10 minute read

How to trade in Exness in India 2025

In this article, we will explore how to trade in Exness in India in detail. From setting up your account to executing your first trade, we've got you covered with a comprehensive step-by-step guide.

Understanding how to trade in Exness in India is essential for maximizing your trading potential while minimizing risks. This article will guide you through every critical step needed to embark on your trading journey with Exness.

Step 1: Open Exness Account in India

Opening an Exness account is the initial step in your trading journey. It’s straightforward and designed to accommodate both novice and seasoned traders.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

Creating Your Exness Account

To begin, visit the official Exness website and locate the "Sign Up" button. Clicking this will direct you to a registration form that requires basic information such as your email address, phone number, and country of residence. Ensure that you provide accurate details, as these will be used in verifying your account later.

👉👉👉Click Here To Register On Exness

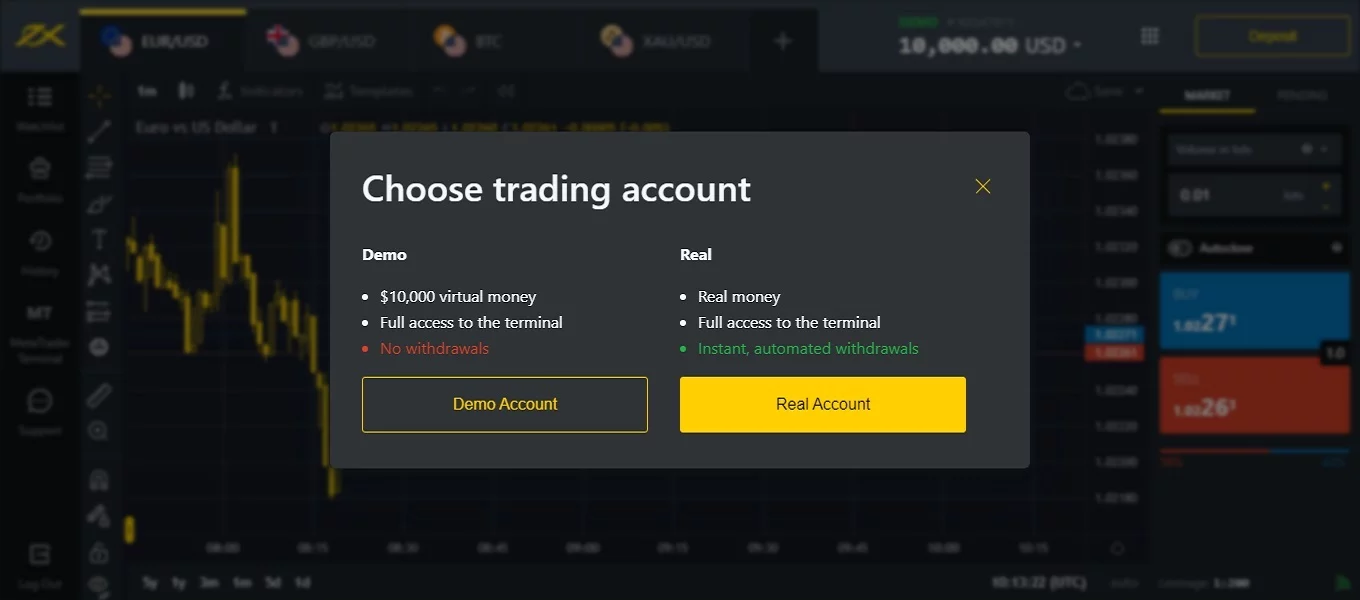

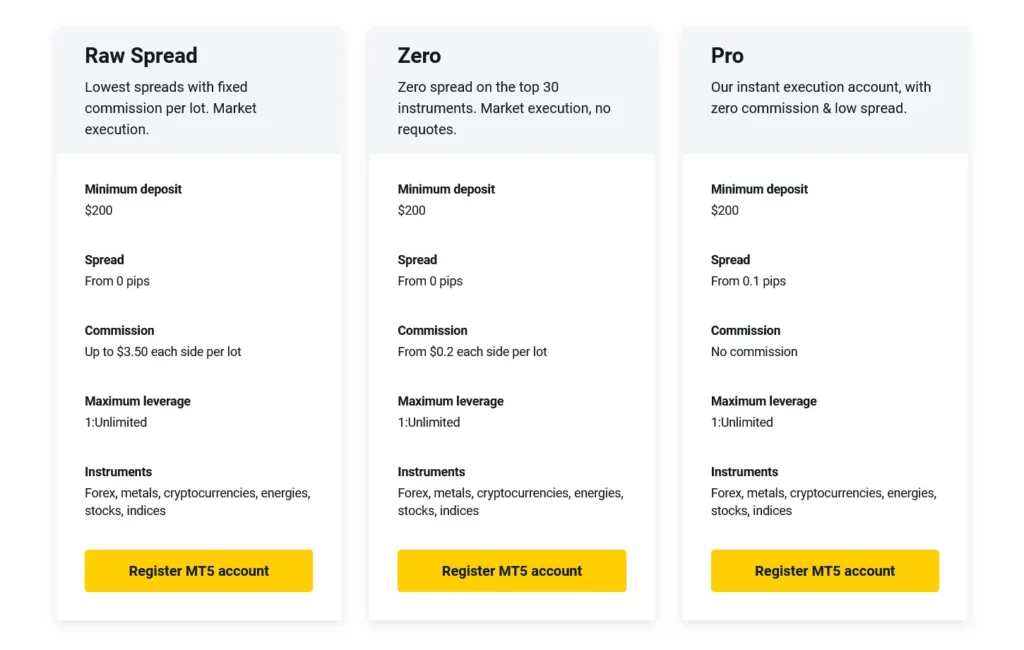

Choosing Your Account Type

Exness offers different account types including Standard, Pro, and Zero accounts. Each account comes with unique features suited for various trading strategies. The Standard account is ideal for beginners who prefer simplicity, whereas the Pro account caters to more experienced traders who need tighter spreads and advanced trading conditions. Selecting the right account type is pivotal as it impacts your overall trading experience.

👉 Open Standard Cent Account MT4

📌 Open Raw Spread Account MT4 ✅

💥 Open Raw Spread Account MT5 ✅

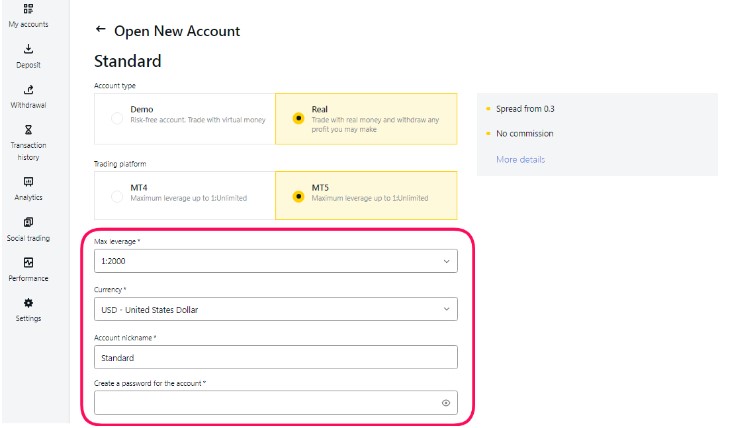

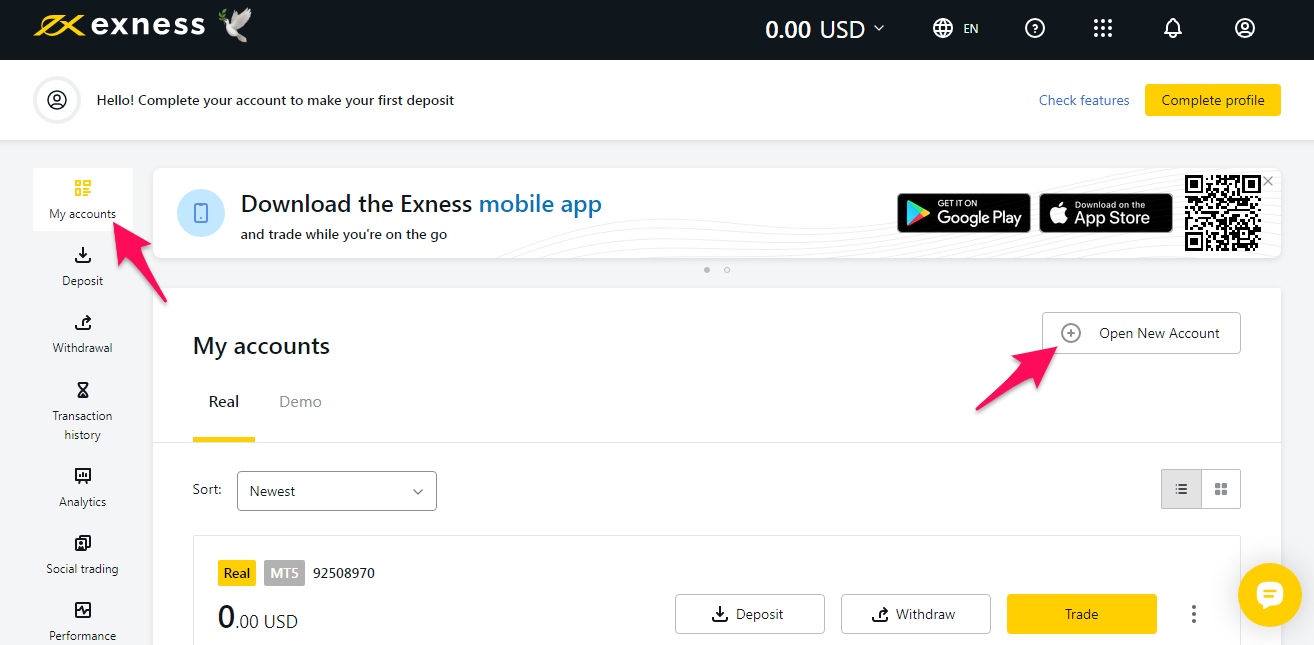

Step 2: Setting Up Your Exness Trading Account in India

Once you've opened your Exness account, the next crucial step is configuring your trading account. A well-set-up trading account ensures a seamless trading experience.

Accessing Your Trading Dashboard

Log in to your Exness account and navigate to the "My Account" section. Here, you will find options to set up your trading account. Depending on the account type you chose during registration, you may have access to multiple accounts under one login.

Selecting Your Base Currency

As an Indian trader, you have the option to choose INR (Indian Rupee) as your base currency for trading. This feature is particularly beneficial as it avoids unnecessary conversions and associated fees when depositing or withdrawing funds. Choosing the right base currency can significantly streamline your trading operations.

Setting Leverage Preferences

Leverage allows traders to increase their exposure to the market without having to fully fund their positions. Exness offers flexible leverage options, which can be adjusted based on your risk tolerance. It's crucial to understand the implications of using leverage and to set a level that aligns with your trading strategy.

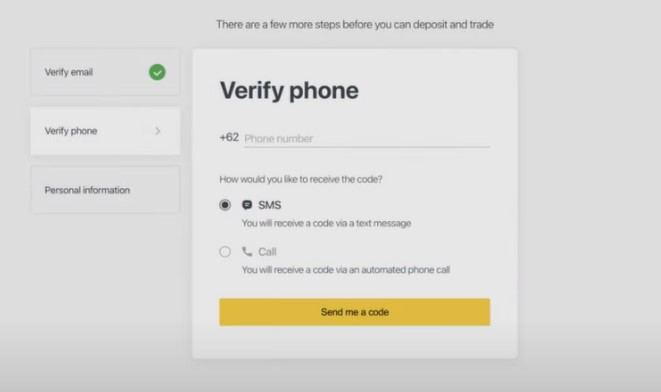

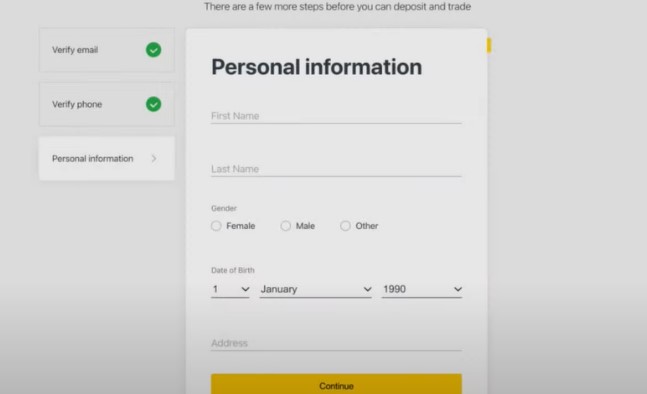

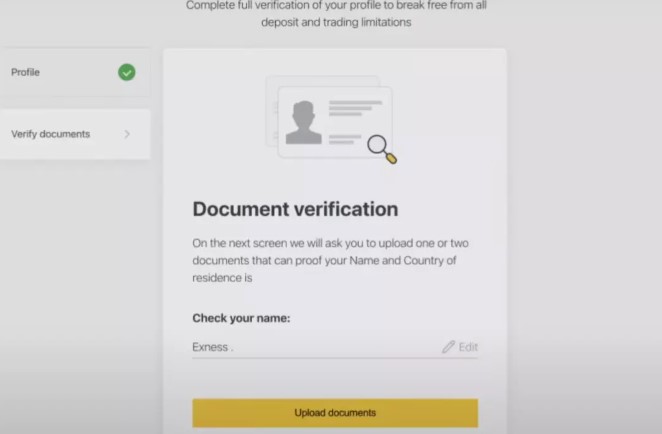

Step 3: Verifying Your Identity on Exness in India

Identity verification is a mandatory process aimed at ensuring security and compliance with legal regulations. This vital step protects both the trader and the broker from fraud and unauthorized activities.

Documents Required for Verification

To verify your identity on Exness, you'll need to submit specific documents. Typically, this includes a government-issued ID (such as an Aadhaar card or passport) and proof of residence (like a utility bill). Make sure the documents are clear and legible; otherwise, the verification process may be delayed.

Step 4: Funding Your Exness Account: Payment Methods for Indians

Having a funded account is crucial for executing trades. Exness offers various payment methods tailored for Indian clients, making it easy to deposit and withdraw funds.

Choosing Your Deposit Method

Exness supports multiple deposit methods including bank transfers, e-wallets like Paytm, Skrill, and Neteller, among others. Each method has its own processing time and fees, so it's essential to review these before making a decision. For immediate transactions, e-wallets are often the preferred choice due to their speed and convenience.

Making Your First Deposit

Once you’ve selected a deposit method, head to the “Deposit” section in your Exness account. Fill in the required information, including the amount you wish to deposit. The minimum deposit varies depending on the account type you selected earlier. After confirming the details, process the transaction.

Step 5: Choosing the Right Trading Platform on Exness

Exness provides various trading platforms designed to cater to the needs of different traders. Understanding these platforms is essential for effective trading.

MetaTrader 4 and MetaTrader 5

Exness primarily supports two trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 is renowned for its user-friendly interface and extensive range of technical indicators, making it perfect for beginners. On the other hand, MT5 offers additional features like more time frames and advanced analytical tools, catering to more experienced traders.

📥📥📥 Link Download MT4 👈👈👈

📥📥📥 Link Download MT5 👈👈👈

Mobile Trading Apps

For traders who prefer flexibility, Exness offers mobile trading apps compatible with both Android and iOS devices. This feature allows you to manage your trades on-the-go, ensuring that you never miss a trading opportunity. The mobile app encapsulates almost all features available on the desktop version, providing a seamless trading experience.

Customizing Your Trading Environment

Both MT4 and MT5 allow traders to customize their workspace by adding indicators, charts, and layouts suited to their trading style. Personalizing your trading environment can enhance focus and efficiency, enabling you to make informed decisions swiftly.

Step 6: Market Analysis Techniques for Beginners in Exness

Effective trading relies heavily on understanding market trends and making informed decisions. As a beginner, familiarizing yourself with market analysis techniques is paramount.

Fundamental Analysis

Fundamental analysis involves assessing economic indicators, news releases, and geopolitical events that influence the financial markets. Keeping track of interest rates, employment figures, and GDP reports can provide valuable insights into market movements. Websites that aggregate financial news can be excellent resources for staying updated.

Technical Analysis

Technical analysis focuses on historical price patterns and market behavior. Utilizing charts and indicators helps identify trends and potential reversal points. As a beginner, learning the basics of reading candlestick patterns and utilizing popular indicators like Moving Averages or RSI can significantly aid in your decision-making.

Integrating Both Approaches

Successful traders often integrate both fundamental and technical analysis. By doing so, they gain a holistic view of the market that aids in making educated trading decisions. For instance, if a significant news event is pending, technical analysis can help determine entry and exit points around that event.

Executing Your First Trade on Exness Step by Step

With everything set up, you're now prepared to execute your first trade on Exness. Following a structured approach is crucial for success.

Analyzing Trade Opportunities

Before executing a trade, conduct thorough market analysis. Identify potential opportunities based on your chosen analysis methods. Look for pairs that align with your trading strategy and where you've identified favorable conditions.

Placing Your Trade

Head to your chosen trading platform, select the asset you wish to trade, and enter the trade ticket. You'll need to specify the trade size, direction (buy/sell), stop loss, and take profit levels. Stop loss and take profit orders are crucial for managing risk effectively; ensure you set them according to your risk management plan.

Monitoring Your Trade

After placing your trade, monitor its performance. Use the charting tools available on your trading platform to analyze price movements. Be prepared to adjust your stop loss or take profit levels based on new market information or shifts in your analysis. This active monitoring is key to optimizing your trade outcomes.

Understanding Leverage and Margin in Exness Trading

Leverage and margin play a crucial role in forex trading, especially when using Exness. Understanding these concepts is vital to navigating the markets effectively.

What is Leverage?

Leverage allows traders to control larger positions than their actual investment. For example, if you use 1:200 leverage, you can trade ₹200,000 with just ₹1,000. While leverage can amplify profits, it can also magnify losses, so it's crucial to use it wisely.

Understanding Margin Requirements

Margin is the amount of money required to open a leveraged position. Exness provides flexible margin requirements depending on your account type and leverage settings. Be aware that insufficient margin can lead to a margin call, where the broker may automatically close your positions to prevent further losses.

Managing Leverage Wisely

While high leverage can enhance profit potential, it also brings higher risks. As a beginner, it's advisable to start with lower leverage ratios until you gain confidence and experience in the markets. Always assess your risk tolerance and consider adopting a conservative approach to leverage usage.

Managing Risk While Trading on Exness in India

Risk management is an integral aspect of trading that helps protect your capital. Implementing effective strategies minimizes potential losses and ensures sustainability in trading.

Setting a Trading Plan

Establish a trading plan that outlines your objectives, risk tolerance, and trading strategies. Consider factors like the maximum amount of capital you are willing to risk per trade (typically 1% to 2% of your total trading capital). This disciplined approach helps in avoiding emotional decision-making during trades.

Utilizing Stop Loss Orders

Stop loss orders are essential for managing risk. By setting a predefined exit point for losing trades, you can protect your capital from larger drawdowns. It allows traders to outline their risk parameters clearly and instills discipline in executing trades according to their plan.

Diversifying Your Portfolio

Avoid putting all your capital into a single trade or asset. Diversification involves spreading your investments across different assets or markets to reduce overall risk. By diversifying, you minimize the impact of poor-performing investments on your overall portfolio, leading to a more balanced approach.

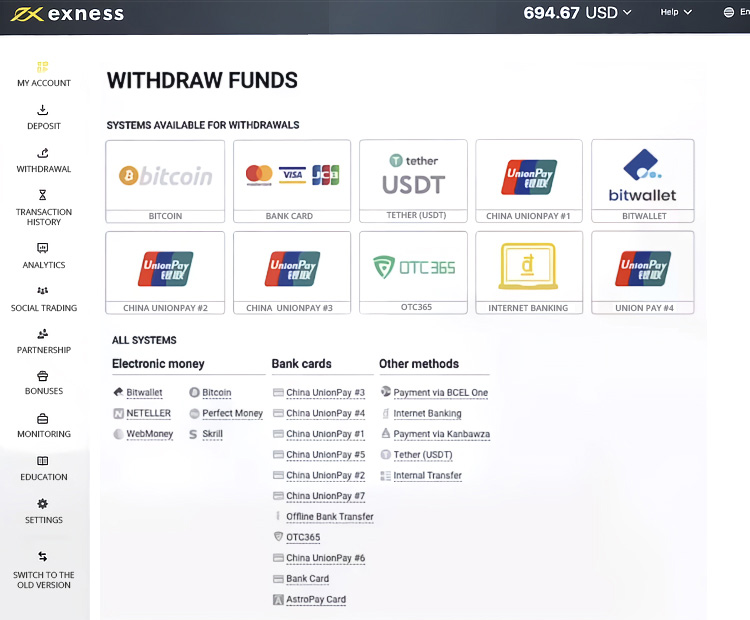

Withdrawing Profits from Your Exness Account in India

After successfully trading, the ultimate goal is to withdraw your profits. Exness has streamlined this process for Indian traders.

Initiating a Withdrawal Request

To withdraw funds, navigate to the "Withdrawal" section in your Exness account. Select your preferred withdrawal method, which should match the deposit method used. Complete the withdrawal form, specifying the amount you wish to withdraw and follow the prompts to finalize the request.

Processing Times and Fees

Withdrawal processing times vary depending on the chosen method. E-wallets typically process transactions faster compared to bank transfers. Review the fee structure associated with your withdrawal method to avoid surprises. Generally, Exness prides itself on offering low-cost withdrawals, enhancing overall trader satisfaction.

Confirming Your Withdrawal

Once your withdrawal request is processed, you'll receive a confirmation notification. Keep an eye on your chosen withdrawal method to ensure the funds have been credited. If there are any delays, reaching out to Exness customer support can help clarify any issues.

Conclusion

Navigating the world of trading in Exness as an Indian trader can be both exciting and rewarding. By following the outlined steps, you can establish a solid foundation for your trading journey. Remember that continuous learning and adapting to market dynamics are crucial components of successful trading.

✳️ Read more: