21 minute read

Budget Transmittal Letter

August 15, 2021

Dear Mayor and City Council: In accordance with the City Charter and the laws of the State of Texas governing home rule cities, please accept this letter as the budget transmittal and executive summary for the Fiscal Year 2022 annual budget. The budget is structurally balanced, meaning that reserves have not been used to balance the operating budget. It provides for all available resources and expenditures for the City and acts as the general financial and operating plan for the City of Forney. INTRODUCTION

As always, this budget was prepared with great diligence in allocating limited resources for the best benefit to the citizens of Forney. The City will finish FY 2021 with an unexpected surplus in funds. Even though many cities experienced a decrease in revenue due to business closures and decreased sales tax, Forney experienced unprecedented growth in both sales tax and building permits and associated fees.

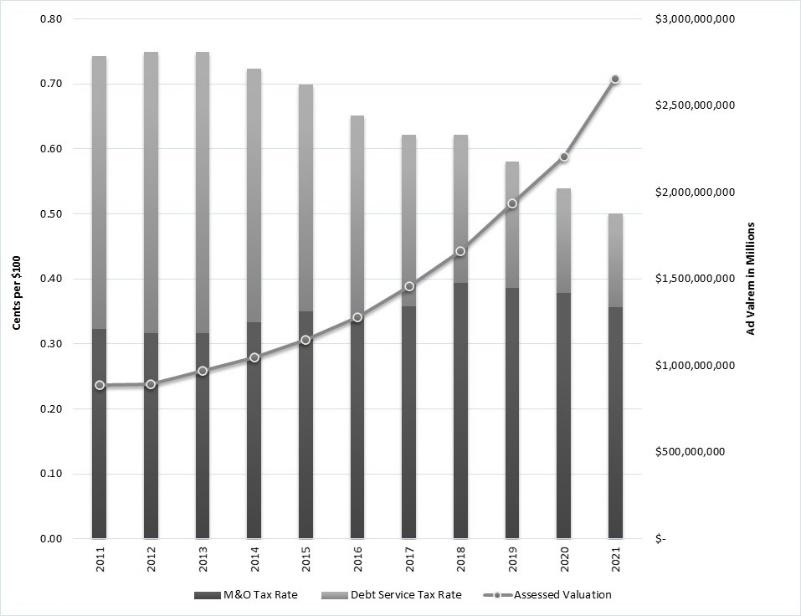

The property tax base in Forney has continued to grow at a rapid rate with a 82% increase in values in the last 5 years. The increased values and early redemption of debt have allowed for a decrease in the property tax rate of just over $0.12 in the same time period. This budget proposes a tax rate of $0.501069 and will raise an additional $825,000 or 14.5% in property tax revenue from FY 2021.

Both sales tax and building permit revenue depend on the health of the economy. Therefore, this budget includes a conservative 7% increase in sales tax over the actual collections in FY 2021 and a modest increase of $250,000 or 33% in building permit revenue. Associated permit fees were also increased to account for the additional building.

Forney’s continued growth and increased revenue will allow the funding of additional staff and supplies required to meet the needs of the citizens. Last year staff was asked to defer personnel requests, so this budget includes 36 new positions of which many were needed in the prior year. All departmental requests were fulfilled for staffing, equipment, and capital projects.

The FY 2022 budget includes new pay plans for both the Police Department and Fire Department with significant increases for uniformed personnel. All civilian employees will receive a 3% cost of living adjustment and a possible 2% merit adjustment. The budget also includes funding for a city-wide compensation study to help determine if employees are

receiving market wages as well as funds to make any necessary adjustments at the completion of the study.

The City of Forney charter specifies that no more than 7% of current expenditures may be kept in the undesignated general fund balance. In effect, this provision requires that excess funds at year end be obligated for one-time purchases or expenditures. The City is poised to complete FY 2021 with a surplus of $15,000,000 of which $13,000,000 will be allocated to capital improvement projects and $2,000,000 to capital equipment purchases.

Forney is a member city of the North Texas Municipal Water District (NTMWD) and purchases water and wastewater services from NTMWD. There are no increases proposed by NTMWD to the price per 1,000 gallons of water purchased and a marginal increase proposed for wastewater services. Therefore, this budget does not include any increase in water or wastewater rates for Forney citizens.

The City recently renewed the contract for solid waste disposal services for a five-year term. The contract includes a provision that there will be no rate increase to the City for a period of three years and thus does not necessitate an increase in rates for the citizens at this time.

Although revenue is projected to increase due to the robust growth in Forney, the continuing COVID pandemic has had a lasting effect on the hotel industry. The Hotel Occupancy Tax (HOT) Fund is a special revenue fund that receives revenue through a 7% tax charged on all room rates by hotels or motels within the city limits. Typically, this fund is used for special events, but a transfer from the general fund will be made to cover events in FY 2022. The HOT fund will accumulate funds until it is at a level to cover events in the future.

The Capital Purchases Fund will provide for General Fund capital purchases through the $2,000,000 transfer from unallocated fund balance. Staff requests for FY 2022 total just over $1,500,000, and the remainder of the transfer will be included in the fund balance for future purchases. Capital requests of $609,000 for equipment to be used by the utility crews will be funded through unallocated fund balance in the utility fund.

The City of Forney Capital Improvement Program (CIP) is comprised of several funds. The General CIP fund accounts for projects such as facilities, parks, technology, and roads. The General Fund transfer of $13,000,000 will fund just over $4,800,000 requested by staff in this budget. The remainder will stay within the fund as unallocated fund balance to be used for future projects. The Utility CIP fund accounts for water and sewer infrastructure projects and will receive a transfer from the Utility Fund in the amount of $4,774,152. Staff has requested $7,779,000 in utility CIP projects and those projects will be funded through a combination of the transfer for FY 2022 as well as unallocated fund balance within the fund.

FINANCIAL INFORMATION & FUND SUMMARIES

GENERAL FUND The General Fund is the City’s principle operating fund and is supported by taxes, fees, and other revenues that are not restricted to specific uses. This fund accounts for City functions such as police, fire, community development, parks, municipal court, and administration.

GENERAL FUND REVENUE Fiscal Year 2021 total General Fund revenue is expected to end the year 42% above the original budget. This is the result of increased permits and inspections as well as sales tax collections.

Total revenue for Fiscal Year 2022 is projected to be $26,788,765. This is an increase of 16.1% from the prior year’s budget. This increase is primarily due to increased property tax and sales tax revenues.

Taxable Valuation & Tax Rate The total certified property valuations for Fiscal Year 2022 are $2,654,551,468. This is an increase of 20.29% or $447,768,539 in total valuation. Forty-two percent of this increase, $187,090,724, can be attributed to new construction. The remainder is an increase in existing property valuation, which indicates a thriving community.

Tax Revenue Sales Revenue Court Fines Permits & Inspections Donations & Grants Parks & Recreation Interest & Penalty Miscellaneous Transfers In to General Fund

General Fund Revenue

History Projected Budget

2020 Actual 2021 Budget 2021 Revised 2022 Budget % Change 18,985,255 19,444,727 21,802,100 22,867,486 17.60% - 15,000 15,000 15,000 0.00% 197,433 180,560 182,560 181,100 0.30% 3,510,990 1,184,500 7,114,000 2,128,000 79.65% 306,407 - 1,634,717 - 0.00% 47,477 36,700 92,290 97,750 166.35% 3,117,026 250,000 67,200 50,000 -80.00% 458,903 50,000 74,424 79,500 59.00% 1,533,300 1,912,190 1,913,390 1,369,929 -28.36%

28,156,791 23,073,677 32,895,681 26,788,765 16.10%

Fiscal Year 2021 Fiscal Year 2022 Variance

M&O 0.378201 $7,587,887 0.356015 $8,265,876 -0.02219 $677,989 Debt Service 0.160509 $3,220,300 0.145054 $3,367,835 -0.01545 $147,525 Total 0.538710 $10,808,187 0.501069 $11,633,710 -0.03764 $825,515 While valuations have increased by 82% since 2017, the total tax rate has decreased by $0.12. The increased valuations, along with sound debt management including early redemptions and refunding, has contributed to the decreased tax rate. A $0.501069 tax rate is proposed for Fiscal Year 2022. This represents a $0.03764 decrease from the prior year. While the debt service portion of the tax rate will be decreasing, the maintenance and operations portion will be increasing slightly. Additional revenue will be generated from

new construction as well as increased valuations and will be used for increased operating cost. Further information on the changes in the tax rate, including adjustments for tax abatements and tax increment financing districts, can be found in the General Fund section of this document.

Sales & Property Reduction Taxes Over the past five years, sales tax revenues have increased an average of 12% per year. This continued increase is indicative of a growing local economy, resulting from continued population growth within the city limits and the surrounding areas, as well as increased commercial development.

The Fiscal Year 2021 budget assumed no increase in sales tax revenue, and actual collections are trending toward an increase of 22% over the prior year.

The 2021 budget was prepared cautiously with the expectation that COVID would decrease revenue and expenses would need to be lowered in order to offset the revenue loss. This has not proven to be the case and as citizens stayed closer to home and worked remotely, our sales tax reciepts have increased. The Fiscal Year 2022 budget remains conservative and projects a 7% increase over 2021 yearend projections.

Permits & Inspections This revenue category as a whole is expected to end the year at approximately 500% above the original budget. While nearly all of the individual permit fee categories will end Fiscal Year 2021 with increases, the largest increases will be reflected in Zoning & Platting Fees, Engineering Consulting Fees and Building Permits.

A Fire Marshal Plan Review fee was added during Fiscal Year 2021 and has collected over $2 million to date. This fee is based on 1% of project valuation, and it has been brought to the attention of the Fire department and Community Development that the way this fee is charged in not in-line with fees charged by other local communities. The fee is being evaluated and is budgeted to reduce in the upcoming year.

Other Revenue Sources Fire Protection fees are charged to the Kaufman County Emergency Services District #6 (ESD #6) and the Town of Talty. Nearly 40% of the Forney Fire Department calls are outside the City limits and in ESD #6. Therefore, ESD #6 will continue to contribute their entire assessment of $0.03 to the City for Fiscal Year 2022. This revenue item is budgeted at a 17% increase based on certified tax valuations.

While Park revenue is not significant in terms of amount, these revenues are increasing as fees are being evaluated, existing programs are being expanded, and new programs are being added. The City Council has requested that these revenues and some of the parks programs expenses be tracked in a more detailed manner. Therefore, a new revenue category has been added for Parks & Recreation.

GENERAL FUND EXPENSES The Fiscal Year 2022 Budget includes an increase in expenditures of 16.81%. This increase is primarily the result of 25 new full-time equivalents that will be added in the fund. Each new employee will not only increase Salary & Benefit costs, but various other expenses will increase as new employees are outfitted and equipped.

Employee Compensation Personnel costs account for 72% of the General Fund’s expenses. The Fiscal Year 2022 budget includes new step plans and increases for existing Police and Fire. This budget also includes a 3% cost of living adjustment and up to 2% merit increases for all other employees. Funds have been added in the Human Resources department for a compensation study to evaluate current pay plans for all employees. Funding has also been set aside to begin addressing any positions that may be determined to be below market. Health Insurance Premiums The budget includes a 12% increase in health care costs. The industry average for health care cost increases is between 12% and 15%. The City competitively bids our employee health insurance in October.

Texas Municipal Retirement System The Texas Municipal Retirement System contribution rate for 2022 will increase to 14.32% from 14.26% in January of 2022. With the longer tenure of employees, increased salaries, and a significant number of new employees, the City’s General Fund contribution to TMRS will increase by $471,023 to $1,971,628 for the upcoming fiscal year.

New Positions The Fiscal Year 2022 budget includes funding for 36 new positions. Twenty-five are funded in the General Fund. Details on the new positions can be found in the Full Time Equivalent section on the following pages.

CATEGORY

Salary & Benefits Services & Supplies Maintenance & Repair Information Technology Parks & Recreation

History Projected Budget 2020 Actual 2021 Budget 2021 Revised 2022 Budget % Change 13,335,338 15,258,819 14,637,278 18,747,455 22.86% 3,035,342 3,599,789 3,737,002 3,583,246 -0.46% 1,336,238 2,249,382 2,338,442 2,348,864 4.42% 577,953 626,709 784,739 1,049,296 67.43% - - - 30,000 Miscellaneous 681,143 518,500 316,055 236,000 -54.48%

General Fund Expenses 18,966,014 22,253,199 21,813,516 25,994,861 16.81%

Contingency & Reserves A $200,000 line-item contingency is included to offset unexpected costs. There will not be a transfer to the emergency reserve fund in Fiscal Year 2022 as the fund balance would adequately cover more that 25% of general fund expenditures.

CAPITAL PURCHASES FUND The Capital Purchases Fund is used to make one-time purchases for General Fund Departments. It is primarily funded through a transfer from the General Fund of unrestricted fund balance. Segregating these purchases in this manner helps to ensure that fund balance is not used for recurring operating expenses and assists in the tracking of fixed assets. The following items are proposed for purchase in 2022:

POLICE • LENCO Bearcat - $286,153 o This is an armored vehicle for SWAT use. • Two Replacement Patrol Vehicles - $180,000

FIRE • Replace Medic 2 Vehicle - $95,000 • Replace Brush 1 Truck - $131,000

STREETS • Large Message Board - $17,000 • Small Message Board - $13,500

NEIGHBORHOOD SERVICES • Two Additional Trucks for New Employees - $90,000

INFORMATION TECHNOLOGY • Public Safety Radio Inventory -$195,000

The total transfer from the General Fund for Fiscal Year 2022 is proposed at $2,000,000. This transfer will cover all of the requested purchases, allow for $500,000 to be committed for the future purchase of a Fire Engine and leave nearly $450,000 in fund balance available for unforeseen or future needs.

UTILITY FUND The Utility Fund is an enterprise fund that accounts for the water, sewer, and refuse services that are provided to the City’s residents. Revenues are derived from charges for water consumption, wastewater collection, and refuse services.

UTILITY FUND REVENUE Fiscal Year 2021 total Utility Fund revenue is expected to end the year 13.2% above the original budget. The increase is attributable to residential and commercial growth as well as new and existing industrial and wholesale contracts.

Sales Revenue Interest & Penalty Miscellaneous Transfers In

Utility Revenue

History Projected Budget

2020 Actual 2021 Budget 2021 Revised 2022 Budget % Change 18,504,931 19,075,733 21,603,873 22,775,390 19.39% 157,441 169,500 185,600 155,600 -8.20% 12,066 6,500 6,500 6,500 - - -

-

-

18,674,438 19,251,733 21,795,973 22,937,490 19.15%

Total Revenue for Fiscal Year 2022 is projected to be $22,937,490. This is an increase of 19.15%.

Utility Rates The North Texas Municipal Water District will not be increasing water rates for Fiscal Year 2022. Therefore, City of Forney utility customers will not receive a rate increase.

Total sewer treatment and transmission costs as applied to the Utility Fund will not be increasing. The sewer rates per 1,000 gallons charged to the city’s retail customers will not be increasing.

The recently renewed garbage contract with Community Waste Disposal (CWD) includes a freeze on rate increases to the city for the next three years. Rates charged to the city’s customers will not be increased during that period.

UTILITY EXPENSES Operating expenses in the Utility Fund are projected to increase 18.66% from $17,104,126 to $20,295,527.

A significant portion of the nearly 19% increase anticipated for Fiscal Year 2022 is related to increased cost of providing water and sewer services.

CATEGORY History Projected Budget

2020 Actual 2021 Budget 2021 Revised 2022 Budget % Change

Salary & Benefits

976,413 1,360,820 1,259,345 2,857,749 110.00% Services & Supplies 1,324,773 1,344,607 1,428,218 1,529,629 13.76% Maintenance & Repair 11,862,068 14,348,699 14,448,699 15,249,149 6.28% Capital Outlay 288,789 - - 609,000 - Miscellaneous 747,523 50,000 - 50,000 -

Utility Expenses 15,199,566 17,104,126 17,136,262 20,295,527 18.66%

The cost of purchasing water for Fiscal Year 2022 will increase by 12.5%. The NTMWD will not be increasing the rate per 1,000 gallons. However, the City has exceeded the 2021 contract minimum of 2,318,622,000 by 254,228,000 gallons. This will result in an annual adjustment of approximately $125,000 for Fiscal Year 2021.

The new contract minimum of 2,572,850,000 gallons for 2022 will result in annual charges of $7,692,822.

The cost of sewer services is split between the Utility Fund and the Interceptor Fund. Maintenance and operation of the interceptors is charged to the Utility Fund and the debt owed for construction of the

interceptor lines is charged to the Interceptor Fund. Total costs for sewer services to the city will be increasing by 8.5%.

Sewer treatment and transmission costs as applied to the Utility Fund will be decreasing by 4.79%.

Sewer PreTreatment Buffalo Creek Interceptor Forney Interceptor Regional Wastewater System Mustang Creek Interceptor 2021 Budget 2021 Revised 2022 Budget Revised vs 2021

29,563 29,563 41,854 42%

455,112 455,112 518,060 518,060

125,994 562,200 4,288,141 4,288,141 4,245,527 300,843 300,843 348,376

5,591,719 5,591,719 5,323,951

-72% 8% -0.99% 81%

-4.79%

Also contributing to the increase in expenses is the transfer of all Public Works Division employees to the Public Works Administration department. This has been done to simplify processes for Public Works, Finance, and Human Resources, and is explained in further detail in the discussion on Full Time Equivalents.

Employee Compensation Personnel costs account for 11% of the Utility Fund’s expenses. The Fiscal Year 2022 budget includes a 3% cost of living adjustment and up to 2% merit increases for all other employees. The Utility Fund will contribute a portion of the funding and implementation of the compensation study through the Utility Operating Transfer to the General Fund. Health Insurance Premiums The budget includes a 12% increase in health care costs. The industry average for health care cost increases is between 12% and 15%. The City competitively bids our employee health insurance in October.

Texas Municipal Retirement System The Texas Municipal Retirement System contribution rate for 2022 will increase to 14.32% from 14.26% in January of 2022. With the longer tenure of employees, increased salaries, and a significant number of new employees, the City’s Utility Fund contribution to TMRS will increase by $171,654 to $293,740 for the upcoming fiscal year.

New Positions The Fiscal Year 2022 budget includes funding for 36 new positions. Eleven are funded in the Utility Fund. Details on the new positions can be found in the Full Time Equivalent section on the following pages.

Capital Purchases The 2022 Utility Fund budget includes $609,000 worth of capital purchases. • Truck for new Water crew • Hydraulic Breaker • Valve Exerciser • Skid Steer • Mini Excavator • Truck for new Sewer crew

• Two Trailers • Sewer Jet Machine • Medium Dump Truck (Replacement)

Contingency & Reserves A $50,000 line-item contingency is included to offset unexpected costs. As with the General Fund Operating Reserve, there will not be a transfer to the reserve fund in Fiscal Year 2022 as the fund balance would adequately cover more that 25% of general fund expenditures.

CAPITAL IMPROVEMENT FUNDS The Capital Improvement Funds account for the design and construction of City facilities, roads and drainage, parks, and water and sewer systems. Unlike the operating budget, the capital improvement budgets do not conclude at the end of each fiscal year, as many CIP projects remain in progress over several years.

Capital Improvement Projects are funded from a number of different sources. Based on the funding sources, projects are put into one of two different funds: the General Capital Improvement fund, or the Utility Capital Improvement Fund.

The City is currently in a unique situation where the caution taken in the prior year’s budget combined with unexpected increases in revenue collections has led to large unrestricted fund balances being available in multiple funds. This budget proposes cash funding for all of the requested capital improvements in the 2022 budget and leaves excess fund balance to be used for possible cash funding of projects currently being considered by the Bond Committee. Current estimates put the CIP fund balance at around $10 million and the Utility CIP fund balance at around $4 million.

The following projects have been proposed to be added to the Capital Improvement Program for 2022:

Project Name Project Type Fund Funding Source Budget

Pavement Condition Index Study Roadway 16 - General Fund Balance 100,000 Community Park Security Technology 16 - General Payment in lieu of Parkland 250,000

Community Park Field Resurfacing Parks 16 - General Payment in lieu of Parkland 60,000 Motorola Radio Core Maintenance Technology 16 – General GF Transfer 282,761 FJC Security Overhaul Technology 16 – General Fund Balance 50,000 Fire Station 1 Remodel Facilities 16 – General Fund Balance 75,000 Fire Station 1 Covered Parking Facilities 16 – General Fund Balance 50,000

Future Land Acquisition for City Facilities Facilities 16 – General Fund Balance 750,000 City Hall Annex & Remodel Facilities 16 – General Fund Balance & GF Transfer 3,000,000 Comprehensive Plan Facilities 16 – General Fund Balance 200,000 CMOM Study Sewer

Sewer Extension from Kaufman to Bowie Sewer Highway 80 Water Line Replacement Water West Highway 80 18” Loop Water

Additional Funding for Clay Pipe Replacement (CIPP) Project 185 Sewer

Total Active Projects 15

06 – Utility Fund Balance 709,000 06 – Utility Fund Balance & UF Transfer 3,335,000 06 - Utility Fund Balance 750,000

12,596,761

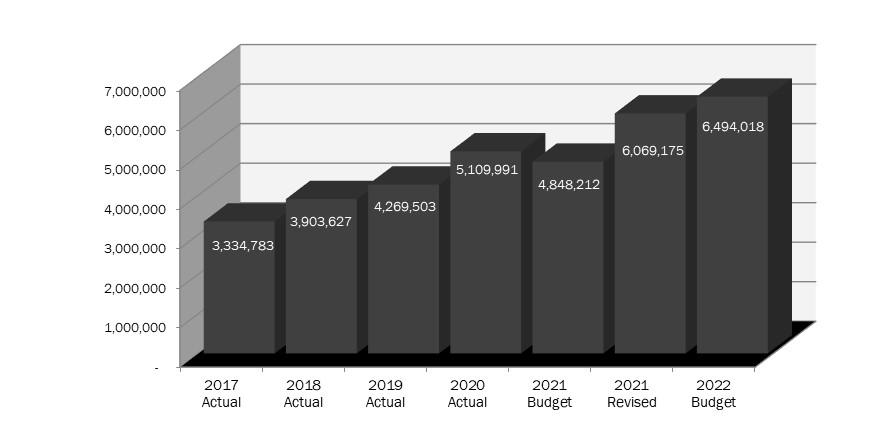

DEBT SERVICE FUNDS The City issues debt to support capital improvements. This debt is either tax supported and accounted for in the Debt Service Fund, or it is utility revenue supported and accounted for in the Utility Debt Service Fund. The combined total debt payments for Fiscal Year 2022 will be $6,256,930.

General Debt Service Fund Revenues required to pay the City’s outstanding tax supported debt are restricted to debt payments. Revenues in this fund are collected through the debt service portion of the property tax rate and from the TxDOT Pass Through Toll reimbursement.

A committed fund balance is designated for early bond redemption. These funds are the accelerated portion of the reimbursement (amount above the guaranteed minimum annual payment) from TxDOT for the Pass Through Toll roadway projects. The City has retired an additional amount of the 2008 GO bonds annually according to the funds available. During Fiscal Year 2021, the City redeemed $2 million, bringing the total early redemption since Fiscal Year 2013 to $17,037,448. To date, this process has saved the City $8,575,962 in interest.

The required general debt payments for Fiscal Year 2022 total $6,054,217. In calculating the debt service tax rate, this number is reduced by the Pass Through Toll guaranteed minimum annual payment of $2,009,570 and $676,813 of available fund balance for the 2014 CO issue and the 2017 Tax Notes. This results in the tax rate being based on payments of $3,367,835 and is a reduction of $0.1157 per $100 valuation.

General Debt Service Prinicipal Interest Annual Payment Paid from Other Tax Rate Series 2008 General Obligation - TXDOT Pass Through - 149,312.50 149,312.50 149,312.50 -

Series 2011 General Obligation Refunding - 38,887.50 38,887.50 0.001675 Series 2012 General Obligation Refunding 195,000.00 4,680.00 199,680.00 0.008600

Series 2012 Certificates of Obligation 50,000.00 15,700.00 65,700.00

0.002830 Series 2014 Certificates of Obligation 235,000.00 118,412.50 353,412.50 353,412.50 Series 2014 General Obligation Refunding (2005A) 220,000.00 18,900.00 238,900.00 0.010290

Series 2015 General Obligation Refunding (2007) - 329,475.00 329,475.00 - 0.014191

Series 2016 General Obligation Refunding (2007) 1,590,000.00 50,050.00 1,640,050.00

0.070638

Series 2016 Certificates of Obligation (Redbud) 105,000.00 54,281.26 159,281.26 - 0.006860

Series 2017 Subordinate Lien Pass Through Refunding 1,830,000.00 262,200.00 2,092,200.00 1,860,257.50 0.009990

Series 2017 Tax Notes (Fire Equipment) 300,000.00 23,400.00 323,400.00 323,400.00 Series 2020 General Obligation Refunding 395,000.00 68,918.25 463,918.25 0.019981

4,920,000.00 1,134,217.01 6,054,217.01 2,686,382.50 0.145054

The final debt service portion of the tax rate is $0.145054 and will generate $3,367,835 in revenue for bond payments. Of this total, $0.095 (65%) results from voter approved general obligation debt.

Utility Debt Service Fund Revenues required to pay the City’s outstanding revenue supported debt are transferred from the Utility Fund, the Water Impact Fund and the Sewer Impact Fund. The exact amount required to cover the year’s bond payments is transferred in each year and the fund maintains a zero fund balance. The total required debt payment for the upcoming year is $298,775.

ECONOMIC DEVELOPMENT CORPORATION FUND The Economic Development (EDC) Fund is a special revenue fund that receives revenue from type 4B sales tax. Expenditures are restricted to activities that support and promote economic and community development.

Economic Development Revenue Economic Development Corporation revenues are expected to finish Fiscal Year 2021 at a 38% increase above the original budget due to increased sales tax collections.

Fiscal Year 2022 revenues are expected to increase 30% from the previous year due to increasing sales tax revenue.

Economic Development Corporation Expense Economic Development Corporation expenses have decreased 21% from the original budget in Fiscal Year 2021. This decrease is primarily the result of a vacancies in the Director and Coordinator positions for much of the year. The Fiscal Year 2022 budget has been left flat with the prior year.

Tax Revenue Interest & Penalty Miscellaneous

Economic Development

History Projected Budget

2020 Actual 2021 Budget 2021 Revised 2022 Budget % Change 2,520,493 2,424,106 3,034,588 3,247,009 33.95% 10,508 10,000 680 1,000 -90.00% 192,552 100,210 463,594 69,844 -30.30%

2,723,553 2,534,316 3,498,862 3,317,853 30.92%

Salary & Benefits Services & Supplies Maintenance & Repair Miscellaneous

Economic Development

History Projected Budget

2020 Actual 2021 Budget 2021 Revised 2022 Budget % Change 223,266 314,480 112,418 290,950 -7.48% 220,134 272,062 227,725 298,750 9.81% 425,799 396,000 410,000 396,000 64,430 25,000 41,775 25,000 -