Twenty years. Is it much or but an eyeblink? It, like many things, depends. Though, it does seem that the Baltic Sea region and its transport & logistics landscape have truly changed over the past two decades. But don’t take my word for it! Instead, The voice of an industry column gathers nearly 40 opinions that both reflect on the past and try to put a finger on the future. Several motives interweave the voices that come from all around our beautiful corner of the world: sustainability, digitalisation and innovation on the brighter, full-of-challenges but also richwith-opportunities side, with armed conflicts, all-too-frequent disruptions to shipping, and the consequences of climate change on the other. Be they good or bad, at least the sector is well aware of what needs to be done and what measures are there in the solutions toolbox. What is encouraging is that the stakeholders who shared their thoughts with us, who come from diverse nooks and crannies of the transport & logistics domain, are by far and large optimistic when it comes to tackling whatever the next 20 years will throw at them. They are also not alone in supplying the future demand for all-round development, so to speak, as one can sense a firm commitment to fostering cross-country and pan-regional partnerships in the opinions.

We would, too, like to add to this level-headed confidence by continuing our journey of delivering the latest & greatest from across the world of transport & logistics – to the benefit of our readers, partners who make it all happen, and the industry at large. Thank you for sailing with us for the past two decades!

Przemysław Myszka

Publisher

BALTIC PRESS SP. Z O.O. Address: Aleja Zwycięstwa 96/98 81-451 Gdynia, Poland office@baltictransportjournal.com

www.baltictransportjournal.com www.europeantransportmaps.com

Board Member BEATA MIŁOWSKA

Managing Director

PRZEMYSŁAW OPŁOCKI

Editor-in-Chief

PRZEMYSŁAW MYSZKA przemek@baltictransportjournal.com

Roving Editor MAREK BŁUŚ marek@baltictransportjournal.com

Proofreading Editor EWA KOCHAŃSKA

Contributing Writers

KISHOR ARUMILLI, NEIL DALUS, PAUL DELOUCHE, BERTIL DUINHOWER, DAN EICHELSDOERFER, MARK FALINSKI, ALBRECHT GRELL, ALEXANDRE HARRY, ALEXA IVY, PETER JAMESON, MAURICE JANSEN, EWA KOCHAŃSKA, PANOS KOUTSOURAKIS, LAURA LARKIN, ALISTAIR MACKENZIE, SIDDHARTH MAHAJAN, KEVIN MALONEY, OSSI METTÄLÄ, ALEKSANDAR-SAŠA MILAKOVIĆ, SIMEN DISERUD MILDAL, HELGE A. NORDAHL, TORILL GRIMSTAD OSBERG, KUNAL PATHAK, MARIELLE REMILLARD, MONIKA ROGO, JULIANA SANDFORD, ARE SOLUM, DAVID YOUNG

Art Director/DTP

DANUTA SAWICKA

Head of Marketing & Sales

PRZEMYSŁAW OPŁOCKI po@baltictransportjournal.com

If you wish to share your feedback or have information for us, do not hesitate to contact us at: editorial@baltictransportjournal.com

Contact us:

PRZEMYSŁAW

3 Editorial

8 Safety news by TT Club

12 The voice of an industry

32 The new (sailing) bridge for trade & tourism – BTJ Trip 2024 / Finnlines’ Malmö-Świnoujście ferry service by Przemysław Myszka and Przemysław Opłocki

36 Ready to rock

– BTJ Trip 2024 / the Port of Jakobstad-Pietarsaari by Przemysław Myszka

40 Events: Radicalism and/vs realism

The Grimaldi Group’s XXVI Euromed Convention From Land to Sea by Przemysław Myszka

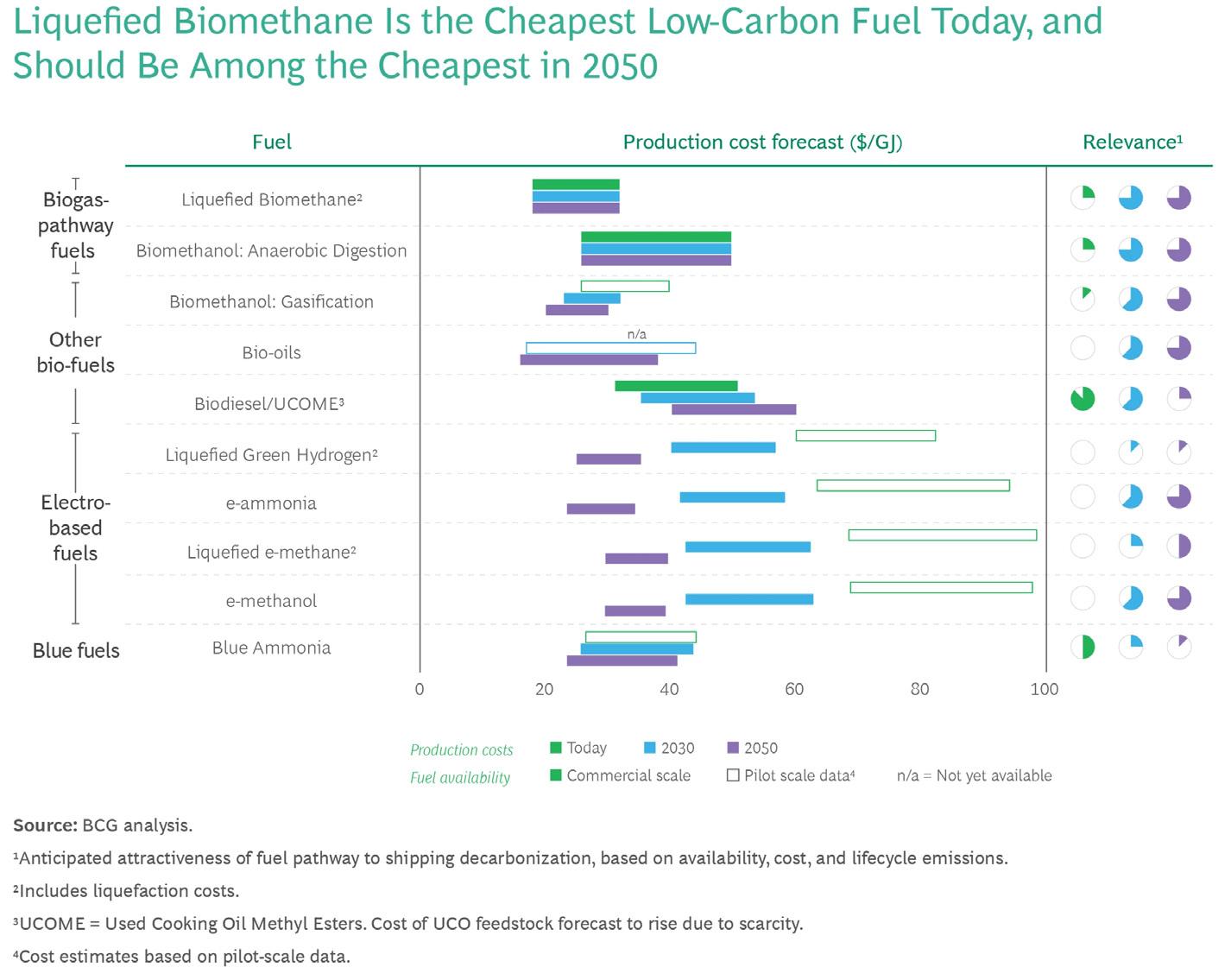

42 We don’t need a winner – Why a single shipping company won’t turn the tide of the fuel market – but the industry at large can (if it only wants to, with the help of policies and other sectors) by Ewa Kochańska

46 Understanding the whole picture – How to bunker liquefied hydrogen – safely by Simen Diserud Mildal, and Torill Grimstad Osberg

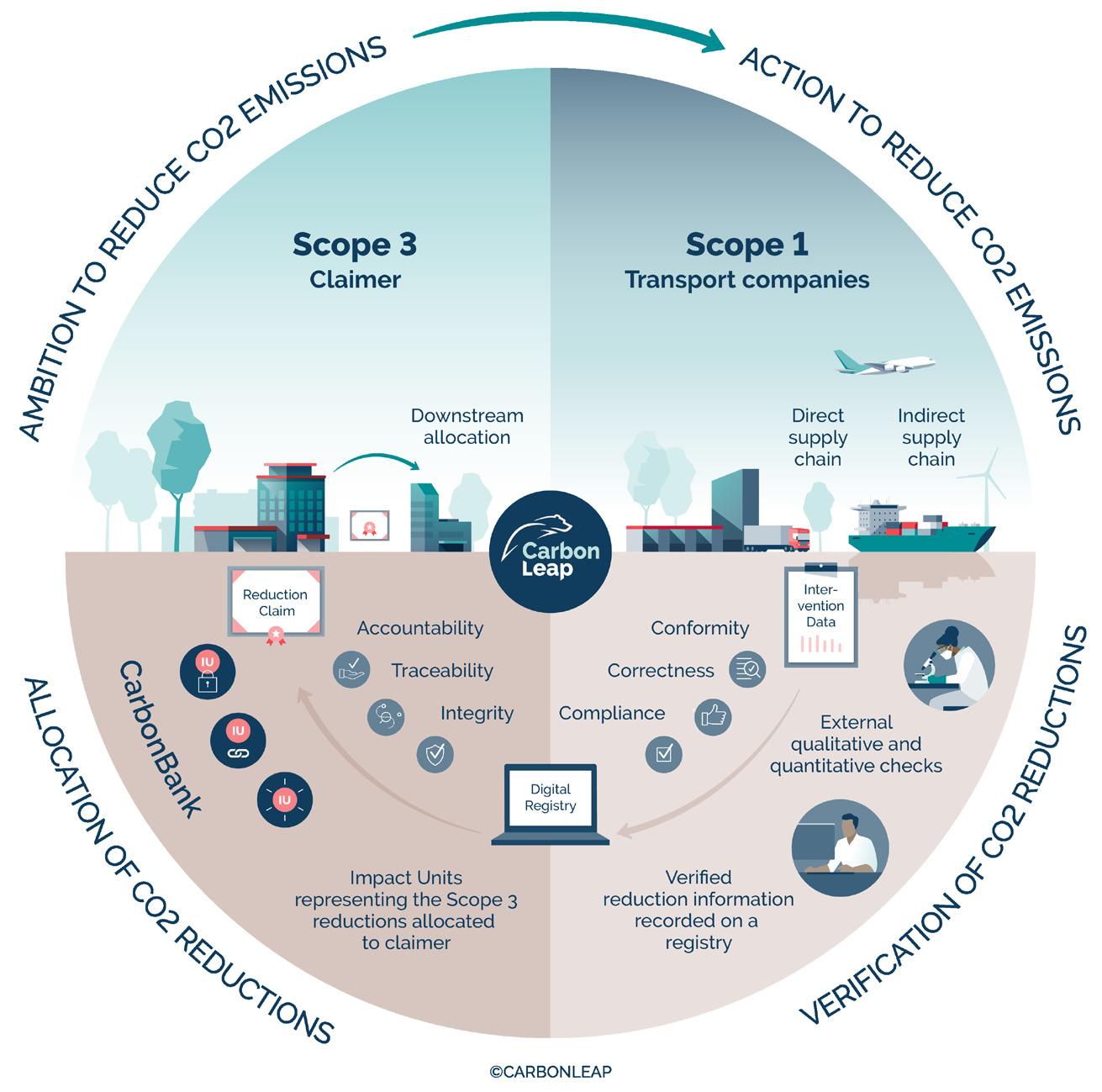

48 Insetting doesn’t have to be upsetting – How carbon units can help to decarbonize supply chains by Bertil Duinhower

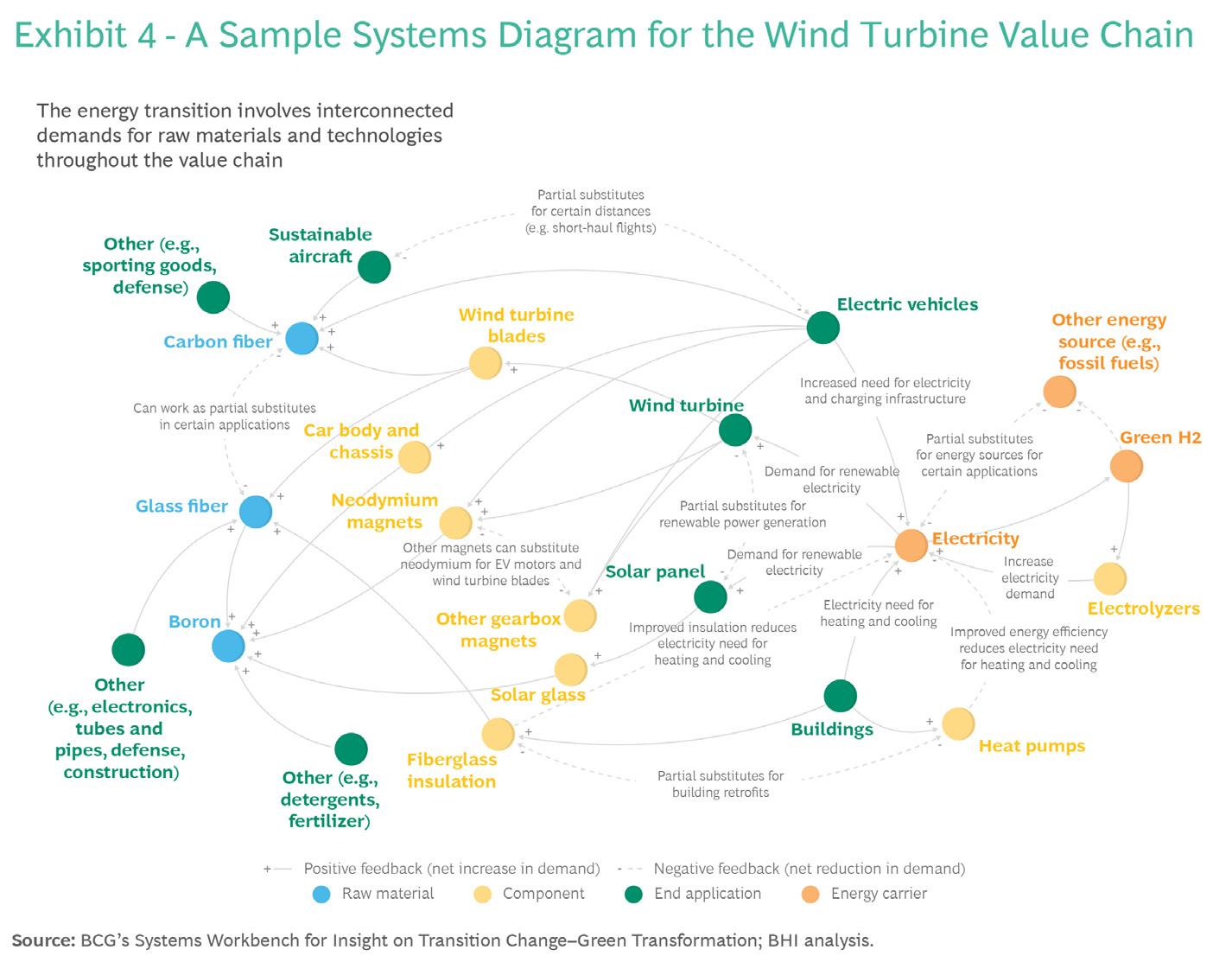

50 The hidden dynamics of the energy transition by David Young, Laura Larkin, Alexandre Harry, Dan Eichelsdoerfer, Mark Falinski, and Juliana Sandford

56 Biogas can help global shipping go green by Peter Jameson, Maurice Jansen, and Kevin Maloney

64 Navigating decarbonization trajectories – Practical solutions and collaborative strategies for the shipping industry by Paul Delouche

68 Beyond the horizon –

Robust value chains are critical to decarbonization and the energy transition by Panos Koutsourakis

Connecting Europe

– with seamless logistics solutions.

72 It pays to be safe!

– Interview with Laurence Jones, Director Global Risk Assessment, TT Club by Przemysław Myszka

76 High waves, high claims

– New study on container losses by Kunal Pathak, Siddharth Mahajan, Are Solum, and Helge A. Nordahl

80 As safe as ports?

– Advances in technology aiding seaport and terminal security by Neil Dalus

82 Shifting priorities & drivers – Highlights from ESPO’s latest port investment study by Ewa Kochańska

86 The price of pooling – Market- & data-based approach to FuelEU Maritime by Albrecht Grell

88 The (critical) cost of carbon – CII is about to get more expensive – here’s how to prepare by Aleksandar-Saša Milaković

90 The image of health – Overcoming obstacles in AI-based container damage detections by Kishor Arumilli

op

Ever since humanity began conquering the oceans, ports have stood as symbols of peace, brotherhood, and safety. Ports worldwide connect nations, enabling trade, tourism, and cultural exchange.

As we commemorate the 35th anniversary of “The Baltic Way,”we celebrate unity and opportunity. History has shown that lasting peace is best secured through meaningful and sustained cooperation between nations and people. Let us draw inspiration from this legacy and further strengthen the ties that have long linked our shores.

94 Sailing blind? – Fuelling the transition to new fuels and greener fleets with data by Ossi Mettälä

96 Never compromise – Interview with Fredrik Rönnqvist, Segment Manager for Material Handling, and Gustav Stigsohn, Product Manager, Fogmaker by Przemysław Myszka

100 Well, duh!

– Can a single maritime artificial intelligence (AI) research project cut 1% of total global emissions? by Alexa Ivy

102 Floating on air – How all vessels can cut their emissions thanks to air lubrication by Alistair Mackenzie

104 Baltic Ports Conference 2024 – the future of ports is now; let’s get strong on it together! by Monika Rogo

Out of 28 entries and then three shortlisted candidates, the judges decided to distinguish the product that came from the partnership between Cross Currents 88 (the solution’s developer) and G2 Ocean (a break-bulk shipping company wanting to increase the safety of vessel loading). The winning Spyder Netting is a thin layer of plastic film netting – a fall barrier system – that can be rolled out across gaps and secured between layers of cargo. The challenge stems from when paper reel products are loaded in the cargo holds of break-bulk vessels, with stowage resulting in gaps between the cargo (particularly along the hold edges where the freight meets the bulkheads). These gaps present a significant fall risk to stevedores working in the cargo holds. The gaps can extend many metres down through the cargo, and, unfortunately, falls into these gaps have resulted in fatalities and severe injuries. “Falls from height during cargo operations is a vitally important risk to be managed. Spyder Netting […] has already saved lives. Cross Currents 88 has been personally thanked by a stevedore whose fall was arrested by the netting,” Richard Steele , CEO of ICHCA International , commented on presenting the award to Cross Currents 88-G2 Ocean. The two other shortlisted parties were Royal HaskoningDHV and Trendsetter Vulcan Offshore . The former entered Smart Mooring into the competition, a system addressing the safety of moored vessel operations in sheltered and exposed ports by predicting excessive ship motions and mooring line forces. The latter came with the Next Generation Lashing System that reduces container motion and controls the dynamics of container stacks. A detailed overview of all the entries can be found in an online digest prepared by TT Club and ICHCA Mike Yarwood , TT Club ’s Managing Director, Loss Prevention, underscored, “We want to nurture widespread and varied advances in safety innovation, so we seek to give all entrants the oxygen of visibility in the marketplace to help develop and grow their initiative to benefit cargo handling operations globally.”

Prompted by the recent spate of container ship fires – two in port (including an explosion in the Port of Ningbo-Zhoushan) and two at sea within the last couple of months – the international freight and logistics insurance provider TT Club stresses the greater need for all players in the global supply chain to recognise their responsibility for accurate and effective communication between all parties for the transport of dangerous goods. “The causes remain under investigation,” says Peregrine Storrs-Fox, Risk Management Director at TT Club, about the four incidents, furthering that, “However, there are strong indications that potentially explosive chemicals and fire accelerators, such as lithium-ion batteries, may be involved in at least two of the cases. As with historical incidents, it is likely that various errors occurred as the shipments were initiated and the exact nature of the cargoes was communicated to supply chain counterparties, giving rise again to ‘perfect storms.’ Every participant in the process needs to act in the best interests of safety at every point in these cargoes’ journeys.”

According to TT Club, the exact number of containers carrying dangerous goods that are shipped annually is difficult to estimate due to mis- and non-declaration. Partly in response to the issues around inaccurate declaration, the International Maritime Organization amended in 2022 the Guidelines for the Implementation of the Inspection of Cargo Transport Units to urge governments to inspect all unit types, regardless of the declared cargo. The recently released consolidated results for 2023, from just eight countries (or 5% of the signatory states), evidence continuing safety concerns. Among others, TT Club points to a rapidly worsening trend in stowage and securing (within units) over the last five years and the worst position since these reports began in 2001. The insurer also notes the five-year worsening trend relating to errors found in documentation. “This spike in serious container ship fires is reminiscent of the spate in 2019, although the 30-year average frequency may remain one every 60 days – but any life-threatening event is one too many,” TT Club warns.

The freight insurance specialist has become a part of the UK’s Department for Transport industry-led Task and Finish Group (TFG), set up to explore raising standards in truck parking facilities to improve driver welfare and cargo security. “TT applauds the UK Government’s initiative and is grateful to add its experience of trends in cargo theft and the modus operandi of criminals in order to encourage adoption of standards at truck stop facilities,” said Mike Yarwood, TT Club’s Managing Director of Loss Prevention, who chairs one of the working groups looking at parking standards. In recent years, TT Club has ramped up its campaign to increase awareness of the risks associated with overnight parking of trucks, not just in the UK but across Europe as a whole. The insurer emphasised in a recent report, penned together with BSI, that over 70% of cargo thefts in 2023 around the world were from trucks. TFG offers an opportunity for a unique gathering of

individuals from industry bodies, truck park and motorway service operators, the police force, standards organisations, insurers, and users to explore, identify and understand the blockers to and opportunities for better security and safer rest facilities for those dubbed the ‘knights of the road.’ TFG will survey why those operators of secure facilities adopt current standards, identify the highest crime locations across the last four years, explore greater use of automatic number-plate recognition/closed-circuit television equipment, and map violent crimes against drivers. “The extent to which the UK and EU economies rely on trucking is staggering. As industry stakeholders, we must strive to both increase the safety of drivers and decrease the loss of cargo. That is why it is hoped that this TFG will result in longer-term strategies to improve the current truck parking landscape in the UK, and, in addition, that useful guidance can be offered to EU legislators,” added Yarwood.

The Maritime Technologies Forum (MTF), an organisation of Flag States and Classification Societies established to provide technical and regulatory expertise to benefit the maritime industry, has released the Guidelines in question with recommendations for developing and implementing the Safety Management System (SMS) under the International Safety Management (ISM) Code for safe onboard handling of the potentially more hazardous alternative fuels. “Safe operations with alternative fuels will require an assessment of the competency, training, familiarisation and resources relevant to the specific alternative fuels. The human element in the operations associated with the handling, storage and utilisation of alternative fuels is critical and should be considered

to ensure safe operations,” MTF underscored in a press brief. Nick Brown, CEO of Lloyd’s Register, added, “These guidelines and recommendations from the MTF are an important step forward to achieving safe and sustainable operations and a great starting point to begin preparing for the use of alternative fuels. The ISM Code provides a top-down approach to safety and is the ideal vehicle through which to drive training and skills for the safe handling of these fuels, not only under routine operations but also during emergencies such as equipment failures, fires, collisions, and malicious attacks. Our biggest strength, however, will be learning from each other throughout the energy transition, ensuring we have a solid foundation to promote safety for our people at sea and in port.”

The report , produced by one of the Global Maritime Forum ’s initiatives (and within the All Aboard Alliance), urges the global shipping industry to improve working conditions, better seafarer well-being, make life at sea safe and inclusive, and future-proof against the changing needs of the maritime labour market to attract future generations of seafarers. These conclusions come from a 10-month global collaboration involving 400 seafarers from 12 ships (each belonging to a different shipping company) that generated over 50 thousand data points. “It is our hope that these preliminary findings and learnings will be embraced by stakeholders across the maritime industry who are looking to make working at sea more attractive and considered by policymakers as valid input for a discussion on minimum standards to ensure that rules and regulations not only keeps pace with the evolving nature of maritime work but also increases inclusivity and safety at sea,” underscored the report’s authors.

The cooperative has been launched to fight organised crime and drug trafficking by leveraging the collective resources and expertise of multiple stakeholders to enhance security measures and enforce stringent controls within port facilities. Praising the initiative, the Federation of European Private Port Companies and Terminals (FEPORT) warned that “[…] we are reaching a situation where criminal networks are using extreme violence, corruption and intimidation that require exceptional mobilisation from public and private stakeholders in ports, national authorities, and law enforcement agencies. Seizures of cocaine in the EU have reached record levels, with more than 300 tonnes seized on an annual basis in recent years.” The Federation also notes that

many effective solutions are already in place, such as screening, intelligent cameras, virtual fences, port worker identity checks, and others. Still, closer international cooperation will be needed as we “[…] should also be aware that the creativity on the side of drug traffickers is huge and that it is going to be a race, a long marathon.” Ylva Johansson, European Commissioner for Home Affairs, stresses, “The vast majority of illicit drugs into the EU are trafficked along maritime routes. 70% of drug seizures are in EU ports. That is why cooperation between national & EU authorities and EU ports is vital. Organised crime is adept at moving from one port to another as opportunities rise and fall. To challenge this network, we must build a network. The violent consequences of drug trafficking are as big as the threat of terrorism.”

The Maritime Just Transition Task Force has launched a collaborative project tasked with creating a framework to equip seafarers with skills as shipping transitions to zero-emission operations. Research commissioned by the organisation identified that 800 thousand of seafarers may require additional training by the mid-2030s in order to operate vessels running on zero- or near-zero emission fuels. The project will be run by the International Maritime Organization (IMO) and the Maritime Just Transition Task Force Secretariat. Lloyd’s Register (whose Foundation will fund the framework alongside IMO) will develop the training framework for seafarers and officers, as well as an instructor handbook for maritime training institutions. The World Maritime University will provide academic expertise, while a large number of organisations will be involved through a global industry peer learning group to provide knowledge-sharing. “Moving towards a low-emission future will require new green jobs and re-skilling, and the global maritime industry is no different.

Future alternative fuel technologies, such as hydrogen, ammonia and methanol, means there is a vital need to up-skill all seafarers,” highlights Ruth Boumphrey, CEO of Lloyd’s Register Foundation. Sturla Henriksen, Special Advisor Ocean of the United Nations Global Compact , adds, “Decarbonising shipping is essential to combat the climate crisis. The global nature of this transition means that no one is alone in tackling this issue, and the Maritime Just Transition Task Force is committed to providing resources to support stakeholders making this journey.” Stephen Cotton , General Secretary of the International Transport Workers’ Federation , shares, “We have heard the message loud and clear from seafarers around the world: they are ready to lead, they are ready to shape the training frameworks for the zero carbon fuels of the future.” In light of these future demands, IMO is reviewing and revising the International Convention on Standards of Training, Certification and Watchkeeping for Seafarers , with input from the industry and seafarer unions.

The Cargo Integrity Group has identified 15 commodities, commonly carried in containers, that, under certain conditions, can cause dangerous incidents. While these are usually transported safely when regulations and guidelines are followed (such as the Quick Guide to the CTU Code), the Group has created this list to highlight cargoes that can become hazardous if mishandled. The industry bodies forming the Group emphasise that cargoes that are mis-declared or have incomplete or incorrect information about their identity are more likely to be involved in incidents. The Cargoes of Concern list is not exhaustive, but each item illustrates a common type of hazard, divided into three categories. First, reactive hazards: these can catch fire and cause significant damage and casualties in specific circumstances. Second, spill or leak risks: these commodities can present a risk if not packed properly or if they are damaged; spills or leaks from such cargoes can harm the health of people cleaning up the spill as well as the environment. Third, improper packing: cargoes that are poorly or incorrectly packed or secured in the container can lead to injuries to personnel or damage to nearby containers, property, or other shipments; such incidents can cause severe accidents at sea or on land, like truck rollovers and train derailments. The Cargo Integrity Group also plans to publish additional guidance on the identification and safe handling of these cargoes. “The combined experience of our organisations has been harnessed to identify these categories and result in pin-pointing some commodities where the risks are perhaps less obvious. While the potential dangers of transporting, for example, calcium hypochlorite or lithium-ion batteries might be more widely appreciated, the combustible qualities of seed cake or the hazards associated with cocoa butter or vegetable oils, will be less well-known,” shared Peregrine Storrs-Fox , Risk Management Director at TT Club. Lars Kjaer, Senior Vice President of the World Shipping Council, added, “Every actor in the global container supply chain is responsible for the health and safety of not only their own people but also those at any onward stage of the container’s journey. Complying with regulations and following the advice in the CTU Code saves lives, and we appeal to everyone shipping, packing and handling commodities that fall within the categories of these Cargoes of Concern to be particularly diligent.”

The initiative – led by the World Shipping Council and supported by the United Nations Development Program, the Global Environment Facility, and the Global Wildlife Program, in collaboration with TRAFFIC and WWF, and co-sponsored by BIC, the Global Shippers Forum, the International Fund for Animal Welfare, and TT Club – saw the release of the Guidelines in question. This toolbox for all supply chain participants includes advice on measures to take, questions to ask to help identify criminal wildlife trade, and guidance on reporting suspicious activities. An accompanying Red Flags document serves as a daily reference for all individuals involved in the supply chain. “Maritime traffic, in particular, remains vulnerable to the trafficking of illegal goods. With the vast volume of trade carried by sea, the demand for faster, just-in-time deliveries and the increasing complexity of intermodal supply chains,

criminals increasingly exploit weaknesses in global maritime supply chains to traffic contraband items,” the parties said in a press release. They also stressed, “Wildlife crime continues to pose a significant threat to biodiversity, local and national economies, as well as national and international security. The illicit trafficking of wildlife not only endangers countless species but also undermines the stability of ecosystems and jeopardises the livelihoods of communities worldwide. […] Illegal wildlife trafficking is not only decimating endangered species worldwide but also fuelling organised crime and threatening global security. The coalition’s joint effort underscores the shared responsibility of all stakeholders in combatting illegal wildlife trafficking. By uniting their expertise and resources, these organisations demonstrate their commitment to protecting wildlife and promoting sustainable trade practices.”

During its 108 th meeting, the International Maritime Organization’s (IMO) Maritime Safety Committee adopted amendments to the International Convention for the Safety of Life at Sea (SOLAS), mandating as of 1 January 2026 that all containers lost at sea should be reported. “The new regulations, specifically amending SOLAS Chapter V Regulations 31 and 32, mark a significant advancement in maritime safety and environmental protection. By ensuring prompt and detailed reporting of lost and drifting containers, these amendments

will enhance navigational safety, facilitate swift response actions, and mitigate potential environmental hazards,” commented Lars Kjaer, Senior Vice President at the World Shipping Council . His organisation, in anticipation of introducing mandatory reporting requirements, has since 2008 gathered information from its members on the number of containers lost at sea. The latest report speaks of 221 boxes lost in 2023 (with a recovery rate of about 33%), a reduction from the previous lowest-ever loss of 661 the year before.

The World Shipping Council ( WSC ) launched a navigational aid called the WSC Whale Chart , the first worldwide mapping of all mandatory and voluntary governmental measures to reduce harm to whales from ships. “With the WSC Whale Chart, seafarers will, for the first time, have a comprehensive global resource offering critical navigational coordinates and concise graphics to identify

routing measures and areas subject to static speed restrictions designed to protect whales and other cetaceans. We hope that by compiling this unique navigational aid, keeping it updated and making it available for free to all navigators, we can help reduce ship strikes and safeguard endangered whale populations across the globe,” highlighted John Butler, President & CEO of the WSC.

TT Club released its latest review of current and ongoing risk trends. The publication includes a variety of studies and reports, including, among others, an analysis of the insurer’s own claims data, as well as detailed research into and advice on mitigating invasive pests in containers, increased cybersecurity risk as ports automate, increasing customs documentation errors; clandestine immigration threats; dangers of plastic micro pellet spillages; and what safety & security aid can drone technology provide. “TT has recently witnessed a renewed focus and commitment towards loss prevention activities, with additional emphasis placed on the Club’s mission statement to make the industry safer, more secure and more sustainable,” comments Mike Yarwood , TT Club’s Loss Prevention Managing Director. He furthered, “Greater safety goes hand-in-hand with enhanced security and consequently sustainability. TT’s mutual ethos demands that we guide those we insure – and indeed the wider industry – in all aspects of risk through the container transport and global logistics supply chain. Via our latest Year in Focus , we aim to add to the large cannon of knowledge and guidance.” Josh Finch , TT Club’s Logistics Risk Manager, also underscores, “The importance of culture within an organisation, particularly where safety is concerned, cannot be underestimated. Safety is everybody’s responsibility, and everyone has a voice in safety matters. A strong safety culture will positively impact safety performance.”

KAIDA KAULER Chairman of the Board, Saarte Liinid

Saarte Liinid is also celebrating its anniversary in 2024 –30 years of dedicated service in the transport & logistics sector. As a key provider of regional passenger, cargo, and small craft port services, we have established ourselves as an essential hub in Estonia’s local transport & logistics network. Additionally, the SL Marinas network, which includes marinas on islands and the coastline, offers a unique tourism product, providing sailors with a distinctive opportunity to explore Estonia’s beautiful islands. Looking towards the future, we will meet challenges in three

In our experience, flexibility is a key element for success and growth in the transport & logistics industry: flexibility in thinking, in processes and their management, and in finding new solutions. Fortunately, the sector attracts people capable of coping with challenges, people who, as they gain experience, invariably also gain the ability to solve problems. It will be easier for them the more time the industry has to prepare – an example being the expected effects of the introduction of SO2 regulations in the Baltic, which did not happen, because there was enough time to get ready. On the other hand, the breakout of the coronavirus pandemic was virtually unpredictable. That said, we managed to deal with it in a cost-effective manner, though, of course, we had to change some processes and monitor the situation closely. Military conflicts, perhaps the least predictable events, required action even from entities in countries not directly involved, as sanctions, new

main areas. First, digitalisation, where we are committed to advancing digital port services, improving infrastructure management, and implementing the smart port concept. The demand for high-quality IT solutions is critical as we embrace the expanding digital possibilities in the sector. Second, environmental sustainability, where we aim to be more adaptable to changing energy needs, such as accommodating electric or hydrogenpowered vessels, and ensure the long-term durability of our port infrastructure. Environmental considerations have already become a vital factor in our investment decisions. And third, evolving customer and partner needs, where understanding and adapting to these changes will be crucial for maintaining our relevance and competitiveness in the dynamic transport landscape. Finally, many thanks to the Baltic Transport Journal for its coverage of these issues. We wish you nothing but success for the future!

cargo flows, and additional transshipments of military equipment drastically changed the situation. Although some segments of transport & logistics will feel the side effects of the war for years to come, for others (including our terminal), it was also an opportunity to showcase flexibility and help the sector continue delivering on its services to industries and the society at large. The future will bring new challenges. Some of these are already becoming clearer, such as the shortage of staff in the labour market, perhaps most evident at present in the case of truck drivers. These can be countered, for example, with training, incentive systems, or solutions based on artificial intelligence or autonomous systems. There are also challenges that we know will happen, but it is not clear what specific form they will take. We know that due to the requirements of the EU and International Maritime Organization’s climate policies, the energy system in seaports will have to change. As an industry, we have only just started on the path to finding suitably efficient and cost-effective solutions. There are also bound to be new, less predictable challenges – the postulated nearshoring and friendshoring could drastically change freight exchange routes, while artificial intelligence and autonomous systems will change the economic landscape.

JÖRGEN NILSSON

CEO, Port of Trelleborg

The Port of Trelleborg, the Baltic Sea’s largest ro-ro port for freight traffic, enjoyed a fantastic development in all areas over the past five years. Among others, we moved the port eastwards and built 500,000 square meters of land where there was previously sea – all to create the best conditions for a modern port and the most efficient internal logistics in Europe while being the most sustainable European ro-ro port. We are convinced that sustainability and creating green corridors will be extremely important now and in the future. For example, the Port of Trelleborg will produce more green energy than we use in our own operations. We encourage other seaports to play their part in the eco game. At the same time, we are absolutely convinced that the European logistics landscape will change in several areas, such as moving home part of the production from, among other countries, China. We also believe that we will see a greater flow of transport and manufacturing coming into Europe from Algeria, Morocco, and Tunisia. Given the persisting lack of truck drivers, we will also see a greater need for intermodal solutions, making sure each mode of transport has its attractive place in the logistics chain – and what’s also crucially important, that intermodality is accessible to all.

CAROLINE SÄFSTRÖM

CEO, Port of Karlshamn

The Port of Karlshamn, located in Southeastern Sweden, stands as a pivotal logistics hub in the Baltic Sea region. Known for handling a diverse range of goods, including forest products, unit loads via ferry and container, together with energy products, the port’s strategic location makes it a crucial node for trade routes between Scandinavia, Europe, and the Baltics. With extensive facilities for storage and transhipment, as well as a sizeable yard, the port is well-equipped to manage large and heavy freight volumes efficiently. The Port of Karlshamn has numerous opportunities for growth and development. A recent memorandum of understanding with RWE to explore offshore wind energy logistics in the Baltic Sea marks a significant step towards diversifying the port’s operations and contributing to sustainable energy initiatives. Karlshamn’s deep-water harbour and advanced logistics infrastructure provide excellent conditions for attracting new business and expanding existing operations. The ongoing development of the intermodal terminal and improved rail connections with Sydostlänken will enhance the port’s connectivity, making it an even more attractive option for international trade. The Port of Karlshamn is well-positioned to capitalize on its strategic location and robust infrastructure. By addressing current challenges and leveraging new opportunities, the port can continue to play a vital role in the

PER FREDMAN VP Sales and Marketing, Member of the Management Team, Port of Södertälje

With my over 40 years within transport & logistics, I have been able to follow trends over the years. When I worked in aviation, we had already seen how companies formed alliances three decades ago as smaller firms otherwise risked being knocked out. Fast forward to our times, and we can witness the same with the creation (and subsequent de-creation and re-creation) of alliances in global container shipping. It is all about getting as low a cost per unit as possible because the competition is

PIIA KARJALAINEN CEO, Finnish Ports Association

As we celebrate the 20th anniversary of the Baltic Transport Journal, it’s a perfect time to reflect on the Baltic Sea port industry’s journey. Over the past two decades, the region’s ports have evolved from traditional cargo hubs to advanced, sustainable logistics centers, setting benchmarks in efficiency, environmental responsibility, and innovation. Today, our seaports are dynamic nodes in the global supply chain, crucial in handling the rise of e-commerce and embracing new energy sources to meet carbon-reduction goals. The Baltic Sea serves already several green corridors, highlighting the region’s commitment to sustainability.

CAESAR LUIKENAAR Managing Director, WEC Lines

With 11 owned vessels, a large container fleet, 17 local offices, and a large worldwide agent network, WEC Lines is a proud container shipping line that has been in operation for 50 years. Headquartered in Rotterdam, it today serves destinations on three different continents, with the aim of connecting Northeast Africa, the Red Sea and Southern to Northwestern Europe and the UK with frequent and environmentally friendly container shipping solutions. With roads being more clogged up on European and UK roads and recent EU directives on reducing CO2 emissions, it’s becoming difficult to ignore that even companies who had in the past been shipping by road are looking into short-sea or intermodal

nothing but fierce. The ships have also become bigger and bigger. The question is when we will reach the maximum size. Already today, the largest vessels can call at a limited number of ports due to draught restrictions. Personally, I already speculated 20 years ago that the largest ships and the biggest alliances would operate east-west and west-east, with several ‘smaller’ shuttle ships feeding the volumes to and from the bulk trades. This speculation is now taking shape following the break-up of the 2M alliance between Maersk and MSC, with the former abandoning direct Far East Asia calls into the Baltic, instead choosing to feed the region with 6,000-7,000-TEUcapacity carriers. Maersk’s Gemini alliance with Hapag-Lloyd will, in essence, do the same to the 26 of their main liner services around the world. We are curiously following how this reorganisation will develop in the future. Will other shipping lines/alliances follow suit?

Going forward, investments in alternative fuels and onshore power will drive emission reductions in ports and shipping, aligning with global climate goals. Simultaneously, the industry faces challenges from geopolitical uncertainties. Automation, AI, and data-sharing will streamline operations, but robust cybersecurity measures are essential, too.

In 2023, 96% of Finland’s foreign trade moved by sea, making the nation entirely dependent on maritime transport through the Baltic Sea. But the region is similarly vital for the EU, as it connects the block’s Member States and acts as a crucial transport corridor both for goods and people. The Baltic’s year-round navigability is essential for the whole of Northern Europe. By focusing on sustainability, digital transformation, and resilience, the regional ports will continue to serve as vital, responsible links in the global movement of freight and people, ready for the challenges and opportunities of tomorrow.

options. In addition, we’ve seen over the years an increase in the demand for reefers with a shift from refrigerated trucks to container transport. In our view, the reefer container market still has enormous potential, and we anticipate cold store operators becoming more integrated into the cold logistics chain – creating potential to help us move cargo from road transportation to sea shipping with potentially various integrated solutions. We expect to further strengthen our presence in the Baltic States, Poland, and the European hinterland thanks to our collaboration with long-time WEC agent, Kontransa from the Arijus Group. They have opened a new office in Gdynia this year and added a new Hamburg call to our services in the autumn of 2024. We will also serve our clients even better with the addition of onward rail connections.

In our view, the future of transport & logistics is in intermodal container transport as it is a reliable, predictable, and costcompetitive alternative to road transport with high – scalability, payloads, and CO 2 savings.

In the past, ports primarily focused on expanding their physical infrastructure. However, the emphasis has shifted towards integrating sustainable solutions, such as green energy, digital logistics, and automation. It is clear that innovation and sustainability are shaping the future of transport.

The Port of Tallinn’s strategy is centered on advanced digital solutions, green initiatives, and multimodality. The industrial parks at the Muuga and Paldiski South harbours are setting new standards by utilizing multimodal connections via sea, rail, and road for efficient access to the European markets. With the new quay development at the latter, the port will be able to accommodate larger vessels and support the growth of offshore wind farms. Additionally, the Rail Baltica freight terminal, set to be located within Muuga – the only port in the Baltics with this opportunity – will further enhance the initiative. Looking ahead, the industry faces increasing environmental challenges, regulatory changes, and the need for more streamlined operations. The Port of Tallinn’s strategy includes adopting alternative fuels, advancing digitalization, and simplifying bureaucratic processes to ensure that the movement of goods and people remains agile and sustainable across the entire logistics

chain. Key areas of focus include further investments in renewable energy hubs, expanding green energy solutions, and continuously developing smart digital tools for port management. As a Nasdaq-listed company involved in passenger and shipping services, as well as real estate development, the Port of Tallinn is taking novel approaches across all sectors and is committed to its goal of achieving carbon neutrality by 2050. A major project in this regard is promoting climate-neutral sea transport in the Gulf of Finland. To achieve this, the port and its partners have endorsed 19 joint projects aimed at reducing the carbon footprint of the entire customer journey along the shipping routes between Estonia and Finland through the Green Corridor initiative. As part of this green passenger journey, the port has already implemented automooring and shore power systems, and the soon-to-be-open tram line will connect the port with the city center and airport, improving regional accessibility through sustainable transport options. In its real estate development at the Old City Harbour, the port remains committed to environmental sustainability, with a particular emphasis on green mobility solutions. The goal of the real estate development is to create a versatile, welcoming urban space at the Old City Harbour, blending port activities with high-quality public areas for a safe and enriching experience. Through these forward-thinking approaches, the Port of Tallinn is not just adapting but shaping the future of logistics in the Baltic Sea region, helping businesses scale efficiently while minimizing their carbon footprint.

Ports of Stockholm establishes Stockholm Norvik Port as a hub for CCUS development

Ports of Stockholm is working on establishing Stockholm Norvik Port as a central hub in Sweden for the emerging carbon capture, utilisation and storage (CCUS) logistic market.

With a strong infrastructure and access to both quayside and storage areas, there are great opportunities to establish an efficient logistics solution that can attract companies that strive for climate neutrality and see carbon management as part of their business strategy. The establishment of such an infrastructure opens the door to a third party system, helping to create a marketplace where cost efficiency and competitiveness are paramount.

The potential capacity to transport carbon dioxide from eastern Sweden is estimated to up to 9 million tonnes per year, which would make Stockholm Norvik one of the largest players in the Swedish carbon management market. This would not only contribute to climate goals, but also strengthen Ports of Stockholm as a strategic partner in the development of sustainable transport solutions for the green business landscape of the future.

The transport & logistics industry is undergoing rapid change, driven by a combination of evolving market demands, technological advancements, and environmental considerations. At X-Press Feeders, we see the future of shipping shaped by innovation, collaboration, and a shared commitment to sustainability.

One key area of focus is improving operational efficiency. With rising global trade volumes and heightened expectations for faster, more reliable deliveries, we are leveraging data analytics and digital tools to optimize shipping routes, reduce fuel consumption, and enhance overall fleet performance. This not only helps us deliver better service but also supports our environmental goals. Sustainability remains a critical priority. The shift towards cleaner

SÖREN JURRAT CEO, Port of Stralsund

Congratulations to the Baltic Transport Journal for its 20-year anniversary, and many thanks for successful and true maritime journalism! I am very glad and proud to be a part of a very special industry in one of the most beautiful regions in the world: the port business around the Baltic Sea! For almost three decades, I have had the opportunity to get in touch with like-minded people and business stakeholders to create a fruitful partnership. Ports are not only logistical hubs for the exchange of cargo and different commodities; they also connect people and bring them together. Cooperation across borders is an accelerator to forming a common,

fuels and energy-efficient solutions is necessary, not just due to regulations like the EU Emissions Trading System and FuelEU Maritime, but because the industry recognizes the importance of reducing its carbon footprint. As part of this effort, X-Press Feeders has already launched two green methanol-powered feeder services, positioning us at the forefront of green shipping. Green Baltic X-Press (GBX) and Green Finland X-Press (GFX) are strategically linking the Baltic with Rotterdam and Antwerp-Bruges. But these initial services mark just the beginning of our journey. As we take delivery of more dual-fuel vessels throughout 2025, we plan to steadily expand our green network across Europe.

The future of the industry also depends on effective partnerships. At X-Press Feeders, we collaborate closely with key stakeholders, such as terminal operators, fuel suppliers and regulators, to stay ahead of evolving environmental and safety standards. These partnerships enable us to maintain a competitive edge in a rapidly shifting industry landscape. We encourage like-minded carriers, forwarders, and shippers to join us in driving this sustainable transformation. Together, we can build a greener, more efficient future for global trade.

prosperous society. Starting with big enthusiasm 35 years ago after the fall of the Iron Curtain, which for so long separated Europe and the Baltic region, we all have achieved a lot mutually. Nowadays, we live in turbulent times, and we are looking towards a challenging future as well. Faced with global climate change and the need to stop it, huge efforts are necessary to transform our core business by creating green ports and sustainable logistic chains. On the other hand, personally, I never would have imagined that in 2024, we’ll be living in a world that faces a revival of political blocks and new borders between them, something that affects the flow of goods and people tremendously. More than ever, we need optimism, confidence, and strength. But I’m firmly convinced that we will cope with all the matters of our times successfully if we continue our unifying strategy to come together, to share experiences, and to cooperate on a high level as we did in recent years! One of the connectors is professional media – good luck for the next decade, dear team of the Baltic Transport Journal!

PETER STÅHLBERG

Managing Director, Wasaline

The future of logistics is changing due to new technology, better transport methods, and a focus on sustainability. Shipping, a key part of global trade, is evolving to become greener and more efficient. New ship designs and alternative fuels are helping to cut emissions and reduce harm to the environment. Multimodal transport, which combines different types of transportation, will, too, be essential for creating smoother, more efficient supply chains. This approach picks the best transport method

for each part of the journey, cutting down travel time and costs. Digital tools, like automation, also improve coordination between different transport types, making deliveries faster and more reliable. Eco-friendly logistics are also becoming more important for businesses. As people and companies care more about sustainability, the logistics industry is moving towards a future that balances efficiency with environmental care, helping the global economy grow while reducing its impact on the planet.

The transport & logistics sector, including the port industry, is undergoing significant changes driven by the global focus on sustainability and supply security. Shipping is a greener alternative to other forms of transport and crucial for ensuring the delivery of goods and raw materials that local communities and industries depend on. To play their part in this dual transition, ports have to offer robust infrastructure, like a deep-water quay

wall and efficient transit facilities. Recently, a national port partnership was announced in Denmark to secure the future of commercial ports. This initiative focuses on improving port capabilities while contributing to sustainability goals. As the sector adapts to new environmental demands and the need for reliable supply chains, collaboration and innovation will be key to its success.

DITTE GERSTRØM SØRENSEN Head of Marketing & Public Relations, Port of Hirtshals

The transport & logistics sector in Denmark and Northern Europe has experienced rapid growth over the years, shaped by both technological advancements and changes in traffic patterns. Innovations in shipping technology, including smart port systems and eco-friendly vessels, will transform operations and provide faster and more reliable transport. The Port of Hirtshals continues to adapt to this evolving logistics landscape. The port has long been a crucial gateway for transport & logistics in Denmark and the North of Europe. Established in the early 20 th century, it quickly became a key ferry and freight hub, facilitating trade and passenger travel across the North Sea. Its strategic location has made it vital to connect Denmark with Norway and the North Atlantic. Today, Hirtshals, like other ports, must embrace digital technologies and sustainable practices to enhance efficiency

CEO, Port of Gdańsk

This year, it will be 50 years since the Northern Port, the deep-water part of the Port of Gdańsk, started its operation. The infrastructure that was created, aimed at servicing the largest vessels passing through the Danish Straits to the Baltic Sea, opened significant opportunities for the Port of Gdańsk. This ambitious project was vast in both scale and vision for those times, enabling the transport of hundreds of thousands of tonnes of cargo via large ships and ensuring a steady supply of liquid

and reduce environmental impact. With an increasing emphasis on green logistics, initiatives such as eco-friendly shipping options and improved cargo handling processes are becoming standard. Looking to the future, the transport & logistics sector in Denmark and Northern Europe faces challenges in terms of rising fuel costs, regulatory pressures, and the need for infrastructure upgrades. The Port of Hirtshals wants to lead this transformation. By focusing on sustainable development and embracing multimodal transport solutions, we can effectively address future demands while maintaining our status as a critical logistics hub. By proactively tackling challenges, fostering innovation, and supporting regional connectivity, Hirtshals can secure a positive future for transport & logistics in Denmark and Northern Europe, ensuring that the movement of goods and people continues smoothly – and in an increasingly greener way. To ensure that the transport & logistics industry remains robust, stakeholders must embrace collaborative approaches, investing in multimodal transport solutions and smart technologies. Enhanced partnerships between port authorities, logistics companies, and government entities will therefore be crucial.

fuels for Poland. Apart from its immediate logistical benefits, this investment also played a transformative role in developing the Gdańsk region, making it a major maritime and industrial hub. The decision to start such an important investment, made in the 1960s, has proven wise, as our port has seen continuous growth over the years. Today, this expansion continues with several ongoing projects at the Port of Gdańsk, including the conversion of water areas into land as part of the Baltic Hub’s operational growth with the T3 and T5 terminals, the construction of new fuel transshipment stations at Naftoport, and the development of the LNG floating, storage and regasification unit, all of them expected to enhance the port’s future potential and competitiveness. Moreover, we are also developing a new long-term strategy, one based on the vision of Gdańsk as a sustainable, economically efficient seaport operating in the blue and green economy.

Secretary General, European Sea Ports Organisation (ESPO)

Let me first congratulate the Baltic Transport Journal on its 20th anniversary, which coincides with the two decades of adhesion of the Baltic States and Poland to the EU. I must say that I cannot think about Europe without the Baltic Sea as much as I also cannot think about ESPO without the region’s ports. The European Union was created in the aftermath of WW2 and was the start of a long period of stability and peace in Europe. But with the Russian aggression against Ukraine in February 2022, the geopolitical landscape has changed drastically, with ports finding themselves in the middle of that. That said, even if geopolitical affairs are coming more and more to the forefront, the climate crisis still remains by far the most important and unprecedented challenge humanity has been facing. What does this all mean for Europe’s ports? As a positive thinker, I would say that challenges also mean opportunities. During the recent pandemic and amidst the current geopolitical context, including the energy crisis the latter brought about, European ports were able to show their role as ‘the’ indispensable nodes in the supply chain by displaying a remarkable level of resilience and flexibility in responding to sudden changes and demands.

At the same time, while ports and their areas are places where a lot of activity and, hence, a lot of emissions are coming together, they will also be the nodes through which new and clean energies will be coming to and from the land; the place where new energies will be produced, converted, and stored. Consequently, ports will be more than ever also part of the climate solution and partners in the energy transition. Moreover, evolving towards net-zero and pollution-free areas, ports and cities might again get closer to each other as economic and societal clusters that strengthen each other. Ports can and will contribute to building a strong, net-zero and resilient Europe, but they will need the policy and financial support to do so.

ELME Spreader was born this year. So was the disco. Follow us in 2024 - we are celebrating it our way, by manufacturing world-leading spreaders.

MATTHIAS HANSEN

Senior Vice President Ocean Freight, GEODIS

This year was another challenging one. With the aftermath of the pandemic, wars, geopolitical tensions, terrorist attacks, natural disasters, and strikes, the logistics industry had to respond to turbulence on an unprecedented scale, leading to disruptions in global supply chains and extraordinary price fluctuations, particularly in global air and ocean freight. As a global logistics provider, GEODIS has to cope with these challenges by offering flexible and resilient logistics solutions to its customers with a strong focus on decarbonization, digitalization, and

Over the past 12 years, Odense has undergone an impressive transformation. We have shown how a former shipyard can be converted into a modern production port and a hub for the wind energy industry, supporting both the green transition and energy security in Europe. However, the future demands even more space for offshore wind production to meet the market needs of 2030 and the political ambitions of installing 300GW of offshore wind in the North Sea by 2050.

Although Odense is Denmark’s largest port, covering 8.5 million m 2 , we launched a development plan earlier this year to expand the port’s fairway and area by an additional 1.0m m 2 . This, along with our allocation of 3.0m m 2 to offshore wind, will ensure that essential offshore wind components can continue to be produced and

derisking. Taking 2022 as the baseline year, the company is targeting a 42% reduction in greenhouse gas emissions from its fleet and buildings (scopes 1 and 2) and a 30% reduction in the carbon intensity of subcontracted transport (scope 3) by 2030. GEODIS has invested in innovative technologies such as artificial intelligence, blockchain, enhanced allocation tools, more customer-specific dashboards and API connections to strengthen the resilience and security of the supply chains, as well as increased its focus on risk management and cybersecurity. To improve productivity and competitiveness, investments have also been made in automation, such as robotics. We expect that 2025 will continue to be challenging. There does not appear to be any real recovery in global freight volumes. Ongoing geopolitical and economic tensions require us to remain flexible and resilient to support our customers through these complex and critical times.

shipped from the country’s largest seaport. Our goal is to become a port where all major components of a turbine are manufactured and pre-installed. This initiative is expected to save the industry hundreds of millions of euros on intermediate transportation costs. By consolidating all component production and pre-installation at the Odense Port, we anticipate achieving savings of 2 to 3% on turbine supply agreements, giving manufacturers based here and the developers they work with a significant competitive edge. In addition to being a competitive port of choice, perfectly situated between the North Sea and the Baltic, we see it as essential that Odense is not only a wind but also a knowledge port. We have on-site some of the most highly renowned test centers specializing in wind energy – and now, also the world’s first robotics center for large-scale constructions. The combination of production and research makes us a powerhouse for wind, knowledge, and growth, contributing to increased innovation, competitiveness, and product quality. With this set-up, we have created a unique hub where heavy industry meets deep knowledge to develop new solutions for future challenges collaboratively.

“We better go big or go home,” was the answer from a senior executive whom I asked, “How will we make sure we stay competitive in the future?” This was during a town hall meeting at the beginning of my career some 15-20 years ago. Back then, this was very much ‘the’ answer to any issue for any player in the maritime industry. One just cannot underestimate what ‘size’ and ‘scale’ have meant for the shipping industry in the last decades. Growing in size and bringing down unit cost has been the overriding theme. No matter if we look at shipping lines, feeder operators, forwarders, ports or terminals, this has been the name of the game for more or less everyone: the closest thing to a silver bullet. Trying to understand what will determine the future successful actors in our industry, I believe this attitude will change, at least to a certain degree. The challenges that we face are many, likewise different from each other. Complexity, the speed of change, and the unpredictability of events characterise the new playing field. Firstly, each and every actor needs to embrace flexibility. The fittest will survive! Secondly, and equally important, will be to find common solutions to common problems. So, I would answer my younger self by saying, “Go together, or go home.” We have known for a long time that being adaptable, rather

than just big or strong, ensures success in transport & logistics. Over the last decade, we’ve seen major changes – from global market ups and downs to fast-moving technology; these have shown us the importance of being flexible and having foresight in our industry. Today, we’re not just moving goods; we’re building smarter, more resilient routes to meet current demands and future needs.

Looking forward, we see an opportunity for sea transport to play a bigger role in sustainable logistics. By using digital innovations and forming partnerships, we believe the maritime sector can lead in efficiency and environmental responsibility. As we mark this milestone, we’re dedicated to evolving with the industry, ensuring we are ready for both challenges and opportunities ahead. This forward-thinking view highlights the need for adaptability and innovation in logistics, positioning the Port of Norrköping as a proactive player in the industry’s evolution.

JOHANNA BOIJER-SVAHNSTRÖM

Senior

Vice President

Corporate Communications & Land-based HR & Sustainability, Viking Line Viking Line is involved in two green corridor projects: between Turku, the Åland Islands and Stockholm, and on the Helsinki-Tallinn crossing. The ports and cities of Helsinki and Tallinn, Viking Line, and other major shipping companies that operate between them signed in October 2023 a mutual understanding agreement to create a sustainable and environmentally neutral maritime transport route between the two destinations. This Green Corridor is a shipping route and an umbrella for several projects at sea and in-shore operations in both capitals, which aim to reduce emissions and increase the use of zero or near-zero emission solutions. Next, Viking Line and the ports of Stockholm and Turku signed a memorandum of understanding to create a green maritime corridor between the two seaports. The goal is for the corridor to be 100% carbon-neutral by 2035. The partnership will serve as an innovative platform for developing scalable solutions for the phase-out of fossil fuels. Work is underway, but a concrete example of green transport has already been introduced: Orkla Finland, Scandic Trans, and Viking Line have launched

a scheduled freight service that runs on biofuel. Specifically, the Felix ketchup, produced by the Orkla Group, began to be shipped to Finland using green biofuel in July this year. The transport chain starts at the ketchup factory in Southern Sweden, with Scandic Trans’ lorries driving to Viking Line’s terminal in Stadsgården in Stockholm. Then, they cross the Baltic Sea on the climate-smart Viking Glory and Viking Grace, delivering their load to Orkla’s logistics centre in Turku. Thanks to biofuel, CO2 emissions along the 683-kilometer-long transport chain are reduced by 90% vs the fossil fuel alternative. Scandic Trans refuels its lorries with biofuel produced from hydrotreated vegetable oil, while Gasum supplies Viking Line with liquefied biogas made from organic waste. “Viking Line is a shipping company with its roots in this sensitive archipelago. For us, the work to protect and preserve the Baltic Sea is in our DNA. We are ambitious pioneers in this industry and are proud to take this step in order to get closer to providing zero-carbon cruises and transport,” adds our President and CEO, Jan Hanses.

Over the past 20 years of publishing, the Baltic Transport Journal recorded and detailed major milestones of the shipping industry in the Baltic Sea region, including those of Finnlines and its parent company, the Grimaldi Group. It has been a valuable source of information as well as a platform for discussions about important issues concerning market trends, technology developments, and the sustainability of shipping and logistics. The publication has followed closely the changes in vessel routes and changes in the tonnage sailing on the Baltic waters, with ships getting larger, more efficient and operations getting more sustainable and environmentally conscious. This trend has been the main driver of the past decade, with disruptors like the COVID-19 pandemic, as well as wars

AXEL MATTERN CEO, Port of Hamburg Marketing

Continuity and change do not necessarily exclude each other. This can be seen in the example of many ports. In recent decades, many trade routes have remained constant. In particular, the many connections between the ports of the Baltic Sea region and the Port of Hamburg are a clear sign of continuity. For the Baltic Sea countries, the Port of Hamburg is considered a stable logistics hub in the global supply chain – whether by ship, rail, or truck. Social and political conditions also affect the ports. For example,

and military conflicts around the world, only proving the importance of the role shipping and logistics play in the global economy. During the past few years, Finnlines has built large and environmentally friendly vessels, recently completing a half-a-billioneuro investment programme that saw the delivery of three ro-ros of the Finneco Class and two Superstar cruise ferries. The Group also expanded its route network with new ports in the Bay of Biscay and the North Sea – services to Bilbao and Vigo, as well as to Rosslare. The latest addition is Świnoujście, where, since 10 April 2024, the freight-passenger vessel Finnfellow has been operating a daily connection to Malmö in Sweden. The next investments are already around the corner: the Neapolitan shipowner group will order nine more new ro-paxes that will be used in the transport of goods and passengers in the Mediterranean and the Baltic. Three of these newbuildings, the Superstar+ ferries, will join Finnlines’ fleet on the Baltic Sea as the company continues its investments in new eco-friendly vessels and works hard to support its customers in growing during those challenging times.

increasing digitalisation is also leading to the automation of many work processes. Many companies in the port industry are providing their employees with further training and preparing them for future job profiles. At the same time, the types of goods also change at regular intervals. With the current energy transition, the ports are once again facing new tasks. In Hamburg, some companies are creating storage capacities for alternative fuels, some are building production capacities for hydrogen, and others are preparing the necessary transport infrastructure. The Port of Hamburg is not alone in experiencing such developments; rather, it is one of many such ports in the region and around the world. The Baltic Transport Journal has successfully covered this change and continuity over the past 20 years. The Port of Hamburg Marketing warmly congratulates the Journal on behalf of all companies in the port industry.

ADAM HOPPE Acting Director, Bureau of Strategy and Market Analysis, Port of Gdynia

The Port of Gdynia owes its creation to the visionary engineer Tadeusz Wenda, who designed it with the foresight to accommodate growth for over a century. Since its creation, numerous modernization projects have been undertaken to adapt to the evolving shipping market. Nowadays, the Port of Gdynia Authority operates under the landlord model, focusing on the maintenance and expansion of infrastructure, thus creating a conducive environment for businesses engaged in the maritime sector. We are now standing at a pivotal moment for the Port of Gdynia, preparing to expand beyond its original boundaries. The construction of the Outer Port is set to transform the port’s potential for generations. Notably, the new handling quay will be accessed from the berth named after engr. Tadeusz Wenda, symbolically linking past ambitions with future possibilities. Crossing the existing breakwater represents not only a physical milestone but also a historical and sentimental journey, echoing Wenda’s vision from 1922.

Recent years have presented significant challenges, including the COVID-19 pandemic, the war in Ukraine, and global

geopolitical tensions, all of which have impacted the Polish economy and international supply chains. Despite these hurdles, terminals operating in the Port of Gdynia have demonstrated remarkable versatility, showing the capability of handling a diverse range of cargoes. This adaptability is vital in navigating market fluctuations, enabling the port to adjust its handling operations to meet changing demands. Recent trends have seen fluctuations in various cargo groups, such as containers, coal, and agricultural products. Strengthening the universal character of the Port of Gdynia is our primary goal. The ongoing development of internal infrastructure is crucial for the port’s efficiency, relying heavily on the modernization of land and sea accessibility. Collaboration with entities responsible for the development of national roads and motorways, railway lines, and maritime accessibility is essential, as their investments directly influence the port’s ability to increase its operations. Key initiatives currently underway, including the construction of the Outer Port, dredging, modernizing quays, and enhancing road and rail connections, will redefine the port’s landscape for decades. The Port of Gdynia is dedicated to strengthening its universal character to effectively serve its clients as well as the economic, energy, and military safety of the Polish economy. A distinctive aspect of this development is a strong emphasis on environmental sustainability and the social surroundings of the port.

BJÖRN BOSTRÖM CEO, Port of Ystad

The map is being redrawn…

The need for transport & logistics has been a necessity since long before the wheel was invented (which just made it more convenient!).

Many countries depended on trade; trade for selling goods to other countries and trade for buying what the country did not produce itself. But when trade began, we had merchandisers that, of course, had to trade for trade itself, namely to make money themselves. This is sometimes a bit peculiar as we can even import and export the same type of goods – and make money out of it both ways. The pattern for transport & logistics has more or less been the same

As BTJ celebrates its 20th anniversary, it’s time to reflect on the many important and timely themes regarding the developments in logistics markets in recent years. The industry has undergone significant changes, with polarization being one of the key trends. Large companies benefit from economies of scale, which can displace medium- and small-sized operators. This can lead to market concentration and reduced competition. Hopefully, collaboration and specialization will help smaller companies maintain their competitiveness. The COVID-19 pandemic, the war in Ukraine, and other global crises have highlighted the importance of information flow and the flexibility of supply chains. Digitalization and real-time tracking can improve the transparency and efficiency of supply chains,

FRIDJOF OSTENBERG Vice-President, Mukran Port

Dear Baltic Transport Journal team, on behalf of Mukran Port, we would like to congratulate you on your 20 th anniversary!

For two decades, you have enriched the maritime industry in the Baltic Sea region with your passionate commitment and intensive work. During this time, the Baltic Transport Journal has become an indispensable companion to the industry. With one exception, the Baltic Sea region has developed into an inland sea of the European Union in recent years. The countries bordering Eastern Europe, in particular, have undergone impressive economic development, which has led

for many, many years. Since WW2, trade in Europe has developed and found its way, oftentimes the same today as in the past.

Peacetime is the key to human survival, and trade is a necessity to have food on the table, a job to go to, and money to spend. Europe has been spared for many years, but now the war in our closest vicinity affects all the values we have – trade included.

The need for quick and reliable transport and movement of people calls for new investments. Modern and bigger highways are built, while bridges and tunnels substitute ferries. At the same time, we have more charges and taxes to deal with the environmental impact of climate change. What was a perfect trade route will no longer be commercially passable. Cargo will have to find new ways to flow.

The map will be redrawn…

For all of us in the transport & logistics industry, we must face that the ways of transporting freight and passengers are changing. We simply must adopt – and do it better than ever. We can do it by sticking together.

which is crucial in the current uncertain world. The other major challenge is driver shortage. Attracting new talent to the industry is difficult, especially when wages and working conditions are not competitive. Solutions could include improving the working environment, raising salaries, and developing training programs. The strengthening of the green transition and the clarification of EU regulations are guiding the logistics sector toward more sustainable solutions; this requires investments in renewable energy sources as well as improving energy efficiency. The growth of e-commerce, in turn, has transformed the transport market, especially in terms of parcel delivery; this requires flexible and efficient delivery solutions, such as automated warehouses and robotics, which can meet the growing demand. Intensified cooperation and optimization of logistics chains in the Baltic Sea region have improved the security of supply; this underscores the importance of regional cooperation and the development of joint solutions, particularly in the current global operating environment. We would like to thank BTJ for their long and excellent collaboration and congratulate them on their 20th birthday!

to a significant increase in traffic volumes in the region. This positive dynamic shows how important the Baltic Sea region has become for the entire European logistics and economy. However, the future also brings challenges. Mukran Port must adapt to the increasing competitive pressure in maritime logistics and, at the same time, manage the transition to sustainable, climate-friendly solutions. The digitalization and automation of processes, as well as adapting to new geopolitical conditions, are further key issues that we must face.

In times of global upheaval and constantly changing supply chains, a reliable medium such as the Baltic Transport Journal is indispensable. It offers important insights into developments in politics, the authorities and companies. For us at Mukran Port, it is particularly important that you accompany our work and report on the changes and progress in our industry. We wish the Baltic Transport Journal continued success for the next 20 years and look forward to working with you in the future!

DR KIMMO NASKI Chairman, Baltic Ports Organization (BPO)

In 2004, the Baltic Sea region was reunited with Western Europe for the second time, so to speak, with Estonia, Latvia, Lithuania and Poland joining the EU. Borders lifted, making way for new opportunities also for the regional seaports. It was just two decades ago, but it truly feels like an entire century.

The Baltic Ports Organization saw the development of the Baltic Transport Journal throughout those years filled with ups & downs (oh, the 2007-2008 financial crisis…), eventually trusting the publication to become its official media partner. The BPO is grateful for the Journal ’s continuous coverage of the latest from across the diverse world of transport & logistics, showcasing and sharing the sometimes more than pioneering works of the regional players with people from all over the globe, at the same time not shying away from putting the spotlight on affairs that, at first glance, go beyond the Baltic. If transport & logistics teach us anything, it is that events and trends are interconnected, and no region is a self-sustained island. The Baltic certainly isn’t!

As such, the past 20 years were rich in countless positive but also

not-so-good happenings, bull and bear markets, regulations covering the entirety of Baltic shipping (remember SECA?), and developments that came here to stay, just to mention the uptake of liquefied natural gas, investments in cold ironing region-wide, or the arrival of direct deep-sea container services with the Far East. Though we are living in “interesting times,” rest assured that the Baltic – transport & logistics stakeholders, including the port business, the closer and farther regulatory landscape, energy transition, digital revolution, war just outside its borders, etc., – won’t hibernate despite achieving so much in so little time. As always, there is plenty of work –modern infrastructure won’t set up itself, services and operations won’t digitalise overnight, and shipping won’t get greener on its own. Likewise, those offshore wind energy farms will need assistance during and post-installation.

The Baltic Sea region is as diverse as it gets, with the same holding for its seaports – big and small alike. But while anybody who has ever been in a few of them knows they are nothing short of being unique, there are also a lot of points of contact where we can learn from and help each other. Knowing more surely won’t stand in the way of making the Baltic greener and even more innovative, future-fit in short, and here the BPO would like to thank the Baltic Transport Journal for keeping its finger on the transport & logistics pulse as well as for sharing our works and contributing to the Organization’s events.

MAGDALENA OGONEK

Marketing and Sales Manager, COSCO Shipping Lines Poland

On behalf of COSCO Shipping Lines Poland, we extend our congratulations to the Baltic Transport Journal on its 20th anniversary. Over two decades, BTJ has been instrumental in providing insights and fostering dialogue within the transport & logistics industry – a true testament to its value and to the resilience of our sector.

On a personal note, BTJ holds a special place in my career. Years ago, as a graduate student, I based my thesis on data from the Baltic Transport Journal – an invaluable resource that shaped my research and boosted my hunger for economic & maritime industry knowledge.

“Navigare necesse est, vivare non est necesse.” This Latin phrase from the 14th century – translated as “sailing is necessary, living is not” – was the slogan of the Hanseatic League when the shipping industry was using sailing ships. Well into the 21st century, it still expresses the essence of seagoing trade. Shipping is one of the oldest businesses in the world, and it has not changed a lot since we learned that the world is indeed round. The most important way of moving cargo across the globe is still by sea, and that is probably one of the reasons why this business is so conservative and stuck with old habits. And why not?

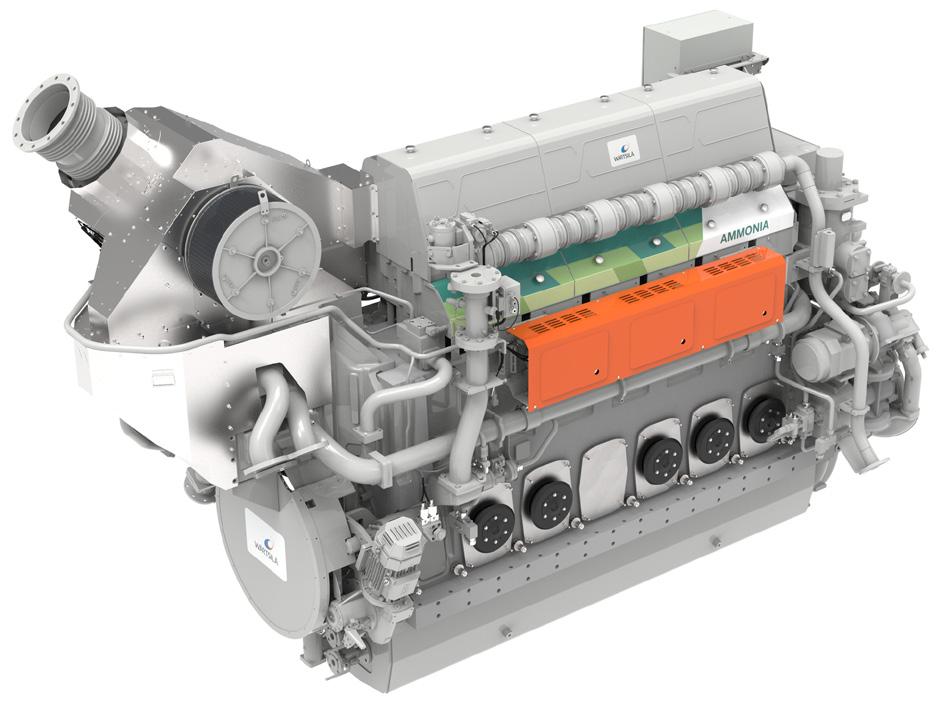

Although there are many challenges that transport, including its maritime part, has to deal with, I would like to draw particular attention to issues related to the sustainable development of the industry and its impact on the environment. Faced with climate change and tightening environmental policies, the sector needs to reduce its carbon footprint, as maritime transport accounts for a not insignificant percentage of global CO2 emissions. The International Maritime Organization’s regulations set increasingly stringent standards for reducing these from shipping, which forces shipowners to invest in technologies that reduce fuel consumption, explore alternative energy sources, and opt for more environmentally friendly engines. Significant measures to reduce CO2 emissions in maritime transport are also being taken by the European Union.