IN MEXICO

SITE VISIT | ‘20-million-oz region’ hosts several gold players

BY COLIN MCCLELLAND

BY COLIN MCCLELLAND

John McConnell and Tara Christie are the Yukon mining power couple. The husband and wife are both presidents and CEOs of Victoria Gold (TSX: VGCX) and Banyan Gold (TSXV: BYN; USOTC: BYAGF), respectively.

Victoria has the territory’s only producing open-pit gold mine, the heap-leach Eagle mine about 275 km east of Dawson City, which posted record first-half output this year. Banyan’s Aurmac project, about 40 km from Eagle, has 312.9 million tonnes grading 0.7 gram gold per tonne for 6.2 million inferred oz., according to a resource update in May.

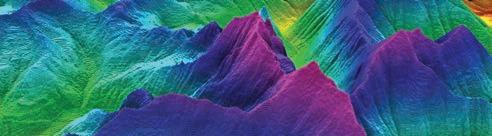

Both sites are part of the Tombstone Gold Belt that arcs across the Yukon including projects held by investor darling Snowline Gold (TSXV: SGD) in the east through Sitka Gold (CSE: SIG) to Kinross Gold’s (TSX: K; NYSE: KGC) Fort Knox mine near Fairbanks, Alaska in the west.

“If you were to draw a 50-km circle around us, the area would already have 20 million ounces in gold-equivalent resources, which is pretty, pretty exciting,” Christie said in an interview with The Northern Miner during site tours on July 20.

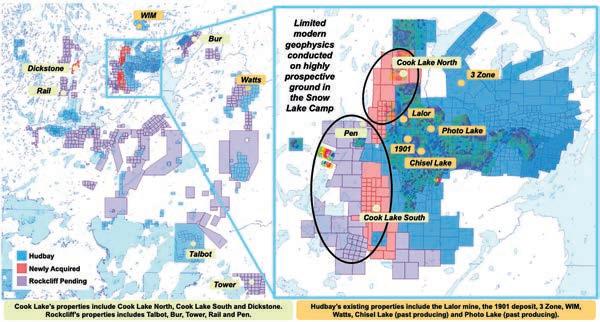

The first discovery in a decade at Hudbay Minerals’ (TSX: HBM; NYSE: HBM) Lalor mine in Snow Lake, Man., has given it a run at finding another anchor deposit to extend the life of its operations beyond 2038.

The company’s winter drilling program had uncovered a trove of new mineralized zones, Hudbay said in a June news release. One drill rig exploring a geophysical anomaly northwest of Lalor has yielded strong results outlining a series of base metal and copper-gold zones, including a highgrade copper-gold-silver zone. The find indicates the potential to enhance near-term production and significantly extend the mine’s life.

metals in the area.

Moreover, recent borehole electromagnetic surveys have identified multiple conductive horizons in the vicinity. Hudbay is already at work, generating targets and formulating plans for future drilling campaigns. The proximity of these mineralized intersections to the existing Lalor underground infrastructure provides an opportunity to enhance the near-term mine plan for Lalor. The potential extension of production and the discovery of new high-grade zones could significantly increase the mine’s output and profitability.

Cook Lake acquisitions

a private placer gold mining company, worked a spell at Newmont (TSX: NGT; NYSE: NEM) in the North and started a consultancy.

Now she’s running Banyan with its 173-sq.-km Aurmac property.

It has three inferred-level deposits, Powerline with 3.4 million oz., Aurex Hill with 1.4 million oz. and Airstrip with 897,000 oz. on moderate topography connected to hydro and a highway that goes to Hecla Mining’s (NYSE: HL) Keno Hill silver operation next door.

“In our first step-out and down-plunge drill program since the initial discovery of the gold and copper-gold lenses at Lalor more than a decade ago, the results demonstrate the potential to replicate our exploration success through the discovery of additional high-grade zones that could enhance near-term production and further extend mine life,” the company’s president and CEO Peter Kukielski said in the release.

Amid the Lalor discovery, Hudbay also solidified its position in the region through strategic land acquisitions. The agreements with multiple landholders have increased the company’s holdings in the Snow Lake area by more than 250%, securing an extensive

“It’s tough to explore in the Yukon because the exploration season is short,” McConnell said in a separate interview. “But the opportunity is that the Yukon is very under-explored.”

The two are long-time northerners steeped in mining culture. British Columbia native McConnell has been in the business for more than 40 years across the north for companies such as De Beers, Western Keltic Mines and Breakwater Resources. He’s held the Victoria Gold posts since 2010.

Panning pro

Christie spent summers in the Yukon from age seven. The youngster and her slightly older brother once panned 16 oz. of gold in a season. She later became a geotechnical engineer and geologist, ran

Banyan is considering how the project could be developed, likely around the same $500-million capital cost as Victoria’s Eagle. If it stays unacquired that long, Christie says.

“There’s about a 25% chance that Banyan is bought by either Hecla or Victoria Gold, it’s a 25% chance somebody will buy it as a standalone and that’s based on incoming interest. And there’s a 25% chance that somebody will come in and buy Victoria and us.”

Snowline spotlight Chances of going it alone are just 5%, she says. But, like other junior miners in the region with a strong resource and drill results such as Sitka Gold, Banyan faces a tough

See TOMBSTONE / 9

The drill program focused on testing a geophysical anomaly about 500 meters northwest of the existing underground infrastructure. This targeted exploration successfully intersected a series of base metal and copper-gold zones.

Among the notable Snow Lake-area holes was hole CH2302 which intersected three mineralized zones, including 7 metres of 3% zinc and 15.1 grams silver per tonne; 3.5 metres of 3.8% copper, 3.75 grams gold per tonne and 104.5 grams silver per tonne; and 7.5 metres of 3.9% zinc and 7.5 grams silver, leaving industry experts buzzing with excitement.

According to Hudbay, silver, the most mobile metal in a volcanogenic massive sulphide (VMS) system, is often an indicator of nearby significant base metal mineralization. This presence of abundant silver in isolation from other metals suggests the immediate proximity of more substantial mineralization. That raises expectations for further discoveries of base and precious

LITHIUM | Near-term enhancements could improve Arizaro’s financial metrics

BY JACKSON CHENLithium Chile’s (TSXV: LITH; US-OTC: LTMCF) Salar de Arizaro project in northern Argentina could produce 25,000 tonnes per year of battery-grade lithium carbonate equivalent (LCE) over 19 years, according to a preliminary economic assessment (PEA) released on Aug. 8.

The study estimates initial capital costs at US$823 million, with an after-tax net present value of US$1.1 billion (at an 8% discount rate), an internal rate of return of 24.1%, and a payback period of 3.6 years. Operating costs are pegged at US$5,197 per tonne of LCE.

“These results support our view that the Arizaro project has the potential to be a world-class producer of lithium carbonate,” said Steve Cochrane, CEO of Lithium Chile. “We are excited about continued advancement of this project – a continuing journey of near-term enhancement opportunities that have already been identified.”

The PEA is based on an indicated resource of 1.5 million tonnes LCE grading 278 mg per litre and an inferred resource of 1.7 million tonnes of LCE at a grade of 360 mg per litre. The resource was increased by 28% in June following diamond drilling at the site, located in Salta province.

Arizaro, the company’s most advanced project is currently undergoing the second phase of its development, with the goal of establishing a measured resource and increasing the LCE grade on the salar. Testing of the brine samples will be done at the company’s lab in Jujuy province to determine best production processes for lithium extraction.

The project is the Calgary-based explorer’s most advanced asset, and a resource update for Arizaro, released last December raised the LCE tonnage by 81%

Shares of Lithium Chile were down more than 5% to 74¢ at press time in Toronto. The company has a market capitalization of $152.6 million. Its shares have traded in a 52-week window of 45¢ and $1.13. TNM

The September 4, 2023, issue will be the last biweekly issue of The Northern Miner. Effective October 2023, The Northern Miner will be switching to a monthly publication schedule.

If you have any questions or concerns, please contact our customer support team at: support@northernminer.com

Standard Lithium’s (TSXV: SLI) South West Arkansas project in the namesake state could produce 30,000-35,000 tonnes per year of battery-quality lithium hydroxide monohydrate (LHM) over a 20-year operating life, according to a preliminary feasibility study released on Aug. 8.

The study, which gives the 30,000-tonne-per-year output as a base case and 35,000 tonnes as the upside, puts capital costs at US$1.3 billion, including a 20% contingency, and all-in operating costs at US$5,229 per tonne of LHM. Most of the operating costs at South West Arkansas (SWA) are associated with reagents required to extract lithium from brine as well as power usage to convert lithium to LHM.

Standard’s flagship projects comprising SWA and Lanxess sit on the Smackover formation, a petroleum reservoir and brine aquifer that stretches from east Texas to Florida. Bromine has been produced from Smackover for more than 60 years.

The study pegs the base case after-tax net present value (NPV) at US$3.1 billion and the internal rate of return (IRR) at 32.8%, both with a discount rate of 8% and a long-term price of US$30,000 per tonne of battery-quality LHM. In the upside case, the NPV and IRR rise to US$3.7 billion and 35.4%, respectively.

“The robust economics from the South West Arkansas Project PFS showcase its incredible potential,” said Dr. Andy Robinson, President and COO of Standard Lithium.

“Our exploration program in the first half of this year yielded significantly improved lithium concentrations and grew the total resource to 1.8 million tonnes of lithium carbonate equivalent (LCE),” he said,

referring to drilling that increased LCE resources to 1.4 million tonnes grading 446 mg per litre in the indicated category and 392,000 tonnes at 405 mg per litre in the inferred category. The updated resource at SWA is 52% larger than the 2021 PEA.

In May, drilling at SWA revealed what Standard called the highest confirmed lithium grade in Arkansas, at 581 mg per litre. That followed drilling at a site in east Texas in March, when the company said a new borehole returned a sample grading 634 mg per litre, what Standard said was the “highest confirmed lithium grade brine” on the continent.

The study envisions a development plan that pumps brine from the Smackover Formation aquifer through production wells, extracts lithium from the brine, converts it to a commercial product, and

then reinjects the effluent brine via injection wells to maintain pressure in the reservoir.

It also outlines that a network of 21 brine supply wells will be completed in the Smackover Formation, producing about 28,390 litres per minute, with another 22 injection wells supporting pressure maintenance in the aquifer to maintain long-term production.

Standard expects to complete a feasibility study for SWA in 2024, and targets construction to start in 2025 and production in 2027. SWA comprises about 110.3 sq. km of lease properties in southwest Arkansas.

Company shares traded at $5.97 apiece at press time in Toronto, valuing the Vancouver-based company at $1 billion. Standard’s shares traded in a 52-week window of $3.85 and $8.58. TNM

QUEBEC | Project has largest lithium pegmatite resource in Americas, estimate says

BY CECILIA JAMASMIE

BY CECILIA JAMASMIE

Patriot Battery Metals (TSXV: PMET; ASX: PMT) has delivered the long-awaited initial resource estimate for the CV5 pegmatite at the Corvette lithium project in James Bay, Que., saying that results confirm the asset as the largest lithium pegmatite mineral resource in the Americas and the eight largest globally.

The estimate indicates the deposit holds 109.2 million inferred tonnes at 1.42% lithium oxide and 160 parts per million tantalum, for 1.6 million tonnes of contained lithium oxide, or 3.8 million tonnes of lithium carbonate equivalent, using a 0.4% lithium cut-off grade.

Using a 1.4% cut-off, the CV5 resource is 46.3 million tonnes at 2.03% lithium oxide or 3.8 million tonnes of contained lithium carbonate equivalent. The figure, though below some analysts’ estimates, is strong enough to disprove criticism levelled by short seller firm Night Market Research.

Shares cratered despite the positive announcement, dropping over 6% in Australia, about 5.5% in New York and 5.9% in Toronto on July 31.

“We could not be happier with the result of this maiden mineral resource estimate at CV5, which will be the first of multiple resource estimates for the Corvette property over the coming years,” company CEO and president Blair Way, said in the statement.

Albemarle (NYSE: ALB), the world’s largest lithium producer, decided to seize the opportunity, offering $109 million on Aug. 1 to Patriot for a 5% stake in the company.

Albemarle will subscribe to around 7.1 million Patriot shares at an issue price of $15.29 per common share under a subscription agreement. The issue price represents a 7% premium to the stock’s July 31 closing price on the TSX Venture Exchange.

Way noted the publication of the first resource for CV5 was a “key milestone” for Patriot, which will underpin future economic and development studies as it looks to aggressively advance the asset on to

production.

The resource and geological modelling has outlined significant potential for growth at CV5, which remains open at both ends along strike, and to depth along a significant portion of its length, the company said.

At press time in Toronto, Patriot shares were trading at $12.56, in a 52-week range of $3.65 and $17.74, giving the company a market cap of $1.1 billion.

Aussie majors circling Rumours of Australian players eyeing Patriot as a potential acquisition target have been on Australian media on and off this year. In February, it was said that Mineral Resources (ASX: MIN), Pilbara Minerals (ASX: PLS) and Wesfarmers (ASX: WES) were all interested in buying the Canadian miner or, at least, a stake in it.

Australian lithium miners, such as Pilbara, Orocobre and Galaxy Resources, seek to expand their footprint and diversify supply sources amid rising demand for battery metals. Analysts say they see Patriot as an attractive opportunity to access to the North American market and secure long-term supply contracts with leading battery manufacturers. Quebec has become a hard rock lithium hotspot as companies vie to supply the surging electric vehicle market. The federal government approved the James Bay open-pit project by Galaxy Resources, a part of Allkem (TSX: AKE; ASX: AKE), in January.

Sayona Mining (ASX: SYA) expected the first spodumene shipment from its North American Lithium operation to take place in July. TNM

An updated feasibility study on Alamos Gold’s (TSX: AGI; NYSE; AGI) Lynn Lake project in Manitoba early this month showed a big increase in reserves, but also a big increase in expected capital expenditures.

Despite the latest study outlining the potential for a larger, longer lasting, and cost-efficient operation, it comes at an 87% higher price tag at US$632 million, some US$294 million more than the initial 2017 capex estimate of US$338 million. The total life of mine capital per ounce increased by 17% to US$381 from the 2017 study.

The base case scenario assumes a gold price of US$1,675 per oz. and reflects an after-tax net present value (NPV) at 5% of US$428 million and an after-tax internal rate of

return (IRR) of 17%. At current gold prices of around US$1,950 per oz., the after-tax NPV is US$670 million with an after-tax IRR of 22%.

While the study showcases higher production estimates, improved cost efficiency and extended mine life compared with the previous report, Haywood Securities mining analyst Kerry Smith said the economics could be improved with a larger mineable reserve.

“The project return is acceptable; we think this district would provide a great return at 3 million oz. mineable, which is a realistic target we believe,” the analyst wrote in a note to clients on Aug. 3.

Kerry said Alamos has “plenty of time” to continue its exploration efforts, as this project would not be funded until the Island Phase 3+ project is complete in 2026.

Alamos CEO, John McCluskey,

said the project is part of its strategy to sustain the company’s longer-term growth aspirations.

“Through Lynn Lake, Island Gold and Young-Davidson (both in Ontario), we have three high-quality assets that can support over 650,000 oz. of annual production in Canada, at all-in sustaining costs below US$1,000 per oz. over the longterm,” McCluskey said.

Alamos plans to fund Lynn Lake internally, leveraging its strong financial position, which includes US$189 million in cash as of June 30, no debt, and strong free cash flow generation.

The study outlines higher production totals on the front end of the mine plan, with the first five years projected to yield an average yearly gold output of 207,000 oz., and the initial 10 years averaging 176,000 ounces. This represents

a noteworthy 23% increase from the 2017 study’s annual average of 143,000 ounces.

The study proposes a more cost-effective operation. The expected mine-site all-in sustaining costs are US$699 per oz. over the first decade and US$814 per oz. over the entire mine life. This reflects a 6% reduction in costs over the initial 10 years compared to the 2017 study, attributed to economies of scale and improved average grades.

The feasibility is underpinned by a 44% boost in the proven and probable mineral reserve, totalling 2.3 million oz. with a grade of 1.5 grams gold per tonne, supporting an extended 17-year mine life (up from 10 years in the 2017 study) and an increase in life-of-mine production by 46% to 2.2 million ounces.

The company received its envi-

ronmental impact statement approval and provincial licences in March.

Lynn Lake offers considerable exploration potential, including opportunities at the Gordon deposit, Burnt Timber, Linkwood, and other regional targets.

On the sustainability front, the study highlights an 18% decrease in greenhouse gas emissions per ounce compared to the 2017 study, now incorporating electric shovels and drills at the MacLellan pit, and productivity improvements with the larger operation. The project will also connect to Manitoba’s clean electric grid.

At press time in Toronto, Alamos’ equity was up 55% over the past 12 months at $15.61, having touched $8.74 and $19.18. It has a market capitalization of $6.1 billion. TNM

LITHIUM | Northern Quebec deposit a ‘tier-1 lithium’ pegmatite resource, says company

BY JACKSON CHEN AND BLAIR MCBRIDEAn update to Allkem’s (TSX: AKE; ASX: AKE) James Bay

lithium project in northern Quebec has increased the resource by 173% over its previous estimate from December 2021, the company said in an Aug. 11 news release.

The new resource is estimated at 110.2 million tonnes averaging 1.3% lithium oxide (Li2O), including 54.3 million tonnes at 1.30% Li2O in the indicated category and 55.9 million tonnes at 1.29% Li2O in the inferred category. The total resource represents a 173% increase over its previous estimate for the project, located 130 km east of James Bay and the Cree Nation of Eastmain.

The Argentina-headquartered company says the increase solidifies the deposit as a tier-1 lithium pegmatite mineral resource and longlife asset.

The updated resource incorporates two drilling campaigns con-

ducted on the project since early 2022, adding about 37,500 metres of delineation drilling to the deposit since the release of the previous feasibility study.

Now included in the James Bay resource is an initial resource estimate (inferred) for the NW Sector, which is open along strike and at depth with growth potential. The

NW Sector resource, according to Allkem, has higher grades than the remainder of the deposit and represents a potential opportunity to improve the grade profile of the future operation. The entire deposit also remains open both along-strike and at depth, and the lithium company says it has implemented a strategy

to continue growing the resource with more drilling.

“James Bay is now one of the largest spodumene lithium assets and clearly has the potential to grow even further as the boundaries of mineralization are tested through an additional drilling program commencing later in the year,” Allkem’s managing director and CEO Martin Perez de Solay said.

“The size and grade of this resource is amongst the best in the world and will underpin Allkem plans for future production and processing of lithium in Quebec,” he added.

The company is proposing to develop the James Bay project as a sustainable, hard-rock operation that maximizes the use of renewable energy, utilizing spodumene expertise gained from its Mt Cattlin operation in Australia.

A December 2021 feasibility study for the project outlined an average annual production of 321,000 tonnes per annum of 5.6% Li2O spodumene concentrate with

an approximate 19-year mine life.

The update comes three months after Allkem and Livent (NYSE: LTHM) merged to form the world’s third-largest miner of the critical mineral by annual production capacity.

The all-share merger created a company with a valuation of US$10.6 billion and a forecasted production capacity of 248,000 tonnes of lithium carbonate equivalent (LCE) a year, representing about 7% of global mine production in 2023, said battery raw materials analyst at Fastmarkets NewGen, Jordan Roberts.

The deal places the new company among the top five lithium producers in terms of market capitalization, behind Albemarle (NYSE: ALB), Chile’s SQM (NYSE: SQM), Ganfeng Lithium and Tianqi Lithium.

Allkem shares were down 2.3% to $11.75 in Toronto at press time, giving it a market capitalization of $7.4 billion. Its shares traded in a 52-week window of $9.08 and $15.19. TNM

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

SENIOR STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PODCAST HOST: Adrian Pocobelli, MA (Engl) apocobelli@northernminer.com

ADVERTISING:

Robert Hertzman

(416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/

CAREER ADS

George Agelopoulos

(416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

ADDRESS:

Mexico’s mining industry faces a potential crisis after a new law this year radically changes how projects can be registered, approved and developed.

Veteran Latin America investor Ross Beaty calls it extremely damaging for investment. Mexico’s top mining organization says it will cost the country billions. Even Canadian politicians are concerned.

President Andres Manuel López Obrador adopted a populist stance since coming to power in 2018, including the nationalization of the lithium industry last year even though it doesn’t have any producing mines yet. It was clear signal that the state wasn’t going to be left out of what could turn out to be one of the most lucrative battery metals.

The worldwide number of electric vehicles is expected to accelerate 10 times current levels to 250 million in just the few years to 2030, according to the International Energy Agency. Mexico’s lithium move coincided with efforts by Latin American powers in the light metal such as Argentina, Chile and Bolivia to increase government control and consider forming a cartel for the commodity like OPEC.

Can similar measures lie ahead for Mexico’s silver output, the world’s largest by far – almost double second-place China – as the metal critical for solar panels become key in the green energy transition?

But that isn’t even the biggest concern right now.

The ruling Morena party passed wider mining legislation in late April that shortened concessions to 30 from 50 years, tightened rules for water permits, boosted local community benefits and imposed a public tender system for all concessions instead of claims staking. The law heightened pre-consultation requirements, toughened impact studies and levied financial commitments, or bonding, that could prove onerous for junior explorers. Some of the language is vague, and opportunities for challenges are clouded by lack of capacity and allegations of corruption.

“The law is a very significant negative to Mexico’s previously good investment climate for mining,” Beaty said at the time. – “It’s extremely damaging, hostile to the industry and harms competitiveness on the global stage.”

Mexico’s mining production was valued at US$16.7 billion in 2021, according to the U.S. Department of Commerce. The country’s national mining chamber, Camimex, says the new law will cost the country US$9 billion in investment and 420,000 jobs.

The new regulations, such as securing bonding for projects, threaten the ability of Canadian juniors to invest in Mexico, says Joe Mazumdar, an analyst with Vancouver-based mining newsletter Exploration Insights. Even more concerning is the provision allowing authorities to cancel exploration concessions if no work is completed within just two years.

Canada’s Trade Minister, Mary Ng, criticized the mining reforms in a call with Mexican Economy Minister Raquel Buenrostro in April. Ng said the law could reduce Canadian investment in Mexico’s mining sector and limit North American supply chain resiliency.

Still, the return of manufacturing operations from countries like the United States and Canada to Mexico is a promising sign of the country’s economic revival. Mexico’s Jan.-Oct 2022 exports of goods to the U.S. rose more than 20% to US$382 billion compared with the same period in 2021, according to U.S. census data.

The S&P Global Mexico Manufacturing Purchasing Managers’ Index, a measure of the country’s factories, rose to 53.2 in July from 50.9 in June, marking the sixth period of expansion and the highest reading since May 2016. This resurgence, fueled by favourable labour costs and trade dynamics, signifies a potential turning point. Mazumdar argues the economic health allows López Obrador to take on challenges in the mining industry.

But on the other hand, gross domestic product per capita in Mexico, at US$10,050 in 2021 according to the World Bank, is a quarter less than China’s at US$12,250 and just a fraction of Canada’s at US$52,000 or the U.S. at US$70,250. It’s poor.

And López Obrador must also consider Mexico’s centuries of mineral exploitation by foreigners. Industry disasters like the 2014 spill of 40 million litres of sulphuric acid above the Sonora River, and coal mine collapses in the state of Coahuila that have killed scores have fed anti-mining sentiment across the country .

López Obrador, who turns 70 in November, has repeatedly said he will not try to change the constitution to run next year for another six-year term. Presidents are limited to one term, so the chance remains for change at the top before this new law becomes ingrained in the bureaucracy. And, as Colin McClelland reports on page 12, mining investment in projects has actually been increasing this year despite the new law.

Analysts agree legal challenges to the constitutionality of these abrupt reforms are expected. Law firms are recommending miners consider trade pacts like the Comprehensive & Progressive Trans-Pacific Partnership for investor-state arbitration.

But the future remains uncertain. The prospect of a protracted legal battle adds to the growing sense of malaise surrounding investments in Mexico’s mining industry.

The impact extends beyond mere financial considerations. The shift to public auctions for granting mineral concessions, a departure from the previous applicant-priority process, adds complexity and unpredictability to an already challenging landscape.

López Obrador already has some crippling labour disruptions to sort out. A strike has closed Newmont’s Peñasquito mine since early June, affecting 28,000 indirect jobs and an operation that contributed US$1.9 billion to Mexico’s economy last year.

In a world where investment capital is increasingly mobile, the Mexican government’s sweeping changes to its mining regulations cools interest from domestic and international investors. The economic impact could be severe. The global mining community is watching closely, assessing the broader implications for the industry and questioning the direction of a nation once poised for mining prosperity. TNM

As the world’s largest metal consumer, the second largest economy in the world, and the largest funder of overseas metal projects, China’s impact on the mining business globally cannot be overstated.

That’s why Canadian miners have been paying close attention to recent political and economic developments involving China.

Three key stories have characterized the first half of the year. First, Canadian businesses are seeing the effects of the new mining investment restrictions which Canada implemented last year, requiring ministerial approval on Chinese investments in the Canadian mining sector. Alongside these new restrictions on inbound Chinese investment, Canada’s traditional allies have been courting Canada as they look to “friend-shore” their supply chains and diversify away from China. Finally, the underwhelming economic rebound following China’s reopening has reduced the Chinese import of metals writ large. These political and economic trends have changed the investors available to Canadian miners and softened demand in the world’s biggest metal consumption market.

We have seen a decline in Chinese investment in Canadian metal firms as a result of the worsening Sino-Canadian relationship. However, politics is not the only factor behind the drop off. It’s also part of a larger slowdown in Chinese dealmaking over the last several years. Chinese miners are facing domestic and international pressure to avoid owning assets abroad, especially in perceived-hostile jurisdictions, like Canada. As President Xi Jinping began his unprecedented third term with a new handpicked Politburo earlier this year, the messaging from China’s highest political organ has set out a more conservative development strategy focused on national self-reliance.

Previous messaging from governmental elites highlighted the need for continual economic growth, since January however, the new committee has instead preached the prioritization of self-reliance, calling on the country to traverse the new “turbulent seas” and “solve the problem of strangleholds by foreign countries.” Within the Chinese political system, state-affiliated firms

take their cues from such elite political messaging and have therefore been hesitant to invest in countries perceived to be geopolitically hostile. As a result, Chinese investment funds and large national miners, which operate with varying degrees of independence but still have close ties to the government, have limited investment abroad.

Canadian inbound investment from China has also been slowed by the Canadian government’s 2022 policy restricting investment by foreign state-owned enterprises (SOEs.) Any new investment would need approval from the Canadian Minister of Innovation, Science, and Industry and will be subject to national security reviews. This policy applies widely to all stages of the value chain, from extraction to refining, and includes both non-direct and non-controlling shares. These Canadian national security measures are indicative of the “stormy seas” that Chinese leadership sees abroad and discourages new investment into Canada.

Given the friction from both the Canadian and Chinese sides, miners are still feeling around for what sorts of deals are possible. Purchasing a Canadian miner’s entire stake in an international project, such as Zijin’s purchase of Suriname’s Rosebel gold mine from Toronto’s Iamgold for US$360 million, seems to be one of the few options left on the table since purchasing stakes in Canadian mines, or miners, or partnering with Canadian firms are all unlikely in the current environment.

Outside of the Sino-Canadian context, Chinese investment in overseas metals has been declining globally. The AEI Chinese Overseas Investment Tracker estimates that Chinese companies spent just under US$8 billion on major investments in overseas metals projects last year. To put this in perspective, Chinese firms spent around US$9 billion annually from 2020-2021. Furthermore, these overseas metal investments are well below the US$20 billion of annual investment that Chinese firms deployed from 2015-2019. EY reports that in the first quarter of 2023, Chinese investment into North America was focused more on healthcare and life science companies than on physical assets. Canadian miners and Chinese

Mexico’s disruptive shift on mining creates far-reaching concerns

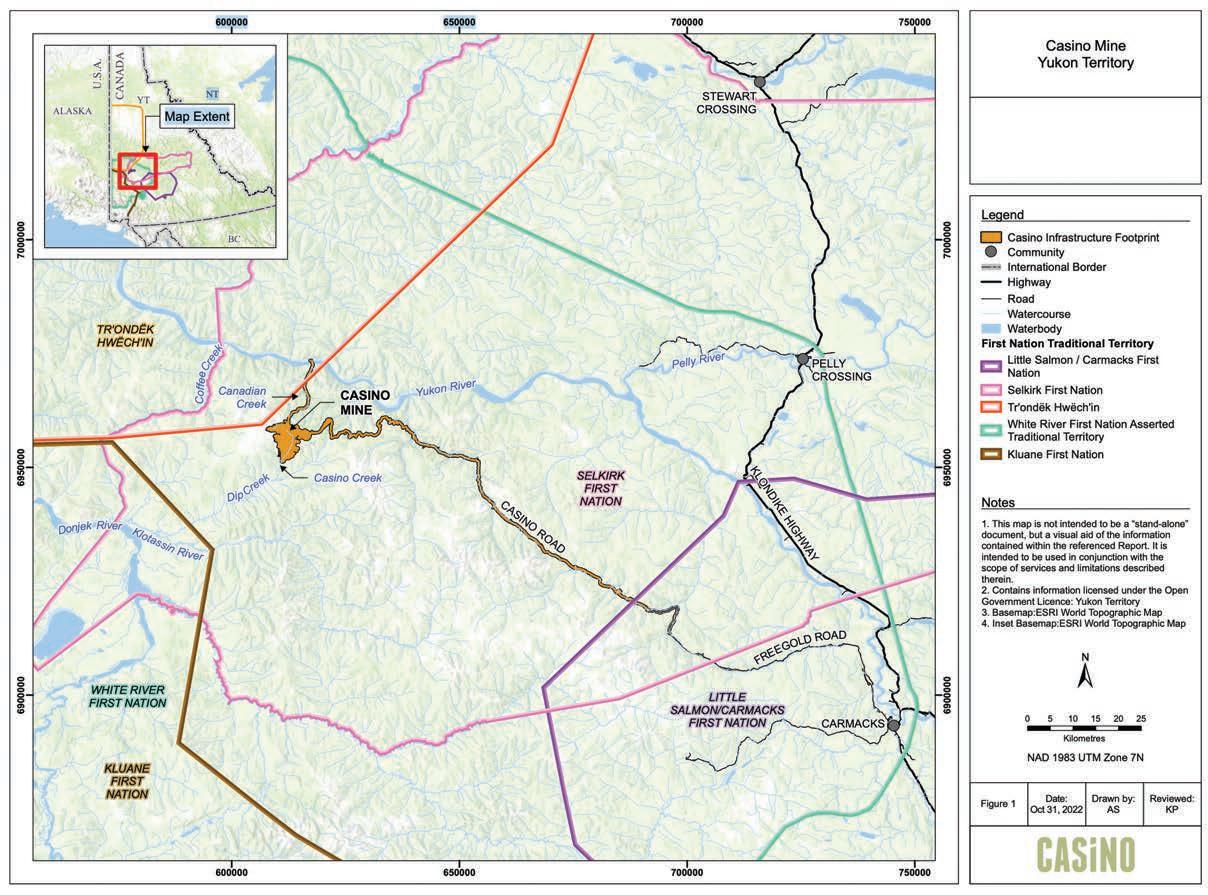

Near Carmacks, Yukon — Decision time for Western Copper and Gold’s (TSX: WRN; NYSE-AM: WRN)

$3.6 billion Casino project in remote Yukon looms less than four months away.

Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO) holds about 8% of the company and must decide by Nov. 28 whether to further invest in the world’s fifth-largest copper-gold project controlled by a junior miner.

“What’s next, we’ll see, but that’s going to be obviously a key development here,” Western CEO Paul West-Sells said in a late July interview in the Yukon with The Northern Miner. “They’re saying the right things, they’re saying ‘Paul, yep, we’re dotting i’s, crossing t’s, we like the project, you know, all the work we did.’”

Casino is named for a creek that runs through the site, 380 km northwest of the Yukon capital, Whitehorse. It also received the backing of a 5% investment by Mitsubishi Materials in March. With the potential to produce 11 billion lb. copper and 21 million oz. gold, it’s Canada’s largest critical minerals project, West-Sells says.

The project has the size to interest major companies on the hunt to supply some of the 12 million tonnes of copper over the next decade needed for zero-emission technologies, widely regarded as crucial to keep global warming to less than 1.5 degrees Celsius. Meanwhile, mines have only supplied 7 million tonnes of copper in the last two decades, Western says.

The project’s scope combines with its location in the desirable jurisdiction of Canada versus troubled South America, plus reasonable economics and good relations with First Nations, West-Sells said.

“Those four things with the background of a strong copper price environment, electrification and every major mining company looking for good copper projects and you’ve got gold companies looking for the copper projects,” he said. “That’s what’s causing the excitement in the story.”

Critics might note Casino lacks road and power connections and has low grades. The mine plan so far is limited to 1.2 billion proven and probable tonnes in its mill reserve because tailings storage is constrained. The ore grades 0.2% copper, 0.2% gold and 0.02% molybdenum for 5.1 billion lb. copper, 8.5 million oz. gold and 572 million oz. molybdenum, according to a feasibility study released last year.

“I always pull my hair out when people show graphs of our project and they just have the copper and it’s like, oh, this thing looks horrible because it’s only got this little copper grade,” West-Sells said during an on-site briefing. “You need all three to make this thing work and molybdenum is a significant part of the story.”

Potential molybdenum giant Casino, which is about 17% molybdenum, should be a top-three producer in the Americas of the metal used to strengthen steel, the CEO said. The deposit is 46% copper and 34% gold. It benefits from a 0.43:1 strip ratio, and an 800 metre by 500 metre core zone showing drill results of 289.6 metres grading 1% copper equivalent from 36.6 metres depth, and 65.8 metres of 2.5% cop-

per equivalent from 10.6 metres downhole.

“I can put a resource around this if I increase my cut-off grade and it’s 430 million tonnes of 0.6% [copper equivalent] in this very rich part of the deposit,” said West-Sells, who trained as a metallurgical engineer. “If we start mining there, for the first four years we’re over that 0.6% and that’s significant because copper mining [at other places] in western Canada is a low-grade, high tonnage operation.”

Western is now engaged with Mitsubishi in a work program on copper concentrate quality and expects to make an announcement within weeks, West-Sells said. The junior is also preparing an envi-

ronmental assessment application to be submitted next year in a process that may take three years for approval.

Work on the assessment actually dates back to 2014 and since then

Western and First Nations have improved proposed tailings storage plans and the development of an access road.

Western took over the project in 2006 in a merger with Ross Beaty’s

Lumina Resources. Drilling and studies accelerated three years ago with a new resource estimate followed by a preliminary economic assessment, Rio Tinto’s interest and the feasibility study. Rio has said its Nuton copper recovery technology wouldn’t apply to the Casino deposit because of its strong gold and molybdenum content, WestSells said.

The Yukon government has already committed $130 million and started to build 100 km of access road from Carmacks, a village bearing the name of a co-discoverer in 1896 of the Klondike gold rush 350 northwest in Dawson City. Western is to build the remaining 100 km to the project with 30% government financing.

The Vancouver-based company plans to ship the concentrate out through the Alaska port of Skagway, one of the gateways to the Klondike 125 years ago and where Yukon has a long-term agreement with the state.

The mine is to be powered by liquid natural gas but the company is encouraged by talks started this year between the Yukon and British Columbia governments to link their grids. It would require some 760 km of new line, so would take more than several years to build before a potential connection to Casino, West-Sells said.

After-tax, Casino has a $2.3 billion net present value at an 8% discount rate, an 18.1% internal rate of return, a three-year payback period and $10 billion in cash flow over the mine life. Sustaining capital would be $751 million for total capital costs of $4.4 billion.

“It’s really driven by those first four years,” said West-Sells, a rare CEO who doesn’t sit on the board of directors. “It’s that early high grade, low strip ratio that really drives things.” TNM

The global uranium industry is bracing for potential fallout from a recent military coup in Niger, accounting for about 5% of global nuclear fuel production.

Several miners active in Niger issued updates following the hostilities on July 28, reassuring investors and stakeholders the situation was under control and their operations remained largely unaffected.

GoviEx Uranium (TSXV: GXU), which in September last year released a feasibility study on its Madaouela project in Niger, confirmed on Aug. 1 that its operations there are proceeding without interruption, with its employees safe and the communities where they operate undisturbed. It was quick to imply that should the situation become untenable, it has an international presence and could quickly leave.

“Whilst we are dedicated to Niger, it is important to note that GoviEx is an international company with a diverse portfolio of projects. Our advanced mine-permitted uranium project in Zambia is operating as normal, showcasing our global presence and operational resilience,” the company said

in a news release. Global Atomic (TSX: GLO), another emerging player in the Niger uranium min ing sector, declared Aug. 1 that its entire team in the country is safe, and normal business operations are continuing.

The company’s Dasa project is progressing, with substantial underground development and preparations for mining operations said to be well underway.

In an Aug. 1 note, Canac cord Genuity mining ana lyst Katie Lachapelle said Niger currently produces about 6 million pounds of uranium oxide yearly and is set to see this position increase with developments at the Madouela and Dasa projects.

“Niger supplies about 15% of France’s uranium needs and accounts for one-fifth of the European Union’s (EU) total uranium imports,” said Lachapelle.

But while the uranium industry faces mounting uncertainties after last week’s coup against Niger’s democratically elected president, Mohamed Bazoum, the geopolitical turmoil has done little to move

the spot price.

According to market research firm and consultancy UxC, the uranium spot price rose to US$56.25 per lb. on Aug. 1, up from US$56.15 a week earlier. While the price has doubled over the past three years, it remains far below its peak of US$140 in 2007.

The political crisis in Niger has sparked international concern, leading to travel and economic sanctions against the impoverished West African nation.

The coup deepened the political crisis in the country. Following the seizure of power by the junta, senior politicians, including the mines minister, were detained on Aug. 1, Bloomberg reported. In response, the West African regional economic body, ECOWAS, announced sanctions against Niger and urged the junta to reinstate the ousted president within one week.

The United States in late July threatened the junta that its support for the Western African nation will dry up unless President Bazoum was released and returned to power. Niger has benefited from hundreds of millions of dollars worth of U.S. military aid and counterterrorism training and has been hosting about 1,100 U.S. troops.

Geopolitical instability has been brewing in the region for some years. Southwestern neighbour Burkina Faso saw two coups in 2022. More than 40% of that country, also a former French colony, is currently outside government control. Thousands have been killed, and about 2 million people have been displaced by fighting since 2015, when an insurgency that began in Mali in 2012 spread to Burkina Faso and other countries

in the Sahel region, south of the Sahara Desert.

Amid concerns for the uranium industry, Niger’s stability in the mining sector has been notable over the last 50 years, despite regime changes, according to Lachapelle.

European nuclear needs

As France, which still maintains a military presence in Niger, evacuated its citizens from the country following the coup, the EU nuclear agency Euratom has stated that there is no immediate risk to nuclear power production in Europe. Utilities in the EU currently hold sufficient uranium inventories to last for three years.

However, in the longer term, the situation in Niger could affect uranium prices and drive utilities to seek contracts with lower-risk jurisdictions.

French nuclear fuels company Orano said on Aug. 1 that operational activities at its Arlit and Akokan sites in Niger are continuing, as well as at its headquarters in Niamey.

Orano highlighted that 99% of its staff in the country were Nigerien nationals, ensuring continuity in their mining operations. TNM

Coups d’états are on the rise in Sub-Saharan Africa. Since 2020, military coups (attempted or successful) took place in Mali, Chad, Burkina Faso, Guinea, Sudan, and most recently in Niger. The increased political instability can have significant adverse impacts on projects operated by mining companies.

Unstable political environments can be extremely challenging for mining companies who face a myriad of risks that could potentially deprive them of their ability to operate, control and reap the benefits of their investments.

Risks arising

Security risk. The most immediate threat to a mining project during a coup d’état is the security of the mine. The physical security of the mining camp, the employees, materials on site, and transport of minerals to point of export are a potential target of fighting between the existing regime and the perpetrators of the coup.

Sanctions Risk. In times of instability and in an effort to apply maximum pressure on the perpetrators of the coup, the international community and the surrounding states could also decide to impose sanctions not only on the new regime but also on the host state as a whole. The most common type of sanctions in these situations include: closure of borders by surrounding states, a halt to financial transactions, and a freeze of assets of the host state. These sanctions can have an indirect but significant impact on the ability of mining companies to operate in the host state. Consequences could range from the restrained ability of mining companies to import equipment

and materials necessary for mineral extraction, inability to export the minerals abroad, or the mining company being unable to access its own assets or even repatriating foreign currency abroad.

Adverse regulatory measures by the new political leadership. During or after a coup, a mining company operating in the host state could be targeted with a variety of measures from the new regime, which could directly hinder its ability to operate and enjoy the benefits of its investment. For example, if the mining company’s home state is not a supporter of the new political leadership, adverse measures by the new regime could include: withdrawal or cancellation of the mining concession; frivolous judicial actions targeting the mining company’s employees in the host state (e.g. exorbitant tax demands; harassment and arrest of the management on the ground); seizure of the min-

ing company’s assets (such as the equipment on the mining site, the minerals extracted or even the foreign currency in local banks).

Governments change, all the time and everywhere. That is their nature. However, in states with a history of political instability and where mining revenues account for an overwhelming share of the state revenue, mining companies investing and operating should always: anticipate, adapt and lobby.

Once a coup happens, it is most likely too late to take meaningful action. That is why at the time of making a final investment decision or even during the operation of the project, it is crucial to carry out a regular horizon scanning of the political developments and economic landscape in the host state. This strategy can provide the mining company with enough time to

assess and weigh its options and, if necessary, to manoeuvre.

One of the legal strategies available for mining companies is seeking the protection of a bilateral investment treaty (BIT). Under a BIT, investments made by foreign mining companies are provided with various kinds of substantive protections against a host state’s wrongful conduct.

The protections that are typically accorded to foreign investors under a BIT include: the guarantee of treating the investor fairly and equitably; not to discriminate against the investor; to allow the investor to freely repatriate funds abroad; to guarantee the full protection and security of the investment; to provide adequate and prompt compensation in the event the investment is expropriated; and to resolve any disputes that arise between the investor and the host state before a neutral arbitral tribunal. If any of these protections are breached by the host state, the mining company is entitled to seek damages.

If there is no treaty between the host state and the mining company’s home state, it may be possible to route the investment through a state that does have a treaty in place with the host state. Mining companies can do so by introducing in the chain of ownership of the investment, a company incorporated in a country which has signed an investment treaty with the host state. This type of restructuring provides investors with a gateway to international legal protection of their rights.

Another option to consider is to seek political risk insurance for the mining project. Political risk insurance could be helpful as it can provide additional cover for political violence or war, which would not come under the scope of a BIT. This type of insurance is provided by both government backed agencies

and private insurance companies and it is important to note that the vast majority of BITs allow political risk insurers to “subrogate” insured investors’ claims against host states, thereby providing a legal basis for the insurance agency to recover benefits paid out to investors.

Finally, mining companies’ recourse to legal remedies against host governments can sometimes lead to undesirable outcomes and could be inflammatory. Thus, commercial interests could sometimes be protected through intensive lobbying and dialogue with the new political regime. For example, a mining company may consider offering a number of incentives to the new government (without endangering its own commercial viability) in order to secure and maintain a presence in the host state. A mining company may also be prepared to slightly decrease its shareholding in a mining project for the benefit of the host state, and offer to build mining infrastructure that could benefit the country (e.g. a copper smelter) in return for security and clarity over its mining permit for another 20 years.

There is no one-size-fits-all solution to deal with coups d’état. However, mining companies have a number of legal strategies available to them under international law in order to mitigate the adverse consequences of a coup. To implement these strategies effectively, timing is key and it is important to seek appropriate legal advice from public international law specialists from the early days of the investment. TNM

Ahmed Abdel-Hakam is a Londonbased Partner at Volterra Fietta. Ahmed has experience in representing private companies, state-owned entities and governments in cases which raise complex questions of international law.

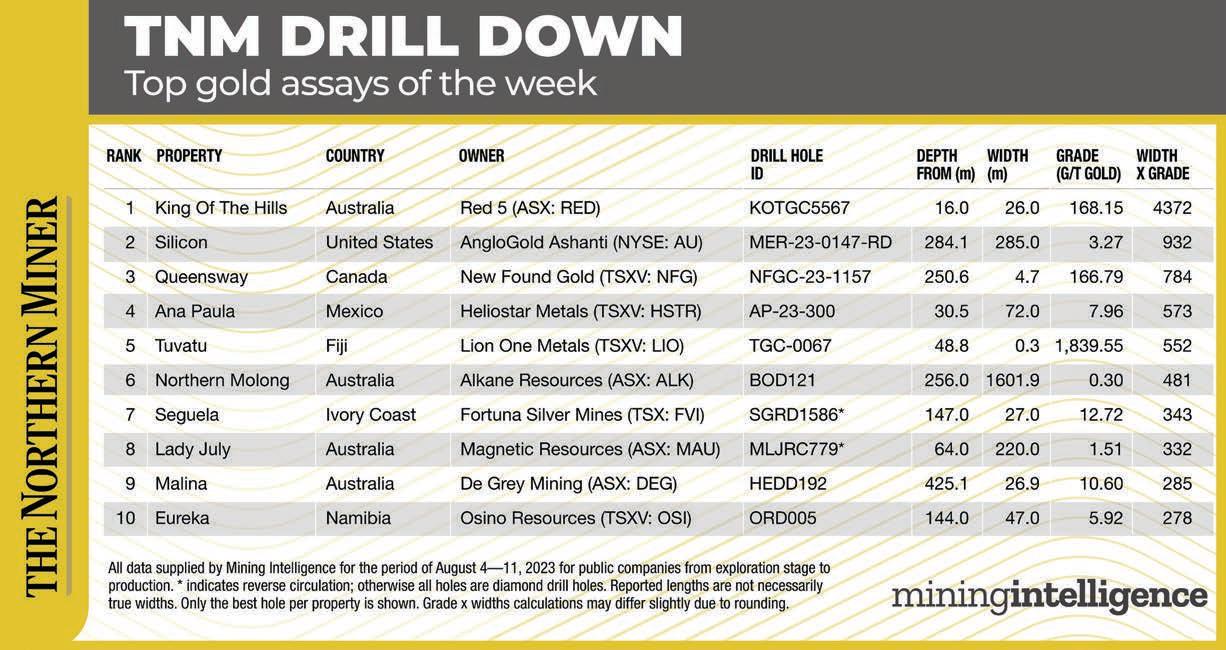

Our TNM Drill Down features highlights of the top gold assays from Aug. 4-11. Drill holes are ranked by gold grade x width, as identified by our data provider Mining Intelligence. (www.miningintelligence.com)

The King of the Hills project in Australia tops last week’s ranking with the best width x grade value reported since The Northern Miner’s first weekly Drill Down report was published on July 25 last year. Red 5 (ASX: RED) said on Aug. 8 that hole KOTHGC5567 cut 26 metres grading 168.15 grams gold per tonne from 16 metres depth for a width x grade value of 4,372. Drilling activity at the King of the Hills mine site in Western Australia has helped solidify the mine plan for 2024 and uncovered the possibility of expanding the areas where valuable resources like diamonds are found. The diamond drilling work has increased confidence in operating the mine in 2024, as around 85% of the planned drilling has been completed. Drill results show there’s a chance to prolong the lifespan of the mine by finding more resources underground, especially in the Regal and Eastern Flank sections. King of the Hills has a June 2022 total measured, indicated and inferred resource of 95.3 million tonnes at 1.4 grams gold per tonne for 4.4 million oz. of contained gold.

Additionally, the tests done in the latter half of FY23 have revealed high-quality deposits

in the extended resource areas and have helped control the quality of ore being extracted from underground.

In the U.S., AngloGold Ashanti (NYSE: AU) reported the second-best assay result last week with a width x grade value of 932 at the company’s Silicon-Merlin project in Nevada.

Hole MER-23-0147-RD cut 285 metres grading 2.27 grams gold per tonne from 284.1 metres depth. The project, in which Orogen Royalties (TSXV: OGN; US-OTC: OGNRF) holds a 1% net smelter return royalty, is said to have an exploration target of

230-250 million tonnes grading 0.8-1 gram gold per tonne for 6-8 million oz. of metal. As of July, the company has completed more than 261 drill holes totalling over 120 km of drilling at Merlin. The Merlin zone remains open to the west, southwest, and north. AngloGold expects to complete a resource delineation drilling program by the end of the current quarter. By year-end, AngloGold plans to release a concept study on the combined Silicon-Merlin project, including an initial resource declaration at Merlin. Drilling continues at Silicon Central and

Merlin for resource conversion and expansion. Last week’s third-best intercept came from Canada, where drilling at New Found Gold’s (TSXV: NFG) Queensway project in Newfoundland, returned 4.7 metres grading 166.79 grams gold per tonne from 250.6 metres depth in hole NFGC-231157, for a width x grade value of 784. On Aug. 9, the company announced the results from nine diamond drill holes completed as part of a follow-up program at its new Iceberg discovery near Gander. Results include 167 grams gold per tonne over 4.7 metres in

NFGC-23-1157, intersecting 32 metres down dip of a previously reported 19.6 grams gold over 5.3 metres in NFGC-23-1217. This interval is interpreted to be close to true width and occurs at a vertical depth of 170 metres, demonstrating strong highgrade gold continuity down-dip at depth. Iceberg is 300 metres northeast of Keats Main zone along the Appleton fault zone. The segment is defined over a strike length of 665 metres, with high-grade gold mineralization starting at surface and currently extends to a vertical depth of 170 metres. TNM

market to raise capital. It appears like Snowline is siphoning most of the interest, including a $19-million investment from B2Gold (TSX: BTO) and a surging stock.

“There’s a general disdain for mining these days,” McConnell said. “And precious metals companies in particular have not been good at creating shareholder value. So, you know, investors are looking at other areas to invest their money.”

Victoria’s backers include GMT Capital with 9.9%, Sprott Asset Management with 6.9%, fund manager Van Eck with 5.5%, CI Investments at 5.4%, Fidelity Investments at 4.8% and the Franklin Gold and Precious Metals fund with 4.4%.

Investors in Banyan include Victoria at 11.3%, Osisko Development (TSXV: ODV; NYSE: ODV) at 4%, Franklin with 9.8% and Fidelity at 7.4%. Other institutions and high-net-worth individuals hold 30% and retail investors also have about 30%.

“Not getting tremendous recognition in the market for having a very significant deposit is definitely one of the challenges, not wanting to burn up cash is another,” Christie said. “There are people waiting for our metallurgy.”

Banyan has $11 million in the bank after completing this year’s 25,000-metre phase one drilling program. Assays reported on July 19 included drill hole AX-23-415 that cut 37.4 metres grading 0.82 gram gold per tonne from 103.4 metres depth; and AX-23-429, which cut 18.5 metres of 2.22 grams

gold from 182 metres.

“That was important for us to show that this [mineralization] is continuous between Powerline and Aurex Hill,” she said. “The key difference between us and [Snowline] is they found their intrusion. We’re still in the rocks that the intrusion is leaked out into. We’re in the metasedimentary host.”

Banyan is poised to drill perhaps another 10,000 metres in phase two this year and conduct geophysical work to try to locate the intrusion, Christie said. The company is exploring design options that might include a higher-grade Powerline pit of 0.95-gram ore for 2 to 4 million oz. of production. It intends to have a flow sheet and more results on recovery levels by late autumn, the CEO said. So far, they’re showing a 90% average.

Still, Christie says it’s too early to start a preliminary economic assessment, which is required by the end of 2025 for full ownership of Aurmac from Victoria, plus $2 million in cash or shares.

“We’re not there yet. We actually think we’ve got a lot more room to grow and add ounces to this deposit as well as grade,” she said.

“There’s no rush for me to earn 100% because if I can get my market cap up, that’s less dilutive and I can pay them in shares.”

Eagle mine

Over at Victoria Gold’s Eagle mine, the company is bouncing back from missing output guidance last year. For the first six months of 2023, it’s posted a 47% increase over the same period last year, producing 83,188 ounces. Victoria was hit by

Covid-19 issues such as high worker turnover and repair delays. The company, which began production in July 2020, responded with more emphasis on recruitment, retention and preventative maintenance.

“The two quarters this year we exceeded our guidance,” McConnell told The Northern Miner in an interview at the mine. “We’re in the penalty box because we missed guidance last year, and we’re undervalued. When you look at us compared to our peers, we trade at a lower price to net asset value and once we demonstrate that Eagle will run at plus-175,000 oz. per year heading towards 200,000 oz. per year the share price will be re-rated.”

Victoria is also considering the prospect of the Raven deposit, discovered 15 km east of Eagle in 2018. A first resource last year estimated

it at 20 million tonnes grading 1.7 grams gold for about 1 million ounces. Assays reported in January included 83.5 metres grading 3.59 grams gold per tonne starting from 213.5 metres. Victoria is drilling 20,000 metres at Raven this year.

Maybe Raven, across a valley from Banyan, could be developed one day with a mill near both operations, Christie says. But kitchen table talk at the McConnellChristie house doesn’t dwell on M&A, she says.

“Victoria and Banyan have taken a lot of steps should Victoria feel it’s the right time to make an offer to Banyan. They have independent directors in place and they’re responsible for that,” she said. “My job is to make sure that there are competitors for and when that happens.” TNM

EXPLORATION | Junior looks for new partner with expertise in sediment-hosted copper

BY ALISHA HIYATEAl Fabbro has been looking for answers for a decade now, ever since Midnight Sun Mining (TSXV: MMA) acquired the Solwezi copper project in Zambia.

The chief executive believes that Solwezi could hold the same scale of deposits as First Quantum Minerals’ (TSX: FM) neighbouring Kansanshi mine, which produced 146,000 tonnes of copper last year.

Or for that matter, the other nearby world-class copper mines: Barrick Gold’s (TSX: ABX; NYSE: GOLD) Lumwana, First Quantum’s Sentinel, or on the other side of the border with the Democratic Republic of Congo, Ivanhoe Mines’ (TSX: IVN) rich Kamoa-Kakula.

Solwezi has generated some excellent drill results. That includes a 2013 reverse-circulation hole that returned 21 metres grading 3.26% copper from 20 metres depth in the 22-zone. The official discovery hole, diamond drill hole DD-1410 completed the following year, returned 11.3 metres (true width) at 5.71% copper.

For the past 10 years, those and similar results hinting at something big have kept Fabbro and VP exploration Rob Sibthorpe going. But modest financings raised through the market — or friends’ and families’ pockets — have only gone so far.

Without a major drilling program — out of reach for a junior of its size — Midnight Sun can’t turn its prospective geology and good neighbourhood into a discovery the scale of which would interest a major.

Fabbro, a 30-year veteran in the finance and mining sectors, including stints at Yorkton Securities and Canaccord Genuity, and as a lead director for Roxgold (now part of Fortuna Silver Mines [TSX: FVI; NYSE: FSM]), says the project has generated “great smoke,” so far.

“There’s a forest fire going on here, but we still don’t know where the forest fire is,” he told The Northern Miner in July.

But Fabbro is hoping to soon attract a partner with deep enough pockets to fund the 40,000-50,000metre drill program needed to

get real answers about Solwezi’s potential.

Kansanshi parallels Midnight Sun’s 506-sq.-km Solwezi land package contains multiple targets and two high-grade discoveries — Kaziba Dome and Mitu — that are similar to Kansanshi.

Kaziba is underlain by a basement dome, the same geological feature that’s associated with copper mineralization at Kansanshi, Lumwana, and Sentinel.

Its 22 Zone discovery at Kaziba Dome was its earliest target and the one that’s seen the most drilling so far. However, it also seems to be the most complex target at Solwezi.

“We had a lot of good holes, but then we figure he had the structure and we’re marching along it, and God, we’d hit this barren hole of marble,” Fabbro says. “It was really hard to figure out.”

The mystery of the spotty results hasn’t been easy to solve.

But parallels with Kansanshi, a sediment-hosted vein deposit that lies just 10 km to the northeast, suggest that may not be unusual.

“Kansanshi is basically a lowgrade deposit maybe 0.25 to 0.3% (copper), then they hit these big wide 10-metre-wide veins that run up to 5% copper, and the 5% carries the low grade,” Fabbro says. “But if you don’t have the veins, it doesn’t work.”

Those veins are present at targets at Solwezi, including at the newly identified Crunch zone, which has returned 10 metres of 2.5% copper in sections with those wide calcite veins.

In 2020, Midnight Sun signed an option agreement with Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO).

Under the $51-million, threestage JV agreement, Rio Tinto could earn up to a 75% stake in Solwezi. The investment would fund enough work to finally understand

the project’s potential.

But Rio terminated in June 2022 without earning an interest.

It wasn’t because of a lack of potential, though, Fabbro says.

“While Rio Tinto were not satisfied with the results generated by their work on our properties, I do not share their feelings,” he said in a news release at the time. “From the outset of this agreement, Rio Tinto made it clear to me they were looking for a ‘Rio sized deposit.’ Falling short of their parameters does not mean we don’t have the makings of an economic orebody on our hands.”

Fabbro notes that few companies, including Rio Tinto, have expertise in sedimentary-hosted copper compared with porphyry deposits.

“Until (Robert) Friedland came across with Kamoa and Kakula, these things were not really well recognized, even with the success of Kansanshi and First Quantum,” Fabbro says.

Rio’s key expert in the deposit type, who had been the technical lead at Solwezi as part of its option agreement, left the company shortly after drilling began.

After that, Rio focused more on geophysical work, in the end completing less than 6,000 metres in combined diamond, RC and aircore drilling.

While it was disappointing to

lose a potential major partner, Fabbro notes that Midnight Sun still got some benefits out of the shortlived arrangement, including cash payments and reams of geophysical data. It’s brought on Simon Dorling, an expert in the Zambian-Congo copper belt, as an adviser to bring the Rio-generated data together with recent research in the region and previous data from Solwezi to build a comprehensive database and help interpret structural-geological settings to identify new targets.

Fabbro says there will be a drill program this year at Solwezi – the only question is the number of metres and who will fund it.

Copper moment

As miners scramble to secure deposits of the red metal in light of its importance to the energy transition and a projected supply gap by 2030 or earlier, copper is in the spotlight. Zambia, as a prospective, underexplored and mining-friendly jurisdiction appears poised to benefit. According to Bloomberg, Barrick Gold recently approached fellow copper belt miner First Quantum with a takeover offer. And in July, Barrick CEO Mark Bristow singled out the Zambian-Congo copper belt as an area where the company is looking for copper assets as it’s also invest-

ing to extend Lumwana’s mine life. In December, Kobold Metals –an AI exploration startup backed by the likes of Bill Gates and Jeff Bezos — committed to US$150 million in funding for the Mingomba copper-cobalt mine in Zambia.

Fabbro says the current President Hakainde Hichilema, who is the leader of the United Party for National Development and was elected in 2021, “gets mining.”

“He is a man of the people of the north, where the mines are,” Fabbro says.

Hichilema has said he’s targeting a 3.5-fold increase in copper production to 3 million tonnes per year by 2032.

Other targets

Recent work has also focused on the Mitu trend, an 8- to 10-km wide corridor of intense deformation that lies on the western margin of the Solwezi Dome on the property, and about 20 km south of Zone 22.

Last year, Midnight Sun completed a 17-hole, 3,600-metre diamond drill program — seven holes at Mitu and 10 at the Crunch zone, which lies between the Kaziba and Solwezi zones.

Drilling at the Mitu Trend, an “ore shale” type deposit like Kansanshi, has returned highlights including 11.6 metres of 3.44% copper 0.067% cobalt, 0.058% nickel and 331 parts per billion gold in 2017, and 11.5 metres of 1.41% copper, 0.11% cobalt and 0.3% nickel in hole MTDD044 completed last year.

Finally, Dumbwa, a 20-km-long, 1-metre-wide soil anomaly that’s on strike with Kansanshi, is the least developed target, but perhaps the most prospective. Dumbwa is believed to be analogous to Lumwana, 60 km west, with stacked mineralized horizons, and will be the company’s priority this year. So far, it’s only seen a few shallow holes, with a highlight hole of 16.5 metres of 0.93% copper, including 5 metres of 1.36% copper.

Midnight Sun has a tight share structure for a 10-year-old junior mining company, with 117.9 million shares outstanding. At press time in Toronto shares traded at 23¢ in a 52-week window of 14-35¢, for a market cap of $27.1 million. TNM

COPPER | Miner completed first shipment of copper concentrate at QB2 in second quarter

Teck Resources (TSX: TECK.A, TECK.B; NYSE: TECK), Canada’s largest diversified miner, has revised down copper production targets for the year after its Quebrada Blanca 2 open-pit mine in northern Chile didn’t meet expected output figures.

QB2, as the new mine area is known, began production in March, two years later than planned due to weather and construction disruptions related to Covid-19 . In the process, the key growth project saw costs balloon.

The Vancouver-based miner lowered its guidance for QB2 to between 80,000 and 100,000 tonnes for 2023 but continues to expect to achieve full production rates by the end of this year.

QB2 is the first step in Teck’s plan to grow its copper footprint and implies extending the aging deposit’s life by 28 years.

QB’s next development phase will be the Quebrada Blanca and mill expansion (QBME). The QBME feasibility study, including all environmental baseline activities, is expected to be completed before year-end.

In terms of overall copper production for the year, the company now expects to churn out between 330,000 and 375,000 tonnes, down from a previous estimation of 390,000 to 445,000 tonnes.

Teck noted its 2024 to 2026 guidance of 545,000 to 640,000 tonnes of copper remains unchanged.

It also reiterated its forecast for steelmaking coal output of 24

million to 26 million tons in 2023, and a similar annual range from 2024 to 2026.

Teck reported lower lead production at its Red Dog operation, one of the world’s largest zinc mines, located north of the Arctic Circle in Alaska.

Lead output at the mine is now expected to be between 95,000 and 110,000 tonnes, compared to a previously targeted 110,000 to 125,000 tonnes.

Teck said it completed the first shipment and sale of copper concentrate at Quebrada Blanca 2 in the second quarter, and it continues to expect to be operating at full production rates by the end of 2023.

Due to delays in construction and commissioning, its 2023 production guidance for QB2 was adjusted to 80,000 to 100,000 tonnes but its prior annual guidance for 2024 to 2026 is unchanged.

“We continue to explore a range of options to realize the full potential of our world-class base metals business and to progress our overall copper growth pipeline, including receiving regulatory approval for our Zafranal project, in May,” chief executive

Jonathan Price said.

Zafranal, in Peru, has an expected mine life of 19 years and will produce copper-gold concentrates through an open-pit mining and conventional concentration process. The mine and concentrator are expected to produce an average of 133,000 tonnes of copper contained in concentrate during its first five years of production. TNM

BY HENRY LAZENBY

BY HENRY LAZENBY

NovaGold Resources (TSX: NG; NYSE: NG) has received a further US$25 million payment from Newmont (TSX: NGT; NYSE: NEM) as part of the major’s 50% acquisition in the Galore Creek Partnership (GCP). Following the transaction, Newmont will form a partnership with Teck Resources (TSX: TECK.A, TECK.B; NYSE: TECK), the owner of the remaining stake to consider the project’s future development.

Under the 2018 share purchase agreement with NovaGold, Newmont made staged and contingent payments totalling US$275 million to gain participation in the copper-gold project in northwestern British Columbia.

Newmont made an initial payment of US$100 million, with an additional US$75 million scheduled upon completion of the prefeasibility study or within three years from closing. Another payment of US$25 million will be made upon completing the feasibility study or within five years from closing, with a final contingent payment of US$75 million, subject to a decision to develop the project.

At the time of the initial agreement, Newmont’s previous president and CEO, Tom Palmer, said in a statement that Galore Creek holds the potential to support “decades of profitable copper and gold production” in a favourable mining jurisdiction, in line with its strategy to

Shares in New Gold (TSX: NGD; NYSE: NGD) fell more than 11% in Toronto on Aug. 10 after it halted underground mining activities at its New Afton gold-copper mine in Kamloops, British Columbia, following an inspection. The Canadian company said experts observed geotechnical variances at the mine’s tailings storage facility during an inspection on Aug. 9. It added the area will have to be

further reviewed by the company’s engineer.

create long-term value for stakeholders.

He also highlighted the benefits of partnering with Teck, leveraging both organizations’ technical, financial, and sustainability strengths to evaluate and refine Galore Creek development plans. Additionally, the partnership aims to build on Teck’s established relationships with the Tahltan First Nation and the provincial government.

In the coming months, Newmont and Teck will define the scope, budget, and timeline for prefeasibility studies, with an expected completion period of three to four years and a yearly budget of US$10-US$15 million (on a 50% basis).

The governance of the GCP will be overseen by a management committee comprising leaders from Newmont and Teck, supported by a GCP study director and team, along with experts from both companies.

Galore Creek holds potential as one of the largest undeveloped copper-gold projects, with measured and indicated resources of 9.3 million oz. gold and 5.1 million tonnes copper held in 1.1 billion tonnes of material grading 0.26 gram gold per tonne and 0.47% copper, as previously reported by Teck in 2014.

The GCP is currently undertaking a prefeasibility study, expected to be completed by mid-2023, which will underpin a major regulatory process incorporating proposed project changes.

A 2023 field program is under-

way and is planned to continue through October. The program includes a drill campaign of about 25,000 metres focused on geotechnical, metallurgical, and resource development drilling.

In addition to the drill program, environmental baseline studies are ongoing throughout the project area and test pitting is underway to characterize surface materials for infrastructure placement and construction. The field and operations team is also working to improve the safety of the access road between Highway 37 and the Ch’iyone camp.

GCP would add to Newmont’s development track record, after building nine new mines and expansions on four continents over the past 10 years, all delivered on or ahead of schedule and at or below budget. These include Akyem in Ghana, Merian in Suriname, and the Tanami expansion project in Australia; as well as several projects in Nevada since 2013 such as the Phoenix copper leach project, the Turf vent shaft at Leeville, Long Canyon, Twin Creeks Underground and Northwest Exodus.

Additionally, the company’s acquisition of Cripple Creek and Victor in Colorado in 2015 followed a subsequent expansion of the mine in 2016.

Newmont shares traded at $54.02 at press time in Toronto, valuing the company at $42.9 billion. The company’s shares traded in a 52-week window of $51.44 and $76.08. TNM

As a result, New Gold said that it has suspended underground mining activities to allow for the review to move forward.

Milling operations will continue as normal, using existing surface stockpiles while the review takes place, it said.

Shares in New Gold bounced back by 8% at press time in Toronto following the Aug. 10 drop, and traded at $1.34 apiece, valuing the company at $916.9 million. TNM

MEXICO

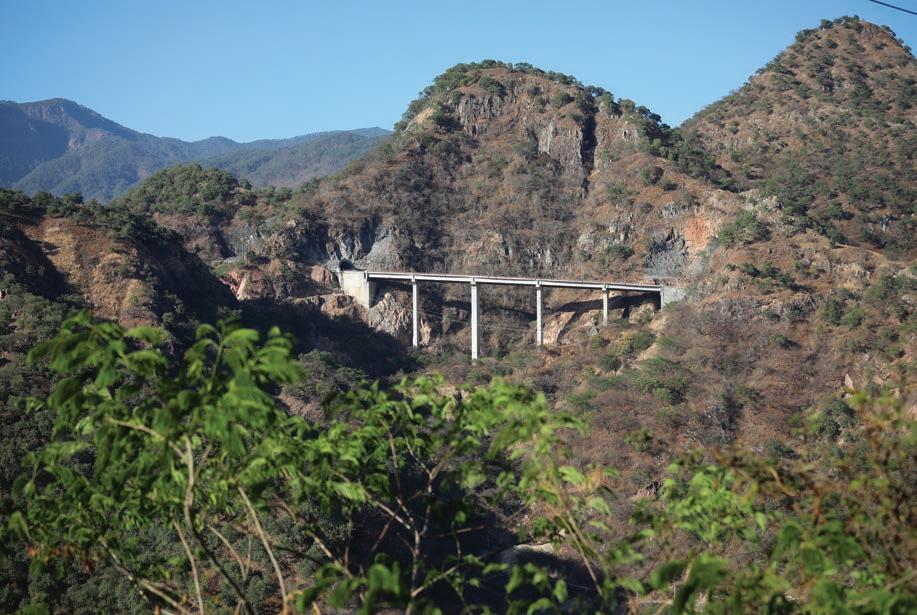

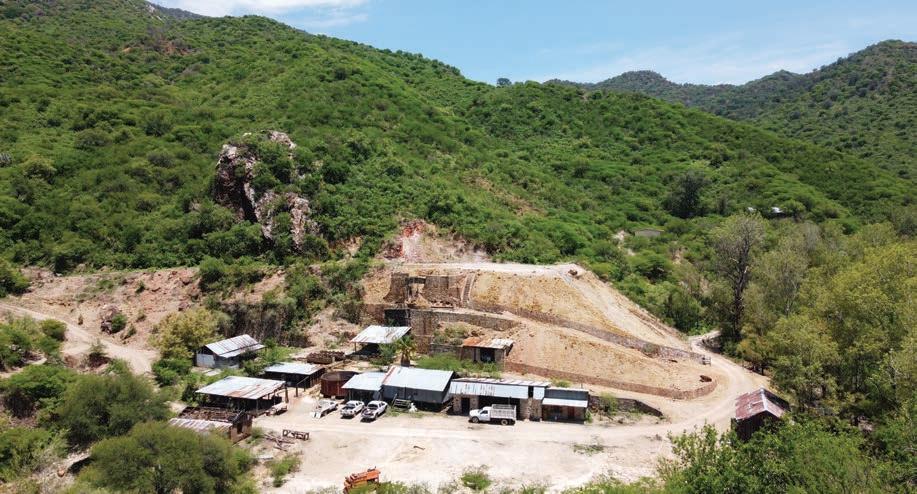

BY COLIN MCCLELLANDWhat’s happening in Mexico? Mining project investments soared this year in the world’s largest silver producer even as the government targeted companies in a restrictive new law a year after it nationalized the lithium industry.

Exploration, development and working capital spending jumped to US$122.4 million in this year’s first quarter, 55% more than the previous three quarters combined, according to data compiled by Mining Intelligence, part of The Northern Miner group. Spending increased even more in the second quarter to US$137.7 million, the data show.

Last year, the government of President Andrés Manuel López Obrador approved legislation giving the state exclusive rights in lithium, although Mexico doesn’t have any producing mines yet. Then in May, the ruling Morena party passed a new mining industry law that shortened concessions to 30 from 50 years, tightened rules for water permits, boosted local community benefits and imposed a public tender system for all concessions instead of claims staking.

While Mexico’s national mining chamber, Camimex, said the new law could cost US$9 billion in investments and up to 420,000 jobs, companies with existing projects such as Torex Gold Resources (TSX: TXG), which has operations in Guerrero state, and Grupo Mexico, the world’s fourth-largest copper producer, expressed confidence they won’t be affected.

“Given that the tenure of Torex concessions has been granted on a 40- and 50-year basis, we see minimal impact to our operations in Mexico,” a company spokesperson said in a statement to The Northern Miner in May. “We are confident that discussions between industry and government will be ongoing.”

If established projects are protected to a point, it still begs the question of whether new entrants will gamble contending with the jurisdiction at all. Just three companies accounted for more than half of the second-quarter spending mentioned above: Discovery Silver (TSX: DSV, US-OTC: DSVSF), Prime Mining (TSXV: PRYM; US-OTC: PRMNF) and Luca Mining (TSXV: LUCA; US-OTC: LUCMF).

Discovery spent US$38.4 million during the quarter as it advanced drilling for a feasibility study on its US$455 million Cordero project in Chihuahua state. It has a database of 310,000 metres of drilling in 800 holes, including assays released this month that cut 52 metres grading 51 grams silver per tonne, 0.2 gram gold, 0.6% lead and 0.9% zinc from 102 metres downhole.

“The additional drilling we have completed, including this current set of drill results, has demonstrated the potential to further grow reserves at what is already one of the largest silver deposits globally,” CEO Tony Makuch said in a release on Aug. 2. Cordero holds 716 million mea-

Trusted. Independent. Committed.

sured and indicated tonnes grading 20 grams silver per tonne, 0.1% gold, 0.3% lead and 0.5% for 467 million oz. silver, 1.3 million oz. gold, 4.5 million lb. lead and 8.5 million lb. zinc.

Prime Mining, backed by a 17% stake held by Franco-Nevada (TSX: FNV; NYSE: FNV) founder Pierre Lassonde, is advancing its Los Reyes gold project in the west-

Our fit-for-purpose solutions encompass the skills of qualified geologists, geostaticians, analytical chemists, mineralogists, metallurgists, process engineers and mining engineers brought together to provide accurate and timely mineral and process evaluation services across the entire mining life cycle.

ern state of Durango. A resource update in May showed 27.2 million tonnes grading 1.2 grams gold, 40.4 grams silver for 1 million oz. gold and 35.3 million oz. silver.

In July, Prime said drill results extended mineralization beyond the open pit outlined in the resource update. Drill hole 23NB46, 150 metres along strike from the bottom of the pit, cut 9.1 metres grading 4.1 grams gold and 67.9 grams silver.

Luca is halfway to reaching 1,000 tonnes per day of commercial production at the Tahuehueto gold project in Durango expected by year’s end. The company spent US$18.8 million in the April-through-June period. The project has a capital cost estimate of US$61.2 million, according to a prefeasibility study released in March 2022.

Headwinds facing industry

It’s not all clear sailing for some companies. A strike at Newmont’s (TSX: NGT; NYSE: NEM) Penasquito gold-silver mine since early June prompted the company to declare force majeur on some metal deliveries last month and withdraw its annual outlook for the mine. The world’s largest gold miner has said it can’t estimate when the work stoppage will end.