18 Risky Business: Managing Uncertainty in Upstream Decision-Making

27 Students Keen on Opportunities at 2016 APEGA GeoSkills

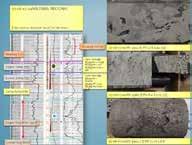

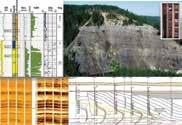

28 Multi-scale reservoir heterogeneities within the McMurray Formation and the impact on thermal production, Athabasca oil sands

28 University Outreach: Distinguished Lecture Tour

$4.00 APRIL 2016 VOLUME 43, ISSUE 04 Canadian Publication Mail Contract – 40070050 RETURN UNDELIVERABLE CANADIAN ADDRESSES TO: CSPG – 110, 333 - 5 Avenue SW Calgary, Alberta T2P 3B6

week

Registration Rates:

International Core Conference registration - $260

- June 23-24 | core displays and presentations, breakfast, lunch and 1 Core Meltdown TicketCore Meltdown Ticket - $35

- June 24th starts at 2:00pm | includes two drink tickets and appetizersFor

AGAT Core Meltdown Party! AGAT Core Meltdown Party!

Wrap Up your Convention week with the Wrap Up your Convention

with the International Core Conference International Core Conference and the and the

more information and to register today go to www.cspg.org

CSPG OFFICE

#110, 333 – 5th Avenue SW

Calgary, Alberta, Canada T2P 3B6

Tel: 403-264-5610

Web: www.cspg.org

Please visit our website for all tickets sales and event/course registrations Office hours: Monday to Friday, 8:00am to 4:30pm

The CSPG Office is Closed the 1st and 3rd Friday of every month.

OFFICE CONTACTS

Membership Inquiries

Tel: 403-264-5610 Email: membership@cspg.org

Advertising Inquiries: Kristy Casebeer

Tel: 403-513-1233 Email: kristy.casebeer@cspg.org

Sponsorship Opportunities: Lis Bjeld

Tel: 403-513-1235 Email: lis.bjeld@cspg.org

Conference Inquiries: Candace Jones

Tel: 403-513-1227 Email: candace.jones@cspg.org

CSPG Foundation: Kasandra Amaro

Tel: 403-513-1234 Email: kasandra.amaro@cspg.org

Accounting Inquiries: Eric Tang

Tel: 403-513-1232

Email: eric.tang@cspg.org

Executive Director: Lis Bjeld

Tel: 403-513-1235, Email: lis.bjeld@cspg.org

EDITORS/AUTHORS

Jason Frank Co-Editor | jfrank@atha.com

Travis Hobbs, Co-Editor | travis.hobbs@encana.com

Please submit RESERVOIR articles to the CSPG office. Submission deadline is the 23rd day of the month, two months prior to issue date. (e.g., January 23 for the March issue).

To publish an article, the CSPG requires digital copies of the document. Text should be in Microsoft Word format and illustrations should be in TIFF format at 300 dpi., at final size.

CSPG COORDINATING EDITOR

Kristy Casebeer, Programs Coordinator, Canadian Society of Petroleum Geologists

Tel: 403-513-1233, kristy.casebeer@cspg.org

The RESERVOIR is published 11 times per year by the Canadian Society of Petroleum Geologists. This includes a combined issue for the months of July and August. The purpose of the RESERVOIR is to publicize the Society’s many activities and to promote the geosciences. We look for both technical and non-technical material to publish. The contents of this publication may not be reproduced either in part or in full without the consent of the publisher. Additional copies of the RESERVOIR are available at the CSPG office.

No official endorsement or sponsorship by the CSPG is implied for any advertisement, insert, or article that appears in the Reservoir unless otherwise noted. All submitted materials are reviewed by the editor. We reserve the right to edit all submissions, including letters to the Editor. Submissions must include your name, address, and membership number (if applicable).The material contained in this publication is intended for informational use only.

While reasonable care has been taken, authors and the CSPG make no guarantees that any of the equations, schematics, or devices discussed will perform as expected or that they will give the desired results. Some information contained herein may be inaccurate or may vary from standard measurements. The CSPG expressly disclaims any and all liability for the acts, omissions, or conduct of any third-party user of information contained in this publication. Under no circumstances shall the CSPG and its officers, directors, employees, and agents be liable for any injury, loss, damage, or expense arising in any manner whatsoever from the acts, omissions, or conduct of any third-party user.

Printed by McAra Printing, Calgary, Alberta.

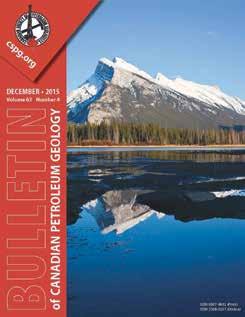

Mt. Ngauruhoe, Tongariro National Park, North Island, New

FRONT COVER

Zealand. This 2291m stratovolcano located along the Ring of Fire is part of the Mt. Ruapheu, Mt. Ngauruhoe, and Mt. Tongariro complex. The oldest lava is dated at approximately 275,000 years ago, while the most recent eruptions occurred in 2012 Bob Leonhardt - diarob@shaw.ca APRIL 2016 – VOLUME 43, ISSUE 04 ARTICLES Risky Business: Managing Uncertainty in Upstream Decision-Making 18 CSPG 2015 Award Citation: Stanley E. Slipper Award ........................................................ 22 CSPG 2015 Award Citation: H.M. Hunter Award 26 CSPG 2015 Award Citation: LINK Award .............................................................................. 27 Students Keen on Opportunities at 2016 APEGA GeoSkills ............................................. 27 Multi-scale reservoir heterogeneities within the McMurray Formation and the impact on thermal production, Athabasca oil sands 28 University Outreach: Distinguished Lecture Tour 28 Quarterly Commodity Pricing Update ................................................................................... 29 DEPARTMENTS Message from the Board 5 Technical Luncheons ................................................................................................................... 8 Division Talks 11 Rock Shop ................................................................................................................................ 9, 27 RESERVOIR ISSUE 04 • APRIL 2016 3

Knowledge has TO BE improved, CHALLENGED, AND INCREASED constantly, OR IT vanishes. geoSCOUT | gDC Upstream knowledge solutions

your upstream decision-making with customer-driven data, integrated software and services from geoLOGIC. At geoLOGIC, we help turn raw data into actionable knowledge. That’s a powerful tool to leverage all your decision making, whether it’s at head office or out in the field. From comprehensive oil and gas data to mapping and analysis, we’ve got you covered. Get all the knowledge you need, all in one place with geoLOGIC. For more on our full suite of decision support tools, visit geoLOGIC.com

Power

CSPG BOARD

PRESIDENT

Greg Lynch • Shell Canada Ltd. president@cspg.org Tel: 403.384.7704

PRESIDENT ELECT

Mark Cooper • Sherwood Geoconsulting Ltd. presidentelect@cspg.org

PAST PRESIDENT

Tony Cadrin pastpresident@cspg.org

FINANCE DIRECTOR

Scott Leroux • Long Run Exploration directorfinance@cspg.org Tel: 403.766.5862

FINANCE DIRECTOR ELECT

Shelley Leggitt • NAL Resources Ltd. directorfinanceelect@cspg.org

DIRECTOR

Mark Caplan conferences@cspg.org

DIRECTOR

Jen Russel-Houston • Osum Oil Sands Corp. Jrussel-houston@osumcorp.com Tel: 403.270.4768

DIRECTOR

Eric Street • Jupiter Resources estreet@jupiterresources.com Tel: 587.747.2631

DIRECTOR

John Cody • Statoil Canada Ltd. industryrelations@cspg.org

DIRECTOR

Ryan Lemiski • Nexen ULC ypg@cspg.org

EXECUTIVE DIRECTOR

Lis Bjeld • CSPG lis.bjeld@cspg.org Tel: 403.513.1235

Message from the Board

A

message from Mark Caplan, CSPG Director

Conference Update: Knowledge Rules!

I am already in my second year as Director responsible for Conferences, Technical Luncheons, Technical Divisions and University Outreach, and I am thoroughly enjoying the experience. It has been a most challenging time for everyone in the Oil and Gas Sector, and remains so. Price of oil is the lowest we’ve seen in over a decade, global oil production continues to increase, oil inventories in North America are at the highest levels seen in many decades, and the demand for oil continues to demonstrate weakness. These conditions have created the “perfect storm” resulting in depressed oil prices and huge layoffs in Calgary, North America and across the globe. Oil prices will eventually climb; however to what level and what timeframe is not known and remains hotly debated by the thinktanks and journalists. The ripple effect on other industries in Calgary is palpable; some restaurants are less crowded, empty seats on public transport and lower occupancy rates in downtown offices. Geoscientists have experienced commodity crashes in the past. We are a resilient lot, and will be preparing for the commodity price recovery.

Many of us geologists find ourselves “in transition”. Those fortunate to still be working have expanded duties and fewer resources available to them. Technical self-development is critically important for the young as well as more experienced professionals. Research and technical advances continue to abound, and we cannot afford to miss out on this knowledge. Education in the form of short courses, field trips, technical luncheons, technical division talks and conferences are designed to help the geoscientist remain technically competitive. The CSPG is proud of the quality of these services that are offered to you. Your society endeavours to continue providing these high-quality services to you during these trying times. Please remember that most of the CSPG technical events qualify

for continuing professional development hours, which are necessary to maintain your professional geologist practising status at APEGA.

I am eager to inform you of several key events of note that are scheduled for 2016. These are:

1. GeoConvention 2016: Optimizing Resources (CSPG/CSEG/CWLS) held March 7-11th

2. Annual Convention and Exhibition (AAPG/CSPG) held June 19th-22nd

3. International Core Conference (CSPG) held June 23rd-24th

4. Gussow 2016 Conference: Clastic Sedimentology (CSPG) October 11th – 13th

GeoConvention is the annual tri-society (CSPG/CSEG/CWLS) technical conference, held from 7-9th March, 2016. As of publication date of this article, we saw that oral and poster presentation submission numbers and quality were high. We are certain that this GeoConvention will be a big success.

The AAPG Annual Convention and Exhibition (ACE) will be held in Calgary from June 19th to 22nd, and is proudly hosted by the CSPG. As always, there will be excellent short courses and field trips besides the technical presentations and posters. This is a convention not to be missed. Immediately following ACE, the CSPG is proud to be hosting the International Core Conference to be held at the world-famous Core Research Centre (Alberta Energy Regulator) in Calgary on 23rd and 24th June. There will be 39 core displays, presentations and, of course, the Core Meltdown. Cores include oil sands, (... Continued on page 7)

RESERVOIR ISSUE 04 • APRIL 2016 5

Before writing an article please contact the series coordinator via email at Philip.Benham@shell.com. He can provide a template document and confirm that a particular hike has not been submitted before.

Submission guidelines:

Preferred format is powerpoint, 2-3 pages in length, include map, hike directions, annotated photos, Geological description and references. While hikes focus on western Canada, hikes in other parts of the world are welcome.

Submit your hike to be featured in the “GO TAKE A HIKE” SERIES

Save The Date!

October 11th - 13th , 2016 Location: Banff, Alberta Don’t forget to Mark Your Calendars! Clastic Sedimentology: New Ideas and Applications 6 RESERVOIR ISSUE 04 • APRIL 2016

Dates:

Alberta Energy Regulator

PLATINUM

Loring Tarcore Labs Ltd.

APEGA

GOLD

MEG Energy Corp.

Progress Energy Ltd.

SILVER

Nexen ULC

Seitel Canada Ltd.

Chinook Consulting

BRONZE

Long

Exxonmobil

Husky Energy Inc.

Pro Geo

CSEG

IHS

MJ

unconventional shale reservoirs and conventional reservoirs, with presentations from Canada, USA, Germany, Turkey and Brazil. Registration for this world-class event is only $260 CAN. Please be sure to register now for this event as it is always immensely popular and a sell-out. To register for the ACE Convention and Core Conference go to www.aapg.com/2016, or to just register for the Core Conference ONLY visit www.cspg.org.

I am also excited to announce CSPG’s annual Gussow Conference, to be held at the Banff Centre, Banff from 11th to 13th, October.The theme this year will be Clastic Sedimentology. We have received a lot of interest from global researchers and industry. So far, we have 5 themes and 7 confirmed session chairs (wellrespected names from across Canada and USA) including the following:

• Continental

• Fluvio-Marine Transition

• Shallow Marine

• Deep Marine

• Fine-Grained

If you would like to contribute to this conference, please stay tuned as we upload new information on the CSPG website in the coming months.

In addition to conventions, the CSPG is proud to continue offering many other highquality events in 2016. Technical luncheons continue to showcase Canadian presenters comprising the CSPG Distinguished Lecturers Series. These luncheons also stage AAPG Distinguished Lecturers that tour North America. The CSPG is also in discussions to invite international distinguished lecturers from outside North America. In response to the prevailing market conditions, the CSPG is

adopting a number of initiatives such as holding a reduced number of technical luncheons in a smaller venue to accommodate fewer guests. Ticket prices have also been reduced to under $40 for CSPG members, which continue to be a great deal. Moreover, please remember that the technical luncheons each count as 1 Professional Development Hour for APEGA practice. Please keep monitoring the CSPG website for new talks in 2016.

CSPG’s technical divisions are stronger than ever. I am proud of the hard work that the volunteers have committed to making these divisions work. They attract strong talks, plenty of them, and have found sponsors to cover refreshments for the events, and in some cases, have also organised social mixers where people can mingle, network and discuss geoscience topics of interest. The number of technical divisions has risen to eight; the newest addition being ”Hydrogeology” (launched in November 2015), which I am happy to announce is doing exceedingly well. It attracted a large crowd of hydrogeologists and geologists alike to its first talk. The Oil Sands and Heavy Oil Division is another revived technical division which has been attracting great-quality talks, huge audiences and very generous sponsors to support breakfast. Please continue to provide support to these divisions.

On behalf of the CSPG Board of Directors and members, I would like to extend a huge thank you to all the volunteers and office staff who have devoted so much time to make these events possible and very successful. Please support YOUR society and sign up for events at http://www.cspg.org/CSPG/ Conferences/ Consider that your technical development is your ticket to a successful and rewarding career. Happy learning!

(... Continued

5) 16th Annual Long-Time Members Reception Tuesday, May 3, 2016 | 4:00 pm – 6:00 pm The Fairmont Palliser Calgary Have you been a member of the CSPG for 30+ consecutive years? If so, watch your email inbox for your invitation to the 16th Annual CSPG Long-Time Members Reception. Attendance is by invitation only. Tickets: $25 - available to purchase through www.cspg.org CORPORATE SPONSORS

Foundation geoLOGIC systems

Laboratories

Corp.

from page

SAMARIUM CSPG

ltd. DIAMOND AGAT

TITANIUM Tourmaline Oil

Weatherford Canada Partnership

Imperial Oil Resources

Exploration

Run

Trust

Crescent Point Energy

Ltd.

Exploration Co.

Consultants

Consulting

Geosciences Ltd.

Belloy Petroleum

Paradigm

Foundation

Canada Limited

Oil and Gas Canada Inc.

Global

Repsol

Systems

Laboratories

Petroleum Consultants Ltd. As of March 3, 2016 A Special Thanks to geoLOGIC systems ltd. RESERVOIR ISSUE 04 • APRIL 2016 7

Core

GLJ

TECHNICAL LUNCHEONS

Mechanical

Stratigraphic Controls on Fracturing (Jointing) and Normal Faulting in

the Eagle Ford Formation, South-Central Texas, U.S.A.

SPEAKER

David A. Ferrill

AAPG Distinguished Lecturer

11:40 am

Wednesday, April 06, 2016

Calgary, TELUS Convention Centre

Calgary, Alberta

Please note: The cut-off date for ticket sales is 1:00 pm, four business days before event [Thursday, March 31, 2016].

CSPG Member Ticket Price: $39.75 + GST.

Non-Member Ticket Price: $47.50 + GST.

Each CSPG Technical Luncheon is 1 APEGA PDH credit. Tickets may be purchased online at https://www.cspg.org

ABSTRACT

Production from self-sourced reservoirs relies on natural and induced fracturing to enhance permeability and produce connected pathways for hydrocarbons to flow back to producing wellbores; thus, natural or induced fracturing is key to the success of unconventional reservoir plays. In addition to enhancing production, large or wellconnected fractures or faults may cause undesirable complications for production. Natural and induced fractures are influenced by: (i) mechanical stratigraphy, (ii) preexisting natural deformation such as faults, fractures, and folds, and (iii) in situ stress conditions, which includes both natural stresses and stresses modified by stimulation and pressure depletion (Ferrill et al. 2014b). Understanding the occurrence and controls on natural and induced faulting and fracturing in selfsourced reservoirs is a key component for

developing effective approaches for exploiting hydrocarbons within self-sourced reservoirs.

Outcrop investigation of the Eagle Ford Formation in south-central Texas reveals a distinctive influence of bed-scale mechanical layering on fracture system development (Ferrill et al. 2014a). Welldeveloped joint networks are present in subhorizontal competent carbonate (chalk) beds. Joint systems are less well-developed in interlayered incompetent calcareous mudrock beds. All observed joints terminate vertically in incompetent mudrock beds (Figure 1). Abutting relationships between joint networks allow determination of the relative timing sequence between joint sets and between joints and faults. Normal faults are common but less abundant than joints (Figure 2). The faults dominantly dip north, northwest, or southeast and joint sets abut against the faults, indicating that the faults formed prior to the joint networks. In addition, the faults cut multiple competent and incompetent beds, providing vertical connectivity across mechanical layering. These faults are products of both hybrid and shear failure. Consequently, the fault dips are steep through competent beds and moderate through incompetent beds, resulting in refracted fault profiles with dilation and calcite precipitation into dilational cavities along steep segments. Fluid inclusions in calcite from the fault zone commonly contain liquid hydrocarbons or in rare two-phase fluid inclusions homogenization temperatures suggest trapping of aqueous fluids at elevated temperatures (40-100° C) and depths on the order of 2 km (6562 ft). Fluid inclusions and stable isotope geochemistry analyses suggest that faults transmitted externally derived fluids. These faults likely formed at depths equivalent to portions of the present-day oil and gas production from the Eagle Ford play in

south Texas. Faults connect across layering and provide pathways for vertical fluid movement within the Eagle Ford Formation, in contrast to vertically restricted joints which produce bed-parallel fracture permeability but have limited vertical connectivity.

Natural fracture systems, along with mechanical stratigraphy and in situ stress conditions, are the context within which hydraulic stimulation programs are performed. The natural faults and joints are preexisting weaknesses that are likely to reactivate before stress conditions required for failure of intact rock are reached. Open or mineralfilled faults and fractures have contrasting porosity and permeability with respect to the host rock layers and will potentially dilate, slip, or compartmentalize fluid pressure increase during induced hydraulic fracturing.

BIOGRAPHY

David A. Ferrill is director of the Department of Earth Material and Planetary Sciences at Southwest Research Institute. He received his B.S. degree in geology from Georgia State University in 1984, his M.S. degree in geology from West Virginia University in 1987, and his Ph.D. in geology from the University of Alabama in 1991, and he is a licensed professional geoscientist (geology) in the state of Texas. Dr. Ferrill is a structural geologist with international research experience in contractional, extensional, and strike-slip tectonic regimes, and international oil and gas exploration and production experience. He has analyzed geometric and kinematic folding and faulting processes, curvature of mountain belts, regional tectonics, hydrocarbon trap integrity, and induced hydraulic fracturing in unconventional reservoirs. He has characterized reservoirs and aquifers, and interpreted tectonic stress fields, rock deformation, and fracture mechanisms and has published extensively on these topics. Study areas

8 RESERVOIR ISSUE 04 • APRIL 2016

APRIL LUNCHEON Webcasts sponsored by

TECHNICAL LUNCHEONS APRIL

have included the French Alps, the Appalachians, the Basin and Range Province and Colorado Plateau of the western United States, the Gulf of Mexico, Trinidad, Iceland, offshore Vietnam, offshore Turkey, the Persian Gulf, plus other planetary bodies including Mars and Ganymede. Dr. Ferrill works with staff to develop execute projects for a wide range of clients related to oil and gas exploration and production, groundwater resource analysis, natural hazard assessment, and planetary research. He leads SwRI’s Eagle Ford structural geology and geomechanics joint industry project, and performs contract consulting and structural geology training for the oil industry that includes regularly teaching structural geology and geomechanics field seminars. Dr. Ferrill led development of the award winning 3DStress®

computer program for interactive analyses of the effects of stresses on faults and fractures, which received an R&D 100 award from R&D Magazine, designating it as one of the world’s 100 most significant technical accomplishments. Before joining Southwest Research Institute in 1993, he was an exploration geologist at Shell Offshore Incorporated, and prior to that an assistant professor at Georgia Southern University. He is editorial board member and former editor of Journal of Structural Geology, and current Chairman of Petroleum Structure and Geomechanics Division of American Association of Petroleum Geologists.

Rock Shop

Independent Wellsite Consultants Highly Skilled Competent Consultants Extensive Industry Experience (18 yrs +) Wellsite & Remote Supervision & Geosteering All Types of Conventional & Unconventional Wells Core, Chip Samples & Thin Section Studies International & Domestic Email: indwellcons5@gmail.com Tel: (403) 540-8496 1602 – 5th St N.E. Calgary, AB T2E 7W3 Phone: 403-233-7729 www.tihconsulting.com e-mail: tih@shaw.ca T.I.H. Consulting Ltd. Geologic Well-Site Supervision Advertise HERE! Contact us today! Email: Kristy.casebeer@cspg.org phone: 403.513.1233 Geological Consulting Services for 35 years Wellsight geological supervision and coring Geo-steering, Petrographic and Sample Studies Conventional & Heavy Plays | SAGD Projects Domestic and International Operations Moh & Associates Oilfield consultants Ltd. Since 1980 Moh Sahota, B.Sc (Hons), M.Sc. President Ph: 403.263.5440 Email: info@mohandassociates.com www.mohandassociates.com RESERVOIR ISSUE 04 • APRIL 2016 9

LUNCHEON Webcasts sponsored by

TECHNICAL LUNCHEONS MAY LUNCHEON

Cognitive Bias, The Elephant in the Living Room of Science and Professionalism

SPEAKER

Peter R. Rose

AAPG Distinguished Lecturer

11:40 am

Tuesday, May 03, 2016

Calgary, TELUS Convention Centre Calgary, Alberta

Please note: The cut-off date for ticket sales is 1:00 pm, four business days before event [Wednesday, April 27, 2016].

CSPG Member Ticket Price: $39.75 + GST. Non-Member Ticket Price: $47.50 + GST.

Each CSPG Technical Luncheon is 1 APEGA PDH credit. Tickets may be purchased online at https://www.cspg.org

ABSTRACT

Cognitive bias, in its many manifestations, is the major cause of geotechnical overestimation and faulty probability forecasts in petroleum geoscience. The five most prevalent cognitive biases in petroleum E&P are: Confirmation Bias; Overconfidence; False Analogs; Anchoring; and Motivational Bias. They are caused by premature selection of theory, personal hubris, lack of perspective, lack of imagination, laziness, and excessive self-interest. Important influences include the existing organizational reward system, economic pressure for objective geotechnical results, and the anticipated consequences of project reviews and evaluations. In fact, the field of E&P Risk Analysis emerged during the 1980s to help identify and reduce bias in assessing the value of new plays and prospects. Companies that routinely utilize disciplined methods of Risk Analysis tend to deliver on their E&P promises.

Pioneering work by Nobel laureate Daniel Kahneman, his late colleague Amos Tversky, and others since the 1970s has made scientists much more aware of the dangers that Cognitive Bias pose for the practice of

objective, reliable science. Even so, increasing awareness of obvious agenda-serving scientific publications, slanted peer review (“palreview”), withholding of codes and formulae, unreproducible experimental results, and scientific fraud indicate that procedures to identify and limit Cognitive Bias are not being appropriately utilized throughout the scientific community. This is probably because many of the organizational and economic pressures routinely experienced by E&P geoscientists are not as intensely or widely operative within academic and governmental organizations.

The late physicist and Nobel laureate Richard Feynman recognized (1974) the danger of Cognitive Bias: “the first principle is that you must not fool yourself – and you are the easiest person to fool.” Feynman knew that dedicated practice of the Scientific Method is the key to elimination of Cognitive Bias, recommending “a kind of scientific integrity, a principle of scientific thought that corresponds to a kind of utter honesty – a kind of leaning over backwards.” A practical research approach familiar to many geoscientists is T. C. Chamberlain’s “Method of Multiple Working Hypotheses”, introduced in 1890. Also important is the separation of E&P activity into two essential and complementary components – 1) play and prospect generation; and 2) play and prospect risk assessment. Professionalism constitutes the conscious honoring of such principles.

Sound and objective science is essential to the continued progress of Society. Is it possible that methods widely applied by Petroleum Geoscience to identify and counter Cognitive Bias might also be useful to other branches of Science?

BIOGRAPHY

Pete Rose (Ph. D., Geology, University of Texas, Austin) has been a professional geologist for 56 years, specializing in Carbonate Stratigraphy, Petroleum Geology, Basin Analysis, E&P Risk Assessment, and Mineral Economics. In 1998, he founded Rose & Associates, LLP. Pete retired in 2005; the Firm continues as the global standard among consulting companies in the field of E&P Risk Analysis.

His 2001 AAPG book, Risk Analysis and Management of Petroleum Exploration Ventures, now in its 7th printing, is widely considered

to be the “Bible” in its field, and has been translated into Japanese, Chinese, and Russian. He has authored or co-authored more than 80 published articles and over 300 presented papers on an extremely wide variety of topics (Micropaleontology to Petroleum Economics!). From 2001 to 2004 Pete wrote a regular column, “The Business Side of Geology”, for The Explorer, AAPG’s monthly news magazine.

Pete received the coveted Parker Memorial Medal from the American Institute of Professional Geologists in 1998. In 2005 he became the 89th President of AAPG. He was co-chair of the 2007 Interdisciplinary Conference on Oil and Gas Reserves Definitions, held in Washington, D.C., which was instrumental in encouraging the U. S. Securities and Exchange Commission to modernize its rules on oil and gas reserves reporting, as occurred the following year. This facilitated the investment component of the “shale revolution” in the U. S. during the 20082015 development period. In 2013 he became the first American recipient of the prestigious Petroleum Group Medal of the Geological Society of London, and in 2014 AAPG honored him with its Halbouty Outstanding Leadership Award.

His many years of experience, helping thousands of geoscientists to improve their geotechnical performance by detecting and reducing bias in their prospect and play evaluations, have prepared Pete Rose well to address the broader effects of cognitive bias in science and professional matters, the subject of his distinguished lecture, “Cognitive Bias, the Elephant in the Living Room of Science and Professionalism”.

10 RESERVOIR ISSUE 04 • APRIL 2016

Webcasts sponsored by

DIVISION TALKS STRUCTURAL DIVISION

The McConnell Thrust Sheet

Revisited

SPEAKER

Deborah Spratt

University of Calgary

12:00 noon

Thursday April 7, 2016

Schlumberger

Second Floor of the Palliser One Building 125 9th Ave, Calgary, AB

ABSTRACT

Seismic imaging and interpretation of structures in and beneath carbonate thrust sheets require an accurate depiction of their geometries to optimize petroleum exploration and production. The McConnell, Exshaw and Rundle thrusts in the Bow-Kananaskis area are examples of a common phenomenon - they appear from afar to have narrow and distinct fault zones on the order of a metre wide, but on closer inspection in good lighting exhibit zones of deformation 10’s to 100’s of metres wide. A variety of fold styles are displayed and thrust splays, duplexes, back-

thrusts and normal faults are common.

The McConnell Thrust zone is the focus of this talk, particularly minor fold and fault data in the frontal ramp at Mount Yamnuska and minor fold, fault, tectonic stylolite and fracture data from the Barrier Lake duplex complex, where the McConnell Thrust laterally ramps up-section southeastward from the Cambrian Eldon Formation to the Devonian Palliser Formation. Data were collected by UofC graduate students, advanced structure students and CSPG Structure Division members on our September 2015 fieldtrip.

We will also go on a virtual fieldtrip through the McConnell Thrust Sheet to compare structures associated with the McConnell, Exshaw and Rundle thrusts. The hanging wall of the Exshaw Thrust displays imbricates of various scales that are reminiscent of those in the Eldon at Mount Yamnuska and in the Eldon, Southesk, Palliser and Banff strata in the Barrier duplex system. The imbrication is also intra-formational and show the scales and geometries of what the Barrier duplex system may have looked like at earlier stages of development. The fact that many of the duplexes involve only one formation allows the thrust sheets and their internal folds to maintain remarkably consistent orientations

along strike - the folds and the faults are coaxially folded. Seismic reflectors with simple geometries found in areas with complex dipmeter data may be fault plane reflections of the roof and floor thrusts of these intraformational duplexes. Some of these horses are large enough to be resolved seismically, but the internal velocity models of the carbonate on carbonate panels would need to be refined in order to image them.

BIOGRAPHY

Deborah Spratt, PhD, PGeo, FGC, began her studies in the Canadian Rockies 40 years ago as a student of Dave Elliott at Johns Hopkins University. She joined the University of Calgary faculty in 1980 and has taught introductory, advanced, and graduate level courses in structural, physical, engineering and field geology and has led numerous field seminars in the Canadian Rockies for the petroleum industry, students from several universities, and in conjunction with CSPG, CSEG, GAC, CGU and AAPG conferences. She co-directed the Fold-Fault Research Project (FRP) consortium of petroleum industry sponsors from 1995-2008 and is now Professor Emeritus, teaching occasional classes and short courses on fold-fault systems.

Strengthen Your Geoscience Career by Joining ‘GeoMatch”

More and more professionals are actively pursuing mentoring to advance their careers. Whether you are participating as the mentee or mentor, these types of partnerships can benefit your career and develop your skills. Once CSPG has enough interest, we will contact applicants for further information, make matches and email details to participants.

There are four different categories as outlined below.

MENTEES:

Young Geoscience Professionals (35 years old and younger) – who wish for a mentor to accelerate their career

Women in Geosciences – for career networking and support

In-Transition (unemployed) - seeking skills clarification and networking opportunities

Recent Immigrants – professionals who have arrived in Canada within the last 12 months

MENTORS:

Retirees and experienced geoscientists who wish to mentor as a consultant to mentees in the categories above

To sign up for the program please visit www.cspg.org/geomatch and make your selection (please ensure you are signed in to the website), or send an email to membership@cspg.org

This program is only open to CSPG members in good standing.

RESERVOIR ISSUE 04 • APRIL 2016 11

DIVISION TALKS INTERNATIONAL DIVISION

Bay du Nord discovery, Flemish Pass

basin, offshore Newfoundland

SPEAKER

Jennifer Young

12:00 noon

Wednesday April 13, 2016

Nexen Annex Theatre

801 7 Ave SW, Calgary AB T2P 3P7

ABSTRACT

In 2013 Statoil made global headlines with the Bay du Nord Discovery announcement. Situated in the long overlooked Flemish

CSPG International Division

Wednesday April 13, 2016

Nexen Annex Theatre

Rock Shot Speaker:

Craig Boland

Boland Exploration

Pass Basin of Offshore Newfoundland, the find was described as “an overnight success ten years in the making”. Truth be told the discovery was the result of over 30 years of fluctuating industry research and activity, a Statoil area of focus for the last 17 of those. As interest in the region faded through ambiguous well results, competing global priorities and unpredictable oil prices Statoil continued to pursue its belief in the Flemish Pass transforming decades of concept maturation to “overnight” success.

Statoil’s activities have ramped up since the Bay du Nord discovery, including additional seismic acquisition, an ongoing appraisal and exploration drilling program and the addition of exploration acreage. Our operations continue to remind us as to how remote this area is and how tough mother nature can be. If asked for a quote today one would likely

describe the Bay du Nord area as “a work in progress, 30 years in the making”.

BIOGRAPHY

Jennifer is currently the Manager of Statoil’s East Coast Canada Exploration Access teamliving in Calgary with a strong tie to her home province of Newfoundland. She joined Statoil in 2011 and has worked as both a geoscientist and manager of the team maturing the Bay du Nord discovery through appraisal. The first 8 years of Jennifer’s career were with Petro-Canada/Suncor working a wide range of projects including onshore conventional Exploration in Libya, business development evaluation in North American unconventionals and development of conventional natural gas fields in the Canadian Foothills. Jennifer holds a B.Sc Geology and M.Sc Geophysics, both from Memorial University.

Rock Shot Title:

The Mesozoic Pedra da Mua & Lagosterios Dinosaur Track Sites at Cabo Espichel, Portugal

12 RESERVOIR ISSUE 04 • APRIL 2016

DIVISION TALKS PALAEONTOLOGY DIVISION

Dental wear of late Pleistocene horses and bison from North America and its implication for the late Pleistocene extinction

SPEAKER

Christian Barron-Oritz

Assistant Curator of Quaternary Palaeontology, Royal Alberta Museum

7:30 p.m.

Friday April 15, 2016

Mount Royal University, Room B108

ABSTRACT

Approximately 50,000 – 11,000 years ago, many species around the world became extinct or were extirpated at a continental scale. The causes for the late Pleistocene

extinctions have been extensively debated, but continue to be poorly understood.As part of my dissertation research, I studied dental wear of horses and bison from different North American localities, in order to infer changes in diet during the late Pleistocene in these two ungulate groups. I specifically focused on testing two nutritionally-based extinction models that have been previously proposed: coevolutionary disequilibrium and mosaic-nutrient models. The results of my study revealed changes in dental wear patterns that are consistent with the coevolutionary disequilibrium model, but not with the mosaic-nutrient model. These results, in addition to other lines of evidence, suggest that environmental changes might have played an important role in the extinction of horses and perhaps other Pleistocene ungulates.

BIOGRAPHY

Christian’s interest for Quaternary Palaeontology originated when he discovered the fossil remains of horses, mammoths, and other Ice Age mammals in his uncle’s farm near to the city of Zacatecas, Mexico,

Monday, May 2nd | 4:00 pm – 6:00 pm

The Fairmont Palliser Calgary | Alberta Room

President’s Award: Paul MacKay

where he grew up. He holds a Ph.D. in Evolutionary Biology from the University of Calgary and recently joined the Royal Alberta Museum as Assistant Curator of Quaternary Palaeontology. His research centers on understanding the palaeoecology, palaeobiology, and systematics of Quaternary ungulate mammals across the breadth of their North American range, from Mexico to the Canadian High Arctic.

INFORMATION

This event is presented jointly by the Alberta Palaeontological Society, the Department of Earth and Environmental Sciences at Mount Royal University, and the Palaeontology Division of the Canadian Society of Petroleum Geologists. For details or to present a talk in the future, please contact CSPG Palaeontology Division Chair Jon Noad at jonnoad@hotmail.com or APS Coordinator Harold Whittaker at 403-2860349 or contact programs1@albertapaleo. org. Visit the APS website for confirmation of event times and upcoming speakers: http://www.albertapaleo.org/

Industry Speaker Luncheon 2015 Technical Award Recipients

Wednesday, May 4th | 11:30am – 1:00pm

The Fairmont Palliser Calgary | Alberta Room

H.M. Hunter Award: Astrid Arts and Kevin Root

Tracks Awards: Samantha Etherington, Andrew

Fox, Raymond Geuder and Ian Kirkland

Partner Tracks Award: Alberta Core Research Centre

Service and Volunteer Awards

Join us as we celebrate the 2015 CSPG Volunteer Award recipients including the following: Tickets:

Stanley Slipper Gold Medal: – Richard Walls

R.J.W. Douglas Medal: – Don Kent

Link Award: – Lindsay Dunn

Medal of Merit: – Jen Russel-Houston & Ken Gray

Join us to hear Richard (Dick) Walls, 2015 CSPG Stanley Slipper Award recipient, give a talk about his industry experience. We will also be presenting the 2015 CSPG Technical Awards as follows: Tickets:

Volunteer

& Icebreaker

President's Reception

Awards

$15

$39.50

RESERVOIR ISSUE 04 • APRIL 2016 13

DIVISION TALKS BASS DIVISION

Sequence

Stratigraphic Analysis of Mixed, Reefal Carbonate and Siliciclastic Systems

SPEAKER

Ashton F. Embry

Geological Survey of Canada ashton.embry@canada.ca

12:00 noon

Wednesday April 27, 2016

ConocoPhillips Auditorium

Gulf Canada Square 401 - 9th Ave SW. Calgary, AB

ABSTRACT

Carbonate reefs are often juxtaposed with off-reef, siliciclastic sediments and sequence stratigraphy provides the best methodology for correlating between the two disparate successions. A sequence analysis also allows the relationship between the carbonates and the siliciclastics to be understood in terms of base level change.

The main sequence stratigraphic surfaces associated with reefs are unconformable shoreline ravinements (SR-U), maximum regressive surfaces (MRS), maximum flooding surfaces (MFS) and slope onlap surfaces (SOS). Off-reef siliciclastics usually contain only MRSs and MFSs.

An SR-U within or capping a reefal succession correlates to an SOS on the reef flank and eventually to a facies contact between basinal carbonates and overlying siliciclastics. This facies contact is often misinterpreted as an MFS. The SR-U also correlates with an MRS which usually occurs near the top of the onlapping siliciclastic succession. An MFS can be traced from the reefal carbonates to near, or at, the top of the siliciclastic succession.

The conjoined reefal SR-U and the MRS high in the siliciclastics constitute a depositional sequence boundary. Such a boundary marks the start of transgression and approximates the start of base level rise.

Transgression allows carbonate deposition to be reinitiated on the reef and shuts off the siliciclastic supply. If the previously deposited siliciclastic sediments filled most of the off-reef area, a prograding carbonate ramp builds from the reef across the former inter-reef basins, downlapping on the MFS. If not, reef growth resumes until the next base level fall exposes the reef and brings back siliciclastic sediments which continue to fill the off-reef basin.

Off-reef siliciclastic sediment can vary from deep water turbidites, through slope shales to shallow shelf sandstones, depending on the proximity of, and the rate of supply from, the siliciclastic source area. Regardless of the specific siliciclastic facies occurring in the off-reef area, the same types of sequence stratigraphic surfaces are present and their correlation allows the depositional history to be determined.

In most situations, reef growth occurs during base level rise and is terminated during base level fall.The associated siliciclastic sediments are deposited almost entirely during base level fall and onlap the SOS on the carbonate slope. This sequence stratigraphic model is equivalent to Wilson’s model of reciprocal sedimentation.

BIOGRAPHY

Ashton Embry obtained his MSc (1970) and PhD (1976) from the University of Calgary. He worked with Mobil Canada and BP Canada in the early to mid-70s and joined the Geological Survey of Canada in 1977. He is currently an emeritus scientist with GSC.

His research at the GSC has focused on the stratigraphy, sedimentology and petroleum geology of the Mesozoic succession of the Sverdrup Basin of the Canadian Arctic Archipelago. This basin has excellent outcrops covering basin edge to basin centre and also has well and seismic control. It has proved to be an excellent laboratory for testing proposed concepts in sequence stratigraphy and for developing new ones.

INFORMATION

BASS Division talks are free. Please bring your lunch. For further information about the Division, to join our mailing list, receive a list of upcoming talks, or if you wish to present a talk or lead a field trip, please contact either Steve Donaldson at 403-808-8641, or Mark Caplan at 403-975-7701, or visit our web page on the CSPG website at http://www.cspg.org.

Loring Tarcore Labs Digital Well Data Management & Interpretation Core Logging Services, Software, and Training Digital Core Libraries High Resolution Digital Core Photog ra phy www.tarcore.com Canada’spioneer in digital core imaging and technology! 14 RESERVOIR ISSUE 04 • APRIL 2016

Improving Fracture Network Models:

A new method for honouring more data and improving realism in engineering studies

SPEAKER

R. Mohan Srivastava

CO-AUTHORS

David Garner, Halliburton/ Landmark

Jeffrey Yarus, Halliburton/ Landmark

12:00 noon

Wednesday April 27, 2016

Husky Conference Room A, 3rd Floor, +30 level, South Tower, 707 8th Ave SW, Calgary, Alberta

ABSTRACT

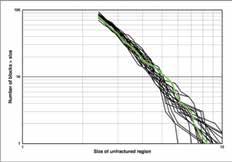

Discrete fracture network models (DFNs) are valuable for risk assessment and engineering design during the development and production of petroleum reservoirs. They have been used as the basis for studies of fluid flow, of production stimulation and of the reservoir’s response to hydraulic fracturing, with mixed success.

Until recently, software tools for building DFNs have randomly located flat disks, allowing the user some choice on the shape of the disks, on their size, orientation and spatial density. While this approach has made DFNs increasingly familiar in practice, it has difficulty honouring some of the field data and geological information that could improve the realism and complexity of actual fracture networks. The status quo models are geologically unrealistic and visually unappealing.

This talk presents an advance in DFN simulation, a geostatistical procedure that has been developed in the past decade, and is now reaching maturity in commercial

software. It was pioneered in nuclear waste management, where honouring all of the available data is important not only for public confidence, but also for the ability to make technically sound predictions of fluid flow and contaminant transport. In addition to honouring fracture size, orientation and density, these geostatistical DFNs are also able to incorporate information on:

i) the undulations of fracture surfaces, which have an important role to play in stress and strain at the local scale;

ii) how fractures preferentially truncate against each other, which influences flow and transport calculations, as well as geomechanical behaviour;

iii) clustering of fractures, i.e. the tendency to have densely-fractured corridors separated by large blocks of very sparsely-fractured rock;

iv) locations and orientations of specific fractures observed in well bores, which figure significantly in studies of hydraulic fracturing in horizontal well bores;

v) connections between fractures observed in different wells; and,

vi) gradual spatial trends in any of the statistics that summarize fracture geometry, such as those that can often be extracted from seismic data.

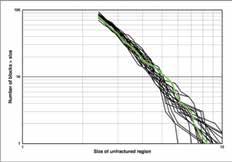

A case study example using fracture data from a chalk formation illustrates how honouring more of what we know about fractures, and what we are able to measure, has the benefit of making DFNs more realistic. Specifically, as shown in Figures 1 through 3, the size distribution of unfractured regions is well honoured by geostatistical DFNs even though this (Continued on page 16...)

Figure 1. Field-mapping of fractures on a 2D plane from a chalk formation, with red circles showing the size distribution of the unfractured regions.

Figure 2. Two computer simulations of geostatistical DFNs for the region shown in Figure 1, with red circles showing the size distribution of the unfractured regions.

GEOMODELING DIVISION RESERVOIR ISSUE 04 • APRIL 2016 15

DIVISION TALKS

(... Continued from page 15)

particular statistic is not one of the user inputs to the creation of those models.

The talk concludes with three short examples of how more realistic DFNs can play a crucial role in various types of studies: modeling where fracture surfaces are open and where they are sealed; caprock integrity in SAGD projects; and analysis of local stress perturbations for fracture design in horizontal wells.

BIOGRAPHY

R. Mohan Srivastava, a consultant with more than 35 years of experience in the practice of geostatistics, is one of the recognized experts in the application of statistical methods to earth science problems.

He is an author of An Introduction to Applied Geostatistics, the major introductory textbook on the practice of geostatistics, and of more than 50 technical articles and reports on the

theory and practice of geostatistics. He has a B.Sc. in Earth Sciences from the MIT and a M.Sc. in Geostatistics from Stanford University. He has taught a total of more than 1,000 students in over 50 short courses for industry, government, academic and research organizations.

His work with the petroleum industry includes studies of volumetric uncertainty, flow modeling for performance prediction and data mining for identifying patterns and trends in geologic data. He has introduced and developed many new tools for data analysis, estimation and simulation, including multiple-point statistics (MPS) and, in the past few years, grid-less methods for reservoir modeling.

Mr. Srivastava is a Professional Geologist in Ontario, a member of the Canadian Institute of Mining, Metallurgy and Petroleum, and of the European Association of Geoscientists and Engineers.

INFORMATION

There is no charge for the division talk and we welcome non-members of the CSPG. Please bring your lunch. For details or to present a talk in the future, please contact Weishan Ren at renws2009@gmail.com

DIVISION TALKS GEOMODELING DIVISION

16 RESERVOIR ISSUE 04 • APRIL 2016 NEW ISSUE OF THE BULLETIN NEW ISSUE OF THE BULLETIN Check out the newest issue of the CSPG Bulletin of Canadian Petroleum Geology online today at www.cspg.org Special Edition from the 2014 Gussow Conference on Advances in Applied Geomodeling

Figure

3. Comparison of the cumulative distribution of the size of unfractured regions from actual field mapping (in green) to the corresponding distributions from geostatistical DFNs (in black).

ACE 2016 FIELD SEMINARS

PRESENTED BY:

Structure of the Canadian Rockies

June 18, 2016

Turner Valley: Cradle of Petroleum Geology in the Canadian Rocky Mountain Foothills

June 18, 2016

Mt. Stephen Fossil Beds

June 23, 2016

Dinosaur Palaeobiology and Preservation in Cretaceous Fluvial Reservoir Analogues of Dinosaur Provincial Park, AB

June 23, 2016

Structural Geology & Hydrocarbon Setting in the Southern AB Foothills

June 23-25, 2016

The Mid-Paleozoic Exshaw/Banff Unconventional Petroleum System, AB: Correlative of Bakken Tight-Oil P lay in Williston Basin

June 24-26, 2016

Sequence Stratigraphy and Resulting Facies Architecture of the Upper Devonian (Frasnian), Main &Front Ranges, West Central AB

June 23-25, 2016

McMurray Formation Oil Sands Deposits From Basin to Molecular Scales: Reservoir Characterization and Insights for Thermal In-situ Recovery

June 22-24, 2016

Turner Valley

Canmore

Lake Louise

Yoho National Park

Structure of the Canadian Rockies

June 18, 2016

Turner Valley: Cradle of Petroleum Geology in the Canadian Rocky Mountain Foothills

June 18, 2016

Mt. Stephen Fossil Beds

June 23, 2016

Dinosaur Palaeobiology and Preservation in Cretaceous Fluvial Reservoir Analogues of Dinosaur Provincial Park, AB

June 23, 2016

Structural Geology & Hydrocarbon Setting in the Southern AB Foothills

June 23-25, 2016

The Mid-Paleozoic Exshaw/Banff Unconventional Petroleum System, AB: Correlative of Bakken Tight-Oil P lay in Williston Basin

June 24-26, 2016

Sequence Stratigraphy and Resulting Facies Architecture of the Upper Devonian (Frasnian), Main &Front Ranges, West Central AB

June 23-25, 2016

McMurray Formation Oil Sands Deposits From Basin to Molecular Scales: Reservoir Characterization and Insights for Thermal In-situ Recovery

June 22-24, 2016

Turner Valley

Canmore

Lake Louise

Yoho National Park

REGISTER THROUGH THE ACE 2016 WEBSITE TODAY! RESERVOIR ISSUE 04 • APRIL 2016 17

RISKY BUSINESS: MANAGING UNCERTAINTY IN UPSTREAM DECISION-MAKING

|

By Tyler Schlosser, P.Eng., Director, Commodities Research, GLJ Petroleum Consultants

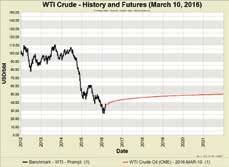

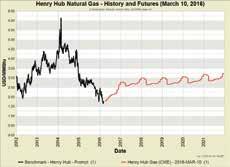

In the oil and gas business today, understanding risk is more important than ever. Years of high commodity prices and easy monetary policy led to an extraordinarily high level of investment in upstream oil and gas projects. This, in turn, has led us to a time where there is plenty of oil and gas supplying the markets with little risk of a shortage on the horizon. Rig efficiency, resource exploitation technology and service cost deflation have led to lower breakeven supply costs, particularly in North American unconventional plays. When commodity prices do recover, many now believe they will not stabilize at the level the industry enjoyed prior to the recent collapse.

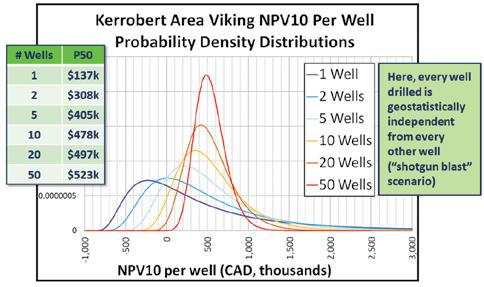

In an effort to make the best decisions in an increasingly challenging upstream environment, a first step might be to identify questions which, if answered, would mitigate risk as a result of improvements in capital allocation. The process outlined here can be applied to a wide range of situations, but will be illustrated through the example of a Viking oil producer trying to get a handle on the range of likely outcomes when drilling additional horizontal wells in the Kerrobert field in western Saksatchewan. So, we’ll put ourselves in the shoes of this producer and examine what we might want to understand before we spend our money.

Here are some questions we might ask to inform our decision process prior to drilling:

1. What is the chance of realizing a 10%-discounted net present value (NPV10) greater than zero for an 8-well horizontal drilling program spread across the Kerrobert area? What if we drill all 8 wells in the same section?

2. How likely is it that a single well in this drilling program will have an internal rate of return (IRR) greater than zero?

3. How many wells would we need to drill to be 90% confident in achieving

a 10%-discounted profitability index (PI10) greater than 1.2? What if we drill all wells within two miles of each other?

4. What is the chance that the price of

WTI crude oil will average at least $60/bbl in 2016?

5. What average 2016 WTI crude oil price are we 90% confident will be exceeded?

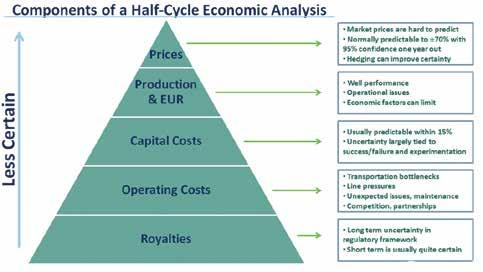

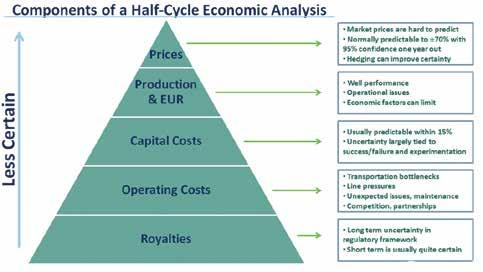

Figure 1.While nearly every part of the analysis has an associated uncertainty, some are more uncertain than others.

Figure 1.While nearly every part of the analysis has an associated uncertainty, some are more uncertain than others.

18 RESERVOIR ISSUE 04 • APRIL 2016

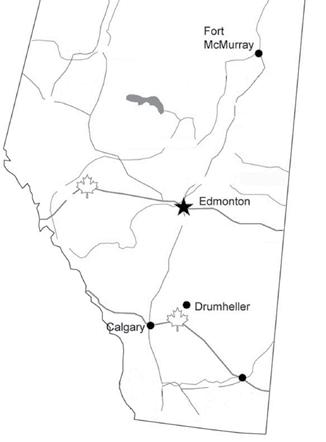

Figure 2.The Kerrobert field in western Saskatchewan

Note: October 6, 2015 is the reference date for futures and options pricing data.

These questions are not trivial, and at first glance, appear very difficult to answer in any meaningful way. However, using probabilistic analysis rooted in evidencebased assumptions which intelligently constrain the problem, we can answer them in a way that adds substantial information – and confidence – to our decision-making process (Figure 1). (Figure 2- Map of the Kerrobert field)

In our example, the first step in our analysis is to identify a representative geographical area containing wells we expect to be analogous to the wells planned for development. This area should be geologically similar to the area considered for development, and the development technique or recovery process planned for the new area should be similar, or at least comparable, to that represented by the existing producing wells. If there is reason to believe that new drilling will be in areas of poorer reservoir quality, or a new and improved completion technique is being used for future development, it may make sense to normalize the data to account for this in some way. (Figure 3)

Next, we analyze the production performance of these existing wells and build production forecasts and ultimate recoverable volume estimates for these wells. These are the “priors” that will inform our expectations for our potential drilling

program. In coming up with these priors, we also make sure to measure the correlations between the parameters that describe our production forecasts – correlations which are often highly significant. The assumption that the parameters describing the production profile of a given well are independent from one another is a common pitfall in current industry practice which may lead to substantial forecasting error. Additionally, if the existing producing wells were developed using shorter horizontal lengths or fewer fractures than what is planned in future drills, the performance can be normalized on a per-horizontallength or per-fracture basis, or in any other useful way.

Once we have our priors from our analogy wells, we want to use them to inform the question we’re trying to answer. For example, if I drill one new horizontal Viking oil well near my sample area, what are the results likely to be? To find out, we sample the parameters that describe our production forecasts and ultimate recoverable volume estimates, and run them through a Monte Carlo simulation. In this case, since the math is relatively quick, we use 100,000 iterations to ensure a well-developed distribution. Again, it is very important to make sure we honor the correlations between the parameters that describe our priors, since sampling these parameters while assuming they are independent will lead to misleading results. The outputs of our Monte Carlo simulation are distributions of production forecasts

and ultimate recoverable volume estimates.

Once we have our distributions of production expectations, we can move on to estimating what sort of revenue, and ultimately, net cash flow we might expect from our potential development project. To come up with revenue forecasts, we must apply an oil price forecast to our production forecast. But, if we are acknowledging the uncertainty in production outcomes of our new development wells, and given that future oil prices are even less certain than our production forecasts, does it make sense to apply a single oil price forecast to the entire distribution of outcomes? There are times when using a single price forecast is useful for benchmarking purposes, but for sound decision-making, it is important to understand all the uncertainties and the full range of potential outcomes.

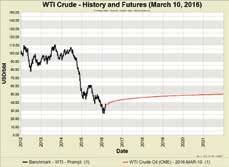

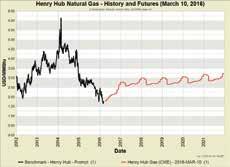

Instead of applying a single oil price forecast, we use a stochastic process with parameters rooted in historical and futures price data, options pricing data, and market fundamentals to generate a distribution of potential future oil price scenarios. In examining WTI crude oil futures and options price data, we can already come up with answers to our initial questions about confidence levels for 2016 WTI crude oil pricing. Unfortunately, the answers on our October 6, 2015 reference date were not all that comforting: In 2016, a 12% chance that the average WTI price will exceed $60/ bbl, and a 90% confidence level in a WTI price of $38/bbl.

Sampling both our distribution of possible price forecasts and our distribution of production forecasts, we now have a distribution of future revenue expectations. We then similarly apply our capital expenditure, operating cost, byproduct yield, byproduct price, and all other associated parameter estimates (all of which can be either fixed values, independent probabilistic variables, or correlated probabilistic variables – capital cost correlated to oil price, for instance) along with our royalty model, to generate a distribution of our final cash flow expectations. In our example, the all-in capital costs were estimated as a normal distribution ranging from 600 to 850 thousand dollars per well.

At this point, distributions for any performance metrics like NPV, IRR, PI, time-to-payout, etc., can be generated (Continued on page 20...)

RESERVOIR ISSUE 04 • APRIL 2016 19

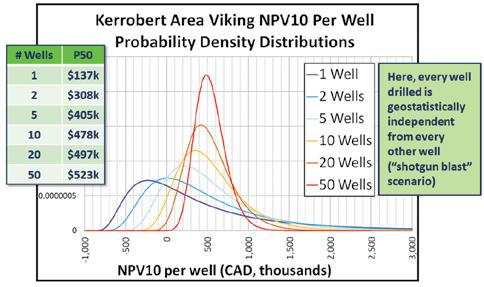

Figure 3. Only horizontal Viking wells are shown here. Much of this field has also experienced vertical well development in the past

from the cash flow distributions, and these distributions can be examined to answer a few more of our questions (Figure 4).

Another key point to keep in mind is that, just as we made sure to respect the correlation between parameters describing individual well production profiles, we must also respect the correlation between well results if we are to answer questions relating to a multi-well drilling program.

If we were to drill 8 wells at scattered locations throughout the field – a “shotgun

blast” development scenario to fill in some vacant spacing units, perhaps – then we can reasonably assume the result of each individual drill to be independent of every other (i.e., zero geocorrelation). Another way to look at this is that we expect each individual well we drill to be analogous to the existing wells in the field, but we expect some of these new wells to be better than average, and some worse than average, since we are not drilling them all right next to each other (Figure 5).

In this case, we already have everything we need to answer some of our questions. To answer our first question, using our cost estimates and the oil price environment on our October 6, 2015 reference date, we find about a 93% chance that an 8-well horizontal drilling program would yield a positive NPV10 if these 8 drills were scattered throughout the field. To answer our second question, we would expect a single well drilled in the field in to have a 66% chance of having an IRR greater than zero. Note that this is much lower than the 93% in the first question despite the rate-ofreturn hurdle being 0% instead of 10%. This is because there is a much higher chance that a single well will be a failed investment than a group of 8 wells, in aggregate, will be a failed investment. This is analogous to drawing a number between 1 and 10 out of a hat once (drilling one well), or drawing a number between 1 and 10 out of a hat 8 times (drilling 8 wells). The odds are much better that you’ll draw a 1, 2 or 3 in a single draw than the odds are of drawing a sum of 24 (3 times 8) or less across 8 draws. Finally, the answer to our third question is that we would need to drill 17 wells to reach 90% confidence in achieving a PI10 greater than 1.2 in this difficult pricing environment.

In reality, a drilling program is unlikely to target random locations around the field, and is more likely to be concentrated in a particular area. To account for this, we must incorporate the effects of geocorrelation – the notion that wells drilled near each other are likely to be more similar than wells drilled further apart. This leads to a lessening of the convergence effect of the law of large numbers. For example, if we drill one well in the middle of a section of land, and its performance is above average (due, perhaps, to encountering betterthan-expected reservoir quality), we would expect a neighboring well to also have above-average results. We can measure this phenomenon in our existing wells and use it to educate our predictions of future development. In the Kerrobert area, we find that the geocorrelation coefficient is approximately 0.3 within a distance of one mile (Figure 6).

Reviewing our questions again, we can now answer those that specify location or spacing as part of what we’d like to learn about our expectations. For an 8-well horizontal drilling program where all 8 wells are drilled in the same section, we

(... Continued from page 19)

Figure 4. The distribution of net present value expectations for a single well drilled in the Kerrobert field indicates a high degree of uncertainty.

20 RESERVOIR ISSUE 04 • APRIL 2016

Figure 5. If each well drilled is considered independent from the others, our range expectations tightens around the expected value (a law of large numbers effect.

would be 87% confident in achieving a 10%-discounted NPV greater than zero (compared to 93% if the wells were drilled in random undeveloped spots throughout the field). To be 90% confident of a 10%-discounted PI greater than 1.2, we’d need to drill 19 wells if they were all within two miles of each other, compared to 17 wells if drilled at random throughout the field. We see that the uncertainty is greater when we correctly account for correlation between the results, and this additional uncertainty is often overlooked.

While evaluating the range of expected outcomes of a drilling program is an excellent application for probabilistic analysis, it is by no means the only one. Understanding the distribution of potential outcomes for a single drilling program is obviously something that can improve a decision, but this process can also be used to analyze multiple development opportunities under a finite capital constraint to achieve an optimal expected value or an optimal expected risk/return profile within a portfolio. While the mean or most likely expectation in developing a particular asset may be higher than all alternatives, it is often the choice of producers to avoid “putting all their eggs in one basket” and pursue the development of multiple varied assets with portions of the total capital pool.

This process can also be useful for judging the likely benefit or detriment of a hedging program after it has been put into place, and to assess if there are any additional market

positions that could be taken at the current time to improve the expected value or risk profile of the existing hedges.

The ability to run data-driven and probabilistic commodity pricing sensitivities is also extremely useful in asset valuation studies where having a better understanding of future value expectations and the uncertainty associated with them is always desirable. This is especially helpful in acquisition target analysis, both on the producing and nonproducing upside portions, since the upstream industry still often represents both volumes and values in a deterministic fashion that can provide a

limited, and in some cases, misleading view.

Business intelligence is another obvious application for this probabilistic approach; understanding what nearby competitors are up to and what their results look like can offer clues to improving one’s own operations. As the industry braces for an era of tougher competition and a more challenging environment, active business intelligence and a more robust understanding of the likeliest outcomes –and the corresponding uncertainty – will be a key differentiator between the cream of the crop and the rest (Figure 7).

While geoscientists have been using probabilistic methods to evaluate prospects for years, the upstream industry has been relatively slow to adopt a probabilistic approach to asset valuation and portfolio optimization. Thankfully, the benefits of probabilistic methods are finally being recognized as a means to significantly improve decision-making and this approach is beginning to gain a foothold among the industry’s cutting-edge teams and thought leaders. From reserves disclosures to data rooms to corporate guidance to deal metrics, you can expect to see probabilistic analysis emerge in its rightful place as a prominent approach in the oil and gas industry in the years to come.

Figure 6. When we examine wells drilled in the same small area and account for geocorrelation, our range of expectations does not tighten as mush since they are more likely to all be above average or all below average due to local reservoir properties.

Figure 7.

CSPG 2015 AWARD CITATION STANLEY E. SLIPPER AWARD

The Stanley Slipper Gold Medal is the CSPG’s highest honour; it is presented annually for outstanding contributions to oil and gas exploration in Canada. The contributions of the winner of this award should encompass a number of activities related to aspects of petroleum exploration. Such activities include: initiating and/or leading exploration programs, significant discoveries on new or existing exploration trends, teaching and/or training of explorationists, and involvement in and leadership within geological societies and professional organizations.

The award winner for 2015 is Dr. Richard “Dick” Alan Walls.

Dick Walls is a lifelong member of the C.S.P.G. He has distinguished himself in both the Canadian and American oil and gas industries in a career spanning almost fourty years.

Combining a strong academic expertise as a well-known authority on Devonian reef and reservoir geology (authoring and publishing numerous scientific articles on the subject), along with a sharp business acumen, he has founded and built more than half a dozen successful companies and is responsible for numerous significant oil and gas discoveries and developments in Western Canada and the U.S. Texas Gulf Coast. During his career, Dick has been involved in all aspects of exploration, development, production and business development in both the upstream and midstream oil and gas industry, as well as various other peripheral business ventures.

Dick’s industry career has been varied, prolific and successful, but was by no means a natural progression from his university days. Although the potential for various assistant professorship teaching positions drew him naturally to an academic, rather than industry vocation, his accomplishments also resulted in an employment offer from Shell Canada, based in Calgary.

Despite having no real idea whether or not he could even be successful in finding oil and gas he decided to give it a try and started the job with Shell in 1977, employed as a Devonian carbonate geologist. Part of his work there involved the southeastern delineation of the Rosevear Devonian Beaverhill Lake Pool, developed in dolomitized carbonates. According to Patricia Lee, Dick’s work was a valuable contribution to her own slightly later studies in the Caroline area in that

same stratigraphic interval that ultimately led to the 1986 discovery of a new 2 Tcf sour gas pool, as recognized by Pat’s own Slipper Award in 2004.

Several years later he moved to become a senior exploration geologist at Canadian Hunter Exploration Ltd, specializing in clastic reservoir exploration in the Deep Basin of Alberta and British Colombia.

Still restless, in 1981 he becameVice President Exploration at Petrosec Exploration Ltd. which he co-founded. While at Petrosec he discovered the Mestena Grande gas and condensate field in South Texas, hosted in Eocene marine sandstones and containing reserves of 120 Bcf gas and 4.8 mmbl of condensate. This tenure also involved a high profile wildcat exploration well on the Alaska North Slope. The well ended up being a dry hole and although it was no doubt a great disappointment to his investors, it didn’t deter him a bit from his next venture.

From 1983 to 1986 Dick was President and CEO of Kentex Oil Corporation, based in Houston, Texas, a private natural gas company that he had founded with his brother. They were responsible for a number of significant discoveries including the highpressured Ynojosa natural gas field in the deep onshore Texas Gulf Coast Basin.

In 1989 he returned to Alberta as founder and President of the private company C&W Energy Ltd. and was responsible

22 RESERVOIR ISSUE 04 • APRIL 2016

for the discovery and development of the deep Leduc pinnacle reservoirs in the Wild River area of west central Alberta. It was his entrepreneurial ability to combine the technical aspects (re: recognizing that deep limestone reefs could actually produce at commercial gas rates) with the commercial/ business aspects (re: securing the pipeline right-of-way), along with an acute “firstmover” instinct that led to this and other successes in business.

In 1993 Dick took control as President and CEO of Pan East Petroleum Corp. and was instrumental in the discovery of the Berland River Wabamun Gas Pool, an accumulation trapped in dolomitized carbonates. The Pan East et al. Berland River West 7-5-59-24W5 well, drilled to a depth of 3740m, had an initial production rate of 48.6 mmcf/d and a cumulative production to 2008 of 61.7 Bcf. Reservoir development of 43m was completely charged with sour gas containing 15% H2S. Dick also led in the development of the Bigstone Dunvegan Gas Pool (360 Bcf) in deltaic sandstone reservoirs including its expansion well beyond its original unit boundaries.

In 1998 Pan East was sold to Poco Petroleum Ltd.

In 1999 Dick became the founder, President and CEO of Canadian Midstream Services, a private oil and natural gas midstream company with gas plants, pipelines and production facilities in Alberta and British Columbia,. In this context Dick also brought important perspectives on subsurface potential to the table as a component of decision-making, an approach not commonly encountered in these more engineeringdominated sorts of facility negotiations. The company was acquired in 2001 by Duke Energy.

Dick then served as the Chief Executive Officer of Fairborne Energy Ltd., which he founded, from May 1, 2002 to June 2005, being its President from January 9, 2002 to June 2005. He was the Chief Executive Officer and President of Fairquest Energy Ltd. from May 2005 to June 2007 and Chairman until 2012 of Fairborne Energy Trust. An excellent summary of their exploration work in the Leduc, Nisku and Wabamun Formations in the Wild River region is contained in Dick’s presentation with Mark Hadley entitled “Devonian Carbonate Reservoirs, Western Canada – The Gift that Keeps on Giving, A Small E&P Company’s Perspective” available

on the AAPG’s Search and Discovery website. Dick and Mark identify some of the major impediments to exploration as being incorrect geophysical and petrophysical interpretations, underestimation of reservoir development and extent, pessimism as to fluid content, remote locations, lack of infrastructure and pessimism over hydrocarbon prices.

From 2002 to 2007 Dick was also the Chairman and major shareholder in OXEN Inc., the parent company of Alberta Watt Exchange, an electronic electricity exchange located in Calgary. Both aforementioned companies were acquired by the Toronto Stock Exchange in 2007.

From 2010 through 2012 he was President and CEO of C&C Energia, a midsize oil company with production of 11,000 bbl/d from assets in Colombia, South America. There the focus was on light oil discoveries in the Llanos and Putumayo Basins (Cretaceous through Tertiary clastic reservoirs). Dick took this enterprise from a private status to a TSX exchange listing before selling the company to Pacific Rubiales Energy Corp. in late 2012.

In 2014 he formed and was a major shareholder in Mapan Energy Ltd. a public company built on natural gas assets in the Deep Basin acquired from Shell. Mapan was acquired by Tourmaline Oil Corp. in September 2015.

Over his industry career, Dick has also served as director on a number of both public and private company boards of energy and other industry companies, helping to expertly guide their corporate development. His knowledge and business acumen are widely respected. A story is told that a brainstorming session at an investment symposium ended with the analysts bringing back from the restaurant the table cloth on which Dick and his counterparts had sketched out their ideas for additional potential in the Western Basin. His own pitches are multifaceted and are considered legendary to the extent that fund managers have to “check their wallets” as they leave.

Although Dick has focused on the pursuit of exploration opportunities, he has not forgotten his technical roots. He has published or co-published over 20 publications in a variety of journals that were focused on sedimentary (carbonates) geochemistry as well as carbonate sedimentology and

diagenesis, particularly on the Devonian reef complexes of Western Canada (Alberta and B.C.). He authored “Golden Spike Reef Complex, Alberta” that appeared as Chapter 8 in the AAPG’s 1983 Memoir 33 “Carbonate Depositional Environments”. He also collaborated with Geoff Burrowes on several related papers and talks including the 1985 SEPM Special Publication 36 paper “The Role of Cementation in the Diagenetic History of Devonian Reefs,Western Canada”.

His quick wit, wicked sense of humour, freely given opinions on almost any subject and acute business instincts and knowledge have been an inspiration to many a business and technical colleague, partner and employee, over many years.

Dick is a devoted and talented father to five children and along with his wife Carolina are active philanthropists, most notably together establishing and donating to the “Best in the West” McGill University Scholarship Program (giving deserving students from western Canada the opportunity to attend McGill University), establishing a scholarship program at Morehead State University, and directly to many other good causes – most notably focused on those involving education, specific needs, direct-funded scholarships and athletics. As he will often say: “he prefers to invest directly in people” (particularly younger people). Dick was inducted into Morehead State University Hall of Fame in 2005 and awarded, along with his wife Carolina, an Honourary Doctorate degree from McGill University in 2013.

Dick shows no signs of slowing down and is currently President of RAW Energy Ltd., a private investment corporation. One of his private companies currently holds 23,000 acres of oil and gas leases in NE Kentucky on a new Cambrian shale gas resource play. As he has been heard to say: “The end of one thing is just the beginning of something else”.

Full citations are published on the CSPG website (www.cspg.org) under Society/Awards.

Dick Walls will be presented with his award and speaking at the CSPG Industry Speaker Luncheon on Wednesday, May 4, 2016. Tickets may be purchased at www.cspg.org under the Events tab.

RESERVOIR ISSUE 04 • APRIL 2016 23

CSPG SPRING EDUCATION WEEK CSPG SPRING EDUCATION WEEK

COURSES

Introductory Engineering & Geoscience (CSPG/SPE Joint Workshop)

SOCIAL EVENTS

CSPG Technical Luncheon Industry Speaker Luncheon (Technical Awards) President’s Reception 4:00-6:00

Long-Time Members Reception 4:00-6:00

Exploration Using Integrated Petrophysics