16 minute read

What is leverage in Exness? What is the best leverage for $100?

What is leverage in Exness? 5 best leverage for $100. Leverage is a powerful financial tool that allows traders to control a larger position in the market than their initial investment would typically allow. In the context of Exness, leverage refers to the ratio between the trader's capital and the position size they can open. For example, if a trader has $100 in their account and they use 1:100 leverage, they can open a position worth $10,000 (100 times their initial capital).

Understanding Leverage in Exness

Leverage is a crucial aspect of trading in Exness, as it can significantly amplify both the potential profits and losses of a trade. By using leverage, traders can potentially generate higher returns on their investment, but it also increases the risk of incurring significant losses.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

The Concept of Leverage in Exness

Leverage in Exness is expressed as a ratio, such as 1:100 or 1:500. This ratio represents the amount of trading capital the trader controls relative to their own capital. For example, with a leverage ratio of 1:100, a trader with $100 in their account can open a position worth $10,000 (100 times their initial capital).

Understanding Leverage Ratios in Exness

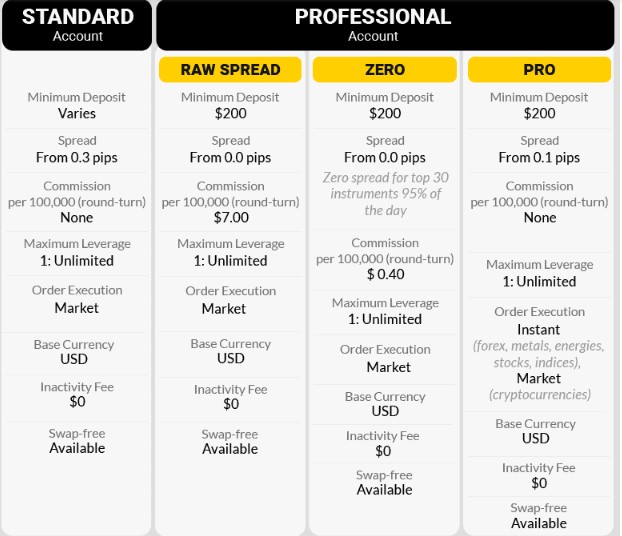

Exness offers a range of leverage ratios, typically from 1:1 up to 1:1000, depending on the asset being traded and the trader's account type. Higher leverage ratios, such as 1:500 or 1:1000, can amplify potential profits, but they also significantly increase the risk of losses. Traders need to carefully consider their risk appetite and trading strategy when selecting the appropriate leverage ratio for their account.

The Importance of Leverage in Exness Trading

Leverage is a crucial component of trading in Exness, as it allows traders to access larger market opportunities with a relatively small initial investment. This can be particularly beneficial for traders with limited capital, as it enables them to participate in the financial markets and potentially generate higher returns. However, it's important to note that leverage can also magnify losses, making it essential for traders to understand and manage the risks associated with its use.

Top 5 Best Leverage Options for $100 in Exness

When trading with a $100 account in Exness, choosing the right leverage ratio is crucial for managing risk and maximizing potential returns. Here are the top 5 best leverage options for a $100 account in Exness:

See more: How to trade in exness in india

1:100 Leverage

A leverage ratio of 1:100 is a popular choice for traders with a $100 account in Exness. This leverage allows the trader to control a position worth $10,000 (100 times their initial capital). This level of leverage can provide the opportunity for significant gains, but it also carries a higher level of risk. Traders need to be cautious and implement effective risk management strategies to mitigate the potential for large losses.

1:50 Leverage

Another suitable leverage option for a $100 account in Exness is 1:50. This leverage ratio allows the trader to control a position worth $5,000 (50 times their initial capital). While the potential returns may not be as high as with a 1:100 leverage, the 1:50 ratio offers a more conservative approach, which may be more suitable for risk-averse traders or those new to leveraged trading.

1:30 Leverage

A leverage ratio of 1:30 is another option for traders with a $100 account in Exness. This level of leverage allows the trader to control a position worth $3,000 (30 times their initial capital). The 1:30 leverage can be a good compromise between risk and potential reward, particularly for traders who want to limit their exposure to market volatility while still taking advantage of the benefits of leverage.

1:20 Leverage

For a $100 account in Exness, a leverage ratio of 1:20 can be a reasonable choice. This leverage allows the trader to control a position worth $2,000 (20 times their initial capital). The 1:20 leverage may be more suitable for conservative traders or those who prioritize risk management over maximum potential returns.

1:10 Leverage

Finally, a leverage ratio of 1:10 can be a conservative option for a $100 account in Exness. This leverage allows the trader to control a position worth $1,000 (10 times their initial capital). While the potential returns may be more limited compared to higher leverage ratios, the 1:10 leverage can be a good starting point for beginner traders or those who prefer a lower-risk approach to trading.

It's important to note that the choice of leverage ratio should be based on the trader's risk tolerance, trading strategy, and overall financial goals. Traders should carefully evaluate their risk management strategies and ensure they fully understand the implications of using leverage before deciding on the appropriate ratio for their Exness account.

Calculating Leverage in Exness: A Step-by-Step Guide

Calculating leverage in Exness is a crucial aspect of effective risk management and trading strategy. Here's a step-by-step guide on how to calculate leverage in Exness:

Understanding the Leverage Ratio

As mentioned earlier, leverage in Exness is expressed as a ratio, such as 1:100 or 1:500. The first number in the ratio represents the trader's capital, while the second number represents the position size that the trader can open.

Calculating the Position Size

To calculate the position size, you need to multiply your trading capital by the leverage ratio. For example, if you have $100 in your Exness account and you're using a 1:100 leverage ratio, your position size would be $10,000 (100 x 100).

Determining the Margin Required

The margin required to open a position is the amount of capital that the trader needs to have in their account to support the position size. In Exness, the margin required is the inverse of the leverage ratio. So, in the example of a 1:100 leverage ratio, the margin required would be 1% of the position size, which is $100.

Calculating the Margin Used

The margin used is the amount of capital that is currently being utilized by the open position. This can be calculated by dividing the position size by the leverage ratio. Using the example of a $100 account with a 1:100 leverage ratio, the margin used would be $100 (10,000 / 100).

Monitoring the Margin Level

In Exness, it's crucial to monitor the margin level of your trading positions. The margin level is the ratio of your equity (account balance plus or minus any open position profits or losses) to the margin required. Exness will typically issue a margin call if your margin level drops below a certain threshold, typically around 50%, at which point you may need to add more capital to your account or close some positions to avoid a potential liquidation.

By understanding and calculating leverage in Exness, traders can make more informed decisions about their trading positions, manage their risk effectively, and potentially optimize their trading outcomes.

Examples of Leverage Calculation in Exness

To further illustrate the concept of leverage calculation in Exness, let's explore a few examples:

Example 1: Calculating Leverage with a $100 Account

Suppose you have a $100 account in Exness and you decide to use a leverage ratio of 1:100. To calculate the position size, you would multiply your trading capital ($100) by the leverage ratio (100), which results in a position size of $10,000.

The margin required to open this position would be 1% of the position size, which is $100 (10,000 / 100). The margin used would be $100, as this is the amount of capital being utilized by the open position.

Example 2: Calculating Leverage with a $1,000 Account

Now, let's say you have a $1,000 account in Exness and you choose to use a leverage ratio of 1:50. To calculate the position size, you would multiply your trading capital ($1,000) by the leverage ratio (50), which gives you a position size of $50,000.

The margin required to open this position would be 2% of the position size, which is $1,000 (50,000 / 50). The margin used would be $1,000, as this is the amount of capital being utilized by the open position.

Example 3: Calculating Leverage with a $10,000 Account

Finally, let's consider a scenario where you have a $10,000 account in Exness and you decide to use a leverage ratio of 1:20. To calculate the position size, you would multiply your trading capital ($10,000) by the leverage ratio (20), which results in a position size of $200,000.

The margin required to open this position would be 5% of the position size, which is $10,000 (200,000 / 20). The margin used would be $10,000, as this is the amount of capital being utilized by the open position.

These examples demonstrate how to calculate the position size, margin required, and margin used based on the trading capital and leverage ratio in Exness. Understanding these calculations is crucial for effectively managing your trading risk and making informed decisions about the appropriate leverage to use for your trading strategy and risk profile.

Benefits of Using Leverage in Trading with Exness

Leverage can be a powerful tool in trading, as it can amplify both potential profits and losses. Here are some of the key benefits of using leverage in trading with Exness:

Increased Market Exposure

Leverage allows traders to control a larger position size than their initial capital would typically allow. This increased market exposure can lead to the potential for higher profits if the trade goes in the trader's favor.

Enhanced Capital Efficiency

By using leverage, traders can potentially generate higher returns on their investment compared to trading without leverage. This can be particularly beneficial for traders with limited capital, as it allows them to participate in larger market opportunities.

Flexibility in Trading Strategies

Leverage provides traders with the flexibility to adjust their trading strategies and position sizes based on market conditions and their risk tolerance. This can enable them to better adapt to changing market dynamics.

Potential for Faster Wealth Accumulation

Leveraged trading, when used responsibly, can potentially lead to faster wealth accumulation compared to trading without leverage. However, it's important to note that leverage can also amplify losses if the trade goes against the trader's position.

Diversification of Trading Portfolio

Leverage can be used as a tool to diversify a trading portfolio by allowing traders to participate in a broader range of market opportunities with a relatively small initial investment.

It's crucial to remember that while leverage can provide significant benefits, it also carries inherent risks. Traders need to carefully evaluate their risk management strategies, trading experience, and overall financial goals before deciding to utilize leverage in their Exness trading activities.

Risks Associated with High Leverage in Exness

While leverage can be a powerful tool in trading, it also carries significant risks, especially when used excessively. Here are some of the key risks associated with high leverage in Exness:

Increased Volatility and Potential for Larger Losses

High leverage amplifies both the potential gains and losses in a trade. This means that even small market movements can result in significant losses, potentially wiping out a trader's entire account balance.

Margin Calls and Involuntary Liquidations

When a trader's position experiences significant losses, Exness may issue a margin call, requiring the trader to add more capital to their account to maintain the position. Failure to meet the margin call can result in the position being automatically liquidated, potentially leading to substantial losses.

Emotional Strain and Pressure

The heightened volatility and potential for large losses associated with high leverage can create significant emotional strain and pressure on traders, leading to impulsive decision-making and increased risk-taking.

Difficulty in Managing Risk

High leverage makes it more challenging for traders to effectively manage their risk, as small market movements can have a disproportionate impact on their trading results. This can lead to the erosion of trading capital over time.

Increased Vulnerability to Market Shocks

In times of market volatility or unexpected events, high leverage can amplify the impact on a trader's positions, leading to significant losses that may be difficult to recover from.

To mitigate the risks associated with high leverage, Exness traders should carefully consider their risk tolerance, trading experience, and the appropriate leverage ratio for their trading strategy and market conditions. Effective risk management, including the use of stop-loss orders and proper position sizing, is crucial when utilizing leverage in Exness.

How to Choose the Right Leverage in Exness

Selecting the appropriate leverage ratio in Exness is a crucial decision that can significantly impact a trader's success. Here are some factors to consider when choosing the right leverage in Exness:

Assess Your Risk Tolerance

Understand your personal risk tolerance and financial ability to withstand potential losses. Traders with a lower risk tolerance may prefer lower leverage ratios, while those with a higher risk appetite may consider using higher leverage.

Consider Your Trading Experience

Leverage should be used with caution, especially for beginner traders. Traders with more experience and a solid understanding of risk management may be better equipped to handle higher leverage ratios.

Evaluate Your Trading Strategy

Different trading strategies may require different leverage levels. For example, swing traders or position traders may prefer lower leverage, while scalpers or day traders may benefit from higher leverage to capture smaller, more frequent market movements.

Analyze the Volatility of the Asset

The volatility of the asset you're trading can also influence the appropriate leverage ratio. Assets with higher volatility may require lower leverage to manage the increased risk, while less volatile assets may allow for the use of higher leverage.

Consider Your Account Size

The size of your Exness account can also play a role in the selection of the leverage ratio. Traders with smaller account sizes may need to use higher leverage to generate meaningful returns, while those with larger accounts may opt for lower leverage to minimize the risk of significant losses.

Implement Effective Risk Management

Regardless of the leverage ratio chosen, it's essential to have a robust risk management strategy in place. This includes the use of stop-loss orders, position sizing, and diversification to mitigate the risks associated with leverage.

By carefully considering these factors, Exness traders can make an informed decision about the appropriate leverage ratio that aligns with their trading goals, risk tolerance, and overall financial objectives.

Impact of Leverage on Trading Outcomes in Exness

The impact of leverage on trading outcomes in Exness can be significant, both in terms of potential profits and losses. Here's a closer look at how leverage can affect trading results:

Amplified Potential Profits

When a trade goes in the trader's favor, leverage can amplify the potential profits. For example, a 10% price movement in the trader's favor with a 1:100 leverage ratio can result in a 1000% return on the initial capital.

Magnified Potential Losses

Conversely, when a trade goes against the trader's position, leverage can also magnify the potential losses. A 10% price movement in the opposite direction with a 1:100 leverage ratio can result in a 100% loss of the trader's initial capital.

Increased Volatility and Risk

High leverage ratios can lead to increased market volatility and significant fluctuations in the trader's account balance. This can be particularly challenging for traders, as it can lead to emotional decision-making and the inability to effectively manage their risk.

Importance of Proper Risk Management

To mitigate the risks associated with leverage, it's crucial for Exness traders to implement robust risk management strategies. This includes setting appropriate stop-loss orders, diversifying their trading portfolio, and practicing disciplined position sizing to limit the impact of potential losses.

Leverage as a Tool, Not a Strategy

Leverage should be viewed as a tool to enhance trading opportunities, not as a standalone trading strategy. Successful Exness traders understand the risks involved and use leverage judiciously, aligning it with their overall trading approach and risk tolerance.

By understanding the impact of leverage on trading outcomes in Exness, traders can make more informed decisions about the appropriate leverage ratio to use, ultimately improving their chances of achieving sustainable trading success.

Leverage Strategies for Beginners in Exness

For beginner traders in Exness, the use of leverage requires careful consideration and a well-planned approach. Here are some leverage strategies that can be beneficial for beginners:

Start with Lower Leverage Ratios

Beginners should start with lower leverage ratios, such as 1:10 or 1:20, to become comfortable with the mechanics of leveraged trading and to develop effective risk management skills. This more conservative approach can help them avoid the potential pitfalls of high leverage.

Focus on Risk Management

Effective risk management should be the primary focus for beginner traders using leverage in Exness. This includes setting appropriate stop-loss orders, practicing proper position sizing, and diversifying their trading portfolio to mitigate the risks associated with leveraged trading.

Gradually Increase Leverage

As beginner traders gain more experience and confidence in their trading abilities, they can gradually increase their leverage ratios, but only if they have a solid understanding of the risks involved and have implemented robust risk management strategies.

Utilize Educational Resources

Exness provides a wealth of educational resources, including tutorials, webinars, and trading guides, that canhelp beginner traders understand the intricacies of leverage and effective trading strategies. Taking advantage of these resources can empower new traders to make informed decisions and enhance their trading skills over time.

Create a Trading Plan

A well-defined trading plan is essential for beginners using leverage in Exness. The plan should outline specific goals, trading strategies, acceptable risk levels, and criteria for entering and exiting trades. By adhering to a structured plan, traders can minimize emotional decision-making and maintain discipline, which is crucial when working with leveraged positions.

Practice with a Demo Account

Before committing real funds, novice traders should consider practicing in a demo account provided by Exness. This allows them to familiarize themselves with the trading platform, test various strategies, and experience how leverage affects trading outcomes without risking actual capital. It’s an excellent opportunity for beginners to learn about market movements and leverage dynamics in a risk-free environment.

By adopting these leverage strategies, beginner traders in Exness can approach the financial markets with greater confidence and a solid foundation, paving the way for long-term trading success.

Conclusion

In conclusion, understanding leverage in Exness is paramount for traders looking to optimize their trading strategies while managing risks effectively. Leverage can significantly amplify both potential profits and losses, making it a double-edged sword that requires careful handling. By evaluating personal risk tolerance, trading experience, strategy specifics, asset volatility, and account size, traders can select the right leverage ratio that aligns with their financial objectives.

See more:

how to withdraw money from Exness in india

Exness is real or fake in india

Exness vs octafx in india? Which is better?

exness is legal or illegal in india 2025?