8 minute read

Exness is legal or illegal in India 2025?

The legality of using Exness in India has been a topic of discussion among traders and investors. In this article, we will explore the legal status of Exness in India, the regulatory framework governing online trading, and the potential risks and considerations for Indian traders using the platform.

Understanding Exness: Legal Status in India

Exness is a global financial services company that provides online trading services to clients around the world, including in India. The company is headquartered in Belize and is regulated by the International Financial Services Commission (IFSC) of Belize.

✅ Exness: Open An Account or Go to Website

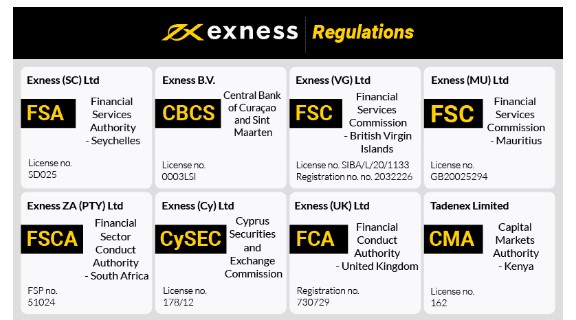

Exness' Regulatory Oversight

Exness is a licensed and regulated broker, with its primary regulatory oversight coming from the IFSC in Belize. The IFSC is the main financial services regulatory body in Belize and is responsible for licensing and supervising various financial institutions, including forex brokers like Exness.

The IFSC's regulatory framework includes requirements for financial reporting, capital adequacy, and client fund protection, among other measures, to ensure the stability and integrity of the financial services industry in Belize.

Exness' Presence in India

Exness has been operating in the Indian market for several years, providing trading services to Indian clients. The company has a strong presence in the country, with a dedicated website and customer support available in local languages.

However, it's important to note that Exness is not directly regulated by any Indian financial authorities, as it is a foreign-based company operating in the Indian market. This means that the legal status of Exness in India may be subject to interpretation and could potentially be affected by changes in Indian financial regulations.

Is Exness Regulated in India?

The regulatory framework governing online trading platforms and forex brokers in India is a complex and evolving landscape. While Exness is a licensed and regulated broker in its primary jurisdiction of Belize, its legality and regulation in the Indian market is not as clear-cut.

Indian Regulatory Bodies and Online Trading

In India, the primary regulatory bodies overseeing financial markets and services are the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). These institutions are responsible for developing and enforcing regulations related to various financial instruments, including forex trading.

SEBI, in particular, has been actively involved in regulating and monitoring the Indian financial markets, including the online trading ecosystem. The regulator has issued guidelines and directives aimed at ensuring the safety and stability of the Indian financial system, which may have implications for the legality of foreign-based trading platforms like Exness.

The Legality of Trading with Exness in India

The legality of trading with Exness in India is a complex issue that depends on various factors, including the regulatory framework, the specific financial instruments offered, and the compliance measures taken by the platform.

✅ Exness: Open An Account or Go to Website

Regulatory Compliance and Indian Law

While Exness is a licensed and regulated broker in Belize, its operations in India may not be directly regulated by Indian financial authorities. This means that the legality of using Exness for trading in India could be subject to interpretation based on the relevant Indian financial laws and regulations.

Indian traders should be aware that engaging in forex trading or other financial activities with foreign-based platforms may potentially be considered a violation of Indian financial regulations, depending on the specific circumstances and the interpretation of the law.

Exness and Indian Financial Regulations

The Indian financial regulatory landscape is continuously evolving, and the laws and regulations governing online trading and foreign-based platforms can be complex and subject to interpretation.

Compliance with Indian Financial Regulations

Exness, as a foreign-based trading platform, may need to ensure compliance with various Indian financial regulations, such as those related to foreign exchange transactions, capital controls, and anti-money laundering measures.

Indian traders should be aware that using Exness or any other foreign-based trading platform may potentially be subject to regulatory scrutiny and could have legal implications if the platform is not fully compliant with Indian financial laws.

Risks of Using Exness for Indian Traders

While Exness is a well-known and reputable trading platform, there are certain risks that Indian traders should be aware of when using the platform.

Regulatory Uncertainty

As discussed earlier, the legal status of Exness in the Indian market is not entirely clear-cut. This regulatory uncertainty could potentially expose Indian traders to legal and financial risks if the platform's operations are deemed non-compliant with Indian financial regulations.

Investor Protection Concerns

Indian traders using Exness may not have the same level of investor protection and recourse as they would with platforms that are directly regulated by Indian financial authorities. This could potentially leave them vulnerable in the event of disputes or issues with the platform.

What Indian Investors Should Know About Exness

Indian investors considering using Exness for their trading activities should be aware of several important factors.

Understanding the Regulatory Landscape

It's crucial for Indian traders to have a thorough understanding of the regulatory landscape governing online trading platforms, including the specific requirements and guidelines set forth by Indian financial authorities.

✅ Exness: Open An Account or Go to Website

Conducting Due Diligence

Before engaging with Exness or any other foreign-based trading platform, Indian investors should conduct extensive due diligence to ensure that the platform is compliant with relevant Indian financial regulations and is a reputable and trustworthy provider.

Legal Implications of Trading on Exness in India

The legal implications of trading on Exness in India can be complex and may vary depending on the specific circumstances of the individual trader and the platform's compliance with Indian financial regulations.

Potential Regulatory Enforcement Actions

If Exness or its Indian operations are found to be non-compliant with Indian financial regulations, Indian traders could potentially face legal and financial consequences, such as regulatory enforcement actions, fines, or even criminal charges.

Investor Recourse and Dispute Resolution

In the event of disputes or issues with Exness, Indian traders may have limited recourse or avenues for dispute resolution, as the platform is not directly regulated by Indian authorities.

User Experiences: Exness in the Indian Market

While Exness has been operating in the Indian market for several years, the experiences of Indian traders using the platform can provide valuable insights into the platform's acceptance and perceived legality in the country.

Feedback from Indian Traders

Indian traders have shared a range of experiences and opinions regarding their use of Exness. Some have reported positive experiences, such as reliable execution, competitive pricing, and responsive customer support. However, others have expressed concerns about the platform's legal status and the potential risks associated with using a foreign-based trading platform.

Regulatory Scrutiny and User Experiences

The level of regulatory scrutiny and enforcement actions (if any) taken by Indian authorities regarding Exness' operations in the country can also influence user experiences and perceptions of the platform's legality.

Future of Exness in India: Legal Perspectives

The future of Exness in the Indian market will likely depend on the ongoing development and interpretation of Indian financial regulations, as well as the platform's ability to ensure compliance with these regulations.

Potential Regulatory Changes

As the Indian financial regulatory landscape continues to evolve, there may be changes or new guidelines that could impact the legal status of foreign-based trading platforms like Exness in the country.

Exness' Compliance Efforts

Exness' ability to adapt to the changing regulatory environment and demonstrate its compliance with Indian financial laws and regulations will be crucial in determining its long-term viability and acceptance in the Indian market.

Conclusion

The legal status of Exness in India is a complex and evolving issue that requires careful consideration from both the platform and Indian traders. While Exness is a licensed and regulated broker in its primary jurisdiction of Belize, its operations in the Indian market may be subject to interpretation and potential scrutiny by Indian financial authorities.

Indian traders considering using Exness or any other foreign-based trading platform should thoroughly research the regulatory landscape, conduct due diligence on the platform, and be aware of the potential risks and legal implications associated with their trading activities. It is essential for traders to stay informed about the latest developments in Indian financial regulations and to ensure that their trading activities are compliant with the relevant laws and guidelines.

✳️ Read more:

Best EXNESS Trading Strategies For Beginners

How to Trade Forex on EXNESS For Beginners

How to Trade Crypto on EXNESS For Beginners

How to Trade Gold on EXNESS For Beginners