14 minute read

How to deposit in Exness in india 2025

How to deposit in Exness in india/How can I deposit money in Exness in India? What is the payment method of Exness in India? ...The article will cover the step-by-step process of depositing funds into your Exness trading account from India. It will explore the various payment methods available, address common issues faced by Indian traders, and provide guidance on ensuring secure and convenient deposits.

Understanding Payment Methods for Exness Deposits in India

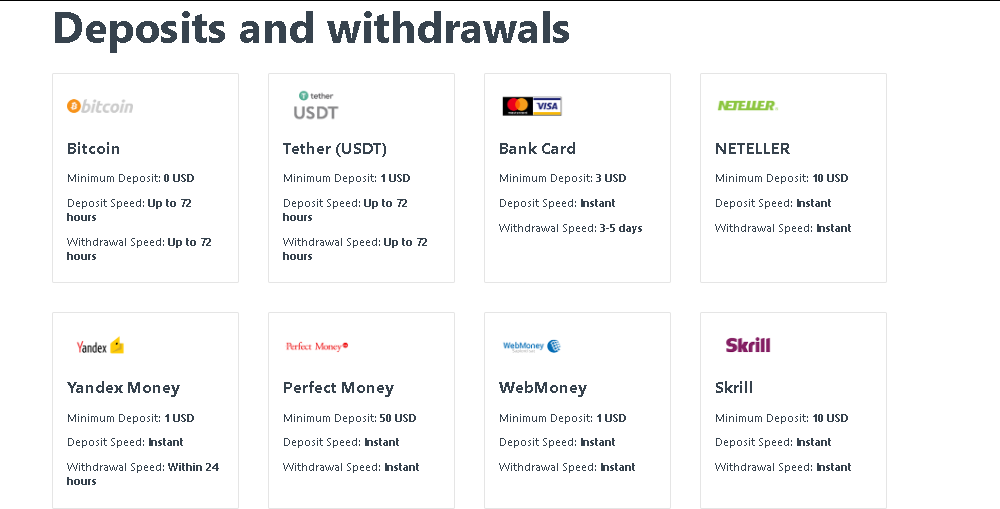

Exness, a leading global forex and CFD broker, offers a range of payment options for Indian traders to facilitate seamless deposits. These include local bank transfers, popular e-wallets, and cryptocurrency options.

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

Local Bank Transfers

One of the most common methods for depositing funds into an Exness account from India is through local bank transfers. Indian traders can initiate direct bank transfers from their domestic bank accounts to their Exness trading account. This method is widely accepted and provides a straightforward way to fund your trading activities.

To execute a bank transfer, you will need to provide your Exness account details, including the unique account number and the broker's bank information. The process typically involves logging into your online banking portal, selecting the "International Transfer" or "Remittance" option, and entering the required details. It's important to ensure that you enter the correct account information to avoid any delays or issues with the deposit.

E-Wallets and Online Payment Gateways

In addition to traditional bank transfers, Exness also supports various e-wallet and online payment gateway options for Indian traders. Services like Skrill, Neteller, and PayPal are widely accepted, providing a convenient and secure way to deposit funds into your Exness account.

The advantage of using e-wallets lies in their ease of use and the speed of transactions. Traders can simply log into their e-wallet accounts, select Exness as the recipient, and initiate the deposit. These payment methods often offer additional features, such as currency conversion and reduced transaction fees, making them attractive options for Indian traders.

It's important to note that the availability and specific requirements for e-wallet deposits may vary based on your location and the Exness regional support. Be sure to review the supported payment methods and any associated fees or limits before selecting your preferred option.

Cryptocurrency Deposits

Exness also offers the option to deposit funds using cryptocurrencies, which can be particularly appealing for Indian traders. Cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, provide a decentralized and secure way to transfer funds across borders without the need for traditional banking intermediaries.

To deposit via cryptocurrency, you will need to have a digital wallet and the necessary funds available. The process typically involves generating a unique deposit address from your Exness account, which you can then use to initiate the cryptocurrency transfer. Once the transaction is confirmed on the blockchain, the funds will be credited to your Exness trading account.

Cryptocurrency deposits can offer several benefits, including faster transaction times, reduced fees, and increased privacy. However, it's essential to exercise caution when handling cryptocurrencies and ensure that you are using reputable and secure wallets and platforms.

Common Issues While Depositing in Exness from India

While Exness strives to provide a seamless deposit experience for Indian traders, there can be occasional challenges or obstacles that may arise. Understanding these potential issues and how to address them can help ensure a smooth and successful deposit process.

Regulatory Restrictions

India's regulatory environment for financial transactions, including forex and CFD trading, can sometimes present hurdles for Indian traders. Certain banking or payment methods may be subject to restrictions or limitations, which can impact the deposit process.

It's essential to stay informed about the latest regulations and guidelines set forth by the Reserve Bank of India (RBI) and other relevant authorities. Exness actively monitors these changes and works to adapt its deposit options accordingly, but it's recommended that you also familiarize yourself with the current regulatory landscape.

Transaction Delays or Rejections

Occasionally, Indian traders may experience delays or rejections in their Exness deposit transactions. This can be due to a variety of reasons, such as issues with the payment method, discrepancies in account information, or even temporary technical glitches.

In the event of a deposit issue, it's crucial to contact Exness customer support promptly. The support team can assist in identifying the root cause of the problem and provide guidance on resolving the transaction. They may also be able to provide insights into any specific requirements or limitations related to the payment method being used.

Currency Conversion Challenges

When depositing funds from India into an Exness trading account, the currency conversion process can sometimes present challenges. Exness supports multiple base currencies, including USD, EUR, and GBP, but the conversion from Indian Rupees (INR) may result in additional fees or unfavorable exchange rates.

To mitigate this issue, it's recommended to explore the various deposit options and compare the overall costs, including any conversion fees or spreads. Some payment methods, such as e-wallets or cryptocurrency, may offer more favorable exchange rates or lower conversion fees, making them a more cost-effective option for Indian traders.

KYC and Account Verification

As part of Exness' compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, Indian traders may be required to provide additional documentation or undergo a verification process. This can include submitting copies of identification documents, proof of address, and other relevant information.

While this process may seem cumbersome, it is a necessary step to ensure the safety and integrity of the Exness trading platform. It's important to cooperate fully with the verification requirements and provide the requested information promptly to avoid delays in the deposit and account activation process.

Minimum Deposit Requirements for Exness in India

Exness has established minimum deposit requirements for Indian traders to open and maintain their trading accounts. These requirements are designed to ensure the stability and sustainability of the trading environment, as well as to provide a level playing field for all participants.

The current minimum deposit requirement for Exness accounts in India is $100 (or the equivalent in Indian Rupees). This means that in order to fund your Exness trading account, you will need to make an initial deposit of at least $100 or the INR equivalent.

It's important to note that this minimum deposit requirement may be subject to change, and Exness may introduce different account types or tiers with varying deposit thresholds. Always refer to the latest information on the Exness website or consult with their customer support team to ensure you have the most up-to-date details.

Using Local Banks to Deposit in Exness from India

Indian traders have the option to utilize their local bank accounts to deposit funds into their Exness trading accounts. This method is widely accepted and provides a familiar and trusted way to transfer money.

Selecting the Right Bank

When depositing in Exness from India, it's essential to choose a bank that is compatible with the broker's payment processing system. Exness works with a network of reputable banks in India, and it's recommended to select one of these partner institutions to ensure a seamless deposit experience.

Some of the popular Indian banks that support Exness deposits include State Bank of India (SBI), ICICI Bank, HDFC Bank, and Axis Bank. These banks have established relationships with Exness and are familiar with the broker's deposit requirements and procedures.

Initiating the Bank Transfer

To deposit funds using a local bank transfer, you will need to log into your Exness trading account and navigate to the deposit section. From there, you can select the "Bank Transfer" option and choose your preferred Indian bank from the list of supported providers.

The process typically involves the following steps:

Obtain your unique Exness account details, including the account number and the broker's bank information.

Log into your Indian bank's online banking platform or visit a local branch.

Initiate an international or cross-border transfer, using the Exness account details provided.

Ensure that you enter the correct information to avoid any delays or issues with the deposit.

Verify the transaction and wait for the funds to be credited to your Exness trading account.

Considerations and Limitations

When using local banks for Exness deposits in India, there are a few important factors to consider:

Transaction Fees: Banks may charge fees for international or cross-border transfers, which can impact the overall cost of the deposit. Be sure to review the applicable fees before initiating the transfer.

Currency Conversion: If your Exness account is denominated in a currency other than Indian Rupees, the bank will need to convert the funds, which may result in less favorable exchange rates or additional conversion fees.

Timing: Bank transfers can sometimes take a few business days to be processed and credited to your Exness account. Plan accordingly and allow sufficient time for the deposit to be completed.

Regulatory Restrictions: Certain banking regulations or government policies in India may impose limitations or restrictions on the transfer of funds for forex and CFD trading. Stay informed about the latest guidelines and requirements.

How to Use E-Wallets for Exness Deposits in India

In addition to traditional bank transfers, Indian traders can also utilize e-wallet services to deposit funds into their Exness trading accounts. E-wallets offer a convenient and secure alternative to bank-based transactions, providing faster processing times and often lower fees.

Supported E-Wallet Options

Exness accepts deposits from various e-wallet providers that are popular among Indian traders. Some of the commonly used e-wallet options include:

Skrill

Neteller

FasaPay

Perfect Money

Bitcoin

Each e-wallet service may have its own set of requirements, fees, and deposit limits, so it's essential to research and compare the options to determine the most suitable one for your needs.

Depositing via E-Wallet

The process of depositing funds into your Exness account using an e-wallet typically involves the following steps:

Log into your Exness trading account and navigate to the deposit section.

Select the e-wallet option from the list of available payment methods.

Provide the necessary details, such as your e-wallet account information or a unique deposit address (in the case of cryptocurrency wallets).

Initiate the transfer from your e-wallet account to the specified Exness account details.

Monitor the transaction status and wait for the funds to be credited to your Exness trading account.

It's important to ensure that you enter the correct e-wallet details and double-check the Exness account information to avoid any delays or issues with the deposit process.

Advantages of E-Wallet Deposits

Using e-wallets for Exness deposits in India offers several advantages for traders:

Faster Transaction Times: E-wallet deposits are generally processed more quickly than traditional bank transfers, providing you with faster access to your trading funds.

Reduced Fees: E-wallet providers often charge lower fees for international or cross-border transactions compared to conventional banking channels.

Enhanced Security: E-wallets typically offer robust security features, such as multi-factor authentication and encryption, to protect your financial information and transactions.

Flexibility: Many e-wallet services support a wide range of currencies, allowing you to deposit and withdraw funds in your preferred currency.

However, it's crucial to research the specific e-wallet provider, understand their terms and conditions, and ensure that the service is reputable and compliant with relevant regulations.

Exploring Cryptocurrency Options for Depositing in Exness in India

In recent years, the adoption of cryptocurrencies has been on the rise in India, including among traders using the Exness platform. Depositing funds in Exness using cryptocurrencies can offer several benefits for Indian traders.

Supported Cryptocurrencies

Exness currently supports a range of popular cryptocurrencies for deposits, including:

Bitcoin (BTC)

Ethereum (ETH)

Litecoin (LTC)

Ripple (XRP)

Tether (USDT)

The availability of specific cryptocurrencies may vary based on your location and the Exness regional support. It's recommended to check the latest information on the Exness website or contact their customer support team to confirm the supported options.

Depositing with Cryptocurrencies

The process of depositing funds into your Exness account using cryptocurrencies involves the following steps:

Obtain a cryptocurrency wallet: You will need to have a digital wallet that supports the cryptocurrency you wish to use for the deposit.

Generate a deposit address: Log into your Exness trading account and navigate to the deposit section. Select the cryptocurrency option and generate a unique deposit address.

Transfer the funds: Send the desired amount of cryptocurrency from your wallet to the Exness-provided deposit address.

Wait for confirmation: Cryptocurrency transactions typically require a certain number of network confirmations before the funds are credited to your Exness account. Monitor the transaction status and wait for the deposit to be completed.

It's crucial to double-check the deposit address and the amount you are sending to ensure a successful and timely transaction.

Advantages of Cryptocurrency Deposits

Depositing in Exness using cryptocurrencies can offer several benefits for Indian traders:

Faster Transactions: Cryptocurrency transactions are generally processed more quickly than traditional bank transfers, allowing you to access your trading funds sooner.

Lower Fees: Cryptocurrency deposits often incur lower fees compared to other payment methods, especially for international or cross-border transactions.

Enhanced Privacy: Cryptocurrencies offer a higher degree of privacy and anonymity compared to traditional banking or e-wallet services.

Accessibility: Cryptocurrency deposits can be a viable option for traders who may have limited access to traditional banking services or face restrictions on international money transfers.

However, it's essential to be aware of the volatility and potential risks associated with cryptocurrencies, and to exercise caution when handling digital assets.

How to Ensure Safe Deposits in Exness for Indian Users

Maintaining the security and integrity of your Exness deposits is of utmost importance. Exness takes various measures to protect the financial transactions of its Indian traders, but it's also crucial for you to be proactive in ensuring the safety of your deposits.

Verifying Exness' Regulatory Compliance

Before depositing funds into your Exness trading account, it's recommended to verify the broker's regulatory compliance and licensing status. Exness is regulated by respected financial authorities, such as the Cyprus Securities and Exchange Commission (CySEC), and holds a valid license to operate in multiple jurisdictions, including India.

You can check the Exness website or reach out to their customer support team to confirm the broker's regulatory status and obtain the necessary information about their compliance measures.

Utilizing Secure Payment Methods

When depositing funds into your Exness account, it's crucial to select secure and reputable payment methods. This includes using trusted banks, e-wallets, and cryptocurrency wallets that employ robust security protocols, such as encryption, multi-factor authentication, and fraud monitoring.

Avoid using unsecured or unverified payment channels, as they may expose your financial information and transactions to potential risks.

Maintaining Vigilance and Monitoring Transactions

As an Exness trader in India, it's important to maintain vigilance and closely monitor your deposit transactions. This includes regularly reviewing your account statements, verifying the accuracy of the deposited funds, and promptly reporting any discrepancies or suspicious activities to the Exness customer support team.

By staying proactive and attentive, you can help safeguard the integrity of your Exness deposits and ensure a secure trading experience.

Seeking Assistance from Exness Support

If you encounter any issues or have concerns regarding the safety of your Exness deposits, don't hesitate to reach out to the Exness customer support team. The support team is equipped to assist you in resolving deposit-related problems, providing guidance on security best practices, and addressing any other queries you may have.

Exness values the security and satisfaction of its Indian traders, and their support team is dedicated to providing timely and effective assistance to ensure a seamless and secure trading experience

Conclusion

Depositing in Exness from India is a straightforward process, provided you understand the payment methods available and adhere to best practices for security and support. Whether you opt for local bank transfers, e-wallets, or even cryptocurrencies, each method has its unique advantages and considerations.

✳️ Read more: