KREBS® Smart Pumps SiteConnect™ and monitoring

Features and Benefits Tap into your resources with SiteConnect, the mobile app that provides remote visibility from any mobile device. The sensors that are already in your pumping systems can help you increase the reliability, lower the production cost per ton and significantly reduce the carbon emissions of your mineral processing operation. In addition, SiteConnect opens the door for FLSmidth product experts to provide regular reports and optimization recommendations.

■ Optimize all pumping systems to lower power and reduce downtime

■ Improve equipment performance visibility

■ Increase expert support

Read more at flsmidth.com

40 Centre of innovation

Several cutting-edge research projects aimed at advancing the mining industry are under way across the province of Ontario

By Kelsey Rolfe

By Kelsey Rolfe

45 Positioned for growth

Fortuna Silver Mines’ Séguéla starts lowcost high-grade operation while exploration continues to strike gold

By Dinah Zeldin

MAY 2023 | MAI 2023

In each issue

8 Editor’s letter

10 President’s notes

Tools of the trade

12 The best in new technology

Compiled by Julianna Martinek

Developments

14 Budget 2023 includes clean tech investment, support for Indigenous consultation

By Matthew Parizot18 Sayona Québec restarts North American Lithium project in Quebec

By Matthew Parizot

By Matthew Parizot

Modern miner

30 Resourceful Paths’ principal consultant Laurie Reemeyer is championing both sustainability and diversity in the mining industry

By Sara King-AbadiUnderground mining

33 How Hecla Mining developed an innovative narrow-vein underhand longhole mining method to better manage seismic events at its Lucky Friday mine

By Alexandra Lopez-Pacheco15

36 Flexible and safe, drones are working their way into underground mining operations

By Lynn Greiner

By Lynn Greiner

Ground control

49 Companies are turning to ground control technologies that support remote operations and provide new insights from existing data

By Tijana MitrovicCIM news

53 The CIM Awards honour industry’s finest for their outstanding contributions in various fields. Their achievements and dedication are what make Canada’s global mineral industry a force to be reckoned with

Contenu francophone

57 Table des matières

57 Lettre de l’éditeur

58 Mot du président

Profil de projet

59 Des perspectives de croissance

La mine de Séguéla de Fortuna Silver Mines commence l’exploitation à haute teneur et à bas prix alors que se poursuit l’exploration, en quête d’or

Par Dinah ZeldinDEEPLY INVESTED

YEARS FOR

Congratulations to CIM for 125 years of excellence in reporting on the mining industry! This incredible achievement demonstrates your investment in the industry – an inspiration to all of us at Brandt. Here’s to a bright future and another 125 years of shared successes with CIM!

125 years of discoveries

Each issue of CIM Magazine begins as just a few, lightly defined ideas: a growing trend, a focus on a jurisdiction or an emerging technology. Some ideas turn out to be not worth pursuing and others send us in directions we hadn’t initially anticipated. In the end, we fill the pages with stories, structure and focus that speak to the current moment. In the process, new discoveries are made and the prospects for future issues are set up.

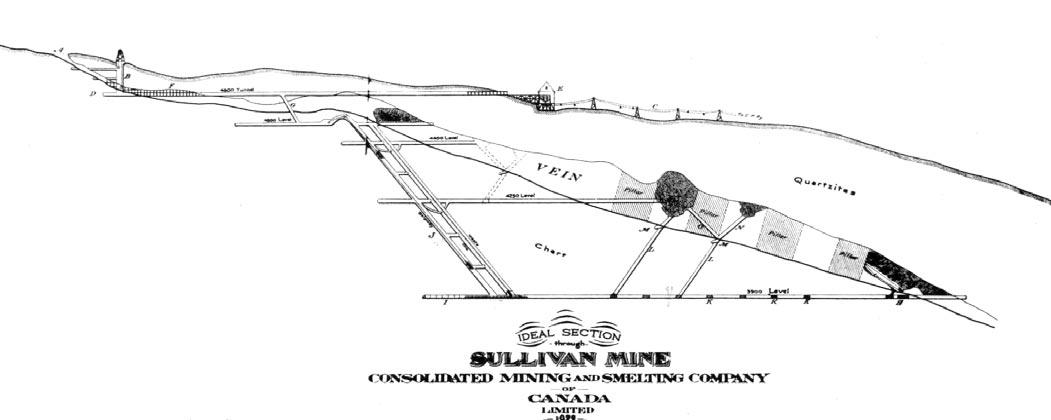

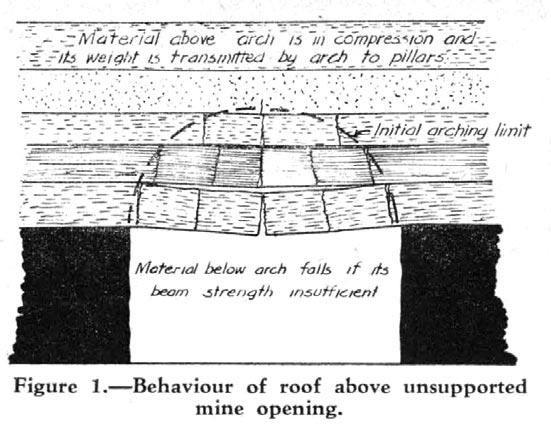

With this commemorative 125 issue, we created a parallel task. Guided by contemporary topics, we dug into the archives to find material that would complement these present-day themes in mining. Some discoveries were right on the nose, such as the analog solution shared in the 1949 CIM Bulletin (pg. 39) to the enduring challenge of underground surveying. Now it is being addressed using drone technology, which writer Lynn Greiner details in “Underground aviation” (pg. 36).

With the column we unearthed from 1899 (pg. 28), the call to develop skilled and educated employees to support operations echoes today, though with a different tenor: The author simply wanted basic science instruction available. Seemingly educated in Great Britain, he managed a smelter in the B.C. interior, and recognized the enormous divide between his origins and his placement in the young province. However it may have benefitted, he recognized B.C. was not ready for an institution such as London’s Royal School of Mines, nor would a place of higher learning even be appropriate. “Indeed, it has been forcibly brought home to me that fine work is not wanted, or at least not appreciated in British Columbia—the rougher the better, usually.”

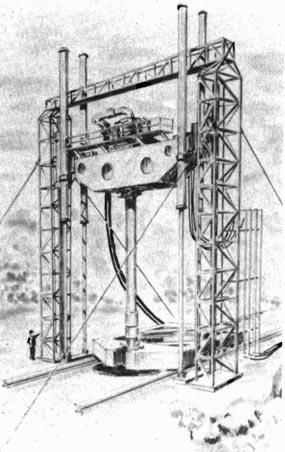

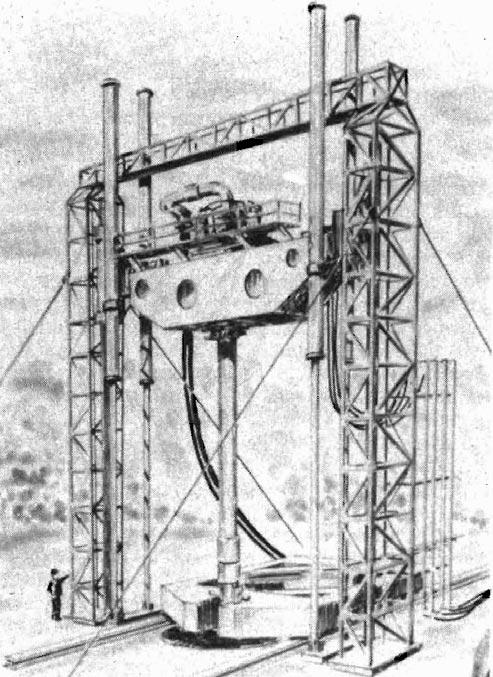

An excerpt from a 1981 paper on advances in shaft drilling (pg. 38) underscores how important funding experimental projects is. It is a good reminder for this country, which has not pri-

Editor-in-chief Ryan Bergen, rbergen@cim.org

oritized research and development and lags well behind its OECD peers in R&D funding.

Scattered throughout the pages are other items drawn from the archives of CIM. This issue—along with many other 125th anniversary initiatives—is also deeply informed by two outstanding works that came from CIM’s 1998 centennial. Pride and Vision, written by E. Tina Crossfield, is a comprehensive recounting of the Institute’s first 100 years. A Century of Achievement, by John Udd, traces the history of Canada’s mining industry. Both were put to the page through the vision of Peter Tarassoff, chair of CIM’s History Editorial Board, and the support of the CIM Centennial Corporation.

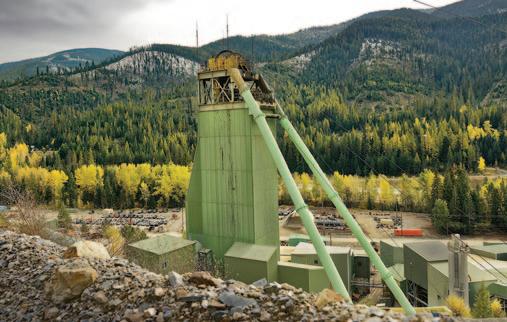

Leafing through the physical and online archives of the last 125 years yielded so many delights and surprises. There was no precise method to our search, but on that, the last word belongs to Robert Horn writing in a 2002 CIM Bulletin on the elusive formula for discovery (pg. 48): “Arizona porphyry copper deposits are scattered like confetti while Bingham Canyon sits in solitary splendour. For every orebody that was discovered in the mythical shadow of the head frame there are probably an equal number such as Cominco’s Red Dog or INCO’s Voisey’s Bay that until their discovery were situated in what was no doubt until then excellent moose or at least Caribou pasture.”

Ryan Bergen, Editor-in-chief editor@cim.org @Ryan_CIM_Mag

Advertising sales Dovetail Communications Inc.

Managing editor Michele Beacom, mbeacom@cim.org

Senior editor Ailbhe Goodbody, agoodbody@cim.org

Section editor Silvia Pikal, spikal@cim.org

Interim section editor Kelsey Rolfe, krolfe@cim.org

Editorial intern Julianna Martinek, jmartinek@cim.org

Contributors Lynn Greiner, Sara King-Abadi, Tijana Mitrovic, Brian Morgan, Alexandra Lopez-Pacheco, Matthew Parizot, Kelsey Rolfe, Dinah Zeldin

Editorial advisory board Mohammad Babaei Khorzhoughi, Vic Pakalnis, Steve Rusk, Nathan Stubina

Translations Karen Rolland, karen.g.rolland@gmail.com

Layout and design Clò Communications Inc., communications.clo@gmail.com

Published 8 times a year by: Canadian Institute of Mining, Metallurgy and Petroleum 1040 – 3500 de Maisonneuve Blvd. West Westmount, QC H3Z 3C1

Tel.: 514.939.2710; Fax: 514.939.2714 www.cim.org; magazine@cim.org

Tel.: 905.886.6640; Fax: 905.886.6615; www.dvtail.com

Senior Account Executives

Leesa Nacht, lnacht@dvtail.com, 905.707.3521

Dinah Quattrin, dquattrin@dvtail.com, 905.707.3508

Christopher Forbes, cforbes@dvtail.com, 905.707.3516

Subscriptions

Online version included in CIM Membership ($197/yr). Print version for institutions or agencies – Canada: $275/yr (AB, BC, MB, NT, NU, SK, YT add 5% GST; ON add 13% HST; QC add 5% GST + 9.975% PST; NB, NL, NS, PE add 15% HST). Print version for institutions or agencies – USA/International: US$325/yr. Online access to single copy: $50.

Copyright©2023. All rights reserved.

ISSN 1718-4177. Publications Mail No. 09786. Postage paid at CPA Saint-Laurent, QC.

Dépôt légal: Bibliothèque nationale du Québec. The Institute, as a body, is not responsible for statements made or opinions advanced either in articles or in any discussion appearing in its publications

President’s notes

Pride and Vision

CIM is celebrating a banner year in 2023. The Dominion Charter of June 18, 1898, officially marked the birth of the Canadian Mining Institute, which subsequently became the Canadian Institute of Mining Metallurgy and Petroleum, or CIM for short, as we know it today.

I’ve been involved with CIM since the early 2000s, but with its 125th birthday, I wanted to learn more about some of its earlier history. I took a look at Pride and Vision, a book by author E. Tina Crossfield that chronicles and celebrates CIM’s first 100 years.

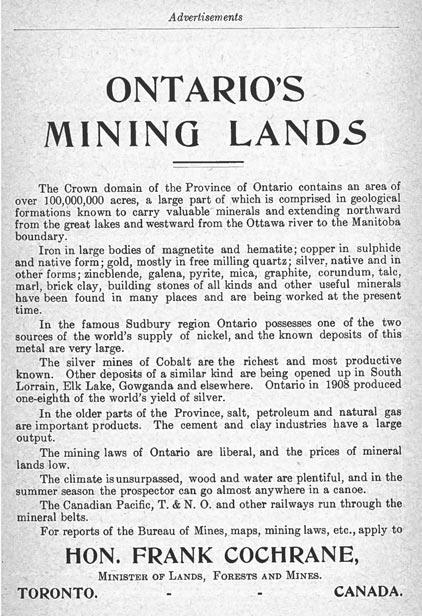

CIM had its roots in the first provincial mining associations with representation from both the east and the west. Mining in Canada had grown quickly and the author notes that it was the growth of both the railways and the need for minerals that were primary factors in the opening up of Canada. Coal mining had been taking place since the early 1700s on Cape Breton Island. Canada’s first iron ore foundry was opened at Quebec’s Les Forges du Saint-Maurice in 1729. The mineral wealth of the Canadian Shield was discovered in the 1860s and discovery of the Sudbury Basin’s copper and nickel deposits followed in the 1880s.

With this growth, members of the mining industry also realized quickly that industry-specific organizations were needed to better inform both them and the general public, as well as to provide an industry voice. One of those organizations was CIM.

During the Second World War, CIM played a significant role in advising a government committee on the sourcing of minerals identified as critical for the war effort. Post-war CIM saw the

knowledge & fellowship

growth of CIM technical divisions and committees, many of which morphed into the CIM Societies we know today.

Along the way, new branches and societies have been formed and new committees struck to recognize both membership needs and industry changes and innovations as they develop. Branches and affiliated student branches continue to have the longest reach across the country and have provided the first interaction with CIM for many new members.

CIM has navigated changes in membership demographics, internal structure and mining economic cycles. To do this, it has increasingly focused on its mandate and strategy. The 100-year history that Crossfield so eloquently chronicled in Pride and Vision finishes with 1997-1998 President Sandy Laird stating that CIM’s fundamental purpose is to provide its members with opportunities for both knowledge and fellowship. Those two guiding principles continue to be primary pillars in CIM’s strategic plans going forward.

I’d like to say thank you to Anne Marie Toutant and the presidents before her, to CIM’s hard-working central office team and to all of you, our members, for all of your efforts that have brought CIM to where it is today. We currently have more than 10,000 individual members and 124 corporate members. We have 30 branches nationwide, 11 societies covering a wide range of industry interests, 11 committees and 10 student chapters. We hold world-renowned events, publish internationally recognized standards, guidelines and leading practices and produce technical content that drives our industry forward.

Happy 125th birthday, CIM! We can look back at our storied history and our contributions to the mining industry with pride, and we will continually strive in our vision to serve our members as we go forward.

Mike Cinnamond CIM President

Safety in Numbers.

Visual tele-remote operation

Hard-Line launched a new add-on feature, Bucket Assist, to its TeleOp systems. Bucket Assist gives TeleOp operators a visual depiction of the position of the boom and bucket in relation to the ground. The visual allows the operator to be closer to the machine without having to leave their TeleOp control station, which the company said would keep the machine operator at a safe distance and increase productivity. “Tactile feedback from the machine is crucial for any machine operator to judge the position and placement for optimum productivity,” said Phil Pelland, vice president of sales at Hard-Line, in a press release.

Connected gas detection

Dräger ’s latest gas detector for mining, the X-am 2800, measures up to four gases and warns the user about gasrelated hazards. It includes sensors for flammable gases and vapours and can detect the presence of oxygen, carbon monoxide, hydrogen sulfide, nitrogen dioxide and sulfur dioxide. The X-am 2800 is paired for use with Dräger’s Gas Detection Connect, a cloud-based software. Data recorded from the device can be transferred to a smartphone via Bluetooth and uploaded to Gas Detection Connect using the Dräger X-dock test station. The detector can be worn on a clip and has large buttons, which make the device easy to use while wearing gloves. The display shows information such as gas readings, alarms and the time, and features a green status light to show when the device is ready to use. The X-am 2800 uses the new CatEx sensor, which is shock and poison resistant and can be configured for flammable vapours.

Sensor fusion technology

Brigade Electronics’ latest concept system, Brigade Fusion, uses sensor fusion technology to combine Brigade’s range of safety devices, including its 360-degree camera and radar obstacle detection, with M2M RTLS (Real Time Location System) technology. Brigade stated that the merging of these technologies can help to prevent high-risk events by providing the operator with prompt alerts. The system adds Earth Moving Equipment Safety Roundtable (EMESRT) levels eight and nine collision avoidance to its existing seven levels. “For operators, it provides a very robust layer of protection and additional peace of mind,” said Warren Di Marco, CEO of Brigade Electronics Canada, in a press release. “With Level 9, in the event the operator is unable to react in time, signals are sent to slow down or stop the machine. Importantly, the solution is not only modular but can be integrated with other customer hardware and data, so it can be designed to meet the customer’s specification.”

Compiled by Julianna Martinek

Compiled by Julianna Martinek

WORK SUIT

From “MIROC and developments in protective equipment for miners” by Peter Pullen, Chief Environmental Engineer for Rio Algom, CIM Bulletin, April 1979. The Mining Industry Research Organization of Canada was created in 1975. The initial work by the organization included work clothing, respiratory equipment and a “space-age” helmet.

The objective in the area of work clothing was to produce a rugged, water resistant, light-weight and temperature tolerant outfit with the underground environment in mind. A neat appearance also was considered important and a professional with experience in designing uniforms was engaged to produce patterns. The suits have been made in two weights, both using a Canadian nylon cotton fabric. The light-weight material is treated for water repellency, for use under conditions that are for the most part dry. In the heavier-weight suit, the same fabric has a back-up coating of TEFLON, for water resistance, while retaining some air porosity. The suits, designed as two-piece for size and temperature tolerance, require a minimum of accessory clothing. On trial at ten mining operations, a number of minor changes have been incorporated in the later model, which is now being re-tested in the field at member company sites.

The jacket has a loose yoke for ventilation, snap closures and convenient pockets. As may be seen, the shoulders have leather patches as protection when carrying materials. The right shoulder patch also has an attachment for the air hose for the supply of filtered air to the helmet. Openings are provided at the side of the jacket for the safety and lamp belt, so that at the back the jacket is inside the belt and at the front the jacket is placed over the belt.

The pants have a bib-front and attached suspenders. Some waist size adjustment is provided by gussets and snap fasteners at the sides. It is expected that the suit will be laundered about weekly and the wearable life is expected to compare well with the conventional alternatives now being used by miners. The weight of the coat is 1 lb, 12 oz, and the pants 1 lb, 8 oz, for a total of 3 lb, 4 oz. This may be compared with 3 lb, 9 oz for a conventional set of “oilers”. CIM

Developments What Budget 2023 means for miners

By Matthew ParizotThe latest federal budget shows the government seeking to push Canada closer to a net-zero economy, introducing new targeted tax credits and new investment to help drive the transition to renewable energy and promote the development of clean technologies, with the mining industry poised to reap the benefits.

In her speech to the House of Commons on March 28, Minister of Finance and Deputy Prime Minister Chrystia Freeland emphasized Canada’s importance to the global energy transition.

“We are going to make Canada a reliable supplier of clean energy to the world, and, from critical minerals to electric vehicles, we are going to ensure that Canadian workers mine, and process, and build, and sell the goods and the resources that our allies need,” she said, noting that the country has free trade deals with countries that represent two-thirds of the global economy.

Budget 2023 introduced a refundable tax credit of up to 30 per cent of the cost of investment in new machinery and equipment for extraction, processing and recycling of lithium, cobalt, nickel, graphite, copper and rare earth elements, which was lauded by both the Mining Association of Canada and the

Prospectors and Developers Association of Canada.

The new tax credit follows the introduction of the federal Critical Minerals Strategy in December and the March 24 launch of the Critical Minerals Infrastructure Fund, which will allocate $1.5 billion for energy and transportation projects to be used in critical minerals operations.

Photinie Koutsavlis, MAC’s vicepresident of economic affairs and climate change, called the new tax credit a “silver bullet” and said it will help keep Canada as a competitive market for investment. While she said investments from the Critical Minerals Strategy, last year’s budget and the 2022 fall economic statement spurred a lot of mineral exploration, there was previously a gap in terms of incentives and support for the upstream part of the mineral value chain, such as the mining and mineral processing sectors.

“We’re very pleased with that tax credit. We think it helps level the playing field a little bit with the incentives and investments that the U.S. has made with the Inflation Reduction Act, and in ensuring that the investment attractiveness of the U.S. doesn’t pull potential investors [away from] Canada,” Koutsavlis said. “I think this tax incentive will definitely be attractive to proponents but also to investors.”

Budget 2023 also proposed an additional $500 million for the government’s Strategic Innovation Fund (SIF) over the next 10 years towards the development of clean technologies. It will also direct $1.5 billion of the fund’s existing resources towards projects in clean technology, critical minerals and industrial transformation. The SIF, founded in 2018, has invested $6.9 billion in 107 projects across numerous sectors.

Clean energy and clean fuel were priorities for the federal government as well.

A refundable tax credit for critical minerals equipment among the features of this year’s federal budgetThe budget, delivered to the House of Commons in March, includes new targeted tax credits and new investment that will benefit the Canadian mining industry. Photo by Steven W. Dengler, courtesy of Wikipedia Commons

The announcement of a 15 per cent refundable tax credit for investments in non-carbon-dioxide-emitting energy systems, including solar photovoltaic, wind and small modular nuclear reactors, could see significant benefits for remote operations opting to use alternatives to fossil fuels at their sites. Additional details were also announced on the implementation of the Clean Hydrogen Investment Tax Credit, first announced in the 2022 fall economic statement. The tax credit will cover between 15 and 40 per cent of eligible costs for clean hydrogen projects, which can be used to fuel large haul trucks.

The federal government also turned its eye towards the impact assessment process, which it said is not approving projects in an efficient manner.

“Building Canada’s clean economy will require significant and sustained private sector investment in clean electricity, critical minerals and other major projects,” the budget read. “Ensuring the timely completion of these projects is essential— it should not take 12 years to open a critical minerals mine.”

The budget promised to release a plan to improve the efficiency of the process, which includes clarifying timelines, reducing inefficiencies and improving the engagement process. The promise builds on several federal investments over the past year to streamline impact assessments, including $1.3 billion over six years to the Impact Assessment Agency and other federal agencies.

Additionally, $11.4 million will be provided over three years to Crown-Indigenous Relations and Northern Affairs Canada to engage with Indigenous communities and update the federal guidelines on Indigenous consultation, in support of the implementation of the United Nations Declaration on the Rights of Indigenous Peoples Act. As well, $19.4 million over five years will be invested in increasing the participation of Indigenous Peoples and northerners in environmental and regulatory assessments of major projects, and $1.6 million over two years will be put towards increasing federal participation in these assessments and consultation with Indigenous communities.

Jeff Killeen, the Prospectors and Developers Association of Canada’s director of policy and programs, said these announcements will be beneficial for building positive relationships between the mining industry and Indigenous communities.

“Prospective lands are an essential part of making new discoveries and building up our critical mineral supply chain,” Killeen said. “Seeing that new funding for supports around Indigenous participation and also [being] able to make smart decisions around conservation is a positive. Because we know that that’s one part of our industry ecosystem that can help us improve, make decisions more quickly and see more mines built in Canada.” CIM

Agnico takes control of Yamana’s Canadian assets

The company’s acquisition of the Canadian Malartic mine and Wasamac project is part of its focus on the Abitibi gold belt

Agnico Eagle Mines has taken full control of the Canadian Malartic gold mine in Quebec’s Abitibi region—the country’s largest openpit mine—after its deal with Yamana Gold closed on March 31.

The deal also gave Agnico control of the Wasamac project in the Abitibi gold belt and several other exploration-stage projects in Ontario and Manitoba.

Shaft Sinking

Mass Excavation

Production Mining

Raiseboring

Raise Mining

Underground Construction

Mechanical Excavation

Engineering & Technical Services

Specialty Services

- THE REDPATH WAY SINCE 1962.

DEPENDABLE, PROFESSIONAL

“As demand for critical metals and minerals increases, pressure is on the mining sector to discover new deposits, develop existing projects quickly, engage with First Nations and local communities so they understand the projects, and work with governments to streamline the permitting process for more timely approvals to meet this growing demand,” said author Mona Forster, who has worked in the mining and mineral exploration sector for over 30 years, in a press release.

“Amongst all these priorities, junior resource executives often overlook or aren’t sure how to respond to new reporting requirements about how their company is undertaking climate-related risk management practices.”

Agnico Eagle and Pan American Silver announced a joint US$4.8 billion acquisition of Yamana in November, beating out Gold Fields’ initial offer. The deal saw Pan American purchase Yamana’s issued and outstanding shares and add four mines to its profile, and Agnico walk away with Yamana’s Canadian assets.

Agnico said in a press release its acquisition of Canadian Malartic and Wasamac was part of its strategy to “solidif[y] its presence” in the Abitibi gold belt of Ontario and Quebec, “a region of low political risk and high geological potential.”

The company forecasted its production from its operations in the gold belt, which also includes its LaRonde Complex, Goldex mine and Detour Lake mine, to be between 1.9 million and 2.1 million ounces of gold per year through to 2025.

In its 2022 annual results, released in February, the company said it planned to focus on “optimizing its expanded strategic positions” in the Abitibi in 2023 by improving mill throughput at Canadian Malartic and LaRonde. The improvements are expected to create excess mill capacity of 40,000 tonnes per day at Canadian Malartic by 2028 and 2,000 tonnes per day at LaRonde Zone 5 by the second quarter of this year.

“By maximizing the mill throughput in the region, the company believes there is potential to increase future gold production at lower capital costs and a reduced environmental footprint,” the company said in its results. Agnico said

it could add roughly 20,000 ounces of extra production in 2024 and scale up to an additional 500,000 ounces of gold per year by 2030.

It said its Wasamac, Macassa nearsurface deposits, Upper Beaver and other Kirkland Lake satellite deposits could be potential future sources for the extra mill capacity.

– Kelsey RolfeGuide: Junior miners must disclose climate risks to investors

Canada Climate Law Initiative report offers guidance for junior mining executives unsure of how to disclose climate risks, greenhouse gas emissions

A new guide by the Canada Climate Law Initiative (CCLI) advises executives of publicly traded junior mining companies to report to their investors the steps they are taking to reduce climate changerelated risks, and it warned that not doing so may result in reduced access to capital and legal action.

Junior miners, which represent almost 60 per cent of companies listed on the Toronto Stock Exchange Venture Exchange (TSXV), tend to have small or insignificant carbon footprints, the report said. But there is a growing demand from investors and regulators for all companies to disclose their emissions and plans to decarbonize.

Changes to securities law and accounting standards will require more thorough climate risk reporting. The Canadian Securities Administrators, the umbrella organization for provincial and territorial securities regulators, called climate change a “mainstream business issue” and requires all public companies to disclose their material climate risks and how they’re managing them. In addition, the proposed National Instrument 51-107, expected to come into force this year, will require more transparency around, and measurability of, companies’ net-zero targets.

The International Financial Reporting Standards Foundation’s new International Sustainability Standards Board has also released two new accounting standards for disclosing material climaterelated matters that will come into force as of Jan. 1, 2024.

The report also pointed to the federal government’s green transition finance taxonomy, released in March. The taxonomy lays out requirements for companies that want financing for projects that advance Canada’s net-zero goals. To qualify, companies will have to set net-zero targets and transition plans, as well as provide effective climate risk disclosure. “The taxonomy should open up new financing for venture issuers that can demonstrate effective climate governance,” the report said.

The CCLI’s guide offers resources to assist companies traded on the TSXV to meet their regulatory and marketing requirements and meet their fiduciary duties to its investors and other stakeholders.

It said juniors must disclose any physical, transition and technological risks to

their business, such as extreme weather events, shifting policy and legal landscapes, reputation risks and employing new technologies.

“In meeting their duty to act in the best interests of the company, directors and officers must be diligent in identifying and managing climate-related

Your partner in the field and beyond

risks and opportunities that could affect the short-, medium-, and long-term viability of their companies,” said Janis Sarra, professor of law at the University of British Columbia and principal coinvestigator at CCLI, in the press release.

The report noted that some disclosure guidance and protocols, such as the Taskforce for Climate-related Financial Disclosures, the Greenhouse Gas Protocol and the federal Greenhouse Gas Reporting Program, can be too onerous for TSXVlisted companies. But it recommended using the Prospectors and Developers Association of Canada’s GHG calculator for exploration stage companies and its framework for responsible exploration. The TSXV also has a primer for environmental and social disclosures that companies can refer to.

It said juniors should be part of the conversation on securities laws and accounting standards given their business model is different than major companies.

The guide is available for download on the Canada Climate Law Initiative website (ccli.ubc.ca) under the knowledge hub. – Julianna Martinek

Sayona Québec restarts North American Lithium project

By Matthew ParizotNorth America’s only major source of spodumene concentrate has reopened its doors, as Sayona Québec announced its successful restart of the North American Lithium (NAL) operation on March 30.

Currently, the mine is targeting 226,000 tonnes of spodumene concentrate production for the next four years, with the first shipment expected in July 2023. At present, Sayona has two major buyers in place for the mine’s product, with LG Chem agreeing to an offtake agreement for 200,000 tonnes over four years and automaker giant Tesla purchasing 125,000 tonnes over three years.

To date, Sayona Québec has invested $98 million in NAL acquisition costs and $55 million in restart expenses to bring the Abitibi, Quebec-based operation to successful production. The mine has a lengthy history of changing hands. Original owner Canada Lithium struggled to achieve commercial production, and after a merger with Sirocco Mining and a name change to RB Energy, shut down operations in 2014 and ultimately filed for bankruptcy. The mine began operation again in 2017, but a drop in lithium prices forced it back into care and maintenance in 2019. NAL, which was a subsidiary of the Chinese firm Contemporary Amperex Tech-

nology Co. Ltd (CATL), filed for bankruptcy protection the same year.

Sayona Québec—a 75-25 joint venture between Australian miner Sayona Mining and American company Piedmont Lithium— purchased NAL in August 2021. The string of previous owners had already invested significant capital into the operation, including the construction of the open pit, crushing plant, mill, flotation plant and more. Patrick Brindle, Piedmont’s executive vice-president and chief operations officer, estimated that around $400 million had already been invested in the operation when Sayona took over. That allowed the company to focus on process improvements during the 18 months it took to bring the operation out of care and maintenance.

“This was a long plan in the making, and we’re very happy that it’s been successfully realized,” he said.

Much of the capital Sayona invested was to optimize the performance of the mill. “[It] really built on the knowledge that prior operations and the management team had built up over time in terms of what it would take to de-bottleneck the operations, what it would take to improve mechanical availability, throughput, recovery and grade,” Brindle said. “There really was no secret sauce, it was really just taking the recommendations

of management and putting them together into a comprehensive brownfield upgrade program.”

The operation is still in its ramp-up phase with more work to be done, including the addition of an extra crushed ore storage dump, the completion of a lift of the tailings dam and upgrading the substation.

Sayona released a definitive feasibility study on April 14 that describes the NAL mine and includes the company’s Authier lithium project, also in the Abitibi region. According to the study, NAL has an aftertax net present value of approximately $1.4 billion with an eight per cent discount rate and a 20-year life of mine, with the potential to extend this with a 50,000metre drilling program scheduled for this year. Its proven and probable reserves total at 235,500 tonnes of contained lithium oxide from 21.7 million tonnes grading at 1.08 per cent. Sayona is also planning to release a pre-feasibility study on the potential completion and restart of NAL’s lithium carbonate plant sometime in the first half of this year.

Electric vehicles (EVs) are the main driver of lithium demand due to its role as a key metal in the creation of batteries. According to the consulting firm McKinsey, 60 per cent of today’s lithium goes towards battery applications, which could grow to reach 95 per cent by 2030. But

The Abitibi-based mine is North America’s only major source of spodumene concentrateCourtesy of Sayona Mining The North American Lithium operation is still in its ramp-up phase with more work to be done.

according to both McKinsey and the International Energy Agency (IEA), demand for the metal is expected to outstrip supply by the beginning of the next decade if no new projects come online. The IEA projected a three- to seven-fold demand increase by 2030, depending on how aggressively countries decarbonize their economies, while McKinsey estimated global supply as of 2030 could be 55 per cent lower than what is needed.

Despite the projected demand, however, the near-term economics tells a different story. After peaking at nearly 600,500 Chinese yuan (approximately $117,000) per tonne in November 2022, the spot price has fallen sharply in 2023 after CATL offered some automakers steep discounts for its battery-grade lithium carbonate. As reported by Reuters , analysts from Goldman Sachs expect supply to grow by around 34 per cent annually through to 2025, outpacing an annual demand growth rate of 25 per cent.

There are other spodumene projects in the works in Quebec, including Nemaska Lithium’s Whabouchi mine and

Patriot Battery Metals’ Corvette property. There is also a push for alternative sources of lithium, such as E3 Lithium’s plan to extract it from brines contained in Alberta’s Leduc aquifer. For Brindle, however, there is an importance in being the first major supplier in North America to try proving that it is possible to establish a battery metals market on this continent.

“I think the narrative in Western economies is that we need to create

Four First Nations say Ontario not consulting them on mining projects

Leaders of northern Ontario First Nations voiced concerns about the province’s amendments to the Mining Act that would speed up mine development timelines

Four Ontario First Nations called out the provincial government for failing to adequately consult with them on mining

ecosystems for battery manufacturing that exist outside of China,” he said. “I think the performance at North American Lithium is really important and will be closely observed by the market and by governments in the coming months going into next year because we want to be able to demonstrate that North America, overall, and Quebec, in particular, can be a successful producer of lithium units.” CIM

activity near their communities as the province seeks to amend the Mining Act to fast-track the time it takes to get mines built.

Leaders of the Neskantaga, Grassy Narrows, Muskrat Dam and Kitchenuhmaykoosib Inninuwug (KI) First Nations also called out the steep increase in staking on their territories over the past few years during a March 29 press conference at Queen’s Park.

“Right now, you see the government fast-tracking their legislative agenda to access our traditional homelands, and that’s just unacceptable,” said Neskantaga

Developments From the wire

Compiled by Julianna MartinekLundin Mining appointed Maria Olivia Recart to its board of directors. Recart was the Dean of Universidad Santo Tomás from 2019 to 2023, and before that was vice president, corporate affairs at BHP from 2010 to 2018. She brings with her a range of experience on environmental and social topics, including community engagement, government relations, sustainable supply chains and social values.

Sandfire Resources America named Lincoln Greenidge as its new chief executive officer. Greenidge joined the company in 2022 as its CFO and has worked for global companies including HudBay Minerals, Iamgold and Nortel Networks.

Suncor Energy appointed Daniel Romasko to its board of directors. Romasko has over 30 years of experience in the energy industry, including most recently as president and chief executive officer of Enlighten Innovations.

Northern Graphite Corporation named Kirsty Liddicoat chief operating officer. Liddicoat is a mine geologist and brings with her more than 18 years of global mining experience. Northern also appointed Dave Marsh as its chief technical officer. Marsh joined Northern Graphite in 2022 and has 40 years of combined experience managing the process engineering divisions of international consulting and operating companies.

Copper Mountain Mining appointed Patrick Merrin as president and chief executive officer, effective April 24. Merrin brings with him 10 years of senior executive operational and technical experience, including most recently as senior vice president of Canadian operations at Newcrest Mining.

Pure Gold Mining named Jonathan Singh chief administrative officer on March 31. Singh is the company’s sole officer and signing authority. Pure Gold also announced that all members of the board of directors have resigned. West Red Lake Gold Mines Ltd. (WRLG) is acquiring Pure Gold for $6.5 million, the companies announced on April 17. The Pure Gold mine near Red Lake, Ontario remains in a state of care and maintenance during Companies’ Creditors Arrangement Act (CCAA) proceedings.

Chief Wayne Moonias. “We’ve been very consistent with our position—until such time as we provide free, prior and informed consent to plans on our homelands, they will not be.”

Neskantaga is one of several First Nations that will be impacted by mineral development in the Ring of Fire region in the James Bay lowlands of northern Ontario, and one of the access roads to the region is set to run through the Nation’s territory.

Provincial Minister of Mines George Pirie announced the government had agreed with Webequie and Marten Falls First Nations on the terms of reference for an environmental assessment for the last of the three proposed roads into the hotly contested Ring of Fire region at the Prospectors and Developers Association of Canada’s annual convention in March. Moonias said at the time Neskantaga had not consented to those terms. The First Nation also sued the province over inadequate consultation in November 2021.

Christopher Moonias, Neskantaga’s Chief-elect, said the government has not sent any representatives to the community in past years. “Consultation happens in the community in the language we understand,” he said. “That’s our understanding of consultation and accommodation.”

The Ontario government unveiled its proposed changes to the provincial mining act in early March through its Building More Mines Act. The act proposes to make it easier for companies to obtain permits to recover

minerals from mine waste and tailings; give companies the option to not make financial assurance payments on closure plans upfront and instead pay them in phases, tied to the project’s construction schedule; and allow more flexibility in the techniques used to rehabilitate closed mines.

The proposed amendments also include allowing miners to file closure plans that do not immediately meet all of the Mining Act’s requirements as long as the plan is updated later, and reducing the number of circumstances under which a company must give notice of a material change to a project.

The mines ministry said the changes would still meet Ontario’s environmental protection standards and would not compromise the province’s duty to consult with First Nations.

“It shouldn’t take 15 years to open a mine. This process is too time-consuming and costly, leading to project delays and lost opportunities for Ontario’s mineral exploration and mining sector,” Pirie said in a release at the time. “We need to get building.”

The proposed changes come as Ontario seeks to ramp up the development of critical minerals projects to meet the needs of the booming electric vehicle market and the future low-carbon economy.

Muskrat Dam Chief Alvin Fiddler and Grassy Narrows Chief Rudy Turtle both expressed concern at the March 29 press conference about the amount of staking taking place near or on their land. According to a graph shown at the press confer-

ence, there are currently roughly 200,000 hectares of staked mining claims on Grassy Narrows’ land, well up from less than 50,000 in 2019.

“Over the years, it’s skyrocketed,” Turtle said, adding that the community had been “very clear” that it did not want any mining development on its land, and had successfully blockaded logging activities on its territory for 20 years.

Fiddler said his community had learned about Platinex Inc.’s expansion of its Muskrat Dam property in January through social media, rather than engagement from the government or company.

He called on the government to honour its obligations under Treaty #9, which covers First Nations in the James Bay and Hudson Bay areas, and the United Nations Declaration on the Rights of Indigenous Peoples.

“We shouldn’t have to beg for meetings with officials. They should reach out on our terms and [come to] our territory,” Fiddler said. “[Premier Doug Ford] knows what his obligations are.”

– Kelsey Rolfe and Julianna MartinekCopper projects from

Rio Tinto, Teck reach big milestones

Two mega copper projects expected to play significant roles in the global supply of copper in the coming decades reached significant production milestones in March

Rio Tinto began underground production at its giant Oyu Tolgoi copper mine in Mongolia’s Gobi Desert on March 13. On March 31, Teck Resources announced its Quebrada Blanca Phase 2 (QB2) project in northern Chile’s Tarapacá region produced its first bulk copper concentrate.

Rio Tinto’s US$7 billion underground expansion project, which is expected to be the fourth-largest copper mine in the world by 2030, got the green light in January 2022 after the company settled a dispute with the Mongolian government over the mine’s economic benefits to the country and a US$2.4 billion debt owed by the government to the company’s then-

subsidiary, Turquoise Hill Resources. Mongolia has a 34 per cent ownership stake in the mine, while Rio Tinto controls the remaining 66 per cent.

Rio Tinto chief executive Jakob Stausholm said in a press release on March 13 that Oyu Tolgoi was “critical” for global copper production and economic development in Mongolia.

Oyu Tolgoi has been operating as an open-pit mine since 2011. The combined surface and underground operations are expected to produce around 500,000 tonnes of copper per year on average between 2028 to 2036, which Rio Tinto said would be enough to produce about six million electric vehicles annually.

“The copper produced in this truly world-class, high-technology mine will help deliver the electrification needed for a net-zero future and grow Rio Tinto’s copper business,” Stausholm said.

The underground operation, which begins 1.3 kilometres below the surface of the desert, is being developed by block caving. Since the early 2022 agreement, the company has blasted 30 drawbells.

Developments

Canada Nickel Company appointed David Smith as Chairman. Smith is a current member of the company’s board and was most recently the EVP finance and CFO at Agnico Eagle Mines.

Asante Gold Corporation appointed David Anthony and Edward Nana Yaw Koranteng to its board of directors. Anthony is currently the chief executive officer of Asante and has more than 40 years of experience in mine project development and operation at the senior management and executive levels. Koranteng is the chief executive officer of Minerals Income Investment Fund and brings with him over 23 years of experience as a lawyer and corporate and investment banker.

Peter Mercer joined the American Pacific Mining Corp. executive leadership team as senior vice president, advanced projects, focusing on the advancement of the Palmer VMS project in Alaska. Mercer brings with him extensive experience in mineral exploration, permitting, construction and mine development, including most recently as vice president at Rambler Metals and Mining.

Probe Gold appointed Renaud Adams to its board of directors. Adams has over 30 years of global mining experience in senior executive positions and currently serves as president and chief executive officer of Iamgold Corporation.

Mike Wainwright, chief operating officer at Trafigura, will retire next year. Wainwright has served as the company’s COO and board member since 2008. At press time, Trafigura has not announced a replacement.

Lundin Gold appointed Christopher Kololian as its new chief financial officer, effective July 1. Kololian brings with him over 16 years of experience in the metals and mining investment banking sector, including most recently as managing director and co-head of metals and mining for Europe, Middle East and Africa with RBC Capital Markets.

QB2, meanwhile, is ramping up to full production over the course of 2023. QB2 is expected to produce between 285,000 and 315,000 tonnes of copper annually between 2024 and 2026. The company has pegged the project’s initial mine life at 27 years based on roughly 18 per cent of its 2022 reserves and resource tonnage, and said it has “significant potential for future growth” in a March 31 press release.

QB2 is one of the world’s largest undeveloped copper resources, and Teck has forecast that it has the potential to double production at QB2 in the future, which it said would put the mine among the top 10 copper producers in the world.

Teck owns an indirect 60 per cent interest in the owner of QB2, Compañía Minera Teck Quebrada Blanca SA (QBSA), while Sumitomo Metal Mining and Sumitomo Corporation have a collective indirect 30 per cent interest in QBSA. The Chilean state-owned company ENAMI has the remaining 10 per cent non-funding interest in QBSA.

“First copper concentrate production at QB2 is an important milestone as we advance our commissioning and ramp up plans towards full production this year,” said Teck CEO Jonathan Price in the release.

Mining at the original Quebrada Blanca open-pit mine ceased in the fourth quarter

of 2018, with mining equipment and employees redeployed to develop QB2. Copper demand has skyrocketed, given its outsized importance in the transition to a low-carbon economy, but according to a November report from S&P Global, the supply gap could be too large to fill.

Copper demand is expected to grow from 25 million tonnes in 2022 to reach 50 million tonnes by 2035, the report said. S&P said that demand could outpace the expected supply by up to 9.9 million tonnes, or roughly 20 per cent of the copper needed to meet energy transition goals.

The report laid out two scenarios; one that would see mine capacity utilization and recycling rates continually increase through to 2035, and one in which they remained constant at 84.1 per cent, the global average capacity utilization for the preceding decade. In the first scenario, global refined copper production could reach 47.3 million tonnes by 2035, or a 3.2 per cent supply gap, and an eventual surplus of 1.3 million tonnes by 2045. In the latter scenario, the report predicts the 9.9 million tonne supply gap, and no prospect of a supply surplus until 2050.

The report said one of the key challenges to ramping up copper supply is the length of time required to bring a new mine online.

Despite rapidly growing demand, a late March report from BMO Capital Markets noted many miners are opting to return cash to shareholders instead of focusing on expansion. In much of the past 20 years, the report said, expansion capital spending in the mining industry has typically exceeded 20 per cent of companies’ earnings before interest, taxes, depreciation and amortization (EBITDA). But in the past five years, that metric has slipped to lower than 15 per cent, and shareholder returns have been prioritized even as miners have seen their free cash increase.

The report said the lack of investment was “storing up issues for later in the decade,” when balance sheets look to be tighter. BMO said it expects miners to look towards “buying rather than building any growth” as high capex costs, shareholder resistance and environmental challenges increase the difficulty of building new projects.

BMO boosted its price forecast for most commodities given these challenges, including boosting its copper forecast by 10 per cent.

– Julianna Martinek and Kelsey RolfeProvincial budgets look to increase exploration funding and streamline processes

British Columbia and Quebec focus on critical minerals while Ontario invests in the Ring of Fire

Mining and mineral exploration featured prominently in several 2023 provincial budgets, with governments earmarking funds to support exploration, particularly for critical minerals, as well as improving permitting and other processes and increasing their attractiveness as mining jurisdictions.

Ontario

The budget put a clear focus on developing northern Ontario and particularly the Ring of Fire region near James Bay, which hosts Ring of Fire Metals’ Eagle’s Nest nickel project. The budget included a nearly $1-billion investment in infra-

Developments

structure to advance the development of critical minerals in the region by building all-season roads and establishing broadband connectivity.

Ontario Minister of Mines George Pirie applauded the budget’s focus on developing infrastructure, transportation and mining in northern Ontario.

“Right off the bat, they talked about mining; they talked about critical minerals; they talked about the Ring of Fire. So, a real high priority is being given to the North,” Pirie told the Timmins Daily Press on March 24. “This ties right back into getting the minerals out of the ground in northern Ontario to secure the supply chain.”

The government also allocated an additional $6 million over two years to the Ontario Junior Exploration Program, which finances junior mining companies’ mineral exploration and development. This brings the province’s total investment in junior exploration companies to $35 million since 2021.

Ontario Mining Association president Chris Hodgson said that the budget was “better than they thought” in committing government resources to mining.

Conspec Controls would like to congratulate the Canadian Institute of Mining, Metallurgy and Petroleum for 125 years of shaping the mining world.

Developments

“We see every government agency and ministry starting to focus on how can we be competitive and how can we get more manufacturing and help with the global challenge of climate change,” Hodgson said. “[The budget] talked so much about the importance of mining for the economic future of Ontario. That was probably the one thing that we were pleased to see because that sets the direction for the whole government.”

British Columbia

The budget, delivered on February 28, came after what provincial Minister of Finance Katrine Conroy said was a “record-breaking” year for mineral exploration.

“Funding for a new critical minerals strategy in this year’s budget will continue to support the sector. B.C. is ready to deliver the essential materials needed to help transition away from fossil fuels and grow a clean economy,” Conroy said.

The province’s $6 million commitment to develop its critical minerals strategy will be spread over three years, facilitating more critical mineral exploration and potential processing and manufacturing. The funding will also support and engage with Indigenous communities and other stakeholders, the budget document said.

The government also outlined $77 million over three years to make natural

resource permitting more efficient. Kendra Johnston, president and CEO of the Association for Mineral Exploration British Columbia, commended the investment in the permitting process. “[We’re] really happy to see that the government understands the importance of permitting for the industry and for other industries across B.C., and that they’re looking to expedite the timelines without reducing any of the regulations,” she said.

The funding will go towards modernizing current permitting processes and services, focusing on approaches that encourage co-management and decisionmaking with Indigenous communities. In June 2022, the province reached a historic agreement with the Tahltan Central Government, the administrative governing body of the Tahltan Nation, that makes the environmental assessment and development of Skeena Resources’ Eskay Creek gold-silver project contingent on the consent of the Tahltan Nation. The agreement was the first of its kind to be negotiated under B.C.’s Declaration on the Rights of Indigenous Peoples Act.

Quebec

To meet the province’s goal of “[harnessing] the value of Quebec’s subsurface minerals,” the provincial government announced $10 million in spending over two years to develop its critical and strategic

minerals sector. The money will also go towards renewing the mandate of the Société d’investissement dans la diversification de l’exploration (SIDEX), which includes investing in exploration companies operating in Quebec, until March 31, 2033. To date, SIDEX has invested over $105 million in mineral exploration companies and projects in the province, including O3 Mining, Kenorland Minerals and Osisko Mining.

Saskatchewan

In its 2023 budget, the Saskatchewan government has committed $4 million to expand the Targeted Mineral Exploration Incentive to increase funding limits and support exploration drilling for all hardrock minerals.

The government has also increased the Saskatchewan Mineral Exploration Tax Credit from 10 per cent to 30 per cent, making it the highest mineral exploration tax credit in Canada. “Saskatchewan is open for business,” Energy and Resources Minister Jim Reiter said in a March 22 press release. “Critical minerals are vital for our modern way of life and in short supply around the world. Saskatchewan is fortunate to have occurrences of 23 of the 31 critical minerals on the Canadian critical mineral list.”

Manitoba

The government renewed its Manitoba Mineral Development Fund partnership with the Manitoba Chamber of Commerce and has committed $10 million over the next three years to help leverage private sector investment in mining. The fund, managed by the Manitoba Chamber of Commerce, has invested nearly $8 million towards mining and development projects across the province and has helped create 73 long-term jobs and form 72 community and Indigenous partnerships since 2020. The 2023 budget also made the Mineral Exploration Tax Credit permanent; the credit was initially set to expire on Dec. 31, 2023.

The budget also outlined a 50 per cent increase in staffing and department capacity for the Department of Mineral Resources, which the Manitoba government says will support increased mining interest by improving permit processing timelines.

Alberta

The budget allocated $18.7 million for the research, design and development of

the provincial Department of Energy’s energy policy. The budget also outlines department objectives around optimizing the energy regulatory system, modernizing legislation and regulations and improving the efficiency of application approval processes. The budget said the funding for those priorities was meant to increase competitiveness and create jobs.

Newfoundland and Labrador

The government is projecting that mineral exploration in the province will reach $238.6 million in 2023 due to increased gold exploration and interest in critical minerals and rare earth elements. The 2023 budget included a $1.7 million commitment to its Mineral Incentive Program, which funds mineral exploration in the province through the Junior Exploration Assistance Program (JEA) and grants and training for prospectors. The JEA program will receive $1.3 million of that funding to support junior mining companies focused on critical mineral exploration.

– Tijana MitrovicNew feasibility study for Marathon palladium-copper project

Generation Mining hopes Marathon will be Canada’s next greenfield critical minerals mine

Generation Mining Limited released an updated feasibility study on March 31 for its Marathon palladium-copper project in northwestern Ontario, which it hopes will become the next greenfield critical minerals mine in Canada. The mine will focus on producing copper concentrate, containing copper, palladium, platinum, gold and silver.

The study outlines the operation of an open-pit mine and process plant expecting to produce a total of 2.1 million ounces of palladium and 517 million pounds of copper over a mine life of 12.5 years.

Results from the study, prepared by G Mining Services, showed an after-tax net present value of $1.16 billion with a

discount rate of six per cent, assuming prices of US$1,800 per ounce for palladium and US$3.70 per pound for copper, and an internal rate of return of 25.8 per cent.

The study anticipates initial capital costs of $1.11 billion with a payback period of 2.3 years, a 25 per cent increase since the last feasibility study, which was completed in March 2021. In a webcast on April 3, executive chairman Kerry Knoll said the new estimate reflects inflation, quotes and estimates on equipment purchases and the work to be done on the site.

“This updated feasibility study underscores just how robust the Marathon project is, even in the current inflationary environment,” said Jamie Levy, president and CEO of Generation Mining, in a March 31 press release. “This, combined with strong demand for critical minerals, makes the rationale for the project becoming Canada’s next critical minerals mine more compelling than ever before.”

With palladium in demand for autocatalysts, which convert toxic emissions

Developments

in car exhaust into less-harmful chemicals, and copper as a key component in electric vehicles, Levy said the project is a “low-cost producer of critical metals that Canada and the rest of the world desperately need.”

According to the study, the Marathon project is expected to be one of the lowest CO2 equivalent intensity mines in the world. The company commissioned Skarn Associates to benchmark the carbon footprint per copper equivalent.

Skarn Associates estimated that carbon emissions worldwide average 4.65 tonnes of carbon dioxide equivalent per tonne of copper equivalent produced, with the Marathon project less than one third of that average. The comparison was made with 13 producing copper mines across the country. On a worldwide basis, the Marathon project would be in the bottom four per cent.

Results from the feasibility study show the project has a total of 127,662 tonnes of proven and probable reserves, with expected average annual payable metals of 166,000 ounces of palladium, 41 million

pounds of copper, 38,000 ounces of platinum, 12,000 ounces of gold and 248,000 of ounces of silver.

“Our team has been working hard to develop the Marathon project and has successfully optimized and improved confidence in the designs of the process plant, the open pits and the necessary infrastructure for the project,” said Drew Anwyll, Generation Mining’s chief operating officer, in the March 31 press release.

Generation Mining stated that since its 2021 feasibility study, the company has performed additional metallurgical test programs to optimize the flowsheet and plant design and improve confidence in metallurgical recoveries. It also performed geotechnical investigations in areas of key infrastructure location and confirmed the locations chosen in the construction design, as well as diamond drilling an additional 18,995 metres within the Marathon deposit.

In the April 3 webcast, the company announced it is currently waiting on three

provincial permits before it can begin construction, which are for the mine closure plan, tree harvesting and species at risk. Levy said the company hopes to start early works construction by the summer or fourth quarter of 2023. The company estimates the project will create over 800 jobs during construction, and over 400 jobs during operations.

Seven Indigenous groups indicated they were interested in participating in consultation processes with Generation Mining’s project, which is located within the territory of the Robinson Superior Treaty area, and the company signed a community benefits agreement with the Biigtigong Nishnaabeg First Nation.

The Marathon project involves the construction, operation, decommissioning and remediation of three open-pit mines to produce copper concentrates. In the webcast, the company stated 60 per cent of the revenue will come from palladium, 30 per cent from copper, and the remaining balance from platinum, gold and silver. – Julianna Martinek

For more information:

ON FILLING THE SKILLS GAP

"On the establishment of science classes, &c." was originally published in The Journal of the Canadian Mining Institute, 1899 The writer, Augustus H. Holdich, held a position at the Hall Mining and Smelter Company, which began operations in Nelson, B.C., in 1896.

It is right to state at the commencement of these few remarks, that the ideas therein contained are not intended to apply to large and well populated cities, where far superior arrangements can readily be made, but rather to the small and scattered towns that help to make up this vast Dominion. The inestimable value of, amounting really to a necessity for, Technical Education will hardly be disputed, and the question now seems to be, by what means can it be best supplied. In the larger cities of the Dominion this offers no difficulty, as the various well known universities can amply supply all needs; but in the less populated districts— British Columbia perhaps especially, no city is yet powerful enough to support a properly constituted and equipped School of Mines, or College for Technical Education, nor could students be moving about from one town to another except at a prohibitive loss of time and money. But the fact remains that this special education ought to be afforded, so that all whose tastes or occupation incline them to take advantage of it should have no difficulty in so doing at the minimum of inconvenience and expense.

If, as the writer ventures to think, these statements will not be disputed, it may not be time wasted if some of it is spent in considering the matter seriously, always of course making use of experience that has been gained in other countries. In England for instance, science classes are held in every town of any pretension, and pretty well all branches of science are taught besides

Technical Education in the chief industries of the district, e.g., dyeing, tanning, carpentery, weaving, and many other allied subjects. In many of these schools, well fitted laboratories are to be found, where the students can carry out practically what they have learnt in theory, and also make experiments in their own particular branch under the guidance of the teacher; and nothing is so productive of permanent knowledge as carefully and thoughtfully performed experiment. In some of the larger institutions there are in addition, fully equipped workshops for making engines, electrical apparatus, and such like machinery, a thorough knowledge of which will ensure a decent living to any ordinarily clever man. It is not my purpose here to refer to the still larger educational establishments such as the Royal School of Mines (London), Owen’s College (Manchester) or the Liverpool University, all of which are far beyond our means, if not our wants, (and indeed it has been forcibly brought home to me that fine work is not wanted, or at least not appreciated in British Columbia—the rougher the better, usually), but merely to see what can be done with the limited means at our disposal, and it seems to me that the establishment of Science classes in all towns where there appears to be a desire for them will prove a comparatively easy task.

The beginning must of course be on a very limited scale; there is no need to build a huge structure till the enterprise is able to afford it; but most towns can find a large room furnished with all that is necessary in which lectures could be

given on various scientific subjects, and possibly some practical instruction as well. A “rough outline” so to speak of a chemical laboratory can be easily and cheaply fitted up, a vast array of uniformly sized bottles with complicated glass apparatus, and any amount of paint and varnish while unquestionably pleasing to the ordinary eye, being totally unnecessary. It is not the bottles and apparatus that do the work, but the man who knows how to use them. The difficulty is that not much experimenting can be done at night—in the 3 hours usually assigned to such work—it is not at all easy to see just what you are doing, and what has actually happened as the result of your experiment, by artificial light. But lectures can easily be given at that time, and possibly a few hours of daylight can be spared during the week as well, for experimenting only. The study of minerals indeed, which is a most important branch, can only he carried on properly by daylight—unless at least some form of electric light can be introduced that is in all respects equal to daylight. However, these and many other points which are liable to crop up at any moment, must be left to be dealt with after the suggested classes are formed and in working order—the first thing is to have such classes organized for the benefit of those who are unable to attend the larger universities and colleges, in the more out of the way towns in this Dominion. The question naturally arises, “who is going to pay for this teaching”? And it is a question that must be answered, as it is the lot of

very few of us to be out here exclusively for the benefit of our health.

How then can the expenses be met?

Well, let us hope that our provincial governments will be able to see their way to assist; and let the pupils themselves pay a certain fee, more of course where laboratory practice is included, and let there be regular examinations (perhaps annually or even twice yearly) upon the results of which the teacher shall receive some grant from Government. The fees to be paid by the pupil probably might have to be varied in different localities, cost of living, &c., being an important factor in the calculation, but the Government grant should be at least equal to such fees, dependent on the condition that the pupil passes a satisfactory examination. The grant might very reasonably be graded, so much per head first class; and so much less for second class; then the teacher would have a very strong incentive to teach the subject thoroughly.

It is very much easier for one man to travel (if he must) 10 or 50 miles once a week so as to teach his particular subject at different centres, than it is for pupils to travel that distance; and it is quite possible that in every town some one man can be found who can teach at least one special subject and do it thoroughly; the same being true of more than one man and more than one subject. In any case, the matter appears to me to be well worth attention, and there are some grounds for hoping that the British Columbia Legislature will take the scheme into consideration at an early date.

Perhaps some members of the Institute will offer their own opinion and suggestions as to the feasibility of starting up even on a small scale some such classes as I have attempted to outline.

In close connection with this subject is the urgent need of some kind of association of analytical chemists and assayers, to prevent the too commonly

utterly incapable man from misleading those who innocently come to him for advice. It has fallen to me more than once in British Columbia to find a man professing to do assays (and even analytical work) who was ignorant of the first principles—and often had quite unsuitable balances. While the assay for gold and silver is not very difficult (but it wants to be performed correctly), yet copper is not quite so easily estimated and requires decidedly more skill and experience, and I have met assayers out here who candidly acknowledged that they could not assay a sample for copper. Can we not join together and insist on a man proving himself capable, before allowing him to practice? or would it be “interfering with the liberty of the subject”? Some action ought to be taken, and it is my sincere hope that these rather random notes may be considered and discussed and that the hoped for good results will follow. CIM

modern miner

The power of speaking up

Resourceful Paths’ principal consultant is championing both sustainability and diversity in the mining industry

By Sara King-Abadi Laurie Reemeyer Principal Consultant Resourceful PathsBEng Honours

Mineral Processing, University of Queensland

MBA Honours

Engineering and Business

Sustainability Certificate, University of California, Berkeley

What is your proudest career highlight?

When a problem with water quality arose at a mine site, we developed a solution, then I effectively communicated our plan to the Aboriginal community and was able to allay people’s concerns. I’m particularly proud of this moment because communicating technical issues can be challenging and requires thoughtfulness, and this was a success.

Name one of your most recent accomplishments.

My presentation at last year's annual CIM Convention, “Making mining more welcoming for young professionals: Reflections from my career to date,” which was my coming out in the mining industry. It was really quite liberating.

Laurie Reemeyer is ready to share his story. The principal consultant for Resourceful Paths, a Vancouver-based consultancy firm that focuses on helping mining companies reduce their impact on the environment, is now speaking openly about his experiences as a member of the 2SLGBTQ+ community in the industry.

For Reemeyer, the public’s growing interest in both sustainability and social issues is not a coincidence. “In general terms, people who care about the environment tend to also care about other things like environmental justice, social justice, those types of principles,” Reemeyer said.

When it comes to diversity, equity and inclusion, these values can strengthen the mining industry, he said.

“When you get into aspects of sustainability and ESG [environmental, social and governance] you realize part of the bigger picture, which is responsible business practices that are also attuned to the needs of stakeholders that are aware of the need for diversity—diversity of thought, diversity of people—[help us] make good choices that are not just centred around the traditional ways of thinking,” he said.

Historically, Reemeyer said, there has been a “colonial view” in the mining industry, leading to the exploitation of resources to the detriment of communities: “Certainly we saw in places like Papua New Guinea, companies would come in and exploit resources with limited regard for impacts. Things did not go well in that part of the world, for example on Bougainville Island, where the impacts of mining led to civil war and a lot of harm, environmentally and socially.”

Looking to reduce the impacts of mining has been an ongoing theme in Reemeyer’s nearly 30-year career.

The early days

With the encouragement of Professor Alban Lynch at the University of Queensland in 1990, Reemeyer did vocational training at BHP’s Broken Hill mine in Australia’s outback, where he worked under metallurgist Fran Burgess in sampling and laboratory techniques

and analysis of the performance of the grinding circuit of one of the concentrators.

Their research was well-received and that exposure to the industry left Reemeyer wanting to learn more. “That was really the trigger for me to choose mineral processing as my selected stream of engineering,” he said.

At the same time, Reemeyer was beginning to realize there were key environmental problems associated with mining. The Ok Tedi environmental disaster in Papua New Guinea in 1984— where 90 million tons of mine waste was annually discharged into the Ok Tedi river for more than 10 years, destroying downstream villages, agriculture and fisheries—was in the foreground of his education.

“We saw images during school and that continued through the ’90s,” Reemeyer recalled. “I found an interest in overcoming processing and engineering challenges, while also recognizing that the environmental and social impacts of mining needed to be better addressed.”

Following graduation from the University of Queensland, Reemeyer started working at Mount Isa Mines in Queensland in 1994, where he performed a wide range of roles, including in smelter emissions and waste management.

“Mount Isa was also an operation with some legacy problems like pollution emitted from the copper smelter,” he recalled. “One of my early jobs was to determine how much sulfur dioxide and heavy metals were going up in the stack ... and it was a lot. Back then, the company was very secretive about discussing these emissions, which made me feel uncomfortable. Later, gov-

ernments required stronger emissions reporting, and at Mount Isa a significant portion of copper smelter gases are now treated in an acid plant.”

That experience gave Reemeyer more insight into the impacts of mining pollution and the potential to optimize processes.

At 30 years old, in 2003, Reemeyer became the plant manager at Zinifex’s Century mine in northwest Queensland. It was a steep learning curve but left him with the skills to weather the high-pressure industry that mining can be.

“It can be very up and down,” he explained. “During times when prices are low, and when times are tough, it can be difficult, you can see friends and colleagues lose their jobs and operations be constrained and you don’t have a lot of resources to get through.”

A bigger impact

While sustainability was always at the back of Reemeyer’s mind, the real turning point for him came in the mid-2000s while at the Century mine. Part of his job was being responsible for the tailings storage facility. The experience familiarized him with tailings management and quality control while working on a progressive expansion of the facility, as well as balancing water management with Aboriginal communities who relied on some of the water discharged by the mine operations.

However, Reemeyer wanted to have an even bigger impact when it came to helping mining companies reduce their impact on the environment, and in 2008, he left Zinifex to pursue an

2022-2023 DISTINGUISHED LECTURERS

MBA with a Certificate in Engineering and Business Sustainability at UC Berkeley in the United States.

“I got very engaged in climate change because of the great research being done there,” he said. “And just connecting the dots between the global scale of climate change, the transition that was coming in terms of things like electric vehicles, and the importance of having the ingredients for green technology. The mining industry is needed to supply these metals.”

After completing his MBA, in 2011 he took a role with the consulting firm AMEC in Vancouver before eventually deciding to strike out on his own to help mining companies find paths for more sustainable extraction and use of natural resources, founding the aptly named Resourceful Paths in 2016. His firm provides a variety of consulting services to assist companies looking to reduce energy and water use, manage climate change and maximize resource recovery.

Deep down, Reemeyer always knew he would carve his own path: “Partly because I like the independence. I like the ability to say what I think needs to be said, and not to be constrained by corporate policies or by bosses that are potentially divisive or scared.”

A culture shift in mining

As the mining industry reacts and adapts to climate change, the industry is changing in other ways too. As a gay man who began working in mining in the 1990s, Reemeyer said the culture shift has been huge in the last few decades.

“For most of my career ... I was almost completely hidden, in terms of my sexuality,” he said.

Electrify your operations

Reemeyer described seeing pictures of topless women where he worked in the ’90s: “There were hardly any women who worked in those areas, but for the ones that did, they were subjected to these images as well. As a gay man, I was always uncomfortable about that ... and there were plenty of times when sexuality was talked about in derogatory ways.”

It wasn’t just inappropriate images that made him feel unwelcome. After a weekend trip to Mardi Gras in Sydney in the early 2000s, Reemeyer returned to a torrent of gossip, innuendo and harassment in the workplace about his sexual orientation. Some of his coworkers were supportive, but the easiest way for Reemeyer to avoid workplace discrimination was “just to deny.”