Austin Tenpenny President aDoor Properties

Josh Rayls Secretary Holiday Builders

Wilma Shortall Past 2nd Vice President The First Bank

Heath Kelly 1st Vice President

Heath Kelly Construction

Kevin Sluder 2rd Vice President Gene’s Floor Covering

Dax Campbell Immediate Past-President CamCon

Shon Owens Tresurer Owens Custom Homes

Janson Thomas 3rd Vice President Swift Supply

Josh Peden Financial Officer Hudson, Peden & Associates

2025 Home Builders

Association of West Florida Board of Directors

Austin Tenpenny, aDoor Properties, President

Heath Kelly, Heath Kelly Construction, First Vice President / President-Elect

Shon Owens, Owens Custom Homes, Treasurer

Josh Rayls, Holiday Builders, Secretary

Kevin Sluder, Gene’s Floor Covering, 2rd Vice President

Janson Thomas, Swift Supply, 3rd Vice President

Wilma Shortall, The First Bank, Past 2nd Vice President

Dax Campbell, CamCon, Immediate Past-President

Josh Peden, Hudson, Peden & Associates, Financial Officer

Stephen Moorhead, Moorhead Law Group, Legal Counsel

Bill Batting, REW Materials

Keith Branch, Good Foundations, Cost and Codes Chair

Rick Byars, Florida Power & Light

Mickey Clinard, Renasant Mortgage

Laura Gilmore, Fairway Ind. Mortgage, Affordable Housing Liaison

Chris Graye, Graye’s Granite

Thomas Hammond, Hammond Engineering, Civil Engineering Liaison

John Hattaway, Hattaway Home Design

Lindy Hurd, First International Title, Sales & Marketing Committee Chair

Shellie Isakson-Smith, SWBC

Mary Jordan, Gulf Coast Insurance, Tradesmen/Workforce Development

Committee Chair

Daniel Monie, KJM Land Surveying

Alex Niedermayer, Underwood Anderson & Associates

Zach Noel, Clear Title of NW FL

Suzanne Pollard-Spann, Legacy Insurance Brokers, Ambassadors Committee Chair

Marty Rich, University Lending Group

John Scanlon, Pensacola Energy

Pam Smith, Real Estate Counselors, Pensacola Assn. of Realtors Liaison

Chris Thomas, Acentria Insurance

BUILDER DIRECTORS

Joel Coleman, P.E., Lennar

Chad Edgar, Joe-Brad Construction

Amir Fooladi, ParsCo, Jessica Ford, FD Builds

Fred Gunther, Gunther Properties

Drew Hardgrave, Landshark Homes

Thomas Henry, Thomas Homes

Alton Lister, Lister Builders, Governmental Affairs Committee Chair

Kyle McGee, Sunchase Construction

Jennifer Reese, Reese Construction Services

Douglas Russell, R-Squared Construction

Anton Zaynakov, Grand Builders

EX-OFFICIO / PAST PRESIDENT BOARD MEMBERS

Edwin Henry, Henry Company Homes

Shelby Johnson, Johnson Construction, Remodeler’s Council Chair

Russ Parris, Parris Construction Company

Executive Director jennifer@hbawf.com

Publisher Malcolm Ballinger malcolm@ballingerpublishing.com

Executive Editor Kelly Oden kelly@ballingerpublishing.com

Art Director Ian Lett ian@ballingerpublishing.com

Graphic Designer/Ad Coordinator Ryan Dugger advertise@ballingerpublishing.com

Editor Morgan Cole morgan@ballingerpublishing.com

Assistant Editor Nicole Willis nicole@ballingerpublishing.com

Sales & Marketing

Paula Rode, Account Executive paula@ballingerpublishing.com

Geneva Strange, Account Executive geneva@ballingerpublishing.com

Regina Barkley, Account Executive regina@ballingerpublishing.com

Cornerstone, the monthly publication of the Home Builders Association of West Florida serving Escambia and Santa Rosa Counties, is published monthly, twelve (12x) per year. Send address changes to HBA of West Florida, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910. Cornerstone, is published in the interests of all segments of the home building industry and is distributed to its members and others associated with the HBA of West Florida. HBA of West Florida and Ballinger Publishing does not accept responsibility for, or endorse any statement or claims made by advertisers or authors of any articles. Every effort has been made to assure ac-curacy of information, but authenticity cannot be guaranteed. No part of this publication may be reproduced without the written consent of Home Builders Association of West Florida, Copyright ©, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910, 850.476.0318. Advertisers and advertorials in Cornerstone do not constitute an offer for sale in states where prohibited by law.

Austin Tenpenny President aDoor Properties

Mid-Year Momentum: Where We Stand and Where We’re Headed Dear Members,

As we reach the midpoint of 2025, it’s clear—we’re building more than homes. We’re building momentum.

This year’s Florida Home Builders Association (FHBA) legislative session was one of the most unpredictable in decades, but the outcome proves that focused advocacy and unified voices still carry tremendous weight in Tallahassee.

I’m proud to report that several of our industry’s top priorities were signed into law by Governor DeSantis— landmark wins that will help us build and develop smarter, faster, and with greater confidence. These victories didn’t come easy, but they reflect what’s possible when the home building industry stands together.

We owe a tremendous thank you to the Florida Home Builders Association (FHBA) for leading the charge at the Capitol. Their Governmental Affairs team and Lobbyist worked tirelessly—day in and day out—through chaotic committee weeks and late-night negotiations to ensure our industry’s priorities remained front and center.

The following FHBA priority issues were signed into law:

Impact Fee Reform (SB 1080 / HB 579)

Creates safeguards against sudden, unaffordable fee hikes by requiring unanimous votes and phased implementation—helping protect affordability and transparency.

Mitigation Banking Access (SB 492 / HB 1175)

Provides much-needed flexibility by allowing developers to access mitigation credits from adjacent service areas when none are available locally.

Platting Process Streamlining (SB 784 / HB 381)

Modernizes and accelerates platting timelines, removing one of the most frustrating delays in the local development process.

Emergency Recovery Provisions (SB 180 / HB 1535)

Expedites post-disaster rebuilding and waives impact fees for replacement homes that don’t increase infrastructure demand.

Live Local Expansion (SB 1730 / HB 943)

Strengthens affordable housing initiatives by opening up new land use opportunities and eliminating local moratoriums on qualified multifamily projects.

Construction Process Improvements (HB 683 / SB 712)

Standardizes regulations on synthetic turf, empowers private inspections, and speeds up approvals for changes in construction— cutting red tape across the board.

Energy Choice Protection (HB 1137 / SB 1002)

Prohibits local governments and utilities from charging access fees based on energy source—protecting builders and future homeowners from unnecessary cost burdens.

Where We’re Headed

These wins are proof of what we can achieve when we work together—builders, trades, developers, and advocates aligned for a common purpose. Now, as implementation begins, we’ll shift our focus to monitoring how these new laws are rolled out at the local level.

I encourage every member to stay engaged and involved. Whether you’re serving on a committee, mentoring young professionals, or speaking at a local commission meeting—your influence matters.

And remember: when you’re a member of the HBA of West Florida, you’re not just part of a local organization—you’re getting three memberships in one. You have the strength of your local HBA, the statewide advocacy of the Florida Home Builders Association, and the national support and resources of the National Association of Home Builders (NAHB). That’s a powerful network, working for you every day.

Let’s keep the momentum going.

Sincerely,

Austin Tenpenny President, Home Builders Association of West Florida

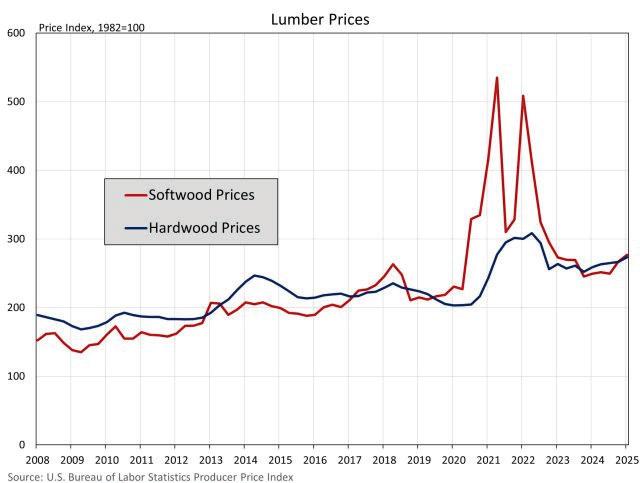

Lumber cost uncertainty has risen from the start of the year, driven in part by potential higher tariffs, particularly on Canadian softwood lumber. Despite the continued use and threat of tariffs, U.S. sawmill and wood preservation firms have not increased production to a level that replaces imports. In fact, utilization rates continue to fall, meaning they have the capacity to produce more lumber but are simply not operating at that level.

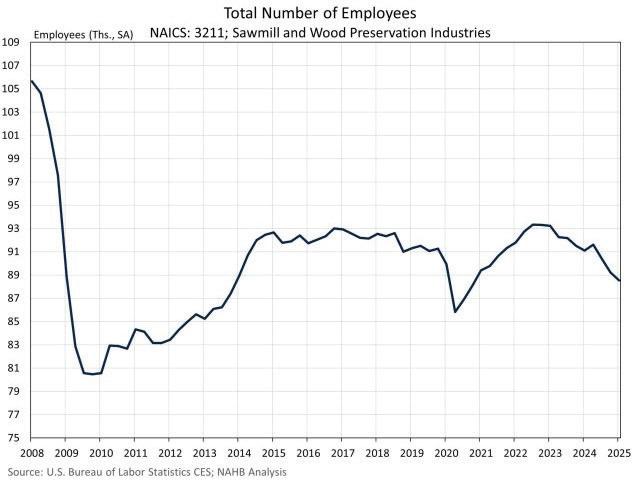

As these firms produce at lower levels, their employment has fallen over the past few quarters. At the same time, reduced foreign competition and artificially higher prices have lessened the incentive for firms to expand output, even as demand remains high. As a result, U.S. mills remain unable to meet the nation’s full lumber consumption needs.

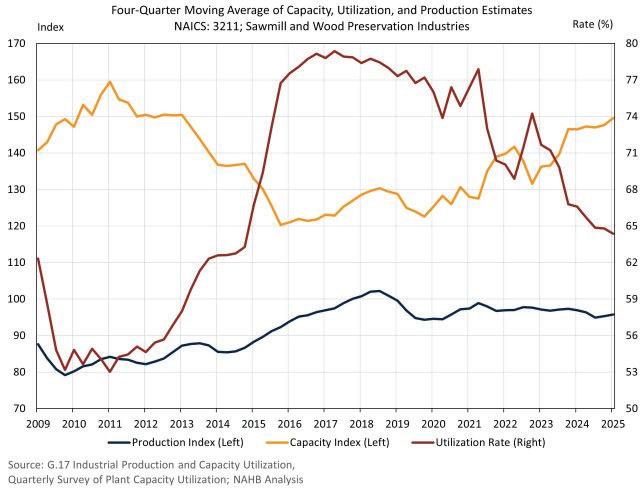

In the first quarter of 2025, sawmill and wood preservation firms continued to report lower capacity utilization coupled with stagnant production. The utilization rate, a ratio of actual production and potential production, was 64.4% in the first quarter on a four-quarter moving average basis. The utilization rate has continued to drop since 2017, as capacity (or the capability to produce) has increased, but production has remained lower than in 2018.

By combining the Federal Reserve’s production index and the Census Bureau’s utilization rate, we can compose a rough index estimate of what the current production capacity is for U.S. sawmills and wood preservation firms. Shown below is a quarterly estimate of the calculated production capacity index with production index and utilization rate estimates.

Based on the data above, sawmill capacity has increased from 2015 but remains lower than peak levels in 2011. Most of the recent capacity gains took place in 2023, followed by little gain over the course of 2024. As evident above, there is ample room to increase production of domestic lumber, but current production levels remain much unchanged over the past several years. Looking at the Producer Price Index, lumber prices remain higher than 2024. At current pricing levels, producers may see no benefit of increasing output, as it would push prices lower since demand has fallen from the start of the year. Notably, even when prices were historically high in 2021 and 2022, producers were unable to increase their production significantly during these periods, potentially due to supply chain disruptions.

Employment at sawmills and wood preservations firms fell again in the first quarter to 88,533 workers. This marks the third consecutive quarter where employment fell in this industry. Tariff policies to protect the U.S. lumber industry have been in place since 2017 in the form of antidumping/countervailing duties. Tariff policies are typically intended to provide stability to the industry and increase employment but here, we are seeing the opposite effect.

These policies specifically place duties on imports of Canadian softwood lumber, where nearly a quarter of the U.S. softwood lumber supply originates. The current AD/CVD rates on Canadian softwood lumber are expected to double this fall to over 30%. Due to U.S. lumber production remaining level since the initial tariff policies were enacted in 2017, doubling these duty costs will likely not increase supply but simply increase costs.

at flsenate.gov/session/bill/2025/683/ billtext/er/pdf.

In a further sign of declining builder sentiment, the use of price incentives increased sharply in June as the housing market continues to soften.

Builder confidence in the market for newly built single-family homes was 32 in June, down two points from May, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. The index has only posted a lower reading twice since 2012 – in December 2022 when it hit 31 and in April 2020 at the start of the pandemic when it plunged more than 40 points to 30.

“Buyers are increasingly moving to the sidelines due to elevated mortgage rates and tariff and economic uncertainty,” said NAHB Chairman Buddy Hughes, a home builder and developer from Lexington, N.C. “To help address affordability concerns and bring hesitant buyers off the fence, a growing number of builders are moving to cut prices.”

Indeed, the latest HMI survey also revealed that 37% of builders reported cutting prices in June, the highest percentage since NAHB began tracking this figure on a monthly basis in 2022. This compares with 34% of builders who reported cutting prices in May and 29% in April. Meanwhile, the average price reduction was 5% in June, the same as it’s been every month since last November. The use of sales incentives was 62% in June, up one percentage point from May.

“Rising inventory levels and prospective home buyers who are on hold waiting for affordability conditions to improve are resulting in weakening price growth in most markets and generating price declines for resales in a growing number of markets,” said NAHB Chief Economist Robert Dietz. “Given current market conditions, NAHB is forecasting a decline in singlefamily starts for 2025.”

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers

as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three of the major HMI indices posted losses in June. The HMI index gauging current sales conditions fell two points in June to a level of 35, the component measuring sales expectations in the next six months dropped two points lower to 40 while the gauge charting traffic of prospective buyers posted a two-point decline to 21, the lowest reading since November 2023.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 43, the Midwest moved one point higher to 41, the South dropped three points to 33 and the West declined four points to 28.

HMI tables can be found at nahb.org/hmi.

On the latest episode of NAHB’s podcast, Housing Developments, sponsored by LG Pro Builder, COO Paul Lopez welcomed NAHB Chief Economist Dr. Robert Dietz and Chief Advocacy Officer Ken Wingert for a mid-year check-in on key economic indicators and NAHB policy priorities driving home building for the rest of 2025.

With NAHB CEO Jim Tobin on travel, Lopez covered a lot of ground with the two experts.

The three discussed NAHB’s recent Legislative Conference, which saw some 1,000 NAHB members come to Washington to meet with their members of Congress. This year, Wingert noted that the key messages delivered by members were hitting a receptive audience.

“Everyone recognizes we need to build more houses,” said Wingert.

The group also talked about the recent Housing Market Index (HMI) reading. Dr. Robert Dietz noted that the combination of builder uncertainty and consumer reticence to buy with interest rates so high has led to falling home builder confidence.

“Builders are telling us it’s tough to price homes because of the uncertainty due to cost factors and availability of labor,” noted Dietz.

But Dietz noted that the foundation of the economy is still solid and his team is forecasting only a 30% chance of a recession in 2025.

Listen to Housing Developments on any podcast provider or watch below for more, including some interesting answers to, “What keeps you up at night?” Be sure to check out the podcast archives on YouTube for past episodes.

In construction, a spike is a steel object that is essential to making a building strong. As in construction, the HBA of West Florida sees a Spike as someone that works to keep our association strong. Spikes work on the recruitment and retention of members in addition to keeping members active with the association. Anyone is eligible for Spike status. On Spike credit is awarded for each new member recruited and an additional credit is awarded for that new member’s renewal on or before their anniversary date. If you help to retain a member, you are eligible to receive a half point for each member.

Spike Candidate 1-5 Credits

Blue Spike 6-24

Life Spike 25-49

Green Spike 50-99

Red Spike 100-149

Royal Spike 150-249

Super Spike 250-499

Statesman Spike 500-999

Grand Spike 1000-1499

All-Time Big Spike 1500+ Spike Club Members and their credits as of 03/31/2025.

Statesman Spike

Harold Logan

Super Spike

Rod Hurston

Royal Spike

Rick Sprague

Edwin Henry

William “Billy” Moore

Bob Boccanfuso

Charlie Rotenberry

Red Spike

Oliver

Newman Rodgers IV

Green Spike

Spike Credits

Shelby

Stud-to-plate connectors

Thr eaded rod systems