Avery Dennison introduces new EV battery venting materials portfolio

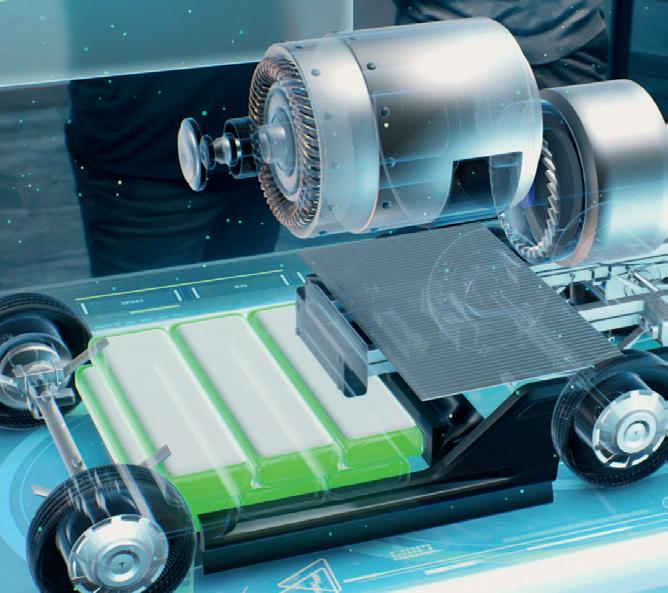

SK On and Nissan announce North American EV battery production

Proventia debuts LFP-based battery packs for heavy machinery

Lithium Americas receives $250-million investment for US lithium project

LG Chem to produce precursor-free battery cathode materials

Flint Engineering launches new heat pipe technology

Renesas introduces low-power Bluetooth SoC for auto applications

dSPACE launches simulation software for power electronics

Electrovaya receives $51-million loan for US battery manufacturing

QinetiQ validates 80% manganese-rich LMFP cathode for Integrals Power

Scania introduces new e-machine, battery and charging options for buses

Ricardo develops electric propulsion motor with no rare earths or copper

Henkel launches silicone-free gel for ADAS thermal degradation protection

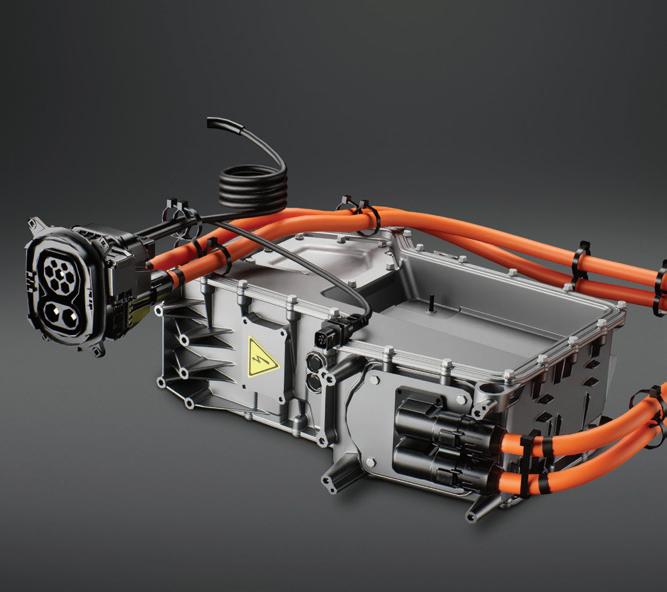

Danfoss introduces electric filter for high-power grid-connected machinery

LION Smart and hofer to bring novel immersion-cooled batteries to market

Rivian opens sales of its commercial van to all US fleets

Virgin Atlantic and Joby plan to launch UK air taxi service

Trova CEO talks about company’s first-ever electric terminal truck

Tradelink Transport buys 14 Volvo VNR Electric semis for drayage operations

Siemens receives first order for Vectron locomotives with battery module

Tadano debuts 100-ton rough-terrain electric crane

Orange EV introduces 7.5-year warranty for its electric terminal trucks

Arriva Shipping expands its fleet with hybrid dry cargo vessel

Nsight Fleet platform enables fleets to electrify refrigerated trailers

Daimler Truck’s RIZON brand begins Canadian deliveries of electric trucks

Mallaghan CT6000E electric catering truck debuts at Boston Logan Airport

Volvo CE reveals A30 Electric articulated hauler

Elgo-Plus introduces new compact electric mini-digger

JFK Airport to deploy a fleet of all-electric ground service equipment

Kia EV9 now available with Wallbox Quasar 2 bidirectional charger

Lucid Motors buys Nikola’s Arizona factory at bankruptcy auction

Electra announces $9 billion in preorders for new hybrid electric aircraft

Swiss transport and waste disposal company buys a FUSO electric truck

Pii’s new line of DC fast chargers can accept a wide range of input voltages

Rideshare/EV charging provider Revel expands to the West Coast

First Student to use Ampcontrol’s charging platform for its school buses

Kempower’s new EV charging station features CCS and NACS connectors

DG Matrix to commercialize its multi-port solid-state transformer solutions

KD Group acquires EV charging and energy management firm Etrel

FTI’s new above-ground cable routing product streamlines charger installation

Canada Infrastructure Bank and Jolt to install 1,500 curbside charging stations

ElectricFish’s microgrid charging solution installs quickly, cuts grid costs

California Energy Commission to launch $55-million charging station funding

ENAPI raises 7.5 million euros for its EV charging connectivity platform

Felten introduces Charge Qube mobile EV charging solution for remote sites

XCharge partners with Orlando Utilities Commission for EV charging research

Birmingham UK partners with ubitricity for on-street charging point network

RMI report finds rideshare drivers prefer to charge their EVs at home

Greenlane and Volvo partner to offer charging for heavy-duty electric trucks

Daimler Truck to launch semi-public European charging network

Delta unveils DC Wallbox EV charger for public charging

NovaCHARGE’s new mobile fast charger is designed for demanding conditions

Publisher Senior Editor

Technology Editor

Segment Leaders

Christian Ruoff

Charles Morris

Jeffrey Jenkins

Joel Franke

Mark Rogers

Greg Schulz

Graphic Designers

Tomislav Vrdoljak

Contributing Writers

Jeffrey Jenkins

Charles Morris

Christian Ruoff

Jonathan Spira

John Voelcker

Cover Image Courtesy of

Hyundai Motor America

For Letters to the Editor, Article Submissions, & Advertising Inquiries Contact: Info@ChargedEVs.com

Special Thanks to

Kelly Ruoff

Sebastien Bourgeois

ETHICS STATEMENT AND COVERAGE POLICY

AS THE LEADING EV INDUSTRY PUBLICATION, CHARGED ELECTRIC VEHICLES MAGAZINE OFTEN COVERS, AND ACCEPTS CONTRIBUTIONS FROM, COMPANIES THAT ADVERTISE IN OUR MEDIA PORTFOLIO. HOWEVER, THE CONTENT WE CHOOSE TO PUBLISH PASSES ONLY TWO TESTS: (1) TO THE BEST OF OUR KNOWLEDGE THE INFORMATION IS ACCURATE, AND (2) IT MEETS THE INTERESTS OF OUR READERSHIP. WE DO NOT ACCEPT PAYMENT FOR EDITORIAL CONTENT, AND THE OPINIONS EXPRESSED BY OUR EDITORS AND WRITERS ARE IN NO WAY AFFECTED BY A COMPANY’S PAST, CURRENT, OR POTENTIAL ADVERTISEMENTS. FURTHERMORE, WE OFTEN ACCEPT ARTICLES AUTHORED BY “INDUSTRY INSIDERS,” IN WHICH CASE THE AUTHOR’S CURRENT EMPLOYMENT, OR RELATIONSHIP TO THE EV INDUSTRY, IS CLEARLY CITED. IF YOU DISAGREE WITH ANY OPINION EXPRESSED IN THE CHARGED MEDIA PORTFOLIO AND/OR WISH TO WRITE ABOUT YOUR PARTICULAR VIEW OF THE INDUSTRY, PLEASE CONTACT US AT CONTENT@CHARGEDEVS.COM. REPRINTING IN WHOLE OR PART IS FORBIDDEN EXPECT BY PERMISSION OF CHARGED ELECTRIC VEHICLES MAGAZINE.

• Developed for Sintering of Power Modules to Cooler

• Precise Pressure Control

• Accurate Temperature Regulation

• Perfect Atmosphere Control

• Fully Automated Production

Many fear (and some hope) that the new world order will cripple or kill the EV industry, but we just don’t see it happening. If you could see our inboxes here at Charged, you’d be impressed with the ongoing explosion of innovation and entrepreneurship, which has so far shown no sign of slowing down.

We’ve been asking every EV industry exec we talk to about the new political climate, and while some are adapting their strategies (for example, electric truck maker Harbinger now guarantees its customers that, if tax credits for EVs are eliminated, the company will cover the price di erence), but none are planning to shut their shops and go home.

On the contrary, we’re seeing steady progress in all the areas of the EV industry that we cover, and some truly amazing developments coming in the near future.

e Tech: If even half of the developing technologies the engineers have been telling us about make it to commercialization, we’re going to be driving some spectacular vehicles in a few years. Sulfur-based batteries (Zeta Energy) could deliver huge reductions in price and environmental impact, and graphite made from forestry by-products (CarbonScape) could make supply chain woes a thing of the past. e shi from 12-volt to 48-volt electrical systems promises to reduce vehicle weight and cost, and enable exciting new features (see our feature article on TE Connectivity on page 32).

e Infrastructure: CPOs are tackling the reliability issues headon (ChargerHelp, FLO), while EVSE manufacturers build evermore-powerful hardware with new features designed to alleviate utility and supply chain bottlenecks (see our feature article on Power Innovations International on page 74).

e Vehicles are selling in record numbers and pushing into new markets. While OEMs continue to incrementally improve performance, the focus seems to have shi ed from increasing range (250 miles seems to be considered quite adequate) to expanding lineups to include more vehicle classes (more SUVs and pickups are in the pipeline), and more variants (read John Voelcker’s review of new “o -road” models from Hyundai and Ford, on page 48).

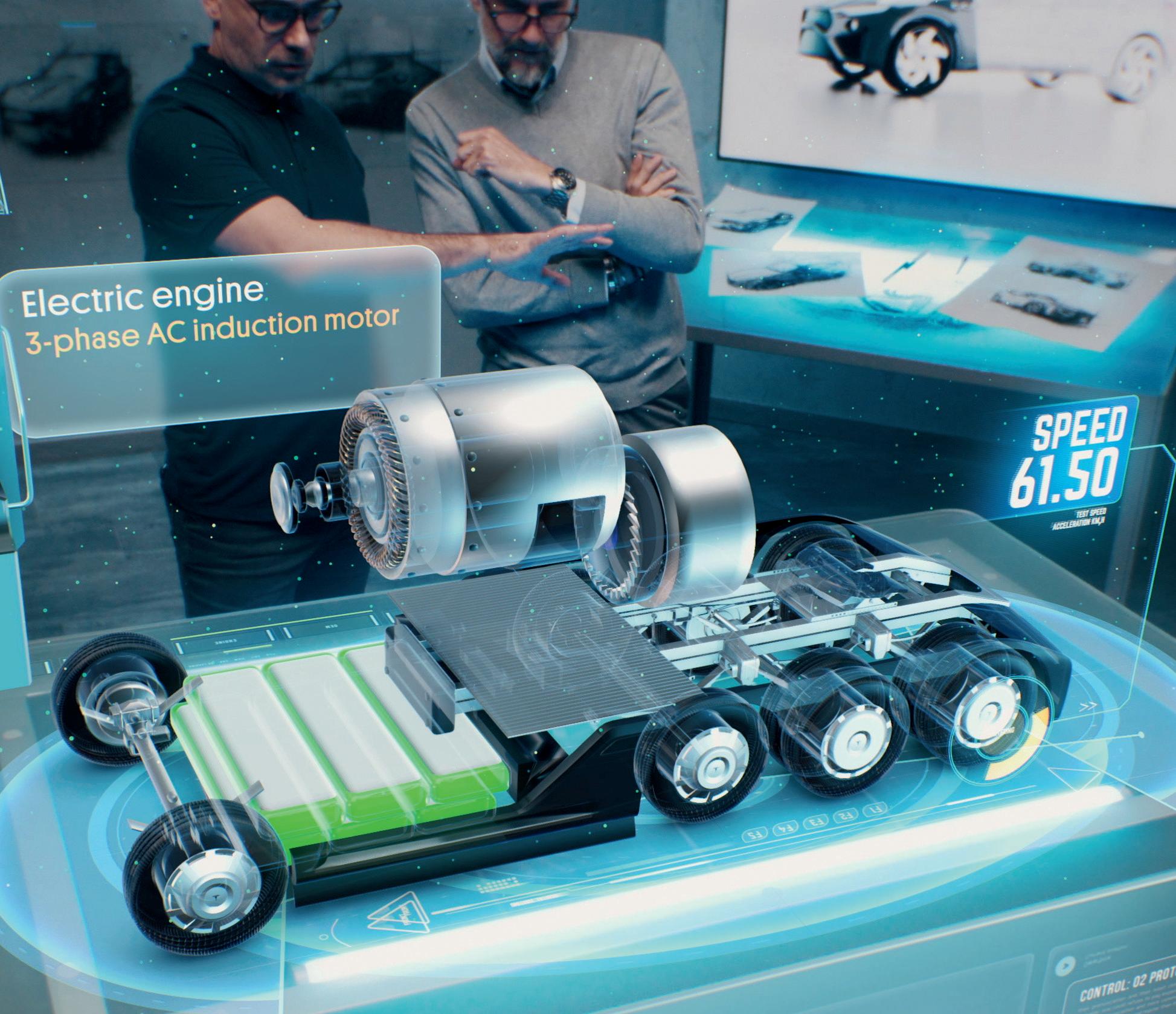

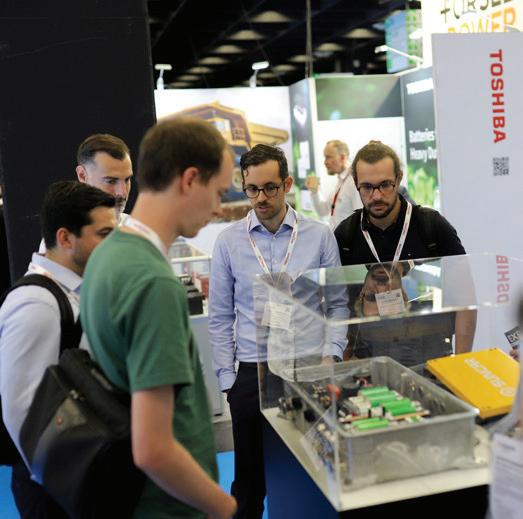

Meanwhile, as was obvious to anyone who attended the recent bauma show in Munich, o -road vehicles are electrifying at an impressive pace. Charged correspondent Greg Schulz was on-site in Germany to chronicle the rapid growth of electri ed technology in construction, mining and other heavy-duty machinery. Check out his coverage of o -highway EVs on our site: www.ChargedEVs.com.

Christian Ruoff | Publisher EVs are here. Try to keep up.

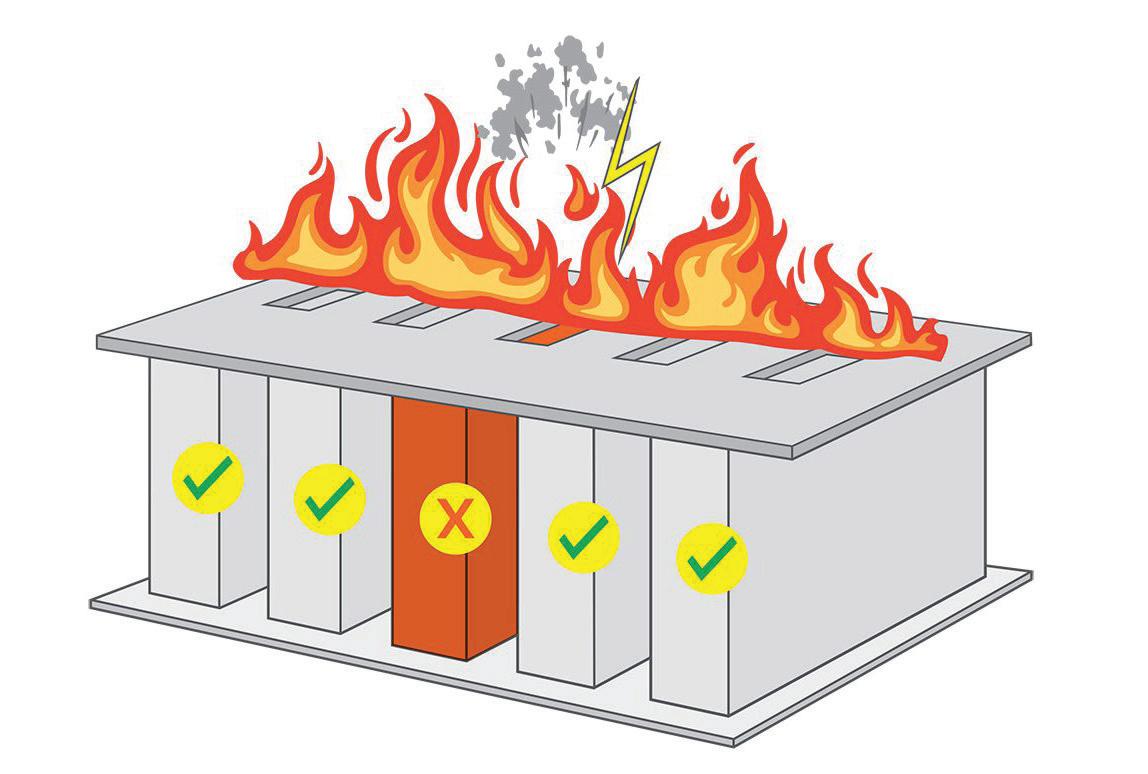

Avery Dennison Performance Tapes has introduced a new EV Battery Venting Materials Portfolio to help counter the risk of thermal runaway and increase safety in EV batteries. ese venting solutions include singleand double-coated anisotropic lmic tapes with proprietary re-barrier coatings and pressure-sensitive adhesives (PSA) for bonding.

EV battery manufacturers implement venting strategies at the cell, module and pack levels. e Avery Dennison battery venting tape solutions, when applied to module- or pack-level venting holes, provide quick burnthrough to facilitate venting via a channel. e opposite side provides extended ame resistance to prevent the migration of ames and hot gases into adjacent cells. e outer side of the lm will last less than 4 seconds under ame. e adhesive side will last longer than 15 seconds.

e combined ame retardancy is designed to counter the risk of thermal runaway.

“Our new venting solutions are engineered to provide di erential performance to ame exposure, which can lead to very elegant emergency venting strategies,” said Max Van Raaphorst, Business Development Manager, eMobility, Automotive & Energy Storage, Avery Dennison Performance Tapes North America. “ ese unique tapes can be combined with a wide range of other thermal runaway mitigation materials to lead to ecient, space saving designs. As always, our goal is to help make EV battery packs more safe, e cient and easier to assemble.”

Global battery manufacturer SK On and Nissan have announced a new battery supply agreement that will support Nissan’s EV production in North America.

Under the agreement, SK On will supply nearly 100 GWh of high-nickel batteries to Nissan from 2028 to 2033. ese US-manufactured batteries will power Nissan’s next-generation EVs to be produced at its Canton, Mississippi assembly plant.

is production is expected to support 1,700 US jobs at SK On, and will involve a total investment of $661 million, including equipment purchases, in addition to Nissan’s $500 million in investments for EV production at the Canton Assembly Plant.

e partnership marks SK On’s rst supply agreement with a Japanese automaker. SK On, a subsidiary of South Korea’s SK Group, currently operates two battery plants in the US, and is building four additional plants with partners. Once fully operational, SK On’s annual US production capacity is expected to exceed 180 GWh.

“ is agreement underscores the strength of our battery technology and our growing presence in the North American market,” said Seok-hee Lee, SK On President and CEO. “Leveraging our production footprint and expertise, we are committed to supporting Nissan’s electri cation strategy.”

Nissan has announced plans to launch 16 new electried vehicle models over the next three years, including all-new EVs from its Canton assembly plant starting in 2028.

“ is agreement with SK On is a signi cant milestone for Nissan’s electri cation journey and supports further investment in US manufacturing,” said Christian Meunier, Chairman, Nissan Americas. “ rough this smart partnership with SK On, we can leverage their growing US production capacity to deliver innovative, high-quality electric vehicles.”

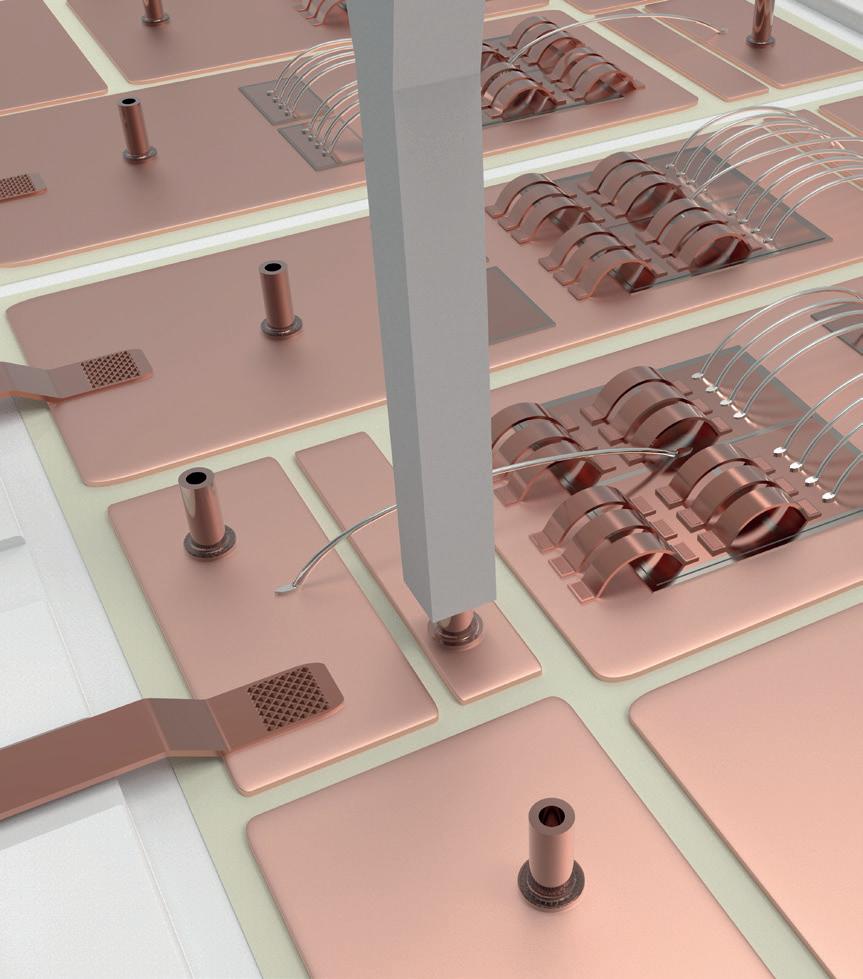

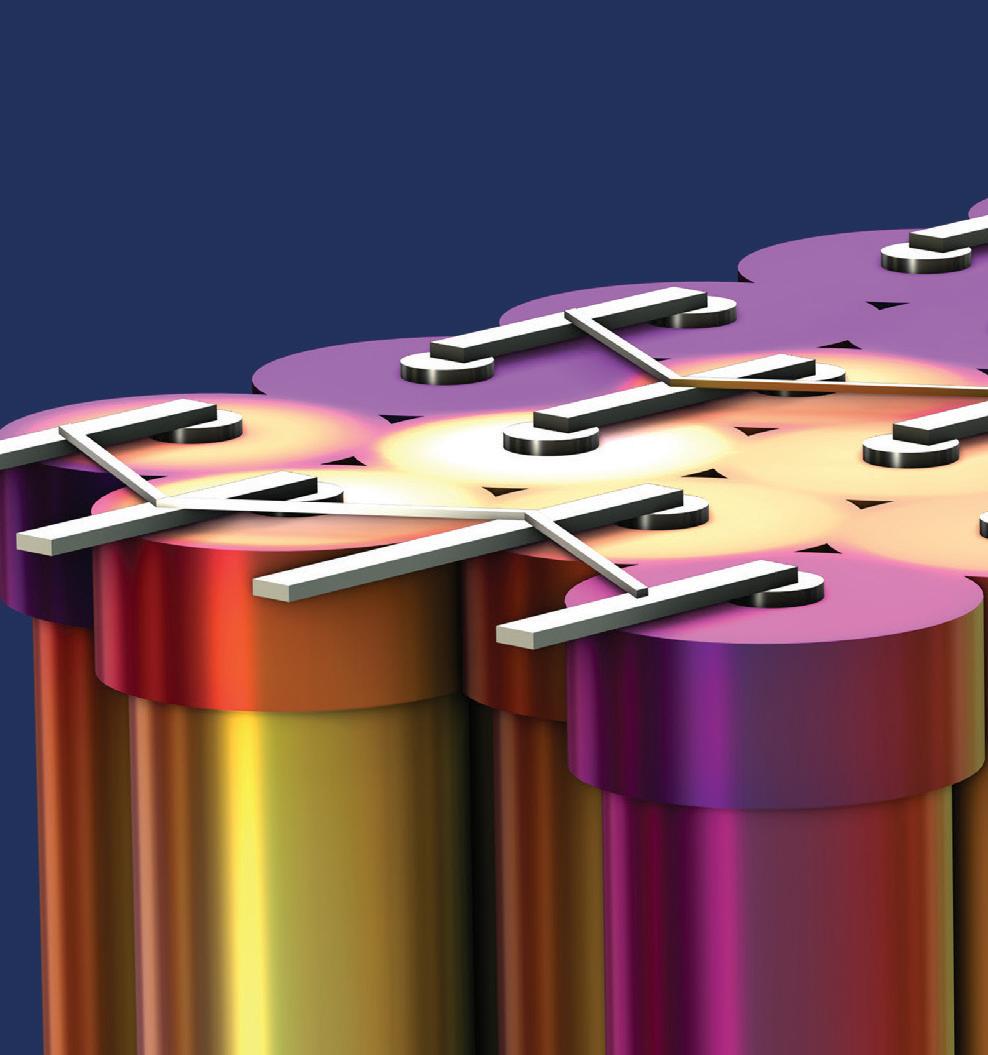

After acquiring the Italian Sovema Group, ANDRITZ Schuler is gradually establishing itself as a system supplier in the field of battery production. The first successful large-scale projects show that the strategy is working.

ANDRITZ Schuler reached an important milestone in its role as a supplier for gigafactories with the construction of a formation line for a prominent German battery cell manufacturer. Scheduled to begin production in May 2025, this line will produce around 80 cylindrical lithium-ion cells per minute. Beyond planning, manufacturing, and assembly, ANDRITZ Schuler oversees intralogistics, steel construction, and digital solutions, including track-and-trace functionality.

This recent expansion into battery cell assembly and formation aligns with a strategic initiative by ANDRITZ Schuler’s parent company, the ANDRITZ Group. With seven targeted growth projects, the aim is to support battery manufacturers in producing competitive batteries in Europe and America. The first major step in this strategy was the acquisition of Italy’s Sovema Group in August 2022.

Sovema has a decade-long reputation in lithium-ion battery systems for pilot and laboratory settings, in addition to its global leadership in turnkey systems for mass-producing lead-acid batteries. Its U.S. subsidiary, Bitrode, further complements this expertise with equipment and specialized knowledge in battery testing of cells, modules, and packs.

Integrating Sovema’s capabilities, ANDRITZ Schuler now covers the complete production process for battery cells, including notching, stacking, housing component manufacturing, electrolyte filling, formation, aging, and sealing. ANDRITZ Schuler’s existing technological strength in battery cell housing production, initiated in 2015, further enhances its capabilities. Recently, ANDRITZ Schuler delivered four fully automated production lines for cylindrical cell housings to renowned automotive companies in Germany and the USA. Another production line for prismatic housings was delivered to Hungary, operating at 100 housings per minute.

Additional expertise from within the ANDRITZ Group significantly boosts ANDRITZ Schuler’s competitive position. ANDRITZ

has been manufacturing centrifuges for lithium mining since the 1960s and provides essential filter and drying systems for cathode material powder processing. The group also has substantial knowledge in calendering processes and battery recycling, specifically in dismantling, deep discharge, and recycling, critical as electric vehicle waste increases.

In November 2022, ANDRITZ Schuler secured an order from the Fraunhofer Research Institution for Battery Cell Manufacturing FFB in Münster, Germany, to design a cell assembly line for large-format pouch cells. Another significant ongoing project involves constructing a pilot assembly line for advanced solid-state battery cells for a major German automotive manufacturer. Solid-state batteries offer substantial benefits, including enhanced safety, higher energy density, extended vehicle range, and shorter charging times. The turnkey facility for this project is also due for completion in May 2025.

Ray Xin Wang, Head of ANDRITZ Schuler’s Battery Giga Projects unit, addressed the current market slowdown, noting a period of disillusionment in battery market expectations based on present electric car sales figures. However, he predicts renewed demand growth and emphasized that ANDRITZ Schuler is leveraging this period to refine products tailored specifically for gigafactory demands.

Regarding competition from the Far East, ANDRITZ Schuler emphasizes innovation, quality, and efficiency. According to Wang, Schuler’s competitive edge includes advanced plant technology tailored for high-volume production. He highlights quality reflected in lower rejection rates, significant energy efficiency of nearly 90% through advanced formation electronics, and optimized plant footprints reducing operational costs.

Finally, Wang stresses the strategic advantage of ANDRITZ Schuler’s local European service model, offering assembly, onsite setup, and reliable after-sales support, ensuring continued productivity and availability for European battery manufacturers.

Proventia, a supplier of emission control systems, thermal insulation components and batteries, has introduced its new Proventia Energy LFP-based battery pack.

Lithium iron phosphate (LFP) technology is a good option for heavy machinery due to its cost e ciency and long lifespan, the company said. e high-energy, high-voltage battery systems are suitable for continuous operation over extended periods.

“ e bene ts of this new product are remarkable, from exceptional engineering to high-quality European origins,” the company said, referring to its use of cells from Morrow Batteries, a Norwegian cell producer.

Proventia explained that the LFP chemistry inside the battery pack “delivers consistent energy,” making it well-suited to applications such as heavy work machines, wheel loaders and tractors, among others. It can be incorporated within either an electric installation or a hybrid installation.

In addition, the Proventia Energy battery pack supports more cycles, over 6,500 charges, and operates throughout a wider temperature range, -20° C to +55° C, than the company’s lithium titanate oxide (LTO) batteries. e LFP battery packs can utilize the full capacity of the battery, Proventia said.

e LFP technology in Proventia Energy battery packs is also more environmentally friendly than LTO technology, the Finnish company said, because it does not contain nickel, cobalt or manganese.

Lithium Americas has received a strategic investment of $250 million from funds managed by Orion Resource Partners, a global investment rm focused on metal and materials projects, for the development and construction of Phase 1 of the acker Pass lithium project in Humboldt County, Nevada. e target for completion of acker Pass Phase 1 is late 2027.

Orion has entered a production payment agreement in which it will pay Lithium Americas $25 million in exchange for payments corresponding to the minerals processed and gross revenue generated by acker Pass.

In addition, Orion has signed a non-binding agreement to evaluate the potential to support up to $500 million of nancing for the construction and development of Phase 2 of the project.

Lithium Americas expects that the investment will satisfy all remaining equity capital fundraising requirements under a previously-announced $2.26-billion DOE loan. e investment positions the company to be fully funded for the duration of construction. It expects to start drawing on the DOE loan during the third quarter of 2025.

“Orion is excited to make this strategic investment in Lithium Americas to support the development of a domestic lithium supply chain to meet the rising demand across industries,” said Oskar Lewnowski, Orion’s founder and Group CEO.

Battery manufacturer LG Chem plans to start mass production of precursor-free battery cathode materials in South Korea in the rst half of this year.

LG Chem produces its LG Precursor Free (LPF) materials by directly calcinating custom-designed metals without precursors, improving power performance at low temperatures and shortening development time.

e company plans to expand LPF technology applications across new products, providing customers with di erentiated, customized options.

LG Chem is also introducing next-generation materials, including safety solutions like Nexul (aerogel thermal barrier), ame barrier foams and ame barrier sheets, which prevent or delay res and limit thermal propagation in batteries. It also produces cables and housings for EV chargers and cathode materials for dry electrode and solid-state batteries.

“We will actively target the future market with next-generation innovative materials for batteries, such as LPF cathode materials and safety solutions,” said Shin Hak-Cheol, CEO of LG Chem.

Multiphysics simulation helps in the development of innovative battery technology by providing insight into mechanisms that impact battery operation, safety, and durability. The ability to run virtual experiments based on multiphysics models, from the detailed cell structure to battery pack scale, helps you make accurate predictions of real-world battery performance.

» comsol.com/feature/battery-design-innovation

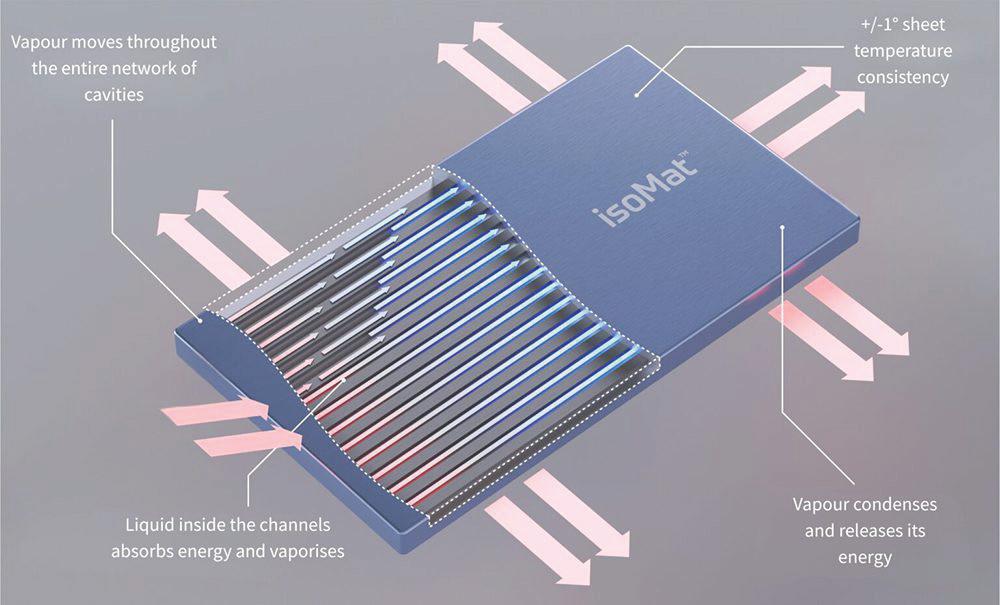

UK-based technology startup Flint Engineering has unveiled IsoMat, which aims to reinvent traditional heat pipe technology through a at aluminum sheet design, featuring an internal network of sealed channels.

When exposed to temperature di erentials, the liquid within the channels undergoes a rapid cycle of evaporation and condensation, resulting in near-instantaneous heat transfer across the entire surface. is enables thermal energy transfer approximately 5,000 times more e ciently than copper or aluminum alone, according to the company.

When incorporated into battery pack casings, IsoMat distributes thermal energy evenly, maintaining batteries at an optimal 25° C (±1° C).

“We’re seeing unprecedented interest across the construction, electri cation and refrigeration sectors—yet these industries represent just a snapshot of the potential for this game-changing innovation. Commercial deployment is scheduled for this year, and we’re preparing to engage with venture capital communities. We’re actively seeking partnerships and welcome ideas from companies across all sectors,” said Mark Robinson, CEO of Flint Engineering.

Renesas has introduced a new automotive-quali ed Bluetooth chip that combines a radio transceiver, an Arm M0+ microcontroller, memory, peripherals and security features in a compact system-on-chip (SoC) design.

e DA14533, the rst device in the company’s Bluetooth Low Energy SoC range quali ed for automotive applications, includes advanced power management features to simplify system integration and reduce power consumption.

e SoC can operate in an extended temperature range from -40° C to 105° C, allowing developers to incorporate it into applications from tire pressure monitoring and keyless entry to wireless sensors and battery management systems. Quali ed against Bluetooth Core 5.3 speci cations, the device also contains security features to safeguard connected devices from various threats.

e DA14533 includes an integrated DC-DC buck converter, which accurately adjusts the output voltage according to system requirements. According to the company, active system power consumption is lower than that of comparable devices in the market, requiring only 3.1 mA during transmission and 2.5 mA during reception. In hibernation mode, the current drops to 500 nA. is helps extend the operational life of small-capacity battery-powered systems and meets the stringent power requirements of tire pressure monitoring systems. A single external crystal oscillator (XTAL) is used for active and sleep modes, eliminating the need for a separate oscillator for sleep mode. e SoC is available in a compact WFFCQFN 22-pin 3.5 x 3.5 mm package and o ers a low engineering bill of materials, integrating into space-constrained systems, reducing overall system costs and accelerating time to market.

e DA14533 is now available along with a Bluetooth Low Energy SoC Development Kit Pro. e kit includes a motherboard, a daughterboard and cables to facilitate application so ware development. e daughterboard is also available by itself to simplify development.

Germany-based dSPACE, a provider of automotive simulation and validation solutions, has released its XSG Power Electronics Systems so ware to support the simulation of highly dynamic switching frequencies of up to 500 kHz.

e so ware for hardware-in-the-loop tests contains a library with ready-to-use models of power electronics circuitry so that users can create their simulations quickly and easily.

XSG PES supports highly dynamic circuitry simulation based on wide-bandgap semiconductors such as silicon carbide (SiC) and gallium nitride (GaN), enables fault simulation in semiconductors and circuitry, making it possible to generate easily reproducible results and to test thermal overload or arcing without risk.

“With XSG Power Electronics Systems, we support the development of the most advanced power converters, which are becoming ever smaller, faster and more powerful,” said Julian Saele, Product Manager E-Mobility at dSPACE.

Lithium-ion battery systems manufacturer Electrovaya has closed a loan of $50.8 million with the Export-Import Bank of the United States to expand its battery-manufacturing capabilities.

e company plans to expand its facility in Jamestown, New York, using the funds. Jamestown’s history as a thriving industrial area in the 20th century is well known, as is its connection to the legendary comedienne Lucille Ball, who was born there in 1911.

Electrovaya plans to manufacture its In nity lithium-ion ceramic cells, which it says o er “industry-leading longevity and safety,” in Jamestown. e battery facility will add approximately 250 jobs to the area, and the company will export its products to Canada, Japan and Australia.

e loan calls for using $46.4 million for lithium-ion cell, module and battery pack manufacturing and $5.3 million for construction and engineering, the company said.

e In nity line of cells, according to Electrovaya, is made using unique ceramic composite cell separator materials that provide the safest cathode combination of nickel-manganese-cobalt. e company promises “extraordinary safety characteristics achieved through a thermally stable full ceramic separator.”

e combination of the EXIM funding with the company’s $20-million BMO credit facility and $12 million in equity capital from December 2024 gives Electrovaya over $80 million at its disposal to fuel its expansion in New York.

Testing by UK defense technology company QinetiQ indicates that lithium manganese iron phosphate (LMFP) cathode active material developed by UK battery materials producer Integrals Power could increase EV range by extending the useable capacity of the battery under high discharge conditions.

Conventional lithium iron phosphate (LFP) chemistries experience a reduction in useable capacity when the battery is operated at in high-discharge conditions, such as prolonged periods of highway driving or in high-power applications such as electric mining vehicles. QinetiQ’s testing demonstrated that the LMFP cells retain a higher percentage of their nominal capacity than LFP under these conditions.

QinetiQ manufactured and tested prototype LMFP pouch cells using the new material and standard commercial-grade graphite anodes and liquid electrolyte that retained 99% of their original capacity at 2 C (30 minutes discharge time), and 95% at 5 C (12 minutes discharge time). Even at 10 C capacity retention was 60%. Each cell was tested at an electrode loading of 2 mAh/cm2

QinetiQ’s assessments follow other third-party testing last year that showed Integrals Power had achieved the breakthrough of incorporating a manganese content of 80% and delivering nearly 150 mAh/g speci c capacity, while overcoming the reduction in energy density that typically occurs at such high levels.

e LMFP used in the tests is one of 25 cathode active materials that Integrals Power is developing at its UK facility, which includes a pilot plant capable of producing 20 tonnes a year from high-purity raw materials rather than bulk precursors.

“Together with the proven energy density improvements of up to 20% compared to LFP unlocked by our 80% manganese content and higher voltage pro le of 4.1 V, we are able to demonstrate to our customers around the world that we can enable signi cant cost and weight reductions, and more compact, more sustainable and longer-lasting battery pack designs,” said Integrals Power founder and CEO Behnam Hormozi.

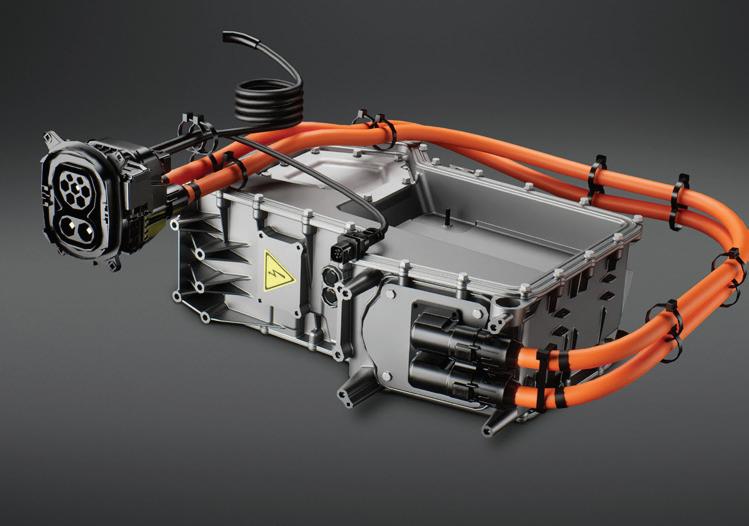

Electric bus OEM Scania has introduced several innovations to its battery-electric bus platform.

e company’s new e-machine now o ers four power options, as well as an integrated two- or fourspeed gearbox. An additional battery option has been added, and a new charging interface at the rear of the bus is designed to deliver faster charging.

Scania’s e-machine is an integrated compact drive device, consisting of electric motor, inverter, gearbox and oil system. e oil system includes two oil pumps, which cool the e-machine and lubricate the gearbox.

e new e-machine has several power options to choose from, in order to suit various operating conditions, giving it more exibility than the previous single power option. e customer can now choose among four di erent power options: 240 kW, 270 kW, 300 kW and 330 kW. e twoor four-speed gearbox improves the energy e ciency of the bus as well as its startability and acceleration, allowing it to move o smoothly and e ciently even under challenging conditions such as hills or heavy-duty operations.

Scania is also introducing a three-battery-pack option with 312 kWh of installed energy, as well as a second charging interface at the rear of its buses. e rear interface delivers charging power of up to 325 kW at up to 500 A, signi cantly higher than the current front charging position’s 130 kW and 200 A.

“We know that bus operators face the push-pull e ect of responding to emission regulations while striving to meet the speci c demands of electric operations. Power needs, exibility, charging time, energy e ciency and operational range are some of the key factors,” says Anna Ställberg, Head of Urban Solutions for People Transport Solutions at Scania Group. “ e new e-machine, battery and charging options are being introduced with our customers’ challenges in mind.”

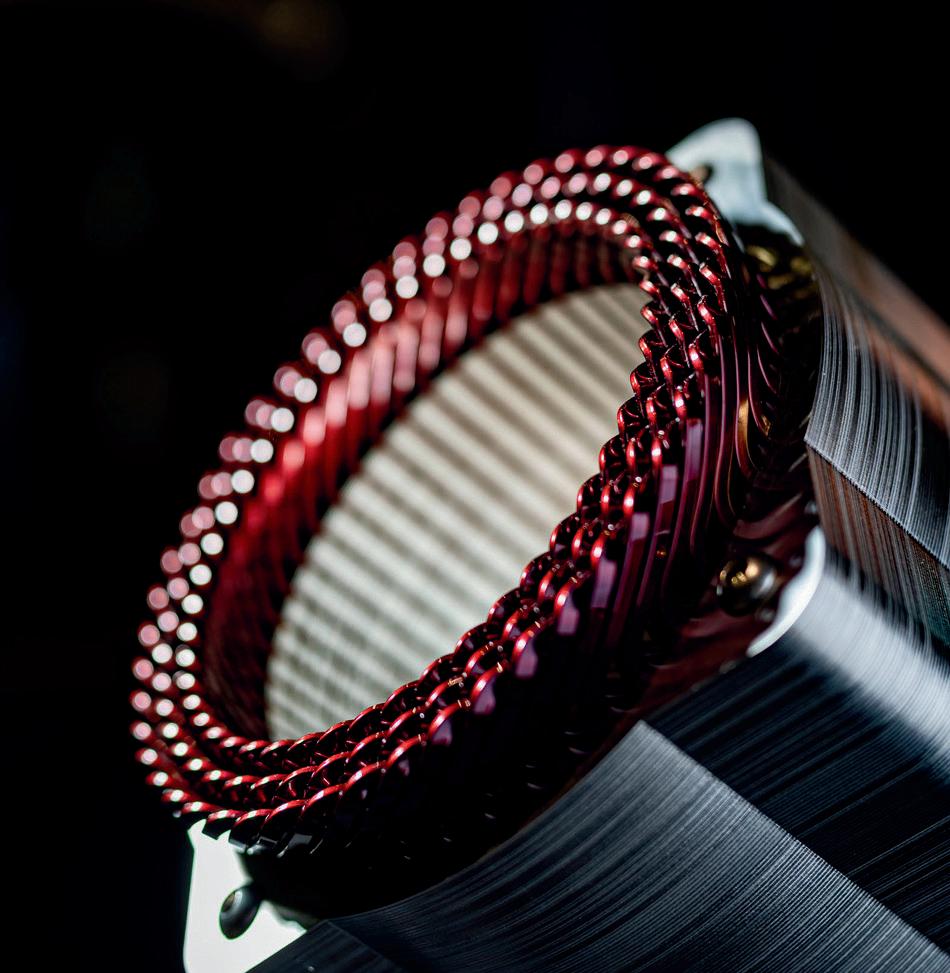

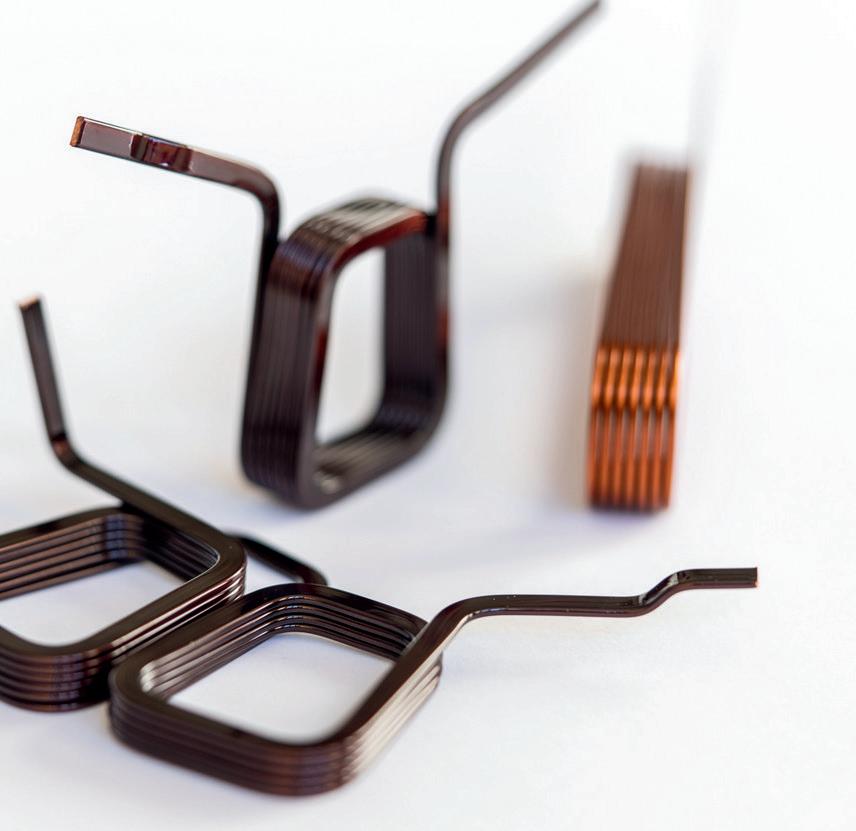

Engineering consulting company Ricardo has designed, developed and tested a prototype electric propulsion module, Alumotor, a synchronous reluctance motor that does not contain critical raw materials such as rare earths or cobalt.

Alumotor was delivered within Innovate UK’s funded consortium, led by Ricardo, which aims to address issues related to the environmental impact of materials for electric motors.

e motor uses aluminum hairpin windings, and the machine is oil-cooled to generate a power output of 214 kW and maximum e ciency greater than 92%, making it suitable for light commercial vehicles and o -highway applications. Full scalability also makes it suitable for other applications.

Dr Dragica Kostic-Perovic, Ricardo Chief Engineer responsible for the Alumotor project, said: “We are excited to be at the forefront of testing aluminum hairpin windings, and are achieving strong performance data that will support future go-to-market activities.”

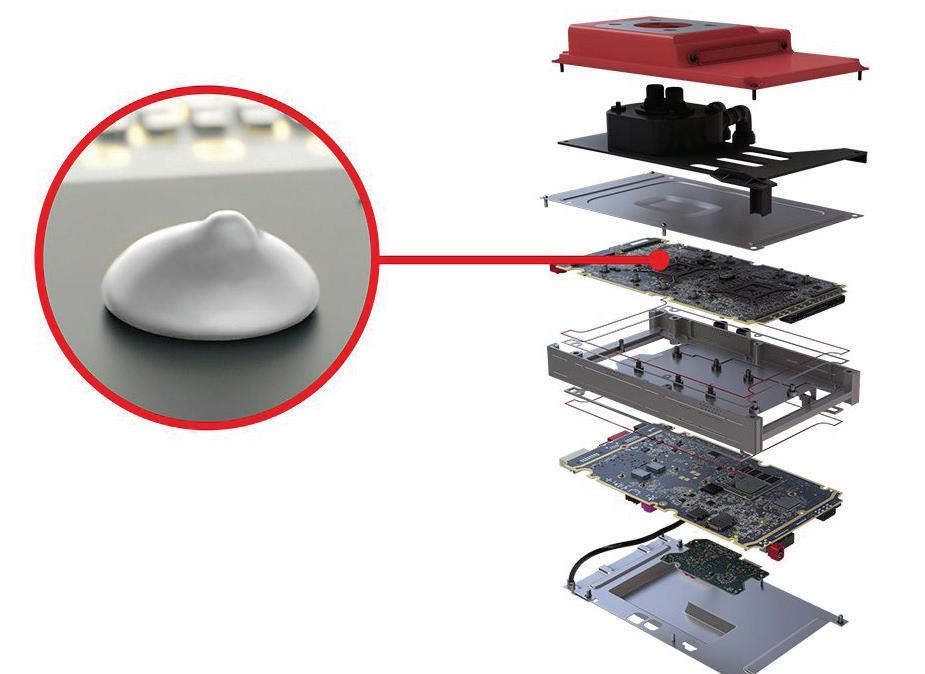

Henkel has launched its Bergquist Liqui Form TLF 6500 CGel-SF, which provides heat dissipation for autonomous driving systems. By delivering a higher level of conductivity, the thermal curable gel is designed to prevent performance degradation and protect the sensitive ADAS domain controllers that enable real-time vehicle decision-making from heat degradation and damage. As ADAS systems process higher volumes of sensor and vehicle data at higher speeds, e ective heat management will become critical to ensure the performance, reliability and longevity of these components, the company said.

e silicone-free thermal management material has a conductivity of 6.5 W/(m·K) and is designed to provide reliability and easier handling. As a cured elastomer, it o ers ultra-low compression stress to protect fragile assemblies and sensitive electronic components. It lls air voids and irregular gaps to ensure even heat transfer across the surface and can be dispensed at high speed to match with just-in-time manufacture processing.

e gel avoids cracking or thermal failure during thermal cycling, extending component lifespan. It protects operators at the production line and avoids fogging issues for components with lenses such as cameras.

Danfoss Power Solutions has launched a new heavy-duty LCL electric lter speci cally designed for o -highway applications. e Editron EC-LCL1200B electric lter is a compact yet robust mobile-grade solution for fully electric, high-power machinery that pulls power from the AC grid rather than batteries. Applications include drilling equipment, material handling equipment, grid-connected excavators and other tethered electric machinery. e LCL1200B lter is designed to be used with the EC-C1200-450-L electric converter. Together the two components create a grid connection. e EC-C1200 converts AC power from the grid to provide DC power for the machine, while the LCL1200B lter reduces electromagnetic interference, improving power quality and maintaining system reliability. e combination of components is bidirectional, so it can both take power from the grid and feed power back to the grid.

e LCL1200B electric lter is designed for machinery operating in demanding o -highway environments. Its robust design withstands high levels of mechanical vibration and shock, and its ingress protection ratings of IP6K9K and IP67 provide protection from moisture and dust. Danfoss points out that electric lters designed for stationary applications require additional measures to provide the same level of protection in harsh conditions.

Rated for up to 560 volts AC and 50/60 Hz, the LCL1200B lter is compatible with European and US three-phase power supplies. All components are rated for 300 ARMS and 250 kVA. e lter is designed for operating altitudes of up to 4,000 meters.

LION Smart and hofer partner to bring novel immersioncooled batteries to market

LION Smart, a subsidiary of battery pack manufacturer LION E-Mobility, has entered into a strategic partnership with hofer powertrain. e two companies intend to develop and commercialize immersion-cooled battery systems with high market potential.

e two companies mean to combine their strengths to bring new battery systems to market maturity. hofer powertrain contributes expertise in the development, validation and rapid implementation of battery systems tailored to speci c customer requirements. LION Smart complements this with its immersion-cooled battery technology, which boasts high thermal stability, improved safety and increased power density compared to current battery designs.

LION E-Mobility has a current annual production capacity of 2 GWh, and operates highly automated module assembly lines at its own production facility in Germany.

“With hofer powertrain, we have a strong partner by our side that perfectly complements our innovative strength. Together, we are accelerating the market entry of our highly innovative high-performance batteries and delivering pioneering solutions for sustainable mobility,” says Joachim Damasky, CEO of LION E-Mobility.

“hofer powertrain stands for innovation, speed, and precision in the development and industrialization of sophisticated drivetrain systems,” adds Johann Paul Hofer, CEO of hofer powertrain. “ e partnership with LION Smart builds precisely on this and opens up new possibilities to transfer cutting-edge battery solutions into industrial applications.”

By Je rey Jenkins

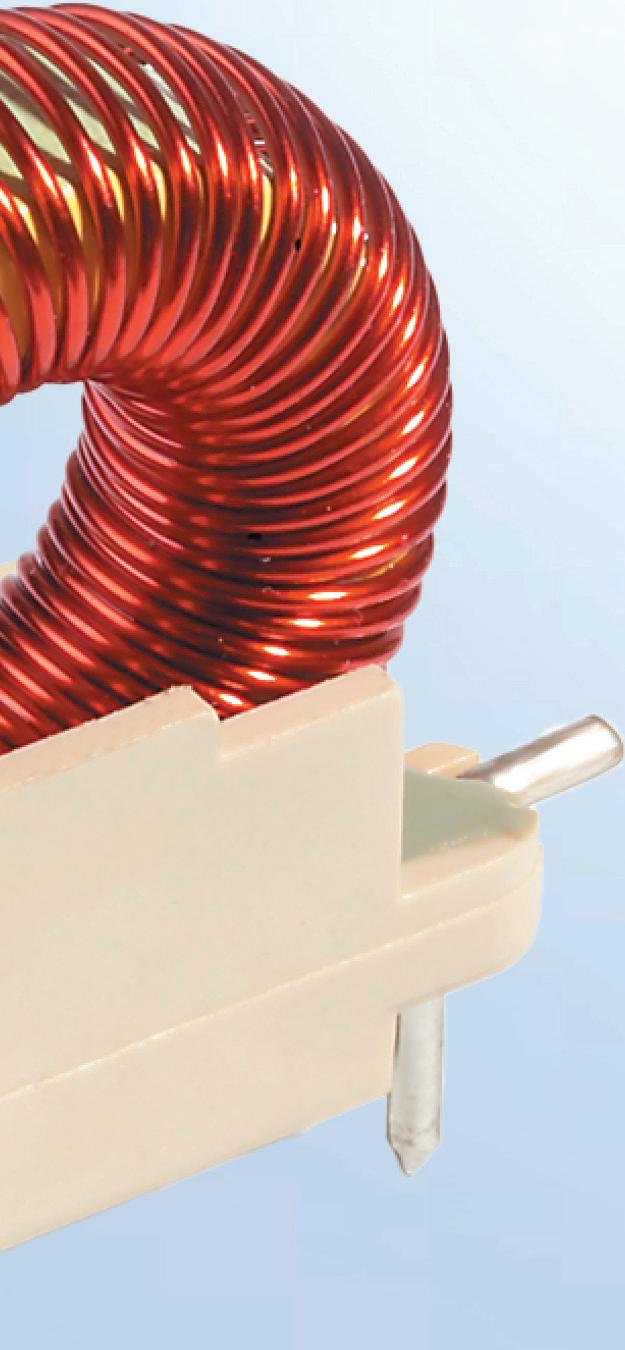

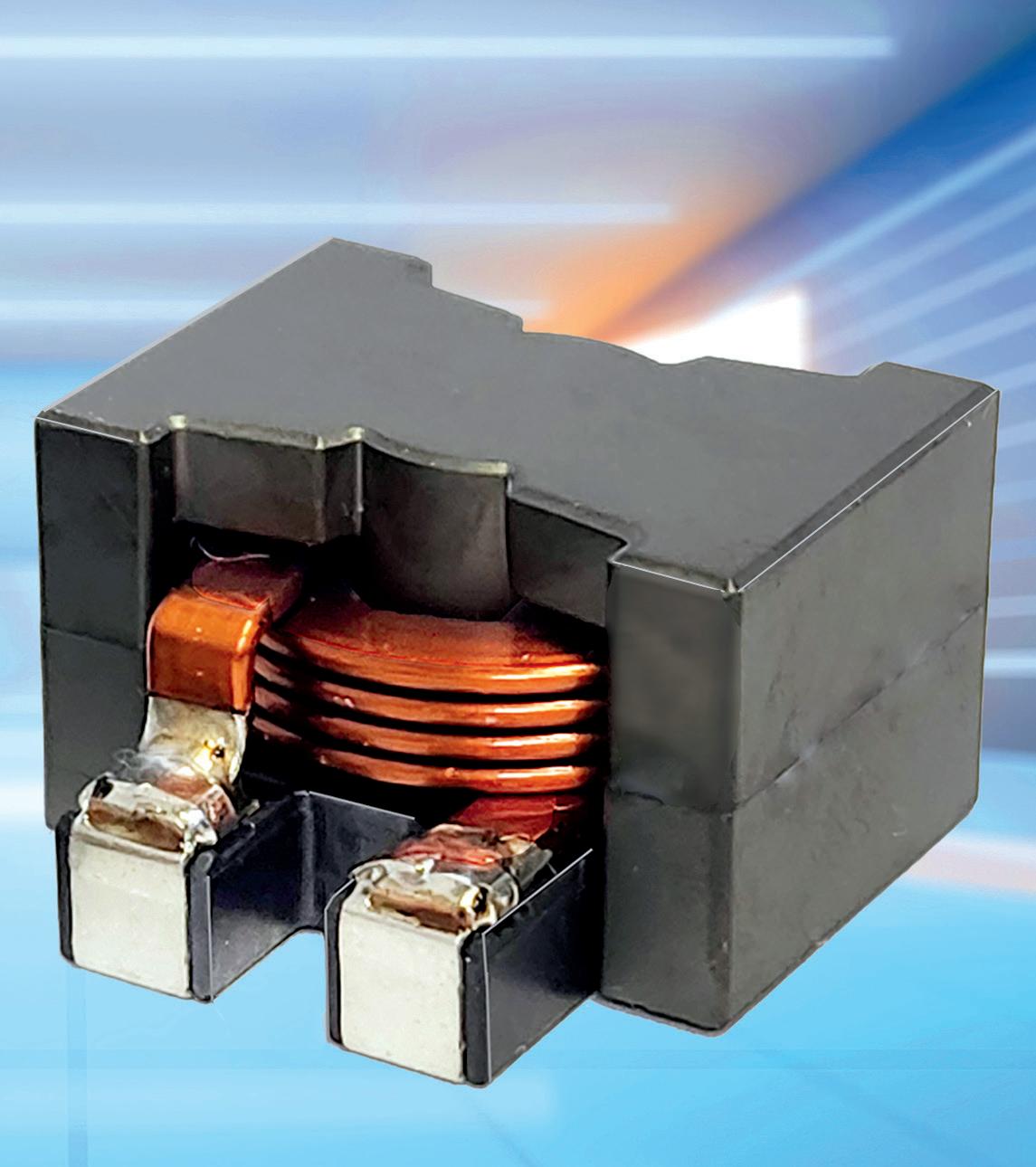

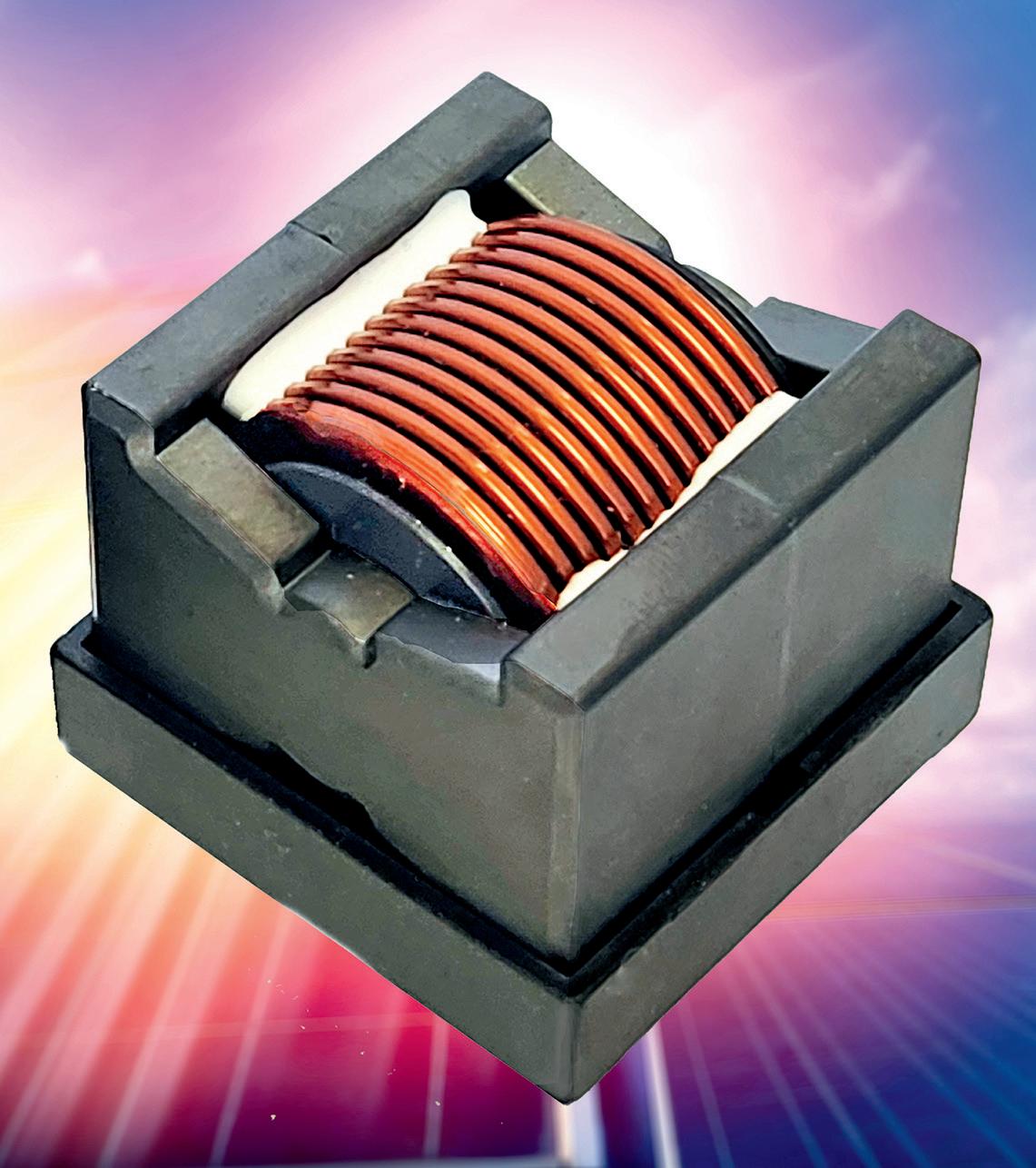

raction motors and transformers are the magnetic components that seem to get all the attention, but the humble inductor/choke is just as critical a component in modern power converters, and it has surprisingly profound e ects on performance, reliability and cost. Another temptation for the bewildered design engineer (or one that is just short on time—but isn’t that all of us?) is that there are numerous inductors/chokes available COTS (Commercially O e Shelf), which is generally not the case for transformers, and choosing a COTS part isn’t necessarily a bad option—specialist suppliers o er very high-quality magnetic components, and possibly for much less than a bespoke component, even in production quantities. However, that doesn’t absolve the design engineer from verifying the suitability of a COTS component in a given application, as the last thing you want is for a component you barely vetted to become an occult source of ine ciency, unreliability, or

TDK’s SMD high current fl at wire indu ors

The humble inductor/choke is a critical component in modern power converters, and it has surprisingly profound effects on performance, reliability and cost.

that most dreaded of outcomes: to cause the device to fail Electromagnetic Compatibility Compliance (EMC) testing.

While a choke is technically a speci c type of inductor (one that can handle signi cant DC bias before fully saturating), the term is frequently abused (e.g. the “common mode choke” found in pretty much all AC mains lters never sees DC, so it is not a choke). erefore, it’s probably best to treat the terms inductor and choke as interchangeable. at said, inductors are broadly used for three major functions in EVs: in conventional low-pass LC lter networks for producing (reasonably) clean DC outputs in switchmode power converters; in tuned (aka resonant) LC networks, either in explicitly-resonant converter topologies, or just to reduce losses during the switching transitions in PWM topologies (aka quasi-resonant or so -switching); and in EMI lters for blocking the emission (or reception) of radio-frequency noise. ese applications place very di erent demands on inductors, hence the earlier admonition that just because you can get one COTS doesn’t necessarily mean it will work all that well in the speci c part of the circuit you’ve dropped it into. e vast majority of inductors used in power converters, regardless of topology, will have a ferromagnetic core—that is, not be a simple coil of wire— and most of the time that core will be in a shape such that the magnetic ux from the windings can follow a completely closed loop (a toroid is the classic example here). e latter feature might not be necessary for the functioning of the circuit, but it is key if you want to pass EMC compliance testing, because any ux lines that don’t escape the core are bound to cause noise issues elsewhere. For example, the now-ubiquitous drum-core SMT inductors that might look ideal for use in low-power auxiliary converters don’t have a closed magnetic loop—the ux lines must pass through air to complete their circuit—which can turn these little devils into miniature “EMI cannons” (an actual sobriquet I’ve heard used to describe them). Choosing a core

Sumida’s magnetically shielded, fl at wire 300-volt SMD power indu ors

Sumida’s magnetically shielded 500-volt power indu ors

The edgewound flat wire construction is preferred at higher current ratings, especially at moderate switching frequencies under 150 kHz.

shape that closes the ux loop is only part of the battle, though, as other parameters and design goals are o en mutually exclusive, so compromise is inevitable. For example, core materials that are optimized for low AC losses (hysteresis and eddy) tend to have a lower saturation ux density, so will require more core area for a given inductance and power handling ability, which in turn increases the amount of stray capacitance, and so on. e main function of the series inductor in an LC output lter is to reduce the amount of AC ripple seen by the shunt capacitor that follows it without also being overwhelmed by the DC owing through it. is increases the importance of minimizing the DC losses of the windings over the AC losses of the same, and of the core. A single layer of conventional magnet wire (using

TDK’s automotive power-over-coax indu or

multiple strands in parallel if necessary to achieve the target current rating) will typically work well. Also possible (at the expense of higher stray capacitance) is the edgewound at wire construction—this type is preferred at higher current ratings, especially at moderate switching frequencies (under 150 kHz), though it tends to have a higher stray capacitance. As for the core itself, almost any “power material” will work here (as opposed to materials optimized for RF/tuned circuits or, worse,

EMI lters), as long as there is either an explicit or distributed air gap to prevent saturation from the DC bias. e gap is explicit (i.e. a literal gap) in ferrite cores, and cores with standard gap lengths are available COTS from most manufacturers, though there is little penalty in specifying a custom gap as long as you buy enough of them, and can wait to have them machined, as it takes diamond tooling to cut ferrite. Note, however, that a discrete gap will be a potent emitter of EMI, so it will almost certainly need to be shielded by the windings (at the cost of increased AC losses in them), hence the gap is almost always cut into the center leg of (for example) pot- or E-shaped cores; shimming the core halves might be ne for prototyping, but not for production. Cores using a mix of powdered metal and a binder typically have a distributed gap which can be adjusted by the manufacturer by varying the ratio of the two. As with ferrites, there are several standard gaps available (speci ed indirectly via the permeability), though here there is a much higher cost penalty for custom values, so one is strongly advised to stick with the standard o erings.

Inductors used in tuned (resonant) LC networks aren’t subjected to any DC bias, but are typically operated at much higher frequencies, that being one of the main goals of resonant (or quasi-resonant) operation, a er all. Consequently, rather more emphasis is placed on minimizing the AC losses in

Eddy current losses are a function of both core material and its construction—a higher bulk resistivity and a minimally thick dimension help the most.

both the core and the windings over simply minimizing the winding resistance, but with one major caveat: the circulating current in a fully-resonant converter operating near resonance will be considerably higher than the actual load current (several times higher, perhaps), so winding resistance shouldn’t be completely ignored. e core losses are the result of hysteresis, or the e ort expended in ipping the magnetic domains back and forth, and eddy currents, which arise from currents being induced into the core normal to the magnetic ux path. Hysteresis losses are entirely a function of the core material. Ferrite and low-mix powdered iron perform the best, as molypermalloy powder (MPP) and other powdered metal mixes trade higher losses for a higher permeability value and saturation ux density. Eddy current losses are a function of both core material and its construction—a higher bulk resistivity and a minimally thick dimension help the most. Of course, the lowest core losses result from having no core at all, and this might very well be an option at frequencies above 500 kHz or so, though if you don’t want this inductor to be an EMI cannon then it would still be best to make it toroidal in shape.

e winding construction for resonant inductors is rather more di cult to optimize from a losses-vs-costs perspective, because the common and low-cost technique of twisting together several smaller magnet wires to get the necessary current rating might not perform nearly so well in a resonant application due to skin and proximity e ects. Skin e ect is a phenomenon in which eddy currents induced into a wire by the very high-frequency current it is carrying force said current into a ring, with no current owing in the center, and this e ect scales with the square root of frequency and the square of the diameter. For example, the maximum frequency a #18 AWG wire (~1 mm diameter) can car-

ry before skin depth starts to a ect it is ~17 kHz, and this drops to a mere ~4.2 kHz for #12 AWG (~2 mm diameter). A huge number of strands will be needed to minimize skin e ect losses above 200 kHz or so, but unless each strand spends the same amount of time (so to speak) facing the core and the wiring surface, proximity e ect starts to dominate the losses (this is basically skin e ect arising from the magnetic elds from adjacent winding layers). Both skin and proximity e ects can be alleviated with Litz wire, which consists of many (up to hundreds!) of individually insulated strands that are woven in such a way that each of them continually changes its position between the center and the perimeter of the wire. ere are practical limits to how far this concept can be taken, however, as the cost of Litz goes up with strand/bundle count, while the individual strands will become too small to withstand the weaving and bundling process at some point (the usual cuto is around #44 AWG). ere are also more subtle reasons to keep the strand count down, such as an increasing ratio of insulation to copper, and the fact that proximity e ect happens between each strand and each bundle of strands (albeit not to the same degree as between actual winding layers). e upshot of all this is that it will o en be more economical overall to go up a step or two in core size just to reduce the number of turns required to achieve the target inductance, and especially to keep all the turns in one layer (which also dramatically reduces the stray capacitance of the winding). Even so, operation at >200 kHz or so will almost certainly require Litz, so budget for that cost increase accordingly.

e nal application for inductors is EMI/noise ltering, and here high AC losses in both the winding and core are more of a feature than a bug, and going with a COTS component might be the best choice. If you are rolling your own—or just to better select a COTS component—then minimizing the stray capacitance of the winding is a relatively higher priority than anything else, as this capacitance is a prime vector for high-frequency noise to bypass the inductor, defeating its very purpose. A single layer winding with a single magnet wire of appropriate gauge for the current is the preferred construction here. If the EMI lter inductor will have to carry considerable DC or low-frequency (i.e. mains) AC current for its size—and this could be on the

It will often be more economical overall to go up a step or two in core size just to reduce the number of turns required to achieve the target inductance, and especially to keep all the turns in one layer—which also dramatically reduces the stray capacitance of the winding.

Coilcra ’s SPT surface-mount toroidal power indu ors

order of a few mA for a signal-level inductor—then the same design guidelines as explained above for DC-biased chokes will apply, though with much more emphasis on employing a closed-form core shape so that these lter chokes doesn’t become impromptu EMI cannons. RF noise typically manifests on all wires passing through an enclosure, so common-mode ltering will be more e ective than individual lters for each power and signal line (i.e. in normal or di erential mode). is is most easily achieved by putting all of the windings for a related group of wires—including their ground return—on a single core (e.g. the AC mains power inlet, signal lines to the motor encoder, throttle pot, etc). e windings will appear in series for common-mode current, but almost disappear for normal-mode current. e latter could be a minor issue in that some inductance may still be desired for di erential-mode ltering, in which case purposefully constructing the windings to have high leakage inductance (e.g. by physically separating them) will prove benecial. e ubiquitous toroidal common-mode choke found in practically every AC mains lter embodies all

SCHURTER’s 800 VDC current-compensated oke

of these principles—the toroidal core is a closed form, so it emits almost zero EMI, and the windings consist of a single layer of a single magnet wire wound on opposite sides of the core, resulting in high AC losses, the minimum possible distributed capacitance, and relatively high leakage inductance, with some di erential-mode ltering thrown in for free. Most COTS common-mode chokes will already be listed/approved with the relevant safety agencies as well, making them an even more compelling choice over bespoke components.

Q&A with measurement engineering experts Coty Harrison and Cristian Loris of Yokogawa Test&Measurement

By Chri ian Ruo

The right tool to measure power in complex EV systems is a purpose-built power analyzer that captures three core parameters—voltage, current and power.

When tasked with measuring the electrical power of complex systems such as EVs, an inexperienced engineer may rst reach for general instrumentation like oscilloscopes, data acquisition (DAQ) systems and digital multimeters (DMMs). While these instruments serve useful roles in electrical testing—oscilloscopes analyze time-dependent signals, DAQs handle large-scale data, and DMMs focus on fundamental electrical measurements—they are not suited for making traceable and accurate electrical power measurements.

All three general tools su er the same shortfalls—they are not designed to measure power accurately, but rather to accurately measure DC or, in some cases, clean AC RMS. Using oscilloscopes, DAQs and DMMs to measure power could compromise product design by creating signi cant (o en invisible) measurement errors.

e right tool to measure power in complex EV systems is a purpose-built power analyzer that captures three core parameters—voltage, current and power—as well as a few very important additional parameters (depending on what system you are testing) that contribute to understanding the e ciency and overall system performance.

To learn more about purpose-built power analyzers, Charged recently chatted with measurement engineering experts Coty Harrison and Cristian Loris of Yokogawa Test&Measurement. Founded in 1911, Yokogawa is a global company that provides a range of products that measure electrical and optical signals and other critical engineering parameters. The company’s systems are used across industries including energy, manufacturing, and increasingly EVs and renewable energy.

For EV applications, it’s no longer a want but a need for a power analyzer to support sampling rates up to 10 megasamples per second (MSps) per channel.

Q Charged: Can you give us a high-level explanation of why purpose-built power analyzers are critical in EV system development?

A Coty Harrison: In EV applications, measurement accuracy must be reliably maintained across a range of frequencies and conditions, so it’s critical that you have a system that captures many di erent elements and channels.

For example, in developing and testing a new EV traction motor design, you need a system that enables engineers to comprehensively measure electrical parameters as well as mechanical parameters like speed and torque.

For EV power measurements, signal conditioning is crucial to reduce noise and maintain signal integrity, especially in high-power systems.

Accuracy becomes especially important during validation, as manufacturers must ensure their products meet stringent e ciency and performance benchmarks before production or delivery to customers. As EVs gained traction and competition increased in the market, engineers began developing more innovative and complex designs, which meant more complicated measurements. For example, we designed our newest power analyzers to provide precision with an error margin as low as 0.03%. is means manufacturers can con dently verify e ciency gains in the 1-2% range, which is critical for competitive advancements. New materials like silicon carbide (SiC) and gallium nitride (GaN) allow higher switching rates, so instruments also evolved to meet increasingly demanding switching requirements. For EV applications, it’s no longer a want but a need for a power analyzer to support sampling rates up to 10 megasamples per second (MSps) per channel. And when you combine that with 18-bit analog-to-digital (A/D) conversion, you ensure accurate data even under high-frequency conditions. is allows EV motor and inverter validation with e ciency measurements that di erentiate between real gains and measurement inaccuracies—vital for performance tuning in automotive.

Q Charged: Can you expand on the example of EV traction motor design? How exactly is a purpose-built power analyzer used to improve the end product?

A Cristian Loris: E ciency directly impacts the range of EVs, which is a key factor for consumers. Small improvements in motor e ciency can signi cantly extend vehicle range and reduce energy consumption. Accurate measurements will optimize performance under various loads, and precision is especially critical when addressing complex drive cycle scenarios. It comes down to two key challenges. First is measur-

ing power to a known, traceable and guaranteed power spec, which isn’t possible if you are using instruments focused on DC specs or AC RMS. AC power—especially noisy switched power—requires integration at a high sample rate, consideration of line lters and zero crossings, etc.

e second challenge is that motors are an inductive load, which will always have some power factor that will further degrade measurement accuracy if you use general tools like oscilloscopes, DAQs and DMMs—as much as 30% or more.

Unlike general-purpose equipment, power analyzers will have dedicated algorithms optimized for traction motor applications, including power calculation over varying load conditions. For EV power measurements, signal conditioning is crucial to reduce noise and maintain signal integrity, especially in high-power systems. Also, purpose-built analyzers are designed to log data consistently over extended periods and o er traceable data records for certi cation purposes, which is important for EV powertrain testing that o en involves long-duration measurements.

A Coty Harrison: To elaborate on this example, a few key parameters need to be measured in traction motor development. e rst is powertrain e ciency, and those measurements require accurate voltage and current readings from the power supplied to the traction motor, both from the battery and the inverter.

e challenge here lies in measuring high-frequency switching waveforms accurately, as traction motors typically operate in dynamic conditions.

en there is the power factor, which impacts the energy transfer from the battery to the motor. Ensuring a higher power factor (as close as possible to the ideal unitary value) improves energy e ciency and reduces losses, and is therefore crucial to measure and control.

Also, harmonics and distortions in current and voltage waveforms lead to energy loss and may impact the performance of the EV motor. Power analyzers that can accurately measure harmonic content help engineers mitigate these losses.

Finally, torque and speed measurements are essential to assess motor output accurately.

Combining the accurate measurement of these parameters will provide engineers with a complete picture of a motor’s e ciency.

Tools that lack AC signal testing will struggle with measurements in dynamic EV conditions.

Q Charged: You mentioned the validation stage of the development process. Is that when power analyzers are mainly used?

A Cristian Loris: Yes, power analyzers are primarily used during the validation stage of EV systems to benchmark e ciency and ensure products meet performance expectations before moving into mass production.

A Coty Harrison: e validation phase includes the component level (i.e. chip makers), the initial system integration level (i.e. Tier 1 suppliers), and the production level (i.e. vehicle OEMs)—to make sure the full production process is working correctly. Generally, component manufacturers can use devices with lower accuracy (around 1%) while designing parts. And then before nalizing designs and shipping parts to customers, they will use power analyzers to benchmark the parts with extremely high accuracy. is is when they create a spec sheet for a part. Ballpark values are insu cient for this step. ey need to have exact power measurements.

Q Charged: What Yokogawa products do EV engineers typically use for power analyzing?

A Coty Harrison: Our Yokogawa WT series power analyzers are designed for this purpose. Unlike general measurement tools, our power analyzers provide both isolated voltage inputs and accurate current measurement capabilities, which are essential for accurately capturing cycle-by-cycle power metrics. Tools that lack AC signal testing will struggle with measurements in the dynamic conditions seen in EVs or other systems with shi ing power factors.

A Cristian Loris: As the automotive industry has embraced electri cation, we’ve added features like

support for multi-motor systems and faster sampling rates to handle higher switching frequencies.

Our WT5000 supports up to seven elements that provide accurate current and voltage measurements. Current sensing is performed using a shunt resistor with temperature and frequency compensation. For the evaluation of motor speed, torque and mechanical power, up to eight input channels (via two modules) are available, enabling the evaluation of four motor systems simultaneously.

Q Charged: Where are power analyzers used outside the EV Industry?

A Cristian Loris: While automotive applications are driving a lot of innovation in the space, our power analyzers are also widely used in industrial motor development, which consumes roughly 60% of global electricity. Enhancing e ciency in these systems has a massive impact on reducing energy usage and costs.

Q Charged: Can you tell us more about your roles at Yokogawa and how you help EV systems engineers?

A Coty Harrison: I’ve been with Yokogawa for eight years. I started as an application engineer, which is where most of our technical sta begin. Given the complexity of our test equipment, it’s important to gain hands-on experience. From there, I transitioned into technical sales and eventually became the North American Sales Manager for our test and measurement team.

A Cristian Loris: I also started with the application engineering team about two and a half years ago. ere, I helped integrate our products into customers’ testing setups, allowing me to see rsthand the industry’s challenges. Since then, I have transitioned into the role of Product Manager for our decarbonization and electri cation product portfolio, including our power analyzers for the EV market.

We work closely with EV systems engineers when they need help figuring out what testing products will work best for their specific applications, and then we help them customize and implement them into their processes.

By Charles Morris

Q&A with TE Connectivity’s Helio Wu and Pradeep Moorthy

Avehicle has always been more than an engine and a set of wheels. Lights, windshield wipers, heaters—these have been essential equipment since the days of hood ornaments, and over the years more and more accessories have come to be seen as indispensable. Power windows, power locks, cruise control, heated/cooled seats, and now infotainment systems and Advanced Driver Assistance Systems—the list grows longer every year. And of course, accessories include not only gadgets for the driver’s comfort, but also systems essential to the operation of the vehicle (e.g. in the old days, alternators and water pumps, nowadays battery management systems).

For decades, electrically-operated accessories have been powered by a 12-volt electrical system, and components, connectors and wiring have all been designed to operate on 12 volts. In recent years, as power demands have increased, automakers have been moving towards 48-volt systems. is is a trend that applies to all types of vehicles, but as TE Connectivity’s Product Manager Helio Wu and Senior Manager of Product Management Pradeep Moorthy explained to Charged, there are several reasons why the transition to EVs is accelerating the transition to 48 volts.

Q Charged: Why are automotive manufacturers shi ing to 48-volt architectures? What are the advantages?

A Helio Wu: e major driver is that power requirements keep increasing, and because of the higher power requirement, the current level keeps increasing as well. e higher current level requires wires with larger diameters, and that is creating a substantial challenge in wiring harness routing. Increasing voltage to 48 volts can reduce the electrical current by three quarters, assuming the same power requirement, and thus we can save a lot in both the wiring harness weight and cost.

Q Charged: If the power remains the same, then the wires can be smaller and lighter. But at the same time, we’re asking for more power. So, is there generally a net reduction in the size and weight of the wiring harness?

A Helio Wu: Yes. e power requirement is increasing, but it doesn’t increase by four times, so overall, we still can expect a lot of weight reduction and cost savings from this transition. Meanwhile, this transition will take place along with a transition to a zonal architecture. e zonal architecture itself can optimize the overall electric architecture in the vehicle and shorten the wiring

harness length, because previously automakers used a centralized star topology. Now it’s decentralized, and the power equipment is managed within the zones, so the total length is going to be reduced.

Q Charged: In a recent video from Rivian, their engineers explained that they were able to reduce the number of controllers and the vehicle weight signicantly, mainly because of the move to a zonal architecture.

A Pradeep Moorthy: I remember watching some videos recently about the things that Rivian’s doing in that space. What we are doing there is consolidating multiple controllers into one in each of the di erent zones of the vehicle, and we are packaging a lot more of the computing capabilities that were in multiple controllers into one—this drives up the power requirements for those controllers, which justi es the switch to 48-volt, so they de nitely are correlated. So, the shi to 48-volt enables the shi to the zonal architecture.

Q Charged: e transition to 48-volt is taking place across all types of vehicles, but tell us about how the rise of electric vehicles is speci cally driving the move.

A Pradeep Moorthy: e switch to 48-volt is not just for electric vehicles. e bene ts are shared regardless of what the propulsion mechanism is. On the EV side, though, there are a couple of speci c things. First, every kilogram you can shave o the weight of the vehicle is more valuable in an EV from a range standpoint, so EVs have more to gain from switching to 48-volt. Second,

Increasing voltage to 48 volts can reduce the electrical current by three quarters, assuming the same power requirement, and thus we can save a lot in both the wiring harness weight and cost.

younger OEMs that focus on EVs are more open to step changes in their architectures. With the switch to 48-volt, you do need to make a signi cant change because most devices throughout the vehicle need to be updated to work on 48 V rather than on 12 V. From an implementation standpoint, the way OEMs are structured today, the EV-speci c teams are better positioned to make that jump.

Helio Wu: ere’s also another reason why we see EVs leading this transition. An internal combustion engine not only drives the vehicle, but also provides power to many auxiliary applications. If we talk about EVs, all those applications traditionally driven by belts now become electric-driven, and they are power-hungry devices. And the more power-hungry it is, the more bene t we can expect if that application can be converted to 48-volt.

Q Charged: Obviously, OEMs that are more innovative, more forward-looking, are moving faster with

electri cation. Are those also the ones that are more interested in 48-volt?

A Pradeep Moorthy: Apart from an innovative mindset, organizational will to implement disruptive changes is necessary. A few OEMs leading the way on electri cation are better structured in that regard. But that’s not to say that the other OEMs are not interested—they are looking at ways to switch to 48-volt as well. e steps taken to switch and the timing will likely be di erent, though.

Q Charged: What are some speci c components we nd in EVs that are driving the move to 48-volt systems?

A Helio Wu: I can give you an example. Earlier this year I had a conversation with a customer engineer and he told me that for him, the biggest advantage from 48-volt is thermal management. In his next-generation vehicle, we have so many electronic components running at high power that if we do not increase the voltage level, the heat generation and the temperature would rise to a level that is unmanageable. Switching to 48-volt reduces the energy dissipation and the heat dissipation, so it can help reduce the temperature of those modules within the system. And it helps a lot in guaranteeing the longevity of those devices, making sure they can work properly through the vehicle life. We talk a lot about the wiring harness weight and cost savings, but reduced heat generation is another major bene t that the OEMs can get from this transition.

Q Charged: Tell us more about how a 48-volt system can improve energy e ciency, something very important for EVs.

A Helio Wu: It’s simple physics. When we talk about the energy loss dissipation in the wires, it’s W = I2 * R, right? Suppose we use the same wire, same wiring resistance. If we reduce the current level to 1/4 of the previous value, that means the energy dissipation can be reduced to 1/16. at’s a lot of reduction, and therefore we improve the energy e ciency and the power delivery e ciency in the vehicle system. is is a direct bene t.

In an EV all those applications traditionally driven by belts now become electric-driven, and they are power-hungry devices.

Indirect bene ts include weight reduction, so we can have a longer range.

Q Charged: Both 12 V and 48 V systems can coexist within the same vehicle, but will 12 V eventually be phased out?

A Helio Wu: I believe that 12-volt and 48-volt will coexist for a period, maybe three years, maybe ve years. Not everybody will be ready for 48-volt. at’s just a reality. Going forward, gradually suppliers’ readiness will be improved, and then eventually, I believe 12 V will be eliminated from the current low-voltage system, and 48 V will be the norm.

Q Charged: at sounds like a pretty quick transition. Within ve years, you say, everything’s going to be 48-volt?

A Helio Wu: at’s my hope, because we believe it will not only bene t the OEMs, but also provide more advanced functions to the end consumer so we can have more exciting vehicles.

Q Charged: Tell us about the role that connectors play in enabling the 48-volt architecture.

A Pradeep Moorthy: From a connectivity standpoint, it’s primarily about safety, when you go from 12 V up to 48 V. With the higher voltage, we want to make sure that there is su cient insulation between circuits and there are safety mechanisms in the vehicle architecture to ensure that people working on their vehicles are protected as well. What we are doing today is looking at our existing portfolio to see which products are already safe to be used in 48-volt applications. We are also building a whole new portfolio of connectors that are designed speci cally for use in 48-volt applications.

We believe that 12-volt and 48volt will coexist for a period, maybe fi ve years. Gradually suppliers’ readiness will be improved, and then 48 V will be the norm.

information from multiple sensors—it’s simple signals, but they also need to be able to communicate with other controllers and devices like cameras, so there’s highspeed data connections in there as well. We are working on a portfolio of what we call mixed and hybrid connections, which have signal, power, and high-speed data connections, all in a single connector.

Q Charged: What about wireless data? I’ve heard about wireless battery management systems. Is that a trend?

Q Charged: Will this eventually mean redesigning your product lineup?

A Pradeep Moorthy: Not necessarily all of it. I think it will be more of an evolution. e key things here are what we call creepage and clearance, which refers to the distance between adjacent circuits to provide su cient insulation and preventing any kind of arcing or current creepage. Because of how they were designed, higher-power connectors for 12 V happen to be safe for 48 V already, so there is a signi cant part of our portfolio that can be used in 48-volt applications without any changes. In the smaller end of our portfolio, where we have very low-power and signal applications today, those connectors tend to be optimized for 12 V applications, so they’re not ready to be used in 48 V applications. In those spaces we are developing new products to ll out the portfolio.

Q Charged: Some of these connectors are just powering devices, some of them are sending data, and some are doing both, right?

A Pradeep Moorthy: Yes, that’s right. Helio and I are both part of the Signal and Power Connectivity Group within TE’s automotive business, and that covers all our products up to 48 volts as an upper limit. e products within this portfolio historically were tailored speci cally for low-voltage power and signal connections, and then we have a whole other group of products that are speci cally designed for high-speed data. More recently, the lines between these di erent categories have started blurring. We have controllers now that are power-hungry, so they need high-power connections. ey bring in

A Pradeep Moorthy: We have seen them in speci c instances, but they’re not broadly adopted yet. Even in the battery example, the wireless connections are inside the battery pack, but there are still wired connections from the pack to the rest of the vehicle. If there are routing challenges, packaging space-related concerns, then it might make sense, and we’ll probably start seeing more wireless connections. But purely from a cost standpoint and from a security standpoint, implementing those will be hindered for some time to come.

Helio Wu: I also think the functional safety is another point to consider. Because the battery is such a critical module, we need some kind of redundancy. I think for wireless communication, maybe we need two connections—one wireless and the other using actual wire as a backup.

Q Charged: As auto manufacturers and suppliers move towards 48-volt architectures, what are the biggest challenges they are going to face?

A Pradeep Moorthy: As I said, an overall switch to 48-volt is still a monumental exercise to take on. ere are so many things, not just the connectors, but the devices within the vehicle, that have to be modi ed to accept 48 volts. Simply from a resource standpoint, there needs to be signi cant investment in making that switch. And there’s the classic chicken-and-egg problem—the OEMs are not willing to switch unless the suppliers are ready to support that switch to 48-volt with their devices, but the suppliers may not be willing to make that investment until the OEMs are ready to bring 48-volt vehicles to market.

A good rst step to overcome this challenge is the coexistence of both 12 V and 48 V in the short term. is will enable OEMs to use 48-volt for speci c applications which are particularly power-hungry, where they can get a signi cant bene t from copper reduction, thermal management and the di erent advantages that we spoke about, without necessarily changing every single device within the vehicle.

Q Charged: What’s an important piece of advice you would give to an automaker to help them more easily transition to 48-volt?

A Pradeep Moorthy: I’d say the most important thing is to keep the system-level bene ts in mind, and to communicate that e ectively to all levels. e switch from 12 V to 48 V does mean redesigning and replacing familiar devices and components. is could lead to higher costs at a component level, but we cannot lose track of the big-picture net savings.

Q Charged: ere’s also talk of a transition in the overall vehicle architecture from 400 volts to 800 volts. Does that have any relation to the 12 V/48 V transition, or are these two separate areas?

A Pradeep Moorthy: ey’re de nitely separate areas. e 400 and 800 V architectures are for EV powertrains. Helio and I are in the Signal and Power Connectivity Group, working with low-voltage applications that are non-powertrain-related, but TE Connectivity does o er connectivity solutions for both 400 and 800 V applications.

Q Charged: Some people nd it hard to understand why an EV still has an ordinary lead-acid battery. I try to explain to them that all the accessories are designed to run on 12 volts. Does the shi to 48-volt bring us closer to the day when that lead-acid battery can go away?

A Helio Wu: Yes. If in the future 48-volt becomes the single power source in the low-voltage system, then that 12-volt battery will go away.

Pradeep Moorthy: Right. But it’s important to remember that you’ll still have a second battery for 48-volt.

You’re not going to drive all the devices on the vehicle from the main traction battery, because there are still going to be applications in the vehicle that need to be running when the vehicle is turned o , and you do not want to be drawing power from the main battery all the time.

Q Charged: What’s the state of industry standards when it comes to the 48-volt transition?

A Helio Wu: Because this is a new transition, standardization is important as it helps everybody to scale up faster. And the earlier we can scale up, reach the higher operational scale, the better we can realize those economy-of-scale gains for everybody. at’s why TE has developed a standard interface for a 48-volt connection system, and we are actively working with di erent OEMs as well as device makers, to try to help everybody to connect the dots. at’s what we do, connectivity.

From my perspective, I think the standards have been well established, looking back several years, roughly from 2016 or 2017. At that time, 48-volt was also a hot topic, but in a di erent context.

At that time, people were talking a lot about 48-volt in mild hybrid vehicles because that is a low-cost entry point for vehicle electri cation. Still today we can see a lot of 48-volt mild hybrid vehicles in the European market or in Asia. Now the interest in 48-volt is being driven by the low-voltage architecture for powering accessories. However, due to the activity several years ago, we already have a lot of established standards and technical requirements from organizations such as SAE, ISO, etc.

Q Charged: What are some exciting innovations coming up in the near future?

A Pradeep Moorthy: For TE as a company, harness connectors and terminals are our core business, but we also have several other solutions that enable the switch to 48-volt. We are working on data/signal hybrid connectors on both harness and device sides that will package better as our customers switch to zonal architectures. We also have heat-shrink tubing, relays, EMI ltering products, etc, and we are making sure to have all of them 48-volt-ready as well. When an OEM is ready to make that switch, TE can be a one-stop shop.

Rivian is opening up sales of the Rivian Commercial Vehicle, the platform on which Amazon based its custom electric delivery van (EDV).

Amazon’s exclusivity period ended in November 2023, and since then Rivian has been trialing its commercial van with several large eets in the US, and preparing its eet management process for the mass market. e van is now available to US eets of any size. Deliveries began in April.

Prices start at $79,900 for the RCV 500 version, which has a GVWR of 9,350 lbs and cargo volume of 487 cubic feet. e longer RCV 700 version o ers a GVWR of 9,500 lbs and cargo volume of 652 cubic feet, and goes for $83,900.

Rivian has also launched the new Rivian Up t Program for eet customers. Up tting is the process of customizing a chassis to create a specialized vehicle for a customer.

Rivian uses a direct-to-consumer model, but its Up t Program is designed to simplify the ordering process and deliver an experience akin to what eet managers would expect from a dealership. Rivian has launched the program in partnership with commercial vehicle providers Ranger Design, Sortimo, Bush Specialty Vehicles, Holman, Legend and EV Sportline.

Rivian’s R1T, R1S and delivery van are all available for up tting under the program.

Virgin Atlantic and Joby Aviation, a maker of electric vertical takeo and landing (eVTOL) aircra , have signed an agreement to create an eVTOL service that the two said will pave the way towards launching an air taxi service across the UK.

An air taxi is an o -highway transportation service that bypasses the tra c and delays of major airports.

e partnership builds on an existing agreement between Joby and Delta Air Lines, which owns a 49% stake in Virgin Atlantic, to launch services in the US and UK.

e two partners have not provided a start date.

e Joby Aviation S4 has room for one pilot and four passengers, along with ample space for luggage. e service will allow for short-range, fully electric o -highway journeys between cities and towns.

Joby’s CEO, JoeBen Bevirt, stated: “We are committed to delivering faster options for mobility across the country, including for Virgin Atlantic and Delta customers as they head to the airport or move between UK towns and cities.”

Once up and running, the air taxi service would connect passengers arriving at London Heathrow and Manchester airports with less in-demand destinations. Journeys in the UK would include a 15-minute ight from Manchester to Leeds, or an 8-minute journey from Heathrow Airport to Canary Wharf, a journey that, by automobile, takes 80 minutes on a good day.

Trova Commercial Vehicles has launched a battery-electric terminal truck, the company’s rst product to reach the market. Terminal trucks are tractors designed to move semi-trailers within a warehouse facility, cargo yard or intermodal facility.

“One of the unique sides of Trova is its leadership team,” CEO Patrick Collignon told Charged, explaining that the team includes several former senior executives of Volvo, owner of Mack Trucks—among them the former President of Mack Trucks and an Executive Vice President of Volvo.

“We were accompanied on our journey by two strategic partner companies: Netgroup, an automotive engineering rm, and Chateau Energy Solutions, with whom we o er complete infrastructure solutions, including EV charging stations, to our customers,” Collignon told us.

“ e terminal tractor’s chassis has been designed from the ground up for our high-voltage driveline,” he added, noting that the battery packs were located inside the chassis rails. Trova believes this approach assists with overall safety and vehicle stability. e company does not use rail-mounted battery packs, to avoid exposure to side-impact accidents and reduce the amount of structural steel needed to mount the battery packs, which in turn reduces the overall weight of the vehicle.

Collignon also said that “the HV architecture consists of ve pre-assembled modules, which not only reduces assembly time but also improves accessibility for a ermarket maintenance and repair.”