Baltic Transport

ECONOMY

Shifting priorities & drivers.

Shifting priorities & drivers.

The Port of HaminaKotka is a versatile Finnish seaport serving trade and industry. The biggest universal port in Finland is an important hub in Europe and in the Baltic Sea region.

Welcome to the Port of HaminaKotka!

If I were to choose a ‘number of the issue,’ then it’d surely be 80. To be precise: 80 billion euros of investments that are, according to a survey conducted by the European Sea Port Organisation (ESPO), needed within a decade for the continent’s harbours to play their role in the energy transition. As we have presented on our latest maps, the Baltic Green Map (and its Catalogue) and the Baltic Offshore Wind Energy Map, there are heaps of all sorts of (ongoing & planned, soft- & hardware) projects tasked with greening transport & logistics as our region is far & wide. Their implementation will certainly benefit from robust financing, a topic analysed in the Shifting priorities & drivers. Highlights from ESPO’s latest port investment study article in the Economy column .

I am also happy to share that this year’s summer issue hosts another coverage from a BTJ Trip. This time around, Finnlines invited us to come and see for ourselves the company’s new ferry service between Malmö and Świnoujście. We also had the opportunity to ask a few questions for Tom Pippingsköld, Finnlines’ President and CEO. This edition is overall interview-rich, as we also talked with TT Club’s Laurence Jones about the importance and evolution of port safety, WindEnergy’s Diana Barrios about the development of the wind energy sector (including, naturally, ports’ part in it), and Fogmaker’s Fredrik Rönnqvist and Gustav Stigsohn about fire suppression systems.

The Legal section brings forth the key takeaways from TT Club’s latest Cargo Theft Report (authored together with BSI) and the organisation’s analysis of container losses – either due to crime or weather. The Maritime column is this time big on regulations – there are reads on a potential shipping decarbonisation mechanism based on the International Maritime Organisation’s Carbon Intensity Indicator, on the likely perils the implementation of the FuelEU Maritime may bring about for Document of Compliance holders, as well as a piece that thoroughly dissects the Regulation itself.

The Technology part of the summer issue has got your back with reads on remote robots for shunting operations (including in Baltic seaports), software that optimises the management and performance of entire fleets, and a real-world case of how wind-assisted propulsion makes shipping greener. In Events , you’ll find coverage of this year’s Spring Congress of the Association of European Vehicle Logistics (ECG).

Finally, Transport miscellany is back, this time with entries on an elegant, likewise famous, ship series, how love costs (and can do it sky-high!), and why bigger doesn’t necessarily have to stand for better (tell that to container carriers, I dare you!).

Have the greatest read ever!

Przemysław Myszka

Baltic Transport Journal

Publisher

BALTIC PRESS SP. Z O.O. Address: ul. Pułaskiego 8 81-368 Gdynia, Poland office@baltictransportjournal.com

www.baltictransportjournal.com www.europeantransportmaps.com

Board Member BEATA MIŁOWSKA

Managing Director

PRZEMYSŁAW OPŁOCKI

Editor-in-Chief

PRZEMYSŁAW MYSZKA przemek@baltictransportjournal.com

Roving Editor MAREK BŁUŚ marek@baltictransportjournal.com

Proofreading Editor EWA KOCHAŃSKA

Contributing Writers

OKSANA ANTIPA, ARNAUD DIANOUX, STAMATIS FRADELOS, ROMAIN GRANDSART, CHRISTIAN RAE HOLM, STEVE MARSHALL, ALEKSANDAR-SAŠA MILAKOVIĆ, MONIKA ROGO, FITZWILLIAM SCOTT, MIKE YARWOOD

Art Director/DTP DANUTA SAWICKA

Head of Marketing & Sales

PRZEMYSŁAW OPŁOCKI po@baltictransportjournal.com

If you wish to share your feedback or have information for us, do not hesitate to contact us at: editorial@baltictransportjournal.com

Contact us:

PRZEMYSŁAW OPŁOCKI tel.: +48 603 520 020 Cover Canva

3 Editorial

8 BTJ calendar of events

10 Safety news by TT Club

12 Market SMS

14 What’s new?

16 Map news

20 Venture forth

26 What’s in the Cabinet

28 Chart of the issue: Baltic port market in 2023

30 The new (sailing) bridge for trade & tourism

– BTJ Trip 2024 / Finnlines’ Malmö-Świnoujście ferry service by Przemysław Myszka and Przemysław Opłocki

34 Coming a long way

– Interview with Tom Pippingsköld, President and CEO, Finnlines by Przemysław Opłocki

78 Events: Transforming vehicle logistics

– Key innovations and strategies highlighted at ECG Spring Congress 2024 by Ewa Kochańska

80 Transport miscellany by Marek Błuś and Przemysław Myszka

84 Who is who

36 It pays to be safe!

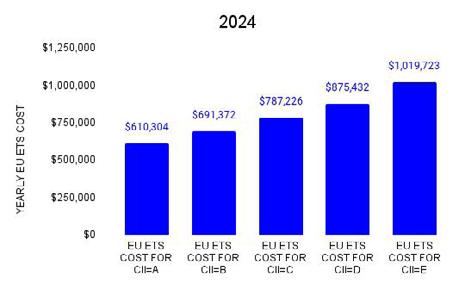

– Interview with Laurence Jones, Director Global Risk Assessment, TT Club by Przemysław Myszka

40 Crime goes up when the global economy goes down

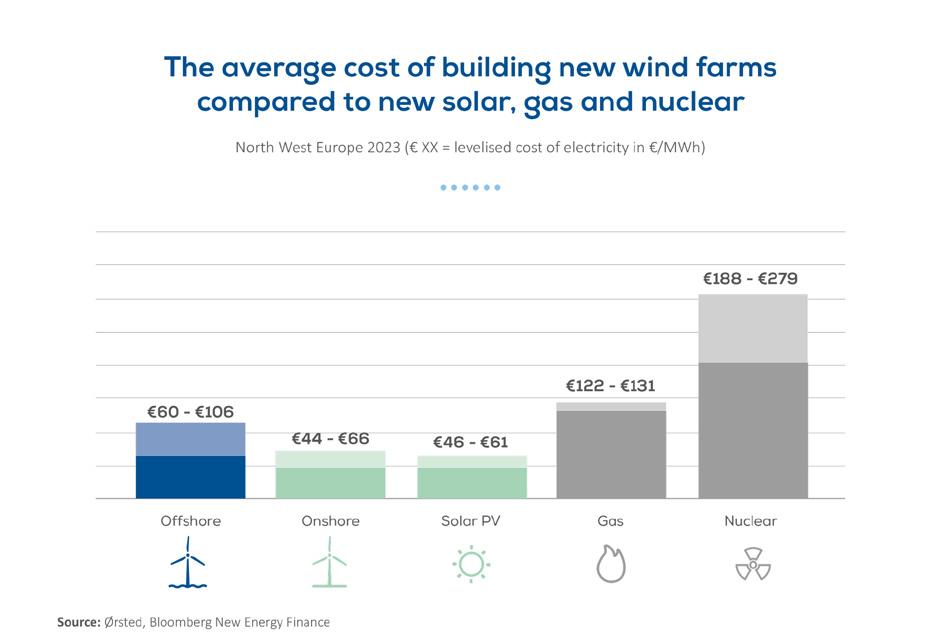

– Key takeaways from TT Club and BSI’s 2023 Cargo Theft Report by Mike Yarwood

42 Missing in action

– Lost containers cause further supply chain disruption by Mike Yarwood

44 Shifting priorities & drivers

– Highlights from ESPO’s latest port investment study by Ewa Kochańska

48 Adaptability and resilience

– Navigating the complexities of logistics in Ukraine amidst war: a perspective from 2022 to present by Oksana Antipa

50 The (critical) cost of carbon – CII is about to get more expensive – here’s how to prepare by Aleksandar-Saša Milaković

52 The faster & safer, the better – Interview with Diana Barrios, Acting Head of Membership, WindEurope by Przemysław Myszka

56 FuelEU for thought

– The new regulation leaves DoC holder with fuel liabilities risk by Steve Marshall

58 Be prepared for the next wave

– FuelEU Maritime explained by Stamatis Fradelos

61 Paving the green path

– ECOLOG-Deltamarin liquid CO2 carrier co-op by Fitzwilliam Scott

62 Baltic Ports Conference 2024: shaping a geopolitically and environmentally aware Baltic maritime industry by Monika Rogo

64 Welcome new Members! by Monika Rogo

66 Data opens new efficiency horizons – Examples from the OSV sector of how digital systems can cut fuel consumption, increase vessel utilisation, improve charter parties, heighten safety, and more by Arnaud Dianoux

68 Pulling power – Vollert’s shunting robots in the Baltic (and beyond) by Fitzwilliam Scott

70 Never compromise

– Interview with Fredrik Rönnqvist, Segment Manager for Material Handling, and Gustav Stigsohn, Product Manager, Fogmaker by Przemysław Myszka

74 Under full sail

– Wind-assisted propulsion first of the line in shipping’s race to net zero by Romain Grandsart

76 No crystal ball needed

– How fit for purpose data can simplify vessel performance by Christian Rae Holm

Baltic Ports Conference 2024 , 4-6/09/24, LT/Klaipėda, www.balticportsconference.com

Join us this early autumn for yet another gathering of the Baltic port industry! This time around, we will focus on increased resilience and harmonized responses to geopolitical changes as the region’s maritime sector, seaports & shipping alike, is forging a new & greener business model.

WindEnergy Hamburg 2024 , 524-27/09/24, DE/Hamburg, windenergyhamburg.com

WindEnergy Hamburg is wholly tailored toward addressing the major issues facing the international wind energy sector. It brings together a high-caliber, professional audience and exhibitors demonstrating their innovations and solutions from across the entire value chain of the industry. Key players will be in the spotlight in every hall, including an expert focus section on storage technologies.

AntwerpXL , 8-10/10/24, BE/Antwerp, www.antwerpxl.com/visit/register-your-interest

Hosted at the heart of the European breakbulk market, AntwerpXL – the award-winning breakbulk, heavy-lift and project cargo event – attracts 3,800+ attendees providing a distinctive platform for fostering trust-based relationships among visitors and exhibitors. With participants from 66+ countries and 100+ exhibitors, AntwerpXL offers access to a premium audience, enabling you to showcase your expertise, expand your network, and engage in quality-driven business interactions.

World Ports Conference 2024 , 8-10/10/24, DE/Hamburg, worldportsconference.com

2024 will be a pivotal year for ports and their communities. Geopolitical instability is on the rise. Physical and digital security is under threat, at sea and on shore. Shipowners, supply chain providers, and cargo owners must adapt rapidly. The energy transition towards low- and zero-carbon fuels must be balanced against national energy security concerns. #IAPH2024 will offer attendees insights on these topics, revealing how ports – from developing and developed nations – are building secure and sustainable solutions to these shared challenges, in a deeply interconnected world.

Bulk Terminals Antwerp 2024 , 23-24/10/24, BE/Antwerp, www.bulkterminals.org/index.php/events

The Annual ABTO Bulk Terminals Conferences are designed for all those involved in the transportation, storage and handling of bulk commodities. We welcome equipment and service suppliers, professional advisors, and academics to the conference in addition to terminals and ports. Indeed, ABTO strongly believes that bulk terminals will achieve increased operational efficiencies, safety, and environmental compliance only through interaction with these other organisations.

GreenPort Congress & Cruise 2024 , 23-25/10/24, FR/Le Havre, portstrategy.com/greenport-cruise-and-congress

GreenPort Congress is a meeting place for the port community to discuss and learn the latest in sustainable environmental practice. Going under the theme of ‘Balancing environmental challenges with economic demands,’ the vent offers ways to reduce their carbon footprint and be more sensitive to environmental considerations, both of which are vital to future success.

Interferry2024 , 26-30/10/24, MA/Marrakech, interferryconference.com

Welcome to Interferry’s first conference on the African continent! Join us for the 48 th edition together with a great number of owners and top-level decision-makers in the ferry industry, along with the lively and interactive atmosphere, to foster the exchange of experience, ideas, and contacts. As always, our event will feature topical speakers and sessions, panels with ferry leaders, many outstanding networking opportunities, and a technical tour. Also, sponsors and exhibitors will enjoy a large exhibition area in which to display their products and services to conference attendees.

Offshore Energy Exhibition & Conference 2024 , 26-27/11/24, oeec.biz

OEEC serves as an essential gathering point for professionals, experts and companies active in the offshore energy sector and beyond. Covering a diverse spectrum – which includes offshore wind, hydrogen, oil & gas, and marine energy – OEEC offers a platform for these industry stakeholders to come together, ignite innovation and shape the future of the energy transition. With expert speakers, interactive exhibits and unparalleled networking opportunities, this event is an opportunity to stay in the curve in the offshore energy game.

www.ttline.com/en/freight

The Bureau International des Containers , the Container Owners Association , the Institute of International Container Lessors , and the World Shipping Council (WSC) – joined this time also by the International Cargo Handling Coordination Association – have released the latest version of the easy-to-use best practices to avoid carrying unwanted stowaways . “Every year, 250 million containers are transported across the world with food, clothes, electronics and other goods we all need. While crucial for the smooth functioning of the global supply chain, containers and their cargoes can also harbour and transfer contaminating

pests. […] Experience shows that the introduction of new pests can severely upset an existing ecosystem, with serious ecological consequences and possibly billion dollar impacts on a nation’s economy,” the parties highlighted in a press release. Lars Kjaer, Senior Vice President of WSC, added, “Each party in the international container supply chain has a custodial responsibility to make sure cargo and containers are clean when they arrive and when they leave their care. If we all live up to these standards, containers will reach their destination faster, and our agriculture, forestry and natural resources will be protected.”

The freight insurance specialist has become a part of the UK’s Department for Transport industry-led Task and Finish Group (TFG), set up to explore raising standards in truck parking facilities to improve driver welfare and cargo security. “TT applauds the UK Government’s initiative and is grateful to add its experience of trends in cargo theft and the modus operandi of criminals in order to encourage adoption of standards at truck stop facilities,” said Mike Yarwood, TT Club’s Managing Director of Loss Prevention, who chairs one of the working groups looking at parking standards. In recent years, TT Club has ramped up its campaign to increase awareness of the risks associated with overnight parking of trucks, not just in the UK but across Europe as a whole. The insurer emphasised in a recent report , penned together with BSI, that over 70% of cargo thefts in 2023 around the world were from trucks. TFG offers an opportunity for a unique gathering

of individuals from industry bodies, truck park and motorway service operators, the police force, standards organisations, insurers, and users to explore, identify and understand the blockers to and opportunities for better security and safer rest facilities for those dubbed the ‘knights of the road.’ TFG will survey why those operators of secure facilities adopt current standards, identify the highest crime locations across the last four years, explore greater use of automatic number-plate recognition/closed-circuit television equipment, and map violent crimes against drivers. “The extent to which the UK and EU economies rely on trucking is staggering. As industry stakeholders, we must strive to both increase the safety of drivers and decrease the loss of cargo. That is why it is hoped that this TFG will result in longer-term strategies to improve the current truck parking landscape in the UK, and, in addition, that useful guidance can be offered to EU legislators,” added Yarwood.

During its 108 th meeting, the International Maritime Organization’s (IMO) Maritime Safety Committee adopted amendments to the International Convention for the Safety of Life at Sea (SOLAS), mandating as of 1 January 2026 that all containers lost at sea should be reported. “The new regulations, specifically amending SOLAS Chapter V Regulations 31 and 32, mark a significant advancement in maritime safety and environmental protection. By ensuring prompt and detailed reporting of lost and drifting containers, these amendments

will enhance navigational safety, facilitate swift response actions, and mitigate potential environmental hazards,” commented Lars Kjaer, Senior Vice President at the World Shipping Council . His organisation, in anticipation of introducing mandatory reporting requirements, has since 2008 gathered information from its members on the number of containers lost at sea. The latest report speaks of 221 boxes lost in 2023 (with a recovery rate of about 33%), a reduction from the previous lowest-ever loss of 661 the year before.

The Cargo Integrity Group has identified 15 commodities, commonly carried in containers, that, under certain conditions, can cause dangerous incidents. While these are usually transported safely when regulations and guidelines are followed (such as the Quick Guide to the CTU Code), the Group has created this list to highlight cargoes that can become hazardous if mishandled. The industry bodies forming the Group emphasise that cargoes that are mis-declared or have incomplete or incorrect information about their identity are more likely to be involved in incidents. The Cargoes of Concern list is not exhaustive, but each item illustrates a common type of hazard, divided into three categories. First, reactive hazards: these can catch fire and cause significant damage and casualties in specific circumstances. Second, spill or leak risks: these commodities can present a risk if not packed properly or if they are damaged; spills or leaks from such cargoes can harm the health of people cleaning up the spill as well as the environment. Third, improper packing: cargoes that are poorly or incorrectly packed or secured in the container can lead to injuries to personnel or damage to nearby containers, property, or other shipments; such

incidents can cause severe accidents at sea or on land, like truck rollovers and train derailments. The Cargo Integrity Group also plans to publish additional guidance on the identification and safe handling of these cargoes. “The combined experience of our organisations has been harnessed to identify these categories and result in pinpointing some commodities where the risks are perhaps less obvious. While the potential dangers of transporting, for example, calcium hypochlorite or lithium-ion batteries might be more widely appreciated, the combustible qualities of seed cake or the hazards associated with cocoa butter or vegetable oils, will be less well-known,” shared Peregrine Storrs-Fox , Risk Management Director at TT Club. Lars Kjaer, Senior Vice President of the World Shipping Council, added, “Every actor in the global container supply chain is responsible for the health and safety of not only their own people but also those at any onward stage of the container’s journey. Complying with regulations and following the advice in the CTU Code saves lives, and we appeal to everyone shipping, packing and handling commodities that fall within the categories of these Cargoes of Concern to be particularly diligent.”

After a decade of work under the Comité Maritime International’s (CMI) International Working Group , the 25 major global principles of maritime law have been put on paper for the very first time. The Draft CMI Lex Maritima was prepared on the initiative of Eric Van Hooydonk, a Ghent University Professor and a lawyer in Antwerp. In 2014, he argued in the Journal of International Maritime Law that, although the existence of a common Lex Maritima is accepted worldwide, the principles in question have never been precisely identified nor formulated in a set of rules. At the Professor’s suggestion, the CMI launched a project to draft the Lex Maritima. Van Hooydonk carried out research on national legal

systems to distil the major, globally accepted common principles from them and drafted the instrument. “It was a fascinating job to search for the deepest, universal core in the vast multitude of international and national maritime rules,” he commented. The Draft CMI Lex Maritima comprises principles on fundamental issues, such as the interpretation and sources of maritime law, the status, ownership and management of ships, the responsibilities and liabilities of shipowners and operators, the shipmaster, the pilot, the limitation of liability, maritime contracts, chartering agreements and contracts of carriage, collision, salvage, general average, wreck removal, liens and mortgages on ships, arrest and detention of vessels, and time bars.

The Paris MOU Committee approved at its 57th meeting the 2023 inspection results and adopted new performance lists (in use from 1 July 2024 to calculate the ship risk profile) for Flag States and Recognized Organizations. The White, Grey and Black (WGB) List presents the full spectrum, from quality flags to those with poor performance that are considered high or very high risk. The WGB List is based on the total number of inspections and detentions during a three-year rolling period for flags with at least 30 inspections in that period. The White List represents quality flags with a consistently low detention percentage. Flags with average performance are

shown on the Grey List; their inclusion may serve as an incentive to improve and move to the White List. “At the same time, flags at the lower end of the Grey List should be careful not to neglect control over their ships and risk ending up on the Black List the following year,” Paris MOU stressed in a press brief. The latest WGB List features 71 flags: 42, 17, and 12, respectively (vs. 2022’s 66: 39, 18, and nine in the respective categories). The Baltic Sea region’s Denmark tops the White List, with Finland in the Best 10 in 6 th place. Sweden (15), Germany (21), Estonia (28), Lithuania (34), and Poland (40) are also on the White List, whereas Latvia (43) opens the Grey List

The 2024 version of Inmarsat Maritime ’s report reveals that Global Maritime Distress and Safety System (GMDSS) calls decreased by 7.6% in 2023 over the previous year. Despite this decline, the service was still triggered on 788 occasions and remains close to the six-year annual average of 799 calls. As well as providing a snapshot of current safety metrics, Inmarsat wants to use The Future of Maritime Safety Report as a call to action for the maritime industry to embrace data sharing and collaborative problem-solving as the sector strives to navigate through significant changes (including the transition to greener propulsion technologies and escalating geopolitical tensions). The report suggests that any concerns regarding data pooling related to confidentiality or reputational damage could be addressed by anonymising casualty and incident data. It recommends that the shipping industry establishes a list of standard data points to monitor and report, including casualties and

incidents, injuries or deaths at sea, and near misses. It also endorses trend analysis to support the development of safety measures, with a particular emphasis on developing risk treatments for well-known and recurring issues. Peter Broadhurst , Senior Vice President Safety and Regulatory at Inmarsat Maritime, said, “By harnessing the power of anonymised safety data, we can identify trends, develop specific mitigation measures, and enhance the overall safety of our ships and crews.” He furthered, “Although progress has been made, shipping continues to experience significant casualty rates. We collect vast amounts of safety data, yet the current siloed-working model hinders our ability to fully leverage the actionable insights available to us. By pooling data, we can create a more holistic and objective view of maritime safety to inform performance improvements and ultimately reduce the occurrence of preventable safety incidents to save lives at sea.”

The European Community Shipowners’ Associations (ECSA) and the European Transport Workers Federation (ETF) have launched the initiative in question to identify and address the challenges of digitalisation for shipping and people working offshore.

The Seafarers Go Digital project recognises the need to adapt international regulations, training programmes, and operational practices so that digital technologies are embraced while the employment rights and well-being of seafarers are safeguarded. The initiative raises awareness in key areas such as onboard digitalisation, cybersecurity, Internet access, e-certification, digital skills, and attractiveness of the maritime profession, putting forward policy recommendations for further cooperation between the industry and the unions, policymakers, and other relevant stakeholders. “Supporting shipping and seafarers in the digital transition is a key priority for European shipowners. We need to ensure that seafarers

are upskilled and reskilled to work safely with the new digital tools and technologies. Digitalisation can help make the profession more attractive and more diverse, offering career opportunities on board and ashore and enhancing the participation of women and underrepresented groups,” underscored Sotiris Raptis , ECSA’s Secretary General. Livia Spera , ETF’s Secretary General, added, “The Seafarers Go Digital initiative responds to the need to prepare the maritime professionals for the digital age. Having in mind the need to safeguard the rights, welfare and safety of seafarers, we want to promote a fair and inclusive digital transition. Digitalisation can be an opportunity and can help improve the attractiveness of the maritime professions. Through this initiative, we commit to working together to benefit the most from the digital transition while mitigating its risks and contributing to a sustainable and attractive future for seafarers.”

The Port of Tallinn: 125,486 TEUs handled in H1 2024 (+15.4% yoy)

Measured in tonnes, the Estonian seaport’s containerised freight traffic totalled 1.03 million tonnes across 2024’s first six months, up 9.8% year-on-year. The Port of Tallinn took care of 6.6mt in H1 2024 (-0.3% yoy), including apart from the above also 3.48mt of wheeled (ferry & ro-ro) cargo (+1.9% yoy), 1.2mt of dry bulk (+15.5% yoy), 648kt of liquids (-33.7% yoy), 233kt of break-bulk (+3.5% yoy), and 7.0kt classified as non-marine cargo (-70% yoy). Tallinn’s passenger traffic totted up to 3.63m, of which the Helsinki crossing accounted for almost 3.21m (+2.8% yoy), followed by the Tallinn-Stockholm service with 255k (-1.8% yoy), 93k across the Muuga-Vuosaari link (+24.3% yoy), 20k labelled as ‘other’ (+3.1% yoy), as well as 54k cruise travellers (-22.7% yoy). The port’s subsidiary TS Laevad also served 1.04m ferry passengers domestically (+1.8% yoy), plus transported 507k private vehicles (+2.9% yoy).

400k ro-ro

The company’s fleet also transported 409 thousand private & commercial passengers, up 33.7% on the result of 2023’s first half. Finnlines also transported 658 thousand tonnes of non-unitised freight (-6.9% year-on-year) and 47k vehicles other than passenger cars (-45.3% yoy).

The Port of HaminaKotka: 289,283 TEUs handled in H1 2024 (-6.2% yoy)

The Finnish seaports handled 6.8 million tonnes in international traffic this half year, down 13.5% year-on-year, including 4.38mt of exports (-14.2% yoy) and 2.42mt of imports (-12.2% yoy). HaminaKotka’s domestic cargo traffic also contracted – by 22.1% yoy to 109kt. In June and July, Kotka’s Kantasatama welcomed this year’s first (out of six) cruise calls: by Phoenix Reisen’s Deutschland and Regent’s Seven Seas Navigator. The cruise season will end on 28 September 2024 with the arrival of Oceania Cruises’ Sirena

According to Statistics Finland, the Finnish seaport’s international ferry traffic also served 72,838 passengers, up 46.1% year-on-year, and 8,896 private vehicles & busses (+41.3% yoy). The Port of Naantali took care of over 1.43 million tonnes from January to April this year (+6.1% yoy), of which international cargo flows advanced by 9.1% yoy to 1.04mt whereas domestic ones contracted by 1.1% yoy to 395.1kt. With 761.3kt (+14.3% yoy), general cargo (chiefly wheeled freight) cut out the biggest share, followed by 399.6kt of oil products (-6.8% yoy), 100.2kt of timber (-17.3% yoy), 65.8kt of grains (+68.8% yoy), 42.1kt of crude minerals and cement (-9% yoy), 30kt of coal & coke (+75.6% yoy), 29.8kt of break-bulk (+7% yoy), 4.6kt of metals and metal manufactures (+77.9% yoy), 274t of plywood & veneers (+94.3% yoy), 58t of chemicals (-97.8% yoy), and 47t of sawn wood (+571% yoy).

143.2 million tonnes handled in H1 2024 (+3% yoy)

With 74.2mt (+6.8% year-on-year), containerised freight cut out the largest share, followed by 46.1mt (+0.7% yoy) of liquid and 7.6mt of dry bulk (+0.4% yoy), 10.3mt of wheeled (ro-ro) cargo (-5.7% yoy), and 5.0mt of break-bulk (-6.2% yoy). Antwerp-Bruges’ container traffic advanced by 4.1% yoy to 6,665k TEUs. The Belgian ports also handled 1.66m vehicles (-9% yoy). The Port of Zeebrugge welcomed 270.6k cruise passengers (+8.9% yoy) on board 82 vessels.

The Port of Helsinki:

345,712 trucks & trailers handled in H1 2024 (+4.7% yoy)

Tonnage-wise, wheeled (ferry & ro-ro) cargo traffic amounted to 4.55 million tonnes, up 7.7% on the H1 2023 result. The Finnish seaport also handled 215,904 TEUs (+0.7% yoy), i.e., 1.66mt of containerised freight (+1.4% yoy). Almost 546kt of dry bulk went through the quays operated by the Port of Helsinki (-19.3% yoy) and 254.8kt of break-bulk (-39.9% yoy). In total, the Port of Helsinki took care of 7.06mt (+0.4% yoy), of which international traffic totted up to 6.95mt (+0.8% yoy) and cabotage – 107.6kt (-20.2% yoy). The Finnish seaport also welcomed 4.18m ferry passengers over 2024’s first half, up 4.8% yoy, including 3.35m with Tallinn (+4.6% yoy), 728.4k with Stockholm (+5.9% yoy), 78.9k with Travemünde (+4.1% yoy), 14.7k with Mariehamn (-22% yoy), and 12.1k classified as ‘others’ (+40.8% yoy). Nearly 662.2k private vehicles were transported in ferry traffic (-3% yoy). On the other hand, there were fewer cruise passengers visiting Helsinki, down 14% yoy to 50.3k.

The Swedish seaport’s rail container traffic advanced by 6.4% year-on-year to 249k TEUs. “The signals we received from the market earlier this year regarding increased purchasing power and demand have proven to be accurate. Export volumes are also continuing to rise, partly due to the Swedish forest industry expanding its exports via the Port of Gothenburg,” Claes Sundmark, Vice President of Sales at the Port of Gothenburg, highlighted. As such, the Swedish seaport is heading towards beating its 2023 all-time high container result. At the same time, ro-ro traffic contracted by 3.6% yoy to 270k units, with the finished vehicle logistics segment noting the same decrease to 132k units. The Port of Gothenburg also took care of 10 million tonnes of liquid bulk (-9.1% yoy) as well as 270kt of dry & break-bulk (+31.1% yoy). With 652k ferry & cruise travellers, passenger traffic was up 2.5% on the H1 2023 result.

At the same time, the company’s ferries served 2,062,271 passengers, down 5.6% on the previous year’s first-half result. The number of travellers on Birka Gotland since the launch of the intra-Baltic cruise service (20 March 2024) was 139,062 (Viking Line shared in its Half year financial report January-June 2024 that “Initial traffic for Birka Gotland has not met the company’s expectations and has entailed higher start-up costs than expected”).

27,847 TEUs handled in Q1 2024 (+21.7% yoy)

POH_205_x_133.5_.qxp_(BTJ Package) 09.02.24 17:46 Seite 1

Tonnage-wise, the Swedish port took care of 219 thousand tonnes of containerised freight, up 31.1% on the January-March 2023 result. The Port of Norrköping handled 986kt over Q1 2024 (+5.8% yearon-year), also including 322kt of liquid bulk (-4.5% yoy), 234kt of forest products (+8.3% yoy), 204kt of dry bulk goods (-1.0% yoy), 5.0kt of steel products (+66.7% yoy), and 2.0kt of break-bulk (-33.3% yoy).

The Port of Gdańsk:

38.1 million tonnes handled in H1 2024 (-7% yoy)

The overall drop comes from the 62% year-onyear decrease in coal turnover, which totalled 3.3mt over 2024’s first half. On the other hand, the handling of liquid bulk advanced by 10% yoy to 20.1mt, followed by general cargo gaining 4.5% yoy to 11.6mt (of which containerised freight accounted for 10.2mt, noting an increase of almost 3% yoy). The Port of Gdańsk also took care of more grains, up 10% on the H1 2023 result to 1.5mt. Other dry bulk goods (1.5mt), as well as iron ore (52kt) and timber (39kt), all noted decreases.

383,855 ferry passengers served in Q1 2024

At the same time, 124,171 private vehicles were carried on board ferries serving Ystad’s traffic, up 9.9% year-on-year. The Swedish seaport handled 690 thousand tonnes over 2024’s first quarter (+3.8% yoy), including 655kt of wheeled (ferry) cargo (+2.8% yoy), 23kt of forest products (+475% yoy), and 12kt of dry bulk (-45.5% yoy). There was no handling of

The Swedish spreader manufacturer will erect 1,700 square metres within its four-facilitystrong base in Älmhult this autumn. “The plan is to facilitate for increased manufacturing capacity in the existing product range as well as for new products that are planned to be launched within the truck and crane segment,” the company highlighted in a press release. Gösta Karlsson, ELME’s CEO, added, “Our investments in product development have turned out well, and we can see an increased demand in Europe as well as Asia and the US. In 2025, we are scheduling several exciting launches, and to meet future capacity needs, we are now investing in larger premises.” The manufacturer, celebrating its 50th anniversary this year, has recently been focusing on developing their crane spreader segment, including talent acquisition and purchasing new machinery to make the production process more efficient.

The Lithuanian Environmental Protection Agency has recently decided that an environmental impact assessment is not required for the seaport to continue working on the new facility. Contract procurement procedures are therefore underway, with the project’s implementation phase expected to start this year. The new cruise terminal, designed by the Office of Consulting Structural Engineers from Lithuania, is planned to be developed on a plot of land owned by the port authority in the central part of the city, where existing quays will be reconstructed, new ones will be built, and the basin deepened. A new administrative building housing the port authority will also be part of the new facility, alongside cafes, a conference room, a rooftop observation deck, a new marina, a waterfront open amphitheatre, pedestrian and cycling paths, and areas for recreation and events. “We are taking another step towards a new infrastructure for cruise shipping in the Port of Klaipėda. Investing in the new terminal is not only about meeting the needs of the ships growing in size but also about creating value for the City of Klaipėda and its residents. I believe that the new terminal will improve the city’s infrastructure, will be an attractive public space for both tourists and residents and at the same time, it will become a symbol of the Port of Klaipėda, which will be visible both in the city’s urban panorama and from the Curonian Spit,” highlighted Algis Latakas, Director General of the Klaipėda Port Authority.

The Finnish shipping line has entrusted the Dutch Royal Bodewes shipyard with the construction of two 6,750-tonne deadweight Ecotraders. The 105-metre-long Ice Class 1A vessels will be built in Hoogezand, with delivery planned for January and December 2026. The pair will sail on biofuel made by Meriaura’s subsidiary VG-Ecofuel, produced from recycled raw material. “This order is a continuum in our series of investments to energy-efficient tonnage that utilises bio-oil. In the current geopolitical situation, we found it best to order the ships from an established shipyard operating in Western Europe, which is also in line with our ESG strategy. Security of delivery, quality and the yard’s ability to comply with safety and environmental regulations, and our good experience with the previous newbuildings were the most important factors in our decision to choose Royal Bodewes as our shipbuilder again,” commented Beppe Rosin, CEO of Meriaura. Jussi Mälkiä, Meriaura’s Founder and Chairman, added, “The two ships ordered now will start our newbuilding program that targets achieving carbon neutrality remarkably faster than IMO’s target [in the 2030s vs. by/around 2050]. Our purpose is to systematically renew our fleet with a series of newbuildings. The use of bio-oil combined with compensation enables us to reach this ambitious goal we have set.”

The ports of Cartagena, Monfalcone, Riga, Trieste, and North Sea Port have teamed up to work on sustainability, energy transition, digitalisation, and the European transport network. The port companies intend to exchange knowledge and best practices in energy management, including the introduction of renewable energy sources, environmental management, and sustainable port operations. The parties will also jointly strengthen commercial interests and support cargo flows between them, as well as share knowledge on further digitalisation, such as a port community system and traffic management. The network will also cooperate around funding opportunities and joint projects under European grants. “With this initiative, the four ports are launching a non-exclusive network of medium-sized ports to exchange knowledge and explore further operational cooperation. The network demonstrates that European port communities are committed and ambitious in achieving European objectives,” the founding ports highlighted in a press release.

The Danish dry bulk & project cargo shipping company eyes the takeover of the Norwegian dry bulk operator Norlat Shipping, specialising in carrying forest products & other bulk commodities on trades from Northern Europe (including the Baltic) to North Africa & North America. The 1986-founded Norlat has offices in Sarpsborg and Bergen in Norway and in the Swedish capital of Stockholm, from where the company’s eight employees operate the asset-light business, based on chartered vessels with four-to-five monthly shipments on predominately Handysize ships. The acquisition is subject to merger clearance. The takeover will be NORDEN’s second, following the mid-2023 acquirement of Thorco Projects’ activities, integrated into NORDEN’s Freight Services & Trading business unit, operating as Projects & Parcelling, with Norlat Shipping also becoming part of that team.

The Finnish Rauma Marine Constructions (RMC) saw the launching and christening (by Barbara Baker, Governor of Tasmania) of the second in a series of two ferries for the Tasmanian TT-Line Company. The 212 by 31 metres, gross tonnage of 48,000 ro-pax, which should be ready next spring, will sail between Devonport and Geelong alongside her sister ship, Spirit of Tasmania IV (launched last October and scheduled for completion and delivery by August 2024). Each ferry will offer room for 1,800 passengers (across 301 cabins) and 3,700 lane metres for cargo. They will replace another made-in-Finland duo from the 1990s. “The Spirit of Tasmania vessels are specifically designed for this route and its demanding sea conditions. Our shipyard is known for its ability and expertise to customise ships to meet the high standards and quality requirements of our clients. I am extremely proud of the progress in the construction of these vessels,” commented Mika Nieminen, RMC’s CEO and President. He also underlined, “The project we are delivering for TT-Line Company is also nationally significant, as it is one of the largest individual export deals between Australia and Finland.” The shipyard, now in its 10 th year, also shared that its current order book extends to 2028. It has recently invested in independent steel production, a new multi-purpose hall, and a heavy transfer ramp, among others.

The Danish construction firm Aarsleff completed the project it had been working on since 2021, erecting a brandnew 90 thousand square metres terminal area that the Ports of Halland will use to ship more forestry products. The works included dredging from two to 11 metres and setting up a 360-metre-long quay plus a 140-metre-long pier. Construction involved ramming 255 steel piles of 600 millimetres in diameter and measuring 35-to-50 metres as the foundation for the quay wall, upon which 223 slabs weighing 60-to165 tonnes rested on 253 pile tops (both produced at Aarsleff’s cement factory in Poland).

The Port of Halmstad will receive SEK12.1 million (almost €1.05m) for setting up a transhipment yard in Oceanhamnen, a brand-new harbour set to be ready by winter 2025/spring 2026. The project, worth in total about SEK30m, will see the construction of a 25,500-squaremetre yard, out of which two 5,120 m 2 areas (four tonnes of bearing capacity per m 2) will be dedicated to storing and handling cargo. “We welcome the news that the EU will further support the development of our port. The port is an important part of Halmstad’s infrastructure and a strong contributing factor for companies to choose to establish and expand in our municipality. This expansion contributes to the green transition, to providing Halmstad residents with work, and to strengthening our growth. Good for people, the environment, and the economy,” commented Stefan Pålsson, who chairs Halmstad’s Municipal Board.

GEODIS has put in motion a 2,200-kilometre-long connection that links Łódź in Central Poland with Barcelona. The first train set, carrying 44 cargo transport units, left Spain on 11 June 2024 and arrived in Poland three days later. According to GEODIS, the rail service spares the environment some 79% in emissions vs. a road alternative. “We have great ambitions for this new line, as we plan to increase the frequency to two trains per week in the near future,” said Marc Vollet, Chief Operations Officer at GEODIS European Road Network.

As of 23 May 2024, a new twice-a-week service (for craneable and non-craneable units) connects Trelleborg and Umeå, with TX logistics providing rail traction. The transit time for the 1,280-kilometre-long route is about 40 hours.

PKP CARGO and AGROMEX have partnered to rail-connect the former’s new multimodal terminal in Zduńska WolaKarsznice with Rotterdam. The twice-weekly crossing uses the T3000E rail wagon platforms suitable for carrying trailers and containers (including tank). The November 2023-opened facility in Zduńska Wola-Karsznice (Central Poland) spans over 13 hectares, including 33 thousand square metres of yard area. The terminal can handle train sets up to 750 metres in length; its yearly handling capacity amounts to 500 thousand cargo transport units.

Lakeway Express, the ro-ro of the Swedish JV between Greencarrier and Wallenius, set sail for her first 22-hour-long voyage between the ports of Gdynia (OT Port Gdynia) and Södertälje on 21 May 2024. The 1,625 lane metres capacity freighter, flying the Swedish flag, plies three times per week in each direction. Following the reconstruction of the Södertälje locks in 2026, the service is expected to expand to include the Port of Västerås on the Lake Mälaren. “This is the first step in our introduction of a new, innovative waterway transport solution directly into Central Sweden and the Mälaren region. Our solution is a very competitive alternative to traditional road transport, providing a shipping option with comparatively low environmental impact,” Fredrik Hermansson, Lakeway Link’s CEO, underlined. He furthered, “Additionally, our service addresses the severe shortage of truck drivers. Being non-driver-dependent, drivers leave their trailers at the quay, and the trailers are driven on board from there.”

The intermodal rail arm of HHLA, with the help of Ukrainian Railways, has organised the first train run between Dąbrowa Górnicza and Mostyska. The companies intend to make it a regular service, linking it with other Ukrainian cities, like Kyiv and Odesa (where HHLA runs a container terminal; the company also owns the domestic Ukrainian Intermodal Company).

The Swedish Gotland Company will take over the Oslo-FrederikshavnCopenhagen (OFC) service for around DKK400 million (about €53.6m) from the Danish shipping & logistics firm. The deal includes the crossing’s ferries Crown Seaways (room for 2,168 passengers and 1,482 lane metres for wheeled cargo) and Pearl Seaways (2,044/1,370), port agreements, and terminal equipment. Some 800 employees in route operations and support functions will also move to Gotland Company (no layoffs are planned as part of the route transfer). DFDS will, after completion of the agreement subject only to customary closing conditions, provide certain support services to the buyer for an agreed and limited period. The deal, which also includes a potential earn-out payment, is expected to be closed in October 2024. The OFC, kicked off together with DFDS’ establishment in 1866, mainly functions as a cruise ferry service nowadays.

The Polish ferry line deployed the 216-metre-long newbuild Varsovia, offering room for 920 passengers and 2,940 lane metres for cargo, on the ŚwinoujścieYstad crossing on 27 July 2024. The ship, built by Visentini Shipyard in Italy according to a design by NAOS Ship and Boat Design, replaced the company’s Cracovia (650 pax/2,196 lm) and Baltivia (250/1,408). The former went on a charter in the Mediterranean as of 1 July 2024. Polferries has chartered Varsovia for 10 years.

Never mind our stunning sea view. Every port has one. We’re talking about the railroad and motorway right outside our office windows. For a port, that’s a view, and a location worth its weight in gold. At the Port of Oxelösund, we have a direct connection to the Swedish railway system, and to Sweden’s biggest motorway, European route E4. This gives us unique possibilities when it comes to processing and transporting goods. If you value logistics with speed and flow, give us a call.

The Port of Oxelösund is more than a port. We can handle your entire logistics chain and optimize every part of your goods’ journey, from start to finish. Our goal is to be the Baltic’s leading port terminal, with Europe’s best stevedoring services.

Starting from 25 July 2024, Transfennica’s Northern Baltic con-ro & break-bulk service calls at CLdN’s Albert II terminal in the Port of Zeebrugge every other Thursday. The connection in question links the Baltic seaports in Hanko, Kotka, Rauma, and Paldiski with the Port of Antwerp. The companies also share freight loading equipment to maximise transshipment efficiency.

After a two-year-long stop due to railroad works on the Polish side, railcars can now be again transported by ferries between the two seaports. The first shipment saw the carriage of rail wagon platforms on board Unity Line’s Polonia, which was sent to Poland for repairs.

The two Swedish shipping lines have partnered to offer single bookings to/from Latvia to Belgium and England. Specifically, it’s now possible to book Wallenius SOL or Stena Line for the entire route from Liepāja to Tilbury via Travemünde and Antwerp-Bruges. Stena Line is responsible for the Liepāja-Travemünde service, while Wallenius SOL handles the TravemündeAntwerp-Bruges-Tilbury leg. The cargo is kept on the same equipment during transhipment in Germany. “This isn’t just a great service for standardised units; it’s perfect for oversized cargo, too. Instead of dealing with permits and the high costs of trucking large and heavy cargo, we’re making it easy to shift to seaways. This option also significantly reduces emissions,” Kai Peränen, Commercial Manager of Central and East Europe at Wallenius SOL, highlighted.

Green Cargo has launched a new connection between Arken Kombiterminal in the Port of Gothenburg and the Port of Norrköping. The service offers daily (overnight) departures Monday through Friday for trailers and containers. “We are seeing an increased demand for combined rail, sea, and road transport. A large volume of goods is currently transported by road in this corridor. In collaboration with the terminals, we aim to offer the market a cost-effective, fast and sustainable transport alternative that strives to reduce its environmental impact,” Matilda Hedström, Strategic Salesperson at Green Cargo, said. Peter Nerheden, Account Manager from DB Cargo FLS Nordic, added, “The new rail solution simplifies our logistics process and offers us a sustainable alternative to truck transport. Our customers want to purchase freight services from a forwarder to effectively coordinate and synchronise communication and slot times. With this new solution from Green Cargo, we can offer our customers a time-efficient and environmentally friendly logistics solution that saves both time and money.”

The Ports of Halland, Stena Recycling, and Hydro Aluminium have partnered to set up a service that carries scrap metal on board ships instead of using trucks. The weekly service connects the Port of Halmstad and Hydro Aluminium’s facilities in Sunndal, Årdal, Høyanger, Husnes, and Karmøy. The previous set-up saw trucks going from Halmstad to Älmhult, where the cargo got smelted before onward transportation to Norway. Whereas the service currently makes use of different berthing places in Halmstad, it will move to the brand-new 12-metre-deep Oceanhamnen once it’s up & running in 2025/2026. “This cooperation plays a central part in the development strategy for the new Oceanhamnen harbour in Halmstad. There, a new 200-metre-long quay together with 21 thousand square metres of yard is being constructed. The new port area is tailor-made for this type of goods handling that comprises containers and bulk cargo,” highlighted Henrik Nanfeldt, the Ports of Halland’s COO. Henning Wiik Tangen, Scrap Purchaser at Hydro Aluminium Metal in Norway, added, “We are very pleased with this sea freight solution from Halmstad, which has just come online. It will decrease CO2 emissions and contribute to Hydro Aluminium achieving its sustainability goals. The Halmstad-Norway by-sea-volume stands for around 600 tonnes less CO2 in 2024.”

Port of Trelleborg, with the ambition of being Europe’s most sustainable RoRo port, is constantly working on various improvement measures within environment and sustainability. We invest a lot in intermodal transports, i.e. a combination of rail, sea and road, since it is the most sustainable way to get your goods.

Port of Trelleborg has worked to ensure that a larger proportion of trailers and containers choose the train to and from Trelleborg, a work that has had a fantastic development in recent years. In 2023 the increase was 12% compared with the previous year, which means that almost 40,000 trailers have traveled to or from Port of Trelleborg by rail. The port’s unique logistical location, where Europe meets Scandinavia, and with the possibility of combining the transport modes sea, rail and road, is a success factor.

By 2033, the forecasts point to 150,000 units. In order to handle this large number, the Port of Trelleborg needs to rebuild the intermodal terminal to improve the handling of intermodal trains and rail connections. Port of Trelleborg works together with the Swedish Transport Administration to reach an agreement regarding a takeover of the old freight railway yard in order to develop and become a modern intermodal terminal. It is our joint hope that such an agreement can be signed around the turn of the year 2024/2025.

Together with our shipping line customers and our partner ports, we can tie together the intermodal solutions to increase the volumes further.

Port of Trelleborg is Scandinavia’s largest RoRo port for rolling traffic, one of Sweden’s five core ports designated as strategically important by the EU and an important part of the European transport corridors. We are also Sweden’s only port with rail ferries. The port is an important node for Sweden’s import and export, and thus has an important meaning and role for the climate transition of freight transports.

• The two cities and their seaports have teamed up to make the crossing between them more environmentally friendly. The parties will work on decreasing the footprint of the ports’ own operations and energy

consumption, providing means for ship, road, and rail port users to green their activities, and investing in infrastructure and equipment to handle larger vessels. •

• The City of Pori and the Port of Pori have commissioned Wega to conduct a preliminary study on the construction of an import/ export terminal for handling liquid carbon dioxide. “The CO2 terminal acts as a decisive catalyst in the construction of electric fuel and hydrogen production facilities in Pori. This is also supported by the region’s strong energy infrastructure and renewable energy production capacities that are either already under construction or

on the drawing board, ensuring Pori’s position as a pioneer in the clean transition,” Lauri Inna, the City of Pori’s Mayor, highlighted. Earlier, the ports of Pori and Raahe have partnered to make sure the right infrastructure and handling capacities are in place so that the development of Finland’s (offshore) wind energy industry isn’t hampered and that renewable energy is available to produce, among others, e-fuels with the use of captured biogenic carbon. •

• The Finnish seaport will receive money from the EU’s Connecting Europe Facility within the 23-FI-TG-Arctic SSE project to set up an onshore power supply facility on the new autumn 2023-opened

quay. Once the investment is up and running, two ships will be able to draw power from the shore concurrently. •

• The ports of Helsinki and Tallinn have yet again secured financial backing from the EU, this time some €15.4 million for, among others, reducing emissions from shipping in their cargo harbours. The total budget of TWIN-PORT VI amounts to €30.8m, of which Tallinn will contribute €20.3m and Helsinki €10.5m. The EU-supported investments will include onshore power supply facilities in Tallinn’s Muuga and Helsinki’s Vuosaari harbours. “The Port of Helsinki’s investments will reduce emissions and improve the efficiency of both passenger and freight transport. The approximately 5.2 million euros in EU support we have now received is important for carrying out our investments. It also shows that the goals of our projects are in line with the development goals of European transport systems,” underscored Pekka Meronen, Vice President – Finance, ICT and Development at the Port of Helsinki. •

• The Danish seaport will help to set up ORLEN and Northland Power’s 1.2-gigawatt offshore wind energy farm in the Baltic. The investment, located some 150 km east of the island of Bornholm, will comprise 76 turbines of Vestas’ V236-15.0MW model to be mounted in 2025. “ We are thrilled and proud that we will now also be the installation port for a Polish wind turbine project and even the first of its kind in the Baltic Sea with the brand new 15MW wind turbine from Vestas. We take it as a sign that we have strengthened the Port of Rønne’s position as the Baltic Sea’s centre for green energy,” Jeppe la Cour, the Danish seaport’s CCO, commented. •

• Climate Leap, an investment programme of the Swedish Environmental Protection Agency, has awarded up to SEK125.6 million (€11m) for the French company’s 10-megawatt production plant in Southern Sweden. Once potentially up & running in 2027, the Trelleborg site will produce up to four tonnes of green hydrogen per day. The grant – which will fund the development & design phases, the supply of equipment, and the construction work –represents about 40% of the total estimated investment in the

project (the implementation of which is subject to the granting of operating authorizations and construction permits, as well as to financial investment decisions). “We are very happy to have been awarded this grant, which is the first project we have been granted subsidies for in Sweden and which we see as a clear reward for our efforts and as the recognition of our expertise in the production and delivery of green hydrogen to multiples customers over the last two years,” said Sara Wihlborg, Country Manager Sweden at Lhyfe. •

• The two have partnered to promote the use of methanol as a marine fuel by encouraging the uptake of SRC’s Methanol Superstorage. “Using the SPS Technology Sandwich Plate System instead of traditional cofferdams that separate tank walls, Methanol Superstorage boosts shipboard tank volumes by 85% and provides effective mitigation for methanol’s significantly lower energy density than conventional HFO [heavy fuel oil],” the parties underlined in a press brief. GREEN MARINE will use its expertise in delivering methanol solutions for all vessel segments (including ship design, yard selection, construction supervision, technical management and operations, training, procurement, sales, and bunkering) to further develop and deliver SRC’s Methanol Superstorage to the market. •

• First, the energy company has signed a memorandum of understanding (MoU) with the Port of Karlshamn aimed at scrutinising the latter’s role in serving future offshore wind energy (OWE) farms in the Baltic. Specifically, the collaboration will explore whether the Port of Karlshamn could be a suitable harbour for logistics, installation, operational and maintenance activities related to RWE’s planned offshore wind projects in the region. In the first step, the partners will map the requirements and necessary build-outs and investments to facilitate the scaling-up of the port’s capacity. “Port capacity and a sustainable supply chain industry are key to the deployment of offshore wind projects. And a new offshore wind farm has the potential to transform a nearby harbour into a dynamic hub that significantly catalyses growth, infrastructure, jobs, and economic benefits for the region. That is why we are looking forward to collaborating with the Port of Karlshamn to evaluate their potential as a future offshore wind hub,” commented Matilda Machacek, Vice President of Offshore Development Nordics at RWE Offshore Wind. To this, Anton Andersson, Project Lead at RWE Renewables Sweden, added, “Our Kårehamn Offshore Wind farm [48MW off the island of Öland commissioned in 2013] is a great example also for harbour development. It has been reliably generating green electricity for thousands of Swedish homes for more than a decade. Thanks to the wind farm, the old fishing harbour has been revitalised. Based on this success, RWE plans to build more offshore wind farms in the Baltic Sea.” Caroline Säfström, the Port of Karlshamn’s CEO, underlined, “The Port of Karlshamn is proud that RWE, one of the world’s leading offshore wind companies, is supporting us in our

plans to become a hub for offshore wind. With its natural, deep harbour and large shipyard, the Port of Karlshamn is well- positioned to meet the future needs of the offshore wind industry in the Baltic Sea. We recognise the demand for port capacity related to offshore wind energy, including after-sales services such as maintenance and operations centres. Expanding the port’s product portfolio in this direction is a natural step given our previous experience with wind energy projects and logistics.” She furthered, “By establishing itself as a hub for offshore wind energy, the Port of Karlshamn is also creating employment opportunities for the region and promoting business opportunities for local companies and suppliers, thus contributing to the economic development of the area and strengthening the local economy.” Shortly afterwards, RWE signed a similar MoU with Smålandshamnar. Niclas Strömqvist, CEO of the Swedish port authority, underscored, “The Port of Oskarshamn is already one of the leading harbours in Sweden for the transport and handling of onshore wind components. We are proud that RWE, one of the world’s leading companies in offshore wind, has taken note of our port and our expertise and supports our plans to become a hub for offshore wind, too. The Port of Oskarshamn is strategically positioned in the Baltic Sea and offers very good conditions and opportunities to meet the needs of future players in offshore wind power. Experience from other ports shows that the offshore wind industry is an employment accelerator that creates growth in the business community and, thus, the conditions for jobs and migration to the area. This will benefit not only Oskarshamn but also the region, Sweden and the green transition.” •

• Wasaline has made it possible also for private travellers to pay a nominal voluntary fee when crossing between Umeå and Vaasa on board the company’s Aurora Botnia ferry. The climate compensation scheme, earlier introduced for cargo customers, is used to buy bioliquefied natural gas to propel the vessel. “By operating with biogas and batteries, the journey is climate neutral. Since Aurora Botnia entered traffic, we have reduced CO2 emissions by 27.1% and last year (2023),

10% of our journeys were operated with biogas. The goal for 2024 is to reduce our CO2 footprint by 15%,” highlighted Peter Ståhlberg, Wasaline’s Managing Director. The company also offers intermodal transports from Umeå to Gothenburg and Trelleborg to cut overland emissions of the (wheeled cargo) transportation sector. Together with Kvarken Ports, the port company managing Umeå and Vaasa, Wasaline works towards making the crossing a Green Shipping Corridor by 2030. •

• MOL and Volvo Penta are trialling the RME225 terminal tractor, featuring three battery packs (270kWh in total), an EPT802 gearbox, two 200kW propulsion motors, and a separate 50kW one to power the hydraulic system and the fifth wheel. “The technical progress achieved through our collaboration with Volvo Penta in creating the full electric 4x4 RME225 terminal tractor demonstrates our efforts to expand our range of new emission-free vehicles specifically for the rigorous needs of heavy-duty port equipment. We’re ensuring that it performs reliably, efficiently, and effectively in real-life operational scenarios,” commented Conrad Verplancke, Sales Engineer, MOL. Jeroen Overvelde, Area Sales Manager, Volvo Penta, added, “The value of electrification extends beyond the

initial technology investment. The full electric tractor matches its diesel counterparts in performance, with potentially higher acceleration rates and available torque on the RME225. Success hinges on delivering superior performance and optimising total cost of ownership.” According to the parties, electrifying a terminal tractor reduces tailpipe emissions, hence air pollution. An electric drivetrain can also lower vibrations, creating a more pleasant and quieter working environment. Raf De Wit, Terminal Director at DFDS’ terminal in the Port of Ghent (where the trial is being carried out), said in this regard, “This is in line with our efforts to decarbonise our land-based activities, improve the working environment, and increase the efficiency of our port operations.” •

• The Swedish tech company from Västerås will equip Corsica Linea’s largest ferry with EcoPilot, an automated eco-sailing system that uses weather forecasts and ship data to calculate the best power plan for a route and a set arrival time. “EcoPilot achieves fuel savings through three main methods: firstly, it automatically executes optimised power plans, keeping the load on the engine constant. Secondly, it prevents instances of ‘hurry up and wait’ and, thirdly, by adapting quickly to changing conditions, ensuring vessels arrive just in time, thus avoiding unnecessary fuel consumption,” explained Per Österberg, CCO at Qtagg. Danielle Casanova will also get the new DEGO IV engine governors, new ASAC actuators, and a new pitch control system. The

EcoPilot power routing system comes with a 3% fuel consumption reduction guarantee, but the expected (conservative-calculation) savings for Danielle Casanova are in the interval of 6-8%. Qtagg says that for shorter voyages, like the trip between Calais and Dover lasting 90 minutes, they’ve observed savings of up to 20% (equating to over €500 thousand/year saved on bunker). The actual fuel reduction will be determined by a four/five-week test period after commissioning. Qtagg will compare this against a baseline from a reference period where the ship operates without EcoPilot. A statistical analysis will confirm the comparison to compensate for any influence from varying environmental, load, and speed conditions. •

• The Swedish shipping line, which started a ro-ro service between Gdynia and Södertälje this spring, will see its Lakeway Express tanked with ScanOcean’s B15-DMA, a marine fuel with 15% renewable content. The bunkering operations of the ISO 8217-compatible and ISCC-EUcertified fuel will take place in the Port of Södertälje. “Our decision to partner with ScanOcean and begin using the B15-DMA fuel is a pivotal step in the journey towards reducing our environmental impact. This initiative not only aligns with our sustainability goals but also sets a new standard in the maritime industry for environmental responsibility,” Fredrik Hermansson, CEO of Lakeway Link, commented. •

• The Finland-headquartered tech company will supply, install, and commission its Groke Pro Situational Awareness System to a pair of bulk carriers operated by a Greek shipowner. The order is for a 60,960-tonne deadweight geared bulk carrier and a slightly smaller ultramax vessel, which will receive the complete Groke Pro package. The sensor unit, to be installed atop the bulkers’ monkey deck, will house two cameras: a thermal night and a day one, as well as IMU, Dual GNSS, and AIS receivers. “Powered by a central unit installed inside the vessel, artificial intelligence and machine vision technologies are used to detect and analyse objects in the vessel’s surroundings. Sensor fusion technology melds data from multiple sources to provide a superior situational awareness, day or

night,” Groke Technologies explained in a press brief. The company furthered, “For the bridge of each vessel, a 27-inch fixed display unit will be installed in addition to iPad Pro-based tablets running the user interface. Groke Fleet, a new solution for fleet managers shoreside, will also be included in the package.” According to Groke Technologies, the installation and commissioning process takes one day, all the while the vessel is operational. “One feature that elevates Groke Pro from a digital watchkeeper to an intelligent companion is its real-time risk analysis capability. This presents the crew with crucial as-it-happens information about the vessel’s surroundings on which to base navigational decisions,” Groke Technologies further underlined. •

• The two Belgian ports have become part of the initiative launched in 2022 by DFDS, North Sea Port, and the Port of Gothenburg. The parties are working on making the 2,500-kilometre-long crossing as environmentally friendly as possible, including the launch of two ammonia-run ro-ros by 2030 (a part of DFDS’s ambition to have six low- and near-zero-emission vessels in operation by the end of this decade). E-trucks and rail will serve hinterland traffic, while berthed ships will have the possibility to draw power from the shore. “DFDS has applied for funding for a total of four ammonia-fuelled vessels and, if the funding is granted, the project including electrification in the ports is expected to reduce 328,000 tonnes

CO2e emissions per year corresponding to around 11% of DFDS’ scope 1 greenhouse gas emissions compared to 2023,” the Danish shipping & logistics company highlighted in a press release. Patrik Benrick, Head of Strategic Development & Innovation at the Port of Gothenburg, also commented, “The Port of Gothenburg is already in the early stages of developing operating regulations for safe and efficient handling and bunkering of ammonia-propelled vessels. We are also working on establishing an ammonia value chain, with the purpose of being able to facilitate everything needed for ammonia-run vessels calling and bunkering in the port on a regular basis in 2030 and beyond.” •

• The company will receive DKK 162.2 million (around €27.4m) from the Danish Green Investment Fund to expand its blade factory in the Port of Aalborg’s East Harbour. The Aalborg City Council has completed the

local development plan, according to which Siemens Gamesa’s premises in the Danish seaport will grow by 400,000 square metres for storing blades for the wind energy industry. •

• The Danish Esvagt saw the launching of its latest service operations vessel (SOV) at the Turkish Cemre Shipyard. The 2022-ordered SOV will be handed over at the end of this year. The dual-fuel ship, also equipped with batteries, will serve Ørsted’s 1.32-gigawatt (165 8.0-megawatt turbines)

Hornsea 2 offshore wind energy farm 89 kilometres off the Yorkshire coast. If fuelled and running on e-methanol, produced with renewables and biogenic carbon, the newbuild will have its annual footprint reduced by some 4,500 tonnes of CO2 vs. when bunkered with fossil fuel. •

• The company, a co-op between the Polish Industrial Development Agency and the Spanish GRI Renewable Industries, has laid the foundation stone for the 150 towers/year production plant on the Ostrów Island

Advertisement

in Gdańsk. The factory, putting together towers for 15 megawatts (and stronger) turbines, is expected to come online in Q2 2025. It will provide 500 highly specialised jobs. •

THE PORT OF KARLSHAMN is one of Sweden’s major ports and is strategically located in the south, facing the ”new” Europe. There are plenty of industries and major consumer areas in the surrounding region. Customers all over the south of Sweden and Denmark can be reached from Karlshamn within 3–5 hours. Karlshamn has lots of development areas offering direct access to the port, intermodal rail terminal, E22, Logistics cluster and

environmentally friendly energy. The port, with it’s business mindset, is constantly developing and expanding. There is ongoing expansion of the RoRo-port with a 3:rd berth and widening of berth no. 2 for 230 m long vessels. Also shore-to-ship power connection, extended line-up areas and more. Large investments are planned for development of the rail infrastructure.

• The Danish shipowner has entrusted the Chinese New Jiangzhou Shipbuilding with delivering eight dual-fuel chemical tankers. The shipbuilder, which also provided the tanker design, will supply the

6,800-tonne deadweight vessels in 2026. The newbuilds will join M.H. Simonsen’s fleet of 14 chemical tankers (primarily used for shipping vegetable edible oils in Europe). •

• The Danish-Swedish port authority has partnered with the Hellerupbased company that wants to turn biomass waste into bioenergy to scrutinise the set-up of a biofuel plant in Malmö. The parties will kick off the works with a pilot study, which will also include securing relevant permits. If everything goes according to the plan, the facility should be up & running by 2030. “Green2x’s technology extracts energy from the straw that remains after harvesting, which enables the production of green energy on a whole new scale because the straw contains a lot of energy, and this technology enables more than 95% of it to be recovered,” reads the companies’ press release. “We are incredibly pleased to join this exciting partnership with CMP and the City of Malmö. Green2x’s strategic plans are now

accelerating, supporting our ambitions to become an international green fuel producer very rapidly. The location in Malmö opens doors to enormous potential. This gives us a unique opportunity to strengthen cooperation with the shipping industry, among others,” commented Mikkel Sjølin Kiil, CEO, Green2x. He furthered, “At the same time, we use the geographical synergies with our plant in Vordingborg, especially when it comes to sourcing large quantities of straw. The tempo, market interest and ambitions are high, and it is gratifying that the next step will be in collaboration with CMP and the City of Malmö.” Green2x has recently obtained a permit for the establishment of its first plant in the Danish Port of Vordingborg, with the start of production scheduled for 2027. •

• The ferry line, a subsidiary of the Danish Molslinjen, will retrofit the ferry operating across the Helsingør-Helsingborg crossing to sail on battery power instead of fossil bunker. The Swedish Echandia will deliver the battery system, scheduled to take place in H1 2025. It will be tailored for a minimum lifespan of 10 years without requiring battery replacement. Recharging will take 11 minutes on average.

Hamlet makes some 8,000 trips annually. It will be Öresundslinjen’s third ferry running on electricity after Tycho Brahe and Aurora (both have 4.16MWh systems). Echandia will also supply two other battery packs for other of Molslinjen’s daughter companies’ ferries: Nerthus will get 3.1MW for serving the Fynshav-Bøjden route while Tyrfing 3.8MW for the longer Ballen-Kalundborg link. •

• Fred. Olsen Windcarrier’s jack-up vessel Blue Tern has erected the first turbine of Iberdrola and Masdar’s JV 476-megawatt offshore wind energy (OWE) project. The investment is scheduled for completion by 2024’s end after setting up 50 wind turbines of

Vestas’ V174-9.5MW model. The project is being carried out from the German Baltic Mukran Port. Together with the already operational 350MW Wikinger and the planned 315MW Windanker OWE farms, Baltic Eagle forms Iberdrola 1.1GW Baltic Hub. •

• The Swedish port company, which manages five harbours on Vänern (the EU’s largest lake), will install 1,000 square metres of photovoltaics (PV) in Otterbäcken. The system will be located on a warehouse roof and produce 181,000kWh per year (some 40% of

the port’s annual consumption). The installation is expected to be ready by the end of this summer. Since 2020, there has already been another PV system up & running in Vänerhamn’s Karlstad, having generated 850,000kWh towards the end of April 2024. •

• UPM Plywood has reached a deal with VR, the Finnish national rail freight haulier, to replace fossil diesel with hydrotreated vegetable oil (HVO) for shipments from the UPM Pellos mill. The fuel swap, coupled with a new operating model (increasing the train filling rate and using one instead of two locomotives), will reduce the total emissions of the WISA® plywood transport in Finland by 24%. The mill in question is in Ristiina, with its output rail-carried to Kouvola and the Port of Kotka. “Only about 60% of Finland’s rail network is electrified, so it is necessary to find other responsible alternatives to electricity. This is the first HVO contract for VR’s rail logistics, which will bring the customer’s transport emissions to almost zero. HVO […] is also produced from crude tall oil by UPM Biofuels at its Lappeenranta refinery,” UPM shared in a press brief. •

• The fuel company from Sweden will use the Finnish tech firm’s schedule optimisation software to reduce shipping emissions by increasing the vessel utilisation rate. Preem schedules and executes over 1,000 voyages annually, including via time-chartered vessels, contracts of affreightment, and spot contracts. “Seaber’s proven optimisation technology will help develop our logistics and shipping operations. We are looking to get an extremely fast return on investment that will have a direct impact on reducing Preem’s emissions and costs. Seaber’s software will complement and unite our logistics process by digitalising our schedule planning,” Daniel Berndolf, Preem’s Manager of Shipping, Supply & Trading, commented. •

To celebrate the 10 th anniversary of setting in motion the Connecting Europe Facility (CEF), the European Climate, Infrastructure and Environment Executive Agency has set up the Greener Transport Infrastructure for Europe interactive map webpage that showcases how CEF projects have contributed to the development of EU’s transport sector. “Focus areas are railway

transport and ERTMS [the European Rail Traffic Management System], inland waterways, ports and alternative fuels, with the overall objective to demonstrate how EU investments throughout the years are having a positive impact on the continent’s transport networks, yielding concrete benefits for businesses and citizens alike,” said the European Commission in a press release.

The Transport & Environment NGO from Brussels has also launched an interactive map, this one presenting e-fuel (green hydrogen, biofuels, e-ammonia, e-methanol) production sites (planned and operational)

across Europe, including ones dedicated to shipping. The observatory dissects supply & demand issues, also in how much e-fuels will be needed to green the business of carrying goods & passengers by ship.

On that topic, the European Commission has proposed to invest one billion euros in alternative fuels infrastructure, through the Alternative Fuels Infrastructure Facility, along the TransEuropean Transport Network (TEN-T) to reach the objectives set in, among others, the FuelEU Maritime Regulation. The call for proposals’ support will include electricity recharging points (also megawatt ones for heavy-duty e-vehicles), hydrogen refuelling stations, and ammonia and methanol port bunkering facilities. There are three cut-off dates for submitting applications: 24 September 2024, 11 June 2025, and 17 December 2025.

Having mentioned TEN-T, the European Parliament and the European Council gave their green light to the revised Regulation that underpins the network. In general, the TEN-T is to become more sustainable, digitalised, and multimodal, as well as to facilitate military mobility. Among many, the new TEN-T will see the deployment of the European Rail Traffic Management System across its entirety (meaning that national legacy class B systems will be phased out), the set-up of new freight terminals (able to accommodate 740-metrelong trains), the creation of the European maritime space (translating into infrastructure and service development, likewise better alignment with other transport modes), and the establishment of

European Transport Corridors with non-EU European countries: EU’s six Balkan partners as well as Moldova and Ukraine. The TEN-T Core Network is to be ready in 2030, its extended version ten years later, and the Comprehensive Network by mid-century. “The TEN-T is a key instrument of the EU’s transport policy with a huge contribution to our sustainable mobility objectives, as well as to economic, social, and territorial cohesion. The adoption of the revised Regulation is a milestone towards a sustainable and resilient transport network in Europe, which should address the mobility concerns of our citizens and businesses for the years to come,” underscored Georges Gilkinet, Belgian Deputy Prime Minister and the country’s Minister of Mobility.

Regarding the bloc’s ties with Ukraine, Ukrainian Railways (UZ) have announced an investment portfolio of €85.9 million, of which €42.9m will come from EU’s Connecting Europe Facility, to develop the country’s westwards standard 1,435 mm rail network. Specifically, the funds will be channelled towards Lviv’s connections with Chop (going further to Slovakia and Hungary) and Vadul-Siret (Romania); the electrification of Uzhhorod’s rail link with Chop; and the design of an electrified track between

Uzhhorod and the Slovakian Maťovské Vojkovce. Funds will also go into assessing the technical specification for interoperability of the mentioned lines as well as two others en route to Poland: Kovel-Yahodyn-Dorohusk and Lviv-Medyka. Yevhen Lyashchenko, Chairperson of UZ’s Board, commented, “Ukraine continues its European integration path and has systemic support from the EU. Thus, for the second year in a row, CEF is allocating funds for the implementation of strategic infrastructure projects.”