10 minute read

Best forex funded account in India

Top 10 best forex funded accounts available is crucial to navigating this complex landscape. With many options featuring various benefits and drawbacks, it’s essential to choose wisely. This article aims to provide an in-depth review of the best forex funded account in india, including platforms such as Exness, JustMarkets, FP Markets, and Avatrade, to help you make informed decisions.

5 BEST FOREX BROKERS in The World

✅ Exness: Open An Account or Go to Website

✅ JustMarkets: Open An Account or Go to Website

✅ XM: Open An Account or Go to Website

✅ FP Markets: Open An Account or Go to Website

✅ Avatrade: Open An Account or Go to Website

Overview of Forex Funded Accounts

Forex funded accounts are accounts that offer traders the opportunity to trade using capital provided by a broker or funding firm. This arrangement allows traders to leverage the expertise of professional fund managers while minimizing their own financial risk. In India, several reputable forex brokers offer funded accounts tailored to the needs of local traders.

1. Exness

Introduction

Exness has established itself as one of the leading forex trading platforms globally and offers a robust funded account program for Indian traders. Known for its transparency and user-friendly interface, Exness provides an excellent opportunity for novice and experienced traders alike.

✅ Exness: Open An Account or Go to Website

Features

Low Minimum Deposit: Exness allows traders to start with a low minimum deposit, making it accessible for new traders.

Variety of Account Types: Offers multiple account types, each suited to different trading styles and experience levels.

Leverage Options: Traders can benefit from high leverage ratios, allowing for increased exposure to the markets.

Comprehensive Educational Resources: Exness provides extensive educational materials and webinars for traders looking to enhance their skills.

Pros

User-friendly platform suitable for beginners

High liquidity and fast execution speeds

Strong customer support available 24/7

Cons

Withdrawal fees on certain methods may apply

Limited range of cryptocurrencies for trading

Your Opinions

Exness is a top contender among the best forex funded accounts in India due to its accessibility and strong support system. The educational resources offered can significantly benefit new traders, enhancing their chances of success.

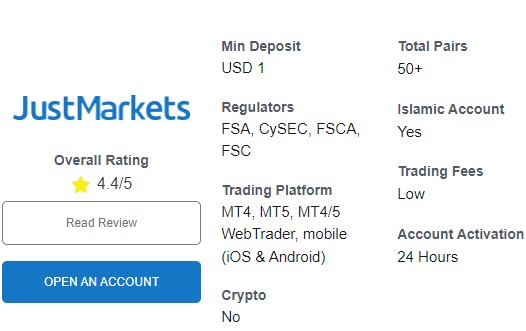

2. JustMarkets

Introduction

JustMarkets is another prominent forex broker that provides funded accounts tailored for Indian traders. It focuses on affordability and offers a diverse range of trading instruments, making it an attractive option for those venturing into the forex market.

✅ JustMarkets: Open An Account or Go to Website

Features

No Minimum Deposit Requirement: Allows traders to start without worrying about initial investment constraints.

Competitive Spreads: Offers tight spreads on major currency pairs, maximizing profit potential.

Multiple Trading Platforms: Supports popular trading platforms like MetaTrader 4 and MetaTrader 5.

Promotions and Bonuses: Frequent promotions enable traders to benefit from additional funds.

Pros

Affordable entry point for beginners

A wide range of trading instruments available

Fast withdrawal processes

Cons

Limited educational resources compared to competitors

Customer support response times can vary

Your Opinions

JustMarkets stands out for its zero minimum deposit requirement, making it an ideal choice for traders who want to dip their toes in forex trading without financial risk. However, the limited educational resources could be a drawback for those seeking comprehensive support.

3. FP Markets

Introduction

FP Markets is an Australia-based broker that has made significant inroads into the Indian forex market. With its impressive range of trading tools and resources, FP Markets is well-suited for both novice and experienced traders.

✅ FP Markets: Open An Account or Go to Website

Features

Direct Market Access: Provides traders with direct access to a vast array of financial markets.

Variety of Account Types: Multiple account types catering to diverse trading needs and strategies.

Trading on Major Exchanges: Ability to trade on leading exchanges around the globe.

Advanced Trading Tools: Access to cutting-edge trading tools and analytics.

Pros

High-quality customer service

Advanced charting tools for serious traders

Comprehensive market research available

Cons

Higher minimum deposit compared to others on this list

Complex fee structure that may confuse new traders

Your Opinions

FP Markets combines advanced trading tools with a solid reputation, making it a worthy candidate for the best forex funded accounts in India. However, potential traders should be cautious about the higher minimum deposit and familiarize themselves with the fee structure.

4. AvaTrade

Introduction

AvaTrade is a well-established global broker known for its reliability and diverse product offerings. It caters to a broad audience, including Indian traders looking for a funded account solution.

✅ Avatrade: Open An Account or Go to Website

Features

Regulated Environment: Operates under strict regulation, ensuring safety for traders’ funds.

Diverse Trading Platforms: Includes web-based trading, mobile apps, and desktop platforms.

Educational Content: Offers a wealth of educational resources and trading guides.

Automated Trading Options: Supports automated trading through APIs and social trading platforms.

Pros

Strong regulatory framework enhances trustworthiness

Wide variety of trading instruments available

Excellent customer support services

Cons

Limited availability of cryptocurrency pairs

Relatively high spread on some instruments

Your Opinions

With its excellent reputation and regulatory compliance, AvaTrade presents a safe and reliable option for those interested in funded accounts in India. The educational content is particularly beneficial for new traders, helping them understand the complexities of forex trading.

5. Forex.com

Introduction

Forex.com is part of the StoneX Group Inc. and is a reputable broker offering funded forex accounts to Indian traders. Its strong market presence and user-friendly platform make it a popular choice.

Features

Multi-Asset Trading Options: Apart from forex, Forex.com offers commodities, indices, and cryptocurrencies.

Robust Trading Technology: Offers proprietary trading platforms with advanced features.

Research and Analysis Tools: Comprehensive research tools and reports to assist traders.

Competitive Pricing Structure: Low commissions and spreads provide cost-effective trading.

Pros

Extensive market research available

User-friendly platform design

Competitive pricing makes it cost-effective

Cons

Limited customer support hours

Some advanced features might require a learning curve

Your Opinions

Forex.com’s strong emphasis on technology and research sets it apart from other brokers. While it offers a compelling funding option, traders must be prepared to navigate the technology for optimal results.

6. IC Markets

Introduction

IC Markets is known for its low spreads and high liquidity, making it an attractive option for day traders and scalpers. It offers funded accounts for Indian traders seeking an edge in the forex market.

Features

Ultra-Low Spreads: IC Markets offers some of the lowest spreads in the industry.

High Leverage Options: Traders can access high leverage to maximize their positions.

Multiple Trading Platforms: Support for MetaTrader 4, MetaTrader 5, and cTrader.

Fast Execution Speeds: Ensures trades are executed promptly, which is crucial for active traders.

Pros

Ideal for scalping and day trading

Highly liquid market conditions

Variety of account types to suit diverse trader needs

Cons

Limited educational resources for beginners

Higher complexity for new users

Your Opinions

For traders focused on high-frequency trading, IC Markets is one of the best forex funded accounts in India. However, the lack of beginner-friendly resources means that new traders may need additional guidance.

7. RoboForex

Introduction

RoboForex is a multi-asset broker that offers an extensive suite of trading instruments, including forex, indices, and commodities. Indian traders can benefit from its funded accounts and competitive trading conditions.

Features

Wide Range of Account Types: Offers several account types catered to various trading styles.

Investment Opportunities: Allows traders to invest in managed accounts.

Innovative Trading Tools: Access to unique tools like CopyFX for copy trading.

Bonus Programs: Various bonuses and promotions to enhance trading capital.

Pros

A variety of investment opportunities available

Innovative trading tools facilitate diverse trading strategies

Attractive bonus programs

Cons

Customer service may not be available around the clock

Regulatory status may vary by region

Your Opinions

RoboForex's innovative approach and variety of investment opportunities make it an appealing choice for advanced traders. However, the variable regulatory status may deter some traders from choosing this broker.

8. HotForex

Introduction

HotForex is a renowned forex and commodities broker that caters to traders across the globe, including India. Its range of funded trading accounts and commitment to client support make it a popular choice.

Features

Multiple Account Types: Offers several account types to meet varying trader needs.

High Leverage: Traders can access high leverage ratios, increasing their trading capacity.

Comprehensive Trading Tools: Provides a wealth of analytical tools and market insights.

Regular Promotions: Attracts traders with ongoing promotional offers.

Pros

Strong reputation and regulatory compliance

Comprehensive educational resources available

Strong customer support team

Cons

Spreads may vary based on account type

Certain withdrawal methods may incur fees

Your Opinions

HotForex's commitment to customer service and educational resources solidifies its place among the top forex funded accounts in India. However, potential users should consider the costs associated with withdrawals and spreads when choosing an account type.

9. XM

Introduction

XM is a well-respected forex broker that offers a range of funded accounts suitable for Indian traders. The company is known for its commitment to providing exceptional client service and a transparent trading environment.

Features

Zero Deposit Fees: Traders can deposit and withdraw without incurring fees.

Multiple Trading Platforms: Offers access to MetaTrader platforms and its proprietary trading app.

Educational Materials: Provides extensive educational content and market analysis.

Flexible Leverage Options: Allows traders to select their preferred leverage.

Pros

Transparent pricing structure with no hidden fees

A variety of educational resources available

High-quality customer support

Cons

Limited choice of cryptocurrencies for trading

Some advanced trading features may have a learning curve

Your Opinions

XM shines in terms of transparency and customer support, making it an excellent option for new traders seeking funded accounts in India. However, the limited cryptocurrency selection may disappoint some traders.

10. OANDA

Introduction

OANDA is a respected online forex broker that provides a secure trading environment for Indian traders through its funded account options. Known for its innovative technology and data-driven insights, OANDA is an attractive choice for many.

Features

Regulatory Oversight: Highly regulated, ensuring safety for investors.

Advanced Trading Platform: Proprietary trading platform equipped with advanced analytics and tools.

Robust Data Offerings: Provides comprehensive market data and analytics.

Flexible Account Types: Offers various account settings to cater to different trading styles.

Pros

Strong regulatory standing increases investor confidence

Excellent analytical tools available

Flexible account types allow customization

Cons

Limited asset classes compared to competitors

Higher minimum deposit requirements than some rivals

Your Opinions

OANDA's advanced technology and strong regulatory framework make it a solid choice for traders looking for the best forex funded accounts in India. However, potential clients should consider the higher minimum deposit and assess whether OANDA’s offerings align with their trading goals.

FAQs

What is a forex funded account?

A funded forex account allows traders to trade using capital provided by a broker or funding firm, reducing the financial risk they face.

How do I qualify for a funded forex account in India?

Qualification criteria vary by broker but generally include demonstrating trading knowledge and passing specific evaluation tests.

Are there any fees associated with funded forex accounts?

Yes, depending on the broker, there may be account maintenance fees, withdrawal fees, and commissions related to trading activities.

Can I trade cryptocurrencies with a funded forex account?

Most forex brokers offer a range of trading instruments, including cryptocurrencies, but availability varies by broker.

Is forex trading legal in India?

Yes, forex trading is legal in India, provided that traders comply with regulations set by the Reserve Bank of India (RBI) and operate through licensed brokers.

Conclusion

Navigating the world of forex trading can be overwhelming, especially for those just starting. Selecting one of the top 10 best forex funded accounts in India—such as Exness, JustMarkets, FP Markets, or AvaTrade—can provide the necessary support and resources for successful trading experiences. Each broker offers unique features, pros, and cons, making it imperative for traders to align their choices with their individual trading goals and capabilities. Cautiously evaluating these options will empower you to take control of your trading journey and achieve your financial aspirations.

✳️ Read more: