serviCes iaflored to )our

B.bf and lbrne &nler oitm vedr awarOs nX ing Display Cenler. Relax and enjoy customers. No buying group. assoaiation or fellow dealers after Show hours at our FREE iS llsaler show offers lhe COMPI,ETE range oif home improvement products you'll lind at the t987 Nalional Home Center Show.

nxcithtg seminars and workshops geared to your specific needs and interests. Here's your opportunity to lisfen 1o and interact wilh experts who understand and can offer solulions to the challenges and opportunities you face on a daily basis as a truilding materials dealer. You'll

Plus, you can hold the line on travel li lnS advantage of our special hotel rates and rock.bollom airline fares. Save $lo by pre-registering TODAY for The national Home Cent€r Show. Fill out lhe registration form below and return it to us by February 6, t987. You'll receive a FREE Show badge by return mailand avoid the $tO at-Show registration fee. Mail yours TODAY!

1. Must be received in the show office by February 6, 1987. contirmation ol pre-registration and hotel reseryalion tormswillbe mailed within threereeks. Free badgeswillbe mailed atterJanuarys, 19gz

2. Lale mail registrations will not be processed. Register again at Show (Al-show registration fee $10.00)

3. REGISTRATION COMPUTERIZED, ALL INFORMATION MUST BE FTLLED IN.

4. NO ONE UNDEB 16 YEARS OLD AOMITTED.

IMPORTANT Please leave space between tirst name or initials and last name

ilililililililililil il il il ililil il il il il il il il t

March 8-11. 19trf Chicago, lllinois

IMPORIANT: In orderto process your registration, your company's business activity must be indicated below:

(l) n Retailer/Dealer

(J) ! Wholesaler/Oistributor

(P) ! Other(pleasedescribe)

llatl!ol xauondxoaiCc"tqsW, soohoshoed

Part hldgc, lt 6068 HS.A.

Holel forms will be sent on receipt of pre-registration forms NOTE: Exhibitor Personnel should not use this torm. Please use form orovided in Exhibitor Kit.

Editor-Publisher David Cutler

Senior Editor Juanita Lovret

Assistant Editor David Koenig

Contributing Editors Dwight Cunan, Gage McKinney, Ken Thim

Art Director Martha Emery

Staff Artist Carole Shinn

Circulation Dorothea Creegan

The Merchant Magazine (USPS 79656000) is published monthly at 45fi) Campus Dr., Suite 480, Nervport Beach, Ca. 92660, phone (714) 852-1990, by The Merchant Magazine, Inc. Second-class postage rates paid at Newport Beach, Ca., and additional offices. POSTMASTER: Send address changes to The Merchant Magazine, 4500 Campus Dr, Suite 480, Newport Beach, Ca. 92660.

A-DVERTISING OFFICES FROM WASHINGTON STATE, ORE. GON, IDAHO, WYOMING, MONTANA, UTAH, COLORADOand CANADA: Contact Carole Holm. Phone (206) 340-0680. FROM NORTTIERN CALIFORNIA & ARIZONA: contact David Cutler. Phone (714) 852-9m.

Advertising rates upon request.

Change of Address-Send subscription orders and address changes to Circulation Dept., The Merchant Magazine, 4500 Campus Dr., Suite 480, Newport Beach, Ca. 92660. Include address label from recent issue ifpossible, new address and zip code.

Subscription Rates-U.S.: $9-one year; $l5two years; $20-three years. Foreign: one year payable in advance in U.S. fundsCanada or Mexico: air-$351 surface-$30; South America: air-$551 surface-$30; Asia: air-$68; surface-$30: Europe: air-$98; surface-$30. Single copies-$2; back copies-$3 when available plus shipping & handling. The Merchant Magazine is an independently owned publication for the retail, wholesale and distribution levels ofthe lumber and home center markets in 13 western states.

IN A recent session of informal shop talk we I heard voiced a theory that we've heard many times before. Namely, that there is a surprisingly high percentage of nice people in the wood products business.

This being the holiday season, good cheer and all that, it seemed an appropriate time to take note of this seeming phenomenon. Not for any collective sense of smugness on the part of an entire industry, but because it's interesting to speculate as to why it might be true.

Those who place the men and women in the lumber industry in the good guy (good person?) category often allude to the high number of transactions done on a handshake, word-of-mouth basis, claiming the untrustworthy are eventually weeded out. The wood business is among the oldest in the U.S. and so has a continuity, with sons and daughters who carry on the business each generation. Ethereal arguments also claim that the natural qualities of the products are somehow respon-

sible and that the business just seems to attract and keep nice people.

Of course, cynics laugh and hoot at the whole thing. To them the quick pay customer is the good guy. The rest are just yokels waiting to be sold something. Cynics feel the so-called trustworthiness in the lumber business is just a function of its backwardness and they can quickly produce a stack of unpaid bills to bolster their position. Tales of flawed transactions are legion, they claim.

We can't imagine there is a scientific answer to this question. Nor is anyone likely to prove or disprove the contention with any finality. But one thing we do know for sure. The number of friendly, likable people we encounter in this business far outweighs the other kind. We hope you've also found this to be true and that your year has been brightened by customers and co-workers.

Seasons greetings and best wishes from all of us at The Merchant Magazine.

D-M-K of *, -"tf."y nrrne)

growr' ss fost

DMI(-Pccrfn iu,If' We\'e affie{ rcnt peopte to our frn to tnroiitrto;in orLr trsditiorl- of senbe Dwight Curran Md exealts@for our crrstomers, our fanity wiahes you on{ your fmity a healtfty on{ happy hoti{ey sedson an{tewyear.

Al" :,',?#'gf; i*,? LIi?. x

the building products industry for 1987 and the rest of the decade. Even though housing starts likely will decline somewhat in the coming year, single family residential construction should remain strong as long as interest rates are affordable.

Remodeling /repair and additions markets, which are already strong, will become even more important to building products manufacturers and distributors in the future. Continued strength and activity of this market, regardless of economic conditions, are an important hedge against the cyclicality of new construction. We also will see more opportunities for new product development to meet the specific needs of this market.

Continued technological improvements also will remain an important factor in industry growth. Because of increased efficiencies in our plants and mills, we can make plywood more economically than we did a decade ago. The advent of new, highly cost-effective structural panels, such as waferboard and oriented strand board, is evidence of the industry's major offensive to reduce housing costs. This progressive trend will continue as

Single family construction strong . . . R&R even more important. .. continued technological improvements.. weak pricing short term... effects of new tax law.

will our ability to increase yield from our raw materials.

These are the kinds of improvements that have strengthened our industry's position as suppliers in global markets. Worldwide, the United States remains the premier supplier of building products, and in the coming years, we will continue to solidify that position.

There will be many opportunities to expand our markets in the future, yet some formidable challenges will shape the way we will do business.

Foremost among these challenges is the new tax reform law, which will force us to realign our priorities in several areas. The repeal of the investment tax credit is a severe blow to expansion and modernization programs crucial not only to improving production and quality standards, but also to maintaining our competitive edge. New capital investment programs will be even more carefully scrutinized for their ability to generate adequate returns.

An extended period of lower

U.S.-dollar exchange rates will make American-made products even more attractive to foreign buyers. We must, however, continue to press for equitable treatment of U.S. exports in world markets. For a level playing field to develop, international markets must be as open to competitive U.S. goods as our own markets are readily accessible to foreign goods.

Weak pricing also will likely continue challenging our industry in the months ahead because of overcapacity in lumber and plywood production. The preliminary l5% countervailing duty recently imposed on Canadian softwood lumber imports should ease the lumber pricing squeeze somewhat, but until demand comes into line with capacity, producers will be hard pressed to increase profit margins.

Investments in new facilities will be fewer in our current environment, with future expansion most likely through acquisition and upgrading existing facilities. The volatility of market conditions makes it increasingly difficult to anticipate future capacity needs, so any commitment of capital to large greenfield projects will be examined even more closely than in the past.

These challenges, however, do not dampen our optimism, but rather reinforce the necessity to take advantage of current possibilities. There are ample opportunities ahead for growth in sales and profits.

llf e ARE forecasting a stron- lU ger economy in 1987 than in 1986,whichhas turned

out to be relatively sluggish. Howi ever, mildly ris: ing mortgage interest rates, overbuilding in such sectors as offices and apartments, and the negativeeffects of tax reform on income property construction year.should reduce activity in the next

Real gross national product is forecast to rise 3.6% from fourthquarter 1986 to fourth-quarter 1987, compared to an estimated 2.70lo during 1986. Fixed mortgage interest rates are forecast to rise from an average of close to l0o/o in fourth quarter of 1986 to around llo/o by the end of 1987. The U. S.

By Phillip E. Yincent Vice President & Senior Economist First Interstate Bancorp.

By Phillip E. Yincent Vice President & Senior Economist First Interstate Bancorp.

Consumer Price Index is expected to rise 4.4% during 1987 compared to an estimated increase of 1.80/o in l 986.

In the national housing market, housing starts are forecast to de-

Reduced construction activity...3.6% rise in GNP.. lower energy prices, money supply growth will help consumption and production wide disparities in outlook for western states.

cline from an estimated 1.88 million in 1986 to L77 million in 1987. The majority of the decline is expected to take place in the multifamily area.

The underlying factors that yield basic optimism for the overall economy include the decline in energy prices, the fall in the value of the dollar, and rapid growth of the money supply. Although some states with major oil and gas reserves have been hit hard by the major drop in oil prices during th€ first part of 1986, the nation is a major net exporter of oil. Thus,

(Please turn to page 71)

E IRST let me give you the good f news: inflation will be under 2o/o for the second year in a row. 1986 will finish at 1.6% and 1987

will be about the same. That's good news if you lease your facilities with Consumer Price Index escalation clauses. But it's bad news if you're investing in real estate in the hope that you'll get appreciation. The median price of existing homes is flat and likely to stay the same in 1987. Although house prices have shot up in certain eastern markets, they have been offset in sunbelt markets. In the long run our industry is better off with relatively stable housing prices because it removes speculators from the market and lessens the "boom or bust" cycle.

More good news. If you liked the ihterest rate trends of 1986, get ready for more in 1987. If you have any doubt about our industry being interest rate sensitive. take a minute and review your company's

financial statements from l98l and 1982. Low interest rates are good for our industry, and that's what we will have in 1987.

The bad news comes from the fact that we've had four straight expansion years in the construction industry. During this time the companies that supply contractors have enjoyed profitability and growth. Many of these have reinvested some of these profits in expanded operations and new operations thereby resulting in increased capacity in the industry and this in turn has put downward pressure on margins. (Remember supply-side economics!) This is the same thing that happened in the home center industry from 1980 through 1985.

Low inflation, low interest rates to continue. added capacity depresses margins. . increasing both sales volume and profit is the challenger of 1987.

By 1986 almost all of them operating in our Southern California market were either losing money or they had dramatically reduced earnings as a result of the overstoring.

What are the implications of these trends of inflation. interest rates and competition for the retailer of lumber and building materials? Getting all the volume we want in 1987 is the easy part. It's no trick to increase sales volume. However, it's no great honor either! Just set your prices low enough and the volume will go up. In our market. Home Club tried this and it worked - they got volume. But they have yet to achieve an operating profit.

The real challenge in 1987 will be to increase sales volume and get a corresponding increase in profit at the same time. I can guarantee you that it is much easier to write these words than it isto actually accomplish what the words say. At Ganahl Lumber, we believe the accomplishment lies in better execution of small things. Our mission is not to do anything extraordinary, but rather, we want to do the ordinary things extraordinarily well.

CONOMIC projections for E 1987 generally indicate a repeat of 1986 business activity. Economists, trade group gurus and tea leaf readers are mildly optimistic in a number of economic areas.

They foresee sluggish but continued improvement in the GNP and another "leg"onthe Bull Market in Wall Street. Perhaps there will be slightly higher interest rates and inflation, but such upward pressures will be minimal. Slight improvement in U.S. international trade should be another plus ingredient. Such general optimism is tempered a bit by the likelihood that economic activity will remain regional in nature. By this we mean, good times on the eastern and western coasts and continued trouble in America's heartland.

For the forest products industry, we should also have a repeat of 1986. If we build 1.8 to 1.85 million housing units in 1986, we might expect a decline of about l0o/o in 1987. NAWLA projects a housing start year in 1987 of 1.63 to 1.65 million units. Tax reform and overbuilding in some areas may affect apartments and multifamily units but the trend towards more single family homes as a percentage of the whole should continue.

Our association sees a substantial increase in remodeling markets during 1987. And this was a great market for wood products this year!

Industrial wood markets have been good and, again, more of the same for 1987. Our wood pallet market is adversely affected by the decision of auto manufacturers and the Federal Government to discontinue the use of wood pallets. These decisions may be reversed, but if not, the remaining industrial market for lumber will be better during 1987.

It looks as if the overseas export of lumber will also improve slightly in 1987. The fall of the dollar in

1986 should provide some better results in U.S. exports.

In summary, demand levels for lumber, plywood and other wood products should be almost as great as in 1986.

ation of oversupply. This means that both the domestic and foreign marketplace will be very competitive. There will be continued pressure on sales margins and continued problems in depressed regions of the U.S. Projecting effects of the Tax Reform Act of 1986 and the controversy over Canadian softwood lumber imports on our lumber business is extremely difficult. If history is any guide, these events will neither be as good nor as detrimental for our industry as some people expect.

Therefore, our message is the same as a year ago:

Conversely, it should that our 1987 projection demand. We also expect

Good management, operating cost containment, and professionalism in marketing and sales will continue to be the answer to profitability and growth.

Q rnucfURAL panel produc1l tion in the U.S., buoyed by rising demand, should reach at least 25 billion square feet, 3/8-inch

Mild optimism... 1.63 to 1.65 million housing starts. . substantial increase in remodeling markets. industrial wood markets good continued oversupply. be noted deals with a continubasis, by the end of this year a 700/o increase over 1985 production and the fourth consecutive annual production record for the panel industry. In spite of an expected slight dip in housing starts, APA expects the strong production pace to be maintained in 1987.

The year ahead should be one of even more diversified penetration in nonhousing markets, particularly

over-the-counter sales through home centers nationwide. This bright forecast takes into account the likelihood of a reduction from 1.85 million housing starts this year to 1,75 million in 1987, due in part to tax changes impacting multifamily construction and to anticipated upward pressure on interest rates in the second half of next year.

In 1987, in excess of 25 billion square feet of structural panel production should be required, as new promotional gains are added to a marketplace which already has strong demand momentum. The current wait-and-see attitude of consumers as they attempt to understand the new tax laws introduces a note of caution, but APA is forecasting that the public will adjust to the tax changes and

be characterized by many challeng-

ing opportunities. These opportunities require an extraordinary effort to be successful, whether it be at the wholesale, manufacturing or retail level.

Contributing factors include our economywhich has become more complicated than ever before, along with the complexity of today's tough competition. Today, we have price wars, better educated consumers and a thriving do-it-yourself market that, overcome reluctance to make new purchasing commitments.

Home additions and remodeling will compensate for the housing decline by adding an estimated 6% to the over-the-counter distribution markets. Another 5 o/o increase in nonresidential can also be seen next year as industry promotion generates new business in the commercial roof deck sector and other areas.

1.75 million housing starts

.1oo/o increase in plywood production . . remodelingwill add 60lo to over-the-counter distribution.. timber supply clouds bright future.

Overseas. too. the outlook is brighter. Markets have pulled out of a long slump, and recovery is evident in Europe and elsewhere. Offshore shipments were 800/o ahead of 1985 for the first eight months of 1986.

A major cloud that could come

despite some maturity, will continue to expand because of mo(e households participating in d-i-y projects.

This increased participation has led to consumers tackling bigger and more complicated projects. The result is a wiser, more knowledgeable consumer who demands quality products in a significant number of categories, along with competitive pncrng.

This evolutionary demand for quality should help U.S. manufacturers whowith a concern for cost controlstend to have better quality products than comparable ones produced offshore. Medium to upper priced/quality products have proved to be most popular in hardlines retail outlets, indicating that consumers do want a choice.

Hardlines retailers who have made a definite effort to offer a selection of products at various quality and price levels have reported consistent, profi table growth in the sale of hardware items.

Expanding d-i-y market. . more consumer demand for quality, competitive pricing . slow growth in number of stores. increased volume per store stores need better identity.

in the way of an even brighter future is in the area of timber supply. In the Pacific Northwest, there appears to be more concern in certain circles for the welfare of the Spotted Owl than for thousands of wood industry employees whose livelihoods are threatened by plans to over-protect the owl. In the south, harvests in some areas are just beginning to overtake net annual growth. What's needed is renewed commitment to timber management on the 70% of southern forest lands that are held by small private owners. Our industry must not give up the fight for capital gains relief on long-range forestry investments, despite the setback it has received in the recently approved Tax Bill.

A sobering reminder is needed, though, that our immediate problem is to do all in our power to assure there will continue to be an adequate raw material baseand at the same time to create markets in the short-term for the 5 billion square feet of unused capacity. We've got the ideas, we've got the programs and we've got the energy. A world of fresh opportunity awaits us.

Recent studies indicate the emphasis among consumers is definitely switching away from price alone and toward quality and added values. Added values, of course, include what hardware/ home center stores are known for: a source of knowledgeable, helpful sales people willing to take the time to advise their customers on their intended projects. With the popularity and growth of ttre d-i-y movement, this has become more important than ever.

The outlook for our industry for the next few years indicates a slower growth in the number of stores but an increase in the average volume per store. This means hardware and home improvement dealers will have to increase their penetration into the d-i-y market segment. Their goals should include increasing the shopping frequency among existing d-iy households, along with efforts to increase the average transaction per sale.

Afocus toward betteruse ofspace ahd inventory, rather than on managing new store unit growth, will be the key to successful retailing over the next five to 10 years.

Successful dealers will keep pace with developments in their marketplace. They will be able to offset competition by offering increased service and value and by forging a real identity for their particular stores in the community they serve.

us will look back upon this year as the "golden year." Building products executlves seeking to repeat the success of 1986 will find that goal more and more elu- siveas the decade progresses. Although we have all enjoyed one of the best years of the decade, there have been some disturbing events taking place. For example, when you add up the construction statistics, most executives are surprised to learn that the best construction year of the decade was not 1986 but 19851 Real construction spending for 1986 is actually off .340/o! Current overbuilding in certain sectors, a weaker economy, and fundamental changes in the tax code all will combine to accelerate the decline that has begun this year.

Certainly, the non-residential sector contains the .greatest exposure to decline for 1987. With total non-residential constuction slipping 100/0, the "red flag" is up as to the true nature of next year's non-residential climate. Put plainly and simply, the traditional three year construction expansion was stretched into four years due to favorable tax laws and a growing economy. The market and the economy can no longer absorb excess non-residential capacity and thus, this sector is poised for a decline next year.

The non-residential sector for 1987 will see significant declines over present levels. However, behind the "doom and gloom" lies opportunities for savvy manufacturers who can successfully target their markets. For example, in a year where office starts could decline to half their level of 1985, institutional building, dependent on demographic changes, will remain close to current levels. The continued increase in the applicability of accessibility codes, particularly in the institutional market, lays the groundwork for a growth segment. Construction of retail buildings, because they follow

housing starts, will actually increase 5% for 1987 creating yet another market niche.

Because of structural changes in the market, all of us will become more dependent on the housing market. With the continued lag of mortgage rates responding to recent declines in short-term rates, the stage has been set for further decreases in the mortgage rate next year. Thus, single-family housing will continue its three year growth strut.

Adding to this synergy is the continued single-family mix change away from starter homes toward

Success will be elusive . . . declining non-residential sector...institutional building steady .5o/o increase in retail buifding ... 12o/od-i-y growth.

move-up homes otlering construction products manufacturers a market with increased spending per home. Multi-family starts will be most affected by tax law changes and are expected to decline by 200/o in 1987.

The rehab market will also see fundamental changes next year. Removal of the Investment Tax Credit will have its primary effect on commercial renovation projects, pushing this sector down 25%. However, with the average age of a commercial building increasing to 23 years (versus 22years in 1985), the replacement market will continue to accelerate.

One of the prime beneficiaries of the strong housing market is the do-it-yourself sector. With 80% of d-i-y projects undertaken within two years of a house purchase and sales of existing homes approaching 3.7 million, the foundation has been laid for a continuation of the l2olo compound annual growth rate in the d-i-y market.

Compared to the past "golden year," 1987 will be a year offundamental structural change in the construction cycle. As the economy continues its slowdown, the construction industry will be challenged to respond to a different set of events.

I N tlzs, after the tast Redwood I National Park expansion, several industry observers were sounding a death knell for the redwood lumber industry. Contrary to predictions, the redwood industry has shown the same resilience and tenacity as the trees that constitute its resource. Major redwood producers recently invested millions of dollars in new sawmills. a certain indication of their confidence. Many mills use the most advanced computer-aided equipment. Most important, redwood production has increased steadily. This makes me feel obliged to com-

ment as Mark Twain did when he cabled the Associated Press from London saying: "The reports of mY death are greatly exaggerated."

In 1986. the California Redwood Association conducted a survey of all redwood producers to help us anticipate the marketing needs of the industry. I'd like to share the results with you. They are interesting and, in some respects, perhaps a little surpnslng.

In a siven vear. redwood accounts for onli 2o/n io 3dh of U.S. softwood produciion which lies in the range of 39 billion board feet. The numbers may seem deceptive because redwood is highly visible in the market place and in applications. Another figure, percentage of sales, provides a different perspective. While redwood accounts for 20lo to 30/o of production, it usually accounts for be-

tween 40lo and 60/o of sales, reflecting redwood's higher value and greater profit margin.

From a modest level of 760 million board feet in 1982, redwood production has increased gradually and is expected to exceed one billion board feet in 1988 where it will remain relatively steady for the remainder of this decade and into the next. The primary reason for this 410/o increase is the coming of age of many young growth redwood forests. Many lands that have been harvested and reforested now hold timber of a marketable age. This is a trend that will continue into the next century.

Redwood lumber is divided into two major product categories. There are the clear, architectural grades, used for siding, interior paneling and millwork and there are the knotty, garden grades, used for decks and outdoor applications. Naturally, the

grade mix developed from young growth timber is different from old growth timber, but one of our survey's surprises is that while prod-

Redwood industry modernizing, increasing production amount of marketable timberincreasing . . . availabil- ity assured into next century. . specialty status to continue.

uction increases, the grade mix will stay proportionate, with about 200/o architectural grades and 800/o garden grades.

These figures bear a few messages for lumber dealers. First of all, redwood will continue to be available in increasing quantity well into the next century. The grade mix for the next five to ten years will remain the same, which means redwood will keep its position as the most highly desired product for the active markets of siding, interior paneling and outdoor decks.

While it will continue to be readily available. redwood will never become a commodity. Redwood production will remain small compared to the total softwood production of U.S. and Canada, More important, redwood's status as a specialty wood is due to aesthetic and physical properties which are unmatched by other woods. The bottom line is lumber retailers stocking redwood will continue to make a greater profit from redwood than other competing species.

I nSf YEAR, we talked about L the disastrous trend in this industry to engage in a price war, and the need to focus on improving

customer service through better employeetraining as an offset to an ever-widening and more destructive price war.

The pricing wars have continued. and the casualties have mounted. Hechinger declared itself out of the warehouse business as this success- ful, always candid giant found warehouses discouraged female traffic and did not produce acceptable rates of return unless one ran the only warehouse game in town.

Mr. How has been parceled off, largely to Builders Square. Homecrafters has been bought by Wickes. Zayre bought HomeClub and finds losses larger than expected and unacceptable. Pay 'n Pak's earnings dropped sharply.

How can one remain a profitable

player in a field so dominated by pricing images? One of the needs is to develop a pricing strategy that identifies the price-sensitive items and allows you to create the right pricing image on those items while finding other products on which tiny margin gains can be achieved.

The whole concept of priceshopping by the consumer, initiated by home center efforts, makes large-margin gains on individual items or merchandise classes increasingly difficult to attain.

Home Center Institute has been seeking ways to develop their pricing strategies during this past year, and in 1987 is offering two new servtces.

Price-shopping competition is nothing new. It's been done for

Casualties mount in price wars. . strategy must be developed . . . large margingains difficult to attain new developments in price checking.

years, but not as regularly as it should be. Now an in-store price auditing system has been developed that will check the everyday shelf price of 1,200 significant items in a variety of storesmass merchandisers, home centers, hardware stores, etc.in key markets around the country. Subscribers will get these price checks in an actionable format as they are developed by market once a year.

What should be the "right" advertised price? No one can be low on every item every day and stay in business. Is there a comfort zone for a line or product? A new service checks print advertising monthly and issues by-item information showing advertised price, regular price, brand name, model number, and description, as well as who advertised the product, where and when. Capable of sorting more than 10,000 advertised items monthly into 3l merchandise categories, this is proving to be a useful management tool.

These are two responses to needs in this highly competitive retail marketplace today.

I N tvtv vlEw, two major facrors I will dominate the evolution of the U.S. economy in the next 12 months: the new tax bill and the

delayed "kicking in" of the effects of a weaker dollar. These factors,inturn, will govern the development of lncome, effiployment and spending trends in 1987.

The Tax Act of 1986 changes dramatically virtually every major parameter of our tax system. Any structural change of this magnitudeeven if its long run effects are likely to be positivewill create dislocations in economic activity that will tend to have a depressive effect in the short run. The long run effects themselves probably will be slightly stimulative on balance. The sharp reduction in personal marginal income tax rates, for example, should encourage workers to supply their labor to the market, resulting in greater employment and labor force participation. These reductions also should put downward pressure on nominal interest rates which some economists believe are sensitive to the rate of taxation.

The "deceleration" of depreciation allowances, the elimination or reduction of tax credits for investment and R&D and the elimination of preferential treatment of capital gains will put downward pressure on the prices of real estate and capital goods prices in the affected sectors. Whether, in the long run, this will have the deleterious result of decreasing the rate of investment in the economy depends upon how rapidly and completely these price adjustments in the capital goods sector occur. My own feeling is that any depressive effects on investment will be short-lived and partially offset by adjustments in the financial cost of capital. It is in 1987. however. that manv of these adjustments will be working themselves out and, on this basis, it is likely to be an unimpressive year.

Let me turn now to the second

issue, that of adjustments to changes in the international value of the dollar. The large decline in the value of the dollar that has occured in the last year and a half has not yet been felt generally in reduced imports or increased export demand. In fact, these changes which have been observed historicallyare occuring at a rate that is about four quarters behind the adjustment pace of past experience.

This implies that 1987 will be a year in which these adjustments are likely to begin to be felt. As a consequence, there will be upward pressure on import prices (and domestic products competitive with these imports) and increased demand for U.S. agricultural, forest product and manufactured goods, to the benefit of these sectors and the trade balance generally. Just how healthy a year 1987 proves to be for enterprises in an industry

such as the forest products industry, therefore, depends upon the balance of these affects and those cited above as a result of tax reform. Although net forei'gn demand will be enhanced, it may be insufficient to offset the likely softness in domestic investment demand for new structures. In the long run, however, as the changes in tax law are "capitalized" into lower land values, as interest rates remain low and the (relatively) preferential treatment afforded residential real estate is recognized, any short run depressive effect on housing starts should be blunted.

These comments are the personal observations of the author and do not necessarily reflect the views ofthe Federal Reserve Bank of San Francisco or the Federal Reserve Svstemed.

Tax bill and weaker dollar will govern income, employment and spending. .. increased forest products demand lower land values, interest rates to blunt depressive effect on housing starts.

He YEAR 1986 win be

TI another record year for lumber consumption in the U.S., with western producers supplying nearly

400/o of the lumber used in the country.

For the third year in a row, Americans are expected to use record volumes of lumber.

Some 46.1 billion board feet of lumber is anticipated to be used in the U.S. in 1986, 4.30/o more than in 1985.

Looking ahead to 1987, slower economic growth and the impacts ofpending tax changes on the construction market will likely force lumber consumption slightly lower.

Yet, with an anticipated decline of 3.7%, next year's lumber consumption of 44.3 billion will be the second highest volume used on record.

Strong lumber consumption . . . single family housing will account for 66% of starts. . increasing international markets for U.S. lumber. Canada will supply 33.1olo of lumber used in U.S.

Western shipments are expected to decrease by 3.20/o to 17 .61 billion feet in 1987, supplying 39.70lo of the lumber used next year.

Housing is forecast to slip to 1.75

T THIS time of the year leaders in the building materials industry are looking over the fence at 1987, attempting to assess the economic environment that will prevail. The question is paramount in all levels of our industry whether it be discussions among management personnel, topics of convention and industry seminars or news articles in leading publications.

In looking ahead to 1987, it seems prudent to assess our present environment. 1986 has brought many changes in the building materials industry to the Pacific

Northwest. We've seen a rekindling of a new housing market in the urban areas, a long awaited expansion of the housing resale market, an increase in commercial construction, gains in home remodeling and, certainly, a more confident consumer. We have seen further expansion in the retail home centers arena. 1986 has been earmarked by the entry of the warehouse home center into the urban markets of the Pacific Northwest.

to the long term direction of the depressed Alaskan market. The only certainty in the 1987 economic climate lies in a continued challenge to building materials management to improve their ability to serve the customer, increase their position in the marketplace and maximize their return on investment,

million units in 1987. The single- family housing market should remain strong next year, accounting for 660/o of total conventional starts. The multi-family housing market, beset by high vacancy rates and changing tax laws, will bear the brunt of the decline. For the year, 16.95 billion feet of lumber should be used in residential construction.

A bright spot in both 1986 and '87 will be the international markets for U.S. lumber. This year, lumber exports are expected to increase to 1.7 45 billion feet, up l5o/0. Next year, U.S. exports should increase another 60/o to 1.85 billion feet. The only major international market where demand for U.S. lumber could be soft in the next two years is Australia.

Canada will again ship a record amount of lumber to the U.S. in 1986. Probably l5 billion feet will be shipped to the U.S. this year, despite strikes at Canadian mills this summer and fall. Next year, Canadian shipments to the U.S. should Lotal 14.7 billion feet, supplying 33.10/o of the lumber used.

Yet, even with increased opportunity, increased competition has caused building material manufacturers, retailers, and wholesalers a continued experience of flat or slow growth sales curves. This factor has led many building material leaders to reevaluate marketing strategies, organizational structuring and purchasing philosophy. Clearly, the emphasis is on P&L statement bottom line and return on investment. The need to focus on the primary aspects of the P&L statement, i.e., sales, margins, and.costs of doing business - along with the contributing factors such as merchandising, purchasing, and streamline costsseems to be the name of the game.

We can agree that although insulated for a number of years, the dynamic merchandising applications of the home center retailer have arrived in the Pacific Northwest and in the years ahead will be a factor in our marketplace. While some would label this change as "turmoil", the ability to face the reality of our market and put aside perhaps antiquated philosophies remains the key to a profitable future. This philosophy stands in stark contrast to those who would deny this new age in our industry, ignore the merchandising needs of our retail customers, and simply cry for more protectionism.

1987 stands before us with few "solutions" to our problems. There is uncertainty regarding the final effects of our new tax bill, where interest rates will stabilize, concern over the impact of the warehouse retailer, and uncertainty over regional economies normally spurred on by the agriculture, timber, aluminum, and high tech industries. In addition, there is still question as

Few solutlons to problems in '97 challenge is to improve service, market position . . maintaining focus and identity is paramount to growth.

The 1987 business environment will help to crystallize the most basic question"What are we, and what do we do?" As we face the new year, maintaining focus and identity will be paramount to our growth.

Survivors in other industries have suggested that the ability to compete lies in the attitude and effectiveness of our people. Whether it be manufacturer, wholesaler, or retailer, the question of sales training, product knowledge, concern for customers, and a sense of ownership will play a vital role, for herein lies the combustion of professionalism and excitement that are necessary for our success. Organizational structures that bring out the creative abilities and entrepreneurship of individual employees to better serve the designated markets will achieve the success we all seek. We have two options. Number onewe can fight the challenge of change, or number twowe can recognize the positive evolvement opportunity and go for it. Those who choose growth would not have it any other way, for the gift of 1987 may very well turn out to be the maturity and strength of our industry.

llf trg A few geographical UU exceptions, 1986 wil be regarded as a banner year for most retail lumber and building material

dealers. Reliable indicators at this time point to the likelihood that 1987 will be equally as good. However, in the oil producing and agricultural regions of the country, as well as a few of the heavy industrial areas, the general economy is still down, thus putting a damper on housing and related economic activities. But all together, 1987 holds promise for a brighter future for many dealers in these slow-growth areas as well.

Although we are optimistic about 1987, many complex issues are yet to be reckoned with that could substantially influence the final outcome. For example, the full impact of the new tax bill on our industrv has not been deter-

mined. If we are to enjoy continued growth, interest rates must remain at or below today's levels. Inflation will have to remain at a moderate rate. A major undertaking of the 100th Congress will. be addressing the potential problems of the huge federal deficits with no adverse impact on economic expansion.

All of these external factors will play an important role in our industry's performance in 1987; some of the effects could be negative. However, because dealers have recently undergone tough economic times, many have emerged better equipped to operate their businesses successfully. Lumber dealers throughout the country have had to become superior managers for inventory control, employee relations, and investments in equipment and warehouse space; they have learned new skills that help bring about an improved return on investment.

Building material dealers fortunate enough to have experienced a high level of growth in the last two or three years should not become

complacent with their local market position. There will always be extremely strong forces vying for the consumers' dollars. The major competition may not be the lumber dealer or home center down the street; more than likely it will be the automobile or larger appliance dealers. These competitors for the consumers' disposable income do an excellent job of marketing their products; they frequently are able to convince the home owner, or potential home owner, that a snazzy new automobile or hightech appliance will enhance their life style more than a new home or a newly remodeled kitchen or bathroom. Lumber dealers must learn to deal with these sophisticated marketing thrusts.

lmpact of tax bill on industry undetermined . . . higherlevels of efficiency needed to im' prove margins and profits. lumber dealers must learn to deal with sophisticated marketing thrusts.

If we effectively cope with the various forces that shape our industry, we can compete successfully. If we do this, 1987 should be a sound economic year.

By Gary D. Schlaeger Senior Assistant Vice President, Forest Products Burlineton Northern Railroad

By Gary D. Schlaeger Senior Assistant Vice President, Forest Products Burlineton Northern Railroad

F8ft ,3JT",in::l'"fl;,,P#t and its predecessor companies have enjoyed a good relationship with

the forest products industry in the UnitedStates and Canada.

A significantportion of the railroad's total freight volume comes from the forest products 6@E&G,r3 il Induslry. Factors affecting the forest products products industry are important to BN.

In 1986, housing starts in the United States will be about l.8 million units. Housing starts are

expected to decline about 5% in 1987, to about 1.7 million units. Lumber consumption for total residential usage will probably decline about 2o/o from 1986 levels.

While the residential repair and remodeling segment of the industry

Canadian softwood lumber duty may increase demand from Pacific Northwest mills ...probable transportation price increase. spot shortages of lumber hauling equipment. prices will hold firm or even increase.

has experienced tremendous growth over the past few years, it will probably soften by about 1.50/o in 1987.

The overall building industry will decline slightly next year, also as a result of the non-residential glut. With an average office vacancy rate of about l6olo in large downtown areas, and up to 230/o in suburban areas, this particular segment needs a shot in the arm.

Finally, the new tax bill passed by Congress contains provisions making investments less attractive. The signs all seem to point to overall volume in the forest products industry declining in 1987, but we

The Merchant Magazine

The !,liedenneyer Co. (industrial and export sales) has been formed in Portland. Or.. by Tom Niedermey'er with Henry Clenro and Audre).' Scto on staff ... Wi,qandCorp.. Colorado Springs, Co., is opening a DC for treated products in Denver. utilizing the former Metz Lumber Yanl...

A unified Canadian oflercombining increased stumpage fees and an exp0rt tax in lieu of the preliminary 15%r countervailing duty set by the U.S. is under consideration by the U.S. Department of Commerce.

Dixieline and Wickes Cos are both negotiating for the So. Ca. Handyman stores due to be liquidated by Dec. 3l . . . Dixie/ine seeks to acquire two San Diego stores and one in neighboring La Mesa to add to its 5store chain which will soon become 6 with a company-built store due reports have it that several [{andyman locations will not close because of lease commitments, but will continue to operate. possibly under a differentname...

Home Depot has posted a lot across the street from Dixieline's Sports Arena Blvd. store, in San Diego, Ca., as a future site . . . Grossman's Inc., (formerly part of Evans Products Co.) has completed reorganization and emerged from bankruptcy proceedings. .

Western Lumber Co., San Diego, Ca., is acquiring the Lumber I subsidiary of Cole Induslrles, National City, Ca.. effective Jan. 1; no price has been disclosed for the 4 retail units and I wholesale operation in San Diego County. .

Wickes Cos. is acquiring Collins & Aikman Corp. (textiles and wallcoverings) for $1.6 billion but has backed off from a $1.7 bitlion offer for Lear Siegler because of difficulty in obtaining bank financing due to the Boesky scandal (see page 63) ..

Lumbermens of Palm Springs, Ca., will open a 4 acre yard in Indio, Ca., in July as part of a Lttmbermens Business Centerof 9 acres of complementing businesses ., Count.y Lumber C'o., Santa Barbara, Ca.. is closing Builders Square, which recently had the right to use that name upheld by a jury in a suit brought by Builders Choice. San Antonio, Tx., has opened a second store in the Portland, Or.. area with two more to debut in 1987 . .

T'um-A-Lum Lumber Co., an 80 year old Vancouver, Wa., c0. is relocating its headquarters to Troutdale, Or. . Wickcs Co.s. is renaming 39 recently acquired Ole's stores as Builders Emporiums.

Home( lub has opened a 100,000 sq. ft warehouse store in Kent, Wa., with plans to open a second Wa. store in Lynnwood early next year . Orchard Sup- ply & Hardware is building a store in Watsonville. Ca.

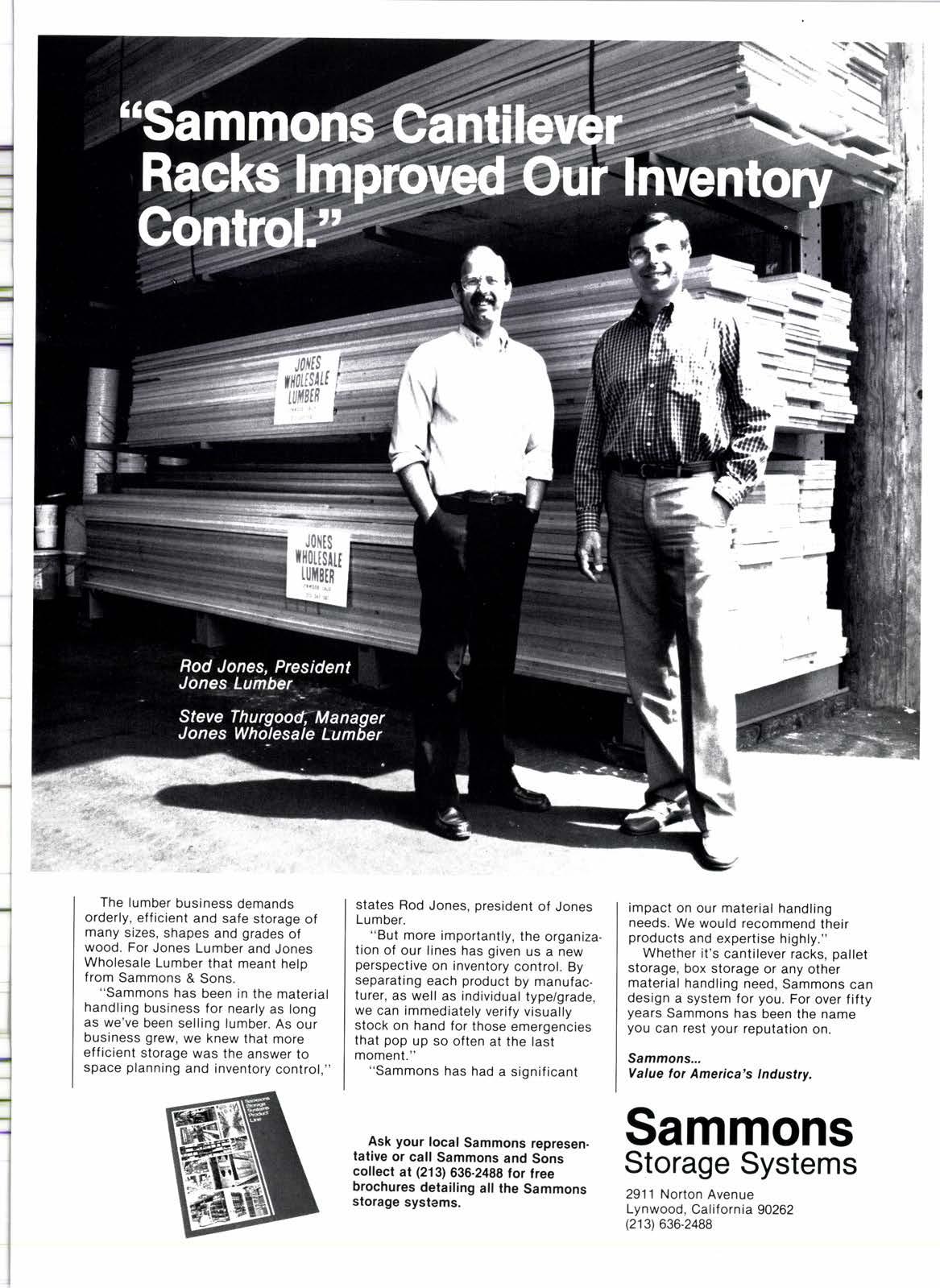

Waldron Forest Products lnc., Sacramento, Ca.. has moved to new offices at 5744 Windmill Way, Suite 6, Carmichael, Ca. 95608 Jones Wholesale Lumber Co. has moved into handsome new 5,000 sq. ft offices at their Lynwood. Ca.. facility

Inland Lumber Co. sold onlv the office equipment but ni, inventory when Martin forest Industries, Healdsburg, C&., acquired its Dublin, Ca., operation; some details of this transaction were incorrectly reported in our Nov. issue . the deal has n0 effeet on other Inland Lumber offices in Ca.. .

Louisiana-Pacific has completed acquisition of 98.000 acres and a sawmill f'rom 7'imber Realizatiort Co. in Ca. for $9,5 million ... Vent-A-Hood o.l Ca. has opened a 7,000 sq. ft. distribution and design center in Hayuard.Ca....

Branson-Cross Luntber Co.. Union City, Ca., has bought land in Lathrop, Ca., with construction of new facilities due in the spring . Blue Lake Forest Pradr/cls is a two mo. old firm being operated by Bruce Taylor at the former MacNamara & Peepe sawmill in Arcata. Ca.

North American Lumber International, Ltd. is a new Portland, Or., co. organized by Cary Rose, formerly with Niedermeyer-Martin .. . California Redwood Moulding Co., Sacramento, Ca., has leased mfg. facilities from River City Moulding.

Anthony Industries, City of Commerce, C?., has acquired Finestone Coatings from Finestone Corp., Detroit, Mi., for its Simplex Products Div. . . . Kohler Co.'s Sterling Faucet Co. plans to buy Owens-Corning's Fiberglasreinforced-plastic components div. for an undisclosed price

Housing srarts in Oct. (latest fies.) dropped to a seasonally adjusted annual rate of 1,648,000 units... single-family starts edged up 0.506 . . multis dropped 1.8%. permits were down 2.90/t . .

lPlease turn t() page 411

We at San Antonio feel strongly that quality has to go into a building from the start. Quality is an integral part of our buildings, not something that is added later.

The quality of a San Antonio building begins {rom the ground .rp . . literally. From the first step of construction until the last, our crews are guided by a quality control program that is part and parcel of everything we do.

One definition of quality is ttconformance to requirements." We like this definition because it means we can completely fill our customers' re. quirements while main. taining the standard of

quality that is the hallmark of all San An. tonio buildings.

Please call us when your needs include a quality building to fill your requirements.

lh0 lilll0 ca||$ tTill| |l|8

is the PR0FESSIOiIAL'S ALt PURP0SE PIASTIC

Boat builders, furniture makers, cabinet makers, etc. have found it the one sure answer to correcting wood defects, filling wood cracks, gouges, covering countersunk nails and screws.

Can be used under Fiber Glass!

Ready to use nght out ol the can, lamowooo . ! applies like putty-sticks like glue; dries iHquickly; won't shrink, a'nd witi not gum up iander. Waterproof -and weatherproof when properly applied. 244

REDWOOD . CEDAR

DOUCLAS FIR . HEM-FIR

PINE COMMONS. PLYWOOD SIDINCS TREATED STOCK

MASONITE BRAND SIDINC

PIYWOOD SHEATHINC

DirectMill .T&T . CarLoads or LCL from our distribution yard 1286 North Broadway Stockton, Ca.95208

(209) 9,{6-02S2

Dub's Ltd. - Dec. 12, goll Richmond Country Club, Richmond, Ca.

San Joaquin Valley Hoo-Hoo Club - Dec. 13, Cal Bowl game & tailgate party, Fresno, Ca.

Kitchen/Bath Industry ShowDec. 14-16, sponsored by National Kitchen & Bath Association, Convention Center, Anaheim, Ca.

Portland Wholesale Lumber AssociationDec. 19. annual Christmas party, Red Lion Motor Inn-Jantzen Beach, Portland, Or.

Coast to Coast HardwareJan. 4-7, spring/summer merchandising show, Cashman Convention & Sports Coinplex, Las Vegas, Nv.

Lumber Merchants Association of Northern CaliforniaJan. 10-11, top management seminar, Asilomar, Ca.

Western Wood Products AssocirtionJan. 12, district meetings: Sheraton Airport, Portland, Or., and Coeur d'Alene Resort, Coeur d'Alene, Id.,; Jan. 13, Riverhouse, Bend, Or., and Valley River Inn, Eugene, Or.; Jan. 14, Host International Hotel/Airport, Sacramento, Ca.; Jan. 15, Red Lion's La Posada, Phoenix, Az.

Mountain States Lumber & Building Material Dealers AssociationJan. L2-16, residential framing lumber estimating and speed estimating seminars, Denver, Co.

Dub's Ltd.Jan. 16, golf, Marin Country Club, Novato' Ca.

National Association of Home BuildersJan. 16-19, annual convention, Dallas Convention Center, Dallas, Tx.

Humboldt Hoo-Hoo ClubJan. 22, annual crab feed, Eureka Inn. Eureka. Ca.

National Wood Window & Door AssociationFeb. 7-11' annual meeting, Inter-Continental Hotel, Maui, Hi.

International Furniture & Woodworking Industry ExhibitionFeb. 7-16, Accra, Ghana.

Dub's Ltd.Feb. 20, golf, Claremont Country Club, Oakland, Ca.

National Association of the Remodeling IndustryFeb. 26-28, annual convention/exposition, Washington, D.C. Convention Center, Washington, D.C.

Forest Industries 19E7 Clinic & Machinery ShowMarch 4-6, Memorial Coliseum, Portland, Or.

International Hardware Trade FairMarch E-10, Cologne, West Germany.

National Home Center ShowMarch E-l1, sponsored by Vance Publishing Corp., McCormick Place, Chicago, Ill.

fohn Diederich - fudy Murphy

Lee Tumer - Gordon Roby * Maff Stanley

Western Wood Products AssociationMarch 17-20, spring meeting, St. Francis Hotel, San Francisco, Ca.

Loss Prevention ConferenceMarch 18-20, sponsored by Home Center Institute, Embassy Suites Hotel, Orlando, Fl.

Woodworking Machinery & Supply ShowMarch 28-30, Toronto, Canada.

San

Diego, Qa.9212E(Since "A Nobody Asked Me. But" column of several years ago attracted so many comments, Bill Fishman is repeating the format with comments anticipating 1987-ed.)

oroo" asked me. but:

Those highly promoted low price guarantees and club membership cards that were so prevalent last year will be discontinued by many of the home centers.

Building material dealers are surprised to find that industrial and commercial buyers react to advertising and promotion directed specifically at them.

'

Independent dealers are getting stronger as the major chains absorb one another. These dealers will find ways to retaliate against their suppliers who sell directly to builders and contractors.

Enthusiasm will sell more products than product knowledge.

If there are lots of printed signs in the store that begin with the words "no" or "don't" you can bet that the sign-making equipment is under the jurisdiction of the store manager not the sales promotion manager.

o The sale and rentals of "How-To" videos will reach its peak within the next twelve months.

The shift has started. There is more available management talent than there are positions available in the home center and building material industry.

Independent retailers still do a poor job of utilizing and administrating cooperative advertising funds.

Invariably, the counterman who produces the largest volume also offers the biggest discounts.

Point of purchase audio/visual equipment will be sabotaged if it is not strategically placed out of ear shot of the selling stations.

Lost sale slips (want cards) will supply a home center with almost all the research needed about fast moving and newly introduced merchandise.

o The theme "Once in a Blue Moon" is the second best promotion in the home center industry. Grand Opening is still the best.

o .A store"r ide sale of'f'ering -i01[, oli' eVer) thing in the storc u'ill bring in l() times nrore traffic than 20'X, off.

.\ honre center that doesn't havc a lriglr cr cning traffic count is in l poor retail Iocation.

Prol'essional speakers are more cntcrtaining, but I learn more from rctililer punclisls.

Iletailers who arc not enclosing stufl'crs u'ith their nronthJl statcnrents urc *asting 22c per custonrer per nronth.

Nlost honre center aclrertrsing now connotcs a scnsc ol urgcncl.

The ar.ailabilin of installllion will be an important and prolitablc scrr icc offered b1 building nrateriul dea lers.

Nc\\ computer technology will makc it cost cffective for building material clcalcrs to offer blueprint take-olf scrviccs.

Intercst rate bu1'-dow'ns rvill spark big ticket packagc salcs next 1ear.

,\t lcast onc hor.r.rc center \\'ill derclo;t lt :;tlcr lrr{rnt{rtion Lilntpaign that docs not l'clture lrroduct prices. Thc ads u ill be dirccted at the most alflucnt nrarket and promote thc loe:rlions. seleetion. priting polio. services and the eclucational and fun aspcct of'shopping their stores. I he .tds lrrrr c conlinuitr and n'ill be gimnticky. east to read. The promotion will be successful.

J'hc t\\,o biggest profit contributrtrs ncxt Vear will come from kitchens ancl winclow treatment products.

R'1 .\ (reacly-to-assenrble) f.urniture will bc thc largcst new volume produccr tor nranl honrc centcr charns.

In spitc ol' incre usecl conrpetition lionr uurchousc opcrators. resourcelul honrc ccnter operators u'ill register thcir best prolit lcar in

SPECIALIZED TREATITIENTS NOW AVAILABLE

. Wolmanized Lumber

o Dricon Fire-Retardant

. Creosote

PROOUCTS AVAILABLE

I Landscape Timbers

r Railroad Ties

r Poles

r Posts

. Dricon Fire Retardant

Treated Wood

. All Weather Wood Foundationso AWPB-FDN Stamped

For infarmation on quick sorvico call the treating exports!

QourHeRN California is fortu- lV nate to have few problems with fraudulent grade stamps because of stringent observance of codes requiring the use of grade stamped lumber.

The industry as a whole is fortunate to have the American Lumber Standards Committee to oversee all grade marking. Their involvement makes the grade stamp a truly significant assurance of quality to the consumer. All retailers should ask for lumber which is grade stamped by an ALSC certified agency.

I have been a member of the ALSC representing retailers since 1965, but the importance of its work was reinforced in my mind during the Nov. 7 meeting in New Orleans, La. Reports were made of fraudulent grade stamps turning up in both the east and the

south. Fortunately, no such problems have been reported in the west.

The Southern Pine Inspection Bureau has had a number ofsuch cases with substantial impact. One grading agency reported over l0 million board feet graded with a fraudulent stamp.

In the discussion of methods of control, it was pointed out that building codes are not always a reliable control since some areas in the south don't have codes. Also, because the fraudulent stamps are deceptively similar to the genuine stamps, it is difficult to recognize lumber which has been fraudulently grade stamped.

An education program to be taken by the agencies to the builders, building officials, retailers and lending institutions was discussed. Southern California initiated a program of this type 30 years ago with success.

In other action, the LASC voted for an increase in fees from 1.50 per thousand bf to 1.750 per thousand bf. This

698O Cheny Avenue. Long Beoch. (olifornio 90805 l2r?l 602-2405

H Must For. Hotels, Hospitols, Schools, Government Institutions. Areos of Public Flssembly, Restouronts, Theoters, Night (lubs, Stores. Hozordous Industriol Flraos in Mines. Foctories & tUorehouses.

Fia-fach tljT-l 09 - R Closs A Product

Intumescent Loter Point (CBO #3656, Stote Fire Morsholl #C-100, LF (itp Fpprovol #24303)

Fie-Tach LlrT-l 0l - R Closs B Product

Intumes<ent Oil Bose Point (ICBO #3656,stoto Fire Morsholl #C-100-1, LA (itg Approvol #94303)

Usc on F amlng Lumber, Plywood and Tlmberr. Class I Intcrlot Flre Retardant Also Av.llable. Flve Day Turn Around,

cost will be paid by the grading agency to cover the services of the ALSC certification and inspectors in the field.

Don Lee Davidson was elected president of ALSC. Other new officers are Jack Rajala, vice president; W. F. Hammond, treasurer, and T. D. Searles, executive vice president.

The LASC annual meeting which was taking place in Palm Springs at presstime will be covered in depth in the Januarv issue.

"Just keep your eyes shut! "

The Merchant Magazlne

ASED UPON a random survey of members, I can provide the following comments on "business in Arizona1986 style."

In general, the Arizona market continues to be strong, based mainly upon

Currentlv utilized to:

r Precision End Trim I Double End Trim o Pencil Trim

Convert Discounted Lengths into Prime Movers

r Crosscut - Efficiently, lnexpensively and Precisely

o Manufacture: Pallet Stock, Fencing, Trusses, Ties.

Bedframes, Shelving and Stickers

Equipment operating, or scheduled for operation, in:

United States: Minnesota, Michigan, Maryland, New York, New Jersey, Ohio, Illinois, Missouri, Kentucky, Virginia, North Carolina, South Carolina, Arkansas, Georgia, Florida. Alabama. California.

population growth. Current data places the state's population at 3.3 million people, an increase of almost one million since the mid seventies. Arizona is definitely in "sun-belt country" and Phoenix and Tucson are most certainly "sun-belt cities." Maricopa (Phoenix) County continues to reap the greatest percentage of growth with roughly 570/o of the state's population followed by

g5o/o

Pima (Tucson) County, a distant second, at 200/0. Much more modest growth is also occurring in areas around Flagstaff, Verde Valley, Prescott and Yuma.

The net result to the state's lumber business has been two-fold. First, a lot more lumber is being consumed and, second, a lot more competition has arrived on the scene. The latter factor more than any other has had the most profound influence on the business climate this past year. Most wholesalers who responded to my survey reported that the volume of lumber sales was either up over the previous year or not significantly different. Most agreed, however, competition is so tight that profit margins are continually squeezed to the point that they unjokingly accuse the competition of "giving it away."

v{i,

Many companies also admitted that they have had to redefine their "bottom line" of profitability many times throughout the year. In summary, in the wholesaler's portion of the industry, it seems that there is enough business for everyone to maintain some "acceptable" degree of market share, but they wish that the days of cheaP lumber would be numbered. However, some companies report that their market shares have been actually increased over the past year, as well as their margins, by aggressively redehning that portion of the market they considered their best.

Lumber retailers were equally in agreement as to the factors of tight competition and reduction of profit margins throughout the year. Sales volumes in many building materials centers, while not reflecting an appreciable growth, did experience shifts in sales percentages of more lumber to other merchandise. The practice of drop shipping of lumber plagued many retailers around the state.

For a detailed information pack, contact: Sam Rashid The Merchant Magazine

Profit margins on so-called "trinket sales" continue to be severely depressed as a result of the presence of mass merchandisers in the metropolitan areas. All in all, retailers generally expressed relief at getting through the year as well as they did. The difference between them seemed to be the level of aggressiveness that they choose to employ in getting more customers into their stores.

Notwithstanding, a common problem with everyone was the identification and determination of credit worthiness of customers. This is a problem that continues to plague everyone in the business. In the words of one typical survey respondent, "it's damned hard to make a good sale and you hope and pray you get paid for it on

Betsy Bendix

Lynn Bethurum

Mary Lou Briseno

John Brown

Miles Butterfield

Maureen Delaney

Tony Fredrickson

Scott Green

Scotty Halliday

Jim Hand

Richard Harvey

Jim Hynick

Mike Johnson

Curt Karstrom

Joe Kayda

Mike LaDuke

Jim Lawson

Robert Malone

Jeff Manning

Paul Miller

Lee Marlatt

Janet Parrella

Mike Parrella

Peter Panella

Frank Pharr

Bill Pritchard

Bob Pritchard

Francis Rich

David Sclimenti

Melinda Taylor

Gilbert Tonez

Frank Via

Pam Winters

WallyWolf

I N rHe ERA of the buying group I and the co-op your friendly lumber/ hardware/building material trade associations have done some heavY dutY soul searching and self examination. There is enormous pressure on these groups to identify the types ofproducts and services they can provide their membership that the for-profit organizations mentioned above don't, won't or can't offer as efficiently. We must either do enough things better to remain viable, or resign ourselves to declining membership and eventual extinction. There is another group that is wrestling with that same problem and retailers canand probablY should - help them find their niche.

Does anyone remember the bad old

days of gypsum board and hardboard allocations? Those were some fun times - trying to meet the needs of your loyal customers, covering bids, wondering if you should even try for the next job that included quantities of those commodities. Similar happenings crop up now and again with insulation, redwood, cedar, and other products you rely on to stay in business. What do you think of first when you remember those times? I hope it's a who and not a what, because in many cases it was an individual or an organizationnot a thingthat got you over the hump.

The independent wholesaler, that broker, reloader, free spirit, good old buddy ofyours, is feeling the pinch and you might be able to return some of the favors he did trying to keep his loyal customers supplied during the bad old days mentioned above. He's also the source of those mixed trucks and

decent tallies you appreciate getting once in a while. One of these days you may have to decide whether or not he is going to stay in business; and the determination is going to be based on whether or not the services mentioned above are important to you.

We'll be the last ones to suggest you turn your back on co-ops and buying groups; that may be one ofthe quickest roads to early retirement available today. But you may want to give some consideration in the process of buying right to shoring up a segment of the industry that has provided valuable cohesion and support in the past. You hope that something extra you provideservice and consistency - brings your customer through the door in spite of the competition. Your suppliers need a more than occasional dose of the same.

Check our Calendar on page 20 tor information on upcoming conventions, meetings and trade shows in your region.

fi ffneflNG data was collecred

V from I 85 dealers and chain outlet managers in a recent Northwestern Lumbermen's Association survey. Hardly enough replies for statistical validity, but certainly indicative of the opinions and thoughts of your functioning kindreds. Here's a bit about them and what they forecast for 1987.

Annual sales volume of 119 of the dealers was less than a million dollars annually. An additional 41 operators did more than this, but less than three million. The other 25 reported from three to over 50 million.

Financial planning received no comment from eight companies. Seventy four reportedly did financial planning each year, but 104 made no financial plan. For 1987 single yards anticipating increases averaged them at 8.10%.

Chain or branch store managers expected 5%o increases on an average. Single operators expecting losses averaged them at 11.680/o and the multi-units at 12.450/0.

Respondents were asked to evaluate growth potential for the next three years from a low of 0 to a high of 7. Store size expansion, yard remodeling and additional locations were heavily weighted toward the lowest potential in terms of contributing to future growth. Increased advertising, additional services, changing market focus, increased market focus and changing market were expected to contribute to growth. Fifty thought new and additional services were important to growth. Changing market focus got a combined 5l votes. There were 47 supporters of increased market focus and 45 believe changing market would contribute to potential growth during the balance of the 1980s.

A second area of the survey asked each respondent to list the first and sec-

ond most important obstacles to development of an acceptable ROI in their company. Competition and economy led the list of obstacles with general generated expense and collection problems next. Lack of capital and unprofitable lines were virtually tied for third place.

A third area asked for the origin of greatest competition during the next three years. The three options were mass merchandisers, marketing by existing competition and new competitors. Mass merchandisers and marketing by existing competitors were leaders. New competition trailed at the bottom.

This information serves as a look into what others in the business, who may well have problems and opportunities exactly like yours, are thinking. For years the idea has been that the basic difference between the successful retailers and also-rans is in three areas: the ability to control expense, to implement cost effective change and to sustain offering of growth opportunity. Being reminded of these may help as you wrestle with the future.

If you would like our free Thrival (contraction ofthrive and survival) list of the top 20 areas doing the most profit damage during 1986, send us a stamped, self-addressed envelope.

If you have ever asked yourself - Am I Cornpetitive? or Am I absolutely sure I buy my Building Materials and Hardwore right? Then you need C.B.S.-Central Builders Suiplies Company.

C.B.S. can take the guesswork out of buying. Since 1937, C.B.S. has been helping indepen- dent building material dealers remain competitive with mammoth corpor;tio; chiins. Because C.B.S. is a dealer owned non-profit corporation, all discounts, rebates, datings and advertising funds are all passed directly to the participating members.

*C.B.S. has been nationally recognized as ,,The Place To Go To Buy Low"*

* As you buy more the cost to belong goes down-not up

* C.B.S. has an in-house Lumber Department

* C.B.S. has a General Building Materials Dept.

* C.B.S. has a program with the Blue Grass Tool Company

Central Builders Supplies Company

215 Broadus Street Sturgis, Michigan 49091

Phone: (616) 65 I - 1455

*C.B.S. was featured in the October 1984 edition of

* C.B.S. is dealer owned

* C.B.S. has a state-of-the-art internal communication system with participating members

* C.B.S. Rebates are paid to the members in cash

* C.B.S. has an in-house Building Specialties Dept.

* C.B.S. operates as a non-profit company

* C.B.S. members share in the cost to oDerate

Heodquarlers./0r rhe

Allied Building Centers

The continuation of reasonable (compared to other recent times) mortgage lnterest rates, minimal escalations in the cost of building materials, the fairly neutral impact of the federal tax law on single family housing, and a continua-

tion of very little negative media input into the thought processes of prospective new home builders and buyers should at least give us an opportunity for another decent vear.

Building material distributors in general are beginning to understand

and cope with the changes that have taken place in their marketplace. New entrants offer opportunities as well as threats. Distributors are finding that they are more and more

Building material distributors can expect another decent year. . . biggest challenge to remain strong and profitable. education a major concern and a priority.

included as an integral part of the national marketing of certain product lines and are serving customers

that were recently perceived to be threats. As time goes on, they will even figure out how to make money on lower margins apparently available in this type of business.

Our biggest challenge is not going to be how to remain an important player in the marketing of building materials, but rather how to remain strong and profitable as an important player.

The National Building Materials Distributors Association, in the development of its strategic plan, emphasized for its membership that education is the kev word. The education of supplieis, customers and our own personnel is a major concern and will be a top priority of our association in the years to come. Our members must become more positively aware of their value in the marketing channel and be able to bring their suppliers and customers to this same awareness.

At the same time, we must educate ourselves in the area of productivity of people and assets. This is our key to the financial strength that we must maintain if we are to continue to reliably serve our markets, to invest in new product lines and new customers in the years to come.

We look forward to 1987 as a year of continuing transition and a settling in the marketplace.

Rosa, Dave Snodgrass, steve Hagen,

Tom Knippen, Dave ponts,

John Souza, Steve Shudoma

.

AnfEn having increased

Fl almost 6000/o from 1975 to 1985 and becoming the fastest growing portion of the lumber industry, sales of pressure treated wood are expected to hold in 1986 at the record breaking level of 1985.

In 1985, totals kept by American

Wood Preservers Bureau (which are estimated to represent 650/o-700/o of total industry sales) showed lumber sales of almost 2.8 billion board feet. This was 0.6 billion (or 270/o) more than in 1984 and 0.2 billion (or nearly 80/o) more than was forecast for 1985. Performance like that

needs to catch its breath eventually, and it looks as if that's what's haPoenins this vear. '

Th6re ar6 a lot of pressures for continued growth, and it's reasonable to expect pressure treated wood sales to resume growing, beginning in the second quarter of 1987, but at a more modest pace. The AWPB total should approach 3.0 billion board feet.

Through September of 1986, AWPB figures for plywood sales show an increase of almost I l0lo over the same period in 1985. Assuming no radical difference in the respective fourth quarters, plywood sales should reach 60 million board feet by year-end. Plywood can be expected to continue as a healthy growth seg-

Treated wood sales catch breath after record breaking growth... 1987 sales expected to continue at slower pace. Western market bet' ter than national as a whole.

ment in 1987, perhaps reaching 63 million board feet, because of increasing usage in new residential construction, remodeling and for industrial uses. Sales of foundation lumber and plywood are both down in 1986 as the industry has softened its emphasis on the Permanent Wood Foundation. For this relatively small segment, we might expect 1987 sales reported bY AWPB to be on the order of 13.3 million board feet of lumber and 17.2 million square feet of plywood.

The slowdown in growth of pressure treated wood is a reflection of uncertainties in the economy as a whole. The slowdown should be onlY temporary, however, since the same factors that have been encouraging srowth are still at work.

- Builders continue as an important element. Consumers are increasingly aware of what pressure treated wood can do for them. Treaters and industry groups like Western Wood Pro-

ducts Association, American Plywood Association and Western Wood Preservers Institute continue to work with lumber dealers, educating salespeople and resassuring consumers on EPA safety issues. Retailers continue to promote pressure treated wood and are selling it better in a yearlong market.

The outlook for pressure treated wood sales nationwide is promising overall. For the Western U.S. the outlook is a little brighter as all market forces continue to take advantage of opportunities in both residential and nonresidential markets.

Sales growth of goods will lag during 1987 as consumers pause from their torrid spending pace begun in 1983 with retailers mirroring these unimpressive results, says James Newton, president of Economic Perspectives, Inc.

For example, lumber yards should post an inflation-adjusted sales jump of about 180/o in 1986 with 1987 anticipated sales improvement plunging to about 2o/0. Home supply stores will also slow from the 1986 pace with real sales growth of about 3ol0.

Newton bases these predictions upon the assumption that the U.S. economy will continue along its slow growth path through the end of 1987. He forecasts a short and shallow recession by 1988.

O'Malley Lumber Co., Phoenix, Az., is establishing a private label credit program from Bencharge Credit Service for customers at its 18 stores in Arizona and Texas.

"The program provides us with our own in-store charge card and also administers all our billing and collection procedures. Our customers receive a higher credit line than most bank cards, and we have the convenience of dealing with a local office, " said Jim Sullivan, O'Malley's director of credit.