International Allies

Bogotá, February, 2023

CONTENTS

BEHAVIOR OF COLOMBIAN EXPORTS IN 2022 AND ITS GREAT CHALLENGES FOR THE NEXT FOUR YEARS.

2022 was a very interesting year for Colombian exports! The statistics show that they grew from USD$41.400 million in 2021 to USD$57.100 million in 2022; that is, they increased by USD$15.7 million (+38%)!

This increase is undoubtedly good news. But when we analyze the reason for this increase, we are surprised to see how 77% of the USD$15.7 million difference was caused by sales of coal (+97%) and oil (+31%) and the increase in their prices due to the Russia-Ukraine conflict.

If we analyze the sectoral behavior of exports, we can record how some products and destination countries grew in 2022 while others decreased.

In terms of agro-industry, we must highlight how coffee exports increased by USD$920 million (+28%), flower exports by USD$325 million (+20%), fats by USD$325 million (40%), exports of live animals doubled to reach USD$320 million (+100%) and in terms of industrial exports three products registered interesting growth: Ferronickel due to the rise in prices increased its exports by USD$400 million (+61%), manufacturing aluminum, especially windows, at USD$247 million (+50%) and vehicle exports at USD$80 million (+25%).

Martín Gustavo Ibarra President of Araujo Ibarra Consultores InternacionalesThe behavior of our main trading partners was as follows:

Our most significant trading partner continues to be the United States, by far, with a 26% share and a 16-point advantage over the second.

The destination country that grew the most in exports was Panama by 145%, to become Colombia's second trading partner with a value close to USD $6,000 million.

The trading partner that grew the most in percentage was the Netherlands, with 175%, reaching USD$2.7004 million, while India, Turkey, and Brazil also had a favorable performance.

The country that decreased the most was China, as our exports fell by 43% and by more than USD$2,000 million, going from second to seventh place as a trading partner, and its participation in total exports fell from 8.8% to 4%.

In terms of exporter per capita, Colombia has already passed the barrier of USD$1,000 per inhabitant (USD$1,120 to be exact), which is very low compared to the USD8,800 per capita of the OECD countries; to the USD2,800 that the world per capita and especially compared to our three partners of the Pacific Alliance, which present USD$4,800 in Chile, USD$3,800 in Mexico and USD$1,700 in Peru.

Expressed another way, if Colombia barely reached the world per capita of exports, it should have exported USD$150,000 million last year and not the USD$57,100 million it exported.

These figures are important because it represents the inventory of foreign trade that President Petro's new government receives. In turn, it constitutes a great challenge facing the Minister of Trade, Industry, and Tourism and the Government in general, not only in the diversification of the country´s export structure which increased its dependence from 43% to 55% on the mining and energy exports, if not primarily because they must align the new export policy to make it coincide with the government's programmatic plan.

And it is there where the attraction of new investment projects in green and blue hydrogen; the geometric increase in agro-industrial exports; the attraction of new industries that require clean energy for their production processes; doubling the participation of small and medium-sized companies from 10% to 20% in our exports, as well as sales to Venezuela, should be this new exporting north.

A significant role within this new scenario will be played by the 122 Free Trade Zones of Colombia, whose new export vocation was underlined in the tax reform and which keep intact their foreign trade and customs regime, which will be a crucial instrument for attracting new export anchors and, to maintain our international fiscal competitiveness vis-à-vis the region.

In addition, reviving a large part of the 2,000 exporters we have lost in the last five years will be essential.

For this, a GREAT NATIONAL CONSENSUS should be promoted, led by the Minister of Trade, Industry, and Tourism, to identify and specify these new opportunities with the very active participation of both Chambers of Commerce, as well as the Foreign Trade Unions, the Regional Agencies for the Promotion of Investment, Exporters, and Procolombia.

Nearshoring is working very well in Latin America: In 2022, industrial exports from the region are projected to grow by USD$200,000 million (29%) and agro-industrial exports by USD$59,000 million (21%), and Colombia cannot lag behind!1

1 The original language of the column is Spanish. This is a free translation by a collaborator of the Bogotá Chamber of Commerce

1 The original language of the column is Spanish. This is a free translation by a collaborator of the Bogotá Chamber of Commerce

2. GOOD NEWS ABOUT COLOMBIA AND BOGOTÁ

GOOD NEWS ABOUT COLOMBIA

• On Mrs. Ngozi Okonjo-Iweala, Director General of the World Trade Organization (WTO)´s visit to Colombia, the event "Economies for Life" took place. In this space led by the Vice President of the Republic, Mrs. Francia Márquez, and in which Mr. Nicolás Uribe Rueda, Executive President of the Bogotá Chamber of Commerce and Chair of the ICC World Chambers Federation participated in the representation of the business sector, in the city of Buenaventura, the Director General stated that the WTO would support access to international markets, product strengthening, and access to credit for Colombian MSMEs in sectors such as tourism, fishing, trade, and online services. For more information, see the following link.

• The International Monetary Fund (IMF) supports the Colombian government´s economic policy. The Fund published its Final Declaration at the end of the 2023 Article IV Consultation, highlighting the country's macroeconomic stability, a prudent Financial Plan for the current year, and the energy transition plan, underscoring the nation´s objective to reduce dependence on coal and oil as economically viable. For more information, see the following link

• Colombia apoya labores humanitarias tras el desastre causado por el terremoto que afectó a Turquía y Siria. Un equipo compuesto por diez militares del Ejército Nacional y ocho binomios de guías y perros adiestrados en labores de búsqueda y rescate, miembros del cuerpo de bomberos, la Defensa Civil, y la Cruz Roja, se unió en Estambul a las brigadas internacionales que prestan labores de apoyo y asistencia humanitaria ante la tragedia. Para más información, consultar el siguiente enlace

• Colombia supports humanitarian efforts after the disaster caused by the earthquake that affected Turkey and Syria. A team made up of ten soldiers from the National Army and eight pairs of guides and dogs trained in search and rescue work, members of the fire brigade, the Civil Defense, and the Red Cross, joined the international brigades in Istanbul that provide humanitarian assistance in the face of the tragedy. For more information, see the following link

• Colombia and Venezuela signed an Agreement for the Promotion and Reciprocal Protection of Investments. The agreement signed in Caracas by the President of Venezuela, Mr. Nicolás Maduro, and the Minister of Trade, Industry, and Tourism of Colombia, Mr. Germán Umaña Mendoza, represents an important milestone in the reestablishment of bilateral relations between the neighboring countries. With this agreement, both countries seek to promote the complementary industry of goods and services, promoting sustainable development, productive diversification, and the creation of qualified jobs. Both governments will now lead the respective legislative internal procedures. For more information, see the following link.

• During the visit of a Korean delegation led by Mr. Kwon Taek Ryoun, Director General of Technological Cooperation of the Rural Development Administration, Colombia and Korea agreed on an international cooperation mechanism to strengthen the implementation of rural reform in the country. In particular,

Korean cooperation will seek to strengthen the country's cadastral system and typographical surveys. For more information, see the following link.

• Colombia signs an agreement with Costa Rica, Ecuador, and Panama to protect the Pacific Marine Corridor. The Environment Ministers of these countries seek, through this agreement, to protect the Galapagos Marine Reserve (Ecuador), the Isla del Coco National Park (Costa Rica), the Isla Coiba National Park (Panama), and both the Gorgona National Park and the Malpelo Fauna and Flora Sanctuary (Colombia). Efforts will focus on achieving the conservation and sustainable use of the region's biological diversity through strengthening governance and cooperation for the management of protected areas, sustainable tourism, and management of the impacts of climate change, among others. For more information, see the following link

GOOD NEWS ABOUT THE BOGOTÁ-REGION

• Investments from Europe in Bogota have exceeded US $9,071 million in the last ten years. These investments have been made through 576 projects, creating more than 50,000 jobs in the Colombian capital. This way, Bogotá continues to consolidate itself as one of the most attractive cities to invest in Latin America. For more information, see the following link

• According to the most recent version of the "Busiest Airports in Latin America" ranking, Bogota's El Dorado International Airport is the busiest in South America and the second in Latin America. This occurred after El Dorado mobilized more than 35.5 million people in 2022. At the moment, it is only behind the Mexico City International Airport. For more information, see the following link.

• Bogotá will be home to one of the most outstanding events promoting the entrepreneurship ecosystem, Startco. This event will bring together entrepreneurs, investors, accelerators, and incubators to facilitate the financing of high-impact ventures. The platform will take place for the first time in Bogotá between March 16 and 17, 2023, thus consolidating Bogotá as an entrepreneurship hub in the region. For more information, see the following link.

• The Spanish BPO multinational, Abai, opened offices in Bogotá and has over 2,500 vacancies. These remote and in-person positions will cover tasks from customer service to digital marketing. According to Invest in Bogotá, Colombia has a growth projection of 7.4% in the BPO industry over the next five years. The country's capital has become one of the growth epicenters of this market, concentrating 70% of the income generated in Colombia, 64% of operations, and 71% of employment. For more information, see the following link

• Between March 7 and 8, the VI Congress of Private Capital and Entrepreneurial Capital of the Pacific Alliance took place in Bogotá. This was an academic space in which participants were able to analyze and debate critical current issues of the industry in the region, generating content and knowledge through keynote addresses by special international guests, discussion panels, and worktables on relevant topics. For more information, see the following link.

3. BCC news and upcoming events

• The Bogotá Chamber of Commerce (BCC) and the ICC World Chambers Federation (WCF) held in Bogotá the first meetings of the General Council and Executive Committee, governing bodies of the ICC WCF, in 2023. Nicolás Uribe Rueda, Chair of the ICC WCF and Executive President of the Bogotá Chamber, welcomed representatives from over 27 countries worldwide to discuss the strategic advances of the ICC WCF in its purpose to promote a more inclusive and sustainable business sector and its goals for 2023. In addition, the "Forum on Opportunities with the Regions of the World" was held, where approximately 900 Colombian MSMEs benefited through conferences and networking spaces with the ICC WCF General Council members and leaders of various international organizations. For more information, see the attached bulletin, which contains all the details of the conferences

• Nearly 2 million euros will be allocated to promoting green economy and environmental sustainability projects in Colombia. The European Union announced the AL-INVEST Green program's five winning projects in Colombia, which will benefit more than 2,500 entrepreneurs and MSMEs from all industries in Colombia. The institutions responsible for the execution of these projects are the Bogotá Chamber of Commerce, the Barranquilla Chamber of Commerce, the Bucaramanga Chamber of Commerce, the Interactuar Corporation, and the National Association of Foreign Trade - ANALDEX. To learn more, see the following link.

• The Bogotá Chamber of Commerce and Planeta Formación y Universidades come together in an alliance that provides entrepreneurs from various economic sectors in Bogotá and Latin America with access to a range of specialized and international programs with the latest market trends. Planeta Formación y Universidades has a global network of high education with twenty-two (22) educational institutions in Spain, Andorra, France, Egypt, Italy, Morocco, Colombia, and the US. To learn more, see the following link.

4. ECONOMIC BEHAVIOR

4.1. GROSS DOMESTIC PRODUCT (GDP)2

In the fourth quarter of 2022, Colombia's GDP grew by 2.9%, thus representing a 4.9 percentage points drop below that of the third quarter, in which the country grew 7.8%. Despite being a positive variation, it was the lowest growth recorded after the pandemic, followed by the first quarter of 2021 (1.5%).

It can be seen how the growth rate in 2022 slowed down compared to 2021. The economic activities with the highest participation in gross value added in the fourth quarter of 2022 were wholesale and retail trade, public administration and defense, and manufacturing industries, with a participation of 20.55%, 15.42%, and 12.6%.

Bogota's GDP grew 9.3% in the third quarter of 2022 compared to the same period in 2021. On the other hand, compared to the third quarter of 2019, the city presented a variation of 13.9%.

Graph 1. Annual growth rate, by quarter, of the GDP between 2019 and 2022 Colombia and Bogotá at constant prices

In February 2023, the monthly price variation in the country, according to DANE, was 1.66%, while in Bogotá, it was 1.89%. Compared to the previous year, the annual price variation for Colombia was 13.28%, while Bogotá´s was 12.94%.

Source: DANE – Consumer Price Index (CPI).

As for the sectors that presented a greater variation in their prices, in Bogotá three sectors stood out: the education sector presented an increase in prices of 7.87%, transport in the city presented a price increase of 2.51%, and non-alcoholic food and drinks prices grew by 2.25%. On the other hand, nationwide, education prices grew by 8.50%, the prices of furniture and household items did so by 2.04%, while those of transport rose by 1.99%. It is important to mention that the education component has greater increases in February and August due to the beginning of the school season.

The monetary policy intervention rate is the minimum interest rate that the Central Bank charges to the financial institutions for the loans that it performs. This rate is the central banks' primary monetary policy intervention mechanism to control inflation. For the month of February, the intervention rate of the Bank of the Republic is 12.75%.

Employment has shown improvement compared to the previous year. At the national level, the unemployment rate in January 2023 was 13.7%, 0.9pp less than January 2022, which represents a total of 139 thousand fewer people unemployed. Meanwhile, the employed population rose by 796 thousand people compared to 2022. The global participation rate increased by 0.8pp, from 62.6% in January 2022 to 63.4% in January 2023.

4 Source: DANE, Gran Encuesta Integrada de Hogares (GEIH). Recovered from: https://www.dane.gov.co/index.php/estadisticas-portema/mercado-laboral/empleo-y-desempleo

4.2. INFLATION

4.2. INFLATION

Source: Gran Encuesta Integrada de Hogares - GEIH (DANE). Published on February 28

In Bogotá, the unemployment rate went from 13.9% in the mobile quarter Nov 21-Jan 22 to 12.0% in the mobile quarter Nov 22-Jan 23, which means that 64 thousand people less were found in unemployment. In the same period, the number of employed people increased from 3,643 thousand people to 3,829 thousand people, an increase of 186,000.

In January 2023, the gap in the unemployment rate between men and women was 6.4pp; while 11.0% of men were unemployed, 17.4% of women were in that condition Nevertheless, the latter represents an improvement compared to January 2022, when the gap was 8.2pp.

4.4. BUSINESS DYNAMIC

In January, 508,242 active companies in Bogotá and the 59 municipalities of Cundinamarca under the jurisdiction of the Bogotá Chamber were reported; 85.5% of these companies are located in Bogotá, while 14.5% are found in the 59 municipalities. MSMEs remain the region's main protagonists; microenterprises represent 93.8% of the total, and only 0.6% of companies correspond to large companies. In comparison to January 2022, it is observed that the number of companies increased by 6%. It is worth noting a 7% growth in terms of microenterprises between January 2022 and January 2023.

The participation of companies in legal order in Bogotá and the region comprises 57% of natural persons and 43% of legal persons. The services sector groups 54.3% of companies, the trade sector 31.8%, while the remaining 13.9% corresponds to companies in the industrial sector.

5. EVOLUTION OF FOREIGN TRADE EXPORTS

In the January-December 2022 period, Colombian exports were US $ 57,115 million FOB and presented an increase of 38.0% compared to 2021, when they reached a total of US $ 41,389 million FOB. When looking at 2019, this increase was 44.6%.

Exports originating in Bogotá went from US $3,327 million FOB in January-December 2021 to US$ 3,949 million FOB in January-December 2022 This represents a growth of 18.7%. On the other hand, in the case of Cundinamarca, a 39.9% increase in exports from January-December 2022 was observed compared to the same period of 2021 after US $ 2,034 million FOB in 2021 to US $ 2,845 million FOB in the same period of 2022.

For January-December 2022, Bogotá was the fourth department in terms of exports, with 10.3% of the country's total, surpassed only by Antioquia, Atlántico, and Cesar. On the other hand, Cundinamarca is the fifth largest exporting department in Colombia, participating with 7.5% of the country´s total exports. This makes BogotáCundinamarca an important export region with 17.8% of the country's total exports.

The United States is the leading destination of goods exported by the Bogotá - Cundinamarca region, representing 36.2% of the total sold from January to September 2022. It is worth pointing out that 30,8% of exports in the region are concentrated in five countries: Ecuador, Brazil, Mexico, Peru, Chile, and Venezuela.

Live plants and floriculture are the leading export products of the Bogotá - Cundinamarca region. In JanuaryDecember 2022, they represented 25.3% of total external sales. After these, combustible and mineral oils and their products register a 14.4% participation, followed by coffee, matte yerba, and spices with 11.3%.

IMPORTS

Imports increased by 26.7% when comparing January-December 2022 with the same 2021 period; goods were bought for US $ 77,413 million. Likewise, when comparing that figure with that of January-December 2019, imports increased by 46.9%.

For the January-December 2022 period, compared to the same period in 2021, manufacturing imports increased by 42.1%, agricultural, food, and drinks increased by 61.4%, and fuels and products from extractive industries increased by 63,1 %. Bogotá increased external purchases of goods by 10.8% between January-December 2022 and the same period of 2021.

The order of products with the highest import value between January and December 2022 is as follows: First, there are the devices and electrical material for recording or image with a 15.0% participation in Bogotá and 12,3% in Cundinamarca. Secondly, there are fuels and mineral oils, with 13.6% in Bogotá and 11.8% in the department. Third, there are nuclear reactors, boilers, and machines, with 10.4% in the city and 11,0% in Cundinamarca.

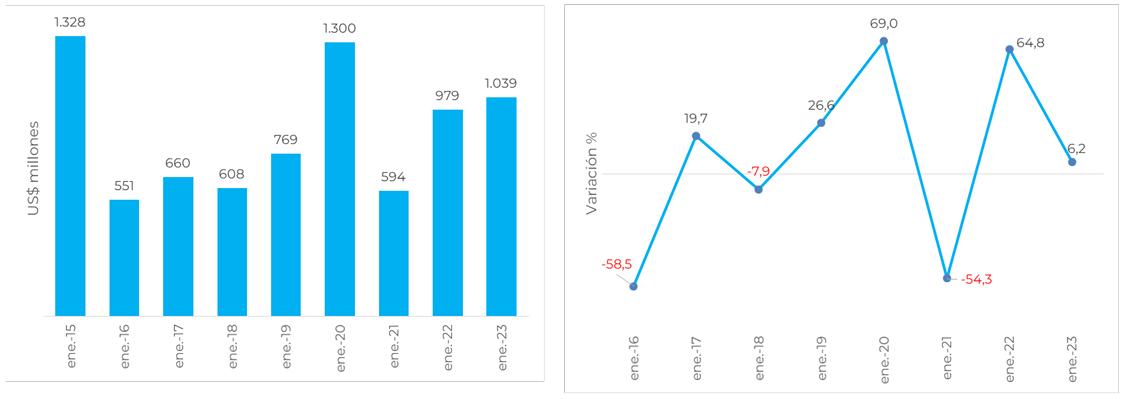

6. FOREIGN DIRECT INVESTMENT

According to Colombia's Ministry of Trade, Industry, and Tourism, foreign direct investment (FDI) stood at US $ 1,039 million in January 2023. The above represents an increase of 6.2% compared to the same month in 2022. For its part, investment in the oil and mining sector (85.2% of the total) stood at US $885 million in January, thus increasing 37.4% compared to January 2022. As for other remaining sectors, other than those of oil and mining (14.8% of the total), the FDI amounted to US$ 154 million in January, presenting a 53.9% reduction compared to the same month of 2022.

Source: Central Bank-Balance of Payment at the Ministry of Trade, Industry, and Tourism January 2023

Graph 2. Foreign Direct Investment. January (2015-2023)

Graph 2. Foreign Direct Investment. January (2015-2023)

7. SOURCES

• For more information, please refer to the Observatory of the Chamber of Commerce of Bogotá. https://www.ccb.org.co/observatorio

• DANE.CuentasNacionales.Recuperadode:https://www.dane.gov.co/index.php/estadisticas-por-tema/cuentas-nacionales/cuentasnacionales-trimestrales

• DANE. Mercado Laboral. Información recuperada de: https://www.dane.gov.co/index.php/estadisticas-por-tema/mercadolaboral/empleo-y-desempleo

• RegistroMercantil,CCB,2019-2020 – 2021-2022.Recuperadode:https://www.ccb.org.co/Inscripciones-y-renovaciones/MatriculaMercantil/Boletines-del-Registro-Mercantil/Boletines-ano-2021

• DANE.EncuestaPulsoSocial.Recuperadode:https://www.dane.gov.co/index.php/estadisticas-por-tema/encuesta-pulso-social

• DANE, Exportaciones. Diciembre 2022. Recuperado de: https://www.dane.gov.co/index.php/estadisticas-por-tema/comerciointernacional/exportaciones

• DANE,Comerciointernacionalimportacionesdiciembre2022.Recuperadode:https://www.dane.gov.co/index.php/estadisticas-portema/comercio-internacional/importaciones

• Ministerio de Comercio, Industria y Turismo. Informes de Inversión Extranjera Directa. Recuperado de: https://www.mincit.gov.co/estudios-economicos/estadisticas-e-informes/informes-de-inversion-extranjera

• Observatorio de Desarrollo Económico de Bogotá. Recuperado de: https://observatorio.desarrolloeconomico.gov.co/expectativas/indice-de-confianza-industrial-vuelve-terreno-positivo