4 minute read

Exness Raw Spread Account vs Zero Account: A Comparison

When starting your trading journey with Exness, one of the first decisions you’ll face is choosing the right account type. Two of the most popular professional accounts are the Exness Raw Spread Account and the Exness Zero Account. Both are designed for traders who value low spreads, fast execution, and transparency, but they differ in fee structures and ideal use cases.

👉 Open your preferred account today at Exness Sign Up.

Introduction – Choosing the Right Exness Account

Why Account Type Matters for Traders

Your account type impacts your trading costs, execution, and strategy performance. Scalpers, day traders, and swing traders may benefit differently depending on whether they choose Raw Spread or Zero Account.

Quick Access to Exness Accounts

Exness offers multiple account types for beginners and professionals. You can explore them all by visiting Exness Home.

What is the Exness Raw Spread Account?

Key Features of Raw Spread Account

Ultra-low spreads starting from 0.0 pips.

Fixed commission per trade.

Suitable for scalping and high-frequency trading.

Trading Costs and Commissions

Traders pay a small commission fee (e.g., $3.50 per lot per side), while spreads remain close to zero.

Who Should Use Raw Spread Account?

Professional traders.

Scalpers who need tight spreads.

Algorithmic traders using Expert Advisors (EAs).

What is the Exness Zero Account?

Key Features of Zero Account

Zero spreads on top 30 trading instruments for most of the day.

Competitive commission fees.

Designed for traders needing predictable spreads.

Trading Costs and Commission Structure

Like Raw Spread, the Zero Account charges commissions, but spreads are consistently 0.0 on major pairs.

Who Should Use Zero Account?

Day traders relying on fixed spread conditions.

Those trading during high-volume hours.

Beginners transitioning to professional trading.

Which Account Should You Choose as a Beginner?

Beginners may prefer the Zero Account because it offers more predictable spreads, making it easier to manage risk.

Which Account is Best for Professionals?

Professionals often choose the Raw Spread Account for its lowest trading costs on high-volume strategies.

Pros and Cons of Raw Spread Account

Pros:

Ultra-low spreads.

Ideal for scalping.

Transparent commission structure.

Cons:

Commission fees per trade.

Spreads may widen in volatile markets.

Pros and Cons of Zero Account

Pros:

Zero spreads on top instruments.

Good for news trading and day trading.

More predictable trading costs.

Cons:

Commissions vary by asset.

Limited to specific instruments.

Exness Trading Platforms Supported (MT4, MT5, Mobile)

Both Raw Spread and Zero Accounts are available on:

MetaTrader 4 (MT4) – Beginner-friendly.

MetaTrader 5 (MT5) – Advanced features.

Exness Mobile App – Trade on the go.

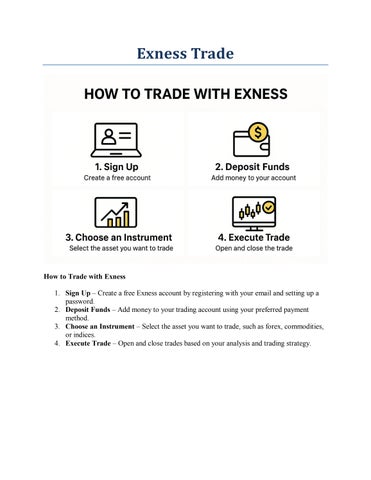

How to Open an Exness Raw Spread or Zero Account

Step 1: Register an Account

Sign up here: Exness Sign Up.

Step 2: Verify Your Account

Upload your ID and address proof to activate all features.

Step 3: Choose Raw Spread or Zero Account

From your Personal Area, select the account type.

Step 4: Fund Your Account and Start Trading

Deposit via bank transfer, card, or e-wallet, then begin trading.

👉 Explore account types at Exness Home.

FAQs – Raw Spread vs Zero Account

1. Which account has lower costs overall?It depends on your trading style. Raw Spread often benefits scalpers, while Zero Account helps day traders.

2. Can I open both Raw Spread and Zero Accounts on Exness?Yes, traders can open multiple accounts simultaneously.

3. Is there a minimum deposit requirement?Yes, usually from $500, depending on region.

4. Do both accounts support crypto trading?Yes, you can trade BTC, ETH, and other crypto pairs on both accounts.

5. Which account is better for beginners?The Zero Account is generally more beginner-friendly.

6. Are spreads always 0.0 in the Zero Account?Spreads are 0.0 on top 30 instruments during most trading hours.

Conclusion – Which Exness Account is Right for You?

Both the Exness Raw Spread Account and the Zero Account are excellent options, but the right choice depends on your strategy. If you want ultra-low spreads with a fixed commission, the Raw Spread Account is ideal. If you prefer zero spreads on major instruments with flexible commissions, the Zero Account may suit you better.

👉 Open your preferred account today at Exness Sign Up and start trading with the right edge.

See more:

How To Create copy trading Account in EXNESS

How To Create a trading Account on EXNESS