Rebound Turning Struggles Into WINS

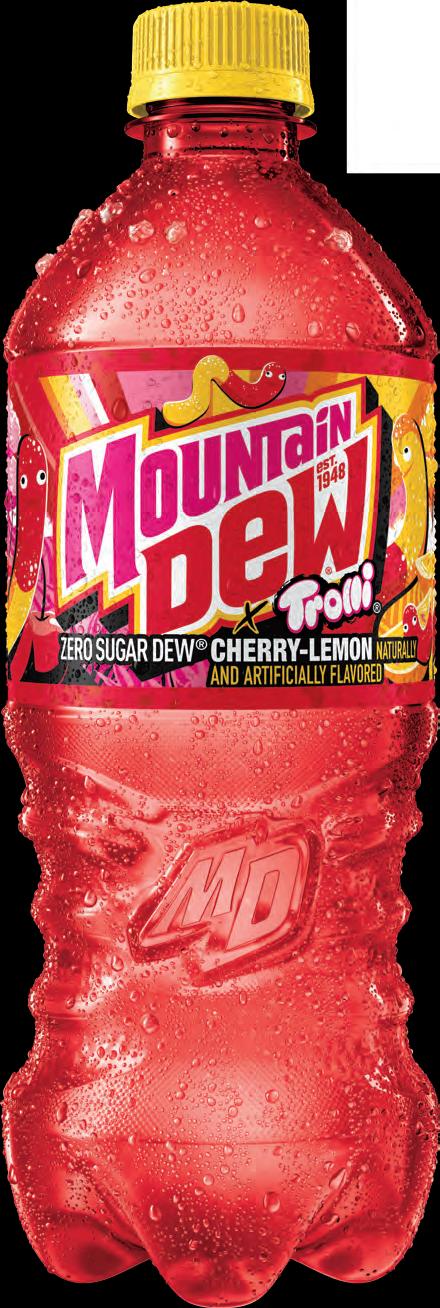

FIZZ FREE PINK LEMONADE

• Fizz Free Pink Lemonade Exclusive!

• First Case Free!

• Exclusive Timing 06/23 - 12/31/25

• P5: 8/27 - 10/28

• P5 Promo: 3/$6.00 (12oz Only)

• P5 FBO Custom POS/In-Store Signage

• P5 MLS Partnership & Consumer Sweepstakes 8/27-10/17

• 3 Day Flyaway trip for 2 to MLS Gold Cup in December!

• GULP Media – Programmatic Display Ads & GSTV

• Social Media & Influencer Support

• Brand Ambassador Challenge

CRUNCH IT’S TiME!

Satisfy your customer’s cravings with the NEW

STOCK UP NOW!

From October 29th, 2025 - January 6th, 2026, Cheez-It® Crunch, Cheez-It Duoz®, and Cheez-It® Snap’d® SKUs will be featured in an in-store 2/$5 promotion. They will also be featured on ramp FFE position on the front endcap.

Cheez-It Duoz®

Cheez-It® Crunch Kick’n Nacho Cheese

Cheez-It®Snap’d® Cheddar Sour Cream & Onion SLIN 300031

Cheez-It® Crunch Zesty Jalapeño Cheddar

Sukhi Sandhu,

Eric H. Karp, General Counsel

Teeto Shirajee, NCASEF Vice Chair

Michelle Niccoli, NCASEF Vice Chair

Tom Ayres, Associate General Counsel—Warner,

Member News

7-Eleven’s Rising Stars

Convenience Store News recently announced its 2025 Future Leaders in Convenience (FLIC), honoring 42 rising stars under age 35 from 27 companies across the industry. Among the standout honorees, 7-Eleven Inc. celebrates five emerging leaders: Caitlin Crutchfield (Manager, Strategic Sourcing), Korynne Foote (TA Project Manager, Employment Branding & Recruitment Marketing), Lauren Tycom (Manager, Replenishment), Jessica Weese (Field Sales Merchandiser), and Elaine Williams (Manager, Talent Management). These individuals were selected based on peer and company nominations recognizing achievements between May 2024 and April 2025, and will be honored at the FLIC Summit in Austin this December.

C-Stores Win Over More QSR Customers

Consumer perceptions of convenience stores are shifting dramatically, with 72 percent now viewing them as legitimate competitors to quick-service restaurants, reported CSP Daily News. According to Intouch Insight, 85 percent of consumers have tried made-to-order food from c-stores.

Eating habits are also evolving: while cars remain the primary dining spot, in-store and destination-based consumption are rising. For example, in-store eating jumped from 5 percent in 2024 to 11 percent in 2025, and eating at one’s destination rose from 18 percent to 22 percent reflecting behaviors more typical of QSR patrons.

The menu mix is expanding as well, with notable year-overyear increases in purchases of sandwiches, wraps, breakfast items, hot meals, salads, and soups— suggesting growing consumer trust in c-store food quality. Promotions and discounts are becoming more influential, rising from 7 percent to 11 percent as a motivator for purchase, mirroring traditional QSR marketing tactics. Handheld items remain dominant, especially for breakfast, due to their portability and car-friendly packaging.

“Seventy-two percent of consumers view c-stores as legitimate competitors to quickservice restaurants.” NATIONAL COALITION OF ASSOCIATIONS OF 7-ELEVEN FRANCHISEES

Candy Remains Strong Despite Inflation

Despite inflationary pressures and rising ingredient costs—especially record-high cocoa prices—candy continued on page 12

The National Coalition Office

The strength of an independent trade association lies in its ability to promote, protect and advance the best interests of its members, something no single member or advisory group can achieve. The independent trade association can create a better understanding between its members and those with whom it deals. National Coalition offices are located in Ceres, California.

3645 Mitchell Road Suite B Ceres, CA 95307

855-444-7711 nationaloffice@ncasef.com

NATIONAL OFFICERS & STAFF

Sukhi Sandhu NATIONAL CHAIRMAN 855-444-7711 sukhi.sandhu@ncasef.com

Nick Bhullar EXECUTIVE VICE CHAIR 626-255-8555 bhullar711@yahoo.com

Teeto Shirajee VICE CHAIR 954-242-8595 teeto.shirajee@yahoo.com

Michelle Niccoli VICE CHAIR 719-661-1048 nicco711@yahoo.com

Khalid Asad VICE CHAIR 913-488-3014 Khalid.asad@aol.com

Rajneesh Singh TREASURER 214-208-6116 rjn_singh@yahoo.com

Shawn Howard OFFICE & VENDOR RELATIONS MANAGER 855-444-7711 shawnh@ncasef.com

Eric H. Karp, Esq. GENERAL COUNSEL 617-512-9004 ekarp@wfrllp.com

John Riggio MEETING/TRADE SHOW COORDINATOR 262-394-5518 johnr@jrplanners.com

John Santiago MANAGING EDITOR 267-994-4144 avantimag@ncasef.com

April J. Key GRAPHIC DESIGNER lirpayek@gmail.com

The Voice of 7-Eleven

Franchisees Join Modesto Police For Operation Chill

NCASEF Chairman Sukhi Sandhu and Central California franchisee Hady Nawabi recently joined the Modesto Police Department to present Slurpee coupons as part of 7-Eleven’s Operation Chill program, thanking officers for their daily service in keeping the community safe. Present at the gathering were Detective Sean Dodge, Chief Brandon Gillespie, Captain Chris Adams, Captain Robert Reyna, and Captain Bob Meredith of the Modesto Police Department. Also in attendance were SEI Area Leaders Stan Peery and Alfonso Franco, along with

REAL PROFITS. REAL BENEFITS.

Western Zone Asset Protection Specialist David Marks and Zone Asset Protection Manager Steve Kellison. This year marked the 30th anniversary of Operation Chill, a signature outreach effort by SEI designed to build stronger connections between law enforcement and local youth. Since its launch, the program has distributed more than 24 million coupons nationwide, encouraging positive interactions between officers and kids by rewarding good deeds with a free Slurpee.

Member News

remains a resilient top-10 in-store category for convenience retailers, generating strong margins and basket-building opportunities, reported NACS Magazine. In 2024, monthly per-store candy sales rose 3.9 percent year-over-year to $9,136, with margins exceeding 51 percent, contributing 3.5 percent to overall in-store sales. While foot traffic into stores remains a challenge, particularly among lowerincome consumers, brands like Mars Wrigley and Hershey continue to innovate with premium offerings, seasonal promotions, and impulsedriven merchandising strategies. Non-chocolate candy, pegged formats, and gum have shown notable growth, with sour and freeze-dried varieties gaining

traction among Gen Z and millennial shoppers. Retailers are responding with value packs, cross-category bundles, and front-end design enhancements to drive impulse purchases and offset price sensitivity.

Store Brands Climb As Shoppers Seek Value

As inflationary pressures persist and supply chain uncertainties linger post-COVID, convenience retailers are increasingly turning to private-label products to boost margins and build customer loyalty, reported CStore Decisions. Chains like Loop Neighborhood are leading the charge by overseeing the full lifecycle of their offerings—from manufacturing to sale—allowing for greater control and profitability.

According to Circana and NielsenIQ reports, private-label sales are rising across mature categories like meat and bakery, as well as emerging ones like candy and snacks. Consumers are responding positively: 75 percent say privatelabel items offer good value, and 72 percent view them as viable alternatives to national brands. Notably, 54 percent of shoppers prioritize product fit over brand name, signaling a shift in purchasing behavior that favors store-owned labels.

Energy Drinks Drive Beverage Sales In C-Stores

Convenience store retailers are increasingly optimistic about

beverage category growth in 2025, with expectations rising to a 3.7 percent sales increase—up from 3.4 percent last quarter—according to a Goldman Sachs survey of operators representing roughly 37,000 U.S. stores. Energy drinks are leading the charge, projected to grow 12 percent this year after four consecutive quarters of gains. Brands like Red Bull, Ghost, and Alani Nu saw double-digit year-over-year growth in Q2, with Alani Nu jumping 45 percent. Monster Energy also posted an 8 percent increase, fueled by the successful launch of its Ultra Vice Guava flavor.

However, challenges remain. Retailers noted a slowdown in promotional activity from beverage manufacturers compared to the

previous quarter, and three-quarters expect price hikes later this year. The beverage category’s resilience is helping offset broader traffic pressures, with energy drinks emerging as a reliable growth engine amid economic uncertainty. Retailers are banking on continued innovation and strategic pricing to sustain momentum, positioning beverages—especially functional and performance-oriented options— as a cornerstone of convenience store profitability.

“Energy drink sales are projected to grow 12 percent this year after four consecutive quarters of gains.”

C-Stores Advance In Breakfast Wars

Fast-food chains are losing their grip on the breakfast market as convenience stores—especially “food-forward” ones like Wawa, Buc-ee’s, and Sheetz—see a surge in morning traffic, reported NBC News. While fast-food breakfast visits rose just 1 percent in the three months ending July 2025, convenience store visits jumped 9 percent, according to Circana. These stores have evolved beyond gas and snacks, offering made-to-order meals, broader beverage options, and perceived value that appeals to budget-conscious consumers. Chains like 7-Eleven are investing heavily in their prepared food offerings, inspired by successful continued on page 47

Reasons

we’re proud to serve you: It’s simple. It’s reliable. It’s Aon. Contact us for any insurance questions: (847) 629-4711 support.7eleven@aondigital.com www.aondigital.com/en-us/7eleven

Optimized our entire service team to continue serving you better. Introduced location-based policies for seamless service everywhere you go and grow.

Launched our digital wallet to continue serving you better with the latest technology. Stores wont be cancelled due to losses We have additional Loss prevention, Employee retention and compliance tools MARKED 20 YEARS AS YOUR OFFICIAL WORKERS’ COMP INSURANCE AND EPLI BROKER!

BY CHILDREN’S MIRACLE NETWORK HOSPITALS

NCASEF Champions Children’s Health During 49th Annual Convention

The National Coalition of Associations of 7-Eleven Franchisees (NCASEF) and its vendor partners rallied around Children’s Miracle Network Hospitals during the 49th Annual Convention and Trade Show, uniting golf, fundraising, and celebration to make a lasting impact. From the tournament at Monarch Beach Golf Links and a lively Charity Night Gala to honoring top fundraising franchisees and FOAs, the week showcased the power of partnership and generosity. With over $250,000 presented to CMN Hospitals, along with special recognitions and heartfelt stories, the event highlighted NCASEF’s commitment to changing kids’ health and shaping a brighter future for communities nationwide.

NCASEF Plays Yellow At Monarch Beach Golf Links

It was a beautiful day at Monarch Beach Golf Links on July 22 as vendor affiliates and franchisees joined together to make an impact for Children’s Miracle Network Hospitals (CMN Hospitals). Golfers, volunteers, and spectators donned yellow ribbons to show their support for Play Yellow, CMN Hospitals’ signature golf program.

Through on-course donations, golfers received mulligans, holein-one entries, and Play Yellow golf balls. Local patient Champion Hudson joined us to send golfers off and share his story around the course. Over $1,900 was raised on the course and will benefit Children’s Hospital of Orange County.

Play Yellow

because yellow is a color close to Jack and Barbara’s hearts, and has come to symbolize their long-time, passionate support of children’s health.

“Through generous individual and FOA gifts, member hospitals across the country will benefit from the 49th Annual Convention and Trade Show for years to come.”

Play Yellow is CMN Hospitals’ golf program that launched through a partnership with Jack and Barbara Nicklaus and the PGA TOUR. Play Yellow unites the golf industry to fundraise for CMN Hospitals. The program was dubbed Play Yellow

The Nicklaus’s passion for the cause of children’s health started in the late 1960s because of their friend Craig Smith, who was stricken with Ewing’s sarcoma as a teenager. As he battled the disease, Jack and Barbara supported Craig and his family in many ways. One way revolved around Jack wearing a yellow shirt, Craig’s favorite color, which Craig said brought Jack luck on the course. Over the years Jack could be seen wearing yellow on tournament Sundays. Craig’s legacy lives on through Jack and Barbara’s passion for helping children everywhere live the healthiest lives possible. When golfers play where the green meets yellow, we make a huge difference in the lives of millions of children and families!

Convention Opening & Annual Charity Night

The CMN Hospitals booth at the NCASEF trade show showcased how our collective efforts to provide member hospitals with the critical funds they need to advance pediatric healthcare at large, ultimately improving individual patients’ health, protecting our children’s futures, and enhancing our communities.

A digital caricature artist gave convention attendees badge caricatures to proudly wear around the convention floor. While waiting, convention attendees shared their reason for raising funds and awareness for Children’s Miracle Network Hospitals.

The annual Charity Night Gala was sponsored by CocaCola, Fairlife, Body Armor, and Monster Energy. The evening consisted of presentations, awards, and successful live and silent auctions. Together, we celebrated the impact of our partnership and raised an additional $48,000 for children’s hospitals across the country.

Through generous individual and FOA gifts, member hospitals across the country will benefit from the 49th Annual Convention and Trade Show for years to come. Thank you to every NCASEF member and affiliate vendor for your continued efforts and dedication to change kids’ health to change the future!

Congratulations to our 2024 fundraising award winners. We are grateful for the many ways you make a difference for local kids in your community!

2024 Top Fundraising Franchisees (Store Fundraising)

• Nick Bhullar

• John Poulos

2024 Top Fundraising FOAs (Event Fundraising & Store Fundraising)

• Southern California FOA

• Texas FOA

• Central Florida FOA

2024 Highest Fundraising Average FOAs (Combined Highest In-Store Fundraising Averages & FOA Giving Averages)

• Cal-Neva FOA

• Greater Oregon FOA

• Central Valley FOA

Hospital Impact Award: Chicagoland FOA (FOAC) & Midwest FOA

We’re proud to honor two extraordinary FOAs with the Hospital Impact Award for their outstanding dedication to Lurie Children’s Hospital. Through their unwavering commitment, in 2024 they raised nearly $70,000, organized impactful events and trade shows, and took the time to personally connect with the hospital’s mission. Their efforts have not only served the greater Chicago community but also earned them Lurie Children’s 2024 Change Maker Award. Please join us in celebrating the Chicagoland FOA and the Midwest FOA for their generosity, dedication, and heart. Together they’ve made a lasting difference for the hospital and the children it serves.

Miracle Champion Award: Naeem Khan

We had the privilege of honoring Naeem Khan with the Miracle Champion Award, recognizing his extraordinary dedication to Children’s Miracle Network Hospitals. Naeem’s commitment to changing kids’ health to change the future is truly inspiring. His efforts span from organizing worldclass golf tournaments to supporting CMN Hospitals at both local and national events, and fundraising through his store and FOA. His FOA consistently ranks among the highest fundraising averages, reflecting the strength of the partnership he’s built with his local hospital.

Thanks to Naeem’s generosity and unwavering support, hundreds of thousands of dollars have been raised to help make miracles happen for children and families across the network. We are proud to celebrate Naeem’s lasting impact and grateful for the difference he continues to make.

Annual Gala & Check Presentation

The convention week culminated with us wearing our fanciest outfits and a check for $250,000 being presented to Children’s Miracle Network Hospitals during the closing night’s Grand Banquet event. The funds from this check will go on to benefit the local member hospital of each donor or FOA, creating a nationwide positive impact.

These funds are unrestricted and go to each hospital’s most urgent needs, whether that’s providing care to children without insurance, investing in research that discovers life-saving treatments and cures, training the next generation of doctors and nurses, or offering families comfort and peace of mind during the most trying moments of their lives.

By improving medical equipment, facilities, and treatments, children’s hospitals are better equipped to address the most challenging health issues of our day.

“Thank you, NCASEF! We couldn’t

Thank you, NCASEF! We couldn’t achieve our mission without you. Together we can change kids’ health and the future—for all of us.

Speaking With One Voice

In business, there’s power in numbers. But numbers alone don’t create change—unity does. For 7-Eleven franchisees, our strength isn’t just in how many stores we operate or how many people we employ. It’s in how we come together to solve the challenges we all face.

“No matter which platform franchisees serve on—NCASEF, FOA, NBLC, or FLR—the issues must be communicated with a united voice.”

When we speak with one voice, we become far more effective at driving meaningful results than if we act alone. Over the years, I’ve seen what happens when franchisees, local FOA leaders, NCASEF Board members, and members of the National Business Leadership Council (NBLC) and Franchise Leadership Roundtable (FLR) speak individually: one person says one thing, another says something else, and SEI ends up hearing multiple versions of the same issue. The core message gets blurred, urgency is lost, and solutions slip further out of reach.

The truth is simple—SEI is far more receptive when we present a united front. When FOAs gather feedback from their members and bring those issues to NCASEF Board meetings, we can craft a single, clear message on behalf of all franchisees. That message, backed by

“It shows we are organized, focused, and determined to fix store-level problems in ways that benefit everyone—franchisees, SEI, and our customers.”

facts and delivered with purpose, is hard to ignore. It shows we are organized, focused, and determined to fix store-level problems in ways that benefit everyone—

BY SUKHI SANDHU NCASEF Chairman

franchisees, SEI, and our customers. No matter which platform franchisees serve on—NCASEF, FOA, NBLC, or FLR—the issues must be communicated with a united voice.

From time to time, the suggestion is made that litigation could be the solution to some of our issues. Litigation might grab headlines, but it rarely produces lasting solutions, and it damages trust and relationships between franchisees and SEI in the long term. It divides us, drains resources, and distracts from what truly matters—improving operations, increasing sales, and making our stores and the brand stronger. Lawsuits should remain a last resort, pursued only when all other avenues have been completely exhausted.

“Together, we can cut through the noise, align on priorities, and present SEI with clear, actionable solutions.”

That’s why unity and constructive dialogue are so important. Together, we can cut through the noise, align on priorities, and present SEI with clear, actionable solutions. One strong voice—representing the full weight of the franchisee community—can achieve what litigation often cannot: real, lasting change that makes our businesses more profitable and our partnerships more productive.

But unity doesn’t happen by chance—it requires planning and communication. Every FOA should regularly meet with its members to discuss store-level issues, gather input, and brainstorm solutions. Those conversations must continue at the national level, where NCASEF can consolidate priorities and present them to SEI. This is NCASEF’s role, and we will keep turning franchisee concerns into action that moves us all forward.

United Chicago FOAs Hold First Picnic Event

On July 19, the Chicagoland FOA, Midwest FOA, and Alliance of 7-Eleven Franchisees FOA came together to host their first United Chicago FOAs Picnic at Busse Woods Grove 27 in Elk Grove Village, Illinois. The event drew more than 400 attendees, creating a lively and festive atmosphere.

Families enjoyed a wide variety of activities, including

a Bubble Show, kite flying, face painting, musical chairs, and music from a DJ. Raffle prizes and games kept the excitement going, while food options such as snow cones, cotton candy, sugar cane juice, and pani puri added to the celebration. The picnic was a memorable opportunity for franchisees and their families to relax, connect, and enjoy time together.

“None of us is as great as all of us together”

The best way to stay informed of the latest changes and challenges to our 7-Eleven system-and the convenience industry, in general-is to join your local Franchise Owner’s Association. FOAs help franchisees share ideas and concerns, and allow us to approach our franchisor and vendor partners with a unified voice. Becoming an FOA member also makes you a member of the National Coalition, which consists of all 41 FOAs nationwide.

To join your local organization, contact the FOA president closest to you, or follow the instructions below to fill out an online membership form. If you cannot find the FOA closest to you, contact nationaloffice@ncasef. com for more information. We welcome your participation!

1. Log in to 7Help using 7Hub (secured) instore or using this link https:/7elevenna. service-now.com/from any external device.

2. In the search bar type “FOA.”

3. Select the popup suggestion “FOA/ PAC:FRANCHISE OWNERS ASSOCIATION.”

4. Type “NONE” in the “Current FOA” box if you are joining an FOA for the first time or you are not a member of any other FOA.

5. Type in the full name of the FOA that you wish to join (No abbreviation) in the “Future FOA” box.

6. Type in the amount of monthly dues as instructed per local FOA.

7. Type “Please enroll (store number) as a member of (name of the local) FOA.”

8. Repeat Step 7.

9. Press the green submit icon.

This isn’t about finger-pointing. It’s about being professional, solution-oriented partners. SEI needs to hear not just what’s wrong, but how we believe it can be fixed. When franchisees, FOAs, and NCASEF are aligned, we send a clear message: we are serious about solving problems, we’re willing to work collaboratively, and we expect SEI to do the same.

At the end of the day, we all want the same thing— thriving stores, satisfied customers, and a partnership that works for everyone—to make our 7-Eleven brand stronger. And the path to that future begins with speaking as one.

Thank You to Franchisees and Vendors

Before I close, I want to express my sincere appreciation to everyone

who joined us at the 49th Annual NCASEF Convention & Trade Show in Anaheim. It was inspiring to see so many familiar faces and to welcome new franchisees to our growing network. This year’s convention set new records with the highest attendance at our seminars, highest vendor participation in the trade show, and most orders placed on the trade show floor than at any previous convention. Your energy and engagement made the event a tremendous success.

A special thank you to our vendor partners for your unwavering support—from sponsoring events to showcasing top-selling products and offering fantastic deals to help our gross profits. Your commitment helps us grow our businesses and better serve our communities. We couldn’t do this without you.

Together—franchisees, FOAs, NCASEF, vendors, distributors, and SEI—we have the opportunity to the kind of unity that drives progress and ensures long-term success. If we continue to speak with one voice, I’m confident we’ll achieve it and strengthen our stores while taking the 7-Eleven brand to the next level.

Franchisee Profitability

Over the past few years there have been two extended but ultimately unsuccessful sagas involving the control of the parent company of 7-Eleven, Inc. (SEI). One was the 2023 initiative of the activist investor ValueAct, which among other things, advocated spinning off the convenience store business into a separate entity. The second was last year’s unsolicited $47B bid by Alimentation Couche-Tard (ACT), the parent company of Circle K, to purchase the company, which was abandoned this past July.

During the course of these episodes, hundreds of pages of PowerPoint presentations, press releases, letters and other communications were issued by both sides, but none of them ever focused on what I think should be a central goal of every franchisor, which is to support and pursue the profitability of its franchisees.

Then, on August 6, 2025 Stephen Hayes Dacus, newly installed CEO of the parent company, delivered a 26page PowerPoint presentation entitled Transformation of 7-Eleven, culminating what he characterized as an extensive bottom-up process to clarify key deliverables, milestones and accountability for this plan. The specific goals involve significant increases in revenue, gross profit and earnings per share, such that EBITDA grows by 45 percent or at the compound rate of 7 percent per year through 2030. The plan seeks to deliver shareholder returns far in excess of what has been experienced in the past, which is what triggered the ValueAct and ACT initiatives.

At the outset, Mr. Dacus identified the reasons for the intended transformation in the following terms:

“I think one of our challenges today is that we have lost some of our founder’s mentality. We are no longer as trusted by our customers as we once were, especially in Japan. We no longer aggressively embrace change the way our founders did. We have become a bit complacent, particularly at headquarters. Getting back to our founders’ mentality is critically important and this plan is an important step in that direction.”

“The presentation identifies the key challenges for SEI specifically as the consumer perception of the food and fuel demand.”

BY ERIC H. KARP General Counsel to NCASEF

The presentation identifies the key challenges for SEI specifically as the consumer perception of the food and fuel demand.

• Food—Management intends to change the perception of the value and the quality of the food products. This will involve tripling the share of proprietary and private brand products to 6.5 percent of merchandise sales in 2030. Mr. Dacus stated that margins on private brands in North America are 18.3 percent higher than national brands with equivalent or better quality.

• Fuel—The intent here is to build vertical integration capabilities to improve margin profile by capturing untapped profit pools within the supply chain, similar to what other competitors are doing at the present. Among other things this will involve supplying fuel to customers in other channels, with the intent to increase EBITDA from fuel by approximately $400M by 2030.

“But in my view, the most consequential challenge identified in the presentation, is that of franchisee profitability.”

But in my view, the most consequential challenge identified in the presentation, is that of franchisee profitability. We don’t know what caused the company to add this to its agenda, but it’s entirely possible that it relates, at least in part, to the fact that Mr. Dacus’ father was a franchisee in the United States and that he worked the midnight shift in that store as a teenager.

The focus on franchisee profitability is a hallmark of many other franchise systems. Cheryl Batchelder was the CEO of Popeyes starting in the mid-1990s. In an article in the 2016 Harvard Business Review entitled “The CEO of Popeyes on Treating Franchisees as the Most Important Customers,” she attributed her massive and stunning turnaround of the company to the following central themes:

• To try to turn Popeyes around, my team and I decided to focus intently on the franchisees rather than other stakeholders. We decided to measure our success by their success.

• The more my team and I talked about it, the more we

FOR

700ml

The slim 700mL bottle is convenient for on-the-go and fits in cupholders and backpacks!

saw the franchisees as our primary customers.

• The Popeyes turnaround has become a case study in what happens when leaders think about serving others— in this case, our franchisees.

The identified challenge of franchisee profitability in the 7-Eleven system was grouped together with issues relating to consumer spending, channel shift, and cost inflation. The presentation identified four approaches to growth in this area. Here is a summary, focusing on those portions relating to SEI:

1. Draw customers with more differentiation in food. Many of the small competitors in the United States are focusing more on food and doing it well. Our very successful and profitable restaurant in-store format generates higher sales and profit and incremental attachment sales of $0.81 for every dollar spent in the restaurant. Grow the number of stores with the restaurant format to 2,000 by 2030.

2. Satisfy changing customer needs with new formats and accelerate openings. Double the projected number of new openings, resulting in 1,300 new larger format stores in North America over the next five years.

3. Expand 7NOW graphic and service coverage. 7NOW satisfies the needs of franchisees for additional revenue streams and the needs of customers for more convenient shopping. The seemingly modest goal is to add 200 stores per year resulting in 8,500 stores in the program by 2030. Enhancements are being tested to enhance its attractiveness and differentiate SEI from its competitors.

4. Rigorous process to review all costs. Cost management is not currently a competitive advantage. SEI is more advanced in this process than SEJ, the benefits of which showed up in the most recent quarterly P&L (which showed Revenue down 6.3 percent but Operating Income was up 21.7 percent).

“The overall and primary goal of the Transformation of 7-Eleven is to generate enhanced capital to unlock and maximize shareholder value totaling nearly $60 billion by 2030.”

The overall and primary goal of the Transformation of 7-Eleven is to generate enhanced capital to unlock and

maximize shareholder value totaling nearly $60 billion by 2030. Nearly $19 billion would be returned to shareholders in the form of share repurchases and dividends. Another $9.5 billion would be used to pay down debt. The balance or about $21.6 billion would be devoted to capital expenditures, including mergers and acquisitions.

“I see this as a first step which will hopefully be followed by meaningful collaboration between representatives of the franchisor and the National Coalition.”

Observations and Questions:

It is very encouraging from management of the parent company of SEI to make clear to shareholders and others that franchisee profitability and the need for additional sources of revenue are on their radar. The challenges that franchisees face includes not only those mentioned, but also those relating to same store sales, transactions and gasoline pricing. I see this as a first step which will hopefully be followed by meaningful collaboration between representatives of the franchisor and the National Coalition. In the interim, here are some questions:

1. How much capital will be invested in converting existing locations to accommodating the in-store restaurant format, to what extent will franchisees have an opportunity to participate in these initiatives and on what basis?

2. Will the initiatives relating to the enhancement of food offerings be limited to the in-store restaurant format and the increase in private brands?

3. How much capital will be allocated to remodeling and renovating franchised stores?

4. Is SEI interested in increasing the percentage of locations in the United States that are franchised from its current levels of just over 60 percent to its historic levels of as much as 89 percent, and on what basis?

5. Is it time to revisit the many revisions to the franchise agreement rolled out in 2019, which transferred many expenses from the franchisor to the franchisees and changed the store level economics in material ways?

6. To what extent are the gross margin advantages of private and proprietary brands going to be memorialized in commitments by both parties?

7. If 7NOW is the future, what will be its specific and reliable impact on store level economics?

Fear-Driven Franchisee Vs Motivated Franchisee

BY TEETO SHIRAJEE NCASEF Vice Chair

When comparing a fear-driven franchisee to a motivated franchisee, the motivated franchisee typically brings more profit for the franchisor. Here’s why:

“Motivated franchisees tend to take initiative, looking for ways to grow their business and improve operations.”

Proactivity: Motivated franchisees tend to take initiative, looking for ways to grow their business and improve operations. They are more likely to implement marketing strategies, engage with customers, and explore expansion opportunities, which can lead to increased sales and profitability.

Customer Focus: Motivated franchisees often prioritize customer satisfaction and experience. A strong focus on delivering excellent service can lead to repeat customers and positive word-of-mouth marketing, which benefits the franchisor’s brand.

“They may experiment with new products, services, or operational improvements, which can result in higher revenues.”

Adaptability and Innovation: Motivated franchisees are generally more open to change and willing to adapt to market trends. They may experiment with new products, services, or operational improvements, which can result in higher revenues.

Long-Term Vision: Motivated franchisees are usually more invested in the long-term success of their business and the brand. This commitment can lead to sustained profitability, benefiting the franchisee and the franchisor.

“Frequent turnover can be costly for franchisors when training new franchisees and maintaining brand consistency.”

Lower Turnover: Fear-driven franchisees may operate under a mindset focused on compliance and avoiding mistakes, leading to a lack of innovation and potentially higher turnover rates. Frequent turnover can be costly for franchisors when training new franchisees and maintaining brand consistency.

In contrast, fear-driven franchisees may prioritize sticking to the status quo and avoiding risks, limiting their growth potential and leading to lower profitability. They might focus on simply meeting minimum standards rather than striving for excellence.

Motivated franchisees are generally more likely to drive profits for the franchisor due to their proactive approach, customer focus, adaptability, commitment, and potential for long-term success.

“When both parties work together effectively, it enhances brand success and profitability for everyone involved.”

When you boil it down, a motivated franchisee creates a successful franchise-franchisor relationship built on clear communication, support, shared goals, brand consistency, mutual investment, adaptability, and performance evaluation. When both parties work together effectively, it enhances brand success and profitability for everyone involved.

Change Kids’ Health Change the Future®.

A car accident changed Will’s life forever, leaving him unable to walk. But with the support of Dell Children’s Medical Center, he found a new path. Therapists helped him regain strength and embrace life in a wheelchair. Today, Will is a wheelchair basketball national champion, proving that nothing can hold him back. His story shows the amazing impact of Children’s Miracle Network Hospitals® , Your donations can help more kids like Will thrive.

Thanks to donations, Dell Children’s Medical Center provided Will with essential therapies, empowering him to overcome adversity and pursue his dreams.

Turning Around A Struggling 7-Eleven

Practical strategies to boost inventory turns, improve profitability, and make staff your biggest asset.

If your store is currently losing money or just not hitting your profit goals, it is time to get serious about understanding what is going wrong and how to fix it. Often, the solution isn’t just about cutting costs—it’s about a comprehensive approach that involves analyzing your numbers, refining how you manage inventory, and most importantly, leveraging your staff. They can be your biggest asset or your biggest obstacle. Here is my take on how to approach that:

“Before making any changes, you need to understand where you stand.”

1. Start with a Full Financial and Performance Check

Before making any changes, you need to understand where you stand:

• Sales Data: Break down your sales carefully—look at which products are moving, which are stagnant, and during what times of day or week sales spike or dwindle. This helps you identify your bestsellers and those that are not worth keeping.

• Inventory Turnover: Calculate how quickly your inventory turns over using the 48P Product Sales Analysis Report and the IMR (Inventory Management Report). A low rate usually means you are holding onto stock too long, which ties up cash and increases spoilage or markdown costs. Aim for a healthy turnover that aligns with your product types.

• Expenses: Take a close look at your biggest costs— payroll, utilities, write-offs, supplies—and compare them to the subgroup and market benchmarks. Is anything out of line? Are there areas where you can tighten spending without sacrificing customer experience?

2. Sharpen Your Inventory Management

Proper inventory management is the backbone of profitability:

• Data-Driven Restocking: Use your POS system to see real-time sales trends. Adjust your stock levels accordingly—build up high-demand, high-margin items, and cut back on slow-moving or obsolete inventory.

BY MICHELLE NICCOLI NCASEF Vice Chair

Think of it as working smarter, not harder.

• Minimize Waste: Train staff on FIFO (first-in, first-out) especially for perishable items and monitor expiration dates consistently. Implement routine stock counts to catch discrepancies early and prevent losses.

• Review Your Product Mix: Regularly evaluate what is selling and what is not. Consider seasonal or trending items that can bring in new customers. Remove dead stock swiftly and focus your space on products that turn over quickly and profitably.

“Promotions are a quick way to boost sales if executed correctly.”

3. Grow Revenue with Smarter Promotions

Promotions are a quick way to boost sales if executed correctly:

• Targeted Discounts: Use your sales data to run timely offers—discounting high-margin items or bundling complementary products to encourage larger transactions.

• Upselling & Cross-selling: Equip your team with menu prompts and scripts to suggest add-ons, upgrades, or related items. Even small suggestions can significantly increase total sales per customer.

• Store Atmosphere: Keep your store inviting—clean, organized, and well-lit. Small improvements in presentation can make a big difference in encouraging customers to linger and buy more.

4. Make Your Employees Your Secret Weapon

Your staff are personally responsible for a large chunk of your store’s success or failure:

• Understanding Their Impact: Disengaged employees tend to miss sales opportunities, mishandle stock, or contribute to theft, which erodes profit. Conversely, engaged staff who know their products and are motivated can drive sales and reduce losses.

• Harness Their Potential: Get your team involved—train them in customer service skills, inventory control, and loss prevention. Recognize their efforts openly; when

ALITTLEsour. ALITTLE sweet.

they see their contributions matter, they are more likely to step up.

5. Invest in Training & Motivation

Well-trained staff do not just sell more—they also help keep your costs down:

• Sales & Customer Service: Regular sessions on product details, upselling, and a friendly attitude encourage customers to spend more.

• Shrinkage Prevention: Teach staff how to spot suspicious activity, manage stock properly, and handle cash accurately. Building a culture of responsibility helps reduce theft and waste.

• Operational Skills: Show your team how to optimize checkout speed, restock efficiently, and minimize waste. Small tweaks in routines can save time and money.

• Recognition & Rewards: Celebrate staff who go above and beyond—this fosters a sense of ownership and accountability.

6. Cut Costs & Improve Operational Efficiency

Be proactive in managing your overhead:

• Smart Scheduling: Use your sales data to align staffing levels with busy periods. Overstaffing during slow times means unnecessary labor costs; understaffing during busy hours can hurt sales and customer experience.

• Control Expenses: Create monthly budgets and stick to them. Communicate the goals to your team. Monitor your progress using your payroll reports, Daily AP9, supply budget, and the 48A, just to name a few.

7. Boost Store Visibility & Customer Traffic

• Local Marketing: Use social media, flyers, or partnerships with nearby businesses to increase awareness. Sometimes simple, targeted outreach can significantly increase foot traffic.

• Store Presentation: Review your store daily. Keep displays fresh and strategically arranged. Highlight high-margin or promotional items at eye level and near entrances to boost impulse buys. Verify that POP is placed and visible.

• Equipment: Monitor cleaning and maintenance of all equipment inside your store. Create a sense of urgency to report issues. Follow-up to ensure timely repair.

• Cleanliness and Layout: Make sure your store is spotless and easy to navigate. An inviting environment encourages customers to stay longer and buy more.

8. Reassess Your Strategy & Store Layout

• Regular Evaluation: Keep track of what marketing tactics and promotions are actually bringing in customers—or not. Be ready to pivot as needed.

• Store Layout Optimization: Place your most profitable and popular products in high-traffic areas. Use signage to draw attention to key items.

• Streamline the Shopping Experience: Simplify the layout to reduce confusion, make checkout faster, and guide customers towards high-margin products.

Why Your Employees Are the Key to Profitability

Your staff can be your best asset or your biggest obstacle:

• Preventing Shrinkage: Employees who are engaged and trained help minimize theft, waste, and inventory errors.

• Driving Sales: Encouraging upselling, friendly service, and initiative-taking engagement increases transaction sizes and overall revenue.

• Managing Inventory: Proper handling, rotation, and regular cycle counts help reduce waste and avoid stockouts.

• Operational Excellence: Well-scheduled and motivated staff work more efficiently, reducing labor costs and improving margins.

Create a culture that values responsibility and recognition. Regular training, clear expectations, and rewards can motivate your team to take ownership of their roles—and ultimately contribute directly to your store’s turnaround.

“The key is to understand your financials inside and out, optimize your inventory, cut unnecessary costs, and, most importantly, empower your staff.”

Final Thoughts

Revitalizing a store that is not performing well takes a comprehensive, disciplined approach. The key is to understand your financials inside and out, optimize your inventory, cut unnecessary costs, and, most importantly, empower your staff. They are your frontline, and their attitude and skills can make or break your store’s success. By focusing on these strategies and fostering a team culture of accountability, continuous improvement, and motivation, you set your store up for a healthier, more profitable future. The work might be challenging, but with focus and the right mindset, turning things around is absolutely within reach.

San Diego FOA Stores Celebrate 7-Eleven Day

San Diego franchisees joined the nationwide celebration of 7-Eleven Day on July 11 by offering free small Slurpees to their communities. Local stores participating included #13662, #33970, and #13628, which welcomed customers eager to take part in the brand’s annual tradition marking its 98th anniversary. Along with giveaways, customers who scanned

their rewards information received a bonus coupon for another free Slurpee, redeemable through July 31, and enjoyed $1 snack and beverage deals throughout the month. The event created a joyful atmosphere across San Diego, as franchisees and customers came together to honor nearly a century of the Slurpee tradition.

How Franchisor Going Public May Affect You

After the Canadian owner of Circle K, Alimentation Couche-Tard, Inc., abandoned its $47 billion purchase bid, on July 17, 2025, the Japanese corporate parent Seven & i Holdings Co., Ltd. (7&i) issued a press release that, among other things, reiterated its plans to make an initial public offering (IPO) of its “North American convenience store business.” An IPO is also known as “going public,” and occurs when a private company first offers its shares

“In March 2025, Seven & i first announced that it planned to make the IPO in the second half of 2026, assuming favorable market conditions.”

of stock for sale to the general investing public. In March 2025, Seven & i first announced that it planned to make the IPO in the second half of 2026, assuming favorable market conditions. Industry analysts expect Seven & i to be the majority shareholder of the new 7 Eleven, Inc. (SEI), but there are many details yet to be determined and disclosed. Here are some thoughts about how an IPO, if it occurs, may affect your franchises.

First, an IPO would generate significant additional capital for SEI, which could be used to:

• expand the number of stores;

• rehabilitate existing stores;

• improve food service capabilities;

• enhance marketing strategies; and/or

• upgrade digital infrastructure, among many other brand-building activities.

Second, SEI would have to make more financial data publicly available and do so more frequently. Currently, the U.S. Federal Trade Commission (FTC) requires franchisors to issue franchise disclosure documents (FDDs) at least once a year so that prospective and renewing franchisees have sufficient information to make investment decisions. Under the FTC’s Franchise Rule, franchisors may—but are not required to—make financial performance representations in Item 19 of the FDD.

BY TOM AYRE ASSOCIATE GENERAL COUNSEL— WARNER, FEDERICO & RYAN, LLP

SEI typically has not provided data regarding revenues, expenses, or profitability of franchised stores. Seven & i is a Japanese public company and provides required financial data, but its North American operations are only a fraction of its total worldwide operations. The U.S. Securities and Exchange Commission (SEC) regulates public corporations and requires them to issue quarterly and annual audited financial reports. If SEI goes public, those reports may very well contain additional data that help North American franchisees better understand the financial health of franchised stores here and the system in general.

Third, SEI would join many well-known restaurant brands that rely on the franchise model like McDonald’s (MCD), Domino’s (DPZ), and Yum! Brands (YUM), which owns a portfolio of franchised brands like KFC, Pizza Hut, and Taco Bell. Other publicly traded brands that

“If SEI goes public, those reports may very well contain additional data that help North American franchisees better understand the financial

of

franchised

health

stores here and the system in general.”

you may know include Planet Fitness (PLNT), Marriott International (MAR), and Driven Brands (DRVN), which is the parent company of automotive service brands Maaco and Meineke. The Franchise Group (FRG) is a conglomerate that owns many different and diverse franchised brands like The Vitamin Shoppe, Pet Supplies Plus, American Freight, and Sylvan Learning. In case you were wondering, yes, franchisees can buy shares in their franchisor’s public corporation if they wish.

We will continue to monitor corporate developments and update you when more information becomes available.

If you have any questions about this topic or anything else relating to your franchise agreement, you can reach me at tayres@wfrllp.com and 617-970-0063.

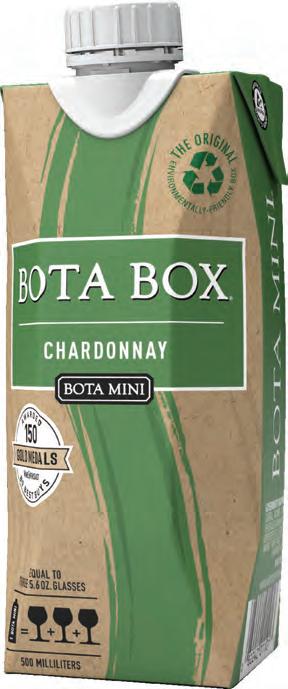

Perfect For Game Day

Chardonnay

Pinot Grigio

BY JOHN WALES Program Manager

Creating A Culture Of Safety

What does it mean to have a “culture of safety?”

To me, it’s the consistent, conscious awareness of potential hazards within your sphere of influence and taking proactive steps to address them before they become problems. The best way to explain this is through two real convenience store visits I’ve made recently.

Example 1: A Missed Opportunity

Recently, I stopped at a store around 11:00 p.m. The parking lot was dimly lit. Trash bins were overflowing. A large handwritten sign on the door announced, “No public restrooms.”

Inside, the lone employee was on their cell phone and never acknowledged me. A dirty mop leaned against the soda fountain, and a musty odor hung in the air. I bought my 20-ounce diet soda and left without a word exchanged. Hazards I noticed immediately:

• Poor lighting and cluttered conditions limited visibility and awareness of who was outside or entering.

• The handwritten sign on the door blocked the security camera’s view of customers’ faces.

• Cleaning equipment was left in a high-traffic area with no caution signage, which is a hazard to both customers and staff.

• Lack of employee engagement created an environment where theft or other issues could go unnoticed. In short, the store didn’t just look uninviting—it felt unsafe.

“To me, it’s the consistent, conscious awareness of potential hazards within your sphere of influence and taking proactive steps to address them before they become problems.”

Example 2: A Culture of Safety in Action

Several weeks later, after a delayed flight, I visited a different store at about 2:00 a.m. This store was the

opposite: brightly lit, clean, and welcoming.

As I entered, the clerk looked up and greeted me with a simple, “Welcome.” I grabbed my diet soda, and the team member pointed out a promotion: two for a better price. I bought two. Then, he mentioned fresh food just put on the roller grill, so I added a hot dog. During checkout, he also mentioned lottery tickets.

“I walked out spending $24 instead of the $3 I planned, and I was happy to do it.”

I walked out spending $24 instead of the $3 I planned, and I was happy to do it. Why?

• I felt safe the entire time.

• The store was clean and well-lit, with clear sightlines down every aisle.

• The employee was attentive, engaged, and took pride in his role.

• The atmosphere invited me to spend more.

“The second store didn’t just sell products— it created an environment where safety and pride were part of the customer experience.”

The Takeaway

The second store didn’t just sell products—it created an environment where safety and pride were part of the customer experience.

When we get caught up in metrics and day-to-day pressures, it’s easy to forget to see your stores from your customers’ perspective. But consistently creating an environment where employees feel safe and proud will make customers feel more comfortable and more likely to spend their hard-earned money at your location.

A true culture of safety starts with you.

If you have safety tips to share or would like to hear about some of the successful strategies I’ve seen, contact me at a trade show or give me a call.

Our greatest successes happen when we work together.

STOCK THE SPRING WATER DIFFERENCE

Maximize velocities and profits with these popular SKUs.

THE CORE 4

20 oz

700mL

• Easy to grab and pack

• Fits nicely in cupholders and purses

• Perfect for a quick pick-me-up

1 Liter

• A multitasking marvel

• Easy to drink and less likely to spill

• Ideal for a run, hike or working outside

1.5 Liter

• Big hydration on hot days

• Select size for long road trips

• Helps shoppers reach hydration goals

• Perfect for sharing

• Helps avoid stops on the road

• More hydration in a single purchase

WHY OUR WATERS WIN

• Regional favorites for generations.

• Locally sourced from carefully selected springs.

• Naturally occurring electrolytes for a crisp taste.

BY THE WATER STREET COLLECTIVE

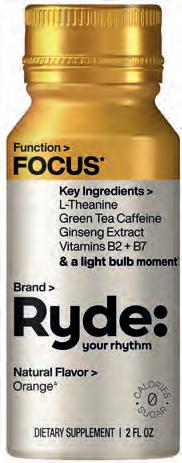

Ryde: Wellbeing Brings Functional Shots To 7-Eleven Stores Nationwide

Ryde: Wellbeing is introducing its scientifically backed line of functional 2-ounce shots to 7-Eleven franchisees across the United States, following a successful launch in Texas earlier this year. This expansion represents a significant opportunity for franchisees to carry an innovative, high-margin product in a fast-growing category.

Developed by The Water Street Collective, Ryde: offers three functional shot varieties, with 7-Eleven featuring two varieties: (1) Energize for a morning or pre-meeting boost* and (2) Focus to help go from distracted to focused and power through the midday slump.* Each is made with Ryde: Ryplenish™, a proprietary blend, along with scientifically backed ingredients selected to support energy and alertness in convenient, portable packaging.*

Ryde: entered the Texas market with 7-Eleven in late 2024 and quickly built repeat sales thanks to a combination of premium product quality, strategic marketing, and targeted sampling efforts. The expansion to new markets gives participating franchisees the opportunity to be the only retail outlet in their area carrying the brand at this time, providing a strong point of differentiation in the functional beverage set. This exclusivity can help build customer loyalty, drive incremental store traffic, and position 7-Eleven as a destination for functional wellness products. The packaging is designed for maximum visual impact in the cold vault. Sleek, resealable aluminum bottles offer not only standout shelf presence but also support sustainability initiatives by being recyclable. The modern design and bold colors make the product instantly recognizable and appealing to consumers seeking functional beverages that align with their active, on-the-

“Franchisees carrying Ryde: can potentially earn over 50 percent gross profit margins per unit, making it one of the more profitable beverage additions in the category.”

go lifestyles.

Franchisees carrying Ryde: can potentially earn over 50 percent gross profit margins per unit, making it one of the more profitable beverage additions in the category. In addition, all participating locations will be integrated into Ryde:’s 2026 Promotional Calendar, which includes:

• In-store merchandising and display support;

• Digital advertising across social media and programmatic channels;

• Targeted sampling programs to drive trial and repeat purchase; and

• Seasonal promotional tie-ins to capture peak demand periods.

Ryde:’s marketing approach blends grassroots activations with broad digital reach. In Texas, the brand executed on-the-ground sampling events, influencer partnerships, and social media content focused on relatable, real-life scenarios from early morning commutes to late-night deadlines, showing exactly when each shot fits into a consumer’s day. This relatable storytelling has been key to fostering authentic brand connections and encouraging repeat purchases.

Partnerships remain an important part of Ryde:’s growth strategy. The brand has collaborated with event organizers, local businesses, and community groups to reach its target audience: young professionals, busy parents, and individuals seeking convenient, effective solutions to keep up with their demanding schedules. By pairing these partnerships with digital and in-store activations, Ryde: builds brand awareness at multiple touchpoints, reinforcing its value proposition.

For 7-Eleven franchisees, Ryde: offers more than just another SKU. It’s a high-margin, ready-to-drink product with demonstrated consumer appeal, designed to keep customers coming back. As the brand says… “Whatever life throws at you, Ryde: it!”

(*These statements have not been evaluated by the Food and Drug Administration. This product is not intended to diagnose, treat, cure, or prevent any disease.)

Franchisee Continues Back-To-School Tradition

California franchisee Ravi Chahal and his wife Harpreet once again brought joy to local families with their annual back-to-school celebrations, held across multiple school district start dates in August. For the eighth year in a row, students were treated to free Slurpees at two of their stores—in Arroyo Grande and Orcutt—along with slices of hot, fresh pizza that earned rave reviews. The event drew large, happy crowds and was made even more special by the presence of the Sheriff’s Department, Police, and Fire Department, who came out with vehicles to greet kids and families. Vendors PepsiCo and Congo Brands also supported the festivities by providing giveaways.

The Chahals make the event a true family affair, involving their children in the fun. Customers and community members look forward to this tradition every year, which has become a meaningful way to kick off the school season. Area leaders David Continente and Cung Pham, Market Leader Griselda Torrero, and Coastal Desert Regional Director Kia Hasheminejad also lent their support. With free treats, strong vendor partnerships, and law enforcement joining in, Ravi and Harpreet once again created a welcoming environment that families won’t soon forget.

A Week Of Unity, Innovation, & Celebration In Anaheim NCASEF’s 49 th Annual Convention & Trade Show

The National Coalition of Associations of 7-Eleven Franchisees (NCASEF) held its 49th Annual Convention and Trade Show from July 21–24, 2025, and the energy throughout the week showed why this event has become such a cornerstone for franchisees across the country.

Held at the Anaheim Convention Center, the event carried the theme “Soaring to New Heights Together,” reminding everyone that the 7-Eleven system is strongest when franchisees, vendors, distributors, and SEI work side by side toward common goals.

NCASEF Chairman Sukhi Sandhu welcomed attendees with a message in the special Avanti convention issue about the power of unity and collaboration. He noted that the convention wasn’t just about deals and products—it was about relationships. “Every conversation, every handshake, and every connection made this week helps reinforce the foundation we’ve built,” he wrote. His words set the tone for a week of learning, networking, and celebration.

The event kicked off with a lively welcome reception on the Grand Plaza of the Anaheim Convention Center featuring food trucks and DJ entertainment. The next day offered franchisees a choice of relaxation or charity: some enjoyed a ferry ride to Catalina Island, while others teed off at Monarch Beach Golf Links for the annual Charity Golf Tournament, which raised funds for Children’s

Miracle Network Hospitals. It was a perfect balance of fun, networking, and giving back.

The heart of the convention came on July 23 and 24 with two days of educational seminars and the highly anticipated trade show. The seminars gave franchisees the chance to hear directly from NCASEF officers as well as SEI leaders, who discussed key topics like operations, merchandising, and government affairs. These sessions were designed to provide real take-home value—information that franchisees could use immediately to strengthen their stores.

Meanwhile, the trade show floor was buzzing with excitement. Exhibitors filled the hall, offering exclusive deals, showcasing new products, and sharing innovative solutions to help franchisees boost sales and efficiency. From energy drinks and fresh foods to cleaning supplies and new snacks, the variety was immense. Vendors sweetened the experience with raffle entries for every order placed, leading up to big prize giveaways that added even more excitement.

SEI also had a strong presence with multiple booths dedicated to areas such as accounting, IT, and asset protection. Company representatives were on hand

continued on page 43

to answer questions, provide updates, and engage directly with franchisees— which franchisees welcomed as a positive sign of SEI’s willingness to engage and work together toward shared goals.

The evenings brought opportunities to celebrate together. The Charity Night Gala blended fine dining, auctions, and live entertainment while raising additional funds for CMN Hospitals. The Grand Banquet on July 24 closed the week with franchisee and vendor recognition awards, a check presentation to CMN Hospitals, and music and dancing to keep the celebration going late into the night.

The 49th Annual Convention and Trade Show proved to be a resounding success. Franchisees discovered new products, gained valuable knowledge, and reconnected with colleagues and vendors. The week revealed an important truth: when franchisees, vendors, distributors, and SEI work together, there are no limits to how high the system can soar.

Mark Your Calendars: Next year NCASEF will celebrate its Golden Jubilee 50th Annual Convention and Trade Show in New York City, July 2124! It promises to be the best one yet!

The National Coalition of Associations of 7-Eleven Franchisees (NCASEF) held its third quarter Board of Directors meeting on July 21, 2025, in Anaheim, California, just before the opening of its 49th Annual Convention and Trade Show. The meeting brought together Board members, franchisees, and SEI representatives for a day of discussions that ranged from store-level issues to SEI’s long-term business strategies.

The meeting covered membership requests from FOAs, including the Empire State FOA, though decisions were tabled until the fourth quarter session to allow for more thorough review. Membership and Bylaws Committee Chair Joe Rossi also noted that another FOA application would be considered at the next Board meeting once all paperwork was in order. Treasurer Raj Singh presented the Treasury Report, which was approved unanimously after review. Committee updates followed, with the Convention & Entertainment Committee addressing final preparations, answering questions, and encouraging Board members to motivate their FOA members to actively participate in upcoming sessions.

NCASEF Board Meets In Anaheim Ahead Of Convention

A highlight of the meeting was a presentation from SEI’s leadership team, led by Senior Vice President of Operations for Franchise Stores Tom Lesser, who reviewed the economic landscape, consumer spending patterns, and SEI’s strategic plans through 2030. Topics included investments in fresh foods, proprietary beverages, digital enhancements, and store development. His presentation also covered brand standards, store cleanliness, foodservice initiatives, and the company’s

continued

RI strategy. Lesser stressed the importance of maintaining consistency across stores, while also highlighting new tools and programs, such as the food planner tool and hot breakfast sandwich program, aimed at driving growth. A Q&A session allowed franchisees to raise issues ranging from increasing labor expenses to maintenance challenges and unexpected equipment installations, which Lesser addressed directly.

General Counsel Eric Karp provided an update on Couche-Tard’s withdrawn bid to acquire Seven & i and discussed its possible implications for the system. He also reviewed SEI’s financials based on public records, prompting questions and discussion from Board members. Additional business included conversations on NCASEF membership requirements, voting privacy, and officer election rules, with clarification offered on which changes could be made through policy and which required bylaw amendments.

The meeting closed with final updates from the Convention and Charity Golf committees, both of which stated the importance of franchisee and vendor participation in making the events successful. Chairman Sukhi Sandhu wrapped up the session by encouraging FOA members to actively engage during the SEI seminar, and thanking the Board and committees for their commitment and hard work leading into the convention.

continued from page 45

German discount grocer Aldi is accelerating its U.S. expansion, planning to add over 200 stores in 2025 and more than 800 by 2028, making it the fastest-growing retailer in the country after the major dollar chains, reported The Wall Street Journal. With 90 percent of its inventory consisting of private-label goods and a cost-cutting model that includes direct-to-shelf crate stocking, Aldi is targeting inflation-weary shoppers and urban markets. • Kroger is reintroducing paper coupons across all stores and slashing prices on over 3,500 items to appeal to shoppers who are less digitally inclined and more price-sensitive, reported Grocery Dive. This back-to-basics approach—coupled with a strong push for private label products and simplified supplier promotions—is improving customer price perception and driving gains in same-store sales. • Casey’s reported a strong first quarter for fiscal 2025, with net income rising 19.5 percent year-over-year to $215.4 million and EBITDA reaching $414.3 million, driven by robust same-store sales and the addition of over 200 new store locations. Inside same-store sales grew 4.3 percent, fueled by successful summer merchandising and reduced labor hours, while fuel gross profit surged 18.8 percent to $373.6 million. • DoorDash’s Iced Coffee Index reveals that iced coffee has evolved into a year-round emotional comfort ritual, with 87 percent of surveyed consumers drinking it even when they don’t need caffeine and 79 percent viewing it as a “little treat” during stressful times. • Wawa recently opened its first travel center in Hope Mills, North Carolina to serve long-haul truckers with amenities such as highspeed diesel lanes, a CAT weigh station, free tractor-trailer parking, and a pet relief area, reported Trucker News. The company said it plans to open two more travels centers—one in Ohio and one in Indiana. • More than half of New Mexico’s 1,687 SNAP-authorized retailers—

models abroad, while others like RaceTrac are acquiring restaurant brands to expand their footprint. The shift reflects a growing consumer preference for variety, convenience, and quality—traits that c-stores are increasingly delivering better than their fast-food counterparts. Meanwhile, fast-food giants like McDonald’s are struggling to maintain breakfast traffic amid rising prices and changing consumer habits. Morning visits to McDonald’s dropped from 33.5 percent of total traffic in early 2019 to 29.9 percent in 2025, and the company now acknowledges breakfast as its weakest daypart. To counter the decline, chains are bundling breakfast items into value meals and borrowing tactics from convenience stores, such as expanding menu options and rethinking store layouts. Yet the data shows that consumers are increasingly choosing c-stores over fast-food for their morning meals, with 72 percent viewing them as viable alternatives.

C-Store Industry’s Mixed 2024 Performance

At the recent 2025 NACS State of the Industry Summit, Varish Goyal, CEO of Loop Neighborhood Markets and a NACS executive committee member, presented a nuanced view of the convenience and fuel retailing sector’s 2024 performance, reported NACS Daily. While total industry sales declined by 2.3 percent—driven largely by a 5.7 percent drop in fuel sales due to falling prices—the second half of the year showed surprising strength. Q3 saw notable

improvements, and Q4 exceeded expectations, with inside store sales growing 2.4 percent, marking the 22nd consecutive year of growth in that category. Goyal emphasized the industry’s resilience, noting that despite a $70 billion revenue drop in fuel, profitability remained intact thanks to strong operational performance and consumer engagement.

Operational expenses continued to climb, though at a slower pace. Direct store operating expenses rose by $9.8 billion to $159.9 billion, with facility-related costs—especially depreciation and amortization—growing at more than double the rate of other categories. Repairs and maintenance surged 10.2 percent, reflecting labor and material shortages. Wage growth, while still rising at 3.4 percent, slowed to single digits, offering a glimmer of hope for labor market stabilization.

Steady Gains Define Couche-Tard’s Q1 FY2026

Alimentation Couche-Tard kicked off fiscal 2026 with solid operational momentum, reporting net earnings of $782.5 million and adjusted net earnings of $737.0 million—a 6.7 percent dip year-over-year, largely due to lower U.S. fuel margins and prior-year asset disposal gains. Despite this, total merchandise and service revenues rose 4.5 percent to $4.7 billion, with same-store sales climbing across all regions: 0.4 percent in the U.S., 3.8 percent in Europe, and 4.1 percent in Canada. Gross profit grew 4.4 percent to $3.3 billion, buoyed by strong food program execution, reduced spoilage,

San Diego FOA Hosts Trade Show & Family Picnic

The San Diego FOA held its Annual Trade Show and Family Picnic on August 7, 2025, at the Four Points by Sheraton in San Diego, California. The event combined business and fun, bringing franchisees, vendors, and families together for a lively day of networking and celebration.

Kids enjoyed a Jump For Adan bounce house, while everyone cooled off with frozen treats from the Kina Ice Truck and savored fresh slices from the URBN Pizza Truck. Franchisees also had the chance to win exciting raffle prizes, making the day both productive and entertaining. The event once again

and disciplined cost control. Notably, the U.S. saw a 0.9 percent increase in merchandise margin, while Canada and Europe experienced slight declines due to legislative shifts affecting product mix.

A major highlight was the $1.6 billion acquisition of 270 GetGo Café + Market sites, expanding Couche-Tard’s footprint across five U.S. states. This move, paired with the divestiture of 35 locations to satisfy FTC conditions, resulted in a $66.4 million gain. Fuel performance was mixed: Canadian volumes rose 2.2 percent, while U.S. and European volumes dipped slightly.

“A major highlight of Couche-Tard’s Q1 financials was the acquisition of 270 GetGo Café + Market sites, expanding its footprint across five U.S. states.”

C-Stores Navigate A Shaky First Half

The Convenience Store News 2025 Midyear Report Card paints a picture of an industry in flux, with most c-store categories posting declines in both dollar sales and unit volume. Cigarettes continued their downward trajectory, falling 2.7 percent in dollar sales and 7.7 percent in units, yet the economy/ value segment surged 10.8 percent and 8.5 percent, respectively— suggesting a consumer pivot toward affordability. Other tobacco products (OTP) posted a 5.8 percent increase in dollar sales, driven by smokeless tobacco alternatives (up 43.4 percent in dollars and 32.2 percent in units) and pipe tobacco (up 5.8 percent and 17.9 percent).

Packaged beverages saw modest growth in dollars (1.9 percent) but a 1.2 percent drop in units, with energy drinks leading the charge (up 8.9 percent in dollars and 6.6 percent in units). Beer and malt beverages declined overall, but nonalcoholic beer exploded with 22.3 percent dollar growth and a staggering 99.8 percent unit increase.

In center-store categories, candy dipped 1.7 percent in dollar sales and 6.5 percent in units, though novelty candy bucked the trend with 27.8 percent and 23.3 percent growth. Salty snacks fell 4.3 percent in dollars and 5.8 percent in units, with potato chips and popcorn hit hardest. Edible grocery dropped 2.4 percent in dollars and 4.9 percent in units, but water/ beverage enhancers soared 24.1 percent and 22.9 percent.

General merchandise showed signs of life, with seasonal items up 5.7 percent in dollars and 37.5 percent in units. Health & beauty care posted a 2.3 percent dollar increase but a 1.9 percent unit decline, with vitamins/ supplements as the lone bright spot (up 9.5 percent and 4.9 percent). Despite pervasive uncertainty, NRF’s chief economist cited solid fundamentals—rising personal income, a strong labor market, and stable pricing—as reasons for cautious optimism.

U.S. Job Growth Stalls

The August 2025 jobs report reveals a troubling slowdown in the U.S. labor market, with only 22,000 jobs added—far below expectations—and a revised loss of 13,000 jobs in June, marking the first monthly decline since the pandemic, reported The Washington

Post. The unemployment rate rose to 4.3 percent, its highest level since 2021, signaling that the economy may be entering a vulnerable phase. Sectors such as manufacturing, construction, and government saw notable job losses, while white-collar industries continued to shed positions. Economists warn that the labor market is at “stall speed,” with hiring slowing across nearly all industries except health care and hospitality. The Trump administration’s trade tariffs and immigration restrictions are cited as key factors contributing to reduced labor supply and weakened job creation.

Wage growth has also cooled, rising just 3.7 percent yearover-year, while long-term unemployment climbed to 1.93 million. The federal government lost 15,000 jobs in August alone, and recent college graduates face a 9.3 percent unemployment rate, up sharply from earlier in the year. The labor market’s fragility is further stressed by rising layoffs and unemployment claims, with economists predicting continued softening and a potential recession if job growth remains below the break-even threshold of 50,000 monthly additions.

Consumer

Inflation Surges

U.S. consumer inflation accelerated in August, marking the largest monthly and annual increases since January, driven by rising costs in housing, food, and tariff-exposed goods, reported Reuters. The Consumer Price Index (CPI) rose 0.4 percent month-over-

Member News

continued from page 49

month and 2.9 percent year-overyear, with notable spikes in shelter, supermarket items, and travelrelated services. Tariffs imposed by President Trump have begun to ripple through the economy, as businesses pass on higher import costs to consumers. Food prices surged—tomatoes up 4.5 percent, beef up 13.9 percent year-over-year, and coffee up 20.9 percent—with labor shortages and immigration crackdowns compounding supply pressures. Core CPI, which excludes food and energy, also rose 0.3 percent, reflecting broad inflation across goods and services, including apparel, vehicles, and lodging.

Shoppers Flock To Five Below

Five Below reported a strong second quarter, driven by a surge in consumer demand for low-cost goods amid economic uncertainty, reported The Wall Street Journal. The discount retailer raised its full-year revenue forecast to $4.44–$4.52 billion, up from $4.33–$4.42 billion, and increased its adjusted earnings per share guidance to $4.76–$5.16. CEO Winnie Park attributed the growth to “delivering extreme value,” which attracted new customers and increased transaction volume. Revenue jumped 24 percent year-over-year to $1.03 billion, beating analyst expectations, while same-store sales rose 12.4 percent, well above the projected 8.9 percent. The company’s simplified pricing

“Five Below reported a strong second quarter, driven by a surge in consumer demand for low-cost goods amid economic uncertainty.”

strategy—rounding prices to whole numbers between $1 and $5— proved effective, with shoppers responding positively even to slight price increases. The retailer also saw strong performance in its back-toschool and kids’ categories, with $5 and $7 backpacks selling briskly.

Downtrading & Alternatives Reshape

Nicotine Sales

Amid inflation and tighter regulations, U.S. tobacco consumers are increasingly downtrading— shifting from premium cigarettes to deep discount brands or alternative nicotine products like pouches and vaporizers, reported Convenience Store News. According to Goldman Sachs’ Q2 “Nicotine Nuggets” survey, which covers roughly 46,000 retail locations, cigarette volume declines accelerated, with nearly three-fourths of respondents reporting share gains for deep discount cigarettes. Smokeless and oral nicotine products, especially ZYN, saw robust growth, while Marlboro’s market share continued to slip. Retailers also flagged illicit e-cigarettes as a persistent concern, despite recent import crackdowns, though optimism is rising that these pressures may ease in 2025.

The survey also revealed weakening manufacturer pricing power, with 61 percent of respondents noting that pricing actions are contributing to volume declines. Encouragingly, 76 percent of retailers said the adult nicotine consumer has remained stable or stronger in recent months, up from 47 percent in Q1. This resilience isn’t limited to lowincome shoppers—trade-down

behavior is now evident across income levels. Brands like Velo Plus are performing well, aided by strong promotions, and retailers are cautiously optimistic about the category’s future.

C-Stores Redefine

“Better-for-You”

Food