8 minute read

Best forex brokers in kenya with low minimum deposit 2025

In this article, we will explore the Top 10 best forex brokers in Kenya with low minimum deposit options available today, such as Exness, OctaFX, and Pepperstone, providing insights into their features, advantages, disadvantages, and personal opinions.

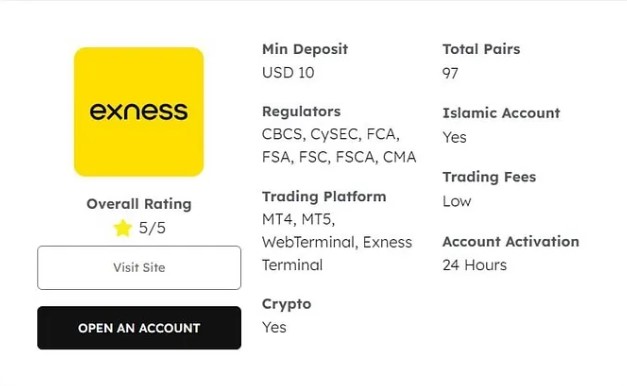

1. Exness

Introduction

Founded in 2008, Exness has established itself as a prominent player in the forex brokerage arena. The platform is particularly well-regarded for its low minimum deposit requirements, making it an attractive choice for new and experienced traders alike.

Features

Minimum Deposit: $1

Leverage: Up to 1:2000

Trading Platforms: MetaTrader 4 & 5

Regulation: CySEC, FCA

Spread: From 0.0 pips on VPS accounts

✅ Exness: Open An Account or Go to Website

Pros and Cons

Pros

Extremely low minimum deposit

High leverage options

User-friendly interface and trading platforms

Competitive spreads

Cons

Limited range of educational resources

Higher fees for withdrawals via credit cards

Your Opinion

Exness stands out for its accessibility to traders at all levels, especially given its incredibly low minimum deposit. Its user-friendly platforms make it easy for beginners to get started, while advanced traders can still benefit from high leverage.

2. OctaFX

Introduction

OctaFX is another leading forex broker that has gained popularity among Kenyan traders. Established in 2011, this broker offers a diverse range of trading options and excellent customer service.

Features

Minimum Deposit: $100

Leverage: Up to 1:500

Trading Platforms: MetaTrader 4, MetaTrader 5, and cTrader

Regulation: Regulated by FSC, St. Vincent, and the Grenadines

Spread: Variable spreads starting from 0.4 pips

Pros and Cons

Pros

Great range of trading instruments

Effective customer support

Good bonuses and promotions

Multiple account types

Cons

Slightly higher minimum deposit compared to others

Limited educational content

Your Opinion

OctaFX's balance between a decent minimum deposit and a wide array of trading opportunities makes it a solid choice for many traders. Their customer support is commendable, which can be a crucial factor for those just starting.

3. Pepperstone

Introduction

Since its inception in 2010, Pepperstone has earned a reputation for providing exceptional trading conditions. Known for its competitive pricing and innovative trading platforms, Pepperstone is a favorite among advanced traders.

Features

Minimum Deposit: $200

Leverage: Up to 1:500

Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader

Regulation: ASIC, FCA

Spread: Starting from 0.0 pips on Razor account

Pros and Cons

Pros

Highly competitive spreads

Fast execution speeds

Access to multiple platforms

Excellent research tools

Cons

Relatively higher minimum deposit requirement

Limited educational materials for novice traders

Your Opinion

Pepperstone is an ideal broker for those who prioritize tight spreads and speed. While it requires a slightly higher minimum deposit, the comprehensive tools provided can justify this investment, particularly for serious traders.

4. HotForex

Introduction

HotForex is a global forex broker that has been offering trading services since 2010. With an emphasis on client satisfaction, HotForex provides various account types tailored to different trader needs.

Features

Minimum Deposit: $5

Leverage: Up to 1:1000

Trading Platforms: MetaTrader 4 and 5

Regulation: FCA, DFSA

Spread: As low as 0.1 pips

Pros and Cons

Pros

Very low minimum deposit requirement

Diverse account types

Strong regulatory background

Good customer service

Cons

Withdrawal fees on certain payment methods

Limited research resources

Your Opinion

With a minimum deposit of just $5, HotForex opens up possibilities for almost anyone interested in forex trading. Their commitment to customer satisfaction and strong regulatory oversight adds to their appeal.

5. FXTM (ForexTime)

Introduction

FXTM is a reputable global broker established in 2011. It caters to both retail and institutional traders featuring various account types suitable for every level of trader.

Features

Minimum Deposit: $10

Leverage: Up to 1:1000

Trading Platforms: MetaTrader 4, MetaTrader 5

Regulation: FCA, CySEC

Spread: From 0.1 pips

Pros and Cons

Pros

Extremely low entry point

Multiple trading instruments

Excellent educational materials

High leverage offerings

Cons

Limited availability of some advanced features

Slower withdrawal process

Your Opinion

FXTM impresses with its low minimum deposit and rich educational resources, making it a fantastic option for beginner traders. The variety of instruments also allows for more diversified trading strategies.

6. IC Markets

Introduction

IC Markets is an Australian-based forex broker that was established in 2007. It is known for its low-cost trading and excellent trading environments, appealing largely to experienced traders.

Features

Minimum Deposit: $200

Leverage: Up to 1:500

Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader

Regulation: ASIC, CySEC

Spread: Starting from 0.0 pips

Pros and Cons

Pros

Low trading costs

Fast execution speeds

Wide range of trading instruments

Robust trading platforms

Cons

Higher minimum deposit requirement than other brokers

Complex for beginners

Your Opinion

Although IC Markets demands a higher minimum deposit than some competitors, the quality of service and trading conditions offered make it worthwhile for active traders seeking low costs.

7. FBS

Introduction

FBS has captured a significant share of the forex market since its establishment in 2009, offering a comprehensive trading environment suitable for all levels of traders.

Features

Minimum Deposit: $1

Leverage: Up to 1:3000

Trading Platforms: MetaTrader 4, MetaTrader 5

Regulation: IFSC

Spread: From 0.0 pips

Pros and Cons

Pros

Very low minimum deposit

Wide range of trading accounts

High leverage options

Great promotional offers

Cons

Limited regulatory oversight

Customer service can be slow

Your Opinion

FBS presents an enticing offer with its remarkably low minimum deposit. However, caution should be exercised due to limited regulatory oversight. It's vital for traders to conduct thorough research before diving in.

8. Alpari

Introduction

Alpari is one of the oldest forex brokers, established in 1998. It offers a user-friendly interface combined with extensive trading options, attracting many Kenyan traders.

Features

Minimum Deposit: $1

Leverage: Up to 1:1000

Trading Platforms: MetaTrader 4, MetaTrader 5

Regulation: IFSC

Spread: From 0.0 pips

Pros and Cons

Pros

Low minimum deposit

Extensive educational resources

Variety of account types

Solid regulation

Cons

Limited trading instruments

Withdrawal fees can apply

Your Opinion

Alpari's long-standing presence and low minimum deposit make it a valid option for any trader. Moreover, the educational resources can significantly benefit those just getting started.

9. AXI

Introduction

AXI, formerly known as AxiTrader, is an Australian broker founded in 2007. They are particularly known for their transparent pricing and dedicated customer service.

Features

Minimum Deposit: $200

Leverage: Up to 1:400

Trading Platforms: MetaTrader 4

Regulation: FCA, ASIC

Spread: Starting from 0.0 pips

Pros and Cons

Pros

Transparent pricing

Strong regulatory framework

Excellent customer support

Variety of trading tools

Cons

Higher minimum deposit requirement

Limited access to advanced trading technologies

Your Opinion

While the minimum deposit might be higher than some competitors, AXI's transparency and customer service create a supportive environment for traders looking for reliability.

10. OANDA

Introduction

OANDA is a well-respected forex broker that has been operating since 1996. Renowned for its extensive market analysis and intuitive trading platforms, OANDA has carved a niche for itself in the trading community.

Features

Minimum Deposit: $0

Leverage: Up to 1:50

Trading Platforms: OANDA Trade Platform, MetaTrader 4

Regulation: CFTC, FCA, IIROC

Spread: Variable spreads starting from 1.0 pips

Pros and Cons

Pros

No minimum deposit requirement

Excellent research tools

Comprehensive educational material

High-level regulation

Cons

Lower leverage compared to competitors

Variable spreads may lead to higher costs

Your Opinion

OANDA’s no-minimum-deposit policy is highly appealing for new traders hesitant to commit funds. The educational resources and strong regulatory backing further enhance its attractiveness.

Frequently Asked Questions

What is the minimum deposit required to trade forex in Kenya?

Most forex brokers in Kenya require a minimum deposit ranging from $1 to $200, depending on the broker. Some brokers like Exness and FBS even allow you to start trading with just $1.

Are forex brokers in Kenya regulated?

Yes, several forex brokers operating in Kenya are regulated by international authorities such as the FCA, CySEC, and ASIC. However, ensure you check the regulatory status of each broker before trading.

Can I trade forex with low capital? (H4)

Absolutely! Many forex brokers allow you to start trading with minimal capital. Brokers listed in the Top 10 best forex brokers in Kenya with low minimum deposit provide an excellent opportunity for beginners.

What trading platforms do these brokers offer?

Most of these brokers offer popular trading platforms such as MetaTrader 4 and MetaTrader 5, alongside proprietary platforms for advanced trading needs.

How do I choose the best forex broker for me?

To choose the best forex broker, consider factors including minimum deposit requirements, fees, available trading platforms, customer support, and regulatory compliance. Always select a broker that aligns with your trading style and goals.

Conclusion

In conclusion, selecting the right forex broker is vital for success in the trading landscape. The Top 10 best forex brokers in Kenya with low minimum deposit outlined in this article cater to various needs and preferences, making it easier for traders to start their journey. Each broker offers unique features, pros, and cons, emphasizing the importance of conducting thorough research to find the perfect fit for your trading aspirations. Whether you're a beginner or an experienced trader, these brokers present viable options to help you navigate the forex market effectively.

See more:

Best forex trading with high leverage

best forex funded account in india

Best Forex Broker With Demo Account 2025