7 minute read

Best Forex Brokers in Kenya 2025

Top 10 Best Forex Brokers in Kenya, this guide will provide you with insights into each broker’s features, pros, cons, and our expert opinions to help you make an informed decision.

5 BEST FOREX BROKERS in The World

✅ Exness: Open An Account or Go to Website

✅ JustMarkets: Open An Account or Go to Website

✅ XM: Open An Account or Go to Website

✅ FP Markets: Open An Account or Go to Website

✅ Avatrade: Open An Account or Go to Website

1. Exness

Introduction

Exness has established itself as a prominent player in the forex trading arena, providing Kenyan traders with robust trading solutions and exceptional customer support

Features

Regulation: Regulated by multiple authorities, including the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

Trading Platforms: Offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their user-friendly interfaces and advanced trading tools.

Account Types: Multiple account types tailored to varying levels of experience, including Standard and Pro accounts.

Pros

High leverage options up to 1:2000.

Low minimum deposit requirement, starting from $1.

Efficient withdrawal processes with various payment methods.

Cons

Limited educational resources for beginners

Your Opinion

Exness is particularly appealing for both novice and experienced traders due to its low entry barrier and diverse account options. Its strong regulatory standing adds to its credibility.

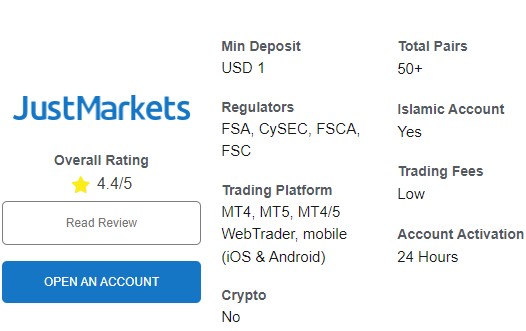

2. JustMarkets

Introduction

JustMarkets stands out for its commitment to transparency and customer satisfaction. Known for offering favorable trade conditions, it is a great choice for Kenyan traders looking for reliability.

✅ JustMarkets: Open An Account or Go to Website✅

Features

Regulation: Registered with the International Financial Services Commission (IFSC).

Low Spreads: Competitive spreads starting from 0.0 pips on certain accounts.

Educational Resources: Provides webinars and trading tutorials to enhance trader knowledge.

Pros

User-friendly interface suitable for beginners.

No commissions on most account types.

Strong customer support available in multiple languages.

Cons

Limited range of trading instruments compared to competitors.

Some withdrawal methods may incur fees.

Your Opinion

JustMarkets offers an excellent balance of affordability and quality service, making it a solid option for those starting on their trading journey.

3. FP Markets

Introduction

FP Markets is an Australian-based broker with a global presence, including a significant clientele base in Kenya. It combines a highly regulated environment with innovative trading technology.

Features

Regulation: Regulated by the Australian Securities and Investments Commission (ASIC).

Wide Range of Instruments: Over 10,000 trading instruments, including forex, stocks, and commodities.

Trading Conditions: Offers tight spreads and fast execution speeds.

✅ FP Markets: Open An Account or Go to Website

Pros

High leverage ratios of up to 1:500.

Excellent trading platforms, including both MT4 and MT5.

Comprehensive market analysis tools provided.

Cons

Complex account setup process.

Limited educational resources for beginner traders.

Your Opinion

FP Markets is ideal for traders who demand flexibility and a broad range of instruments, especially if they aim to diversify their portfolios.

4. OctaFX

Introduction

OctaFX is a well-established forex broker that is popular among Kenyan traders. It is known for its user-friendly platform and flexible trading options.

Features

Regulation: Registered in St. Vincent and the Grenadines.

Variety of Platforms: Supports MT4, MT5, and its proprietary trading app.

Promotions: Frequent bonuses and promotions for both new and existing clients.

Pros

Low minimum deposit requirement of $100.

Various trading accounts, including ECN accounts.

Strong emphasis on social trading features.

Cons

Limited regulatory oversight.

Withdrawal fees may apply depending on the method chosen.

Your Opinion

For traders keen on social trading, OctaFX offers unique features that facilitate collaboration and shared learning among users.

5. HotForex

Introduction

HotForex has grown into a respected broker globally, providing comprehensive trading solutions tailored to the needs of Kenyan traders.

Features

Regulation: Regulated by several top-tier financial authorities.

Multiple Account Types: From micro to VIP accounts, catering to different trading styles.

Educational Materials: A wealth of resources including eBooks, webinars, and market analysis.

Pros

Tight spreads and zero commissions on specific accounts.

Accessible customer service available 24/5.

Robust mobile trading application.

Cons

Withdrawal process can take longer than expected.

Some advanced features may not be available on all accounts.

Your Opinion

HotForex excels in providing a well-rounded trading experience, particularly for those looking for comprehensive educational resources.

6. XM

Introduction

XM is a globally recognized broker known for its exceptional customer service and competitive trading conditions. It is a favorite among many traders in Kenya.

✅ XM: Open An Account or Go to Website

Features

Regulation: Licensed by ASIC and CySEC, ensuring safety for traders.

Leverage Options: High leverage up to 1:888.

Research Tools: Extensive market analysis and research materials available.

Pros

Variety of account types catering to different trading preferences.

Negative balance protection offered.

No hidden fees on withdrawals.

Cons

Limited payment methods for deposits and withdrawals.

The educational section could be more extensive.

Your Opinion

XM is particularly effective for serious traders who value strong analytical tools and high leverage options.

7. ICM Capital

Introduction

ICM Capital has made a name for itself as a reliable forex broker, offering a seamless trading experience for Kenyan traders.

Features

Regulation: Regulated by the Financial Conduct Authority (FCA) in the UK.

Instant Execution: Fast execution speeds for trades.

Account Types: Multiple accounts including demo accounts for practice.

Pros

Competitive spreads starting from 1 pip.

Multi-currency accounts available.

Advanced trading tools provided for professional traders.

Cons

Limited range of educational resources.

Higher minimum deposit for certain account types.

Your Opinion

ICM Capital is a strong contender for experienced traders who seek sophisticated trading tools and quick execution.

8. AvaTrade

Introduction

AvaTrade is a well-established broker offering an impressive range of trading instruments and platforms for Kenyan traders.

✅ Avatrade: Open An Account or Go to Website

Features

Regulation: Regulated across several jurisdictions including Europe and Australia.

Wide Range of Assets: Trades on forex, cryptocurrencies, commodities, and indices.

User-Friendly Platforms: Includes proprietary trading platform along with MT4 and MT5.

Pros

Excellent educational resources, including web trading courses.

Strong customer support services.

Variety of trading tools and resources.

Cons

Higher spreads compared to some other brokers.

Inactivity fees apply after a period of no trading activity.

Your Opinion

AvaTrade is commendable for its consistent commitment to educating traders and providing a wide array of assets for diversification.

9. FXTM (ForexTime)

Introduction

FXTM is a global forex broker recognized for its innovative services and customer-centric approach, making it popular among Kenyan traders.

Features

Regulation: Regulated by FCA UK and CySEC.

Flexible Leverage: Up to 1:1000 leverage offered.

Various Account Types: Including Cent accounts for beginners.

Pros

Extensive selection of educational resources.

Quick account opening process.

Wide range of trading tools and analytics available.

Cons

Higher minimum deposit for certain accounts.

Spreads can vary significantly based on market volatility.

Your Opinion

FXTM is particularly beneficial for traders who appreciate flexibility in leverage and access to vast educational resources.

10. Deriv

Introduction

Deriv provides a modern trading platform that focuses on innovation and cutting-edge technology, making it a suitable choice for Kenyan traders.

Features

Regulation: Registered under multiple regulators worldwide.

Customizable Trading Platform: Offers a unique trading platform tailored to individual traders’ needs.

Diverse Trading Products: Includes forex, synthetic indices, and options trading.

Pros

User-friendly interface designed for all skill levels.

Instantaneous order execution with low latency.

Demo accounts available for practice.

Cons

Limited educational resources compared to others.

Regulatory status may be a concern for some traders.

Your Opinion

Deriv appeals to tech-savvy traders who prioritize a customizable trading experience and quick execution times.

Conclusion

Navigating the forex trading landscape in Kenya can be challenging, but understanding the Top 10 Best Forex Brokers in Kenya provides a solid foundation for your trading journey. Each broker mentioned has distinct features, benefits, and drawbacks that cater to different trading styles and preferences. By considering these factors, you can choose a broker that aligns with your trading goals and enhances your chances of success in the forex market.

See more: