Spring brings much-needed daylight after a long winter, it marks the start of construction season and this year, spring is also bringing renewed energy to the Canadian commercial real estate industry.

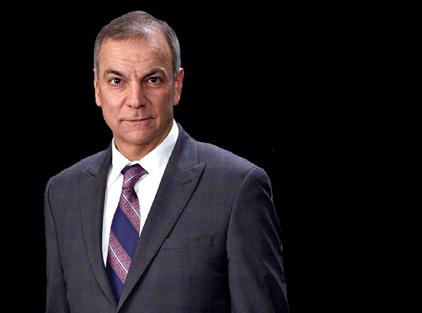

Since becoming CBRE Canada’s new President and CEO late last year, I have been meeting with many of Canada’s largest organizations and investors. Despite ongoing uncertainties in the marketplace, I am encouraged by what I’m hearing. There is a common thread and focus on a higher purpose and a desire to make a material change beyond the day-to-day.

There’s real energy and purpose in our industry right now that has me excited for the future.

This edition of Advantage Magazine is dedicated to this fresh perspective and to the limitless potential that we have as an industry to do things more meaningfully and differently.

We get a glimpse of the changing nature of commercial real estate transactions in a feature on green leasing. We see how a new approach to the standard lease has the potential to reduce energy consumption in office buildings by as much as 22%. We also have a story on how some office users are breaking with traditional thinking to move back-office data servers off-site to make major steps forward on ESG targets.

Developers are persevering through market uncertainties and are building with an eye to the future. You’ll read about

EMBLEM Developments championing city building in Hamilton with the support of CBRE advisors. On the other side of the Greater Toronto Area, we have a piece that showcases how Crestpoint Real Estate Investments is rethinking industrial real estate in Ajax and how they are using a unique mix of natural and urban amenities to solve for a skilled worker shortage.

If you were unable to attend CBRE’s Canadian Market Outlook Breakfast in Toronto, we have all the highlights for you, including Paul Morassutti’s keynote speech and my one-on-one discussion with CIBC deputy chief economist and industry favourite, Benjamin Tal.

All that plus we highlight some of the incredible women who are helping elevate real estate services in in our industry in the wake of International Women’s Day.

We hope this edition of Advantage Magazine helps inspire you to challenge the status quo, make positive change and embrace your own limitless potential.

All the best!

A green lease is like a standard lease but with clauses that realign financial and sustainability objectives between a landlord and tenant. A report by the Institute for Market Transformation estimates that green leases could reduce energy consumption in office buildings by as much as 22%, resulting in significant cost savings.

A green lease can include changes in operational procedures, commitments to building retrofits using sustainable materials and appliances, and utility tracking requirements.

TD Bank has a green lease clause requiring an Energy Star rating of 75 or higher, a maximum water consumption rate of 9 gallons per square foot, and a waste diversion rate of 50% or more across its office portfolio. Dream Office REIT has committed to a 10% reduction of its energy consumption across its portfolio by 2025. First Capital REIT introduced the requirement for all their tenants to provide annual utility data to support energy benchmarking and disclosure efforts.

Green leases can also include changes such as changing fluorescent lights to LEDs, introducing recycling and composting programs, and swapping out old inefficient windows.

“Companies have sustainability targets to meet and green leases could be part of the solution,” says Amy Bugg, CBRE’s Senior Director of Client Care. “We’re learning a lot from the UK and Europe, and it won’t be long before green leases become the norm in Canada as well. “Most of our clients have heard of green leases,” she adds, “but many aren’t sure how to get started or which questions to ask. We’re here to help.”

“Companies have sustainability targets to meet and green leases could be part of the solution.”

AMY BUGG CBRE CLIENT SOLUTIONS

In the pursuit of ESG targets, businesses and governments around the world are committing to ambitious decarbonization goals. With office buildings among the biggest energy consumers, forward-thinking landlords are introducing green leases in a bid to improve the situation.

When Ontario introduced public sector sustainability targets several years ago, institutional clients turned to CBRE for advice on green leasing their portfolios.

“Our team identifies efficiencies that benefit both the environment and everyone’s bottom line,” says CBRE’s Nicholas Foster, who supports institutional clients on green leasing strategies. “We create long-term value for tenants by working with building owners to improve the functionality of their spaces and enhancing their experience.”

CBRE’s Energy Management team works with clients to gather utility metrics on the water and electricity usage in their portfolios. The data is then used to determine where to best focus their greening efforts.

“We use benchmarking and energy performance metrics to recommend ways to minimize usage and costs related to operations,” says Melissa Yake, Director of Energy, Sustainability and Resilience for CBRE. This can include installing energy efficient appliances and fixtures and limiting lighting load.

Yake’s team also audits and reviews submeters to provide tenants with information on their performance data. Organizations often require this data to report on sustainability metrics and to enact changes to their consumption.

Foster and his team identify the lease clauses that will work to meet their client’s priorities and have the greatest impacts while mitigating risks to tenants.

“We’ve found that sustainability often goes hand-in-hand with other advantages such as health and safety and cost savings,” says Foster.

He points to the upgrading of HVAC systems as an example. Many properties benefitted from investments in modern HVAC systems supporting MERV13 filters as a COVID-related measure to improve air quality. But the perks related to these upgrades went beyond health and safety. They also boosted efficiency and reduced HVAC-related energy consumption.

Smart building technologies monitor the weather and adjust building temperatures accordingly. Such technologies save energy by only heating or cooling when necessary and can prevent damage to pipes during cold snaps by anticipating the need to heat the building.

“Technology is evolving quickly,” says Foster. “It’s giving us new opportunities to improve our buildings and reduce our footprints.”

Green leases are beginning to look beyond building systems and utilities. They’re taking into account construction methods and materials and the cleaning products used in buildings, ensuring they are free from volatile organic compounds (VOCs).

Green leases are re-evaluating what it means to create a sustainable working environment.

All of it promises to keep Foster, Yake and the rest of the team on their toes and working hard to ensure clients can meet their ambitious green goals.

“We’re in an exciting time where change is happening rapidly,” says Foster.

It’s going to be a bit of a bumpy first half of 2023 for Canadian commercial real estate, with tougher financing conditions and a potential economic slowdown inhibiting activity.

But by year’s end big deals and more visibility on interest rates should see transactions ramp up considerably, setting the stage for an all-time high for investment volume of $59.3 billion for 2023.

“With better visibility around interest rates, pricing expectations will recalibrate in 2023, deal flow will pick up, and by Q3 and Q4 we should see more robust investment activity.”

• As companies fine tune their optimal remote-office balance, office utilization and the space needed per worker will reach a new equilibrium. Spaces that help attract workers back to the office will be a priority.

• Tenants are demanding more from spaces and prioritizing offices that support new ways of working. Not all buildings are created equal, and the bifurcation of office space will widen in 2023.

• As vacancy continues to increase, the prospects for older office space become more challenging. Conversions to residential are increasingly being discussed, but, to date, feasible opportunities are limited.

• Industrial rents will continue to be driven up by strong levels of demand as well as from the influx of new builds that command higher asking rents due to increased construction costs.

• For the highly desired big box segment, available space remains scarce and will come at a premium. Despite a record 46.4 million sq. ft. of new supply expected to be delivered in 2023, the industrial market will remain undersupplied relative to demand.

• Robust pre-leasing activity and a conservative approach to construction in Canada means the national availability rate is forecast to only rise modestly by 40 bps to 2.0% in 2023. Industrial construction starts are expected to ease in 2023 as markets across Canada work through their existing development pipelines.

• Speculative construction may also become less viable amid elevated financing and construction costs, in addition to rising capitalization rates.

• Growing demand for multifamily rental compressed the overall vacancy rate in Canada to a 20-year low of 2.0% in 2022. Elevated demand levels will continue to persist and drive vacancy even lower in 2023, led by higher immigration targets.

• Rising office attendance is also driving increased demand for urban rental product as workers returning to the office look to minimize commute times.

• A continued supply-demand imbalance is expected to push multifamily rents higher in 2023, with rent growth forecast to remain largely in line with last year’s record pace.

• More than half of the 30 top performing regional shopping malls in Canada are undergoing redevelopment, which will add thousands of residential units to these properties.

• Revenge shopping has started to cool and is anticipated to slow further in the year ahead. Inflation and elevated interest rates have constrained wallets and led to a more cautious consumer in 2023.

• Changing behaviours will redefine new growth opportunities for retailers, especially among the value category, as consumers become more cost-conscious. Brands will need to differentiate their products or provide a higher quality of service in the year ahead to capture consumer attention and dollars.

• Retail foot traffic levels have largely returned to pre-pandemic levels with consumers eager to engage in more lively, personalized shopping experiences that cannot be offered online.

Here is a sector-by-sector breakdown of commercial real estate trends that CBRE will be watching for this year. Download our new Canada Real Estate Market Outlook to read more.

Paul Morassutti opened his keynote at the CBRE Canadian Real Estate Market Outlook on a cautiously optimistic note.

“We are fundamentally very positive about Canadian commercial real estate but it also undeniable that the short term is going to be very bumpy,” CBRE Canada’s Chairman told a gathering of thousands at the Metro Toronto Convention Centre, the company’s first live in-person Outlook event in Toronto since 2020.

“This intersection of short term changes and longer term fundamentals is where most of the uncertainty lies.”

With better visibility around where interest rates are settling, however, Morassutti said pricing expectations will re-calibrate, deal flow will pick up and by Q3 and Q4, “we expect much more robust investment activity.”

Morassutti went on to explore each commercial property type in detail. He painted a complex, but encouraging picture of the year ahead, drawing attention to data and finer market details, and uncovering trends that don’t grab headlines.

The retail market is in good shape considering the ravages that COVID threw at it, Morassutti noted. “Investment activity has been fairly strong. Retail sales are up. Rents are up. Pure digital brands are moving into physical space and new retail concepts are emerging.”

And global sentiment for retail is quite strong. A recent CBRE survey indicates that 7 out 10 shoppers prefer the in-store experience over online.

“While it is widely assumed that that younger consumers are highly engaged with e-commerce, Gen Zers are less likely to shop online than millennials,” said Morassutti. “Despite being digital natives, even the youngest consumers are choosing to shop in-store.

“So much for the death of retail.”

Ditto the death of the office. Companies are learning that remote and ‘in real life’ are not binary choices, Morassutti said, “but in fact each reinforces the other.

“Our internal surveys indicate that offering flexibility provides an opportunity to build trust – a key ingredient of employee engagement. And whether we are talking about pre-COVID or post-COVID, employee engagement is crucial.”

There will be a greater separation between high quality, highly amenetized office assets for which there will still be demand, and older, dated product. “Some assets, and some owners, will be left behind,” Morassutti said.

Some office buildings will get converted to much-needed residential housing, although Morassutti cautioned, “that is no silver buillet. There are many reasons why conversions are difficult and in most Canadian markets government subsidies are required.”

Office buildings will have to include not just physical amenities but also more programming and activation and importantly, more service. “It is easy to change light bulbs and collect rent,” said Morassutti. “It is much harder to provide a differentiated offering that is compelling and engaging to tenants and employees.”

The coming years will see less office development, which is a good thing, Morassutti said, and what does get developed will be aligned with demand and modern sustainability requirements.

“The office sector is not dying it is evolving. We will build less of it. We will refurbish more. Remember that the greenest building there is, is the one already standing.”

Investor sentiment in regards to office assets remains weak and those dark clouds are unlikely to part in 2023. But operationally, things could look quite different a year out, Morassutti told the Outlook audience.

The tech sector will be healthier, recession fears will have abated and interest rates will be closer to coming down than going up. New supply will be less of an issue.

“There will still be challenges but we see an evolution of the sector rather than a revolution which is what some are pricing in,” said Morassutti. “Uncertainty is kryptonite to the real estate industry and unfortunately, the office sector still reflects a lot of uncertainty.”

After 11 years of consecutive rental growth and an off-the-charts 2022, Morassutti said that, “many are wondering if the party might be over.” He noted that rental deceleration has begun in five Canadian markets and for the first time in eight years, new supply is finally outpacing net absorption.

In 9 out of 10 Canadian markets, vacancy rates are forecast to increase, a result of new supply completions and weaker economic growth.

However a deceleration in rental growth is not the same as declining rental growth,” Morassutti said, “and we are forecasting a year of growth well in excess of inflation.”

The industrial market is still strong – especially third party logistics leasing activity – and there remains runway for further rental growth, albeit not at last year’s pace. “We won’t see any records set this year – but that is not a bad thing.”

After a disruption in multifamily rental growth over the COVID period, rental growth has resumed as students flocked back to cities, immigration began flowing once more, and home affordability worsened.

Affordability is having both a positive and negative effect on the multifamily market, Morassutti said.

“Affordability is currently the worst it has ever been in Canada, with no region spared and with Toronto and Vancouver at the top of the list. Even as house prices have fallen affordability has not improved as interest rates now take a bigger bite of monthly carrying costs.”

While virtually everyone recognizes that new supply is the ultimate solution to this problem Morassutti suggested that the audience shouldn’t bet on a rescue anytime soon. “It is certainly encouraging that virtually every level of government is finally responding and there are good initiatives underway. But the chances of meeting the proposed target of 1.5 million new homes in Ontario over the next decade is somewhere between slim and none.

“We have to do more and there no easy solutions.”

This fundamental supply/demand imbalance is a very real concern to the average Canadian, Morassutti said. “No one wants Vancouver or Toronto to be become the next San Francisco.”

The housing crisis was top of mind at CBRE’s Canadian Market Outlook in Toronto on February 28. And featured guest, CIBC deputy chief economist Benjamin Tal, wasted no time in floating his suggestion for how the federal government could help solve it: Eliminate the Goods and Services Tax on purpose-built rental projects and the development charges that go along with those projects.

“Purpose-built rental development is one of the only solutions to the affordability crisis we have,” Tal told CBRE President and CEO Jon Ramscar in a one-on-one conversation at the Metro Toronto Convention Centre.

“We need rental units. Therefore I believe we should eliminate the GST on purpose-built and DCs – I speak to many builders about this. And the government can afford (the GST cut) if you designate this as a crisis, which it is. And it’s getting worse.”

“The only way to solve it is to improve productivity, build differently, introduce changes to the immigration system to bring in more trades, and clearly make purpose-built more affordable and more economical. Right now it isn’t.”

There is simply not enough housing supply to accommodate the 1million newcomers Canada is expecting in 2023.

“Nobody is carrying their house on their back,” Tal said. “I think we need to start thinking in terms of emergency measures to house them. The government that set the immigration quota must be a

big part of the solution to house them. The private sector can’t do it by itself.”

Homebuyers can expect a bit of help from the pricing correction that is under way, Tal said. “The correction isn’t over, and it’s a very healthy correction. After housing prices rose by 46% in the two years during COVID, you need a correction otherwise we’re in a bubble.

“This is not a freefall,” he added, “it’s the reallocation of activity because during COVID we front-loaded activity; borrowed activity from the future.

“I’m announcing now that the future has arrived.”

Tal told Ramscar he’s optimistic about where inflation is headed, with wages and fuel prices trending downward. “Housing inflation not so much.”

He said he believes Canada could reach 3.0% month-over-month inflation by this spring, en route to hitting the 2.0% the Bank of Canada is targeting. “If you look at core inflation, it’s approaching 2.0% on an annual basis.”

The Bank of Canada should stop raising interest rates, Tal said (and the BOC appears to have heeded his call, maintaining the current rate at its most recent meeting on March 8), but should

also make sure that inflation is “absolutely dead” before beginning to cut interest rates. “Remember the 70s and 80s!,” Tal said. “We had a double dip recession because of monetary policy easing that was premature.”

The BOC will want to keep interest rates (currently at 4.5%) higher longer “just to buy some assurance that inflation will not reappear.” Tal said he expects the BOC will wait until 2024 to cut rates. “Then when you cut, the question is by how much? I say go to 3%,” almost double what it was before the rate hikes began.

Why maintain a higher rate? Tal said because there are four major inflationary forces “cooking in the background”: Deglobalization; justin-case inventories replacing just-in-time inventories; rising wages; and increased expenses for green initiatives.

“All of these forces are inflationary,” Tal said. “So the target is 2%. I speak to the Bank of Canada all the time, and I can tell you, they are not going to change the target.”

Deputy Chief Economist, CIBCToronto Downtown Managing Director Michael Case discusses what he sees ahead for the Toronto office market.

Ottawa Managing Director Louis Karam tells us how he sees the capital’s commercial real estate market shaping up this year.

What’s ahead for Montreal commercial real estate in 2023? CBRE’s Quebec Managing Director Ruth Fischer tells us what she’ll be watching for.

Halifax has quickly become an attractive place to work, live and invest, despite the economic headwinds impacting the commercial real estate market in recent years.

Lauren White’s initiation into CBRE was a trial by fire. It was 2008, and she was working with Mike Czestochowski’s Land Services Group in CBRE’s Toronto North office, learning the ropes of commercial real estate.

White had first come to CBRE two years earlier, as a summer student while studying at University of Guelph, eventually parlaying this into a full-time job on Czestochowski’s team. “She was so smart I didn’t want to let her leave,” he says.

When Czestochowski fell ill in 2008 and went on leave, White suddenly was thrust into the centre of the action to run the team. Before she knew it, she was jetting off to Detroit to assist CBRE Chairman John O’Bryan on a pitch. “I remember thinking, ‘How did I get here?’”

“It was a nerve-wracking experience running things all of a sudden,” she adds. “But it taught me perseverance and to not give up”

White and O’Bryan prevailed in winning the business in Detroit. And she set out on an impressive career trajectory over the next decade and a half that culminated in her becoming the second woman to earn the title of Executive Vice President in CBRE Canada’s history.

White co-leads a team of 11 with Czestochowski, and nine of the 11 are women. The team’s diversity has proven to be its strength, helping it to produce results for clients. And it could increase the group’s resilience in a down market.

The Women of the Land Services Group: Millie Ye, Marina Lonska, Chloe Pereira, Laura Malaka, Lauren White, Emelie Rowe, Amanah Rahal, Fariya Ali and Alina Politika.

“Clients want ideas,” says White, “and women have provided the fresh perspectives and innovations that have allowed us to outcompete and exceed expectations.”

The Land Services Group had its best year ever in 2021, logging $1.3 billion in sales. For White’s part, she ranked #2 in the CBRE Toronto North Office for top sales representatives in 2021, the same year she ranked #20 on CBRE Canada’s sales leader list nationally.

“It has been a long and winding road to this point, with no shortage of challenges, including the Financial Crisis of 2008,” says White. “But today I co-lead a team that I’m proud of and wish had existed when I started in the business. We have the expertise, diversity and innovative thinking that helps our clients navigate the ups and downs of the post-pandemic land market.”

White studied real estate at Guelph University, where her program included 12 men and just two women in her graduating year.

She might have been the odd woman out, but found she loved learning about real estate. Plus, she wanted to create her own path and career and couldn’t see that happening in any other industry as quickly.

White hopes she can offer inspiration to women contemplating a career in real estate and has done significant outreach, including working with Grade 12 women students at TCREW, the ULI Mentorship program, and CBRE’s Women’s Network mentorship program.

“We’re proving that women offer incredible advantages to clients and partners,” says White. “Brokerage is a great career for women. It provides the flexibility to set your own schedule and run your own business and should allow them to succeed through various life stages.

“As a mother of two, I’ve navigated a few of those life stages and this industry and career allowed me to keep pace, keep building and keep leading.”

If the Land Services Group’s list of recent deals serves as any indication, diversity of thought and innovative spirit is translating into concrete successes.

In April 2022, the team completed the largest residential land transaction in Ottawa’s history: 212 acres of land in Kanata for $245 million. The plan calls for a significant mixed-use development with 2,755 residential units and retail space along a new LRT line.

In January 2022 the Land Services Group ran the sale of Grand Park Village in Toronto to Minto Communities for $129 million. The 5.5 acre site, near Mimico GO Station, will include three residential towers connected with an eight-storey podium.

Months before that the Land Services Group closed on a 7-acre deal at Bloor Street West and Dufferin Street, where they represented the Toron-

to District School Board in the disposition of an excess school site that sold for $151.4 million.

“We’ve had a good run in the past few years,” says Czestochowski, “and looking ahead, I believe this team is uniquely positioned for whatever the economy has in store. I’ve never had so much confidence in the team as I do right now.”

“We work well because we are constantly collaborative, where every team member has a say and brings something unique to the table,” White adds.

“We have strong communication and we believe in being proactive, sharing good ideas and strategies to strengthen our foresight.”

“When times get tough, this is exactly the kind of team you need on your side.”

“Women have provided the fresh perspectives that have allowed us to outcompete and exceed expectations.”

LAUREN WHITE CBRE TORONTOLSG sold 212 acres of land in Kanata for $245 million.

Kate Camenzuli once swore she’d never become a broker. But it became clear that this was her calling.

Part of the hesitation may have stemmed from the fact that Camenzuli is a fierce advocate for representation. Commercial real estate hasn’t always had such a strong track record in this area. Camenzuli, who is based in Toronto, has since built a team specializing in working with retail companies and they pride themselves on their white glove service and attention to the details of each business.

“It might just be my personality, but I am drawn to big challenges and forging new paths,” Camenzuli says. “For example, I see a huge benefit in creating strong relationships with private equity sponsors that own portfolio companies.”

While partnering with private equity companies wasn’t something CBRE had traditionally done, Camenzuli reached out to people who believed in her and continued to push for her idea. These days, her team partners with a multitude of private equity groups, bringing her vision a step closer to reality.

“Having the tenacity and grit to stand for what you believe in will get you far,” she says.

In honour of International Women’s Day, we spoke to Camenzuli and three other CBRE women about building successful careers in commercial real estate, the challenges they’ve faced along the way, and how to empower women to thrive in the workplace.

Like Camenzuli, Vancouver-based Andrea Teahen had not planned on becoming a commercial real estate broker.

Her career began in the classroom, where as a middle school teacher she honed her negotiation skills. She went on to work as a sales manager, which sparked a passion for client care and creative problem-solving. Her brother suggested a career in real estate. But as a mother of three, Teahen had to find the right moment to complete her licence.

Joining a competing commercial real estate brokerage mere months before the pandemic, Teahen’s transition into her new office sales and leasing role was dominated by Zoom meetings and working from home. Not an ideal start in an industry built on relationships. And it made it even harder to network and learn the tricks of the trade.

“Some truths are universal. I reminded myself that everyone takes a different path to success and have their own challenges to face,” says Teahen, who joined CBRE in February. “It’s important to take care of yourself in those challenging moments. Making your wellness a priority impacts your work; it’s like driving on a clear sunny day, as opposed to driving in a snowstorm.”

These days, Teahen has built a strong client base and has successfully closed numerous deals across Victoria.

“Making your wellness a priority impacts your work; it’s like driving on a clear sunny day, as opposed to driving in a snowstorm.”

ANDREA TEAHEN CBRE VANCOUVER

“Having the tenacity and grit to stand for what you believe in will get you far.”

KATE CAMENZULI CBRE TORONTO

Edwina Govindsamy started her commercial real estate career straight out of university, with no prior experience in the industry. She quickly moved up the ladder, transitioning from a client services role to a marketing coordinator position, where she oversaw the marketing for New Brunswick, Nova Scotia, and Newfoundland. In 2021, she welcome a new opportunity and took on her current role as office administrator at CBRE Halifax, where she manages operations across the Atlantic offices.

“The transition from marketing to operations seemed daunting at first,” she says, admitting she initially experienced imposter syndrome but found that being vulnerable and sharing her experience with others has led to honest and open conversations.

“Talking openly about what you’re going through takes courage, but knowing you’re not alone is encouraging. That’s certainly one benefit of having a diverse workplace.” Govindsamy suggests there’s opportunity in dialogue. “You’ll find that people are very supportive, and many have experienced similar feelings at different moments in their life.”

Govindsamy now uses this experience to guide her colleagues in their own growth and development. She helps them lean into their strengths and in moments of doubt, reminds them that they were chosen for their jobs for a reason. Mentoring younger colleagues has become one of her favourite parts of the job.

Amanda Fediuc, Managing Director for Southwestern Ontario, previously worked for the CBRE People team. So she is no stranger to supporting professionals across the real estate industry. She encourages women to take on new opportunities and get involved in different experiences.

“I had an unconventional path to where I am now, leading multiple offices of sales professionals, and it goes to show the importance of including people from diverse backgrounds and areas of expertise in meetings and conversations. We all bring something unique to the conversation, and there’s great value in hearing a different perspective,” she says. “My career was shaped by this kind of exposure to different parts of the business and having leaders who believed in me.”

Fediuc is encouraged that so many businesses are prioritizing diversity and seeking better ways to empower women. But she acknowledges that it will take time to see truly meaningful change.

“There’s still bias, largely unconscious, that surfaces from time to time in the way of comments and assumptions,” Fediuc says. “But there is more awareness than ever before, which means that there’s also the potential to address issues and do things differently.”

“I’m proud of the culture in my offices where there are great people ready to speak out, provide support and do incredible work together. For some, positive change is intentional, for others it’s the biproduct of a supportive corporate culture and changing societal norms. Either way, the outcome is increasingly the same and it’s very encouraging.”

“There’s great value in including people from diverse backgrounds and areas of expertise in meetings and convervations.”

AMANDA FEDIUC CBRE WATERLOO REGION

“Talking openly about what you’re going through takes courage, but knowing you’re not alone is encouraging.”

EDWINA GOVINDSAMY CBRE HALIFAX

While economic headwinds are adding pressure on real estate, Ontario’s Steeltown may be among the best positioned cities for the future.

And Hamilton is providing developers and investors an alluring alternative to Toronto thanks to the availability and affordability of development sites.

CBRE’s Brett Taggart and Brad Walford are at the centre of the action, having sold four significant high-rise development properties in downtown Hamilton that promise to redefine the city’s skyline.

Two of those sites were acquired by their client EMBLEM Developments.

“We had a lot of interest in these sites and got a lot of questions about Hamilton,” notes Taggart. “Many of the potential buyers were Toronto-based developers looking at Hamilton for affordability reasons. They see the potential for housing values to close the gap with the rest of the GTA.”

That includes Toronto-based EMBLEM, which sees Hamilton as a significant destination for future development projects.

The attraction appears to be mutual. The first tower at EMBLEM’s master-planned project, The Design District, had overwhelming success, with the second tower launching 4 weeks after.

Understanding the cost of living is a driving factor for major decisions in housing. EMBLEM’s mandate is to create the most efficient unit layouts in the market. Their first project in Hamilton, 1 Jarvis, won the Best Suite Layout award by the North American Association of Home Builders.

Interest rate hikes and rising construction costs have affected the velocity of sales timelines across the country. Hamilton is no different.

“That same trepidation exists here,” says Taggart. “But we know this city will be among the better positioned markets when things shake out economically speaking.”

A big reason why is that the downtown Hamilton secondary plan is facilitating new development in an effort to promote revitalization of the entire city.

Various levels of government have invested $3.4 billion in a new 14-kilometre, 17-stop light rail transit line for Hamilton, to accommodate the city’s growing workforce, which is expanding at a rapid clip thanks to a steady flow of immigration and new residents priced out of other cities in Ontario.

Expanded GO Transit service will also provide greater connectivity for Hamilton to major job centers across “Hamilton will be quick to emerge when the volatility calms, because of the momentum that’s been building to this point,” says Walford. “We think this market will pick up where it’s left off. Hamilton will be high on the list of alternative cities people want to explore.”

Alan Leela, VP of Investments at EMBLEM Developments, was an early believer in Hamilton’s potential. The company made its first investments in Hamilton in 2019 and continues to seek more opportunities.

“Toronto was getting expensive. For half the price, people could have access to high-quality jobs and education, not to mention a meaningful cultural experience in a burgeoning downtown, with all the new restaurants, bars, shopping and entertainment options opening up here.”

This includes the $500-million development of a new entertainment hub that incorporates FirstOntario Concert Hall, the FirstOntario Centre, the Hamilton Convention Centre and the Art Gallery of Hamilton. The city’s makeover involves a $140-million redevelopment project on the Hamilton waterfront, which will transform the harbour into a pedestrian-friendly community with a commercial village and public plaza.

“We know that people want to be where the cool is happening, and we saw it happening in Hamilton five years ago,” Leela says. “We took a risk as a first-mover, but we are proud to see the city continuing to evolve and progress towards its true potential.”

The flagship of EMBLEM’s Hamilton developments is The Design District, a master-planned community at 41 Wilson St. in the heart of the downtown core.

With architecture by IBI Group and interior design by Burdifilek, The Design District will include three 31-storey towers totaling 931 suites above a retail podium. Construction on the project is set to begin in spring 2023.

“The ripple effects from The Design District will be considerable,” says Leela, noting that EMBLEM themselves bought the site across the street, 92 John Street, for a future project. And their first acquisition in Hamilton, 1 Jarvis, also located in the same area, tops off this year.

“When you’re in a market on the precipice of change like Hamilton is, you maximize your investment positively contributing to the local area with high-quality, complete developments” Leela says.

“You create critical mass to accelerate the evolution.”

“There’s great value in including people from diverse backgrounds and areas of expertise in meetings and conversations”

BRAD WALFORD CBRE TORONTO

And office buildings have hefty carbon footprints, the older ones especially.

“Real estate today is all about energy and how you’re going to craft a clean carbonless strategy,” says CBRE’s Scott Harper, whose team specializes in guiding tenants on evaluating their carbon footprint and how best to optimize it.

Tenants who want to tick the boxes on their ESG scorecards are looking to locate in newer, state of the art buildings that can achieve the greatest sustainability standards.

But this can represent a daunting challenge for groups like law firms and banks, which typically host their highly sensitive data onsite in the form of back-office servers.

“If the best footprint for you is to be in a better building that’s ESG-friendly, it becomes challenging when your relocation involves a very expensive built out of new data center that is currently exists in your older office premises,” Harper says.

“The problem is that these tenants can’t meet their ESG objectives because they’re being held hostage by the infrastructure cost to relocate.”

Free to Flee and Fulfill Harper and his team can see a way forward. They have successfully strategized with tenants to move data to the cloud, or off-site, freeing them up to lease whatever office space allows them to meet their business and sustainability goals.

“You can go choose the building that represents the most economically feasible business case for your organization, and that will drive an energy strategy that is more sustainable.”

“Why be stuck in an older building with a massive carbon footprint and it’s totally ineffective because you’ve got a data centre there,” Harper asks. “It makes no sense.”

His team has been working with CBRE’s U.S.-based carbon rating software specialists, introducing them to Canadian landlords to help rate the carbon footprint of their properties.

“Landlords who are holding buildings for 20 years are eager to get into the carbon rating game, so they can use it as a baseline to get better and show tenants they’re getting better. It can be a real differentiator in the market right now.”

In the 2022 Canadian Real Estate Lenders’ Report, 86% of those surveyed reported that they either already have or plan to incorporate some form of ESG criteria into their real estate lending decisions. However, lenders felt that there was still a 3 to 5 year window before mortgage availability was impacted for carbon-intensive assets.

ESG requirements and reporting are even more developed in Europe. Many Canadian landlords and lenders with a global presence are bringing best practices to Canada, including emissions reporting, action plan verification, future ESG capital expenditure assessments and 3rd party ESG consultants.

“ESG is driving real estate leasing and investment decisions, not to mention future capital availability. It’s not a future prospect, it’s here and now. That’s why the unthinkable, like moving on-site servers into data centres, is suddenly viable,” says Amy Bugg, Senior Director of Client Care at CBRE in Canada.

“Look for energy efficiencies to move into the top tier of real estate requirements for office tenants along with building amenities. ESG is not as sexy as amenities, but is no less important.“

“Real estate today is all about energy and how you’re going to craft a clean carbonless strategy.”

SCOTT HARPER CBRE TORONTO

Canadian retail markets are showing signs of stability and growth as in-person shopping has returned with a vengeance, according to CBRE’s Retail Rent Survey. Here are some of the report highlights.

Despite economic headwinds, retail sentiment remains positive for 2023. In-person shopping has made a comeback. Most Canadian cities recorded stable or growing retail rental rates in the second half of 2022, with 23 increases and only three rent declines observed nationally. This increased retail activity bodes well for the coming year.

Asking rents are soaring across Canada amid growing demand from new-to-market and existing retailers, limited new supply and inflated construction costs. Cities west of Winnipeg observed the most rent appreciation. Leading the increases were Saskatoon and Vancouver.

While construction costs have dropped from their peak in many cities, the combination of high costs, increasing interest rates and weak residential markets has hindered development activity. Many retailers are opting for second-generation space to save on buildout costs, particularly in Toronto and Vancouver.

2023 with see the arrival of several new retail projects. Keep your eyes peeled for The Post in downtown Vancouver and the expansion of Willowbrook Mall in Langley, BC, as well as mixed-use projects such as the Bridgewater and Sage Creek neighbourhoods in Winnipeg, and Richmond Yards, Halifax’s largest mixed-use development. In Toronto, The Well is set to begin occupancy this year.

You may have noticed some of your favourite online brands sprouting into physical stores. Digitally native brands such as Mejuri, Allbirds, Monos and Vessi are proving that brick and mortar continues to play an important role in the retail ecosystem and the customer experience. Shoppers can expect this trend to continue into 2023, along with the growth of specialty grocers, the reemergence of luxury brands, and the rise of non-traditional medical users such as fertility centres, medical spas, and plastic surgery clinics.

To emphasize the point, the developer spells it out in the project’s name: Ajax Industrial on the Park.

The first phase of this three-building campus – currently under construction and slated for a 2024 delivery – will be a 700,000 sq .ft. industrial facility, with pioneering environmental specifications aimed at delivering superior energy efficiencies.

But what sets the project apart is that this industrial park, surrounded by 82 acres of green space and wetlands, offers what few others in the GTA can: access to walking trails and nature.

Employees at Ajax Industrial on the Park will be able to re-energize themselves by taking pleasant strolls through adjacent meadows as Duffins Creek and Millers Creek flow by.

The project will be connected to public transit, and also 400-series highways, but will be equipped with electric vehicle charging stations to help offset the buildings’ carbon emissions.

“Two years ago, most saw automation when envisioning industrial facilities, with fewer workers inside the space,” says CBRE’s Samantha Sukumar, who is leasing Ajax Industrial on the Park.

“This project addresses the critical importance of skilled labour. Durham Region has a strong labour pool and we want to attract it. And we’re doing that by highlighting how this is an industrial campus unlike any other in the GTA.”

The emphasis here, Sukumar says, is not just on building sustainability and eco-friendly construction practices; above all else it’s about employee wellness.

“In the industrial market people spend a lot of time focusing on the E of ESG and not as much on the others. That’s not the case at Ajax Industrial on the Park. This will be one of the most forward-looking developments in the GTA when it comes to prioritizing worker wellness.”

Ajax Industrial on the Park will meet rigorous sustainability standards.

If creekside strolls don’t appeal, Ajax Industrial on the Park also happens

to be located across the road from Durham Live, or DLive, with its hotels, casino and dining venues.

For corporate users, this could make Crestpoint’s industrial development an ideal head office location, Sukumar suggests. “They can stay at the hotel, have all their employees based here, and build up their workplace as an attraction in Durham.

“It’s just another example of how this is not your traditional industrial offering.”

Crestpoint is ensuring the buildings at Ajax Industrial on the Park will meet rigorous sustainability standards.

This includes upping the roof and wall insulation to decrease heat loss and minimize the amount of heating required, helping to ultimately reduce carbon emissions.

Rooftop space on the buildings will support renewable energy in the form of solar photovoltaics panels.

And as noted, the facilities are being engineered to accommodate electric vehicle charging stations.

Not surprisingly, Ajax Industrial on the Park is targeting ESG-minded tenants.

“The idea is if companies are promoting ESG principles when it comes to the sustainable manufacturing of their products, then they’ll also want their real estate to reflect that ESG ethos,” Sukumar says.

The experience of working on Ajax Industrial on the Park has given Sukumar a unique perspective on the intersection of ESG and industrial real estate, enabling her to hone this as a new area of professional expertise and do her part to promote sustainability.

“ESG is an essential aspect of development and leasing that will only become more critical in the years to come,” she says.

“I’m excited we can offer our clients this kind of specialized, forward-focused expertise. The future has arrived!”

“People focus on the E of ESG and not as much on the others. That’s not the case at Ajax Industrial on the Park.”

SAMANTHA SUKUMAR CBRE TORONTOAjax Industrial on the Park

Anyone who has the pleasure of spending time with Kay Locke quickly learns two things: she is candid and extremely passionate about what she does.

Based in CBRE’s Toronto West office, Locke specializes in advising office using clients on their real estate and provides strategies and solutions to suit their long-term objectives. She is dynamic and driven, qualities that have no doubt contributed to her success.

We spoke to Locke about her passion for client service and her advice for young brokers.

Tell us about your career path to this point.

I got into real estate straight out of university, as an administrative assistant for an industrial team. Eventually, I decided to take the leap onto the sales floor on my own as an office broker. I went all in and was 100% commission-based from day one.

What inspires you about commercial real estate in Toronto West?

I love being able to dig into what companies do and learn new things every day. There is such a variety of fascinating businesses and approaches to learn about, both on the occupier and on the landlord side.

What is the best advice you’ve received?

Silence is golden. If you’re in the middle of a deal and talking to someone on the other side, ask them a few strategic leading questions, then let them do the talking. Stay a little quiet; it pays off and you’ll learn so much.

How is your perspective helpful to clients?

I always consider the long term. When talking to tenants, I take the time to assess their needs now, in the mid-future and in the long run. From there, we structure the real estate. My job is to solution real estate around my clients’ business needs, so it’s critical that I take the time to understand who they are, what they do and how they operate before moving forward with options.

Too many people start with the real estate and try to make it work backwards, but it doesn’t benefit the client.

Which trend are you most excited about in your market?

I can’t wait to see what happens with the B- and C-class office product. Tenants have been taking advantage of nicely built-out A-class space and moving out of older outdated offices during COVID, which was a major flight to quality trend. While some of those B- and C-class office buildings became redevelopments, that is no longer trending. I’m looking forward to seeing how they will be repositioned or repurposed in the future.

Do you have tips for others starting their commercial real estate careers?

Play the long game, build relationships, and make client service your priority. Providing good customer service will create business in the future. I used to do so much work for very little commission, but the learned experiences and the knowledge I gained got me to where I am now.

Don’t be afraid to take on projects you may not have otherwise considered; you never know where they’ll take you.

What’s something your colleagues would be surprised to learn about you?

I would be surprised if people knew that my name is Katherine.

What’s a good book you’ve read recently?

I read a book called “Pay Up: The Future of Women and Work (and Why It’s Different Than You Think),” which is about women in business and thinking differently. As a woman working in sales, I’ve often had to think outside the box, so I recommend giving it a read.

If you weren’t in commercial real estate, what would you do?

Besides surfing in Bali – who wouldn’t want to do that – I’d probably do a sales job similar to brokerage. I wouldn’t necessarily need to sell a product, but I’d want the client interface and customer service aspects.

What’s a cause that’s important to you?

I was on the inaugural Canadian Diversity, Equity & Inclusion committee. While we’ve taken significant steps, I know we still have a lot of work to do. I believe everybody could be doing more to support DE&I, but I’m excited about the direction we’re heading.

“Building strong relationships is the most important thing in this business.”

KAY LOCKE CBRE TORONTO

The company’s best and brightest young talents share insights and perspectives on the challenges and opportunities that come with building a career in commercial real estate.

Christina Shore has developed a reputation for her excellent client service and forward-thinking solutions. Having worked in commercial real estate since 2005, she has developed a keen understanding of the London, Ont., market and built a business on strong relationships and transparency.

Shore tells us about the path that led her to commercial real estate brokerage, the mentors who guided her along the way and her love for horseback riding.

How did you get into commercial real estate?

In my early 20s I was hired to put together offers and marketing materials at a brokerage firm in Mississauga and worked my way onto an industrial team as an assistant. I got my brokerage licence and was hired by a U.S. industrial developer, who ended up pulling out of the GTA during the 2008 recession.

In 2011 I joined CBRE as a licensed assistant on Randy Fisher and Larin Shouldice’s industrial team. Over time I decided I wanted to participate in the transactions; either I’d make it in sales or leave brokerage.

Luckily, I was given the opportunity to partner with Rick Spencer, whose skillset complemented mine. It’s been a wonderful partnership since; we have fun every day.

What inspires you about commercial real estate in London?

I moved to London about 12 years ago and have seen the city undergo tons of development and growth. I’ve always been a bit of a country girl, so I love that London has a country charm and can be crossed in about half an hour, while still having a big city feel. It’s a nice place to live and to do business.

London offers a lot of opportunities. Small business owners and large companies alike see the appeal of investing here. And we’ve seen

an influx of new residents, thanks in part to our health care sector, education institutions and relatively affordable housing.

What is the best advice you’ve received?

Don’t be afraid to ask questions. Questions facilitate discussion and show that you’re interested, that you care and that you want to learn.

How is your perspective helpful to clients?

I think I bring complementary skills and perspectives to my team and our clients. Collectively, Rick and I bring unique skillsets and ideas to the table. His business background and his experience working in the office sector complement my understanding of the industrial market. But our strongest asset is our relationship building. We truly want what’s best for our clients and consider many of them our friends. They know that we have their best interests at heart.

Which trend are you most excited about in your market?

There are lots of new residential developments going up all over town because people want to be in London and be part of its growth. This also drives exciting new development on the commercial side of things.

Do you have some tips for others who are just starting their commercial real estate career?

Use the resources at your fingertips. We’re surrounded by experienced people, so tap into that wealth of knowledge. And don’t be afraid to ask for feedback or ideas for a tough deal. People are always happy to help.

Can you talk about a mentor you’ve had and how they helped you?

I’ve been lucky to have many impactful mentors.

Randy Fisher was my first mentor at CBRE. He has a way of finding creative solutions when deals get tough, so being involved in those conversations taught me a lot.

Peter Whatmore, London’s managing director for many years, always offered the support I needed as a woman in a male-dominated industry and is a great person to brainstorm with.

Finally, Rick helped me build the confidence to do what I am doing today.

What’s something your colleagues would be surprised to learn about you?

Horses have always been a big part of my world. I grew up riding English, showing, and spent time following the rodeo circuit. In my early 20s I visited a ranch called Flag Is Up Farms, in Solvang, California. It was home to Monty Roberts, one of the most renowned horse trainers in the world. I got to learn his technique with him and his trainers, so that was an exciting time in my life. It taught me a lot about focus and perseverance.

What’s your favourite place you’ve been?

I’d have to say Flag Is Up Farms. It’s truly an incredible place with the desert, the mountains, the beaches, the warmth… and of course the horses. It’s beautiful.

If you weren’t in commercial real estate, what would you do?

I’d be a horse trainer.

“Don’t be afraid to ask the hard questions because you often gain the most from them.”

CHRISTINA SHORE CBRE LONDON