Cornell Equity Research is proud to announce a remarkable fall semester. With in-person meetings and increased engagement, our team is stronger than ever.

This semester, we recruited six new members, representing four of the undergraduate colleges at Cornell. The executive board has continued its central committees, ranging from publishing to recruiting. We welcomed an enhanced new member education program filled with internship panels, special speakers, and rigorous coursework. The executive board has also worked to design the organization’s first merchandise for all current members.

The publication this fall reflects the volatile financial markets this past year. The theme for the report is centered around drawings that illustrate this economic climate of high inflation. To combat the soaring prices, the Fed has been determined to keep hiking interest rates. As the financial markets price in the rate hikes, rumors of a potential recession circulate. Given these economic conditions, our team is thrilled to present our selected stocks for this semester. Thank you to the executive board, sector analysts, associates, alumni, and guest speakers for contributing to another successful and rewarding semester!

Current Price: $37.19

Price Target: $33.39

● Revenue (LTM): $133.6B

● Market Cap: $156.19B

● Post-pandemic, the telecom industry is seeing an increased need to rapidly expand 5G and broadband offerings

Competitor Statistics from Q2 2022

Subscribers: 142.8 M

Revenue: $135.6 B

Subscribers: 110 M

Revenue: $80.1 B

Subscribers: 196.6 M

Revenue: $155.3 B

As the second largest mobile telephone service provider in the U.S., Verizon reigns within the telecom industry as one of the most prominent companies. Holding 142.8 million subscribers, the company remains second only to AT&T, but has developed plans to grow in relation to its competitors.

My buy recommendation reflects a belief that Verizon is performing better and with greater consistency than competitors like T-Mobile–which is currently undergoing a merger–while developing its 5G and phone plan offerings at a rapid rate that will only increase the company’s value.

My comps analysis on Verizon (VZ) has an implied share price of $33.39, with a current price trading at $37.19, indicating thatthe current stock price is overvalued. This comps analysis incorporated findings from T-Mobile, AT&T, and Comcast, in addition to Verizon, to help develop this argument.

Despite this assessment, however, most other researchers believe Verizon is undervalued, with Morningstar recently predictingan implied share price of around $59. These predictions are on the basis of Verizon catching up to its competitors in the 5G battle, and because of its limited growth in relation to competitors masking that Verizon has remained the most internally stable of the major providers. So, despite my comps analysis, I believe Verizon is a buy.

Verizon has recently launched 5G “Ultrawideband,” or UWB, whose mobile services use cutting-edge high frequency, mmWave spectrum technology. These 5G options provide increased speed for users and opportunities for innovation for the company.

As 5G continues to become more commonplace for phone network companies, experts expect 5G wireless to have a major role in the progress of manufacturing automation, cloud gaming, autonomous vehicles, drones, and remote health services. Verizon is continuing to develop its offerings even further, having recently partnered with Amazon Web Services and IBM to design 5G apps for the web-connected industrial devices.

Overview:

Verizon’s subscriber base grew at a steady rate, similarly to those of T-Mobile and AT&T, securing its place as the second largest provider in the U.S. This, combined with its increasing advances in 5G that are expected to roll out have culminated in a year of strong, steady growth that remained relatively out of the spotlight in 2022. This could lead to the company having more significant growth in the near future, outside of what is reflected in my comps analysis.

Source: Yahoo Finance Risk Potential

Competition with AT&T: In the second quarter of 2022,AT&T gained 813,000 postpaid phone net adds, which was the wireless segment’s strongest subscriber growth in a decade. It also had a phone churn of 0.75%, which was lower than that of Verizon’s at 0.81%. Further, AT&T consistently outperforms Verizon and other competitors in its subscriber base and in its total revenues. Verizon could risk continuing to fall further behind AT&T, and being stuck in a state of “treading water” without additional product innovations.

T-Mobile/Sprint Merger: T-Mobile recently underwenta merger with Sprint in 2020, and the two companies are still finalizing the pieces of that merger. While this merger allowed T-Mobile to grow to be a leader in the U.S. telecom industry, it also caused increased difficulties internally, as well as further customer service difficulties. Investors believe that while T-Mobile’s growth could pose a risk to Verizon, the company has an opportunity to outperform its competitors by remaining focused in its competitive strategy, without the hassles of the mergers.

Lower Prices on Prepaid Plans: Verizon recently unveileda trimmed down prepaid plan lineup. The company now sells a 15GB prepaid plan that starts at $45/mo. They also sell two unlimited plans which cost $60/mo or $70/mo with autopay, with all of these prices reduced since before. These new plans may attract more customers to the company, with more affordable unlimited options, potentially increasing overall value.

Current Price: $5.87

Price Target: $3.32

● Lumen eliminates its dividend, displeasing investors

● Comcast fails to increase broadband subscribers in Q2 2022

● Verizon, AT&T to delay some 5G development until mid-2023

Investment Thesis:

Parent company CenturyLink’s stock price peaked in 2007, but even as it rebranded its most profitable business functions as Lumen Technologies in 2020, the stock has shown nothing but a steady crawl to the bottom, with a cumulative 57.59% decline.

My “sell” recommendation reflects a belief that Lumen shows no signs of stopping its decline in stock price long-term, due to declining subscribers, its recent sale of two business segments, and a stock buyback ineffective in fixing the stock’s core issues.

Competitor Statistics from Q3 2021

Subscribers: 4.5M Revenue: $18.5B

As of November 18th, 2022, Lumen Technologies (LUMN) is trading at $5.87. I believe that this equity is overvalued andexpected to decrease to $3.32 within six months. I arrived at this conclusionthrough a comps model, comparing eight different mid-cap telecom companies including Altice USA, Frontier Communications, and Cable One and using their multiples to guide my valuation of Lumen Technologies.

Over the past few years, Lumen subscribers have stagnated in number and besides a slight 4% growth in Q4 of 2020, the trend shows no sign of recovery. Annual numbers show that average subscribers are 4.5M for both 2020 and 2021, showing no signs of further growth. and signaling a poor revenue forecast for the foreseeable future.

Subscribers: 3.1M Revenue: $7.2B

In 2021, Lumen saw total assets increase from $57.9B to $59.4B and net debt decrease by $1.5B, reflecting Lumen’s commitment to reducing debt and expanding its assets. $2.1B was given to shareholders through dividends and stock repurchases, further showing a general priority to satisfying stockholders.

Subscribers: 500K Revenue: $12.9B

Despite competitors’ focus on 5G and mass market products, Lumen is still trying to shift its focus from its small and medium businesses segment to fully emphasize its mass markets division as of Q2 of 2022. Lumen’s slow entry into the mass market reflects CenturyLink’s weaknesses that persist even through the rebranding.

Victoria Gong | November 18, 2022

*assuming (i) the investment of $100 on January 1, 2017, at closing prices on December 31, 2016 and (ii) reinvestment of dividends

Source: Capital IQ Risk Potential

Sale of Auxiliary Businesses: In 2021, Lumen announcedthe sale of two major business factions: its Latin America business to Stonepeak for $2.7B, nearly 9x the unit’s 2020 adjusted EBITDA; and its legacy ILEC telecom business to affiliates of Apollo Global for $7.5 billion at 5.5x the unit’s 2020 adjusted EBITDA. Although these sales look profitable by the books, the effects have yet to be reflected in Lumen’s financials. The Latin America sale was closed in August this year, but Lumen’s disappointing financial results in Q3 persisted despite the gains from the sale of their business.

Share buyback and historical dividends: As of November3, 2022, Lumen announced a $1.5B share buyback plan following disappointing Q3 results. They also announced that there would be no dividend for investors this year despite them being paid regularly, sending investors negative signals regarding the company’s financial health. However, given Lumen’s increasing debt, $1.5B is a huge cash drain and may leave the company with more potential liabilities than gains.

CEO Transition: New CEO Kate Johnson was officiallyappointed President and CEO as of September 13, 2022 after Former CEO Jeff Storey stepped down after 40 years. A former Microsoft executive, Johnson is focused on fiber rollout and may be essential to transforming Lumen from a telecoms company to a tech company. Though it may benefit Lumen in the long run, this goal’s very limited timeframe of the coming six months means that it will likely not be enough time for Johnson to enact significant changes that will bring up the stock price,

Sources: Lumen Technology Investor Relations | Fierce Telecom | Seeking Alpha | Statista | Capital IQ | CNBC

Current Price: $20.2

Price Target: $84.78

Company Updates / News

● November 16, 2022, Liberty Global to present at Morgan Stanley European TMT Conference

● Market capitalization: 9.17B

● Revenue LTM: 11.98B

Investment

Since Liberty Global’s listing in the New York Stock Exchange in 2013, the stock has grown more than 630%. Since then, Liberty Global has continuously expanded its footprint in the European as well as the U.S market, proving it to be a promising global telecom corporation.

My buy recommendation reflects a belief that Liberty Global will continue to perform well, given the continuous merger deals and and the synergies between the recent merger.

Competitor Statistics from 2021

As of November 18, Liberty Global plc (LBTY.A) is trading at$20.2. I believe that this equity is undervalued and expected to increase drastically to $84.78 within this year. I arrived at this conclusion by conducting a comparable company analysis with a 319.72% growth comparing 5 midcap companies including Globalstar, Inc., Cogent Communication and AST SpaceMobile. I also used the company’s performance history to guide my valuation.

Revenue: $68.4B

Liberty Global completed numerous strategic acquisitions in the last 3 years, strengthening its position in the international telecom industry. In April 2021, it completed acquiring 100% share capital of Sunrise Communications Group based in Switzerland. In June 2019, Telenet, Liberty Global’s sub-company, acquired De Vijver Media NV to expand its product on broadcasting and advertising services. In June 2019, Telenet acquired SFR BeLux to strengthen its broadband operations.

Revenue: $5.7 B

Revenue: $11.6B

The company focuses on many areas: WiFi, internet services, video, mobile and telephony. With a cloud-based ecosystem “ONE Connect”, home users can benefit from “Connect App” gaining access to all of the firm’s services not restricted to “Connect Box” and “Intelligent WiFi”.

May Ton | November 18

Liberty Global Stock Price, June–November 2022:

Source: Capital IQ Risk Potential

Increasingly Competitive Market: Liberty Global operatedin a highly competitive market where products for mobile services and broadband internet are continuously innovated to accommodate the customer’s rising demands. Also, as the company operates outside the U.S in countries such as the Netherlands, Belgium, it faces competition from the main Internet providers in those countries. Given the development in wireless technologies such as 5G and FWA, they are creating more competitive challenges.

Exclusively Foreign External Operation Liberty Globalworks under a lot of foreign companies in countries ranging from Poland to the U.K, and is thus subject to each country’s economic rules and situation. This often exposes the company to foreign currency exchange risk. For example, the U.K departure from the EU in 2020 created a change in foreign currency exchange rates in the capital markets. This could potentially have an adverse effect on the company’s financial operations.

Sources: Liberty Global plc Investor Relations | Deloitte | Investors.com | Bloomberg | SEC.gov | Capital IQ | Financial Times

Current Price: $384.47

Price Target: $429.59

● Charter Communications announced a partnership with RingCentral to develop advanced high speed two new cloud communication offerings.

● Q3 reports show Charter is following through on its promise to expand rural broadband access with $525M spent on rural infrastructure construction.

Competitor Statistics from Q3 2022

Customers: 32 M Revenue: $13.55 B

Customers: 92.9 M

Revenue: $30.04 B

Over the last few years, Charter Communications Inc. has seen its total revenue nearly double as daily life transitioned online during the COVID-19 pandemic. They have capitalized on this shift by rapidly expanding broadband services coast to coast. The pandemic emphasized the vital importance of the telecommunications industry, and based on the earnings reports from the industry leaders, this boost in online commerce is sticking around even as the imminence of COVID-19 fades.

Based on these factors I recommend Charter as a “buy”. Charter is targeting three significant areas in which to expand its market dominance. First, by expanding into rural communities to provide fiber optic service to over 1M new homes over the next few years. Second, by growing their Spectrum One program, which bundles “the nation’s fastest internet and Unlimited Spectrum Mobile.” And finally, by launching their new cloud communications software, jointly developed by Charter and tech company RingCentral.

As of November 18th, Charter Communications Inc. (CHTR) is trading at $384.47. I firmly believe that (CHTR) is undervaluedand, over the next two years, will reach a valuation of $429.59. I derivedthis valuation through a comparative company analysis with top competitors like AT&T and Verizon. In Q3, Charter demonstrated their confidence in its stock by repurchasing 5.8M shares of Charter Class A common stock for $2.6B. While Charter has yet to become a major player in fiber optic connection, it will soon be the sole high-speed carrier for millions of Americans.

In 2021 Charter announced a $5B investment towards expanding high-speed broadband connection coast to coast. Q3 2022 saw $525 million dedicated towards this project. Communities that suffered the greatest during the pandemic were those without stable internet connections. This initiative will thrust Charter into the fiber optics foreground and significantly expand opportunities for rural regions to participate in a more virtual world.

RingCentral Partnership:

Charter Spectrum is breaking into the cloud communications market through its partnership with software company RingCentral. The two new products they are jointly launching, Spectrum Business Connect and Spectrum Enterprise Unified Communications, aims to be the most advanced conferencing platform on the market by integrating AI enhancements to help businesses run more efficiently.

Customers: 143 M Revenue: $34.24 B

Beau Gillam | November 18th, 2022

Beau Gillam | November 18th, 2022

Source: Yahoo Finance Risk Potential

Competition: Charter Communications is trying to expandinto heavily contested markets, with Zoom already dominating the virtual conferencing space with its worldwide brand recognition built throughout the pandemic. Even with their recent advancements in AI integration, it will be an uphill battle to grow its Charter’s presence. They face similar challenges with their Spectrum One platform since 80% of consumers report already having a bundled telecom service.

Return To Work: According to a study published inHRDIVE, "90% of companies will require employees to return to the office." While Rutledge is confident that business will continue to be conducted primarily online, there are signs employees are ready to return to work in person. This would not bode well for Charter’s partnership with RingCentral, which is designed to facilitate remote interactions.

Liquidity: Regardless of the quality of a company'sproduct, there is an inherent risk associated with having extremely low liquidity. Charter's current ratio is a meager 0.29, which means it can only pay off 29% of its short-term liabilities. In comparison, the median current ratio for US-based publicly traded companies is 1.94, nearly seven times Charters. Even though Charter's reputation, size, and credit rating would allow for some leniency, if the markets were to suddenly turn around, Charter may have problems satisfying its liability obligations.

Sources: Charter Communications Inc. Investor Relations | Investor.com | The Wall Street Journal | Yahoo Finance | Consumer Reports | AT&T Investor Relations| HRDIVE | Capital IQ | Verizon Investor Relations

Current Price: $3.41

Price Target: $5.17

● Following the death of former CFO Gustavo Arnal, the Board of Directors voted unanimously to continue the tenure of CEO Sue Gove.

● Fears of an inflation-related recession in late 2022 have not impacted the consumer retail industry, as consumer spending remained high throughout Q3.

Competitor Statistics from Q3 2022

Over the last few years, Bed Bath & Beyond Inc. has struggled with maintaining profit margins, finding new opportunities for growth, and ultimately maintaining its once dominant market share within the consumer good and retail space. Emerging out of the COVID-19 pandemic having shuttered approximately 21% of all retail locations and shedding thousands of jobs, change was finally on the horizon as executive turnover initiated a complete overhaul in leadership, including members of the Board, the CEO, and CFO, as well as numerous c-suite positions. This brought in a wave of fresh new ideas to reform Bed Bath & Beyond and pivot the once-dying brand into a slim yet profitable enterprise.

Under CEO Sue Gove, Bed Bath & Beyond has focused on three primary avenues on its path to profitability. First, shuttering and selling off unprofitable assets both with regards to brands and physical store locations, then investing heavily in a revitalized online and in-person customer experience, and finally finding opportunities for expansion into markets that are parallel and logical to the existing Bed Bath & Beyond brand.

As of November 18th, Bed Bath & Beyond Inc. (BBBY) is trading at$3.41. I believe that this equity is undervalued and expected to increase to $5.17 within the next three years. I arrived at this conclusion by conducting a comparative company analysis with Bed Bath & Beyond Inc.’s competitors including Kohl’s Inc. and J.C. Penny Inc. Additionally, due to the nature of the stock being driven by “meme interest” I did research and analysis into the surrounding virality of the equity, and thus developing a better understanding of the probability of a breakout beyond a fundamental economic assessment.

Financial restructuring has played a critical role in how Bed Bath & Beyond has attempted to create a path to profitability, with CEO Sue Gove characterizing the new strategy as “embracing a straight-forward, back-to-basics philosophy that focuses on better serving our customers, driving growth, and delivering business returns.” This has included the raising of a $1.13 billion asset-backed revolving credit facility, a commitment to reducing SG&A by approximately $250 million in fiscal 2022, and the closure of approximately 150 lower-producing Bed Bath & Beyond banner stores.

Bed Bath & Beyond has experienced moments of virality throughout 2020-2022, including five instances of at least a 75% appreciation in stock price while rapidly oscillating primarily as a result of online discussion.

Andrew

Source: Yahoo Finance Risk Potential

Bankruptcy: Bed Bath & Beyond is at a financial andeconomic inflection point in the company’s history, meaning it can either be salvaged and steered into a positive direction or eventually be sold for pennies on the dollar (think Toys’ R’ Us, Blockbuster, etc). While it is impossible to predict the long-term success of the company at this point, the continued risk of failure is present and amicable, and something that must be accounted for and considered when making investment decisions in the organization.

Instability: Consistent c-suite and executive turnover,while can be viewed as a critical act of reforming an organization, can bring long-term instability as competing visions and financial directions will pull a company at the seams. With a new CEO and a change of the board who is actively altering the traditional investment philosophy of Bed Bath & Beyond, there is an inherent risk that the new direction results in further business failure that only cements a lack of investor confidence in the leadership team and further reflects itself in the value of the equity.

“Black Swan” Disruptions: Whether it be the inflationeconomy of the post-pandemic world or the ongoing Ukraine-Russia conflict, unprecedented and unpredictable “black swan” events can have a sizable dent for any company, much less one in the reformative phase of its life-like Bed Bath & Beyond, Inc is. Investors should focus less on the probability of the events themselves occurring (as they are virtually impossible to predict), and an independent analysis of Bed Bath & Beyond should be made regarding resiliency given an unprecedented economic downtown (looking at company liquidity, analyzing market resilience, etc).

Sources: Bed Bath & Beyond Inc. Investor Relations | Investor.com | The Washington Post | Yahoo Finance | KeyCorp Investor Relations | Huntington Bancorp Investor Relations | Bloomberg | Capital IQ | Financial Times

Andrew Grinzayd | November 18th, 2022

Current Price: $5.38

Price Target: $11.45

Company Updates / News

● Student Loan Moratorium extended until end of year.

● Recently had lower than expected losses during a tough year.

● Added nearly 424,000 new members the past year, raising the total to 4.7 million members.

SoFi Technologies, Inc (SOFI) has grown into one of the largest personal loan financiers as well as providing multiple non-lending products to its customer. It has recently become the primary sponsor of theLos Angeles Rams stadium as it has continued to grow since its inception in 2011.

My buy recommendation reflects a belief that SoFi will continue to perform well, as it continues to weather the downturn in the economy as well as it pivots to new ventures.

Competitor Statistics from Q3 2022

As of November 18th, SoFi Technologies, Inc (SOFI) is trading at$5.58. I believe that this equity is undervalued and expected to increase to $11.45 within this year. I arrived at this conclusion by conducting a DCF analysis with a 4% growth, 10% operating margin, and a WACC of 3.19% across 5 years. I used these assumptions based off of historical data and an optimistic view given SoFi’s performance history.

Members: 4.7 M

Revenue: $1.36 B

Due to the student loan moratorium and forgiveness program implemented by the Biden administration, SoFi has been forced to pivot its business away from solely relying on debt and loan refinancing. One of the biggest moves they made was the acquisition of Golden Pacific Bancorp, which has allowed the company to both establish a banking charter and also the ability to expand its business.

This pivot has allowed the companyto better weatherthe current downturn of the economy as well as any coming recessions. SoFi has continued to have stellar growth by pivoting with the banking charter venture as well as becoming a one-stop shop for all of their members needs.

Members: 20.1 M

Revenue: $1.04 B

As the company has begun to shift towards what CEO Anthony Noto has described as a “one-stop shop for financial services product”, membership has increased dramatically year over year. This year, it has grown 61% to 4.7 million members.

Members: 4.0 M

Revenue: $1.24 B

This has been a consistent trend as the company has only been growing membership as a tool for expansion. As SoFi shifts away from a primarily student loan financier, it has only increased its potential to grow as it grows into more financial services areas.

Source: Yahoo Finance Risk Potential

Student Loan Forgiveness One of the biggest piecesof the Biden administration’s agenda has been focusing on student loans. SoFihas seen itsshares drop 61% since the announcement that the student loan moratorium was extended until the end of 2022. It remains to be seen how manystudent loans willbe forgiven and when payments will begin again as this has become a key political issue for the Democratic party.

Interest Rates SoFi primarily focuses on lendingservices, so its business operations are extremely sensitive to changes in the interest rates and recessions. The Federal Reserve has shown no sign of slowing down its interest rates hikes, which could put the economy into to recession in the coming years. More recently, there were better than expected retail earning which could lead the Federal Reserve to continue its interest rates hikes in the coming months.

Sources: SoFi Investor Relations | Investors.com | Yahoo Finance | Wall Street Journal | New York Times | LendingTree Investor Relations | Lending Club Investor Relations | Bloomberg | SEC.gov | Capital IQ | Financial Times

Current Price: $45.32

Price Target: $36.79

● Market Cap: 183.31 B

● PE Ratio: 15.85

● 52 Week High: 64.29

● 52 Week Low: 38.60

● Cisco recently announced a $600M restructuring plan associated with layoffs and restructuring of its businesses

Investment Thesis:

Competitor Statistics

2022

Since Cisco’s listing on the New York Stock Exchange on February 16, 1990, the stock has largely continued to improve. Having grown to one of the largest technology companies, Cisco reliably provides computer networking products to many companies and consumers.

My sell recommendation stems from a number of recent global challenges, posing threats to Cisco’s growth with revenue declining steadily due to international conflict and supply-chain disruption

As of November 16th, Cisco (CSCO) is trading at$45.32.I believe that this equity is overvalued and expected to decrease to $36.79 within this year. I arrived at this conclusion by conducting a comparative analysis using 5 companies with similar financial data within the same industry. I ultimately used an EV/Revenue approach to make the final determination.

Cisco Umbrella: Cisco Umbrella is cloud-delivered enterprise network security which provides users with a first line of defense against cybersecurity threats. The Umbrella roaming client is designed to frequently detect changes in a computer's networking configuration. Each day, the Cisco Umbrella global network processes over 250 billion recursive Domain Name System (DNS) requests cementing it as one of the largest networks globally. Additionally, a newer technology called Anycast Routing helps Cisco maintain widespread availability, and is a main driver for growth at Cisco.

Competitive and Effective Services: Cisco’s competitive advantage comes from the unique nature of the products it offers to customers. With state-of-the-art products, Cisco has taken a step further against competitors and fully transitioned customer services online, which ensures that customer needs, queries, and concerns can be addressed quickly.

Further is the fact that Cisco uses cutting-edge technology in the development of its products resulting in the ability to sell at cheaper prices and undercut competitors. Using Anycast Routing also allows the company to easily scale their cloud security service globally by adding more data centers and servers, with no extra involvement needed from users and added flexibility and capacity capabilities.

Anika Mittle| November 15, 2022

Source: Yahoo Finance

Risk Potential

International Conflict: In March, Cisco halted itsbusiness operations in Russia and Belarus due to Russia's invasion of Ukraine. This decision ultimately cost the company roughly $200 million in quarterly revenue according to the earnings release. Cisco has also said it will communicate directly with customers, partners, and vendors “to settle [its] financial matters, including refunding prepaid service and software arrangements, to the extent permissible under applicable laws and regulations.”

Supply-Chain Shortages: Supply chain risk managementis critical for Cisco Systems because it relies on outsourced manufacturing for more than 99% of the products it delivers, of which most are configured-to-order. In response to COVID-19, China's shutdown of Shanghai–the country's largest shipping port–stopped Cisco from receiving hundreds of critical components. As a result, CEO Chuck Robbins reported that Cisco's inability to obtain power supply components out of China prevented the company from manufacturing around 11,000 printed circuit board assemblies. The missing parts had a $300 million impact on revenue.

Cyber Attacks: Recently, Cisco announced that thecompany was the victim of a cyberattack that targeted its corporate IT infrastructure. Cisco Talos, the company’s threat intelligence arm, found that an employee’s credentials were compromised after the attacker took control of a personal Google account in which the individual’s credentials were stored and synchronized. Although some files were compromised and published, Cisco stated that no ransomware had been found, that it managed to block further attempts to access its network beyond the initial breach, and that it has ramped up its defenses to prevent further such incidents.

Sources: Cisco Umbrella | Yahoo Finance | Bloomberg| Capital IQ | Cisco Investor Relations | Financial Times | Yahoo Finance | Market Watch

Current Price: $115.43

Price Target: $106.71

Company Updates / News

● Missed 2022 Q3 projections

● Broadcom’s acquisition of VMware is currently on hold due to regulator process

● VMware announced an advanced partnership with HPE to further commit to the digital transformation of the Cloud experience

● SEC fined VMware $8mm due to “misleading investors”

● VMware ranked #1 in IT automation and configuration management by global firm

Competitor Statistics

from Q3 2021

(NOW): $392.26

Revenue: $6.9B

(WDAY): $164.61

Revenue: $5.7 B (HP): $47.19 Revenue: $42.8B

Investment Thesis:

VMWare Inc. has proven to be a strong standalone business since it successfully completed its spin-off from Dell. The company has maintained a consistent level of revenue and net income during this period of uncertainty.

While the business model remains unchanged, I believe the lack of support from investors in the tech industry will cause the stock price to dip in the coming months.

As of November 18th, VMware Inc. (VMW) is trading at$115.43. I believe that this equity is overvalued and expected to decrease to $106.71 within the next 12 months. I arrived at this conclusion by conducting a comparable company analysis (COMPS). I found five other comparable companies with similar financial data within the same industry and ultimately used an EV/EBITDA multiple to reach the share price.

A key part of the company’s business strategy to remain relevant is to acquire other competitive companies and add their products and services to their offerings. Most recently Mesh7 in 2021. This business model allows them to offer end-to-end products all in one place.

On the other hand, Broadcom reached a $61 billion deal to acquire VMware. This was announced in May of 2022 and has been under review by both European and United States courts. Broadcom has said that they expect the deal to close in late 2023.

In 2022 Q2, VMware has seen a 15% increase in YOY revenue. This is mainly supported by higher subscription and SaaS sales. This reflects the market trend of companies transitioning their business to cloud-based services. Again, this is ideal positioning for VMware because they offer all the essential needs of companies from security to cloud services to networking.

Total spending on cloud services is near $500 billion globally, up 20% YOY. This pattern is not expected to end anytime soon with increasingly more business being handled virtually. VMware is strategically placed to take advantage of new business opportunities due to its excellent track record of customer satisfaction and commitment to bringing new and improved technologies to market.

VMW Stock Price, Last Six Months:

Source: Yahoo Finance Risk Potential

Missed High Expectations: virtual takeover have been missed by a long shot. While there is still an undoubtedly strong demand, it is not at the level that was anticipated. This bear market trend can be seen in the tech-heavy NASDAQ, which is down almost 30% from its peak almost a year ago. Similar firms have announced major layoffs and it would not be out of the picture for VMware to follow suit.

Inflation: hot topic issue being addressed by both the FED and elected officials it will still have negative short-term and long-term impacts on the company. Unless there is a parallel increase in pricing for customers, increasing labor costs to general expense increases will negatively impact the company’s bottom line.

Merger Completion: give generous amounts of synergies and new business capabilities to both firms. It is still under review by two separate courts that can veto it because of monopoly laws. This would effectively eliminate planned projects and synergies and negatively impact projections for the company for years to come.

Sources: VMware. Investor Relations | Deloitte | Investors.com | CFRA Equity Research | fool.com | Yahoo Finance | ServiceNow Investor Relations | Workday Investor Relations | Bloomberg | SEC.gov | Capital IQ | Financial Times

Current Price: 122.43

Price Target: 172.86

Company Updates / News

● Metaverse could contribute more than $3 trillion alone to the global GDP by 2031

● META Quest plans to allow viewers to watch the 2022 World Cup in Virtual Reality

● Meta released improved privacy updates to Instagram and Facebook this month to increase online safety for teenagers

Competitor Statistics from Q3 2021

With 2.5 billion monthly active users, META Platforms Inc. (META) is the world's largest online social network. It is the parent company to almost every popular social media platform, most notably Facebook, Instagram, messenger, and whatsapp.

My buy recommendation reflects my belief that META’s long term investment in the metaverse has large upside. Additionally, their monopoly in the social media space shows no signs of slowing growth, which results in a steady stream of ad revenue.

As of December 5th, META Platforms Inc. (META) is trading at $122.43. While in the short term I believe that this equity is undervalued and expected to drop to $110.45 by the end of the year, based on their poor earnings report from last quarter. However, I believe that in the long term this equity is expected to increase to $172.86 within the next 5 years.

I arrived at this conclusion by first conducting a DCF analysis with a 3.98% growth, 9.7% operating margin, and a WACC of 3.19% across 5 years given historical performance and an optimistic view of the size and potential of META.

Since 2012, Facebook has seen an increase in active users every year with the lowest recorded growth rate of users in 2021-2022. Even with this lower growth rate, other platforms like Instagram and Messenger are making up for Meta’s overall user popularity, having seen massive increases in their user quantities every quarter. More users across Meta platforms leads to a direct increase in ad revenue across the board.

Meta is an incredibly strong player in the social media space alone, not to mention other technological ventures. The drop in Meta’s revenues are often due to cutting back on advertisements and higher fixed costs in the current economic downturn. However, given its stability and dominant presence in the market, Meta’s revenues can expect to return to baseline with more favorable economic forces in the future. Additionally, Meta has invested large amounts into their Virtual Reality program. While it is reporting massive losses, these losses continue to shrink each quarter, which in turn aids overall revenue. As a novel technology with great potential, VR could soon turn more profitable for Meta.

Metaverse: Since 2019, Meta has invested $36 billioninto its Virtual Reality development. Since then, this investment has only caused losses, with Meta reporting a $3.67 billion loss in Q3 alone. This investment has made investors worried about heavy spending and long-term focus within the company.

Apple: In the Spring of 2021 Apple overhauled IOSprivacy settings, allowing users to opt out of activity tracking while using iPhone apps. For Meta, whose revenue comes largely (~90%) from ad revenue and user data, this change turned out to be extremely costly. They are still adjusting to this change, and it will be some time until their information capabilities return to the same level as before.

New Competitors: With the impactful introduction ofTikTok into the social media market, other platforms have needed to adjust to combat their new competitor’s rapid growth. With only 2% of teenagers consistently using Facebook, trailing Snapchat, TikTok, and YouTube, Meta is facing an existential threat to its relevance. While Meta platforms have attempted to compete by adding Instagram and Facebook “Reels”, the threat of TikTok’s continuous and massive growth will continue to put massive pressure on Meta to evolve in the future

Current Price: $147.64

Price Target: $179.53

Company Updates / News

● Market Cap: 133.49 B

● PE Ratio: 16.64

● Since releasing its Q3 earnings over a month ago, shares have increased by 13.9%, exceeding predicted expectations by the S&P 500

● IBM recently unveiled the world's largest quantum computer at 433 qubits, tripling the size of competitor computers, revolutionize several industry verticals and characterizing IBM as a technological leader

Competitor Statistics from Q3 2022

Revenue: $16.2B

Since IBM’s listing on the New York Stock Exchange in 1962 at $11.34, the stock price has grown more than 1300%. Since then, IBM has been solidified as one of the leading companies in the Information Technology industry, operating in over 170 countries and employing over 345,000 individuals. My buy recommendation reflects a belief that IBM will continue to perform well given the increasing demand for hybrid cloud platforms and the popularity of cybersecurity in the market.

As of November 18th, International Business Machines (IBM) is trading at $147.64. I believe that this equity is undervaluedand expected to increase to $179.53 within this year. I arrived at this conclusionby conducting a DCF analysis with a 1.5% perpetuity growth rate, 9.33% operating margin, and a WACC of 4.5% across 1 year. I used these assumptions based on historical data and an optimistic view given IBM’s performance history.

IBM is a leader in its cloud computing services, introducing this new sector of the corporation in 2011. Cloud computing is the on-demand availability of computer system resources without manual user management, specifically focusing on the bandwidth of a computing device and its data storage. Large clouds – data centers that contain large amounts of information – are often distributed across various locations, but IBM combines its powerful infrastructure into handling critical information. This global cloud computing market is projected to grow from $480.04 billion in 2022 to $1712.44 billion by 2029, at a CAGR of 19.9% in the forecast period.

Because IBM additionally works with a large international customer base, there is an immense and exciting potential for cloud computing to store data around the world and not just within specific regions. In addition, through the acquisition of Red Hat, there is an increased potential for industry agility and business continuity.

IBM’s investment in a variety of partner channels builds the strong ecosystem of its products and service offerings, strengthening R&D capabilities, enhancing the ability to deliver innovative solutions to clients, and extending its technology portfolio’s value. Just last year, the Hybrid Cloud Ecosystem was created to address the $1.2 trillion hybrid-cloud opportunity, and in just three months since its establishment, over 30 partners have joined the secure financial services ecosystem, as one example of this ecosystem’s strength and overall success.

Source: Yahoo Finance Risk Potential

Legal Liabilities of Data Security:In any technologycompany, data security is always one topic of major concern, where IBM’s data center is a key component to the security of client networks. Due to the importance of protecting the security of its thousands of clients, there is the potential for exposure to legal liabilities. While IBM has addressed data security concerns and continues to with new technological developments, there are currently numerous lawsuits IBM is involved with regarding security breaches on its databases.

Mature Competition: Many of IBM’s key competitorsare other leaders in the Information Technology sector, where these rivals make use of their lower-cost product and service offerings to gain market share. As a result, IBM is frequently faced with the threat of competitors that have the ability to lower their prices, offering aggressive pricing structures to clients. However, IBM is frequently characterized as a technology company of innovation, and as the technology market grows, IBM will have many chances to innovate and outperform competitors.

Imitable Offerings: Due to IBM’s mature competitionand its challenges in lowering its prices, another risk of investment IBM faces relates to the offerings IBM offers. IBM’s product line is fairly vast, addressing the needs of its large customer base. However, as a result of IBM’s limited offering scope, these products and services have the ability to be imitated and replicated by competitors, those that are leaders in the same industry. IBM’s cloud computing, for example, has been challenged by Amazon Web Services and Microsoft Azure, providing very similar offerings at a greatly discounted price.

Sources: Yahoo Finance | Fortune | IBM.com | Bloomberg | SEC.gov | Capital IQ | Financial Times

Current Price: $148.04

Price Target: $105.83

● Parker Harris, Salesforce’s CTO and Co-Founder, sold nearly 50,000 shares in a recently released SEC filing

● Gavin Peterson, the Chief Strategy Officer, announced his departure from Salesforce in November 2022

● Over 1,000 employees in the San Francisco office were laid off in November 2022

● Co-CEO Bret Taylor stepped down in December 2022

CRM Competitor Statistics from Q2 2022

Investment Thesis: Salesforce was founded during the height of the dotcom era in February 1999 and has continued to grow ever since. As a leader in the Customer Relationship Management (CRM) industry, over 150,000 corporate clients rely on the open-source cloud platform to optimize sales and operate accounts.

My sell recommendation is based on recent troubling actions by management, shifts in the industry’s dominant leaders, and the impending recession. Analysis of these factors indicate that faltering product quality and company culture will devalue the stock.

As of November 18th, Salesforce (CRM) is trading at$148.04. This equity is overvalued and expected to decrease to $105.83 withinthe next year. This conclusion was derived from a Comparable Companies analysis. The companies used to forecast the valuation were SAP, Oracle, and HubSpot. Using historical data and the higher end of the EV/EBITDA multiple calculation, it is evident that Salesforce is severely overvalued in the market.

Thought Leader: Salesforce has been a driver of growth and innovation in the cloud computing and CRM industries; this has afforded management to craft opportunities for expansion. In 2009, the company launched its venture capital division and in 2019, Salesforce acquired Tableau: a leading data visualization platform. These serve to showcase that Salesforce is dedicated to continually diversifying its revenue streams, acquiring talent, and long-term sustainability.

Corp. customers: 150,000 Revenue: $7.72B

In September 2022, Salesforce forecasted a favorable total addressable market from 2022 to 2026. By Q4 2026, its revenue from its five arms (sales, service, digital, platform, and data) will be nearly $300 billion and will experience a 13% CAGR in each line of business.

Corp. customers: 13,000 Revenue: $3.13B

The cloud computing industry has always been at the forefront of lowering fixed costs as Salesforce and Oracle revolutionized the licensing pricing model. This enhanced ability to adapt to change has allowed Salesforce to prevail in cost efficiency in the post-COVID working era.

In November 2022, Salesforce announced it plans to rent one-third of its iconic Salesforce tower in San Francisco as employees embrace working from home. As the tech industry continues to evolve, Salesforce has shown it can adapt with relative ease.

Source: Bloomberg Terminal

Risk Potential

Recession: Economists and Wall Street leaders havepredicted that the American economy will likely plunge into a recession within the next year, and that industries will be impacted across the board. In the technology space, companies are looking to lower costs leading to a massive wave of employee layoffs. This week alone, Salesforce laid off over 1,000 workers in its San Francisco office with only two month severance packages, marking the beginning of internal cost efficiency efforts The low packages may be a larger signal of financial instability and without this personnel, the quality of Salesforce’s product offerings may begin to suffer.

Customer Retention: The cloud management industry–specificallyCRM and ERP offerings–is projected to see exponential growth through 2030; however, new monopolistic conglomerates will likely overtake Salesforce’s historic dominance. Amazon and Microsoft have also expanded into this space, both offering a wider array of products. These new entrants are extremely attractive to corporations and there is a high risk of Salesforce clients shifting their business towards these new competitors.

Troubling Executive Suite: Recent actions by leadersat Salesforce signal that there is little trust in the future economic and strategic viability of the company. The Chief Strategy Officer resigned and the Chief Technology Officer, who is also a co-founder, has sold a relatively large number of shares. These cues may signal that leaders do not necessarily believe that the company will succeed through the recession.

Sources: Salesforce Investor Relations | Forbes | Microsoft Investor Relations | Ameriprise Financial | SAP Investor Relations | Yahoo Finance | SEC.gov | Bloomberg | San Francisco Business Times | Capital IQ | Wall Street Journal

Sarah Boyle | December 5, 2022

Current Price: $168.74

Price Target: $201.83

● Market Capitalization: $100.57 B

● 363 aircraft deliveries in 2022 as of October 31st compared to 340 deliveries in 2021

● The Southeast Asia aviation market is increasing as travel restrictions are easing

● $7.2 trillion in Boeing airplane deliveries is forecasted over the next 20 years

Statistics

2021

Boeing, a multinational aerospace company, designs and manufactures commercial airplanes and defense and space systems. Operating under four business units: Commercial Airplanes; Defense, Space & Security (BDS); Global Services (BGS); and Capital Corporation. Boeing develops a wide range of products from commercial jetlines, aircrafts, missiles, bombers, rockets, satellites, and spacecrafts. Since its founding in 1916, Boeing has grown to become the world’s largest aerospace company and the US’s largest manufacturing exporter, operating in more than 150 countries. Although it is still recovering from its market cap drop at the onset of the COVID-19 pandemic, Boeing is bouncing back.

My buy recommendation reflects the belief that Boeing’s share price will increase in the long run as global travel surpasses pre-pandemic levels and the demand for air cargo increases.

As of November 9th, Boeing (BA) shares are trading at$168.74. I believe that this equity is undervalued and expected to increase to $201.83 within the next year. I arrived at this conclusion by conducting a Comparable Company Analysis, comparing Garmin to Raytheon Technologies Corporation, General Dynamics Corporation, Lockheed Martin Corporation, Airbus SE, and BAE Systems plc, and using the EV / Revenue valuation multiples.

Airline Travel:

Travel is almost back to pre-pandemic levels. Domestically, the US experienced an increase in travel this fall compared to pre-pandemic levels. European travel is down only 14%. Recently, major destinations like Japan, Hong Kong, and Taiwan, lifted their border restrictions. Although, business travel and international travel are still lagging behind. One of the biggest hindrances to air travel is China’s ongoing Zero-Covid policy, although Bloomberg predicts that these restrictions might be eased soon. Boasting an impressive list of customers, including Delta Air Lines, American Airlines, Southwest Airlines, and United Airlines, Boeing will increase supply as these airlines place orders as demand for air travel increases.

Air cargo as a transportation method is expected to grow globally over $100 billion over the next five years, a 5.8% annual growth rate. These projections are quite stable, as the air cargo industry isn’t as susceptible to major events like the airline industry is. For example, airlines experienced dramatic decreases in revenues with the pandemic, while air cargo companies experienced increases. Boeing estimates that it will produce 2,795 freighter deliveries over the next 20 years in order to keep up with the demand.

Source:

Statista Risk Potential737 Max Crashes: Two Boeing 737 Max planes crashedin October 2018 and March 2019, killing 347 people. After the first crash, it was reported that the CEO at the time, Dennis Muilenburg, knew of the safety issue but allowed for the continued use of the model. So, when the second 737 Max crashed just five months later, this caused public outrage as well as a wave of lawsuits. This has already cost Boeing over $20 billion, and outstanding claims that are to be reviewed next year will likely increase this sum. Furthermore, in light of these incidents, the US Congress passed stricter legislation on the Federal Aviation Administration safety approvals. These reforms have not only increased the cost of getting an aircraft certified, but they also delay the process.

International Instability: As an international company,Boeing relies on foreign countries, both as suppliers and customers. Non-US customers accounted for 37% of Boeing’s revenues last year. Business is dependent upon world events and could be negatively affected when conflicts and political instability arises. For example, Boeing relies heavily on Russia for certain metals. In the midst of the Russian invasion of Ukraine, the US has significantly limited its Russian imports, potentially affecting how Boeing obtains these metals. Moreover, since Boeing is an American company, it must comply with American regulatory requirements. In 2018, for example, during the US-China trade war, significant tariff increases were imposed. This caused China to reduce American imports, hurting Boeing as China is Boeing’s second-largest market behind the US. Such conflict and political events can arise at any time and unexpectedly reduce Boeing’s revenues.

Nature of Contracts:A great deal of estimation goesinto projecting the cost of a project. These projects come with a lot of variability, including supply-chain costs and labor costs, causing potentially inaccurate estimates. This is a problem when dealing with fixed-price contracts. Almost 70% of all contracts that fell under Boeing’s BDS and BGS segments were fixed-price contracts. Although this can be beneficial if the company improves upon efficiency and completes the project in a cheaper and/or quicker manner, it can also bring about major financial losses if time and/or resources are underestimated. For example, in 2018, Boeing won three Pentagon fixed-price contracts. Because of unexpected interruptions and supply-chain issues, the company has lost over $1.5 billion, and continues to lose more by the day as they continue to work on the unfinished projects.

AdelynCurrent Price: $478.67

Price Target: $443.44

Company Updates / News

● Germany becomes the ninth foreign country to join the F-35 Lighting II Global Team in December

● Lockheed Martin, Microsoft Announce Landmark Agreement

On Classified Cloud, Advanced Technologies For Department Of Defense

Competitor Statistics from Q3 2022

Revenue: $16.58 B

Revenue: $16.95 B

Revenue: $8.97.B

Investment Thesis:

Since the merging of Lockheed Corporation and Martin Marietta on March 15, 1995, the stock has grown more than 1508.81%. Since then, Lockheed Martin Co. has grown into one of the largest aerospace companies in the world with worldwide interests. My hold recommendation is based on the fact that despite the stock’s overvaluation, Lockheed Martin’s stable growth as well as its stable backing of revenue by the U.S. Government.

As of November 18th, T-Mobile (TMUS) is trading at$478.67. According to the EV/EBITDA valuation multiple, the fair value of Lockheed Martin per share is $430.74. Although the stock is currentlyovervalued by a difference of $47.93, considering the company's rates of growthand its stable source of net sales (The U.S. Government), the stocks of Lockheed Martin were rated as a hold.

The F-35 Lightning II is currently developed by Lockheed Martin, and it leads the international supply chain for fighter aircrafts. Lockheed Martin claims that the F-35 Lightning II is the most advanced fighter jet in the world, currently serving as the backbone of allied airpower for over thirteen nations.

The Lockheed Martin X-35 won out against Boeing’s X-32 to be chosen as the main model to be supplied for the Joint Strike Fighter (JSF) program, which is intended to replace a wide range of existing fighter, strike, and ground attack aircrafts for eight nations (U.S., U.K., Italy, Canada, Australia, the Netherlands, Denmark, Norway). Apart from these countries Belgium, Finland, Germany, Israel, South Korea, Japan, Singapore, and Switzerland have purchased these aircrafts.

Lockheed Martin produces a unique asset that is nearly irreplaceable, providing a long term, stable competitive advantage. Their innovative company mindset has set them apart from their competitors, developing innovative technologies such as augmented reality combat training software, autonomous war vehicles, and of course, the F-35. As the largest military defense contractor in the world, Lockheed Martin has an array of competitive advantages, including a monopoly on government defense spending, inseparable lobbying and congressional ties, an immunity from market forces, as well as unparalleled technology and human capital. Lastly, their focus and expertise on space exploration and communications systems puts them in a favorable position to dominate the coming frontier.

Alexander

Source: Yahoo Finance Risk Potential

F-35 Production: The F-35 program constitutes a largeportion of Lockheed Martin’s net sales. The program represented 27% of Lockheed’s revenue in 2021. The company explained that due to the program’s inherent size and complexity, they anticipate that it will be under continual review. Spending cuts and delays in orders will negatively impact a considerable portion of their business. Lockheed also mentioned that supply complications due to ramifications of the COVID pandemic may hinder the program’s operations.

Provision Changes for R&D Expenditures: Beginningin 2022, companies no longer have the ability to deduct R&D expenditures immediately. They are required to spread out the deductions over five years instead. This could lead to reduced cash flow and increased tax rates for companies. Lockheed Martin cautions that if these provisions are not changed, it could take $500 million of its cash from operations in 2022.

Sources: T-Mobile Investor Relations | Deloitte | Investors.com | CFRA Equity Research | fool.com | Yahoo Finance |

Alexander Chung | November 2022Current Price: $159.09

Price Target: $177.49

● Waste industry has outperformed the overall market over the past 5 years due to increased waste output and expansion into new markets through M&A

● Waste Management (WM) came out with quarterly earnings of $1.56 per share, beating consensus estimates

Competitor Statistics from Q3 2022

Investment Thesis:

Since being listed on the New York Stock Exchange in 1971, Waste Management has pursued an aggressive acquisition process and has become America's leading provider of waste management services, operating 260 landfill sites and 340 compacting stations.

I recommend a buy for Waste Management at $159.09 with a price target of $177.49, implying an 11.6% upside based on Urbanization & Increasing Waste Trends, Expansion into Recycling & Renewable Energy, and a continued aggressive acquisition strategy.

As of November 17th, WM is trading at $159.09. I believethis equity is undervalued and expected to increase to $177.49 witha two-year investment horizon. I arrived at this conclusion by conducting a DCF analysis with a 2.3% growth, a 15.55x EV/EBITDA Exit, and a WACC of 5.55% across five years. I used these assumptions based on historical data and an optimistic view given Waste Management’s performance history.

Revenue: $5.07B

Construction and demolition sectors account for 30-35%of total US waste. Since America is short more than 5M homes due to labor shortages, supply chain issues, the growing work-from-home trend, and younger first-time home-buying population, we can expect increasing housing demand. Thus, cities around the country are increasing spending on building new homes, and we can expect heightened demand for waste removal.

WM has the largest waste-carrying capacity operating with a fleet of 26,000 trucks. It also possesses the most transfer stations in the industry that compact trash to increase density of waste being transported. These factors allow WM to have the most cost-effective waste transportation to fully take advantage over these industry trends.

Revenue: $3.6 B

Revenue: $1.9B

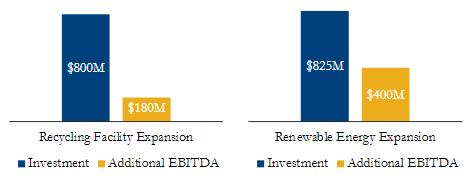

As consumer-packaged goods companies continue to set aggressive recycling goals, Waste Management has kept its recycling capabilities on par with packaging changes. By 2023, Waste Management plans to outfit 95% of its recycling facilities with updated recycling technology. The company announced that it expects to invest $800 million in recycling infrastructure over the next four years. Investments will target accelerating automation in its current single-stream facilities and expanding its recycling footprint in underserved markets.

Source: WM Investor Presentations

Risk Potential

Supply Chain & Distribution Issues: China’s NationalSword Program restricts imports of recycled products, causing collected materials to stagnate. Further, unprocessed recycled materials typically exported no longer are delivered to the historically largest market. This is mitigated by WM’s priority on other revenue lines. WM’s main business is collection and landfill, at 60% and 21% of revenue, respectively. Recycling is only 8% of revenue, so profits from other services will offset the volatility of recycling commodities.

Dependency on Natural Gas: 53% of WM’s truck fleetsuse natural gas for fuel, which is subject to increased sensitivity to prices and hurts operating profits. Also, a lack of natural gas infrastructure in the US and Canada demands capital investments from WM in fleet logistics. However, WM has a sustainable competitive advantage as they allocated $550 million in capital to renewable energy growth. Further, operating costs decrease from vehicle efficiency and WM extracts natural gas from its landfills, with 13,000 gallons daily—enough to power 300 vehicles a day.

Public & Private Competition: Governmental servicesand private waste management companies compete for necessary contracts with municipalities and counties. Competitors with large national accounts can afford to set lower prices and cost strategies which poses a risk to WM. This is mitigated because as a major player, WM can influence contract pricing. Revenue increases are forecasted to more than cover operational cost increases, expanding EBITDA margins. Lastly, post-pandemic market growth in commercial and housing increases demand for all revenue segments.

Sources: WM Investor Relations | Capital IQ |Investors.com | CFRA Equity Research | Yahoo Finance | Bloomberg | SEC.gov | WSJ| Financial Times

Current Price: 102.28

Price Target: 98.96

Company Updates / News

● P/E: 41.08

● EPS: 2.37

● Market Cap: 127,915B

● Positive Quarter Three results in light of FY 2021 volatility

● Experimenting with increased remote service options to fulfill prescriptions

Competitor Statistics from Q3 2022

Since CVS’ listing in the New York Stock Exchange in 1984, the stock has grown steadily, with a steep uptick following the Global Financial Crisis of 2008, a fall in recent years, and a recovery that rivals its earlier ascent. CVS has grown to be one of the largest healthcare companies, providing service to over 50 million customers.

My hold recommendation reflects a belief that CVS will continue to perform well, given its hybrid services and rising revenues.

As of December 5th, CVS (NYSE: CVS) is trading at$102.28. I believe that this equity is undervalued and expected to increase to $98.96 within this next year. I arrived at this conclusion by conducting a comparable companies analysis. I used these assumptions based on historical data and an optimistic view given CVS performance history.

CVS Health Corporation

Customers: 98.3 M

Revenue: $314,343 MM

CVS has recently beaten out analyst expectations for three quarters in a row now, with revenues rising 10% year-over-year in the latest earnings report. That has caused CVS to up its outlook for the next fiscal year. This change is reflected in the company acquisition activity, as CVS has recently purchased telehealth care company Signify. This signals CVS’ intent to compete in an increasingly tight healthcare industry. Additionally, earlier this year CVS reported that it had reached 44 million unique digital customers, a sign of the company’s continued ability to expand in the post-COVID-19 fiscal environment,

UnitedHealth Group Incorporated

Customers: 147 M

Revenue: $315,118 MM

CVS is a company with many divisions and businesses. Despite being beat out in customers served on a client-basis by competitors UnitedHealth Group Incorporated and Cigna Corporation, it currently retains the advantage of its Minute Clinic arm, which reaches 50 million customers annually in in-person visits.

Overview:

In 2022, through three quarters, CVS saw total assets remain steady from a total of $232,999 million to $231,212 million and total liabilities increase from $157,618 million to $169,201 million, reflecting the recent merger activity and growth operations.

Cigna Corporation

Customers: 190 M

Revenue: $180,026 MM

Consistent growth in net income over the past few quarters has allowed CVS to invest its earnings into growth opportunities such as acquiring Signify (units: mm).

Source: Capital IQ

Opioid Settlement: CVS recently made an agreementto pay $5 billion over the next decade to settle opioid claims. This is in lieu with many other health care companies, Walgreens and Walmart included, also facing lawsuits over their direct and indirect involvements in America’s opioid crisis. Regulatory and compliance risks will persist for CVS in the near future, and investors should be aware of the increasing pressure lawmakers have applied to the industry.

Response to Competition: CVS’ stock price history,as noted earlier, was on a steady incline until 2016. The reasons for this, as argued by several commentators, was competitor M&A activity and the loss of contracts with the U.S. military. The nature of the healthcare industry is such that customers often get swept in varying directions when M&A activity occurs, thus CVS will need to match such M&A activity amidst activity from rivals or continue to make their services compelling enough to stay on.

High Debt: CVS, by comparison to its competitors,has significantly higher levels of debt—double that of Cigna Corporation ($25,000 million). This makes for a degree of inflexibility in terms of growth given the interest expenses CVS must fulfill in order to remain operating. CVS’ several areas of growth opportunities should ease investors, but the company’s debt is worth being cognizant of.

Sources: CVS Investor Relations | Capital IQ | Foxbusiness.com | Fiercehealthcare.com |Yahoo Finance | CNBC.com | UnitedHealth Group Incorporated Investor Relations | Cigna Corporation Investor Relations

Current Price: $76.50

Price Target: $80.45

● Market Cap: $18.81 billion

● P/E Ratio: 15.12

● EPS: 5.06

● In early November, Hologic announced that it was awarded $19 million from the Biomedical Advanced Research and Development Authority (BARDA) to support its R&D efforts for its COVID molecular tests.

● Earlier in 2022, Hologic’s Project Health Equality partnered with Promise Fund of Florida to increase access to care for underserved women with cervical and breast cancers, uterine fibroids and abnormal uterine bleeding.

Competitor Statistics

For Q4 2022

Stock Price: $76.50

Market Cap: $18.81B

Stock Price: $87.69 Market Cap: $5.79B

Stock Price: $106.23 Market Cap: $22.29B

Investment Thesis: Hologic, Inc. is a developer, manufacturer, and supplier of premium diagnostic products, medical systems, and surgical products. The company focuses primarily on women’s health with business units in breast health, gynecologic health, and sexual health. My buy recommendation reflects my belief that Hologic is emerging out of the pandemic as a company well-equipped to expand its product offerings and broaden its women’s health initiatives.

As of December 4, Hologic (HOLX) is trading at$76.50.I believe that this equity is currently undervalued and expected to increase to $80.45 within this year. I arrived at this conclusion by conducting a comparable companies analysis. I chose to give Hologic a buy rating based off historical data and an optimistic view given the company’s strong growth potential.

Pioneer in the Women’s Health Movement: Even though Hologic has maintained a strong position amongst its competitors, its commitment to championing women’s health is what differentiates the company from its competitors. For instance, Hologic created a Global Women’s Health Index that works to measure women’s experiences with healthcare. The index’s findings are then used to raise international awareness of the importance of women’s health to our society.

Hologic also leads an initiative called Project Health Equality, which strives to provide underserved women with access to superior breast and cervical cancer screening technology. The project partners with nonprofit organizations that can help make a meaningful difference for women of color. Having strong social initiatives puts Hologic at the forefront of the women empowerment movement, which will help expand the company’s customer outreach and further build on its mission.

Hologic used its increased cash flows from the pandemic to focus more on inorganic growth through recent acquisitions. For instance, the company signed an agreement to acquire Bolder Surgical for $160 million back in 2021. Bolder’s capabilities in the surgical devices space helped to diversify Hologic’s portfolio and expand the company’s product opportunities.

Hologic’s strategic acquisitions put it in a perfect position for long-term growth. While the company is well known for its public initiatives in women’s health, having strong growth in its surgical space can put Hologic at the forefront of surgical technology products. Recently, Bolder was recognized for its CoolSeal device, which improves surgical efficiency by reducing the need for multiple instruments. Finding an opportunity to improve outcomes for patients using innovative technology primes Hologic for greater success in the post-pandemic world.

Source: Yahoo Finance Risk Potential

Acquisitions Carry Great Amounts of Risk:Althoughacquisitions provide strong opportunities for long term growth, they also provide a great amount of financial risk for the company. If the acquired companies have any sort of bad press or downturns, this could make the deal unprofitable for Hologic and cause the company to lose revenues. Furthermore, focusing on inorganic growth also carries a risk of not having synergies. Having to expand Hologic’s product offerings through various other companies may cause clashes within its operations and culture.

Concerns With Future Growth After COVID: Even thoughHologic has maintained a steady stream of revenue throughout the pandemic due to its breakthrough COVID tests, it saw a decrease in sales in its Breast Health and GYN Surgical sectors. As the pandemic subsides, investors are questioning whether Hologic can still outperform expectations. Since the company has recently been focusing on improving and diversifying its surgical sectors with more innovative technology, there is a risk that these efforts may not maintain the growth that Hologic had during the pandemic. If Hologic cannot continue to maintain a steady stream of revenue, the company’s image and financial stability could be jeopardized.

Medical Device Industry is Very Saturated: The globalmedical devices market size was valued at $489 billion in 2021 and is projected to grow from $495.46 billion in 2022 to $718.92 billion by 2029, which exhibits a CAGR of around 5.5%. The growing demand for medical devices in the midst of increasing surgical and diagnostic procedures has led to the market becoming very saturated and competitive. Success in the medical device industry centers around having the most innovative technology, which requires a massive investment into R&D. Therefore, Hologic carries a consistent risk of falling behind the technological trends.

Sources: Hologic Investor Relations | Bloomberg | Markets Insider | Capital IQ | Seeking Alpha | Global Women’s Health Index | Yahoo Finance

Current Price: $248.01

Price Target: $350.00

● 3/8/22: Shockwave Medical named to Fast Company’s “Most Innovative Company” List

● 3/31/22: Announces global launch of new peripheral intravascular lithotripsy catheter

● 5/23/22: Obtains regulatory approval in China for Intravascular Lithotripsy

● 11/16/22: Publishes inaugural ESG report demonstrating CSR and sustainability initiatives

Competitor Statistics from LTM

Investment Thesis:

Shockwave Medical is a relatively new medical technology company that has already seen major growth in price from under $50 three years ago to consistently being listed at over $200 today. With one major product already bringing increased profit margins, the company has shown it can succeed and that it has plenty of room to grow.

My Cautious Buy position reflects my belief that the company is headed in the right direction for major gains but still needs to exhibit a wider influence in the market of medical technology before finding greater success.

As of November 18th, Shockwave Medical (SWAV) is trading at$248.01. I believe that this equity is slightly undervalued and expected to increase to $350.00 by the end of next year. I arrived at thisconclusion by conducting a Comparable Company Analysis and noting the young age of the stock and its recent spikes in price spurred by new, higher revenue streams. As revenue streams will stabilize, the current P/E ratio of 101.82 should fall, further stabilizing the stock and increasing its value.

Net Income: $88.03 M

The newfound success and growth of Shockwave Medical can largely be attributed to its new Intravascular Lithotripsy Catheter used to treat cardiovascular calcium. Adapted from treatment for kidney stones, the device can more safely and less invasively combat one of the many precursors for complications from heart disease, including but not limited to heart attacks.

Overview:

Net Income: $(30.51) M

In 2022, Shockwave Medical saw an increase in EBITDA to nearly $100M after not having seen a positive value in the previous three years. Net Income has also reached a positive mark, suggesting the company is moving in the right direction. Its new catheter is spurring the bulk of this growth, and should continue to bring in positive revenue streams in the near future.

However, the company will need more big wins in different areas of medical technology if it is to truly emerge as a key provider in the industry.

Net Income: $412.63 M

Net Income: $61.73 M

Source: Yahoo Finance Risk Potential

Lack of Diversification in Product Portfolio:ShockwaveMedical has moved ahead of competitors Penumbra and Inari Medical in terms of Net Income, but remains behind Teleflex and Merit Medical Systems. Outside of its innovative catheter, the company has few large products driving growth, while the two companies it is trying to catch exhibit better diversification in other medical areas, such as surgical equipment and dialysis products.

A Large Uphill Battle: The medical devices and healthcareindustries in the US are filled with big name players such as Pfizer, Inc. and Medtronic that are constantly racing to develop the latest technology. With larger funds to devote to R&D, it may be difficult for the up-and-coming Shockwave Medical to keep pace with these larger firms. While it may be advantageous from this perspective to focus on one or two specific areas (such as cardiovascular health), that could leave the company exposed, as previously mentioned.

Market Uncertainty due to COVID-19: The COVID-19 pandemicsaw a forced stop on many elective surgeries. Since then, many consumers have been hesitant to seek access to healthcare when not in a dire situation. While this trend has shown some signs of reversal, the pandemic added a previously inexperienced level of volatility in the demand for medical and surgical technology.

Sources: Shockwave Medical Investor Relations | Yahoo Finance | Capital IQ | US Food and Drug Administration | Teleflex, Inc. Investor Relations | Merit Medical Systems, Inc. Investor Relations | Fortune Business Insights

Current Price: $517.19

Price Target: $595

Company Updates / News

● UnitedHealth Group and Change merger is being appealed by the DOJ

● UnitedHealth Group’s Board of Directors authorized a quarterly cash dividend of $1.65 per share

● YoY Revenue Growth: 12.82%

● EPS YoY Growth: 28%

● Return on Equity: 23.4%

● Beta: 0.73

Competitor Statistics from Q3 2021

Revenue:$315B

Revenue: $314B

Revenue: $180B

Investment Thesis: UnitedHealth Group Incorporated is a managed healthcare and insurance company, and the largest healthcare company by revenue. It had four major segments: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx.

Due to consistent, stable growth, as well as solid fundamental financials, I rate UNH as a “moderate buy,” reflecting that purchasers may be paying a slight premium for this dependability.

For the US healthcare industry as a whole, spending is projected to grow at a rate of anywhere between 5 to 15% CAGR over the next several years.

UNH as a company has also seen growth, both as a result of growth in membership and growth within their Optum segment. UNH reported Q3 revenues of $315 billion, the largest out of any competitors, and a 12.82% increase in YoY revenue growth. This revenue growth is compared to CVS’s 10.69%, Cigna’s 5.65%, and Elevance Health’s 14.47% growth. UNH also has the largest net income margin percentage: 6.17%, compared to CVS’s 1%, Cigna’s 3.67%, and Elevance’s 4.05%. Within just their Optum unit specifically, UNH reported 34% revenue growth.

For Q3, UNH also reported adjusted net earnings of $5.79 per share, a 28% YoY increase, and consistent with their trend of EPS growth over the past several years.

In addition to growth in revenue, net income margin %, and EPS, UNH has other indicators of solid financial health.

As of 9/30, UNH’s Debt to Equity (D/E) ratio was .587, indicating a very healthy capacity to repay debts. In comparison, CVS, Cigna, and Elevance reported D/E’s of 1, .711, and .665. With a Return on Assets of 7%, UNH shows strong profitability in relation to its total assets. Comparatively, CVS, Cigna, and Elevance reported 4%, 3.4%, and 5.6%. Return on Equity (ROE) indicates how well a company is managing investments provided by shareholders. UNH has an ROE of 23.4%, compared to CVS’s 4.44%, Cigna’s 14.7%, and Elevance Health’s 17.2%.

UNH also has a beta of .73, indicating a low volatility.

Revenue: $153B