breakeven rates (what investors are betting inflation will be in the future) have plummeted.

The result of all this was a roundtrip ride for long-term Treasury bond yields in 2018 (up for the most of the year before falling precipitously at the end), significant flattening of the yield curve as the Fed has pushed the short end higher, and widening corporate spreads toward the end of the year as investors repriced risky assets.

We believe it is extremely unlikely that

the Federal Reserve will be able to raise the fed funds rate two times in 2019 as policymakers have guided, and view no hikes at all during the year as the most likely outcome. This is already incorporated into market prices. Rate cuts could be on the table if the environment continues to deteriorate, but we view it as more likely that the Fed will slow the pace of its balance sheet runoff. Fed chair Jerome Powell said on January 4 that the Fed “will be prepared to adjust policy quickly and flexibly and to use all of our tools to support the economy.” Still, it’s safe to say that rate cuts will only occur as a last resort. New dovishness from the Fed, which we expect, is likely to be bearish for long-term Treasury bonds as investors’ fears of policy overshoot recede.

The trade conflict between the U.S. and China is another real worry for investors, but this could be remedied in the upcoming months if both sides decide to cut a deal.

We believe President Trump will choose this route as the 2020 presidential election cycle is already underway and economic growth is increasingly imperiled by the prolonged conflict. There is a precedent for this as President Trump, after railing against the North American Free Trade Agreement for years, eventually agreed to modest reforms and a change of the name of the deal. It is likely that a resolution to the trade conflict between China and the U.S. would also be bearish for long-term Treasuries, as an important cause for investor worry would be removed.

With this outlook in mind we are shortening duration in our intermediate duration portfolios and anticipate adding additional credit exposure where appropriate. Pessimism is elevated today and we could see a dramatic swing higher in long-term Treasury yields (combined with steepening) if a trade deal is reached or if Fed leaders

announce a significant change of policy. We are not making significant adjustments to our short duration strategies, as a change in Fed policy is likely to result in lower yields on the short end of the curve, which should benefit these portfolios.

OUTLOOK FOR EQUITIES IMPROVED AFTER SELLOFF

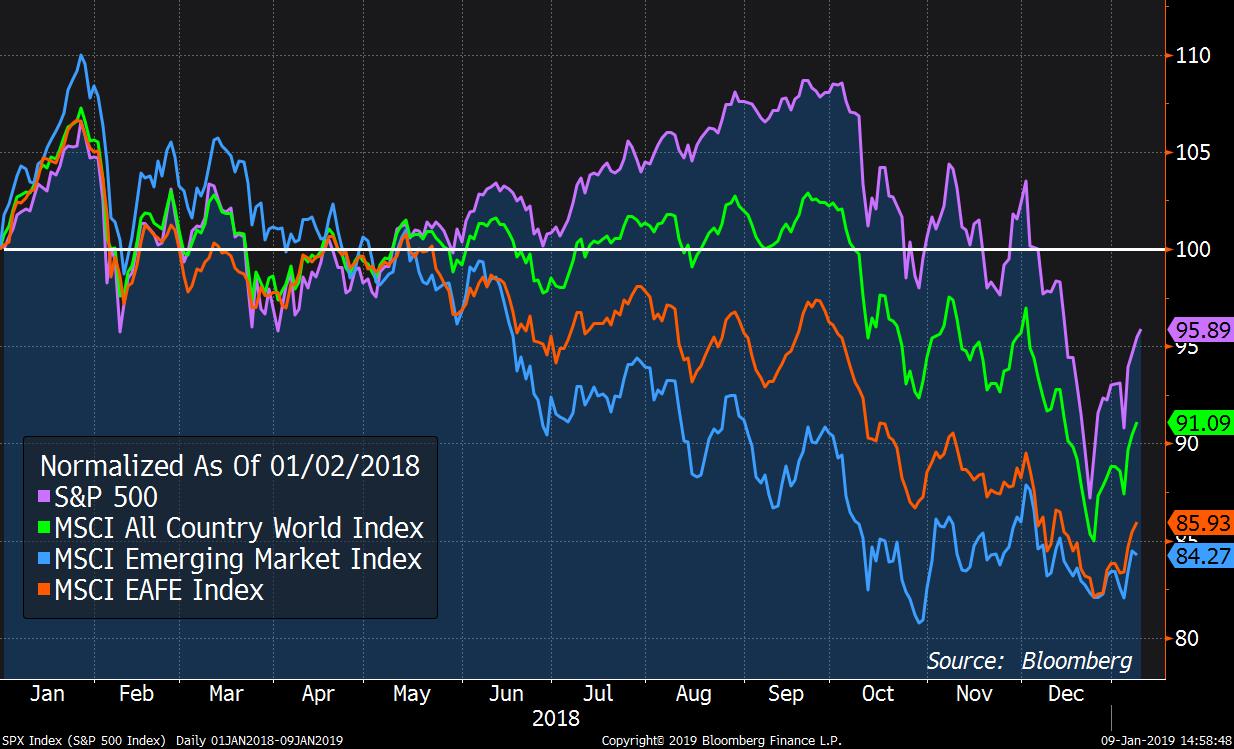

The stock market ended 2018 on a volatile note with the same factors that caused long-term Treasury yields to fall and the yield curve to flatten (trade conflict, Federal Reserve overshoot, slowing economic growth) converging to push equity investors to reassess their previous sanguine outlook. The MSCI All Country World Index (which measures the global stock market) fell 12.7% in the fourth quarter, returning -9.0% for full-year 2018. The S&P 500, a measure of large cap domestic stocks, was down 13.5% in the fourth quarter and returned -4.4% for the full year. The MSCI EAFE Index, which tracks international developed (ex-U.S.) equities, fell 13.3% in 2018, while the MSCI Emerging Markets Index was down 14.5%.

Despite the multiple issues currently weighing on investor

sentiment, we see reason to be optimistic as 2019 gets underway. First, it is very likely that Federal Reserve policymakers will embrace a more dovish monetary policy this year. Such a move is likely to be positive for stocks.

A second reason for optimism is that President Trump might decide to finally hammer out a trade deal with China. The prolonged trade conflict has certainly been a negative for stocks as so many companies rely on sales in China and logistical networks involving the country. It’s likely that a resolution to the conflict would be very positive for the broad equity market, and especially for companies with significant direct operations in China (there are many).

Admittedly, trade negotiations with China are more

complicated than were negotiations with Canada and Mexico as many in the administration view China as a strategic foe and trade as part of a larger conflict. Still, we think the odds today favor a deal and this has us optimistic regarding the outlook for stocks.

The outlook for the domestic economy is admittedly somewhat dreary, but significant relief would be offered if the Fed does indeed alter its tightening policy and trade conflicts are brought to an end. In our view the gloom in investors’ minds today is already appropriately priced into stock prices, with the S&P 500 and MSCI All Country World Index trading at a roughly neutral 14.3 and 13.1 times expected 2019 earnings, respectively.

In our equity portfolios we are maintaining an overweight position to U.S.-based stocks and to the healthcare sector, which benefits from aging demographics in the U.S.,

Europe, and Japan, and increased spending in the emerging markets. We view this as a core long-term position. In recent days we have decreased an overweight to consumer staples and increased our exposure to financials, technology, and industrials, taking advantage of attractive relative valuations. After these moves our equity portfolios are no longer positioned as defensively as they were last quarter. Should the stock market fall further, we will look to further lower our positioning to defensive sectors, hoping to take advantage of cheaper prices in more cyclical sectors of the stock market.

BrandonFitzpatrick

THIS PUBLICATION IS FOR INFORMATIONAL PURPOSES ONLY. THIS PUBLICATION IS IN NO WAY A SOLICITATION OR OFFER TO SELL SECURITIES OR INVESTMENT ADVISORY SERVICES, EXCEPT WHERE APPLICABLE, IN STATES WHERE D.B. FITZPATRICK & COMPANY IS REGISTERED OR WHERE AN EXEMPTION OR EXCLUSION FROM SUCH REGISTRATION EXISTS.

INFORMATION THROUGHOUT THIS PUBLICATION, WHETHER STOCK QUOTES, CHARTS, ARTICLES, OR ANY OTHER STATEMENT OR STATEMENTS REGARDING MARKET OR OTHER FINANCIAL INFORMATION, IS OBTAINED FROM SOURCES WHICH WE AND OUR SUPPLIERS BELIEVE RELIABLE, BUT WE DO NOT WARRANT OR GUARANTEE THE TIMELINESS OR ACCURACY OF THIS INFORMATION. BLOOMBERG FINANCE L.P. IS THE SOURCE UTILIZED FOR GRAPHS THROUGHOUT THIS PUBLICATION. THE GRAPHS ARE USED WITH PERMISSION OF BLOOMBERG FINANCE L.P. NEITHER WE NOR OUR INFORMATION PROVIDERS SHALL BE LIABLE FOR ANY ERRORS OR INACCURACIES, REGARDLESS OF CAUSE, OR THE LACK OF TIMELINESS OF, OR FOR ANY DELAY OR INTERRUPTION IN THE TRANSMISSION THEREOF TO THE USER. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS PUBLICATION.

NOTHING IN THIS PUBLICATION SHOULD BE INTERPRETED TO STATE OR IMPLY THAT PAST RESULTS ARE AN INDICATION OF FUTURE PERFORMANCE.