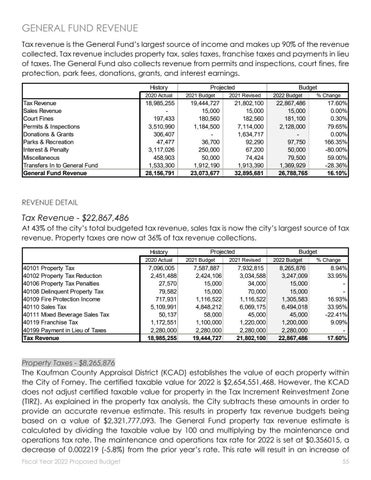

GENERAL FUND REVENUE Tax revenue is the General Fund’s largest source of income and makes up 90% of the revenue collected. Tax revenue includes property tax, sales taxes, franchise taxes and payments in lieu of taxes. The General Fund also collects revenue from permits and inspections, court fines, fire protection, park fees, donations, grants, and interest earnings. History Tax Revenue Sales Revenue Court Fines Permits & Inspections Donations & Grants Parks & Recreation Interest & Penalty Miscellaneous Transfers In to General Fund General Fund Revenue

2020 Actual

18,985,255 197,433 3,510,990 306,407 47,477 3,117,026 458,903 1,533,300 28,156,791

Projected 2021 Budget

19,444,727 15,000 180,560 1,184,500 36,700 250,000 50,000 1,912,190 23,073,677

Budget

2021 Revised

21,802,100 15,000 182,560 7,114,000 1,634,717 92,290 67,200 74,424 1,913,390 32,895,681

2022 Budget

22,867,486 15,000 181,100 2,128,000 97,750 50,000 79,500 1,369,929 26,788,765

% Change

17.60% 0.00% 0.30% 79.65% 0.00% 166.35% -80.00% 59.00% -28.36% 16.10%

REVENUE DETAIL

Tax Revenue - $22,867,486

At 43% of the city’s total budgeted tax revenue, sales tax is now the city’s largest source of tax revenue. Property taxes are now at 36% of tax revenue collections. History 2020 Actual

40101 Property Tax 40102 Property Tax Reduction 40106 Property Tax Penalties 40108 Delinquent Property Tax 40109 Fire Protection Income 40110 Sales Tax 40111 Mixed Beverage Sales Tax 40119 Franchise Tax 40199 Payment in Lieu of Taxes Tax Revenue

7,096,005 2,451,488 27,570 79,582 717,931 5,109,991 50,137 1,172,551 2,280,000 18,985,255

Projected 2021 Budget

7,587,887 2,424,106 15,000 15,000 1,116,522 4,848,212 58,000 1,100,000 2,280,000 19,444,727

Budget

2021 Revised

7,932,815 3,034,588 34,000 70,000 1,116,522 6,069,175 45,000 1,220,000 2,280,000 21,802,100

2022 Budget

8,265,876 3,247,009 15,000 15,000 1,305,583 6,494,018 45,000 1,200,000 2,280,000 22,867,486

% Change

8.94% 33.95% 16.93% 33.95% -22.41% 9.09% 17.60%

Property Taxes - $8,265,876 The Kaufman County Appraisal District (KCAD) establishes the value of each property within the City of Forney. The certified taxable value for 2022 is $2,654,551,468. However, the KCAD does not adjust certified taxable value for property in the Tax Increment Reinvestment Zone (TIRZ). As explained in the property tax analysis, the City subtracts these amounts in order to provide an accurate revenue estimate. This results in property tax revenue budgets being based on a value of $2,321,777,093. The General Fund property tax revenue estimate is calculated by dividing the taxable value by 100 and multiplying by the maintenance and operations tax rate. The maintenance and operations tax rate for 2022 is set at $0.356015, a decrease of 0.002219 (-5.8%) from the prior year’s rate. This rate will result in an increase of Fiscal Year 2022 Proposed Budget

55