Anglia Farmer

Editor:

Johann Tasker | T: 07967 634971

E: johann@ruralcity.co.uk

Design:

Mark Shreeve | T: 01502 725839

E: mark.shreeve@micropress.co.uk

Advertisement production:

Polly Coleman | T: 01502 725841

E: polly.coleman@micropress.co.uk

Jade Soanes | T: 01502 725840

E: jade.soanes@micropress.co.uk

ADVERTISING SALES

Danny Lewis | T: 01502 725862

E: danny.lewis@micropress.co.uk

Lawrence Kenny | T: 01502 725860

E: lawrence.kenny@micropress.co.uk

Harvey Taylor | T: 01502 725804

E: harvey.taylor@micropress.co.uk

Anglia Farmer is a controlled circulation magazine published monthly for farmers and growers in the eastern counties. To be included on the circulation list, a farmer must have a minimum of 70 acres of land, or 50 dairy/beef stock, or 50 breeding sows/250 growing stock, or 15,000 laying hens/broiler chickens. Intensive horticulture units are required to have a minimum of two hectares. Subscription is £18 a year (including postage). No responsibility can be accepted by the publishers for the opinions expressed by contributors.

If you no longer wish to receive this magazine, please email gemma.mathers@micropress.co.uk

© Countrywide Publications 2025

Published by Countrywide Publications, Fountain Way, Reydon Business Park, Reydon Suffolk IP18 6DH T: 01502 725800

Printed by Micropress Ltd, Suffolk.

Visit our website for all the latest farming news

Food security has moved from abstract talking point to urgent political priority in recent months.

Yet our political leaders still risk sleepwalking into a crisis of their own making – despite the challenges of geo-political instability and increasingly unpredictable weather.

Government ministers are fond of saying that food security is national security. Industry leaders have now set out a clear vision to achieve this: create policies fit for farming, reform the planning system and unlock investment through smarter tax reliefs.

Some 27 food and farming organisations – from processors to retailers – have told farm minister Angela Eagle that Britain’s farmers and food producers stand ready to deliver growth, as long as government policy enables rather than hinders.

Resilience is under mounting strain. A stark report from Science for Sustainable Agriculture warns that as much as 23% of farmland could be lost to competing land-use pressures – housing, solar, tree planting, carbon schemes.

The danger is not just the area lost but the complacent view that imports can always fill the gap.

Reliance on world markets leaves low-income

families most exposed when shocks come – as they inevitably do. Meanwhile, growers themselves are hedging against volatility.

The surge in forward wheat sales – even into the 2026 crop – signals deep unease about profitability. Some farms have posted their worst results in recent memory. Cashflow is already fragile; policy uncertainty only compounds the risk.

Livestock farmers too face their own pressures – including the threat of illegal meat imports.

With forage stocks already dwindling this autumn, producers are relying on root crops to keep cattle fed through winter. It is a reminder that resilience depends on practical choices at field level as much as grand strategy in Whitehall. If government truly believes food security is national security, then this is the moment to prove it: set targets for homegrown production, support innovation without red tape, and balance environmental goals with the land still needed to feed the nation.

Farmers are ready for action. We should not be expected to wait until the shelves are bare.

Johann Tasker Editor

• Letter sent to farm minister

• Call to enshrine food strategy

• Three key priorities for Defra

Food and farming leaders have urged the government to work with the industry and deliver growth across the sector.

It comes after the NFU convened a Food Resilience Roundtable – attended farm minister Angela Eagle – alongside food retailers, processors and farm businesses.

Roundtable participants highlighted the need for a clear government ambition for homegrown food production. Some 27 industry leaders have now sent a letter to Dame Angela outlining ways Defra can work with them to grow the food sector.

The UK food and drink sector contributes more than £150bn to the national economy – making it the country’s largest manufacturing sector. But industry leaders say rising costs are among the barriers to growth.

“We want to go further than this

that enables growth and innovation, not a barrier to improving high welfare and sustainable food production.

• Improved tax relief to stimulate investment and growth – increasing the scope and size of the Annual Investment Allowance and introducing enhanced capital allowances to incentivise low-carbon investments.

• Enabling access to the right people for skilled work – reforming the Apprenticeship Levy and clarification on the visas available for the Seasonal Workers Scheme.

Fundamental NFU president Tom Bradshaw said: “Food is such a fundamental part of our lives and our society, and the government has rightly said that ‘food security is national security’.

“We want to go further than this –we want to be a driving force behind Britain’s economic renewal – and every person who signed this letter agrees that our sector has real potential for growth.”

The government’s developing food strategy should also focus on resil-

The potential loss of up to 23% of UK farm land threatens to undermine UK food security, says a report.

Farmland is being lost to housing, solar energy, tree planting, biodiversity restoration and carbon sequestration – all of which threatens to displace UK food production at an unprecedented scale, says the study.

Called UK Food Security – Outlook to 2050, the report says the UK faces a steep decline in its ability to feed itself unless urgent steps are taken to balance land use, environmental goals, and food production.

The analysis was led by Derrick Wilkinson, a former chief economist for the NFU and Country Land and Business Association. It was published by the industry-funded think-tank Science for Sustainable Agriculture.

Greater reliance on food imports could expose UK households to higher prices and global supply

ing food production with the targets that already exist for protecting the

“The UK’s food sector is ready to

rent inflationary pressures and build

Plans to reduce water abstraction for irrigation in east Suffolk could be made workable by making it easier to invest in reservoirs and infrastructure, says a report.

A planned 30% reduction in water for irrigation over the next 20 years would translate directly into lost output across the local and national economy, suggests the study. This could cost an estimated 2,500 jobs.

But those losses could be avoided by making it easier for farmers to invest in reservoirs and water management infrastructure – while continuing to protect the environment while producing high-value irrigated crops.

The value of water used for food production was studied by consultants from Risk and Policy Analysts on behalf of the East Suffolk Water Abstractors Group (Eswag) and Norfolk Environment Food and Farming.

John Patrick of Eswag delivered a stark message. Without adequate water, farming on the Suffolk coast would be impossible, he told a recent meeting of farmers and other stakeholders at Home Farm Nacton, near Ipswich.

Home Farm Nacton managing director Andrew Francis said he was increasing the farm’s water storage capacity by 35,000m3 by extending one of its eight reservoirs, which can already hold more than 800,000m3 of water.

The business recently missed out on grant funding due to a technicality, explained Mr Fran cis. A long term outlook was vital to encourage investment and ensure that farmers and food producers had adequate water, he added.

Much of the farmed area in east Suffolk is light land which can be worked year round. This makes it highly productive. But without irriga tion, it remains difficult to compete in terms of producing mainstream crops.

With the capability to irrigate 98% of the farmed area, Nacton focuses on high-value, ear ly-season crops harvested from May to July fol lowed by winter-harvested second crops.

Water consultant Bob Hillier, who attended the meeting, said: “We need water storage. We need more reservoirs and we need the Rural Payments Agency working with Defra and government to come out with the next round of grants.”

A lot of innovative irrigation systems relied on water storage, said Mr Hillier. More invest ment, more amenable planning rules and a sen sible approach to abstraction licences would all help to improve water management.

Land agent Savills has strengthened its rural agency team in the East of England with the appointment of a new associate.

Jamie Elbourn has worked in the agricultural sector for seven years –most recently as the lead rural agent for Carter Jonas across East Anglia and the East Midlands, specialising in the sale of farmland, equestrian and leisure properties.

Mr Elbourn will be based predominately in the Savills Chelmsford office. He will be responsible for advising clients on the sale of their farms and estates across the East of England including Essex, Suffolk and Cambridgeshire.

“Solutions are required now because climate change and population growth are already having an impact on access to water. There needs to be more innovative solutions that meet environmental targets as well.”

No flowers please, but donations welcome to benefit the Big ‘C’ charity and the Royal Norfolk Agricultural Association Food & Farming Discovery Trust. To do so – and to confirm attendance, visit www.ivanfisher.co.uk/ davidrichardson

Future-proof the landscape of East Anglia, and help your land thrive. The Woodland Trust is here to help, with our tailored offers in the Eastern Claylands of Suffolk, Essex and Norfolk.

Tree packs

Fully subsidised tree packs are available, containing 50 tree saplings carefully selected for the Eastern Claylands landscape. Trees will be supplied with tubes and stakes. Max 2 per landholding. To sign up for yours email

If you’re looking for a reliable non-cereal break crop that’s proven to deliver competitively against the alternatives - sugar beet ticks all the boxes.

Over the past 15 years our partnership with growers has seen sugar beet yields increase by 21%.

Here’s how we help you grow:

• One-year fixed price contract at £30/t (without optional Yield Protection)*

• One-year contract with a guaranteed £25 base price (without optional Yield Protection) plus Market-linked Bonus that gives growers a share in the upside when the sugar market is favourable**

• Interest-free Cash Advance option on 20% on the 2026/27, paid in June 2026 - you don’t get this with any other crop

• Late Delivery Allowance for beet delivered on or after 26 December - increasing bonus as the campaign progresses***

• Agriculture Manager as your dedicated crop expert offering free, practical support to maximise your returns - again, you don’t get this benefit with other crops

To find out more, speak to your Agriculture Manager or contact British Sugar Services team on freephone 0800 090 2376 or email: agriculture@britishsugar.com

further information about the 2026/27 contract including terms and conditions for the

Reduced yellow rust resistance among winter wheat varieties means growers should look at additional ways of managing the disease this autumn.

A substantial number of winter wheat varieties have seen a fall in their single-year yellow rust resistance ratings compared with previous ratings which were based on three years of data.

The drop follows the yellow rust pathogen overcoming the YR15 plant resistance gene, with some variety resistance ratings tumbling by as much as 4 or 5 points on the 1-9 resistance scale this autumn.

“This puts extra reliance on other methods to help counter the disease – not least in case fungicide applications next spring end up being delayed,” says Mike Thornton of agronomy firm Procam.

Yellow rust can flare up rapidly in suitable weather. And with little movement towards drilling wheat varieties with greater resistance this autumn, growers should be thinking of ways to help make plants more resilient.

“Yellow rust tends to be less of a problem in earlier-drilled winter wheat crops than in later-drilled ones. So avoiding later drilling is a consideration – but this needs balancing against the increased risks from Septoria and grassweeds from early drilling.

“But in addition to drilling date, we also know that plants under stress tend to be more susceptible to yellow rust infection, and there are several ways to help plants become less exposed to stress factors.”

Beginning in autumn, these include getting autumn nutrition right to improve rooting for better access to soil moisture and nutrients. Arguably, this is something that growers should

be considering anyway, in case next year is also incredibly dry.

Potash (K) and phosphate (P) are both important for root development. Mr Thornton recommends using soil testing to assess the levels of these nutrients in the soil. Growers should also to assess the levels available to the plant, he says.

Low soil temperatures as we head towards winter tend to reduce phosphate availability and acidic soils cause phosphate to be locked up, says Mr Thornton.

If there’s a need to improve phosphate availability, consider a pre-emergence application of LibPhos. This preferentially binds to calcium in the soil, freeing up soluble phosphate that can be absorbed by the plant.

“To encourage rooting at the post-emergence stage, consider a seaweed-based biostimulant such as Zodiac, or the pidolic acid and phosphite biostimulant, Incite. These types of

treatment are a sensible cost and can soon deliver a return.

“They can be tank-mixed with certain aphicides. If you’re paying to go through the crop with the sprayer anyway, it makes sense to get the best return on investment from that operation.

“We need to think about adopting an intentional approach to building better root systems in autumn. Even if your farm didn’t succumb to the effects of reduced wheat yellow rust resistance in 2025, it’s still important not to be complacent.”

Ecant structural damage and wasted costs, say experts.

Lack of rain and high temperatures weather mean growers should put soil conditions at the forefront of deci sion-making this autumn, says Dick Neale, technical manager at crop pro duction specialists Hutchinsons.

Mr Neale made the comments to farmers attending a recent demon stration day held in partnership with Sumo and Wilfred Scruton at HS Thirsk & Son of Little Grange Farm, Pocklington, Yorkshire.

may not have been trafficked for years, allowing root networks, fissures, and earthworms to build strong natural structure.

While an over-aggressive pass risks undoing years of natural soil development, an under-aggressive pass can be just as damaging. “Failing to address compaction properly still costs as much as doing it right — but without the benefit.”

Farmers on lighter soils also need to tread carefully. “Over time, such soils may acidify in the upper profile, creating the need for occasional deeper cultivation.

cultivating

Left: Technical manager Dick Neale

er to work the soil at all,” advised Mr Neale. “Be patient – consider leaving soil re-structuring to nature rather than reaching for a big bit of metal.”

Minimal intervention, he suggested, is often best. Where cultivations are required, the seedbed need not be more than a couple of inches deep. “Ask yourself whether working deeper than

Minimal intervention is often best

This can help mix more alkaline subsoil into the top layer, reducing acidity in a way that may be more sustainable than repeated lime applications. Beyond mechanical options, cover crops offer another route to improved soil condition.

“Deep-rooting species such as brassicas, linseed, vetch, lucerne, chicory, and plantain can help break through compaction layers and redistribute nutrients vertically, however, identified compaction zones should be addressed with appropriate cultivation rather than rely on roots alone “

“Establishment need not be costly, with 10–12 kg/ha of seed often sufficient to protect soil, improve infiltration, and maintain biological activity over winter.”

Given the year’s dry conditions, Mr Neale stressed the importance of checking soils carefully before any action.

A Visual Evaluation of Soil Structure (VESS) test, ideally carried out in early spring when soils have re-wetted, allows farmers to spot signs of compaction, assess rooting, and judge changes in aggregation and colour.

“Remember, healthy soil smells sweet – but unhealthy soils can give off a noticeably stagnant

aroma. It’s the biology you’re smelling”.

Looking ahead, technology could add new dimensions to soil monitoring. Hutchinsons is currently testing an “electronic nose” developed by PES Technologies,

This can analyse soil quickly to provide data on microbial biomass, respiratory activity, nutrient availability, acidity, water content and soil texture.

“If the technology delivers consistent data, it could become a valuable on-farm tool,” Mr Neale added.

More growers are using farm-saved seed to save costs – but certified seed still has a place

Wcreas-ingly tempted by the apparent savings of replanting their own grain. But certified seed has benefits too.

While farm-saved seed can offer some upfront cost savings, avoiding certified seed may result in hidden costs later on, says Kirsty Richards, national technical manager for seed at Frontier Agriculture.

“Farm-saved seed has long been an attractive option for arable farmers looking to cut costs – on the surface, it seems straightforward to clean, test, treat and replant grain from last year’s harvest without purchasing certified seed.”

The key risks of using farm-saved seed include weed infestations, seedborne diseases, and inconsistent germination rates.

While farm-saved seed is now cleaner than it once was, certified seed undergoes rigorous testing and traceability checks.

the seed, which can

“Growers who use farmsaved seed must also factor in additional costs for cleaning, treating, and testing the seed, which can add up quickly, especially if poor germination or contamination arises.”

certified seed is invaluable, particularly in a year when conditions have been difficult.”

“It performs consistently across a wide range of UK growing condiadds: “Using

Farm-saved seed can be cost-effective for growers looking to secure next season’s crop. But success depends on rigorous management from field to store, says the Agriculture and Horticulture Development Board.

Saving your own seed can offer real advantages: lower cost, greater control over quality and treatment, and early availability for drilling without waiting on supply chains. But it must be managed with care – and certainly within legal limits.

Choosing the right land is critical: seed crops should be grown in clean fields with low weed pressure, minimal disease carryover, good drainage and balanced nutrition., says the AHDB.

seed crops for various plant breeders

Left: Using certified seed can build resilience, says Matt Kerton

certified seeds rather than

Selecting the right variety is equally important. The AHDB advises using the Recommended Lists to match disease resistance, straw strength, and market needs, while ensuring seed lines are derived from certified stock wherever possible.

Harvest requires particular attention to machinery. Combines should be thoroughly cleaned to avoid contamination. Cleaning and grading can be carried out with specialist equipment, including gravity or colour sorters, to ensure seed quality.

Storage also matters. The AHDB stresses the need to dry grain carefully and keep it labelled, safely segregated and free from contaminants.

Growers must also comply with farm-saved seed rules, including paying royalties through the British Society of Plant Breeders.

Wicken Estate, says there are definite benefits to using certified seed.

“When certified seed arrives on farm, you know it’s only second or third generation, which means it’s got the optimal amount of vigour that breeders have intended, and has less chance of being contaminated with disease.

“With certified seed, you are guaranteed strong germination, and a very high thousand-grain weight (TGW) and importantly, it will be without any inherent disease issues that you risk with home-grown seed.”

Mr Hogsbjerg says it is important for farmers to support seed breeders. “Yes, the seed can be more expensive, but when you factor in the higher yields and the lower risk of disease and weed pressure, the return on investment is there.”

• Fungicides and crop disease

• Late blight warning system

• Better informed decisions

Crop management during a challenging season topped the agenda for growers attending the recent Potatoes in Practice showcase in Scotland.

Bringing together the latest research and demonstrations, the annual event at Balruddery Farm near Dundee, was hosted by the James Hutton Institute, Scotland’s Rural College SRUC and crop management company Agrii.

It also provided crop protection company BASF the opportunity to demonstrate its support for the adoption of practices and solutions which improve sustainability and resilience in potato production.

This includes the Hutton institute’s Fight Against Blight (FAB), a tool which has identified and mapped potato late blight pathogen populations

demonstrating the performance of our two fungicides.

“Honesty is a liquid tuber treat ment containing Xemium, available in partner packs with an application enhancer. It has strong activity on rhizoctonia, silver scurf, and black dot, with incidental activity against dry rot and gangrene.

Visitors were treated to a number of crop plots

These diseases can have a significant impact on the yield and marketability of potato crops. Honesty also brings physiological benefits, giving more stolon initiation, leading to more uniform potatoes and higher marketable yield.

BASF’s other fungicide Allstar contains Xemium. Applied in-furrow at planting, it gives moderate control of black scurf caused by soil-borne Rhizoctonia solani. In-furrow application means the soil around the plant is

It produces clean and uniform potatoes. “

regular skin setting, and helps crops develop faster and produce more potatoes.

A third BASF demonstration plot at the event contained a beneficials nectar mix, which is designed for integrated pest management, and provides food for natural predators that help control aphids.

Aphid-borne viruses can affect ware and seed growers, causing significant economic losses. Potato leafroll virus is a re-emerging UK threat and has become the main virus seen in seed certification inspections, said Adrian Fox, of Fera Science.

Experts were on hand to talk and answer questions during the day

Late blight was a common topic of conversation on the BASF stand as Phytophthora infestans has developed resistance to two key fungicide active ingredients, bringing exceptional pressure to late blight management strategies across Europe.

Privest (Initium + potassium phosphonates) works systemically and has activity against all late blight genotypes with no resistance issues. BASF says its strong efficacy aims to help build a sustainable programme for current crops and future crops.

“We also have another stand-alone protectant late blight fungicide coming to market soon (subject to approval) which will give growers another option in the ongoing fight against this disease,” said Mr Milne.

“The huge amount of expert knowledge at Potatoes in Practice, one of the UK’s premier field-based potato events, will help those involved in this vital industry make informed decisions for this and future seasons.”

(Fertiliser and seed bags, all sizes & types of spray containers & cardboard collected off farm).

Collections over East Anglia, further afield on request.

For more information please call Katherine Smith – 07590 850307 Tom Smith – 07801 416942

Control measures for potato cyst nematode (PCN) were highlighted during a demonstration day hosted by the Potato Partnership.

With a background pressure of 9 to 116 eggs of Globodera pallida per gramme of soil, it was a tough test for the potato varieties, nematicides and biological control solutions on trial at the partnership’s trials site in Suffolk.

To achieve a fair comparison, the field is separated into blocks according to the PCN pressure, and the treatments are stratified across low, medium and high classifications, explained Graham Tomalin, of VCS Potatoes.

“We’re trying to even out the pressure; it’s not perfect because it’s PCN,” he said

Tolerance and resistance

The trial aims to examine PCN tolerance and resistance between varieties. Leaf ground cover and yield are being compared against two control varieties: non-resistant, high-toler-

ance variety Cara; and non-resistant but low-tolerance variety Marfona.

Selecting the varieties to test was led by TPP members and seed houses – usually once varieties have been named and are close to market. However, some coded varieties in the trial are of interest to the group.

“We’re in the game of continuing to look at interesting things that might work,” said James Wrinch, of East Suffolk Produce. “It doesn’t mean it is the best, but you have to keep looking, otherwise you don’t learn.”

Mr Tomalin added: “It’s much better to know a variety that has a particular trait in a small plot than when you’re growing 20 or 30 hectares.”

The trials also looked at PCN treatment options. Maris Peer was used as the variety, which has a resistance score of two, and is known for poor tolerance, added to the high background pressure and stressful conditions for

Continued on p18

Although often used interchangeably, tolerance and resistance are words with very different meanings.

Resistance is a measure of how much a variety will multiply PCN, says Graham Tomalin. If the variety is completely resistant, there will be no multiplication of larvae which attach to plant roots, he explains.

But there will always be a few eggs within cysts which remain where the stimulus to hatch from the growing plants flails to reach. This can become complicated depending on the pathotype of G. Pallida present, which in the UK to date is within PA2/3.

Mr Tomalin cites the example of Lanorma, which has varying levels of resistance in different parts of the country which is likely to be a result of the individual field population within the wide PA2/3 pathotype range

On the other hand, tolerance is the ability of a variety to grow within a PCN pressure. While PCN is feeding on the roots, it will carry on growing and still produce the yields, he added. Generally stronger rooting, indeterminate varieties will demonstrate improved tolerance.

Tolerance is hard to score because other aspects such as seasonality, soil type and nutrition also affect crop performance in the presence of PCN. That said, Mr Tomalin says grouping the varieties with low, medium and high classifications is useful.

It has proved to be a valuable resource to see how new genetics will perform in a PCN situation compared to existing standards.

Continued from p16

the crop this season.

“In this year’s trial, we have focused on the treatments that are currently available to us: Nemathorin (fosthiazate) and Velum Prime (fluopyram),” said Don Pendergrast, technical manager for non-combinable crops at Agrii.

“We have also looked at a completely new biological product, a potentially completely new synthetic product that might be available in the future, and investigated how we might partner with Velum Prime several products that have previously looked promising.”

Last year, the best-performing treatment, in terms of efficacy, was a programme of Velum Prime at full rate combined with Nemathorin at half rate and a silicone wetter. However, the full-rate Nemathorin has looked better this year.

“We have looked at Velum plus SP058, which is a silicone wetter,” said Mr Pendergast.

We have examined it in trials almost every year, consistently observ-

With over £300,000 invested in potato trials to date, the Potato Partnership brings together growers and the industry to tackle some of the key agronomic challenges facing the sector.

The partners want to fill the gaps resulting from the loss of AHDB potatoes and its SPoT Farm East. “We wanted to continue those learnings in the field in a conversational way,” said James Wrinch, director of East Suffolk Produce, (pictured right, addressing growers at the demonstration day

The main partners are Agrii, VCS, James Foskett Farms, East Suffolk Produce, and Greenwell Farms. There are also industry sponsors – including CUPGRA which is contributing to the Integrated control of PCN – as well as several seed houses.

In addition to in-field demo events, there are three regional winter trials results meetings where all the information gathered is shared. This is also available in the members’ area on demand; last year’s data has just been uploaded to the site.

For more details, visit www.thepotatopartnership.co.uk

ing benefits in both canopy cover and overall yield. It works by improving the distribution of Velum in the soil profile, to get it to the PCN.

The biologicals tested, notably the Nemguard liquid formulation, showed a benefit to the untreated, but were noticeably behind the synthetic options. The initial control looked in line with

Prime, then after six weeks, the performance dropped away.

“It is great that some biological options are coming through, but we really have to look again at utilising them slightly differently, either by stacking them with synthetic chemistry or finding ways to use them later in the season.”

• Soils likely to be nutrient deficient

• Early kickstart benefits crop yields

• Strong root formation remains key

Application of a simple liquid complexing agent could prove beneficial to soils this autumn – and boost crop establishment.

"Soil health and fertility have taken a hammering in recent months across much of the country," says Agrii national fertiliser manager Tom Land. This makes stronger root formation particularly important, he adds.

Early-season nutrient technology contained in Agrii-Start Release can release as much as 40kg/ha of locked up phosphate from the soil, reducing the need for fertiliser and increasing winter wheat yields by up to 1.0t/ha, says Mr Land.

"If you are on high pH soils, growing a second wheat or maybe drilling later in the year, releasing P from the soil is a super-efficient way to kickstart crops, but it's got advantages for all wheat growers.

"That's particularly the case if you are farming on land with inherently low P indices or have deliberately chosen to take a P and K holiday because of costs in recent years.

"There are signs that such a strategy is not only reducing yields and soil fertility but we are also starting to see declining P levels in grain now and this is directly linked to low N levels in the grain too, so grain quality is starting to suffer.

"We would hope to see grain P levels around 0.32% but 0.25% is increasingly common and where grain P levels are below optimum, this could result in yield loss due to insufficient soil P."

Getting soil phosphate mobilised and absorbed by crops is increasingly important, therefore, but the issue is the majority of P in the soil is in essentially insoluble forms and unavailable to plants, he points out.

"A large proportion of UK agricultural soils are over chalk or limestone and these have high levels of Ca which in turn means they generally have a very high pH and the P contained within them is largely locked up.

"Agrii-Start Release is soil applied and works on cations in the soil to displace the phosphate that is locked up, with not only Calcium but also Aluminium and Iron, and keeps this in plant available forms for uptake by plant roots.

"We also know that largest amounts of P are held in the topsoil, typically in the 0-30cm rooting zone, so what we really want to do is increase plant available P at this depth during establishment.

Soluble form

"Agrii-Start Release helps to keep P in a water soluble form that roots can easily access and makes this available for anything up to 120 days, so plants have this vital nutrient early in the growing cycle when they really need it.

"Once those roots have been formed, the plant is in the ideal position to make as much use of future nutrient applications and gives it real resilience to cope with future abiotic stresses and challenging weather conditions.

Good nutrition means a better start for crops

"Agrii-Start Release also has great relevance to farmers in high P areas who for environmental reasons cannot apply any extra nutrients. The approach can release P from the soils to satisfy crop needs without the need for any applied fertiliser and also helps to manage P levels longer term."

Below: Good soil benefits crops, says Tom Land

"In two years of trials with wheat set at a current price of £180/tonne, the improvements in margin range from around £60/ha to over 120/ha giving a return on investment of £36/ ha to £81/ha.

"Plus, don't forget the saving you will be making on applied fertilisers in any one give year and the environmental gains be ensuring P is taken up by crops and not left sitting in soils from where it can potentially leave

Agrii-Start Release has been shown to replace up to 40kg/ha P from applied fertiliser and, depending on pH and the existing P index of the soil, yield responses range from 0.5t/ha to 0.9t/ha in Winter Wheat, Tom Land explains.

"In high P soils at index 4.1 and a

relatively neutral pH of 6.9 we've seen yield responses as high as 0.7t/ha and in lower P soils at index 1.1 and a higher pH at 7.9 we've seen yield increases of

For autum use in winter wheat, the product can be applied at drilling or emergence at a rate of 4.0l/ ha with a water volume of 150 to 200l/ha and can be used effectively with glyphosate and pre-emergence herbicides, says

Land.

Spring applications have proved beneficial in late drilled crops although Agrii-Start Release is best applied during the establishment phase and just prior to a period of active crop growth when seedling and young plant phosphate demand is at its height.

FOR INDUSTRIAL AGRICULTURAL & DOMESTIC USE

We also supply... composite panels, fibre cement sheeting, accessories, fixings, fillers, mastics and can deliver to almost anywhere in the UK

years experience in the roller shutter industry call us anytime for a competitive price.

New herbicides are a rarity these days, but one fresh option is available in wheat and barley this autumn. Anglia Farmer finds out why it could be a game-changer in the fight against an increasingly troublesome broad-leaved enemy.

Across the UK, growers are increasingly worried about tougher-to-control broad-leaved weeds, with groundsel a stand-out example.

The arrival of Fundatis, a herbicide approved for use this autumn and effective against a wide range of dicot weeds, including strong activity on groundsel, will therefore be welcomed by many.

The eastern and central arable areas of England are often associated with an abundance of difficult grassweeds like blackgrass and increasingly Italian ryegrass.

However, management of some broad-leaved species has become a major headache, with groundsel particularly problematic, according to Association of Independent Crop Consultants (AICC) agronomist Martyn Cox.

He says many of his peers are very concerned about how abundant it’s become across rotations in The East, which often contain field veg crops like carrots, parsnips and onions.

Lack of effective chemistry in these crops, particularly post-emergence, has not allowed growers and agronomists to get on top of groundsel populations.

you have a mild winter like the last one – is that you’re seeing it continue to germinate and grow rapidly through until spring,” says Martyn.

The weed can complete its lifecycle in just 6-8 weeks, given the right conditions, and Martyn says an increase in maize across the region could also be helping the weed increase its seed bank in the soil.

In a mild and wet winter, on land that is destined maize, groundsel can flower and set seed before there’s an opportunity to spray it off, leading to increased populations.

Martyn notes that there are already cases of herbicide resistant groundsel in the UK, specifi-

cally to triazinone herbicides like metribuzin and metamitron, so

There is a suspicion that the species has already developed resistance to ALS chemistry although this is yet to be officially confirmed.

“In cereals, it makes it particularly important to get an effective, pre-emergence residual herbicide on and then top up a few weeks later.

“If you miss those timings and groundsel is allowed to survive, it will be very difficult to get on top of in the spring,” says Martyn.

The toughening of groundsel isn’t confined to Eastern areas.

One Cornish grower is seeing much more of the weed across his mixed farm enterprise near Camborne.

Alongside 40ha of grass, Pete Olds grows 160ha of cereals; twofifths each of wheat and barley, and one fifth oats, which are all used to feed the business’ 17,000 free-range chickens.

Break crops include cabbage and cauliflower, and he’s experimenting with lupins for use in the poultry ration while he lets ground to maize and potato growers when there’s demand.

The presence of open crops such as brassicas, maize and potatoes has facilitated groundsel

Groundsel is increasingly found in rotations with field vegetables Continued overleaf

Continued from p23

infestations and he’s looking to bring the new chemistry of Fundatis into his cereal herbicide programmes to tackle the issue.

Following its recent launch Fundatis (beflubutamid + bixlozone) can now be used in winter wheat pre-emergence and up to GS13 and in winter barley pre-emergence only.

Having hosted trials for Fundatis manufacturer FMC, Pete has been encouraged by its activity on broad-leaved weeds like groundsel and sees it as a valuable addition to his weed control armoury.

“We need slightly different chemistry coming in to help combat these problem weeds and any resistance that might be developing. Mixing things up is the name of the game.

“We’ll be trying some at a commercial level this year and I’m particularly keen to see how it goes in barley, where effective chemistry is even more limited than in wheat,” he says.

Kirsty McKenzie, FMC’s commercial technical manager for the west and north, says the focus in these areas has traditionally been on broad-leaved weeds and annual meadowgrass.

Fundatis gives high levels of autumn groundsel control

Below: Kirsty McKenzie

perceived to be offering reduced control.

She notes that this is often down to suboptimal and late application to healthy, strong and waxed-up weeds in the spring, rather than resistance.

“That’s why having something like Fundatis giving high levels of groundsel control in the autumn is so useful. It can significantly reduce the pressure on other herbicides groups, which can only be a positive thing.

meadow grass and are also continuing to assess its activity on other species like brome and wild oats, which are not yet on the label.

“We know it offers activity, but we need to gain a better understanding about how it performs in commercial trials this year,” notes Kirsty.

“When followed up with a tribenuron-methyl-containing product like Ally Max SX –which is the strongest on groundsel – very good control can be achieved.”

In conversations she’s had with growers, groundsel is a weed that has become a particularly emotive subject with the challenging, wet autumns resulting in thinner, uncompetitive plant stands.

Kirsty maintains Fundatis will deliver a timely step forward in groundsel control as some spring-applied SU herbicides are

Kirsty adds that groundsel is just one target on the product’s label listing a plethora of other species susceptible including ivy-leaved speedwell, another weed that has become harder to clean up in recent seasons in certain regions.

Added to the product’s strength on grassweeds this should make it a good fit into most UK farms integrated weed control programme.

“We know it has very good activity on annual

Groundsel pressure rising across UK arable rotations

Resistance confirmed to triazinones; ALS resistance suspected

Fundatis (beflubutamid + bixlozone) approved this autumn for wheat and barley Strong activity on groundsel and wide range of other grass- and broad-leaved weeds

Autumn use supports integrated control and eases pressure on spring herbicides

• Growers assess role for crop

• Mix of factors affect demand

• Wider role for winter varieties

Subdued prices, rising input costs and lack of end-user contracts growers remain cautious about planting winter barley this autumn.

Winter barley performed strongly in Agrii trials in 2025, with seed sales for drilling this autumn progressing well despite continuing pressure on crop prices, reports the company's seed specialist David Leaper.

"Seed volumes are only slightly down on the same time last year which considering the year we have had, shows strong and ongoing support for the crop, plus there is still time for further uptake."

"For two-row conventional varieties, the top yielders LG Caravelle and KWS Tardis account for over 80% of sales but there are several good varieties behind these that have earned their place in grower portfolios.

and AHDB trial data shows average yields of 9.0 t/ha across the country, with yields reaching 11.5 t/ha and higher, recorded further north and on heavier soils, says Mr Leaper.

"Considering many growers experienced exceptionally wet conditions which made drilling and establishment difficult, the crop proved its resilience, and this has since been underlined by it coping well with the dry conditions in the spring.”

Key role

It's a crop that continues to play a key role in distributing both drilling and harvest workloads. In areas affected by blackgrass, for example, it is often the first cereal to be sown ahead of wheat which is now typically delayed until October.

David Leaper: mixed demand for winter barley

"While winter barley may not actively reduce grassweed populations, it can help maintain control, particularly when hybrid varieties are used.

cisions. In the right situation, it's a

"In light of the early harvest and last year’s difficult autumn, an early drilling season is expected, and, in this context, winter barley offers a valuable option, especially where grassweed pressure is a concern.

"Equally, winter barley is better as a second cereal crop than winter wheat particularly on medium and lighter soils where it withstands take-all better.

"Winter barley also remains the ideal entry for oilseed rape owing to its early harvest window and with encouraging OSR yields this season and the crop continuing to lead on gross margin performance, this could be increasingly important in the future."

While the overall area of winter barley has declined in recent years with spring barley increasingly popular, the dry 2025 season has highlighted the inherent risks of spring cropping, which plays into the winter crop's strengths.

Malting barley

"It is clear, however, that the demand for winter malting-types, Craft and Buccaneer, is noticeably down due to lack of end-user contracts.

“Interest in hybrids remains strong with SY Kingsbarn, SY Quantock, and SY Armadillo leading hybrid variety choice, with growing interest in KWS Inys and the BYDV-resistant SY Kestrel.”

Combined Agrii

But whatever the type or variety of barley chosen, there is no avoiding the effects of low grain prices and rising input costs, he stresses.

"Variable costs are now approaching £660/ha and with grain prices hovering around £150/t, gross margins remain challenging at approximately £620/ha. The additional value of straw, at around £90 per tonne, does add to this, however."

Growers need to also evaluate the broader rotational benefits winter barley brings

"Its suitability for early drilling and harvest, combined with its role in weed suppression and rotational flexibility, make it an important component for risk management and operational efficiency,” says Mr Leaper.

"Furthermore, maintaining a diverse cropping strategy remains a sensible approach to mitigating market and seasonal risks and ensuring a resilient arable enterprise.

"Including some winter barley within the rotation, therefore, provides a useful hedge against seasonal uncertainty. While winter barley prices remain subdued, the crop continues to hold strategic value within UK arable rotations."

Sugar beet growers are being encouraged to adopt a just-in-time approach to lifting the crop as mild autumn weather continues.

Preserving sugar content during harvesting, cleaning and loading is a priority – especially while temperatures remain warm, says the latest bulletin from the British Beet Research Organisation.

Crops should spend a minimum time in the clamp. Growers should strive for optimum crowning – and avoid excess remaining tops for justin-time loading and delivery with low levels of root damage and bruising.

To minimise root breakage, avoid running the harvester too aggressively, assessing for root breakage and bruising at the clamp, says the BBRO bulletin.

“Ensure a regular dialogue between harvester and haulier. If clamping is required, avoid too much soil or tops. Keep clamps low and wide to help with air flow which is particularly important in warmer weather, do not pushup or level the clamp.”

Sugar beet crops should still be monitored for foliar diseases, says the BBRO. Powdery mildew has been most prevalent this year and should have been well managed with fungicides, it adds.

“Rust and Cercospora are now evident in most fields and need to be closely monitored in case we suddenly experience warm weather conducive to either disease,” says the BBRO bulletin.

“If disease symptoms begin to show, be prepared to spray an additional fungicide, especially on crops

Preserving sugar content should be a priority

planned to be harvested from mid-November onwards as this will protect the crop canopy and, therefore, yield.”

British Sugar agriculture director Dan Green said: “We look forward to working together with growers, harvesters and hauliers. We’d like to wish everyone across the British beet sugar industry all the best for a safe and successful campaign.”

Growers with queries as lifting progresses should call their British Sugar agriculture manager or British Sugar Services on 0800 090 2376.

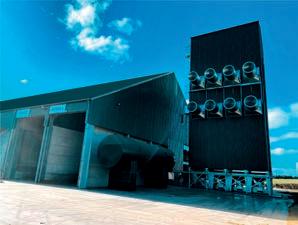

Johnstruct Ltd.’s RIDBA-Award-winning grain store at Home Farm near Wellingborough is a masterclass in modern agricultural storage. Johnstruct Ltd. delivered a high-quality steel-frame building that offers multiple-use storage efficiency and durability, recognised for its excellence in agricultural design and innovation.

This superior facility includes robust, pre-cast concrete panels for secure and effective grain retention, as well as for spray store & workshop containment. Featuring a specialist ventilated floor and Plenum chamber system, it ensures optimal crop storage conditions, safeguarding their clients harvest and maximising profitability.

Johnstruct's commitment to quality and attention to detail shines through in every aspect of the project, from initial discussions, concept design to completion. This award-winning project exceeds the highest industry standards but also sets a benchmark for agricultural storage solutions. It’s an investment that guarantees performance and longevity for years to come for their customer.

Director of Johnstruct, Mark Allen said “It’s always a team effort – I would like to thank all those involved with our projects. This recognition is testament to their hard work”.

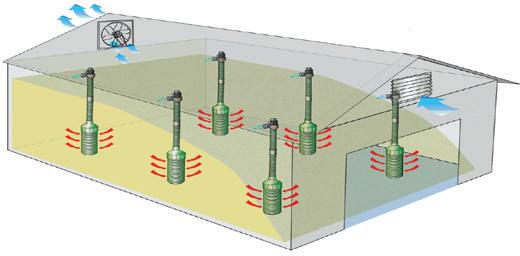

• Bio oil fired heaters

• Oil and gas fired cabinet heaters

• Suspended oil and gas fired unit heaters

• Portable and mobile heaters

• Electric heaters

MAIN OFFICE: 02476 357960

SALES CONTACTS: Andy Wallis 07850 988382 andy@thermobile.co.uk | John Hall 07775 635527 john@thermobile.co.uk WEB: www.thermobile.co.uk

More wheat is being sold forward as growers try to mitigate market uncertainty and lower commodity prices.

Farmers are continuing to turn to forward-selling as grain market pressures persist, says the latest report from the Hectare Trading platform. It follows an increasing intent by farmers to sell crops forward over the harvest period.

Only 25.1% of wheat sales have been offered for immediate movement since the start of July, compared to 44.7% over the same period last year. Some 14.8% of sales have been for 5-10 months forward, compared to just 3.4% a year ago.

Similarly, for wheat sales agreed, only 50.0% have been for immediate movement compared to 79.0% a year ago, again with an increasing proportion of sales for forward months, says the trading platform.

Hectare Trading has also seen farmers selling their 2026 crop before the seed is even in the ground. The last time UK farmers sold the following year’s harvest at such an early stage was in 2022 – amid high prices following Russia’s invasion of Ukraine.

By contrast, for the past year, prices have been on a slow decline. The average Hectare Trading price for feed wheat in the Midlands has weakened from £184/t in August 2024 to £165/t in August 2025, dipping as low as £161/t in May.

In the Midlands, the ex-farm basis –the difference between the regional exfarm price and the futures price – for feed wheat typically lags the futures through the second half of the year, reaching parity only towards the expiry of the November contract.

This year spot prices moved to parity sooner than usual. Tracking

Wheat spot prices moved to parity sooner than usual this year

the seven-day moving average, feed wheat in the Midlands was trading at +£0.23/t relative to the futures price in mid-September compared to -£5.74/t at the same stage last year.

“This harvest has been extremely challenging for many growers, with considerable variability in yields across the country – within regions and even farms,” says the Agriculture and Horticulture Development Board.

“Even where yields have been above expectations, price declines throughout the course of the year will have a significant impact on profitability and cash flow for arable farms. For those record-

ing low yields, the situation looks even more challenging.”

The wheat harvest arguably showed the greatest variability of all the major cereal crops, says the AHDB. Significant variation meant it was difficult for any summary to reflect all individual farm circumstances.

“While some farms have performed notably well, a large number have also had some of the worst years on recent record,” it said.

Some 26% of the farms in this survey are down on yield by 10% or more against their five-year average. The lowest reported during the survey is a 21% decline against the farms’ fiveyear average wheat yield.

Final figures for Europe’s 2025 cereal harvest are likely to be better than expected – despite the challenges faced by many farmers.

The latest forecast from European trade association Coceral suggests a 306.8 million tonne grain crop for the EU and UK. This is significantly higher than the 300.7Mt projected in June and the 279.1Mt harvested last year.

Favourable weather

Wheat production is forecast at 147.4Mt compared to 143.1Mt forecast in June and

125.6Mt t last year. Upward revisions have been mainly made for France, Germany, Poland, and south-east Europe due to favourable weather and yields.

This year’s wheat crop is the highest and the barley crop the second highest in 10 years. Barley production for the EU27+UK is forecast at 63.8Mt, up from the previous forecast of 59.2Mt and from the 57.5Mt reached in 2024.

The rapeseed crop is estimated at 21.6Mt –well above the 20.0Mt forecast in June and almost 4Mt higher than the 17.9Mt which was achieved last year.

With 40 years expertise in Grain Management, we combine industry-leading experience with state-of-the-art facilities, including an in-house laboratory, continuous flow dryer, and 25,000 tonnes of storage capacity.

Whatever your requirements, we have the capability and confidence to deliver.

Get in touch today:

01785 282255

Edward: 07855 795 856

Brin: 07855 795 856

07711 205 354

Email: office@hartleygrains.co.uk

Website: grainmanagement.co.uk

Hartley Farms, Bridgeford Hurst Farm

Great Bridgeford, Stafford, ST18 9PS

Group 3 winter wheat Bamford has once again cemented its reputation as one of the most reliable and high-performing varieties on the AHDB Recommended List – despite the driest spring in over a century.

Many arable areas received less than 13mm of rainfall between March and June – with an Environment Agency report released in late August confirming that spring 2025 was the driest since 1921.

Yet growers from Suffolk and Lincolnshire to Berwickshire are reporting robust yields, excellent grain quality and no visible yellow rust in Bamford – setting it apart from some other wheats hit by weather stress and disease pressure.

In Suffolk, agronomist and consultant Peter Wilson of Ceres Rural grew 50ha of Bamford near Needham Market, drilled on 16 October into sandy clay loam at 400 seeds/m?.

“Prior to Bamford’s arrival on the RL, we’d essentially given up on Group 3s after several disappointing seasons,” he said. “We were initially cautious and didn’t grow it in its first year on the list – but it’s clear now that Bamford has reinvigorated the sector.”

Mr Wilson’s crop established quick-

wouldn’t break,” he said.

By early July, signs of drought stress were evident. Peter decided to harvest on 20 July, The crop averaged 9.2t/ha – comfortably ahead of the farm’s five-year average despite lack of moisture.

“It was a remarkable result given the weather. With just a bit more rain in May, we’d have smashed our fiveyear average. We also grew Group 4 hard wheat Champion alongside it. That only returned just over 8t/ha, which was respectable—but Bamford clearly had the edge.”

Grain quality was strong: specific weight of 80.4kg/hl and protein at 11.2%, comfortably making soft wheat specification and attracting a premium offer post-harvest.

At Swineshead in east Lincolnshire, Tim Booth of JN Booth & Sons grew 40ha of Bamford, combining the crop between 17 and 19 July.

“Our average was 10t/ha, but that doesn’t tell the full story—our best fields did over 12t/ha,” said Mr Booth. “But like almost everyone, we saw big yield variation depending on soil type and rainfall.”

Grain quality remained strong despite conditions: bushel weight 79kg/ hl, Hagberg 295, and protein 10.7%.

“That was a huge plus for us. A lot of the Group 4 hard wheats we looked at were struggling badly. Bamford didn’t show any yellow rust, so we’re increasing our area to 70ha this autumn.”

A crop of It was remarkable given the weather “

In Northumberland, farmer Robert Sloan, who grows near Berwick-upon-Tweed, recorded a 12.96t/ha average from 21.07ha of Bamford drilled after vining peas on 18 September at a seed rate of 185kg/ha.

“The crop established and wintered well, helped by a decent early spring,” he said. “But from late March onwards the taps just turned off. Between our T1 fungicide spray and harvest, we had less than half an inch of rain.”

Combining his crop in the first week of August, Mr Sloan recorded moisture levels of 14.6%, bushel weight of 81.6kg/hl, protein content of 9.77% and a Hagberg Falling Number of 289. Regular fungicide and plant growth regulator applications helped the crop through to harvest, says Mr Sloan “In view of its performance in such a tough year, I’ll be increasing my Bamford area to 60ha this autumn.”

Toby Reich, head of sales at Bamford breeder Elsoms Seeds, from the variety had come through another very challenging season with strong yields, excellent specific weights and solid market performance. “As a Group 3 soft wheat, it offers unmatched market flexibility—from biscuits to distilling and export markets. And on disease resistance, it hasn’t been affected by yellow rust in the same way that many Group 4s have.”

• Mix of varieties may be best

• Milling specification tested

• Assessing yield and quality

Researchers hope to discover whether growing a mix of varieties could help deliver better milling wheat crops.

Funded by the AHDB, the fouryear project will assess the potential of milling-wheat variety blends to deliver on yield, meet milling specifications and contribute to more sustainable production practices.

The need for robust information on blends – growing multiple varieties as a single crop – was identified during the most recent review of the AHDB Recommended Lists for cereals and oilseeds.

As well as the potential to deliver stronger yield and quality, farmers and researchers believe cereal blends may produce other benefits too – such as better yield stability and reduced disease severity.

Millers and farmers will be asked about their experience of blends – including whether they have helped reduce fungicide spray intensity, contributed to fungicide-resistance-risk management and prolonged the durability of disease resistance genes.

The AHDB variety blend tool for winter wheat and experience will be used to identify hard milling varieties (UKFM Groups 1 and 2) to include in the project’s dedicated variety blend trials. They will also feature the same varieties in single stands.

Georgia Hassell, who leads the variety blends initiative at AHDB, said:

Right: Georgia Hassell – blends could have lots of potential

“Based on pedigree information and RL agronomic data, the AHDB variety blend tool for winter wheat can iden tify potential blends.

"However, as the tool data is based on varieties grown as straights, it does not account for complementarity of traits. In other words, it does not in dicate whether a mix will be greater or less than the sum of its parts.

Ms Hassell added: “These trials will specifically assess how varieties com plement each other in mixes – including how they exploit resources in a relative ly wide range of timings and spaces.”

Starting this year, the trials will be drilled for three consecutive autumns at Agrii Throws Farm in Essex, which generally sees high yellow rust pressure; and Harper Adams University in Shropshire, which generally sees high

sity treatment to test the additional benefits of blends, and grain quality data.

Various measurements will be taken including disease levels, canopy assessments, growth stages, height and yield. The project will also assess grain quality data, milling and baking tests, mycotoxin concentrations and the presence of ergot.

Led by experts at Harper Adams University and Cope Seeds, the new work will deliver evidence on the performance of variety blends, prime conversations among farmers and millers, and ultimately underpin the adoption of blends in the UK.

Post-harvest is an ideal time to assess nutrient off-take and set the foundations for the next crop, says Open-

Soil sampling provides a cost-effective, reliable snapshot of soil health, identifying key nutrient levels and acidity, explains Ms King. Lower than optimal pH levels will limit nutrient availability, reduce yield and cause financial implications.

“Testing pH helps determine if lime application is needed to correct these issues,” explains Ms King.

“This means understanding your soil’s nutrient profile is essential for planning fertiliser applications.”

Tailored PK blends can be formulated to meet field-specific needs. Fertiliser grades can also be enhanced with micronutrients such as manganese which is crucial for enzyme activity and protected phosphate to minimise nutrient lock-up.

Soil sampling helps ensure compliance with Farming Rules for Water and Sustainable Farming Incentive requirements. It also optimises nutrient management and boosts yields by maximising nutrient uptake, leading to better performance.

, Rugby

TASCC ASSURED GRAIN STORE

Located within 3 miles of junctions on the M1, M6, M69 and A14.

Located within 3 miles of junctions on the M1,M6, M69 and A14.

We can offer individual storage Drying and cleaning facilities. Handling of infested loads as well as rolling cereals and pulses on site.

We can offer individual storage. Drying and cleaning facilities. Handling of infested loads as well as rolling cereals and pulses on site. Agents for DICKEYjohn moisture meters The DICKEYjohn Mini GAC 2500

fo DICKEYjohn moisture meters

The DICKEYjohn Mini GAC 2500

The Mini GAC 2500 hand-held has proved to be the UK’s most accurate moisture meter. Consistently proving its accuracy and reliability using the lasest 149MHz technology and is cheaper than similar UK models. 07973 159903 store@jbgrayfarming.co.uk www.midlandsgrainstorage.uk

The Mini GAC 2500 hand-held has proved to be the UK’s most accurate moisture meter. Consistently proving its accuracy and reliability using the lasest 149MHz technology and is cheaper than similar UK models. Email : store@jbgrayfarming.co.uk

Tel: 07973 159903 Visit our website at: www.graygrainstorage.co.uk

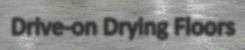

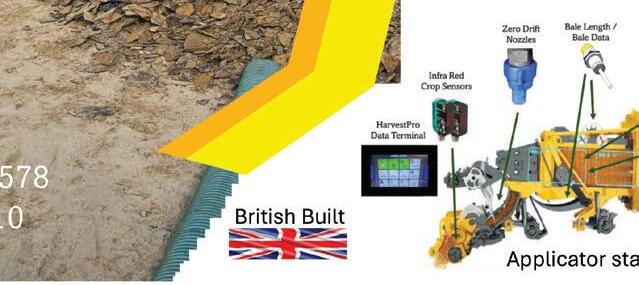

This year we launched two new products, the first being a tray drying stirrer system which we launched at this year�s Lamma show in January with a 2-metre cut down demo version. ��e stirrer unit can be installed to new or e�sistin� tray floor syste�s� �tirrers enables �ore efficient airflow t�rou�� t�e �rain w�ic� allows for dee�er dryin� and reduced dryin� ti�es� �obust construction and direct drive syste�s �no c�ains� for tray widt�s u� to �� �etres and ����� dia�eter au�ers for �rain and woodc�i� u� to � �etres dee�

�ur second �roduct is our very own truc� sa��lin� �robe usin� �ydraulics controlled by our own s�ecially desi�ned �ydraulic �ower �ac� and �oystic� wit� a ��� flus� �ounted colour ca�era �onitor for directin� t�e �robe

Visit our website for our contact details and we will visit you

We at �rainte� can undertake the complete project from design to construction, building, manufacture, installation of handling equipment and the wiring, giving the customer a complete turnkey project so that he�s�e can concentrate on his job at hand without the hassle.

We �anufacture a range of grain dryers from 2 to 400 tonnes/Hr and �ave wor�s�o�s and offices in �a�brid�e��dinbur�� and �berdeens�ire

• Durability key for savvy growers

• Farms seek long-lasting systems

• Value for money and service key

Mers consistent performance, even after more than a decade in service.

sooner, an increasing number of growers say they are prioritising durability, simplicity and responsive support – qualities they say are essential to keep fixed costs down.

all these boxes is Mecmar. Its mobile grain dryers continue to perform reliably, sometimes more than 15 years after installation – with a service model focused on maintenance rather than replacement.

Breaking the cycle

Northumberland grower Graham Carr, who farms near Belsay, replaced his previous driers every five years due to wear and reliability issues. After researching alternatives, he purchased a Mecmar D24T around a decade ago.

says Mr Carr. “The Mecmar felt heavier-built and less likely to fatigue—and it’s proved itself over ten seasons.”

The machine continues to operate without major repairs. Phone-based support has resolved issues quickly, including electrical problems. “They talk me through fixes in real time. That keeps us going in harvest when downtime costs us the most.”

Rebuilding after fire

just about the machine, it’s about who stands behind it.

Expanding output

John McArthur: Relability and service are increasingly important

In Earlston, near Kelso, Douglas Stewart replaced his entire grain handling system after fire destroyed his old dryer in 2018. “We lost the whole drying system and had to rely on neighbours to get through harvest. It forced me to think long-term.”

In Leicestershire, James Wheeler still uses the Mecmar D20T he bought in 2009, originally installed to replace a drying floor. Since then, he’s expanded to 950ha of combinable crops, which prompted him to build a new grain store in 2022.

night-time harvest run, Mr Wheeler called technicians after midnight. “They answered, diagnosed the problem – and got the part out by 7:30am. That kind of support is rare – and it matters.”

Mr Stewart built a new grain store, trench intake, and elevator system, placing a Mecmar S40T at the centre. After speaking with other farmers, he chose the brand for its build quality and reputation for producing consistent grain results.

The new dryer has a lower labour requirement. Its aspirator system has improved air quality around the site and it is simpler to operate. “We save time, the

Rather than purchase a new drier, Mr Wheeler chose to refurbish the existing unit and integrate it into the new storage system. “Labour was the constraint,” he says. “We used to run it manually, but with the expansion, we needed automation.”

The dryer’s automated features were updated and linked into a Skandia trench intake. Grain now feeds directly into the Mecmar for drying and cooling, before being conveyed to the main store. A secondary bay allows overflow or alternative crop handling.

Scott McArthur, project director for grain handling specialists and Mecmar suppliers McArthur BDC, says farmers are focusing on reliability, integration and service rather than simply upgrading every few years.

“Farmers need systems that last,” he says. “Many of them now look at refurbishment, lifecycle support, and retrofit options before considering a replacement.”

The traditional model – buying new equipment every few years – no longer works in a sector facing labour shortages, compressed harvest windows, and rising input costs, says Mr McArthur.

“The refurbished Mecmar met our new needs at

“A mobile drier today must fit into a broader handling system, adapt to changing volumes, and be easy to maintain,” he says. “Farmers can’t afford downtime, and they need support they can count on.”

Farmer-owned storage coopera tive Camgrain says it is working harder than ever to deliver val ue for money to growers following a difficult season.

In a message to Camgrain members, cooperative chairman Carl Driver said he was acutely aware of the challenges facing the region's grain producers –including low prices, reduced yields, the loss of subsidies, and increasing import pressure.

“These issues affect every one of us,” said Mr Driver. “Please be assured that both the Camgrain team and I are working harder than ever to ensure our society continues to deliver value for money and supports you.

“At times like these, the strength of being part of a cooperative really mat ters – we are in this together. To anyone who hasn’t yet paid their annual storage and handling invoice, prompt payment would be appreciated.”

On a positive note, this year saw much less ergot. This allowed Camgrain to focus on segregation by quality rather than by ergot levels. Cost-reduction remained a priority.

“Plans are in place for blending to extract as much value as possible from our collective harvest. Once again, our stores are at full capacity, a testament to the continued trust members place

“The team are carefully balancing efficiency with effectiveness ensuring that we do not cut corners but, equally, that no unnecessary costs remain,” said Mr Driver. “We recognise the reality that farmers cannot afford excess in their operations, and nor can

Looking at his own harvest, Mr Driver said results were disappoint-

ing against long-term averages but performance had been respectable. Crop quality has been encouraging which helps to offset the yield losses, he added.

Blending helps extract as much value as possible

He concluded: “As a farmer myself, with no diversifications beyond my core business, I know first-hand just how tough the current environment is but, by working together, we strengthen our position and face the future with greater resilience.”

Electrically operated or manual options

Compliant with current standard BSEN 12604

Heavy Duty and long lasting

For 50 years, Martin Lishman Ltd has been at the forefront of post-harvest crop storage solutions, helping farmers maintain grain quality while reducing costs. From our industry-leading Barn Owl Wireless automated monitoring and control system to trusted essentials like Pile-Dry Pedestals, FloorVent under floor ventilation systems and Trouble-Dry hot spot spears, we provide practical tools designed to keep crops safe, cool and market-ready.

“Our ethos has always been about providing effective solutions that make a real difference on farm,” explains Joel Capper, Managing Director at Martin Lishman. “The strength of our systems lies in their reliability and the positive feedback we hear every year from growers who rely on them to protect their livelihoods.”

One such example comes from Sutton Cheney Farms Partnership, a 2,000-acre family-run estate in Warwickshire. Faced with the challenge of conditioning a brand new 3,200-tonne store, the team turned to Martin Lishman’s Barn Owl Wireless and FloorVent systems.

The impact was immediate: crop temperatures dropped from an average of 22°C in August to 12°C in September. “FloorVent did a fantastic job of pulling the heat out, cooling the crop quickly and effectively,” says Farm Manager Tom Ingram. “Now, with Barn Owl Wireless web app, we can check on our store instantly from anywhere – it’s made the whole process safer, faster and more efficient.”

Like many farms across the UK and beyond, Sutton Cheney’s experience underlines why Martin Lishman products have become trusted mainstays in modern grain storage. The message is clear: when it comes to keeping crops in peak condition, it pays to choose systems that are proven to work – not just by us, but by farmers everywhere.

Farmers are being reminded that it is now illegal to use second-generation anti-coagulant rodenticides in outdoor locations unless connected to a building.

The Campaign for Responsible Rodenticide Use (CRRU) updated its guidance before the law change came into effect on 1 January. It aims to support professional rodenticide applications alongside safe and effective rodent pest management.

Revisions to the fourth edition of the document – seen as an essential source of information for pest controllers – account for the withdrawal of the ‘open area’ pattern of use for second-generation anti-coagulant rodenticides (SGARs).

CRRU best practice leader Nic

Blaszkowicz said the industry-led partnership was tightening up the patterns of use to reach the end goal of reducing rodenticide residues in non-target animals, such as barn owls.

“There have been great strides with stewardship to date – and people are now much more educated, qualified and knowledgeable about responsible rodent control,” said Mr Blaszkowicz.

The CRRU code of best practice offers a range of effective methods for successful rodent management,

Best practice guidelines should be followed on rodenticides

including eliminating harbourage, food, and water, trapping, shooting

When rodenticide application is however required, the handbook stresses the need for trained professionals to read the product label text and strictly adhere to the instructions

If residues carry on going up the food chain into the wildlife, the government may regulate to the effect that SGARs can no longer be used for infestation management, other than inside closed buildings.

NFU senior plant health adviser Alison Warrington said rodenticides were important tactic for rodent management on many farms, and reducing the risk of accidental exposure of humans and non-target animals remained a priority.

“It is imperative users continue to adhere to the best practice guidelines and product instructions, and where necessary, engage in continuing professional development, ensuring maximum knowledge and results from practical application.”

• Five-year strategy launched

• Markets and sustainability

• Focus on health and welfare

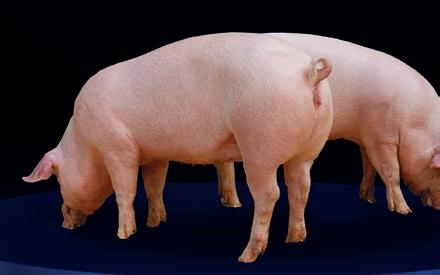

Plans to ensure dairy-beef calves are reared with purpose are achievable but not without their challenges, says a leading vet.

The GB Calf Strategy 2025-2030 was launched last month for the sector to ensure every calf is reared with care, purpose and value – including those which are often perceived as being of less value.

The five-year strategy was put together by the Agriculture and Horticulture Development Board, Innovation for Agriculture, the NFU and Ruminant Health and Welfare (RH&W). It follows the similar 20202023 GB Dairy Calf Strategy.

One focus is to drive better breeding strategies in the industry – by considering the end purpose of the animal from day one. It also means encouraging evidence-based best practice rearing management and advice.

Supporters say the strategy has been designed to ensure every calf has access to the right route to market – whether through an integrated dairy-beef scheme, direct sale or an auction market.

The goal is to embed best practice in the sector, says Holly Shearman

“Early-life care shapes a calf’s future

fessional stockmanship, and better health and welfare outcomes.

rear every calf with purpose.

Route to market

Sarah Tomlinson, lead veterinary science expert at AHDB said: “This new five-year strategy marks the next chapter for the industry, builds on the success of the outcomes already delivered and brings us all together for a shared vision.

“To reach its potential, we all believe that every calf born in Great Britain should have the right genetics, the right start, and the right route, as this will be critical in enabling thriving, sustainable and high-welfare beef and dairy industries.

“However, delivering on this ambitious strategy will not be without its challenges.”

Holly Shearman, head of

“We know that early-life care shapes a calf’s future, from its welfare and productivity to its resistance to disease, but care can vary hugely so our aim is to create a consistent approach that works in the real world but is rooted in science-led best practice.

NFU livestock adviser, Phoebe Traquair said: “Having a functioning and fair route to market that supports calf – and subsequent cattle – supply chains is essential for animal welfare, sustainability and profitability.

“With increasing pressure on farmers, we want to focus on removing market barriers for calves where possible. We need to ensure bio-secure routes to market are accessible to herds affected by bovine tuberculosis.

“The goal is to see standard operating procedures in place on all farms, peer networks to share learning, and a clear professional pathway for calf rearers."

RH&W chairman Gwyn Jones said: “There has been significant change since we initially developed a calf strategy back in 2020, but we all continue to have a role to play so this new five-year strategy is launching at a key time for the industry.

“Data will also play an important role to help improve productivity and already great traceability across the supply chain. Finally, we need to ensure domestic and international trade is facilitated at every opportunity.”

Dairy-beef calf registrations have risen by 74%

The strategy cab be downloaded from the Ruminant Health and Welfare (RH&W) website at r uminanthw.org.uk.

JDP supports the modern farm with products and solutions for livestock and equine feeding, cleaning and hygiene.

• CROP & ANIMAL HUSBANDRY

• LAND DRAIN

• MAINS SUPPLY

• STORMWATER

• RESIDENTIAL

CONTACT US

JDP Cambridge 01223 654310 cambridge@jdpipes.co.uk

JDP Norwich 01603 931318 norwich@jdpipes.co.uk www.jdpipes.co.uk

• Tight forage supplies this winter

• Look to maximise forage quality

• Can consider alternative options

Dairy farmers are being urged to carry out their winter forage budgets early to give them enough time to secure any additional feed requirements.

Farmers may be caught out if they leave it late to secure additional winter forage stocks, says Csaba Adamik, regional business manager for Lallemand Animal Nutrition. “It’s been a very mixed year for forage quality and quantity.”

While areas of Scotland, Wales and Northern Ireland have generally fared well, prolonged drought conditions in other regions have left farmers facing tight stocks going into autumn and winter.

“We’re already seeing some producers selling off low-yielding or problem cows to ease pressure, while others will have bought in extra forage or standing crops,” says Mr Adamik.

Forage quality

Producers who haven’t done so are advised to assess forage quality and quantity as a matter of priority.

“Make sure you complete your forage budget early because there’s still something you can do about it in early autumn.”

“If you leave it until late into the autumn, it can be difficult – especially in areas where there are forage shortages because you’ll be competing with other farmers in the area for any excess forage.”