INVESTMENT OUTLOOK

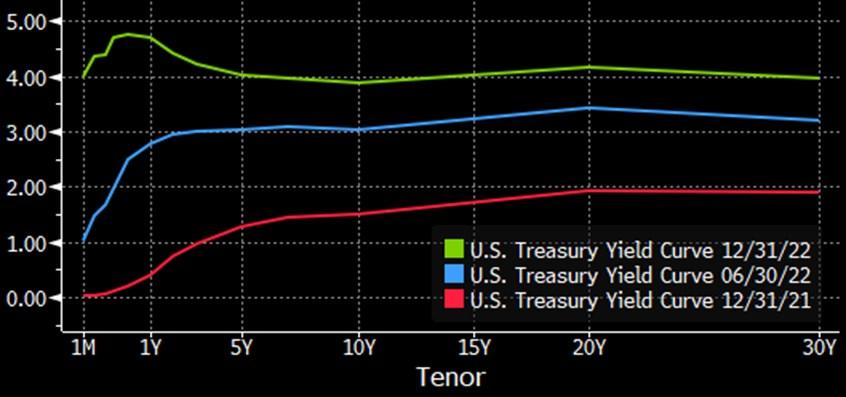

2022 was a challenging year for the bond market, with heightened inflation in the aftermath of the pandemic forcing U.S. Federal Reserve (Fed) policymakers to aggressively tighten monetary policy. The U.S. Treasury yield curve rose across all tenors in 2022, while inverting during the second half of the year. Cash was the best performing asset class, with short duration bond strategies significantly outperforming longer duration strategies. The Bloomberg U.S. Treasury 1-3 Year Index returned -3.8% in 2022, for example, while the Bloomberg U.S. Treasury Long Index returned -29.3%. Intermediate duration strategies were between these extremes, with the Bloomberg U.S. Aggregate Index returning -13.0% during the year.

Inflation continues to be a serious issue confronting the financial markets, but recent data point to improvement. The 2-year inflation breakeven rate (roughly what bond investors expect inflation to be during the coming two years) was 2.31% at the end of December, much lower than recently reported U.S. Consumer Price Index data

(which look backward) and near the Fed’s long-term 2.0% inflation target. Longer-term inflation

expectations are also down, with the 10-year inflation breakeven rate 2.30% at the end of December.

Supply constraints remain an important issue impacting inflation across the world, but the situation

today is greatly improved from a year ago. Despite the continued war in Ukraine and recent spike of COVID-19 cases in China, global supply chain pressures are likely to ease further in the longer term. Additionally, there is considerable evidence that Federal Reserve policymakers’ tightening regime is negatively impacting aggregate demand. We believe that these two factors point to supply and demand coming into balance, decreasing price pressures.

In addition to lower inflation, we’re forecasting that the real rate of interest (roughly U.S. Treasury yields minus inflation expectations) will decrease as Fed policymakers begin to slow monetary policy tightening this year. Consequently, we have extended duration in our intermediate duration bond strategies, while maintaining duration of short duration portfolios slightly longer than that of their

benchmark. We have been adding to agency mortgage-backed security positions and hold an overweight position to the sector across all our fixed income strategies. MBS option-adjusted spreads have fallen recently but remain attractive vis-à-vis U.S. Treasury bonds, given the diminished prepayment risk that exists for most MBS coupons.

Rising interest rates made for a difficult environment for the bond market during the last 12 months, but the outlook today is much improved. Bonds are attractive, with U.S. Treasury bond yields near 15year highs and macroeconomic factors pointing toward a much more favorable environment for fixed income in 2023.

Higher interest rates made 2022 a tough year for the equity market, with the prolonged war in Ukraine and increasing probability of economic slowdown in 2023 further

weighing on investor sentiment.

The MSCI All Country World Index, a measure of the global stock market, returned -18.0% during the year, while the S&P 500 returned

-18.1%. International developed stocks outperformed their U.S. counterparts, while emerging market stocks underperformed developed markets.

The most significant risk for equities today is not high inflation but that Fed policymakers overshoot in their inflation fight, thereby inducing an economic slowdown beyond what the market currently expects. This is an important possibility, but we take the view that the approaching slowdown will be mild. Even as certain macroeconomic data have softened in recent months, both labor demand and consumer balance sheet strength remain in a relatively robust position today. In any case, we will be closely scrutinizing this important issue and the dynamics that underpin it. We expect volatility to remain heightened in the first quarter of 2023. Looking beyond short-term uncertainty, today’s higher interest rates mean that ex-

pected returns for equities are greater today than they’ve been in several years. This bolsters the longterm outlook for stocks and strengthens the case for investors to stay fully invested.

Our equity portfolios have overweight positions to the healthcare and industrial sectors, and underweight positions to energy, financials, and consumer staples.

Brandon Fitzpatrick, CFADB Fitzpatrick

800 W. Main Street, Suite 1200 Boise, Idaho 83702 www.dbfitzpatrick.com | (208) 342-2280