Magnachip introduces TOLT-packaged MOSFET for EVs

Wacker announces extrudable silicone for EV busbar insulation

imc Test & Measurement launches high-isolation temperature module

TotalEnergies and XING Mobility partner on immersion cooling battery tech

Eaton supplies SQ8 high-power connector for vehicle platform

MAHLE begins e-compressor production in Tennessee

BRUSA HyPower launches heavy-duty on-board charger and DC-DC converter

Rimac Technology debuts next-gen systems for high-performance EVs

Vishay unveils high-temperature DC-link capacitors for EV power electronics

Europe’s EV battery passport will bring transparency to the battery industry

Flux Power lands $1.2-million order for ground support equipment batteries

Dürr Systems debuts two-sided simultaneous electrode coater

AM Batteries helps battery OEMs calculate dry electrode manufacturing savings

Thermo King introduces new heat pump for electric buses

Toshiba launches 650 V SiC MOSFETs in TOLL packages

Lucid drops a few more details on future midsize models

Revel decides to exit the rideshare business

Australia Post pilots Mercedes-Benz eVito electric vans

Daimler Buses delivers eCitaro electric buses plus charging infrastructure

DPD tests electric Terberg tug at UK delivery hub

GreenPower to develop New Mexico electric school bus pilot program

Soaring electric truck sales cut into diesel consumption in China

MAN Trucks launches series production electric semis, rolls out charging cubes

New York state announces $200 million in funding for electric school buses

Suffolk County Transit orders 132 electric and hybrid buses from NFI Group

National construction company deploys its 100th Chevrolet Silverado EV

Chevrolet Silverado EV achieves world-record 1,059 miles on a charge

Joby to acquire Blade air taxi passenger operations

Arcady Sosinov on charger reliability, credit card readers and the impending industry shakeout

What’s going to happen to the NEVI EV charging infrastructure program?

ChargePoint and Eaton launch V2X-capable EV fleet charging system

EV Realty and Prologis Mobility connect charging hubs for commercial fleets

FRYTE Mobility debuts e-truck charging process with automated reservations

Greenlane establishes new I-10 electric truck charging corridor

Xos mobile EV charging unit now available for under $100,000 with incentive Ford Charge network launches with fast charging stations at 320 dealerships

Nissan and ChargeScape announce new vehicle-to-grid pilot

Designwerk achieves 1.1 megawatt EV charging of heavy-duty trucks

Shell launches integrated EV charging network for heavy-duty fleets in Europe

Tellus Power introduces two new 600 kW DC fast EV chargers

Siemens invests in home energy management provider Emporia Energy

Lincoln Electric introduces 50 kW mobile DC fast charger for EV fleet operations

Electric Era installs 200 kW battery-backed EV chargers in just 54 days

J.D. Power finds public EV charging infrastructure is becoming more reliable

Orange EV and Optigrid unveil battery-integrated DC fast charger

ABB’s new energy management system helps avoid expensive panel upgrades

Publisher

Senior Editor

Technology Editor

Segment Leaders

Christian Ruoff

Charles Morris

Jeffrey Jenkins

Joel Franke

Mark Rogers

Jeremy Ewald

Graphic Designers

Tomislav Vrdoljak

Contributing Writers

Jeffrey Jenkins

Charles Morris

Christian Ruoff

Jonathan Spira

Nicole Willing

John Voelcker

Cover Image Courtesy of

Special Thanks to

General Motors

Kelly Ruoff

Sebastien Bourgeois

ETHICS STATEMENT AND COVERAGE POLICY

For Letters to the Editor, Article Submissions, & Advertising Inquiries Contact: Info@ChargedEVs.com

AS THE LEADING EV INDUSTRY PUBLICATION, CHARGED ELECTRIC VEHICLES MAGAZINE OFTEN COVERS, AND ACCEPTS CONTRIBUTIONS FROM, COMPANIES THAT ADVERTISE IN OUR MEDIA PORTFOLIO. HOWEVER, THE CONTENT WE CHOOSE TO PUBLISH PASSES ONLY TWO TESTS: (1) TO THE BEST OF OUR KNOWLEDGE THE INFORMATION IS ACCURATE, AND (2) IT MEETS THE INTERESTS OF OUR READERSHIP. WE DO NOT ACCEPT PAYMENT FOR EDITORIAL CONTENT, AND THE OPINIONS EXPRESSED BY OUR EDITORS AND WRITERS ARE IN NO WAY AFFECTED BY A COMPANY’S PAST, CURRENT, OR POTENTIAL ADVERTISEMENTS. FURTHERMORE, WE OFTEN ACCEPT ARTICLES AUTHORED BY “INDUSTRY INSIDERS,” IN WHICH CASE THE AUTHOR’S CURRENT EMPLOYMENT, OR RELATIONSHIP TO THE EV INDUSTRY, IS CLEARLY CITED. IF YOU DISAGREE WITH ANY OPINION EXPRESSED IN THE CHARGED MEDIA PORTFOLIO AND/OR WISH TO WRITE ABOUT YOUR PARTICULAR VIEW OF THE INDUSTRY, PLEASE CONTACT US AT CONTENT@CHARGEDEVS.COM. REPRINTING IN WHOLE OR PART IS FORBIDDEN EXPECT BY PERMISSION OF CHARGED ELECTRIC VEHICLES MAGAZINE.

www.hesse-mechatronics.com

Does it seem to you that everybody and their dogs are selling EV chargers these days? It’s not your imagination—we recently tried to make a list of companies o ering chargers, and stopped counting at 100. (How many are manufacturers, and how many are reselling white-label products? Who knows?)

Every company that makes anything with a cord seems to have launched a line of Level 2 chargers. Out ts known for everything from utility-scale electrical equipment to residential lighting to consumer electronics to power tools have gotten into the EVSE game. Why so many?

For one thing, a Level 2 charger is (in theory) a simple device. Regular Charged readers know that quality designs, however, aren’t that simple. A lot of chargers for sale on Amazon and other mass-market outlets are shoddy products that haven’t been tested for safety by any reputable organization. If you’d prefer not to burn your house down, simply don’t buy anything that is not tested and certi ed by a Nationally Recognized Testing Laboratory, like UL, ETL (Intertek), CSA Group or TÜV. at said, building a basic EV charger isn’t that challenging for a competent engineer, and therein lies the making of a bubble. Other than adding fancy features, or designing a really cool-looking enclosure, there are few ways to di erentiate your product other than by slashing your price. Low-margin segments tend to shrink to a small number of very large players, and that’s just what execs in the EV industry have been predicting for the last year—a shakeout is on the way at all levels of the charging industry, or has already begun.

Tritium was one of the rst big dominos to fall, as Arcady Sosinov, the company’s new CEO, told us (see page 74). In 2024, the company got overextended and became insolvent, but it had such a large installed base that it was well worth saving, and Indian power management company Exicom stepped in and reorganized.

Even as we were speaking with Sosinov, other dominos were falling. He estimates that the industry can support no more than half a dozen global high-volume suppliers of DC fast chargers for public and eet charging hubs. And the market for Level 2 residential chargers is similarly crowded, and is seeing a similar shakeout.

What about charge point operators? at’s a much more complex business than building chargers, but one that also has low margins—and a low level of customer satisfaction at the moment. We’ll likely see major consolidation there too.

In the end, creative destruction will be a positive thing for the industry (and some Nietzscheans believe the end of government support will also make us stronger). But things are going to start changing fast, and in unpredictable ways. What if freight haulers decide they’d rather electrify their trailers than shell out big money for electric Class 8 trucks? (See page 57). What if the centers of EV adoption shi to so-called developing countries? (See page 82).

Christian Ruoff |

Publisher EVs are here. Try to keep up.

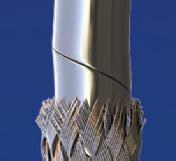

South Korea-based Magnachip Semiconductor has released its new 80 V MXT MV MOSFET, MDLT080N017RH, featuring a TO-Leaded Top-Side Cooling (TOLT) package for thermal management and power e ciency in motor control systems for e-scooters and light EVs.

e company has begun supplying the MOSFET to “a global electric motor manufacturer.”

Unlike conventional TOLL (TO-Leadless) packages that dissipate heat through the bottom, the TOLT package is engineered to release heat directly from the top via a mounted metal heat sink. is reduces thermal resistance between the junction and the external environment, making it well-suited for thermally demanding applications, according to the company.

Simulations and testing demonstrated that the TOLT package achieved an average 22% reduction in junction temperature compared to using standard TOLL packages. is extends an application’s lifespan and enhances system reliability. e TOLT package enables compact, lightweight application designs thanks to its high power density and e cient thermal ow, which does not compromise current-handling capability and thermal safety margins.

“ is new 80 V MXT MV MOSFET, equipped with the TOLT package, is a testament to Magnachip’s advanced capabilities in high-performance and energy-e cient power semiconductors,” said YJ Kim, CEO of Magnachip. “We remain committed to delivering next-generation solutions that address evolving customer needs to strengthen our position in the global power market.”

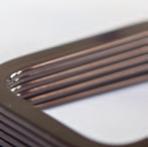

Wacker has announced a new extrudable silicone rubber designed to insulate busbars in high-voltage traction batteries for electric vehicles. e new material, ELASTOSIL R 531/60, addresses increased electrical and thermal demands resulting from rising EV battery voltages. Nominal system voltages commonly range from 300 to 900 volts. e company says the material’s processability by extrusion makes it a cost-e cient solution for large-scale component insulation.

According to Wacker, ELASTOSIL R 531/60 provides ame resistance and robust protection against leakage currents and energy losses. e insulation reportedly remains e ective at continuous operating temperatures up to 205 ° C. In the event of a re, the cured silicone rubber forms a ceramic shell around the busbar, creating an electrically insulating layer that maintains protection and prevents short circuits at temperatures from 800° to 1,000° C.

e silicone rubber features a hardness of 60 Shore A and can be extruded directly onto busbars, streamlining the sheathing process. Wacker says the material’s exibility and tear strength enable insulated busbars to be bent and tted into compact battery architectures without cracking or damage, even a er impact testing. Also, the material maintains exibility at temperatures as low as -40° C, which helps dampen vibrations and impacts from vehicle operation, o ering mechanical protection for traction batteries.

The ICM3S series of Inverter Control Modules forms the heart of CISSOID’s modular inverter platform, leveraging Intel® Automotive’s ultra-fast Adaptive Control Unit T222 and the Adaptive Control App - T222 Inverter software for rapid development of electric motor drive trains. Detroit,6-9October

NEW Inverter Control Module ISO26262 ASIL-C Ready certified

• 3-phase 1200V 340-550A SiC power module

Integrated HADES2-based gate driver board

Dual ARM® Cortex-R5F in lockstep

Advanced Motor Event Control (AMEC®) unit

Real-time actuator & sensor control and processing T222 processor & software ISO26262 ASIL-D certified

Discover a new formation chamber with high-efficiency power electronics! The chamber is designed for the initial charging and discharging of cylindrical cells. This advanced power electronics solution complies with high level safety standards and offers an energy efficiency of 85 percent from

grid to cell and cell to grid – even 92 percent is possible from cell to cell. Turnkey equipment and service solutions for battery cell assembly and finishing, including the chamber, will be showcased by ANDRITZ at the Battery Show North America. ANDRITZ. FOR GROWTH THAT MATTERS.

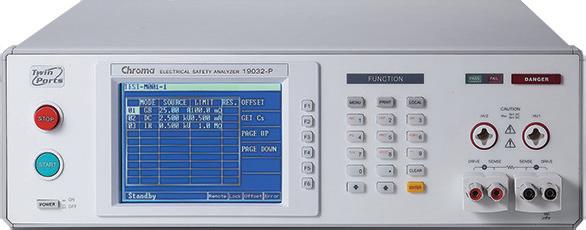

imc Test & Measurement, part of Axiometrix Solutions, has announced the launch of the imc CANSAS ex HISO-T-8-2L, a high-isolation CAN bus-based temperature measurement module designed for high-voltage environments. e company says the device speci cally addresses advanced requirements in EV battery development, research and testing, particularly as battery system voltages rise beyond 800 V.

e HISO-T-8-2L module features eight thermocouple channels accessible via LEMO.2P Re-del connectors, supporting four Type K thermocouples per connector.

e module is rated for high-voltage safety isolation at up to 1,400 VDC, and is tested at up to 8 kV peak and 4.4 kV root mean square (rms) voltages.

e company says the module delivers high measurement accuracy for precise battery temperature monitoring, a critical parameter in EV battery system performance and safety. e HISO-T-8-2L integrates into the existing CANSAS ex (CANFX) data acquisition platform, and supports cable-free installation with a click-in design. It is also rack-ready for use in standard 19-inch test stand systems.

e HISO-T-8-2L replaces a previous-generation CANSAS ex module, and is intended for applications such as testing DC power links, high-voltage batteries and complete electric drive systems.

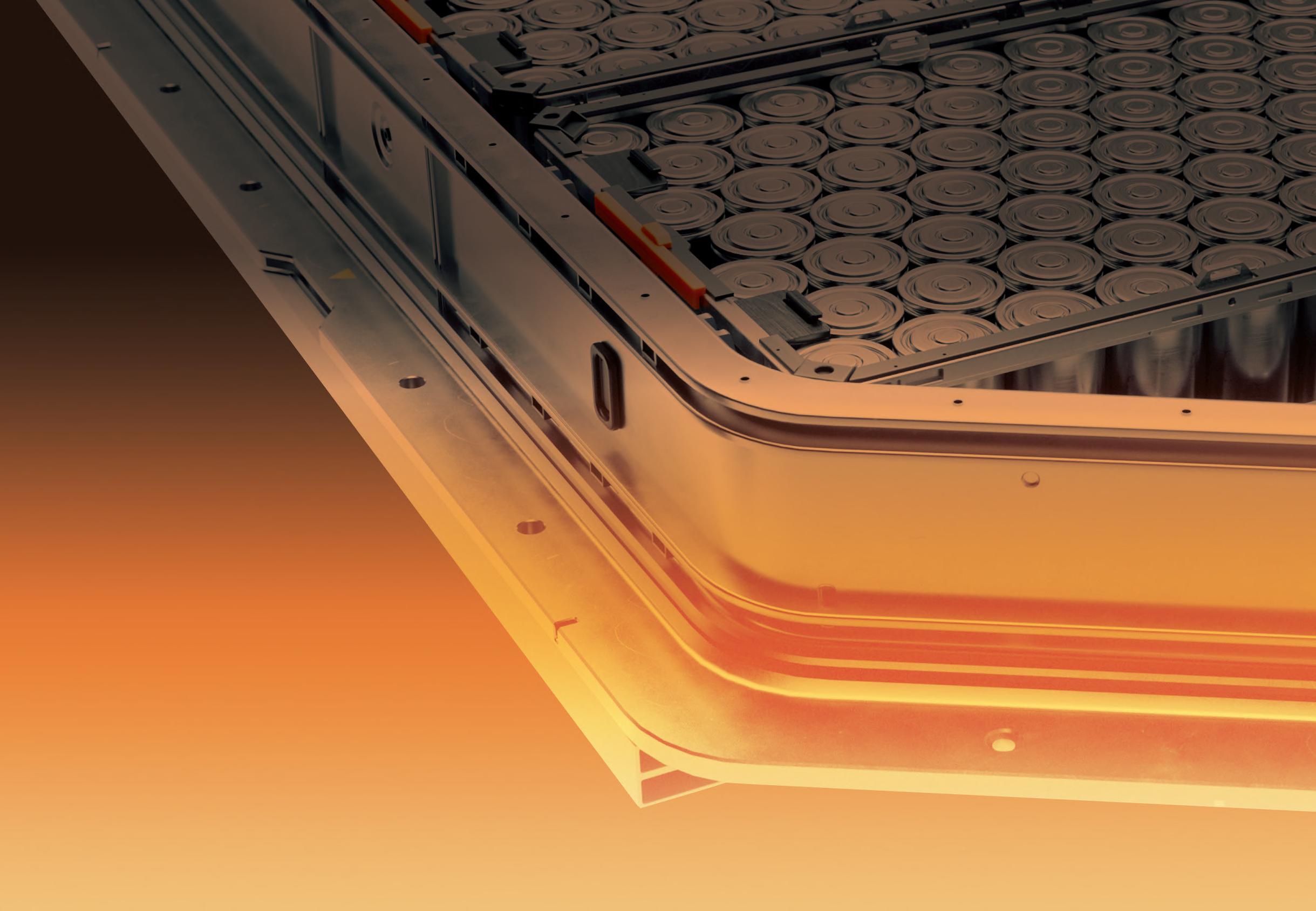

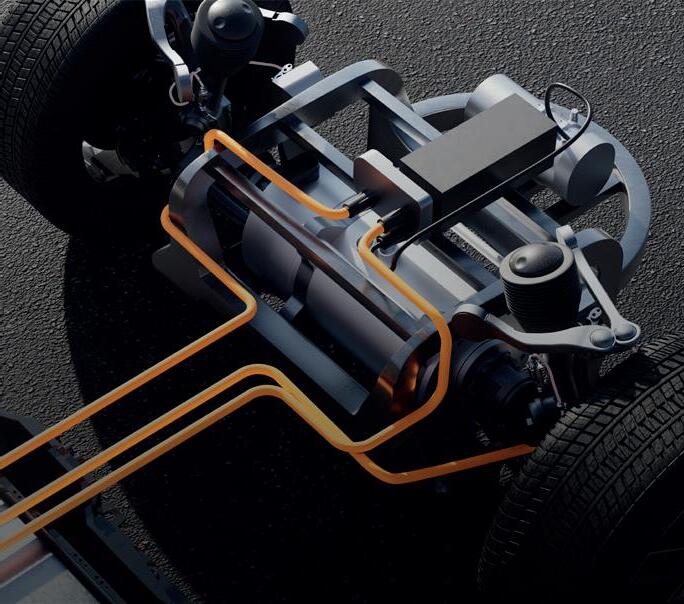

TotalEnergies Lubri ants and XING Mobility have partnered to promote and optimize immersion cooling battery technologies. e partnership will initially focus on electri ed marine applications, and the companies plan to extend it to energy storage systems, mobility sectors and backup power solutions for data centers.

XING Mobility has developed an immersion cooling battery system originally aimed at high-performance electric sports cars, which is now being commercialized for broader electric mobility and energy storage markets.

e partnership will combine XING Mobility’s battery architecture with TotalEnergies’ high-performance dielectric uids. e companies say the collaboration will accelerate the adoption of direct immersion cooling in European-certi ed marine platforms and high-power, high-safety energy storage systems.

e immersion technology targets improved thermal e ciency and re safety, and has been validated in a range of applications including passenger and commercial vehicles, agricultural and industrial machinery and the rst immersion-cooled energy storage system for wind farms.

“ is collaboration sets the stage for joint market development e orts, leveraging TotalEnergies’ international network and XING Mobility’s technical leadership to expand the global reach of direct immersion cooling technology,” said Jean Parizot, Vice President Automotive at TotalEnergies Lubri ants.

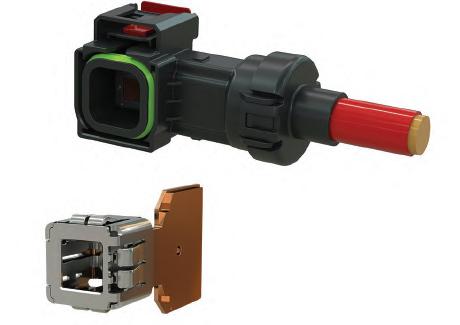

Eaton’s Mobility Group will supply its High-Power Lock Box (HPLB) SQ8 connector system to a major global OEM for a new PHEV platform. is agreement is the rst application of the SQ8 variant in a PHEV.

e SQ8 con guration of the HPLB connector features a patented, inverted terminal contact design that combines a stainless-steel spring to maintain consistent contact force—especially a er repeated thermal cycling—with a copper current carrier to maximize conductivity. Eaton says this design addresses common failure modes like mechanical relaxation found in high-vibration electric vehicle environments.

e HPLB SQ8 terminal has been internally tested and benchmarked against publicly avail-able competitor data, reportedly delivering a 2535% improvement in current-carrying capability for a given wire size, and 30-60% higher current per unit volume, which can support lighter and more e cient vehicle platforms.

e HPLB SQ8 connector is designed for demanding applications such as battery disconnect units (BDUs), high-voltage heaters and propulsion systems in EVs, PHEVs and heavy-duty commercial vehicles. e system supports up to 270 amps of current with minimal resistance loss and operates at temperatures up to125° C. It o ers a tool-free push-click-pull mating process that requires only 70 newtons of force, intended to reduce operator fatigue and eliminate the need for mechanical levers.

Technical highlights include a two-piece terminal compatible with 25-70 mm² wire gauges, exible 90° and 180° terminal orientations for demanding packaging constraints, eight spring-loaded contact points, and compliance with USCAR-2 T3/V2/S3 and ISO standards. e connector is nger-proof, validated for up to 10 mating cycles, and features QR code-enabled part traceability for logistics and quality control.

Eaton notes that its HPLB family of connectors, including the previously released SQ4 variant, has already been deployed in commercial truck platforms, select electric vehicle applications and high-current heating systems.

Cable solutions for dynamic applications

Shifting into high gears for your success: our innovative cables stand for a safer future of electromobility.

Discover our products:

For the tightest installation spaces – extremely flexible

Special conductor design for excellent ultrasonic welding properties

Highest concentricity supports optimal automated processing

Excellent sealing properties

Free of PCB and talcum powder

Come visit us:

The Battery Show Booth No.: 5622

October 06-09, 2025 Huntington Place, Detroit

MAHLE has announced the start of production for its high-voltage HVAC e-compressors at its Tennessee facility—the rst time the component has been manufactured in North America. E-compressors are critical components for managing e cient HVAC systems in EVs, which have a direct impact on driving range.

e Morristown facility, previously focused on steel piston production for internal combustion engines, will now produce both legacy and EV products at one site.

MAHLE says the new e-compressor production line is part of its larger commitment to the US market and local manufacturing. Over the last ve years, MAHLE has created more than 300 jobs in Tennessee through its thermal management operations in Murfreesboro. Activation of this new production line is expected to create 50 new jobs, bringing total employment at the Morristown site to almost 800.

“Starting the e-compressor production in Morristown, Tennessee, marks an important milestone for MAHLE as we further strengthen our footprint in the USA and our role as local employer,” said Arnd Franz, Chairman of the Management Board and CEO of MAHLE.

BRUSA HyPower specializes in electrical energy conversion systems—including DC-to-DC converters and onboard charging systems—for automotive and stationary applications.

e company has announced the series launch of its OBC7 and BSC7 product families, both certi ed for automotive use. ese products have been developed for modern electric vehicles, including passenger cars, commercial vehicles and o -highway applications, with a focus on high performance, durability and sustainability.

e OBC7 is an on-board charger designed for fast and e cient charging of electric vehicles. It supports charging at up to 19.2 kW for single-phase AC and up to 22 kW for three-phase AC, and is compatible with both 400 V and 800 V battery systems. e charger is based on cost-optimized silicon carbide (SiC) technology and features galvanic isolation and integrated DC charging management. e OBC7’s charging power can be scaled by connecting multiple units in parallel.

e BSC7 is a bidirectional supply converter designed for versatility across automotive applications, from passenger cars to heavy-duty trucks. e company highlights the BSC7’s compact footprint (56 x 196 x 272 mm), weight of under four kilograms, and galvanic isolation between the high-voltage (HV) and low-voltage (LV) sides. e BSC7 is compatible with 400 V and 800 V battery architectures, and is designed with environmental compatibility and longevity in mind, BRUSA notes.

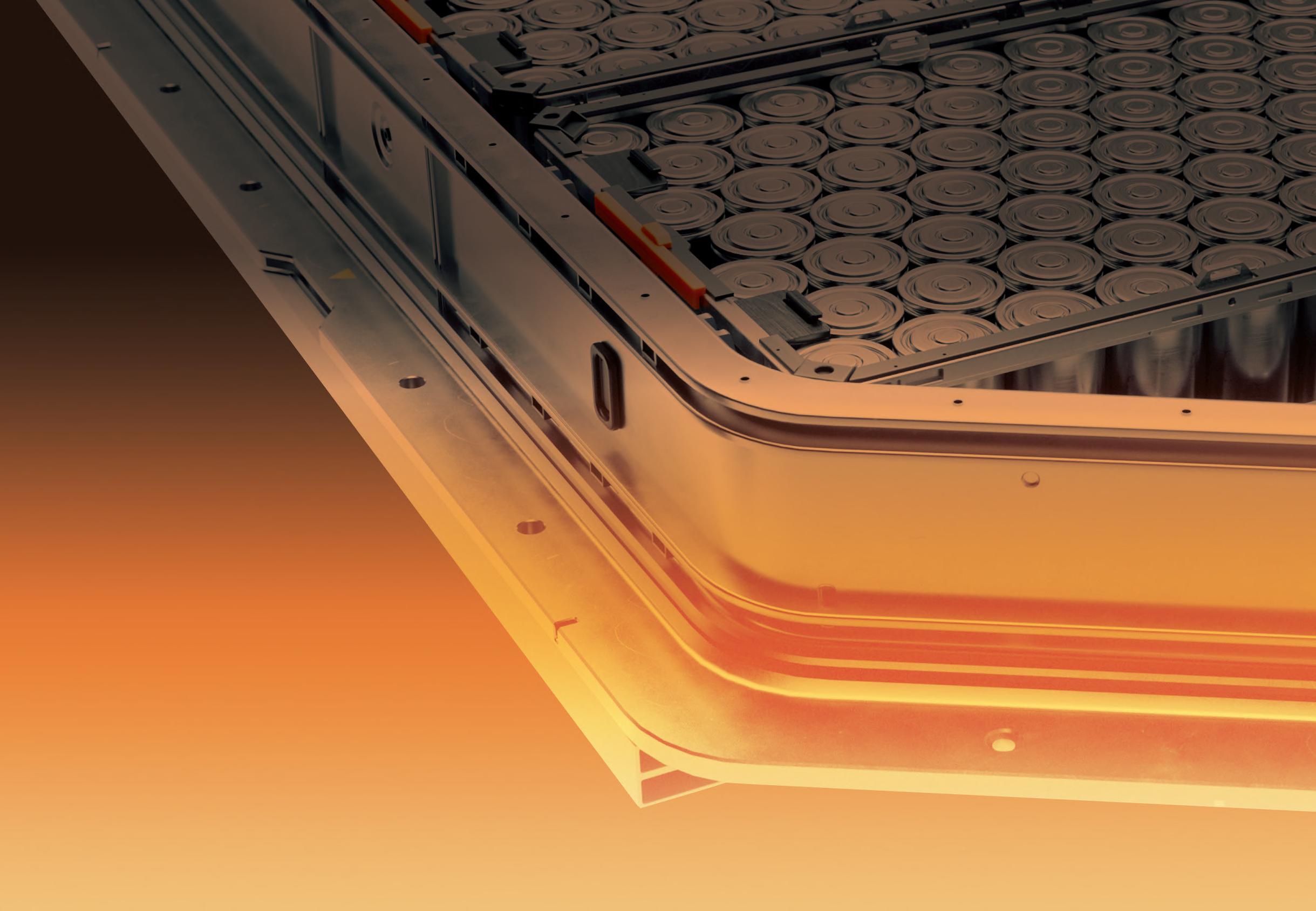

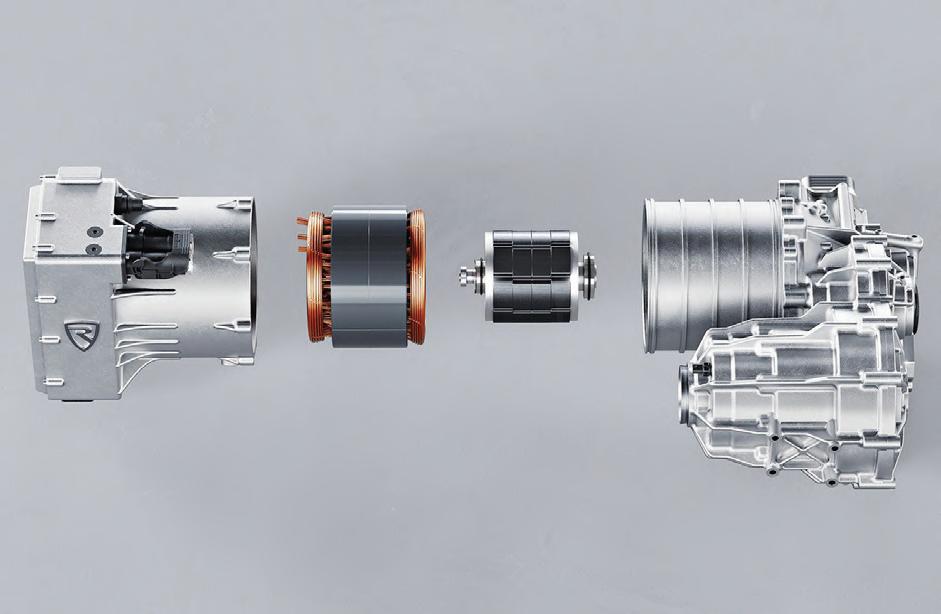

Rimac Technology has unveiled new EV battery platforms, ultra-compact powertrains and next-generation control electronics developed through collaborations with ProLogium, Mitsubishi Chemical Group and Kautex Textron. e products are designed for large-scale production, and are production-ready, according to Rimac.

Rimac’s next-generation battery system integrates solid-state cell technology and new housing solutions. e company designed a platform supporting both high-energy and high-power con gurations using either 46XX or 2170 cell formats, with scalable cell-to-pack architecture and integrated safety and thermal features.

Rimac’s new powertrain platforms include the SINTEG 300 and 550 single electric motor eAxles, which can reach over 8 kW/kg power density and more than 90 Nm/kg torque density. e patented rotor achieves speeds up to 25,000 rpm. Both coaxial and o set layouts o er output from 150 to 360 kW and torque between 2,500 and 6,250 Nm. ese are targeted at a range of EV applications, from sports coupes to SUVs. Rimac is also developing a high-torque XXL Axle—a dual-motor unit validated at over 11,000 Nm—which is to enter production in 2026 with a global automaker.

Rimac has also launched a portfolio of domain and zonal electronic control units (ECUs) powered by NXP’s S32E2 processors. ese units consolidate multiple traditional ECUs into high-performance domain controllers, managing tasks such as torque vectoring, battery management and high-voltage distribution. e architecture is designed around centralized so ware-de ned vehicle principles, supporting real-time operation, over-the-air updates and advanced safety requirements.

All the newly unveiled technologies will be produced at Rimac’s Croatian manufacturing facilities, which consist of over 95,000 square meters of space across two sites.

ese technologies represent “the convergence of breakthrough innovation and production readiness,” said Rimac Technology COO Nurdin Pitarević. “ ese aren’t simply concept technologies—they’ve been developed to be production-ready solutions that will power hundreds of thousands of vehicles in the coming years.”

Actively cooled high-voltage cables

Keeping your performance cool! Our actively cooled cables deliver peak performance and absolute reliability, no matter how tough the conditions.

Discover our products:

Smaller conductors reduce weight

Reliable operation in any environment

For smaller diameters with highest performance

Shielded or unshielded, copper or aluminum

Less material, lower cost

Come visit us:

The Battery Show Booth No.: 5622

October 06-09, 2025 Huntington Place, Detroit

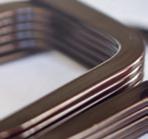

Vishay Intertechnology has introduced the MKP1848e, an AEC-Q200-quali ed, metallized polypropylene lm capacitor engineered for demanding automotive, energy and industrial environments. e MKP1848e capacitor supports operation at temperatures up to 125° C, and is designed to withstand harsh operational and environmental stresses, making it suitable for EV powertrain applications.

e MKP1848e o ers rated capacitance values ranging from 1 microfarad to 140 microfarads, and supports voltages from 500 VDC to 1,300 VDC. Vishay says the device achieves low equivalent series resistance (ESR) values down to 1.0 milliohm and supports ripple current up to 44.5 A. e capacitor provides 25% higher ripple current density compared to previous-generation devices with identical volume. e MKP1848e can also withstand temperature humidity bias conditions per Grade III of IEC60384-16 edition 3 (60° C, 93% relative humidity, 1,344 hours at rated voltage) and endures 1,000 thermal shock cycles from -40° C to 125° C, each with a 30-minute dwell time.

e MKP1848e matches the high voltage standards required for EV and PHEV platforms, withstanding operating voltages from 250 VDC to 800 VDC at 125° C for a limited period. e component features optional customized terminals and supports compact designs with pitch options as low as 22.5 mm, enabling up to 40% volume reduction at 500 VDC and 15% at 900 VDC.

Target applications include fast chargers, solar inverters, hydrogen electrolyzer recti ers, battery storage systems, motor drives and uninterruptible power supplies. Samples and production volumes of the MKP1848e are currently available with a typical lead time of 10 weeks.

Starting in February 2027, every EV and industrial battery sold or used in the EU must include a digital record called a battery passport.

e battery passport, which is linked to a QR code directly on the battery, provides information on where the battery was manufactured, the types of materials used, and the environmental and social impact of its production (including carbon emissions and labor practices throughout the supply chain).

As Christopher Chico reports in his Battery Chronicle newsletter, the main purpose of the EU Battery Regulation is to improve transparency within the battery industry by providing information to recyclers, customers and regulators. To ensure security and transparency, battery passports must use open data formats.

e requirements of the law are being phased in over a period of several years. e regulation became active in August 2023. In 2024, safety and performance standards became mandatory. In 2025, companies were required to start reporting the carbon footprints of their EV batteries, and to document ethical management of their supply chains. In 2026, carbon footprint labels and data-access rules will be nalized, and in 2027, digital passports will become compulsory for entering the European market.

Battery passports will organize information into three categories: public, restricted and regulatory.

Public data will include the battery type, its carbon footprint, and details about ethical sourcing.

Restricted information will include repair and recycling instructions for service technicians and recycling facilities.

Regulatory data, accessible only to government agencies, will include compliance reports and test results.

Flux Power has announced a $1.2-million order from a major North American airline for its G80 lithium-ion energy systems integrated with the SkyEMS so ware platform.

e G80 solution combines hardware and so ware in a single platform to deliver real-time data on eet performance, asset health and maintenance requirements. Flux Power says this enables predictive maintenance, improves asset uptime and addresses operational speed and reliability for airport ground support eets. e modular architecture of the G80 battery units is designed to allow rapid eld servicing and minimize downtime, while the system’s operational intelligence suite generates actionable insights for preventive maintenance and decision-making.

e airline’s purchase, handled through Flux Power’s aviation partner Averest, covers deliveries scheduled throughout 2025. Additional orders are expected, Flux Power reports, citing ongoing momentum for intelligent battery systems in the aviation sector.

“Airlines today need more than just batteries; they need data-driven solutions that keep them ahead of challenges on the ground,” said Krishna Vanka, CEO of Flux Power. “Our integrated hardware and so ware o ering delivers not only the power to move equipment but the intelligence to keep operations running at peak performance.”

While this project focuses on aviation ground support, Flux Power designs and manufactures lithium-ion storage and battery management systems for a range of industrial, commercial and stationary applications.

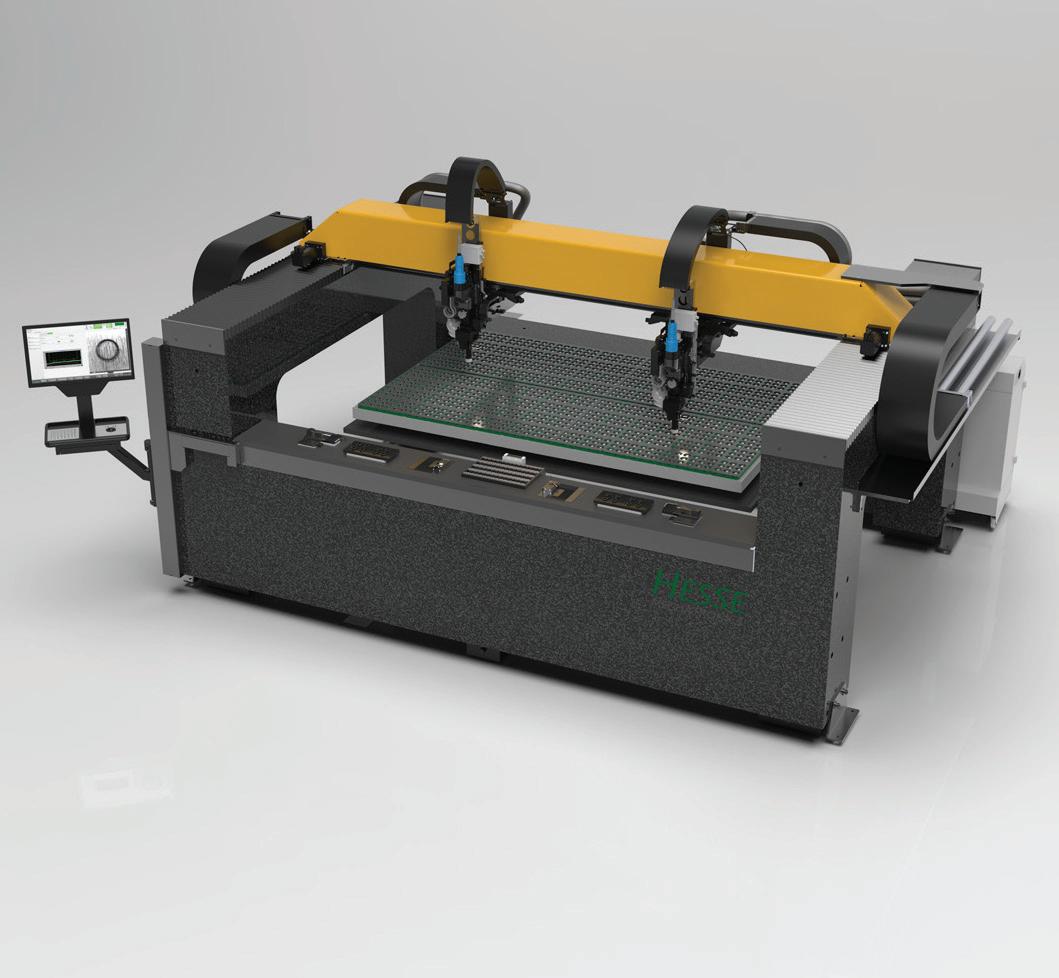

Dürr Systems debuts two-sided simultaneous electrode coater for battery cell OEMs

German engineering rm Dürr Systems has expanded its portfolio of two-sided simultaneous electrode coating machines with a new coater that uses Siemens technologies to support tension-controlled coating capabilities. e company’s product is tailored to customers’ requirements for a complete electrode coating process that supports integrated solvent recovery and onsite re ning along with state-of-the-art roll presses, said CTS Sales Director Jim Hartnett. Dürr also o ers Tandem Coater equipment with integrated solvent recovery.

“While the Tandem Coater remains the industry’s preferred means of battery electrode production and still a viable OEM option for our customers with many years le in its lifecycle, we wanted to leverage our engineering know-how from it to give our customers another way to elevate and expand their production,” Hartnett said.

e Dürr GigaCoater has a straight-path product ow on a single coating station. Slot-die coating on a backing roll is immediately followed by a tensioned-web slotdie coating to coat both sides of the current collector in one pass. An air otation dryer enables simultaneous two-sided coating as the foil runs through a non-contact drying process.

For help with automation and controls, especially motion control, Dürr chose Siemens partner and systems integrator DMC.

e GigaCoater’s automation and control system contains numerous Siemens components from its Totally Integrated Automation (TIA) portfolio. ese include the SIMATIC S7-1500 Programmable Logic Controllers (PLCs), which oversee the two-sided simultaneous coating processes to precisely manage the movement, alignment, and timing of numerous servo motors as the copper foil substrate moves through the machine and its oat-drying modules.

US-based AM Batteries (AMB) has launched an interactive Savings Calculator to enable battery makers to quantify the cost and performance impact of using its Powder-to-Electrode dry-coating equipment to produce lithium-ion batteries.

e calculator uses inputs including factory location, production capacity, cathode and anode materials, electrode thickness, process yield and vendor tier to provide estimates for CapEx, OpEx and factory footprint. It benchmarks conventional slurry-based methods against AMB’s dry approach under real-world conditions.

A cell maker operating a 30 GWh gigafactory could save more than $100 million in annual operating expenses by switching to dry electrodes, the company claims, while producing higher-performing cells with improved adhesion, higher areal loading capacity and longer cycle life.

AMB’s process eliminates solvents and energy-intensive drying ovens to deliver more than 60% lower operating costs and up to 40% lower capital expenditure, while also reducing facility footprints by 30%, the company said. e process enhances cell performance by enabling faster wetting, binder exibility and recyclability of excess powder.

“ is tool transforms the value of dry electrode from theory into data,” said Lie Shi, CEO of AM Batteries. “Within minutes, manufacturers can see how our Powder-to-Electrode process impacts their cost structure and the performance of the cells they produce.”

Transport climate control specialist ermo King, a brand of Trane Technologies, has introduced a new heat pump for battery-electric buses operating in moderate and colder climates.

Part of ermo King’s all-electric TE Series product line, the new TE Series Heat Pump enables eet operators to extend bus range, further reduce emissions and maintain passenger comfort.

Electric resistance heaters signi cantly reduce operating range by drawing substantial amounts of energy from vehicle batteries. e TE Series Heat Pump applies Trane’s expertise in heat pump technology, which has been applied across commercial buildings and homes, to public transit applications.

e TE Series Heat Pump extracts heat from ambient air rather than generating heat from battery power, delivering up to 2.5 times more energy e ciency than resistance heaters, which translates to more miles per charge. ermo King says buses equipped with the TE Series Heat Pump can achieve up to 50% more range at moderate temperatures (40° F) and up to 30% more range at colder temperatures (20° F) compared to those using resistance heaters.

e system e ectively keeps passengers warm at temperatures as low as 20° F without the need for backup heating. In colder climates requiring auxiliary heat, the TE Series Heat Pump allows for extended bus routes and reduced reliance on battery recharging.

“ is product is a critical step in continuing to make public transportation more e cient, reliable and eco-friendly, proving that decarbonization and operational excellence can go hand in hand,” said Chris Tanaka, VP of Product Management for ermo King Americas.

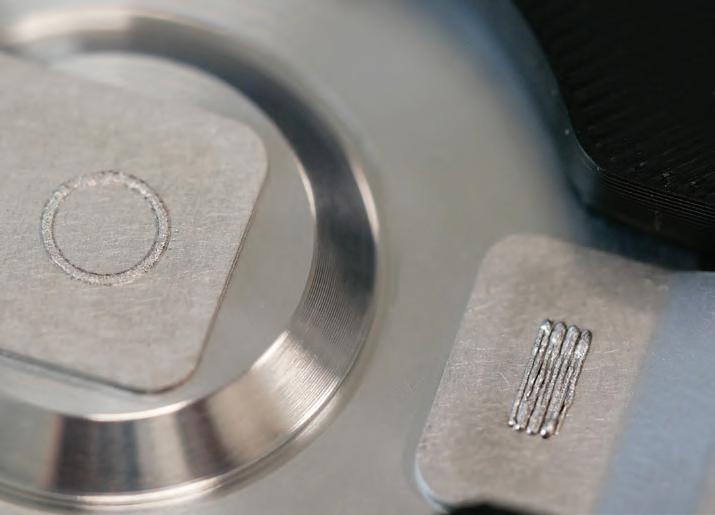

Toshiba Electronic Devices & Storage Corporation has introduced three 650 V silicon carbide (SiC) metal-oxide-semiconductor eld-e ect transistors (MOSFETs). ese new devices, part numbers TW027U65C, TW048U65C and TW083U65C, are designed for industrial power electronics.

ese third-generation SiC MOSFETs are housed in general-purpose TOLL surface-mount packages, which reduce device volume by more than 80 percent compared to through-hole packages such as TO-247 and TO-2474L(X). is enables increased equipment power density and supports automated manufacturing.

Toshiba says the TOLL package o ers lower parasitic impedance—resistance and inductance—than through-

hole packages, resulting in decreased switching losses. As a four-terminal package, TOLL allows for a Kelvin connection signal source, which minimizes the impact of source wire inductance on gate driving performance. is design leads to higher switching speeds—for example, the TW048U65C reportedly achieves approximately 55 percent lower turn-on loss and 25 percent lower turno loss compared to previous Toshiba 650 V SiC MOSFETs in a TO-247 package without Kelvin connection.

While the new components are suitable for various industrial power electronics, Toshiba identi es EV charging stations and photovoltaic inverters as speci c target applications. e devices are also intended for switched-mode power supplies in data centers, servers, communications equipment and uninterruptible power supplies.

Inspired by temperature

By Jeffrey Jenkins

The vast majority of power converters used in the EV space—from battery chargers to traction inverters—are classi ed as voltagefed, meaning they expect to be supplied from a source whose voltage varies little with changes in current draw (i.e. has a low impedance), and the best way to ensure this condition is with a capacitor across the power input, as it will e ectively nullify any upstream stray inductance in the wiring, etc. e amount of input capacitance required tends to scale directly with current draw or power level, and inversely with pulse frequency or voltage, but once you get to the kW power level and/or above 48 V, you can pretty much guarantee that directly connecting power without some means of controlling the ensuing inrush current will end in tears, as dividing a high supply voltage by a low loop impedance (including the capacitor Equivalent Series Resistance, or ESR) can easily result in tens of kiloamperes of inrush. ere is an easy solution to the problem—well, easy in theory, anyway—and that is to bring the capacitor voltage up slowly, a process typically referred to as precharging.

e sophistication (read: complexity and cost) of these precharging (and inrush current control measures in general) also tends to go up with supply voltage and power level, though complicating factors like safety agency requirements will o en severely constrain what approaches will be acceptable, regardless of how e ective they might be.

Low-power auxiliary converters supplied by moderately high voltages (drawing a continuous current of <100 mA or so) can simply use a xed resistor which is permanently wired in series with the supply to control inrush current, and o en this resistor can perform double duty as a fuse (in which case it’s a fusible resistor). While this might sound like anathema from an e ciency standpoint, the absolute losses we are talking about here should be less (much less, really) than 1 W. For example, a 100 Ω resistor in series with a 340 V supply will limit inrush current to a downstream converter to a maximum of 3.4 A, and if the converter only has to supply a load of 5 W at an e ciency (sans resistor) of 65%, then it will draw about 23 mA, incurring an additional loss in the series resistor of

around 50 mW. at’s a minuscule increase in loss by any standard, but do keep in mind that this loss will scale with the square of converter power, and once it reaches about 1 W, the size of the resistor required to keep its surface temperature reasonable (i.e. well below 100° C) starts to get ridiculous.

Another inrush current-limiting solution that is just as simple as a xed resistor is one with a negative temperature coe cient. Such NTC inrush current limiters are resistors that will typically swing from 5 Ω to 50 Ω at 25° C down to 1/10th to as little as 1/50th of that value when heated (by the current owing through them) to around 100-200° C. is 10x to 50x reduction in continuous losses without any penalty in inrush current limiting makes a compelling case for the NTC resistor, but one major downside for EV applications—especially for onboard devices—is that the allowable ambient temperature range is necessarily limited. A less-appreciated caveat is that a properly spec’ed NTC inrush current limiter will necessarily get quite hot during operation, and there is no option to oversize it to reduce said operating temperature, as is possible with a xed resistor. Another possible downside is that the NTC resistor will need some time to cool o when the load is removed before it will once again limit inrush current (1-2 minutes is typical), so loads that are cycled o en (or which vary considerably) aren’t a good t.

e next approach for controlling inrush current is with a xed resistor that is switched in to bypass the main contactor before the latter is closed. e trigger conditions for the precharge switch can be as simple as a xed time delay (though this is really not recommended), or something more elaborate, such as when the capacitor voltage comes up to within a few volts of the incoming supply, or the current through the precharge resistor drops below a certain value. e precharge resistor can be tricky to properly specify, however, as it needs to be of a construction that is capable of handling a very high peak power (namely, W = V IN 2 / R), even though the average power may be quite low, depending on the time between power cycles (according to the equation W = C * V IN 2 / 2 * seconds). Generally speaking, bulk metal, wirewound and metal oxide resistors are most suitable for precharge use, while the lm types—pretty much regardless of construction—tend to die prematurely.

The precharge resistor can be tricky to properly specify, as it needs to be of a construction that is capable of handling a very high peak power.

Resistors appropriate for precharging applications will o en be speci ed by energy rating in addition to the more usual power rating, with the required energy rating coming from the capacitor energy equation (i.e. J = C * V IN 2 / 2). For example, if the incoming supply is 340 VDC and the capacitor is 1,000 μF, then the precharge resistor will need an energy rating of at least 58 J. Sometimes a pulse energy rating in joules isn’t directly speci ed for a resistor of a preferred construction, but if a short-time overload of, say, x times the rated wattage for y seconds is given, then the energy rating can be extrapolated by simply multiplying x and y. For example, the Ohmite TWW series (wirewound) are speci ed for 10x rated power for 5 seconds, so a 5 W resistor in this series could theoretically handle 250 J. at’s the theory, anyway, but my experience is that it’s best to assume the peak power rating is only tolerable for 1-2 seconds, max, and to string several smaller power resistors in series—particularly when V IN exceeds 300 V—to achieve the necessary energy rating. Finally, ensure that the average power rating won’t be exceeded, and be generous with this derating, as well, if for no other reason than to protect nearby components from excessive heat.

e switch in series with the precharge resistor also needs to be chosen carefully, as it must withstand the full supply voltage when open, and will then have to close into the highest current expected once precharging commences. e latter condition is notorious for welding the contacts of an electromechanical relay (an issue that is sidestepped with a solid-state relay). It is also important to consider what might happen to the precharge switch (and the main contactor it bypasses) during a short-circuit fault downstream, as then the voltage on the bus capacitor won’t rise, so

either the precharge switch will have to open under its maximum DC current—which will result in arcing in an electromechanical relay—or else the main contactor will be closing into a short (if the precharging sequence is performed blindly).

Standard electromechanical relays intended for AC switching are notoriously poor at breaking even a few tens of mA of DC current—the datasheet will typically show 1/10th the maximum AC rating at a mere 30 VDC—which is yet another argument for the SSR, but regardless, monitoring the bus capacitor’s voltage and aborting precharge if it doesn’t rise to the expected value within the expected time (+/- whatever tolerance is appropriate for the variation in capacitance value as well as that of the incoming supply voltage) is still highly recommended. Such monitoring also allows for closing the main contactor when there is an ideal 5-10 V still to go, as this will ensure that enough current ows during closure to blast oxides o its contacts, but not so much that they weld. Also note that electromagnetic relays don’t tolerate high shock loads/vibration without some e ort going into hardening them against such, which puts them at a further disadvantage against SSRs when used onboard an EV. at said, they are typically a lot cheaper than their solid-state counterparts, and they possess one advantage that is rarely (pretty much never) found in an SSR, which

Modeling and simulation accelerates design iteration, understanding, and project planning, but requires specific expertise that is not easy to access from the field, factory, or lab where in-the-moment decisions are made. Extend the benefits of simulation to those who need it, when they need it with your own custom apps.

» comsol.com/feature/apps

When simulation experts build apps based on their models, colleagues and customers can use simulation to guide decisions in real time.

Compile and distribute standalone apps worldwide with COMSOL Compiler and manage access to the apps with your own COMSOL Server™ environment. The choice is yours.

is a true Form C contact arrangement—that is, dualthrow, or a common pole switching between normally closed and normally open positions—which makes it very easy for the precharge resistor to turn around and discharge the bus capacitance. Not that there isn’t a semiconductor-based solution to rapidly discharging the bus capacitance, just that a SPDT relay can do such for (almost) free.

Finally, there is active precharging, which e ectively replaces the resistor in the passive methods discussed above with a current source. is can dramatically reduce the peak power that must be handled without a corresponding increase in the precharging time, as the current source will cause the capacitor voltage to rise linearly over time, rather than in an exponentially decreasing fashion. is comes at the expense of increased complexity, if not total cost itself, hence active precharging methods are best reserved for applications which have a large value bus capacitance that needs to be precharged rapidly (e.g. the traction inverter in an EV). e current source for active precharging can be a fairly simple linear type comprised of bipolar junction transistors or depletion-mode FETs, but note that this really just shi s the burden of dissipating power during precharging from a physically robust resistor to a comparatively more fragile transistor. ese losses can be eliminated by using a standalone switchmode converter that is con gured as a current source to do the active precharging. While almost any switchmode converter can be made into a current source via its control loop, some topologies are more suitable for this job than others. For example, the classic ringing choke converter (aka blocking oscillator or self-oscil-

Finally, there is active precharging, which effectively replaces the resistor in the passive methods discussed above with a current source.

Another good topology choice for active precharging is the buck converter, with the capacitor to be precharged substituting for its output capacitor.

lating yback) was very commonly used to charge the energy storage capacitor in battery-powered xenon photo ash strobes (and was responsible for their distinctive rising-pitch whine), which is pretty much what is required here. e RCC topology automatically limits output voltage and current even without a formal control loop, which is a big plus, but one major downside is that its switch must withstand more than twice the input voltage (assuming a 1:1 transformer turns ratio), which means a lot of board space will be needed just to accommodate the creepage and clearance requirements around it, if nothing else.

Another good topology choice for active precharging is the buck converter, with the capacitor to be precharged substituting for its output capacitor. A control loop will be needed to limit and/or regulate the output current with the buck, but the switch (and freewheeling diode) never see more than the input voltage, and the buck choke only needs a single winding, rather than at least three windings, as is required for the RCC. at said, the buck will require a lowvoltage power rail for its control circuit and some means of driving its (usually high-side) switch, meaning a gate driver IC that is either of the level-shi ing type (overall less robust and limited in the range of duty cycle it can handle) or which provides isolation (somewhat more expensive). For those interested in further reading on active precharging, Texas Instruments’ design guide, TIDA-050063, describes several approaches, including a buck converter-based solution for precharging a capacitance of 2,000 μF up to 800 VDC in 400 ms—something which would almost certainly be cost- and space-prohibitive if attempted with a resistor and a relay!

By Nicole Willing

As EV adoption accelerates, so does the frequency of battery recalls—and the operational expertise they require.

In recent months, a string of recalls from major automakers has underscored the complexities of EV battery systems. Hyundai recently pulled back a limited number of 2025 IONIQ 5s in the US a er identifying a short-circuit risk linked to a faulty battery pack busbar. Ford has expanded its recall of 2022 Mustang Mach-E models with extended-range batteries owing to overheating contactors that could cause a sudden loss of drive power. And BMW has faced back-to-back recalls—one a ecting more than 70,000 vehicles over a so ware issue that could cause the high-voltage system to shut down unexpectedly, and another targeting 136 EVs in the US for incorrectly assembled battery cell modules that could lead to power loss or re.

In some cases, these issues can be remedied with soware updates. In others, the battery needs to be removed entirely and replaced.

Unlike traditional vehicle recalls, which can o en be resolved with a quick part swap, removing and replacing an EV battery can take hours and must be repeated across hundreds or thousands of vehicles—o en under tight timelines. For a recent luxury EV model recall of more than 25,000 vehicles, the removal took nine hours per battery.

Once consumers are noti ed, an extensive technical response is mobilized. Teams of technicians, transport specialists and supply chain managers coordinate a complex operation to ensure that every recalled battery is safely handled, shipped, and then repaired, recycled or disposed of under strict protocols.

To understand the realities of this process, Charged spoke with Bryce Cornet, Senior Manager of Supply Chain Logistics at EV Battery Solutions by Cox Automotive.

We discussed what happens behind the scenes of an EV battery recall, how the process di ers from tradi-

tional ICE vehicle recalls, and the safety protocols that determine where each battery ends up.

Q Charged: What are the rst steps when a battery recall is announced?

A Bryce Cornet: e rst thing that is considered is whether it is a safety recall or a traditional mechanical recall.

When batteries have a safety recall applied to them, most of the time an OEM has had discussions with agencies like NHTSA and then released an announcement to customers. Customers get a letter in the mail saying the battery in their vehicle is a ected by a safety recall. ere could be instructions, depending on how severe the safety situation is, but for the most part it’s to explain to the customer that they need to bring their car in for battery replacement. If the recall is large enough, it may be bucketed based on the criticality of potential failures. e OEM will have data around when the production failure happened. Some batteries may be more critical than others, and they have an idea of which Vehicle Identi cation Numbers, or VINs, have these batteries in them. at’s something we’re able to help with too, because we have a so ware system that ties into the vehicle.

O en dealers are doing these repairs for the OEM. Is the dealer prepared to take on a large number of recalled repairs? ey may go from doing one repair a month to 20 repairs a month. Do they have the space to store battery packs? What are the ergonomics of moving a battery through a dealership network? Do they have the tools?

Another question is whether the recall is pack-level or cell-level. Primarily, what we deal with are module- and cell-level recalls. In that case, the whole battery pack is removed from the vehicle and shipped to us, either for module replacements—maybe we can nd the critical module and replace it and certify it—or it could be that the full battery pack needs to be re-cycled, in which case we do disassembly operations to make it safe to recycle.

On top of disassembly and recycling, there is a storage component to consider. Some of these battery packs may be held for a certain amount of time, but they need to be held safely.

Our warehouses at EV Battery Solutions have high-pressure re suppression systems. We support the dealer in getting batteries away from the dealership as quickly as possible, because they o en don’t have a lot of extra storage for battery packs. e important thing is getting the pack

Primarily, what we deal with are module- and cell-level recalls.

In that case, the whole battery pack is removed from the vehicle and shipped to us.

and storing it if we have to, or getting it quickly to recycling, to get rid of any type of risk.

Q Charged: How is transportation handled, given the risks of shipping large lithium-ion batteries?

A Bryce Cornet: EV batteries are packaged more robustly if it is a safety recall. A portion of this is planning, to safely transport a battery from a dealership or from distribution sites. at battery has to move through public ecosystems on trucks.

When a safety recall hits, the battery falls under a hazmat

regulation in 49 CFR with the Pipeline and Hazardous Materials Safety Administration, PHMSA, which states if the battery is damaged, defective or recalled, it cannot be transported by air or other means. We’re passionate about making recycling as close to a dealership as possible, because you don’t want to transport batteries far that potentially could have safety recalls.

Q Charged: Can you walk us through the logistical process of removing and handling a recalled battery?

A Bryce Cornet: e process varies based on the OEM, because every OEM has their secret sauce for how the battery ts into the vehicle. e form factor is di erent. You’re o en dealing with high-voltage connections, and it may not be easy to get to them to pull them out.

One thing that we o en run into, in addition to understanding how di cult it could be for dealers to remove that from the vehicle, is simply when we get it to our sites, there’s another layer of complexity, depending on how the battery shell mounts over the modules. Is it sealed with a glue? Is it bolted down and sealed?

We have to account for the time it takes to do the disassembly-to-recycling option, because o en there’s a rush to get these batteries o the road and get them recycled quickly. at can be quite the undertaking, especially as it can take anywhere from four to nine hours to fully disassemble a battery pack.

We have to account for the time it takes to do the disassemblyto-recycling option...anywhere from four to nine hours to fully disassemble a battery pack.

Q Charged: What are the biggest safety risks technicians face during battery removal, and how are those managed?

A Bryce Cornet: e biggest risk is that you’re dealing with something that has charge within it, which is somewhat di erent from pulling an engine out. You’re having to work around high-voltage cables. ere is a process to limit the voltage on the pack before they work on it, which should be a part of training.

Personal protective equipment, PPE, while they’re doing the job is likely di erent from traditional repairs and is important. And then a er you remove the pack you don’t want to store the battery pack outside.

Depending on what may be communicated by the OEM, if it is a safety recall and there are risks, you have to consider storage and packaging. You want to make sure that it’s packaged in compliant packaging and not le on a pallet outside. ere are also requirements to protect the environment that the dealer would need to know.

Q Charged: Are there enough skilled technicians in the industry to manage the process?

A Bryce Cornet: Part of the safety aspect is safe scaling. We o en have to train, hire and rehire to stand up more disassembly base. e dealer may also have to dedicate more people and more bays to these repairs, because that’s the quickest way to address long repair times.

Every time we’ve done a recall, we’ve had to hire new people that may not have been involved with EV batteries before, and that’s a risk. You have to be on it with operating instructions, having safety meetings every morning, and training your team before turning them loose on po-

We have an initiative inside Cox that is training all of our Manheim Auction sites to be EV-certifi ed. Dealers are doing the same thing and that’s getting better.

tential repairs. Dealers face the same issues with getting new EV technicians.

e number is growing, but it’s not necessarily at the point where every OEM is happy with the number of EV-certi ed techs.

We have an initiative inside Cox that is training all of our Manheim Auction sites to be EV-certi ed. Dealers are doing the same thing and that’s getting better. But nding high-quality, good talent to work on EVs can be a challenge—it is a di erence from ICE. You see a lot of ICE technicians moving over to EVs, because some OEMs are adding more EVs to their eets.

Q Charged: How does an EV recall di er from an ICE recall?

A Bryce Cornet: One thing is the size—the battery can be quite large. One of the recalls we supported was a battery pack that was about 1,000 pounds. It was about 1,800 pounds in a crate in total. You have a dealership inserting an item that may be ve times the size of the engines and transmissions they’re used to dealing with. And that leads into other factors that are di erent for

EV batteries. It goes all the way down to logistics. Carriers are used to moving all kinds of cargo, not just batteries. We need to educate the carrier to take precautions when they’re handling a battery.

ere are technical requirements when we take an order. A dealer will contact us to say they have a vehicle down and need a battery. ere is speci c information we need to take from the dealer about the battery that is di erent from a transmission.

On a transmission, you’re looking at mileage as an indicator of health. But for batteries, you are looking at mileage, but you’re also looking at state of charge, how much percentage charge is in the battery. at a ects how the OEM and how we interact with the battery when it arrives.

When we get a battery in, we’re o en assessing if it’s good enough to go back into a vehicle or not. Is it safe? Are there things we can do to repair it, or does it need to go to recycling? ere are di erent technical requirements for EVs, for us to make a decision on its criticality.

Q Charged: How do you decide whether it’s repaired, recycled or scrapped?

A Bryce Cornet: You wouldn’t want to nd out that a vehicle that was once a part of a safety recall ever has a battery that is part of another recall. Most of the time

these batteries—the full packs— are disassembled and recycled immediately.

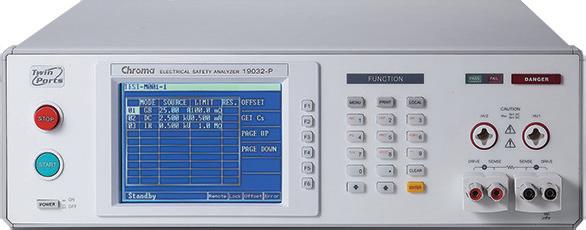

When we take in a battery, we get a core of varying health. e dealer doesn’t know of its health, usually, and we transport it here to diagnose it. We run a series of resistance measurements and voltage checks to get a baseline of what we’re looking at. ose baseline measurements are o en

partnered with diagnostic trouble codes, or DTCs, that tell us if there’s a low cell, a dead cell, or something speci c.

Enough of that data leads us to a direction to tell if it is a good repair. If it has this DTC and these readings, we can potentially repair it. If it falls outside that window, we may have to recycle it.

At one time, we were manufacturing our own second-life energy storage systems. We’ve since stopped, but we do support other entities and OEMs with nding and testing battery cores to potentially allow them to do second life.

What we’ve o en found di cult is that, to be used for second life, a battery has to be in a sweet spot in between being good enough to go back into a car or bad enough that it needs to be recycled. And as pro table as recycling is becoming, for a lot of OEMs and for recyclers, there’s less of the second use happening.

Q Charged: What’s the biggest recall you’ve been involved in?

A Bryce Cornet: e biggest recall a ected about 150,000 vehicles in the US and Europe. My team had been doing 200-300 battery shipments a month, and at the peak of this recall we were doing about 600 battery shipments a day from a site in Detroit and a site in Oklahoma City.

We were shipping out new batteries and getting back the bad batteries. ese batteries weighed 1,500 pounds, and there was a process in which we had to move each battery from one crate to another before we could ship it. We had workstations with cranes, and we built a whole process where it was like a pit stop for a battery. We had about four people under that crane and they all had their job. e same thing was done for the shipping process to speed up how many we were doing.

We had a timeline of how quickly this speci c client wanted the recall completed. We reduced our ful llment times from about 20 minutes per battery pack to about ve minutes. ere were so ware enhancements that we did to make it more automated. We developed a Quick Connect system to li the battery pack out that saved ve minutes alone. In these large peaks of volume, you start to see a lot of innovation happen.

Q Charged: Are you seeing innovations in robotics or AI that could be incorporated into the process?

A Bryce Cornet: It could be valuable in assessing a battery for damage when it’s brought in. We’re also looking into robotic automation to limit the risk to technicians from having to pull modules out of the battery, and cut out any

issues with human error that could happen with tedious tasks like replacing modules.

Q Charged: As commercial EV adoption increases, how does that potentially a ect a big recall?

A Bryce Cornet: We have a lot of partners where we deal with battery packs as large as 4,500 to 10,000 pounds, where you’re touching some of those commercial applications.

We have an e cient model to deal with scaling for a recall. But any time that happens we run into issues like truck availability. Moving these large battery packs requires speci c types of logistics or carrier transport—speci c trailers to move the battery on. at could strain the supply chain, because it’s not traditional for those trailers to be used in high volume.

We’re knowledgeable about that now, because we’ve faced it, but in a high volume we would have to work with our partners to make that change.

How does LFP affect potential recalls? Is it easier to handle LFP than the traditional NMC packs? We don’t have the answer yet, but as some of these OEMs change their chemistries, we’ll quickly fi nd out.

Q Charged: As EV adoption grows, do you expect recalls to become more frequent, or could the technology develop in a way that recalls become less likely?

A Bryce Cornet: It’s hard to say. It is true that as the sample size grows, we could have more recalls just from having more EVs on the road, or OEMs trying more things.

But what’s interesting is the changing of chemistries. A lot of OEMs are talking about LFP. e term solid-state is thrown around a lot, and there are a lot of di erent potential chemistries and ideas. How does LFP a ect potential recalls? Does it make it better or worse? Is it easier to handle LFP than the traditional NMC packs? We don’t have the answer yet, but as some of these OEMs change their chemistries, we’ll quickly nd out.

By John Voelcker

Looked at one way, the EV startup Lucid Motors faces huge challenges. For ve years, it’s only sold about 10,000 cars a year, its cash burn is prodigious even by auto startup standards, and it hasn’t had a permanent CEO since longtime leader Peter Rawlinson resigned in February.

On the other hand, acting CEO Marc Winterho was distinctly upbeat during the keynote address he gave at the recent IAA Mobility trade show in Munich.

e Gravity electric SUV is now available for orders in Europe, and deliveries are to start early next year. Europeans can order the high-end Grand Touring trim now, at a starting price of 116,900 Euros (roughly $137,000) in Germany. e Touring trim will be available “later,” at a price of 99,900 Euros. Range of the 123-kilowatt-hour battery version is quoted at up to 748 kilometers (465 miles) on 20- or 21-inch wheels, tested on the European WLTP cycle (US EPA testing rates the same SUV at 450 miles of range).

e Gravity is a known quantity in North America by now, at least to auto reporters and most EV shoppers. e company o ered drives of prototype vehicles 18 months ago, and US deliveries of the Gravity started recently. e launch Dream Edition has already sold out, and Lucid expects the majority of its deliveries for the rest of the year to be Gravity SUVs, rather than the 4-year-old Air luxury sedan. Winterho said Gravity demand has been strong enough to exceed current production capacity.

So … what’s next?

Following the Tesla playbook, just as EV startup Rivian is doing, Lucid plans to supplement lower volumes of its large luxury models with a range of smaller, more a ordable premium midsize vehicles—and it turns out there will be several of them.

Eighteen months ago, the company ashed a quick image of a shrouded midsize crossover on the screen during a presentation to show o its retooled and expanded Arizona factory. en, a year ago, it showed a slightly clearer partial rendering of what appeared to be that same vehicle—saying production would start in “late 2026” with a starting price “under $50K.” Lucid promised the midsize SUV would deliver “the same range as

competitors” using a smaller battery, which helps keep the price low.

In a recent media interview, Winterho reiterated plans for a production date at the end of 2026 for its rst midsize vehicle, almost surely the SUV. is vehicle will compete with the Rivian R2, the aging Tesla Model Y, and various EV utilities from established makers.

More interestingly, he said a second model—or “top hat” in industry lingo—would follow “shortly therea er,” and a third roughly one and a half years a er that. e rst two are thus likely to be 2027 models, and when the third will hit the market is anyone’s guess.

So, if the rst of the new models is the SUV, will the second be a sedan, reversing the Tesla cadence? Or will it be something di erent? Asked about commercial applications—think Rivian’s battery-electric delivery vans, for instance—Winterho said the midsize vehicles largely target retail buyers, but will have a role in the eet market as well. ( ey will be assembled from Completely Knocked Down (CKD) kits in Lucid’s Saudi Arabia factory.)

Furthermore, Winterho suggested, the company’s midsize platform could serve as a future platform for driverless vehicles—like, perhaps, the robotaxis it announced in July that it would develop with Uber. Is that vehicle the third model on the midsize platform? It’s entirely possible.

Lucid has many bridges to cross before it begins volume production of a ordable EVs. First, the Gravity has to be a sales success not only in North America, but in Europe and other markets as well. Second, further factory expansion will be a necessity. And, of course, the company has to be able to deliver on the promise of elegant luxury, long range, and a desirable vehicle that’s still priced under $50,000.

Lucid’s acting CEO is exuding con dence that it can do all that. Stay tuned.

a sign of weakness, or a shrewd

Revel’s distinctive light blue electric cars will soon disappear from the streets of New York. e company has decided to end its rideshare service in order to focus on expanding its network of EV charging stations. e company says it’s making the move for the same reason it retired its iconic blue electric scooters in 2023—New Yorkers have plenty of transport options, and Revel has plenty of competitors. As a rideshare provider, Revel is a small sh in a huge pond—it provided some 80,000 rides in June in New York City, compared with about 20 million total rides for Uber and Ly , according to the NYC Taxi and Limousine Commission.

Now, all too o en when we hear a company announce something like this, we expect to hear about bankruptcy soon a er (successful companies tend to spin out unwanted subsidiaries, or sell them). But in Revel’s case, this could very well be a wise decision that positions the company for further growth.

As COO Paul Suhey explained to Charged in a 2023 feature interview, the reason Revel decided to develop rideshare and EV charging in tandem is that they were complimentary businesses—the company’s charging hubs kept its EVs charged, and the rideshare business provided the utilization rate required to justify the cost of the charging hubs. at strategy gave the young company a jump-start, but charger utilization no longer seems to be an issue. Revel told TechCrunch that the utilization rate of its charging network in early 2023 was just 21%, some 19% of that by its own eet. By early 2025, that utilization rate had jumped to 45%, only 12% of that from Revel’s eet. e company now seems to see the bigger rideshare players as partners—it made a deal with Uber in 2024, and over the last couple of years, it has seen an increasing number of Uber and Ly drivers using its charging hubs.

New York City’s Green Rides Initiative, introduced in 2024, mandates that 5 percent of rideshare trips need to be conducted by zero-emission or wheelchair-accessible vehicles. e share of Uber and Ly trips conducted by EVs more than tripled a few months a er the initiative took e ect, according to the NYC Taxi and Limousine Commission. Revel says it will now focus on building charging hubs in rideshare-dense urban areas. It plans to increase its charging stall count in the NYC region from 88 to 278 by the end of next year, and hopes to be operating some 2,000 chargers in New York, Los Angeles and San Francisco by 2030.

Australia Post has begun a pilot deployment of 36 Mercedes-Benz eVito electric vans. e agency’s existing eet includes some 3,600 three-wheeled delivery vehicles and several Mitsubishi eFUSO electric box vans. is will be its largest electric van trial to date.

Mercedes’ eVito features a 60 kWh battery pack and an 85 kW (115 hp) motor. e company’s factory up t program, Mercedes-Benz Vans Courier Solutions, allows customers to spec out their vans exactly the way they want them. Australia Post will work with the automaker to train team members and support the smooth introduction of the new electric vans.

Australia Post expects the eVito electric van’s 162-mile range to be su cient for the stop-and-go duty cycle of a delivery vehicle. Could drivers actually see more real-world range? at’s the sort of question this 36-van pilot is meant to answer. e vans will be powered by 100% renewable electricity, thanks to Australia Post’s existing charging infrastructure.

“ is is a meaningful step forward as we continue building a modern, sustainable delivery network that meets the evolving needs of our customers while reducing our environmental impact,” said Australia Post Chief Sustainability O cer Richard Pittard.

Daimler Buses has delivered ten battery-electric 12-meter Mercedes-Benz eCitaro city buses to German transit agency Stadtwerke Bonn (SWB). Daimler has also delivered a turnkey charging system with ten charging points.

e eCitaro buses will be used in scheduled service in the city of Bonn, coexisting with electric buses from other manufacturers, which have been part of the SWB eet for several years.

Daimler Buses assumed overall responsibility for all planning, civil engineering and construction services in this project, which will result in the gradual electri cation of all of Bonn’s buses.

Each of Bonn’s eCitaro buses features ve NMC3 battery packs with a total capacity of 490 kWh. Each can be charged via a CCS2 charging socket or via a roof-mounted pantograph system.

e charging infrastructure at the SWB depot in Friesdorf comprises two CCS2 charging points and eight pantograph charging points. e pantographs are mounted on a steel traverse, which is equipped with mobile concrete foundations, making the structure “reasonably easy to move to another location” if desired.

European parcel delivery rm DPD has tested the YT203-EV electric terminal tractor (o en called a tug in Europe) from Dutch rm Terburg at its hub in Oldbury, UK.

DPD runs a eet of more than 50 tugs to move trailers at its ve centralized sorting hubs in Oldbury, Smethwick and Hinckley in the UK. e company is keen to understand how the electric vehicle could help as part of a move to a more sustainable HGV eet in the longer term.

e model tested was tted with two 78 kWh batteries and comprehensive regenerative braking. e YT203-EV can be charged at standard DC charging stations.

e Royal Terberg Group specializes in the development, production and modi cation of special transport vehicles and systems for port terminals, logistics and waste collection. e YT203-EV o ers performance similar to that of a diesel engine, while delivering the potential for more sustainable shunting as well as a better working environment for drivers, according to the company.

“Clearly there are major advantages to the EV version in terms of emissions and the working environment for our drivers, but it was also really good to understand how the vehicles operate in a real-world scenario, including how they can be charged e ectively during the day to maximize working hours,” said Tim Jones, Director of Marketing, Communications & Sustainability at DPDgroup UK.

US-based EV manufacturer GreenPower Motor has signed a contract with the state of New Mexico to implement an electric school bus pilot project.

e two-year pilot project will deploy three GreenPower Type A Nano BEAST Access school buses in the 2025-2026 school year and three GreenPower Type D BEAST and Mega BEAST school buses in the 2026-2027 school year. e Mega BEAST delivers a range of up to 300 miles from its 387 kWh battery pack.

e contract between GreenPower and the state of New Mexico provides more than $5 million for the purchase of vehicles, cost of charging infrastructure and overall management of the pilot. Based on voluntary requests to participate, school districts are currently being selected by the state to participate in the pilot.

e school buses will rotate around the state in ve six-week pilot rounds each school year. GreenPower will install charging systems, provide training for the drivers, mechanics and the community’s rst responders, and help ensure a seamless testing period.

GreenPower is partnering with Highland Electric Fleets to install and implement the necessary charging infrastructure. e pilot will include DC fast chargers and Level 2 AC chargers for the Nano BEAST Access school buses, and will evaluate DC fast charging in the second year with the BEAST school buses. ere will also be a vehicle-to-grid (V2G) evaluation in the second year using the Mega BEAST.

“ e project is leveraging the successful pilot that GreenPower conducted in West Virginia, but also has a concentration on evaluating charging options and infrastructure,” said GreenPower President Brendan Riley.

Electric heavy trucks are rapidly gaining market share in China, driven by subsidies and the quick rollout of chargers. Reuters reports that this is cutting into diesel usage and denting oil demand from the world’s biggest crude oil importer.

EVs aren’t the only factor in the diesel decline—the rise of LNG-powered heavy trucks and recently, slowing economic growth, have also reduced demand for diesel. But surging sales of EVs are causing analysts to revise previous projections. Consulting rm Sublime China Information (SCI) estimates that sales of new energy trucks rose 175% year-over-year in the rst half of this year, representing about a quarter of new truck sales. Battery-electric models, mostly used for short-haul runs around ports, mines and factories, accounted for over 90% of that increase.

SCI analyst Xu Lei told Reuters that the rm has cut its forecast for China’s diesel demand by 1%-2%. Diesel consumption this year is now forecast to fall by 6.3%. A similar decrease was seen last year.

“ e surge in electric heavy trucks was a surprise and has become a new factor accelerating China’s oil consumption to peak, most likely this year,” Ye Lin, VP of Rystad Energy, told Reuters. Rystad expects China’s transport sector to use 40% less diesel by 2030, cutting overall consumption by about a quarter compared to 2024 levels.

e bull market for electric trucks is partly due to cheap electricity and government subsidies of up to 95,000 yuan ($13,264) for new vehicles. China’s rapid rollout of charging infrastructure along industrial corridors is another factor. Infrastructure provider Teld has built more than 2,400 truck charging stations across China, and recently opened an 800 km corridor linking Shanxi and Shandong provinces, a key route through the country’s coal-producing region.

Shortly a er bringing a line of electric semi-trucks into production, German truck manufacturer MAN Trucks, in cooperation with AW Automotive, has introduced a mobile battery energy storage system (BESS) designed to bring charging for heavy-duty vehicles to remote sites.

As Autoweek reports, MAN’s Smart Charging Cube is designed to be operated almost anywhere, with no need for a grid connection. It includes a stationary battery ranging in capacity from 500 kWh to 1,100 kWh, coupled with as many as four CCS charging ports with a power capacity of up to 400 kW.

e Smart Charging Cube can also support the Megawatt Charging System (MCS), which can deliver over 1,000 kW of power (few current EVs can take advantage of such high charging speeds, but automakers and infrastructure providers have plans to roll out MCS rapidly over the next few years).

“ e Smart Charging Cube can integrate self-generated electricity, for example from photovoltaic systems,” says MAN. “In addition, various charging functions are possible, including peak shaving, dynamic power consumption and bidirectional charging.”

e truck maker plans to sell, rent or lease these cubes to customers. A natural t would be the construction industry, which o en needs to operate excavators and other equipment at remote sites away from grid connections.

e cubes can be trickle-charged from grid power connections at currents from 32 A to 630 A, or paired with portable solar panels or other power sources.

Volvo has recently developed a similar cube aimed at the same sort of o -grid applications.

New York Governor Kathy Hochul has announced that an additional $200 million is now available for zero-emission school buses through the third installment of funding from the $4.2-billion Clean Water, Clean Air, and Green Jobs Environmental Bond Act of 2022.

e funding, distributed through the New York School Bus Incentive Program (NYSBIP), supports the purchase of electric buses, charging infrastructure and eet electri cation planning.

Administered by the New York State Energy Research and Development Authority (NYSERDA), NYSBIP provides incentives to eligible school bus eet operators, including school districts and school bus operators, that purchase zero-emission buses. It also o ers charging infrastructure vouchers to help support the installation of Level 2 or DC fast chargers, and provides funding to develop Fleet Electri cation Plans, which provide a customized roadmap for electric bus adoption.

e funding is available on a rst-come, rst-served basis. Incentive amounts cover up to 100 percent of the incremental cost of a new or repowered electric school bus, helping to o set some or all of the di erence in purchase price between zero-emission buses and legacy ICE buses.

Program eligibility criteria and rules can be found in the NYSBIP Implementation Manual. Fleet operators do not apply directly for funding—vehicle dealers apply the incentives to the price of buses a er eet operators have issued purchase orders. Fleet operators apply directly to NYSERDA for charging vouchers, which support adding charging infrastructure to their depots.