14 minute read

How to withdraw money from Exness in India

How to withdraw money from Exness in India is a common query among Indian traders and investors. Exness, a leading global forex and CFD broker, offers several withdrawal options for its Indian clients. In this comprehensive blog post, we'll guide you through the step-by-step process of withdrawing funds from your Exness account in India, the available withdrawal methods, associated fees, and the time frame for the transactions.

Step-by-Step Guide to Withdraw Money from Exness in India

Withdrawing money from your Exness account in India is a straightforward process. Here's a detailed step-by-step guide to help you navigate the withdrawal procedure:

Accessing Your Exness Account

To initiate a withdrawal, you'll need to log in to your Exness trading account. This can be done through the Exness client portal or the Exness mobile app, both of which are accessible to Indian clients.

Log in to Your Exness Account: Enter your login credentials, which typically include your username or email address and your password, to access your Exness account.

Navigate to the Withdrawal Section: Once logged in, locate the withdrawal section, which is usually found under the "Banking" or "Cashier" tab in your Exness account interface.

See more: How to trade in exness in india

Download Exness Platform

Selecting the Withdrawal Method

Exness offers several withdrawal options for Indian clients, each with its own set of requirements and processing times. In the withdrawal section, you'll be prompted to choose the preferred withdrawal method. We'll explore the available options in more detail in the next section.

Choose the Withdrawal Method: Review the different withdrawal methods available to you and select the one that best suits your needs.

Provide the Necessary Details: Depending on the chosen withdrawal method, you may be required to enter specific information, such as your bank account details or e-wallet credentials.

Completing the Withdrawal Request

After selecting the withdrawal method and providing the necessary details, you can proceed with the withdrawal request.

Review the Withdrawal Details: Carefully review the withdrawal details, including the withdrawal amount, the selected withdrawal method, and any applicable fees.

Submit the Withdrawal Request: Once you're satisfied with the information, you can submit the withdrawal request.

Monitoring the Withdrawal Status

After submitting the withdrawal request, you can monitor the status of the transaction through your Exness account.

Check the Withdrawal Status: The withdrawal status may be displayed as "Pending," "Processing," or "Completed," depending on the stage of the transaction.

Track the Withdrawal Progress: You can keep track of the withdrawal progress by regularly checking the status in your Exness account.

Remember, the specific steps may vary slightly depending on the Exness platform or mobile app version you're using, but the overall withdrawal process should be similar.

Understanding the Withdrawal Process on Exness in India

The withdrawal process on Exness for Indian clients involves several steps and considerations. Let's dive deeper into the intricacies of withdrawing funds from your Exness account in India.

Initiating the Withdrawal Request

As mentioned earlier, the withdrawal process begins by accessing the withdrawal section within your Exness account. This is typically found under the "Banking" or "Cashier" tab.

Withdrawal Section: The withdrawal section will provide you with the necessary options and tools to initiate and complete the withdrawal request.

Withdrawal Amount: Decide on the amount you wish to withdraw from your Exness account. Remember to consider any applicable withdrawal fees or minimum withdrawal requirements.

Verifying Your Account

Before processing the withdrawal, Exness may require you to verify your account. This is a standard practice to ensure the security of your funds and to comply with anti-money laundering (AML) regulations.

Account Verification: Exness may request additional documentation, such as a copy of your government-issued ID, proof of address, or bank statements, to verify your identity and the source of your funds.

Compliance with AML Regulations: The account verification process is crucial to comply with AML regulations and prevent any potential fraudulent activities.

Choosing the Withdrawal Method

Exness offers various withdrawal methods for its Indian clients, each with its own set of benefits, processing times, and fees. We'll explore the available withdrawal options in more detail in the next section.

Withdrawal Method Selection: Carefully evaluate the different withdrawal methods and choose the one that best suits your needs and preferences.

Withdrawal Method Suitability: Consider factors such as processing time, fees, and the compatibility of the withdrawal method with your personal banking or payment preferences.

Tracking the Withdrawal Status

Once you've submitted the withdrawal request, you can monitor the status of the transaction through your Exness account.

Withdrawal Status Updates: Exness will provide you with updates on the status of your withdrawal, which may include "Pending," "Processing," or "Completed."

Withdrawal Timeline: The time frame for the withdrawal to be processed and the funds to be credited to your preferred destination may vary depending on the withdrawal method and the specific circumstances.

Understanding the withdrawal process on Exness in India is crucial to ensure a smooth and timely transfer of your funds. By familiarizing yourself with the steps involved, you can make informed decisions and manage your withdrawals effectively.

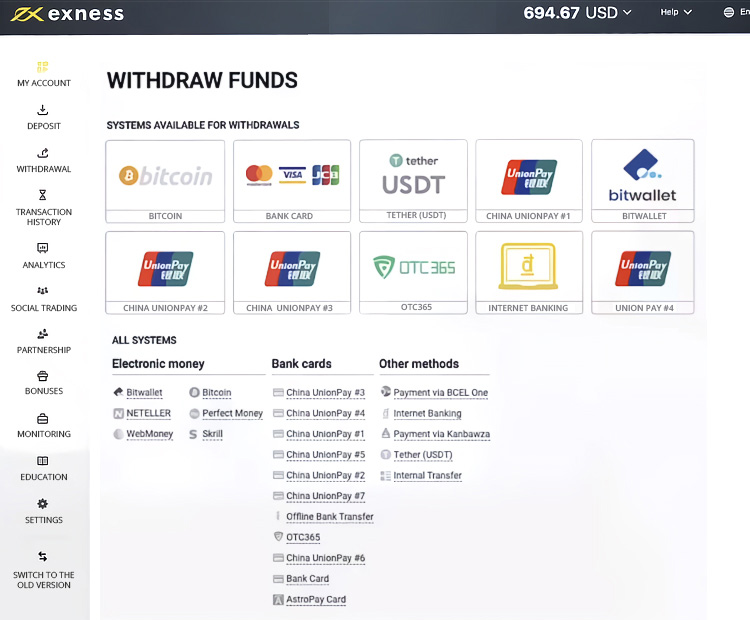

Exness Withdrawal Options Available for Indian Users

Exness offers a range of withdrawal methods for its Indian clients, each with its own set of features, processing times, and associated fees. Let's explore the various withdrawal options available to you as an Exness user in India.

Bank Wire Transfers

One of the most common withdrawal methods for Indian Exness users is the bank wire transfer.

Bank Wire Transfer: This option allows you to transfer funds directly from your Exness account to your bank account in India.

Processing Time: Bank wire transfers typically take 1-3 business days to be credited to your bank account, though the exact time frame may vary.

Fees: Exness may charge a fee for bank wire withdrawals, and your bank may also impose additional fees. It's essential to familiarize yourself with the applicable fees before initiating the withdrawal.

Local Bank Transfers

Exness also offers the option of local bank transfers for Indian clients, allowing you to withdraw funds directly to your Indian bank account.

Local Bank Transfer: This withdrawal method enables you to transfer funds from your Exness account to a bank account within India.

Processing Time: Local bank transfers are generally faster than international wire transfers, with funds typically being credited to your account within 1-2 business days.

Fees: The fees associated with local bank transfers may be lower than international wire transfers, but it's essential to check the specific fees charged by Exness and your bank.

Electronic Wallets (e-Wallets)

Exness supports withdrawal to various electronic wallets (e-wallets) that are popular among Indian traders and investors.

E-Wallet Options: Exness may offer withdrawal options to e-wallets such as Skrill, Neteller, and local Indian e-wallet solutions.

Processing Time: Withdrawals to e-wallets are generally faster than bank transfers, with funds often being credited within 1-2 business days.

Fees: The fees for e-wallet withdrawals may be lower compared to bank transfers, but it's important to review the specific fees charged by Exness and the e-wallet providers.

Debit/Credit Card Withdrawals

Exness also allows Indian clients to withdraw funds directly to their debit or credit cards.

Card Withdrawal: This option enables you to withdraw funds from your Exness account to the debit or credit card associated with your trading account.

Processing Time: Card withdrawals are typically processed more quickly than bank transfers, with funds being credited to your card within 1-2 business days.

Fees: Exness may charge a fee for card withdrawals, and your card issuer may also impose additional fees. It's essential to understand the applicable fees before initiating the withdrawal.

When choosing the withdrawal method, consider factors such as processing time, fees, and the compatibility of the withdrawal option with your personal banking or payment preferences. By understanding the various withdrawal options available on Exness in India, you can make an informed decision that best suits your needs.

How to Choose the Best Withdrawal Method on Exness in India

Selecting the most suitable withdrawal method on Exness for your needs as an Indian trader or investor is crucial. Each withdrawal option has its own advantages and considerations, and it's essential to weigh these factors to make an informed decision.

Factors to Consider When Choosing a Withdrawal Method

When selecting the withdrawal method on Exness in India, consider the following key factors:

Processing Time: The time it takes for the funds to be credited to your preferred destination can vary significantly between withdrawal methods. If you need the funds quickly, you may want to opt for a faster option, such as e-wallet or card withdrawals.

Fees: Withdrawal fees can vary depending on the method chosen and the payment provider involved. Carefully review the applicable fees charged by Exness and any third-party providers to ensure you're not incurring unnecessary costs.

Withdrawal Limits: Some withdrawal methods may have minimum or maximum withdrawal limits, which can impact your ability to withdraw the desired amount. Ensure the withdrawal method you choose aligns with your withdrawal needs.

Compatibility with Your Banking or Payment Preferences: Consider the compatibility of the withdrawal method with your personal banking or payment preferences. For example, if you primarily use a certain e-wallet or have a preference for bank transfers, that may influence your choice.

Security and Reliability: Evaluate the security and reliability of the withdrawal method, as you'll be entrusting Exness and the associated payment providers with your financial information and funds. Opt for well-established and reputable withdrawal options.

Regulatory Compliance: Exness, as a regulated broker, must adhere to various financial regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements. Ensure the withdrawal method you choose aligns with these regulatory requirements.

Weighing the Pros and Cons of Each Withdrawal Method

Once you've identified the key factors to consider, you can evaluate the pros and cons of each withdrawal method available on Exness in India. This analysis will help you make an informed decision that best suits your needs and preferences.

For example, bank wire transfers may offer more security and reliability, but they may also have longer processing times and higher fees. On the other hand, e-wallet withdrawals could be faster and more cost-effective, but they may not align with your personal banking preferences.

By carefully considering the various factors and weighing the pros and cons of each withdrawal method, you can select the option that provides the optimal balance of speed, cost-effectiveness, and compatibility with your needs as an Exness user in India.

Time Frame for Withdrawals from Exness in India

The time frame for withdrawals from Exness in India can vary depending on the selected withdrawal method and the specific circumstances surrounding the transaction. Understanding the typical processing times for each withdrawal option can help you manage your expectations and plan your financial activities accordingly.

Bank Wire Transfers

Bank wire transfers are generally the slowest withdrawal method on Exness for Indian clients. The typical time frame for a bank wire withdrawal is:

Processing Time: 1-3 business days, though it may occasionally take longer depending on the respective banking institutions involved.

Factors Affecting Processing Time: The processing time can be influenced by factors such as the cutoff time for wire transfer requests, the workload of the banking institutions, and any additional verification or security checks required.

Local Bank Transfers

Local bank transfers within India are generally faster than international wire transfers on Exness. The typical time frame for a local bank transfer withdrawal is:

Processing Time: 1-2 business days, as the funds are being transferred domestically.

Factors Affecting Processing Time: The processing time for local bank transfers can be influenced by the efficiency of the banking systems and any potential delays or investigations conducted by the financial institutions involved.

Electronic Wallet (e-Wallet) Withdrawals

Withdrawals to electronic wallets (e-wallets) are typically the fastest withdrawal method on Exness for Indian clients. The typical time frame for an e-wallet withdrawal is:

Processing Time: 1-2 business days, as e-wallet providers generally have streamlined withdrawal processes.

Factors Affecting Processing Time: The processing time for e-wallet withdrawals can be influenced by the specific e-wallet provider, the volume of withdrawal requests, and any additional verification or security checks required.

Debit/Credit Card Withdrawals

Debit and credit card withdrawals on Exness for Indian clients are also relatively fast. The typical time frame for a card withdrawal is:

Processing Time: 1-2 business days, as card transactions are typically processed more efficiently.

Factors Affecting Processing Time: The processing time for card withdrawals can be influenced by the card issuer, the volume of transactions, and any potential security or fraud checks performed.

It's important to note that the actual processing times may vary depending on various factors, such as the specific withdrawal method, the banking or payment provider involved, the workload of the institutions, and any potential delays or investigations that may occur. It's always advisable to check the Exness website or reach out to their customer support for the most up-to-date information on withdrawal timelines.

Fees Associated with Withdrawing Funds from Exness in India

When withdrawing funds from your Exness account in India, it's essential to be aware of the various fees and charges that may be applicable. These fees can vary depending on the withdrawal method chosen, the payment provider, and the specific terms and conditions set by Exness.

Exness Withdrawal Fees

Exness, as the forex and CFD broker, may charge fees for withdrawals made by its Indian clients. These fees can include:

Withdrawal Processing Fee: Exness may impose a fixed or percentage-based fee for processing the withdrawal request.

Currency Conversion Fee: If the withdrawal is made in a currency different from your Exness account base currency, Exness may charge a currency conversion fee.

Minimum Withdrawal Fee: Exness may have a minimum withdrawal amount, and a fee may be charged if the withdrawal amount is below the minimum.

It's important to note that the withdrawal fees charged by Exness may be subject to change, so it's essential to check the current fee structure on the Exness website or by contacting their customer support.

Third-Party Payment Provider Fees

In addition to the Exness withdrawal fees, you may also incur fees from the third-party payment providers involved in the withdrawal process. These can include:

Bank Wire Transfer Fees: Your bank or the recipient bank may charge fees for incoming or outgoing wire transfers.

E-Wallet Fees: E-wallet providers, such as Skrill or Neteller, may charge fees for withdrawals from your Exness account to their platforms.

Card Transaction Fees: Your card issuer may impose fees for withdrawals made using your debit or credit card.

It's crucial to familiarize yourself with the fees charged by the various payment providers and factor them into your withdrawal planning to avoid unexpected costs.

Minimizing Withdrawal Fees

To minimize the fees associated with withdrawing funds from your Exness account in India, consider the following strategies:

Comparison of Withdrawal Methods: Carefully compare the fees for different withdrawal methods and choose the option that best suits your needs while minimizing the overall costs.

Timing of Withdrawals: Plan your withdrawals to coincide with favorable currency exchange rates, which can help reduce currency conversion fees.

Withdrawal Amount Optimization: Consider withdrawing larger amounts at a time to potentially reduce the impact of fixed withdrawal fees.

Communication with Exness: Stay informed about any changes in the Exness withdrawal fee structure by regularly checking their website or communicating with their customer support team.

By understanding the fees associated with withdrawing funds from your Exness account in India and employing strategies to minimize these costs, you can maximize the amount of money you receive from your Exness account.

Conclusion

In conclusion, withdrawing money from your Exness account in India involves a straightforward process that includes selecting the withdrawal method, providing the necessary details, and monitoring the transaction status. Exness offers a range of withdrawal options for its Indian clients, including bank wire transfers, local bank transfers, electronic wallets (e-wallets), and debit/credit card withdrawals, each with its own set of features, processing times, and associated fees.

See more:

is Exness banned in india 2025

how to open account in Exness in india

Best Exness trading time in india

✳️ Read more:

Best EXNESS Trading Strategies For Beginners

How to Trade Forex on EXNESS For Beginners

How to Trade Crypto on EXNESS For Beginners

How to Trade Gold on EXNESS For Beginners