6 minute read

Real Estate Brokers & Land Developers compliance with aml/cft/cpf obligations in The Bahamas – Compliance Commission of The Bahamas

By Andrew Strachan

The Financial Action Task Force (FATF) has recognized that the real estate sector is attractive for potential misuse by money launderers and terrorist financiers. Real estate is often chosen globally as a vehicle for criminals to launder ill-gotten gains because property offers a path to legitimacy and will appreciate over time. This allows criminals to enjoy their property and eventually the proceeds of sale.

Advertisement

The Bahamas’ political and financial stability, international accessibility and tropical climate make it one of the most sought-after real estate investment destinations in the world. The real estate market offers Bahamians and foreigners opportunities for medium to long-term price appreciation and rental yields. The market attracts local citizens as well as foreigners in search of primary and secondary homes.

Luxury properties including upscale condominiums, tourist resorts and second home developments have long drawn wealthy foreign investors. The large sums associated with this market, along with the enhanced lifestyle make Bahamian luxury property a potentially attractive option for laundering the proceeds of crime. For this reason, the high-end real estate market continues to present a substantial potential ML/TF/PF risk to the economy.

In order to maintain the positive image of The Bahamas as an attractive choice for foreign investors, real estate brokers and land developers must be in compliance with international AML/CFT/CPF obligations and discourage attempts by money launderers or terrorists to abuse the sector.

The Bahamas has implemented international standards through AML/CFT/CPF legislation in 2018 and 2019. Under the guidance and supervision of the Group of Financial Service Regulators (GFSRs), strict controls have been imposed at all levels of the real estate transaction process.

In November 2021, the Caribbean Financial Action Task Force (CFATF) assessed The Bahamas Technical Compliance as compliant or largely compliant with 38 out of 40 of the FATF recommendations, placing The Bahamas in the top category of Technical Compliance world rankings.

The Compliance Commission of The Bahamas is an Independent Statutory Authority established under section 39 of the Financial Transactions Reporting Act, 2000 (FTRA, 2000) and continues in existence under section 31 of the Financial Transactions Reporting Act, 2018 (FTRA, 2018). The Commission supervises Designated Non-Financial Businesses & Professions (DNFBPs) including Real Estate Brokers & Land Developers.

The Commission’s mandate is to ensure registrants’ compliance with the provisions of the Bahamas’ AML/CFT/CPF laws and has extensive legal powers to regulate the sectors. The supervisory approach is to assess DNFBPs’ policies, procedures, and controls for identifying and managing ML/TF/PF risk and compliance with AML/CFT/CPF preventive measures. The risk based supervisory framework is aligned with FATF standards for an effective supervisory regime and The Bahamas AML/CFT/CPF legislation including:

• Market entry controls to prevent criminals and their associates from acquiring an ownership or management position in a registrant.

• Understanding the ML/TF/PF sectorial risks, monitoring to assess compliance with AML/CFT/CPF obligations to mitigate ML/TF/PF risks.

• Assigning effective proportionate sanctions and applying remedial actions.

• Promoting a clear understanding of obligations and ML/ TF/PF risks.

• Raising the level of compliance with AML/CFT/CPF obligations.

Registration with the CC is a requirement in law, with penalties for not registering, whenever a firm is conducting the specified services, aligned with FATF standards, in the FTRA 2018 section 4.

The services under AML/CFT/CPF supervision include:

• Real estate brokers acting in the buying or selling of real estate and with respect to both vendors and purchasers.

• Land Developers engaged in the sale, partition or condominium of any part, parcel, lot or condominium unit of any larger tract or lot of land or any development of land involving the building of units sharing walls, common areas and utilities.

The sector is relatively new to AML/CFT/CPF supervision, as the FTRA 2018 strengthen the AML/CFT/CPF obligations and widen the prescribed financial services for the sector. Prior to the introduction of the FTRA 2018, real estate brokers were only captured in the AML/CFT/CPF regime if they received funds. The CC has implemented an ongoing training program to increase the awareness of AML obligations and continue to work with The Bahamas Real Estate Association (BREA) to ensure that The Bahamas remains an attractive location for real estate investment and adheres to the AML/CFT/CPF obligations for the sector.

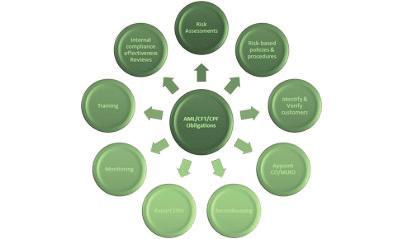

Registrants in the real estate sector must comply with the AML/CFT/CPF requirements for the DNFBP sector, the associated AML/CFT/CPF legislation in The Bahamas and applicable guidelines. These include implementing a compliance program that encompasses key compliance pillars as shown below. The identification of the beneficial owner is a requirement by law in The Bahamas. The Register of Beneficial Ownership Act 2018 provides for the establishment of a secure search system, known as BOSS, for registered agents to maintain information on beneficial ownership of a legal entity for which it has responsibility.

Real Estate brokers & Land Developers are expected to understand the ML/TF/PF risk its business is exposed to, mitigate the risks, know the ML/TF/PF red flags and fulfill the obligations under the AML/CFT/CPF laws.

The impact of the measures to upgrade the AML laws and guidelines is shown in the significant increase in the number of real estate brokers and land developers registered with the CC.

The role of real estate brokers is to represent the vendor via a listing agreement and arrange property viewings. Real estate brokers receive commissions on transactions, but the money flow involves lawyers and banks. However, their relationship with both the buyers and sellers of properties can provide crucial information to identify suspicious transactions and are required to conduct CDD checks on both the buyers and sellers of property and identify the beneficial owner of properties and their source of funds.

In a research study conducted by the Central Bank of The Bahamas (CBOB) April 2019, domestic bank deposit cash inflows from 17 potentially problematic AML sectors were examined for the 2018 calendar year. The study found that deposits received from real estate brokers and agents, attorneys and legal firms, and land and real estate developers respectively accounted for a substantial proportion of potentially worrisome deposits. The real estate industry was found to be large enough to constitute a potential threat, arising from BSD (Bahamian dollar) and non-BSD flows, but not from currency-based money laundering. Nearly the entirety of Bahamian real estate deposit inflows is already in the banking system. Non-BSD accounts are substantially associated with real estate transactions, most of which stem from foreigners purchasing Bahamian property. There has been no evidence for many years that foreign real estate purchases are a major AML conduit.

The CC issued a research paper in May 2022 on “AML/CFT/CPF controls in the Real Estate Sector” and identifies the comprehensive controls present throughout the real estate transaction process, steps involved in real estate transactions and explain the AML/CFT/CPF controls in place to mitigate ML/TF/PF risks for Bahamians and NonBahamians. Based on this study the CC determined that although luxury real estate requires constant monitoring as a potential money laundering risk, The Bahamas currently has satisfactory controls in place to mitigate ML and other financial crime risks flowing through luxury real estate, and particularly cross border real estate, making it unlikely that The Bahamas is a real estate-based money laundering center.

The real estate sector was valued at $1.74 billion in 2021, representing approximately 17% of The Bahamas’ GDP, a 5.4% increase from 2020 ($1.65 billion). Since 2017 the real estate sector has been a steady contributor to GDP and was also the largest industry contributor for 2021, followed by wholesale/retail trade/ motor vehicle repairs and financial/insurance industries. Industries such as construction remained a significant contributor to GDP and stood at roughly $703 million in 2021.

The CC has implemented RegTech solutions to enhance supervisory functions including digitalizing most of the examinations procedures and launched an online registration portal in 2021 that allows registrants to register and update information.

The goal is to ensure that the real estate sector maintains compliance with the AML/CFT/CPF international standards and protect the financial system from the threats of ML/TF/PF.

1Anti-Money Laundering/Countering the Financing of Terrorism/Countering Proliferation Financing

2We note that offshore property owners are generally entitled to vacation in or live in their Bahamian properties, but this does not trigger Bahamian citizenship by investment

3The CC falls under The Ministry of Finance

4FTRA, 2018 s 4

5If a property is being purchased in the name of a corporate entity that is incorporated under the IBC Act, it must also have a registered agent in The Bahamas.

6Guidance on co-brokering is in the CDD guidance, CC website

7Contributions from CBOB-posted on the CC website https://ccb.finance.gov.bs

Andrew Strachan has over 25 years of experience in international private banking and compliance at Clariden Leu Nassau Branch and Credit Suisse Bahamas. Andrew has held senior positions – Senior Vice President, Portfolio Manager, Relationship Manager and Deputy to the Managing Director at Clariden Leu, Vice President Portfolio Manager at Credit Suisse and has studied and trained in the United States, England, Canada and Switzerland. Mr. Strachan has also completed Assessor training, by the Caribbean Financial Action Task Force (CFATF) and Financial Action Task Force (FATF) standards training.Andrew is presently the Inspector of the Compliance Commission of The Bahamas and designated certain duties of The Competent Authority with responsibility for the operation of the exchange of information for the Foreign Accounts Tax Compliance Act, 2015 (FATCA) purposes, Country by Country Reporting (CbC) and Common Reporting Standard (CRS).

Mr. Strachan has served on a number of public and private boards, financial organizations, and advisory committees in The Bahamas, including the Bahamas Financial Services Board and the Investment Committee of The National Insurance. Mr. Strachan is a past president of the CFA Society The Bahamas and currently Chairman of the Bahamas International Securities Exchange (BISX)