11 minute read

Does Exness have volatility index 2025

Does Exness have volatility index? This is a question that many traders and investors have been asking, as the volatility index has become an increasingly important tool in the world of financial markets. In this comprehensive blog post, we will explore the concept of the volatility index, its significance in the trading landscape, and whether Exness, a leading online broker, provides access to this financial instrument.

Understanding Exness and the Volatility Index

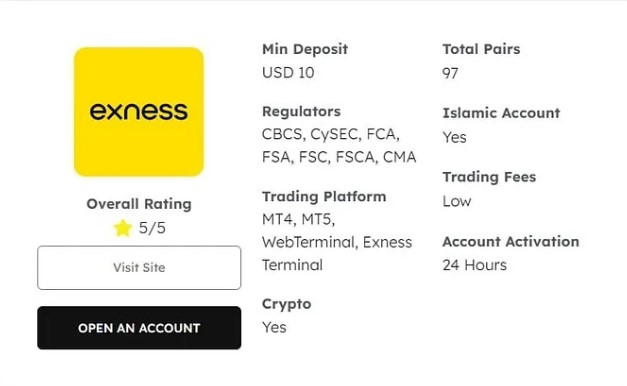

Exness is a global online broker that has been operating in the financial markets for over a decade. It offers a wide range of trading instruments, including forex, commodities, stocks, and CFDs. Exness has gained a reputation for its robust trading platform, competitive spreads, and comprehensive educational resources.

Exness: A Global Online Broker

Exness is a renowned online broker that has established a strong presence in the global financial markets. The company was founded in 2008 and has since expanded its operations to various regions, including Europe, Asia, and the Middle East. Exness is known for its commitment to providing a secure and reliable trading environment for its clients.

✅ Exness: Open An Account or Go to Website

The Importance of the Volatility Index

The volatility index, also known as the VIX, is a widely-followed financial indicator that measures the expected volatility of the stock market. It is often referred to as the "fear index" because it reflects the market's perception of upcoming market turbulence. Traders and investors closely monitor the volatility index as it can provide valuable insights into market sentiment and potential opportunities.

Understanding the Relationship between Exness and the Volatility Index

As an online broker, Exness offers a diverse range of trading instruments, including those that are closely linked to market volatility. The question of whether Exness provides direct access to the volatility index is an important consideration for traders who wish to incorporate this indicator into their trading strategies.

Volatility Index Explained

The volatility index, or VIX, is a real-time market index that represents the market's expectation of 30-day forward-looking volatility based on S&P 500 index options. It is calculated and published by the Chicago Board Options Exchange (CBOE) and is widely regarded as the premier barometer of investor sentiment and market volatility.

The Concept of Volatility

Volatility is a measure of the degree of variation in the price of a financial instrument over time. It is a crucial factor in determining the risk associated with an investment, as higher volatility typically implies greater price fluctuations and, consequently, higher risk.

Calculating the Volatility Index

The VIX is calculated using a proprietary formula that takes into account the weighted average of the implied volatilities of a range of S&P 500 index options. The index is updated and published in real-time, providing investors with a continuous measure of the market's expectation of future volatility.

Interpreting the Volatility Index

The VIX is commonly interpreted as follows:

A high VIX value (generally above 20) indicates increased market volatility and investor fear, often associated with bearish market conditions.

A low VIX value (generally below 20) suggests a more stable and calm market environment, which may signal investor complacency.

The Significance of the Volatility Index

The volatility index is a crucial tool for traders and investors as it can provide valuable insights into market sentiment and potential opportunities. By monitoring the VIX, traders can make more informed decisions about their trading strategies and risk management practices.

Does Exness Provide Access to Volatility Index?

The question of whether Exness provides access to the volatility index is an important one for traders and investors who wish to incorporate this financial instrument into their trading strategies. Let's explore this in more detail.

Exness and the Volatility Index

Exness, as a leading online broker, offers a wide range of trading instruments, including forex, commodities, stocks, and CFDs. However, the availability of the volatility index as a tradable instrument on the Exness platform is a topic that requires further investigation.

Indirect Access to Volatility Index

While Exness may not offer a direct trading instrument based on the volatility index, traders may still be able to gain exposure to market volatility through other means. For example, Exness offers a variety of volatility-sensitive assets, such as currency pairs, indices, and commodities, which can be used to create trading strategies that incorporate the volatility index indirectly.

Utilizing Volatility-Sensitive Instruments on Exness

Traders on the Exness platform can explore various volatility-sensitive instruments, such as currency pairs with high historical volatility, indices that are known to be sensitive to market fluctuations, or commodities that tend to experience sharp price movements. By analyzing the behavior of these assets in relation to the volatility index, traders can develop trading strategies that leverage the insights provided by this key financial indicator.

Accessing Volatility Index Data on Exness

While Exness may not offer a direct trading instrument based on the volatility index, the broker may provide access to volatility index data and analysis through its educational resources or third-party integration. Traders should explore the Exness platform and resources to determine the availability of volatility index-related information and tools.

How to Trade Volatility Index with Exness

If Exness does not provide a direct trading instrument based on the volatility index, traders may still be able to leverage the insights provided by this key financial indicator through various strategies. Let's explore how traders can approach trading volatility on the Exness platform.

Utilizing Volatility-Sensitive Assets

As mentioned earlier, Exness offers a range of volatility-sensitive assets, such as currency pairs, indices, and commodities. Traders can analyze the historical behavior of these assets in relation to the volatility index and develop trading strategies that capitalize on the insights provided by the VIX.

Implementing Volatility-Based Trading Strategies

Traders on the Exness platform can explore a variety of volatility-based trading strategies, such as:

Volatility breakout trading: Identifying and capitalizing on periods of increased market volatility.

Volatility mean reversion trading: Identifying and trading the reversion of volatility to its historical mean.

Volatility spread trading: Exploiting the relationship between different volatility-sensitive instruments.

Incorporating Volatility Indicators and Analysis

In addition to utilizing volatility-sensitive assets, traders on the Exness platform can also incorporate volatility indicators and analysis into their trading strategies. This may involve using technical indicators that measure volatility, such as the Average True Range (ATR), or conducting in-depth analysis of the volatility index and its historical behavior.

Backtesting and Optimization

Before implementing any volatility-based trading strategies on the Exness platform, it is essential for traders to conduct thorough backtesting and optimization. This process involves testing the proposed strategies on historical data to assess their performance, identify potential weaknesses, and refine the trading approach.

Account Types for Trading Volatility Index at Exness

As Exness may not offer a direct trading instrument based on the volatility index, the choice of account type for traders who wish to incorporate volatility-based strategies may depend on the specific trading instruments and tools available on the Exness platform.

Standard Account

Exness' Standard account is a popular choice for many traders, offering access to a wide range of trading instruments, including those that may be sensitive to market volatility. Traders with a Standard account can explore volatility-based trading strategies and utilize the available tools and resources to support their decision-making process.

Pro Account

The Pro account at Exness is designed for more experienced traders who may require additional features and benefits. Traders with a Pro account may have access to more advanced trading tools, research, and analysis, which could potentially include volatility-related resources and indicators.

ECN Account

Exness also offers an ECN (Electronic Communication Network) account, which provides direct access to the interbank market and potentially tighter spreads. Traders who are focused on volatility-based strategies may find the ECN account to be a suitable option, as the improved market access and liquidity can be beneficial for implementing such strategies.

Choosing the Appropriate Account

When selecting an account type for trading volatility-based strategies on the Exness platform, traders should carefully consider their trading experience, risk appetite, and the specific features and tools required to support their volatility-focused approach. The choice of account type may also depend on the availability of volatility-related instruments and resources on the Exness platform.

Risk Management When Trading Volatility Index on Exness

Trading the volatility index or volatility-sensitive instruments on the Exness platform requires a robust risk management approach. Effective risk management is crucial for traders who wish to navigate the inherent volatility and uncertainty associated with these types of investments.

Understanding Volatility Risk

Volatility-based trading strategies inherently carry a higher degree of risk compared to more traditional trading approaches. Traders must be aware of the potential for sudden and dramatic price fluctuations, which can result in significant losses if not managed properly.

Applying Appropriate Position Sizing

When trading volatility-sensitive instruments on the Exness platform, it is essential for traders to practice prudent position sizing. This involves carefully calculating the appropriate trade size based on factors such as account balance, risk tolerance, and the volatility characteristics of the underlying asset.

Utilizing Stop-Loss Orders

The use of stop-loss orders is a crucial risk management tool for traders on the Exness platform who are engaging in volatility-based strategies. Stop-loss orders can help limit potential losses by automatically closing a trade when the market price reaches a predetermined level.

Diversifying Across Asset Classes

To mitigate the risks associated with volatility-based trading, traders on the Exness platform should consider diversifying their portfolios across various asset classes, including those that may not be directly linked to market volatility. This can help reduce the overall risk exposure and provide more stability to the trading strategy.

Continuously Monitoring and Adapting

Successful trading of the volatility index or volatility-sensitive instruments on the Exness platform requires constant monitoring and the ability to adapt to changing market conditions. Traders should regularly review their trading strategies, risk management practices, and performance to make necessary adjustments and ensure the continued effectiveness of their approach.

User Experiences: Trading Volatility Index on Exness

To provide a comprehensive understanding of trading the volatility index on the Exness platform, it is valuable to consider the experiences and perspectives of traders who have engaged in such activities. Let's explore some user experiences and insights.

Positive Experiences

Many traders who have leveraged volatility-based strategies on the Exness platform have reported positive experiences, particularly when they have been able to successfully navigate the inherent risks and capitalize on market volatility. These traders often cite the availability of volatility-sensitive instruments, the platform's functionality, and the quality of the provided educational resources as key factors contributing to their success.

Challenges and Limitations

However, some traders may also have encountered challenges or limitations when attempting to trade the volatility index or volatility-sensitive instruments on the Exness platform. These may include the lack of a direct trading instrument based on the VIX, the need for more advanced volatility-specific tools and analysis, or the inherent difficulty in consistently profiting from volatile market conditions.

Adapting to Market Conditions

Successful trading of the volatility index or volatility-sensitive instruments on the Exness platform often requires a high degree of adaptability and the ability to adjust trading strategies based on changing market conditions. Traders who have been able to effectively monitor and respond to market volatility have generally reported more positive experiences.

Importance of Risk Management

Across various user experiences, the importance of robust risk management practices emerges as a recurring theme. Traders who have been diligent in their approach to position sizing, stop-loss orders, and portfolio diversification tend to have a more favorable outlook on their volatility-based trading activities on the Exness platform.

Conclusion

In conclusion, the question of whether Exness provides access to the volatility index is a complex one that requires a nuanced understanding of the broker's offerings and the trading landscape. While Exness may not offer a direct trading instrument based on the VIX, the broker does provide access to a wide range of volatility-sensitive assets that can be leveraged to incorporate volatility-based strategies into one's trading approach.

✳️ Read more:

how to use EXNESS trading app for beginners

Is Exness legal in Dubai, UAE?