11 minute read

Does exness allow copy trading in India?

Understanding Copy Trading with Exness in IndiaCopy trading is a financial technology that allows traders to automatically copy the trades of other, more experienced traders. In the context of Exness Trading, this feature empowers Indian traders to leverage the expertise and strategies of successful traders, potentially enhancing their own trading performance.

Does exness allow copy trading in india? In this comprehensive blog post, we will delve into the world of copy trading with Exness in India, exploring the nuances, benefits, and potential risks associated with this investment approach.

Understanding Copy Trading with Exness in India

Copy trading is a financial technology that allows traders to automatically copy the trades of other, more experienced traders. In the context of Exness, this feature empowers Indian traders to leverage the expertise and strategies of successful traders, potentially enhancing their own trading performance.

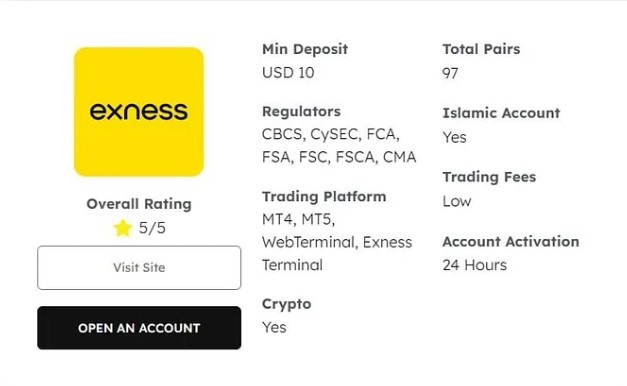

✅ Exness: Open An Account or Go to Website

The Mechanics of Copy Trading with Exness

At its core, copy trading on Exness involves linking your trading account to that of a successful trader, known as a "Strategy Provider." Once you've identified a Strategy Provider whose trading approach aligns with your investment goals, you can choose to copy their trades automatically. This means that whenever the Strategy Provider executes a trade, the same trade is replicated in your own trading account, proportional to the amount you've allocated for copy trading.

The Role of Strategy Providers in Exness Copy Trading

Strategy Providers on the Exness platform are traders who have demonstrated consistent and successful trading strategies. These individuals share their trading activities and insights, allowing other traders to benefit from their expertise. Exness provides a comprehensive suite of tools and metrics to help you evaluate the performance, risk profile, and trading history of potential Strategy Providers, enabling you to make informed decisions about whom to follow.

The Advantages of Copy Trading for Indian Traders

Copy trading on Exness offers several advantages for Indian traders. Firstly, it provides an opportunity for those with limited trading experience to gain exposure to the financial markets and learn from seasoned professionals. By copying the trades of successful Strategy Providers, novice traders can develop a better understanding of market dynamics, risk management, and trading strategies, ultimately enhancing their own trading skills over time.

How to Start Copy Trading on Exness in India

Embarking on your copy trading journey with Exness in India is a straightforward process. In this section, we'll guide you through the step-by-step process of setting up and initiating your copy trading activities.

Creating an Exness Trading Account

The first step is to open an Exness trading account. You can do this by visiting the Exness website and completing the registration process. Ensure that you provide accurate personal and financial information, as this will be necessary for the account verification and activation.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

Exploring the Exness Copy Trading Platform

Once your Exness trading account is set up, you'll have access to the copy trading platform. This platform is designed to be user-friendly and intuitive, allowing you to navigate through the various features and tools available for copy trading.

Researching and Selecting Strategy Providers

The heart of the copy trading process is the selection of suitable Strategy Providers. Exness provides a comprehensive database of Strategy Providers, along with detailed performance metrics and risk profiles. Carefully review the historical trading data, risk scores, and other relevant information to identify Strategy Providers whose trading strategies align with your investment objectives and risk tolerance.

Allocating Funds for Copy Trading

After selecting your desired Strategy Providers, you'll need to allocate a portion of your trading account funds to the copy trading feature. Exness allows you to manage your copy trading exposure by setting the desired allocation percentage, ensuring that you maintain control over your overall investment portfolio.

Monitoring and Adjusting Your Copy Trading Strategies

Copy trading is an ongoing process that requires active monitoring and, if necessary, adjustments. Exness provides real-time updates on the performance of your copied trades, allowing you to stay informed and make informed decisions about continuing, modifying, or terminating your copy trading relationships.

Benefits of Copy Trading with Exness for Indian Traders

Copy trading with Exness offers a wealth of benefits for Indian traders, both experienced and novice. In this section, we'll delve into the key advantages that make copy trading an attractive investment strategy.

Access to Proven Trading Strategies

One of the primary benefits of copy trading with Exness is the ability to access and replicate the trading strategies of successful professionals. By copying the trades of seasoned Strategy Providers, Indian traders can leverage their expertise and potentially achieve better trading outcomes than they would on their own, especially for those with limited trading experience.

Diversification and Risk Management

Copy trading on Exness allows for diversification of your investment portfolio. By allocating funds across multiple Strategy Providers, you can mitigate the risks associated with relying on a single trading approach. This diversification can help you manage your overall risk exposure and potentially enhance the stability of your investment returns.

Opportunity for Skill Development

Copy trading serves as an excellent learning opportunity for Indian traders. By observing the decision-making processes and trading strategies of successful Strategy Providers, you can gain valuable insights and develop your own trading skills over time. This can be particularly beneficial for novice traders, who can learn from experienced professionals and gradually transition to more independent trading.

Cost-Effective Investment Solution

Compared to traditional investment management services, copy trading on Exness can be a more cost-effective solution for Indian traders. The platform's transparent fee structure and the ability to allocate funds across multiple Strategy Providers can help you maximize your investment returns while minimizing the impact of fees and commissions.

Convenience and Accessibility

Exness's copy trading feature offers a high degree of convenience and accessibility for Indian traders. With the ability to monitor and manage your copy trading activities from your mobile device or desktop, you can stay informed and responsive to market developments, regardless of your location.

Exness Copy Trading Features Available in India

Exness has tailored its copy trading offerings to cater to the unique needs and preferences of Indian traders. In this section, we'll explore the key features of Exness's copy trading platform that are available in India.

Comprehensive Strategy Provider Profiles

Exness provides detailed profiles of its Strategy Providers, allowing Indian traders to make informed decisions about whom to follow. These profiles include comprehensive information such as trading performance history, risk scores, and detailed trading strategies, giving you the insights you need to select the right Strategy Providers for your investment goals.

Customizable Copy Trading Ratios

Exness's copy trading platform offers flexible and customizable copy trading ratios. This means that you can choose the percentage of a Strategy Provider's trades that you wish to copy, enabling you to fine-tune your exposure and manage your risk accordingly.

Real-Time Trade Copying

The Exness copy trading platform operates in real-time, ensuring that your trades are executed simultaneously with those of the Strategy Providers you're following. This minimizes the potential for slippage or delays, providing you with a seamless and efficient copy trading experience.

Comprehensive Reporting and Analytics

Exness's copy trading platform offers robust reporting and analytics features, allowing you to track the performance of your copied trades, monitor your overall investment portfolio, and make informed decisions about your copy trading strategies.

Seamless Mobile Integration

Exness's copy trading platform is designed to be accessible and user-friendly on mobile devices. This means that you can manage your copy trading activities, monitor your performance, and make adjustments to your strategies from anywhere, ensuring that you can stay connected to the markets and make timely decisions.

Step-by-Step Guide to Copy Trading on Exness in India

Embarking on your copy trading journey with Exness in India is a straightforward process. In this section, we'll guide you through the step-by-step process of setting up and initiating your copy trading activities.

Creating an Exness Trading Account

The first step is to open an Exness trading account. You can do this by visiting the Exness website and completing the registration process. Ensure that you provide accurate personal and financial information, as this will be necessary for the account verification and activation.

Exploring the Exness Copy Trading Platform

Once your Exness trading account is set up, you'll have access to the copy trading platform. This platform is designed to be user-friendly and intuitive, allowing you to navigate through the various features and tools available for copy trading.

Researching and Selecting Strategy Providers

The heart of the copy trading process is the selection of suitable Strategy Providers. Exness provides a comprehensive database of Strategy Providers, along with detailed performance metrics and risk profiles. Carefully review the historical trading data, risk scores, and other relevant information to identify Strategy Providers whose trading strategies align with your investment objectives and risk tolerance.

Allocating Funds for Copy Trading

After selecting your desired Strategy Providers, you'll need to allocate a portion of your trading account funds to the copy trading feature. Exness allows you to manage your copy trading exposure by setting the desired allocation percentage, ensuring that you maintain control over your overall investment portfolio.

Monitoring and Adjusting Your Copy Trading Strategies

Copy trading is an ongoing process that requires active monitoring and, if necessary, adjustments. Exness provides real-time updates on the performance of your copied trades, allowing you to stay informed and make informed decisions about continuing, modifying, or terminating your copy trading relationships.

Risks Involved in Copy Trading with Exness in India

While copy trading with Exness offers numerous benefits, it's essential to understand the potential risks associated with this investment strategy. In this section, we'll explore the key risks and how to mitigate them.

Reliance on Strategy Providers

One of the primary risks in copy trading is the reliance on the performance and decision-making of the Strategy Providers you choose to follow. If a Strategy Provider experiences a sudden downturn in their trading performance or makes decisions that are not aligned with your investment goals, it can have a direct impact on your own trading results.

Leverage and Margin Risks

Exness's copy trading platform allows the use of leverage, which can amplify both potential gains and losses. It's crucial to understand the risks associated with leveraged trading and to manage your exposure accordingly to avoid significant losses.

Market Volatility and Unpredictability

The financial markets are inherently volatile and unpredictable, and this uncertainty can introduce risks to your copy trading activities. Sudden market movements or unexpected events can lead to significant fluctuations in the performance of your copied trades, potentially resulting in losses.

Operational and Technological Risks

Copy trading relies on the seamless integration of various technological systems, including the Exness platform, the Strategy Providers' trading systems, and your own internet connectivity. Any disruptions or malfunctions in these systems can impact the timely execution and replication of trades, leading to potential losses or missed opportunities.

Regulatory and Legal Considerations

The regulatory landscape for copy trading may evolve over time, and it's crucial for Indian traders to stay informed about the latest rules and regulations governing this investment strategy. Failure to comply with these regulations could expose you to legal and financial risks.

Conclusion

In conclusion, copy trading with Exness in India offers a compelling investment opportunity for both experienced and novice traders. By leveraging the expertise of successful Strategy Providers, Indian traders can gain exposure to the financial markets, diversify their investment portfolios, and potentially enhance their trading performance.

Exness's comprehensive copy trading platform, tailored features, and user-friendly interface make it an attractive choice for Indian traders looking to explore the benefits of this investment strategy. However, it's essential to understand the associated risks and to approach copy trading with a prudent and well-informed mindset.

By carefully selecting Strategy Providers, allocating funds judiciously, and actively monitoring your copy trading activities, Indian traders can navigate the world of copy trading on Exness and potentially achieve their investment goals. As with any investment, it's crucial to conduct thorough research, seek professional advice if necessary, and manage your risks effectively to ensure a successful and rewarding copy trading experience.

✳️ Read more:

how to use EXNESS trading app for beginners

Is Exness legal in Dubai, UAE?