The Bahamas: A World Contender

How first-class regulatory innovation can be crucial to a jurisdiction

Tokenization: The Future of Entrepreneurial Finance Fund Administration & The Impact of the Pandemic

The Bahamas: A World Contender

How first-class regulatory innovation can be crucial to a jurisdiction

Tokenization: The Future of Entrepreneurial Finance Fund Administration & The Impact of the Pandemic

The Bahamas has always sought to provide superior financial products and services and a world class client experience in a well regulated environment. It has proven itself to be nimble and responsive to global changes – always mindful of the need to adhere to international standards.

This is complemented by the fact that the Bahamas is not only somewhere that offers bespoke private wealth management, but it is also a beautiful location to call home.

The Bahamas: A World Contender 02

Wendy Warren Partner, Founder & Managing Member Caystone Solutions

How first-class regulatory innovation can be crucial to a jurisdiction 08

Christina Rolle, Executive Director Securities Commission of The Bahamas

Achieving Technical Effectiveness at FATF Standards 14

Cassandra Nottage, National Identified Risk Framework Coordinator Office of the Attorney General Estate Planning: a Source of Certainty in Uncertain Times 15

Sharmon Ingraham, Partner, Higgs & Johnson

Currency Evolves in The Bahamas 22

Alexander M. B. Christie Partner & Associate at McKinney, Bancroft & Hughes

Vanessa M. R. Hall Partner & Associate at McKinney, Bancroft & Hughes

Fund Administration and The Impact of the Pandemic 27

Antoine Bastian Executive Chairman and CEO of Genesis Fund Services Limited

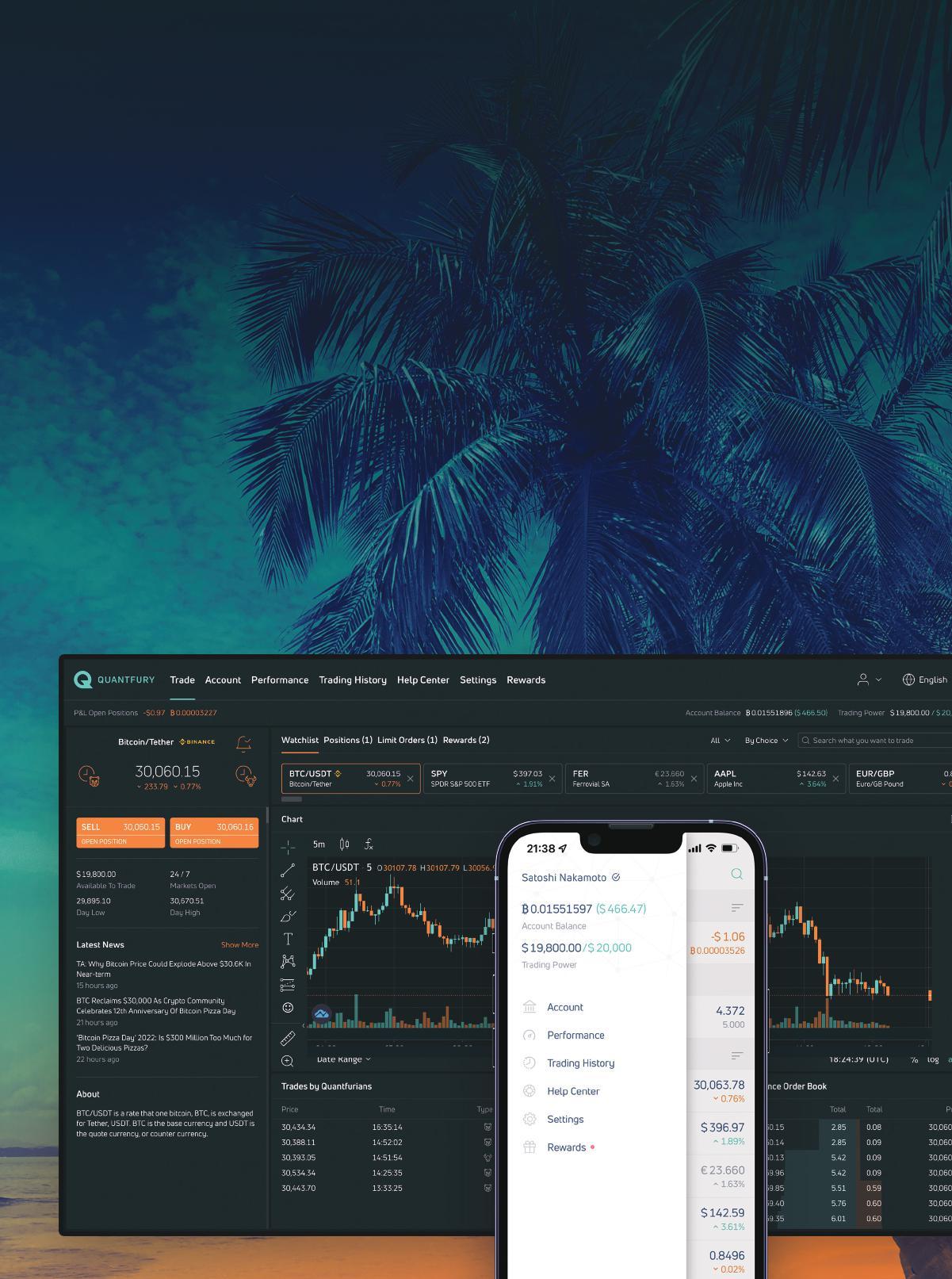

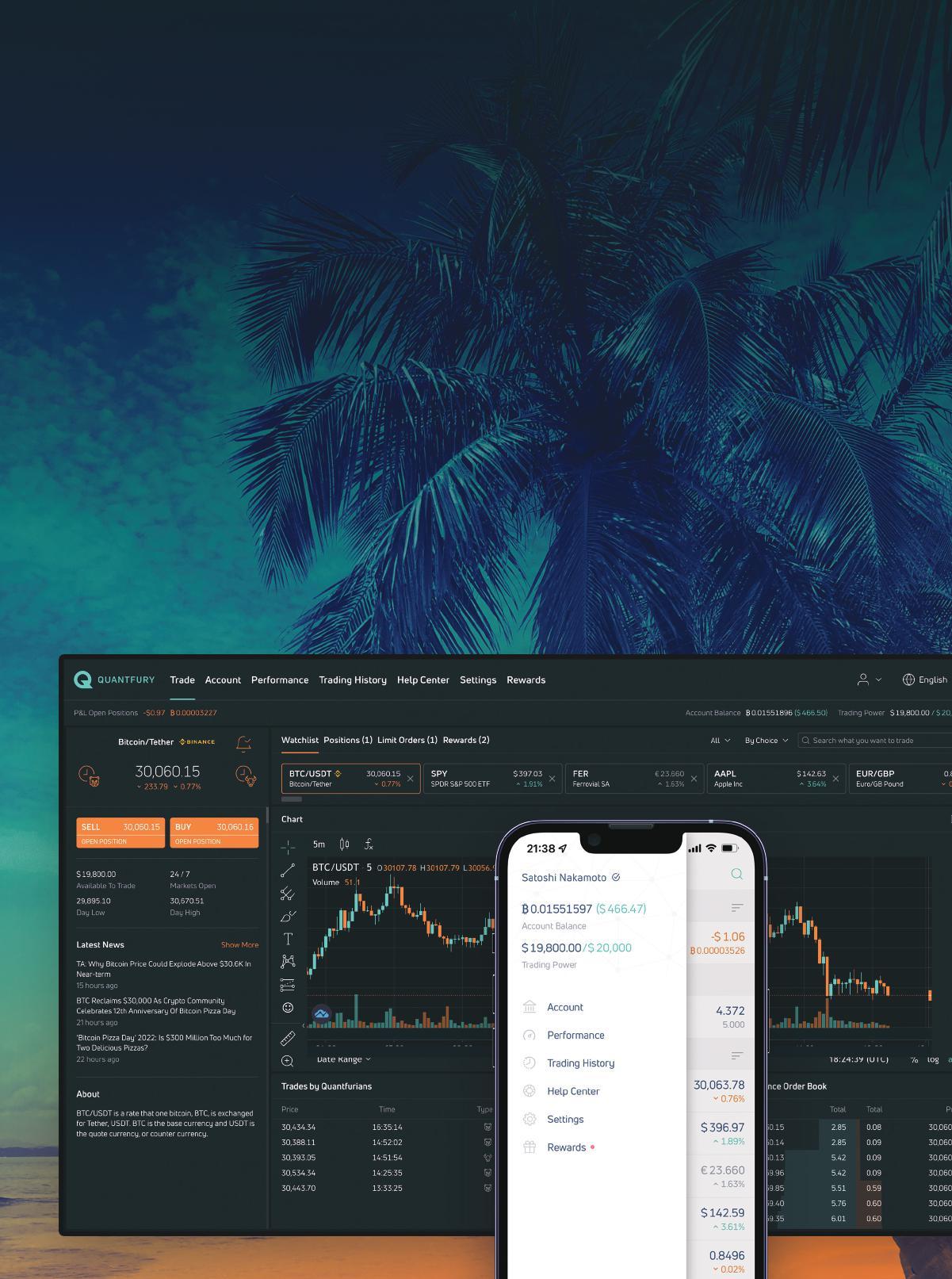

Tokenization: The Future of Entrepreneurial Finance 32 Dr. Iyandra Bryan, General Manager, Quantfury Trading Limited

As we turn the page on the challenges of the past few years , we do so with the confidence that 2023 will continue to see The Bahamas move ahead in building on its reputation as a world-class financial centre. This confidence is based on the knowledge that whatever lies ahead we possess the expertise and innovative spirit to be responsive to the institutions and clients who look to The Bahamas for bespoke financial services solutions.

This issue of Gateway explores the many dimensions of the depth of offerings s and why The Bahamas is a world contender and the clear choice for international financial services. It explores how a commitment to balancing innovation with compliance to international standards underpins all that we do. Commentary on entrepreneurial finance and the evolution of digital currency are included in this issue as well as perspectives on investments and estate planning in today’s uncertain times and the impact of the pandemic on fund administration. And with our sights fixed on the LATAM region, we focus in on what’s ahead for Mexico in particular.

The pathway for international financial services will always be lined with new hurdles . With this issue of Gateway, we have presented how The Bahamas is fearlessly confronting these challenges to ensure that it remains the complete and compelling choice for financial services.

BFSB and its member firms would like to take this opportunity to thank its many business partners and colleagues globally for your continued support. You can be assured that we will work hard, relentlessly, and responsively to retain your support.

By Wendy Warren

By Wendy Warren

By any standards international financial centres such as The Bahamas have faced unprecedented challenges over the past several years and in even in most recent months. The ongoing COVID-19 pandemic, recent economic turbulence and never-ending scrutiny by international bodies have intensified the business and competitive environment confronting global financial centres.

Yet despite these conditions and the associated pressures, The Bahamas continues to be among the world contenders for international financial services. This kind of resilience is a hallmark of the financial services sector in The Bahamas. No matter the state of the economy, no matter what changes are occurring in the financial services and regulatory landscape, The Bahamas has always maintained its status as a global leader by being able to adapt to the new normal.

Three factors contribute to The Bahamas hardened resilience and ability to compete successfully on the global stage: true to its roots and pedigree; adopting the highest standards for compliance, innovation and client centric responsiveness; and focusing and embracing developments emerging in the New Economy.

This trifold formula has been paramount in the Bahamas’ ability

to attract and welcome international families, capital and business to its shores. In fact, the demand for residences and talent that The Bahamas offers, which is being embraced by family offices and those seeking wealth management services, underscores why the Bahamas location, regulatory environment and forward looking legislation are gaining strength and acceptance as core compelling attributes of the jurisdiction.

The Bahamas is home to over 270 licensed banks and trust companies, including seven of the world’s top eight private banks and 35 of the top 100 global banks. These financial institutions deliver a range of services including private banking, trusts, fund administration, accounting, legal e-commerce, insurance, corporate and maritime services. North American banks have been doing business in The Bahamas for more than a century, and European and Swiss banks have deep roots established over more than 70 years. Financial institutions from other regions with growing economies are recognizing the advantages of operating in The Bahamas. Additionally, there is an excess of 800 funds that are licensed in The Bahamas and more than 60 fund administrators.

With an 80 plus year track record in financial services, few jurisdictions offer the wealth management experience that exists in The Bahamas. This heritage is the basis for the strong legal framework that has been cultivated for financial services, an investment climate that has been nurtured over the decades and a stable and predictable business environment anchored by the thousands of Bahamian professionals who work side by side with expatriate colleagues in the many hundreds of service providers that call The Bahamas their home.

There is a sound and proven infrastructure in place that has been built and modernized over the last 20 years. This has facilitated a highly competitive and market responsive financial service offerings and at the same time allowed The Bahamas to move forward in a very confident fashion into the new economy and the various elements of these new economies.

One of the key elements of the Bahamas infrastructure is a

very strong public-private partnership where communication is open and frank among all three participants that are involved with this agenda: government, regulator and private sector. This public-private partnership facilitates our engagement in creating and investing in our wealth management pedigree and areas of new economies such as digital assets, carbon credits, and ESG relevant solutions.

The Bahamas, as a financial center post 2000, had to become far more conscious of and proactive in reflecting global norms. As a result, our regulatory foundation has become strong. From a global connectivity perspective, we see this transition paying dividends today in light of what we endured in the past two decades. It has been a dynamic period in that we have had to be fearless in striking the right balance between being compliant and aggressive. If we perceive there is a need to tweak, we will tweak, but we will not stand still, we will always be responsive and reflect the needs of our clients and our partners.

Foundations are a prime example of this fearlessness. When The Bahamas made certain changes to facilitate the introduction of Foundations, we received significant pushback. Some people said, “Wait a minute - Foundations, are these not tools for inappropriate behavior?” But we were very confident that our regime was sufficiently strong to provide a robust, well-regulated environment in which foundations can be utilized in an appropriate manner. So, the perception of Foundations might have been negative elsewhere, but when we look some ten years later, other common law jurisdictions have followed suit.

While 2020 and 2021 have been unprecedented years for many industries, for local financial and corporate service providers in The Bahamas, this period brought in a host of new and amended regulations which carry the potential to transform the very landscape of the industry.

The Financial and Corporate Service Providers Act, 2020 enhances the legal and regulatory framework for those providing corporate and administrative services. Meanwhile, the new Banks and Trust Companies Regulations Act, 2020 consolidates and modernises the law regulating local banks

and trust companies to enhance governing powers for The Central Bank of The Bahamas. The introduction of the new Investment Funds Act, 2019 which further enhances the regulatory framework of Bahamas investment funds allows for the appointment of international fund administrators, and generally rationalises the responsibilities of all the key parties

From a level playing field perspective, within the past few years, The Bahamas has passed a compendium of legislation to meet international standards regarding economic substance, removal of preferential exemptions, and automatic exchange of tax information to meet the EU and OECD’s criteria on tax matters which resulted in the European Union removing The Bahamas from its list of uncooperative jurisdictions for tax purposes in March 2020. In addition, The Bahamas maintains the highest standards in the fight against money laundering, terrorist financing and other identified risks and therefore has been making significant strides in the fight against financial crime.

The anti-money laundering, counter financing of terrorism and counterproliferation legislative, regulatory and enforcement landscapes have been thoroughly reviewed and strengthened with The Bahamas being deemed compliant or largely compliant with 38 out of 40 standards established by the Financial Action Task Force.

The Office of The Bahamas Attorney General will be submitting a re-rating of the final 2 of the 40 Recommendations to the CFATF – one addressing Not for Profits, and another addressing the effective regulation and supervision/monitoring of virtual asset services providers, working with the Securities Commission of The Bahamas on the latter. The intent of these latest changes is to ensure compliance with all 40 of the FATF Recommendations.

All of these efforts aid in enhancing the risk profile of The Bahamas as an international financial centre, making it an attractive jurisdiction for financial services.

Despite the recent turmoil in the crypto market, The Bahamas remains bullish on the mid to long term prospects for digital assets. It was one of the first countries in the world to

introduce a digital currency in the form of the Bahamian Sand Dollar. And the recently introduced Digital Assets and Regulatory Exchange Act (DARE) was developed with the view of how we approach the wider picture. DARE is not a stand- alone single solution but rather the broad features of the jurisdiction such as private banking and funds coming together to recognize why it and a broader based Fintech capability is required. It is just the latest example of the strength and flexibility of the jurisdiction -- the weaving together of elements to create a financial services fabric that is durable and responsive.

The emergence of The Bahamas as a digital assets hub has resulted in companies such as FTX establishing their global headquarters in Nassau as well as a strong interest in Bahamian corporate vehicles to house the operations of digital asset businesses.

At the same time emerging developments in this space has meant The Bahamas, in being true to its market responsiveness DNA, is keeping pace with changes that are required to be a world contender as a hub for digital assets. The capital markets regulator --the Securities Commission of The Bahamas -- is spearheading a raft of initiatives to advance this transformation, including Amendments to the Digital Assets and Registered Exchanges Act (DARE) to address key developments since its promulgation.

The new Bahamian economy however is much more than digital asset leadership and companies being incorporated into the wide range of financial service providers in the country. The sector’s sustainability has implications for the broader economy. The diversity within the financial services sector in terms of product offerings contributes in a meaningful way to the livelihood of the Bahamian people and the country’s economy. This contribution will become more pronounced as the country pivots to invest in diversification with a focus on the “blue and orange” economies, which have been identified as pathways for greater economic expansion, new business opportunities and wealth creation for Bahamians and international investors alike.

The Bahamas is looking to modernise its fishing industry, generating ocean sciences and marine conservation opportunities while sustainably developing marine biotechnology, aquaculture, and deep-sea exploration initiatives. Renewable energy industries are also on the horizon. Meanwhile, as a vital component of the Bahamian economy, the tourism sector is looking to design a new tourism model which fully integrates culture and the creative industry in The Bahamas.

Both tourism and financial services are actively supporting these initiatives both domestically and internationally. This foreshadows deploying the linkages when the country’s traditional economic engines engage the country’s New Economy with benefits accruing to both.

Founder and Managing Member of Caystone Solutions (“Caystone”).

Prior to establishing Caystone in January 2012, Wendy served for 11 years as CEO and Executive Director of the Bahamas Financial Services Board (“BFSB”). BFSB works with The Bahamas government, regulators and private industry to ensure The Bahamas provides global clients with best in class financial services.

Beginning her professional career in 1988, Wendy has worked in a variety of roles in the fund administration, wealth management and audit fields. She has served on various boards and committees including Bahamasair Holdings, Bahamas Electricity Corporation, Bahamas Trade Commission, the Financial Services Consultative Forum and the Bahamas Association of Mutual Fund Administrators. Wendy is also a Chartered Accountant and holds a Bachelors Degree in Accounting from the University of Waterloo, Canada.

Governance Services including Directorship & Protectorship.

Oversight & Execution of Payments.

Settlement of Fund Subscriptions & Redemptions.

Tax Information Reporting/Reporting Officer Services.

Escrow Services.

Accounting Services for Investment Funds.

Investor Relations with Registrar and Transfer Agent Services.

Regulatory & Special Reporting. Audit Coordination.

Accounting Services for Investment Funds, Fiduciary Structures, Private Companies, Operating Entities & Audit Coordination.

Establish Companies, Foundations, Executive Entities & ICONs.

Full Administration & Registered Agent & Office Services.

Business Application Coordination. Residence & Work Permit Coordination.

Business & Residential Concierge Services. Bill Payments.

Establish Private Trust Companies. Registered Representative services.

Regulatory Application Coordination. Compliance Officer & MLRO Services.

Oversight of Ongoing Regulatory Compliance.

and logistical concerns, so they can focus on value generation & growth.

By Christina R. Rolle

By Christina R. Rolle

The Bahamas is a swiftly evolving environment for securities and investments and the regulatory body in charge of the process has used its imagination to modernise the rules. Its watchword is pragmatism.

The Digital Assets and Registered Exchanges Act 2020 –otherwise known as the DARE Act – and the Investment Funds Act – or IFA 2019 – have gained international acclaim for their innovative, pragmatic responses to vexing regulatory concerns. Legislative initiatives are opportunities to solve problems but they are also opportunities to innovate. At the Securities Commission of The Bahamas (SCB), we are deeply committed to coping with regulatory risks pragmatically, taking the view that this will distinguish us from others.

Before 2019, by way of illustration, the legal framework that governed investment funds had not kept pace with international best practices and standards. It had supported The Bahamas’ wealth management industry at the start of the millennium, but a peer review that The Bahamas underwent as part of the International Monetary Funds’ Financial Sector Assessment Programme in 2012 found it to be deficient in several key areas. As for the digital

assets space, despite its growing importance to investors and wealth managers there was no body of law in place to provide much-sought-after legal and regulatory clarity. In both instances, the Commission found itself in a position to use its technical expertise to develop legislation and recommend same to the Government of The Bahamas. We looked at the needs of stakeholders, prioritised those needs and then came up with – and carried out – pragmatic, sustainable, best-in-class solutions.

The IFA 2019 dictates that an investment fund that carries on (or attempts to carry on) business in or from The Bahamas must be licensed as a Standard, Professional, or Specific Mandate Alternative Regulatory Test (SMART) fund. ‘Carrying on business’ in this context now applies to an investment fund that is incorporated in The Bahamas or offered for sale to non-accredited investors in The Bahamas. An investment fund is therefore required to be licensed based on the activity that it conducts or intends to conduct rather than on whether or not certain service providers to the fund are located or licensed in The Bahamas.

The previous investment fund legislation did not provide for the regulation of investment managers and placed burdensome responsibilities on investment fund

administrators for funds licensed in The Bahamas. This may have met the needs of the primary users of investment funds in the early 2000s – private banks and trust companies servicing their clients – but as the funds industry evolved, this misalignment of responsibilities became too onerous for administrators and did not address the lacuna of fiduciary duties which should be the responsibility of the investment manager.

Funds needed flexibility in selecting administrators and non-accredited investors expected to be able to deal with vetted and licensed investment managers. The IFA 2019 brought these things about by arranging for the licensing and supervision of investment managers.

A fund based in The Bahamas is no longer required to appoint an investment fund administrator in The Bahamas to provide its principal office. Investment fund administrators for Bahamian investment funds may be licensed under the Investment Funds Act, or licensed and operating in any prescribed jurisdiction anywhere in the world. This approach opens the door for international administrators to license funds under the Act.

The IFA obliges each fund to appoint an investment fund manager, except in some very specific circumstances. The investment manager must be licensed if the fund is being sold to non-accredited investors but the manager or fund need not be licensed if the fund is being sold to accredited investors only. Importantly, the fund may appoint an investment manager licensed or registered in a prescribed jurisdiction without the need for licensing in The Bahamas. In such a case, there is a simple registration process.

Each investment fund must appoint a custodian that must be independent of its administrator, manager and operator, unless the fund’s operators certify that the fund’s structure or the nature of its assets do not require the appointment

of a custodian. An investment fund’s operators are determined based on its legal structure. Operators are responsible for the operation of the fund in compliance with the IFA. The operator is subject to an assessment of its fitness and propriety and must be independent of the administrator, unless exempted from this requirement, or the fund is structured as an investment condominium.

Finally, the IFA 2019 is also compliant with the European Union’s Alternative Investment Fund Managers Directive, or AIFMD. This allows The Bahamas to qualify for ‘passporting’ in accordance with the Directive. The law grants a distinct licence to a manager that operates in the European Union or manages funds from the EU.

The IFA 2019 also addresses the EU’s standards for investment funds regarding the regulation of auditors. Every fund that does not submit to a full annual audit is required to receive a certificate every three years from a qualified accountant that states that its books are being maintained in line either with International Financial Reporting Standards or the United States’ Generally Accepted Accounting Practices. Auditors must be approved by the Commission if they want to act on behalf of regulated persons.

The SCB’s primary objective in developing the DARE Act was to bring regulatory certainty to the dynamic, fastpaced and evolving crypto-space. The Commission had already spotted the potential that the space represented for The Bahamas’ wealth management industry as the interest of investors in financial technology (fintech) and crypto-assets was increasing globally. The SCB fielded interest from international fintech operators that wanted

to operate in a well-regulated, compliant jurisdiction. The Government of The Bahamas had also made it clear that it intended to transform the jurisdiction into a regional fintech hub.

Given that the digital assets market or crypto-space is still in its infancy (or, in any event, far from mature), it was clear to the Commission that it needed to establish a legislative framework that was not overly prescriptive. The Act allows the jurisdiction to be nimble and able to react to new risk-related trends, or market development opportunities, as the evolving landscape demands.

To develop the legislation, the Commission first conducted a benchmarking exercise of 13 select jurisdictions, concentrating on their approaches to regulation and also on global standards and best practices in the business of digital and virtual assets. It reached out to other regulators with relevant experience and consulted the financial industry and other stakeholders.

The DARE Act came into effect on the 14 December 2020. It provided much-sought-after clarity and successfully established a Bahamian legal and regulatory regime for the registration of digital token exchanges and for the issuance of digital tokens through initial token offerings.

DARE defines salient terms such as digital asset business, digital assets service provider, digital token, non-fungible token, utility token and virtual currency token, among others. It intentionally does not set out to answer the question of whether a digital asset is a security or not. The Act defines various types of digital assets and is clear about what is in scope for regulation. It also recognises digital assets or crypto-currencies as members of their own asset class.

By giving the space its own regulatory regime, The Bahamas has removed the narrow question of whether a crypto-currency is a security and has, instead, provided

a framework whereby digital assets can be addressed holistically.

DARE’s approach to global anti-money-laundering standards and standards that counter the financing of terrorism and the proliferation of weapons of mass destruction (AML/CFT/PF) is vitally important. The Commission continues to concentrate on complying with the Financial Action Task Force’s Recommendation 15, along with its evolving interpretative notes. In keeping with R15’s principles, DARE subjects the digital assets business to the primary national AML/CFT/PF legislation of The Bahamas, which includes the Proceeds of Crime Act 2018, the Anti-Terrorism Act 2019 and the Financial Transactions Reporting Act 2018. In keeping with the FATF’s recommendations, DARE focuses AML/CFT/ PF supervision and oversight on the digital asset service provider rather than on the new technologies themselves.

The term ‘beneficial owner’ in DARE is assigned the same meaning as in The Bahamas’ Proceeds of Crime Act. DARE requires financial institutions to perform initial risk assessments prior to launch. The Act requires digital-asset businesses to have systems in place to prevent and detect money laundering, terrorist financing and suspicious transactions and report the reasons for their suspicion to relevant competent authorities. They must also comply with the Securities Commission’s rules, polices and guidelines that govern risk management and the prevention of money laundering and terrorist financing.

On 16 March 2022, the Commission published its AML/ CFT/PF Rules for DARE. These rules are based on the FATF’s Recommendation 15 and its interpretative notes.

They are supplementary to DARE and are also expected to evolve as the market evolves.

Pragmatism is a key consideration for The Bahamas in its approach to regulation and the jurisdiction continues to watch as trends indicate a move towards securities and other asset classes becoming tokenized. We are also mindful of recent emerging risks that came to the fore in the aftermath of the great bear market or “crypto-winter” of 2017-18. These risks must now be addressed in the regulatory framework and clear best practices must be established to protect investors.

If you know anything about The Bahamas, you know that we do not view our size as a handicap but as something that we can use to our advantage. The access that we, as regulators, have to industry players and regulatory addressees, policy makers and the consumers and investors whom we aim to protect, allows us to identify and act on urgent matters and to be innovative in providing pragmatic solutions to regulatory concerns.

Ms. Christina R. Rolle is the Executive Director of the Securities Commission of The Bahamas, having been appointed effective 26 January 2015.

Ms. Rolle has over 25 years of experience in the financial services industry. Prior to her appointment as Executive Director, Ms. Rolle has acted as Director and Deputy CEO for a prominent international private bank and held various senior managerial positions with local and other international institutions including Head of Trust and Fiduciary, Head of Risk, Compliance and Corporate Governance and Manager of Banking Services.

Ms. Rolle was a member of the FATCA advisory group for the Government of The Bahamas and has served on the Board of Directors of The Bahamas Financial Services Board (2009 – 2012) and the Society of Trust and Estate Practitioners (STEP), Bahamas branch (2003 – 2005).

In March 2020, Ms. Rolle was elected Vice Chair of the Inter American Regional Committee (IARC) of the International Organization of Securities Commissions (IOSCO), for a two-year term. As Vice Chair of IARC, Ms. Rolle is a member of the Board of Directors of IOSCO.

In April 2020, Ms. Rolle was appointed to The Bahamas’ Economic Recovery Committee by Prime Minster the Most Hon. Dr. Hubert Minnis, to make recommendations to the Cabinet on the long-term economic recovery of The Bahamas economy, including job-creation and stimulating small business recovery and development in response to COVID-19.

Ms. Rolle holds an MBA from Kellogg School of Management, Northwestern University and is an alumni of Harvard Business School.

Christina R. Rolle Executive Director Securities Commission of The Bahamas

BAHAMAS GATEWAY

Ms. Rolle holds an MBA from Kellogg School of Management, Northwestern University and is an alumni of Harvard Business School.

Christina R. Rolle Executive Director Securities Commission of The Bahamas

BAHAMAS GATEWAY

In December 2015, The Caribbean Financial Action Task Force (CFATF) conducted a mutual evaluation of The Bahamas’ technical and effectiveness compliance with the Financial Action Task Force (FATF) 40 Recommendations. The MER of The Bahamas was published in July 2017. The Bahamas was rated as “Compliant or Largely Compliant” with 18 FATF Recommendations, “Partially Compliant” with 21 FATF Recommendations and “Non-Compliant” with 1 FATF Recommendation. Accordingly, the country satisfied the criteria for being placed into the ‘CFATF Enhanced Followup Process’ and the ‘FATF International Cooperation Review Group Process’.

Over the last five years, there have been tremendous efforts made to address all concerns of the CFATF and the FATF regarding The Bahamas’ anti-money laundering, counter financing of terrorism and counter proliferation (AML/CFT/ CFP) framework. Accordingly, the legislative, regulatory and enforcement landscapes have been thoroughly reviewed and strengthened. The Bahamas’ commitment to maintaining highest level of best practices and standards in AML/CFT/ CFP is an ongoing focus.

By Cassandra Nottage

By Cassandra Nottage

Within 10 months after the publication of its CFATF MER in July 2017, The Bahamas had readied itself for re-rating of technical compliance with the FATF Recommendations, through remediation of the most pressing issues and deficiencies identified by the CFATF. Based on the incredible amount of work completed by the members of the Identified Risk Framework Steering Committee, The Bahamas applied to CFATF for a re-rating of its technical compliance with 21 FATF Recommendations in May 2018. The Bahamas, at the CFATF November 2018 Plenary and meetings, was successful in obtaining 13 upgraded ratings of ‘Compliant or Largely Compliant’ in 12 FATF Recommendations and a ‘Partially Compliant’ for the 1 ‘Non-Compliant’ Recommendation of the 2017 Mutual Evaluation. The country became the first CFATF Member country to achieve such a feat in such a short period of time with The Bahamas achieving an overall position of Compliant and Largely Compliant ratings in 30 of the 40 FATF Recommendations and 10 Partially Compliant ratings – placing the country firmly on par with the top FATF member states (i.e., USA, Switzerland, Ireland, etc.).

Not willing to rest on our laurels, during 2019 and into 2020, at the height of the COVID19 pandemic, the government with the regulatory and law enforcement agencies continued to work on dual tracks addressing the FATF agreed Action Plan for the removal of the country from the FATF Grey List and the technical gaps regarding the remaining 10 FATF Recommendations. In February 2020, following the country’s submission of its fourth progress report with supporting documentation in December 2019 to the FATF ICRG for desktop review, the FATF deemed that The Bahamas had made sustainable progress towards addressing the ‘Action Plan’ items and approved an onsite visit review to the country to verify the actions taken. The agreed date for the onsite review was the week of the 28th of April 2020. The visit, however, was rescheduled for November 2020 due to COVID19 restrictions. The onsite review was successful with over 100 persons being involved in the discussions or preparation of same.

The Bahamas, while preparing to receive the FATF onsite team, was working on its re-rating application to CFATF. Accordingly, in May 2020 the country was able to make such an application for the re-rating of the FATF 10 Recommendations. In November 2020 at the CFATF Plenary, the country was successful in obtaining re-ratings of compliant and largely compliant scores in 9 of the 10 Recommendations. However, due to FATF revisions to Recommendation 15 (the addition of requirements for Virtual Assets), the country was downgraded in its compliance from largely compliant to partially compliant for this recommendation. Overall, The Bahamas achieved the second-best record of 38 compliant and largely compliant scores amongst the CFATF membership. Partially compliant ratings were recorded for Recommendations 8 (NPOs) and 15 (New Technologies inclusive of VASPs).

To end the year off with a bang, in December 2020, the FATF delisted the country from its Grey List. The added freed resources released from focus on the FATF Greylisting, allowed for the government to concentrate on a more aggressive push for the delisting from the EU AML Blacklist which the country had been placed on in October 2020. The Bahamas had been considered for this Blacklisting due to its

placement on the FATF Grey-list. While the IRF Steering Committee members worked tirelessly on completing the remediation of the last remaining technical deficiencies for FATF Recommendations 8 & 15, the Office of the Attorney General’s team (Attorney General, National Identified Risk Framework Coordinator and the International Cooperation Legal Unit) focused on engagement with the EU with countless zoom meetings and discussions with EU membership and EU DG FISMA (EU committee responsible for evaluating the AML/CFT/CFP regimes) on Bahamas’ evaluation report and international cooperation. The intense engagement with EU partners and DG FISMA led to the country being delisted on the 7 January 2022 from the EU AML Blacklist. Significant manpower and resources were expended to address the CFATF, FATF and EU identified deficiencies in our AML/ CFT/CFP regime.

Our remaining focus for the 2021 /2022 years has been to complete the work required to apply for the re-rating of the FATF Recommendation 8 and 15 and the National AML/ CFT/CFP Risk Assessment. We have applied in May 2022 to CFATF for the re-rating of the two Recommendations and is about 90% completed with the National Risk Assessment with an expected completion date of November 2022. We are now awaiting the outcome of the CFATF re-rating application, and we are hopeful we will obtain re-rating scores of Compliant or Largely Compliant for the FATF Recommendations 8 and 15. Should we be awarded such ratings, The Bahamas will become one of two jurisdictions in CFATF and one of six jurisdictions in the FATF Global Network to achieve 40 out of 40 Compliant and /or Largely Compliant technical ratings for the FATF 40 Recommendations.

We will continue to lean forward in our efforts to stay abreast of international standards and best practices. Further, we pledge to work closely with our industry partners forging a path ahead for the country’s second economic pillar – Financial Services. It has been a long five years to get to this point. Hard work, perspiration, persistence and consistent efforts by government, regulatory and law enforcement agencies and private industry stakeholders have made this successful story possible.

Dr. Cassandra Nottage was appointed to the post of the National Identified Risk Framework Coordinator (NIRFC) effective August 14, 2018. Dr. Nottage has over 40 years of experience in Anti-Money Laundering/Countering the Financing of Terrorism and Proliferation.

Dr. Nottage held the post of Manager of Bank Supervision at The Central Bank of The Bahamas for 12 years (2002 - 2014) with a total tenure of 36 years with the institution. Post departure from the Central Bank, Dr. Nottage commenced a financial sector and regulatory consulting business. It is through this consulting business that Dr. Nottage would be recruited to assist the Office of The Attorney General with its AML/CFT/ CFP mandate and progressed to the posting as the NIRFC.

Dr. Cassandra Nottage is a decorated Anti-Money Laundering/Countering the Financing of Terrorism Veteran. An avid scholar, Dr. Nottage took up the challenge to pursue a Doctorate’s Degree in Business Administration (with a concentration in International Business), days after retiring from the Central Bank, with Walden University after a 31 year hiatus from Academia.

Dr. Nottage successfully attained a Doctorate Degree from Walden University on October 28, 2018 and celebrated this milestone event on January 19, 2019 at formal graduation exercises. Dr. Nottage’ studies centred on the Bahamian financial sector – “Compliance Strategies to reduce the risks of Money Laundering and Terrorist Financing”.

Dr. Nottage has held prominent positions on the Central Bank’s Policy Advisory, Monetary Policy, Regulatory Decisions and Financial Stability Committees. She is a past Director of the Bahamas’ Deposit Insurance Corporation, Caribbean Financial Action Task Force Financial Expert, Caribbean Director on the governing Board of the Association of Banks of The Americas, twice past Chair of the Caribbean Group of Banking Supervisors and an Associate of the Toronto Leadership Centre.

Dr. Nottage has been a guest lecturer with the Bahamas Compliance Association and Bahamas Institute of Financial Services for 19 years lecturing in the ICA Anti-Money Laundering and Compliance Diploma Programmes and the Banking Certificates programme.

Dr. Nottage, while at the Central Bank travelled widely representing her country at international and regional conferences and seminars where at times she was a presenter on topical issues of banking supervision and anti-money laundering issues.

Legal Advice & Service from a Team you can Trust.

Operating from one of the world’s leading offshore international financial centres, HIGGS & JOHNSON offers sound legal counsel and business insight to discerning clients around the globe.

When a high-net-worth individual becomes incapacitated, her indisposition can interrupt the smooth management of her resources and can even cause discord between members of her family. Good estate planning – at which Bahamian lawyers and financial coaches are adept – can anticipate these problems, usually through the creation of a will, an enduring power of attorney and/or a health care and personal care declaration.

These documents – which can be used in combination with each other – enforce the wishes and directions of the person in question during any period of incapacity, whether physical or mental. The individual, known in some cases as the donor, might be unable to communicate with people because she has had a stroke or an accident or because medical treatment has incapacitated her. She may be in ‘lockdown’ at a time when her business requires hands-on management. One of her offspring might have been trying to convince her to fund a business venture before her debilitating accident occurred, but other relatives might be trying to prevent this from happening now that the accident has happened. Her relatives, alternatively, might be vying to control her resources in the absence of any clear legal arrangements to cope with her incapacity. It is also likely that she will eventually grow old and cease to be able to decide where she ought to live, who should look after her and who should take charge of her business. The purpose of the documents is to forestall these problems by enforcing written decisions that the donor made before her incapacity.

The pandemic has brought much uncertainty into wealthy people’s lives. They are not able to predict its future course but they can, at least, plan for the future of their wealth and (in the event of incapacity) of their everyday lives. They are more anxious to do so now than they were before the outbreak. Many have made it a priority to organise their affairs, taking steps to have their wishes documented and ready to be effected if necessary. Many people consider wills to be the only documents that they need to help them organise their estates.

Although the creation of a will is a prudent step, it is effective only between the date of death and the moment when the estate is wound up. To make sure that somebody is in charge of things when the high-net-worth individual is still alive but cannot express her wishes very well, she ought to tell her lawyers to prepare other documents while she is still capable. They should pay special attention to the creation of powers of attorney, enduring powers of attorney and health care and personal welfare declarations. These are all parts of proper estate planning.

The law of agency comes into play when someone engages someone else to act on her behalf. The ancient power of attorney is founded in this sector of the law. It gives a person appointed by its terms the authority to deal with the financial and business affairs of another. The donor in question may –or may not – give this power to a relative. She might grant it to that person generally or she might limit it to a specific transaction or time frame. This traditional power of attorney, in its original format and usage, is terminated by any period during which the donor is mentally incapacitated – perhaps if she suffers from a mental disorder, dementia or Alzheimer’s disease. There is, however, a more recent version of the power in British and Bahamian law.

An enduring power of attorney, created by the Powers of Attorney Act, Chapter 81, Statute Law of The Bahamas, makes it possible for a power of attorney to remain in existence and valid after a person has become mentally incapacitated. The use of powers of attorney and enduring powers of attorney permits the financial and business affairs of the donor to continue uninterrupted during periods of absence, confinement, quarantine or incapability and enables the donee to act on her behalf.

A health care or personal welfare declaration enables the donor to convey her wishes and desires regarding medical treatment, the extent of any medical intervention and her personal care. In relation to periods of confinement, quarantine or inability, whether as a result of health concerns, restricted movement or otherwise, these additional documents can ensure that the plans and aspirations of the donor are discerned and fulfilled.

Section 4 Powers of Attorney Act, which introduced enduring powers of attorney into the law of The Bahamas, provides:

“(1) The authority of a donee given by an instrument creating a power of attorney that –

•provides that the authority is to continue notwithstanding any mental incapacity of the donor; and

• is signed by the donor and a witness to the signature of the donor, other than the donee or the spouse of the donee, is not terminated by reason only of the subsequent mental incapacity of the donor that would but for this Act terminate the authority.”

The Powers of Attorney Rules, established in accordance with the Act, go into more detail. The instrument must be drawn up in a certain way. Both the person who appoints someone to deal with her financial and business affairs and the person(s) she is appointing must sign it. It must then be lodged at the Supreme Court Registry. From then on, subject to any restrictions in the document, the appointed person(s) may use it and rely on it.

If, however, someone has to make decisions about health care and personal care, a power of attorney or an enduring power of attorney cannot apply. The scope of the authority derived from an enduring power of attorney is limited to property, business and financial matters. If it is desirable to convey wishes or instructions for medical or healthcare decisions or other personal matters, these ought to be set out in a statement that declares the person’s directions.

Many people consider it unthinkable and/or inhumane to be placed on machines or given other methods of treatment to sustain bodily functions when there is no detectable brain function, while other people want every medical resource to be available to sustain life for as long as possible. A health care and personal welfare statement

or declaration can help members of a family determine their loved one’s position with regard to such treatment.

In some jurisdictions, such documents are termed ‘living wills’ or ‘advanced directives’ and are supported by legislation enacted for that purpose. There is, as yet, no Act in The Bahamas that mentions or permits the creation of such instruments specifically, but a person can declare her wishes in accordance with the Oaths Act, Chapter 60, Statute law of The Bahamas with the aim of preventing uncertainty and conflict from plaguing her family after she becomes vulnerable.

In creating a health care declaration, one may derive guidance from the decisions of the courts of the United Kingdom. When considering the issuance of such instruments regarding medical treatment, Lord Donaldson of the English Court of Appeal held, in Re T (Adult: Refusal of Treatment) [1993] Fam 95, that:

“An adult patient who, like Miss T, suffers from no mental incapacity, has an absolute right to choose whether to consent to medical treatment, to refuse it or to choose one rather than another of the treatments being offered...This right of choice is not limited to decisions which others might regard as sensible. It exists notwithstanding that the reasons for making the choice are rational, irrational, unknown or even non-existent.”

In another English case, Re C (adult: refusal of medical treatment) [1994] 1 All ER 819, it was held that the court may exercise its inherent jurisdiction and rule, through an injunction or a declaration, that an individual is capable of refusing or consenting to medical treatment. This can include future medical treatment.

Finally, Mr Justice Munby stated in HE v A Hospital NHS Trust and another [2003] EWHC 1017 (Fam):

“I can summarise the law as follows:

These documents are all parts of proper estate planning

• There are no formal requirements for a valid advance directive. An advance directive need not be either in or evidenced in writing. An advance directive may be oral or in writing.

• There are no formal requirements for the revocation of an advanced directive.

• An advance directive is inherently revocable. Any condition in an advance directive purporting to make it irrevocable...and any provision in an advance directive purporting to impose formal or other conditions upon its revocation, is contrary to public policy and void.

• The existence and continuing validity and applicability of an advance directive is a question of fact. Whether an advance directive has been revoked or has for some other reason ceased to be operative is a question of fact.

• The burden of proof is on those who seek to establish the existence and continuing validity and applicability of an advance directive.

• Where life is at stake, the evidence must be scrutinised with especial care. Clear and convincing proof is required.

• If there is doubt, that doubt falls to be resolved in favour of the preservation of life.”

This makes it clear that it is permissible for someone to make directions for medical and health care as well as for personal care. For certainty and ease of reference, the authorisation ought to be in writing. There is no reported Bahamian case law on the issue as yet, but the expression of a person’s wishes, instructions and directions for medical treatment at some time in the future when she cannot communicate instructions verbally can help members of her family and medical professionals draw up a treatment plan. If the declaration addresses personal care, her wishes regarding such matters as living arrangements (whether to receive care at home or go to a residential institution) will help her family avoid conflict about “where grandma should live.”

Good estate planning can offset problems that might arise when the donor is away from home for a long time. By creating a will, an enduring power of attorney and/or a health care and personal care declaration, she can ensure that her wishes and directions are clearly discerned and effected during any periods of incapacity, whether physical or mental. The existence of such essential estate-planning documents can also ward off conflict and discord in her family. They are a source of comfort and certainty in the midst of uncertain and unsettling times.

Sharmon Ingraham Partner, Higgs & JohnsonSharmon Y. Ingraham is a Partner and Deputy Chair of the Private Client and Wealth Management practice group at Higgs & Johnson. Her practice includes providing advice to trust companies on matters concerning trust administration and creation, pension trust creation and administration, estate administration, private client wealth management, wills and probate matters, company law and international commercial contracts. She also has experience in trust, commercial and maritime litigation, ship financing and registration matters, and banking and insurance regulatory matters. Sharmon has authored commentaries on various trust law topics including most recently: estate planning and administration, Foundations and Private Trust Companies in The Bahamas. Sharmon holds a dual honours degree in Law and International Politics from the University of Keele and qualified as a Barrister (non-practising) in England and Wales. She is a member of Middle Temple, the Bahamas Bar Association, STEP (Bahamas Chapter) and a member of the editorial committee for STEP.

All financial jurisdictions must evolve or die. The world is changing swiftly and it is almost essential for anyone who wants to keep up with the times to use digital currencies. Central banks around the world are experimenting with various forms of digital currency and The Bahamas is no exception.

The Bahamas is the first country to implement a government-backed, blockchain-based Central Bank Digital Currency. According to ConsenSys, the blockchain software technology company, a CBDC is “a digital form of central bank money, which is legal tender created and backed by a central bank that represents a claim against the central bank and not against a commercial bank or a Payment Service Provider.”

The innovative Central Bank of the Bahamas Act 2020 includes, among other things, “electronic money” in its definition of currency. A year after passing it, legislators went a step further and implemented the Bahamian Dollar Digital Currency [BDDC] Regulations 2021, which define the BDDC as an electronic version of the Bahamian dollar which the Central Bank issues in accordance with the Central Bank Act. It is fully backed by reserves that the Central Bank holds and it represents a direct claim against the Central Bank.

CALLOUT: The Bahamas is the first country to create a government-backed, blockchain-based CBDC

According to the BDDC Regulations, a Bahamian Dollar Digital Currency wallet is a digital wallet issued by a regulated wallet provider that holds BDDC and is registered under the Central Bank Act. The regulations set out a clear and detailed process by which a firm can apply to do this business. They also safeguard the currency in those wallets with conditions that wallet providers must satisfy before registering as wallet providers or before continuing to provide wallet-related services.

Each applicant must:

(i) have adequate software and hardware;

(ii) have taken adequate steps to safeguard the wallet holders’ funds;

(iii) have clear rules to help it resolve disputes about the provision of wallet services;

(iv) have a safe and reliable information technology system and “adequate interfaces to ensure interoperability, access and data protection, as well as robust contingency and disaster-recovery procedures"; and

(v) have effective arrangements in place for the protection of clients’ assets and monetary arrangements consistent with any prescribed rules or guidelines that the Central Bank might issue.

Registered wallet providers must also follow strict guidelines if they wish to remain registered. The Central Bank can suspend or cancel a wallet provider’s registration if it believes that the wallet provider, among other things:

(i) has not distributed BDDC within twelve months of the date on which its registration was approved;

(ii) has obtained approval for registration through false statements or some other irregular means;

(iii) has ceased to meet the criteria set out in the BDDC Regulations;

(iv) is contravening the regulations or breaking any other law of The Bahamas;

(v) is doing business in a manner which is detrimental to the public interest or to the interests of its wallet holders; and

(vi) is contravening any term or condition subject to which the Central Bank granted its registration.

Although only the Central Bank can issue BDDC, the need for wallet providers creates opportunities for investment in The Bahamas.

The Act empowers the Central Bank to issue any amount of BDDC that it sees fit, as long as it promotes and oversees a safe, sound and efficient national payment system. Nobody else may issue the currency of The Bahamas as electronic money in the jurisdiction.

The regulations empower the bank to promulgate such codes, rules, guidelines, policy statements and practice notes as it sees fit in order to set limits or restrictions on wallet balances and transaction values for different categories of wallet holders:

(a) in furtherance of its regulatory objectives;

(b) in relation to any matter relating to any of its functions under the regulations; and

(c) in relation to the operation of any provisions of the regulations.

Furthermore, the Central Bank may issue written directions, generally or specifically, to any wallet provider in any circumstance where it believes that:

(i) it is necessary or expedient for ensuring the integrity or proper management of BDDC and the technology platform;

(ii) it is necessary or expedient for the effective administration of the regulations;

(iii) it is of public interest;

(iv) a person is engaged in, or is about to engage in, an unsafe, unsound or unfair practice with respect to BDDC; or

(v) a person is likely to contravene or fail to comply with the regulations or any codes, rules, guidelines, policy statements and practice notes that have the force of law. These provisions make the regime responsive to a fastmaturing and evolving industry.

The recent Central Bank Act and the implementation of the BDDC Regulations lay the foundation for the Bahamian CBDC, the so-called Sand Dollar. This is the digital form of

the Bahamian dollar that the Central Bank of The Bahamas issues through authorized financial institutions. The user keeps the currency in his digital wallet by means of a mobile phone app or by using a physical card.

Ultimately, a CBDC such as the BDDC is an extension of paper money, also known as fiat currency. Fiat currency is legal tender issued by the Central Bank in the form of notes (sometimes called bills) and coins. The use of fiat currency is still the most popular method of payment. Some may argue that it is the most secure means of exchange and it is certainly the fastest. A payment via credit and debits cards, while still considered a digital payment, is nonetheless an example of banks moving fiat currency about. It is not as secure as a fiat currency transaction, due to the threat of accounts linked to such cards being hacked or by a card being compromised, but it is certainly efficient.

Both physical fiat currency and digital fiat currency have their pros and cons and it appears that the objective of the CBDC is to merge those pros and cons. By doing so, it makes payments quick and secure.

Why are central banks going down this path? They have, traditionally, participated in two kinds of payment transaction – fiat currency and intermediary bank payments. Technology is progressing in both of those areas and has led to the implementation of other (decentralized) digital currencies. People sometimes argue that physical fiat currency is on its way out, but the Central Bank says that it has no plans to eliminate cash.

More and more central banks in emerging markets are thinking of setting up their own digital currencies, the better to include more people in the financial system and decrease the cost of handling cash. This school of thought is in line with the Sand Dollar’s objective, which is to “[a] chieve greater financial inclusion, cost-effectiveness, and provide greater access to financial services across all of The Bahamas.”

So why is this even remotely beneficial to Sand-Dollar holders? The Sand Dollar allows for a better payment process, a reduction in transaction costs and better security in the form of multi-factor authentication, wallet security and cyber-security assessment.

Kristilina Georgina, the managing director of the International Monetary Fund, has summed up the objective of CBDCs perfectly.

The Bahamas has taken a bold and innovative first leap into this new chapter, accomplishing something that no jurisdiction has done before. In doing so, the country has equipped itself well for the quickly-approaching brave new world of tomorrow.

Alexander provides unmatched expertise to help solve complex legal problems. He specializes in advising in financial services and commercial transactions and is particularly experienced with matters involving real estate and conveyancing, trusts, asset protection structures, banking, company law, and incorporation of corporate vehicles. Alexander also leads the firm’s Fintech Practice Group. Alexander is well-known for his ability in drafting commercial instruments and his creativity in constructing complex asset protection structures. Alexander is an advocate of constant networking and attentiveness to the needs of his clients, something that has helped him maintain client relationships globally and foster his reputation as a reliable legal professional.

Vanessa is an associate of McKinney Bancroft & Hughes whose areas of expertise include real estate transactions and conveyancing, corporate transactions, financial services and private client wealth management. Vanessa is also a part of the firm’s Fintech practice group. Vanessa is passionate and driven, and believes in upholding the integrity of the profession. She possesses excellent problem-solving skills and her clients admire the way in which she always makes herself accessible to them. Vanessa also prides herself on working on areas of the law that are unchartered. Outside of the law, Vanessa is passionate about cooking and baking plant based cuisine and she also enjoys community service, laughing with friends, and spending time with her family

“The history of money is entering a new chapter. Countries are seeking to preserve key aspects of their traditional monetary and financial systems, while experimenting with new digital forms of money.”

The Coronavirus has caused immense disruption to business throughout the financial services industry, both in The Bahamas and abroad. Some fund administrators, however, have taken it in their stride. This is the story of one business that benefited from early updates to its practices in ways that it could not envisage before the virus struck.

During the past two years of this COVID pandemic, all business operations have had to deal with change on a large scale. Even the world of fund administration has changed and, at Genesis Fund Services, these changes have affected not only what we do but also the way we do it.

Before the pandemic, we all tended to view change as inevitable. However, the general pace of change in our industry was moderate until COVID arrived. That pace then

accelerated enormously and catapulted us into an uncertain future. Change occurred more quickly than we might have liked or expected, but undoubtedly it has been for the better.

We now seem to be emerging from the worst of the pandemic and entering a new era. This is a 'new normal' for clients, for employees, for fund investors, for fund managers and for the jurisdiction. Technology, talent management and digitisation lie at the heart of this new normality.

At Genesis, we took the fortuitous decision in early 2018 to

create a paperless office. We did not have a crystal ball to help us foresee the events of 2020/21, which included the sudden and unfortunate COVID-19 lock-down mandate. We did, however, see that digital technology was evolving and pushing our processes – and the industry as a whole –towards more digitisation. We had to satisfy the demands of our clients and fund investors (especially institutional investors) for more advanced technological reporting, communication and management of their business data.

Fund administration’s age-old reliance on manual processes and high volumes of paper was near death. Fortunately, before the pandemic struck, we reduced our paper processes and all remaining manual processes dramatically. COVID simply hastened and obliterated any vestiges of paper processes that were left because manual applications simply could not happen when everybody was working from home. The fund administration industry, and we here at Genesis, therefore adapted to the 'new normal' of paperless processing. We did this with subscriptions, redemptions, accounting and, most importantly, the review and collection of 'due diligence' data.

Without the advent of COVID, we would simply not have collected, vetted and processed 'due diligence' information from home as soon as we did. Before COVID, Genesis would never have permitted its employees, even its most capable and trusted employees, to have taken customers' passports, bank details and other information into their homes because of the need for privacy and accountability.

However, to continue operations effectively and to satisfy regulatory responsibility while keeping up best practices, we had to work quickly to improve and monitor our cybersecurity data-protection – fund administration’s newest cost centre. We had never anticipated a time when 100% of the workforce had to work at home and the firm therefore had to take on the unbudgeted costs of buying everyone a new laptop, a second screen and an updated wifi device to speed up their work.

The advent of intense training in cyber-security and updates to controls that safeguard clients' information have led to major improvements and benefits at financial service providers. Now, employees who are not in the compliance

department have to discharge responsibilities for 'due diligence' when they are at home and must be conscious of the need to safeguard clients’ information and mitigate the risks involved in that work. This they now do very well.

The use of two- and three-factor authentication has become the norm. Firms are far more aware of their duty to safeguard clients' data and have overwhelmingly improved the ways in which they mitigate risks that pertain to individuals during the pandemic. Videos, memos and virtual meetings regarding privacy and risk have increased tenfold...or at least, it feels like tenfold!

At Genesis, we have observed that COVID has made all staff more conscious of the risks that cyber-maladies pose. It has also made them realise that it is their regulatory – and laborious – duty to safeguard clients' data.

Many fund administration staff have worked arduously and conscientiously at home. Buckling under the stress of working all hours in a domestic setting, logging on in the middle of the night and answering emails at ungodly hours, they want to take some time off and not be overwhelmed by their new virtual world. In short, they need help and the senior management team has to make it available to them. Because of this, the issue of everyone's work/life balance has become a key issue at every meeting with the senior management team.

During the past two years of dreadful lockdowns, isolation and the need to work from home have changed the way in which so many of our colleagues view the work experience. Some of them have seen their parents and other family members succumb to the vicious disease or suffer grave illness from it. Many have changed careers and residency or moved to different firms in the same sector. Human capital has moved around in an unpredictable and somewhat disruptive way.

The retention of talent is also a top agenda item for the

leaders of fund administrators. I remember, years ago, working outrageously long hours in fund administration –Sundays included. My employers expected this of me, but it is impossible for today's firms to expect the same; people will not come in on Sundays. Firms must now be more flexible and competitive. They must hold onto well-trained, experienced and talented people. They must, moreover, be able to attract and recruit talented professionals.

Despite having experienced some staff attrition, fund administrators have had many opportunities recently to hire eager, talented professionals from all over the globe and from career paths outside the world of financial services. When considering human resources, fund administrators no longer want to employ mechanically-minded people to perform robotic functions. They would rather invest in versatile, problem-solving individuals who can work with various aspects of the business.

Although the cost of recruiting, retraining and developing professionals has increased, firms have now fast-tracked these elements of the work experience and are using creative means to do so. When COVID disappears, the result at every firm will be a well-trained staff, a greater capacity for work and a better experience for clients.

During this period of COVID, fund administrators have been working hard to improve their technology. A few years ago, any one of them would have been served adequately by one system that handled accounting and its relationships with investors, one for corporate and compliance matters and perhaps another for other aspects of the business. However, although fees have gone down for services over the past ten years, the cost of providing straight-through processing (STP) safely and efficiently has sky-rocketed along with the cost of both hardware and software.

Investment managers and investors in funds, moreover, have been insisting that their fund administrators ought to improve their reporting, data delivery and cyber-security continuously. Smaller fund administrators have found the piecemeal nature of their technologicalsolutions burdensome.

COVID has hastened their need for software connectivity, the better to improve results for clients. Technology is not only crucial for the provision of excellent service; it has become as essential as talented human capital. The need for fund administrators to provide collaborative business data through the use of technology has become standard. Their further collaboration with investment managers and fund administrators through the use of technology – with regards to both the safeguarding of clients' data and the provision of seamless services – is another part of the 'new normal.'

Investment managers have had to face similar burdensome movements in human resources and changes in technology and regulatory rules. As such, they have had to reassess their service providers to ensure that their talent, the quality of their services and the technology that they require have improved beyond pre-pandemic norms.

Over the decade prior to the pandemic, 'due diligence' questionnaires for fund administrators were standard. The pandemic, however, caused a noticeable increase in questions to do with technology and 'due diligence' which covered, among other things, data protection, redundancy and cyber-security. Investment managers and institutional investors have also intentionally asked more questions about corporate governance, diversity, equity and inclusion. It is now normal for fund administrators to provide dynamic governance, diversity and technological platforms.

Although technology and human capital are of prime concern for a good fund services organisation, it must have a good corporate culture that can knit the two together. An intentional drive to formulate and implement plans to ensure that we have a cohesive team has been crucial for us during COVID. The demand for talks and seminars on communication, mental health and mindfulness, or other subjects to do with the development of the whole person, has outweighed the demand for more accounting or compliance training by far. People want to work with people whom they like or admire, or with people who can help their careers.

The creation of a new 'conscientious culture' during and after COVID has become as important as the development of efficient accounting or 'due diligence' processes. At the same time, the maintenance and progression of a vibrant

corporate culture has been one of the most difficult aspects of business in this pandemic. Collaboration among leaders and coaching in the workplace will continue to be an important aspect of the future work environment. All highly-functioning organisations have, or should have, continual plans to improve their corporate culture.

After the pandemic, The Bahamas will continue to be an important jurisdiction for investment funds. There is a high buzz about crypto-investing in our jurisdiction and the Government has recently issued a White Paper on the future of digital assets; it is evident that crypto-funds as an asset class represent the future. Globally, investment by institutional investors in the crypto-fund arena is relatively small but many fund managers are starting to consider some investment there, either directly in various crypto-currencies or through such other means as cryptoderivatives, crypto-firms or crypto-ETFs, i.e. exchangetraded funds.

The Bahamas’ regulated 'SMART' and 'Professional' fund classes are primed for the exploration of these new and exciting, but very real, structures. Investment managers or institutions that are trying to figure it out can use the SMART fund model to gain crypto-exposure. Bahamian Professional Funds have no limitation on types of assets and can also be used as vehicles for crypto-asset exposure.

Whether in crypto-funds, private equity funds or hedge funds, the 'new normal' has positioned Genesis to be even more capable of providing fund-administration services of high quality in the world after COVID than it was before. Our base in the Bahamas has helped us retain and recruit highly talented staff. It has also been crucial for the creation of our fast and reliable technological platform.

Antoine Bastian Executive Chairman and CEO of Genesis Fund Services LimitedAntoine W. Bastian currently serves as the Executive Chairman and CEO of Genesis Fund Services Limited, a licensed Investment Fund Administrator in the Bahamas and the CEO of GFS Financial Services LTD, an affiliate fund administrator in Singapore.

Antoine Bastian earned his B.Sc. in Accounting from Indiana University in 1989. After university, Antoine joined Deloitte and Touché, Nassau Bahamas and subsequently qualified as a Certified Public Accountant.

Shortly thereafter, Antoine was a mutual fund administrator with MeesPierson Fund Service and after that a manager at St. Matthew Investment Fund Accounting Limited... a Bahamian fund administrator that was associated with Michael J. Liccar & Co, based in Chicago, Illinois.

Subsequent to this position, Antoine served on the Board of The Private Trust Corporation Limited and as Manager of its Mutual Fund Department, Genesis. In 2004, the department was relaunched as an independent entity, Genesis Fund Services Limited.

By Dr Iyandra Smith Bryan

By Dr Iyandra Smith Bryan

As early as the 2000s, entrepreneurs have sought innovative and dynamic methods of raising capital from the public. We have seen this evident in the surge of crowdfunding platforms attracting professional and retail investors that have been at the center of digital transformation. At the height of the emergence of digital transformation having an incredulous impact on entrepreneurship financing, tokens have emerged allowing entrepreneurs to receive capital easily, quickly, and efficiently. Entrepreneurs are

able to raise capital by issuing tokens to token holders in a similar way as a company would issue shares to its investors, in exchange for consideration (the token price). While tokens customarily are not representative of actual ownership in a company, token holders often seek to acquire tokens in anticipation of such tokens increasing in value post their acquisition, and later being sold on a secondary market.

So what is a token? A token is a digital representation of a right(s) to any tangible (financial or otherwise) or intangible assets, stored and recorded on a blockchain. There are different concepts of tokens: tokenized securities, security tokens, utility tokens, or payment tokens. Utility tokens are primarily focused on supporting and developing a communitybased ecosystem by awarding consumptive rights to

token holders, while payment tokens are a means of payment in a blockchain based ecosystem. Tokenized securities are customarily considered to be a traditional, regulated security type with a digital wrapper; that is, where the proof of ownership in the company is recorded on a distributed ledger. On the other hand, security tokens tend to have a much expansive scope and inherent characteristics that are formulated to constitute or represent assets typically of an underlying financial type, such as participation in a company’s earnings streams, or an entitlement to dividends or interest payments, or a combination thereof packaged together. Such tokens may be classified as equities, bonds, collective investment schemes, or derivatives, dependent upon their economic functions and terms.

In modern times and in order to take advantage of the heightened process efficiency and greater ability to access global liquidity pools, we have seen new alternative assets formulated as a result of isolating specific economic functions, such as tokenized cash flows from real estate projects or royalty cash flows from works of art. For the purpose of this article, we will focus on security tokens. Security tokens introduce a myriad of benefits to entrepreneurs: first, they create an innovative new financing and capital raising model that leverages scalable efficiencies. They provide enhanced and easily accessible liquidity. Moreover, by removing third party intermediaries traditionally involved in the post-trading process, tokenization offers significant cost-efficiency benefits. A study by Ghent University concluded that tokenization could offer total cost savings of up to EUR 4.6 billion by 2030, provided adoption rates were high. Further, tokens provide customizable opportunities and

bridge legacy finance with the new world of digitization, gleaning benefits from each. Customizing and designing security tokens carefully can equip entrepreneurs with heightened abilities to raise more capital easily and quickly. In addition, a data flow free of friction, provided that there is a regulatory framework and adequate policies in place, permits greater transparency.

Tokenization takes place when a new blockchain monopolizing an underlying protocol of various cryptocurrencies is instituted by the company issuing the tokens, and thereafter, the tokens issued by the company are sent directly to the token holder’s digital wallet address or through a crypto-exchange. Blockchain is a “shared distributed ledger that facilitates the process of recording transactions or tracking assets in a business network1.” Thus, blockchainis a distributed database for recording transactions. The word “distributed” means that there is no centralized storage location such as a central server or a cloud computing platform; instead, the information and technical transactions are spread across a wide network of computers. The blockchain concept was first discussed in a Bitcoin white paper, written by Satoshi Nakamoto, in which he referred to the distributed ledger as “a chain of blocks2.” In this white paper, Nakamoto suggested a peer-to-peer distributed ledger platform for the processing of financial transactions without relying on trusted third parties for their execution. The network is founded on a peer-to-peer distributed architecture which necessitates consensus calculations and/or algorithms to ensure that the transactions across the blockchain network are duplicated so that the ledger maintains its integrity. What this means is that anyone with access to the blockchain network will be able to see the same information. Blockchain networks can be public and accessible by anyone, such as Bitcoin and Ethereum, or private and permissioned, such as a corporate network for asset tracking. Beneficially, trust is incorporated into the structure of the network.

In some jurisdictions, tokens continue to be unregulated, while in other jurisdictions, regulatory guidance has been issued or a regulatory framework has been put in place to govern token offerings. In the past, some token issuers took the position that so long as the token being offered was not a security under the laws of the jurisdiction if its issuance, there was no need to consider whether the token constituted

a security in any of the jurisdictions in which the token may ultimately be purchased or resold. It is clear that this reasoning is faulty. Before issuing tokens, companies should ensure the requisite regulatory and legal analysis is undertaken to determine whether regulation would apply and their tokens could be considered a token, and the steps that must be taken to ensure adequate compliance. If the primary goal is to raise money, rather than for example to build a network, legal and commercial arise are likely to arise that require a consideration before conducting a token sale.

For example, in the United States, the Chairman of the Securities Exchange Commission (“the SEC”) has provided guidance to the effect that the SEC will apply the tests and standards that have been laid down by the Supreme Court in the well-established case, Securities Exchange Commission v WJ Howey Co. (“Howey”)3 In Howey, the Supreme Court held that the offering by a token constituted a security offering subject to the Securities Act. When determining whether a token offering constitutes a security offering that is subject to the Securities Act, the Supreme Court laid down the following four-prong test: Is there: