BUDGET SUBMISSION 2024

Foreword

Introduction

Submission

Membership Priorities '23/'24

Housing Infrastructure

Economic Development & Employment

Energy & Climate Action

Conclusion

Budget 2024 should prioritise growth and competitiveness in both international and domestic businesses. Our economy has rebounded strongly from a succession of unprecedented challenges over the past five years. However, there is no room for complacency. This year’s Budget comes at a time when geopolitical tensions, inflation and supply chain challenges are reshaping the world economic order. As a small, highly globalised and open economy, Ireland is at the mercy of these influences. The economy must be robust and resilient against this uncertain backdrop. Now is the time to press on with capital projects that will improve the country’s position in relation to housing, climate change and infrastructure.

It is vital Ireland continues to attract foreign direct investment (FDI) but there also needs to be strong focus on building a strong indigenous economy. Tax measures introduced over the last 10 years are not working as intended, notably the Key Employee Engagement Programme (KEEP), the R&D tax credit and CGT Entrepreneur Relief.

In our Pre-Budget Submission, we have detailed the changes that in our view need to be made to boost productivity and innovation in the economy for the benefit for all.

Mairéad Hennessy President, County Kildare Chamber

Certainty is critical to business. Ireland needs to continue with its reputation of maintaining certainty and we must look to develop on it. We must look to minimise unexpected changes so that long term investment decisions can be made. Our pre Budget submission addresses key priority areas such as housing and infrastructural needs.

We face a volatile global backdrop of rising inflation, a deepening energy crisis and extreme geopolitical stress. Add to this the domestic issues of inadequate housing supply, public health service challenges and ageing demographics and the challenge facing the Government becomes clear, but with an unprecedented exchequer surplus the Government can ensure all in society can benefit from this budget.

Allan Shine Chief Executive, County Kildare Chamber

County Kildare Chamber is the business organisation in Kildare, proactively working to identify and progress developments that are facilitative of economic and sustainable growth. Representing an employer base of 400 businesses and over 42,000 employees across the county, County Kildare Chamber is the largest business organisation in the mid-east region of Ireland.

Given the significant breadth and depth of our membership, and our representation on various bodies at local and national level, County Kildare Chamber constitutes the representative voice for business in Kildare, a particularly important role given the current economic climate in the county and the state.

County Kildare Chamber is committed to improving the business environment and quality of life in Kildare and the wider region. County Kildare Chamber welcomes the opportunity to comment on Budget 2024, which comes at a time of increased financial pressure and uncertainty for businesses and consumers.

As a business organisation, County Kildare Chamber believes that long term planning for the development of the Country is essential in responding to the challenges presented by housing & skills shortages, climate change, Brexit, and the current crisis in Europe. We have set out below several broad areas for you to consider within the confines of Budget 2024.

2)

3)

4)

As a county, Kildare has a number of significant attributes. Kildare, according to the last census has a population of 246,977, the fifth highest in the state, a growth of 11% over the past six years and is projected to grow again by up to 44,000 by 2031. It has a substantial multinational economic cluster, a highly skilled workforce coupled with a high quality of life, our infrastructure provision and connectivity (port, airport, and digital infrastructure) ensures we are well placed to achieve the goals set out in the National Planning Framework.

At County Kildare Chamber, our overarching vision is to become a world-leading Chamber of Commerce that actively contributes to a progressive economic, social, and sustainability agenda within our vibrant business community. We are committed to upholding the United Nations Sustainable Development Goals (SDGs) as a guiding framework for our actions. In collaboration with the Chambers Ireland network, we have identified five specific SDGs that we prioritise.

Goal 11: Sustainable Cities and Communities. By advocating for policies and initiatives that promote sustainable urban development, affordable housing, and accessible infrastructure, we aim to create inclusive and resilient communities within Kildare.

Goal 8: Decent Work and Economic Growth. Our efforts are directed towards fostering an environment that promotes job creation, fair employment practices, and entrepreneurship. By supporting the growth of businesses and facilitating opportunities for decent work, we aim to enhance economic prosperity and social well-being in our region.

Goal 9: Industry, Innovation, and Infrastructure is another key area of our focus. We believe in fostering a culture of innovation, supporting the development of robust infrastructure, and encouraging investment in advanced technologies. By doing so, we strive to drive industrial growth, stimulate innovation, and create a competitive business environment that benefits our entire community.

Gender equality, as outlined in Goal 5, is a fundamental principle that guides our actions. We are committed to promoting diversity and inclusion, ensuring equal opportunities for all genders, and actively addressing any barriers that impede progress towards gender equality in the workplace and society.

Goal 13: Climate Action. Through our policy outputs and collaborative efforts, we advocate for sustainable practices, renewable energy solutions, and environmental stewardship within our business community. By promoting climate-conscious actions and supporting the transition to a low-carbon economy, we aim to mitigate climate change and build a sustainable future.

Through our Budget 2024 Submission and all our policy initiatives, we align our actions with these identified SDGs, ensuring that our efforts are in line with our vision of being a

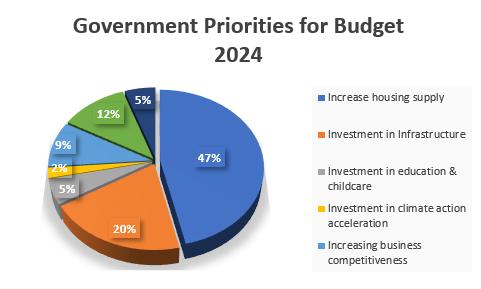

From the Q2 2023 survey conducted by County Kildare Chamber in 2023, the experiences of our members during the second quarter (Q2) of this year and their priorities for Budget 2024 were assessed. The insights gathered from the survey responses have helped shape this budgetary submission. Among the priorities highlighted by businesses for the upcoming budget, addressing the availability of housing emerged as the most critical concern, with nearly 50% of companies emphasising it as the government's top priority for Budget 2024. Housing shortages have transitioned from being solely a social issue to becoming a pressing concern for the business community as well.

Investment in infrastructure and measures to enhance business competitiveness emerged as the second key budgetary priority for companies, with over 20% emphasising the importance of addressing capacity constraints through substantial public investments to enable sustainable growth. Additionally, businesses expressed concerns about inflation and the ongoing conflict in Ukraine, which are impacting competitiveness across various sectors.

In summary, based on the survey findings, this budgetary submission emphasises the significance of ensuring adequate housing supply, investing in infrastructure and skills, and implementing measures to enhance business competitiveness. These priorities reflect the urgent need to support businesses, address capacity constraints, and navigate challenges affecting economic growth and sustainability in the Kildare region.

A recent survey of our membership identified housing availability as the number one issue affecting business competitiveness in Kildare over the past 12 months. Low levels of residential construction during the post 2008 recession in Ireland, has not kept pace with the growing levels of employment and population in the mid-eastern region. Given that current housing stock levels are inadequate, it is crucial that the level of housing supply target is correct for key growth areas such as Naas, Maynooth and the surrounds. This ongoing housing crisis has the potential to impede business activity, Foreign Direct Investment (FDI), our international reputation and ability to attract talent.

The average house price in Kildare in Q1 2023 was €361,250, up 11% on the December 2021 average of €325,000. This is a multiple of 7.4 times the average industrial wage of €44,824. According to the National Competitiveness and Productivity Council’s (NCPC) competitiveness scorecard for 2023, “Infrastructural constraints are undermining Ireland’s current competitiveness performance, with housing supply the most serious of several problem areas”. The report continued stating

A comprehensive review of the NPF & Housing for All unit targets

Activation of vacant and derelict property

Croí Conaithe (Town) Scheme review, introduction of staged payments

State financial aid to brownfield developments

Renew the Derelict Sites Act 1990

Landlords (Corporate & Individuals) should be taxed equally at 25%, LPT should be allowed as a tax deduction against rental income. Where landlords retrofit a property, 100% capital allowances should be available in the year the work is completed.

Capital Gains Tax rate should be reduced from 33% to 20% to incentivise the release of residential property back into the market.

County Kildare Chamber believes the housing targets as set out in both the National Planning Framework and Housing for All, need to be revised and expanded. The current plan from 2023-2029 gives a target figure of 9,144 housing units for Kildare. This is 13,000 fewer homes than were permitted under the previous development plan up to 2023.

Census data from 2022 shows Kildare’s population grew by over 11% in the six-year period between 2016 and 2022. Current targets are based on Census 2016 data and are now defunct.

The activation of vacant and derelict property is crucial to increasing the housing stock. As per Census 2022, there are currently 4,797 vacant properties within Kildare. The introduction of the Vacant Home Tax in Finance Act 2022 is welcome. It is important that Revenue actively police the collection of this tax to ensure that is achieving the policy aims envisaged with its introduction. Owners need to be required to register vacant properties and an annually increasing lien should apply to such properties, regardless of use. This should be complemented by reform of the Compulsory Purchase Order system to include Compulsory Sales Orders.

Encouraging adaptive reuse and repurposing of vacant properties can contribute to their activation most important is the streamlining of both the regulations and processes for changing the use of existing properties.

Croi Conaithe

County Kildare Chamber welcomes the increase in payment for the Croí Conaithe (Town) Scheme, €30,000 to €50,000 for vacant properties and from €50,000 to €70,000 for derelict properties. Also welcome is the extension to cover houses built up to 2007 and the inclusion of rental as well as owner-occupied.

However, in its current format, the grant is only paid to homeowners after they have completed works to their property and an inspection has been carried out. The lack of coherence between fireregulations and other planning requirements is preventing the repurposing of above street level properties to housing.

County Kildare Chamber believes a review of the scheme and the introduction of a staged payment scheme will alleviate this problem, whilst providing peace of mind to scheme applicates and prospective homeowners.

Promotion of Brownfield redevelopments support the viability of urban developments that already have access to public services.

Renew the Derelict Sites Act 1990 must be used to strengthen its elements to incentivise infill and brownfield construction.

County Kildare Chamber believes by providing financial support to brownfield projects, key growth towns and urban centres can be revitalised in a sustainable way, stimulating local economies and protecting green spaces. Brownfield sites often have existing infrastructure in place, such as roads, water supply, and public transportation networks.

To address the cost disparity between brownfield and greenfield developments, providing up-front grant aid and financing assistance can make high-density projects in town centre and urban areas financially viable.

By incentivising brownfield redevelopment through financial assistance, government can encourage sustainable urban growth, preserve green spaces, and foster vibrant, resilient communities. The result is a more balanced and sustainable approach to land use and development.

According to the Society of Chartered Surveyors, over 40% of properties being put on the market for sale in Q4 2022, were landlords selling an investment property[1] It appears that landlords, owning a small number of residential properties, no longer consider it to be economical to continue to rent out their properties.

[1] SCSI survey: House prices will stabilise in 2023, but landlord exodus continues (breakingnews.ie)

Currently corporate landlords have more favourable tax treatment than individuals holding property given that corporates pay tax at 25% while individuals face tax rates of 5255%. This needs to be addressed, Local Property Tax should be allowed as a tax deduction against rental income. Tax deductible expenses against rental income are very prescriptive in the legislation (Section 97 TCA 1997).[1]

The wording of the legislation should be amended so that tax deductible rental expenses are more aligned with normal trading deductions i.e., expenses that are revenue in nature and incurred wholly and exclusively for the purposes of the landlord’s rental business.

Where landlords retrofit a property to improve its energy rating, 100% capital allowances should be available in the year that the work is completed.

At present, the treatment of rental losses in a personal capacity is very restricted and should be reviewed. For example:

A landlord cannot offset rental losses against other income or carry them back to a previous year. Rental losses made by one spouse or civil partner cannot be offset against the rental profits of another.

Equality in the tax treatment of corporate and individual landlords should also be looked at e.g., a flat 25% rate on rental (Case V) income for all landlords.

With respect to landlords, we believe incentives, in the form of tax relief or a lower rate of 25% should be applied to Landlords including individual landlords who have demonstrated they are renting efficient units (i.e., units with a BER "B" rating).

[1] Finance Act 2021, pdf (irishstatutebook.ie)

Ireland’s Capital Gains Tax rate of 33% is high by any international comparison and consideration should be given to reducing same. In particular, given the lack of available rental accommodation, consideration should be given to whether CGT can be used as a mechanism to (1) incentivise new landlords into the market and (2) provide those landlords who are currently supplying rental property with an incentive to continue to do so.

Reduce the rate of Capital Gains Tax from 33% to 20% to incentivise the release of residential property back into the market.

Since the enhanced The Help to Buy scheme was introduced in 2021, it has aided more than 2,570 people in Kildare to secure their own home and to address the housing crisis. County Kildare Chamber recommend consideration is given to

extending the existing scheme to second-hand homes and apartments which meet certain pre specified criteria (e.g., this would also incentivise owners to ensure their property is at a certain level i.e., prior to sale).

Since 2022, the planning environment in Ireland has deteriorated, leading to significant challenges in accommodating the necessary volume of development in the coming years. The capacity constraints within the planning system raise concerns about the State's ability to meet its goals, including those outlined in the NPF, Housing for All, Climate Action Plan, and the decarbonisation of the grid.

These goals are becoming increasingly less credible due to the existing skills and capacity gaps within state agencies. To address these challenges, it is essential to foster more partnerships between the public and private sectors. Public Private Partnerships can help navigate the complexities of the planning process and withstand potential legal scrutiny.

carefully managed to ensure fair and timely decisionmaking.

We believe the Living City Initiative should be extended and established on a long-term basis out to 2030 and should be expanded to include long term vacant commercial properties-built post 1915.

The establishment of the Environment and Planning court should be prioritised to address delays within the legal system. Access to the High Court poses a significant regulatory risk for developments in Ireland, and the swift commencement of the Environment and Planning court can help mitigate this issue.

Additionally, it is crucial to closely monitor An Bord Pleanála, to prevent the

Special Regeneration Areas should also be expanded to bring more potential housing stock under the LCI.

Residential relief should be extended to all works on any building which qualifies for LCI.

strategic use of technical reasons for invalidating proposals as a means of reducing the development pipeline. The backlog of cases that has accumulated over the past 12 months needs to be

Industry and infrastructural development are crucial to Ireland's continued growth. To achieve sustainable industrialisation and innovation, several key points need to be considered:

While Ireland has been successful in attracting multinational companies in sectors like information technology and pharmaceuticals, there is a need for a more diverse and sustainable industrial base, like AI, robotics, quantum computing, digital health and space technologies. Over-reliance on specific sectors poses risks to the economy and job market, especially during downturns. Fostering domestic industries can lead to productivity improvements and increased trade opportunities.

Ireland's transportation, energy, water, and digital infrastructure require sufficient funding to ensure sustainable and resilient development. The current backloading of projects in the National Development Plan, with most scheduled for completion in 2030,

Emphasising connectivity and digitalisation is essential. Projects like the National Broadband Plan support the expansion of remote and flexible working, promoting economic growth and innovation.

This shift requires a focus on waste management, resource efficiency, and sustainable manufacturing practices. Embracing circular principles can lead to economic and environmental benefits.

State bodies play a crucial role in enabling the decarbonisation transition and mitigating regulatory risks associated with various development projects. Timely decision-making that withstands legal scrutiny is necessary to attract investments and maintain investor confidence. Addressing the shortcomings in the current decision-making process is crucial to avoid the loss of opportunities and the departure of companies from the Irish market.

The establishment of an independent agency to lead and develop medium-long term infrastructure policy within Ireland

Accelerated delivery of the electrification expansion of the Maynooth Dart+ West rail line

Introduction of a flexi tax saver ticket for hybrid workers (3day)

Tax incentives for hybrid/electric vehicles such as super deductions and accelerated capital allowances

Accelerated rollout of fast charging points nationwide for EV’s, with particular focus on regional areas.

Long-term planning in Ireland has faced continued constraints due to the nature of its government and political systems. In Ireland, our political system operates within a parliamentary democracy, where governments can change following general elections (with one term being five years in length). This creates challenges for continuity in infrastructure planning, as shifts in political power can lead to changes in priorities and policies.

The fragmented governance structure, with various government departments and agencies responsible for different sectors, further complicates coordination and alignment in long-term infrastructure planning.

These factors make it challenging to maintain a consistent, integrated approach to infrastructure development over extended periods.

County Kildare Chamber believes an independent state agency should be established with sole responsibility for the medium/long term strategic and infrastructure planning and policy within Ireland.

This agency would have a clearly defined mandate and objectives established through legislation or government directives and would develop long-term infrastructure plans and strategies that align with national priorities and goals. The agency would also consider emerging trends, technological advancements, and sustainability considerations in its planning process.

With regards to future residential or commercial development, the government must ensure facilities are delivered in conjunction or in advance and are sufficient to cope with inevitable increased demand into the future.

Specifically, accelerated delivery of the electrification expansion of the Maynooth Dart+ West rail line and establish a timeline towards developing an all-electric rail network. Thus, encouraging reduced carbon footprint and reliance on private car travel, providing a healthier, more sustainable attitude towards transport.

The Chamber also supports changes to the TaxSaver Commuter Ticket Scheme. It reduces the cost for workers using public transport, but it is not limited to State-owned public transport. Employers can make PRSI savings of up to 11.05% and employees can save between 31% and 52% of travel costs because of tax, PRSI and USC savings by using a TaxSaver ticket. However, with hybrid working now an option for many, the scheme needs to be adapted for workers who only commute to work for 1-3 days per week. At

present, such workers only have an option of purchasing monthly or annual tickets, when they are only travelling to the office occasionally. We would support and recommend an introduction of a flexi tax saver ticket for hybrid workers, as an additional cost-of-living support measure.

County Kildare Chamber also asks Budget 2024 look at Electric Vehicles. We would encourage wider adoption of electric/hybrid vehicles via:

Tax incentives for hybrid/electric vehicles such as super deductions and accelerated capital allowances

Lower rates of VRT on electric/hybrid vehicles

Lower rates of motor tax on hybrid/electrical vehicles

Currently, there are limits on the amount of capital allowances a business may claim on a company car i.e., regardless of the cost of the car, the capital allowances that may be claimed

may be claimed over the lifetime of the car is €24,000.

The limit on capital allowances for EVs must be increased to make the acquisition of such vehicles more attractive.

Consider the VAT rate of electric and hybrid vehicles in order to bring the cost of such vehicles to a more competitive level. Extend the benefit-in-kind exemption for electric vehicles when the current scheme expires and to review the BIK treatment of cars provided by car sharing organisations.

Accelerated rollout of fast charging

County Kildare Chamber also supports a significant increase in investment to acceleration in the rollout of a national fast charging network, with a focus on regionals areas, outside of Dublin, whilst also providing for public transport in urban settings.

With ongoing focus on increased inflation and the costs associated with same, including reduced consumer confidence, consideration should be given to reducing the VAT rate on EVs to bring the cost of these vehicles into a more competitive range with ICE vehicles.

County Kildare Chamber is also calling for the development of inter-urban and intra-urban public transport networks and invest in the urban built environment to promote local active transport networks which extend the utility of public transport. Coinciding with this, a feasibility study, and cost benefit analyses should be initiated on upgrading the links between the National Development Plan growth towns/cities such as Naas, through the rail network.

Kildare, as a key commuter county with a large population and excellent connectivity to airports, rail, and port services, plays a vital role in the national economy. The county is home to numerous multinational and domestic companies that employ a highly skilled workforce. To maintain the region's international competitiveness and support its economic growth, it is crucial for Budget 2024 to create an environment conducive to the establishment of quality jobs in various locations throughout Kildare.

In 2022 alone, over 55% of IDA employment in the Mid-East region was accounted for within Kildare through Foreign Direct Investment. Similarly, over 34% of Enterprise Ireland growth in the region was accounted for in Kildare.

With Kildare continuing to attract new and expanding economic opportunities and with Ireland at record levels of employment, severe issues with regards to the availability of skills and talent have begun to emerge. County Kildare Chambers Q2 2023 business survey found that close to 70% of our employers have struggled to fill a specific skills gap within the last 12 months. This is affecting Kildare and the mid-eastern region as an attractive location and undermining competitiveness.

Given the increasing demand on the labour force, we believe several measures must be used to alleviate pressure and encourage, particularly women, back into the workforce.

Introduce coherent and integrated flexible working policy

Build on current investment in childcare services, and early education infrastructure.

Dedicated supports should be offered to women seeking to open business

Simplified work permit process

Increase of the Employer Apprenticeship Grant from €2,000 to €8,000

Increase the 40% tax band to income over €45,000

Simplification & enhancement of the EII Scheme, Extend the Start-Up Relief for Entrepreneurs to individuals who were previously self-employed.

Reform of the KEEP

Introduce a coherent and integrated flexible working policy which aligns the hybrid working, Work/Life Balance Act, so leave and part- time work is available to all employees ensuring that parents are not discriminated against.

Childcare costs in Ireland are among the highest in Europe. Increasing investment in childcare services, and early education infrastructure are key.

County Kildare Chamber believes the government needs to build upon last year’s increased investment in early learning and care (ELC) and school age childcare (SAC) with sustained supports for childcare services, early education infrastructure and schools to facilitate breakfast clubs and after school childcare in all parts of the country to help working parents.

Expand mentoring programmes like “Better Start” that aim to improve the quality of childcare and early childhood education. Ensure continued investment in the Early Childhood Care and Education (ECCE). This should be done in conjunction with increased investment in services and infrastructure to enable childcare providers to expand places for children under the age of three.

Introduce specific entrepreneurial training and funding opportunities that are directed at women and other

disadvantaged groups. Dedicated supports should be offered to women who avail of entrepreneurial training to seek to open their own businesses.

Reforming and simplify the work permit process is also vital in developing and attracting talent to Ireland. Rising inflation, costs and a housing crisis mean Ireland is no longer seen as the attractive location it was, we need to minimise barriers for non-EU citizens accessing our workforce.

County Kildare Chamber is calling for an expansion of the Employer Apprenticeship Grant from €2,000 to €8,000.

Employers lead the apprenticeship programme in Ireland. We currently have approx. 26,000 apprenticeships in the system,

which has risen continually over the last 4 years. However, this needs to continue to ensure we meet our construction demands and skills /retraining which will be needed to future proof our green energy & technology sectors.

The Chamber fully supports access to the workforce for all and fully supports greater incentives for businesses to employ people with disabilities.

Increase of 40% tax band to €45,000

Currently within Ireland entry to the higher tax band is at a level of income below the average industry wage, this is counter intuitive as it discourages labour force participation & the desire for an individual to upskill & seek a promotion. County Kildare Chamber believes there is an opportunity to make reforms to the personal tax system to encourage individuals to fulfil their potential and help ease the burden for middle income earners by increasing the entry point to the marginal 40% income tax rate to €45,000.

The additional 3% USC surcharge on self-employed income over €100,000 should be removed, with provision made for automatic inflationary increases to tax rates and bands.

Key factors that impact on SMEs’ ability to scale and grow are access to adequate finance and a skilled workforce. These are areas where the personal income tax system can play a significant role with targeted tax incentives and reliefs.

Simplify and Enhance the

Incentive Scheme (EIIS) to increase its uptake. At present, the EIIS provisions are very complex and are difficult for start-ups to understand. The penalties for getting it wrong are material.

Extend the Start-Up Relief for

Entrepreneurs (“SURE”) to individuals who were previously self-employed. This relief is only available to previously employed or unemployed individuals. We recommend that the SURE scheme be extended to include new business founders who were previously self‐employed.

Apply a capped 20% income tax rate to dividends paid by trading SMEs.

Reform of KEEP

Reform the Key Employee Engagement Programme (KEEP) to make it effective. Introducing safe harbour provisions with respect to the valuation of the shares and options to provide a level of assurance that a valuation will not be challenged where the requirements for the safe harbour were met.

Enhance SARP

Enhance SARP and extend its scope to Irish indigenous businesses. The high personal tax burden in Ireland on high earners is potentially deterring

executives from choosing Ireland as a location to work, who have the choice to work in other countries. Extend SARP to Irish indigenous businesses who hire from abroad. Reduce the ‘base salary’ entry requirement from €100,000 to €50,000, whilst also removing the €1 million cap.

The discriminative tax treatment of service companies, who are regarded as providing “professional” services should be reformed to;

ensure these companies can access the EII Scheme / SURE and the Start Up Company Relief abolish the 15% surcharge on undistributed profits on professional income

PRSI employer deferral

County Kildare Chamber believes a PRSI deferral for employers in respect of new joiners, should be considered. Employers by nature bear a cost (time and investment) of integrating their employee into the workplace, particularly in a

tight labour market. This cost would be recouped and be made payable by the employer to Revenue following the completion of 12 months of employment by the employee. Where the employee does not remain in the position for the 12 months, the PRSI liability is not accounted by Revenue. Antiavoidance measures would also need to be considered to ensure the deferral is not abused or misused by a business.

Ireland’s Capital Gains Tax rate of 33% is currently the third highest in Europe. County Kildare Chamber is asking for a reduction in the current headline capital gains tax (CGT) rate of 33% to bring this down to 20% for investment in active Irish trading businesses.

History shows that when a market is buoyant, receipts arising from a lower rate of CGT increases the tax collected overall - a reduction would therefore be a very welcome move. However, for CGT to be reduced, there would need to be

a re-introduced of indexation relief should in the computation of chargeable gains for CGT for the purposes to ensuring that only ‘real’ gains are subject to taxation. Enhancement of CGT entrepreneur relief by increasing the lifetime limit to €12 million for entrepreneurs who reinvest in a new business.

In order to help SME’s, we believe the R&D tax credit process should be reviewed and simplified.

An increase in the rate of the relief to at least 35% for the first €1 million of qualifying R&D expenditure. Automatic cash refunds in one instalment in Year 1 where the RDTC amount is below €300k (this should be particularly beneficial to SMEs).

This change in the administrative process would not affect Revenue’s right to

audit and review the claims but would reduce delays within the system currently experienced by claimants and would also benefit SMEs who in particular experience cashflow issues.

Ireland urgently needs to move to a territorial system of taxation with the implementation of a participation exemption for dividends and foreign branch exemption to ensure Ireland’s position as an attractive place to do business. The current concerning relief from double taxation on foreign earnings are complex and result in an onerous administrative burden being placed on companies to claim double tax relief.

Adopting a participation exemption and a foreign branch exemption would help to align the Irish corporation tax code with those operated by other EU Member States and with the Pillar Two GloBE Rules, which have been conceived in line with a territorial system of taxation.

exemption for foreign dividends puts Ireland at a disadvantage when competing for foreign indirect investment with other OECD and EU countries that operate exemption systems. Large multinational companies that are located in Ireland are evaluating the potential impact of Pillar Two on their businesses and making decisions regarding how to structure their operations going forward.

The absence of a participation exemption in the Irish tax code is acting as a disincentive for such companies when determining where to locate future investment.

In recent years, Ireland has enacted numerous tax antiavoidance measures as part of its implementation of EU AntiAvoidance Directives, which are more congruent with a territorial system of taxation than the current credit-based worldwide system of taxation.

The absence of a participation

County Kildare Chamber has for a number of years been a strong voice in advocating for sustainability in the region. In March 2020, County Kildare Chamber, Chambers Ireland, and ICC Ireland announced that we had signed up to a new charter supporting the UN Sustainability Goals (SDGs). Two of these goals, which we have worked to advocate for are the Sustainable Cities and Communities Goal and the Climate Action Goal.

Ireland's geographical position offers great potential for the production of renewable electricity from sources like onshore wind, offshore wind, solar, and wave/tidal power. This presents an opportunity for Ireland and Kildare to achieve energy selfsufficiency and explore possibilities for energy export. Having surplus renewable energy opens doors for additional ventures such as the production of renewable fuels like green hydrogen. To achieve its emissions reduction targets, the International Monetary Fund (IMF) estimates that Ireland will need to invest €20 billion annually (equivalent to 5% of GDP) over the next decade in climate-related infrastructure and mitigation measures. Generating surplus green energy that can be exported or used to produce other renewable fuels can help offset the costs associated with this investment.

It is crucial to stimulate investment in green infrastructure and technology while providing clear and certain tax rules. The Sustainable Finance Roadmap, released in October 2021 as part of the "Ireland for Finance" strategy, emphasizes the importance of private finance in meeting investment needs, with the Irish financial services sector playing a key role. To facilitate this, tax measures should create an environment that fosters sustainable finance, enabling it to flourish and attract investments. By offering a best-in-class environment for sustainable

development, Ireland can encourage and attract investment in green infrastructure and technology. This, in turn, will support the transition to a low-carbon economy, contribute to achieving emissions reduction goals, and position Ireland as a leader in sustainable growth.

Key Asks:

Re-introduction of the corporate tax relief for equity investment in companies involved in renewable energy generation

R&D tax credit expanded to encourage green technology

Expand the network of local authority energy agencies

County Kildare Chamber believe the corporate tax relief for equity investment in companies involved in renewable energy generation should be reintroduced. The relief was given in the form of a deduction from a company’s profits for its direct investment in new ordinary shares in a qualifying renewable energy company. To have qualified for this relief, the energy project must have been in the solar, wind, hydro, or biomass technology categories. The relief was capped at the lesser of 50% of all capital expenditure (excluding lands), net of grants or €9,525,000 for a single project.

We believe this relief would encourage corporate shareholders to invest in renewable energy projects. However, consideration should be given to allowing the relief to be used to shelter income or gains taxed at the higher rates of 25% and 33%.

Green energy and its increasing prominence within all areas of Irelands economy will mean as technology advance so too will the training for those supplying the upgraded technology and those transitioning from employment reliant on fossil fuels. In this regard, the Chamber particularly welcomes support for the implementation of the ‘Local Just Transition Plan for West Kildare’ to identify actions to support and advance sustainable, social, economic, environmental development in the transition to a low carbon future in the West Kildare region. This region will be most affected by the phasing out of peat fired electrical generation.

Ringfence all Exchequer returns from Carbon Tax and strategically invest in green infrastructure, public transport, and funds that will support communities to transition to green transport and heating

alternatives.

Introduce IRLGOVT Green bonds coherent with ESG and EU Taxonomy to support NDP investments in green infrastructure.

These agencies would act as local one-stop-shops providing practical advice to households and businesses on reducing carbon emissions, retrofitting homes and availing of Government supports/ advice from agencies like the SEAI or the Climate Action Regional Offices. Classify SEAI supported retrofitting projects as 5% VAT rated products.

The state will need to increase spending and targeted funding to support making our gas networks transition ready so they can be adapted to supply renewable energy systems, such as hydrogen. As well as

the progression of the North-South and Celtic Interconnector projects.

Funding should also be allocated to the research of innovative technologies such as Carbon Capture storage and anaerobic digestion.

A strategic risk assessment of our energy supply and storage is needed to ensure security of supply, should international supply reduce resources to Ireland.

Throughout 2023 and looking towards Budget 2024, it is becoming increasingly clear that housing is a profound challenge in maintaining Kildare's competitiveness as a county. The crisis in the availability of housing and rental accommodation in Kildare is becoming the critical barrier to the continued growth and development of our economic ecosystem.

At a time where there are multifaceted challenges pulling stakeholders in different directions it is imperative that Kildare addresses any structural weaknesses that work against long run competitiveness and more widespread productivity growth, such as housing, business supports and talent attraction & retention. Quality of life, housing availability, infrastructure, transport, sustainable practised and economic growth will all be dominant topics for the foreseeable future, it is essential for the continued success of Kildare, its communities, and businesses that progress is made in each of these areas.

County Kildare Chamber looks forward to working with the Government and our local stakeholders to deliver a successful outcome for the county, and we are always available for consultation, discussion, and support.

Chief Executive, County Kildare Chamber