9 minute read

Best Forex Brokers in Bangladesh 2025

Top 10 Best Forex Brokers in Bangladesh 2025, we will analyze renowned platforms such as Exness, JusMarkets, Avatrade, and XM. Each broker offers distinct features tailored to meet various trading needs.

5 BEST FOREX BROKERS in The World

✅ Exness: Open An Account or Go to Website

✅ JustMarkets: Open An Account or Go to Website

✅ XM: Open An Account or Go to Website

✅ FP Markets: Open An Account or Go to Website

✅ Avatrade: Open An Account or Go to Website

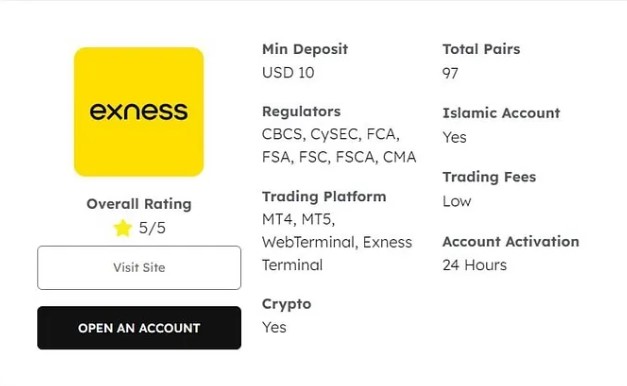

1. Exness

Introduction

Established in 2008, Exness has emerged as a leading forex broker globally. With its user-friendly platform and extensive range of trading instruments, Exness is particularly appealing to both novice and experienced traders in Bangladesh.

💥💥💥Visit Website Exness Official ✅

Features

Regulation: Regulated by CySEC and FCA.

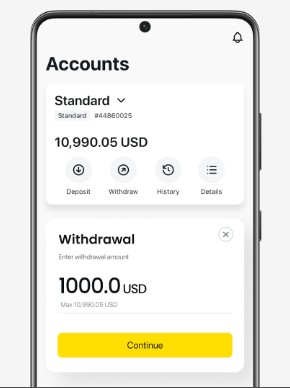

Trading Accounts: Offers several account types, including Standard and Pro accounts.

Leverage: High leverage options up to 1:2000 available.

Withdrawal Options: Multiple withdrawal methods, including local bank transfers.

Pros and Cons

Pros:

Low spreads starting from 0.0 pips.

Highly responsive customer support.

Reliable educational resources for beginner traders.

Cons:

Limited selection of cryptocurrencies.

Some advanced trading tools may require additional fees.

Your Opinion

Exness stands out due to its robust regulatory framework and commitment to trader education. Its low-cost structure makes it an attractive option for new traders looking to minimize expenses while gaining valuable experience.

2. JusMarkets

Introduction

JusMarkets is a relatively new entrant in the forex trading landscape, but it has quickly gained traction with Bangladeshi traders due to its competitive offerings and user-centric policies.

✅ JustMarkets: Open An Account or Go to Website

Features

Account Flexibility: Provides various account types, including Islamic accounts.

Trading Platforms: Offers MetaTrader 4 and MetaTrader 5 platforms.

Educational Resources: Comprehensive tutorials, webinars, and market analysis.

Pros and Cons

Pros:

Competitive spreads and low commission rates.

User-friendly interface on both desktop and mobile.

Active promotions and bonuses for new clients.

Cons:

Not as widely recognized as other brokers.

Limited customer support channels.

Your Opinion

JusMarkets offers an excellent balance between affordability and quality service, making it a viable choice for traders seeking a straightforward trading experience without unnecessary complexities.

3. AvaTrade

✅ Avatrade: Open An Account or Go to Website

Introduction

AvaTrade is a well-established forex broker that has garnered a dedicated following since its inception in 2006. With a strong presence in multiple countries, AvaTrade is known for its diverse trading options and robust educational tools.

Features

Regulatory Compliance: Regulated in multiple jurisdictions, ensuring trader safety.

Asset Variety: Offers forex, commodities, indices, stocks, and cryptocurrencies.

Platforms: Supports various platforms, including Web Trading and mobile applications.

Pros and Cons

Pros:

Excellent educational resources, including a demo account.

No deposit or withdrawal fees.

Copy trading feature allowing less experienced traders to follow successful traders.

Cons:

Higher spreads compared to certain competitors.

Limited customer support during weekends.

Your Opinion

AvaTrade excels in providing a comprehensive range of assets and educational resources, positioning itself as a solid choice for those committed to enhancing their trading skills and knowledge.

4. XM

✅ XM: Open An Account or Go to Website

Introduction

Founded in 2009, XM has become one of the most recognized forex brokers worldwide. Catering to over a million clients, XM offers a blend of cutting-edge technology and dedication to trader satisfaction.

Features

Regulation: Regulated by CySEC and ASIC.

Free Demo Account: Unlimited access to demo accounts.

Bonuses and Promotions: Attractive bonuses for both new and existing clients.

Pros and Cons

Pros:

Exceptional customer service available 24/5.

Variety of account types catering to different trader profiles.

Competitive pricing with low spreads.

Cons:

Complex fee structures for specific account types.

Limited trading tools compared to some competitors.

Your Opinion

XM is a robust option for traders who value exceptional customer service and comprehensive educational materials. However, traders should be mindful of its complex fee structure when selecting account types.

5. IC Markets

Introduction

IC Markets is an Australian-based forex broker that has gained recognition for its superior execution speeds and low latency. Since its launch in 2007, it has attracted numerous traders, especially scalpers, seeking tight spreads.

Features

Spreads: Offers spreads as low as 0.0 pips.

Liquidity Providers: Access to multiple liquidity providers ensures competitive pricing.

Multiple Platforms: Supports MetaTrader 4, MetaTrader 5, and cTrader.

Pros and Cons

Pros:

Superior order execution speeds.

Wide range of trading instruments.

Strong focus on forex and CFD trading.

Cons:

Limited educational resources for beginners.

Slightly higher minimum deposit requirement.

Your Opinion

IC Markets caters to serious traders who prioritize order execution speed and low costs. While the broker may not be as beginner-friendly, it is well-suited for more seasoned traders who can navigate markets independently.

6. FBS

Introduction

FBS is a global brokerage firm that has made significant strides in the forex sector since its establishment in 2009. Known for its versatile services, FBS appeals to a broad spectrum of traders.

Features

Market Analysis: Regular market updates and analysis provided.

Promotions: Ongoing promotions, including no-deposit bonuses.

Account Types: Various accounts available, including Cent, Micro, and Standard accounts.

Pros and Cons

Pros:

User-friendly interface suitable for beginners.

Bonuses and promotions that enhance trading capital.

Excellent educational materials available.

Cons:

Limited asset classes beyond forex.

Customer support response times can vary.

Your Opinion

FBS is an excellent choice for beginners and casual traders who appreciate promotional offers and educational support. Its flexible account types make it easy for traders at various levels to find a suitable option.

7. OctaFX

Introduction

OctaFX has built a solid reputation for providing trading services across multiple regions, offering an attractive platform for forex enthusiasts. Launched in 2011, OctaFX focuses on delivering optimal trading conditions.

Features

Trading Conditions: Flexible trading conditions with a focus on low spreads.

Financial Instruments: Offers forex, cryptocurrency, commodities, and indices.

Affiliate Program: Attractive affiliate program with commissions.

Pros and Cons

Pros:

User-friendly trading platform with effective tools.

Competitive spreads and low commissions.

Strong emphasis on customer engagement.

Cons:

Limited educational content compared to larger brokers.

Regulatory status could be improved.

Your Opinion

OctaFX serves as a great option for traders looking for competitive trading conditions and a straightforward platform. The affiliate program also adds an interesting dimension for those wishing to capitalize on their network.

8. HotForex

Introduction

HotForex is a respected forex broker that has been operational since 2010. It is known for its commitment to transparency and trader support, making it a preferred choice in many regions.

Features

Account Types: Wide array of accounts, including micro and professional accounts.

Trading Tools: Access to various trading tools, including VPS services.

Regulation: Regulated by several prestigious authorities.

Pros and Cons

Pros:

Extensive range of trading instruments.

Strong customer support and educational resources.

Competitive trading conditions for all types of traders.

Cons:

Slightly higher spreads on certain accounts.

Withdrawal process may take longer than expected.

Your Opinion

HotForex shines as a well-rounded broker that prioritizes customer satisfaction and offers a diverse trading environment. Its commitment to education further enhances its appeal to traders of all experience levels.

9. FXTM (ForexTime)

Introduction

ForexTime (FXTM) is a global forex broker that has made significant waves in the industry since 2011. It is particularly recognized for its innovative trading solutions and strong focus on client education.

Features

Leverage Options: Offers flexibility with leverage ratios up to 1:1000.

Trading Accounts: Multi-tiered account structures to cater to different trading styles.

Market Research: Regular market analysis and insights provided.

Pros and Cons

Pros:

Robust educational offerings, including webinars and seminars.

High leverage options suitable for aggressive traders.

Wide variety of payment methods available.

Cons:

Spread can widen during major news events.

Limited product offerings outside forex.

Your Opinion

FXTM is a powerhouse for traders interested in extensive educational resources and innovative trading solutions. Its high leverage options are enticing for those looking to maximize their returns, albeit with increased risk.

10. Pepperstone

Introduction

Pepperstone, established in 2010, is an award-winning forex broker known for its transparent pricing and superior execution speeds. It has established a strong presence among traders worldwide.

Features

Trading Platforms: Offers MetaTrader 4, MetaTrader 5, and cTrader.

Low Spreads: Competitive spreads starting from 0.0 pips.

Regulatory Compliance: Regulated by ASIC and FCA, ensuring trader safety.

Pros and Cons

Pros:

Excellent execution speeds suitable for scalpers.

Wide range of account types catering to different strategies.

Strong focus on transparency.

Cons:

Limited research tools compared to larger firms.

Higher minimum deposit requirements for certain accounts.

Your Opinion

Pepperstone excels in providing traders with the tools necessary for high-performance trading. Its focus on transparency and execution speed makes it a top choice for those engaged in high-frequency trading strategies.

Frequently Asked Questions (FAQs)

What is forex trading?

Forex trading refers to the exchange of currencies in the foreign exchange market. Traders buy and sell currency pairs in hopes of profiting from fluctuations in exchange rates.

How do I choose the best forex broker?

To choose the best forex broker, consider factors such as regulation, trading fees, available trading instruments, customer support, and educational resources.

Is forex trading legal in Bangladesh?

Yes, forex trading is legal in Bangladesh, but it is important to trade through regulated brokers to ensure compliance with local laws.

What are the risks of forex trading?

Forex trading involves significant risks, including market volatility, leverage risks, and potential for loss of capital. Proper risk management strategies are essential.

Can I trade forex with a small investment?

Yes, many brokers offer micro and cent accounts that allow traders to start with a small initial investment. However, it is advisable to understand the risks involved.

Conclusion

Selecting the right broker is a crucial step toward achieving success in forex trading. The Top 10 Best Forex Brokers in Bangladesh 2025 featured in this article each possess unique strengths that cater to the diverse needs of traders. Whether you are a beginner or an experienced trader, it is vital to conduct thorough research and consider your individual trading style and objectives before making a decision. By choosing one of these reputable brokers, you will be better equipped to navigate the complexities of the forex market and work towards your financial goals.

See more: