15 minute read

How to invest in Exness in India 2025

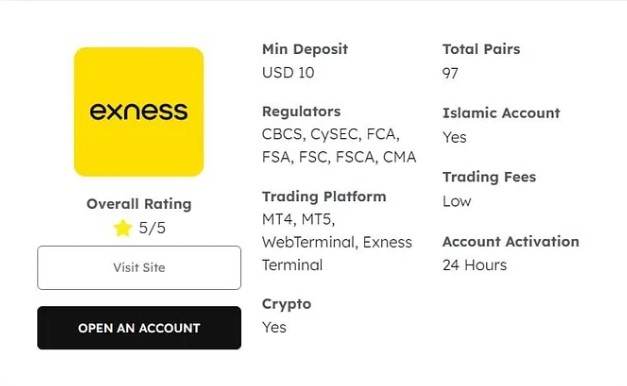

How to invest in Exness in India is a popular topic among traders and investors in the country. Exness, a leading global forex and CFD broker, has been gaining significant traction in the Indian market due to its robust trading platform, competitive spreads, and innovative features.

This comprehensive guide will walk you through the step-by-step process of opening an Exness account in India, exploring the platform's features, and providing valuable insights on effective trading strategies and risk management.

Start your first forex trade at Exness

How to trade in Exness in india

Step-by-Step Guide to Opening an Exness Account in India

Opening an Exness account in India is a straightforward process that can be completed entirely online. Before getting started, it's important to ensure that you meet the necessary requirements, such as being of legal age and having a valid government-issued ID.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

Navigating the Exness Website and Selecting the Appropriate Account Type

The first step is to visit the Exness website and click on the "Open an Account" button. This will take you to the account opening page, where you can choose the account type that best suits your trading goals and experience level. Exness offers several account options, including Standard, Pro, and Islamic accounts, each with its own set of features and trading conditions.

Providing Personal and Contact Information

Once you've selected the account type, you'll need to provide your personal and contact information, such as your full name, date of birth, nationality, and email address. It's crucial to ensure that all the details you enter are accurate and match the information on your government-issued ID, as this will be required for verification later in the process.

Verifying Your Identity and Residency

After submitting your personal information, you'll be required to provide copies of your government-issued ID (such as a passport or national ID card) and a proof of residency document (such as a utility bill or bank statement). This step is necessary to comply with the know-your-customer (KYC) and anti-money laundering (AML) regulations in India.

Funding Your Exness Account

With your account information and identity verified, the next step is to fund your Exness account. Exness offers a range of payment methods suitable for Indian traders, including bank transfers, debit/credit cards, and e-wallets. You can choose the option that best fits your preferences and banking situation.

Completing the Account Opening Process

The final step is to review and accept the terms and conditions of the Exness account agreement. Once you've completed all the necessary steps, your Exness account will be activated, and you'll be ready to start trading on the platform.

Choosing the Right Trading Platform: Exness Features Explained

Exness is renowned for its user-friendly and feature-rich trading platform, which caters to traders of all skill levels, from beginners to seasoned professionals. Understanding the platform's features and capabilities is crucial for making informed trading decisions and maximizing your investment potential.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

Intuitive User Interface and Customization Options

The Exness trading platform boasts an intuitive and user-friendly interface, making it easy for traders to navigate and access the tools and features they need. The platform also offers a high degree of customization, allowing users to personalize the layout, indicators, and other settings to suit their individual trading styles.

Comprehensive Charting and Technical Analysis Tools

Exness provides a comprehensive suite of charting and technical analysis tools, enabling traders to conduct in-depth market research and identify trading opportunities. The platform offers a wide range of technical indicators, drawing tools, and advanced charting options, allowing traders to perform thorough technical analysis and make data-driven investment decisions.

Diverse Range of Trading Instruments and Markets

Exness offers a diverse range of trading instruments, including forex, CFDs on stocks, commodities, indices, and cryptocurrencies. This diversity allows traders to diversify their portfolios and explore opportunities across various asset classes, catering to different risk appetites and investment strategies.

Competitive Spreads and Execution Speeds

One of the key advantages of trading with Exness is the broker's competitive spreads and lightning-fast execution speeds. Exness is known for its tight spreads, particularly on major currency pairs, which can help traders minimize their trading costs and maximize their potential profits.

Seamless Mobile Trading Experience

Exness recognizes the importance of on-the-go trading, and its platform is optimized for seamless mobile trading. Traders can access the full range of Exness features and functionalities through the broker's user-friendly mobile app, allowing them to monitor the markets and execute trades from anywhere.

Funding Your Exness Account: Payment Methods Available in India

Funding your Exness account is a crucial step in your trading journey, as it enables you to access the platform and start investing. Exness offers a variety of payment methods tailored to the needs of Indian traders, ensuring a smooth and convenient funding process.

Bank Transfers

One of the most popular payment methods for Exness traders in India is bank transfers. Exness supports both domestic and international bank transfers, allowing you to securely and efficiently fund your account from your local Indian bank account.

Debit and Credit Cards

Exness also accepts debit and credit card payments, making it easy for traders to fund their accounts using their existing payment cards. This option is particularly convenient for those who prefer a faster and more straightforward funding process.

📌📌📌 Open Exness An Account ✅

E-Wallets and Digital Payment Platforms

In addition to traditional banking methods, Exness supports a range of e-wallet and digital payment platforms that are widely used in India, such as Skrill, Neteller, and PayTM. These payment options offer a fast and secure way to fund your Exness account.

Withdrawal Options and Processing Times

When it comes to withdrawing your profits, Exness offers a variety of withdrawal methods, including bank transfers, e-wallets, and debit/credit cards. The processing times for withdrawals can vary depending on the payment method chosen, but Exness strives to ensure a seamless and efficient withdrawal experience for its clients.

Navigating Currency Conversions and Fees

It's important to be aware of any currency conversion fees or additional charges that may be associated with funding your Exness account or withdrawing your funds. Exness provides transparent information about its fees and charges, allowing traders to make informed decisions and plan their financial transactions accordingly.

Analyzing Market Trends: Tips for New Investors on Exness

Successful trading on the Exness platform requires a deep understanding of market trends and the ability to analyze various economic and financial indicators. As a new investor, it's crucial to develop a solid foundation in market analysis to make informed trading decisions and manage your risk effectively.

Fundamental Analysis: Understanding the Bigger Picture

Fundamental analysis involves examining the underlying economic, political, and social factors that can influence the performance of financial assets. As an Exness trader in India, you should closely monitor macroeconomic indicators, such as GDP growth, inflation, interest rates, and employment data, as these can have a significant impact on currency and commodity prices.

Technical Analysis: Identifying Patterns and Trends

Technical analysis focuses on the study of historical price data and the identification of patterns and trends that can help predict future market movements. Exness traders can leverage a variety of technical indicators, such as moving averages, oscillators, and chart patterns, to identify potential entry and exit points for their trades.

Combining Fundamental and Technical Analysis

To gain a comprehensive understanding of the markets, it's often beneficial to combine both fundamental and technical analysis. By considering the broader economic and geopolitical factors, as well as the technical patterns and trends, Exness traders can make more informed and well-rounded trading decisions.

Staying Informed with Market News and Updates

Keeping up-to-date with the latest market news and developments is crucial for Exness traders in India. Subscribing to reputable financial news sources, monitoring economic calendars, and staying informed about global events can help you anticipate market shifts and react accordingly.

Developing a Structured Approach to Market Analysis

Successful trading on the Exness platform requires a structured and disciplined approach to market analysis. This may involve creating a trading plan, establishing risk management strategies, and continuously refining your analytical skills through practice and education.

Risk Management Strategies for Trading on Exness

Effective risk management is a critical aspect of successful trading on the Exness platform. By implementing robust risk management strategies, Exness traders in India can protect their capital and ensure the long-term sustainability of their trading activities.

Understanding and Defining Your Risk Appetite

The first step in effective risk management is to clearly define your risk appetite. This involves assessing your financial situation, investment goals, and tolerance for potential losses. Exness traders should determine the maximum amount of capital they are willing to risk per trade and per overall portfolio.

Utilizing Protective Tools and Features

Exness offers a range of tools and features to help traders manage their risk effectively. These include stop-loss orders, which automatically close a position when it reaches a predetermined price level, and take-profit orders, which allow traders to lock in gains at a specific target price.

Diversifying Your Portfolio

Diversification is a key principle of risk management. By spreading your investments across a range of assets, such as different currency pairs, commodities, and indices, Exness traders can reduce their overall exposure to market volatility and mitigate the impact of individual trade losses.

Implementing Responsible Position Sizing

Responsible position sizing is crucial for managing risk on the Exness platform. Traders should ensure that the size of their trades is in line with their risk appetite and account size, avoiding overexposure that could lead to significant losses.

Regularly Reviewing and Adjusting Your Risk Management Strategies

Risk management is an ongoing process that requires regular review and adjustment. Exness traders should continuously monitor their trading performance, assess the effectiveness of their risk management strategies, and make necessary modifications to adapt to changing market conditions.

How to Withdraw Profits from Exness in India

As an Exness trader in India, successfully withdrawing your profits is the ultimate goal. Exness offers a range of withdrawal options and processes to ensure a smooth and efficient transfer of your hard-earned funds.

Selecting the Appropriate Withdrawal Method

Exness provides several withdrawal methods for Indian traders, including bank transfers, debit/credit cards, and e-wallets. Carefully consider the fees, processing times, and any currency conversion requirements associated with each option to determine the best fit for your needs.

Initiating the Withdrawal Process

To initiate a withdrawal, simply log into your Exness account, navigate to the withdrawal section, and select your preferred payment method. Ensure that the details you provide, such as your bank account information or e-wallet credentials, are accurate to avoid delays or issues with the transfer.

Verifying Your Withdrawal Request

Exness may require additional verification steps, such as providing copies of your identification documents or proof of ownership of the withdrawal method, to comply with regulatory requirements and ensure the security of your funds. Be prepared to submit these documents promptly to expedite the withdrawal process.

Monitoring the Withdrawal Status and Processing Times

The time it takes for your withdrawal to be processed can vary depending on the payment method and your location. Exness provides transparent information about expected processing times, and you can track the status of your withdrawal request through your Exness account dashboard.

Ensuring Smooth Currency Conversions and Minimizing Fees

If your trading profits are denominated in a currency that differs from your withdrawal method, Exness will handle the currency conversion process. Be mindful of any applicable fees or exchange rates, as these can impact the final amount you receive in your local currency.

Common Mistakes to Avoid When Investing in Exness

While the Exness platform offers a robust and user-friendly trading experience, it's important for Indian traders to be aware of common pitfalls and mistakes that can hinder their success. By understanding and avoiding these pitfalls, you can optimize your trading performance and protect your capital.

Overlooking the Importance of Risk Management

One of the most common mistakes made by new Exness traders is the failure to implement effective risk management strategies. Disregarding stop-loss orders, overexposing your capital, and neglecting portfolio diversification can lead to significant losses.

Lack of Market Research and Analysis

Successful trading on the Exness platform requires a deep understanding of market trends, economic indicators, and technical analysis. Failing to conduct thorough research and analysis can result in uninformed trading decisions and increased risk.

Emotional Decision-Making and Impulsive Trading

Trading can be an emotionally-charged activity, and it's crucial for Exness traders to maintain a disciplined and objective approach. Allowing emotions like fear, greed, and FOMO to influence your trading decisions can lead to costly mistakes.

Neglecting Continuous Learning and Skill Development

The financial markets are constantly evolving, and successful Exness traders must be committed to ongoing learning and skill development. Failing to stay up-to-date with market trends, new trading strategies, and platform updates can limit your growth and adaptability.

Disregarding Regulatory and Compliance Requirements

As an Exness trader in India, it's essential to understand and comply with the relevant regulatory requirements, such as KYC and AML procedures. Ignoring these rules can lead to account restrictions or even legal issues.

Leveraging Educational Resources Provided by Exness

Exness recognizes the importance of empowering its traders with the knowledge and skills necessary for success. The broker offers a comprehensive suite of educational resources and tools to help Indian traders navigate the financial markets and optimize their trading strategies.

Comprehensive Trading Tutorials and Guides

Exness provides a wealth of educational content, including comprehensive trading tutorials, beginner guides, and in-depth articles on various trading topics. These resources cover a wide range of subjects, from fundamental and technical analysis to risk management and trading psychology.

Webinars and Live Trading Workshops

Exness regularly hosts informative webinars and live trading workshops, led by experienced market analysts and trading experts. These events provide valuable insights, real-time market updates, and opportunities for interactive learning and Q&A sessions.

Demo Trading Accounts and Practice Environments

Exness offers demo trading accounts, allowing traders to practice their skills and test new strategies in a risk-free environment. This feature is particularly beneficial for new traders, as it enables them to familiarize themselves with the platform and develop their trading abilities without risking real capital.

Access to Market Research and Analysis

Exness provides its traders with in-depth market research and analysis, including daily market updates, economic calendars, and comprehensive reports on various asset classes. This information can help traders stay informed about the latest market developments and make more informed trading decisions.

Personalized Support and Guidance

Exness also offers personalized support and guidance to its traders, with a dedicated customer service team available to assist with any questions or concerns. This level of support can be invaluable for new traders, helping them navigate the platform and address any issues they may encounter.

Success Stories: Indian Traders Who Excelled with Exness

The Exness platform has not only provided a robust trading environment for Indian traders but has also empowered many individuals to achieve remarkable success in the financial markets. Here are a few inspiring stories of Indian traders who have thrived with Exness.

Arjun Sharma: From Novice to Consistent Profit-Maker

Arjun Sharma, a 32-year-old IT professional from Mumbai, started his trading journey with Exness just a few years ago. Despite having no prior experience in the financial markets, Arjun diligently utilized the educational resources provided by Exness, including the comprehensive trading guides and webinars. Through consistent practice and a disciplined approach to risk management, Arjun was able to transform himself from a novice trader to a consistent profit-maker, regularly generating stable returns from his Exness account.

Priya Kapoor: Capitalizing on Market Volatility

Priya Kapoor, a 27-year-old business analyst from Bangalore, has found tremendous success in leveraging the Exness platform to capitalize on market volatility. Leveraging her strong background in financial analysis, Priya has developed a keen eye for identifying trading opportunities across various asset classes. By combining fundamental and technical analysis, she has been able to consistently generate profits, even in challenging market conditions, thanks to Exness's competitive spreads and fast execution speeds.

Aditya Singh: Mastering the Art of Forex Trading

Aditya Singh, a 35-year-old entrepreneur from New Delhi, has emerged as a forex trading virtuoso on the Exness platform. With a deep understanding of currency market dynamics and a disciplined approach to risk management, Aditya has been able to consistently generate impressive returns from his Exness account. His success has been further amplified by the platform's comprehensive charting tools and extensive educational resources, which have enabled him to refine his trading strategies and navigate the complexities of the forex market.

These are just a few examples of the many Indian traders who have achieved remarkable success by leveraging the Exness platform. Their stories serve as a testament to the broker's commitment to empowering traders and providing the necessary resources for long-term trading excellence.

Conclusion

Investing in Exness in India presents a compelling opportunity for traders and investors to participate in the global financial markets. This comprehensive guide has outlined the step-by-step process of opening an Exness account, explored the platform's features and capabilities, and provided valuable insights on effective trading strategies, risk management, and withdrawal procedures.

See more:

how to deposit in Exness in india

Exness india customer care number 24 7

Exness forex trading legal in india

is Exness trading app legal in india?

You can trade Exness in India by:

✳️ Read more:

Best EXNESS Trading Strategies For Beginners

How to Trade Forex on EXNESS For Beginners

How to Trade Crypto on EXNESS For Beginners

How to Trade Gold on EXNESS For Beginners