№ 5/2023 (115), SEPTEMBER/OCTOBER

ISSN 1733-6732

bimonthly-daily companion

Journal

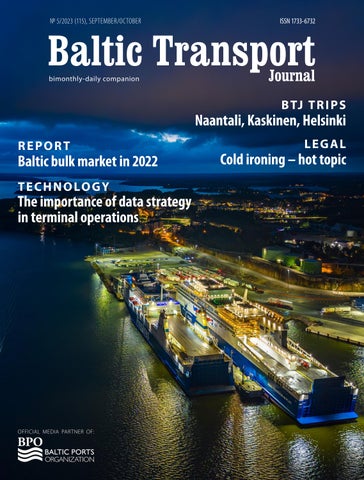

Baltic Transport

B TJ T R I P S

Naantali, Kaskinen, Helsinki REPORT

Baltic bulk market in 2022 T E C H N O LO G Y

The importance of data strategy in terminal operations

OFFICIAL MEDIA PARTNER OF:

LEGAL

Cold ironing – hot topic