McEwen calls for Uber moment to kickstart mining industry talent

BY COLIN MCCLELLAND

The mining industry needs radical change, like how Uber slew taxis, if it wants to get more youth involved in the metals for a greener planet, veteran project developer Rob McEwen says.

One option is to develop sustainable mines that slash water use, grow their own food and generate reusable energy. That’s how McEwen Mining (TSX: MUX; NYSE: MUX) wants to develop its US$2.4 billion Los Azules copper project in Argentina with the backing of Rio Tinto (NYSE: RIO; ASX RIO) and automaker Stellantis.

“Uber addressed most of the concerns about the taxi industry and they decimated the taxi industry,” McEwen, chairman of the company, told The Northern Miner’s Global Mining Symposium on May 25 at the TSX in Toronto.

“Why don’t we look at the mining industry and say what are the issues, the behaviours that the general public doesn’t like?”

Canada has less than half the mining and geology students it had in 1970, while electric batteries will require 336 new mines globally by 2035, according to Benchmark Mineral Intelligence. McEwen, who developed Goldcorp into an $8 billion behemoth, likes to cite Finland’s Geological Society, which has estimated that just one genera tion of renewable technologies to address climate change needs 4.5 billion tonnes of copper. That’s six times the volume of all copper mined throughout history.

Compared to that, even the Los Azules project, the world’s ninth-largest undeveloped copper deposit, would only produce 415 million lb. of copper annually for the first 13 years of a 36-year life.

However, the project envisions a solar-powered year-round residence that’s three football fields long and collects its own water to cut usage by 90%. It features terraced gardens for growing food hydroponically and aeroponically (in mist) in a closed ecosystem with ponds where fish excrement becomes fertilizer.

Residents would also benefit from higher oxygen levels indoors than prevailing at 3,000 metres above sea level. For the fit, there’s an outdoor soccer field. Going

green is one way to ease project approvals and should be a flag to attract youth to the industry, McEwen says.

“The mining industry is one of the highest paying industries in the country and in most countries around the world. But why is it unattractive? Because most people have thought this is something they don’t want to do. But it uses so many skills of today.”

Bumpy road to green energy Consultancy PwC forecasts there will be US$33.9 trillion of assets under management related to environmental, social and governance (ESG) issues by 2026, up 84% from US$18.4 trillion in 2021. ESG assets held by institutional investors may reach 21.5% of total global assets under management in less than five

years, it said.

“Just think if our industry could get some of that money by changing our ways,” McEwen said.

“To me an added expense to get through that doorway and get part of that US$20 trillion, it’s worth the price.”

Still, skeptics say the road to sustainable green energy won’t necessarily be smooth as we replace dirty but abundant and cheap fossil fuels with unprecedented mining and new technology. Many minerals require poisonous processing and some jurisdictions in Africa and the Far East can be just as toxic politically and environmentally.

And despite all the talk of incipient shortages in most metals, the price of copper itself has been languishing far below the US$4 per lb. threshold that miners want to see to develop projects.

Lower-than-expected copper prices are just a short-term product of high interest rates and concerns over an incipient recession that has investors opting for bonds, McEwen said. Widespread forecasts predict supply gaps in critical minerals as automakers race to snap up supplies, he said.

The Los Azules project, with its proposed residence and outdoor

soccer field pictured above, boasts 14% stakes held each by Rio Tinto, Stellantis and McEwen himself, plus 52% with McEwen Mining. The Toronto-based company filed an environmental impact statement in April. Government approvals may take 18 months, a feasibility study may be completed by early 2025 and construction could start near the end of this decade, McEwen said.

Initial ore processing would be 125,000 tonnes a year, ramping up to 175,000 tonnes, he said. The 2017 preliminary economic assessment (PEA) envisioned starting at 80,000 tonnes and increasing to 120,000 tonnes in the firth year.

Los Azules holds 962 million indicated tonnes grading 0.48% copper, 0.06 gram gold per tonne and 1.8 grams silver for 10.2 billion lb. copper, 1.7 million oz. gold and 55.7 million oz. silver, according to the 2017 PEA. The project has an after-tax net present value of US$2.2 billion at an 8% discount rate for an internal rate of return of 20% and a 3.6-year payback period. Cash cost would be US$1.14 per lb. copper.

South American headwinds

Operating in Argentina faces headwinds of inflation at more than 100% a year and an uncertain mining rulebook, which McEwen says is part of a populist movement sweeping South America. The com-

pany also faces political challenges in Mexico at the El Gallo gold project where the Fenix expansion envisions a new process.

“We’re uncertain, because it is definitely not a mining-friendly government right now,” he said. “Chile and Peru send shivers down the spine of everybody in the copper industry and that worsens the deficit that’s being projected, because Chile and Peru produce 40% of the world’s copper.”

McEwen is open to new technology, whether it’s hypersonic plugs fired at rock faces to mine faster and easier than blasting, or Rio Tinto’s Nuton unit adding a catalyst to the heap bleach process to slash water use while nearly matching conventional flotation mills for recovery.

“I remember walking through the SpaceX factory — just gleaming white floors, long, beautiful stainless steel, people moving with purpose — I’d like to see a mine like that,” he said. “We can involve the most current technologies and philosophies about what a mine could look like.” TNM

COPPER FAILS TO MEET U.S. CRITICAL MINERALS CRITERIA / 3 905 841 5004 | geotech.ca VTEM™ | ZTEM™ | Gravity | Magnetics Geotech_Earlug_2016_Alt2.pdf 1 2016-06-24 4:27:20 PM WWW.SGS.COM/MINING MINERALS@SGS.COM DELIVERING QUALITY EXPERTISE GLOBALLY ACROSS THE ENTIRE MINING LIFE CYCLE expert advice from exploration to closure .com JUNE 12 —24, 2023 / VOL. 109 ISSUE 12 / GLOBAL MINING NEWS • SINCE 1915 / $5.25 / WWW.NORTHERNMINER.COM

INNOVATION | Veteran proposes self-sustaining mines as way of the future

TNM’S IN-PERSON GLOBAL MINING SYMPOSIUM COMES TO TORONTO / 8-9

PM40069240

MCEWEN MINING

Above: McEwen envisions mining’s future. Inset: Los Azules, Argentina.

SPECIAL FOCUS TOP 10 AUSTRALIAN JUNIORS EXPLORING FOR DIAMONDS, CRITICAL METALS AND MORE / P13-16

Volt Lithium stock leaps amid claims of oil-brine recovery breakthrough

ALBERTA | 90% recovery for lithium levels as low as 34 mg per litre

BY BLAIR MCBRIDE

Volt Lithium (TSXV:

VLT)

shares jumped by almost 20% on May 24 after it announced lithium recoveries of 90% at relatively low operating costs,testing at its Rainbow Lake lithium property in northwestern Alberta shows.

The pilot project, using Volt’s patented direct lithium extraction (DLE) technology achieved 90% lithium recoveries at concentrations as low as 34 mg per litre, the company said in a release. It also simulated operating conditions at concentrations of 120 mg per litre and recovered up to 97% lithium. Assuming average annual production of 20,000 tonnes of lithium hydroxide monohydrate, operating costs would be under $4,000 per tonne.

In the coming weeks\, Volt aims to process brines with concentrations of 120 mg per litre to validate the simulated results of the pilot project.

The results come as the Vancouver-based lithium developer looks to finish a preliminary economic assessment for Rainbow Lake by the end of the summer.

“It’s been a technological breakthrough,” said Volt president and CEO Alex Wylie, in a webinar on

May 24. “We’ve proved the technology side and we’ve shown we can do it economically. We’re able to…open up any major oil field across North America that has lith-

ium in it.”

Volt started the project in March, which was designed to simulate a commercial operating environment and allow the to confirm

economic recoveries of the battery mineral from oil field brines.

Volt noted that the recovery concentrations of up to 120 mg lithium per litre are equivalent to concentrations found in the Muskeg aquifer at Rainbow Lake. A technical report published on May 18 stated the property hosts an inferred resource of 4.3 million tonnes of lithium carbonate equivalent in the Sulphur Point, Muskeg and Key River aquifers. In total, the property contains about 15.7 billion cubic metres of brine, with lithium concentrations as high as 121 mg per litre, with an average associated lithium concentration of 51 mg per litre.

Wylie said the company aims to start commercial production by the second half of 2024, with output of 1,000 tonnes per year of lithium in the first stage and up to 7,500 tonnes per year in the second.

Wylie said Volt could reach 20,000 tonnes per year by 2026 or 2027.

“It’s not just Rainbow Lake,” he said. “I’d like to plant my flag on a number of fields as we start the business.”

The company’s DLE technology extracts lithium from oilfield brine in a two-stage process. In the first stage, the brine is treated to remove contaminants, and in the second,

Volt’s IES-300 technology extracts the lithium which is concentrated down to a lithium chloride solution. That solution is eventually upgraded to lithium hydroxide monohydrate, a raw material needed for electric vehicle batteries. Its operating costs in the pilot translate to recoveries of $3,944 per tonne at concentrations of 120 mg per litre, $5,951 per tonne at 75 mg per litre and $8,627 at 50 mg per litre.

Wylie said its pilot and Rainbow Lake fit into a larger “North American solution” to lithium prices.

“The [lithium] market is really controlled a lot out of China. As we bring on North American production it’ll change the price because there’ll be a lot of demand. At US$40,000 to US$50,000 per tonne I think it’s a big opportunity for brine companies.”

Volt is looking to establish a permanent pilot plant to continue refining the IES-300 technology and improving operating conditions to keep reducing operating costs.

Volt shares rose by 19% on the morning of May 24, spiking to 55¢ and setting a new 52-week high, before declining to 24¢ just before press time. Its yearly low was 6¢. The company has a market capitalization of $33.8 million. TNM

LithiumBank stock soars on US$2 billion Alberta project economics

BATTERY METALS | Direct extraction brine process to slash water use

BY COLIN MCCLELLAND

Shares in Alberta-focused LithiumBank Resources (TSXV: LBNK; US-OTC: LBNKF) jumped after a new study shows its Boardwalk project using an uncommon technique could operate at about a quarter of the lithium hydroxide spot price.

The shares gained more than 16% on the May 26 news to $1.42 apiece before easing to $1.35 closer to press time, within a 52-week range of 62¢ and $1.72, valuing the company at $52.2 million.

Operating costs at the Boardwalk brine project in west-central Alberta would be US$6,807 per tonne of lithium hydroxide while the study envisions the project at a long-term metal price US$26,000 per tonne, according to the preliminary economic assessment (PEA) released on May 25. The spot price was US$41,100 per tonne approaching press time, according to The Wall St. Journal

“Boardwalk is unique with an uncomplicated mineral title containing a 6.2 million-tonne lithium carbonate equivalent brine resource that has the potential to produce battery grade lithium hydroxide for 20 years right here in North America,” LithiumBank executive chairman Paul Matysek said in a news release accompanying the study.

“There is potential for substantial upside on these economics from the recently announced Canadian Investment Tax Credit and other numerous optimization

opportunities.”

Calgary-based LithiumBank plans a direct lithium extraction process, one of only a handful in the world it says have been the focus of economic studies. It would use less water than conventional brine evaporation methods and only a fraction of the surface footprint of hard rock lithium mining.

Neighbour E3 Lithium (TSXV: ETL; US-OTC: EEMMF) plans to use similar technology to develop the province’s Bashaw district, Canada’s largest brine project. While demand for lithium continues to grow for electric vehicles as automakers secure off-take

agreements, surpluses are likely from next year before sinking into a deficit again from 2029, according to data in April from Benchmark Mineral Intelligence.

Bullish metrics Boardwalk would have an aftertax net present value of US$1.7 billion at an 8% discount rate with an internal rate of return of 17.8%, the study shows. It would produce 31,350 tonnes per year of battery-grade lithium hydroxide over a 20-year period, the largest proposed output in North America, the company says.

The operation would cost almost

US$2.1 billion to build, including a US$575 million processing plant, US$276 for brine wellfield services, US$265 in other infrastructure and US$360 million for contingencies, the early-stage study shows.

The project envisions pumping lithium-rich brine from the historic Leduc oil field, where Alberta’s petroleum boom started in the 1940s, to a processing plant. Ion-exchange technology is to extract lithium from the brine before purification, concentration and conversion to battery-grade lithium hydroxide.

Boardwalk also intends to capture and sequester CO2 emissions to

produce carbon credits, and extract magnesium from barren brine to produce low-carbon cement that will lower brine reinjection amounts by at least 10%. Power is to be generated on site using gas turbines to help lower the project’s carbon footprint. The proposed gas turbine units may be run on 80% hydrogen when a reliable supply is available, LithiumBank said.

The company intends to apply for federal tax credits for critical mineral extraction as mentioned in this year’s federal budget. It plans to cut costs by using recently-developed brine reagents, submersible electric pumps, 3-D modelling of reservoirs, and existing roads, well pads, pipelines and utilities as shown in the study.

“It sets the stage for our team to now pursue lithium resource development in western Canada with a significantly enhanced environmental, social and governance profile compared to other forms of lithium mining,” Rob Shewchuk CEO and director of LithiumBank, said in the release.

LithiumBank plans to soon file another PEA, on the Park Place lithium brine project 50 km to the south, and by the end of this year start pilot plant studies on both sites. The parallel developments could cut costs and improve net present value and rates of return, Shewchuk said.

“We believe this has the potential to place both the Boardwalk and Park Place districts among the most attractive direct brine projects.” TNM

2 JUNE 12 — 24, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

Lithium carbonate precipitate floating on brine. JOHN NAKATAADOBE IMAGES

LithiumBank’s Boardwalk brine project in Alberta is planning to use the direct lithium extraction method. LITHIUMBANK

Copper loses battle in fight for critical mineral status in the US

POLICY | U.S. Geological Survey says copper doesn’t meet critical status threshold

BY MINING.COM EDITOR

The U.S. Geological Survey (USGS) has told congressmen and senators that copper has not reached the status of critical minerals needed to be added to the official list of commodities at risk of undersupply, the Copper Development Association (CDA) said.

The USGS decision comes despite some high-ranking political allies throwing their support behind the local copper sector.

The copper marketing body says the metal’s supply risk score is now above the threshold for automatic inclusion on the 2022 Critical Minerals list. It adds the USGS justified its decision by quoting misleading arguments that were not part of its own official 2022 methodology.

“Unlike in Europe, where copper was recently added to its proposed Critical Raw Material and Strategic Raw Material lists based on forecasting future supply and demand projections, USGS addresses supply risk with a rearward looking analysis,” the CDA said.

It noted the USGS did not address current and forward-looking policy demands that can leave domestic supply chains short of copper.

“Continued supply trends and solid data confirm that the supply risk for copper is not a short-term issue that will self-correct without determined, immediate, and strategic action,” CDA’s president and

CEO Andrew G. Kireta said in the statement.

The USGS’s last official evaluation for the 2022 Critical Minerals List is based on copper trade data that represents supply risk from 2014 to 2018, which is too old to be meaningful, Kireta noted.

Early this year, Senator Kyrsten Sinema, an Independent from Arizona, sent a letter urging Interior Secretary Deb Haaland to “revisit and reconsider the designation of copper as a critical mineral.”

Supporters included other senators whose home states are hubs of copper production and manufacturing, including Mark Kelly of Arizona, Joe Manchin of West Virginia, Indiana’s Mike Braun, Raphael Warnock of Georgia and Mitt Romney of Utah.

“This should be a no-brainer,” Sinema said in an interview with Bloomberg in February. “We have major gaps in both our ability to mine and process these minerals to ensure our energy security for the future, and the administration knows how important copper is to our domestic and national security.”

CDA members include some of the biggest copper miner including Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO), BHP (NYSE: BHP; LSE: BHP; ASX: BHP), and Freeport-McMoRan (NYSE: FCX), as well as manufacturers such as Mueller Industries Inc.

Pending approval of First Quantum deal with Panama haunts miner

COPPER

| Fitch gives company’s notes negative outlook, B+ rating

BY CECILIA JAMASMIE

The pending congressional approval of a new contract agreed between First Quantum Minerals (TSX: FM) and the Panamanian government over the Canadian miner’s giant Cobre Panama copper mine continues to weigh on the company.

In mid-May, First Quantum completed the pricing for a US$1.3 billion offering of senior notes, with proceeds earmarked for debt repayment.

Analysts did not seem impressed by the move, with Credit ratings agency Fitch giving First Quantum’s notes, which are due in 2031, a ‘B+’ with a negative outlook.

“Following a recent agreement reached in principle between First Quantum Minerals and the government, we expect to resolve the [negative outlook] once the agreement has been formalized,” Fitch said in the statement.

Production at Cobre Panama was halted in February amid a dispute with authorities over tax and royalty payments.

During the weeks the mine remained shut, First Quantum said it lost US$8 million a day in terms of costs that would never be recovered.

First Quantum reached a new deal with Panama in March, with mining operations ramping up to full production levels within two days and five shipments of copper sailing during the month.

Lawmakers are expected to formalize the agreement between the company and Panama during the term starting Jul. 1. They will only be able to do so after a period for public comment concludes and all permits are acquired.

First Quantum’s earnings in the first quarter of the year fell by more than 80% to US$75 million from the US$385 million recorded in the same period of 2022. TNM

The U.S. critical minerals list is updated every three years and includes key battery metals needed for electric vehicle production such as nickel, lithium and zinc.

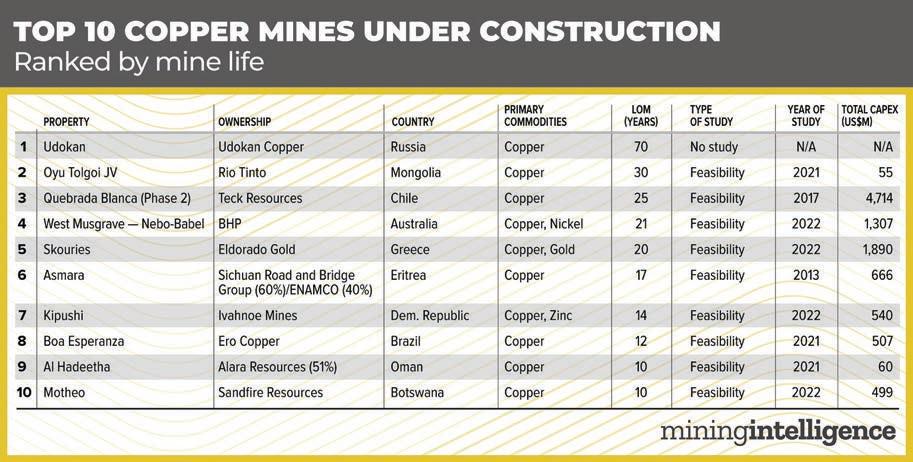

Eight Escondida mines needed

Based on studies conducted by the world’s largest copper miner, Chile’s Codelco, the world’s energy transition to address climate

change will take demand for the metal from 25 million tonnes per year now to just over 31 million tonnes in 2032.

This means the world would need to build eight projects the size of BHP’s Escondida in Chile, the world’s largest copper mine, over the next eight years.

In terms of investment, experts estimate the industry needs more than US$100 billion to build mines able to close what could be an annual supply deficit of 4.7 million tonnes expected by 2030. TNM

Investing in the Canadian Resource Sector at Reduced Cost of Captial

PearTree is a Canadian Securities Dealer and Investment Fund Manager advancing over (CAD) $500 million annually for resource exploration and mine development in a uniquely Canadian structure which results in as much as $2.00 of capital deployed for every $1.00 invested by global institutions and family offices.

Averaging $500M deployed through PearTree in 2021 and 2022 for the mineral exploration & development sector

Watch our video in English, Français, Deutsch and Español on our website

peartreecanada.com

GLOBAL MINING NEWS THE NORTHERN MINER / JUNE 12 — 24, 2023 3

Expanding the universe of exploration capital.

BHP’s Escondida mine in Chile. BHP

First Quantum Minerals’ Cobre Panama copper mine. FIRST QUANTUM MINERALS

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

SENIOR STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PODCAST HOST: Adrian Pocobelli, MA (Engl) apocobelli@northernminer.com

ADVERTISING:

Robert Hertzman

(416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/

CAREER ADS

George Agelopoulos

(416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

ADDRESS:

New Alternative Minimum Tax measures a death knell to junior finance

Metals Commentary: Platinum Investment Council forecasts

deepening deficit

PLATINUM | Market deficit of 983,000 oz. on stronger demand and weaker supply

BY HENRY LAZENBY

The recently announced changes to the Alternative Minimum Tax (AMT) calculation effective in 2024 have sent shockwaves through the finance industry, raising concerns about their impact on junior finance and philanthropic activities. These measures, intended to ensure a minimum level of tax payment, may have unintended consequences that undermine investment, charitable giving, and the mineral exploration sector. It is crucial to understand the potentially far-reaching implications of these changes and their negative impact on various sectors of the economy.

One of the major consequences of the new AMT rules is the significant reduction in the volume of flow-through share finance activity. A very small group of Canadian high net-worth taxpayers – less than 2,000 – provide about three-quarters of all flow-through share exploration capital driving critical mineral and metals exploration. The current AMT rules already limit this investment incentive. The 2024 implementation is expected to result in a one-third reduction in flow-through exploration financing representing at least $250 million in lost exploration jobs in northern and remote communities with particular impact on Indigenous communities.

As these rules reduce the availability of credits, fewer individuals will be able to invest, leading to issuers having to reduce their premiums, resulting in increased dilution. This contraction of flow-through share activity threatens to hamper the growth and development of junior finance, a vital sector that drives innovation and economic progress.

Furthermore, these changes have dire consequences for philanthropy and foreign investment. Those familiar with the flow-through share regime know that about 75% of all flow-through share financing is through the operation of what is now known as Charitable Flow-Through in which Canadian taxpayers interested in giving more to charity buy flow-through shares which are immediately donated and then sold by charities to global end buyers. This approach results in a double win for Canada, increased philanthropy, and northern job creation. Most of the critical mineral end buyers over the past year were Australian. The new AMT rules will go a long way in killing what was a very successful low-cost government initiative.

The AMT calculation penalizes individuals who selflessly choose to give away their money by subjecting them to taxation on their donations. This disincentive to give away money will undoubtedly impact the ability of charitable organizations to carry out their essential work and positively impact society.

The mineral exploration sector, too, will be hit hard by the changes to the AMT calculation. The flow-through share format has become Canada’s preferred method for funding exploration activities, accounting for about $1 billion in activity last year. However, the new rules will limit the ability of individuals to invest in flow-through shares, resulting in a contraction of available funds. This, in turn, will hinder the exploration sector’s ability to access capital and carry out vital mineral exploration projects, which are crucial for economic growth and resource development.

Fluctuations in prices and demand can substantially impact investment decisions, making it essential to provide the best possible tax incentives during cooperative market conditions. While gold and other traditional resources may have lost their lustre recently, the focus has shifted towards critical minerals such as lithium, which hold immense promise for the future.

It is worth noting that the exploration sector, particularly in critical minerals, faces vulnerability to fast money investors seeking quick returns. When marijuana investment was in vogue the junior resource sector investment saw high risk investment migrate away from junior exploration. Currently, the rise of artificial intelligence investments emphasizes the need for a robust tax incentive framework to ensure the continued growth and stability of the critical mineral sector funding Canadian jobs.

The availability of funds and the number of participants are key factors influencing the sector’s success. While a small group of individuals has been instrumental in driving investments, there is a pressing need to broaden the base of participants to ensure sustained growth. The recent influx of funds from Australia highlights the international interest in Canadian critical mineral resources. However, Canada must improve its regulatory framework to attract and retain investments, as the country’s potential may remain untapped if progress is hindered.

While it is essential to strike a balance and risk-adjust certain activities, tax credits have proven to be a powerful tool in stimulating investment.

The Critical Mineral Tax Credit was introduced in the federal March 2022 budget. Coincidentally the world came to understand that critical miner-

The following is an excerpt from the World Platinum Investment Council’s May 15 Platinum Quarterly report, accessible at https://platinuminvestment.com.

There were a number of developments during the first quarter of 2023 that in aggregate had a significant impact on market balances and provide read-throughs to the outlook for the year as a whole.

Starting with supply, mine supply was significantly curtailed in South Africa by the worsening electricity shortage there. This led to increased work-in-progress concentrate at the major producers, the unwinding of which is uncertain from a timing perspective as utilizing excess smelting capacity is dependent upon the availability of electricity.

On the other hand, Russian mine supply increased on the release of some work in progress inventory. The net impact was a 7% year-on-year decline in total mine supply to 1.2 million ounces.

Recycling supply also struggled, down 12% year-on-year at 413,000 oz., due to an ongoing shortage of automotive scrap availability as users are forced to run older vehicles for longer, while jewelry recycling was impacted by lower new jewelry sales in China.

Total supply in Q1 came to 1.6 million oz., down 9% year-onyear and 8% quarter-on-quarter.

Demand, meanwhile, remained robust at 2 million oz., up 28% yearon-year due to continued strength in demand from the automotive and industrial sectors (+112,000 oz. year-on-year) and a 340,000 oz. improvement in quarterly investment demand year-on-year.

Automotive demand in the first quarter rose by 9% year-onyear on increasing platinum for palladium substitution, growing vehicle numbers and higher platinum group metal loadings due to tighter emissions legislation. Industrial demand rose by 8% with a number of capacity additions in the chemicals industry offsetting weaker to stable demand elsewhere, while jewelry demand fell 2% year-on-year mainly due to ongoing weakness in China. Bar and coin investment demand of 102,000 oz. in Q1 was complemented by a move from significant ETF and exchange stock outflows in Q1’21 (-224,000 oz.) moving to net positive demand in Q1’22 (+73,000 ounces).

The net impact was a significant quarterly deficit of 392,000 oz. in Q1’23, which represents the first substantial quarterly deficit since Q3’20.

The forecast deficit for 2023 (-983,000 oz.) is 77% deeper than projected in the Q4’22 Platinum Quarterly in March 2023, and reflects a 1% decline in total supply and a 28% increase in demand versus 2022.

Year-long view

The full year 2023 outlook for total mine supply is 62,000 oz. lower than the outlook included in the last Platinum Quarterly. This reduced forecast could be further restricted by electricity shortages in South Africa and,

potentially, sanctions-related operational challenges in Russia. The electricity crisis in South Africa will, at best, keep output constrained to 2022 levels, which was itself down 6% versus the average production level since 2013.

Similarly, in Russia, operational challenges are projected to cap production at 8% below average production rates over the same time period. Whilst operating challenges are factored into the outlook on a global basis, mine supply risks are biased to the downside. Recycling supply chain constraints experienced in 2022 are continuing into 2023 causing more disruption than originally anticipated. In aggregate, recycling supply is down by 174,000 oz. versus previous expectations.

Consequently, total supply for 2023 is 236,000 oz. lower than previously forecast at 7.2 million oz., down 1% versus 2022.

Automotive demand is expected to total 3.3 million oz., up 12% on 2022 and 9,000 oz. up versus previous estimates due to ongoing strong substitution of platinum for palladium in gasoline vehicles as well as higher overall loadings, particularly in the heavy duty and non-road vehicle categories. Jewelry demand continues to face headwinds (China revised lower) and is expected to be down 2% year-on-year at 1.9 million oz. Total industrial demand is forecast at 2.6 million oz., up 17% year-on-year, which means 2023 is on-track to be the strongest year for industrial demand on record.

Glass capacity additions and to a lesser extent chemical capacity additions are the big drivers of the year-on-year growth of total industrial demand, offsetting slightly weaker year-on-year demand from the petroleum and electrical segments.

Investment demand has seen significant changes versus the last Platinum Quarterly outlook. Total investment demand for 2023 is expected to come to 433,000 oz., which is up 135,000 oz. versus last quarter’s outlook. Within this increase, however, is a 48,000 oz. reduction to bar and coin demand after a challenging start to 2023, although this is now showing signs of improvement. Bar and coin weakness is more than offset by a 162,000 oz. improvement in the outlook for ETF flows for the year and a 20,000 oz. increase in exchange stock flows. Previously expected to be negative in 2023, ETF flows are now projected to creep into positive territory (plus-30,000 oz.), while exchange stocks are expected to remain flat on 2022.

The net impact is for total demand of 8.2 million oz. in 2023, up 192,000 oz. from our last update.

Combining the weaker supply outlook and strong demand projections results in the projected deficit for 2023 increasing from 556,000 oz. (per the previous Platinum Quarterly) to a more significant deficit of 983,000 oz. This would be the deepest deficit in the current time-series going back to 2013. TNM

4 JUNE 12 — 24, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

225

RATES: Canada: C$130.00 one year; 5% G.S.T. to CDN orders. 7% P.S.T. to BC orders 13% H.S.T. to ON, NL orders 14% H.S.T. to PEI orders 15% H.S.T. to NB, NS orders U.S.A.: C$172.00 one year Foreign: C$222.00 one year GST Registration

CANADA POST: Return undeliverable Canadian addresses to Circulation Dept. c/o The Northern Miner 225 Duncan Mill Road, Suite 320 Toronto, ON M3B 3K9 Publication Mail Agreement #40069240 Periodicals Postage Rates paid at Niagara Falls, NY, 14304. U.S. office of publication 2424 Niagara Falls Blvd, Niagara Falls, N.Y. 14304. U.S. POSTMASTER: send address corrections to: Northern Miner Box 1118 Niagara Falls, N.Y. 14304.-7118 THE NORTHERN MINER is published biweekly by Glacier Resource Innovation Group, a division of Glacier Media Inc., a leading Canadian media company with interests in business-to-business information services. From time to time we make our subscription list available to select companies and organizations whose products or services may interest you. If you do not wish your contact information to be made available, please contact us by one of the following methods: Phone: 1-888-502-3456; Fax: (416) 447-7658; Mail to: Privacy Officer, The Northern Miner, 225 Duncan Mill Road, Suite 320, Toronto, ON M3B 3K9. EDITORIAL

Toronto Head Office

Duncan Mill Road, Suite 320 Toronto, ON, M3B 3K9 (416) 510-6789 tnm@northernminer.com SUBSCRIPTION

# 809744071RT001 (ISSN 0029-3164)

COMPANY INDEX 92 Energy 13 Aston Minerals 13 Auteco Minerals 13 Burgundy Diamond Mines 13 Catalyst Metals 5 Collective Mining 5 Critical Resources 13 Cygnus Metals 13 First Quantum Minerals 13 GoGold Resources 5 Jameson Resources 13 Kaiser Reef 5 Kenorland Minerals 5 Kodiak Copper 12 LithiumBank Resources 2 Matador Mining 13 McEwen Mining 1 Metals Australia..................................................13 New Pacific Metals 5 North Arrow Minerals 13 Power Metals 13 Probe Gold 5 Reunion Gold 5 Rio Tinto 1 South32.................................................................6 Southern Cross Gold 5 Sumitomo Metal Mining 5 Trilogy Metals 6 Volt Lithium...........................................................2 Westhaven Gold 5 Wia Gold 5 Winsome Resources 13 See EDITORIAL / 9

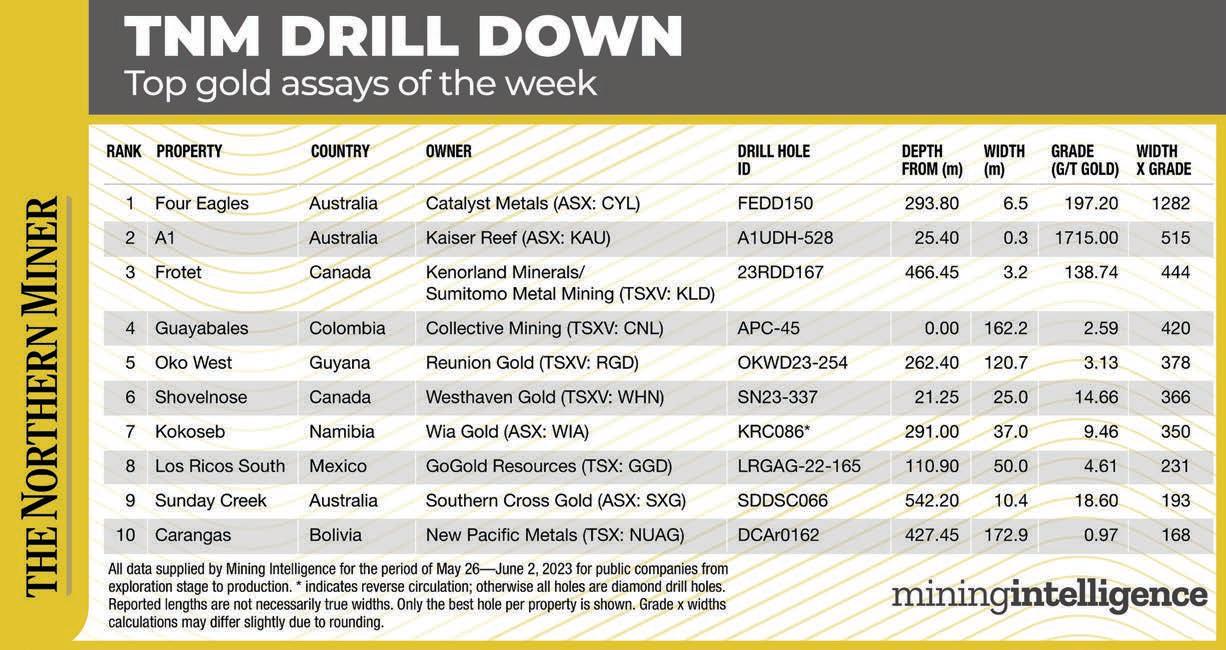

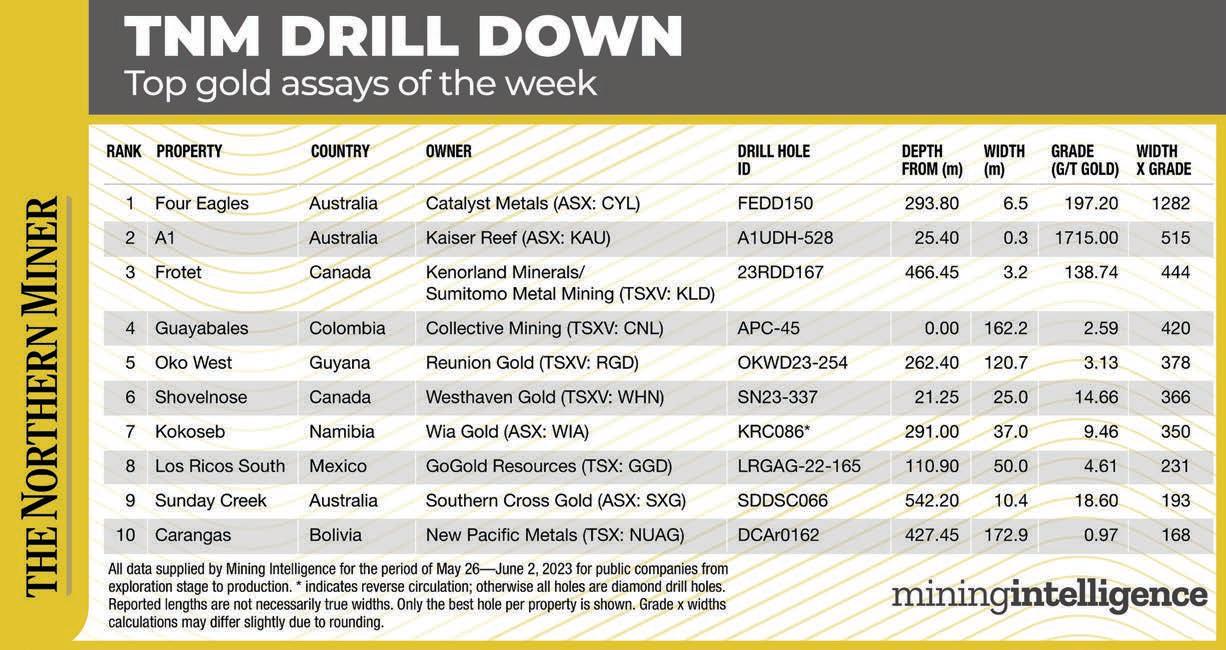

TNM DRILL DOWN:

Australia delivers week’s hottest gold assays

BY HENRY LAZENBY

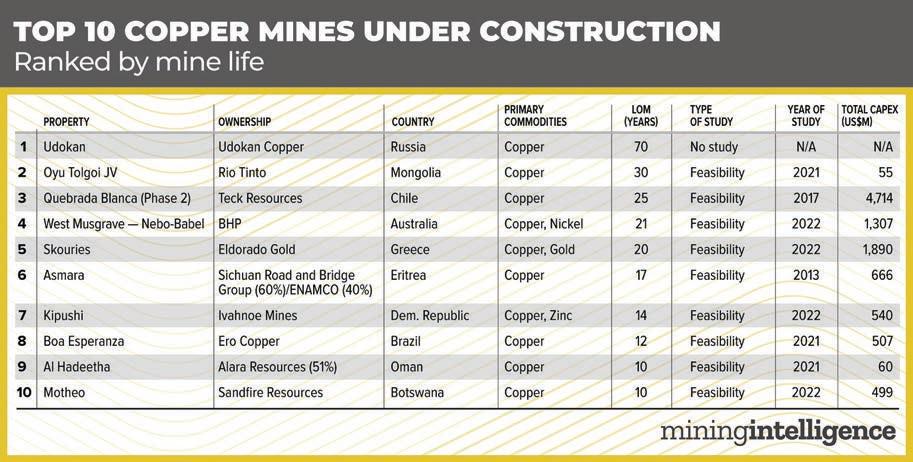

Our TNM Drill Down features highlights of the top gold assays of the past week (May 26-June 2). Drill holes are ranked by gold grade x width, as identified by our data provider Mining Intelligence. (www.miningintelligence.com).

Two Australian and one Canada-based gold projects topped this week’s ranking of the best gold assays. On Jun. 1, Catalyst Metals (ASX: CYL) reported the week’s best assay at the Four Eagles project, which the company believes has the potential to entail an extension of the historical 22 million oz. Bendigo Goldfield of Victoria. The company reported that hole FEDD150 cut 6.5 metres grading 197.2 grams gold per tonne from 6293.8 metres depth for a width x grade value of 1,282. The latest assays show drilling intersected gold in seven holes at the Iris Zone. This takes the total number of holes reporting gold to 14 and extends the strike length of the known mineralization from 350 metres to 500 metres. The Iris Zone sits about 150 metres below the shallow mineralization at Boyd’s Dam, within a near-vertical shear zone striking almost north-south and containing rich quartz, often laminated with arsenopyrite and native gold.

Kaiser Reef (ASX: KAU) reported the week’s next-best intercept at the A1 gold mine in

Victoria. On May 29, the company said that hole A1UDG528 returned 0.3 metres grading 1,715 grams gold per tonne from 25.4 metres depth for a width x grade value of 515. The hole is part of the company’s 1410 South drilling program targeting the southern A1 Dyke between the 1410mRL to just below the 1350mRL areas. The target zone represents one of, if not the most, under-drilled portions of the A1 mine, which is much higher (more than 100 metres) in the mine than the

current production centre below the 1250mRL. Drilling resumed in the 1410 South Drive site testing a window of dyke around the historically mined Victory, Welcome and Dawn Reefs, as well as likely repeat structures in footwall and hanging-wall positions to these historically rich reefs. There is almost no exploration drilling data in this area. This historical data gap artifact may be attributed mainly to stope shadows and lack of historical investment in developing optimal drilling positions.

A Canada-focused joint venture reported the week’s third-best drill result. Kenorland Minerals (TSXV: KLD) and Sumitomo Metal Mining said on May 31 that hole 23RDD167 had cut 3.2 metres grading 138.74 grams gold per tonne from a depth of 466.45 metres for a width x grade value of 443.9. The 2023 winter drill program was mainly designed to test the strike and depth of several new vein discoveries of 2022, including the R5, R6, R7, and R8 structures. Drilling was

focused in an area between these new vein discoveries to the east and the R2 and R3 structures to the west, where there had been limited drilling to date. All drill holes intersected significant gold mineralization across multiple structures, linking the eastern vein discoveries to the western structures and defining a corridor of up to 1.8 kilometres of strike containing multiple sub-parallel vein structures hosting high-grade gold mineralization. TNM

Probe Gold’s Novador may hold 6M oz., Quebec project’s assays indicate

GOLD | Large regional players might want to buy it, analysts say

BY COLIN MCCLELLAND

Probe Gold’s (TSXV: PRB) latest assays from its Novador gold project in Quebec’s Abitibi region lengthen the strike, likely increase the resource and make it an acquisition target.

Toronto-based Probe’s 175-sq.-km Novador project, about 500 km northwest of Montreal, holds the past-producing Beliveau, Bussière and Monique mines. The site, 25 km east of Val-d’Or consists of three satellite areas, Monique, Pascalis and Courvan. Probe issued assay results for Novador, which used to be called Val-d’Or East, in a news release on May 30.

“At least 500 metres of strike length has been added to the known Courvan resource size between two previously defined open-pits,” Barry Allan, a mining analyst for Laurentian Bank, wrote in a note on May 30. “The high success rate of drilling suggests a total resource increase of 1 million oz. or more to over 6 million oz. total.”

The improved resource potential, following the tripling of the indicated gold resource at the Monique deposit in January, places the Novador project on a path to be acquired by an established mine builder with experience in the region, such as Agnico Eagle

Mines (TSX: AEM; NYSE: AEM), Eldorado Gold (TSX: ELD; NYSE: EGO) or Iamgold (TSX: IMG; NYSE: IAG), Allan said.

The new assays should lower the overall strip ratio when Probe updates a prefeasibility study later this year, the analyst said. It will incorporate an updated resource estimate for the Courvan and Pas-

calis deposits due next month. Standout assays include expansion drill hole CO-22-324 north of the former Bussiere mine, which cut 17.9 metres grading 9.2 grams gold per tonne from 63.1 metres downhole, Probe said. It’s one of 67 assays issued totalling 19,400 meters that all reported intercepts above a cutoff level of 0.4 gram gold per tonne.

Probe president and CEO David Palmer said the results align with success across the project as the company continues with more expansion drilling.

“We are seeing additional improvement in both grade and thickness and are achieving our objectives of resource improvement across all three deposits,”

Palmer said in the release. “With the exceptional drill results that have been coming in from the 2022 program, we will evaluate potential increases in annual production.”

Andrew Mikitchook, a mining analyst at BMO Capital Markets, also said Novador’s resource will increase and looks forward to results from the company’s exploration program this year, which has already drilled 45,000 metres.

“New parallel gold zones near the Bussiere and Creek deposits were identified through last year’s expansion drilling,” Mikitchook said in a note on May 30. “The Bussiere and Creek deposits have been drilled only at shallow depth. A few drill intercepts below 350 metres at the Creek deposit returned positive results, a potential indication that the deposit may remain open at depths.”

Allan said selling Novador would allow Probe to focus on the La Peltrie project near Detour Lake, Que., a copper-gold-silver-molybdenum deposit about 190 km north of Rouyn-Noranda in the Abitibi region. Probe is exploring it with Midland Exploration (TSXV: MD). Probe shares rose 7¢ to $1.68 each on the news before easing to $1.62 closer to press time, within 52-week range of $1.09 and $1.90, valuing the company at $257.4 million. TNM

GLOBAL MINING NEWS THE NORTHERN MINER / JUNE 12 — 24, 2023 5

Probe Gold’s Novador project sits on three past producing mines. PROBE GOLD

YMP Scholarship Fund offers 45 awards this year

HONOURS | $200,000, potential internships targeted for students

BY NORM TOLLINSKY

Applications for the 2023 Young Mining Professionals (YMP) Scholarship Fund are now open for students in mining-related programs at Canadian post-secondary institutions.

A total of 45 scholarships ranging in value from $2,000 to $15,000 will be awarded this year, up from 44 last year, courtesy of 23 sponsors. Reputed to be the largest mining scholarship program in the world, the YMP Scholarship Fund has grown from $12,000 in 2018, when it was co-founded by Stephen Stewart, chairman of the Ore Group, and Anthony Moreau, CEO of American Eagle Gold, to $200,000 this year. Since its inception, the fund has attracted sponsorships totalling $650,000.

In addition to the cash awards, many of the scholarships include opportunities for internships, offering students valuable experience in the mining industry. Many of these internships and relationships between scholarship winners and donors also lead to full time employment The deadline for applications is Aug. 31, 2023, with successful applicants to be announced on Oct. 1.

The Scholarship Fund’s mandate to support students pursuing post-secondary studies in a mining-related discipline also benefits sponsoring mining companies who use it as a means of identifying and recruiting “the best of the best to their organizations,” said Moreau, director of the scholarship program.

“If you’re a mining company looking for top talent, look no further than the YMP Scholarship Fund,” he said. “Last year, we received over 1,500 applications, so it’s an ideal way to recruit graduates of mining-related programs to your organization.”

Illustrating the importance of the fund to participating sponsors, Moreau cites the example of Barrick Gold CEO Mark Bristow, who personally called the winner of Barrick’s 2022 Peter Munk Scholarship to offer them employment.

“This individual had a job with

a company in another industry but was persuaded to join Barrick and stay in the mining industry that he had spent four years studying to join,” said Moreau. “It’s not every day that a student receives a call from the CEO of a $40-billion company, and it shows how much our

sponsors value the opportunity to recruit top talent by leveraging the Scholarship Fund.”

The fact that the fund is managed entirely by volunteers and that 100% of all money donated goes to students is also a factor in its success.

Many of the scholarships generally target students in mining programs, while others are available specifically to women, Indigenous students, new Canadians or residents of a region or province. Applicants are selected based on a combination of academic achievement, extracurricular activities, and essays or other submissions demonstrating innovative ideas and a commitment to the mining industry.

Applicants who are not successful scholarship recipients are automatically enrolled in a $5,000 Mining Lottery sponsored by YMP Toronto, Kinross and Sprott Inc. that will award a $500 prize to 10 students.

A complete list of YMP scholarships as well as eligibility and application requirements are on the YMP Scholarship website at www. ympscholarships.com/applications-2023.

Students may apply for as many scholarships as they qualify for.

The YMP Scholarship Fund, a registered Canadian charity offering tax receipts to donors, is always open to new sponsors both for this year’s program and future years. Companies and individuals interested in sponsoring a scholarship are encouraged to email scholarships@youngminingprofessionals. com. TNM

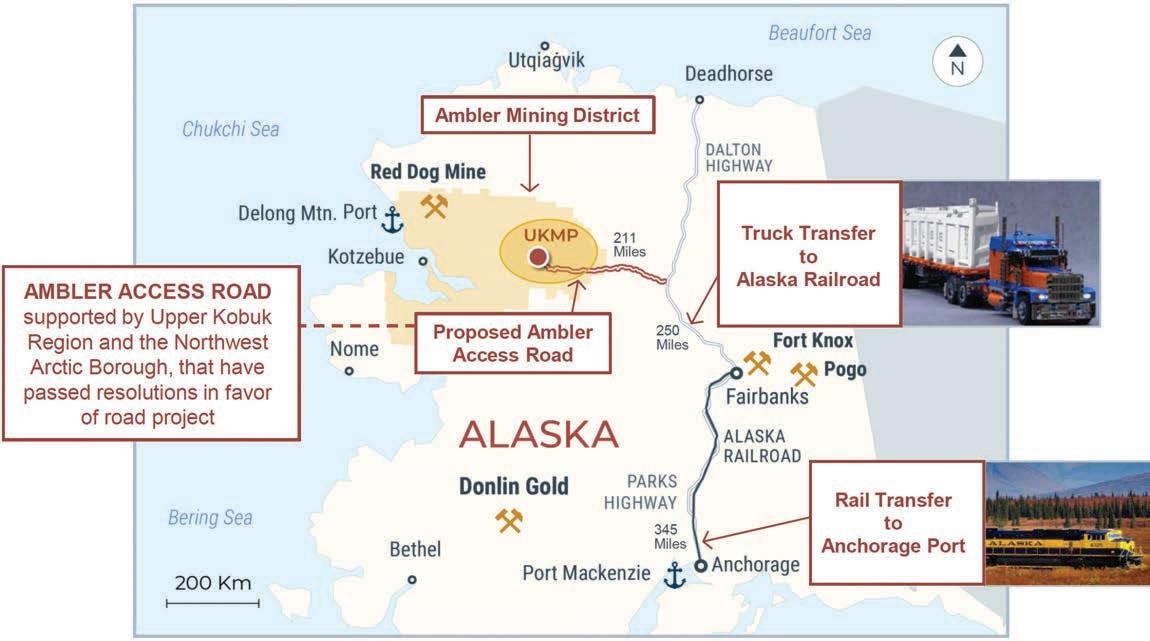

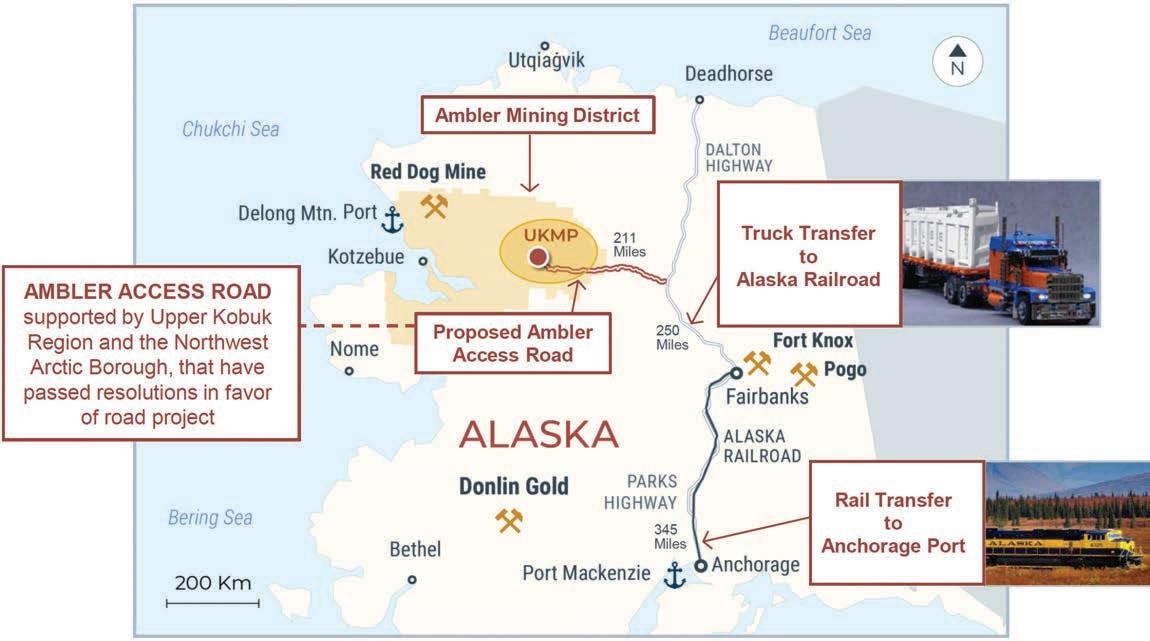

Ambler road decision in Alaska delayed again, this time to

mid-2024

INFRASTRUCTURE | 340-km road would link access to large copper-zinc projects

BY CECILIA JAMASMIE

The U.S. Department of the Interior (DOI) has once again delayed the release of the record of decision (RoD) for the Ambler road project, which will give access to untouched deposits of copper, zinc, lead, silver and gold in northwestern Alaska.

The resolution on Trilogy Met als’ (TSX: TMQ; NYSE: TMQ) and South32’s (LSE: S32; ASX: S32; JSE: S32) proposed 340-km road from the Upper Kobuk Mineral Projects (UKMP) to the Dalton Highway is now expected in the second quar ter of 2024.

As of the late-May status report, the DOI was promising a decision by the end of the year.

The need for an industrial access road has been recognized by U.S. lawmakers for decades, but it wasn’t until 2020 that the Bureau of Land Management (BLM) the Army Corps of Engineers, and the National Park Service issued a joint decision providing the federal authorizations needed to build it.

Last year, however, BLM suspended the permits issued under the Trump administration, citing a

lack of adequate consultation with Alaska tribes and evaluation of the road’s potential impacts on fish and caribou habitats. The Biden administration sus-

pended at the time the issuing of permits for all projects that cross federal lands. The Ambler access road would cut through gates of the Arctic National Park and Preserve,

crossing 11 major rivers and thousands of streams.

Ambler Metals, formed in 2019 by Trilogy Metals and South32, said the fresh “unnecessary” delay

threatened a project that will provide much-needed jobs and economic growth for Alaskans.

“We are obviously disappointed to hear the latest status update from the DOI,” president and CEO Ramzi Fawaz said in the statement.

“It has been a year since the court granted DOI’s request for a voluntary remand of the permit, providing ample time for the department to conduct the needed supplemental work on the EIS”, Fawaz added.

The UKMP projects, consisting of Arctic and earlier-stage Bornite copper assets, have a combined resource of 8 billion lb. of copper, 3 billion lb. of zinc and 1 million oz. of gold equivalent.

The proposed mine is expected to produce more than 159 million lb. of copper, 199 million lb. of zinc, 33 million lb. of lead, 30,600 oz. of gold and 3.3 million oz. of silver annually over a 12-year mine life.

Based on studies conducted by Chile’s Codelco, the global energy transition to confront climate change will raise demand for the metal from 25 million tonnes per year now to just over 31 million tonnes in 2032. TNM

6 JUNE 12 — 24, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

Some of the winners of Young Mining Professionals’ scholarships in 2022. JONAH ODLOZINSKI

The route of the proposed Ambler Access Project in Alaska. TRILOGY METALS

GLOBAL MINING NEWS THE NORTHERN MINER / JUNE 12 — 24, 2023 7 Good lucktoall applicants! www.ympscholarships.com scholarships@youngminingprofessionals.com ACQUIRE | DI SCOVER FINANCE | BUI LD | OPERATE The YMPScholarship Fund isawarding $200,000over45scholarships. Thankyou to ourpartnersfor supporting mining’s future leaders! Toronto

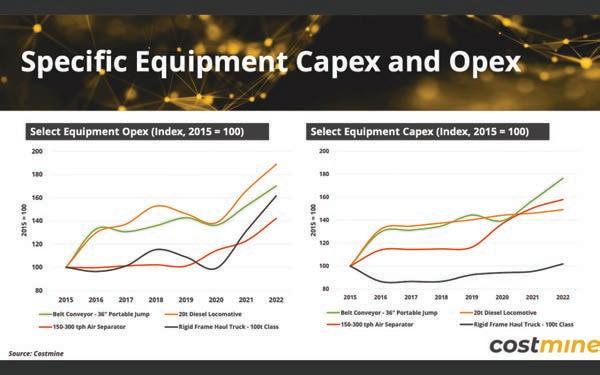

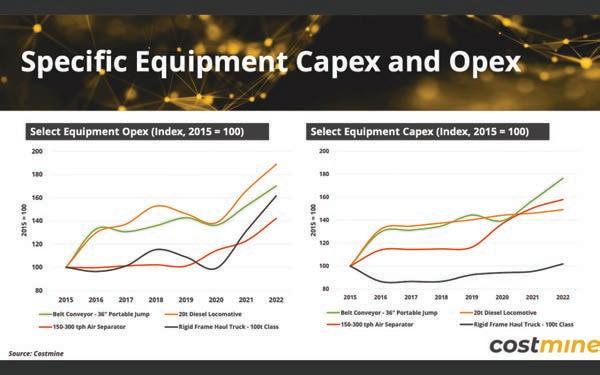

Worker pay to beat oil as mine’s biggest expense, new data indicate

COSTMINE | Inflation hits opex harder than capex

BY COLIN MCCLELLAND

BY COLIN MCCLELLAND

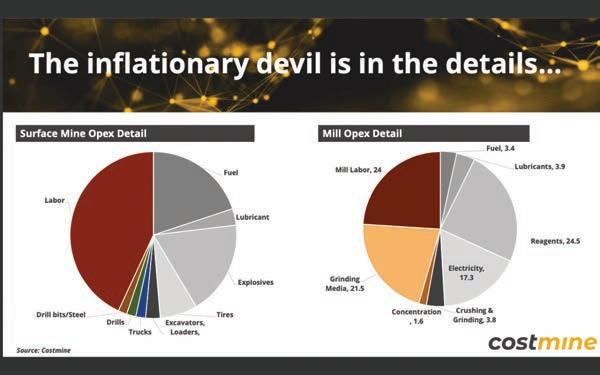

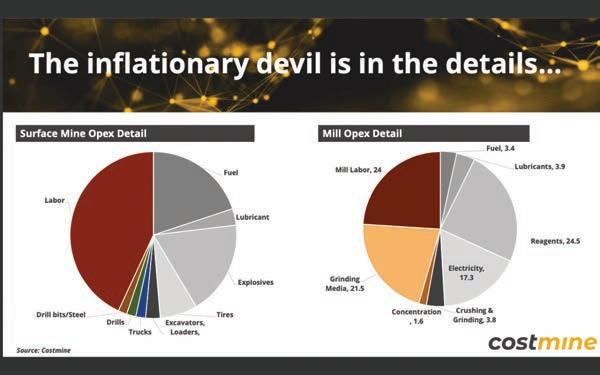

Labour is replacing oil products as a mine’s most expensive item as inflation impacts operating expenses more than capital costs, new reports show.

Wages for some copper and gold mine employees in the southwest United States increased by around 10% in the last year and a half, helping raise hourly pay by 4% at unionized and non-union surface and underground metal and industrial mineral mines across the U.S., according to Costmine Intelligence, a unit of The Northern Miner Group.

The trend is part of 30% higher labour costs since the 2015 commodity bear market, Costmine vice-president Mike Sinden said in an interview in early June. Barring another oil price shock, U.S. workforce costs are expected to be the fastest increasing element in a mine’s expenses, Sinden said. For open pit mines, he says labour could exceed half of their costs.

“As non-unionized labour gains bargaining power and union contracts roll off, we expect to see double-digit labour costs,” Sinden said. “That could really add fuel to the fire if energy prices stay strong.”

Labour costs are rising in Canada and the U.S. at a similar pace when accounting for foreign exchange. Until 2021, wage cost increases largely matched inflation at around 2% to 4%, but last year saw some pay increases of 5% to 12%, Costmine data show. Salaried staff saw similar increases.

The workforce accounts for some 43% of operating costs at a surface mine while oil-based products — such as fuel, explosives and tires — account for just less than half, Costmine data show. Labour at 24% is less of a component to run a mill, where 21.5% of operating costs is grinding media. But oilbased products make up about half

of the mill’s operating costs.

The price of a common big-ticket item, a 100-ton hauling truck, has increased little from US$1.6 million eight years ago, but the cost of running it has rocketed the most on a Costmine index of operating expenses that also included a locomotive and a conveyor belt.

The inflation factor

A truck that was US$108 an hour to run in 2015, cost US$175 an hour last year. There have also been several reports of underground jumbo drill operators earning US$100 an hour, two to three times what Costmine has tallied in the past, Sinden said. As forecasts call for constructing hundreds of mines for the metals to tackle climate change, there’s bound to be a crunch.

“The theme is going to be cost inflation,” Sinden said. “Everyone’s going to rush to develop a mine, going to want labour, want a jumbo drill and 100-ton trucks. And the next 10 years are going to be really spicy when it comes to inflation.”

One somewhat hidden aspect of the pay raises is the role bonuses have increasingly played over

recent decades, Sinden said. Some 70% of U.S. mines offer bonuses, many tied to production, attendance and commodity prices. They will further drive wage inflation if shortages spur metal price hikes.

The bonus figure for Canada is about 41% of mines, but data are incomplete, Costmine says. In the U.S., bonus plans are found at about 90% of coal mines, which can siphon 5% to 15% of a mine’s profit. Coal prices shot up after the war in Ukraine cut off Russian gas supplies to Europe, and metallurgical coal for steel production similarly rocketed. Only about 20% of coal mines offered bonuses in the 1980s, Sinden said.

Globally, a semblance of parity in surface mine operating costs is emerging among jurisdictions, Costmine data show. Australia has the smoothest trends compared with the U.S. and Canada because 52% of its costs are attributable to unionized labour. Still, Canada has just under 90% of its mine employees unionized, while it’s about 43% in the U.S., Costmine says.

That means the impact of inflation would be felt slower in Canada

because of “sticky” contracts compared with the more flexible U.S. labour market, the analysis unit says.

In capital costs, economies reopening in 2020-21 after the worst of the pandemic drove steel prices higher, then the Russia-Ukraine war increased energy prices, especially metallurgical coal for steel, and supply chain constraints kept prices elevated. Steel prices have since eased but the potential for volatility remains, Sinden said.

Equipment that is more special-

ized, such as conveyor belts linking specific operations, tends to show higher inflation than haulage trucks that are common across mines, the data show.

“Ultimately, capex will rely on your view of steel prices and to some degree, copper, zinc and nickel,” Sinden said. “But again, labour could creep into this equation. At current levels, a flattening of capex escalation would be a reasonable assumption, but the labour component of capex could drive the next leg higher in inflation.” TNM

Dundee’s process innovations help miners get greener

ENVIRONMENT | Firm’s tech scrubs toxins from extraction, processing at mines

BY NORTHERN MINER STAFF

The mining and smelting industry has faced environmental risks for decades, but now new mineral extraction and metallurgical technologies are helping to mitigate them.

Dundee Sustainable Technologies has developed two key technologies: CLEVR, a cyanide-free gold extraction process; and GlassLock, a process for the removal and stabilization of arsenic.

“What we were really trying to do was address some of the challenges that the industry is facing in terms of environmental challenges and metallurgical challenges and that’s what really drove us [to innovate],” the company’s president and CEO, Jean-Philippe Mai, said on the Process Innovation Panel at the Global Mining Symposium at the TSX on May 25. “Both of our processes have been developed and demonstrated at the industrial scale and we are now commercializing them within the mining industry.”

The CLEVR process offers a cleaner, more efficient, and cost-effective alternative for gold extraction, Mai said. It doesn’t use cyanide or produce toxic liq-

uid or gaseous effluents. The process cuts contact times from more than 36 hours to about two hours, and is a closed loop, which means all reagents are re-circulated. That eliminates the need for tailings ponds.

The company’s GlassLock process removes the arsenic often linked to gold, copper, silver or polymetallic deposits, and incorporates it into a stable and insoluble glass product that can contain up to 20% arsenic.

Applications can include metal-

lurgical flue dusts (smelting); mineral concentrates (arsenopyrite, cobaltite, enargite, and tennantite); soluble arsenic in Pregnant Leach Solutions (PLS), acidic or alkaline; and arsenic in tailings, tailing drainages and wastewater.

Novel technologies like these ones are critical for a greener future, he argued.

“We know that mining is a rather conservative industry, however there’s always been a desire and a strong interest for project developers and miners to innovate and

improve their projects through processes, improved ESG policies and actions,” he told The Northern Miner’s Editor-in-Chief Alisha Hiyate, who moderated the panel. “With a lack of or very few really novel innovations and processes to be offered to the industry I think now we are filling in one of these gaps here.”

Mai, who has spent more than 15 years in the mining industry as a geologist, senior project manager and executive in coal, base metals and gold projects in Canada, Australia and South America, noted

that the new technologies will cut costs as well as meet increasingly stringent environmental requirements.

“A true definition of innovation is processes that are improving operational efficiencies and improving environmental practices,” he said, adding that changing recovery methods has a huge impact on the project, whether it is reducing its footprint, eliminating the use of tailings ponds, using dry stack tailings or removing contaminants. “All of these aspects can definitely improve the economics of a project,” he said.

Dundee works with project developers and miners to test and apply its processes on specific projects, ore, and mineralogy.

“Typically, a company can send us some samples, we’ll run some preliminary test work, some optimization test work and then using the data that is generated by using our industrial demonstration campaign, we can build numeric process models and then output opex and capital costs associated with the incorporation of our processes within a specific project,” Mai said.

The Montreal-headquartered Dundee has more than 50 patents in more than 15 countries. TNM

8 JUNE 12 — 24, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

Costmine vice-president Mike Sinden speaks at GMS in Toronto. ERIK ROTTER PHOTOGRAPHY

Dundee Sustainable Technologies president and CEO, Jean-Philippe Mai (second from left), participates in a thought-leadership panel during the recent GMS event ERIK ROTTER PHOTOGRAPHY

Quebec touts funding from $400 billion pension for battery metal projects

GMS | Unique financing model helps advance exploration, mining

BY COLIN MCCLELLAND

Quebec is becoming known for mining project funding that hands out several hundred million dollars a year and promotes the province as a battery metals hotspot.

The province’s funding structure features Investment Quebec with its ability to tap funds from the province’s $402 billion pension plan, the Caisse de dépôt et placement du Québec. Resources Quebec, a unit of Investment Quebec, oversees mining funding from the $1 billion Natural Resources and Energy Fund, and $600 million held by Resources Quebec.

There are no set limits, but it averages about $200 million a year in exploration and project funding, Amyot Choquette, senior director of investment at Resources Quebec, told The Northern Miner’s Global Mining Symposium on May 25 at the Toronto Stock Exchange. Last year’s amount was $116.8 million, less than half the previous year’s $259.2 million because some investment decisions landed after the year-end, he said.

“It’s just a question of timing of projects coming in,” Choquette said. “We invest in construction projects and we can write large investments a big ticket, $5 million or $100 million and more.”

Quebec holds a handful of debt and royalties in companies and equity stakes in about a dozen others including Nouveau Monde Graphite (TSXV: NOU; NYSE: NMG) and Mason Graphite (TSXV: LLG; US-OTC: MGPHF), which are advancing the Uatnan project. It also owns part of North American Lithium, which restarted its plant 60 km north of Val-d’Or in March and is controlled by Sayona Mining (ASX: SYA) and Piedmont Lithium (NASDAQ: PLL, ASX: PLL).

The Société Québécoise d’explo-

ration minière, known as Soquem, also funds about $15 million a year in exploration. And separate from Investment Quebec is the smaller Diversification of Exploration Investment Partnership (Sidex) with a funding budget of about $7 million a year.

Formed in 2001 by the province and its largest labour union, the FTQ, Sidex grants $50,000 to $1.5 million each in equity investments to about 25 mostly exploration projects a year, president and CEO Paul Carmel told the symposium.

Sidex has aided many of the lithium projects in a hotspot east of James Bay making up almost half of Canada’s more than 400 mostly early-stage lithium projects. Quebec is keen to invest in battery metal exploration to become a major supplier to North American automakers. The province wants to expand its mineral success beyond the nearly half of its investments in gold, copper and zinc, and a con-

centration in the Abitibi region which has Canada’s largest gold mine, Canadian Malartic, run by Agnico Eagle Mines (TSX: AEM; NYSE: AEM).

“We really like to encourage exploration in new geological contexts and in a variety of commodities,” Carmel said. “So if you come to us with a gold propped in the Abitibi, we go okay, you know, we’ll look at it, it’s interesting. But if you come to us with a nickel project in a different geological context altogether, it kind of goes to the top of the pile and gets our attention.”

Support pays off

Quebec also owns half of Nemaska Lithium after an earlier version of the company failed in 2019 and the province lost $71 million, showing that even the green energy transition has risks. The other half is held by Livent (NYSE: LTHM) and Allkem (TSX: AKE; ASX: AKE) which merged last month to form

the third-largest lithium miner. Nemaska was boosted last month with the signing of a deal to annually supply Ford with 13,000 tonnes of lithium for 11 years.

“When you start seeing off-take agreements, that means it’s getting really hot and it’s become the next kind of frontier,” Carmel said. “What’s different is that it’s actually led to economic mines, juniors are actually putting these things into production.”

Quebec has incentives including unique-in-Canada refunds of 8% of exploration-related development or 16% of pre-production development; allowances for projects in northern Quebec that cover 25% of exploration expenses and for bringing projects into production; and a 15-year tax holiday for major investment projects.

There’s also the resource tax credit, which provides a refund of up to 38.75% of eligible exploration expenses; and a bonus to the typi-

SCP Resource Finance enters the critical fray

GMS | New firm forms amid precious, critical metal tailwinds

BY BLAIR MCBRIDE

Mere weeks after its formation, SCP Resource Finance is ready to bring its mining finance expertise offering to clients.

The newly constituted Toronto-based company developed from a management-led buyout from Sprott Inc in early May, with a resulting name change from Sprott Capital Partners to SCP Resource Finance LP.

“[We’re] a sell-side broker, but mining specialist. We focus on finding world class assets across multiple commodities,” Brandon Gaspar, vice president, research analyst at SCP Resource Finance told The Northern Miner in a May 25 interview at the GMS in Toronto.

Gaspar also joined Northern Miner Group president Anthony Vaccaro on stage at GMS for a discussion on commodities and critical minerals.

While SCP’s name might be new, its day-to-day operations are largely the same and it aims to continue bringing its expertise and

knowledge to its work with clients.

“Everybody on our team has significant industry experience in commodities, from lithium to rare earths; [we have] mining engineers, geologists, chemical engineers. It’s unique and definitely a strong suit of ours,” Gaspar said, adding that the team’s knowledge equips it to

find quality assets for foreign investments and institutional clients.

SCP’s entry into the mining finance sector also comes as critical minerals grow to be an ever-larger concern in Canada, with explorers such as LithiumBank Resources and Volt Lithium in Alberta experiencing share price peaks on the

news last month of new recovery methods in oil well brines. In late May, Quebec’s Nemaska Lithium also inked an agreement with Ford Motor Co to supply the automaker with up to 13,000 tonnes of lithium hydroxide per year, produced at the company’s plant in Bécancour, Que.

Those developments come as lithium carbonate prices, at US$42,100 per tonne, are still far below record highs from a year ago of US$69,450, according to data from the Wall Street Journal

“Precious metals [are] looking very strong here. And then you also have the critical mineral movements and it’s sort of a double avenue for unprecedented growth on multiple fronts,” Gaspar said. “For us at SCP it’s a very important year… because we’re just getting started…and now we’re fully independent and have that flexibility to capitalize on multiple avenues of what’s happening in the mining sector right now. It’s perfect timing.”

cal Canadian flow-through share system, where investors in Quebec can deduct up to 120% of the cost of their investment.

Sidex, which began with a $50 million cash pool, is valued at $75 million this year and has a portfolio invested in about 50 companies, Carmel said.

The province’s penchant for investing in mines stretches across political parties and back to when Teck Resources (TSX: TECK.A, TECK.B; NYSE: TECK) and Barrick Gold (TSX: ABX; NYSE: GOLD) were small and the provincial pension plan bought the third-highest stakes in each, recalled Carmel, who worked at the plan years ago.

“Investing is just in our DNA, it sort of has to be there,” Carmel said. “l’ve had calls from other provinces trying to duplicate a Sidex. But you really have to have the desire, the government has to actually want to do it. You know, you can lead a horse to water.” TNM

EDITORIAL from 4

als are essential and many critical minerals including lithium were at all time commodity highs. The combination of the Critical Mineral Tax Credit and the Charity Flow-through structure resulted in over $350 million invested in Canada in the first 12 months. Commodity prices have fallen with the falling pricing resuting in reduced financing activity. The new AMT rules will take the wind out of what was a great incentive. Comparatively, if grants were used instead of tax credits, progress would have been sluggish, plagued by endless deliberations and bureaucratic processes.

The impact of these changes extends beyond a specific group; it affects all stakeholders. Ultimately, everybody loses in this scenario, and the consequences are far-reaching.

The new AMT measures threaten to derail the progress made in the junior finance sector, limit funding for crucial exploration projects, and discourage individuals from supporting charitable causes. These unintended consequences must be taken seriously, and policymakers need to reconsider the impact of these measures on the overall economy. Striking a balance between tax fairness and supporting economic growth is essential. TNM

GLOBAL MINING NEWS THE NORTHERN MINER / JUNE 12 — 24, 2023 9

Sidex president and CEO Paul Carmel (L) and Amyot Choquette (middle), senior director of investment at Resources Quebec in conversation. ERIK ROTTER PHOTOGRAPHY

Peter Grosskopf, who was CEO of Sprott from 2010 — 2022 will continue as CEO of SCP. TNM

Brandon Gaspar (L), VP, research analyst at SCP Resource Finance. ERIK ROTTER

Canadian Mining Hall of Fame looks to the future with newest inductees

HONOURS | New members hailed for enhancing environmental ethics, innovation and prominence of Canadian mining industry

BY BLAIR MCBRIDE

The Canadian Mining Hall of Fame (CMHF) held its 35th annual induction ceremony on May 24 at the Carlu in Toronto, welcoming three new honourees, and bringing total membership up to 203.

The gala celebration, attended by around 530 people, was hosted by The Northern Miner Group’s president, Anthony Vaccaro, and the president and CEO of the Mining Association of Canada, Pierre Gratton.

Jim Cooney:

A non-miner no longer

The first inductee of the night was Jim Cooney, who promoted the concept of sustainable development and encouraged the adoption of policies to improve mining’s environmental and social impacts.

In 1976, he was hired “as an outsider” by Cominco (now Teck Resources) as a researcher with the company’s strategic planning group. He would eventually become a leading advocate for sustainable development in mining, particularly at Placer Dome which became the first mining company to adopt a corporate sustainable development policy in 1997.

In a video interview, Cooney said his first assignment was to go to Tanzania to prepare a country risk assessment, a task he was given for his unique perspectives based on his study of political science at Georgetown University and Asian languages and philosophy at the University of Toronto. Those perspectives set him apart from most people in the business.

He was inspired by the UN’s Brundtland Commission’s 1987 report “Our Common Future,” which formally introduced sustainable development in its report. But, five years later when Cooney learned that no mining companies had attended the Rio Earth Summit, he realized the mining world

was lagging behind.

“There was resistance to sustainable development when I first proposed it,” he said.

In a meeting with the World Bank in 1997, he introduced the concept of “social licence to operate” to explain the risk of conflicts between the mining industry and host communities. That concept has since spread throughout the industry.

Before presenting the Hall of Fame award to Cooney, MAC’s Gratton recalled how Cooney had inspired him in Gratton’s first address to the Vancouver Board of Trade several years ago.

“Jim gave me the idea… on how our sector’s complexity calls for an immense diversity of talent, including even theologians and linguists like Jim,” Gratton said. “Sustainable mining, which is now being implemented in 13 countries worldwide continues to expand. It would not have been possible if there hadn’t been a Jim Cooney laying the groundwork for all of this work.”

In his acceptance speech, Cooney received roaring applause when told the audience the Hall of Fame event symbolizes that his transformation from non-miner to miner is complete.

“My three children... were the primary motivators of my career in the mining industry, inspiring me to do whatever I could think of to stay employed, so essentially,

I started thinking of sustainable development and social licence, and it worked. I kept my job!” he joked.

“Sustainable development essentially means that the economic, environmental and social dimensions of any industrial activity... must be continuously rebalanced and reintegrated, always with a focus on the long- term well-being of humanity and the planet. This means that the mining industry must engage in a never- ending effort to find compromise, and build consensus with those whose values and priorities differ from ours.”

While Cooney said he was alone in the industry when he first advocated for sustainable development and introduced social licence, he noted that he wasn’t alone for long.

He singled out John Wilson, CEO of Placer from 1993 to 2000, whose encouragement and enthusiasm made possible Cooney’s contributions to mining.

“I feel proud, very proud that Placer Dome became the first mining company to embrace sustainable development and social licence and that so many other mining companies individually and through their industry associations followed suit,” Cooney said. “This industry’s ability to redefine itself and adapt to changing expectations and demands is truly extraordinary.”

Douglas Balfour Silver: Infinitely curious

The second inductee was Douglas Balfour Silver, whose unique skills in valuations and appraisals helped improve due diligence in the mining industry, and he created several highly valuable royalty portfolios in Canada.

Raised in New Jersey, Silver studied zoology and geology before completing a master’s degree in economic geology at the University of Arizona. Not one to sit still, Silver explained in a tribute video that he inherited a “genetic disorder” from his mother that makes him infinitely curious.

“I’ve switched about five or six times in different aspects of the

mining industry, always because it just sounded more interesting or it was new, and I wanted change,” he said. “Change is good. I’ve always benefited from change.”

In 1987, he launched Colorado-based Balfour Holdings, and built comprehensive databases on mining issues as his fascination with data propelled him forward.

He recalled in a tribute video being one of the first discoverers of the high-grade Silver Creek molybdenum deposit in Colorado, although it was too deep to develop into a mine. He recounted how in those pre-computer days, his team spent eight months drawing isometric diagrams by hand trying to figure out where the deposit was.

“The thrill you get from making major mineral discoveries is

10 JUNE 12 — 24, 2023 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

Jim Cooney

Douglas Balfour Silver

“I feel proud, very proud that Placer Dome became the first mining company to embrace sustainable development and social licence.” — JIM COONEY

Phillip John Mackey, inducted into the hall of fame in 2022, sits with his wife Angele at the gala dinner on May 25. MORGAN HOTSTON/CMHF

like nothing else in the world. But what it did was put me on a path of thinking about doing things first. Your life is actually a series of firsts,” he said.

When the industry went into a downturn, Silver went back to school to study appraisal theory. He leveraged that education into Balfour Holdings.

“At the time, I don’t think there were five people in the world that had both a mining background and an appraisal background,” he said. “Balfour Holdings became a premier place for people to get appraisals because I had this dual skill set. It was a marvelous way to be very heavily embedded in the acquisition and mergers business.”

His foray into Canadian mining began with his founding of the Denver Gold Group in 1989, a forum to link gold companies with institutional investors.

Several years later, Silver joined private equity firm Orion Resource Partners, and built a royalty portfolio that eventually sold for $1.1 billion to Osisko Gold Royalties, one of the largest royalty transactions ever.

But Silver’s career has been about more than big deals. He has always valued education and people, making donations to higher education in the mineral sector, as well as time and effort to mentoring students. He has also supported the advancement of women in mining.

“That never made sense to me about this glass ceiling,” he said in a video. “Women can multitask and one industry that needs multitasking is mining. We’re seeing a lot more women CEOs, we’re seeing a lot more women on boards, but it’s been long overdue, and I did what I could to break the glass.”

After TNM’s Vaccaro presented the award to Silver, he said he’s been a closet Canadian for decades and the CMHF gala is his coming out party.

“There are more public mineral and mining companies in Canada than anywhere else in the world. This is like… winning an Olympic gold medal in hockey and dare I say against the Americans.”

Silver closed by thanking his ex-wife for raising their children, allowing him the freedom to do the work that made him successful.

“I think a lot of times recipients of awards don’t appreciate what their significant others do for them. Thank you and for all the significant others regardless of pronoun, thank you.”

Alexander John Davidson: From the bush to the biggest deposits in Peru

Alex Davidson, the final inductee of 2023, has been behind the discovery of major deposits in Canada and South America, and his leadership within Barrick Gold helped advance the company into the world’s leading gold producer.

Born in Montreal, Davidson graduated from McGill University in 1976 with a M.Sc. degree in economic geology.

His drive to apply geology in a hands-on way soon took him to an exploration project in northern Quebec, where Indigenous people taught him how to survive in the bush.

“They taught me how to capture rabbits with a snare, fish with a broken line, never wash because the soap attracts mosquitoes, black flies and deer flies, and also how to strike a tent and put up camp in the rain. It was an invaluable exercise,” he recalled in a tribute video.

Not long after, he was leading an exploration program for a predecessor of Cameco in Saskatchewan’s Athabasca Basin, where his team drilled the discovery hole at the McArthur Lake uranium deposit.

After joining Falconbridge Cop-

per in Ontario in 1980, Davidson helped discover the high-grade Winston Lake zinc deposit, which produced from 1988 to 1999.

His success led him to Barrick in 1993, a firm that he described as very small but with big ambitions, and led at the time by CMHF inductees Peter Munk and Robert Smith.

“That’s why we went down to Peru. It was a very motivated team and it was a lot of fun to work there,” Davidson said.

After the company discovered the Pierina deposit in Peru, Davidson’s team found the even-larger Lagunas Norte deposit. It eventually produced more than 10 million oz. of gold.

His work helped raise the profile of Canadian mining and earned him the Prospectors and Developers Association of Canada’s Prospector of the Year Award in 2003, the Canadian Institute of Mining, Metallurgy and Petroleum’s A.O. Dufresne Award in 2005 and the Society for Mining, Metallurgy and Exploration’s Charles F. Rand Gold Medal in 2019.