7 minute read

Best forex broker 500 leverage 2025

This article will explore the Top 10 best forex broker 500 leverage, including reputable names such as Exness, Avatrade, JustMarkets, XM, and FP Markets. Each of these brokers offers unique features, pros and cons, enabling traders to make educated decisions tailored to their specific trading strategies.

5 BEST FOREX BROKERS in The World

✅ Exness: Open An Account or Go to Website

✅ JustMarkets: Open An Account or Go to Website

✅ XM: Open An Account or Go to Website

✅ FP Markets: Open An Account or Go to Website

✅ Avatrade: Open An Account or Go to Website

1. Exness

Introduction

Exness is a well-regarded global forex broker that provides traders with access to a variety of financial markets. Known for its user-friendly platform and comprehensive support, Exness stands out for its impressive leverage options, making it an appealing choice for both novice and experienced traders.

✅ Exness: Open An Account or Go to Website

Features

Leverage: Up to 1:500.

Account Types: Multiple account types catering to different levels of trading experience.

Trading Platforms: MetaTrader 4 and MetaTrader 5.

Customer Support: 24/7 multilingual support.

Regulation: Licensed by multiple regulatory bodies including FCA and CySEC.

Pros and Cons

Pros:

High leverage options enable significant trading potential.

Strong regulatory framework enhancing security.

Varied account types provide flexibility based on trader needs.

Cons:

Limited educational resources for beginners.

Spreads can vary, impacting trading costs.

Your Opinion

In my view, Exness is a solid choice for those looking to utilize 500 leverage effectively. The combination of high leverage and robust platform capabilities makes it particularly attractive to serious traders seeking to maximize their returns.

2. Avatrade

Introduction

Avatrade is a globally recognized forex broker that prides itself on offering innovative trading solutions. With a strong emphasis on customer service and education, Avatrade caters to traders of all skill levels, making it a versatile choice in the forex market.

✅ Avatrade: Open An Account or Go to Website

Features

Leverage: Up to 1:400.

Account Types: Standard, Islamic, and demo accounts.

Trading Platforms: AvaTradeGO, MetaTrader 4, and other proprietary platforms.

Educational Resources: Extensive learning materials and webinars.

Regulation: Regulated by authorities including ASIC, FSA, and Central Bank of Ireland.

Pros and Cons

Pros:

Comprehensive educational resources are perfect for beginners.

User-friendly mobile app enhances trading accessibility.

Strong customer service available in multiple languages.

Cons:

Leverage may not reach the 1:500 mark like some competitors.

Fees for certain withdrawals could be higher than average.

Your Opinion

Avatrade presents a balanced approach for traders interested in leveraging their investments without extensive risk. While the leverage might not be quite as high as 1:500, the educational resources and support available make it a favorable option for many traders.

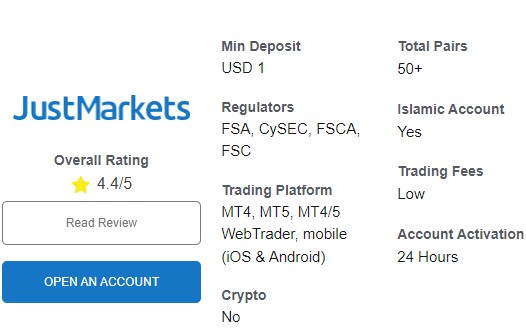

3. JustMarkets

Introduction

JustMarkets is gaining traction in the forex trading industry due to its competitive trading conditions. With an emphasis on fairness and transparency, this broker aims to ensure that traders have the tools they need to succeed while offering high leverage options.

✅ JustMarkets: Open An Account or Go to Website

Features

Leverage: Up to 1:500.

Account Types: ECN, Standard, and demo accounts.

Trading Platforms: MetaTrader 4 and MetaTrader 5.

Deposit Options: Various deposit methods, including cryptocurrencies.

Regulation: Registered under the IFSC.

Pros and Cons

Pros:

High leverage allows traders to increase their exposure.

Competitive spreads and commissions on trades.

A responsive customer support team.

Cons:

Limited regulatory oversight compared to larger brokers.

Educational resources are somewhat basic.

Your Opinion

For traders who prioritize high leverage, JustMarkets stands out as a commendable option. Their straightforward approach and willingness to cater to traders from various backgrounds make them an appealing choice.

4. XM

Introduction

XM has established itself as a prominent player in the forex industry, particularly noted for its high-quality execution and excellent customer service. The broker offers several enhancements for traders, particularly with its leverage offerings.

✅ XM: Open An Account or Go to Website

Features

Leverage: Up to 1:888 (though regulated countries may have restrictions).

Account Types: Micro, Standard, and Zero accounts.

Trading Platforms: MetaTrader 4 and MetaTrader 5.

Promotions: Regular bonuses and promotional campaigns.

Regulation: Regulated by ASIC, FCA, and CySEC.

Pros and Cons

Pros:

Extremely high leverage options for aggressive traders.

Tight spreads across various account types.

Wide range of assets available for trading.

Cons:

Some restrictions based on geographical locations.

Customer service response times can vary.

Your Opinion

XM successfully balances high leverage with the ability to trade a wide array of instruments, which I find advantageous for traders aiming to diversify their portfolios. However, it's important to consider the associated risks with such high leverage.

5. FP Markets

Introduction

FP Markets is known for providing deep liquidity and advanced trading technologies, making it a popular choice among professional traders. This broker combines an efficient trading environment with favorable leverage options to attract a diverse clientele.

Features

Leverage: Up to 1:500.

Account Types: Standard, Raw, and demo accounts.

Trading Platforms: MetaTrader 4, MetaTrader 5, and IRESS.

Market Access: Offers more than 10,000 trading instruments.

Regulation: Regulated by ASIC and CySEC.

Pros and Cons

Pros:

High leverage options facilitate greater trading potential.

Diverse range of trading instruments available.

Robust trading platform options for technical analysis.

Cons:

Limited educational offerings for new traders.

Withdrawal fees can accumulate over time.

Your Opinion

FP Markets appeals to those with experience in the forex market, especially given its competitive leverage options and expansive range of instruments. However, traders should be mindful of the additional costs associated with withdrawals.

FAQs

What is Forex Trading Leverage?

Leverage refers to using borrowed funds to increase the potential return on investment in trading. In forex, brokers often allow high leverage ratios, enabling traders to control larger positions than their capital would otherwise permit.

How does using 500 Leverage affect my trading?

Utilizing 500 leverage increases your buying power significantly, meaning you can open larger positions with a smaller amount of capital. However, it also amplifies losses, so risk management is essential.

Which is the best forex broker offering 500 leverage?

The best broker varies depending on individual needs; however, some strong contenders include Exness and JustMarkets for their impressive leverage options and overall trading conditions.

Can I lose more money than I deposited when using high leverage?

Yes, when using high leverage, it is possible to lose more than your initial deposit. Traders must implement effective risk management strategies to mitigate this risk.

Are there any regulations governing leverage limits?

Yes, various regulatory bodies impose limits on leverage based on the region and the type of trader. For instance, retail traders may face lower leverage limits compared to professional traders.

✳️ Read more:

Conclusion

In conclusion, selecting the right forex broker with high leverage is crucial for maximizing trading potential while managing risk effectively. The Top best forex broker 500 leverage discussed in this article—Exness, Avatrade, JustMarkets, XM, and FP Markets—each offer unique advantages tailored to various trading styles and preferences. As always, traders should conduct thorough research and consider their individual strategies before choosing a broker. By understanding the features, pros and cons of each option, traders can make informed decisions that align with their financial goals and risk tolerance.