14 minute read

Is Exness trading app legal in India?

Is Exness trading app legal in india? In this comprehensive blog post, we will explore the legal framework governing trading apps in India, evaluate the legitimacy of Exness in the Indian market, and provide insights into navigating the legal landscape of online trading in the country.

Legal Framework for Trading Apps in India

The Indian financial system is regulated by a robust legal framework that aims to protect investors and maintain market stability. This framework includes various laws and regulations governing the securities market, including the Securities and Exchange Board of India (SEBI) Act, the Foreign Exchange Management Act (FEMA), and the Prevention of Money Laundering Act (PMLA).

📌📌📌 Open Exness An Account ✅

💥💥💥Visit Website Exness Official ✅

Understanding SEBI's Role in Regulating Trading Platforms

SEBI, the primary regulator of the Indian securities market, plays a crucial role in overseeing the activities of trading platforms, including those operating in the online and mobile app space. The SEBI (Stock Brokers and Sub-Brokers) Regulations, 1992, and the SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003, provide the legal framework for the registration and compliance requirements of trading platforms.

SEBI requires all trading platforms, including mobile apps, to be registered as stock brokers or sub-brokers to operate legally in India.

The regulations mandate that trading platforms adhere to stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) norms to prevent fraudulent activities.

SEBI also monitors the activities of trading platforms to ensure they comply with disclosure requirements, client fund segregation, and other investor protection measures.

Navigating FEMA and its Impact on Cross-Border Trading

The Foreign Exchange Management Act (FEMA) is another crucial piece of legislation that governs the cross-border movement of capital in India. This law impacts the legality of using foreign-based trading platforms, such as Exness, within the Indian market.

FEMA regulates the purchase and sale of foreign exchange, as well as the transfer of assets and liabilities between residents and non-residents.

Under FEMA, Indian residents are generally permitted to invest in overseas securities, including through online trading platforms, subject to certain limits and reporting requirements.

However, the legality of using a foreign-based trading platform like Exness in India may depend on factors such as the platform's compliance with FEMA regulations, the registration status of the platform's Indian entity (if any), and the specific investment activities being conducted.

Evaluating the Legitimacy of Exness in the Indian Market

Exness, a global online trading platform, has gained a significant presence in the Indian market. However, the question of its legal status in India remains a crucial consideration for investors.

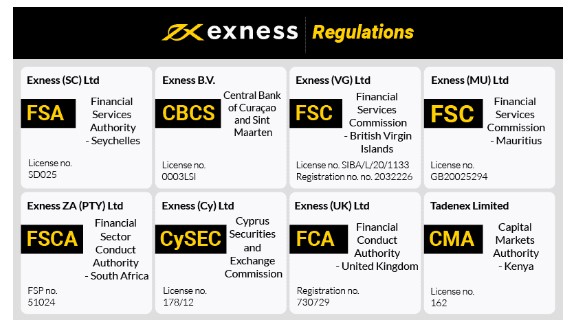

Exness's Regulatory Status in India

Exness operates as a foreign-based trading platform, with its headquarters located outside of India. To legally offer services to Indian investors, Exness would need to have a registered entity and obtain the necessary regulatory approvals from SEBI and other relevant authorities.

Exness maintains an Indian subsidiary, Exness India Private Limited, which is registered with the Ministry of Corporate Affairs.

However, the registration of the Indian subsidiary does not automatically confer regulatory approval for Exness to operate as a trading platform in India.

Investors should carefully verify the licensing and registration status of Exness in India, as well as the platform's compliance with local laws and regulations.

Evaluating Exness's Adherence to Indian Regulations

Ensuring that a trading platform like Exness complies with Indian regulations is essential for investors to make informed decisions. This evaluation should include an assessment of the platform's KYC and AML measures, client fund segregation practices, and overall transparency in its operations.

Exness claims to adhere to SEBI and FEMA regulations, but the extent of its compliance should be independently verified by investors.

Investors should also review Exness's track record of resolving customer complaints and its responsiveness to regulatory inquiries (if any) in the Indian market.

Comparing Exness to Regulated Indian Trading Platforms

When evaluating the legitimacy of Exness in the Indian market, it is also important to compare the platform's offerings and practices to those of regulated Indian trading platforms. This comparison can provide valuable insights into the level of investor protection and regulatory oversight.

Registered Indian trading platforms are subject to SEBI's stringent guidelines and must comply with the regulator's rules and regulations.

Investors may find it prudent to prioritize the use of SEBI-registered trading platforms, which have a clear regulatory framework and investor protection measures in place.

Are Foreign Trading Platforms Like Exness Legal in India?

The legality of using foreign-based trading platforms like Exness in India is a complex issue, as it involves navigating the intersection of different laws and regulations.

Compliance with FEMA Regulations

As mentioned earlier, the Foreign Exchange Management Act (FEMA) is a critical consideration when it comes to the legality of using foreign trading platforms in India.

FEMA allows Indian residents to invest in overseas securities, including through online trading platforms, subject to certain limits and reporting requirements.

However, the specific details of Exness's compliance with FEMA regulations and the extent of its registration in India may impact the legality of using the platform.

Investors should carefully review Exness's adherence to FEMA requirements and its registration status in India to ensure they are using the platform legally.

Regulatory Oversight and Investor Protection

The level of regulatory oversight and investor protection measures in place for foreign trading platforms is another crucial factor in determining their legality in the Indian market.

SEBI's regulations for stock brokers and sub-brokers apply to both domestic and foreign trading platforms operating in India.

Investors should ensure that foreign platforms like Exness have obtained the necessary regulatory approvals from SEBI and are complying with the regulator's guidelines.

The availability of investor grievance redressal mechanisms and the platform's track record in addressing customer concerns are also important considerations.

Potential Risks and Implications

The use of unregulated or non-compliant foreign trading platforms in India may expose investors to various risks, including:

Lack of investor protection measures

Potential for fraudulent activities and market manipulation

Challenges in recourse and dispute resolution

Possible regulatory actions or penalties

Investors should carefully evaluate these risks and consult with financial or legal experts to make informed decisions about using foreign trading platforms in India.

Navigating the Legal Landscape of Online Trading in India

As the Indian financial landscape continues to evolve, investors must navigate the complex legal framework governing online trading platforms, including foreign-based platforms like Exness.

Understanding the Regulatory Environment

Staying up-to-date with the latest regulations and guidelines issued by SEBI and other relevant authorities is crucial for investors using online trading platforms.

SEBI's website and official communications provide valuable information on the regulatory requirements for trading platforms.

Investors should monitor any updates or changes in the legal framework to ensure they are using platforms that comply with the latest regulations.

Verifying the Registration and Compliance Status

Investors should diligently verify the registration and compliance status of any trading platform they intend to use, including Exness.

Checking the SEBI website for a list of registered stock brokers and sub-brokers can help confirm the platform's regulatory status.

Reviewing the platform's website, regulatory disclosures, and customer feedback can also provide insights into its compliance with Indian laws and regulations.

Seeking Guidance from Financial and Legal Experts

Given the complexity of the legal landscape, investors may benefit from seeking guidance from financial and legal experts when using online trading platforms, especially those based outside of India.

Financial advisors can provide insights into the suitability and risks associated with using a particular trading platform.

Legal professionals can offer advice on the legal implications and compliance requirements for using foreign-based trading platforms in India.

Consulting with these experts can help investors make informed decisions and navigate the legal landscape more effectively.

User Experiences: Exness Trading App in India

As investors explore the use of the Exness trading app in India, it is valuable to understand the experiences and perspectives of those who have utilized the platform.

Feedback from Indian Exness Users

Reviews and testimonials from Indian Exness users can provide valuable insights into the platform's performance, customer service, and overall user experience.

Users may share their perspectives on the platform's ease of use, execution of trades, and the availability of trading tools and resources.

Feedback on the platform's responsiveness to customer inquiries and the effectiveness of its dispute resolution mechanisms can also be informative.

Investors should carefully review both positive and negative user experiences to gain a well-rounded understanding of the Exness trading app in the Indian context.

Comparison to Regulated Indian Trading Platforms

Comparing the user experiences of the Exness trading app to those of regulated Indian trading platforms can help investors assess the relative benefits and drawbacks of using Exness in India.

Users may share their perspectives on the differences in user interface, trading features, customer support, and overall quality of service between Exness and Indian trading platforms.

Insights into the ease of account opening, fund transfers, and the reliability of the trading platform can also be valuable in this comparison.

Addressing Potential Regulatory Concerns

User experiences may also shed light on any regulatory concerns or challenges faced by Exness users in the Indian market.

Investors may share their perspectives on the platform's compliance with Indian regulations and the ease of navigating any regulatory requirements.

Feedback on the platform's responsiveness to regulatory inquiries or any issues related to investor protection can provide valuable information.

Regulatory Challenges for Exness in the Indian Trading Sector

As a foreign-based trading platform, Exness may face various regulatory challenges in establishing a strong presence and gaining the trust of investors in the Indian market.

Obtaining Regulatory Approvals from SEBI

One of the primary challenges for Exness is to obtain the necessary regulatory approvals from SEBI to operate as a trading platform in India.

SEBI's registration and compliance requirements for stock brokers and sub-brokers apply to both domestic and foreign-based platforms.

Exness would need to demonstrate its adherence to SEBI's guidelines and obtain the appropriate registration to legally offer its services in India.

The process of obtaining regulatory approvals can be complex and time-consuming, requiring Exness to navigate the Indian regulatory landscape effectively.

Compliance with FEMA Regulations

As discussed earlier, the Foreign Exchange Management Act (FEMA) is a crucial consideration for foreign-based trading platforms like Exness operating in the Indian market.

Exness would need to ensure that its operations and investment activities comply with the regulations and reporting requirements under FEMA.

Any non-compliance or violations of FEMA could expose Exness and its Indian users to potential legal and financial consequences.

Addressing Investor Protection Concerns

Investor protection is a top priority for SEBI and other regulatory authorities in India. Exness would need to demonstrate its ability to safeguard investor interests and comply with the regulator's guidelines on client fund segregation, transparency, and dispute resolution.

Exness would need to have robust KYC and AML procedures in place to prevent fraudulent activities and protect investors.

The platform's track record in addressing customer complaints and its responsiveness to regulatory inquiries would be crucial factors in establishing trust among Indian investors.

Navigating the Evolving Regulatory Landscape

The Indian financial regulatory environment is constantly evolving, with SEBI and other authorities regularly updating guidelines and policies. Exness would need to stay vigilant and adapt its operations to ensure ongoing compliance with the changing regulatory landscape.

Monitoring and responding to regulatory updates in a timely manner would be essential for Exness to maintain its legitimacy in the Indian market.

Collaborating with local financial and legal experts can help Exness navigate the complexities of the Indian regulatory framework more effectively.

How to Use Exness Safely and Legally in India

For Indian investors considering the use of the Exness trading app, it is crucial to understand the steps and precautions necessary to engage with the platform safely and legally.

Verifying Exness's Regulatory Status in India

The first and most critical step is to verify Exness's regulatory status and compliance with Indian laws and regulations.

Investors should check the SEBI website and other official sources to confirm if Exness is registered as a stock broker or sub-broker in India.

Reviewing Exness's disclosures and customer reviews can also provide insights into the platform's adherence to local regulations.

Complying with FEMA Requirements

As an Indian resident using a foreign-based trading platform, investors must ensure compliance with the Foreign Exchange Management Act (FEMA) regulations.

Familiarize yourself with the FEMA guidelines on overseas investments and the applicable limits and reporting requirements.

Ensure that your trading activities and fund transfers through Exness are in line with FEMA regulations.

Prioritizing Investor Protection Measures

When using Exness or any other trading platform, investors should prioritize measures that safeguard their interests and assets.

Assess the platform's KYC and AML procedures, as well as its client fund segregation practices.

Review the platform's dispute resolution mechanisms and track record of addressing customer complaints.

Seeking Professional Guidance

Given the complexities involved, it is advisable for investors to seek guidance from financial and legal professionals when using Exness or any other foreign-based trading platform in India.

Consult with a financial advisor to understand the suitability and risks associated with using Exness in your investment portfolio.

Engage with a legal expert to obtain advice on the legal implications and compliance requirements for using Exness in the Indian market.

Continuously Monitoring Regulatory Updates

As the regulatory landscape evolves, investors should stay informed about any changes or updates that may impact the legality and usage of the Exness trading app in India.

Regularly check SEBI's website and other official sources for any new regulations or guidelines related to online trading platforms.

Be vigilant about any regulatory actions or advisories concerning the use of foreign-based trading platforms in India.

By following these steps and exercising caution, Indian investors can explore the use of the Exness trading app while prioritizing their safety and compliance with the relevant laws and regulations.

Expert Opinions on Exness Trading App's Legality in India

To gain a well-rounded understanding of the legality of the Exness trading app in India, it is valuable to consider the perspectives of financial and legal experts in the industry.

Regulatory Experts' Perspectives

Regulatory experts, such as former SEBI officials or legal professionals specializing in financial regulations, can provide insights into the legal framework governing trading platforms in India and the specific challenges faced by foreign-based platforms like Exness.

Experts may analyze the registration and compliance requirements for Exness to operate legally in India, as well as the potential regulatory risks and implications for investors.

They can also offer guidance on the steps Exness would need to take to establish its legitimacy and gain the trust of Indian investors.

Financial Analysts' Views

Financial analysts who have closely followed the Indian trading landscape can offer valuable perspectives on the competitive landscape and the role of foreign-based platforms like Exness.

Analysts may assess the advantages and disadvantages of using Exness compared to regulated Indian trading platforms, considering factors such as trading features, customer service, and regulatory oversight.

They can also provide insights into the potential market opportunities and challenges faced by Exness in the Indian context.

Legal Experts' Assessments

Legal experts specializing in financial regulations and cross-border transactions can provide in-depth analysis on the legal complexities surrounding the use of Exness in India.

Lawyers can delve into the specific legal requirements and compliance obligations that Exness would need to fulfill to operate legally in India.

They can also offer guidance on the potential legal risks and implications for Indian investors using the Exness trading app, particularly in terms of FEMA regulations and investor protection measures.

By incorporating the perspectives of these expert voices, investors can gain a more comprehensive understanding of the legality and risks associated with using the Exness trading app in the Indian market.

Conclusion

The question of whether the Exness trading app is legal in India is a complex one that requires a nuanced understanding of the regulatory framework governing online trading platforms in the country.

While Exness maintains a presence in the Indian market, its compliance with SEBI and FEMA regulations remains a critical consideration for investors. Verifying the platform's registration status, adherence to investor protection measures, and track record of addressing customer concerns are essential steps for investors to make informed decisions.

✳️ Read more: