International Allies

Bogotá, June 2023

CONTENT

International Allies

Bogotá, June 2023

CONTENT

In this issue, I must say goodbye to the network of allies and friends of the Bogotá Chamber of Commerce (BCC) who have been receiving this newsletter periodically for nearly two years and have been interested in knowing and finding out about the progress of our business sector and the country´s economy. This month I finished my work as president of the Bogotá Chamber of Commerce after three and a half years, and I can’t but write and share a few lines about the activities we have promoted to create opportunities for Colombian businesspeople abroad during these years.

The Bogotá Chamber of Commerce is an organization that today has international recognition and influence and that has been able to implement, in recent years, despite the confinement brought by the pandemic, an agenda in favor of entrepreneurs and their internationalization needs while also promoting our country as an ideal destination for foreign investment, expressing the potential of our business community in all scenarios and, strengthening ties with the world.

During these last three years from the BCC, we have accompanied nearly 4,800 companies with international business agendas, we have received, organized, and managed business delegations in Colombia and abroad, and thus we have facilitated export and internationalization opportunities for many of them. Between 2020 and 2022, more than ten business delegations from the United Arab Emirates (UAE), Paraguay, India, the United States, Spain, Chile, and European international organizations were hosted

In-person and virtual business agendas have been developed to support companies’ internationalization process. In this same period, 18 memorandums of understanding were signed with chambers of commerce, federations, and international organization, from markets such as Chile, Paraguay, Israel, Vietnam, Budapest (Hungary), Bolivia, Panama, Quito (Ecuador), Spain and Turin (Italy), fostering consistent knowledge and economic data exchange and support and encouragement of business initiatives to improve market access and increase trade and investment opportunities between countries. We currently have 72 work plans with embassies, chambers of commerce, and international organizations to strengthen relations with our international allies

Among many initiatives we created, the Cooperation Management program has been critical. Through it, we structured an intervention route that supports businessmen and women to access financial and technical resources for national and international cooperation. With it, we attended, in over two years, more than 664 companies.

Also, 14 economic diplomacy missions have been carried out in the past three years to various countries, including South Korea, the United States, Mexico, the United Arab Emirates, Spain, Israel, Belgium, France, Switzerland, and

Indonesia. Thanks to our active international engagement, in July 2022, and after working for almost six months, I had the honor of being elected Chair of the World Chambers Federation, a body of the International Chamber of Commerce that represents 1,300 chambers. of commerce in more than 100 countries of the world. This dignity, which for the first time was occupied by a representative from the Americas, reflects the international leadership of the BCC in the chamber community, but, above all, it is an opportunity for Colombia to take advantage of a global scenario to put at the service of its businesses.

During the first months of our tenure at the Federation, a strategic plan was developed to support Chambers and MSMEs worldwide to promote sustainable economic and social development through four (4) transversal axes: (i) women´s empowerment, (ii) sustainability and climate action, (iii) digitization, (iv) access to international markets. These initiatives are led today by cameral leaders from five continents.

As I enter this new chapter of my professional life and send one last message through this newsletter, which has now gone on for 21 editions, I want to reaffirm my conviction of the potential that global trade has and the importance of economic activity and multilateralism in building societies that grow faster, more sustainably and inclusively. Only by working in coordination and collaborating to develop our talents will we be able to solve the biggest challenges we face today and take advantage of a world of opportunities to progress.

Nicolás Uribe Rueda Executive President, Bogotá Chamber of Commerce

Nicolás Uribe Rueda Executive President, Bogotá Chamber of Commerce

• Queen Letizia of Spain returned to Colombia after 14 years to strengthen cooperation between the two countries. Her visit focused on projects related to vocational training for young people, generating economic opportunities for vulnerable communities, and increasing access to water and sanitation. Accompanied by the First Lady of Colombia, Verónica Alcocer García, Queen Letizia visited the expansion of the El Bosque Water Treatment Plant in Cartagena, where access to drinking water has been improved for more than 165,000 people. Colombia is a priority country for Spanish Cooperation, focusing on gender equality and support for the peace process. Both countries collaborate in achieving the Sustainable Development Goals of the 2030 Agenda For further information, click on the following link

• Colombia is selected by FIFA to host the U-20 Women's World Cup. In a letter addressed to FIFA President Gianni Infantino, President Petro expressed his gratitude, highlighting that sports, youth and women are fundamental pillars of Colombian society. The event will be held from September 5 to 22, 2024. Colombia has hosted highlevel sporting events in the past and the country is excited to host the Women's World Cup. The cities that will host the 16 participating teams will be announced soon. For further information, click on the following link

• Three-day diplomatic visit to Germany, where President Petro sought an agreement for the production and export of green hydrogen in Colombia. During his visit, a Declaration of Intent for the Climate and Just Energy Transition Partnership between Colombia and Germany was signed. The objective is to offset Colombia's coal exports by financing the production and export of clean fuels, such as green hydrogen. The partnership will focus on strengthening initiatives and projects related to energy transition, climate and environmental protection, biodiversity, and sustainable economic development. Germany expressed its support for Colombia's energy transformation and stressed the importance of social justice in the transition to clean energy. For further information, click on the following link.

• Colombia has assumed the leadership position as Pro Tempore President of the Mesoamerica Project, an integration mechanism involving 10 countries in the Americas and the Caribbean. During its six-month term, Colombia will focus on promoting the creation of monitoring indicators, strengthening cooperation among southern countries and leading various activities, such as the establishment of the Environmental Education Observatory and the advancement of the electrical interconnection between Colombia and Panama. The objective of the Mesoamerica Project is to improve the quality of life in the region through social and economic development projects, and it is important for Colombia to strengthen ties with the countries of Central America and Mexico. Key integration issues include transportation, energy, telecommunications, health, environment, and food security, among others. For further information, click on the following link

• Bogota, Colombia, hosted the Colombia-Japan Startup Forum, organized by B Venture Capital in collaboration with Invest in Bogota, AWS and Skylight. The main objective of this event was to foster collaboration and exchange between the startup communities of both countries. The forum provided a space for learning and networking among entrepreneurs, investors, and professionals from the entrepreneurial ecosystem. The event established a bridge between the startup ecosystems of Colombia and Japan, promoting the exchange of best practices and exploring investment and business opportunities. Leading entrepreneurs from Colombia and Japan shared their experiences and knowledge, providing unique perspectives on entrepreneurship in both countries. For further information, click on the following link

• Made in Bogota Pride', a fair of LGBTI entrepreneurship that seeks to support and make visible entrepreneurs of the community. The event, organized by the Secretariat of Economic Development, offers commercial and cultural activities, as well as business forums, art galleries and a Pride march. With the participation of 96 local producers, the fair promotes diversity, social inclusion, and pride in the city. In addition, it seeks to establish labor and commercial connections for LGBTI people, especially for trans talent, and to position Bogotá as a tourist destination that celebrates diversity and supports the local economy. For further information, click on the following link.

• The successful participation of the President of the Bogota Chamber of Commerce in the 13th World Chambers Congress in Geneva (13WCC) concludes. Nicolás Uribe, on behalf of the CCB, and in his capacity as President of the World Chambers Federation, strengthened bilateral and institutional business relations with key organizations in Europe. During the congress, he chaired the Federation's Executive Committee and presented strategic advances for the promotion of chambers and MSMEs worldwide. He also held meetings with important entities such as the World Trade Organization and Eurochambres, consolidating alliances for the benefit of the business sector. For the main conclusions of the 13WCC, please consult the following link

• The CCB was awarded in the #LatamDigital awards in the category of best data analysis project for the campaign #SoyEmpresaria #SoyEmpresario. The event is recognized as the most important in the digital industry in Latin America and the Caribbean. The CCB was also nominated in two other categories: best digital transformation project with the Conexión project and best use of data for Digital Government for the BazzarBog strategy. The event was attended by more than 2,400 professionals and rewards the best digital marketing and communications initiatives. To learn more about the award-winning campaign, please see the following link.

In the first quarter of 2023, Colombia's GDP grew 3.0% with respect to the same period of the previous year, this means a growth of 5.2 percentage points below the first quarter of 2022 in which the country grew 8.2%, however, it was a growth 0.9 percentage points higher than the fourth quarter of 2022.

It is observed how the growth rate of the national total slowed down with respect to the first half of 2022. The economic activities with the highest share in gross value added in the first quarter of 2023 were wholesale and retail trade, public administration and defense, and manufacturing industries, with a share of 20.64%, 14.5%, and 12.56%.

As for Bogota, a deceleration in GDP growth is also observed, annual growth in the first quarter of 2021 was 3.4%, lower compared to the 11.1% recorded in the same period of the previous year. Despite the deceleration, Bogota shows a slightly better performance than the national average and a change of trend in growth with respect to the last half of 2022 where the economy presented an annual variation of 2.1%, suggesting some resilience in the capital's economy.

Figure 1. Annual GDP growth rate, by quarter, between 2019 and 2023 Colombia and Bogota

Source: DANE-SDDE

Figure 1. Annual GDP growth rate, by quarter, between 2019 and 2023 Colombia and Bogota

Source: DANE-SDDE

In May 2023, price variation data in Colombia and Bogota show some notable trends. First, the monthly variation in prices has decreased compared to April. In Colombia, the monthly variation has fallen to 0.43%, while in Bogota it has been even lower, reaching 0.34%. This decrease in the monthly variation indicates lower inflationary pressure and greater price control in both places.

In Bogota, the monthly price variation in May 2023 was 0.34%, which represents a significant reduction compared to the 0.82% recorded in the same month of the previous year. On the other hand, the annual price variation in the city increased from 8.33% in May 2022 to 12.29% in May 2023.

The data also show that the year-over-year variation in Colombia and Bogota in May 2023 decreased, compared to the same month of the previous year. In Colombia, the year-over-year price variation decreased from 6.55% in May 2022 to 5.83% in May 2023, while in Bogota it also decreased from 6.22% in May 2022 to 6.16% in May 2023.

The number of active companies in the jurisdiction of the Bogota Chamber of Commerce increased compared to previous years. In May 2023, a total of 400,506 active companies were registered, representing an increase of 1.72% compared to the previous year. In addition, it is highlighted that there has been a continuous increase since 2021, with a cumulative variation of 8.64% in the last two years.

In participation of companies by size in May 2023, micro-enterprises represent the majority of active companies in the jurisdiction of the Bogota Chamber of Commerce, with an impressive 91.5% share. There is a slight increase of 0.26pp compared to 2022, and they continue to be the largest and most significant group in terms of business presence in the region.

Employment has shown an improvement with respect to the previous year; at the national level, the unemployment rate in April 2023 was 10.7%, 0.44pp lower than in April 2022; likewise, the employment rate has increased 1.21pp in the last year, reaching 57.7% in April 2023. The overall participation rate increased by 1.04pp, from 63.6% in April 2022 to 64.6% in April 2023. This is a good indicator of the improvement of the labor market, even though more people are participating in the labor market, unemployment in April 2023 remains at lower levels than in the previous year.

In the case of Bogota, the unemployment rate was 10.7% for the mobile quarter Feb23-Apr23, equal to the national unemployment rate for the same period; for the same quarter, the capital shows an employment rate of 60.9%, 3.6pp above the national employment rate for the same quarter. The data show that even though more people of working age are participating in the labor market in the capital (68.2%) than in the country (64.2%), the unemployment rate is not higher.

The number of employed persons grew by 785 thousand people from April 2022 to April 2023, while the number of non-employed persons decreased by 1.0%, which means 29 thousand less people in a condition of nonemployment. The outlook for the number of employed persons is multiple, since economic growth in 2023 is expected to be lower than in 2022.

As for labor market figures differentiated by sex, in April 2023 the gap in the unemployment rate between men and women was 5.6pp, 0.26pp more than in the same month of 2022, so it is a point that deserves attention, it may be that the reactivation of the economy may lag women in the labor market of not paying attention to female jobs. However, while female unemployment remains very high, with an unemployment rate of 13.9%, female unemployment fell 0.3pp from April 2022 to April 2023.

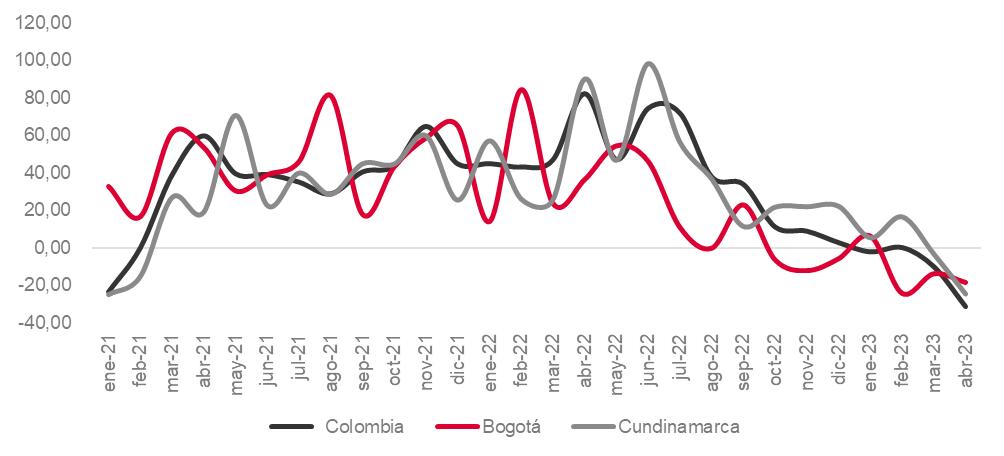

In April 2023, Colombia's exports experienced a sharp decrease of 31.53% compared to the same month of the previous year. This drop represents a negative trend in the country's export performance. For its part, Bogota experienced a significant increase of 36.37% in its exports compared to the same month of the previous year, while Cundinamarca recorded a remarkable growth of 90.16% in its annual exports. These variations highlight the volatility of the export sector in the region, which may be influenced by factors such as competitiveness, external demand, and international economic conditions.

It is important to mention that, in March 2023, both Bogota (-13.96%) and Cundinamarca (-3.42%) had already experienced decreases in their exports compared to the same month of the previous year. This negative trend intensified in April 2023, accentuating the challenges faced by both regions in foreign trade.

Figure 2. Annual variation of Colombian exports in Bogota and Cundinamarca 2021-2023

Source: DANE, Comercio internacional.

Figure 2. Annual variation of Colombian exports in Bogota and Cundinamarca 2021-2023

Source: DANE, Comercio internacional.

In the period between April 2021 and April 2023, significant changes have been observed in exports from Colombia, Bogota, and Cundinamarca. In April 2022, Colombia experienced a remarkable growth in its exports, reaching a value of US$5,460.53 million FOB, which represents an increase of 83.46% compared to the same month of the previous year. In turn, Bogota recorded exports of $361.93 million dollars FOB, showing an increase of 36.37%, while Cundinamarca exhibited a growth of 90.16% with exports of $259 million dollars FOB.

However, in April 2023, there was a slowdown in export performance. Colombia experienced a drop, with exports reaching US$3,738.57 million FOB. Bogota also suffered a decrease, reaching $294.52 million FOB dollars in exports, and Cundinamarca showed a reduction with exports of $194.81 million FOB dollars.

Total exports from the Bogota-Cundinamarca region for the month of April 2023 amounted to $489.32 million FOB. These data represent the general total of exports and serve as a reference to analyze the participation of each country in this total. First, the United States stands out as the main destination for exports from BogotáCundinamarca, with a value of $160.63 million dollars FOB and a 32.83% share of the overall total. This indicates the region's strong dependence on the U.S. market.

In second place, Ecuador is positioned as another relevant country in terms of exports, with a value of US$54.20 million FOB and a share of 11.08%. Although its share is lower than that of the United States, it still represents a significant portion of the region's exports. In third place is Brazil with $36.85 million dollars FOB in exports, equivalent to a 7.53% share. Mexico follows with US$22.27 million FOB and a share of 4.55%. Both countries prove to be relevant destinations for products exported from Bogotá-Cundinamarca.

Other countries worth mentioning include Peru, with US$22.19 million FOB and a share of 4.53%, Chile with US$13.72 million FOB and a share of 2.80%, China with US$11.37 million FOB and a share of 2.32%, Panama with US$10.80 million FOB and a share of 2.21%, the Netherlands with US$10.61 million FOB and a share of 2.17%, and Japan with US$9.81 million FOB and a share of 2.01%.

In summary, exports from Colombia, Bogota, and Cundinamarca have shown significant variations during the period analyzed, the destinations of their exports are varied but always led by the United States. Although there were moments of outstanding growth, such as in April 2022, in general, there is a downward trend in exports, especially in April 2023. This context reflects the challenges faced by these regions in international trade, requiring strategies and policies that promote the recovery and strengthening of their export sectors.

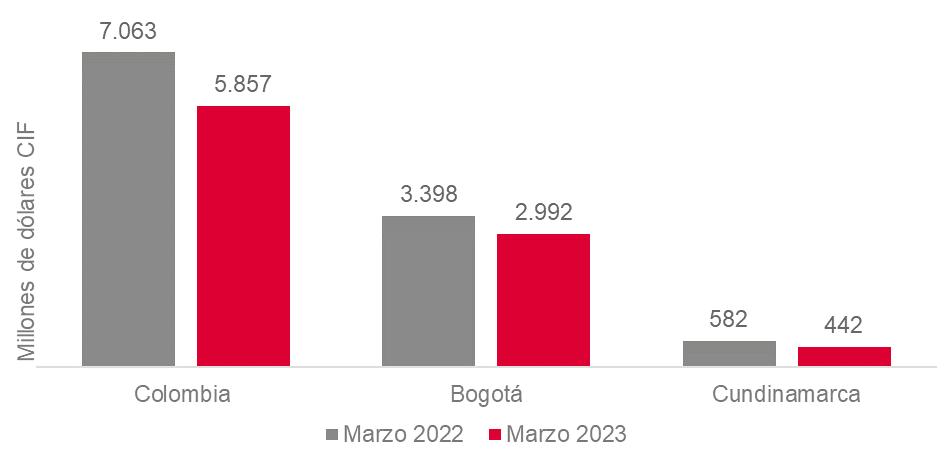

In March 2023, Colombia's total imports reached $5,857 million CIF dollars. As for Bogota's imports, a value of $2,992 million CIF dollars was recorded in March 2023, which represents a decrease of 12% compared to the same month of the previous year, even so, Bogota continues to be one of the main cities receiving imports in Colombia.

For its part, Cundinamarca recorded imports worth $442 million CIF dollars in March 2023, showing a significant decrease of 24% compared to March 2022. This drop can be attributed to various economic and commercial factors.

As for the Bogota-Cundinamarca region, which includes Bogota and Cundinamarca as a whole, imports reached $3,434 million CIF in March 2023. This represents a decrease of 14% compared to the same month of the previous

year. Bogota maintained its prominent position as one of the main recipients of imports in Colombia, with a 51.1% share of the national total, while Cundinamarca had a 7.6% share of Colombia's total imports.

The United States was the main country of origin of imports, with a value of US$970.63 million CIF and a share of 28.26% of the overall total. China was in second place, with imports valued at $648.91 million CIF, representing 18.89% of the total share. Brazil and Mexico also stood out as significant countries of origin, with imports of $227.62 million CIF and $209.45 million CIF, respectively.

Other important countries in terms of imports for the Bogota-Cundinamarca region include Germany with $187.46 million CIF, Argentina with $114.77 million CIF, and Spain with $106.55 million CIF.

In summary, in March 2023, the Bogota-Cundinamarca region's imports were led by the United States and China as the main countries of origin. These countries accounted for a significant proportion of the region's total imports, highlighting the importance of trade relations with these partners. It is important to diversify imports from other countries and continue strengthening trade ties with these and other markets.

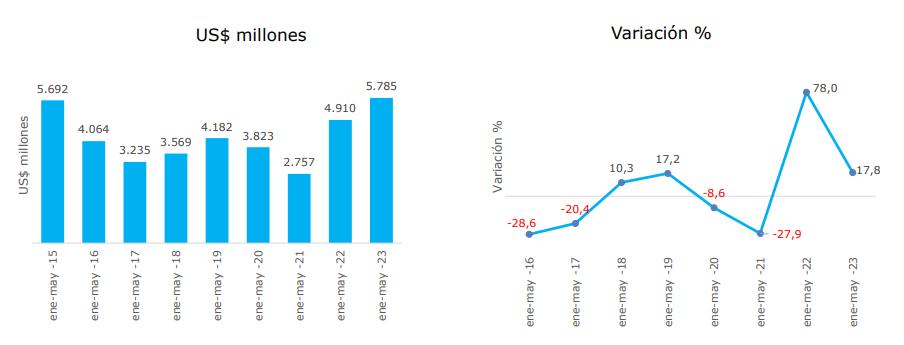

According to the Colombian Ministry of Commerce, Industry, and Tourism, Foreign Direct Investment (FDI) stood at US $ 4,801 million in the accumulated total for the year to May 2023. This represents an increase of 19.6% over the same period (January-May) of the previous year.

On the other hand, investment in the oil and mining sector stood at US $3,935 million in the January-May 2023 period, an increase of 50.3% compared to the same period in 2022. As for sectors other than oil and mining, FDI amounted to US$866 million in the accumulated to May, presenting a reduction of 37.9% compared to the same period of 2022. In total, FDI in the mining and energy sector represented 82% of the investment received so far this year.

Figure 3. Imports from Colombia, Bogotá, and Cundinamarca (March 2022 - 2023) Source: DANE, Importaciones

• For more information, please refer to the Observatory of the Bogotá Chamber of Commerce. https://www.ccb.org.co/observatorio

• DANE. Cuentas Nacionales. Retrieved from: https://www.dane.gov.co/index.php/estadisticas-portema/cuentas-nacionales/cuentas-nacionales-trimestrales

• DANE. Mercado Laboral. Retrieved from: https://www.dane.gov.co/index.php/estadisticas-por-tema/mercadolaboral/empleo-y-desempleo

• Registro Mercantil, CCB, 2019 - 2020 – 2021 - 2022 Retrieved from: https://www.ccb.org.co/Inscripciones-yrenovaciones/Matricula-Mercantil/Boletines-del-Registro-Mercantil/Boletines-ano-2021

• DANE. Encuesta Pulso Social. Retrieved from: https://www.dane.gov.co/index.php/estadisticas-portema/encuesta-pulso-social

• DANE, Exportaciones. Febrero abril Retrieved from: https://www.dane.gov.co/index.php/estadisticas-portema/comercio-internacional/exportaciones

• DANE, Comercio internacional importaciones abril 2023 Retrieved from: https://www.dane.gov.co/index.php/estadisticas-por-tema/comercio-internacional/importaciones

• Ministerio de Comercio, Industria y Turismo. Informes de Inversión Extranjera Directa. Retrieved from: https://www.mincit.gov.co/estudios-economicos/estadisticas-e-informes/informes-de-inversion-extranjera

Figure 4. Foreign Direct Investment. January-April (2015-2023)

Source: Banco de la República-Balanza cambiaria en Ministerio de Comercio, Industria y Turismo Abril 2023

Figure 4. Foreign Direct Investment. January-April (2015-2023)

Source: Banco de la República-Balanza cambiaria en Ministerio de Comercio, Industria y Turismo Abril 2023

• Observatorio de Desarrollo Económico de Bogotá. Retrieved from: https://observatorio.desarrolloeconomico.gov.co/expectativas/indice-de-confianza-industrial-vuelve-terrenopositivo