Restructured and Recharged On The Frontier of Solar Energy Returns Could Be Sweet and Green

A curated semesterly roundup of stocks that we are currently obsessed with in the market.

Restructured and Recharged On The Frontier of Solar Energy Returns Could Be Sweet and Green

A curated semesterly roundup of stocks that we are currently obsessed with in the market.

Now in our fifth year, Cornell Equity Research has made this semester one of innovation and an unwavering commitment to excellence in student-led financial research and publication.

As Fall 2024 comes to a close, it is an honour to continue leading such an intelligent, passionate, and creative executive board who, along with our dedicated sector leads, constantly strive to improve the quality of our research and the experience for our members. As we look to Spring 2025, I cannot help but be optimistic for the future of the club. Whether it be connecting further with our alumni, hosting more social events, or inspiring a passion for financial research, I know I speak for everyone in the organisation when I say this has been an impactful semester, and we cannot wait to see what the new year brings. We invite you all to join us in our upcoming endeavours.

Yours Sincerely,

Kaleb Kavuma President, 2024-25

Overview and Themes: Since the last publication, generative AI continues to be the primary driver of equity markets and valuation across global markets. Nonetheless, two significant changes to the market view affected the outlook: the election of Donald Trump and the rising ROI debate across the AI value chain. Over the summer of 2024, investors began questioning tech firms’ trillion-dollar investments in semiconductors and relevant PP&Es, causing temporary volatilities in Nasdaq-100. The red-sweep of legislative and executive branches of the US government adds complexity to the discussion, where a pro-business yet anti-trade administration complicates a globally dependent tech industry. Looking ahead, company management reiterated continued CapEx in AI and digital transformation, as well as a rise in M&A amid anticipated favorable domestic political policies

Generative AI remained the trailblazer, with companies like NVIDIA and OpenAI capitalizing on foundational LLM models Semiconductor firms continued to witness 50-100% YoY increases in chip demand, the fuel for LLM computation and processes Major tech players like Microsoft, Google, Oracle, Amazon, and Tesla are the main customers of these chips, fueling their productivity, particularly in software development, content creation, and customer service Cloud hyperscalers, including Amazon’s AWS and Microsoft Azure, expanded AI-driven services, facilitating enterprise adoption and introducing B2B AI productivity suites. The stocks of these big-player tech firms (Magnificient 7) continue to dominate the market, driving Nasdaq-100 up nearly 21% since May 2024. Nonetheless, there was a market sell-off in early August during earnings season, contributed by systematic and idiosyncratic risks.

2025 Outlook: Investors will be interested in how the AI trade could expand beyond the seven stocks to the other 493 in the S&P 500. There is hope for the “democratization” of AI applications integrated across sales, marketing, and enterprise operations. Earnings calls reaffirmed previous anticipations of sustained investment in AI infrastructure, mainly supplied by Nvidia – its Blackwell chips being the show's highlight. Institutional and retail investors want to see certainty from tech firms like Microsoft that the $60k/unit chips are bringing tangible revenue for the firm, something that has been more opaque in 2024.

There’s a central theme of convergence with advanced technology in media, especially towards personalization driven by AI. Notable deals included Amazon’s acquisition of smaller content creators to bolster Prime Video and a resurgence of sports streaming as a growth segment. Social media increasingly emphasizes short-form video content, with professional media giant LinkedIn launching its version of Tik-Tok-related scrolling montage. These developments, whether fueled by decreased human attention span or genuine product demand, underscored consumer shifts toward interactive and immersive entertainment. Media did experience considerable pushback, especially with the US government actively seeking to ban TikTok within its borders and Australia banning all social media for children under sixteen. These political headwinds may slow the revenue realization of AI integration in media relative to other industries. The S&P 500 Media Index has returned about 16% since May 2024.

2025 Outlook: The media landscape is set to see augmented reality (AR) and virtual reality (VR) gain traction, particularly in gaming and live events. Apple’s release of Vision Pro and Meta’s new AI glasses bring new stages for the media industry to dance on. Similar to joint ventures in the semiconductor, there could be vital partnerships between content creators to maximize this tech-enabled growth opportunity. There were also discussions about utilizing blockchain to secure individual content creators’ artworks online, where originality is becoming less consistent.

5G deployment continued to be the priority for telecom firms approaching near-global rollout in developed markets. This also means that the bulk of Cloud Service Providers (CSP) – think IBM, AWS –spending on 5G equipment seems to be finished, meaning higher cash flows for CSPs but negative for 5G wireless equipment suppliers like Qualcomm and Intel. The M&A space was active, with Vodafone and Verizon finalizing landmark deals to expand network reach to every corner of the United States There’s also an emergence of terrestrial connectivity, where direct-to-device satellite phone connectivity provides unparalleled connectivity in areas of distress, like Ukraine Starlink, now equipped with nearly 7,000 satellites in space, approaches 60% of all functional artificial satellites, with an estimated valuation of $137 billion; there are rumors of a 2025 IPO with favorable political and market conditions. The S&P 500 Telecom Services has returned about 11% since May 2024.

2025 Outlook: Investors could be looking out for early definitions of 6G from 2025-2028, considering that each generation takes a decade to come to fruition. With the advent of localized LLMs, the increased specialized data comes with increased cybersecurity risks. These developments are expected to increase demand for cloud solutions that can operate locally. There would also be an emphasis on how AI could be integrated into the industry. Investors anticipate AI revenue impact in 2025, especially in edge computing beyond rudimentary applications like customer service.

Vatsal Kalola| November 29, 2024

Rating: Buy

Current Price: $38.10

2026 Price Target: $72.59

Company Updates / News

● DigitalOcean beat both sales and revenue expectations for Q3

● Although FY guidance was raised, DOCN traded down around 14% → +8% since ● NDR, a KPI for both DOCN and investors has been stuck at around 97% for 3Qs

Key Statistics from Q3 2024

DigitalOcean is a leading alternative cloud service provider catering primarily to small and medium-sized businesses (SMBs) and developers. With its simple, cost-effective, and developer-friendly platform, DOCN offers a competitive alternative to hyperscalers like AWS, Azure, and GCP through its droplets and offerings across the tech stack. Recently, DOCN has acquired Cloudways and Paperspace, which has significantly boosted its managed cloud hosting and AI/ML offerings

DigitalOcean has a moat around its product offering and target market as it is a very capital-intensive industry to enter and hyperscalers don’t have the financial incentive to go after SMBs. As DOCN scales its product offering, it will be able to not only be able to scale ARR from existing “Builders/Scalers” (customers that spend >$50/mo), but they will also continue to poach customers from hyperscalers as mentioned in the Q3 earnings call Once DOCN laps the price increase on its Cloudways offering, churn will stabilize, coupled with upselling new products → Inflection in NDR and accelerated ARR growth. Investors that use both these measures as KPIs for long-term business quality will drive up the share price as the story gets better

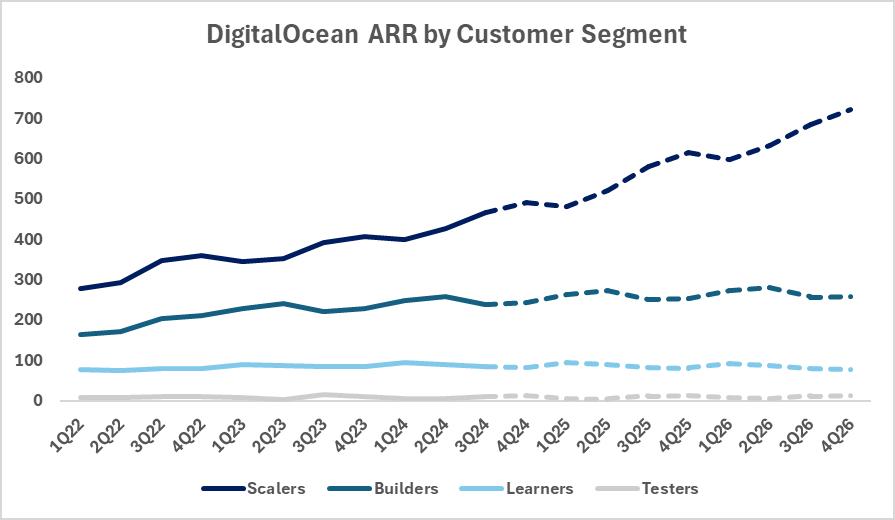

As of November 29th, 2024, DigitalOcean Holdings was trading at $38 10 per share I believe that this equity is undervalued and will increase significantly to $72 59 by the end of 2026. DOCN splits customers into Scalers, Builders, Learners, and Testers based on monthly spend I built out a granular operating model looking at # of customers, ARR, and ARPU for these segments and then used conservative assumptions to arrive at projected ARR numbers. Then I built out a cost model to arrive at projected adjusted EBITDA values to which I placed a fair 18 5x industry multiple on 2026E adj. EBITDA to arrive at a $72.59/share valuation.

According to management, DigitalOcean has seen a positive trend in NDR during the current quarter although it has stayed flat at 97% with core DO NDR ahead of that due to the headwind from Cloudways pricing until 2H25. AI products are not included in NDR currently as the offering has been for training models for a couple months However, as DOCN expands the GPU droplet offerings, upselling will be easier as well as maintaining spend from the largest customers I expect that by 2H25 into 2026, the AI/ML offerings will be included in NDR, which management has said would already be a 2pt boost. DigitalOcean is also shifting to an outbound sales motion, which has resulted in customers with around $5-6K monthly spend vs $15-20 for self-serve Although this will be a slight NT margin headwind, DO is opening a new Atlanta Data Center, which is likely to drive significant margin upside from reshaping their DC footprint from consolidating workloads from expensive locations. Additionally, it will provide NT incremental power/space.

Vatsal Kalola| November 29, 2024

DigitalOcean by the Numbers:

Scaler ARR accelerates from new product offerings. NDR inflects into FY25 driving ARR Growth.

Overall, the accelerated product rollout and ability for DigitalOcean to capitalize on overarching AI/ML trends will allow it to reignite ARR growth that has been lacking over the past couple years. DOCN has lost over 70% of its value since the ATH in late 2021 after the market correction in 2022. This has led investors to be wary of what has been viewed as a stable, but dying cloud/software company. However, recent management changes, product rollouts, and cost initiatives provide real upside to the current valuation as the narrative around the company shifts with KPIs improving over the next 1-2 years.

Risk Potential:

The DigitalOcean existence risk comes from the hyperscalers and other CSPs taking their customers However, the SMB target market for DOCN is perfect because it's big enough to feed new customers with high levels of demand, but small enough to not be enough of an incentive to be interfered with by large competitors

DigitalOcean’s NDR has plateaued at 97% over the last 3Qs, below the desired 100%. This has been attributed to the large number of customers that it serves, causing NDR growth to slow However, the recent positive trends seen by management in core DO offerings and lapping the churn caused by pricing in the Cloudways segment should jumpstart growth. Additionally, the 3Q inflection above 100% built into the valuation model is conservative and even with a slight delay, returns will stay similar due to the accelerated product rollout and outbound sales motion.

Ultimately spending in this sector often comes down to the macro environment especially in the SMB segment. However, with interest rates coming down there seems to be optimism regarding IT spending budgets, which will positively impact DOCN's growth. Additionally, because DOCN provides a cost-effective alternative to other CSPs and other tech companies, it will still prove valuable to SMBs even within an economic downturn.

Sources: digitalocean.com | NY Times | Barrons | Business Wire | Yahoo Finance | investors.digitalocean.com

Kashmir Tai | November 6, 2024

Rating: Buy

Current Price: $123.00

Price Target: $132.9

● Total Revenue: $23 81B

● EV/EBITDA: 16.88

● Market Cap: $28 55B

● Beta: 1 33

● EPS: 1.09

● Live Nation Entertainment completed a $1 7B debt refinancing with a close date of November 5th

● Portland's City Council has approved Live Nation's proposal to build a new concert venue, despite an appeal from Oregon’s music industry advocacy group on September 18th

Competitor Statistics from Q2 2024

Total Revenue: $3 1B (€2 87B)

EV/EBITDA: 17.10

Total Revenue: $6 38B

EV/EBITDA: 15 3

Total Revenue: $858M (€793.6M)

EV/EBITDA: 14 31

Live Nation Entertainment (LVY) is a leading global live entertainment company founded in 2010 after its merger with Ticketmaster No doubt the giant in the industry, Live Nation occupies 32 9% of the total live concert industry revenue as estimated ($11.7 billion). After its revival from the devastating blow of the pandemic since 2020, Live Nation aims to boost concert attendance, targeting over 145 million fans by expanding its global footprint and increasing events at owned or operated venues.

My recommendation is a buy for Live Nation Entertainment It will maintain its strong growth and remain in its leading position in the live concert industry, given healthy global demand trends, promising adjusted operating income (AOI) outperformance, and a steady stadium pipeline

As of November 6th, Live Nation Entertainment (LVY) is trading at $123.00. I believe that this equity is fairly valued and expected to increase to $132.90 within this year I arrived at this conclusion by conducting a DCF analysis with a terminal growth rate of 2.5%, a WACC of 9.89% across 5 years, and a $650 million Capex of estimation for the year 2024 I used these assumptions based on historical data and an optimistic view given Live Nation’s outperformance after the pandemic and its recent 2024 Q2 report’s projection on capital expense to support venue expansion globally.

Live Nation Entertainment has three clear sections that make its business thrive: Concerts, Ticketing, and Sponsorship & Advertising The Concerts segment generates most of Live Nation's revenue among the three segments. In 2023, the Concerts segment generated $18 8 billion in revenue, achieving an AOI margin of 1 7% The Ticketing segment reported $3 billion in revenue, achieving a 37 7% AOI margin Meanwhile, Sponsorship & Advertising earned $1.1 billion in revenue with a high 61 6% margin

Interestingly, the main driver for the increase of AOI margin in all three segments is not how Live Nation cut their direct operating expenses or SG&A; rather, it is the increased revenue in 2024 In fact, Live Nation's direct operating expenses, SG&A, and D&A all increased compared to 2023 Q2 performance (an increase of 12%, 22%, and 7%, respectively) Nevertheless, the increased revenue offset the decrease in Live Nation's operation costs by enlarging its fan base and expanding its venue numbers in the US and globally. The following sections will explain why it is expected that Live Nation will continue to maintain relatively similar or even higher AOI growth in 2024-2025

Live Nation has deep connections with 765 million fans across 49 countries For the first six months in 2024, approximately 62 million fans attended Live Nation shows, an improvement of 6 million fans or 10% compared to the same period in 2023 As Live Nation plans to open 14 potential venues in 2024-2025 (explain in detail in the next section), it is estimated that 20 million new fans will be drawn to Live Nation concerts and shows, ultimately contributing to a $350 million AOI increase

After dominating the US entertainment market with almost a third of the industry revenue, Live Nation emphasizes the idea of expanding its global platform many times to the public. They believe that this business strategy will strengthen its portfolio in the global music market, bringing additional revenue opportunities by connecting with new fans, artists, sponsorship, and partnerships across Europe, Asia, and the South Pacific

Currently, Live Nation owns about 370 venues globally; it plans to develop 14 new venues over 2024-2025 (have yet to disclose all locations to the public) By the end of June, 2024, the new venues have contributed to $149 6 million revenue In the near future, major sports events like the 2026 FIFA World Cup, 2026 Winter Olympics, and 2028 Summer Olympics are significant revenue growth catalysts, as well as ongoing large-scale concerts and annual festivals such as Coachella, EDC, and tours by artists like Usher, Katy Perry, Ed Sheeran, Billie Eilish, and Ariana Grande. Accordingly, the increased stadium activity will drive higher revenue and AOI margins, particularly in the ticketing segment.

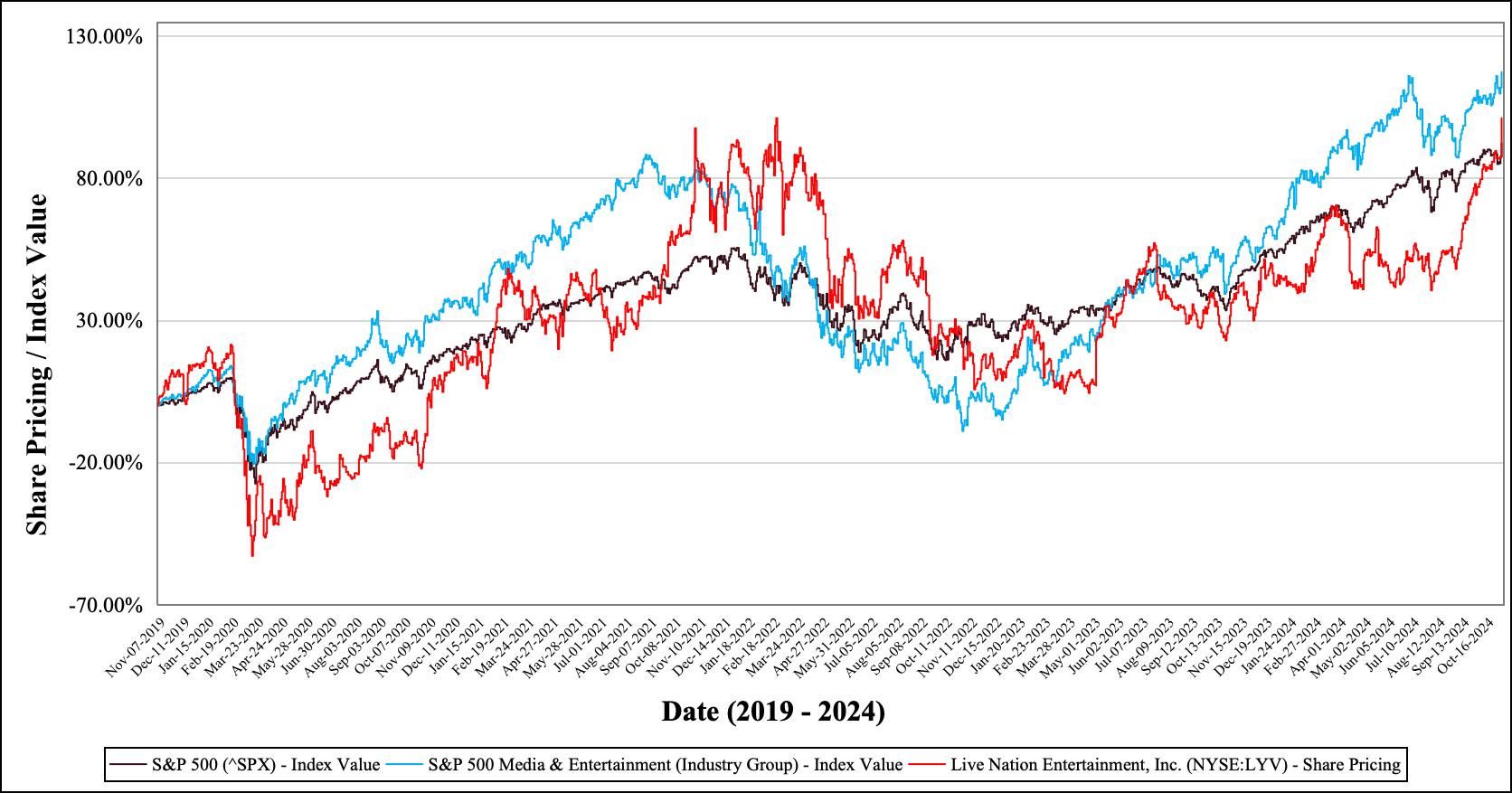

Share Price of Live Nation Vs. S&P and S&P (Media & Entertainment)

Source: Capital IQ

Risk Potential

DOJ & Trump’s Administration on Antitrust Law

On May 2nd, 2024, the U.S. Department of Justice in 29 states and the District of Columbia sued Live Nation Entertainment, dominating the concert industry by locking venues and selling exclusive presale tickets. Live Nation defends by stating that its integration improves service quality and lowers costs The executive vice president, Dan Wall, claims that Live Nation's net profits with Ticketmaster do not wield monopoly power, and this lawsuit will not reduce the price of tickets or service fees.

As Trump wins the 2024 election, many agencies expect he will replace Ms Khan, the FTC commissioner who champions antitrust regulations and chooses leaders from his party. To foster a better economic environment in the US, Trump will release fewer business regulations, including solid opposition to monopolies in industries such as energy and technology It is still not clear if Live Nation will benefit from this election. Still, I believe that Live Nation could take advantage of the loose business regulations under Trump's administration, further dominating the live concert industry.

In May 2024, Ticketmaster experienced a serious customer account security issue A hacking group called ShinyHunters disclosed 560 million users' personal information online. To fix this issue, Ticketmaster introduced a two-factor authentication process for ticket transfers. This suggests that Live Nation's ticketing system still has room for improvement, such as offering enhanced encryption practices and continuous system monitoring.

One thing that Live Nation should be concerned about while expanding its global presence is the ongoing geopolitical conflicts. Past tragedies include the Manchester, England bombing attack at the 2017 Ariana Grande concert; Pairs, France, massive shooting incidents at the 2015 Vince Neilstein metal concert; and recent news of how terrorist threats pushed Taylor Swift to cancel her concerts in Vienna. Therefore, Live Nation should prepare each concert event with effective risk management, or else there will be undesired terrorist attacks and massive shooting incidents harming Live Nation's long-term growth.

Sources:

Capital IQ | IBIS World | BBC News | Yahoo Finance | Seeking Alpha | Financial Times | CFRA Equity Research | Evercore ISI | Deutsche Bank Research | Oppenheimer | Macquarie Equity Research |Guggenheim

Eva Shrayer | December, 1st 2023

Rating: Buy

Current Price: $257.07

Company Updates / News

Q2 2024 Highlights

● $41B Market Capitalization

● $3.6B Revenue

● $44,465 Enterprise Value (MM)

● $738M Adjusted EBITA

● $171M Free Cash Flow

● $2.62 Adjusted EPS

● 1,680,606 Average Daily Volume

● 32M Active Users

Competitor Statistics

55M Loyalty Members

11.53B

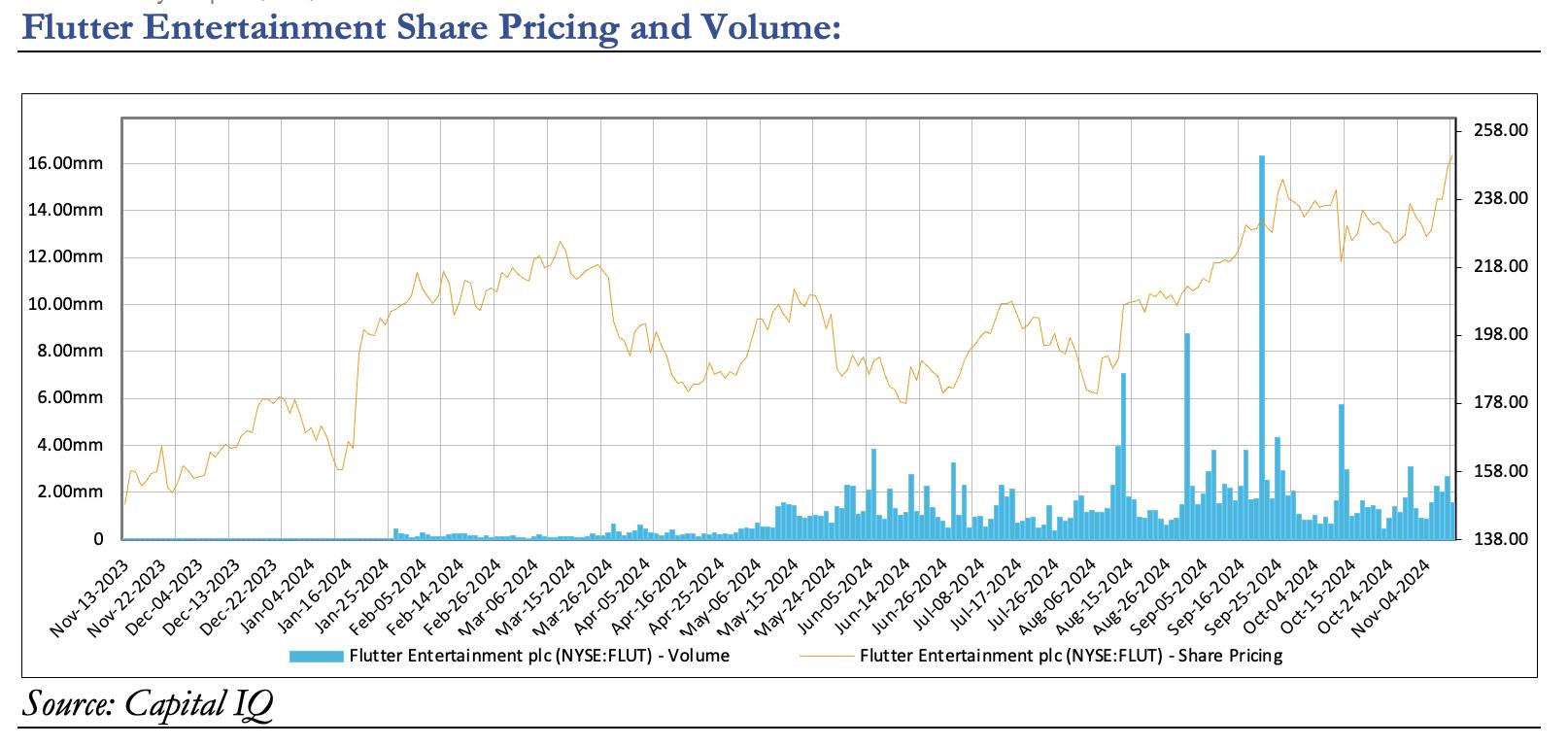

All in on Flutter: Bet on Big Growth

Since Flutter’s listing in the New York Stock Exchange on January 29, 2024, the stock has grown 17% and is up 42.32 % year to date. Flutter is a best-in-class B2C gaming operator, with a leading presence across all of its key markets including the US, UK, Australia and Italy which together account for 90% of group revenues It has a leading product, scale, and brand which continues to reinforce its positioning despite increase competitive intensity and ongoing regulatory headwinds. Its competitive advantage lies in its wide-reaching digital platform, strong customer acquisition strategies and well diversified geographic footprint My buy recommendation reflects a belief that Flutter will continue to perform well, given the rising popularity of online sports betting and the legalization in more states across the US

Using comparable company analysis, Flutter is set to outperform its competitors With M&A acquisitions coming into play soon, they are set to grow especially in different geographic regions. For 2024, the revenue is expected to grow 20.7% Y/Y with an EBITA margin of 19 9% The EV/Sales ratio is projected to be 3 3x compared to competitor DraftKings at 3.7x as well as EV/EBITA of 18.3x vs. 47.6x.

Flutter Entertainment’s technology serves as a cornerstone of its competitive advantage, enabling it to deliver a superior user experience, drive engagement, and maintain operational agility in a rapidly evolving market The company has invested heavily in developing proprietary in-house platforms that power its major brands, allowing for greater control over the customer journey and enhancing platform stability Unlike competitors that rely on third-party systems, Flutter’s in-house technology gives it the flexibility to quickly adapt to regulatory changes, launch new products, and offer innovative betting features tailored to customer preferences. For instance, Flutter has pioneered advanced live betting options, such as enhanced NBA live betting and MLB prop betting, which have increased user engagement and retention by catering to bettors who favor real-time wagering. The technology also supports cross-product promotions and personalized recommendations, making it easier for users to explore different types of betting within Flutter’s ecosystem, thus increasing customer lifetime value. Furthermore, Flutter’s transition to an integrated technology platform has streamlined its operations, reducing costs and boosting margins by consolidating resources across its brands

In a ~$368B regulated sports betting and gaming market, Flutter has a strong 8% CAGR to 2030 with a current market capitalization of $44B. In 2024, Flutter Entertainment reported a significant increase in total assets, reaching approximately $35 billion, reflecting growth across its global betting and gaming brands, including FanDuel, Paddy Power, Betfair, and PokerStars. The company has expanded its market presence, particularly in the US , where FanDuel holds a dominant share of the online sports betting market (38%). Flutter's total revenue rose to approximately $12 billion, with the U.S. market contributing around 40% of this total due to rapid growth in legalized sports betting The company's customer loyalty is reflected in FanDuel’s strong position in active monthly users and high engagement levels in regulated markets.

Eva Shrayer | December, 1st 2023

Government Regulation: The regulatory landscape of U.S. sports betting has rapidly evolved since the 2018 repeal of PASPA, allowing states to independently legalize and regulate the industry Currently, sports betting is legal and regulated in 38 States and the District of Columbia. This change has created significant opportunities for Flutter Entertainment, whose FanDuel brand has established a leading position in the U.S. market. As more states, including potential large markets like California and Texas, consider legalization, Flutter is well-positioned to capture a substantial share of this growth. However, the fragmented state-by-state regulation requires Flutter to navigate complex licensing requirements, varying tax rates, and specific advertising and responsible gaming regulations, which impact profitability In addition, the rule of thumb is that leading scale operators can initially mitigate 50% of a potential tax hike (marketing lever, repricing of odds), which in theory should be more over time as smaller/sub-scale operators end up struggling and potentially exiting the market (Australia is a good example). I believe regulation will gradually increase, in line with more mature geographies, but at the same time will offer scale operators the opportunity to consolidate the industry further. The blended tax rate in the US, as last communicated at FanDuel’s CMD in 2022, was 33% of NGR, and this should not be too different today (a touch higher given tax increases in Ohio and Illinois)

M&A Acquisitions: Flutter has recently acquired an initial 56% stake in NSX Group, a leading Brazilian operator of Brazilian gaming Group Betnacional seeking to expand into the soon-to-be regulated market (early 2025) After the regulation, there will be less competition and small/sub sale operators will find it challenging to operate. Brazil’s market is particularly attractive due to its population of over 200 million with soccer and sports being a key part in the culture There is a strong demand for sports betting and iGaming products with compound annual gross gaming revenue growth in the unregulated market of 38% since 2018, to almost $3bn in 2023.

Flutter has also agreed to acquire Snaitech (“Snai”), one of Italy’s leading omni channel gaming operators Expected to close by Q2 of 2025, upon completion, combining Snai with its existing Italian leading business, it will be the country’s gaming leader with about 30% of the online market. Italy is the largest gambling market in Europe with an estimated gross gaming revenue of €21bn in 2023 Greater digital adoption is expected to drive online market growth at a compound rate of approximately 10%6 over the next three years.

Sources: Sources: Flutter Investor Relations | JPMorgan Equity Research |Yahoo Finance | Capital IQ | Financial Times

Lucas Lee | Nov 29

Rating: Hold

Current Price: $44.38

Price Target: $45.47

● Market Capitalization: $170.41 B

● EPS: $1.19

● 2023 Revenue: $134.00 B

● 3-year Sharpe Ratio: -0.7

● 5-year Beta: 0.42

● Gross Margins: 60.28%

● P/E: 17.48

● Dividend Yield: 6.68%

Competitor Statistics from Q3 2024

Market Cap: $273.07 B 2023 Revenue: $78.6B

Market Cap: $168.02 B 2023 Revenue: $121.57 B

Market Cap: $160.30 B 2023 Revenue: $128.4 B

Headquartered in New York City, Verizon was formed in 2000 through a merger between Bell Atlantic Corp. and GTE Corp. Verizon is currently one of the world’s leading providers of communications, technology, information, and entertainment products/services to consumers, businesses, and government entities. With a presence around the world, Verizon offers solutions that are designed to meet customers’ demand for mobility, reliable network connectivity, and security. The company operates in two segments: the Consumer Group and the Business Group The Consumer Group provides goods and services to individual customers while the Business Group serves businesses and government agencies.

The forecast for Verizon is clouded by a combination of strong strategic initiatives and unimpressive financial reports. While Verizon is advancing in key areas such as 5G expansion and broadband services, it holds a giant long-term fixed debt of almost $150 billion and has lost in net income each of the past 2 years, with a major decrease by $10 Billion. The dissatisfaction with the locked up cash has projected itself in the stock price being at a 10-Year low in October 2023. Today, the stock has recovered nearly 30% with increased free cash flow and increased dividend payments Verizon also announced the acquisition of Frontier in October 2024, which will have unknown long-term effects While Verizon will expand its coverage from this deal, it will have to navigate through the challenges of taking it on. Hence, I believe Verizon to be a Hold.

As of November 29th, Verizon (VZ) is trading at $44.38 Using a DCF analysis, I believe that the equity is fairly valued. I came to a target price of $45.47, using a 1.2% growth rate and WACC of 4.2% across 5 years These assumptions are based on a realistic representation of Verizon’s recent performance history of slow growth.

In its most recent quarter, Verizon reported a net total broadband addition of 389,000. It added a net total of 363,000 fixed wireless subscribers, bringing that total to 4.2 million. The company hit its fixed wireless subscriber target 15 months ahead of schedule. Total broadband connections are up 16% YoY and fixed wireless revenue is up YoY.

Lucas Lee | Nov 29

Verizon has been committed to rewarding its investors with consistent and increasing dividend payments. The company’s free cash flow has been growing over the years, typically paying out ⅔ of it to investors They provide investors with a high yield and the company has increased dividends for the 18th consecutive year

Verizon plans to acquire Frontier for $20 B in cash. What Verizon hopes to see from this acquisition is the expansion of its fiber footprint and good synergy However, Verizon will acquire $11 B of Frontier’s debt, which may bring more financial restrictions and reduce future dividends

Verizon 10-Year Graph:

Source: Capital IQ

Risk Potential

Debt: Verizon has generated minimal revenue growth and experienced declines in earnings. In efforts to grow, it has used debt to finance growth. However, its debt has been adding up, racking up to $178 B Its current debt/equity ratio sits at 1.564 since September 2024. The debt/equity is a little higher than its competitors, meaning it is financially more risky Though, high debt is not unique to Verizon but rather the telecommunications industry

Market Saturation: Taking a deeper look into the industry, heavy competition in a highly saturated market affects growth potential. Most American consumers are already involved in the wireless market. While Verizon makes up for the largest customer base and achieves the highest revenue, T-Mobile dominates the market in terms of market cap This industry has been stagnant for some time now, making the emergence of the next big thing a huge differentiator in the space

Sources: Verizon Financial Reporting Summary | Capital IQ | Morningstar | Nasdaq | WSJ | Yahoo Finance

reaches S&P 500 Consumer Defensive stocks, including companies that manufacture food, beverages, persona and housing products, and other packaging, have revealed an upward 2024 trend, alongside the S&P 500 Index, year-to-date. While the S&P 500 is up +26.47% YTD, Consumer Defensive is shy of that at +19.76%. This is partly driven by Costo (COST) and Walmart Inc. (WMT). Costco is up +47.24% YTD, and Walmart is up +76.02% YTD. For a more holistic view, we can look at Invesco S&P 500 Equal Weight Consumer Discretionary ETF, which includes top holdings of Las Vegas Sands Bath & Body Works, Tesla, Tapestry, and Ralph Lauren. Due to greater diversification, the YTD returns are at +12.71%.

Consumer growth can, in large part, be attributed to control by the Republican party in office Following US elections, consumer discretionary stocks rallied. Previously, in September, buyers poured into the market at a low, in anticipation of interest rate cuts by the Federal Reserve Should the Federal Reserve cut rates once again, the economy would continue to grow further Looking toward debt, we can examine the US Consumers’ Debt-Service Ratio, examining the change in aggregate disposable household income with the amount owed. This has been on the rise and reveals the ease at which individualism can cover its debts If it stays as is now over the next year, consumers will have more spending money. Healthier debt ratios may also encourage consumers to dine out more, which would again boost consumer equities among the food and beverage sub-sectors.

Despite growth in the overall consumer sector, fashion stocks have declined post-pandemic boom. Volatility in the area brings great risk to investors. Demand for luxury goods is on the decline particularly with weak Chinese consumer demand driving a sales dip. Shares of luxury giant Louis Vuitton Moet-Hennessy (LVMH) declined nearly 7% after disappointing Q3 sales were announced, due to the conglomerate’s sales in Asia dropping 16%. While seemingly disappointing, the drop in luxury demand may drive brands like Indirex (ITX), owner of Zara, to perform well.

Lastly, we can predict the demand for home-related consumer goods by looking at the real estate market. Lower interest rates, boost the real-estate market, as borrowing liquidity becomes easier, which would drive the demand for home-related goods

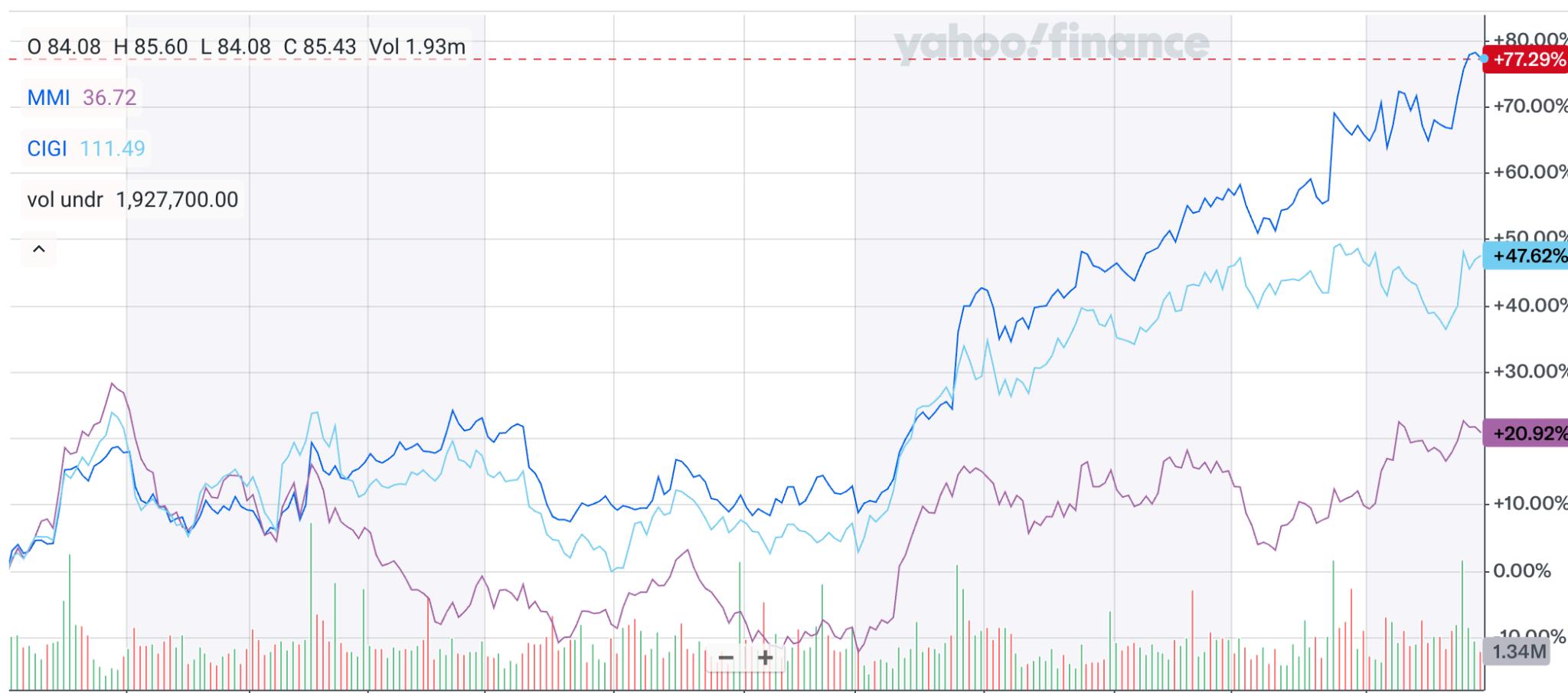

Consumer Defensive + S&P 500 (Source: Yahoo Finance)

Emily Hong | December 1, 2024

Rating: Hold

Current Price: $106.87

Price Target: $127.46

● Market Cap: $4.67B

● Beta (Yahoo Finance): 0.27

● EPS (TTM): $5.53

● PE Ratio (TTM): 19.33

● 52 Week High: $108.48

● 52 Week Low: $54.81

● 1Q25 filings show 30% increase in Career Learning enrollments YoY, ~41% of total enrollments

● Revenue per enrollment saw little change: 1.0% in Career Learning and 0.8% in General Education

● Optimistic forecasts for 2Q25, including revenues in the range of $560mm - $580mm, up from 1Q total revenue of $551mm

Competitor Statistics

incl. Statistics from Yahoo Finance

EV/Revenue: 0.73x

Revenue (TTM): $684.37mm

Stride, Inc. is an education services provider company with a focus on products supporting virtual and blended learning. Stride’s technology-based products and services span across curricula, learning management systems, instruction assistance tools, support services, and more. Stride operates a “school-as-a-service” model, namely an integrated package of these assorted offerings in order to service their clients across all elements of education Further, the company breaks revenue down into two key streams General Education and Career Learning. While General Education, the business’ K-12 focus, has historically been Stride’s focus, recent trends show shifts toward career learning. My hold recommendation reflects an excitement about Stride’s ability to continue developing Career Learning under the industry-wide trend of shifts toward seeking alternatives to traditional higher education, tempered by a realistic mentality toward current market enthusiasm toward the company, which has driven high valuations

As of November 29th, 2024, Stride, Inc. trades at $106 87 per share, sitting right under the company’s 52-week high of $108 48 per share This situates the share price slightly below my anticipated 2026E price of $127.46 per share, calculated through a Discounted Cash Flow analysis with a 2 50% terminal growth rate and 8 37% WACC Notably, this model utilizes a beta of 0 58, average between Yahoo Finance and Barra, the latter of which offers a more conservative beta estimate of 0.88. Despite the slight upside of the anticipated share price over its current price, I do not believe the upside substantiates a buy recommendation, given comparable growth of peer companies; the growth rate of the S&P 500 and other indices; and anticipated YoY inflation rates.

A key observation from Stride’s October release of its 1Q 2025 earnings report is the continued increase in Career Learning enrollments, not only nominally, but more notably as a percentage of Stride’s total enrollments. Compared to 1Q24, Career Learning enrollments increased by approximately 21,400 students, boosting the segment’s portion of total enrollments from ~37% to ~41% In parallel, trends in the education industry as a whole suggest rising interest in career development and alternative education outside of traditional higher education, with cost of attendance skyrocketing for university degrees that generate waning ROI for the majority of the population. Further, rports from the Bureau of Labor Statistics (referenced in Stride’s 10K23) estimate a 6 7% growth in demand for job occupations that require nondegree postgraduate education, and companies like Stride service that gap, providing good reason for the mirrored industry trends in the company’s financials. Still, it is important to note that Career Learning, compared to General Education, generates slightly lower revenue numbers, although it has seen slightly higher growth (1 0% vs 0 8% General Education) If Stride can adequately boost revenue numbers from Career Learning in its continued expansion and compress margins, that would positively impact its future valuation.

Emily Hong | December 1, 2024

Source: S&P Capital IQ

Risk Potential

Regulatory Policy:

Given that much of Stride’s General Education growth depends on state-level education policy as well as the company’s collaborations with individual state boards of education, regulatory uncertainty is a meaningful concern when evaluating Stride’s future performance Political changes, such as the recent election playing a new party in power, may affect national-level budgeting decisions, which would trickle into budget allocations and constraints for education in different states Further, tightening of technology policies in education, homeschooling policies, or virtual education would impact both enrollment and recurring revenue Collaboation with policymakers and staying on top of policy trends remains important in order to mitigate this risk.

While Stride is a fairly established player in the online education space, there remains the risk of technological disruption or competition from smaller companies or other education-technology firms. These risks are larger in the Career Learning space, as Stride’s products and relationships with firms are less differentiated in comparison to General Education, where the company’s position in public education is more formidable. Because of this, Stride must continue to innovate, both in terms of curriculum and products itself as well as its underlying technologies. The Career Learning space as a whole is very competitive, and Stride faces—like any other company operating in this space—strong challenges of differentiating its brand name, product, and customer relationships from peers.

While economic downturns and higher unemployment may boost demand for Career Learning, as students opt away from attending college or postgraduate degrees due to high costs and low employment rates, a prolonged period of poor economic performance could also reduce household disposable income as a whole, limiting customers’ willingness to spend on education as a whole. Further, in periods of cost-cutting due to poor performance or growth, companies themselves may also be more reluctant to spend on career development tools for their employees in partnership with Stride, which would also reduce revenues in the Career Learning space.

Sources: Capital IQ | Stride Company Filings | Yahoo Finance

Aditya Mehra| November 11, 2024

Rating: Buy

Current Price: $124.87

Price Target: $166.57

Company Updates / News

● Market Cap: $193.8B

● Dividend Yield: 4.18%

● PE Ratio: 19.86

● 52 Week High: $134.15

● 52 Week Low: $87.82

● Hits all-time high after Q3 earnings, driven by raised guidance and double-digit revenue growth

● Smoke free segment is growing at double the rate of its core combustible segment

● The tobacco and nicotine segment face headwinds due to regulatory uncertainty

Competitor Statistics from Q3 2024

EV/EBITDA: 9.87

Revenue: $21.6B

EV/EBITD Revenue: $20.4B

Created by the spinoff of the international operations of Altria in 2008, Phillip Morris operates as a multinational tobacco company delivering products in the tobacco and nicotine sectors It is most well known for its best-selling product Marlboro, and is now working to deliver a smoke-free future and evolving its portfolio for the long term to include products outside its core segment Philip Morris International sells cigarettes and reduced-risk products, including heatsticks, vapes, and oral nicotine products through Swedish Match, in more than 180 countries primarily outside of the US The stock is ~9% below its all-time high and has been outperforming the S&P by nearly 5% this year, with an implied beta of 0.6. My buy rating is reflected by the stock being attractively valued at current levels, creating a compelling value and income opportunity through its high dividend yield Despite declining global cigarette consumption, Phillip Morris’ pricing power and growth in emerging markets support revenue growth and margin expansion

As of November 11th , 2024, Phillip Morris was trading at $124.87 per share. I believe that this equity is undervalued and will increase to $166 57 within the next year, implying a 33% upside. I conducted a Discounted Cash Flow Analysis with a terminal growth rate of 3 00% and a weighted average cost of capital of 6 6% across 5 years to arrive at this valuation My assumptions are based upon Phillip Morris’ guidance and an optimistic view of Phillip Morris’ future performance in growing segments.

The acquisition of Swedish Match in 2022 has been beneficial to PM on two primary fronts The primary advantage of PM relative to its competitors, given the relatively lower dividend yield and higher valuation, is the fact that its smoke-free revenue is more than double its competitors as a percentage of sales. From its iQOS heatsticks to oral nicotine products (ZYN and Snus) through Swedish Match, its brands are market-leading, and purchasing this stock is a bet on the consumer transition away from cigarettes. Its iQOS segment has increased customers by nearly 15% in FY23, spurred by growth in Japan, Europe, and a broad range of low-income countries

Given the nature of the spinoff from Altria, Phillip Morris’ US presence remains low, accounting for only 6% of its revenues. While PM does not disclose segmentation for which products comprise this 6%, it is fair to assume that Swedish Match accounts for a significant portion of their American sales Phillip Morris is gearing up to grow this portion, with plans to invest 800 million dollars in building ZYN factories in the US to meet higher demand, creating a new entry route to rebuilding its US presence Furthermore, PM has been good at targeting lower-income markets and acquiring brands, notably with its purchase of Sampoerna cigarettes in Indonesia. In the US, PM acquired the rights to commercialize iQOS from Altria, effective April 30th 2024 The US smoke-free market is growing at the second quickest rate behind China, and this combined with its oral nicotine offerings will assist PM in capitalizing on this growth

Aditya Mehra| November 11, 2024

Source: S&P Capital IQ

Risk Potential

According to estimates based on company guidance, the forward price to non-GAAP earnings stands at 18.8x, and while this is considerably undervalued given the Shiller PE ratio at 37x, this compares unfavorably to PM’s historical PE of 16.2, implying a 14% downside. Given its successful pivot to next-generation products, there is some justification for PM’s premium valuation, accounting for 36.5% of net revenues Regardless, it is important to look at comparable valuations given the uncertainty of its core business

Phillip Morris’ earnings are negatively impacted by the overall regulatory outlook, and the company is already subject to heavy government intervention in their sector Phillip Morris’ net revenues are 60% below revenues before excise taxes (government-imposed taxes on production and distribution), and regulatory scrutiny could lead to higher-than-expected excise taxes In June 2024, PM disclosed a subpoena from the attorney general of D.C regarding the sale of flavored pouches, stating “a material liability is reasonably possible ”

Sources:

Kevin Feng| November 11, 2024

Rating: Buy

Current Price: $39.04

Price Target: $47.69

● Market Cap: $4.9B

● Beta: 2.33

● EPS: (0.78)

● PE Ratio: NM

● 52 Week High: $42.77

● 52 Week Low: $8.83

● Sweetgreen’s 2024 Q3 results report positive but slightly below-expectation growth

● SG’s Infinite Kitchen automation initiative is under trial & expects to be fully implemented within 5 years

● Cost-push inflation in 2024 drives more consumers transition to dine-at-home options

Competitor Statistics up to Q3 2024

EV/Revenue: 7.6x

Revenue: $10.98B

Sweetgreen Inc (NYSE: SG) is a mission-driven restaurant brand in the fast-casual restaurant industry that differentiates itself with a set of “green” ethos, including healthiness & freshness of ingredients, local sourcing, seasonality celebration, etc It now operates over 200 restaurants in more than 18 states, sourcing from 200+ domestic partners and serving 13+ menu items With a young group of company management members, Sweetgreen seeks continued growth into the future with a heavy focus on adopting new technology From building more diverse, digital distribution channels to automating its kitchens, there is significant room to increase sales, enhance cost efficiencies, and break even in the near future. However, given fierce competition and potential drops in consumer spending, realizing the margin improvements may face difficulties. Altogether, combining quantitative valuation results giving a 20%+ upside with these trends, Sweetgreen is given a “Buy” rating.

As of November 11th , 2024, Sweetgreen (SG) is trading at $39.04. Using a Comps analysis with 5 competitors in the fast-casual restaurant industry and median EV/Rev & P/B multiples, the implied share price is $50.08. Only these multiples are chosen because current earnings are negative. Conducting a Discounted Cash Flow (DCF) analysis for SG until 2030, with WACC 8.22% and terminal value calculated from an average of Perpetuity Growth & EV/EBITDA multiple TV, the implied stock price is $45.30. Applying an equal weight, the target price will be $47.69, an upside of 22%.

Sweetgreen has been expanding the number of its distribution channels to the current count of 5, particularly emphasizing the digital channels. Its own digital app & website, combined with the previously used Marketplace channel, constitutes 59% of FY 2023’s total revenues. In particular, per-order value generated is reported to be higher for digital orders than in-store ones, reflective of an increasingly larger loyal customer base and further room for sales growth. Moreover, while more revenue is generated, cost-efficiencies have been improving too – the support center costs has grown by merely 4% between 2020-23 while revenue in the same period has grown by over 100%, reflective of shared overhead costs rendering some economies of scale Combined with initiatives like its “Sweetpass+” membership & its outpost channel for group orders, the multi-channel growth of Sweetgreen has enhanced the customer experience and built loyalty

EV/Revenue: 10.3x Revenue: $25.94B

EV/Revenue: 19.9x Revenue: $12.17B

Since Sweetgreen’s acquisition of Spyce, a robotic-powered restaurant chain, in 2021, it has announced plans to automate both its ordering system & the salad-making process This initiative provides room for Sweetgreen to greatly reduce labor costs, which currently is around 30% of COGS; CFO Mitch Reback estimates a 7% margin increase for each store that can be sustained into the future Moreover, same-store sales growth, which has been consistently growing at ~3-5%, could be maintained, if not enhanced, with the automation capable of supporting staff during peak times. Management plans full implementation at all stores within 5 years; initial attempts has proven successful with more traffic throughout the day and improved efficiencies by around 10%.

Kevin Feng| November 11, 2024

Sweetgreen vs. S&P 600 Restaurants Sub-Index Stock Price Performance (1Y)

Source: S&P Capital IQ

Risk Potential

The US restaurant industry, particularly the fast-casual industry, faces significant competition with over 200,000 businesses For example, Chipotle (CMG), one of the biggest, well-established players, shares merely 2 7% of the market; Sweetgreen is about 1/20 of Chipotle. As a result, switching costs between alternatives are low. Dine-at-home options are also becoming more appealing, particularly caused by the diminishing market segment of low-income households However, the competitive landscape is also one that favors unique value propositions, such as a focus on health; in this realm, Sweetgreen is the leading restaurant in the industry with the main product line being salads, and may generate a loyal, younger-generation customer base.

Given positive prospects from automation in the future, Sweetgreen may see limited effectiveness in improving its current cost structure, in the short-term. For one, each installment of the Infinite Kitchen automation technology costs between $450,000 and $500,000, a significant CAPEX within the next five years Given 2024 Q3 results, margin improvements appear to be slow, and whether this will be sustained or not may be uncertain.

Any unfavorable conditions for consumer spending in the future, such as higher interest rates, higher taxes, or less certainty, could all significantly reduce revenues for Sweetgreen and the restaurant industry altogether. Particularly for Sweetgreen, whose menu options are slightly pricier than McDonald’s or Chipotle at ~$20 per item, lower consumer spending may affect same-store traffic, the rate at which new stores are opened, and the ability to pass on higher costs through higher menu prices

Sources: Yahoo Finance | Capital IQ | SeekingAlpha | investor.sweetgreen.com | SEC/EDGAR | CNBC | IBIS World

Abstract: Energy in Q3 has experienced many complex trendsacrossbasicallyeveryverticalandcommodity.Asthe industry navigates into Q4, therearestillmanyunknowns regarding the demand, supply, and pricing thatleaveboth investors and companies confused. While oil prices have beendeclining,gaspriceshavegrownsigni�cantlytoalmost over50%ofitspricesinceAugust.

Oil prices have been on a bit of a rollercoaster this quarter. Uncertainty coming from both geopolitical tensions, new presidents and unclear policies, and fluctuations in demand have caused investors to have very mixed feelings about the market. To effectively break these pricing mechanics down, it is important to view each event holistically

Starting with geopolitical tensions, the conflict in the Middle East has been slowly involving more and more countries, as the US encourages warring nations to not strike key energy and oil infrastructure. So far, these methods of protecting oil supply have worked, keeping oil prices relatively subdued. However, there is always the possibility of further escalation, which has led to energy trading being a major profit driver for many companies this quarter. Shell and Exxon have seen relatively strong Q3’s compared to historical data due to higher profits from risk hedging.

Trump’s Presidency: with Trump back in office, there are major expectations from analysts across each vertical. For oil, the entire situation can be encapsulated with one simple phrase. “Drill, baby, drill.” Trump has made it clear he wants to increase US oil supply through slashing regulations to increase production. However, this is troubling for many oil giants, as Trump's actions would not only drive oil prices down, but increase competitors as well.

Finally, with unclear actions from OPEC and the lack of a complete economic policy from China has brought uncertainty for both supply and demand. As such, the commodity hasn’t stuck to any particular trend or forecast.

Commodity Pricing Last 3 Months Oil (Brent Crude and WTI)

Source: Yahoo Finance

Natural Gas (NG Futures)

Source: Yahoo Finance

Renewable Energy Demand

Source: US EIA

As for natural gas, the consistent price increases from increasing demand along with Trump's promise to cut regulation on exports could mean a booming industry for the next four years. Natural gas, and especially liquid natural gas products, have been exploding in demand due to their flexibility, versatility, and low cost.

With many economic sanctions resulting from the Russo-Ukraine war, natural gas has been a key commodity in Western Europe US exports could potentially relieve EU countries' current reliance on Russia for gas China, once again, has seen unsteady demand and no clear direction or focus for their economy in Q3, leading investor confusion and uncertainty

However, there are many complexities with Trump and the IRA. In particular, the probability of the IRA completely disappearing is very unlikely. Similarly, while the renewable energy industry might have taken a hit, there is very little chance that the energy transition is over.

Source: US EIA

These trends are consistent with other renewable energies like solar as well. This shows that the IRA and its grants, subsidies, and tax credits/breaks are incredibly important for both Red and Blue states. This, along with the IRA’s role in promoting general energy transition technology that has been increasingly important to the US economy, should safeguard most of the IRA from Trump’s ambitious program cutting goals

Although Trump has appointed conservative leaders to both the Energy Secretary and EPA, many Republican states rely heavily on the clean energy sector for employment and economic benefit. From the graph showing state energy generation from wind, the top 5 wind energy generating states are all Red states.

Finally, while M&A deal flow recovered a bit in Q3, expectations with Trump in office and the potential removal of FTC chair Lina Khan could mean further consolidation and increased M&A deals for energy companies. Currently, oil and gas have already reached high level of consolidation, and renewable energies companies are often too small to attract the fees necessary for the bulge bracket banks to act. As such, many middle market firms have seen an influx of deals and activity The future of energy will likely continue to dependent on government policy, tariffs, and commodity prices What we can expect in the immediate future in Q4 is the recovery for M&A, especially in the middle market due to the already consolidated large energy companies

All in all, the energy industry is going to experience a lot of changes as policies and expectations become much more clearer from some of the world’s largest economies.

Justin Li| November 11, 2024

Rating: Buy

Current Price: $40.14

Price Target: $52.05

Company Updates / News

● Market Cap: $5.765B

● Beta: 1.41

● EPS: 3.98

● PE Ratio: 10.08x

● 52 Week High: $62.31

● 52 Week Low: $30.93

● Nextracker’s Q3 earnings beat expectations

● Revenue increased 11% from Q3 last year driven by increased sales

● Adjusted EBITDA grew by a massive +57% from YoYr, signifying Nextracker’s transition to profitability

Competitor Statistics from Q3 2024

EV/EBITDA: 10.9

Revenue: $0.982B

EV/EBITDA: 8.72

Revenue: $4.017B

EV/EBITDA: -1.13

Revenue: $0.144B

Investment Thesis:

Nextracker is a solar technology and software company, whose product is intended to be used alongside solar panels to improve and optimize performance. Nextracker’s core offerings reflect its niche well; the NX Horizon product line offers three types of solar panel mounts that adjust to the altitude (angle) of the sun throughout the day to maximize solar exposure and energy generation Nextracker supports mainly commercial and agricultural solar panels for profit, and the company’s technology greatly contributes to increasing reliability and stability of solar panels across the globe However, it is important to note that the recent US Presidential election may bring unforeseen challenges for Nextracker due to Trump’s explicit stance against renewable energy tax credits. My buy recommendation reflects the belief that although there is substantial uncertainty for Nextracker, the company’s potential to continue to outperform the rest of the renewable energy market is highly likely due to recent recognized revenue synergies and its resilient core business model

As of November 8th , 2024, Target Corporation was trading at $40.14 per share. I believe that this equity is undervalued and will increase by 30% to $52 05 within the next year. I conducted a Discounted Cash Flow Analysis with a terminal growth rate of 3 00% and a WACC of 11 4% across 10 years to arrive at this valuation My assumptions are based upon NXT historical data and an optimistic view of NXT’s future performance.

Over the last year, Nextracker has seen its stock price beaten down by negative street sentiment; however, its core financial health and profitability has always been stable Nextracker has been able to consistently meet or beat earnings because of its financial stability during a time of policy uncertainty. What has been consistently driving financial gain in this company is innovation of technology Nextracker was founded with this idea in mind, and it currently has over 600 patents pending, which will soon materialize into additional revenue and profit for investors. Finally, the recent acquisition of Ojjo will create revenue synergies that the market has crucially undervalued. Ojjo has land support systems that allow Nextracker to deploy their solutions in brand new markets and boost revenues for Nextracker

Currently, Nextracker has over 4.5 billion dollars backlogged orders and unearned revenues. From an accounting perspective, this means that there are 4.5 billion dollars of revenue through contracts that have yet to be officially recognized on the income statement for Nextracker. Furthermore, despite the fact that these 4.5 billion dollars of revenues have not been recognized, Nextracker was still able to beat the adjusted EBITDA target by over 57%. Management at Nextracker expects that over the next two years, 90% of the 4.5 billion dollars will be recognized as services and goods are rolled out, which will truly reflect just how profitable the company is.

Justin Li| November 11, 2024

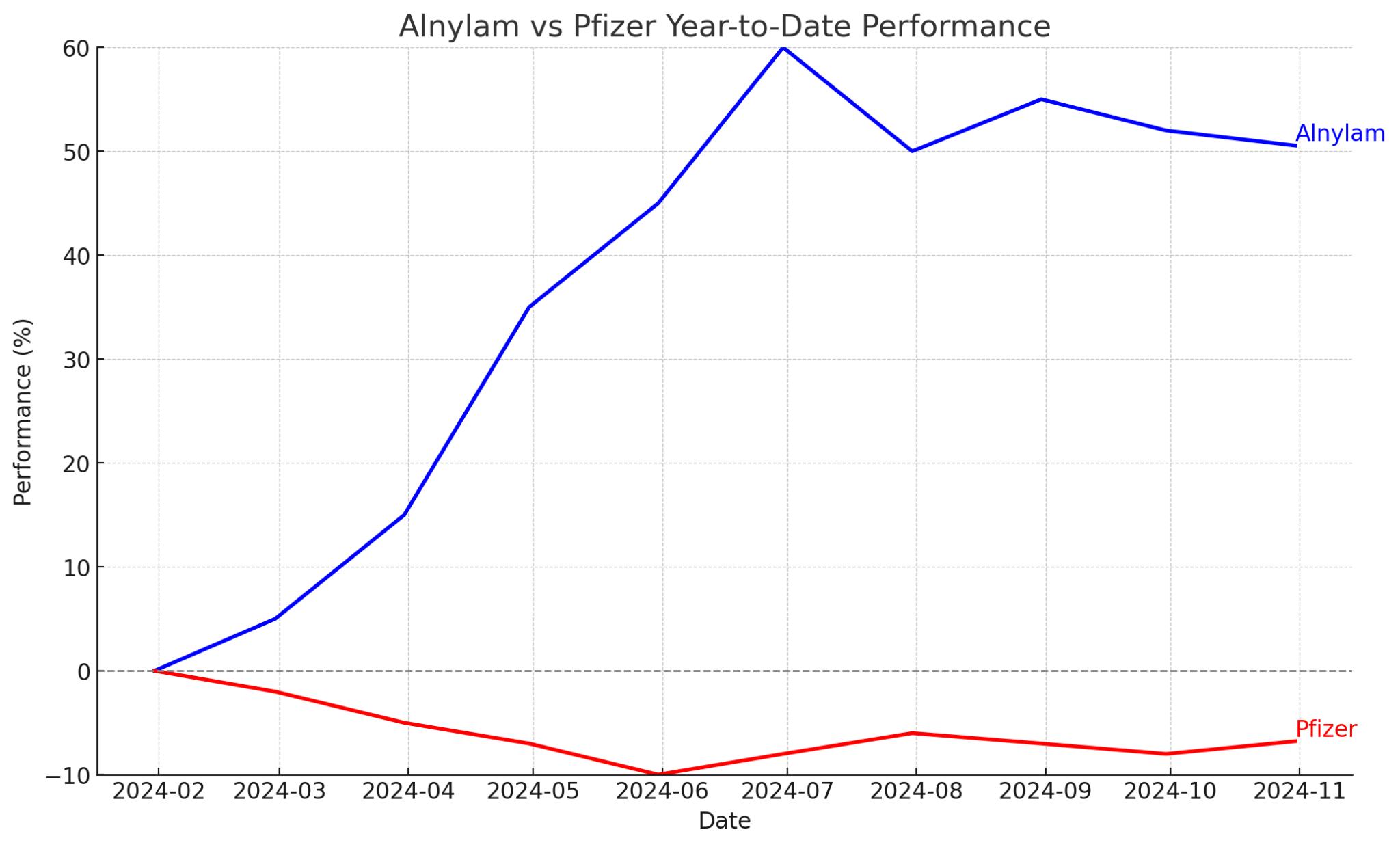

Nextracker vs. Array Monthly Share Price (YTD)

Source: S&P Capital IQ

Risk Potential

Newly elected US President Donald Trump has made it clear through both personal statements and party alignments that there will likely be some reductions to renewable tax credit incentives. This would hamper Nextracker’s business as its solar trackers need solar panels. Furthermore, with the US Congress and Supreme Court both aligning with Trump’s political party, additional policies could be passed to reduce incentives for solar energy.

The solar tracking and software industry is quite small, and while Nextracker has been fortunate enough to become a consolidated leader in the field, there is mounting competition that cannot be ignored. Nextracker faces a critical moment in its life as a company. Many strategy choices must be made to maintain its first-mover advantage, all of which could bring potential downside and loss.

Nextracker is heavily dependent on raw materials to build its trackers but also on the continued production of solar panels from other companies. As such, with rising silicon costs, disruptions in shipments from geopolitical conflicts, and skyrocketing expenses for precious metals, Nextracker’s profit margins and overall revenue could be significantly impacted in the coming years.

Sources: investors.nextracker.com | NY Times | Barrons | CFRA Equity Research| Yahoo Finance | ir.arraytechinc.com | investors.sensata.com | Capital IQ | Robinhood |investor.ftcsolar.com

Laurent Vo| November 11, 2024

Rating: BUY

Current Price: $206.67

Price Target: $230.11

● Market Cap: $10.6B

● Beta: 1.02

● EPS: 14.22

● PE Ratio: 13.51

● 52 Week High: $214.00

● 52 Week Low: $52.01

● Talen Energy Reports Q3 Revenue Growth Driven by Capacity Price Increases

● Talen’s Q3 Earnings Exceed Forecasts on Higher Capacity Revenues

● Talen Energy Q3 Results Reflect Strong Revenue and Strategic Diversification

Competitor Statistics from Q3 2024

EV/EBITDA: 4.6

Revenue: $14.78B

EV/EBITDA: 8.5

Revenue: $10.1B

EV/EBITDA: 7.2

Revenue: $26.9B

Investment Thesis:

Talen Energy (NASDAQ: TLN) is a US -based independent power producer with a diverse portfolio spanning nuclear, natural gas, and coal-fired assets. Following a recent Chapter 11 restructuring, Talen has emerged with a fortified balance sheet and improved operational focus, positioning it well in the changing energy landscape The company has renewed its emphasis on sustainable growth including investments in data center power solutions and cryptocurrency mining, showcasing adaptability and ambition to diversify revenue streams. Despite regulatory setbacks, such as the recent denial of its proposal with Amazon by the FERC (Federal Energy Regulatory Commision), Talen’s strategic initiatives and favorable positioning within the PJM market create a solid growth outlook. Furthermore, Talen’s unhedged capacity through 2026 allows it to capture potential market upsides as energy prices fluctuate

Given these factors, I issue a Buy recommendation on Talen Energy with a price target of $230.11 The company’s balanced approach to growth and risk management, combined with favorable market trends and a strengthened financial position, make it a great stock for portfolios looking for exposure in the energy market.investment opportunity

Talen Energy’s financial position brings both opportunities and challenges, with its outlook being closely tied to interest rates On the positive side, Talen boasts strong revenue numbers of $2.11 Billion and a gross margin of 31.9%, which indicate key profitability must most importantly highlight market demand With over $1 1 Billion in EBITDA, Talen also shows excellent operational management and earnings potential. A cash flow of $587 provides Talen the mobility for new investments, which they have largely capitalized on including their new data center power solutions and cryptocurrency mining operations.

Given Talen’s current stock price and its competitors, an EPS of 14 96 is deemed solid given the capital-intensive industry they operate in. It is important to keep in mind however, that Talen’s debt-to-equity of 114 77% means that it is substantially leveraged even if they boast strong liquidity ratios. The Federal Reserve’s recent rate cut is a good indication for Talen, as lower interest rates allow them to reduce debt expenses and improve their already solid cash flows Recent repricing of its Term Loans B and C have already saved Talen an estimated $13 million annually, positioning it to benefit even further from a progressively low-interest environment

Compared to its peers, Talen Energy’s valuation metrics show a mixed positioning. Its P/E ratio of 12 63 is lower than that of many competitors, indicating that it might be undervalued relative to its earnings. However, its EV/EBITDA of 18.36 is higher, suggesting the market values its earnings at a premium, likely due to strategic assets or growth potential The P/B ratio of 3 70 is moderate compared to peers, showing a balanced valuation relative to its assets.

Sources: Talenenergy | Capital IQ | Yahoo Finance |Davis Polk | Quantisnow | S&P Global | UtilityDive | Barrons

Source: Talenenergy

Amazon situation, what now?

The bullish case for energy stocks for the year of 2024, were in part on Tech companies signing lucrative agreements to plug their data centers directly into power plants. In fact, since January 2nd, 2024, Talen’s stock price (previously $66.55) has seen an appreciation of 192%. The Talen and Amazon deal aimed at directly supplying nuclear power to Amazon’s data center in Pennsylvania The deal fell through when the FERC rejected it due to concerns about market fairness and pricing impacts This setback complicates Talen’s strategy to secure a stable and long-term revenue stream through power agreements seeking clean energy Although it leaves Talen’s nuclear energy plans on hold, there are still other ways Talen can profit from its diversified portfolio

Talen Energy is well-positioned to benefit from strong regulatory support and its role within the PJM Interconnection, which powers much of the U.S. PJM’s structure helps maintain stable energy pricing, which supports Talen’s nuclear, gas, and coal assets. The recent PJM capacity price auction significantly boosted Talen’s outlook; on July 30, 2024, prices for 2025-2026 jumped to $268 92 per megawatt-day from $49 49 This surge reflects a growing gap between supply and demand, driven by underinvestment in baseload, retiring dispatchable power, and rising demand from AI infrastructure. For Talen, this price increase translates to about $670 million in capacity revenue for 2025-2026, a $285 million year-over-year gain While prices may eventually stabilize, demand drivers suggest elevated rates could persist, positioning Talen’s revenue base for ongoing growth.

A second Trump administration is expected to bolster domestic energy production which mainly benefit traditional power sources like natural gas and coal. There are mixed views however about Trump’s support for nuclear development. Although he has historically backed nuclear innovation and signed critical legislation like the Nuclear Energy Innovation and Modernization Act, recent comments suggest he may see large-scale nuclear projects as overly complex and costly potentially leading to reduced federal funding Despite navigating an uncertain policy landscape that could limit growth in advanced nuclear initiatives, Talen’s dual-fuel and coal-fired initiatives are expected to benefit from the PJM pipeline

Sources: Talenenergy | Capital IQ | Yahoo Finance |Davis Polk | Quantisnow | S&P Global | UtilityDive | Barrons

Andy

Rating: BUY

Current Price: $214.88

$248.00

Company Updates / News

● Earnings Per Share (EPS): 3.84

● 52 Week Range: 152.31 - 215.84

● Market Cap: $48.21B

● PE Ratio: 13.51

● Dividend Yield: 0.93%

● Corpus Christi, with 3 LNG Trains undergoing expansion, projected to be finished in 2025

Adjacent Market Statistics from Q3 2024

Revenue: $3.7B Market Cap: $60.0B

Revenue: $5.02B Market Cap: $63.7B

Revenue: $2.65B Market Cap: $69.36B

Cho | November 17, 2024 Sources:

Investment Thesis:

Since its uplisting on the New York Stock Exchange on December 31, 2011, Cheniere Energy (NYSE: LNG) has grown by 4,000%, establishing itself as the leading Liquefied Natural Gas (LNG) exporter in the United States

My buy recommendation is driven by three catalysts First, AI integration in production is projected to expand EBITDA margins by 3 2% from 2024 to 2028 through increased LNG yield and reduced quality control costs. Second, higher U.S. LNG production under Trump’s policies will lower domestic sourcing costs, while rising international demand will boost exports. As an exporter, Cheniere is poised to benefit, with these trends contributing an estimated 1.8% to EBITDA margin growth over the same period Lastly, with the Corpus Christi expansion completed in late 2025, declining capital expenditures will free up billions for share repurchases, reducing shares outstanding from 228 to 203 million by 2027

As of November 11, Cheniere Energy is trading at $214.88. Based on my analysis, I believe the stock is undervalued, and I estimate a target price of $248.00 within the next 12 months with a 15 41% upside I derived this target from a DCF analysis using 1) WACC of 7.83%; 2) expected revenue of $11.9 billion in 2024, with annual growth rate of 4 09% through 2028; 3) a 47% EBITDA Margin in 2024 that expands to 51% by 2028; 4) a decrease in total shares outstanding from 228 million to 205 million My assumptions are based on historical data and an optimistic outlook for Q3.

Liquefied Natural Gas (LNG) is natural gas cooled to -260°F (-162°C), reducing its volume by 600 times to facilitate storage and transportation, especially to areas without pipeline access Once delivered, it is regasified and fed into pipelines or power plants for distribution. LNG acts as a bridge fuel in energy grids, balancing real-time supply and demand by managing sudden electricity spikes and stabilizing the grid during peak periods Its reliability and scalability also make it essential for industrial settings with fluctuating energy needs. As a cleaner alternative to coal and petroleum, LNG supports the energy transition by providing a lower-carbon solution to meet demands while enabling the shift to renewable sources.

Cheniere Energy, a Houston-based liquefied natural gas (LNG) tolling and liquefaction provider (exporter), operates nine LNG export trains across its Sabine Pass facility in Louisiana and Corpus Christi facility in Texas As of 2023, the company’s total liquefaction capacity was approximately 45 million tonnes per annum (MTPA), with around 95% of its output secured under long-term, take-or-pay contracts The Corpus Christi facility is expanding to add 10 million tonnes per annum (MTPA) of capacity with anticipated completion in late 2025.

Andy Cho | November 17, 2024

This productive scale provides a significant competitive advantage over US competitors. The US LNG exports market is heavily regulated Under the Natural Gas Act (NGA), all LNG exporters must receive authorization from the Department of Energy (DOE), a process that typically takes 3 to 7 years This regulatory barrier has allowed Cheniere to operate in a relatively shielded market. In a market where new entrants cannot enter in the mid-term Cheniere dominates through its scale. The 45 mtpa production capacity outpaces competitors like Freeport LNG (15 mtpa) and Cameron LNG (12 mtpa) This significant capacity advantage enables Cheniere to meet global LNG demand more effectively.

The US LNG market is poised for growth, with several factors driving its expansion Favorable regulatory policies under President-elect Donald Trump are expected to boost U.S. LNG exports. Trump’s focus on reducing the trade deficit may pressure trade partners like the European Union and Taiwan countries with trade surpluses with the US to increase imports of U.S. LNG as a way to offset tariffs and maintain favorable trade relations. This geopolitical dynamic creates a supportive macroeconomic environment for U.S. LNG growth. Another key driver is China’s economic recovery, including 5 3% year-on-year growth in the first quarter and steady progress in the second quarter of 2024, China’s industrial expansion is expected to sustain its demand for LNG imports.

Domestically, rising US natural gas production ensures LNG sourcing costs remain low and stable Currently averaging $2 45 per MMBtu, these costs are projected to stay consistent over the next five years. Meanwhile, LNG prices in Asia are expected to increase from $11 75 to $12 25 per MMBtu during the same period This widening price differential significantly boosts the profitability of U.S. LNG exports. As the largest LNG exporter, Cheniere is well-positioned to leverage its scale and infrastructure to capitalize on this enduring trend.

LNG production is seasonally sensitive and labor-intensive, driving up maintenance costs due to the constant need for equipment monitoring and repairs. Additionally, there is a disconnect between the vast data generated equipment performance, environmental conditions, and process variables and LNG output efficiency

Cheniere can leverage AI to optimize this complex production processes, driving significant margin expansion. According to Bloomberg, AI could boost production yield by 1% per LNG train and reduce quality control costs by 50% With quality control at 4.5% of COGS as the industry standard, this equates to a 2.25% decrease in COGS, and combined with a 1% increase in LNG yield, results in a projected 3 2% EBITDA margin expansion from 2024 to 2028

With Corpus Chrisit expansion expected to completed by late 2025. Returns from this expansion should start flowing by early 2026, generating cash that Cheniere can reallocate from growth projects to share buybacks Consequently, outstanding shares will decline from 230 million to around 205 million by 2027

Andy Cho | November 17, 2024

Source: Capital IQ

Risk Potential

DOE pause on non-FTA exports: Cheniere’s ability to export to non-FTA (Non-Free Trade Agreement) countries requires approval from the US Department of Energy (DOE) Any pause or restriction on these approvals poses a significant risk, as a portion of Cheniere's revenue relies on sales to non-FTA countries.

Construction Risk: The expansion of the Corpus Christi project carries construction risks. Unexpected delays, cost overruns, or operational challenges could result in substantial financial losses, affecting both the project's profitability and timeline

Debt Schedule Risk: Cheniere is exposed to U.S. geopolitical risks, including the possibility of embargoes on U.S. LNG (liquefied natural gas) exports. Such restrictions could disrupt Cheniere’s international sales, potentially forcing the company to seek alternative markets or adjust its operations

Sources:

Kristian Suh | November 20, 2024

Rating: Buy

Current Price: $70.91

Price Target: $82.20

Company Updates / News

● Enphase Energy Launches the IQ PowerPack 1500 in the United States and Canada

● Enphase Energy Begins Shipments for IQ Battery 5Ps Produced in the United States

● Enphase Energy Unveils AI-Powered DIY Permitting Feature for Solargraf, Slashing Solar Permit Plan Creation Times by up to 95%

Competitor Statistics

Investment Thesis:

Enphase Energy is a leader in micro inverter technology, offering unparalleled efficiency and reliability in residential solar solutions Despite short-term challenges, the company is well-positioned to capitalize on long-term growth in renewable energy markets, supported by favorable policies like the Inflation Reduction Act and growing demand for integrated solar-plus-storage systems

My Buy recommendation reflects confidence in Enphase’s ability to rebound from recent headwinds. With a robust product pipeline, including the IQ9 Microinverter and AI-enhanced batteries, Enphase is positioned to benefit from a recovery in solar demand and increasing adoption of clean energy solutions globally

As of November 22, 2024, Enphase is trading at $70.91. I believe this equity is undervalued and expected to reach $82.20 within the next twelve months. I arrived at this conclusion through a comparable company analysis I used these assumptions based on historical data and an optimistic view given Enphase Energy’s position in the market

US Demand and Policy Tailwinds:

The US represents 64% of Enphase’s total revenue, driven by strong demand for solar-plus-storage solutions. While California’s NEM 3.0 initially posed headwinds, it has ultimately incentivized customers to adopt battery storage alongside solar systems, aligning perfectly with Enphase’s product offerings The Inflation Reduction Act plays a pivotal role in supporting Enphase’s growth. Its 30% tax credit and domestic manufacturing incentives enable Enphase to expand operations stateside while capturing premium pricing for U.S.-produced components. With normalized channel inventories, the U.S. market is expected to be a key driver of Enphase’s growth through 2025

While European sales saw a 15% quarterly decline in Q3 2024, Enphase is well-positioned for recovery in international markets The company’s IQ9 Microinverters and 4th-generation battery systems, set to launch in 2025, are designed to meet growing demand in markets like Germany and the Netherlands, where solar adoption continues to rise Enphase’s expansion into emerging regions, such as Asia and the Middle East, represents additional upside As global energy policies increasingly favor renewables, Enphase’s diversified product portfolio ensures it remains competitive across a variety of market conditions

Suh | November 20, 2024

Source: Yahoo Finance

Risk Potential

Interest Rate Risk: Elevated interest rates continue to weigh heavily on consumer financing for residential solar systems, a key market for Enphase. High borrowing costs discourage homeowners from adopting solar-plus-storage solutions, particularly in regions like the U.S. where solar installations are often financed through loans. Additionally, the Federal Reserve's commitment to maintaining higher rates for an extended period could delay a recovery in demand, further straining Enphase’s revenue growth in the near term.

Production Costs: As Enphase ramps up U.S.-based manufacturing to comply with IRA domestic content requirements, it faces significant operating expenses In 2024, the company reported total debt of $1.29 billion, with a debt/capitalization ratio of 56%, which remains high for a capital-intensive business Managing these costs while scaling production capacity will be critical to maintaining margins Enphase is also exposed to supply chain challenges, particularly in sourcing advanced components for its microinverters and batteries, which could further pressure operating performance if material costs rise

Sources: McKinsey & Company | CFRA Equity Research | Wall Street Journal | Yahoo Finance |Alpha Energy | Insight Trends | Bloomberg | Capital IQ | Financial Times

Erin Limb| December 4, 2024

Rating: Buy

Current Price: $254.20

Price Target: $272.50

Company Updates / News

● Market Cap: $80.24B

● Beta: 0.71

● EPS: 9.02

● PE Ratio: 28.46

● 52 Week High: $288.75

● 52 Week Low: $109.44

● Q3 2024 Results: GAAP EPS $3.82; Adjusted EPS $2.74

● 2024 Guidance Update: Adjusted EPS range raised to $8.00–$8.40

● Key Agreement: Signed 20-year PPA with Microsoft for Crane Clean Energy Center

Competitor Statistics from Q3 2024

EV/EBITDA: 16.1

Revenue: $26.25B

EV/EBITDA: 12.1

Revenue: $29.75B

EV/EBITDA: 11.6

Revenue: $22.92B