Repayment is structured with a minimum annual payment, with an additional accelerated portion (amount above the guaranteed minimum annual payment) based on traffic counts. The minimum annual payment is $2,009,570. The City Council has deemed any amount above the minimum payment be held as committed fund balance and, if possible, used for early redemption in order to reduce future interest payments. The city has redeemed an additional $17,037,448 resulting in $8,575,962 in interest savings. Combined with general obligation refunding and increasing property values, this early redemption process has also helped to decrease the debt service tax rate by just under $0.25 since Fiscal Year 2014. To date, the 2014 Certificates of Obligation and the 2017 Tax Notes have not impacted the debt service tax rate. The proceeds from the certificates were used to fund construction of Fire Station #2 and the Animal Shelter, and the proceeds from the tax notes funded fire department equipment. The payments have been made from fund balance in the Debt Service fund. This fund balance is the result of interest collected in the fund, as well as delinquent and penalty taxes that have accumulated over prior years and is restricted to use on debt payments.

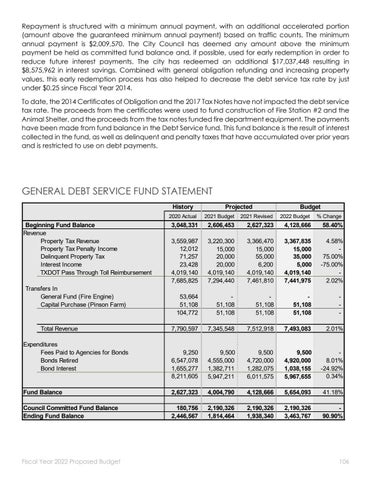

GENERAL DEBT SERVICE FUND STATEMENT History

Projected

Budget

2020 Actual

2021 Budget

2021 Revised

2022 Budget

% Change

3,048,331

2,606,453

2,627,323

4,128,666

58.40%

3,559,987 12,012 71,257 23,428 4,019,140 7,685,825

3,220,300 15,000 20,000 20,000 4,019,140 7,294,440

3,366,470 15,000 55,000 6,200 4,019,140 7,461,810

3,367,835 15,000 35,000 5,000 4,019,140 7,441,975

4.58% 75.00% -75.00% 2.02%

53,664 51,108 104,772

51,108 51,108

51,108 51,108

51,108 51,108

7,790,597

7,345,548

7,512,918

7,493,083

2.01%

9,250 6,547,078 1,655,277 8,211,605

9,500 4,555,000 1,382,711 5,947,211

9,500 4,720,000 1,282,075 6,011,575

9,500 4,920,000 1,038,155 5,967,655

8.01% -24.92% 0.34%

Fund Balance

2,627,323

4,004,790

4,128,666

5,654,093

41.18%

Council Committed Fund Balance Ending Fund Balance

180,756 2,446,567

2,190,326 1,814,464

2,190,326 1,938,340

2,190,326 3,463,767

90.90%

Beginning Fund Balance Revenue Property Tax Revenue Property Tax Penalty Income Delinquent Property Tax Interest Income TXDOT Pass Through Toll Reimbursement Transfers In General Fund (Fire Engine) Capital Purchase (Pinson Farm)

Total Revenue Expenditures Fees Paid to Agencies for Bonds Bonds Retired Bond Interest

Fiscal Year 2022 Proposed Budget

-

106