7 minute read

Best Forex Brokers in Saudi Arabia 2025

Top 10 Best Forex Brokers in Saudi Arabia 2025, With the right information and tools at your fingertips, traders can make informed choices that align with their trading goals. This guide will delve into the features, pros and cons, and opinions surrounding each brokerage, ensuring you have all the necessary details to navigate through your options effectively.

BEST FOREX BROKERS in The World

✅ Exness: Open An Account or Go to Website

✅ JustMarkets: Open An Account or Go to Website

✅ XM: Open An Account or Go to Website

✅ FP Markets: Open An Account or Go to Website

✅ Avatrade: Open An Account or Go to Website

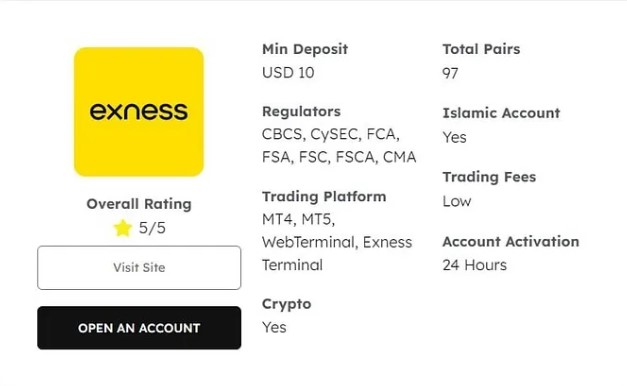

1. Exness

Introduction

Exness has carved a niche for itself as one of the leading forex brokers in Saudi Arabia, renowned for its competitive trading conditions and exceptional customer support.

Features

Regulation: Licensed and regulated by multiple authorities, including CySEC and FCA.

Trading Platforms: MetaTrader 4 and MetaTrader 5 accessible on various devices.

Leverage: Offers leverage up to 1:2000, allowing traders to maximize their potential returns.

✅ Exness: Open An Account or Go to Website

Pros and Cons

Pros:

Low spreads and commissions.

Excellent customer service.

Multiple account types tailored to different trading needs.

Cons:

Limited educational resources for beginners.

Withdrawal fees may apply depending on the method.

Opinion

Exness stands out for its user-friendly platform and responsive support team. However, beginners may need to seek external resources for education.

2. XM

Introduction

XM is another prominent player in the forex market, offering a wide range of trading instruments, including forex, commodities, and indices.

✅ XM: Open An Account or Go to Website

Features

Regulation: Regulated by ASIC and CySEC, ensuring a safe trading environment.

Trading Platforms: User-friendly MT4 and MT5 platforms with advanced charting tools.

Bonus Program: Unique bonus offerings for new and existing traders.

Pros and Cons

Pros:

Competitive spreads and no hidden fees.

Comprehensive educational resources available.

Excellent trade execution speed.

Cons:

Limited payment options in some regions.

Customer support can be slow during peak hours.

Opinion

XM’s commitment to trader education and top-notch execution makes it a solid choice for traders in Saudi Arabia. However, users might face delays during high-demand times.

3. IG Group

Introduction

IG Group is a well-established broker known for its extensive research and market analysis tools.

Features

Regulation: Heavily regulated, providing a secure trading environment.

Trading Platforms: Proprietary trading platform alongside MT4.

Market Research: Extensive market insights and forecasting reports.

Pros and Cons

Pros:

Wide range of tradable assets.

Strong educational content.

Excellent mobile application.

Cons:

Higher fees compared to some competitors.

Limited bonuses and promotions.

Opinion

IG Group is ideal for serious traders looking for comprehensive market analysis and a robust platform, though costs may be higher than average.

4. Pepperstone

Introduction

Pepperstone is recognized for its fast execution speeds and low latency trading.

Features

Regulation: Regulated by ASIC and FCA.

Trading Platforms: MT4, MT5, and cTrader available.

Account Types: Different account types catered to varying trader preferences.

Pros and Cons

Pros:

Extremely low spreads.

Excellent customer service and support.

Access to VPS services for automated trading.

Cons:

Limited educational resources for novices.

Inactivity fees after a period of non-trading.

Opinion

Pepperstone is a preferred choice for scalpers and day traders due to its superior execution speed. However, beginners may find the learning curve steep.

5. AvaTrade

Introduction

AvaTrade offers a comprehensive trading experience across various asset classes, including forex.

✅ Avatrade: Open An Account or Go to Website

Features

Regulation: Regulated by multiple authorities worldwide.

Trading Platforms: Supports MT4, MT5, and proprietary platforms.

Copy Trading: Allows newer traders to follow and copy experienced traders.

Pros and Cons

Pros:

Comprehensive educational resources.

Copy trading feature beneficial for beginners.

Wide range of markets.

Cons:

Spreads can be higher on certain accounts.

Limited cryptocurrency options.

Opinion

AvaTrade excels in providing educational materials and innovative trading features, making it an excellent option for novice traders seeking guidance.

6. HotForex

Introduction

HotForex is known for its attractive trading conditions and diverse account types.

Features

Regulation: Operates under strict regulations in multiple jurisdictions.

Trading Platforms: Offers MT4, MT5, and mobile trading options.

Account Variety: Six different account types for various trading strategies.

Pros and Cons

Pros:

No commission on trades in specific accounts.

Comprehensive market analysis and research tools.

Multi-language customer support.

Cons:

Limited educational content for beginners.

Withdrawal fees may vary based on method.

Opinion

HotForex is well-suited for traders looking for flexible trading options, though educational resources could improve for new entrants.

7. FBS

Introduction

FBS is popular among traders for its high leverage options and promotional offers.

Features

Regulation: Regulated in several regions, ensuring safety for clients.

Trading Platforms: Accessible on MT4 and MT5.

Promotions: Frequent bonuses and special offers for new clients.

Pros and Cons

Pros:

High leverage options (up to 1:3000).

User-friendly platform.

Strong community engagement and support.

Cons:

High spreads on specific accounts.

Limited educational materials.

Opinion

FBS appeals to risk-tolerant traders interested in leverage. However, the lack of comprehensive educational resources can be a drawback for beginners.

8. IC Markets

Introduction

IC Markets is reputed for its low-cost trading and advanced technology.

Features

Regulation: Well-regulated, providing peace of mind for traders.

Trading Platforms: Offers MT4, MT5, and cTrader platforms.

Liquidity Providers: Access to numerous liquidity providers for better pricing.

Pros and Cons

Pros:

Ultra-low spreads and commission rates.

Fast execution speeds.

Excellent selection of currency pairs.

Cons:

Not as many educational resources available.

Inactivity fees apply.

Opinion

IC Markets is perfect for professional traders aiming for low cost and speed of execution, while beginners might struggle without adequate educational support.

9. FXTM (ForexTime)

Introduction

FXTM is known for its global reach and extensive array of trading instruments.

Features

Regulation: Regulated by several global authorities.

Trading Platforms: Offers MT4 and MT5, with access to mobile trading.

Educational Resources: Comprehensive materials for traders of all levels.

Pros and Cons

Pros:

Strong emphasis on education.

Wide variety of trading accounts.

Various deposit methods available.

Cons:

Spread can vary during volatile markets.

High fees for certain withdrawals.

Opinion

FXTM’s focus on education and diversity in account types makes it suitable for all traders, though costs may be a concern during high volatility.

10. eToro

Introduction

eToro is a pioneering social trading platform that has gained immense popularity for its innovative features.

Features

Regulation: Regulated by ESMA and FCA.

Trading Platform: Proprietary platform with social trading features.

CopyTrading: Users can copy successful traders’ strategies effortlessly.

Pros and Cons

Pros:

Unique social trading functionalities.

Comprehensive educational sections.

User-friendly interface.

Cons:

Spreads may be wider than some competitors.

Limited asset range compared to traditional brokers.

Opinion

eToro is an excellent choice for traders interested in social trading and copying strategies. However, those looking for lower spreads may want to explore other options.

Frequently Asked Questions (FAQs)

H4 What is forex trading?

Forex trading involves buying and selling currencies in the foreign exchange market to profit from changes in exchange rates.

H4 How do I choose the right forex broker?

Consider factors such as regulation, trading platforms, available assets, customer support, and trading conditions when choosing a forex broker.

H4 Are forex brokers in Saudi Arabia regulated?

Yes, many forex brokers operating in Saudi Arabia are regulated by international financial authorities, providing a secure trading environment.

H4 Can I trade forex without prior experience?

Yes, many brokers offer demo accounts and educational resources to help beginners learn how to trade successfully.

H4 What is the minimum deposit required to start trading?

The minimum deposit varies by broker but generally ranges from $100 to $500. Always check with the specific broker for accurate information.

Conclusion

As the forex market continues to grow and evolve, staying informed about the Top 10 Best Forex Brokers in Saudi Arabia 2025 will be crucial for traders looking to maximize their profitability. Each broker reviewed in this article offers unique advantages and challenges, so it is imperative to evaluate them against your personal trading needs and preferences. By conducting thorough research and utilizing the information provided, you can select the best forex broker that aligns with your trading goals, ensuring a productive and rewarding trading experience in 2025 and beyond.

See more: