SEPTEMBER/OCTOBER 2025 • SEPTEMBRE/OCTOBRE 2025 MAGAZINE.CIM.ORG

SEPTEMBER/OCTOBER 2025 • SEPTEMBRE/OCTOBRE 2025 MAGAZINE.CIM.ORG

The Eccentric Roll Crusher (ERC) has an innovative and patented design that improves mine performance.

With a compact and low-wear design, the Eccentric Roll Crusher (ERC) provides greater throughput, reduced energy consumption and has improved durability. Use FLS technology to meet your operational goals today!

Explore more about

Key features:

■ CAPEX reduction of up to 10% for the overall plant

■ High efficiency with up to 40% energy cost savings

■ Up to 10% higher throughput compared to industrial benchmarks

Discovery to production timelines are stubbornly long. The demand for critical minerals is only growing. Should the industry re-imagine mine planning and design?

By Tijana Mitrovic

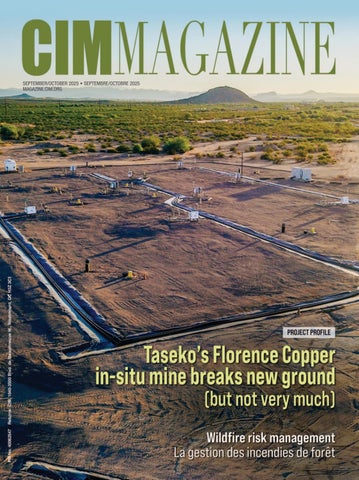

The world’s first greenfield in-situ copper recovery operation is set to produce first copper by the end of the year

By Ailbhe Goodbody

Advancements in ventilation technologies are reshaping underground mining for safety, efficiency and cost savings

By Mehanaz Yakub

9 The best in new technology

Compiled by Ashley Fish-Robertson Developments

10 Drillers rescued at Red Chris

By Ashley Fish-Robertson

11 Canada and Northwest Territories launch drill core scan project

By Ashley Fish-Robertson

14 New mining engineering program to launch in Nova Scotia

By Kelsey Rolfe

18 Nanotechnology start-up focuses on brines with low lithium concentration

By Sara King-Abadi

23 Only relevant and reliable historical information should be part of your technical disclosure

By

James

Whyte and Craig Waldie

24 Canadians need more publicly accessible information about the origins and processes behind the materials we use every day

By Donna Beneteau and Bruce Downing

Indigenous participation in mining

26 Taykwa Tagamou Nation’s $20 million investment into Canada Nickel is the largest of its kind in Canada

By Tijana Mitrovic

Risk management

28 The mining industry is undergoing significant digital transformation, but new technologies can also increase vulnerability to cybersecurity threats

By Lynn Greiner

30 The mining industry’s response to the enduring challenge of driving down the rate of fatalities and serious injuries

By Rosalind Stefanac

32 Forsite Fire’s Andy Low explains how wildfires can impact mine sites and why comprehensive mitigation planning is key to long-term resilience

By Mehanaz Yakub

CIM news

45 We are profiling CIM-Bedford Canadian Young Mining Leaders Award winners to learn how they are shaping the future of the industry. Meet Annabelle Rioux

By Tijana Mitrovic

46 Norman B. Keevil Jr. has created an endowment in his brothers’ names to help Indigenous students pursue a career in mining

By Michele Beacom

47 A great turnout for COM & LightMAT 2025

Mining the archives

64 A look at the development of Saskatchewan’s first uranium mining region in Beaverlodge

By Ailbhe Goodbody

54 Table des matières

54 Lettre de l’éditeur

56 Mot de la présidente

57 Ressources Winsome résilie l’option sur la mine Renard Par Ashley Fish-Robertson

Gestion des risques

59 Andy Low de Forsite Fire explique l’incidence des incendies de forêt sur les sites miniers et l’importance des programmes d’atténuation exhaustifs pour la résilience à long terme

Par Mehanaz Yakub

In June, I picked up a copy of Vaclav Smil’s How the World Really Works. The jacket copy is almost disingenuous about what is inside, calling it “an essential analysis of the modern science and technology that shape our twenty-first century lives,” which makes sense, because “why we ought to be more thoughtful about our reliance on crude oil, concrete, steel and fertilizers” would be a much tougher sell.

With Smil’s book rattling around in my head, I dashed off to Spain while the rest of the editorial team had their shoulders to the wheel preparing this issue. (If you have the good fortune to reach 50, why not celebrate? It will happen only once after all.) Which is why, when I made one of my first stops at the Guggenheim Museum Bilbao, not only mortality but the material reality of things was front of mind.

Most people will recognize this contemporary art gallery by sight, with its massive undulating walls clad in titanium (ore mined in Russia, processed and metal rolled in the United States.) A recently created panoramic audio-visual installation occupied a large room inside. It was an artificial intelligence (AI) spectacle, where a flowing display of designs, textures and colours had been generated using a database of images that were added to a “large architectural model.” This wraparound light projection was complemented by AI-generated audio.

“Built upon ethically sourced data and powered by sustainable computing practices,” the curator noted, “the installation reflects a conscientious approach to digital creation, where innovation and responsibility go hand in hand.” By all measures, it was up-to-the-minute contemporary. It also drew the largest crowd.

Smil’s concern is that, in our post-industrial, service-based economy, we have lost sight of the fact that, while software may

Editor-in-chief Ryan Bergen, rbergen@cim.org

be endlessly diverting, it is fossil fuels and carbon-intensive material production that help the billions of us humans meet our fundamental needs. Ignorance of this makes it possible to push the idea that net-zero greenhouse gas emissions in the next 25 years is possible without being hugely disruptive, while at the same time making it more difficult to have productive conversations on the best ways to trim our massive carbon diet.

Thus, the work that most thoroughly rose to the moment was a series of permanent sculpture installations made of great planes of weathered steel. Recognizing that Bilbao was once a major shipbuilding centre, the nature of the material was as fundamental to the experience as the flowing designs the artist worked the metal into.

Where the framing of the AI exhibit emphasized its lack of a physical footprint, the write-up accompanying the steel sculptures detailed the millennia-long relationship between the region and its iron deposits. Housed within the Guggenheim collection made possible through wealth amassed from mining and metal processing, it had a conscientiousness about its origins that we would do well to take seriously.

Ryan Bergen, Editor-in-chief editor@cim.org

Managing editor Michele Beacom, mbeacom@cim.org

Senior editor Ailbhe Goodbody, agoodbody@cim.org

Special projects editor Silvia Pikal

Contributing editors Kelsey Rolfe; Mehanaz Yakub, myakub@cim.org

Staff writer Ashley Fish-Robertson, afrobertson@cim.org

Contributors Donna Beneteau, Bruce Downing, Lynn Greiner, Sara King-Abadi, Tijana Mitrovic, Rosalind Stefanac, Craig Waldie, James Whyte

Editorial advisory board Mohammad Babaei Khorzhoughi, Vic Pakalnis, Steve Rusk, Nathan Stubina

Translations Karen Rolland, karen.g.rolland@gmail.com

Layout and design Clò Communications Inc., communications.clo@gmail.com

Published 8 times a year by: Canadian Institute of Mining, Metallurgy and Petroleum 1040 – 3500 de Maisonneuve Blvd. West Westmount, QC H3Z 3C1 Tel.: 514.939.2710; Fax: 514.939.2714 www.cim.org; magazine@cim.org

Advertising Senior Account Executives Marlene Mignardi, mmignardi@cim.org, 416-843-1961 Dinah Quattrin, dquattrin@cim.org, 416-993-9636

Subscriptions

Online version included in CIM Membership ($215/yr). Print version for institutions or agencies – Canada: $275/yr (AB, BC, MB, NT, NU, SK, YT add 5% GST; ON add 13% HST; QC add 5% GST + 9.975% PST; NB, NL, NS, PE add 15% HST). Print version for institutions or agencies – USA/International: US$325/yr. Online access to single copy: $50.

Copyright©2025. All rights reserved. ISSN 1718-4177. Publications Mail No. 09786. Postage paid at CPA Saint-Laurent, QC.

Dépôt légal: Bibliothèque nationale du Québec. The Institute, as a body, is not responsible for statements made or opinions advanced either in articles or in any discussion appearing in its publications

Printed in Canada

The old adage of “buy low, sell high” became widely popularized in the stock market boom of the early 20th century. The issue with this concept in a cyclical industry is how to know when prices have peaked to make sound decisions on capital investment and project development. The mining industry is notoriously cyclical, and the recent outperformance of gold has shone a spotlight on the potential for large-magnitude price increases.

The price of gold has experienced a meteoric rise over the past year, with an almost US$1,000 per ounce price increase from August 2024 compared to the same month in 2025, hitting a record high of US$3,500 per ounce in April. The World Gold Council attributed the price increase to the global macro-economic uncertainty around tariffs and geopolitical tensions, supported by stable interest rates and a weaker U.S. dollar. The question many investors are asking is, how high will it climb? I won’t attempt to predict if or when gold prices will moderate. However, the recent trend highlights the challenges with the cyclical nature of metal prices and how quickly prices may rise…or decline.

Nickel prices also experienced a similar roller coaster ride recently, giving investors and companies a more traditional thrill, or terrifying experience, with a return to the bottom from the crest of the peak. After a price spike in the spring of 2024—supported by the expectation of supply/demand tightness due to the shift to electrification and battery storage, as well as bans on the import of Russian nickel into exchanges—a quick supply

The question many investors are asking is, how high will the price of gold climb?

response, primarily from Indonesia, resulted in prices reaching a five-year low in April 2025, sending a booming industry into care and maintenance. Further, weaker-than-expected electric vehicle adoption rates, unprofitable production and slowerthan-anticipated stainless steel growth have plagued the metal.

The resource industry is characterized by expensive and long-duration capital investment. In this uncertain pricing environment, companies are forced to make decisions based on longterm price assumptions that have diverged from analyst and internal forecasts. The investor anticipation for merger and acquisition activity is high, yet management teams have learned lessons the hard way that investors do not like when companies buy high and shareholder value is eroded. Boards of directors are paying close attention to capital allocation and investment returns when evaluating potential transactions.

The economics of new development projects are calculated using an estimate of long-term future metal prices, which remain on their roller coaster ride. Previous projects that were considered uneconomic at lower prices are starting to be reconsidered using higher long-term metal price assumptions, yet how do companies manage the risk surrounding their pricing assumptions to ensure value creation for their stakeholders?

In our business, increasing metal prices are welcomed, to make up for the prolonged periods of pricing drought. However, management teams face increasing pressure to bring on critical minerals supply in this current volatile and uncertain environment, without pricing certainty. This paradox is not new to the resource industry. But as investment decisions are contemplated for new development projects to satisfy critical minerals and metals demand, the question remains: what long-term price should we use?

Candace MacGibbon President, CIM president@cim.org

Underground OEM Fletcher and simulation training solution developer Simformotion recently introduced the High Reach Scaler simulator, which provides underground mining operators with a realistic virtual training environment for learning how to safely remove loose or unstable rock and debris from tunnel walls and roofs. The simulator features Fletcher controls and several exercises covering machine inspection, start-up and shut-down procedures, scaling and tram operations. With virtual reality technology and a motion system, operators can gain depth perception and hands-on experience without real life risks. The integrated SimU Campus software can track users’ sessions and produce performance reports. Paired with the SimScholars online curriculum, the system offers a comprehensive, flexible training solution that can help mining companies develop skilled operators while reducing safety risks.

Septentrio recently released the AsteRx RB3 and RBi3 global navigation satellite system (GNSS) receivers, with the RBi3 featuring both GNSS and inertial navigation system (INS) capabilities. The receivers are engineered for highprecision real-time kinematic positioning in demanding surface mining environments. Designed for easy installation on machine exteriors or chassis, these receivers can withstand shocks, vibrations, extreme temperatures and corrosive conditions, making them ideal for heavy machinery. Delivering centimetre-level accuracy and reliable positioning using multi-frequency, multi-constellation GNSS tracking, the combination of GNSS and INS for the RBi3 provides redundance of positioning, dead reckoning and improved positioning integrity—all critical for safe autonomous operations.

Epiroc’s Minetruck MT22 is a compact, 22-tonne underground mining truck tailored for small drift sizes that is a successor to the MT2200, the company’s smallest underground truck model. It has the same exterior design as the MT2200 but features several upgrades, such as the option of a Cummins QSL9 Stage V engine and an advanced after-treatment system that significantly reduces harmful emissions—such as particulate matter and nitrogen oxides—and improves underground air quality. The Stage V engine also cuts fuel consumption by five per cent compared to previous generations, lowers noise and extends oil change intervals from 500 to 1,000 hours, minimizing maintenance requirements and reducing operational downtime. The MT22 can support renewable hydrotreated vegetable oil fuel, reducing greenhouse gas emissions and pollutants. Epiroc also introduced several safety enhancements to the MT22, including an integrated loadweighing system and a three-point seatbelt.

Compiled by Ashley Fish-Robertson

By Ashley Fish-Robertson

Three Hy-Tech Drilling workers were safely rescued on July 24, after being trapped underground for more than 60 hours at Newmont’s Red Chris coppergold mine in northern British Columbia.

(continued on page 11)

The workers—Kevin Coumbs, a driller from Ontario; Jesse Chubaty, a driller from Manitoba; and Darien Maduke, a driller’s helper from B.C.—were caught underground following two fall-ofground incidents on July 22.

“We are relieved to share that all three individuals are safe, and in good health and spirits,” Newmont said in a July 25 statement. “This was a carefully planned and meticulously executed rescue plan. Kevin, Darien and Jesse demonstrated the utmost dedication to our

safety procedures, adhering to protocols for more than 60 hours underground.”

Newmont’s rescue operation team used specialized drones to assess the underground geotechnical conditions and a remote-controlled scoop to clear a massive rockfall, estimated at 20 to 30 metres long and seven to eight metres high.

Production at the site halted on July 23 to allow full focus on rescue efforts and to restore communication with the trapped workers.

At the start of the incident, the trapped workers were more than 500 metres below the affected zone and were able to move to a designated refuge station before a subsequent fall-of-ground collapse blocked the access route. The self-contained refuge bay was equipped with adequate food, water and ventilation to support their extended stay.

Newmont said that it would conduct a comprehensive investigation into the incident and share the lessons learned with the industry. CIM

By Ashley Fish-Robertson

The Canadian and Northwest Territories governments are launching a pilot project to re-examine historic drill samples with artificial intelligence (AI) and digital core scanning technologies.

The project, first announced on July 14, will target the scanning and analysis of archived core samples from the Northwest Territories Geological Survey’s extensive collection. Its main goal is to pinpoint high-potential critical mineral zones within the Slave Geological Province, a vast, largely unexplored region considered to be one of Canada’s most promising areas for lithium, copper, cobalt and rare earth elements.

The area spans roughly 190,000 square kilometres in eastern N.W.T. and northwestern Nunavut, extending from Great Slave Lake to the Coronation Gulf in the Arctic Ocean. According to the N.W.T. government, the territory is the world’s third-largest diamond producer and holds over 12 per cent of the Earth’s known bismuth reserves.

This pilot project is part of a broader initiative to advance critical minerals exploration, with the re-examined core samples contributing to a future digital core library that will digitize geological drill cores from across Canada, making them more accessible nationwide.

“ By modernizing how we analyze and share geological data, we’re opening the door to new exploration, new partnerships and new economic oppor-

This pilot project will apply digital analysis to archived drill cores, reducing the need for new drilling and promoting sustainable exploration.

tunities,” said Caitlin Cleveland, minister of industry, tourism and investment for the territorial government, in a press release.

Devin Baines, senior communications advisor for Natural Resources Canada, told CIM Magazine in a written statement that AI tools will help to

detect previously overlooked mineral signatures, re-evaluate historic discoveries, and highlight new targets for critical minerals. Combined with AI analytics, he said that the pilot project will aim to use high-resolution digital scanning, such as core imagery and hyperspectral imaging, instead of relying on traditional manual visual and logbased methods.

High-resolution digital scanning will allow for automated, quantitative mineral mapping of entire core lengths, enabling detection beyond manual inspection, Baines said. He said details on the format, availability and accessibility of the resulting data are still being finalized.

“The intent will be to have data from this initiative integrated into a centralized digital platform, forming the foundation of a forthcoming Canadian Digital Core Library, which will reduce barriers and support exploration across Canada,” he said. “This pilot will act as a proof of concept to show how archived core data can be digitally transformed, enhanced and utilized for machine learning, and made accessible through a centralized platform.”

Another key goal of the project is to reduce further land disturbance. Baines explained that by digitally analyzing existing drill cores instead of commissioning new drilling, the initiative lowers environmental impacts, minimizes disruption to sensitive northern lands and allows for sustainable exploration using existing archives.

While the digital core scanning project focuses on unlocking mineral potential using existing data, Caroline Wawzonek, the territory’s minister of infrastructure, energy and supply chains stressed in the press release that infrastructure is equally critical to realizing these opportunities.

“That is why we’re advancing the Mackenzie Valley Highway (MVH) and the Arctic Security Corridor,” she added.

The MVH project aims to replace approximately 320 kilometres of the seasonal Mackenzie Valley Winter Road by extending all-season road access from the end of Highway 1 to the Sahturegion communities of Wrigley, Tulita and Norman Wells. It would also enhance transportation to NorZinc’s Prairie Creek zinc-lead-silver project,

situated about 200 kilometres west of Fort Simpson.

The MVH is currently undergoing an environmental assessment and consultation with local Indigenous communities. Once the assessment is complete and following final ministerial approvals and a formal decision by the N.W.T government

Denison Mines received provincial environmental assessment (EA) approval for its flagship Wheeler River uranium project in northern Saskatchewan’s Athabasca Basin, advancing what could be Canada’s first in-situ recovery (ISR) uranium mine.

Denison president and CEO David Cates said in an Aug. 5 press release that with the approval, the company has cleared one of the final regulatory milestones to begin constructing its Phoenix mine, “which is on track to become Canada’s next new large-scale uranium mine.”

Wheeler River, the largest undeveloped uranium project in the eastern Athabasca Basin, includes the highgrade Phoenix and Gryphon uranium deposits, which Denison discovered in 2008 and 2014, respectively. According to a 2023 feasibility study, the Phoenix project has a post-tax net present value of $1.56 billion and could generate a return of 90 per cent at capital costs of around $419 million. The mine is expected to operate for 10 years.

The project hosts proven reserves of 6,300 tonnes grading 24.5 per cent uranium oxide for 3.4 million pounds, and probable reserves of 212,700 tonnes at 11.4 per cent uranium oxide for 53.3 million pounds.

As part of its plan to streamline regulatory approvals, Denison submitted the provincial EA for final approval in late 2024 after completing several key milestones in the federal review process. The company has finished the Canadian Nuclear Safety Commission’s detailed technical review and received its final environmental impact statement.

Denison also announced the closing of a US$345 million convertible senior

to advance the project, a final construction decision is anticipated in late 2027 or early 2028.

The Arctic Security Corridor, involving the construction of an all-season road from Yellowknife to Grays Bay, Nunavut, is also undergoing an environmental assessment. CIM

note on Aug. 15 to fund the further the development of Wheeler River.

The company still needs to secure a provincial pollutant control facility permit, federal EA approval and a federal licence to prepare the site for construction. Canadian Nuclear Safety Commission hearings on the federal EA and licence are scheduled for October and December this year, potentially paving the way for a final investment decision in the first half of 2026.

– Ashley Fish-Robertson

Torex Gold Resources will buy Prime Mining in an approximately $449 million all-share transaction, the companies announced July 28. The deal will add Prime’s Los Reyes gold-silver project in Mexico to Torex’s expanding portfolio of assets across the country.

Under the terms of the agreement, Prime Mining shareholders will receive 0.06 Torex shares for each Prime share they own. This exchange ratio represents an 18.5 per cent premium to Prime’s most recent closing price and a 32.4 per cent premium to its 30-day volume-weighted average. Upon completion of the transaction, Prime shareholders will own approximately 10.7 per cent of the combined company.

The companies expect to finalize the deal later this year, subject to shareholder, court and regulatory approvals, including Mexican antitrust clearance.

Prime’s Los Reyes project is 43 kilometres southeast of Cosalá in Mexico’s Sinaloa state, encompassing a contiguous land package of 6,273 hectares. It is situated within the Guadalupe De Los Reyes mining district, known for its significant mining activity dating back to the 1700s.

The indicated mineral resources for the Los Reyes project are 49 million tonnes grading 0.95 grams per tonne of gold, containing approximately 1.49 million ounces of gold, and 34.2 grams per tonne of silver, containing approximately 54 million ounces of silver.

“The Los Reyes Project represents a unique opportunity for the Torex team to develop a high-quality asset with the potential for a high margin, low capital, and long-life operation in a jurisdiction that we know very well,” said Jody Kuzenko, president and CEO of Torex, in a press release.

The deal comes on the heels of Torex’s late-June, $36 million acquisition of Vancouver-headquartered junior Reyna Silver, which allowed the company to scoop up Reyna’s exploration projects,

including the Batopilas and Guigui silver projects in Mexico.

Kuzenko said both acquisitions support the company’s strategy to “system-

atically build a diversified, Americasfocused precious metals producer with a portfolio of producing, development and exploration stage assets.”

The Future of Mining Challenge is a catalyst for industry-wide innovation. At Wheaton, we are committed to supporting the mining industry as a strategic partner in producing some of the world’s most important commodities.

For the 2025/2026 Challenge, US$1 million will be awarded to a cleantech venture with innovative technology that seeks to advance sustainable water management in mining. Learn more at www.futureofmining.ca.

Torex currently has several operations in Mexico. The company is focused on the exploration, development and operation

of its Morelos Property in Mexico, which comprises the El Limón Guajes and Media Luna mines. Covering 29,000 hectares, the

property is situated in the Guerrero gold belt, roughly 180 kilometres southwest of Mexico City. – Ashley Fish-Robertson

Saint Mary’s University, filling a vacuum left by Dalhousie, promises to graduate a new type of mining engineer

By Kelsey Rolfe

Mining engineering education in Nova Scotia is about to get a second life, as Saint Mary’s University (SMU) in Halifax prepares to launch a new resource engineering program to fill the gap left when Dalhousie University shuttered its program.

Don MacNeil, director of the engineering program at SMU, told CIM Magazine in an interview that the new program will graduate “a new generation of engineers.”

The program is meant to teach students essential technical skills as well as soft skills including project management, financial analysis, engagement with First Nations communities and an understanding of the full life cycle of a mine, from project proposal through to its closure and legacy.

“We’re looking to produce engineers with a much more well-rounded approach —through experience, familiarity and education—to a project, as opposed to just the technical skills that might have been focused on earlier,” MacNeil said.

SMU currently offers a two-year engineering diploma, from which point students can transfer to Dalhousie or other universities to complete two more years of study in a specialized area, such as civil or mechanical engineering. SMU’s engineering department is currently in the project proposal and development stage for its own final two-year program, with a 16-month co-op in between years, that would give students a bachelor’s degree in resource engineering.

MacNeil said the department finalized its proposed curriculum in midAugust, which it expects to submit to the Maritime Provinces Higher Education Commission for provincial government approval in the fall, and to Engineers Canada for program accreditation in

2026. He anticipates the university could have its first cohort of third-year resource engineering students by September 2026, and its first graduates of the program by April 2028.

Students will be able to choose a specialization in mining engineering, or a renewable energy engineering specialization that would prepare students for working on projects such as wind farms or battery development. Students in the mining stream will have technical classes, as well as full courses dedicated to project approval and First Nations engagement, the environmental impact of projects and more. MacNeil noted that other mining engineering programs sometimes cover these topics as a single “mining and society” course or as modules within other courses.

He said the engineering school heard consistently from members of industry that they were looking for more wellrounded mining engineering graduates.

“They said, ‘we don’t really need an engineer with an in-depth knowledge in any given area.’ But they did want the engineers with an appreciation for, or an understanding of, these other topics.”

The new program is coming at an ideal time. The federal and provincial governments are seeking to make Canada a critical minerals powerhouse; in Nova Scotia, the Progressive Conservative government lifted a long-time ban on uranium mining this year and also put $1 million of funding from Natural Resources Canada towards studying how the province’s critical minerals can be developed and creating a model of critical mineral potential in the province.

At the same time, the industry is facing a looming workforce shortage. According to the Mining Industry Human Resources Council, one in every five min-

ing workers was 55 or older in 2023. “With the rising demand for critical minerals, one thing is clear—Canada’s mining industry needs a fresh influx of talent,” the council said in its mining talent pipeline report.

When Dalhousie shut down its program, MacNeil said it paved the way for SMU to create its own. The university had a long-standing agreement that it would not impede students from going to Dalhousie after they completed their diploma at SMU.

“This was always an idea, and always something that we floated. And then with Dal’s suspension of their program, it basically freed up that opportunity,” MacNeil said.

Dalhousie’s engineering school announced in 2019 it would eliminate its mineral resource engineering program. The university’s final graduating class crossed the convocation stage in 2024.

Dalhousie’s engineering school declined CIM Magazine’s request for comment.

Dalhousie’s program dates back to the dawn of the 20th century. When the Nova Scotia Technical College opened in

1907, it started with four engineering disciplines, including mining. According to the Mining Society of Nova Scotia, the first graduating class, in 1910, consisted of two mining engineering students, and seven from other disciplines. In 1980, the college was renamed the Technical College of Nova Scotia, and in 1997 it amalgamated with Dalhousie. In total, the program graduated 1,073 mineral resource engineers over its 114-year life.

With the closure of Dalhousie’s program, there are currently 10 mining engineering programs in Canada, and none in Atlantic Canada (there are also none in the territories).

Don Jones, a former Dalhousie professor who is advising SMU on its curriculum development, told CIM Magazine that small class sizes are common for mining engineering programs; his survey of Canadian mining engineering schools, presented at the 2023 CIM Convention, found that all mining engineering schools on average did not have enough students to meet their full enrolment capacity.

Engineers Canada also reported in 2020 that mining engineering programs had seen a 33.5 per cent decline in enrolment since 2016.

Dalhousie’s program was among the more well-attended while it was operating, Jones said. His survey found that between 2009 and 2019, Dalhousie had an average undergraduate class size of 20.9 students. That number rose to an average 30.9-student class size when looking at the 10 years from 2010 to 2019, and to 39.5 students per class in the fiveyear period between 2015 to 2019. Its numbers after the closure announcement were notably smaller.

In comparison, the three most wellattended undergraduate programs had similar class sizes. Between 2021 and 2024, the University of British Columbia graduated between 28 and 35 undergraduate mining engineers per year, Queen’s University graduated between 12 and 43 per year, and the University of Alberta graduated between 16 and 37 per year, according to Jones’ presentation.

MacNeil said SMU could economically run the program with the same class sizes

as Dalhousie had. The university is planning to draw on current lecturers from other faculties, including environmental science, geology and business, though it does plan to hire some new professors. It is also able to integrate existing courses: MacNeil estimated that about half of the

Taseko Mines recently released a technical report for its Yellowhead copper project in central B.C., announcing improved economics for a 90,000-tonneper-day open-pit operation with a mine life of 25 years.

The Yellowhead copper project is located around 150 kilometres north of Kamloops. Taseko, which also operates the Gibraltar copper and molybdenum mine near Williams Lake, B.C., acquired the project for $13 million in shares in February 2019 as part of its acquisition of Yellowhead Mining Inc.

178 million

According to the new technical report, which summarizes engineering and costs estimates at the pre-feasibility level, the project has an initial capital cost of $2 billion, an after-tax net present value (NPV) of $2 billion at an eight per cent discount rate and an internal rate of return (IRR) of 21 per cent, based on metal prices of US$4.25 per pound for copper.

The previous technical report from January 2020 calculated the project’s cost at $1.3 billion, the NPV as $700 million after-tax with a 14 per cent IRR and an anticipated copper price of US$3.10 per pound of copper.

The Yellowhead project is expected to produce an average of 178 million pounds of copper annually at cash costs of US$1.90 per pound. Over the entire life of the mine, production is expected to reach 4.4 billion pounds of copper, 282,000 ounces of gold and 19.4 million ounces of silver.

“This new technical report establishes Yellowhead as a world-class copper project in a tier one jurisdiction,”

courses that would fall under the mining program are already operating.

Because the new resource engineering program will be a key focus for the department, he said he believes it will be able to attract more students than universities where mining engineering is one of many

offered disciplines. MacNeil said SMU is planning to host guest speakers from the industry and have mine site field trips for first- and second-year students. “That’s going to give the exposure that we think is going to convince enough students to say, ‘this is something I want to do.’” CIM

said Stuart McDonald, president and CEO of Taseko Mines, in a July 10 press release. “With strengthening copper prices, the project economics have improved significantly since the 2020 technical report. The project now has a $2 billion NPV and the potential to become one of the largest copper mines in North America.”

McDonald stated that, over the next few years, alongside the permitting process, Taseko will also be advancing engineering, community engagement, copper offtake discussions and project financing initiatives.

During operations, the project is expected to support approximately 590 direct jobs and around 1,120 indirect and induced jobs locally.

Taseko said it expects the project will be eligible for the federal Clean Technology Manufacturing Investment Tax Credit, which the company estimated would result in about $540 million of qualifying initial capital costs being reimbursed in the first year of operations.

On July 8, Taseko also announced the formal commencement of the environmental assessment process for the Yellowhead project. This includes both the provincial and federal regulatory reviews, as well as the Simpcw Process, an Indigenous-led assessment. Addition-

ally, Taseko has signed a relationship negotiation agreement with the Simpcw First Nation to define their role in project oversight and planning, and to establish a long-term economic partnership.

– Ashley Fish-Robertson

Australian miner Winsome Resources withdrew its option agreement to acquire the Renard diamond mine in Quebec in late July, stepping back from a deal that was seen as key to accelerating lithium production at its nearby flagship Adina project by repurposing the Renard plant for lithium processing.

“While the decision to step back from the Renard option was not the outcome we had originally envisaged, it reflects the realities of current global market conditions,” said Chris Evans, managing director of Winsome Resources, in a written statement to CIM Magazine. “Importantly, it allows us to sharpen our focus on advancing our world-class Adina project.”

In a press release, the company cited falling lithium prices and broader macroeconomic headwinds as the reasoning behind terminating the

option, but said it remains focused on advancing Adina, and could revisit the purchase in the future.

“After having recently received the directive from the environmental authorities in Quebec, we can proceed on our pathway towards the environmental and social impact assessment [for Adina],” Evans added. “Recent weeks

have shown encouraging signs of a potential market rebound, and Winsome is positioning itself to take full advantage of improving conditions.”

The Renard site, roughly 60 kilometres south of Adina, was formerly owned by Stornoway Diamonds and holds the distinction of being Quebec’s first diamond mine. The site includes a process-

ing plant equipped with a dense media separation plant, ore sorting and a grinding circuit.

Winsome initially secured the exclusive option to acquire the site for $52 million in April 2024, with $4 million paid upfront and $1 million due at closing. The remaining amount was to be paid in instalments, and the latest extension of the option expired on Aug. 31.

It said in the press release that Renard remains “the most viable option in terms of operations, costs and logistics,” and said it would continue engaging with Stornoway, the provincial and federal governments and other stakeholders “to explore opportunities to work together regarding the synergies between the Adina and Renard projects.”

Construction of the Renard mine began in 2014, with commercial production commencing in 2017. However, facing operational and financial challenges amid mounting uncertainty in global diamond prices, Stornoway suspended operations in October 2023. The mine has remained on care and maintenance since. – Ashley Fish-Robertson

By Sara King-Abadi

A Calgary-based nanotechnology company’s one-step, environmentally friendly lithium extraction pilot project, deployed in the field in July, is already showing promising results.

Litus has developed a pilot project consisting of a single modular unit that uses its LiNC direct lithium extraction (DLE) solution, which employs nanotechnology to selectively extract lithium from any type of source brine. It is achieving recovery rates of up to 99.5 per cent in lithium brines with concentrations as low as 30 parts per million (ppm). Currently, the lower end of economically viable lithium brine concentrations is around 50 ppm.

The efficacy is due to the “extreme” capabilities of the nanomaterials, the details of which are patented and cannot be disclosed, resulting in a single-step process with very little pretreatment, said Litus CEO and cofounder Ghada Nafie in an interview with CIM Magazine

Nafie, who holds a PhD in chemical engineering from the University of

In case you missed it, here’s some notable news since the last issue of CIM Magazine, which is just a sample of the news you’ll find in our weekly recap emailed to our newsletter subscribers.

Calgary, also credited the effectiveness of the unit to the robust quality of the nanomaterials, which can be reused. Litus built a manufacturing facility in Calgary in October 2023 to develop and manufacture the proprietary nanotechnology used by the unit.

“We’ve built a manufacturing facility to ensure the reliable supply of these nanomaterials to our customers,” said Nafie.

The location of the deployment, along with other fine details, is under a nondisclosure agreement; however, Nafie confirmed the pilot testing is with an energy company.

Traditional lithium brine extraction methods use evaporation and tend to be costly, time-consuming and can be harmful to the environment due to extensive land use and high water consumption. Recent DLE processes target source brines to remove lithium in a more environmentally friendly, faster and cost-efficient manner.

The pilot unit’s extraction process takes eight to 10 hours, Nafie said.

A team of researchers from the SETI Institute in the United States believe they may have identified a new iron sulfate mineral on Mars. Laboratory experiments indicate that the mineral—ferric hydroxysulfate— formed when hydrated ferrous sulfates were heated in conditions involving oxygen, with the reaction producing water. The transformation occurs only at temperatures exceeding 100 degrees Celsius, likely from volcanic activity or geothermal energy. Its distinctive crystal structure suggests it may be a previously unknown mineral, according to the researchers.

Northcliff Resources received $8.2 million from the federal government to advance its fully permitted Sisson tungsten-molybdenum project in New Brunswick in midAugust. Funds will be used to update the project’s 2013 feasibility study, complete engineering and support pre-construction work.

Traditional lithium brine evaporation processes can take up to two years.

While the process has demonstrated consistent ability to extract lithium from all different source brines, it has stood out specifically for its ability to extract from low-concentration brines, Nafie said.

99.5%

The highest recovery rate Litus has recorded in lithium brines with concentrations as low as 30 parts per million

An Alberta Energy Regulator report on lithium potential in Alberta, published in June, noted that lithium has been found in oil and gas reservoirs since the early 1990s, and has been extracted from brine concentrations as low as 50 ppm.

“We particularly found ourselves in a bit of a niche market where we’re able to

Green Technology Metals has obtained two new 21-year mining leases for its Seymour lithium project, located around 230 kilometres north of Thunder Bay, Ontario, ensuring full lease coverage of the intended construction site. Issued by Ontario’s Ministry of Mines in August, the new leases complement the original mining lease secured in December 2023. The project will be subject solely to a provincial environmental assessment, bypassing a federal review under Canada’s Impact Assessment Act.

Frontier Lithium has launched a definitive feasibility study for its lithium conversion facility in Thunder Bay. The facility, which would be fed by Frontier’s Pakeagama lithium deposit, is expected to produce 20,000 tonnes of lithium hydroxide annually, enough for 500,000 electric vehicle batteries. Frontier aims to have the study completed within 18 months. The project is majority-owned by Frontier, and Mitsubishi has a 7.5 per cent interest.

extract lithium from low-concentration sources with high efficiency and effectiveness, and we can do so in a profitable manner,” she said.

That is good news for regions such as North America and Europe, and in particular for the oil and gas industry, where operations tend to produce brine with low lithium concentrations as a byproduct.

The ability to extract lithium from oilfield brines that were previously considered uneconomical could mean a

The Metals Company released a technical report in August estimating there are more than 50 million tonnes of probable mineral reserves in deep-sea polymetallic nodules located in the Pacific Ocean’s Clarion Clipperton Zone (CCZ). In March, the Canadian miner began the process of seeking licences from the U.S. National Oceanic and Atmospheric Administration to explore and extract minerals from the CCZ. The company aims to begin production in the fourth quarter of 2027. TMC stated in a press release that the company’s prefeasibility study for the project “marks a worldfirst declaration of probable mineral reserves for deep-sea polymetallic nodules.”

McEwen Mining said it would acquire Canadian Gold in an all-share deal in late July, giving the company control of the Tartan Lake gold project near Flin Flon, Manitoba. McEwen chief owner Rob McEwen said he sees the potential to restart the past-producing Tartan in the near term. The deal, pending approval by the end of

diversified revenue stream for oil and gas companies, said Nafie.

“Right now, [for] all of these oil and gas companies, their produced water [a byproduct of oil and gas extraction] goes to waste,” she said. “We are working on, instead of [it] going to waste, actually monetizing some of that by extracting the lithium out of that low-concentration stream.”

Global demand for lithium has soared in recent years, due to its use as a key material for manufacturing recharge -

the year, will make Canadian Gold a McEwen subsidiary, with its shareholders owning 8.2 per cent of the combined company.

Prime Minister Mark Carney said the new major federal projects office and Indigenous advisory council will be established by early September, with the aim of speeding up project approvals across Canada. Carney made the announcement at a three-day gathering of provincial and territorial premiers in late July. At the same event, Ontario, Alberta and Saskatchewan signed a memorandum of understanding pledging to cooperate on building pipelines, railways and energy and trade infrastructure using Ontario steel, which will be essential for transporting the country’s critical minerals and oil and gas to new markets.

Nine Ontario First Nations filed for an injunction against Canada’s and Ontario’s major projects legislation in July, arguing the laws

able batteries. Electric vehicles, electronic devices and grid storage are responsible for 87 per cent of total demand for lithium, according to Natural Resources Canada.

One of the perks of being a technology company is not having to navigate permitting and other red tape that falls onto producers. “We get in there and we integrate our technology to the brine source,” said Nafie.

After the several-months pilot phase, Litus plans to have larger, onsite units up and running commercially by 2028. Litus is supported by the National Research Council of Canada’s industrial research assistance program; the Mining Innovation Commercialization Accelerator; Emissions Reduction Alberta; Sustainable Development Technology Canada; Alberta Innovates; The Firehood, a network supporting women in technology; urban innovation hub MaRS; and cleantech innovation and adoption broker Foresight Canada.

While the pilot unit’s extraction process takes less than a day, the road to deployment has been nearly a decade in the making.

“It is one of the best and most satisfying feelings to actually have the chance as a researcher early on to develop something that I’m able to see in large scale,” said Nafie. “It’s incredible.” CIM

threaten their self-determination rights. The federal Bill C-5 allows Ottawa to fasttrack major projects, while Ontario’s Bill 5 lets the province override local laws in “special economic zones.” At a two-day summit with First Nations leaders in July, Carney vowed long-term prosperity for First Nations rights holders through major projects, but some Indigenous leaders criticized the rushed process and lack of meaningful engagement.

Stay up to date on the latest mining developments with our weekly news recap, where we catch you up on the most relevant and topical mining news from CIM Magazine and elsewhere you might have missed.

The first phase of BHP’s Jansen potash project in Saskatchewan will cost up to 30 per cent more than initially planned and be delayed by a year, the company said on July 18.

Initial production from Jansen’s Phase 1 will be postponed to mid-2027 from its original late 2026 target, and BHP has increased the estimated capital expenditure from US$5.7 billion to between US$7 billion and US$7.4 billion.

“The estimated cost increase is driven by inflationary and real cost escalation pressures, design development and scope changes, and our current assessment of lower productivity outcomes over the construction period,” BHP said in its operational review for the year ending June 30, which was released on July 18.

In its annual report on Aug. 19, the company confirmed it is also delaying the first production from Jansen’s Phase 2 by two years from 2029 to 2031

as part of its regular review of capital expenditure plans, citing the possibility of increased potash supply entering the market in the medium term as the reason.

The construction of Jansen’s Phase 1 is now 68 per cent complete, and Phase 2 is 11 per cent complete. BHP reached the halfway mark for Phase 1 construction in July 2024.

In 2023, BHP approved a US$4.9 billion investment for Phase 2 but has spent just US$400 million to date. The company said it plans to share an update on the revised capital spending

Compiled by Ashley Fish-Robertson

Rio Tinto appointed Simon Trott as the company’s new CEO, succeeding Jakob Stausholm, who had led the company since 2021 and whose unexpected departure was announced in May. Trott, who previously served as iron ore chief executive, has been with Rio Tinto for over 25 years in various capacities.

Steve Vanry has joined GoldHaven Resources as chief financial officer (CFO), succeeding Sead Hamzagic, who resigned from the role in June. Vanry brings 25 years of experience in senior management to this new position, including his past role as CFO and director of Oroco Resource Corp.

estimate for Phase 2 in the second half of 2026.

In its latest operational review, the company reported producing more than two million tonnes of copper across its

Copper Road Resources has recruited Brian Howlett as its new president and CEO. Previous roles for Howlett have included president and CFO of Superior Copper Corp. from 2012 to 2014 and CFO of Dumont Nickel in 2007. Howlett succeeds Mark Goodman, who served as interim president and CEO after John Timmons’s departure from the company last year.

Philip Samar has retired from his role as vicepresident (VP) of government and community affairs at K92 Mining and will continue to contribute to the company in a consulting capacity as a senior advisor. Samar first joined the company in 2019 as VP of external and corporate affairs. Before K92, Samar served as managing director of the Mineral Resources Authority from 2012 to 2018.

Todd Stone has joined the Association for Mineral Exploration (AME) as its new president and CEO, succeeding Keerit Jutla, who stepped down in February. Prior to joining

operations in fiscal year 2025, a company record, along with 263 million tonnes of iron ore from its operations in Western Australia.

– Ashley Fish-Robertson

AME, Stone served as MLA for KamloopsSouth Thompson from 2013 to 2024, where he represented the B.C. Liberal Party, renamed BC United in 2023.

Darren Hall, Equinox Gold’s president and chief operating officer (COO), has been promoted to CEO and director of the company following the departure of Greg Smith, a founding executive and shareholder who led the company from its inception in 2017. Relatedly, David Schummer, previously executive VP of operations, has taken on the role of COO.

The Global Tailings Management Institute (GTMI), established in January to advance the safety of mine tailings facilities worldwide, has appointed Mark Cutifani, former CEO of Anglo American, as chair of its board of directors. Additionally, Vicente Mello, senior VP of global infrastructure, technical, environmental and social consultancy at AECOM, has joined the board as its deputy chair.

CIM Awards elevate the people who drive our industry forward. Let's celebrate them together.

Except for those nominated for the CIM Distinguished Service Award and the CIM Distinguished Lecturer Award.

By James Whyte and Craig Waldie

Part six of a series on NI 43-101 myths

ld mineral projects that didn’t make it before are often dusted off, given new wings and told to fly again. That’s not necessarily a bad thing—better technologies and changing economics can sometimes elevate a project awaiting its chance. And a project with a past could be seen to have a head start based on previous work.

When a company has a project with previous work or previous mineral inventories, that history will often be material information the company should include in its technical disclosure.

Accurate and complete disclosure of historical information gives investors a good idea of what kind of work a project may need; that five other juniors poked some holes in the property and cut a few interesting intersections could mean the property has potential or could just mean it’s been a five-time disappointment.

If there are historical estimates—and the estimates still have some relevance to the project today—then those numbers will help the public understand a project’s potential.

If you’ve been following this series of columns, you’ll know we always pull out the “damning but.” This time, it’s to say but historical information is not your work You did not control it, and you don’t know for sure how good it is. That is why National Instrument 43-101 provides a way to let the public see the information without forcing the company to file a technical report. But that also means the need for handling the information responsibly. Historical information requires a source and date, an opinion on its relevance and reliability, and context.

Historical estimates can be anything from a detailed data set transferred to a new project operator to a simple record of an old tonnage and grade calculation in an assessment file. Solid information about that “relevance and reliability” that the Instrument requires you to comment on is easy to come by in the first case, and a closed book in the other. It is important to assess whether that closed-book estimate brings any value at all to an investment decision—and it certainly won’t if you can’t trace it to its origin.

The fact is that a long list of old estimates does little more than tell the public there’s some mineralization there—quantifying that may not help much.

It is worth noting that a historical estimate—whatever label a previous operator might have stuck on it—is no longer a mineral resource or mineral reserve, even though the mineralization might still be there. Loose talk about having “a mineral reserve from 1962” or “an NI 43-101 compliant mineral resource by a previous operator” is nonsense. Why?

Because it’s only a resource or reserve once it meets the CIM definitions, and it’s only a current mineral resource or reserve

once the company discloses its own estimate (and starts the clock on filing its own technical report).

A historical estimate is no longer a mineral resource or mineral reserve, even though the mineralization might still be there.

We should also draw a distinction between historical estimates and legacy data. Having legacy data can permit you to go back and verify it through resampling core, twinning holes or infill drilling. Having old estimates, but no access to core or data, means only that you can tell the public an old operator thought it had a mineral deposit, but the new operator has to verify this for itself.

Once a company is ready to file its own technical report on the property, it becomes important to remember that Item 6 on Form 43-101F1, the “History” section, is intended only to be a summary and not an exhaustive documentation of everything that has been done since Georgius Agricola swung his pick. Chances are most of that history is not material.

The History section gets even worse when it is used to shoehorn an in-depth account of the previous operator’s resource estimates, which directly contradicts the cautionary language that is supposed to accompany it—especially the part that says you’re “not treating the historical estimate as current mineral resources or mineral reserves.” What you are actually saying is “Look at the exquisite work that last operator did. Look at its quality control, its semivariograms and its swath plots, aren’t they pretty? We’re immensely confident in their mineral resource estimate, as you should be too. We’re just not putting our names on the estimate ourselves.”

Old economic studies by others are not historical estimates so the allowance for disclosure with caution does not apply.

In the 2003 movie Big Fish, Albert Finney plays a character whose fondness for historical accounts of his fantastical past complicates his relationships with others who try to separate fact from fiction. You can avoid complications by always keeping project histories simple and limiting them to their genuinely important and relevant parts. While Albert Finney’s character continued on, your mineral project may not. CIM

James Whyte, P.Geo., retired in 2023 from his role as senior geologist at the Ontario Securities Commission. Craig Waldie is a senior geologist at the Ontario Securities Commission. Both authors are writing in their private capacity.

Send comments to editor@cim.org

By Donna Beneteau and Bruce Downing

ach time we attend a mining conference, we leave more convinced of one thing: our industry is not doing enough to tell our story. There are so many incredible projects happening in the mining industry, and so many brilliant and engaged people. Yet we remain mediocre at communicating these stories, both within the sector and to the broader public. And it is costing us. University and college mining programs are closing. Projects are being delayed. We are struggling to attract the talent we need to drive the energy transition.

We all know the reasons, which include misinformation, mistrust and a societal disconnect from the materials that underpin modern life. Some information is available about mines and quarries on Canadian land. Canada has rigorous public reporting standards, most notably the NI 43-101 disclosure requirements that apply to companies listed on Canadian exchanges. For those companies’ mines, the NI 43-101 technical report contains the basic engineering details, such as mining methods, production quantities and infrastructure layouts.

However, in practice, many producing mines in Canada— particularly those run by private companies or those listed only on foreign stock exchanges—could be under no obligation to disclose detailed technical information to the public, as these operations fall outside the requirements of Canada’s NI 43-101 reporting system. While these sites may comply with environmental or permitting regulations, the broader technical context of how mining is done often remains behind closed doors. Occasionally, a technical report may be available through another global reporting framework, but this is not guaranteed.

As a result, when citizens, students or educators seek out information, they often hit a wall. There is no consistent, accessible way to trace the materials we rely on back to their source, making it more difficult to spark curiosity, build trust or foster informed public dialogue about the realities of modern mining. We can ask, “What have you done today that did not involve a mineral?”, but it will be difficult to find reliable information about where those minerals come from.

To prove how patchy the information is, we analyzed who owns the producing metal, non-metal, coal and oil sands mines listed in Canada’s Minerals and Mining Map, hosted online via Natural Resources Canada. In July 2025, only 35 per cent of those operating mines in Canada were listed on the Toronto Stock Exchange (TSX), which requires NI 43-101 technical disclosures. The remainder are either privately owned or listed on other global exchanges. While 60 per cent of metal and 75 per cent of oil sands mines located in Canada are TSX-listed, only 14 per cent of nonmetal and zero per cent of coal mines are listed. So while NI 43101 is an effective tool within its scope, it doesn’t cover the full landscape of Canadian mining. And that matters because without a comprehensive disclosure mechanism, even those inside the industry struggle to access reliable technical information.

To help Canadians meaningfully, we need more publicly accessible information about the origins and processes behind the materials we use every day. This is about more than disclosure requirements. It is about trust, education and transparency. We must stop thinking of technical information as something for regulators and investors alone. It should also serve the public, especially if we want to maintain social licence and attract new generations to the field.

Canadians need more publicly accessible information about the origins and processes behind the materials we use every day.

And let’s not forget the bigger picture. The Canadian Critical Minerals Strategy document notes that “Canada already produces more than 60 minerals and metals.” However, while developing the Historical Canadian Mines Data Hub, we discovered that over 100 different minerals and rocks of economic value are tracked across the provinces and territories. Just for fun, we asked ChatGPT which minerals and rocks are essential to humans. It came back with a list of over 40, grouped into categories, such as those essential for human health, construction and infrastructure, energy and electronics, tools, jewellery and key industrial uses. Meanwhile, the International Mineralogical Association recognizes over 5,000 minerals on Earth. Somewhere between economic, decorative and essential lies the public’s need to understand why elements, rocks and minerals truly matter, and how they get from the Earth into our hands. Imagine if, just like food packaging lists ingredients, every product came with a label showing Earth’s contributions. Maybe then we could really, truly appreciate how the planet supports human life, and the incredible science and engineering that makes it all possible.

This is a call to action. What are you doing at your site, in your company, in the classroom or in the community to help make mining understandable? We cannot wait for public perception to shift on its own. We must take ownership of our story and share it clearly, honestly, and often. One way to contribute right now is by supporting a growing public resource: submit data to the Historical Canadian Mines Data Hub. The Hub database can be accessed via CIM.org/the-hub. If you have questions and/or would like information on this project, you can send them by email to: minesdatabase@cim.org CIM

Donna Beneteau is an associate professor of civil, geological and environmental engineering at the University of Saskatchewan and the driving force behind the Historical Canadian Mines Data Hub. Bruce Downing is a geoscientist based in Langley, B.C.

CIM’s Distinguished Lecturers have been selected for their accomplishments in scienti昀c, technical, management or educational activities. They are available to present at CIM branch, technical society, student chapter and university events.

Joël Kapusta PhD, FCIM Subject Ma琀er Expert, Sonic Injection and Pyrometallurgy, BBA Consultants

“Can we solve the copper and nickel smelting paradox? Reconciling energy transition needs with environmental compliance and societal acceptance”

McNulty DSc President, T. P. McNulty and Associates, Inc.

“McNulty ramp-up curves: An update and new perspectives”

Lesley Warren PhD Director & Chief Principal Investigator, Mining Futures Professor, Civil and Mineral Engineering, University of Toronto

“Nature-based solutions: Addressing thiosalts management and treatment ine�ciencies”

Nadia Mykytczuk PhD CEO and President MIRARCO, and Executive Director of the Goodman School of Mines, Laurentian University

“Mining value from waste through biotechnology”

Invite a lecturer to your event today. Scan this code for more information.

The CIM Foundation’s generous support allows the CIM Distinguished Lecturers Program to connect CIM members with leading industry expertise. The CIM Distinguished Lecturers program is owned and operated by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM).

Taykwa Tagamou Nation’s $20 million investment into Canada Nickel is the largest of its kind in Canada

By Tijana Mitrovic

What can economic reconciliation and a shared prosperity model look like in mining? For Taykwa Tagamou Nation (TTN) and Canada Nickel, it means investing in nationbuilding and developing Canada’s domestic critical minerals supply chain.

In May, Toronto-based miner Canada Nickel announced the closing of the $20 million convertible note with TTN. It is the largest known direct investment by a First Nation into a critical minerals project or company in Canada. According to Canada Nickel, the note gives TTN the right to convert into 16.67 million common shares, for $1.20 per share, a 7.9 per cent equity interest in Canada Nickel, as well as a seat on the company’s board of directors.

“Reconciliation isn’t just about acknowledgements, it’s about action,” Chief Bruce Archibald of TTN told CIM Magazine in a written statement. “Economic reconciliation means First Nations are not just consulted, but [are] co-owners and decision makers. This partnership represents a real shift towards that model [and] shows what’s possible when First Nations have both a voice and a stake.”

According to Canada Nickel, the Crawford nickel sulfide project—located just 42 kilometres north of Timmins, Ontario,

and on the traditional territories of TTN—is the world’s second-largest nickel resource and reserve and is projected to be Canada’s largest nickel mine. The large-scale, open-pit mine and mill operation is expected to produce an average of 38,000 tonnes of nickel a year over the course of its 41-year mine life, according to a 2023 feasibility study

The Ontario government recently identified the $3.5 billion capex project as a priority critical minerals and nation-building project. In the fall, Canada Nickel received a letter of intent from Export Development Canada for up to $500 million in long-term debt financing. It has also recently received nearly $20 million in private placements, including funding from Agnico Eagle and a separate US$20 million bridge loan.

Canada Nickel is on track to receive federal permits for Crawford by the end of 2025 and is aiming to begin production in late 2027 or early 2028.

According to Canada Nickel CEO and director Mark Selby, when TTN first approached the company with its interest in investing, the company considered a number of different options

for TTN to invest its own capital. “We thought a convertible note was the best case,” he said. “It gives [TTN] equity exposure as if they owned equity, but it also provides them downside protection, as effectively it’s a debt instrument at the beginning, in that it gives them security over the land package. We thought this was a good risk-return trade-off.”

TTN has been involved with Canada Nickel since 2019 and has seen Crawford grow from an early-stage project to nearing mine construction. “From the outset, we saw a company that was willing to listen and collaborate, and not just check boxes,” Chief Archibald said. “We did not have conversations around typical ‘consultation’; we immediately were into deeper conversations about how we can collaborate through equity participation, infrastructure collaboration, shared governance and TTN’s visions for its nation.”

According to Sydney Oakes, director of Indigenous relations and public affairs at Canada Nickel, the connection between TTN and the company was mutual. “From the beginning, the relationship has been rooted in co-development, mutual respect and a shared vision for long-term, sustainable success—for both TTN’s generational wealth and our company’s operational growth,” Oakes told CIM Magazine . “[This] level of governance participation is a reflection of how far the relationship has come—from engagement to co-ownership and co-development.”

The relationship began with a transmission services agreement, where TTN committed to develop and operate a power line to supply electricity to the project, and later a haul fleet financing agreement, where TTN will finance all or a portion of the electric mining fleet for the project. Throughout these developments, TTN has also been working to move towards being self-sustaining through communityled development. The nation saw this investment as an opportunity to take a step closer to this vision with longterm and sustainable benefits.

“[The Crawford project] aligned with our values on clean energy, environmental responsibility and long-term economic growth,” Chief Archibald said. “This investment gives our nation a true seat at the table and a stake in shaping a 40-plus year project that will have lasting impact on our traditional territory.”

The investment also goes beyond the Crawford project to the company overall, meaning TTN will be able to partner with

Canada Nickel in its downstream processing facilities, other exploration properties and future opportunities or projects, which is why TTN considered the board seat an essential component of the agreement. “It’s not enough to be involved, we need to be part of the decision making,” Chief Archibald said. “Canada Nickel understood that early on, and it became a core part of our discussions. Our seat ensures our values—from environmental stewardship to community well-being—are represented at the highest level.”

For Canada Nickel, the investment partnership means TTN is an equal contributor. “I think [the partnership] is taking economic reconciliation to that real natural place where First Nations are having a say and having a seat at the table in terms of how economic development occurs on their territory,” Selby said.

An added benefit for the company is that the investment partnership strengthens its social licence to operate and adds operational strength and local support to the Crawford project, particularly as TTN already plays a key role in its infrastructure. And according to Oakes, the board representation means that TTN will be able to contribute its deep knowledge of the land, a long-term perspective on sustainable development and a credible voice when engaging with governments and regulators.

“If we’re serious about shared ownership, we have to be serious about shared governance,” Oakes said. “It makes our projects stronger [and] more grounded, more collaborative and more aligned with the community’s needs and expectations.”

What makes the investment partnership unique for the mining industry is both the quantity and the scale of the investment, as well as TTN coming in at an earlier point in the project. “There have been other transactions where communities bought X per cent of assets that have been operating for 30 years,” Selby said. “This is coming at a different risk-reward point, where it does give a lot more upside potential to the First Nations community. And it’s also at a point in time where it’s very helpful for us in terms of being able to get through the final stages of permitting and get big investors to the table in terms of project partnerships.”

Both the leadership of TTN and Canada Nickel believe this partnership can serve as a model for other mining companies to go beyond consultation to economic reconciliation. Chief Archibald said companies should do more than just consultation and explore what equity, governance and shared planning can look like. “Economic reconciliation requires companies to be willing to give up some control and truly partner with First Nations,” he said. “It’s about long-term relationships, not shortterm approvals.”

According to Selby, mining companies cannot develop this type of relationship and reach economic reconciliation overnight. It takes time to set the foundation of how companies approach their work on First Nations’ territories. “[If you] do it with a real spirit of partnership and openness to sharing the benefits, and if you start that as early as possible, then that gives you the time to build the relationship,” he said. CIM

Indigenous Participation in Mining will run throughout 2025 and explore the people, the ideas and the models that are moving mining projects and economic reconciliation forward.

The mining industry is undergoing significant digital transformation, but new technologies can also increase vulnerability to cybersecurity threats

By Lynn Greiner

Digital transformation can be a double-edged sword for mining companies. On one hand, it can improve operations, cut costs and reduce danger to miners. On the other hand, it can introduce risks that turn those improvements on their ears.

This often causes cybersecurity managers to object to digital innovation, warning companies that they are opening themselves up to unacceptable cybersecurity risks by introducing new technology. But it does not have to be that way; when properly managed, cybersecurity can be a business enabler.

“Digital transformation is supercharging efficiency in the mining sector, but it’s also widening the attack surface—the number of opportunities for cybercriminals to access a company’s internal systems—in the process,” noted Matt Breuillac, managing director at Perth, Australia-based Cyber Node. “As mining companies embrace cloud-based analytics, Industrial Internet of Things (IIoT) and remote operations, they’re also connecting OT [operational technology] and IT [information technology] environments more tightly than ever. In doing so, they’re exposing themselves to new classes of threats, many of which they’re not fully equipped to handle.”

Those threats, he explained, are some that the average enterprise does not face.

“While traditional businesses prioritize IT security, mining companies often prioritize OT security first due to its direct link to uptime, safety and environmental impact,” he said. “That’s because mining operations are built on a foundation of industrial IoT and legacy OT systems—technologies that weren’t designed with cybersecurity in mind, but now sit at the heart of critical processes. These environments are packed with sensors, SCADA [supervisory control and data acquisition] systems and remote monitoring set-ups that aren’t easily patched or rebooted like typical IT infrastructure.”

Add to that the connectivity challenges often faced at remote locations, which make secure remote access—an essential requirement for many technologies—difficult to maintain.

“All these technologies, while essential as the mining companies innovate, bring an increased set of cyber risks if not designed and deployed in a secure manner,” said Lester Chng, senior cybersecurity advisor at Rogers Cybersecure Catalyst, Toronto Metropolitan University’s national centre for cyber training, acceleration, applied research and development and

public education. “Of most concern is the push for optimization of mining operations via the increased connectivity of IT networks and equipment with that of OT.”

Carlos Chalico, EY Americas metals and mining cybersecurity leader, pointed out that from a cybersecurity perspective, mining companies not only need to pay attention to IT challenges, but also to those on the OT side. “This challenge is specifically related to the fact that, in the past, OT devices and networks had their own communications protocol and they were not connected to traditional office IT networks,” he said. “But now that has changed and the two of these networks can be connected to each other—so if one is compromised, the other one can be impacted.”

Those OT networks may include anything from sensors and devices in the mine itself to automation in processing plants and autonomous vehicles hauling ore.

If an intruder manages to compromise either the IT or OT network, they could extend their attack into the other, hitting both the business side and the operations side of the company.

“In the end, what we need is a way to properly segment the network, to properly manage these devices in a way that is not only responding to the operation, but is also helping reduce the risk of exposure to all these elements,” Chalico said.

Security professionals also have to protect multiple connected locations, making their jobs even more complicated. And, noted Chng, one key difference between mining companies and other businesses is the scale of the disruption caused by a cyberattack. “This disruption can cause significant revenue loss due to inability to monitor and manage incidents that impact OT equipment,” he said. “An incident impacting OT can range from catastrophic production downtime to loss of life and limb.”

The potential safety impacts on mining operations from OT cyberattacks could be severe, according to Chng. For example, a cyberattack on haul trucks or excavator control systems could cause sudden acceleration, braking or steering changes, putting operators and nearby workers at risk; attacks on ventilation controls could stop airflow or reverse fans, leading to a dangerous buildup of toxic gases or depletion of oxygen; and a sudden conveyor belt stoppage or restart could cause material spills, crushing hazards or entrapment for maintenance crews.

However, those risks should not be the reason that companies step back from digital innovation, said Rob Labbé, CEO and chief information security officer (CISO)-in-residence at the Mining and Metals Information Sharing and Analysis Centre (MMISAC), a not-for-profit organization committed to improving the cyber resilience of mining and metals companies. Instead, they should look at ways to increase their operation’s resilience.

The solution: having a good mitigation plan. But, Labbé noted, when companies introduce technology, they may neglect to re-evaluate their business continuity, resilience and disaster recovery plans. “There are ‘now’ problems and there are ‘not now’ problems, and it’s very easy to push this into a ‘not now’ problem,” he said.