18 minute read

Is exness Regulated in India?

Is exness regulated in india? The question of whether Exness, a leading global forex and CFD broker, is regulated in India is a critical one for traders and investors in the country.

This blog post aims to provide a comprehensive analysis of Exness' regulatory status in India, covering key aspects such as licensing, compliance, and the overall legitimacy of the broker's operations within the Indian market.

Understanding Exness Regulation in India

Exness' Regulatory Footprint in India

✅ Exness: Open An Account or Go to Website

Exness, as a global financial services provider, operates in multiple jurisdictions around the world, each with its own set of regulatory frameworks and requirements. In the case of India, Exness' regulatory status is a complex and nuanced topic that requires careful examination.

Exness is not directly licensed or regulated by any Indian financial regulatory authority, such as the Securities and Exchange Board of India (SEBI) or the Reserve Bank of India (RBI).

However, Exness does maintain a presence in India through its representative office, which serves as a point of contact for Indian clients and provides support and information services.

The representative office in India is not a licensed or regulated entity, but rather a liaison office that facilitates the company's operations and client interactions within the country.

Exness' Regulatory Oversight Outside of India

While Exness may not be directly regulated in India, the company is subject to regulatory oversight in other jurisdictions where it holds licenses and operates its core business activities.

✅ Exness: Open An Account or Go to Website

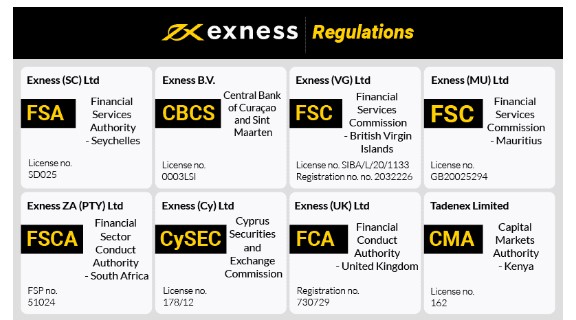

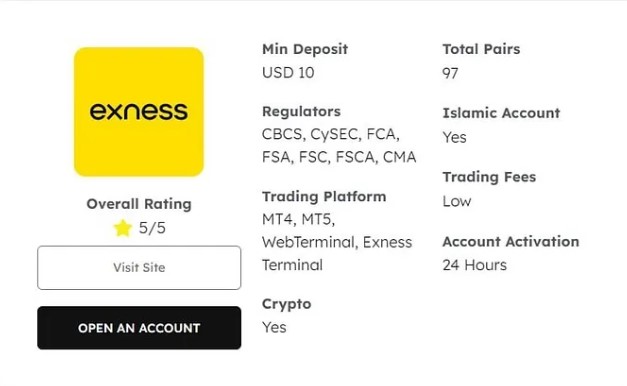

Exness is primarily regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a member of the European Union's regulatory framework.

The company also holds licenses and regulatory approvals from authorities in other regions, such as the Financial Sector Conduct Authority (FSCA) in South Africa and the Financial Services Authority (FSA) in the Seychelles.

These international regulatory authorities impose stringent requirements on Exness, including capital adequacy, client fund segregation, and compliance with anti-money laundering (AML) and know-your-customer (KYC) policies.

The Implications of Exness' Regulatory Status in India

The fact that Exness is not directly regulated in India has several implications for Indian traders and investors who may be considering using the broker's services.

Lack of direct regulatory oversight means that Indian clients do not have the same level of protection and recourse as they would have with a SEBI-regulated broker.

However, Exness' compliance with international regulatory standards and its adherence to global best practices in the industry may provide a certain level of assurance for Indian clients.

It is crucial for Indian traders to thoroughly research and understand Exness' regulatory status, as well as the potential risks and benefits associated with using the broker's services.

Is Exness a Regulated Broker in India?

As mentioned earlier, Exness does not hold a direct regulatory license or approval from any Indian financial authority. However, the company's overall regulatory standing and compliance with global standards can still be an important consideration for Indian traders and investors.

Exness' Regulatory Compliance and Licensing

While Exness may not be directly regulated in India, the company does hold licenses and regulatory approvals from reputable authorities in other jurisdictions.

Exness is primarily regulated by the Cyprus Securities and Exchange Commission (CySEC), a member of the European Union's regulatory framework.

The company also holds licenses from the Financial Sector Conduct Authority (FSCA) in South Africa and the Financial Services Authority (FSA) in the Seychelles.

These regulatory authorities impose strict requirements on Exness, including capital adequacy, client fund segregation, and compliance with anti-money laundering (AML) and know-your-customer (KYC) policies.

Implications of Exness' Regulatory Status for Indian Traders

The fact that Exness is not directly regulated in India means that Indian traders and investors may not have the same level of protection and recourse as they would have with a SEBI-regulated broker.

✅ Exness: Open An Account or Go to Website

Without direct oversight from Indian regulatory authorities, Indian clients may have limited options for dispute resolution or compensation in the event of any issues or misconduct by Exness.

However, Exness' compliance with international regulatory standards and its adherence to global best practices in the industry may provide a certain level of assurance for Indian clients.

It is crucial for Indian traders to thoroughly research and understand Exness' regulatory status, as well as the potential risks and benefits associated with using the broker's services.

Transparency and Disclosure by Exness

Exness, as a globally operating broker, is required to be transparent about its regulatory status and any potential risks associated with its services.

The company's website and client-facing materials clearly disclose its regulatory licenses and the jurisdictions in which it operates.

Exness also provides detailed information about the potential risks and limitations associated with trading its products, particularly for clients located in non-regulated markets like India.

This level of transparency and disclosure allows Indian traders to make informed decisions about using Exness' services and to understand the regulatory environment in which the broker operates.

Exness License and Regulatory Compliance in India

While Exness does not hold a direct regulatory license in India, the company's overall compliance with international standards and its adherence to global best practices in the industry can still be an important consideration for Indian traders and investors.

Exness' International Regulatory Licensing

As mentioned earlier, Exness holds licenses and regulatory approvals from several reputable authorities outside of India, including:

Cyprus Securities and Exchange Commission (CySEC)

Financial Sector Conduct Authority (FSCA) in South Africa

Financial Services Authority (FSA) in the Seychelles

These regulatory bodies impose strict requirements on Exness, such as:

Maintaining adequate capital reserves

Segregating client funds

Complying with anti-money laundering (AML) and know-your-customer (KYC) policies

By adhering to these international regulatory standards, Exness demonstrates a commitment to transparency, risk management, and client protection - factors that may be appealing to Indian traders.

Exness' Compliance with Indian Regulations

While Exness is not directly regulated in India, the company does have to operate within the broader regulatory framework of the country, particularly when it comes to its representative office and interactions with Indian clients.

Exness' representative office in India must comply with local laws and regulations, such as those related to the establishment and operations of a liaison office.

The company must also ensure that its marketing and advertising activities in India are in line with Indian financial regulations and consumer protection guidelines.

Exness' compliance with Indian regulations, even without a direct regulatory license, can be seen as a sign of the broker's commitment to operating responsibly in the country.

Transparency and Disclosure for Indian Clients

Exness has made efforts to be transparent about its regulatory status and the potential risks associated with its services, particularly for clients located in non-regulated markets like India.

The company's website and client-facing materials clearly disclose its regulatory licenses and the jurisdictions in which it operates.

Exness also provides detailed information about the potential risks and limitations associated with trading its products, allowing Indian traders to make informed decisions.

This level of transparency and disclosure can be seen as a positive factor in Exness' overall approach to serving the Indian market.

How Exness Operates Within Indian Regulations

While Exness may not be directly regulated in India, the company has still had to adapt its operations and practices to navigate the country's financial regulatory landscape. Understanding how Exness operates within the Indian market can provide valuable insights into the broker's commitment to compliance and its efforts to serve Indian traders.

Exness' Representative Office in India

As mentioned earlier, Exness maintains a representative office in India, which serves as a point of contact for Indian clients and provides support and information services.

The representative office is not a licensed or regulated entity, but rather a liaison office that facilitates the company's operations and client interactions within the country.

This office must comply with local laws and regulations related to the establishment and operations of such a representative presence in India.

By maintaining a physical presence in the country, Exness demonstrates a commitment to serving the Indian market and a willingness to operate within the local regulatory framework.

Compliance with Indian Financial Regulations

While Exness may not be directly regulated by Indian authorities, the company still has to ensure that its activities and services comply with the broader financial regulations in the country.

Exness must adhere to Indian regulations related to foreign exchange transactions, cross-border fund transfers, and anti-money laundering (AML) measures.

The company's marketing and advertising activities in India must also align with consumer protection guidelines and financial advertising regulations.

By demonstrating compliance with these Indian regulations, Exness can build trust and credibility with Indian traders, even in the absence of a direct regulatory license.

Client Funds and Asset Protection

One of the key concerns for Indian traders using a non-regulated broker like Exness is the protection of their funds and assets.

Exness has implemented measures to segregate client funds and assets, ensuring they are kept separate from the company's own operational funds.

The company also maintains insurance coverage and other safeguards to protect client funds in the event of any issues or insolvency.

While these measures may not offer the same level of protection as those provided by Indian regulatory authorities, they can still provide a certain level of assurance for Exness' Indian clients.

Dispute Resolution and Client Support

In the absence of direct regulatory oversight from Indian authorities, Exness has established its own mechanisms for dispute resolution and client support.

The company has a well-defined client complaints and dispute resolution process, which is accessible to Indian traders.

Exness also provides dedicated support and assistance to its Indian clients, including through its representative office and various communication channels.

While the options for recourse may be more limited than those available with a SEBI-regulated broker, Exness' commitment to client support and dispute resolution can still be a positive factor for Indian traders.

The Legitimacy of Exness in the Indian Market

While Exness may not be directly regulated in India, the company's overall regulatory compliance, global presence, and commitment to serving the Indian market can still contribute to its legitimacy and trustworthiness in the eyes of Indian traders and investors.

Exness' Regulatory Licensing and Compliance

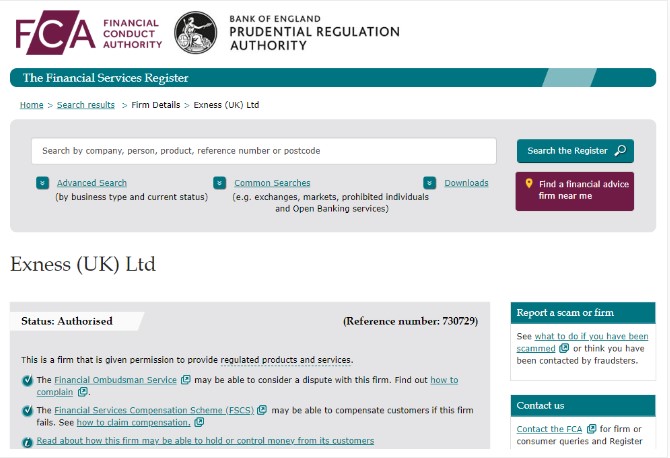

As discussed earlier, Exness holds licenses and regulatory approvals from reputable authorities in other jurisdictions, such as CySEC, FSCA, and FSA. This demonstrates the company's adherence to international regulatory standards and best practices in the industry.

The fact that Exness is able to maintain these licenses and approvals from well-respected regulators can be seen as a positive indicator of the broker's legitimacy and credibility.

Additionally, Exness' compliance with the requirements set by these regulatory bodies, such as capital adequacy, client fund segregation, and AML/KYC measures, can provide a certain level of assurance for Indian traders.

Exness' Global Presence and Experience

Exness is a globally recognized broker with a presence in multiple countries around the world. This global reach and experience can contribute to the perception of the company's legitimacy in the Indian market.

Exness has been operating in the forex and CFD trading industry for over a decade, serving clients from various regions and maintaining a strong reputation.

The company's longevity and ability to operate successfully in different regulatory environments can be seen as a testament to its legitimacy and expertise.

Indian traders may find comfort in the fact that Exness has a proven track record of serving clients globally, even if it is not directly regulated in India.

Exness' Commitment to the Indian Market

Despite the lack of direct regulation in India, Exness has demonstrated a commitment to serving the Indian market through its representative office and various client-centric initiatives.

The presence of a dedicated representative office in India shows Exness' willingness to engage with and support Indian traders, even in the absence of a direct regulatory license.

The company's efforts to ensure compliance with Indian financial regulations, provide transparent information, and offer client support can also contribute to its perceived legitimacy in the Indian market.

Indian traders may view Exness' commitment to the Indian market as a positive factor, as it suggests the company's intention to operate responsibly and build long-term relationships with its Indian clients.

Reputation and Client Feedback

While not a direct measure of regulatory compliance, Exness' reputation and the feedback from its existing Indian clients can also play a role in the perception of the company's legitimacy.

Positive reviews, testimonials, and client satisfaction metrics can help build trust and credibility for Exness among Indian traders.

The absence of significant issues or complaints from Indian clients can also be seen as a positive indicator of the broker's legitimacy and reliability.

However, it is important for Indian traders to thoroughly research and verify Exness' reputation from multiple reliable sources before making a decision.

Exness and Indian Financial Regulations

While Exness is not directly regulated by Indian authorities, the company's operations in the country must still adhere to the broader financial regulations and guidelines set forth by the Indian government and its regulatory bodies.

Compliance with Indian Foreign Exchange Regulations

As a global broker offering forex and CFD trading services, Exness must ensure that its activities in India comply with the country's foreign exchange regulations.

This includes adherence to guidelines set by the Reserve Bank of India (RBI) regarding cross-border fund transfers, currency conversion, and reporting requirements.

Exness must also ensure that its marketing and advertising related to forex and CFD trading in India align with the RBI's directives and consumer protection measures.

By demonstrating compliance with these regulations, Exness can build trust and credibility with Indian traders, even in the absence of a direct regulatory license.

Alignment with Indian Anti-Money Laundering (AML) Measures

In addition to foreign exchange regulations, Exness must also adhere to India's anti-money laundering (AML) and know-your-customer (KYC) guidelines when serving Indian clients.

The company must implement robust AML and KYC procedures to prevent the use of its platform for illicit financial activities.

Exness' compliance with Indian AML regulations can be seen as a positive factor, as it helps to ensure the integrity and security of the trading environment for Indian traders.

By demonstrating a commitment to AML compliance, Exness can further enhance its legitimacy and trustworthiness in the Indian market.

Adherence to Indian Advertising and Consumer Protection Regulations

Exness' marketing and advertising activities in India must also align with the country's financial advertising regulations and consumer protection guidelines.

The company's promotional materials, risk disclosures, and client communications must comply with the standards set by Indian authorities, such as the Securities and Exchange Board of India (SEBI).

Exness must ensure that its advertising and marketing practices do not mislead or misrepresent the nature of its services, risks involved, or the potential returns for Indian traders.

By adhering to these regulations, Exness can demonstrate its commitment to transparency and the protection of Indian consumers, further contributing to its legitimacy in the market.

Cooperation with Indian Regulatory Authorities

While Exness may not be directly regulated in India, the company's willingness to cooperate with Indian regulatory authorities can also be seen as a positive factor.

Exness may engage with Indian authorities, such as the RBI or SEBI, to ensure that its operations and activities are aligned with the country's financial regulations.

This cooperation and open communication can help to build trust and credibility with Indian traders, as it suggests Exness' commitment to operating responsibly within the Indian market.

Assessing the Regulation of Exness for Indian Users

When it comes to assessing the regulation of Exness for Indian users, it is important to consider both the company's direct regulatory status in India, as well as its compliance with international standards and broader financial regulations within the country.

Exness' Regulatory Status in India

As previously discussed, Exness does not hold a direct regulatory license or approval from any Indian financial authority, such as SEBI or the RBI. This means that Indian traders using Exness' services may not have the same level of protection and recourse as they would have with a SEBI-regulated broker.

The lack of direct oversight from Indian regulators can be a significant concern for some Indian traders, as it can limit their options for dispute resolution and compensation in the event of any issues or misconduct by Exness.

However, Exness' compliance with international regulatory standards and its adherence to global best practices in the industry may provide a certain level of assurance for Indian clients.

Exness' Compliance with International Regulations

While Exness may not be directly regulated in India, the company does hold licenses and regulatory approvals from reputable authorities in other jurisdictions, such as CySEC, FSCA, and FSA.

The fact that Exness is able to maintain these international regulatory licenses and approvals can be seen as a positive indicator of the broker's legitimacy and commitment to compliance.

Additionally, Exness' adherence to the requirements set by these regulatory bodies, such as capital adequacy, client fund segregation, and AML/KYC measures, can provide a certain level of assurance for Indian traders.

Exness' Compliance with Indian Regulations

Even though Exness is not directly regulated in India, the company must still operate within the broader financial regulatory framework of the country.

Exness' representative office in India must comply withthe various guidelines set forth by Indian regulatory bodies concerning foreign exchange and consumer protection.

This means that Exness must ensure that its marketing communications do not mislead potential clients about the risks associated with trading in forex and contracts for difference (CFDs). It is essential for traders to be fully informed about the nature of these instruments, including their complexities and the potential for both substantial gains and losses.

By adhering to these requirements, Exness demonstrates a commitment to maintaining high standards of practice that prioritize trader safety and transparency, which can enhance confidence among Indian users even without direct regulation from local authorities.

The Importance of Trader Education and Awareness

The assessment of Exness' regulation for Indian users would be incomplete without highlighting the necessity of education and awareness among traders.

Understanding the regulatory landscape and the implications of using a broker that is not licensed locally is crucial for traders. Many brokers like Exness offer educational resources, webinars, and tutorials that can empower traders to make informed decisions.

These resources help bridge the gap created by the absence of direct regulation, as they equip traders with knowledge about risk management, trading strategies, and market dynamics.

Furthermore, an educated trader is more likely to navigate challenges effectively and identify red flags that could indicate poor brokerage practices. This proactive approach to learning can significantly increase the overall trading experience and success rate.

Exness Trading Environment in India: A Regulatory Perspective

The trading environment offered by Exness in India deserves careful examination through the lens of regulatory frameworks and practices.

Accessibility and User Experience

Exness provides Indian traders with a user-friendly platform that caters to various experience levels, making it accessible for both novice and seasoned traders.

The trading platform incorporates intuitive design elements that simplify navigation, enabling traders to execute trades swiftly while accessing a wealth of educational materials and resources.

Moreover, the availability of multiple account types allows traders to select an option that best suits their individual needs and preferences. Such flexibility ensures that even investors with smaller capital can participate in the markets.

Risk Management and Security Measures

In any trading environment, especially one that operates outside the purview of local regulators, ensuring risk management practices and security is paramount.

Exness offers several risk management tools such as stop-loss orders, take-profit limits, and margin calls, which are essential for helping traders protect their funds from volatility.

Additionally, robust security measures, such as encryption protocols and two-factor authentication, enhance the protection of client accounts against unauthorized access or cyber threats.

Even though Exness isn't directly supervised by Indian authorities, the implementation of these security features indicates a strong commitment to safeguarding trader interests.

Feedback from Indian Traders

Feedback from existing Indian traders who use Exness can provide valuable insights into the overall trading environment and compliance with local expectations.

Positive testimonials often reflect satisfaction with the trading conditions, execution speed, and customer support provided by Exness. However, contrasting voices may express concerns regarding the lack of local regulatory oversight.

Engaging with community forums or social media groups dedicated to trading can help potential users gauge sentiments surrounding Exness. This collective opinion matters since peer experiences can heavily influence trust and adoption among new users.

Conclusion

In summary, understanding the regulation of Exness in India highlights various aspects that impact the trading experience for Indian users. While Exness lacks direct regulatory approval from Indian authorities, it compensates for this through compliant practices with international regulations and adherence to broader financial guidelines within India.

✳️ Read more:

how to use EXNESS trading app for beginners

Is Exness legal in Dubai, UAE?