GM and LG partner on prismatic cell development

Stellantis and Zeta Energy to develop lithium-sulfur EV batteries

Elaphe’s new Sonic.1 front in-wheel motor delivers up to 347 peak hp

Danfoss launches 690-volt motor for off-highway applications

American Battery Factory partners with KAN Battery ahead of US launch

ZF to supply OEM with brake-by-wire technology for 5 million vehicles

Honeywell releases a new generation of battery safety sensors

German testing agency finds EV batteries last longer than expected

CATL’s new Bedrock Chassis for EVs can withstand high impacts

Wevo-Chemie unveils silicone filler for power electronics and batteries

Ascend Elements to increase US lithium carbonate production

Power Integrations’ wide-creepage IC switcher targets 800 V applications

Yamaichi upgrades connector system for EV battery applications

Novonix receives $755-million conditional DOE loan for US graphite plant

Study finds recycling battery metals could supply a quarter of Europe’s EVs

Stellantis and CATL to invest up to €4.1 billion in Spanish LFP battery plant

Toshiba releases automotive photorelay for 400 V battery control systems

MP Materials establishes rare earth magnet production in the US

Mining firm Fortescue orders $400 million worth of electric mining equipment

ICF’s PowerGuide helps utilities identify the best fleets for electrification

Isuzu begins customer deliveries of its NRR-EV Class 5 electric truck

Thomas Built Buses unveils second-generation Jouley electric school bus

Rio Tinto and SPIC partner to test electric mining trucks with battery swapping

Other automakers “knocking on the door” to access EV tech from Rivian/VW

SkyDrive and SAI Flight to develop electric air taxi routes in South Carolina

Stockholm construction site uses 50% electric construction equipment

Daimler Truck begins series production of Mercedes-Benz eActros 600 truck

Bollinger Motors delivers first Class 4 B4 electric trucks to West Coast

Polestar starts US production of single-motor variant

Scout Motors is confident it will win the right to sell EVs directly to customers

Lake Tahoe to link 14 ski resorts with Candela P-12 electric hydrofoil ferry

Lyteflo closes $3-million seed round to help dealers sell EVs

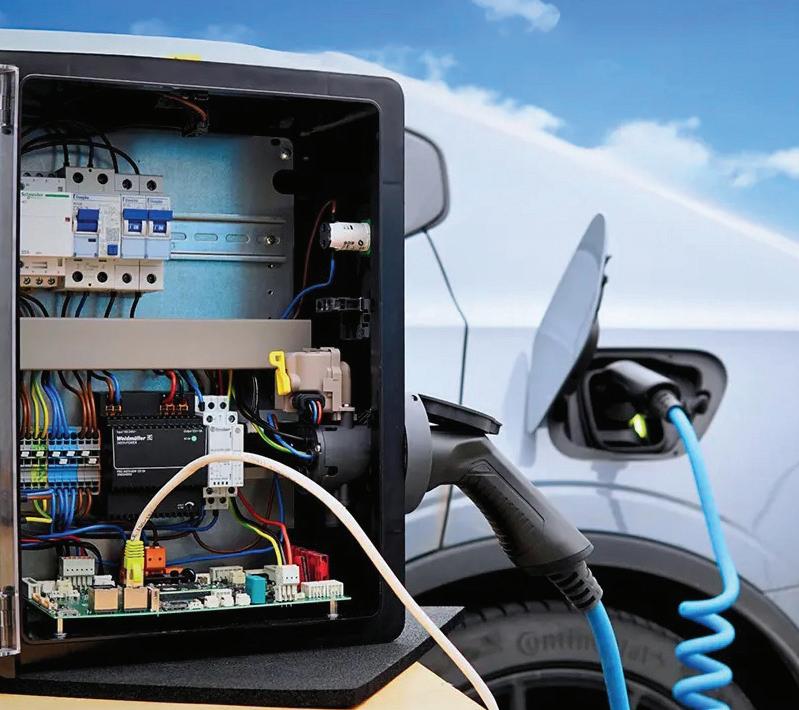

ABB and Black Box partner on management system to avoid panel upgrades

Smiths Interconnect’s new socket boasts more efficient energy transfer

GM and Reliant offer free nighttime charging to Chevrolet EV owners in Texas

Multi-story garage with charging spots for 2,000 EVs opens in Canada

Lectron producing up to 12,000 NACS-to-CCS charging adapters per week

EVgo to install up to 480 fast charging stalls at Meijer grocery stores

XCharge and Grensol to improve recycling for EVSE supply chain waste

PHYTEC and PIONIX release EVCS-Cube development kit

California revises LCFS regulations to favor EV charging over biofuels

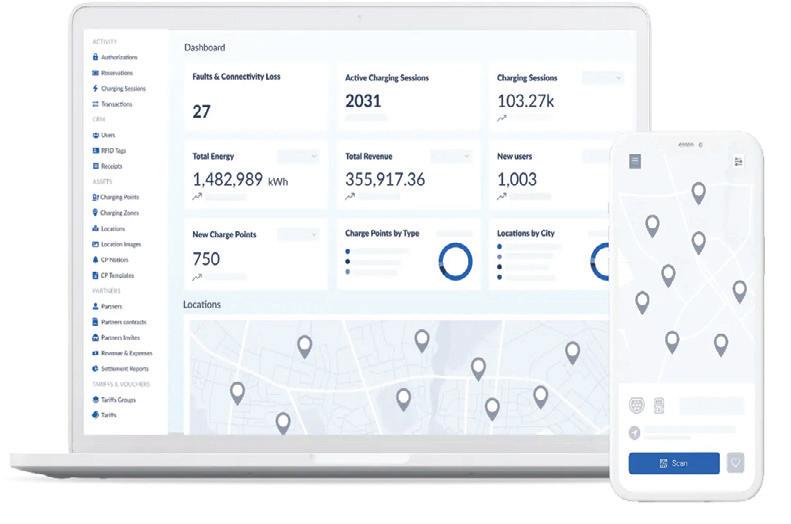

Charging software provider AMPECO raises $26 million in funding

GM and EVgo surpass 2,000 co-branded public fast charging stalls in the US

Tritium to start “a new chapter” under CEO Arcady Sosinov

UK’s Project EV introduces MCS charger with vehicle-to-grid features

and Treehouse collaborate on home

charging management

Publisher Senior Editor

Technology

Editor

Business Development

Graphic Designers

Christian Ruoff

Charles Morris

Jeffrey Jenkins

Joel Franke

Mark Rogers

Greg Schulz

Tomislav Vrdoljak

Jeffrey Jenkins

Charles Morris

Christian Ruoff

Jonathan Spira

John Voelcker

Volvo Car Corporation

Kelly Ruoff

Sebastien Bourgeois

For Letters to the Editor, Article Submissions, & Advertising Inquiries Contact: Info@ChargedEVs.com

1. PUBLICATION TITLE: CHARGED ELECTRIC VEHICLES MAGAZINE. 2. PUBLICATION NUMBER: 18170. 3. FILING DATE: SEPTEMBER 29, 2024. 4. ISSUE FREQUENCY: QUARTERLY.

5. NUMBER OF ISSUES PUBLISHED ANNUALLY: 4. 6. ANNUAL SUBSCRIPTION PRICE (IF ANY). 7. COMPLETE MAILING ADDRESS OF KNOWN OFFICE OF PUBLICATION: CHARGED ELECTRIC VEHICLES MAGAZINE, 136 4TH STREET NORTH, STE 201, SAINT PETERSBURG, FL 33701. CONTACT PERSON: CHRISTIAN RUOFF. TELEPHONE: (727) 522-0039. 8. COMPLETE MAILING ADDRESS OF HEADQUARTERS OR GENERAL BUSINESS OFFICE OF PUBLISHER: CHARGED ELECTRIC VEHICLES MAGAZINE, 136 4TH STREET NORTH, STE 201, SAINT PETERSBURG, FL 33701. 9. FULL NAMES AND COMPLETE MAILING ADDRESSES OF PUBLISHER, EDITOR, AND MANAGING EDITOR: PUBLISHER, EDITOR, AND MANAGING EDITOR: CHRISTIAN RUOFF, 136 4TH STREET NORTH, STE 201, SAINT PETERSBURG, FL 33701.10. OWNER. FULL NAME: CHRISTIAN RUOFF. COMPLETE MAILING ADDRESS: 136 4TH STREET NORTH, STE 201, SAINT PETERSBURG, FL 33701. 11. KNOWN BONDHOLDERS, MORTGAGEES, AND OTHER SECURITY HOLDERS OWNING OR HOLDING 1 PERCENT OR MORE OF TOTAL AMOUNT OF BONDS, MORTGAGES, OR OTHER SECURITIES: NONE. 13. PUBLICATION TITLE: CHARGED ELECTRIC VEHICLES MAGAZINE.14. ISSUE DATE FOR CIRCULATION DATA BELOW: #69, JULY-SEPTEMBER 2024. 15. EXTENT AND NATURE OF CIRCULATION. A. TOTAL NUMBER OF COPIES (NET PRESS RUN). AVERAGE NO. COPIES EACH ISSUE DURING PRECEDING 12 MONTHS: 12250; NO. COPIES OF SINGLE ISSUE PUBLISHED NEAREST TO FILING DATE: 12500. B. LEGITIMATE PAID AND/OR REQUESTED DISTRIBUTION (BY MAIL AND OUTSIDE THE MAIL): (1) OUTSIDE COUNTY PAID/REQUESTED MAIL SUBSCRIPTIONS STATED ON PS FORM 3541: 9685; 9675. (2) IN-COUNTY PAID/REQUESTED MAIL SUBSCRIPTIONS STATED ON PS FORM 3541: 0; 0. (3) SALES THROUGH DEALERS AND CARRIERS, STREET VENDORS, COUNTER SALES, AND OTHER PAID OR REQUESTED DISTRIBUTION OUTSIDE USPS: 0; 0. (4) REQUESTED COPIES DISTRIBUTED BY OTHER MAIL CLASSES THROUGH THE USPS: 0; 0. C. TOTAL PAID AND/OR REQUESTED CIRCULATION (SUM OF 15B (1), (2), (3), AND (4)): 9685; 9675. D. NON-REQUESTED DISTRIBUTION (BY MAIL AND OUTSIDE THE MAIL): (1) OUTSIDE COUNTY NONREQUESTED COPIES STATED ON PS FORM 3541: 0; 0. (2) IN-COUNTY NONREQUESTED COPIES STATED ON PS FORM 3541: 0; 0. (3) NONREQUESTED COPIES DISTRIBUTED THROUGH THE USPS BY OTHER CLASSES OF MAIL: 72; 32. (4) NONREQUESTED COPIES DISTRIBUTED OUTSIDE THE MAIL: 973; 855. E. TOTAL NONREQUESTED DISTRIBUTION [SUM OF 15D (1), (2), (3) AND (4)]: 1045; 887. F. TOTAL DISTRIBUTION (SUM OF 15C AND E): 10730; 10562. G. COPIES NOT DISTRIBUTED: 1520; 1938. H. TOTAL (SUM OF 15F AND G): 12250; 12500. I. PERCENT PAID AND/OR REQUESTED CIRCULATION (15C DIVIDED BY 15F TIMES 100): .9026; .9160. I CERTIFY THAT 50% OF ALL MY DISTRIBUTED COPIES (ELECTRONIC AND PRINT) ARE LEGITIMATE REQUESTS OR PAID COPIES. 17. PUBLICATION OF STATEMENT OF OWNERSHIP FOR A REQUESTER PUBLICATION IS REQUIRED AND WILL BE PRINTED IN THE ISSUE OF THIS PUBLICATION: ISSUE 70, OCTOBER-DECEMBER 2024. 18. I CERTIFY THAT ALL INFORMATION FURNISHED ON THIS FORM IS TRUE AND COMPLETE. CHRISTIAN RUOFF, PUBLISHER, SEPTEMBER 29, 2024.

With the rise of hybrid and electric vehicles, the automotive industry is undergoing an unprecedented shift marked by significant engineering and design changes.

At Shell, we are supporting this transformation by working in close technical partnership with equipment manufacturers to develop a range of fluids specifically for high-tech hybrid and EV powertrains.

Much has changed in the US federal government, and I’ve read many di ering takes about what it will mean for our EV industry. One thing is certain: it’s tough to discern between political theater and concrete policies that will have a tangible impact on the auto industry. However, there is a long list of trends that are not likely to change.

Technological genies don’t go back into their bottles, ever. An astonishing amount of engineering resources have been poured into EV tech in the past decade, and, as a result, the nal products have gotten much better and simultaneously much cheaper. When you consider that Wall Street continues to reward EV leaders while punishing the laggards, it’s hard to imagine that any global automaker will stop investing heavily in the EV race.

ese engineering achievements helped to make 2024 a record year for EV sales, and trends point to faster growth. Entry-level EVs that are much better products and cost less than comparable legacy ICE cars are appearing worldwide (and not all of them are Chinese-made). At the same time, the uncertainties surrounding various charging challenges that have plagued EVs for years are being solved one a er another. e charging industry is coalescing around common standards and protocols that will make the EV owner’s experience much more consumer-friendly. Innovations in areas like better corridor fast charging and curbside chargers for urban drivers are popping up everywhere.

Obviously, there are areas in which anti-EV politicians could impact the market, although I think any e ects would be short-lived. e example of Germany shows how important purchase incentives are for new consumer EV adoption. While it seems very possible the federal tax incentive for EV buyers could go away, in other areas, I’m not that pessimistic.

ere are still funds from the National Electric Vehicle Infrastructure program, established under the Bipartisan Infrastructure Law, that could be clawed back, delayed or diverted away from EV charging. However, billions have already been sent to states to deploy, and shovels are in the ground. ere are also plenty of important projects in the works that will proceed without government funding. en there is the In ation Reduction Act of 2022, which has signi cantly incentivized battery and automotive manufacturing in the US through a series of strategies to promote domestic production. e early results are in: it’s working. If these incentives are not reversed, which would require passing new legislation, I think history will view the IRA as one of the biggest boons to US manufacturing ever. And, as it turns out, a massive amount of the new EV/battery supply chains and factories are now being built in states and districts represented by politicians who originally opposed the bills that made it happen.

Will there now be enough political will (and attention span) to pass a new law to kill all these projects and jobs, including those designed to keep at-risk auto factories open? When e Verge recently asked former Transportation Secretary Buttigieg, he said, “For every conservative legislator publicly threatening to reverse our work, there’s two or three who look like they’re trying to take credit for it.” For the good of the US auto industry, we hope this is what happens. A er all, it’s much easier—and more common—for politicians to try to take credit for popular projects they initially opposed than it is to repeal and replace them.

One thing that de nitely will not change is our mission at Charged—to keep you informed of the latest developments in the global EV industry. We’re more excited than ever about the progress we’re seeing worldwide and we have some awesome new projects rolling out this year to help you keep up with it all.

Christian

Ruoff | Publisher EVs are here. Try to keep up.

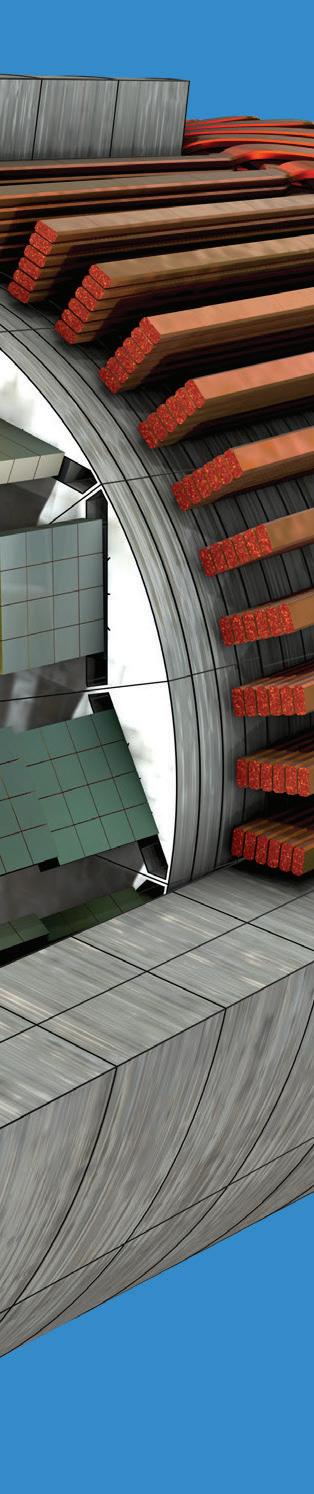

CNC BENDING TECHNOLOGY FOR BUSBARS

Busbar Bending Machine for large wire dimensions

Unstripping of the insulation coating by laser or milling process

Device for Twisting the Busbar

Transfer of actual geometries and correction values

Real-time simulation for calculating cycle times and for collision monitoring

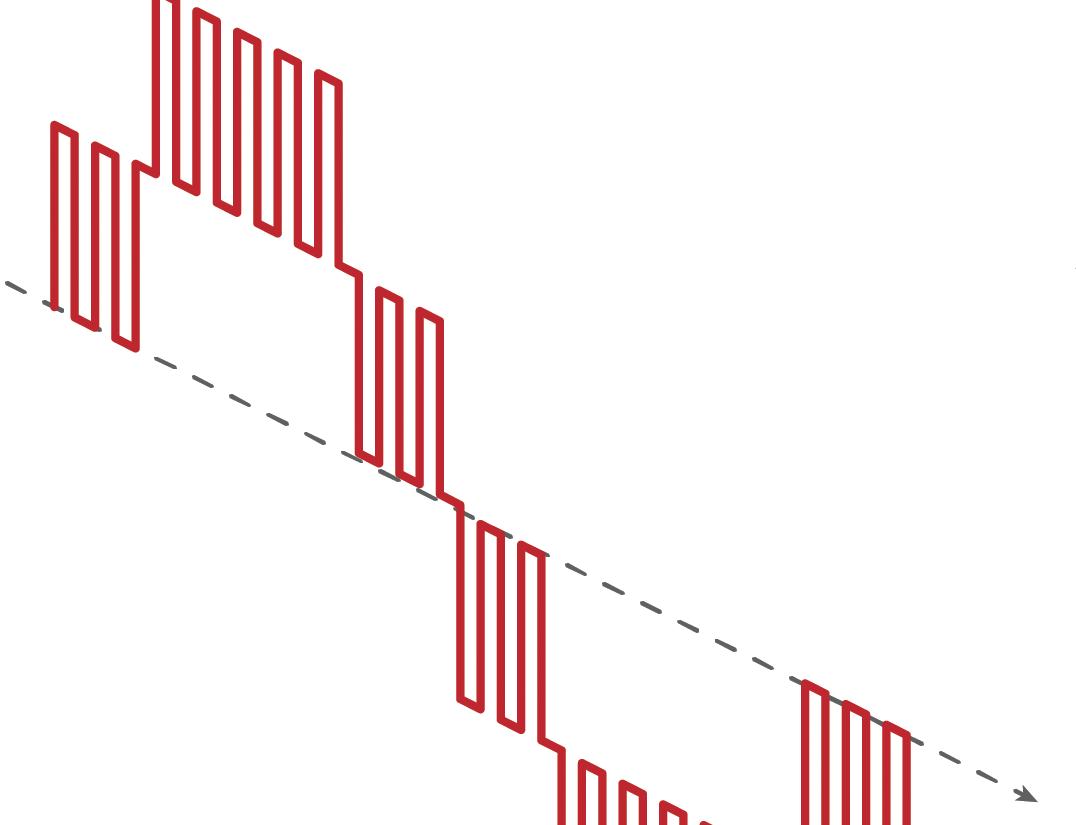

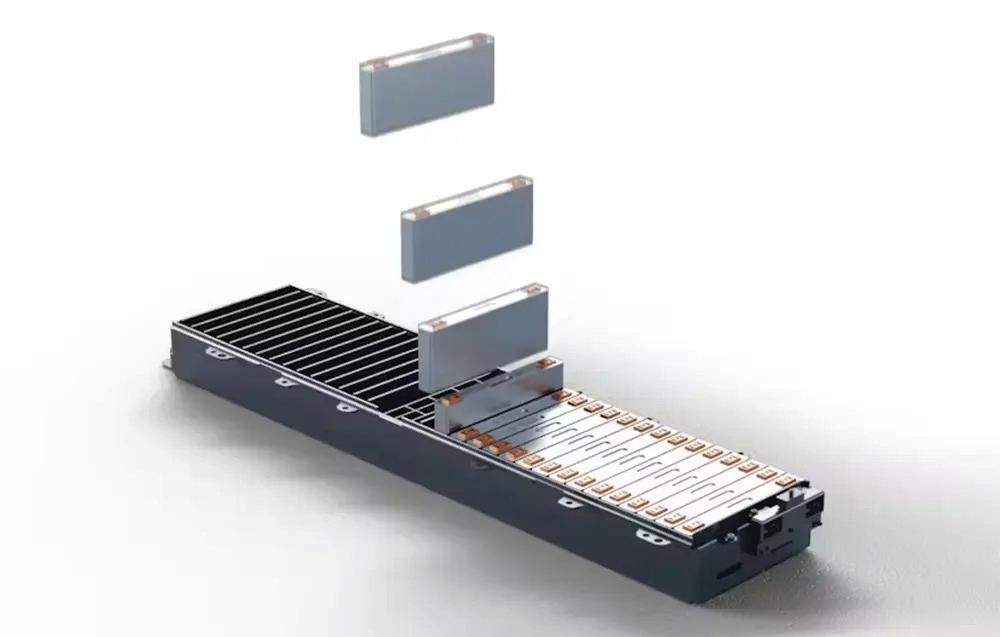

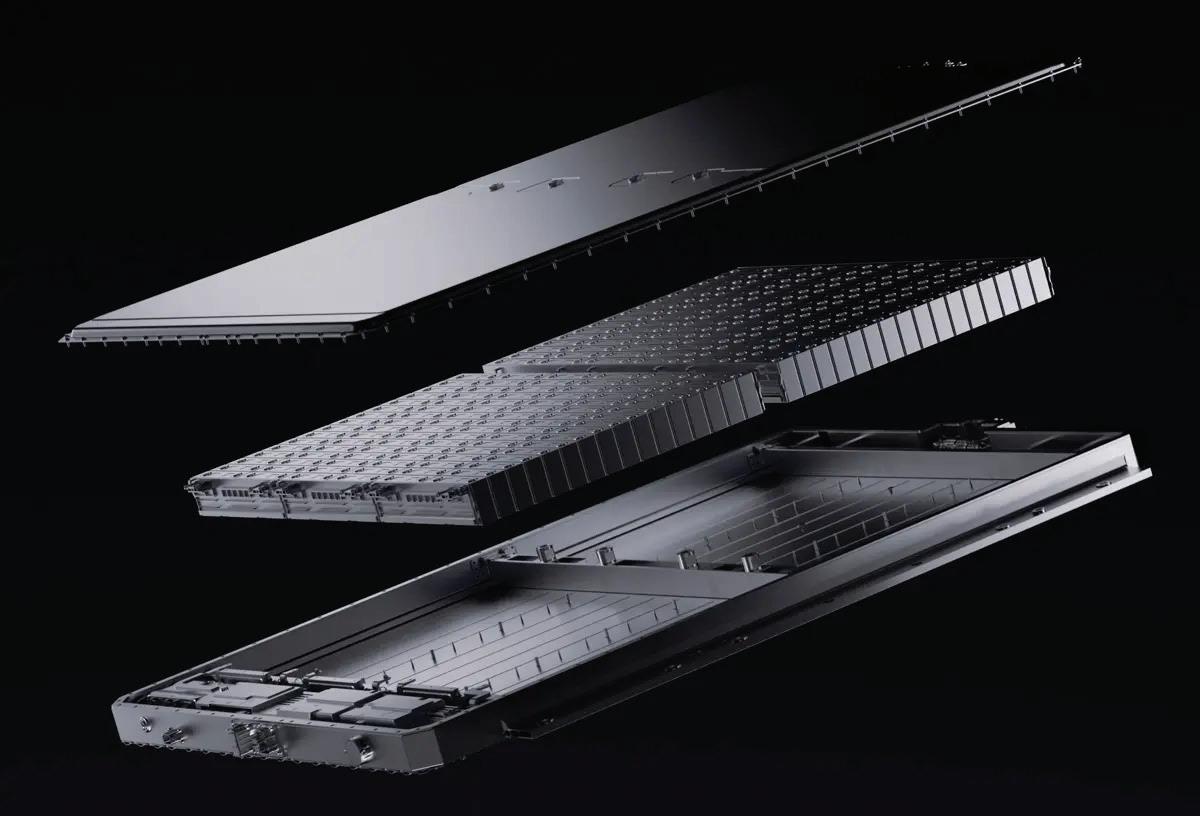

US automaker GM is extending its 14-year collaboration with South Korean battery maker LG Energy Solution to develop prismatic cell technology.

GM expects the cells that the companies develop to power its future EV models, as part of its strategy to diversify its supply chain, using multiple chemistries and form factors. GM will continue to use the pouch battery cells produced at the companies’ Ultium Cells joint venture plants in Warren, Ohio and Spring Hill, Tennessee.

Prismatic cells are at and rectangular in shape and have a rigid enclosure, which saves space within battery modules and packs. is can reduce EV weight and cost, while simplifying manufacturing by reducing the number of modules and mechanical components. LG Energy Solution has experience with prismatic cell production and an extensive patent portfolio on battery design and manufacturing technologies, including packaging.

“Together with LG Energy Solution, we’ve built Ultium Cells into one of the largest battery cell manufacturers in North America, powering our diverse EV portfolio,” said Kurt Kelty, GM VP of Batteries. “We’re focused on optimizing our battery technology by developing the right battery chemistries and form factors to improve EV performance, enhance safety and reduce costs.”

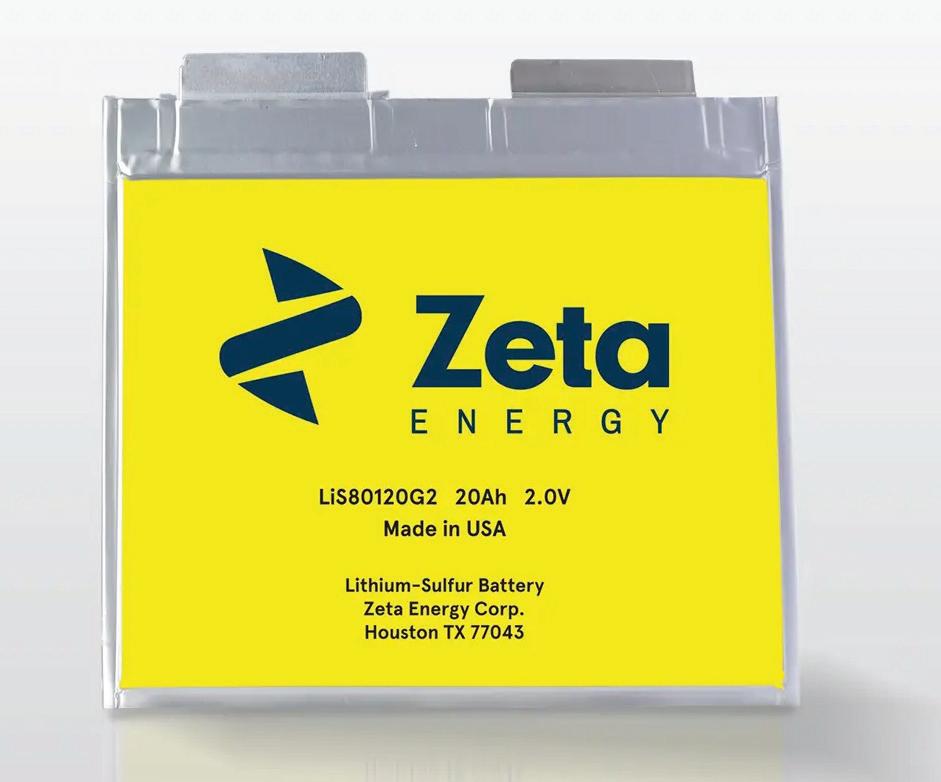

Netherlands-headquartered automaker Stellantis and US battery technology rm Zeta Energy have signed a joint development agreement to develop lithium-sulfur EV batteries that have energy density comparable to that of lithium-ion technology.

e collaboration includes pre-production development and planning for future production. Stellantis aims to use the batteries in its vehicles by 2030.

Lithium-sulfur battery technology has the potential to create a lighter battery pack with the same usable energy as lithium-ion batteries, enabling greater driving range, improved handling and enhanced performance. e technology can potentially improve fast charging speeds by up to 50%. Sulfur, being widely available and cost-effective, reduces production expenses and supply-chain risk. Lithium-sulfur batteries are expected to cost less than half the price per kWh of current lithium-ion batteries.

Zeta’s lithium-sulfur battery design uses waste materials, methane and unre ned sulfur, a byproduct from various industries, and does not require cobalt, graphite, manganese or nickel. e technology is intended to be manufacturable within existing gigafactories and would leverage a short, entirely domestic supply chain in Europe or North America.

“ e combination of Zeta Energy’s lithium-sulfur battery technology with Stellantis’s expertise in innovation, global manufacturing and distribution can improve the performance and cost pro le of electric vehicles while increasing the supply chain resiliency for batteries and EVs,” said Tom Pilette, CEO of Zeta Energy.

The Supply Chain Expo & Technical Programme for the Global Magnetics Industry

The Pasadena Convention Center, California May 14 – 15 2025

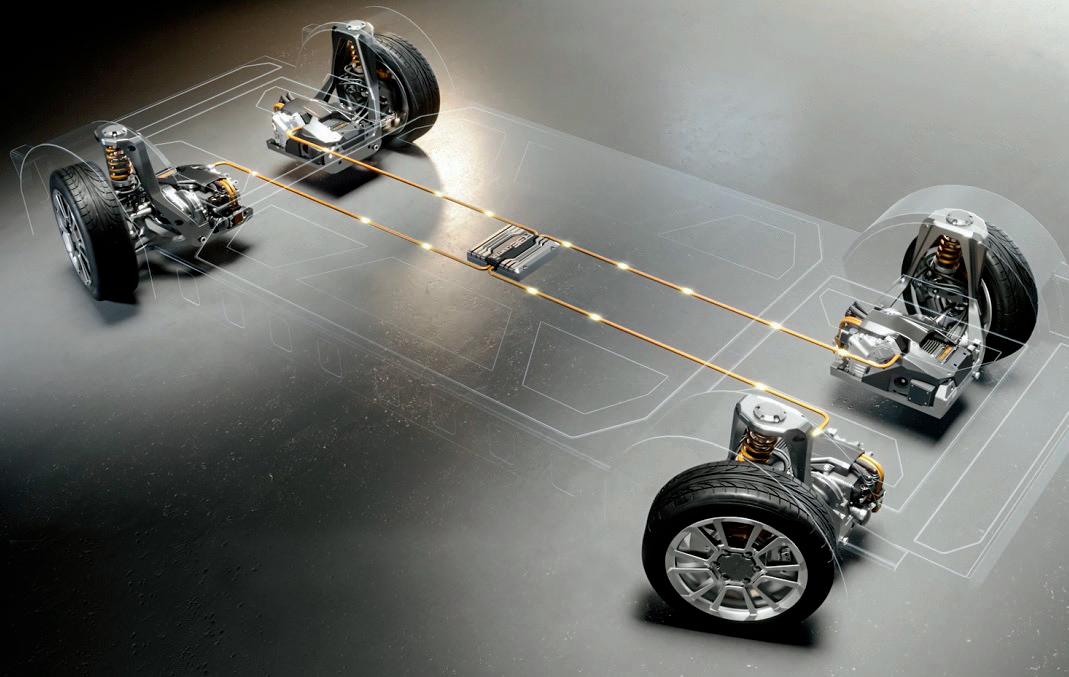

Elaphe, a Slovenia-based developer of in-wheel motor technology, has introduced a new front-wheel in-wheel motor for electric and hybrid vehicles.

e motor integrates a large 400 mm brake disc in a 21-inch rim, making it well-suited to high-performance vehicles in which space and weight are key considerations. e motor delivers continuous power output of 272 horsepower per wheel, and can reach up to 347 peak hp.

e scalable design o ers potential axle peak power of up to 1 MW in rear-wheel-drive con gurations and 8 kW/kg of continuous speci c power.

Traction control and torque vectoring improve vehicle handling, acceleration and braking, o ering faster wheel response compared to conventional wheel and suspension setups, according to the company.

e Sonic.1 is designed to be easily integrated into existing and new supercar models, and to enable vehicle designers to improve aerodynamics as well as component placement and styling.

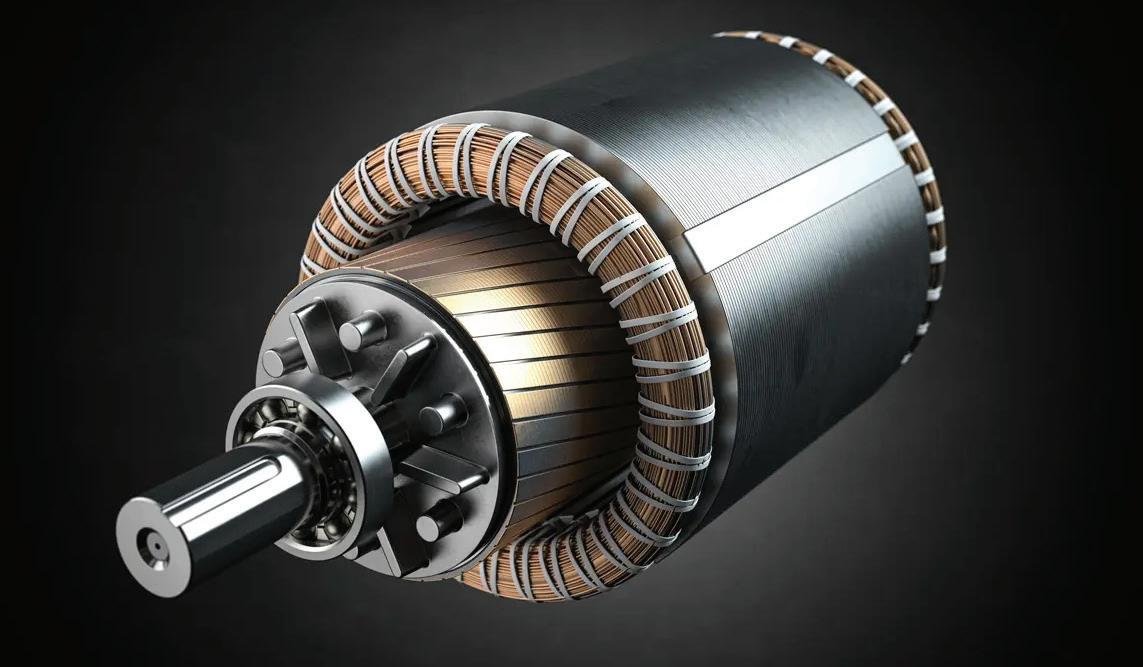

Danfoss Power Solutions has announced the launch of the Editron EM-PMI375 690 Volt electric motor. Based on synchronous reluctance-assisted permanent magnet technology, the EM-PMI375 functions as both a motor and a generator. It is designed to work with the Editron EC-C1700B inverter, o ering a system solution for 690 V AC and 1,050 V DC applications such as winches, cranes, marine vessels, and mining and material handling machinery.

e motor o ers up to 96% e ciency throughout its operating range, and Danfoss says it’s smaller and lighter than competing products. Developed especially for demanding applications, the motor features a compact and robust aluminum frame structure with an IP67 ingress protection rating.

“Our new EM-PMI375 690 Volt motor and ECC1700B inverter are the rst two pieces of our 690-volt ecosystem, with more to come,” said Chao Wang, Head of Portfolio Management for the company’s Editron division. “ ere are few, if any, options out there for true 690-volt mobile-grade inverters and motors. Most are based on industrial solutions, and thus o er much lower vibration and shock tolerance.”

e EM-PMI375 electric motor is available in four sizes to suit a range of torque and power needs. Models o er continuous torque ratings of 200 Nm to 1,100 Nm and power range from 63 kW to 296 kW.

All models feature a speed range of up to 4,000 rpm. e motors are liquid-cooled and have low coolant ow requirements.

Lithium iron phosphate (LFP) battery cell manufacturer American Battery Factory (ABF) has formed a partnership with Chinese manufacturer KAN Battery to develop a pilot line of battery cells at its facility and accelerate its US production launch.

As part of the collaboration, ABF will secure training in the latest analytics and machining for its workforce, re ne battery cell production and launch its subsidiary ABF China.

At the facility in China, ABF will work alongside KAN Battery to run an initial 1 GWh factory line to produce high-capacity prismatic cells o ering 105 to 300 Ah outputs. e 750,000-square-foot line will enable the company to immediately start production at scale. ABF will supply select battery cells produced at the factory to o -takers such as Lion Energy ahead of its full US cell production.

By re ning the production process while it prepares for the construction of its rst gigafactory in Tucson, Arizona, ABF will bring together its experience in machining, battery chemistry and business analytics at launch. e company expects to complete the rst phase of the Tuscon plant in the second half of 2026. e site will include the company’s headquarters, an R&D innovation center and the initial 2 x 2 GWh factory module. ABF’s battery cells are designed to last up to 10,000 life cycles or an average of 20-30 years.

“ e United States is 10 years behind the leaders of battery cell production. To develop a domestic supply chain, we must work together with the best in the world,” said John Kem, President of American Battery Factory.

German automotive parts supplier ZF has signed a deal with a global manufacturer that includes planned volume production of brake-by-wire technology to equip nearly 5 million vehicles with electro-mechanical braking (EMB) over the length of the contract.

Featuring electro-mechanical brake and by-wire technology on the rear brakes, the project will also include ZF’s integrated brake control (IBC) and traditional front calipers, creating a hybrid braking system of by-wire and hydraulics that o ers the manufacturer increased exibility.

e agreement will also provide steering technology with ZF’s Electric Recirculating Ball Steering Gear (RBSG). EMB, as a key component of the brake-by-wire technology, lays the foundation for the so ware-de ned vehicle that will lead to new functions and features, such as autonomous braking and steering in a crash, according to the company.

ZF’s EMB is at the center of its “dry brake” system, which does not require brake uid. Brake pressure is not generated by the pressure of uids in the hydraulic system, but by electric motors. Braking signals from the pedal to the electric motor are also transmitted electronically.

e EMB works with the IBC, a non-vacuum, fully integrated electro-hydraulic system providing high brake performance for automatic emergency braking, full energy recuperation and redundant fallback options up to full automated driving for passenger car and light truck segments.

e hybrid system is created by an electric system on the rear axle and hydraulics at the front, featuring ZF’s Colette-type caliper, which is available for passenger car and light commercial vehicles in single and twin piston designs.

e RBSG is a 48 V electrically powered gear designed to replace current hydraulic applications as an integrated unit that reduces vehicle assembly costs. It allows for ADAS features up to Level 2 as well as improved steering and performance.

Honeywell has released a new generation of battery safety sensors. e Battery Safety Electrolyte Sensor (BES) series is designed speci cally for enhanced safety in lithium-ion battery onroad applications, and exceeds industry standards for performance and reliability, according to the company.

e new BES uses Honeywell’s proprietary Li-ion Tamer [clever!] electrolyte gas detection technology to identify “ rst vent” events. ese events serve as early warning signs of potential battery malfunctions, enabling the system to issue alerts 5 to 20 minutes prior to a risk of re.

e sensors can detect multiple gases released during thermal runaway, which minimizes the risk of false negatives. e integration process is facilitated by a rate of change algorithm, which eliminates the need for target gas threshold testing. is feature is designed to reduce integration costs and shorten project timelines.

e sensors incorporate the CAN communication protocol, and feature two operating modes, which can be selected via CAN commands. In Normal mode, the sensor operates at full functionality with active CAN communication. In Eco mode, CAN communication is disabled, which reduces power consumption by 60%—however, the sensor automatically reverts to Normal mode to send alarm signals to the Battery Management System (BMS) in the event of an alarm condition.

German testing organization DEKRA has developed a standardized test that measures the health of an individual EV’s battery, and has now completed more than 25,000 state-of-health tests using its patented procedure. DEKRA reports that “the batteries of electric cars are more durable than consumers sometimes fear.”

DEKRA’s rapid battery test, which was introduced in 2022, is currently available for around 130 di erent vehicle models and is o ered in several European countries. e procedure takes 15 minutes, and includes a static test and a short acceleration drive of around 50 to 100 meters.

e real-world results of an individual test are compared to the “parameterization” of the individual vehicle models, which includes data gathered from complex test drives under a wide variety of conditions. “ is creates a kind of coordinate structure that our system uses to analyze and evaluate the actual measured values during the test,” explains Christoph Nolte, Executive Vice President of DEKRA. “ e bottom line is a statement on the battery condition that no other method on the market can o er as quickly and at the same time as precisely.”

e growing data pool enables the DEKRA experts to make more general statements about battery aging, and they say that “even with higher mileages, the vast majority of traction batteries are still in good condition.”

As one example, DEKRA cites a eet of Jaguar I-Pace electric taxis that went into service in Munich in 2018. DEKRA tested six of the vehicles in 2024, and found that, with mileages between 180,000 and 260,000 kilometers, the state of health of the traction batteries was between 95 and 97 percent.

“On average, we charged the vehicles about one and a half times a day, and not particularly gently, but always fully charged to give the drivers the appropriate level of safety in terms of range,” said Gregor Beiner, Managing Director of the Munich Taxi Centre (MTZ). “ e batteries are very, very durable and, especially with the safety bu ers that the manufacturers install, they retain their capacity for a very long time.”

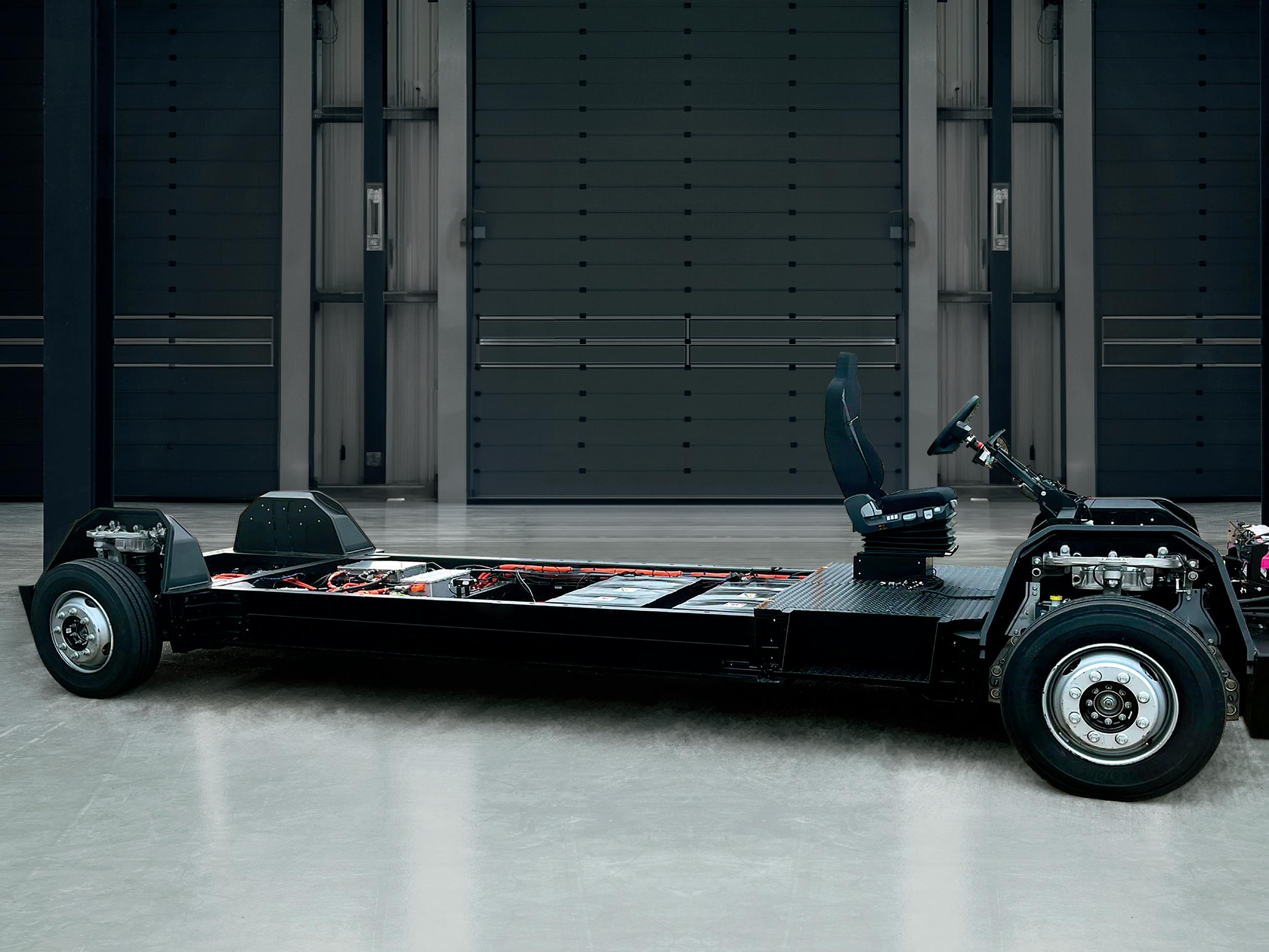

Chinese battery manufacturer CATL has launched the CATL Bedrock Chassis, a skateboard chassis that can withstand 120 km/h frontal impacts without catching re or exploding.

e battery-centered design uses cell-to-chassis integration technology, which directly integrates the battery cells into the chassis and allows for a shared structural design. Based on the decoupling of the chassis from the upper body, the Bedrock Chassis can absorb 85% of the vehicle’s collision energy, compared to around 60% absorbed by traditional chassis, according to the company.

e speed for frontal impact safety tests in the commonly used China New Car Assessment Program (C-NCAP) is 56 km/h, which, when experiencing a frontal impact at this speed, generates collision energy equivalent to falling from a 12-meter-high building. In comparison, a frontal impact at 120 km/h generates a collision energy 4.6 times that of collision at 56 km/h.

e Bedrock Chassis incorporates three core characteristics: internal integration; decoupling of the chassis from the upper body; and external openness.

e CATL Bedrock Chassis introduces a three-dimensional biomimetic tortoise-shell structure—the body and energy unit framework are integrated to protect the energy unit. Its aircra carrier-grade arresting structure disperses impact forces across multiple pathways during a crash, gradually decelerating the vehicle and signi cantly reducing the depth and speed at which obstacles intrude into the cabin. e utilization of submarine-grade hot-formed steel with a strength of 2,000 MPa, aerospace-grade aluminum alloy with a strength of 600 MPa and multiple barrier structures further enhance the rigidity of the chassis.

e chassis instantly disconnects its high-voltage circuit within 0.01 seconds of impact and completes the discharge of residual high-voltage energy in the vehicle within 0.2 seconds. e battery cells have undergone tests including high-speed sled impact tests at 60 km/h, 90-degree bending tests and sawing tests.

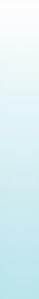

German adhesives and sealants producer Wevo-Chemie is expanding its portfolio of thermal interface materials with an optimized silicone gap ller.

WEVOSIL 26040 FL features high thermal conductivity of 4 W/m*K for e cient heat dissipation for large surfaces. e material has been formulated to be resistant to sedimentation, allowing it to be stored, used and transported over long distances for at least three months without having to be rehomogenized.

e material’s specially developed ller combination and the resulting low bond line thickness of <70 µm bridge small gaps. Material properties such as reactivity can be customized to individual needs, according to the company.

e optimized dosing properties permit simple and e cient handling, high dispensing speeds and ne dosing patterns. is ensures greater precision and exibility in production compared to thermally conductive pads, particularly when manufacturing large unit volumes.

e ller provides high temperature resistance of up to 200° C, ame-retardant properties in accordance with UL 94 V-0 (at a thickness of just 2 mm) and mechanical properties including elongation at break of more than 30%.

When cured, WEVOSIL 26040 FL meets the requirements of the PV 3040 test speci cation for low-volatile emissions in the automotive industry.

“Whether it’s high dosage volumes, reliable heat dissipation for large surfaces or mechanically demanding thermal joints that are needed, the new silicone gap ller from Wevo is a solution for numerous requirements in contemporary electronics and electrical engineering,” the company said.

US battery materials manufacturer Ascend Elements will commission a new lithium carbonate recovery line at its battery recycling facility in Covington, Georgia in 2025 to start producing 99% pure lithium carbonate (Li2CO3) recovered from used lithium-ion batteries.

e company plans to produce up to 3,000 metric tons of lithium carbonate annually. Its Hydro-to-Cathode direct precursor synthesis technology produces new cathode material from spent lithium-ion cells more e ciently than traditional methods, according to the company, resulting in lower costs and carbon emissions.

Ascend’s Covington facility has been operational since August 2022. It has the capacity to recycle up to 30,000 metric tons of lithium-ion battery materials—the equivalent of approximately 70,000 EV battery packs—annually.

“ is new domestic supply of a critical battery material will help US industries meet growing demand while avoiding the possibility of tari s on imported materials,” said Eric Gratz, co-founder and CTO of Ascend Elements.

US-based Power Integrations, which produces high-voltage integrated circuits for energy-e cient power conversion, has introduced a wide-creepage package option for its InnoSwitch3-AQ yback switcher IC for automotive applications.

A wide drain-to-source-pin creepage distance of 5.1 mm eliminates the need for conformal coating, making the IC compliant with the IEC60664-1 standard in 800 V vehicles while simplifying manufacturing and increasing system reliability.

e 1,700 volt-rated CV/CC InnoSwitch3-AQ switching power supply ICs incorporate a silicon carbide (SiC) primary switch capable of delivering up to 80 watts of output power. e highly integrated ICs reduce the number of components required to implement a power supply by as much as 50%, saving space, enhancing system reliability and mitigating component sourcing challenges, according to the company. An increased drain-pin width assists in withstanding high levels of shock and vibration, especially in eAxle automotive applications.

Target automotive applications include battery management systems, DC-DC converters, control circuits and emergency power supplies in the main traction inverter.

e new ICs in the range start up with as little as 30 V on the drain without external circuitry—which is critical for functional safety. Additional protection features include input under-voltage, output overvoltage and overcurrent limiting.

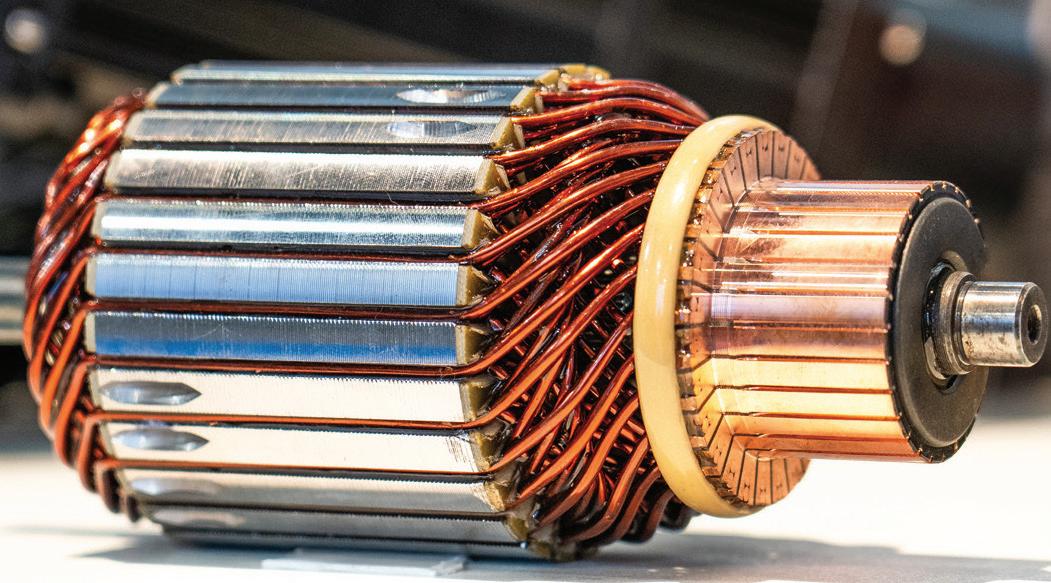

Yamaichi Electronics, a manufacturer of test and burn-in sockets, connectors and test contacts, has released the newest version of its Y-Lock Pullforce connector system to meet the requirements of battery applications.

e exible at cable (FFC) or the exible printed circuit board (FPC) is inserted into the connector using the pre-assembled sti ener. e Y-Lock V4 series has a double locking function, via two lateral locking hooks and a central locking mechanism on the long side of the insulator.

e two-part sti ener design ensures that the FFC or FPC are protected against contact, so that the cable can be handled safely during servicing. is feature also ensures that the plug cannot be inserted at an angle or upside-down, preventing short circuits. e sti ener can be permanently locked to the connector by an additional plastic part.

e Y-Lock V4 series is available with gold or tin plating. It is currently available in a 90° version, and its 4.5 mm height is well suited to the tight installation spaces in battery applications.

e connector system is available with di erent contact spacings: 1.0 mm, 1.2 mm, 1.8 mm and 2 mm, for various clearance and creepage distances.

Novonix, a battery materials and technology company, has received a conditional commitment from the US Department of Energy for a direct loan of up to $754.8 million for a proposed graphite facility in Tennessee.

If nalized, the nancing from the DOE’s Loan Programs O ce would be applied towards partially nancing the construction of the new facility to manufacture synthetic graphite, primarily for use in EV batteries.

e new facility is expected to produce approximately 31,500 tonnes of synthetic graphite annually, supporting the production of lithium-ion batteries for approximately 325,000 EVs each year. e plant is expected to reach full production capacity by the end of 2028.

Novonix has previously discussed plans to build a new facility in the southeastern US that could expand to 75,000 tonnes of annual production capacity.

e proposed loan is being o ered under the LPO’s Advanced Technology Vehicles Manufacturing (ATVM) Loan Program. It would be structured in two tranches based on a phased completion of infrastructure and production lines from a total eligible investment of $943.6 million. e rst tranche would support the site and infrastructure for the new facility and 21,000 tonnes per year of production capacity, while the second tranche would support an additional 10,500 tonnes.

is year, Novonix signed binding o ake agreements to supply synthetic graphite to Panasonic Energy, Stellantis and Volkswagen’s PowerCo. e company’s Riverside facility, located in Chattanooga, is scheduled to start commercial production in 2025, with plans to increase output to 20,000 tonnes annually to meet current customer commitments. Expansion of the new plant would depend on customer demand and access to additional nancing.

Novonix has been awarded a $100-million grant and $103-million investment tax credit by the DOE’s O ce of Manufacturing and Energy Supply Chains (MESC) towards the funding of the Riverside facility.

Materials recovered from end-of-life batteries and gigafactory scrap have the potential to supply up to 2.4 million EVs in Europe by the end of the decade, cutting the continent’s reliance on mineral imports, according to research by non-governmental sustainability group Transport & Environment (T&E).

Recycling spent battery cells and production scrap could provide 14% of the lithium, 16% of the nickel, 17% of the manganese, and 25% of the cobalt that Europe will need for electric cars in 2030, the study found. e region has the potential to be almost self-su cient in supplying cobalt for EVs in 2040.

Recycling could replace the need for primary ores, avoiding the need to build twelve new mines globally by 2040: four lithium, three nickel, four cobalt and one manganese. is would also reduce the potential negative environmental e ects on water, soil and biodiversity from those mines. However, to reap the economic and sustainability bene ts, Europe needs to scale up its recycling industry. e EU and the UK will not be able to harness this potential unless they secure recycling projects that are at risk of being canceled, T&E said. Almost half of the recycling capacity that has been announced for the region is on hold or uncertain whether it will go ahead.

T&E called on the EU and the UK to urgently prioritize support for recycling across their policies and funding programs.

“If Europe delivers on its recycling plans, it can slash its reliance on imported critical metals. e expected volumes of locally recovered materials can enable Europe to build millions of clean electric vehicles locally,” said Julia Poliscanova, Senior Director at T&E. “Neither the EU nor the UK are ready to capture the recycling opportunity. Almost half of the planned recycling capacity is at risk due to high energy costs, a shortage of technical expertise or a lack of nancial support. It’s time to start treating battery recycling like another clean tech and prioritize it in our policy and grant making.”

Netherlands-headquartered automaker Stellantis and Chinese battery manufacturer CATL have agreed to invest up to €4.1 billion to form a 50/50 joint venture that will build a large-scale lithium iron phosphate (LFP) battery plant in Zaragoza, Spain.

e battery plant is targeted to start production by the end of 2026 at Stellantis’s Zaragoza site. It will be implemented in several phases, and could reach up to 50 GWh of annual capacity. is will depend on the evolution of the EV market in Europe and continued support from authorities in Spain and the European Union, the companies said.

e agreement follows a non-binding memorandum of understanding (MOU) the companies signed in November 2023 for the local supply of LFP battery cells and modules and a long-term collaboration on two strategic fronts—creating a technology roadmap to support Stellantis’s EVs and identifying opportunities to further strengthen the battery value chain.

CATL operates battery manufacturing plants in Germany and Hungary. e Spanish facility will enhance its capabilities to supply European automakers as well as the global market.

Stellantis is employing a dual-chemistry approach— using lithium-ion nickel manganese cobalt (NMC) and lithium iron phosphate (LFP) batteries. e JV will enable the automaker to o er more electric passenger cars, crossovers and SUVs in the B and C segments with intermediate ranges in Europe.

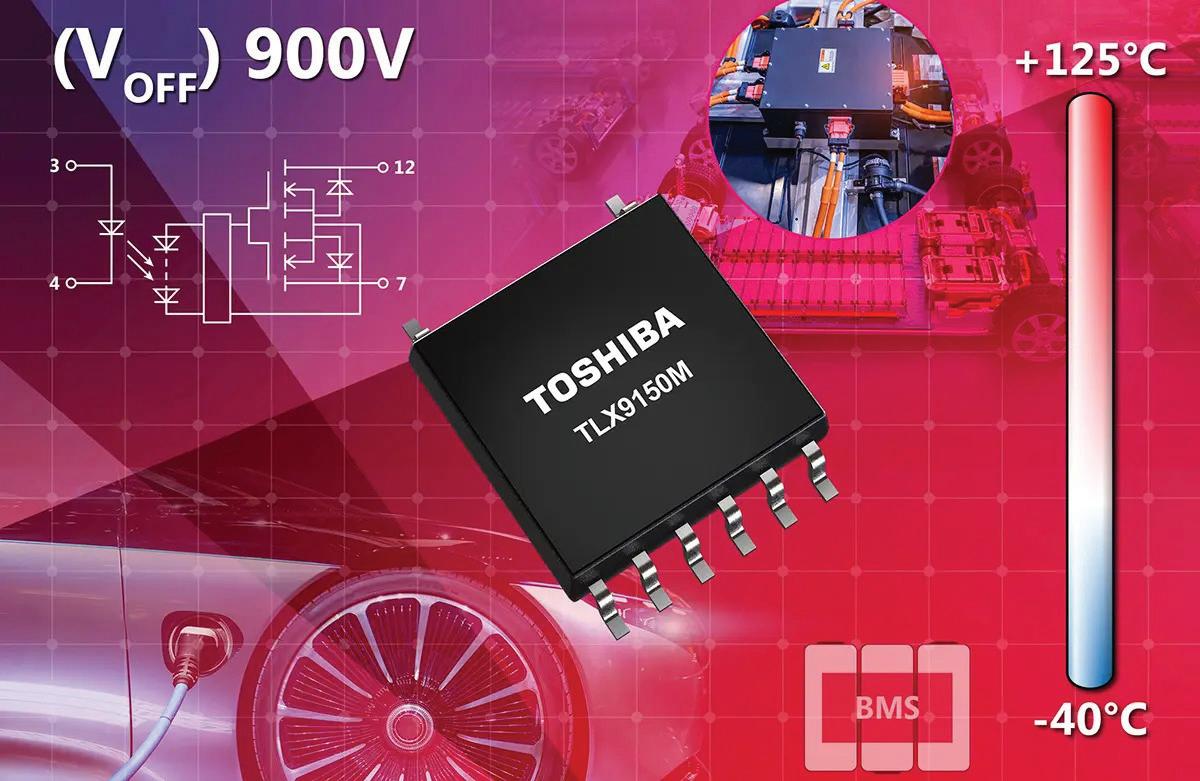

Toshiba Electronics Europe has introduced a high-voltage transistor output photorelay for 400 V automotive battery-related control systems.

e automotive-compliant TLX9150M is housed in a compact SO12L-T package. Its space-saving form factor of 7.76 mm × 10 mm × 2.45 mm is 25% smaller than Toshiba’s existing package SO16L-T. is helps to miniaturize the battery unit and reduce costs.

e photorelay delivers a minimum breakdown voltage (VOFF) of 900 V with a maximum reaction (TON/ TOFF) time of 1 ms. is is important for control-sensitive applications such as battery and fuel cell control and battery management systems (BMS) for monitoring voltages, as well as detecting mechanical relay sticking and ground faults.

e TLX9150M consists of an infrared (IR) emitting diode optically coupled to a photo-MOSFET, providing electrical isolation between the primary (control) side and the secondary (switch) side, enabling safe switch control across varying ground potentials.

e trigger current (IFT) is more than 3 mA, minimizing system energy consumption. e device’s o -state current (IOFF) is 100 nA maximum at ambient temperature, drawing minimal power while inactive. e IR LED has a forward current (IF) rating of 30 mA, while its photodetection element has an on-state current (ION) rating of 50 mA at ambient temperatures.

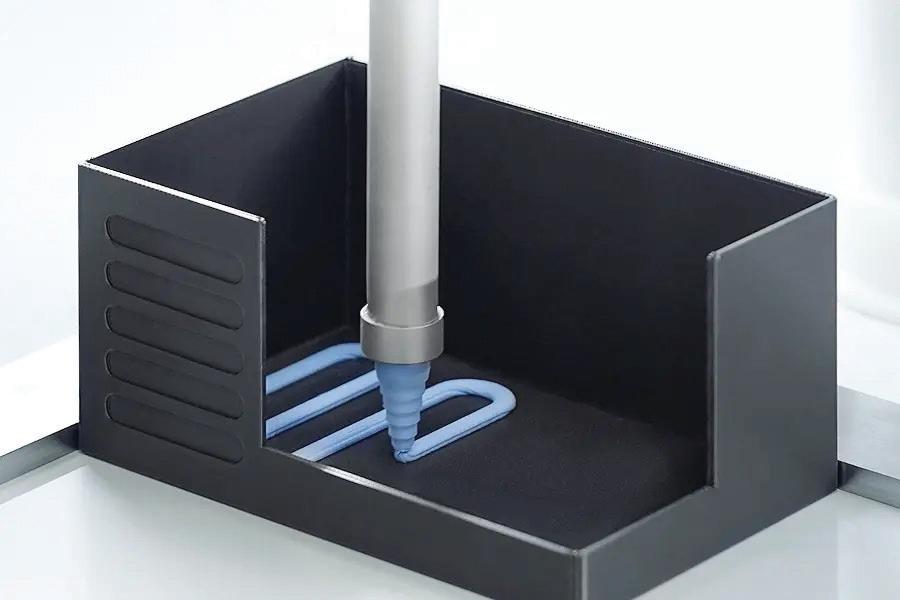

MP Materials produces specialty materials that are vital inputs for the EV and renewable energy industries. e company is expanding its manufacturing operations downstream to provide a full supply chain solution from raw materials to magnetic products.

Now MP Materials says its agship Independence facility in Fort Worth, Texas has begun commercial production of neodymium-praseodymium (NdPr) metal and trial production of automotive-grade, sintered neodymium-iron-boron (NdFeB) magnets.

NdFeB magnets are essential components in vehicles, drones, robotics, electronics, and aerospace and defense systems. For decades, the US has relied almost entirely on foreign sources for these critical materials.

e Independence facility is poised to produce approximately 1,000 metric tons of nished NdFeB magnets per year, and production will ramp up beginning in late 2025. e facility will supply magnets to GM and other manufacturers, sourcing its raw materials from Mountain Pass, MP Materials’ mine and processing facility in California.

In 2024, the Mountain Pass mine delivered more than 45,000 metric tons of rare earth oxides (REO) contained in concentrate, as well as approximately 1,300 metric tons of NdPr oxide, in addition to cerium, lanthanum, and other separated and re ned products.

“ is milestone marks a major step forward in restoring a fully integrated rare earth magnet supply chain in the United States,” said James Litinsky, founder, Chairman and CEO of MP Materials.

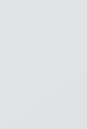

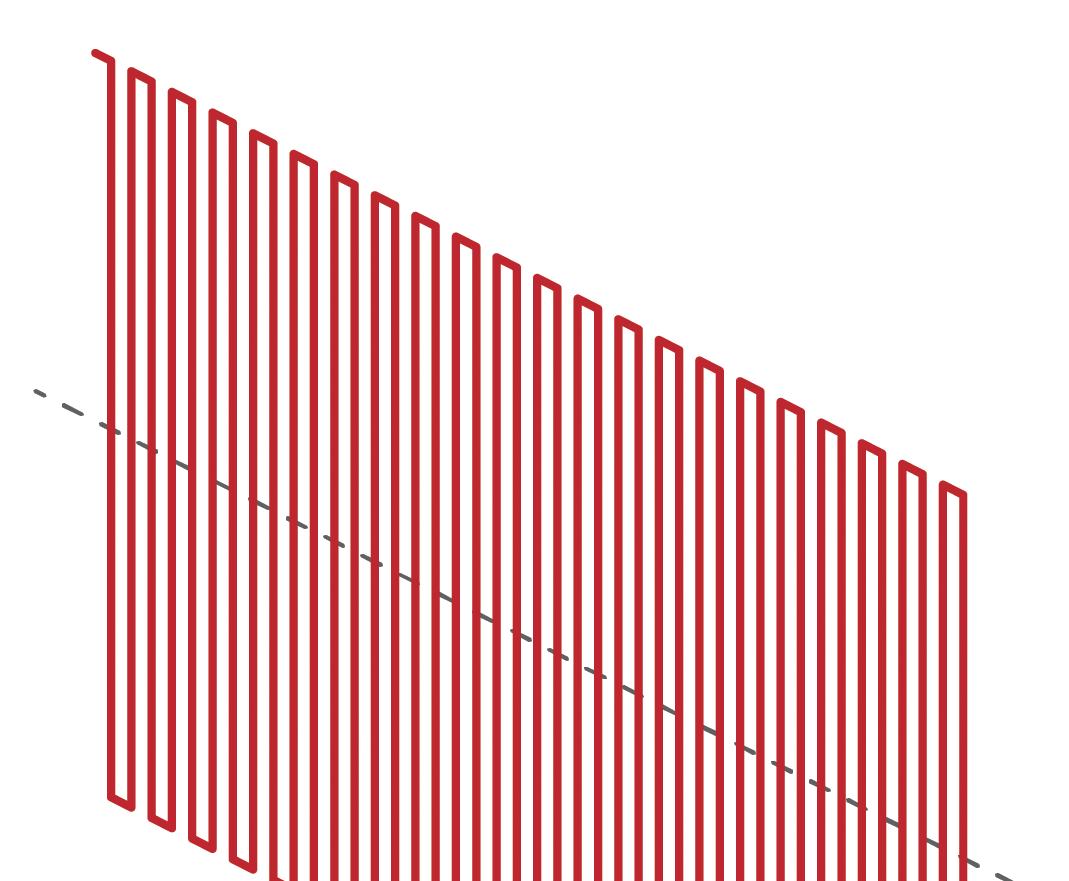

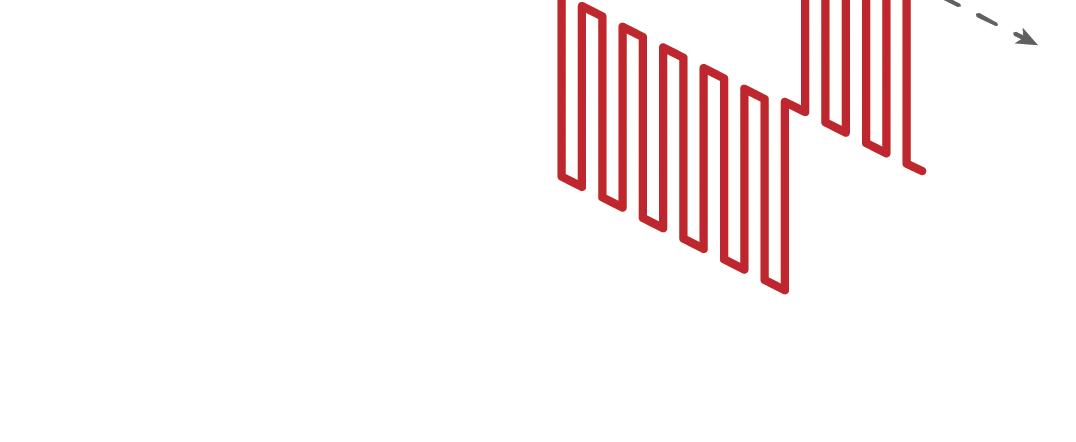

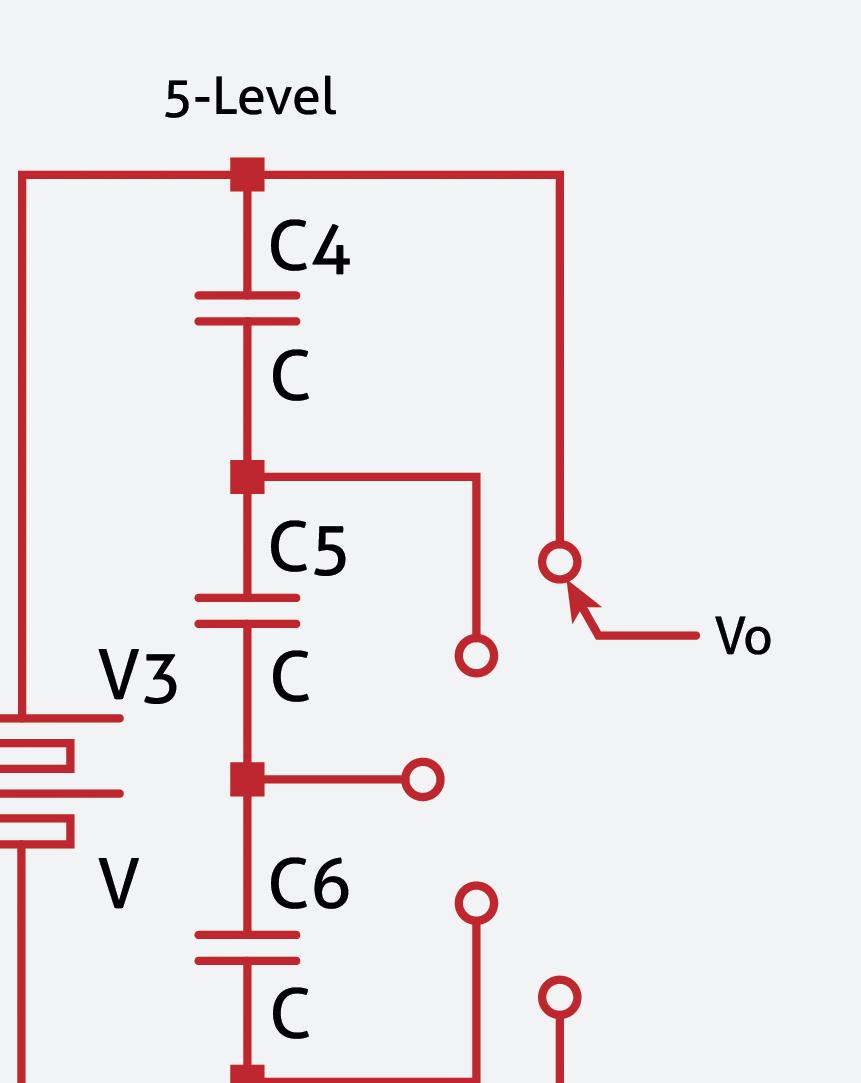

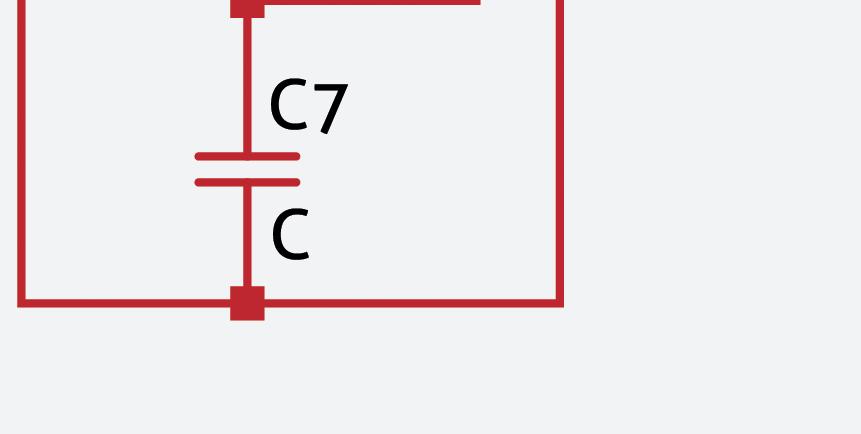

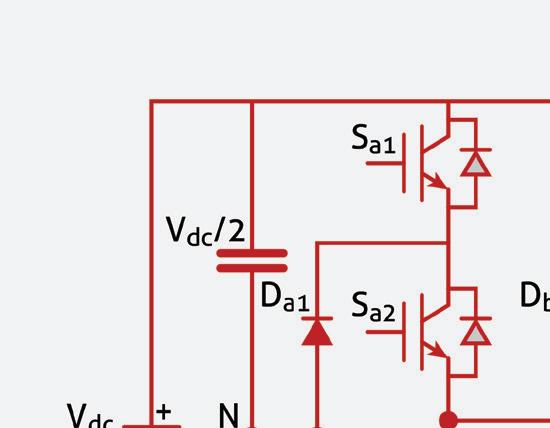

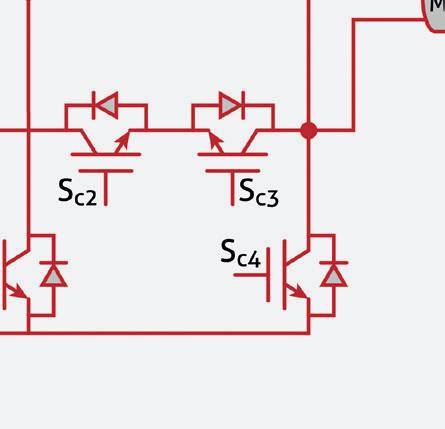

Figure 1: The differences in the voltage waveforms produced by the conventional 2-level inverter vs. 3-level and 5-level MLIs.

5-Level

By Je rey Jenkins

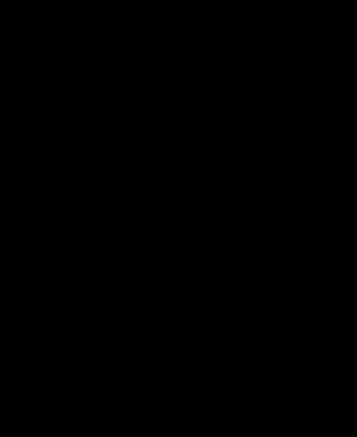

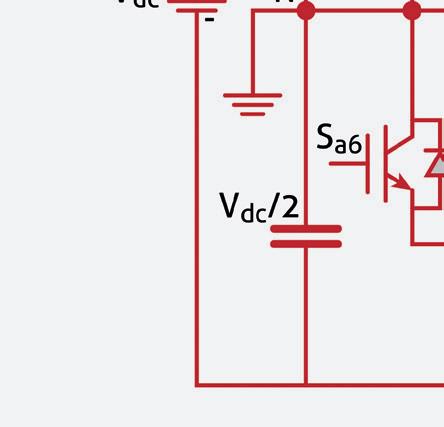

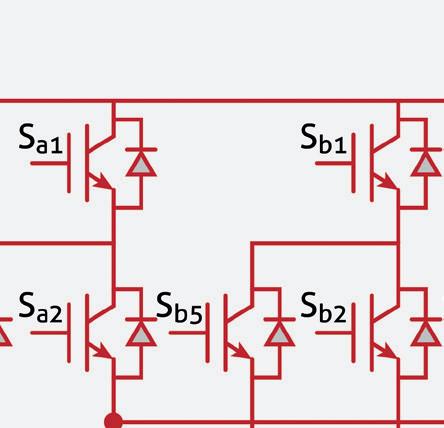

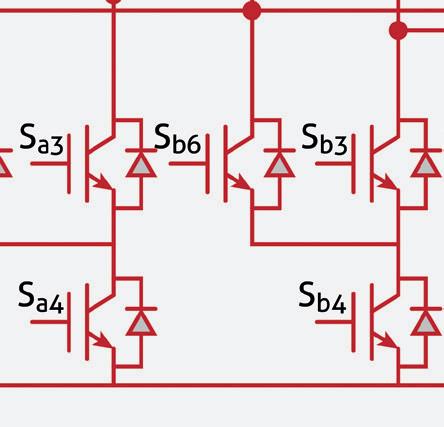

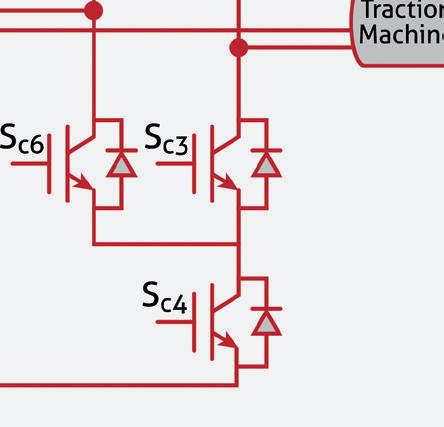

The vast majority of EV traction motors must be supplied with sinusoidal 3-phase alternating current with the frequency proportional to RPM, and the overwhelmingly favorite way to do this is with a triple half-bridge voltage source inverter, or VSI.

In this topology, each bridge switch can connect its output terminal (i.e. motor phase winding) either to the positive or the negative rail of a voltage source (i.e. the battery in an EV, herea er referred to as +Vbatt and -Vbatt), ignoring the useless choice of both switches being o , and the destructive choice of both being on, hence this type of inverter is further described as “2-level.”

e output waveform of a 2-level inverter operating at the fundamental frequency is a square wave, and while it is possible to drive AC motors with square waves, they don’t much like it because of the high harmonic content, which produces excessive heating, a reduction in maximum achievable torque at any RPM, and more vibration. e traditional approach to reducing the harmonic content is by chopping each output pulse up into many slices and modulating their on times, or duty cycles, sinusoidally. e inductance of the motor windings then integrates this pulsating voltage waveform into a sinusoidal current, with a consequent improvement in torque, vibration and losses. e higher the PWM frequency—i.e. the more slices for each output pulse— the lower the total harmonic distortion, or THD, in the current waveform, which can only be a good thing...up until it isn’t, anyway.

e rst major obstacle to increasing the PWM frequency without end is that the percentage of time spent in the switching transitions (i.e. o to on and on to o ) increases unless the switches are also proportionally faster. As the switch e ectively acts like a resistor during the transitions, these so-called switching losses increase with PWM frequency, all else being equal. However, employing faster switches—such as the latest technology SiC MOSFETs and GaN HEMTs (High Electron Mobility Transistors)—leads to its own set of headaches, as just because you can switch 400 to 800 V in 10-30 ns with these technologies doesn’t mean you should; the extremely high dV / dt of such rapid switching produces prodigious amounts of RF noise, and also causes winding insulation and sha bearing-destroying common-mode currents to ow. In fact, a rule of thumb says that the effective RF bandwidth, in MHz, of a switching transition, in ns, is 350 / dV / dt; e.g. a 10 ns switching time will generate signi cant RF energy out to 35 MHz.

One solution to so en the switching transitions without slowing down the switches is to add an LC low-pass lter directly a er each inverter output (especially if the motor is more than a few meters away, as the intercon-

nect cables make embarrassingly good radio antennas). Setting the lter’s cuto frequency to 1/10th the e ective bandwidth frequency as calculated above (e.g. 3.5 MHz for the previous example) will su ce for so ening the transitions, which will drastically reduce o ending RF noise emissions while not introducing enough phase shi to cause problems with vector motor control schemes. ese so-called dV / dt lters won’t help much with reducing the common-mode currents, though, as the motor voltage waveform will still very much consist of pulses that span the full battery voltage.

To e ectively integrate the chopped voltage waveform into a nice sine wave (i.e. same as the current waveform) would require the LC lter cuto frequency be no higher than 1/10th the actual PWM frequency, and that would take up a lot more volume (and cost more) while almost certainly introducing enough phase shi to interfere with vector control schemes if not addressed in hardware and/or so ware.

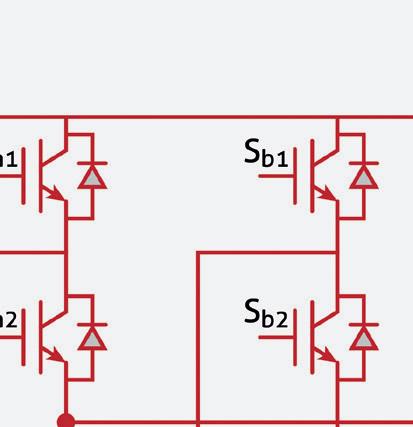

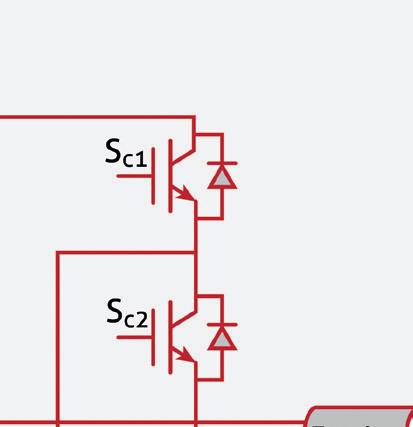

Another way to lower the THD and reduce the magnitude of common-mode currents is to add more steps to the voltage waveform generated by the inverter—a multilevel inverter, or MLI, in other words. Figure 1 illustrates the di erences in the voltage waveforms produced by the conventional 2-level inverter vs 3-level and 5-level MLIs. It’s di cult to see how the 2-level inverter even produces a

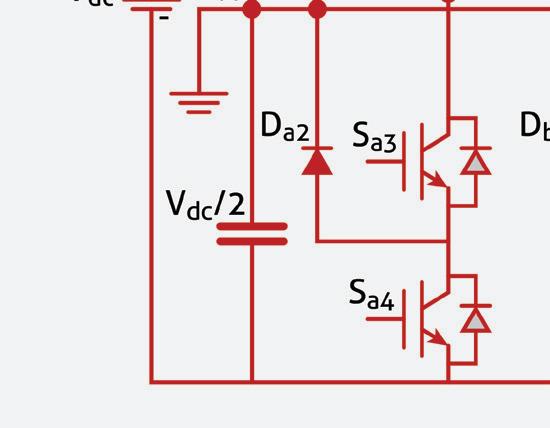

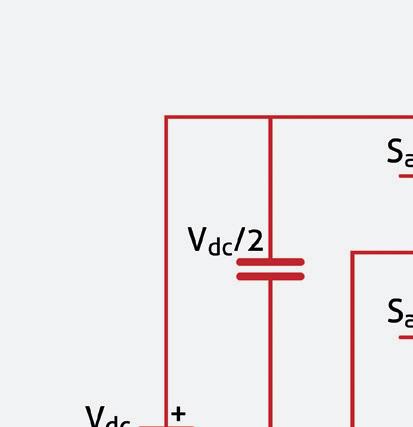

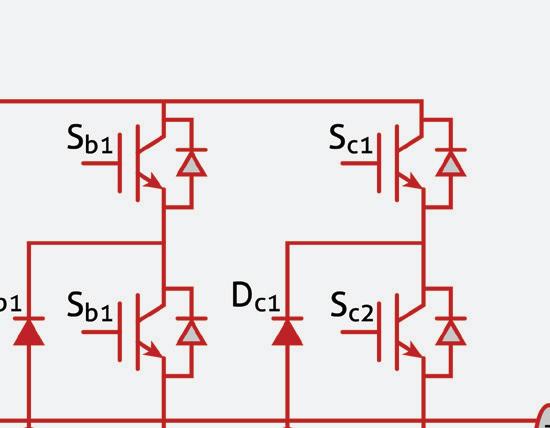

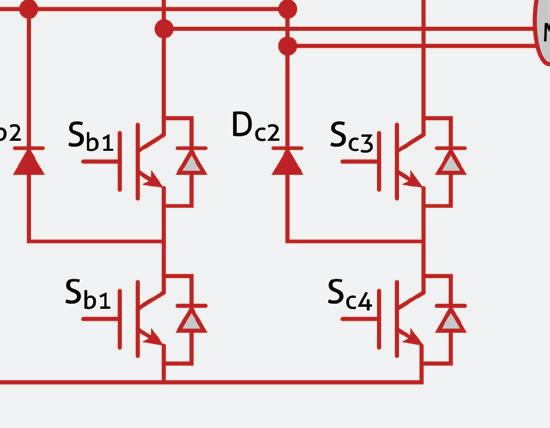

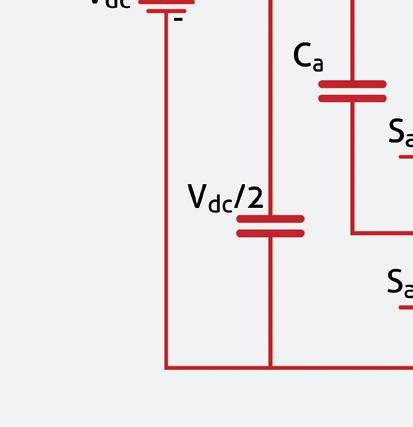

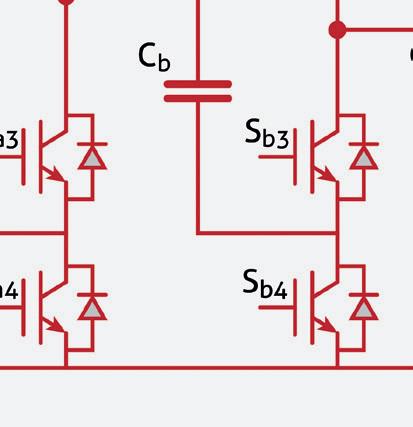

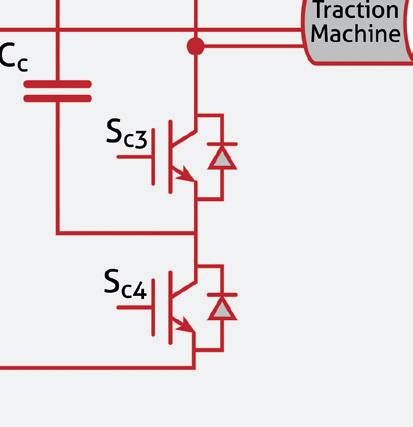

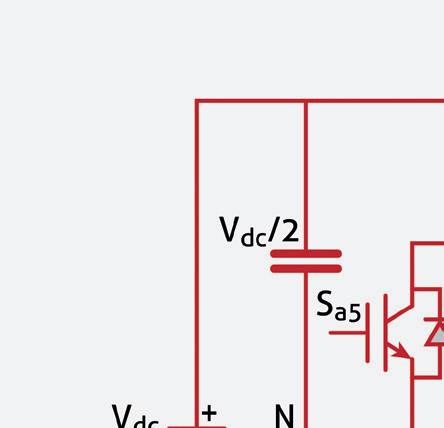

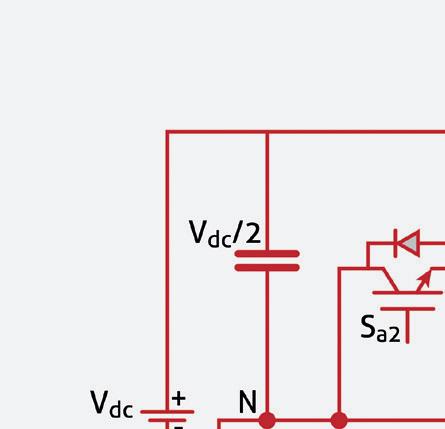

Multilevel inverters obviously need access to separate voltage sources for each output voltage level, or else must create the voltage levels indirectly.

sinusoidal current, whereas it’s much more obvious in the 3-level and 5-level MLIs. Note also that each PWM pulse in the 2-level inverter swings the full battery voltage, but only half Vbatt for the 3-level MLI, and a quarter of Vbatt for the 5-level MLI, etc. e price you pay for lower THD and common mode currents at a given PWM frequency with all multilevel inverter topologies is that they are much more complicated than their 2-level progenitor (ridiculously so, in some cases), and might very well not be worth paying for when compared to the more band-aid-type solutions of additional LC ltering, hardening of the motor against common-mode currents, etc.

Multilevel inverters obviously need access to separate voltage sources for each output voltage level (and each motor phase, for some MLI topologies), or else must create the voltage levels indirectly (typically with capacitive voltage dividers). An example of the former type of MLI is the

Cascaded H-Bridge, which has found some use in industrial applications because the separate DC voltages can be supplied by a mains transformer with multiple secondaries, but won’t be considered further here because it would require a Rube Goldberg-like arrangement of isolated battery packs and chargers in an EV.

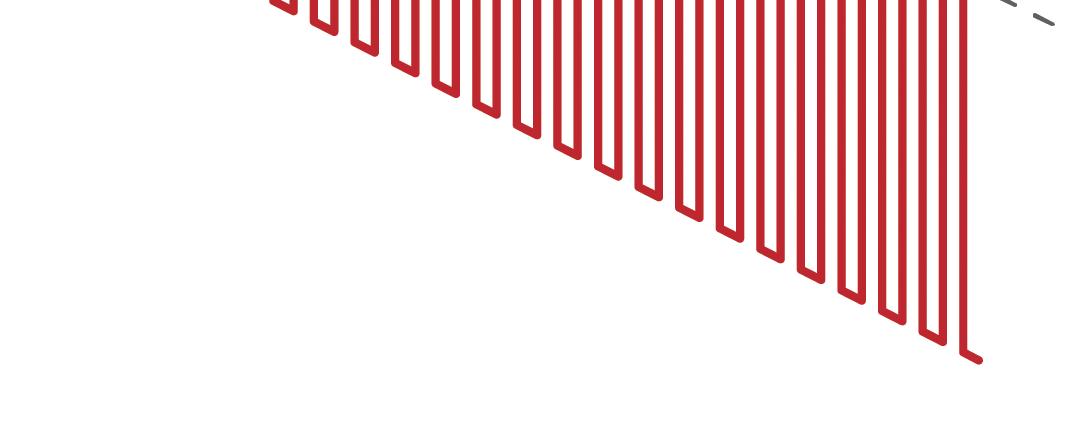

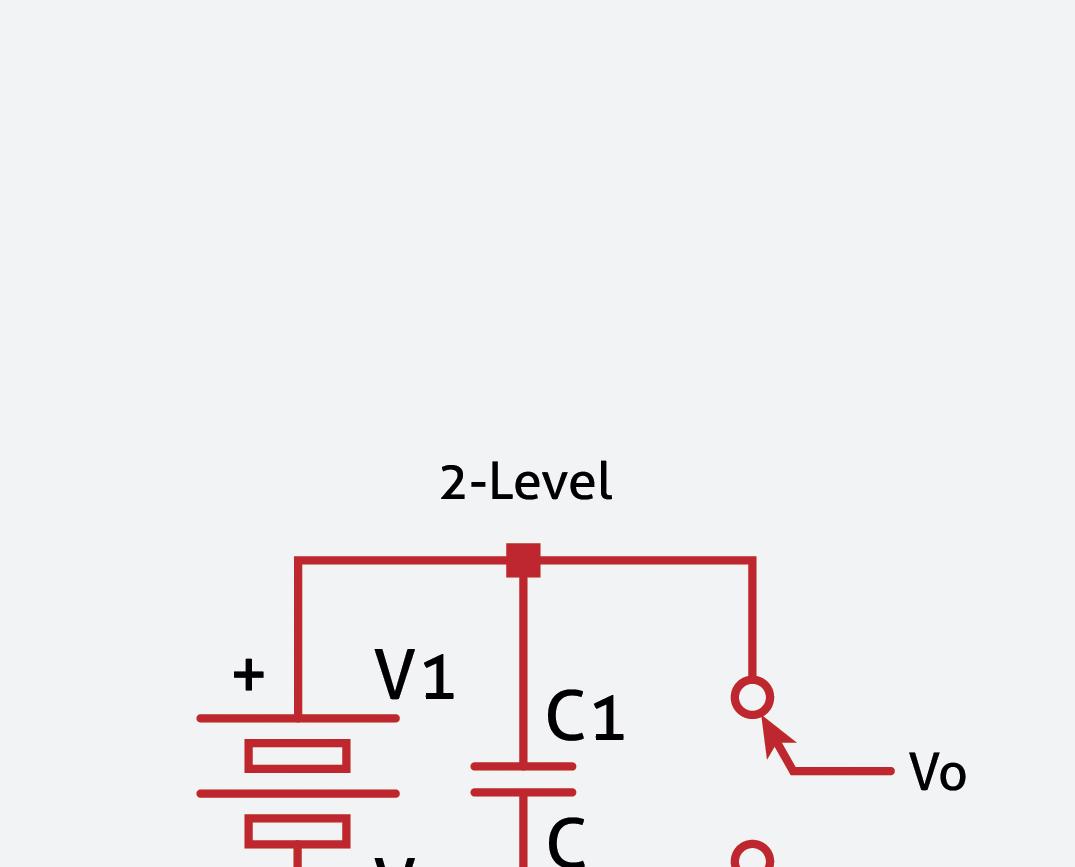

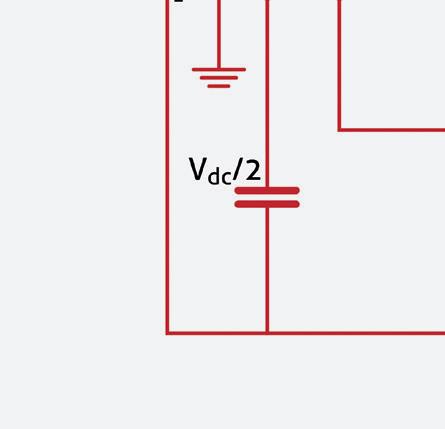

A far simpler way to generate the di erent voltage levels is the capacitive voltage divider (examples of such for 3- and 5-level MLIs shown in Figure 2), which acts just like a resistive voltage divider, though only for alternating currents. Wiring two equal-value capacitors in series will divide the bus voltage in half, and the midpoint will become a new 0 V reference for the MLI (i.e. the power stage of a 3-level MLI generates pulses with amplitudes of +Vbatt / 2, 0 V, or -Vbatt / 2, with respect to the midpoint).

e divider function can be extended by adding more pairs of capacitors, in which case the midpoint of each junction becomes a new voltage level (so the 4-capacitor divider string for a 5-level MLI creates voltage levels of +Vbatt / 2, +Vbatt / 4, 0 V, -Vbatt / 4 and -Vbatt / 2, once again assuming all capacitor values are equal).

As advantageous as reducing the voltage swing of the pulses might be, the law of diminishing returns will kick in at some point, as the sheer volume of the capacitors required—and the complexity of the rest of the MLI—scales directly with the number of voltage levels. It is also important to note that the capacitors in the voltage dividers have to carry considerable ripple current, both at the fundamental (motor) frequency and the PWM frequency, meaning that they will likely need to have relatively large capacitance values (to minimize ripple voltage from the low-frequency currents) and a lm dielectric (to minimize losses from the high-frequency currents), which is not terribly cost- or volume-e ective.

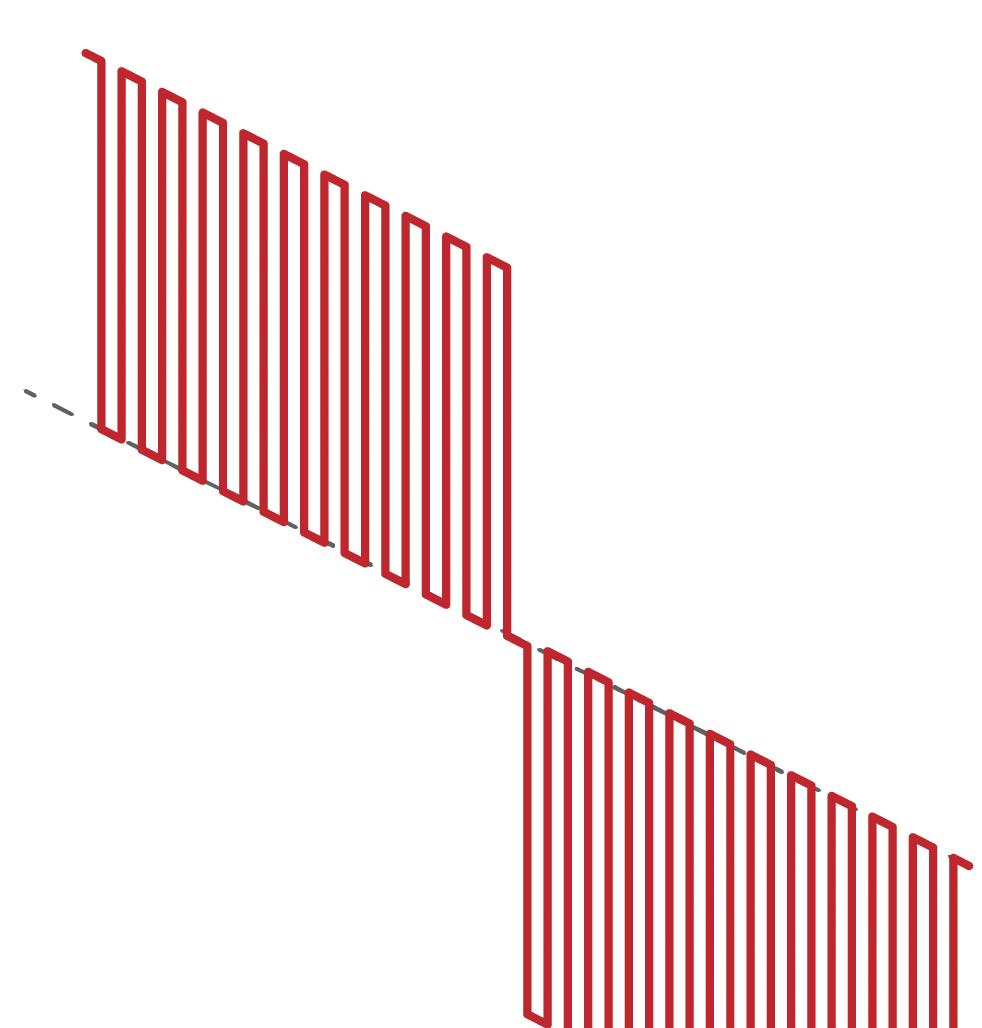

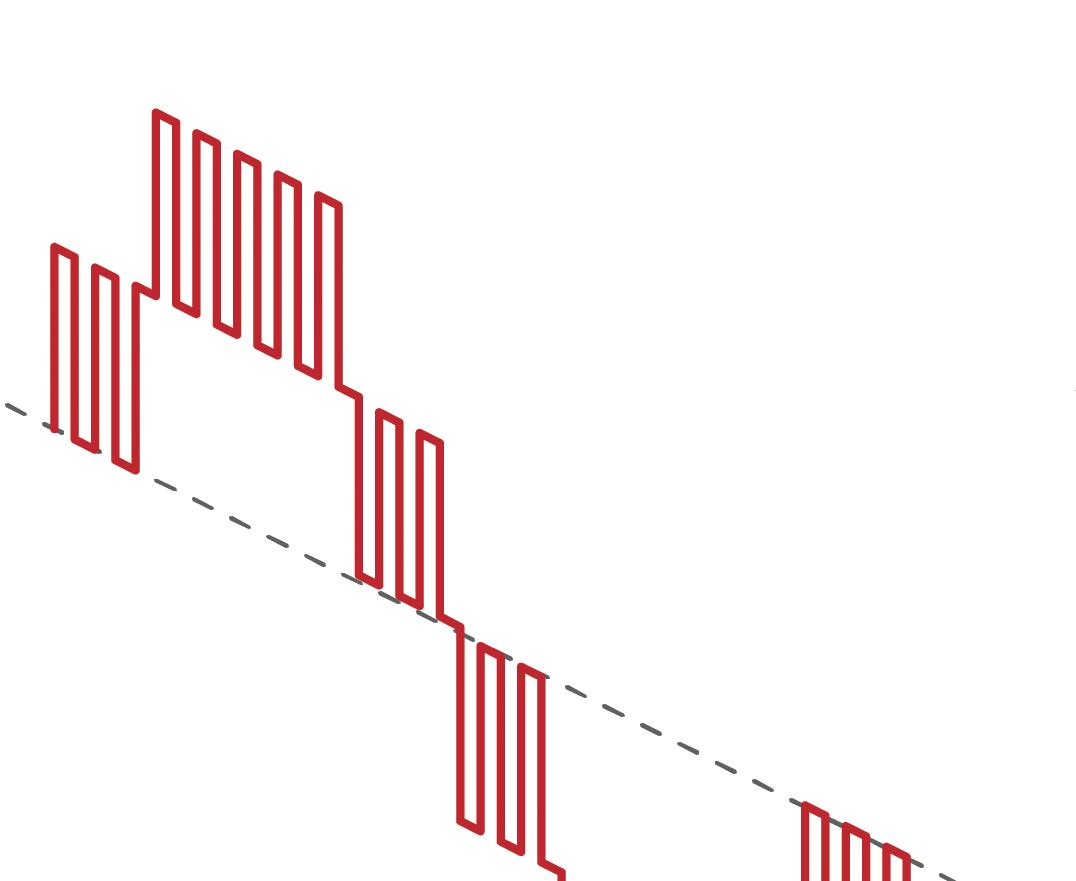

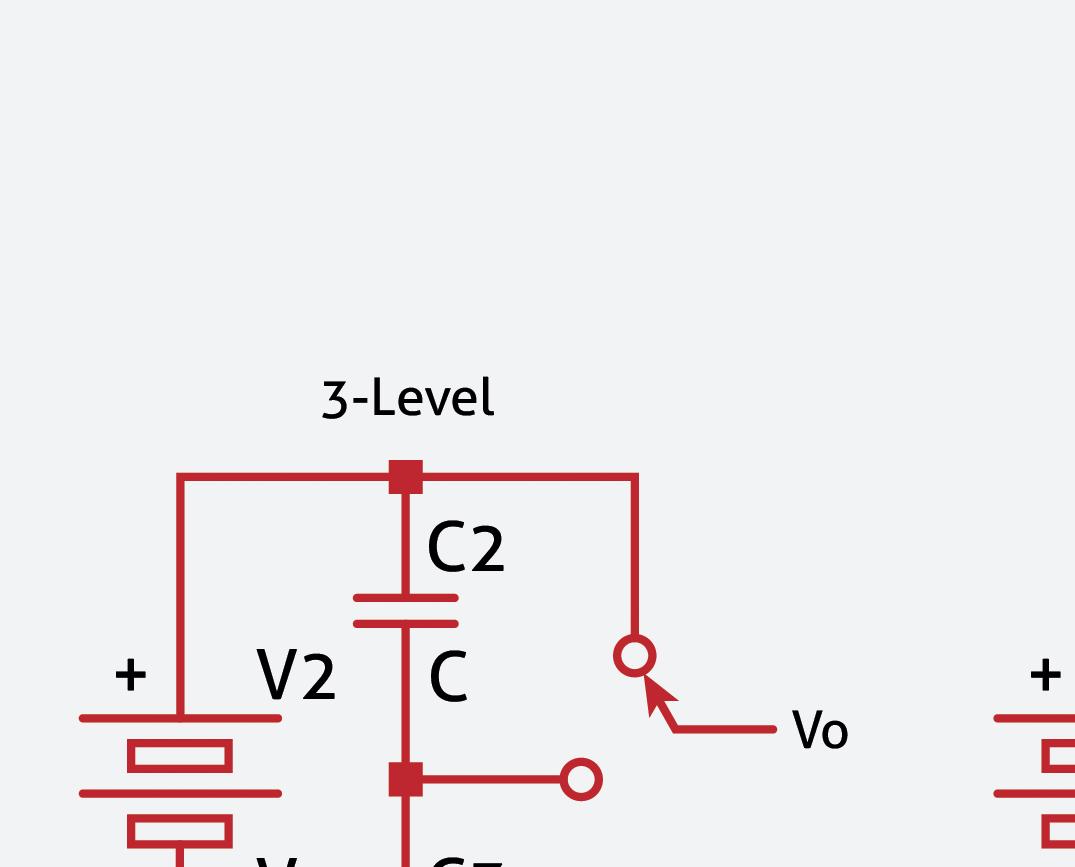

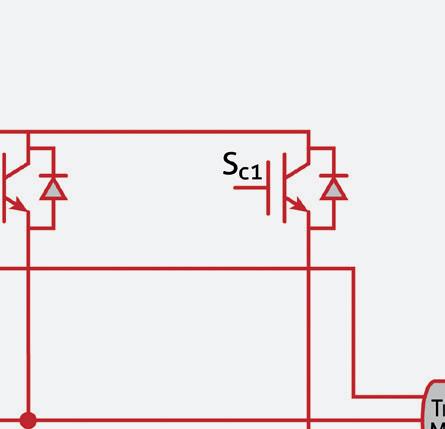

Two of the original multilevel inverter topologies that could be used in EVs are the Neutral Point Clamped (NPC) and Flying Capacitor (FC) types, shown in Figures 3 and 4, respectively, which use the same basic power stage structure but di erent methods of generating the 0 V

Capacitor types of multilevel inverter topologies use the same basic power stage structure but different methods of generating the 0 V output level.

output level. In each of these 3-level MLIs, a phase winding is connected to +Vbatt when the upper two switches are on, or -Vbatt when the lower two switches are on, but the 0 V output level is generated directly in the NPC type by turning on the inner two switches, while in the FC type it is generated indirectly by turning on the upper and lower-inner switches at the same time to charge the ying capacitor, followed by the upper-inner and lower switches to discharge it. Neither of these methods allow for actively balancing charge on the divider capacitors, so there tends

to be more voltage ripple across them, and as mentioned above, the more ripple on the divider capacitors, the higher the THD. e NPC type is easier to control (far easier, in fact), while the FC type has higher fault tolerance (a capacitor is in series with the motor windings during the 0 V state) and can achieve a lower ultimate THD, but it is endishly di cult to control and introduces the thorny problem of how to pre-charge its ying capacitors during startup.

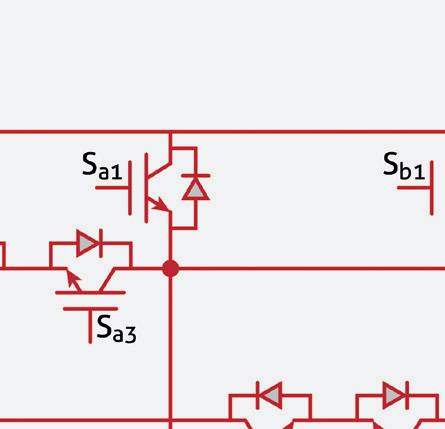

Two MLI topologies that use active switches to better maintain charge balance on their divider capacitors while preserving the ability to handle loads with a wide power factor range (read: induction motors) are the Active Neutral Point Clamped (ANPC) and the T-type, shown in Figures 5 and 6, respectively.

e ANPC MLI replaces the clamping diodes in the NPC with switches that are turned on in conjunction with their respective middle bridge switch to clamp that winding to a capacitor midpoint. e key di erence in operation compared to the passive clamping with diodes is that the on time of the clamping switches can be varied to better control the charge balance on the divider capacitors.

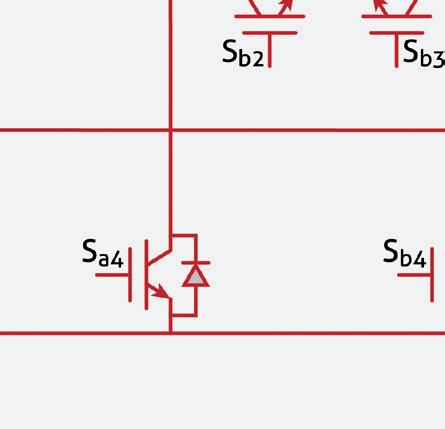

e T-type MLI operates in a similar fashion but saves two switches by replacing the clamping and inner bridge switches with a single bidirectional switch (composed of two conventional unidirectionally-blocking switches wired back-to-back) that directly connects a phase winding to a divider midpoint while allowing for bidirectional current ow when on, and bidirectional blocking when o . e main advantage of the T-type inverter is that it uses a standard triple half-bridge for driving the motor, but that also means the bridge switches must be rated to comfortably withstand the full battery voltage, whereas all of the other MLI topologies considered here stack two switches in series at the outer (highest

voltage) bridge positions (the inner switches only see a fraction of Vbatt), so all of the switches can theoretically be rated for half the blocking voltage (in a 3-level MLI). at’s particularly helpful for current-technology GaN HEMTs as they most commonly top out at a 650 VDC rating, but not so relevant with SiC MOSFETs (or older-technology Si IGBTs) as they are widely available in the 1.2 kV and 1.7 kV ratings that would be appropriate for battery voltages in the 600-800 VDC range. ere are numerous other MLI topologies that are even more complex, but they won’t be considered here—the considerable increase in component count going from a 2-level VSI to any of the 3-level (much less 5-level!) MLI topologies is enough of an obstacle to their adoption as it is. Another obstacle is that all of the MLI topologies require changes to the power stage switch control schemes, which means their development will be far more costly (and take more time than anticipated—but isn’t that always the case?). When one also considers that just the AC voltage divider capacitors required by most MLI topologies will likely take up as much volume all by themselves as a complete 2-level VSI (to say nothing of the ying capacitors also required in the FC MLI), and that a substantial reduction in RF noise emissions—and even common-mode noise currents— can be achieved in the 2-level VSI simply by adding LC lters to each phase output, the argument for MLIs in EVs is a tough one to sell.

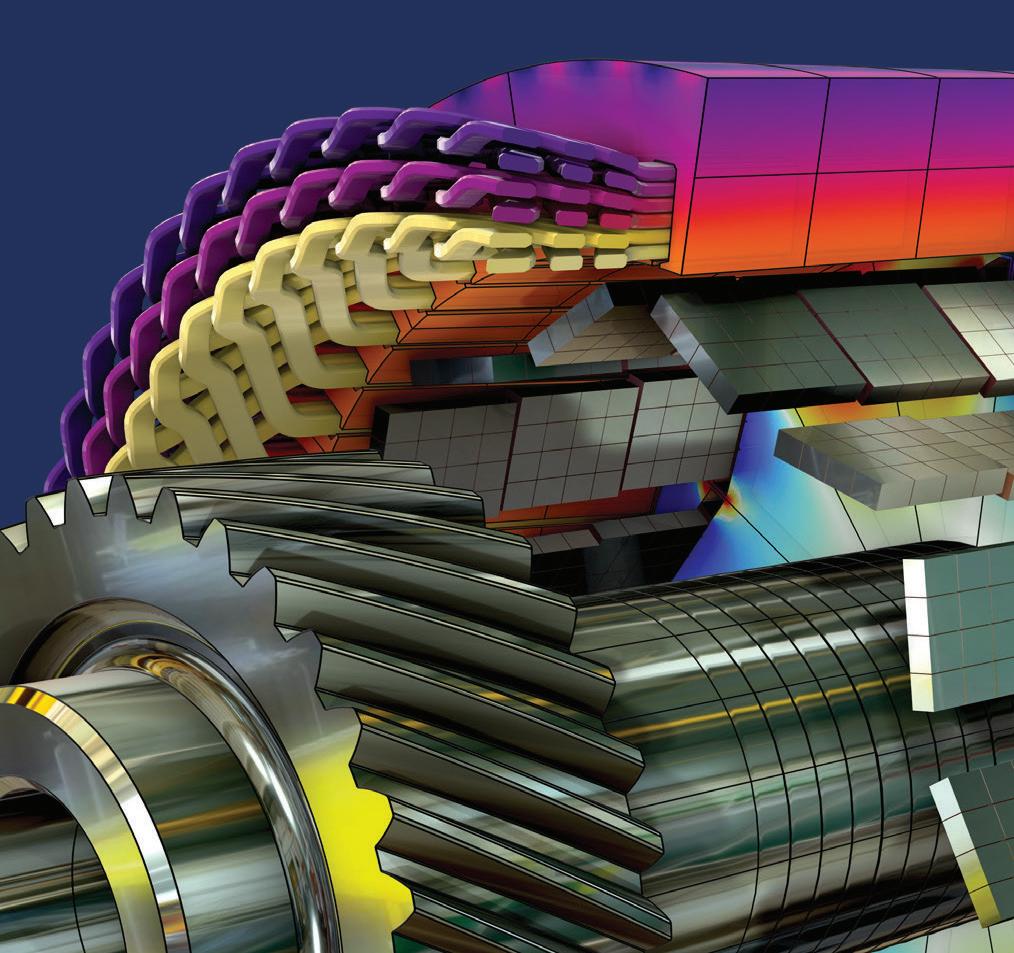

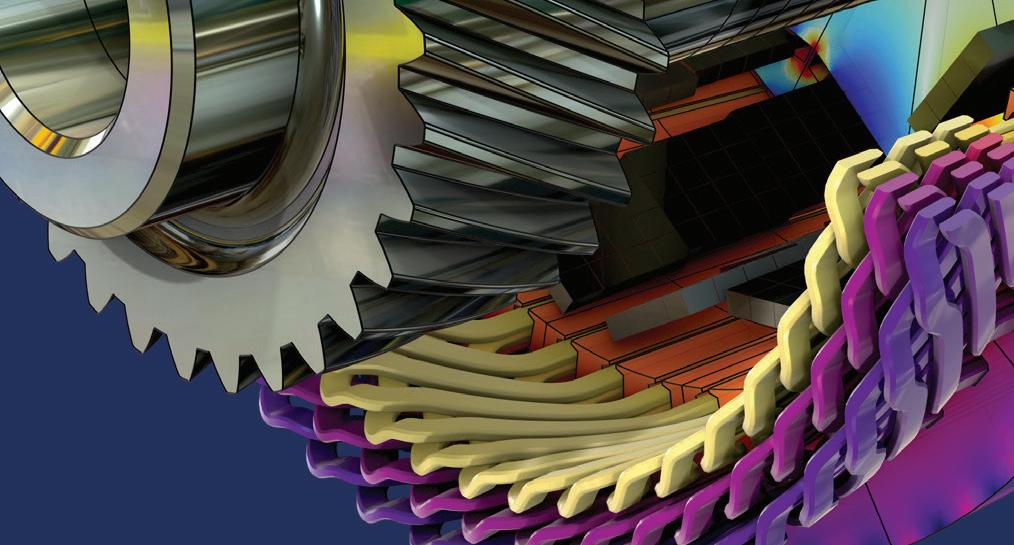

Multiphysics simulation software feeds the innovation of electric components, batteries, sound systems, and other automotive parts. By building models that accurately represent the real world, engineers are able to develop, test, and verify their designs faster.

» comsol.com/feature/automotive-innovation

$400 million worth of electric mining equipment from

Australian mining company Fortescue has placed a $400-million order with Chinese heavy equipment maker XCMG (Xuzhou Construction Machinery Group). e sale, which includes over 100 pieces of electric equipment, is the largest single export deal in XCMG’s history. e massive contract includes a wide range of battery-electric heavy equipment, including electric wheel loaders, dozers, semi-trucks and graders, which will be delivered to Fortescue’s mining operations in Pilbara, Australia, in stages between 2025 and 2030.

Fortescue says the use of this equipment will displace millions of gallons of diesel fuel at the company’s iron ore operations over the life of the assets.

“We’re moving rapidly to decarbonize our Pilbara iron ore operations and eliminate our Scope 1 and 2 terrestrial emissions by 2030,” said Fortescue Metals CEO Dino Otranto. “To achieve this target, we will need to swap out hundreds of pieces of diesel mining equipment at the end of their life with zero-emissions alternatives.”

XCMG is embracing electri cation across its product lines. “XCMG is dedicated to long-term sustainable development, o ering high-end, intelligent and green product+scenario full-life-cycle solutions to global customers,” said XCMG Chairman Yang Dongsheng. “ e company has achieved electri cation across its entire product range, and new energy products account for 18 percent of revenue.”

ICF’s new PowerGuide helps utilities identify likely candidates for fleet electrification

ICF provides energy e ciency, electri cation and demand management programs to over 60 utilities across North America, including Duke Energy, Con Edison and National Grid.

Now the company has launched PowerGuide, a cloudbased customer engagement, education and analytics platform designed to provide utilities and their customers real-time insights on the costs and bene ts of eet electri cation.

Drawing from a data collection of over 200 eets across 16 US states and a database of over 600 EV models, PowerGuide o ers utility customers market awareness, education and modeling to help make the transition to electri ed eets easier. e platform is designed to support informed decision-making on vehicle costs, maintenance schedules, grid impacts and community bene ts.

e platform also helps utilities to identify prospective customers for eet electri cation, including businesses and communities that could generate high environmental bene ts.

“PowerGuide gives us the ability to coordinate with customers who will bene t the most from eet electrication, allowing us to make real and lasting impacts on emissions,” said Ryan Hawthorne, VP of Electric Engineering and Operations at Central Hudson, a New York utility that is an early adopter of the platform.

“Utility customers are trying to navigate a complex landscape to make decisions about their eet electrication programs,” said ICF Executive VP Anne Choate. “Our new platform, supported by our industry-leading energy experts, will help utilities successfully guide their customers through their electri cation journey, provide tailored resources, eet insights and ultimately a ordable choices.”

Red Bull North America has become the rst customer for Isuzu’s new NRR-EV Class 5 electric box truck. e medium-duty trucks are now delivering cans of the neon-red sugar-and-ca eine concoction in Southern California. (We haven’t been able to learn how many units Red Bull bought, but a photo provided by the company shows six of the trucks.)

e NRR-EV is available with several battery con gurations, ranging from three to nine 20 kWh battery packs (60 kWh to 180 kWh total). e nine-pack version boasts up to 235 miles of range with a 19,500-pound GVWR. A 150 kW (200 hp) electric motor delivers 380 lb- of torque.

Red Bull’s Isuzu trucks ship with a “big enough” battery capacity of 100 kWh, are tted with a lightweight aluminum 6-bay beverage body, and have a 9,000 lb payload.

Isuzu began assembling NRR-EV trucks at its Charlotte, Michigan assembly plant in August 2024, and plans to expand customer deliveries nationally in Q1 of 2025.

“Watching the NRR-EV evolve from a concept to a viable operating product is a big deal,” said Shaun Skinner, President of Isuzu Commercial Truck of America. “Our teams and our clients have put so much time and e ort into making this happen, and it speaks to our teamwork and dedication to more sustainable transportation solutions.”

omas Built Buses, a subsidiary of Daimler Truck, has announced the launch of the second-generation Saf-T-Liner C2 Jouley battery-electric school bus.

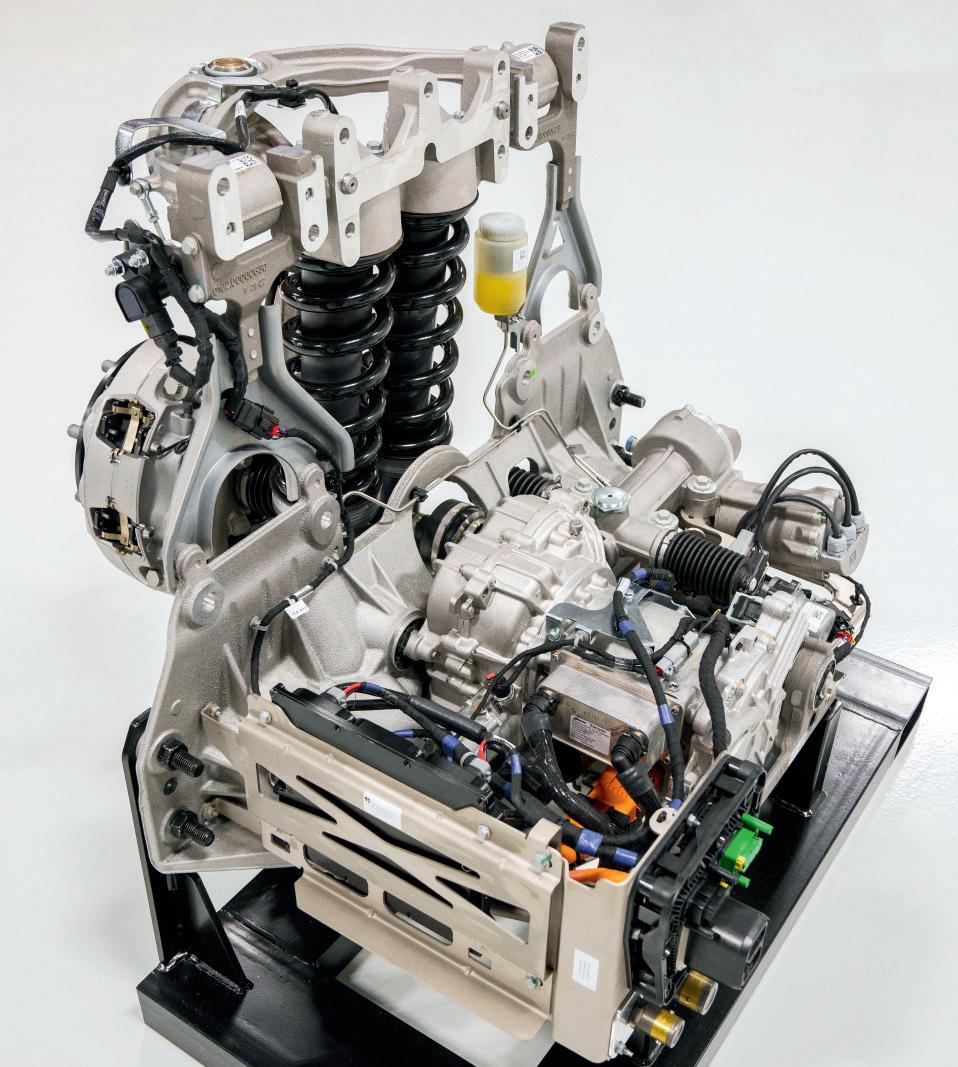

At the core of the second-generation Jouley is the 14Xe eAxle from Accelera by Cummins, an all-in-one unit that integrates the motor, two-speed transmission, disc brakes and rear-drive gear set into one package mounted on the rear axle. is eliminates the need for a traditional drivesha , which omas explains makes the drivetrain lighter, more e cient and less complex. e streamlined design of the eAxle simpli es maintenance by reducing the number of moving parts. e eAxle, coupled with Accelera’s ELFA inverter, delivers power directly to the wheels, enhancing acceleration and torque for a smoother ride.

Accelera’s eAxle enables shorter wheelbase architectures. e second-generation Jouley o ers a new 219inch wheelbase, which improves the overall maneuverability of the vehicle.

“ e 14Xe eAxle elevates expectations for performance, e ciency and serviceability, setting a new standard for the industry. School buses are an ideal application for electri cation,” said Brian Wilson, General Manager of eMobility for Accelera.

e second-gen Jouley is equipped with an 800-volt Proterra battery system. “ e higher voltage along with the eAxle makes it ideal for diverse terrains, including hills and mountains,” omas explains. “ is upgrade also supports the integration of additional components like air conditioning, heaters and other essential features without compromising performance.”

“With features that enhance e ciency, performance and serviceability, the new Jouley delivers unmatched value for both current electric bus operators and new adopters who are ready to embrace cleaner, smarter solutions,” said T.J. Reed, President and CEO of omas Built Buses.

Mining giant Rio Tinto will partner with China’s State Power Investment Corporation (SPIC) to demonstrate battery-swap-capable electric haul trucks at the Oyu Tolgoi copper mine in Mongolia.

e technology is already in use on haul trucks in mining operations in China, and this collaboration will enable Rio Tinto to demonstrate a complete battery-electric truck and charging ecosystem.

e two-year project will demonstrate 8 mining haul trucks (91-tonne payload), 13 batteries (800 kWh), and a robotic battery swap and charging station. Technical experts from Rio Tinto and Oyu Tolgoi have worked closely with SPIC and truck manufacturer Tonly to align the equipment design with Rio Tinto’s requirements. e trucks will perform non-production activities in the aboveground operations—speci cally, tailings dam rehabilitation work and topsoil movement.

Rio Tinto operates about 700 haul trucks across its global operations, of which 100 are classi ed as small or medium class (100-200-tonne payload).

Each battery charge is expected to last up to 8 hours, depending on the work performed, and the battery swap process takes around 7 minutes.

e rst truck is scheduled to arrive at Oyu Tolgoi this year, and the remaining 7 trucks, along with the battery swap and charging infrastructure, will be in operation by mid-2025.

e joint venture between Rivian and Volkswagen could someday supply EV tech to other automakers.

Developing the so ware that is a critical component of modern autos has proven to be a struggle for legacy automakers, including VW, but comes more naturally to an internet-era startup such as Rivian. Volkswagen plans to invest $5.8 billion in the joint venture, which was ocially launched last November. e JV will focus on the development of electrical architecture and so ware for a new line of so ware-de ned EVs, which are expected to start appearing in 2027.

It’s a win/win deal: higher production volume should allow Rivian to negotiate better supplier deals and reduce costs, and VW’s investment shores up the company’s capital position. Meanwhile, Volkswagen will get access to the so ware mojo it lacks. Now Rivian says other legacy automakers want a piece of the action.

“I’d say that many other OEMs are knocking on our door,” Rivian Chief So ware O cer Was-sym Bensaid said (as reported by Reuters). “Any other OEM who wants to make a leap from a technology standpoint, the joint venture today becomes one of the key partners with whom they can make that collaboration.”

Bensaid didn’t name any of the interested automakers, or discuss what stage the talks were at.

Rivian’s next-generation architecture requires fewer electronic control units and signi cantly less wiring than its rst generation (which was already ahead of the legacy brands’ tech), reducing vehicle weight and simplifying manufacturing.

Volkswagen CEO Oliver Blume recently told Der Spiegel that VW might expand the partnership with Rivian: “We are thinking about sharing modules and bundling purchasing volumes.”

Japan-headquartered eVTOL aircra manufacturer SkyDrive, South Carolina-based private jet charter company SAI Flight and Greenville Downtown Airport have signed an agreement to jointly develop air cargo, air taxi and emergency service opportunities using SkyDrive’s aircra .

e three organizations are collaborating with local and state governments and local businesses to design practical routes originating from Greenville Downtown Airport to such destinations as the city center and Greenville-Spartanburg International Airport.

SAI Flight has placed a pre-order for 10 SkyDrive aircra , and its SAI Flight Services division will oversee operations and maintenance from its base at Greenville Downtown Airport.

“ is partnership marks a milestone in our e orts to drive business growth in South Carolina,” said SkyDrive CEO Tomohiro Fukuzawa. “We will continue to deepen our cooperation with local partners, while making strategic preparations to fully realize our innovative business model.”

Construction vehicles and equipment are rapidly going electric, and Volvo Construction Equipment is a major purveyor of electric equipment—so it’s not surprising to nd that a construction site in Stockholm is a testing ground for sustainable construction technologies.

A construction site in Slakthusområdet, a former meat-packing district in central Stockholm that has been rejuvenated as a trendy nightlife destination, has reached a milestone: 50% of its operations are now performed by electric equipment.

Volvo CE electric machines in use on the project include two EC230 Electric crawler excavators and an L120H Electric Conversion wheel loader. ese are supported by two Volvo electric trailer trucks.

“ e rst phase [of the project] showed the e ectiveness of electric machines in performing tasks while signi cantly reducing CO2 emissions,” said Fredrik Tjernström, Head of Electromobility Solutions Sales at Volvo CE. In the next phase, which is scheduled for completion in 2025, Volvo aims to reduce emissions even further, reaching target of 3.5 tonnes of CO2 per SEK 1 million in turnover. “ is is a dramatic decrease on the 11 to 29 tons typically emitted in similar projects.”

e city of Stockholm has set a goal of becoming climate-positive by 2030.

“ is proactive approach creates a ripple e ect throughout the entire value chain, pushing all stakeholders to explore new possibilities and expand the boundaries of what can be achieved in sustainable construction,” said Anna Göransdotter, Project Manager at construction company Skanska.

Daimler Truck has begun series production of the Mercedes-Benz eActros 600 at its plant in Wörth am Rhein, Germany.

Mercedes-Benz’s third electric truck model a er the eActros 300/400 and the eEconic, the eActros 600 is designed for long-haul applications. It boasts up to 500 km of range, depending on the speci c application and ambient conditions. Its three battery packs, each with 207 kWh, provide a total installed capacity of 621 kWh.

e eActros 600 is manufactured on the existing assembly line of the Wörth A-series production alongside diesel-drive trucks. It is the rst electric truck from Wörth to be assembled in one production hall. Its battery-electric drive components, including electric axles, transmission components and front boxes, are supplied by company plants in Mannheim, Gaggenau and Kassel.

e truck will contribute to the complete electri cation of delivery tra c into the Wörth plant by the end of 2026, according to the company.

“Our eActros 600 is addressing the long-haul segment in Europe which is responsible for two thirds of CO2 emissions from heavy road freight,” said Daimler Truck CEO Karin Rådström.

Michigan-based electric truck maker Bollinger Motors, a majority-owned company of California-headquartered Mullen Automotive, has delivered three 2025 Bollinger B4 Chassis Cabs to TEC Equipment dealerships on the West Coast.

e trucks, equipped with 158 kWh battery packs, were delivered to Lacey, Washington; Fontana, California; and Oakland, California.

TEC is headquartered in Portland, Oregon, and has more than 30 locations across eight states.

Swedish EV manufacturer Polestar has started US production of the long-range single-motor variant of its Polestar 3 SUV at the plant near Charleston, South Carolina, that it shares with Volvo.

e model has a certi ed WLTP range of up to 438 miles and a certi ed EPA range of up to 350 miles. It uses the same 111 kWh battery pack as the dual-motor version and has the same 250 kW peak charging capability.

e motor produces 220 kW and 490 Nm of torque and can accelerate from 0 to 100 km/h in 7.8 seconds. e long-range single-motor variant uses the same Brembo braking system as the rest of the Polestar 3 range. It comes with a new entry price in Germany of €79,890.

“ is new entry point for our full-sized agship electric SUV means Polestar 3 is now accessible to even more consumers than before,” said Polestar CEO Michael Lohscheller.

Scout Motors, a brand of the Volkswagen Group that builds rugged, o -road-capable electried vehicles, has announced plans to sell its electric trucks directly to consumers when they launch in 2027, with transparent pricing, online orders and company-owned stores. Dealer groups are already organizing legal challenges.

InsideEVs’ Mack Hogan writes that Volkswagen dealers are “furious” that Scout plans to cut them out of the picture. “To just show these new vehicles that would have t very nicely into VW’s portfolio, it’s like rubbing salt in the wound here,” National Auto Dealers Association CEO Mike Stanton told Automotive News.

California dealers are planning to sue, arguing that Scout is competing with VW’s own dealers. Scout contends that it’s a di erent company than VW.

Scout execs believe they’ll be able to stave o the legal challenges. “We’re highly con dent we’re going to prevail,” Cody acker, Scout Motors’ VP of Growth, told InsideEVs. “We think we have the right position here, and it’s never a bad spot to be advocating for consumer choice and consumer freedom in car buying.”

e car dealer groups’ claims are “what you would expect from a lobbying entity,” acker added. “It’s what you would expect from a trade association. We don’t believe that there’s any validity to the claims.”

“To me there is no doubt that if we can o er a buying process that is transparent, that is seamless, that is fast and that is truly enjoyable, that’s what we’re doing,” Scout CEO Scott Keogh told InsideEVs. “I think these things should be decided by the American consumer and businesses should innovate and compete.”

e legal battles will probably be fought ought state by state over the course of years (as is the case with Tesla’s ongoing saga), and Mr. Hogan notes that Scout does not need to win in every state. Rivian and Tesla get around local prohibitions by simply doing the paperwork for a sale in one state, and delivering the vehicle in another.

Lake Tahoe, the largest Alpine lake in North America, became a transportation hub a er the 1848 California Gold Rush. Mail delivery then took place via a sailboat that visited each community, and steamboats began plying the river in 1863. e advent of automobiles in the 20th century diminished the steamers’ popularity, but the pendulum might swing back to greenwater transit a er FlyTahoe launches its rst Candela P-12 electric hydrofoil boat.

FlyTahoe plans to link the 14 ski resorts that encircle the lake by electric ferry. At 30 minutes, the travel time from the northern to the southern part of the lake via the FlyTahoe ferry service will compare favorably with driving around the lake, which can take up to two hours in the winter.

Because Lake Tahoe does not freeze, the delays and disruptions caused by road closures due to heavy snow will be greatly reduced.

e P-12, thanks to its hydrofoil design, o ers passengers a much smoother ride than traditional ferries and o ers operators improved e ciency.

e P-12 seats up to 30 passengers, with plenty of room to stow skis and bikes. It is 39 feet in length, has a 14-foot beam, and displaces 11.02 tons. e rst P-12 ferry went into service in Sweden at the start of November and o ers green travel among Stockholm’s 14 islands.

e ferry’s manufacturer, Candela recently raised an additional $14 million in its Series C round, putting the company’s total secured funding in 2024 at over $40 million. e investment will help Candela meet the increased demand for its vessels and allow it to ramp up production.

“ is is the dawn of a zero-emission revival in waterborne transportation,” said Gustav Hasselskog, Candela’s founder and CEO.

Lyte o, a new EV merchandising company, has received $3 million in seed funding.

Lyte o’s platform integrates into auto dealership web sites to help them move their EV inventory faster and appraise EV batteries with precision. It provides data-backed sales tools to answer customers’ most prominent questions.

Lyte o’s EV Revenue Platform provides a suite of tools that communicate VIN-speci c EV savings including fuel and maintenance savings, state, federal and local tax incentives, a charger and trip planner, personalized ownership reports and EV data enrichment, adding EV-speci c information to a dealership vehicle’s detail pages.

Dealerships are embedding Lyte o into their web sites to increase EV lead conversion and ultimately sell EVs faster. e company is working on integrating additional tools into the platform, including EV battery testing and health reports.

Lyte o also recently announced a partnership with DealerOn, connecting the company with 7,000 dealers around the US.

By John Voelcker

Kia kicked it off last year with the EV9, but the latest EV three-row utilities—the Volvo EX90 and Hyundai Ioniq 9—are far from the last.

It all started, of course, with the Tesla Model X. Only the second vehicle built and sold in volume by the Silicon Valley EV startup, it was instantly recognizable—for its whalelike shape, its lack of any pretense at a front grille, and most of all the Falcon Wing doors that elevated vertically from the spine down the roof and hinged in the middle as they rose.

Seven years would pass before another maker launched a three-row electric SUV. at was the Rivian R1S, including a seven-seat option, from a di erent EV startup—one that had already launched an EV pickup truck. First deliveries of the R1S took place during 2022; it’s built in Illinois.

at meant the 2024 Kia EV9, on sale for much of 2024 and now built in the US to boot, was a revelation: the rst three-row EV utility from an established carmaker. Its striking looks, capacious third row and 800-volt battery charging positioned it as a mass-market successor to the Model X—which by this point had become a low-volume, high-performance ancillary model to Tesla’s high-volume Model Y, which only o ered ve seats.

Now the 2025 Volvo EX90 has gone into production in the US as well; it can be found at Volvo dealers throughout North America. (See separate feature story on page 42.) It’s the high end of Volvo’s EV range, and is likely to be joined in due course by a midsize EX60, along with the subcompact EX30 now starting deliveries in small volumes.

At November’s Los Angeles auto show, the 2025 Hyundai Ioniq 9 broke cover as well. While it uses many of the same underpinnings as its Kia counterpart, the design and interior ttings di er signi cantly. It too will be US-built—and Hyundai promises 300 miles of EPArated range from every version.

After the launch of Tesla’s Model X in late 2015, seven years would pass before another maker launched a three-row electric SUV, Rivian's R1S.

Hyundai Ioniq 9

And that’s hardly the end of it. e 2025 Cadillac Vistiq will go on sale during 2025 as well, the last of four Cadillac EVs that started with the midsize Lyriq. e full range of four EVs will shortly add the compact Optiq, and top out with the seven-row Vistiq and its even larger sibling, the truck-based Escalade IQ (which will also have seven seats).

While the US EV market as a whole promises to be turbulent over the next few years, it’s clear that the most American of all vehicle types—the seven-seat “family SUV”—is sticking around, whether powered by gasoline or electricity. We wouldn’t bet on the EV models we’ve named here being the full list, either. So far, Chevrolet, Ford and Dodge have no o erings in the segment. Nor do Toyota, Honda, Nissan or Volkswagen. Ditto the German luxury brands. We expect that to change over the next ve years. Meanwhile, US EV shoppers have plenty to choose from—and there’s more on the way.

While the US EV market as a whole promises to be turbulent over the next few years, it’s clear that the most American of all vehicle types—the seven-seat “family SUV”—is sticking around.

Volvo’s flagship all-electric SUV is quiet, competent and safe, but it has its quirks.

By John Voelcker

The 2025 Volvo EX90 three-row electric SUV has been a long time coming. First unveiled in Sweden back in November 2022, its production at a new plant in Charleston, South Carolina, was delayed for many months to resolve so ware issues. e EX90 entered production there in June 2024 for North American and European markets. ( e same plant also builds the sleeker Polestar 3 SUV, with which the EX90 shares underpinnings—that model went into production a couple of months later.)

Now on sale at Volvo dealers, the EX90 is Volvo’s batteryelectric agship, at the high end of the range that’s anchored at its low end by the EX30 subcompact crossover. at EV too has been delayed in its launch, though Volvo has imported a small number of the cars from China to satisfy its earliest reservation holders before production for North American markets starts in Belgium in mid-2025.

We drove a very early production EX90 for most of a day in late summer in and around Newport Coast, California. e temperate weather and an a uent suburb in the most EV-friendly state in the US o ered the perfect backdrop for Volvo’s new agship.

You’re unlikely to see the EX90 and identify it as anything other than a Volvo. e big electric SUV updates the classic shape and proportions of the gasoline XC90, while appearing cleaner and more modern both inside and

The big electric SUV updates the classic shape and proportions of the gasoline XC90, but appearing cleaner and more modern both inside and out.

out. Its wheelbase is identical, at 117.5 inches, but it’s 3.3 inches longer and 1.6 inches taller. e biggest giveaway is the blanking plate between the headlights, where you’d expect a grille. Only tech geeks will be likely to notice a small bulge in the roo ine, just above the windshield, that houses a Lidar sensor for partial self-driving functions to come in the future.

Riding on 22-inch summer tires, our test car was painted in a light beige shade called Sand Dune, which one reporter accurately pegged as “vintage Band-Aid color.”

Inside, the interior was light and airy, helped by the massive glass roof—though the lack of a sunshade made the inside of the roof hot to the touch. (An a ermarket sunshade is o ered in some markets as a dealer accessory.) Interior materials use Volvo’s customary quiet palette, in this case a bio-based leather-free upholstery called Dawn Quilted Nordico o set by a light ash trim that’s lit from the back at night—a startling but memorable touch.

A massive 111-kilowatt-hour nickel-manganese-cobalt battery pack, of which 107 kWh is usable, powers the EX90 Twin Motor.

For the moment, the EX90 comes only as a three-row vehicle, with seven seats provided by the rear bench, or six if you opt for the $500 second-row captain’s chair option.

Behind the steering wheel, the design language could be called the evolved, digital version of Volvo, but it di ers considerably from that of the XC90. A short, wide 9-inch digital display sits behind the steering wheel, similar to that of the Ford Mustang Mach-E (it also adjusts with the wheel), to give running information to the driver. A head-up display also projects speed, navigation directions, and other vital information onto the windshield. A vertical 14-inch touchscreen sits proud of the dash as well; it has permanent icons at the bottom for home, climate control and hazard ashers. Audio, phone and other infotainment functions are activated via widgets.

Volvo and its sister brand Polestar are migrating all their vehicles to use Android operating so ware. at company’s voice recognition is head and shoulders above any other maker’s, though it wasn’t clear how o en the Google Maps navigation system for EVs updated its list of public charging locations. To reassure anxious shoppers who’ve seen GM’s latest EV o erings, the EX90 still o ers cellphone mirroring via both Android Auto and Apple CarPlay.

A massive 111-kilowatt-hour nickel-manganese-cobalt battery pack, of which 107 kWh is usable, powers the EX90 Twin Motor. Both versions are EPA-rated at 300 or more miles combined. e standard powertrain is rated at 296 kilowatts (402 horsepower) and 568 lb- of torque, while the Performance model boosts that to 380 kW (510 hp) and 671 lb- , courtesy of its more powerful rear motor. In both versions, the vehicle moves away from a stop using both motors, but then defaults to cruising on

It’s the car’s overall hush inside that left the biggest impression. This thing is genuinely tomblike.

only the front motor as soon as conditions permit. At roughly 3 tons, the EX90 is faster than you might expect, with quiet, no-nonsense acceleration. But it’s the car’s overall hush inside that le the biggest impression. is thing is genuinely tomblike, which means the optional 25-speaker Bowers & Wilkins stereo can show o its Dolby Atmos sound in utter silence. e dual-chamber air springs and adaptive dampers together isolate occupants from all but the worst road-surface irregularities. Overall, this is one very re ned big luxury SUV.