As the academic year ends, one thing is clear—2024–25 was a defining year for Cornell Equity Research. A year of innovation, momentum, and cementing our position as the standard for student-led financial research. Since our founding in 2019, our mission has been set: to bring professional-standard financial research to the undergraduate campus. This year, we’ve not only lived up to that goal—we’ve exceeded it.

Our newly established CER Weekly Newsletter has quickly become the cornerstone of our research output, with 21 consecutive issues spanning seven sectors. This initiative has empowered members to engage consistently with the markets, raising the visibility and impact of student research at Cornell.

Meaningful steps to bolster our alumni network and relations have been taken, hosting six successful events with CER alumni working across leading financial institutions. These events not only provided insights into various sectors of the industry but also reinforced the lasting community CER continues to build.

This semester, we welcomed nine new members whose dedication and curiosity have added new energy to our team. At the same time, we proudly celebrate the graduation of ten seniors in the Class of 2025. Their dedication, rigour, and friendship have shaped the club’s identity in lasting ways—we thank them deeply and wish them the very best in the next chapter of their journeys.

As my term as President concludes, I’m incredibly proud of what we’ve achieved together. From launching our

first-ever weekly newsletter to expanding alumni engagement and standardizing our research output, this year has marked a transformative chapter in CER’s history.

These milestones reflect not only the progress of our fifth year but also the spirit of CER itself—bold, forward-thinking, and committed to excellence. I’ve always believed that CER should not just reflect the standards of the financial industry but help set them for student research. This year, we’ve moved many steps closer to that vision.

It has been a privilege to work alongside such an intelligent, motivated, and collaborative team. I’m thrilled to pass the torch to Khanh Nguyen, who will serve as President for the 2025–26 academic year. With her leadership, I have every confidence that CER will continue to innovate, inspire, and lead.

Thank you to every member, alumni, and leader who made this year possible. What we’ve built together in CER’s fifth year won’t just be remembered—it will be the foundation others build on.

Yours Sincerely,

Kaleb Kavuma President, 2024-25

As tariff headlines and near-record levels of uncertainty clouded global markets, the U.S. economy in the first quarter of 2025 presented a mixed picture of solid domestic demand undercut by significant external headwinds affecting markets to a near-unprecedented effect. Real GDP growth appears to have slowed sharply and may even have turned negative on an annualised basis due to a record trade deficit and inventory adjustments, even as core domestic consumption remained moderately positive i Consumer spending remained resilient overall, but momentum cooled from late-2024’s pace. Inflation stayed above the Federal Reserve’s 2% target, with headline CPI averaging around a 3% annualised rate in Q1 and core inflation somewhat higher. However, both measures showed modest deceleration over the quarter, with sticky core inflation partly fuelled by new import tariffs.ii The labour market stayed historically tight – unemployment hovered near 4.1–4.2% with broader underemployment ~7.9% – though job gains decelerated, and wage growth moderated to just under 4%.iii

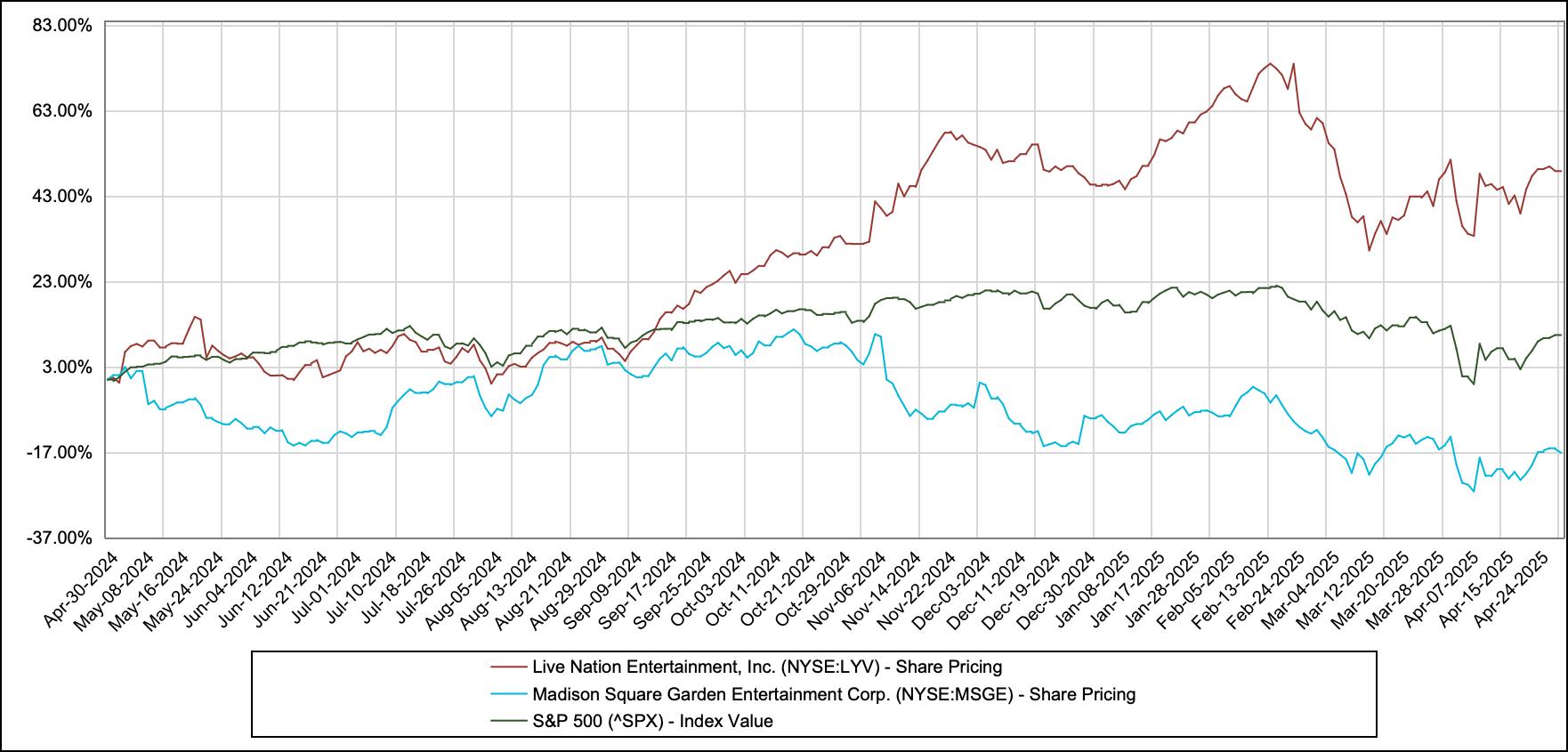

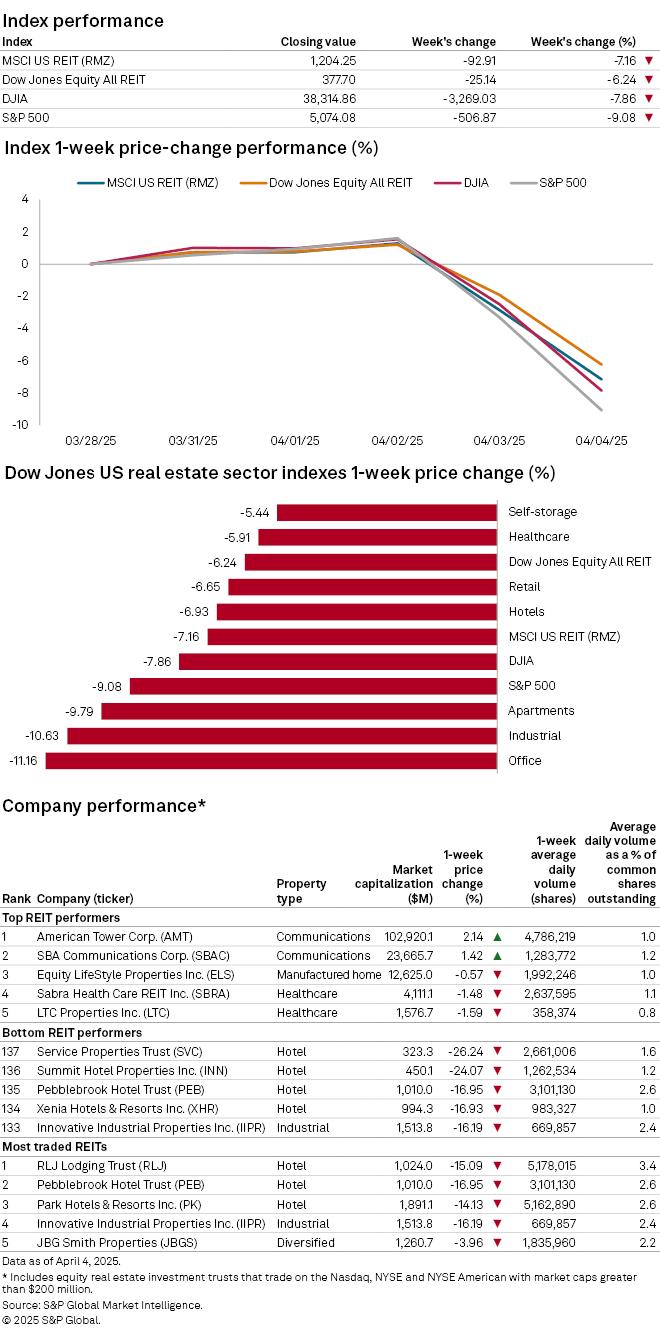

Equity markets experienced heightened volatility amid these crosscurrents. After a strong start to the year, stocks sold off in February, leaving the S&P 500 down at its worst 18.95% and 9.98% for YTDiv . Investor sentiment swung in reaction to monetary policy signals and trade turmoil. The Federal Reserve paused interest rate adjustments (holding the Federal Funds Effective Rate at 4.33%) as it assessed balanced risks between still-elevated inflation, emerging growth risks,v missteps, and reduced foreign demand for Treasuries. However, a new U.S. trade policy regime – including hefty tariffs on major trading partners such as Canada, China and Mexico as well as blanket global tariffs on all imports vi – sparked a surge in imports and retaliatory measures, rattling global markets, with some retaliations such as China’s reaching 125% in April 2025 prompting widespread concernvii .

The U.S. dollar, once buoyed by safe-haven demand, plunged to multiyear lows, down 9.28% YTDviii , as confidence in U.S. policy stability deteriorated ix . Meanwhile, bond yields spiked (the 10-year Treasury yield’s 50-basis point surge was its steepest weekly jump since Nov 2001x), reflecting fears of inflationary policy.

April 30, 2025

Term vs 2nd Term

are showing YTD)

Despite the turbulence, underlying domestic fundamentals remained somewhat positive. After decreasing significantly month-on-month in Jan ‘25 to -0.6% growth, the Real Personal Consumption Expenditures figure for March ’25 was up 0.6%, showing potential signs of growth and consumer resilience (BEA, Real Personal Consumption Expenditures; FRED series: PCEC96).

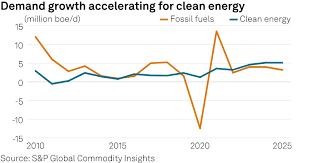

Key service industries continued expanding, and household balance sheets – buttressed by prior income gains – provided a cushion. Sector performance diverged: Industrial Production in the United States increased 1.3% year-on-year in March 2025, following an upwardly revised 1.5% rise in February. Utilities surged 4.4%, and both manufacturing and mining went up 1% xi (ISM Manufacturing PMI, March 2025: 49.0; Federal Reserve Industrial Production Index, Feb 2025), while Services PMI fell sharply to 50.8 in March 2025 from 53.5 in February, well below forecasts of 53 (ISM Services PMI, March 2025). High-growth technology stocks suffered a significant correction after two years of outsized gains (NASDAQ-100, S&P 500 Information Technology Sector, Q1 2025), yet energy and traditional value sectors fared better as leadership rotated. The U.S. trade deficit widened sharply, driven by a front-loading of imports as businesses and consumers accelerated purchases ahead of expected tariff implementation.

Fiscal and monetary policy were generally supportive of growth but approached an inflection point. The new administration in Washington pursued an agenda of “America First” trade rebalancing and industrial revival, introducing uncertainty even as it promised long-term benefits to domestic producersxii. The Fed struck a cautious tone, signalling readiness to adjust policy in either direction depending on incoming dataxiii

Overall, equity investors face a complex macroeconomic backdrop of moderating growth, persistent inflation, and escalating geopolitical risk. A disciplined, sector-selective approach is warranted, with emphasis on beneficiaries of policy shifts such as infrastructure and defence firms and companies with strong pricing power to weather the inflationary environment. Looking ahead to mid-2025, the baseline outlook is for continued sub-trend growth alongside an inflationary trend, with stagflation risk. However, significant uncertainty remains, from the timing of Fed policy adjustments to the potential escalation or de-escalation of trade tensions. While markets may price in individual risks or even a combination of them, the overarching challenge is the heightened uncertainty introduced by current U.S. policy direction and global instability.

Markets Perfotmance Q1 '25

This report provides an in-depth analysis of U.S. macroeconomic conditions in the first quarter of 2025, with an emphasis on implications for equity markets. It is tailored for industry professionals and investors, blending an investor-oriented perspective with academic rigour in assessing the data. The report covers the broad economy (growth, inflation, labour markets, and spending); sectoral performance in areas critical to equities; the policy environment (monetary, fiscal, and trade); international trade and capital flows; and key risks and uncertainties on the horizon. My goal is to distil how Q1 2025’s economic developments are likely to influence corporate earnings, valuation, and investment strategy going forward.

Methodology:

This analysis draws on official economic data releases from agencies including the Bureau of Economic Analysis (BEA), Bureau of Labour Statistics (BLS), and the Federal Reserve System (Fed). These include reports on gross domestic product (GDP), consumer spending, employment, and inflation. Where relevant, I also reference aggregated datasets from the Federal Reserve Economic Data (FRED) platform, the Survey of Professional Forecasters (SPF), and projections published by the Federal Open Market Committee (FOMC).

Primary sources (e.g., BEA, BLS, and the U.S. Census Bureau) are prioritised for accuracy and transparency, with FRED used to consolidate and standardise time series data. I incorporate insights from Fed communications including FOMC statements, meeting minutes, and speeches to capture evolving policy guidance and its influence on market sentiment. The

After a robust second half of 2024, U.S. real GDP growth downshifted markedly in Q1 2025. While the advance estimate is pending, preliminary models provide divergent signals. Growth was close to flat or slightly negative for the quarter. The Atlanta Fed’s GDP Now model estimated -2.4% growth as of April 9, while an alternative adjusted model put the figure closer to -0.3% (Federal Reserve Bank of Atlanta 2025) The Philadelphia Fed’s Survey of Professional Forecasters (SPF) had previously forecast +2.5% annualised Q1 growth, although this predated trade disruptions (Federal Reserve Bank of Philadelphia 2025). Meanwhile, Goldman Sachs and J.P. Morgan revised recession probabilities upwards to 45% and 60%, respectively, by late April (Bloomberg 2025).

Key Drivers: Consumer spending and government spending were positive contributors, while net exports and inventories likely made large negative contributions to Q1 GDP. In late 2024 the economy had considerable momentum – Q4 real GDP grew 2.4%, fuelled by strong consumer expenditure (+4.2% annualised in Q4 PCE). Entering Q1, underlying domestic demand stayed firm: final sales to private domestic purchasers (a measure excluding trade and inventories) are estimated to have grown around ~2% in Q1, indicating the U.S. private sector continued to expand at a moderate rate. However, businesses likely pared back inventory accumulation after the holiday buildup, and trade flows swung dramatically (as detailed in the Trade section), subtracting from headline growth. On a year-over-year basis, real GDP in Q1 2025 was roughly 1.6% higher than a year ago (subject to revision), reflecting the economy’s come-down from above-trend growth in 2021–2023 toward a slower trend. Notably, the range of estimates is unusually wide, highlighting elevated uncertainty. Optimistic scenarios see a soft landing with modest growth resuming by Q2; pessimistic views warn that Q1 could mark the start of a mild recession if consumption falters further. The SPF panel puts only a ~10% probability on Q1 2025 real GDP contracting, though that was before the tariff shock – subsequent developments suggest that risk was higher in reality.

Investor Implications: The abrupt growth slowdown has two primary implications for investors:

1. Corporate revenue growth may weaken in upcoming quarters, especially for industries reliant on trade and manufacturing, necessitating more cautious earnings expectations.

2. The slowdown increases pressure on the Federal Reserve to consider policy easing a dynamic that typically supports equity valuations if inflation risks are contained. However, as discussed in subsequent sections, inflation and policy constraints complicate this outlook.

Inflationary pressures in Q1 2025 remained elevated but showed early signs of moderation, with key differences between headline and core measures. The Consumer Price Index (CPI) from the U.S. Bureau of Labour Statistics (BLS) and the Personal Consumption Expenditures (PCE) price index from the U.S. Bureau of Economic Analysis (BEA) both increased at an annualised pace of approximately 3%–4%, above the Federal Reserve’s 2% target but far below the 2022 peaks (BLS 2025; BEA 2025a).

According to the Federal Reserve Bank of Philadelphia’s Survey of Professional Forecasters (March 2025), headline CPI inflation in Q1 was approximately 3.0% annualised, while headline PCE inflation was around 2.5% (FRBP 2025). These figures slightly exceeded earlier forecasts, suggesting inflation ran hotter than expected early in the quarter. Core inflation, which excludes volatile food and energy components, remained sticky: the BLS estimated core CPI at ~5.3% year-over-year, and the BEA reported core PCE at ~4.3% YoY as of February 2025 (BLS 2025; BEA 2025b). These levels reflect persistent inflation in service categories despite easing goods inflation. The PCE

index the Fed’s preferred inflation gauge rose 4.2% YoY in February, down from over 5% a year earlier, but still more than double the central bank’s inflation target (BEA 2025b).

Drivers of inflation in Q1 were mixed. Energy prices declined during the quarter, with WTI crude oil falling from around $76 in January to roughly $63 by April, with lows of $59, contributing to lower gasoline prices and deflation in the energy sub-index (FRED 2025a). However, tariff-related import cost pressures countered that disinflationary impulse. In March, the ISM Manufacturing PMI indicated that “price growth accelerated due to tariffs”, as businesses pre-emptively stockpiled goods ahead of higher duties. This likely pushed up input costs and flowed into final goods prices (ISM 2025). Meanwhile, services inflation particularly in housing, healthcare, and personal services remained robust, driven by wage growth and continued demand. The ISM Services PMI prices sub-index stayed above 60 throughout Q1, signalling elevated cost pressures across the service sector (ISM 2025).

Wage growth slowed somewhat, which may ease core inflation going forward. Average hourly earnings rose 3.8% year-over-year in March 2025, down from over 5% the previous year (BLS 2025). Yet, rent inflation persisted, with Owners’ Equivalent Rent (OER) still rising at an annual rate of around 6% in the CPI.

Looking ahead, investors are watching for further confirmation that inflation is trending downward. The Federal Reserve’s March 2025 Summary of Economic Projections forecasts PCE inflation at 2.7% (Q4/Q4) by year-end (Federal Reserve 2025). Market-based expectations (e.g., TIPS break-evens) and survey-based forecasts suggest a slow disinflation path, though the durability of tariff-related inflation shocks remains uncertain. Long-run expectations remain anchored the SPF panel pegs 10-year expected CPI inflation at ~2.3% a reassuring sign for markets (FRBP 2025). For equity investors, this creates a dual challenge: while moderating headline inflation supports purchasing power and real income growth, elevated core inflation continues to restrict the Federal Reserve’s ability to pivot toward easing. Sustained progress on core inflation would likely boost equity valuations by reducing both input cost pressures and interest rate overhangs.

In my view, the policy environment is turning what might otherwise have been a relatively well-understood and manageable inflationary environment into one marked by elevated uncertainty. While the underlying trend suggests gradual disinflation driven by cooling wage growth, easing energy prices, and anchored long-term expectations the introduction of new tariffs, shifting geopolitical dynamics, and the Federal Reserve’s data-dependent posture have injected renewed volatility into the inflation outlook.

Absent these shocks, inflation would likely have continued to moderate along a clearer trajectory, allowing the Fed greater flexibility to begin easing without risking credibility. Instead, policymakers now face a more complex tradeoff: act too soon and risk fuelling renewed price pressures; act too late and potentially deepen a slowdown already visible in GDP growth and labour market cooling.

Thus, while headline inflation is easing, core pressures particularly in services remain sticky.

This uncertain policy landscape complicates valuation and sector allocation decisions for investors. It raises the risk of mispricing both in duration-sensitive assets and in sectors heavily reliant on cost stability. For now, it reinforces the case for focusing on firms with pricing power and operational agility those able to weather a longer stretch of elevated input costs and unpredictable monetary responses. Until inflation’s trajectory is clarified, and the Fed’s reaction function becomes more transparent, markets are likely to remain sensitive to even minor inflation surprises or shifts in policy tone.

The U.S. labour market remained a source of strength in Q1 2025, though signs of cooling emerged in hiring and participation. The unemployment rate (U-3) held steady in a tight range, ending the quarter at 4.2% in March (little changed from ~4.0% late last year). Unemployment has plateaued in the low 4% range since mid-2024, indicating the jobs market has loosened only marginally from the ultralow 3.5%–3.7% rates of 2022–2023. The broad underemployment measure (U-6), which includes discouraged workers and part-timers who want full-time jobs, ticked up slightly to 7.9% in March (seasonally adjusted) from about 7.5% at the start of the quarter – still low by historical standards but reflecting a modest rise in labour under-utilisation. Notably, the number of people working part-time for economic reasons (4.8 million) was little changed in Q1, and labour force participation remained stable around 62.5% This suggests that while more workers are available than a year ago, the labour supply has not dramatically expanded.

Job growth continued in Q1 but at a slower pace. Monthly payroll gains averaged roughly +150k in Q1 (after revisions) – for instance, +228,000 jobs in March, but January and February were revised down to ~+111k and +117k, respectively. This marks a deceleration from the 2024 average (~250k/month). The cooling was most pronounced in interest-rate-sensitive sectors and those affected by trade uncertainty. For example, manufacturing payrolls were flat to down in some months, and the ISM report noted manufacturing employment contracting in March In contrast, services sectors like health care, social assistance, transportation, and retail continued to add jobs in March, even getting a temporary boost from the resolution of a retail strike. Wage growth decelerated in tandem. Average hourly earnings for all private employees rose 0.3% in March (MoM) and 3.8% over the past year – a clear step down from ~5% annual wage gains seen in 2022 Wage increases are now only slightly above inflation, meaning real wage growth is just turning positive after a prolonged squeeze on households. The easing of wage pressures is a welcome development for the Fed’s inflation fight, though it could slightly dampen consumer spending power compared to the robust real income gains of 2020–2021.

From an investor viewpoint, the Q1 labour data sends mixed signals. On one hand, continued low unemployment underpins consumer confidence and spending – a positive for sectors like consumer discretionary and financials (credit quality tends to remain strong when employment is high). Solid job gains in services indicate that the domestic economy isn’t falling off a cliff, supporting earnings in those industries. On the other hand, slower overall hiring and higher unemployment than a year ago hint at later-cycle dynamics; companies facing profit margin pressures have become more cautious on expanding payrolls. Importantly, unit labour costs may start to stabilise or even fall if productivity picks up and wage growth cools, which would be positive for corporate margins in the long run. In Q1, productivity growth was modest, but if businesses adjust to higher interest rates by investing in efficiency (automation, etc.), it could bolster output per worker.

A Final Note: labour market risks include the possibility of a sharper slowdown in hiring if profit warnings rise and potential strikes or labour disputes as workers seek to keep up with inflation (the quarter saw some disruptions, though not on the scale of 2023’s industrial actions). So far, the labour market has achieved a very delicate balance –cooling enough to ease inflation fears but not so much as to cause a collapse in income and demand. Maintaining that balance will be critical for a soft landing. Still, this balance remains precarious, especially if profit margins erode further.

Consumer spending – which comprises about 68% of GDP – grew in Q1 but at a moderate and uneven pace. Real Personal Consumption Expenditures (PCE) appear to have increased only slightly quarter-on-quarter, a slowdown from the vigorous 4.2% annualised growth in Q4. Monthly data show a dip in spending in January followed by a rebound in February: real PCE fell -0.3% in January but then rose +0.4% in February. Early indications (e.g., credit card spending trackers) suggest March was modest, resulting in roughly 1–2% annualised real consumption growth for Q1 as a whole. Households started 2025 on a cautious note; perhaps post-holiday retrenchment and higher utility bills in a cold January dented discretionary outlays. The February bounce-back was encouraging and partly weather-related (a warm spell and improved auto inventories boosted sales). Retail sales figures (ex-auto) similarly showed a January drop and February recovery, reflecting this volatility. Consumers also shifted spending patterns: goods outlays were choppy (down in January, up in Feb), while services spending – on travel, dining, healthcare, etc. – maintained a steadier climb, benefiting from the ongoing normalisation of activities.

Several factors influenced consumer behaviour in Q1:

• Inflation and Real Incomes: Easing inflation improved households’ purchasing power compared to a year ago. Real disposable income grew in Jan/Feb as headline inflation cooled and cost-of-living adjustments (e.g., to Social Security cheques) kicked in. However, the re-imposition of student loan payments (for those whose moratorium ended) and higher shelter costs absorbed some of that gain. Wage growth, while slower, still ran above inflation (3.8% vs ~3% CPI), yielding slight real wage gains. This helped support consumer spending, especially for lower-income cohorts, who had been squeezed by high inflation previously.

• Labour Market Strength: High employment levels provided income security. The unemployment rate stabilising just above 4% means relatively few people experienced job loss. Job additions, though slower, were enough to keep aggregate labour income on an upward trend. Consequently, consumer confidence was mixed: the University of Michigan index dipped in February on tariff fears, but overall sentiment remained far above recessionary lows, buoyed by employment optimism.

• Tariff-Driven Buying Behaviour: Anticipation of tariffs on various consumer goods led to some front-loading of purchases. There is anecdotal evidence (and some survey data) that consumers and businesses rushed to buy big-ticket items (appliances, electronics, and even jewellery) before higher import duties took effect. This could explain strong durable goods spending late in 2024 and a giveback in early 2025. Indeed, durable goods PCE jumped at a 12% annual rate in Q4 2024, then likely flattened in Q1 as those purchases were satiated. I expect some payback in Q2 as well, meaning consumer spending might downshift further absent new stimulus.

• Excess Savings and Credit: Households still hold some excess savings from earlier fiscal stimulus, but that buffer is dwindling and skewed toward higher-income families. The personal saving rate hovered around 4–5% in Q1, up from record lows but below long-term norms, indicating consumers are not overly cautious. Credit card and consumer loan data show higher borrowing – household debt rose by $93 billion in Q4 2024 and likely continued rising in Q1 – which suggests consumers are willing to leverage to maintain spending. However, rising interest rates have made credit card balances more expensive, and delinquency rates have inched up from historic lows (though remain manageable). This dynamic bears watching, as a significant tightening of credit conditions could constrain spending for more indebted households.

In summary, the U.S. consumer in Q1 2025 was still spending, but selectively. Essentials and pent-up service demand were funded, while more discretionary purchases saw some tightening. Real consumer spending growth of roughly 1% (annualised) likely contributed only about ~0.7 percentage points to Q1 GDP growth, a noticeable drop from the 2+ point contribution in late 2024. For equity investors, this means revenue growth in consumer-oriented sectors (retail, restaurants, travel) was positive but not booming in Q1. Companies with pricing power likely fared better, as consumers became more price-sensitive. The quarter also showed that consumer behaviour can pivot quickly with shifts in policy expectations – a risk going forward if, for instance, uncertainty around the debt ceiling or further tariffs undermines confidence. On the upside, as inflation ebbs and if wage gains are sustained, consumers could regain momentum later in 2025, supporting a reacceleration in consumption. Much will depend on how the labour market and fiscal policy evolve, as well as the trajectory of household savings and credit conditions.

International trade became a front-and-centre issue in Q1 2025, as the U.S. implemented new tariff measures that reverberated through trade balances, exchange rates, and capital flows. Meanwhile, the broader global macro environment – including a modest recovery in Europe and challenges in China – influenced U.S. external sectors. Here I assess the trade balance, exchange rate movements, capital flows, and global trends and their implications.

The United States entered 2025 with a historically large trade deficit, and Q1 saw that deficit surge to record levels. In January, the overall trade gap (goods and services) widened by 34% in one month to an all-time high of $131.4 billion This spike was driven primarily by an imports surge: total imports leapt 10% in January (the most since mid2020), as businesses front-loaded purchases ahead of new tariffs. According to the Commerce Department, goods imports hit a record $329.5 billion in January. The composition of this import spike is telling – there was a $23 billion jump in industrial supplies/materials imports (mostly gold and metals), plus notable increases in consumer goods like pharmaceuticals, mobile phones, and capital goods like computers. Essentially, importers rushed to bring in items before tariffs on key trading partners (China, Mexico, and Canada) took effect or increased. Exports, in contrast, rose only 1.2% in January, not nearly enough to offset the import bill, hence the blowout deficit.

February data (advance figures) suggested some reversal – imports likely cooled after the January binge, and exports grew slightly. The goods deficit narrowed in Feb from January’s extreme, but the 3-month average deficit ending in January was $102.6B per month, far higher than the prior quarter. Net exports therefore are almost certainly a large drag on Q1 GDP, which aligns with the weak GDP Now estimate.

• Trade with specific partners: The trade policy changes targeted North American neighbours and China in particular. In early March, President Trump imposed a new 25% tariff on all imports from Mexico and Canada and doubled tariffs on Chinese goods from 10% to 20%. These actions immediately impacted trade flows:

• China: U.S. goods trade with China had already been on a downtrend due to the earlier trade war. The deficit with China in January was -$31.7B (goods only), and interestingly, it shrank to -$21.1B by February, likely because U.S. imports from China dropped off sharply once tariffs increased. However, those “lost” Chinese imports partly shifted to imports from other countries (Vietnam, etc.) or from surging domestic inventory drawdowns, so the overall import bill didn’t shrink as much. China, for its part, retaliated with tariffs on certain U.S. exports like large agricultural products (e.g., a mooted tariff on U.S. corn and pork was signalled). This likely contributed to weaker U.S. exports of agriculture to China in Q1.

• Mexico and Canada: These are the #1 and #2 U.S. trading partners. The tariffs on them were controversial domestically (given integrated supply chains). Mexican goods imports jumped in January as companies rushed in shipments of auto parts, electronics, etc., ahead of tariffs. I saw border congestion in late Jan as trucks rushed to beat deadlines. The January trade deficit with Mexico widened. By Feb-March, some U.S. importers cut back, awaiting clarity or trying to source elsewhere. Canada’s case is similar; one unique aspect was oil – the U.S. imports a lot of Canadian crude, which was included in tariffs, raising costs for U.S. refiners in the Gulf. There’s talk of exemptions for strategic imports, but none are implemented yet. Both Mexico and Canada announced partial retaliatory tariffs on U.S. exports in March (Mexico targeted certain manufactured goods, and Canada on U.S. steel). The new strain puts the USMCA trade pact under pressure – ironically, the USTR’s agenda calls for a review of USMCA’s impacts ahead of 2026.

• Others: The EU had not been directly targeted by new U.S. tariffs in Q1, but it responded to a lingering dispute (maybe over digital service taxes or steel) by placing retaliatory tariffs on select U.S. goods in March. The items were small scale but symbolic (Harley-Davidson motorcycles, some ag goods). The U.K. and allies haven’t joined the tariff war but are wary. Meanwhile, U.S. trade with other Asia (Vietnam, India, etc.) increased as supply chains rerouted around China’s tariffs. Emerging market exporters of commodities (e.g., Brazil for soy) took some U.S. market share in China.

Capital flows and investment: The trade turmoil influenced capital flows significantly. Typically, a larger trade deficit is financed by capital inflows (foreign investment in U.S. assets). But in Q1, I saw unusual patterns:

• Foreign Portfolio Investment: As noted, foreign investors (especially central banks and sovereign funds) became net sellers of U.S. Treasuries in late March. The loss of confidence in U.S. policy stability due to erratic tariff moves led to what Reuters described as offshore funds fleeing Treasuries, causing yields to spike. The dollar’s steep decline also suggests reduced appetite for U.S. assets – global investors might have reallocated toward European or Japanese assets, expecting those economies to suffer less from a trade war. Indeed, anecdotal reports say March saw large outflows from U.S. equity funds and some outflows from U.S. bond funds, while European markets had inflows (helping their outperformance). If such trends persist, financing the U.S. deficit could force higher interest rates to attract capital.

• FDI and Corporate Flows: On the flip side, onshoring sentiment rose. Some multinational companies announced plans to invest in U.S. production (to avoid tariffs and benefit from incentives), e.g., there were new factory announcements in the Midwest for electronics assembly (spurred by tariffs on imported finished goods). This could portend a pickup in foreign direct investment (FDI) into the U.S. manufacturing sector over time. Q1 data on FDI isn’t in yet, but I might see an uptick in commitments. However, uncertainty can also delay investments – companies might wait to see if tariffs are permanent or negotiable.

• U.S. Investment Abroad: U.S. firms also repositioned. Some offshore production further to circumvent China tariffs (moving from China to Vietnam, etc.), which is a continuation of the “China+1” strategy many had adopted. Also, U.S. financial flows to emerging markets may have increased given the relative undervaluation (and maybe some speculation that emerging Asia will benefit from the U.S.-China rift).

Currency markets reacted strongly to the new U.S. trade policies. The U.S. dollar, which had been relatively strong in 2024, weakened notably in Q1 2025. By early April, the dollar index (DXY) was down roughly 7% year-to-date, reaching its lowest levels in about a decade against some currencies. The dollar fell below $1.15 per euro (from $1.08 at end-2024) and hit multi-year lows versus safe havens like the Swiss franc. The sharp drop in the dollar in late March – described as a “flash crash” by traders – was directly linked to the erosion of trust in U.S. policy consistency. Traditionally, when the U.S. imposes tariffs or seems willing to tolerate a weaker dollar to improve

trade balances, the FX market often marks down the currency. Moreover, rising U.S. yields would normally attract capital and support the dollar, but in this case, the reason yields spiked (loss of safe-haven status) spooked investors enough that it hurt the dollar. Analysts like NAB’s Ray Attrill noted an “almost overnight loss of safe-haven attributes” for the U.S., an extraordinary statement. Essentially, the currency market saw the U.S. as exporting instability rather than being a refuge from it.

Other currencies responded accordingly: the euro and yen strengthened against USD. The euro’s rise was also supported by the Eurozone avoiding recession and the ECB still in tightening mode. Emerging market currencies were mixed – some that benefit from commodity exports or alternative supply chain roles (like the Brazilian real and Mexican peso after an initial dip) held up, whereas those reliant on U.S. demand had more volatility.

From the U.S. perspective, a weaker dollar does have a silver lining: it makes U.S. exports more competitive and imports more expensive, which theoretically helps narrow the trade deficit (over time). Indeed, in March the dollar depreciation likely started to marginally help exporters. However, the flipside is imported inflation – a weaker dollar can push up prices of imported goods and commodities, potentially complicating the inflation fight. The Fed will weigh this if the trend persists. For now, the Treasury seems content to let the market dictate the dollar while emphasising that erratic moves are unwelcome. I should note that if the dollar decline were to become disorderly, coordinated intervention could be considered, but that’s premature.

For equity investors, currency moves can affect the earnings of multinationals: the weakening dollar is actually a tailwind for U.S. companies’ foreign revenues, as those translate into more dollars. This is especially relevant for sectors like tech and industrials with large overseas sales. For foreign companies, the stronger euro/yen can be a headwind. Thus, the dollar’s path will influence earnings in coming quarters (Q1 likely saw some forex losses for companies hedged expecting a stronger dollar, but going forward it may boost guidance).

The macroeconomic landscape is fraught with risks and uncertainties that could materially impact both the real economy and financial markets. Investors should remain vigilant of these potential pitfalls:

Treasury Market Breakdown: An additional risk is the potential for a disorderly sell-off in the U.S. Treasury market. With over $7 trillion in debt maturing in 2025, the government faces significant refinancing needs amid already elevated deficits If demand particularly from foreign buyers continues to weaken due to rising geopolitical tensions and diminished confidence in U.S. fiscal discipline, bond supply could overwhelm demand. This scenario would exert downward pressure on prices and upward pressure on yields, potentially destabilising financial markets. Term premiums have already risen, reflecting increased uncertainty, and Treasury prices have declined significantly since 2020. If this trend accelerates, it could trigger broader financial instability pushing mortgage rates higher, undercutting equity valuations, and tightening credit across the economy. For investors, the takeaway is clear: the U.S. government bond market may collapse and cause not only a domestic recession but fundamentally and irreversibly alter the long-term trajectory for the United States as a key entity in the global financial market.

Monetary Policy Missteps (Fed Risks): The Federal Reserve faces a narrow path. One risk is tightening too little, allowing inflation to become entrenched at a high level, which could force more aggressive hikes later and derail the economy. Conversely, tightening (or staying too tight) for too long could choke off the recovery and tip the economy into an unnecessary recession. This “stop-go” policy risk is reminiscent of past episodes. So far, the Fed has paused, but if inflation surprises on the upside in Q2 (perhaps due to tariffs and dollar weakness), the Fed might resume hikes,

catching markets off guard. The Fed’s own projections show core inflation still above 2% through 2025 – if that persists, the Fed might keep rates higher for longer than markets expect, pressuring equity valuations. Additionally, communication risks are high: a misinterpreted Fed statement or a dissent within the FOMC could inject volatility. In short, there’s a risk of a policy error, either by prematurely easing (reigniting inflation) or over-tightening (causing a hard landing).

Persistent or Resurgent Inflation: While inflation has come down from peaks, there’s a non-trivial risk it persists above target or even reaccelerates. Potential catalysts include a wage-price spiral – though wage growth moderated to 3.8%, it’s still above productivity growth, which could sustain services inflation. If tariffs remain or escalate, import prices could drive a new wave of cost-push inflation (already ISM noted tariffs lifting prices ). Energy prices could swing upward – for example, OPEC+ could cut output in Q2 to prop up oil, or geopolitical tensions (Middle East flare-up) could spike oil prices, feeding into headline inflation. Sticky shelter costs are another worry; if housing rents don’t decelerate as expected, core CPI will stay elevated. Inflation running at, say, 3% into late 2025 would mean higher real yields and likely lower equity multiples. It would also erode consumer real incomes again, threatening corporate revenues. The risk of stagflation (low growth + persistent inflation) cannot be ruled out, which would be a worst-case for many assets.

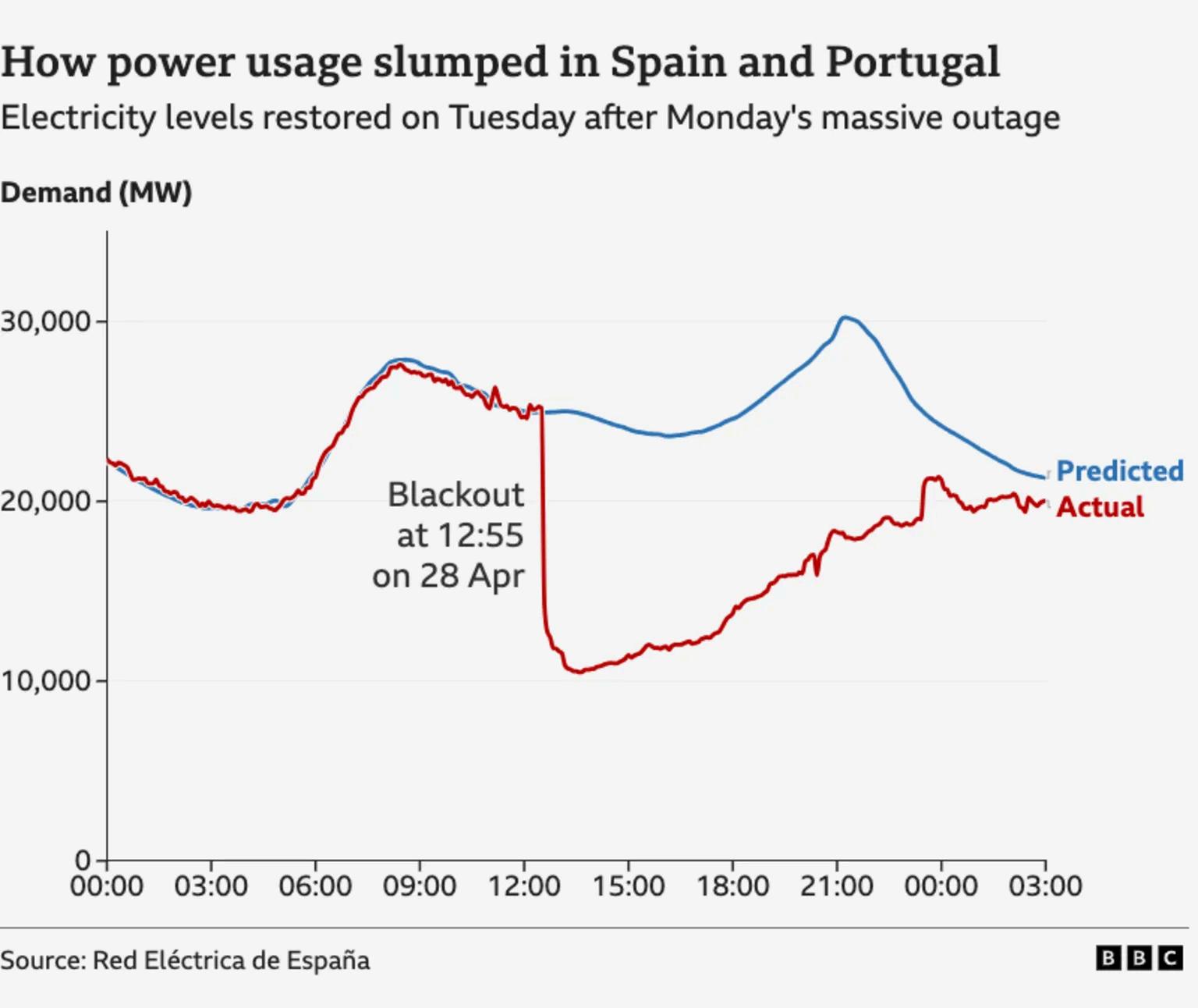

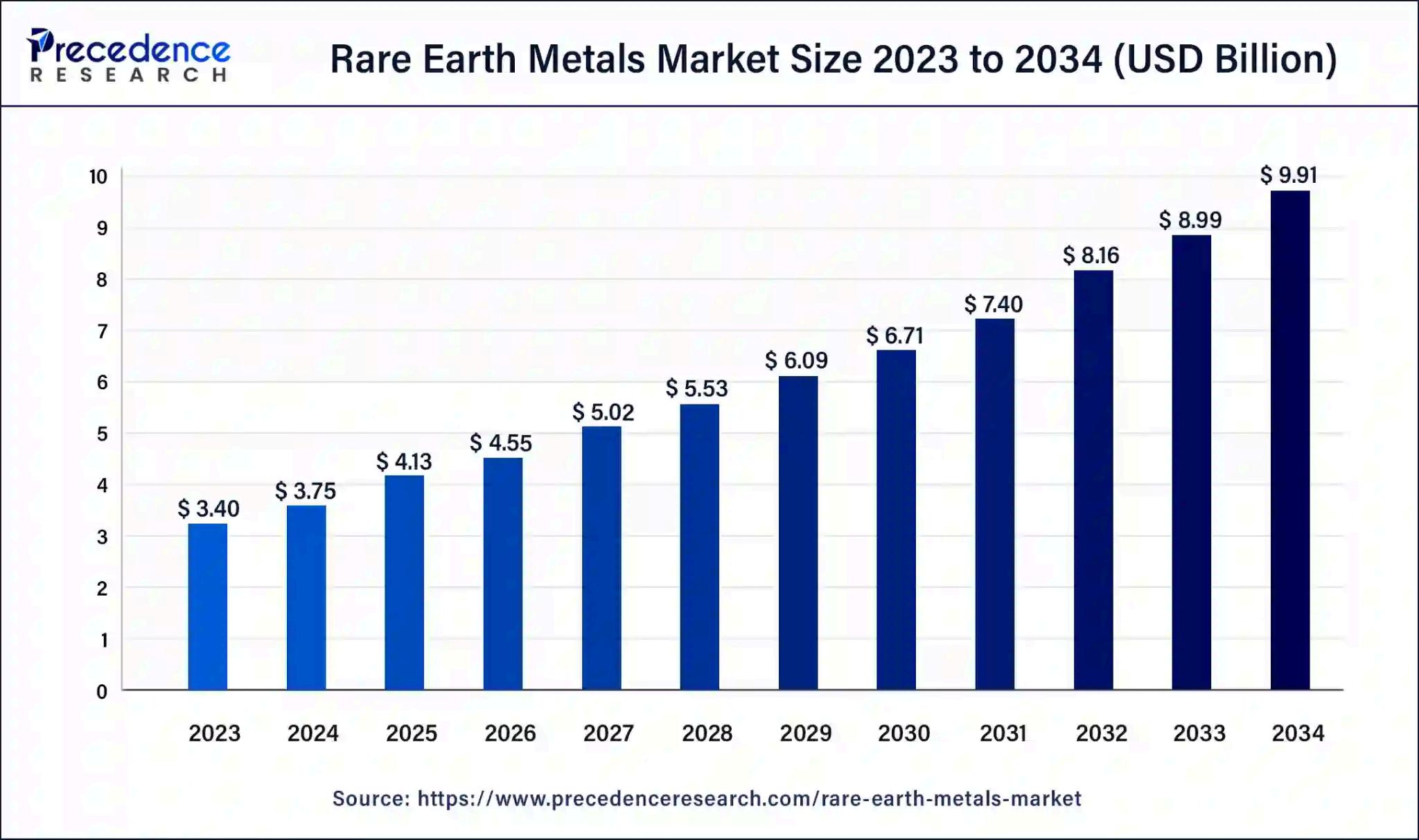

Geopolitical Risks: The war in Ukraine remains a significant wildcard. Thus far, the economic damage is mostly localised to Europe via energy, but an escalation – e.g., if the conflict spills beyond Ukraine or if a disruptive cyberattack hits Western infrastructure – could shock markets. There’s also risk around war fatigue: changes in U.S./European political support could alter the war’s course, with unpredictable consequences for European stability and defence companies’ prospects. The China-Taiwan situation is perhaps an even greater tail risk. Any military confrontation or blockade involving Taiwan would likely cause a major global downturn: it could sever the flow of semiconductor chips (Taiwan makes the majority of advanced chips), hobble tech supply chains, and likely prompt harsh sanctions that fragment the global economy severely. Even short of conflict, increased military posturing in the Taiwan Strait ups uncertainty. Meanwhile, U.S.-China decoupling might intensify – if negotiations fail, the tariff war could broaden or tech decoupling could accelerate (China could retaliate by restricting exports of rare earth minerals essential to U.S. tech manufacturing, for example). Geopolitical tensions also raise the risk of cyber warfare or trade alliance reshuffling (e.g., China deepening ties with sanctioned states, undermining Western sanctions' efficacy).

Trade War and Protectionism Spiral: The tariffs introduced by the U.S. have already provoked retaliation from multiple partners. There’s a risk of a protectionism spiral – allies imposing their own tariffs, WTO disputes going unenforced (the WTO’s arbitration is hamstrung already). If global trade fractures further, companies could face rising costs and lost markets. Sectors like agriculture and autos are particularly vulnerable if foreign markets close off. Investors should watch for any signs that negotiations might resolve these issues vs. signs they will escalate (e.g., an absence of talks by summer would be worrying). Also, supply chain disruptions could reappear if countries impose export controls (imagine China limiting rare earth exports or medical supplies in response to U.S. actions). Less globalisation could mean structurally higher inflation and lower global growth – not an immediate shock, but a grinding risk.

Financial Market Instability: The volatility in late Q1 is a reminder that financial stability can be tenuous. Rapid interest rate changes have the potential to cause stress in debt markets. For instance, the “largest weekly rise in Treasury yields since 1982” indicates unusual stress – such moves can hurt portfolios of leveraged investors (like hedge funds using Treasuries as collateral) or banks’ balance sheets (as bond prices fall). A specific concern: commercial real estate (CRE). With higher rates and shifts in office usage, CRE valuations are under pressure, which could hit regional banks that have large CRE loan books. A spike in CRE loan defaults might pose systemic concerns. Similarly, corporate debt risk is inching up – Moody’s projects default rates on speculative-grade loans could rise to

post-2008 highs by the end of 2025 If credit spreads blow out, weaker companies might face refinancing crises. The leveraged loan and private credit markets, which grew in low-rate times, have yet to be tested in high-rate environment; problems there could ricochet into broader markets. Non-bank financial institutions (like certain fintechs or shadow banks) could be another locus of risk if liquidity dries up. On the flip side, if the economy sharply weakens, deflationary or liquidity trap risks (less likely, but possible if, say, inflation plunges, and the Fed has to slash rates quickly) could lead to near-zero rates and financial repression.

U.S. Fiscal Showdown: The upcoming debt ceiling debate is a critical risk in mid-2025. Political polarisation is high, and a miscalculation could result in a technical U.S. default or at least a close call. In 2011, such brinkmanship led to a U.S. credit rating downgrade and a stock market correction. A repeat would likely roil bond markets and cause a spike in volatility. Even absent default, resolving the trajectory of U.S. fiscal deficits is important – continued large deficits might push yields structurally higher if foreign demand stays weak, crowding out private investment (bad for long-run growth) and raising the government’s interest burden (which could eventually force spending cuts or tax hikes, affecting sectors like defence or healthcare which rely on federal funding).

Pandemic or Other Tail Risks: While COVID-19 is no longer front-page, the risk of a new variant or another type of pandemic (or, say, a biosecurity threat) always looms. Such an event could shock demand/supply in unforeseen ways. Other natural disasters (climate-related events, etc.) could also have outsized impacts, e.g., a severe hurricane season affecting oil refining or a drought hitting agriculture yields (pushing food inflation up and straining farm incomes).

In assessing these risks, I note that not all are equal probability. Some (like the debt ceiling and Fed policy error) are relatively likely in the next 3-6 months, while others (Taiwan conflict) are low-probability but high-impact. Investors should consider stress-testing portfolios against scenarios: What if inflation is 1% higher than base case? What if the Fed has to hike to 6%? What if global GDP is 1% lower due to a trade war?. Diversification, quality bias (strong balance sheets), and perhaps increasing exposure to defensive assets (like certain commodities or gold, which often shine in geopolitical crises) could be prudent hedges. Indeed, gold’s import surge in Q1 suggests some savvy actors are hedging

On the positive side, if many of these risks don’t materialize (i.e., gradual easing of inflation, no major geopolitical flare, etc.), there’s upside potential for a relief rally and stronger growth than expected (a “Goldilocks” scenario). But given the current environment, it’s wise to assume a more volatile road ahead, with above-mentioned risks as key mile-markers to watch.

Q1 2025 was a crossroads for the U.S. economy – a quarter where post-pandemic growth momentum encountered new headwinds from policy shifts and global uncertainties. The data show an economy that is resilient yet slowing: consumer and business fundamentals remain intact, but aggregate growth likely stalled due to a policy-induced trade shock and the cumulative effect of past monetary tightening. Inflation is off its peaks but not yet vanquished, keeping policymakers on alert. Financial markets have reacted by repricing risk, resulting in higher volatility and divergent sector performance.

Unfortunately, I don’t believe in macroeconomic forecasts, especially in unprecedented times like this, so my outlook is one of cautious optimism tempered by significant risks. A recession is still possible, and so too is a huge rally after potential policy corrections. Caution, timing, and risk management will be the name of the game.

Appendix A: Key Economic Indicators and Data Sources (Q1 2025)

• Nonfarm Payrolls: Bureau of Labour Statistics (BLS), Establishment Survey (CES). Q1 2025 monthly average: ~150k jobs. March +228k (Jan +111k, Feb +117k after revisions). FRED series: PAYEMS.

• Wage Growth: BLS, Average Hourly Earnings (Total Private). March 2025: $36.00, +3.8% YoY. FRED series: CES0500000003. Employment Cost Index for Q1 2025 due late April; Q4 2024 was +4.6% YoY.

• Consumer Spending: Bureau of Economic Analysis (BEA), Real Personal Consumption Expenditures (PCE). Jan 2025: -0.3% MoM; Feb 2025: +0.4% MoM. FRED series: PCEC96. Retail Sales (Census Bureau), ex-auto: Jan -2.0%, Feb +0.2%. FRED series: RSAFSNA.

• ISM Manufacturing PMI: Institute for Supply Management (ISM), Manufacturing Report. Mar 2025: 49.0. FRED series: NAPM.

• ISM Services PMI: ISM, Services Report. Mar 2025: 50.8. Note: No direct FRED series.

• Industrial Production Index: Federal Reserve, G.17 Release. Feb 2025: +0.7% MoM. FRED series: INDPRO (total), IPMAN (manufacturing). Capacity Utilisation: Feb 2025 manufacturing 77.0%. FRED series: MCUMFN.

• Federal Funds Rate: Federal Reserve, target range 4.25–4.50%, effective ~4.33%. FRED series: FEDFUNDS.

• 10-Year Treasury Yield: Market yield. End-Mar 2025 ~4.7%. FRED series: DGS10.

• Trade Balance: BEA/Census Bureau. Jan 2025 deficit: -$68.3B in goods, -$131.4B total. Feb 2025 advance deficit ~$91B. FRED series: BOPGSTB.

• Exchange Rate: Federal Reserve, Broad Dollar Index. Mar 2025 average ~105. FRED series: DTWEXBGS.

• Commodity Prices: WTI crude ~$70 in Q1. FRED series: MCOILWTICO. Natural gas ~$3 (EIA). Gold ~$2000/oz (market data).

• GDP & National Accounts: BEA GDP release (March 27, 2025); FRED GDPC1. Bloomberg ticker: GDP CQOQ Index.

• Labour Market Data: BLS Employment Situation (monthly); FRED: UNRATE, U6RATE. Bloomberg: USURTOT, NFP TCH Index.

• Inflation Data: BLS CPI (Apr 2025 for Mar CPI), BEA PCE (Mar 28, 2025, for Feb). FRED: CPIAUCSL, PCEPI. Bloomberg: CPI YOY, PCE Deflator.

• ISM & PMI: ISM official site. Bloomberg: NAPMPMI (Mfg.), NMAPMNON (Services).

• Industrial Production: Federal Reserve G.17 (Mar 2025). FRED: INDPRO. Bloomberg: IP CHNG.

• FOMC Policy Info: Federal Reserve statements and minutes (e.g., Jan 29, 2025). FRED: FEDFUNDS. Bloomberg: FOMC.

• Trade Data: Census Bureau FT900 (Mar 6, 2025). FRED: BOPGSTB. Bloomberg: USBALBS$.

• Global Indicators: IMF World Economic Outlook (Apr 2025). China data: NBS. Eurozone: Eurostat. Bloomberg: ECSTCHIN, GRGRACEZ.

• Adjustments: All data seasonally adjusted unless noted. GDP is shown as annualised QoQ. Monthly indicators are shown MoM unless stated.

• Surveys vs Official: Surveys (e.g., ISM, sentiment indexes) used as directional indicators, not exact measures.

• FRED Series: All time-series data retrieved via Federal Reserve Economic Data (FRED). Codes provided for traceability.

• Bloomberg Codes: Market-relevant Bloomberg codes are included for reference where applicable.

• Forecasts: Based on FOMC Summary of Economic Projections, SPF, and private forecasts.

• Data Access: Primary source sites: bea.gov, bls.gov, census.gov, federalreserve.gov, ismworld.org, ustr.gov.

i Real GDP Growth: BEA, Gross Domestic Product (Quarterly, SAAR). Q4 2024: +2.4%, Q1 2025: ~0% (est.). FRED series: GDPC1 for real GDP level; advance estimate via BEA News Release. Atlanta Fed GDP Now tracking: -2.4% as of Apr 9 (standard model)

ii BLS, Consumer Price Index – All Urban Consumers (CPI-U). March 2025 CPI ~3.0% annualized (Q1), headline CPI around 3% annualized rate; core CPI somewhat higher (~5.3% YoY as of March 2025 estimate).

FRED series: CPIAUCSL (all items SA), CPILFESL (core CPI).

PCE Price Index: BEA, Personal Income and Outlays. Feb 2025 headline PCE +5.0% YoY (est.), core PCE +4.3% YoY (est.)

FRED series: PCEPI (headline), PCEPILFE (core)

iii BLS, Current Population Survey. March 2025: 4.2% (SA). Jan–Mar range: 4.1–4.2%. Broader underemployment (U-6): ~7.9% as of March 2025.

FRED series: UNRATE (U-3), U6RATE (U-6).

iv Worst drop from “Liberation day” Feb 19th, 2025, to April 8th, 2025. YTD as of April 20th, 2025.

v Board of Governors of the Federal Reserve System (US). Federal Funds Effective Rate, 4.33% as of April 2025. FRED, Federal Reserve Bank of St. Louis. Accessed April 20, 2025. https://fred.stlouisfed.org/series/FEDFUNDS

vi Trump, Donald J. Executive Order 14257 of April 2, 2025: Regulating Imports With a Reciprocal Tariff To Rectify Trade Practices That Contribute to Large and Persistent Annual United States Goods Trade Deficits. Federal Register 90, no. 65 (April 7, 2025): 15041–15109.

vii Xiao, Josh. “China Raises Tariffs on US Goods to 125% in Retaliation.” Bloomberg, April 11, 2025. https://www.bloomberg.com/news/articles/2025-04-11/china-raises-tariffs-on-us-goods-to-125-in-retaliation.

viii As of April 20th, 2025.

ix Yahoo Finance. US Dollar Index (DX-Y.NYB). Accessed April 20, 2025.

x McGeever, Jamie. “Trading Day: Tariff Relief, but How Brief?” Reuters, April 14, 2025.

xi Trading Economics. “United States Industrial Production.” Accessed April 20, 2025. https://tradingeconomics.com/united-states/industrial-production.

xii Trump, Donald J. “Presidential Memorandum on America First Trade Policy.” The White House, January 20, 2025. Available at: https://www.whitehouse.gov/presidential-actions/2025/01/america-first-trade-policy/.

xiii Board of Governors of the Federal Reserve System. “Federal Reserve issues FOMC statement.” March 19, 2025. https://www.federalreserve.gov/newsevents/pressreleases/monetary20250319a.htm.

Insearchforthewinningracehorse-the�rst100daysofthe Trumppresidencyhavecreatednear-termturmoilascompanies rush to adapt. However, this has created an opportunity for innovativecompaniestoemergeasgainersfromthevolatility As tari� impacts trickle down, consumerhealthcontinuestobear thebruntofmacroeconomicuncertaintyaslarge-caphealthcare companiesshedunderperformingsegmentswhilekeepingwatch foropportunisticacquisitions.

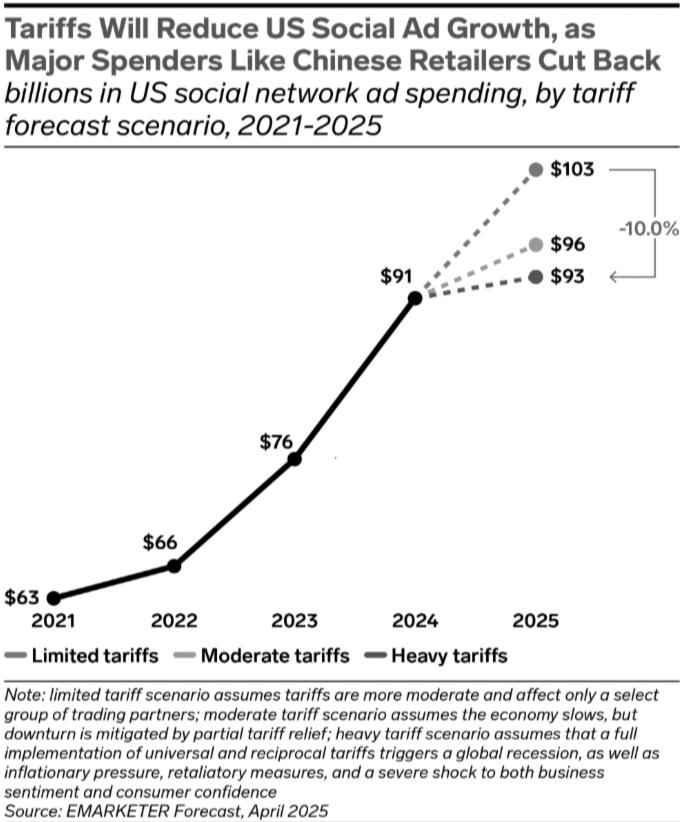

Regulatory spotlight: despite supply chain diversification and domestication efforts during COVID-19, a substantial amount of Active Pharmaceutical Ingredients (APIs) and 48% and 13% of finished medications are manufactured in India and China, respectively Generics heavily reliant on Chinese APIs are projected to have at least a 10% cost increase Imposing 25% tariffs on Mexico, the top exporter of medical goods to the United States, will significantly increase medical device costs (69% manufactured outside of the US).1 On managed care, CMS announced an average increase of 5.06% in Medicare Advantage payments to plans in CY 2026, pricing in long-overdue inflation adjustments and boosting large insurers Major weight-loss drugs no longer in shortage, producers partnering with telehealth channels (e.g. Wegovy through Hims and Hers) to increase GLP-1 accessibility & adoption.

As policies often turn out to be, liberation day’s consequences come at a critical juncture for generic manufacturing when as many as 170 drugs could lose exclusivity over 2025-30, leaving more than $360 billion of US and EU large drugmakers' annual sales exposed to generics. Split between biologics and easily-replicable small molecules (40% of expiring patents), consensus sees up to $140 billion in sales erosion through 2030. Additionally, shifting manufacturing to India due to significant cost-savings (consensus view of India-based generic pharmaceuticals generating over half of generics revenue by 2030, from 27% in 2011, largely with declines in European and Israeli manufacturers who focus more on branded drugs, could present significant cost-saving opportunities

Fig.11-yearS&P500vs.Vanguard HealthcareETF–Healthcarediverged post-electionsbutnowfollowsbroadermarket

Fig.2CountryshareofUSpharmaceutical importsbyyear–ChinaandIndiamakeup 576%ofUnitedStatesPharmaceuticalImports, accordingtotheCPA

Fig.3Licensingdealsbycompanythoughthe number dealshavelargelydeclinedsince2021,deal sizehasincreasedespeciallywithChinesepartners

Despite these tailwinds, this trend needs to be weighed against disrupted supply chains, which will have an outsized impact on generic drugs due to their lower margins, and potential for increased regulatory scrutiny on FDA biosimilar and generics approval, leading to confounding factors that may end up giving large cap pharmaceuticals more time to extend their patents 2

On our coverage, pharmaceuticals are in focus this semester with AbbVie, Eli Lilly, and AstraZenaca vying for a piece of the GLP-1 pie among other therapies. As the FDA announced that Wegovy and Zepbound were no longer in shortage, pharmaceutical companies are filling in manufacturing gaps with in-house manufacturing and licensing agreements (e.g. AbbVie with Denmark-based Gubra A/S) as well as experimenting with different methods of administration (Novo Nordisk’s recent application for FDA approval for an orally-administered GLP-1 therapy). As the space gets more diversified, pharmaceutical companies are also partnering with novel channels, such as telehealth companies like Hims and Hers, which soared on April 29 after announcing a partnership with Novo Nordisk to carry Wegovy, increasing the accessibility of weight-loss drugs to the general public Finally, CMS’s proposed 2025-2026 rate increase of 5% is finally giving payors the inflation-adjusted rate they need, and those with the savvy to navigate the regulatory environment and take advantage of M&A opportunities like Addus HomeCare will continue to win share.

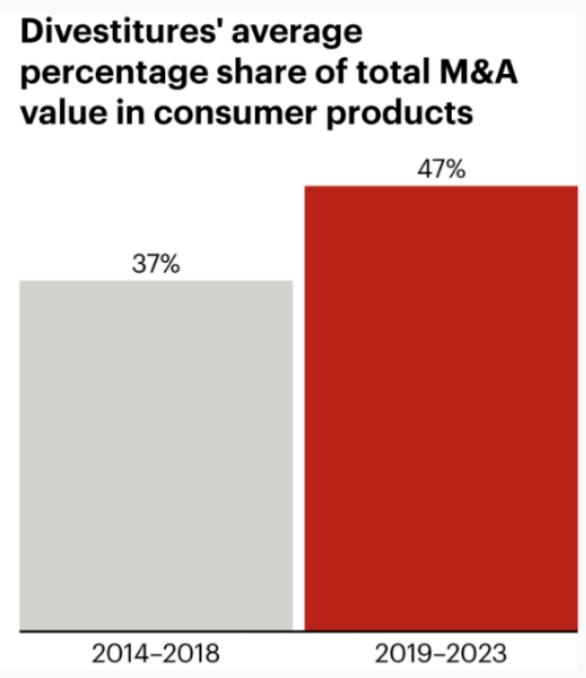

Private markets to take on the risk of consumer weakness - there has been a flurry of private market activity as the optimal structure of companies in the industry begins to shift. In early March, Walgreens Boots Alliance announced its take-private by Sycamore Partners for $10 bn, only 10% of its peak market valuation of $100 bn. Due to the lower margins in the consumer business compared to pharmaceutical segments, Sanofi sold a 50% controlling stake in its consumer health business Opella to US private equity firm Clayton, Dubilier & Rice (CD&R) for 10bn euros ($11.4 bn) which closed on April 30.3 This follows J&J’s spinoff of Kenvue and GSK/Pfizer spinoff of Haleon

before, suggesting a long-term trend in large healthcare companies shedding less profitable consumer health businesses As consumers are hit with a tougher macroeconomic environment and sales slump, companies that may want to spin off consumer health or other “noncore” divisions may have limited opportunities to do so at fair valuations Bayer’s stock slumped significantly when management declared the company would not be altering its corporate structure, coinciding with a 3Q24 earnings miss and underperformance in the noncore sector of Crop Sciences due to pricing headwinds.4

In conclusion, the overall healthcare industry has performed in line with or under market as the magnificent seven and AI-related names took the spotlight in 2024. As we await new clinical trial updates and other catalysts in 2025, macroeconomic headwinds will continue to separate the outperformers.

2 Bloomberg Intelligence

3 https://www fiercepharma com/pharma/sanofi-gaining-eu10b-sale-opella-expect-more-bolt-deals

4 Bloomberg Intelligence

Justin

Li| May 1st, 2025

Rating: Buy

Current Price: $67.59

Price Target: $92.49

Company Updates / News

● Market Cap: $208B

● Beta: 1.25

● EPS: $2.25

● PE Ratio: 33.08x

● 52 Week High: $87.68

● 52 Week Low: $62.75

● AstraZeneca blew past Q4 expectations with a double-digit earnings beat

● Total Revenue Growth: AstraZeneca's total revenue increased by 21% ($54.1 billion)

● Core EPS Growth: Core EPS grew by 19% to $8.21, indicating strong profitability momentum

Competitor Statistics from Q4 2024

EV/EBITDA: 13.8x

Revenue: $85.68B

EV/EBITDA: 6.0x

Revenue: $11.73B

EV/EBITDA: 7.2x

Revenue: $12.34B

Investment Thesis:

AstraZeneca is a British-Swedish global biopharmaceutical company specializing in the discovery, development, and commercialization of prescription medicines across five key therapy areas: oncology, biopharmaceuticals (cardiovascular, renal & metabolism, and respiratory & immunology), rare diseases, vaccines & immune therapies, and infectious diseases

Though one of the long-standing industry giants, AstraZenaca has not lost its innovative spark Its oncology portfolio, accounting for the largest share of revenue, includes leading cancer treatments like Tagrisso for EGFR-mutated lung cancer, Lynparza for ovarian and breast cancers, and Enhertu, a promising drug for HER2-positive and HER2-low breast cancer, just a few of the life-saving solutions the company has developed over the years. AstraZeneca’s strong future growth prospects come from its entry into the weight-loss drug industry and its expansion in emerging markets, with a focus on China

As of March 13th , 2025, AstraZeneca was trading at $67 59 per share I believe that this equity is undervalued and will increase by 37% to $92.49 within the next year. I conducted a Discounted Cash Flow Analysis with a terminal growth rate of 2 00% and a WACC of 8 92% to arrive at this valuation My assumptions are based upon historical data and an optimistic view of AstraZeneca’s future performance.

AstraZeneca is making a significant move into the high-growth obesity and metabolic disease market with an oral GLP-1 receptor agonist in collaboration with Eccogene, a Shanghai-based small-molecule therapeutics company The GLP-1 drug class, which includes Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound, has seen exponential demand, creating a massive commercial opportunity While AstraZeneca is entering this space later than competitors, its medicine (which may hit the markets as soon as 2026) functions as both a weight loss drug but also a treatment option for Type 2 diabetes By focusing on mitigating the side effects through cardiometabolic disease management, AstraZeneca will be able to provide a safer alternative for the market.

China remains a critical growth driver for AstraZeneca, even as the company navigates regulatory pressures and pricing reforms in the region. Effective January 1st, 2025, AstraZeneca successfully secured National Reimbursement Drug List (NRDL) renewals for major oncology products, including Tagrisso and Calquence, without price cuts Additionally, the company is expanding its footprint in China’s rare disease market, where there is growing demand for innovative treatments While AstraZeneca faces headwinds from regulatory scrutiny over drug imports, it continues to reinforce its market presence through new product launches, expanded indications, and increased investment in local partnerships. With China remaining one of AstraZeneca’s largest markets, its recent legal win to protect its pricing shows both the efficacy of the company’s drugs and secured future growth

Justin Li| May 1st, 2025

AstraZeneca vs. Novo Nordisk Daily % Change in Share Price (YTD)

Source: S&P Capital IQ

Risk Potential

Intensifying Competition in the Oncology

AstraZeneca faces growing competition in oncology as various patents (both from the company and from competitors) expire New treatments like biosimilars and next-generation therapies threaten AZN’s core drugs like Tagrisso, Lynparza, and Enhertu To stay ahead, AZN should continue to expand its pipeline, focusing on the seven Phase III readouts in 2025, and investing in next-generation Antibody-Drug Conjugates (ADCs) like Datopotamab deruxtecan (Datroway) through partnerships with Daiichi Sankyo

The Inflation Reduction Act (IRA) introduces Medicare price negotiations, potentially reducing AstraZeneca’s pricing power in the United States To counter this, AstraZeneca should diversify revenue streams, expand in Europe and emerging markets, and focus on specialty medicines and rare disease treatments, such as those in its Alexion portfolio, which are less subject to government price controls and unfavorable price elasticities.

AstraZeneca relies on a complex global supply chain, exposing it to risks from raw material shortages, trade restrictions, and regulatory delays. Under the Trump administration, there is concern regarding potential trade wars and cost increases as a result. To hedge against these risks, AstraZeneca can consider diversifying suppliers and expanding in-house manufacturing. This will allow AstraZeneca to form its own efficient, robust supply chain.

Sources:

AstraZeneca IR | Bayer IR | Novo Nordisk IR |BMS IR |Capital IQ

Laurent Vo| April 26, 2025

Rating: BUY

Current Price: $186.06

Price Target: $210.12

● Market Cap: $330B

● Beta: 0.54

● EPS: 2.46

● PE Ratio: 15.3x

● 52 Week High: 218.66

● 52 Week Low: $153.58

● AbbVie Q1 Revenue Beats Estimates on Strong Immunology Growth

● AbbVie Raises Full-Year 2025 Earnings Guidance Amid Skyrizi and Rinvoq Momentum

● AbbVie Expands Neuroscience Pipeline Despite Emraclidine Setback

Competitor Statistics from Q1 2025

EV/EBITDA: 9.55

Revenue: $14.58B

EV/EBITDA: 12.46

Revenue: $21.89B

EV/EBITDA: 8.57

Revenue: $15.5B

Investment Thesis:

AbbVie (NYSE: ABBV) is a US -based biopharmaceutical company with a diversified portfolio of therapies spanning immunology, oncology, neuroscience, and aesthetics. Following the patent expiration of its flagship rheumatoid arthritis drug Humira, AbbVie has strategically shifted focus to its newer immunology drugs, Skyrizi and Rinvoq, which have demonstrated robust growth and are expected to generate over $31 billion in combined sales by 2027

In Q1 2025, AbbVie reported an 8.4% year-over-year increase in revenue to $13.34 billion, driven by a 70 5% rise in Skyrizi sales and a 57 2% increase in Rinvoq sales Adjusted EPS for the quarter was $2.46, surpassing expectations and leading management to raise its full-year EPS guidance to a range of $12 09–$12 29 AbbVie is also investing $10 billion in US manufacturing over the next decade, including the construction of four new facilities, to mitigate potential risks from proposed pharmaceutical tariffs and to strengthen its domestic supply chain

Given AbbVie's strong performance in its immunology portfolio, strategic investments in domestic manufacturing, and proactive approach to offsetting Humira's decline, I issue a Buy recommendation with a price target of $210.12.

The company’s revenue for Q1 reached $13 34 billion, marking an 8 4% year-over-year increase, driven by a 70 5% rise in Skyrizi sales and a 57 2% increase in Rinvoq sales. Together, these two drugs contributed approximately $5.1 billion to the quarter’s revenue base

Adjusted earnings per share (EPS) stood at $2 46, reflecting a 6 5% year-over-year increase and surpassing expectations. Adjusted gross margins held strong at 84.1%, with an operating margin of 42.3%, reinforcing AbbVie's efficiency even as it invests heavily in next-generation therapies and US manufacturing capacity

AbbVie’s current P/E ratio sits around 15 3x, which is modest compared to large-cap healthcare peers, indicating potential undervaluation relative to earnings strength. The company's dividend yield of 3 64% remains attractive, particularly given its strong free cash flow profile and consistent payout history

Using a DCF valuation model incorporating modest revenue growth of 4 5% through 2029, stable operating margins, and a WACC of 8.0%, I came to an implied share price of around $210.12 for AbbVie This represents approximately 13% upside from the current price of $186. The DCF model reflects confidence in AbbVie's next phase of revenue driven from its new pipeline assets, offsetting Humira’s decline.

AbbVie’s strategic $10 billion domestic manufacturing expansion over the next decade, paired with its strong immunology growth engine, positions the company for both defensive resilience and upside capture within the healthcare sector.

Sources: Abbvie| Capital IQ | Yahoo Finance |Reuters | WSJJournal| S&P Global | UtilityDive | Barrons | Investors

Laurent Vo| April 26, 2025

Source: CSIMarket

In November 2024, AbbVie faced a significant setback when its experimental schizophrenia drug, Emraclidine, failed to meet primary endpoints in two Phase 2 trials This led to a $3 5 billion impairment charge and a 12% drop in the company's stock price. The failure not only impacts AbbVie's neuroscience ambitions but also raises concerns about the company's acquisition strategy, particularly the $8 7 billion purchase of Cerevel Therapeutics aimed at bolstering its central nervous system pipeline

AbbVie has entered the obesity treatment market through a licensing agreement with Denmark-based Gubra A/S, valued at up to $2 23 billion The deal focuses on developing an amylin-based therapy, a novel approach compared to existing GLP-1 treatments. While initial Phase 1 trials showed promising results, with patients achieving a 3% average weight loss, the company faces stiff competition from established players like Novo Nordisk and Eli Lilly The success of this venture will depend on further clinical validation and market acceptance

The current US administration's proposed pharmaceutical tariffs pose a potential risk to AbbVie's international operations In response, AbbVie has committed to investing over $10 billion in US manufacturing over the next decade, expanding its domestic footprint with four new facilities . This proactive move positions AbbVie ahead of some competitors; for instance, Pfizer has expressed intentions to increase US investments but is currently holding back due to tariff uncertainties While companies like Merck and Eli Lilly have announced significant U.S. investments , $1 billion and $27 billion respectively, their projects are either in early stages or spread over longer timelines . AbbVie's aggressive approach not only mitigates potential tariff impacts but also aligns with its strategic expansion into areas like obesity treatment However, the substantial capital expenditure and the time required to operationalize new facilities could pose near-term headwinds to earnings. Continuous monitoring is essential as the competitive landscape and policy environment evolve

Sources: Abbvie| Capital IQ | Yahoo Finance |Reuters | WSJJournal| S&P Global | UtilityDive | Barrons | Investors

Amy Zhang| April 17, 2025

Rating: Buy

Current Price: $26.81

Price Target: $32.47

Company Updates / News

● Market Cap: $5.96B

● Beta: 1.65

● EPS: 0.53

● PE Ratio: 50.58

● 52 Week High: $72.98

● 52 Week Low: $11.20

● A Super Bowl ad in Q1 2025 reached 115M viewers and drove a 37% QoQ increase in site traffic and 25% YoY growth in customer signups

● Shares fell after the FDA banned compounded semaglutide, which made up $230M of 2024 revenue

● Hims has since announced it will offer FDA-approved GLP-1 drugs, preserving its weight loss revenue stream

Competitor from Q1 2025

Revenue: $184.41M

Revenue: $750M

Company Overview: Hims & Hers Health, Inc. (NYSE: HIMS) is a leading direct-to-consumer telehealth platform offering personalized treatments across categories like mental health, dermatology, sexual health, and weight management. My buy recommendation is supported by two: first, core business performance remains robust excluding GLP-1 products, 2024 revenue grew 43% year-over-year to over $1.2 billion, signaling strong demand for its broader portfolio. Second, Hims & Hers continues to lead the personalized healthcare space, capturing an estimated 47% market share in 2024 While recent investor sentiment has weakened due to the FDA’s declared end to the semaglutide shortage effectively banning further production of HIMS’s compounded versions that generated $230 million in revenue for the company in 2024 – HIMS’s scalable model, strong brand, and continued focus on tailored treatments position it well for long-term growth, regardless of near-term regulatory headwinds

As of April 10th, 2025, Hims & Hers Health, Inc (NYSE: HIMS) was trading at $26 81 per share I believe that this equity is slightly undervalued and has the potential to reach $32.47 within the current year. I conducted a Discounted Cash Flow Analysis with a terminal growth rate of 3.00% and a weighted average cost of capital (WACC) of 11 7% My assumptions are based on the company’s historical performance and an optimistic outlook on Hims & Hers’ future growth in personalized prescription healthcare and consumer-driven weight management solutions

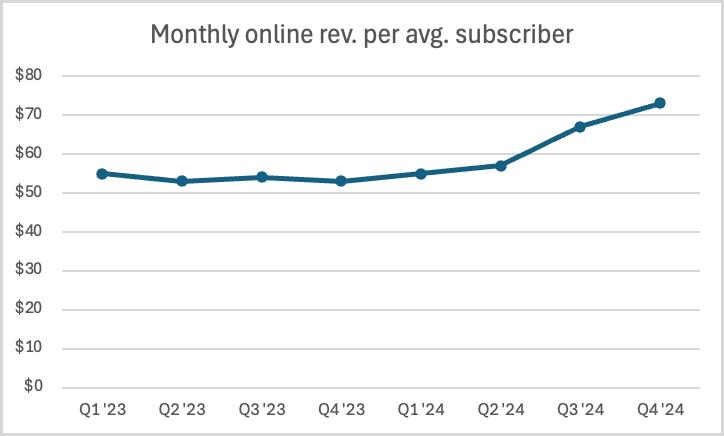

Revenue Growth: Hims & Hers’ core business remains strong, even excluding GLP-1 products, with total revenue reaching over $1 2 billion in 2024, representing 43% year-over-year growth. This performance was largely driven by a 172% increase in personalized healthcare subscribers and a 95% increase in total revenue in Q4 alone The company continues to expand its user base through multi-channel brand development, partnerships, and brand ambassadors. Notably, strategic marketing initiatives, including high-visibility campaigns like their Super Bowl ad, significantly enhanced brand visibility and customer acquisition, contributing to the surge in subscribers and revenue. Additionally, Hims & Hers has successfully boosted revenue per subscriber through increased multi-month adoption, proprietary product usage, and a growing breadth of offerings. Investments in clinical excellence, customer experience, and personalized content have contributed to strong subscriber retention and engagement As monthly online revenue per subscriber climbed from $55 in Q1 to $73 in Q4, Hims & Hers' ability to scale both acquisition and monetization reflects the strength of its consumer health platform and long-term growth potential

Weight Loss Category: Hims & Hers is taking deliberate steps to solidify its long-term leadership in the weight loss category, even after the FDA’s decision effectively halted sales of compounded semaglutide. The

Amy Zhang| April 17, 2025

Revenue: $750M

company has swiftly expanded its portfolio to include FDA-approved alternatives, most notably announcing the addition of Eli Lilly’s blockbuster GLP-1 drug Zepbound to its platform. Looking ahead, Hims & Hers plans to launch liraglutide—the first generic GLP-1 solution—by 2025, while continuing to grow its range of oral-based treatments that target the root causes of weight gain, including insulin resistance and metabolic disorders. These offerings, available at price points as low as $69 per month, allow the company to serve a broader population while reducing reliance on any single product. Backed by strong provider access, proprietary tools, and a data-driven approach to personalization, Hims & Hers has built a highly retentive subscriber base and is well-positioned to lead in the fast-growing digital weight loss space.

Hims & Hers Revenue for the Past Two Years

Source: Hims & Hers Investors Presentations

Risk Potential

Competitor Retaliation: A growing risk for Hims & Hers is potential lobbying by traditional healthcare players seeking to limit access to high-margin drugs like GLP-1s through tighter distribution controls. If successful, such efforts could restrict the company’s ability to offer key treatments directly to consumers. To safeguard access, digital health firms may need to engage policymakers and industry stakeholders amid increasing competitive pressures.

Macroeconomic Volatility: Another risk is increased stock volatility during a market downturn. As a high-growth company, Hims & Hers may face outsized declines even though its fundamentals remain strong, driven by steady subscriber growth, rising revenue per user, and demand for affordable, subscription-based care. While macro-driven selloffs may not reflect business performance, they could still affect short-term returns and investor confidence.

Sources: Hims.com | Seeking Alpha | Yahoo Finance | Capital IQ | Robinhood

Laura Zhai | April 9th, 2025

Rating: BUY

Current Price: $753.71

Price Target: $778.16

Company Updates / News

● Market Cap: $714.51B

● Beta: 0.5

● EPS: 11.49

● PE Ratio: 62.75

● 52-Week High: $972.53

● 52-Week Low: $677.09

● For the full year 2025, the company has provided an estimated revenue growth between $58 billion and $61 billion, representing approximately 32% growth compared to 2024

● Plans to launch its diabetes and weight-loss drug, Mounjaro, in major emerging markets like India, Brazil, and Mexico in the second half of 2025.

Competitor Statistics from Q4 2024

EV/EBITDA: 13.8

Investment Thesis:

Founded in 1876 in Indiana, Eli Lilly and Co has become one of the leading pharmaceutical companies, operating globally with plans for continued expansion. It invents, develops, and manufactures medicines that address four key categories: cardiometabolic health, oncology, immunology, and neuroscience. It invests heavily in R&D and often collaborates with and/or acquires other pharmaceutical and biotechnology companies to develop innovative products. Ultimately, its main source of revenue comes from patents and other forms of intellectual property rights.

Supported by a healthy balance sheet, pricing power, and operational scale, Eli Lilly and Co. has demonstrated great potential for growth. Its rapid expansion in the weight loss and diabetes markets, coupled with its strategic plans for global penetration, further strengthens its long-term outlook.

As of April 9th, 2025, Eli Lilly and Co. is trading at $753.71 per share. I believe that the security is undervalued; I conducted a Discounted Cash Flow Analysis with a weighted average cost of capital (WACC) of 9% and a terminal growth rate of 3% across five years. My assumptions are based on Eli Lilly and Co.’s historical data, an overall optimistic view of Eli Lilly and Co’s future performance, and industry analysis I came to a valuation of $778 16, suggesting a 3 3% undervaluation of the current stock price.

In February 2025, President Donald Trump announced the US would impose tariffs starting at 25% on pharmaceutical imports In response, Eli Lilly and Co decided it will invest at least $27 billion in building four manufacturing plants within the US over the next five years. This would reduce reliance on production overseas and mitigate trade barriers The company’s swift tariff response also reflects its adaptability and forces increased capital investment, which demonstrates strong financial support.

R EV/EBITDA: 14.01

Revenue: $54.1B

In the fourth quarter of 2024, Eli Lilly and Co. reported $13.53 billion in revenue, a 45% increase year-over-year This robust growth can be largely attributed to the success of its diabetes and obesity treatments with its GLP-1 receptor agonists, Monjaro and Zepbound; sales of Monjaro reached $3.53 billion, while Zepbound brought in $1 9 billion, contributing to about 40 13% of the total revenue in Q4 The obesity treatment market is expected to display substantial growth, estimated to reach $173 5 billion by 2031 While there are strong competitors, such as Novo Nordisk (the maker of Ozempic/Wegovy), Lily’s Zepound has shown superior weight loss results and a more reliable supply chain capacity to meet demand. Therefore, Lilly plans to utilize this momentum to expand further and launch its blockbuster weight loss drugs in underpenetrated markets in Europe and Asia.

Laura Zhai | April 9th, 2025

Source: Seeking Alpha

Potential Regulatory Challenges

The Trump administration has decided to exclude Medicare coverage for weight-loss medications, which include Eli Lilly’s Zepbound. This would limit access for more than 20 million Medicare beneficiaries, leading to significant losses in sales Additionally, the recent appointment of Robert F Kennedy Jr as Secretary of Health and Human Services, given his skepticism toward pharmaceutical practices, could signal stricter regulations This shift may prolong drug approval processes

The financial burden imposed by substantial tariffs on imports may require Eli Lilly to reduce its research and development budgets, which may hinder innovation. Eli Lilly and Co relies heavily on global markets for the production of its drugs Although it has plans to invest in domestic manufacturing, these new facilities can take several years to become operational. This suggests that the increase in operational costs from the tariffs would pose potential threats to its profit margins, R&D spending, and long-term innovation capacity.